Consolidated Financial Statements FBLC Senior Loan Fund LLC For the period from January 20, 2021 (Commencement of Operations) to December 31, 2021

FBLC Senior Loan Fund LLC Table of Contents Page(s) Report of Independent Auditors 1-2 Consolidated Statement of Assets, Liabilities and Members’ Capital 3 Consolidated Schedule of Investments 4-7 Consolidated Statement of Operations 8 Consolidated Statement of Changes in Members’ Capital 9 Consolidated Statement of Cash Flows 10 Notes to Consolidated Financial Statements 11-18

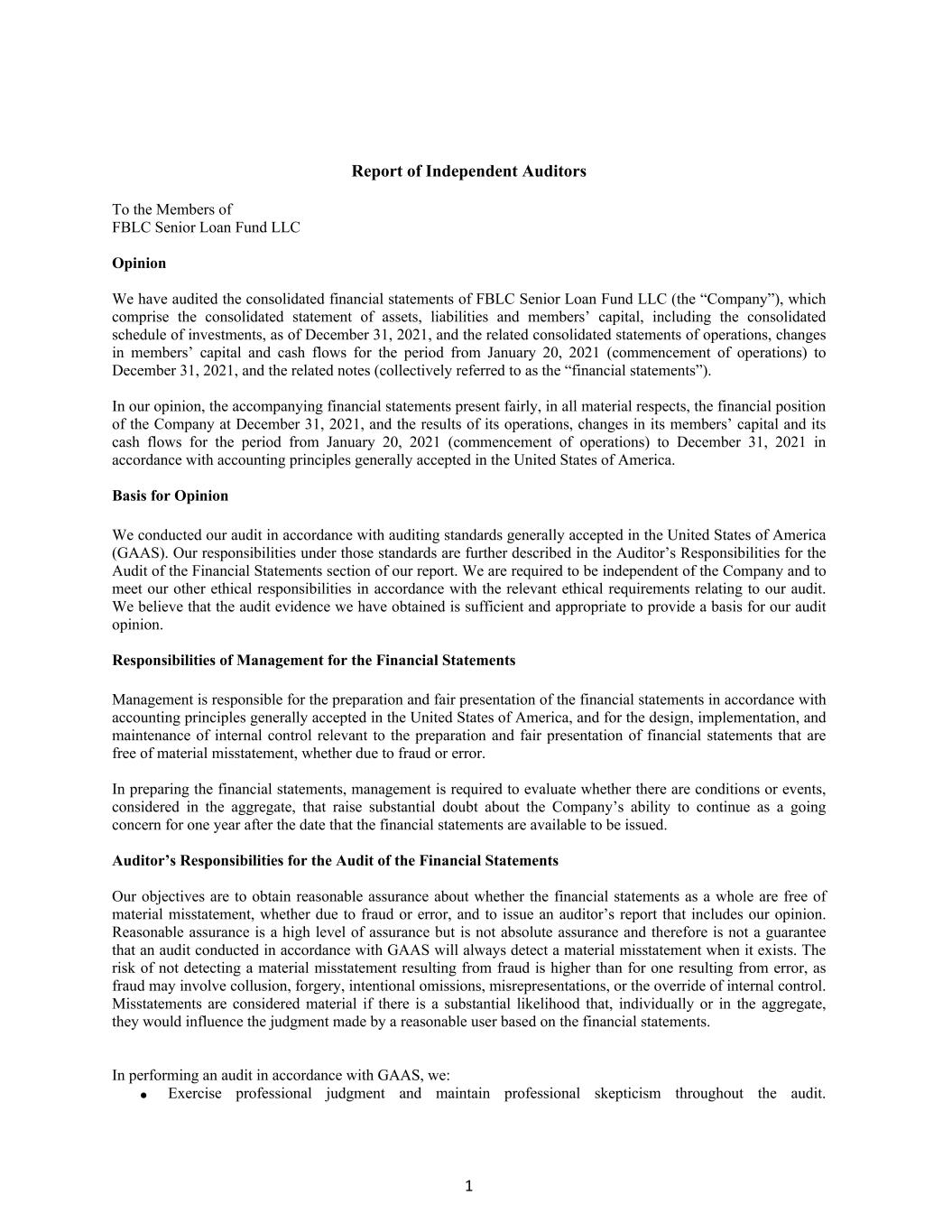

1 Report of Independent Auditors To the Members of FBLC Senior Loan Fund LLC Opinion We have audited the consolidated financial statements of FBLC Senior Loan Fund LLC (the “Company”), which comprise the consolidated statement of assets, liabilities and members’ capital, including the consolidated schedule of investments, as of December 31, 2021, and the related consolidated statements of operations, changes in members’ capital and cash flows for the period from January 20, 2021 (commencement of operations) to December 31, 2021, and the related notes (collectively referred to as the “financial statements”). In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2021, and the results of its operations, changes in its members’ capital and its cash flows for the period from January 20, 2021 (commencement of operations) to December 31, 2021 in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued. Auditor’s Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free of material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements. In performing an audit in accordance with GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit.

2 Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. /s/ Ernst & Young LLP March 16, 2022

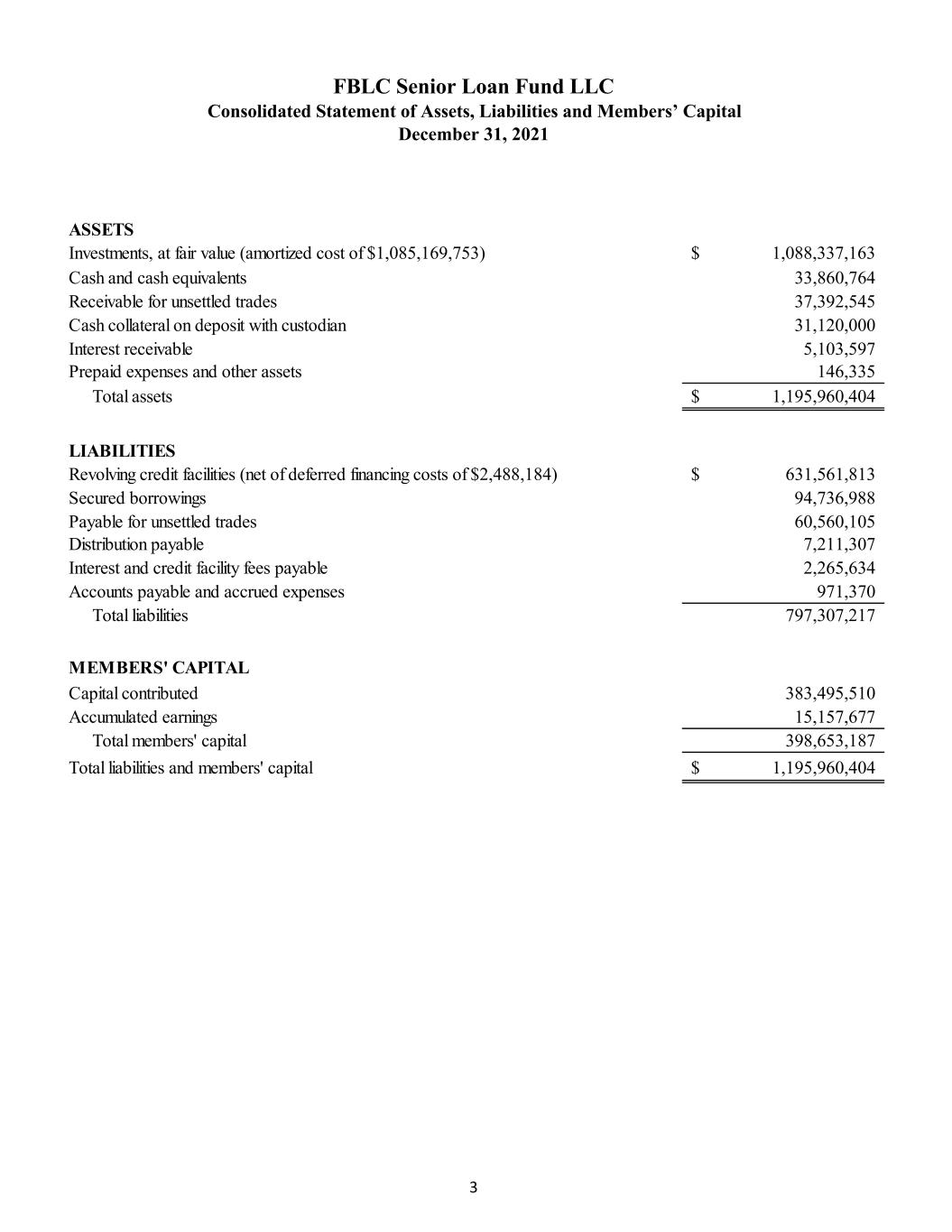

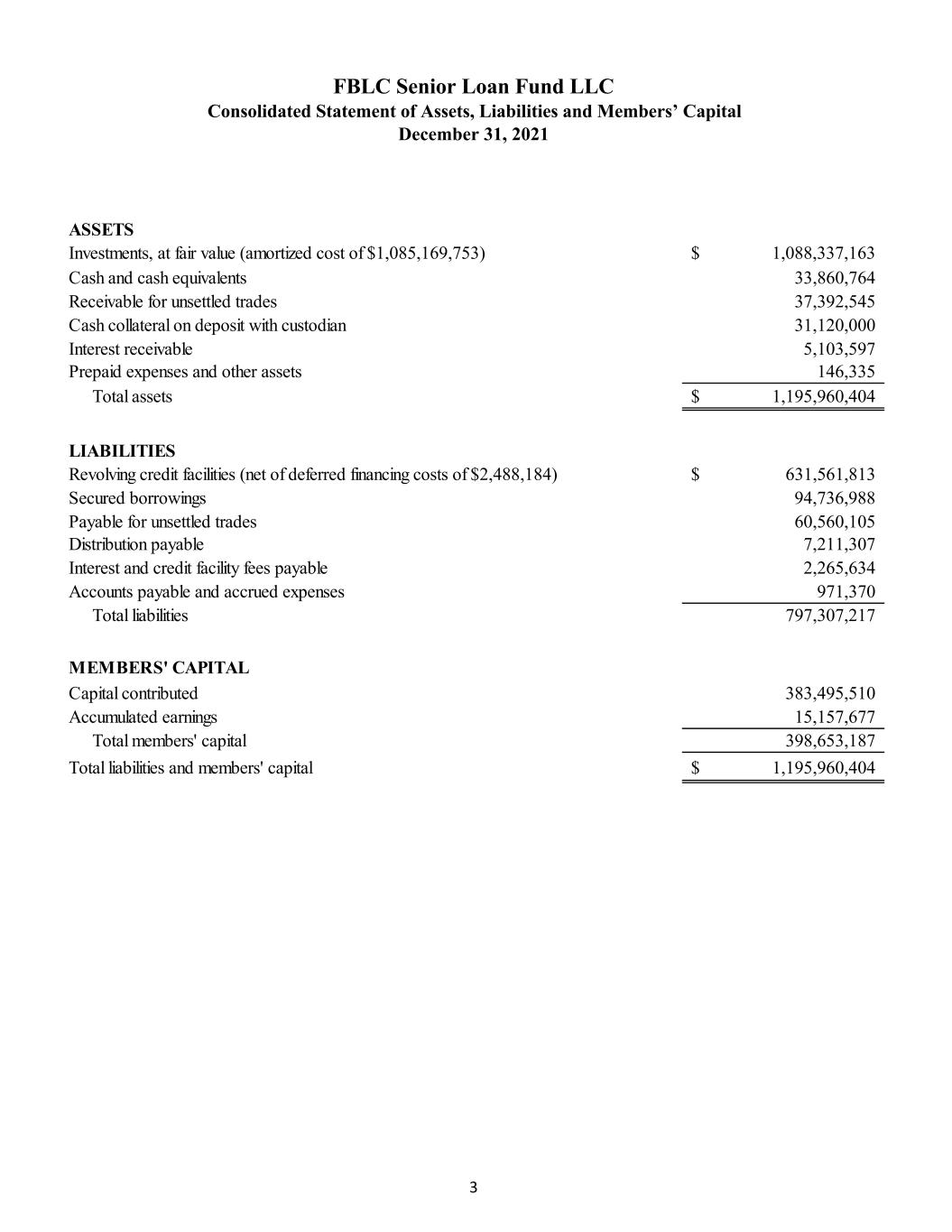

FBLC Senior Loan Fund LLC Consolidated Statement of Assets, Liabilities and Members’ Capital December 31, 2021 3 Investments, at fair value (amortized cost of $1,085,169,753) 1,088,337,163$ Cash and cash equivalents 33,860,764 Receivable for unsettled trades 37,392,545 Cash collateral on deposit with custodian 31,120,000 Interest receivable 5,103,597 Prepaid expenses and other assets 146,335 Total assets 1,195,960,404$ Revolving credit facilities (net of deferred financing costs of $2,488,184) 631,561,813$ Secured borrowings 94,736,988 Payable for unsettled trades 60,560,105 Distribution payable 7,211,307 Interest and credit facility fees payable 2,265,634 Accounts payable and accrued expenses 971,370 Total liabilities 797,307,217 Capital contributed 383,495,510 Accumulated earnings 15,157,677 Total members' capital 398,653,187 Total liabilities and members' capital 1,195,960,404$ MEMBERS' CAPITAL ASSETS LIABILITIES

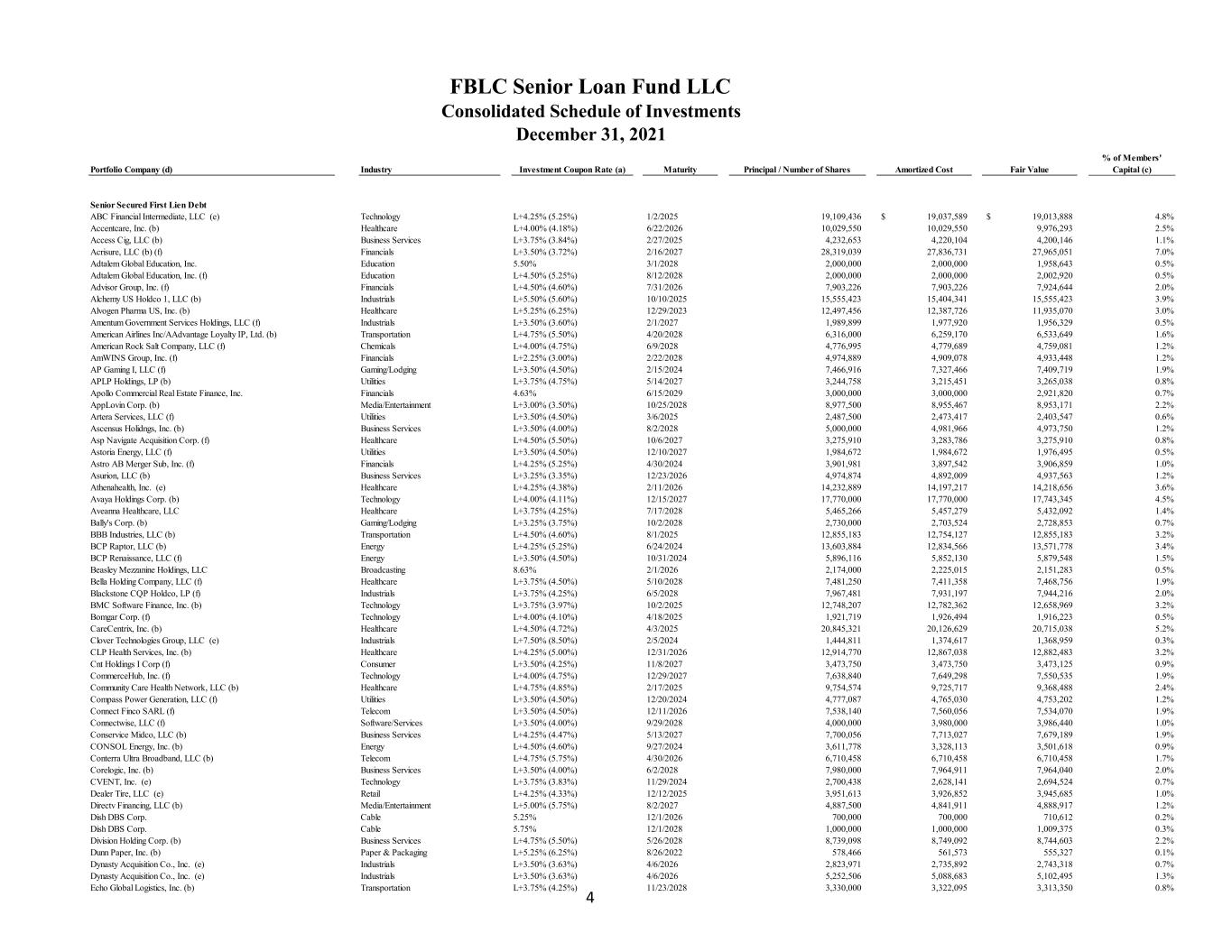

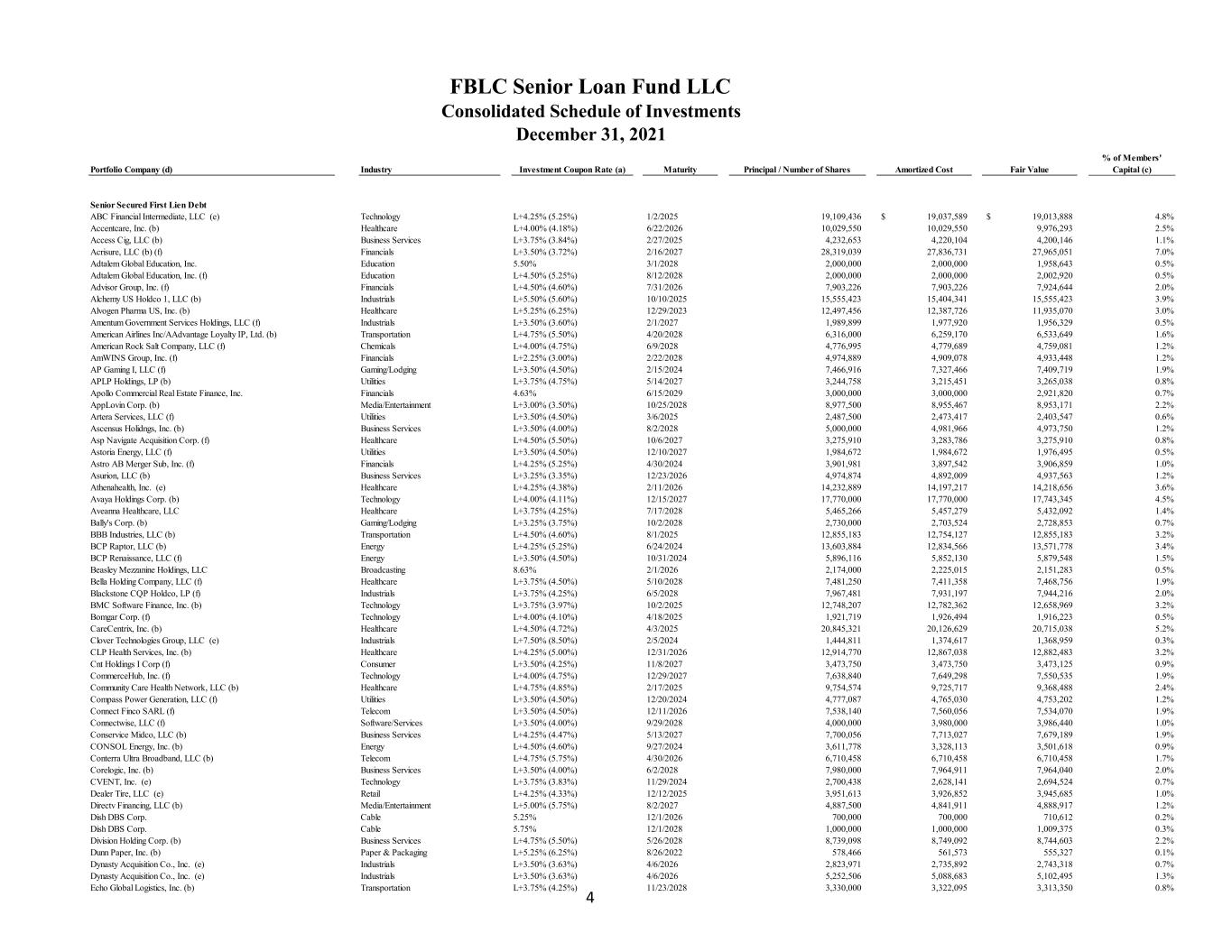

FBLC Senior Loan Fund LLC Consolidated Schedule of Investments December 31, 2021 4 Portfolio Company (d) Industry Investment Coupon Rate (a) Maturity Principal / Number of Shares Amortized Cost Fair Value % of Members' Capital (c) Senior Secured First Lien Debt ABC Financial Intermediate, LLC (e) Technology L+4.25% (5.25%) 1/2/2025 19,109,436 19,037,589$ 19,013,888$ 4.8% Accentcare, Inc. (b) Healthcare L+4.00% (4.18%) 6/22/2026 10,029,550 10,029,550 9,976,293 2.5% Access Cig, LLC (b) Business Services L+3.75% (3.84%) 2/27/2025 4,232,653 4,220,104 4,200,146 1.1% Acrisure, LLC (b) (f) Financials L+3.50% (3.72%) 2/16/2027 28,319,039 27,836,731 27,965,051 7.0% Adtalem Global Education, Inc. Education 5.50% 3/1/2028 2,000,000 2,000,000 1,958,643 0.5% Adtalem Global Education, Inc. (f) Education L+4.50% (5.25%) 8/12/2028 2,000,000 2,000,000 2,002,920 0.5% Advisor Group, Inc. (f) Financials L+4.50% (4.60%) 7/31/2026 7,903,226 7,903,226 7,924,644 2.0% Alchemy US Holdco 1, LLC (b) Industrials L+5.50% (5.60%) 10/10/2025 15,555,423 15,404,341 15,555,423 3.9% Alvogen Pharma US, Inc. (b) Healthcare L+5.25% (6.25%) 12/29/2023 12,497,456 12,387,726 11,935,070 3.0% Amentum Government Services Holdings, LLC (f) Industrials L+3.50% (3.60%) 2/1/2027 1,989,899 1,977,920 1,956,329 0.5% American Airlines Inc/AAdvantage Loyalty IP, Ltd. (b) Transportation L+4.75% (5.50%) 4/20/2028 6,316,000 6,259,170 6,533,649 1.6% American Rock Salt Company, LLC (f) Chemicals L+4.00% (4.75%) 6/9/2028 4,776,995 4,779,689 4,759,081 1.2% AmWINS Group, Inc. (f) Financials L+2.25% (3.00%) 2/22/2028 4,974,889 4,909,078 4,933,448 1.2% AP Gaming I, LLC (f) Gaming/Lodging L+3.50% (4.50%) 2/15/2024 7,466,916 7,327,466 7,409,719 1.9% APLP Holdings, LP (b) Utilities L+3.75% (4.75%) 5/14/2027 3,244,758 3,215,451 3,265,038 0.8% Apollo Commercial Real Estate Finance, Inc. Financials 4.63% 6/15/2029 3,000,000 3,000,000 2,921,820 0.7% AppLovin Corp. (b) Media/Entertainment L+3.00% (3.50%) 10/25/2028 8,977,500 8,955,467 8,953,171 2.2% Artera Services, LLC (f) Utilities L+3.50% (4.50%) 3/6/2025 2,487,500 2,473,417 2,403,547 0.6% Ascensus Holidngs, Inc. (b) Business Services L+3.50% (4.00%) 8/2/2028 5,000,000 4,981,966 4,973,750 1.2% Asp Navigate Acquisition Corp. (f) Healthcare L+4.50% (5.50%) 10/6/2027 3,275,910 3,283,786 3,275,910 0.8% Astoria Energy, LLC (f) Utilities L+3.50% (4.50%) 12/10/2027 1,984,672 1,984,672 1,976,495 0.5% Astro AB Merger Sub, Inc. (f) Financials L+4.25% (5.25%) 4/30/2024 3,901,981 3,897,542 3,906,859 1.0% Asurion, LLC (b) Business Services L+3.25% (3.35%) 12/23/2026 4,974,874 4,892,009 4,937,563 1.2% Athenahealth, Inc. (e) Healthcare L+4.25% (4.38%) 2/11/2026 14,232,889 14,197,217 14,218,656 3.6% Avaya Holdings Corp. (b) Technology L+4.00% (4.11%) 12/15/2027 17,770,000 17,770,000 17,743,345 4.5% Aveanna Healthcare, LLC Healthcare L+3.75% (4.25%) 7/17/2028 5,465,266 5,457,279 5,432,092 1.4% Bally's Corp. (b) Gaming/Lodging L+3.25% (3.75%) 10/2/2028 2,730,000 2,703,524 2,728,853 0.7% BBB Industries, LLC (b) Transportation L+4.50% (4.60%) 8/1/2025 12,855,183 12,754,127 12,855,183 3.2% BCP Raptor, LLC (b) Energy L+4.25% (5.25%) 6/24/2024 13,603,884 12,834,566 13,571,778 3.4% BCP Renaissance, LLC (f) Energy L+3.50% (4.50%) 10/31/2024 5,896,116 5,852,130 5,879,548 1.5% Beasley Mezzanine Holdings, LLC Broadcasting 8.63% 2/1/2026 2,174,000 2,225,015 2,151,283 0.5% Bella Holding Company, LLC (f) Healthcare L+3.75% (4.50%) 5/10/2028 7,481,250 7,411,358 7,468,756 1.9% Blackstone CQP Holdco, LP (f) Industrials L+3.75% (4.25%) 6/5/2028 7,967,481 7,931,197 7,944,216 2.0% BMC Software Finance, Inc. (b) Technology L+3.75% (3.97%) 10/2/2025 12,748,207 12,782,362 12,658,969 3.2% Bomgar Corp. (f) Technology L+4.00% (4.10%) 4/18/2025 1,921,719 1,926,494 1,916,223 0.5% CareCentrix, Inc. (b) Healthcare L+4.50% (4.72%) 4/3/2025 20,845,321 20,126,629 20,715,038 5.2% Clover Technologies Group, LLC (e) Industrials L+7.50% (8.50%) 2/5/2024 1,444,811 1,374,617 1,368,959 0.3% CLP Health Services, Inc. (b) Healthcare L+4.25% (5.00%) 12/31/2026 12,914,770 12,867,038 12,882,483 3.2% Cnt Holdings I Corp (f) Consumer L+3.50% (4.25%) 11/8/2027 3,473,750 3,473,750 3,473,125 0.9% CommerceHub, Inc. (f) Technology L+4.00% (4.75%) 12/29/2027 7,638,840 7,649,298 7,550,535 1.9% Community Care Health Network, LLC (b) Healthcare L+4.75% (4.85%) 2/17/2025 9,754,574 9,725,717 9,368,488 2.4% Compass Power Generation, LLC (f) Utilities L+3.50% (4.50%) 12/20/2024 4,777,087 4,765,030 4,753,202 1.2% Connect Finco SARL (f) Telecom L+3.50% (4.50%) 12/11/2026 7,538,140 7,560,056 7,534,070 1.9% Connectwise, LLC (f) Software/Services L+3.50% (4.00%) 9/29/2028 4,000,000 3,980,000 3,986,440 1.0% Conservice Midco, LLC (b) Business Services L+4.25% (4.47%) 5/13/2027 7,700,056 7,713,027 7,679,189 1.9% CONSOL Energy, Inc. (b) Energy L+4.50% (4.60%) 9/27/2024 3,611,778 3,328,113 3,501,618 0.9% Conterra Ultra Broadband, LLC (b) Telecom L+4.75% (5.75%) 4/30/2026 6,710,458 6,710,458 6,710,458 1.7% Corelogic, Inc. (b) Business Services L+3.50% (4.00%) 6/2/2028 7,980,000 7,964,911 7,964,040 2.0% CVENT, Inc. (e) Technology L+3.75% (3.83%) 11/29/2024 2,700,438 2,628,141 2,694,524 0.7% Dealer Tire, LLC (e) Retail L+4.25% (4.33%) 12/12/2025 3,951,613 3,926,852 3,945,685 1.0% Directv Financing, LLC (b) Media/Entertainment L+5.00% (5.75%) 8/2/2027 4,887,500 4,841,911 4,888,917 1.2% Dish DBS Corp. Cable 5.25% 12/1/2026 700,000 700,000 710,612 0.2% Dish DBS Corp. Cable 5.75% 12/1/2028 1,000,000 1,000,000 1,009,375 0.3% Division Holding Corp. (b) Business Services L+4.75% (5.50%) 5/26/2028 8,739,098 8,749,092 8,744,603 2.2% Dunn Paper, Inc. (b) Paper & Packaging L+5.25% (6.25%) 8/26/2022 578,466 561,573 555,327 0.1% Dynasty Acquisition Co., Inc. (e) Industrials L+3.50% (3.63%) 4/6/2026 2,823,971 2,735,892 2,743,318 0.7% Dynasty Acquisition Co., Inc. (e) Industrials L+3.50% (3.63%) 4/6/2026 5,252,506 5,088,683 5,102,495 1.3% Echo Global Logistics, Inc. (b) Transportation L+3.75% (4.25%) 11/23/2028 3,330,000 3,322,095 3,313,350 0.8%

FBLC Senior Loan Fund LLC Consolidated Schedule of Investments December 31, 2021 5 Portfolio Company (d) Industry Investment Coupon Rate (a) Maturity Principal / Number of Shares Amortized Cost Fair Value % of Members' Capital (c) Edgewater Generation, LLC (b) Utilities L+3.75% (3.85%) 12/12/2025 2,490,651 2,475,609$ 2,348,559$ 0.6% Emerald 2, Ltd. (b) Industrials L+3.25% (3.47%) 7/12/2028 517,635 515,156 513,753 0.1% Fastlane Parent Co, Inc. (b) Transportation L+4.50% (4.60%) 2/4/2026 1,568,548 1,568,548 1,567,294 0.4% Flex Acquisition Company, Inc. (f) Paper & Packaging L+3.50% (4.00%) 3/2/2028 6,957,499 6,919,943 6,938,644 1.7% Florida Food Products, LLC (f) Food & Beverage L+5.00% (5.75%) 10/18/2028 8,000,000 7,880,689 7,860,000 2.0% Frontier Communications Corp. Telecom 5.00% 5/1/2028 1,240,000 1,302,789 1,276,129 0.3% Frontier Communications Corp. (b) Telecom L+3.75% (4.50%) 5/1/2028 19,425,210 19,406,712 19,386,360 4.9% Geon Performance Solutions, LLC (b) Chemicals L+4.75% (5.50%) 8/18/2028 4,705,208 4,671,418 4,739,038 1.2% Gogo Intermediate Holdings, LLC (f) Telecom L+3.75% (4.50%) 4/28/2028 8,380,885 8,380,885 8,373,426 2.1% Golden Nugget, LLC (b) (f) Gaming/Lodging L+2.50% (3.25%) 10/4/2023 3,960,469 3,931,849 3,932,548 1.0% Gordian Medical, Inc. (b) Healthcare L+6.25% (7.00%) 1/31/2027 11,060,280 10,987,182 10,968,148 2.8% Greenway Health, LLC (f) Healthcare L+3.75% (4.75%) 2/16/2024 4,732,701 4,461,720 4,496,066 1.1% GVC Holdings Gibraltar, Ltd. (f) Gaming/Lodging L+2.50% (3.00%) 3/29/2027 4,975,000 4,968,781 4,957,587 1.2% HAH Group Holding Company, LLC (b) Healthcare L+5.00% (6.00%) 10/29/2027 737,295 737,295 737,295 0.2% HAH Group Holding Company, LLC (b) Healthcare L+5.00% (6.00%) 10/29/2027 5,826,968 5,747,733 5,826,967 1.5% Hamilton Projects Acquiror, LLC (f) Utilities L+4.50% (5.25%) 6/17/2027 5,718,436 5,693,865 5,710,087 1.4% Heartland Dental, LLC (e) Healthcare L+3.50% (3.58%) 4/30/2025 4,153,969 4,075,881 4,108,982 1.0% Hertz Corp. (b) (f) Transportation L+3.25% (3.75%) 6/30/2028 4,185,511 4,169,816 4,185,511 1.0% Hertz Corp. (b) (f) Transportation L+3.25% (3.75%) 6/30/2028 793,456 790,489 793,456 0.2% HireRight, Inc. (f) Business Services L+3.75% (3.85%) 7/11/2025 7,237,011 7,196,875 7,202,635 1.8% Hudson River Trading, LLC (b) Financials L+3.00% (3.10%) 3/20/2028 4,974,937 4,910,190 4,933,198 1.2% ICP Industrial, Inc. (f) Chemicals L+3.75% (4.50%) 12/29/2027 4,974,937 4,971,269 4,900,313 1.2% IDERA, Inc. (f) Technology L+3.75% (4.50%) 3/2/2028 6,982,716 6,993,733 6,971,823 1.7% Ineos Us Finance, LLC (f) Chemicals L+2.50% (3.00%) 11/6/2028 4,000,000 3,995,000 3,976,680 1.0% Iri Holdings, Inc. (b) Business Services L+4.25% (4.35%) 12/1/2025 7,819,000 7,799,791 7,809,226 2.0% Jack Ohio Finance, LLC (f) Gaming/Lodging L+4.75% (5.50%) 10/4/2028 4,000,000 3,980,443 3,980,000 1.0% Jane Street Group, LLC (f) Financials L+2.75% (2.85%) 1/26/2028 4,937,594 4,931,736 4,895,427 1.2% Jump Financial, LLC (b) Financials L+3.50% (4.00%) 8/7/2028 2,493,750 2,481,573 2,475,047 0.6% Kissner Milling Co., Ltd. Industrials 4.88% 5/1/2028 5,000,000 5,034,939 4,813,550 1.2% LABL, Inc. (b) Paper & Packaging L+5.00% (5.50%) 10/30/2028 5,000,000 4,925,177 4,987,500 1.3% Liquid Tech Solutions Holdings, LLC (b) (f) Industrials L+4.75% (5.50%) 3/20/2028 10,215,665 10,165,797 10,215,665 2.6% Luxembourg Investment Co., 428 SARL (b) Chemicals S+5.00% (5.50%) 1/3/2029 3,864,000 3,825,360 3,826,519 1.0% Medallion Midland Acquisition, LP (f) Energy L+3.75% (4.50%) 10/18/2028 3,614,067 3,578,858 3,594,190 0.9% Meridian Adhesives Group, Inc. (b) Chemicals L+4.00% (4.75%) 7/24/2028 5,000,000 4,952,672 5,000,000 1.3% MH Sub I, LLC (f) Business Services L+3.75% (4.75%) 9/13/2024 8,641,073 8,635,796 8,650,060 2.2% Michael Baker International, LLC (b) Industrials L+5.00% (5.75%) 12/1/2028 3,334,000 3,300,707 3,300,993 0.8% MicroStrategy, Inc. Software/Services 6.13% 6/15/2028 1,500,000 1,500,000 1,507,500 0.4% Monitronics International, Inc. (b) Business Services L+6.50% (7.75%) 3/29/2024 5,508,332 5,301,490 5,164,061 1.3% MPH Acquisition Holdings, LLC (b) Healthcare L+4.25% (4.75%) 9/1/2028 4,987,500 4,895,197 4,859,720 1.2% MSG NATIONAL PROPERTIES, LLC (b) Media/Entertainment L+6.25% (7.00%) 11/12/2025 12,187,890 12,430,843 12,187,890 3.1% MYOB US Borrower, LLC (f) Business Services L+4.00% (4.10%) 5/6/2026 5,467,537 5,452,965 5,421,992 1.4% National Mentor Holdings, Inc. (b) (f) Healthcare L+3.75% (4.50%) 3/2/2028 7,370,376 7,336,482 7,282,373 1.8% National Mentor Holdings, Inc. (f) Healthcare L+3.75% (4.50%) 3/2/2028 233,236 232,145 230,451 0.1% Navitas Midstream Midland Basin, LLC (b) Energy L+4.00% (4.75%) 12/13/2024 10,676,409 10,676,409 10,639,042 2.7% Nexus Buyer, LLC (f) Business Services L+3.75% (3.85%) 11/9/2026 1,488,608 1,485,095 1,480,361 0.4% Nouryon USA, LLC (e) Chemicals L+3.00% (3.10%) 10/1/2025 2,342,129 2,310,311 2,331,894 0.6% Paysafe Finance, PLC Software/Services 4.00% 6/15/2029 400,000 400,000 372,764 0.1% Perstorp Holding Ab (b) Chemicals L+4.75% (4.91%) 2/27/2026 8,777,486 8,324,837 8,777,486 2.2% PG&E Corp. (f) Utilities L+3.00% (3.50%) 6/23/2025 10,697,818 10,734,849 10,569,444 2.7% Proofpoint, Inc. (b) Software/Services L+3.25% (3.75%) 8/31/2028 2,500,000 2,493,906 2,487,700 0.6% Protective Industrial Products, Inc. (b) Industrials L+4.00% (4.75%) 12/29/2027 9,126,552 9,090,541 9,086,669 2.3% Pug, LLC (f) Technology L+3.50% (3.60%) 2/12/2027 4,962,025 4,842,627 4,843,135 1.2% Pug, LLC (f) Technology L+4.25% (4.75%) 2/13/2027 1,995,000 1,985,518 1,982,531 0.5% Quikrete Holdings, Inc. (f) Industrials L+3.00% (3.19%) 6/11/2028 8,000,000 7,958,750 7,977,760 2.0% Regionalcare Hospital Partners Holdings, Inc. Healthcare 4.38% 2/15/2027 2,000,000 2,000,000 2,025,333 0.5% Regionalcare Hospital Partners Holdings, Inc. (b) Healthcare L+3.75% (3.85%) 11/14/2025 5,195,289 5,214,231 5,185,574 1.3% RXB Holdings, Inc. (f) Healthcare L+4.50% (5.25%) 12/20/2027 10,205,242 10,243,512 10,205,242 2.6%

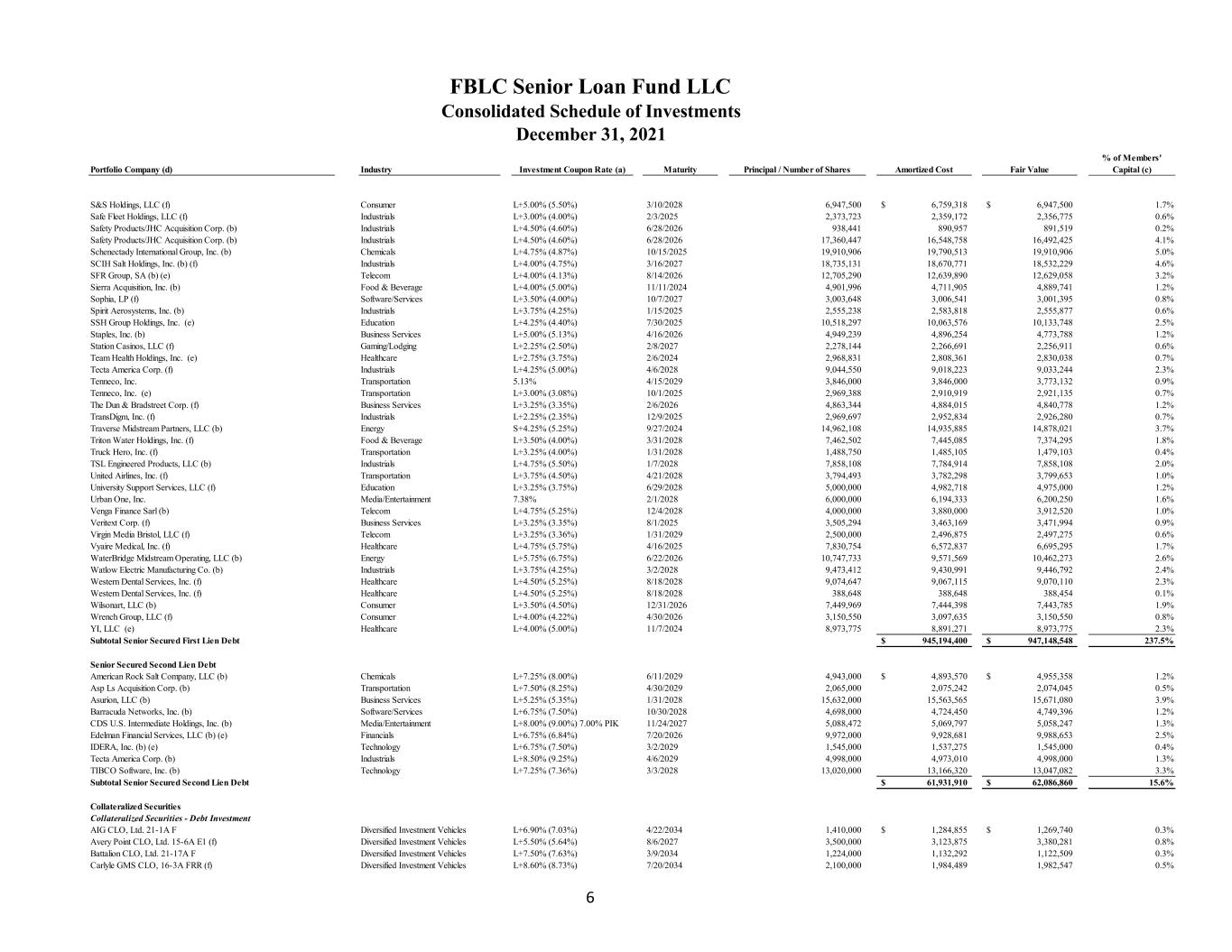

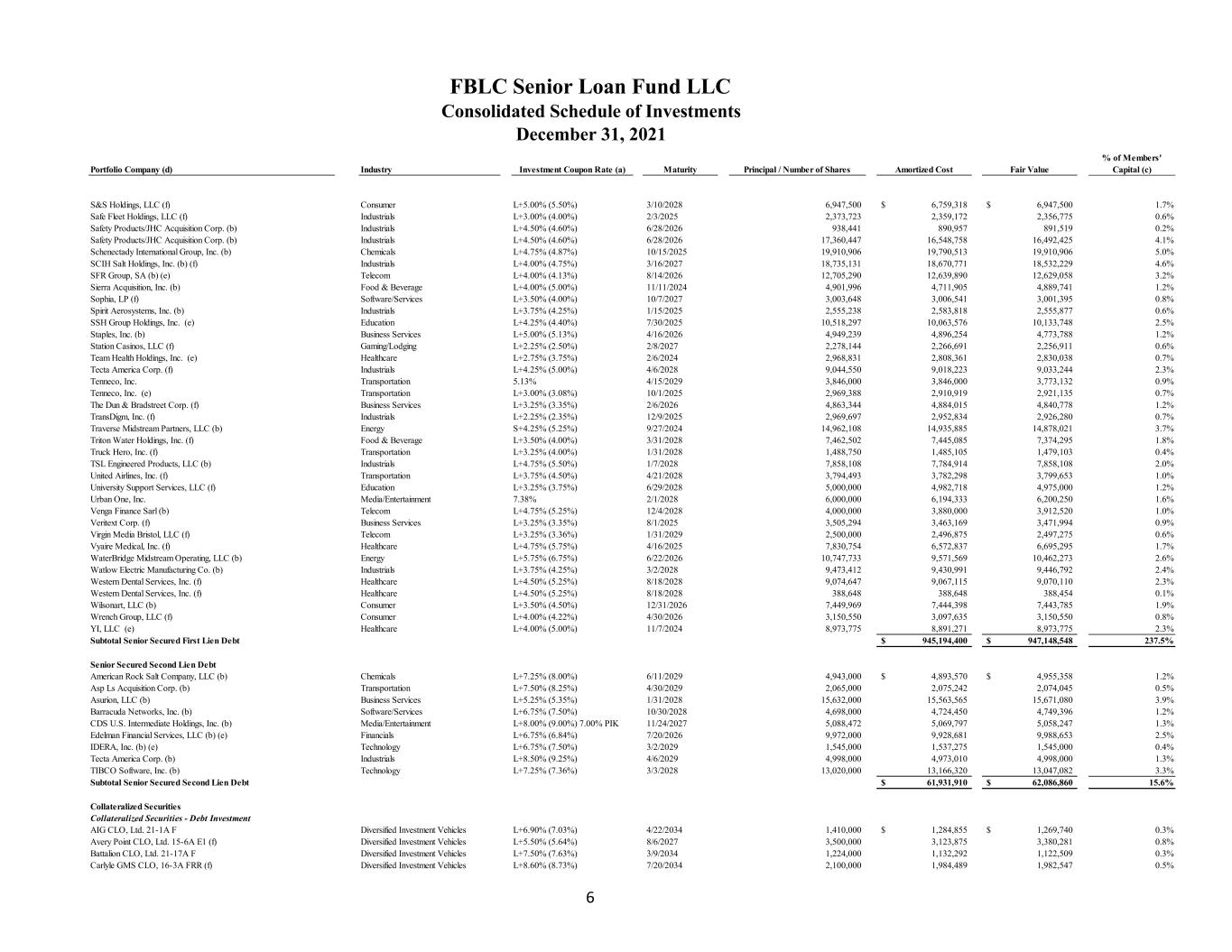

FBLC Senior Loan Fund LLC Consolidated Schedule of Investments December 31, 2021 6 Portfolio Company (d) Industry Investment Coupon Rate (a) Maturity Principal / Number of Shares Amortized Cost Fair Value % of Members' Capital (c) S&S Holdings, LLC (f) Consumer L+5.00% (5.50%) 3/10/2028 6,947,500 6,759,318$ 6,947,500$ 1.7% Safe Fleet Holdings, LLC (f) Industrials L+3.00% (4.00%) 2/3/2025 2,373,723 2,359,172 2,356,775 0.6% Safety Products/JHC Acquisition Corp. (b) Industrials L+4.50% (4.60%) 6/28/2026 938,441 890,957 891,519 0.2% Safety Products/JHC Acquisition Corp. (b) Industrials L+4.50% (4.60%) 6/28/2026 17,360,447 16,548,758 16,492,425 4.1% Schenectady International Group, Inc. (b) Chemicals L+4.75% (4.87%) 10/15/2025 19,910,906 19,790,513 19,910,906 5.0% SCIH Salt Holdings, Inc. (b) (f) Industrials L+4.00% (4.75%) 3/16/2027 18,735,131 18,670,771 18,532,229 4.6% SFR Group, SA (b) (e) Telecom L+4.00% (4.13%) 8/14/2026 12,705,290 12,639,890 12,629,058 3.2% Sierra Acquisition, Inc. (b) Food & Beverage L+4.00% (5.00%) 11/11/2024 4,901,996 4,711,905 4,889,741 1.2% Sophia, LP (f) Software/Services L+3.50% (4.00%) 10/7/2027 3,003,648 3,006,541 3,001,395 0.8% Spirit Aerosystems, Inc. (b) Industrials L+3.75% (4.25%) 1/15/2025 2,555,238 2,583,818 2,555,877 0.6% SSH Group Holdings, Inc. (e) Education L+4.25% (4.40%) 7/30/2025 10,518,297 10,063,576 10,133,748 2.5% Staples, Inc. (b) Business Services L+5.00% (5.13%) 4/16/2026 4,949,239 4,896,254 4,773,788 1.2% Station Casinos, LLC (f) Gaming/Lodging L+2.25% (2.50%) 2/8/2027 2,278,144 2,266,691 2,256,911 0.6% Team Health Holdings, Inc. (e) Healthcare L+2.75% (3.75%) 2/6/2024 2,968,831 2,808,361 2,830,038 0.7% Tecta America Corp. (f) Industrials L+4.25% (5.00%) 4/6/2028 9,044,550 9,018,223 9,033,244 2.3% Tenneco, Inc. Transportation 5.13% 4/15/2029 3,846,000 3,846,000 3,773,132 0.9% Tenneco, Inc. (e) Transportation L+3.00% (3.08%) 10/1/2025 2,969,388 2,910,919 2,921,135 0.7% The Dun & Bradstreet Corp. (f) Business Services L+3.25% (3.35%) 2/6/2026 4,863,344 4,884,015 4,840,778 1.2% TransDigm, Inc. (f) Industrials L+2.25% (2.35%) 12/9/2025 2,969,697 2,952,834 2,926,280 0.7% Traverse Midstream Partners, LLC (b) Energy S+4.25% (5.25%) 9/27/2024 14,962,108 14,935,885 14,878,021 3.7% Triton Water Holdings, Inc. (f) Food & Beverage L+3.50% (4.00%) 3/31/2028 7,462,502 7,445,085 7,374,295 1.8% Truck Hero, Inc. (f) Transportation L+3.25% (4.00%) 1/31/2028 1,488,750 1,485,105 1,479,103 0.4% TSL Engineered Products, LLC (b) Industrials L+4.75% (5.50%) 1/7/2028 7,858,108 7,784,914 7,858,108 2.0% United Airlines, Inc. (f) Transportation L+3.75% (4.50%) 4/21/2028 3,794,493 3,782,298 3,799,653 1.0% University Support Services, LLC (f) Education L+3.25% (3.75%) 6/29/2028 5,000,000 4,982,718 4,975,000 1.2% Urban One, Inc. Media/Entertainment 7.38% 2/1/2028 6,000,000 6,194,333 6,200,250 1.6% Venga Finance Sarl (b) Telecom L+4.75% (5.25%) 12/4/2028 4,000,000 3,880,000 3,912,520 1.0% Veritext Corp. (f) Business Services L+3.25% (3.35%) 8/1/2025 3,505,294 3,463,169 3,471,994 0.9% Virgin Media Bristol, LLC (f) Telecom L+3.25% (3.36%) 1/31/2029 2,500,000 2,496,875 2,497,275 0.6% Vyaire Medical, Inc. (f) Healthcare L+4.75% (5.75%) 4/16/2025 7,830,754 6,572,837 6,695,295 1.7% WaterBridge Midstream Operating, LLC (b) Energy L+5.75% (6.75%) 6/22/2026 10,747,733 9,571,569 10,462,273 2.6% Watlow Electric Manufacturing Co. (b) Industrials L+3.75% (4.25%) 3/2/2028 9,473,412 9,430,991 9,446,792 2.4% Western Dental Services, Inc. (f) Healthcare L+4.50% (5.25%) 8/18/2028 9,074,647 9,067,115 9,070,110 2.3% Western Dental Services, Inc. (f) Healthcare L+4.50% (5.25%) 8/18/2028 388,648 388,648 388,454 0.1% Wilsonart, LLC (b) Consumer L+3.50% (4.50%) 12/31/2026 7,449,969 7,444,398 7,443,785 1.9% Wrench Group, LLC (f) Consumer L+4.00% (4.22%) 4/30/2026 3,150,550 3,097,635 3,150,550 0.8% YI, LLC (e) Healthcare L+4.00% (5.00%) 11/7/2024 8,973,775 8,891,271 8,973,775 2.3% Subtotal Senior Secured First Lien Debt 945,194,400$ 947,148,548$ 237.5% Senior Secured Second Lien Debt American Rock Salt Company, LLC (b) Chemicals L+7.25% (8.00%) 6/11/2029 4,943,000 4,893,570$ 4,955,358$ 1.2% Asp Ls Acquisition Corp. (b) Transportation L+7.50% (8.25%) 4/30/2029 2,065,000 2,075,242 2,074,045 0.5% Asurion, LLC (b) Business Services L+5.25% (5.35%) 1/31/2028 15,632,000 15,563,565 15,671,080 3.9% Barracuda Networks, Inc. (b) Software/Services L+6.75% (7.50%) 10/30/2028 4,698,000 4,724,450 4,749,396 1.2% CDS U.S. Intermediate Holdings, Inc. (b) Media/Entertainment L+8.00% (9.00%) 7.00% PIK 11/24/2027 5,088,472 5,069,797 5,058,247 1.3% Edelman Financial Services, LLC (b) (e) Financials L+6.75% (6.84%) 7/20/2026 9,972,000 9,928,681 9,988,653 2.5% IDERA, Inc. (b) (e) Technology L+6.75% (7.50%) 3/2/2029 1,545,000 1,537,275 1,545,000 0.4% Tecta America Corp. (b) Industrials L+8.50% (9.25%) 4/6/2029 4,998,000 4,973,010 4,998,000 1.3% TIBCO Software, Inc. (b) Technology L+7.25% (7.36%) 3/3/2028 13,020,000 13,166,320 13,047,082 3.3% Subtotal Senior Secured Second Lien Debt 61,931,910$ 62,086,860$ 15.6% Collateralized Securities Collateralized Securities - Debt Investment AIG CLO, Ltd. 21-1A F Diversified Investment Vehicles L+6.90% (7.03%) 4/22/2034 1,410,000 1,284,855$ 1,269,740$ 0.3% Avery Point CLO, Ltd. 15-6A E1 (f) Diversified Investment Vehicles L+5.50% (5.64%) 8/6/2027 3,500,000 3,123,875 3,380,281 0.8% Battalion CLO, Ltd. 21-17A F Diversified Investment Vehicles L+7.50% (7.63%) 3/9/2034 1,224,000 1,132,292 1,122,509 0.3% Carlyle GMS CLO, 16-3A FRR (f) Diversified Investment Vehicles L+8.60% (8.73%) 7/20/2034 2,100,000 1,984,489 1,982,547 0.5%

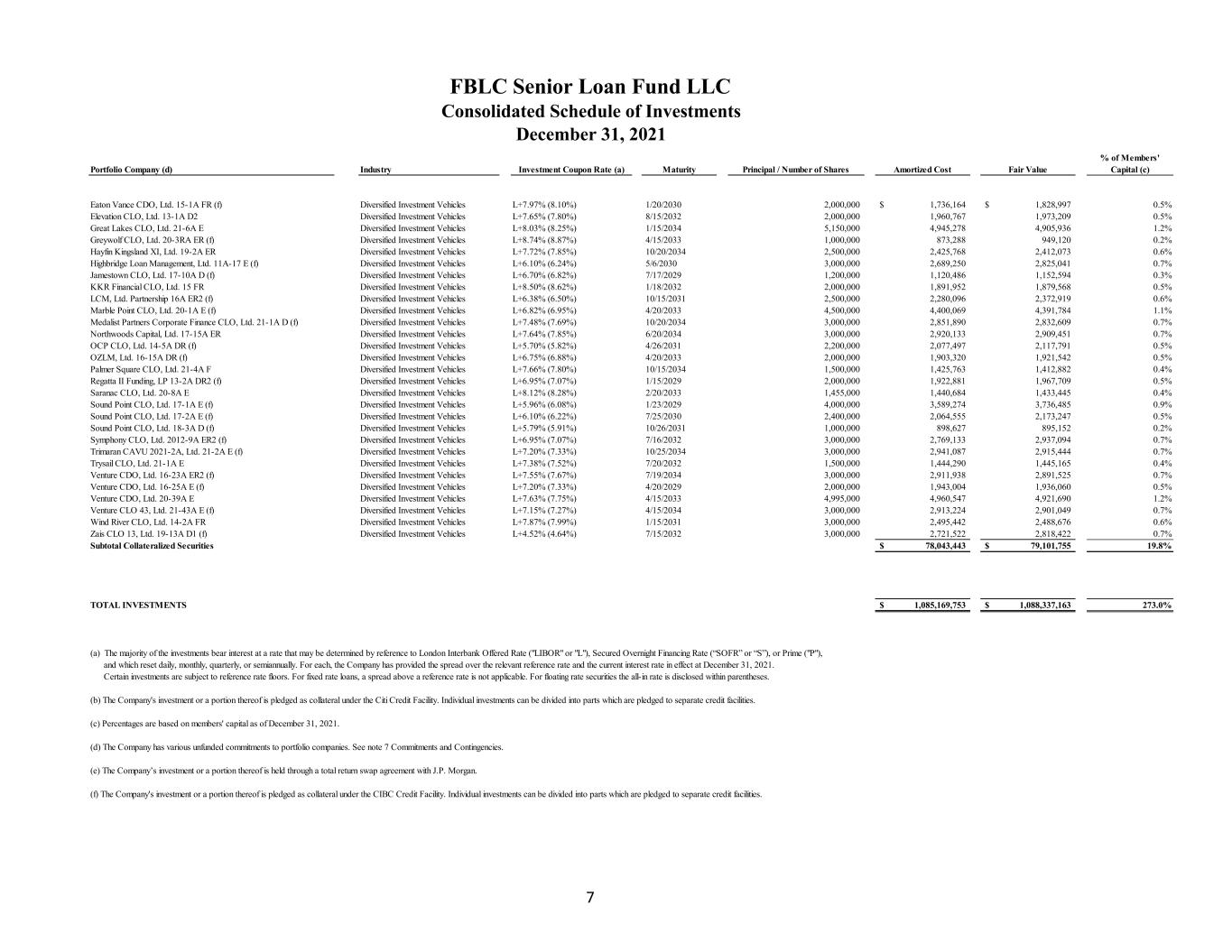

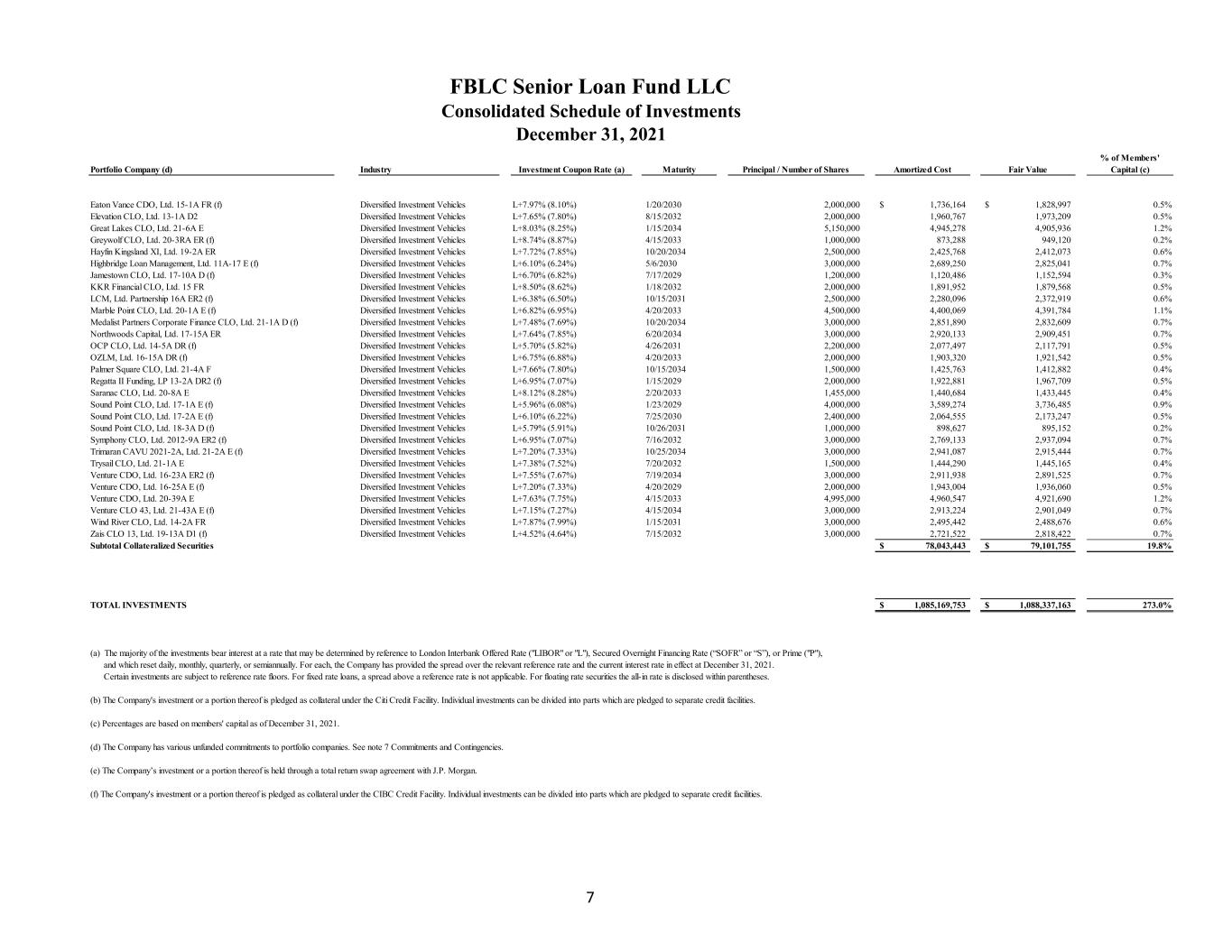

FBLC Senior Loan Fund LLC Consolidated Schedule of Investments December 31, 2021 7 Portfolio Company (d) Industry Investment Coupon Rate (a) Maturity Principal / Number of Shares Amortized Cost Fair Value % of Members' Capital (c) Eaton Vance CDO, Ltd. 15-1A FR (f) Diversified Investment Vehicles L+7.97% (8.10%) 1/20/2030 2,000,000 1,736,164$ 1,828,997$ 0.5% Elevation CLO, Ltd. 13-1A D2 Diversified Investment Vehicles L+7.65% (7.80%) 8/15/2032 2,000,000 1,960,767 1,973,209 0.5% Great Lakes CLO, Ltd. 21-6A E Diversified Investment Vehicles L+8.03% (8.25%) 1/15/2034 5,150,000 4,945,278 4,905,936 1.2% Greywolf CLO, Ltd. 20-3RA ER (f) Diversified Investment Vehicles L+8.74% (8.87%) 4/15/2033 1,000,000 873,288 949,120 0.2% Hayfin Kingsland XI, Ltd. 19-2A ER Diversified Investment Vehicles L+7.72% (7.85%) 10/20/2034 2,500,000 2,425,768 2,412,073 0.6% Highbridge Loan Management, Ltd. 11A-17 E (f) Diversified Investment Vehicles L+6.10% (6.24%) 5/6/2030 3,000,000 2,689,250 2,825,041 0.7% Jamestown CLO, Ltd. 17-10A D (f) Diversified Investment Vehicles L+6.70% (6.82%) 7/17/2029 1,200,000 1,120,486 1,152,594 0.3% KKR Financial CLO, Ltd. 15 FR Diversified Investment Vehicles L+8.50% (8.62%) 1/18/2032 2,000,000 1,891,952 1,879,568 0.5% LCM, Ltd. Partnership 16A ER2 (f) Diversified Investment Vehicles L+6.38% (6.50%) 10/15/2031 2,500,000 2,280,096 2,372,919 0.6% Marble Point CLO, Ltd. 20-1A E (f) Diversified Investment Vehicles L+6.82% (6.95%) 4/20/2033 4,500,000 4,400,069 4,391,784 1.1% Medalist Partners Corporate Finance CLO, Ltd. 21-1A D (f) Diversified Investment Vehicles L+7.48% (7.69%) 10/20/2034 3,000,000 2,851,890 2,832,609 0.7% Northwoods Capital, Ltd. 17-15A ER Diversified Investment Vehicles L+7.64% (7.85%) 6/20/2034 3,000,000 2,920,133 2,909,451 0.7% OCP CLO, Ltd. 14-5A DR (f) Diversified Investment Vehicles L+5.70% (5.82%) 4/26/2031 2,200,000 2,077,497 2,117,791 0.5% OZLM, Ltd. 16-15A DR (f) Diversified Investment Vehicles L+6.75% (6.88%) 4/20/2033 2,000,000 1,903,320 1,921,542 0.5% Palmer Square CLO, Ltd. 21-4A F Diversified Investment Vehicles L+7.66% (7.80%) 10/15/2034 1,500,000 1,425,763 1,412,882 0.4% Regatta II Funding, LP 13-2A DR2 (f) Diversified Investment Vehicles L+6.95% (7.07%) 1/15/2029 2,000,000 1,922,881 1,967,709 0.5% Saranac CLO, Ltd. 20-8A E Diversified Investment Vehicles L+8.12% (8.28%) 2/20/2033 1,455,000 1,440,684 1,433,445 0.4% Sound Point CLO, Ltd. 17-1A E (f) Diversified Investment Vehicles L+5.96% (6.08%) 1/23/2029 4,000,000 3,589,274 3,736,485 0.9% Sound Point CLO, Ltd. 17-2A E (f) Diversified Investment Vehicles L+6.10% (6.22%) 7/25/2030 2,400,000 2,064,555 2,173,247 0.5% Sound Point CLO, Ltd. 18-3A D (f) Diversified Investment Vehicles L+5.79% (5.91%) 10/26/2031 1,000,000 898,627 895,152 0.2% Symphony CLO, Ltd. 2012-9A ER2 (f) Diversified Investment Vehicles L+6.95% (7.07%) 7/16/2032 3,000,000 2,769,133 2,937,094 0.7% Trimaran CAVU 2021-2A, Ltd. 21-2A E (f) Diversified Investment Vehicles L+7.20% (7.33%) 10/25/2034 3,000,000 2,941,087 2,915,444 0.7% Trysail CLO, Ltd. 21-1A E Diversified Investment Vehicles L+7.38% (7.52%) 7/20/2032 1,500,000 1,444,290 1,445,165 0.4% Venture CDO, Ltd. 16-23A ER2 (f) Diversified Investment Vehicles L+7.55% (7.67%) 7/19/2034 3,000,000 2,911,938 2,891,525 0.7% Venture CDO, Ltd. 16-25A E (f) Diversified Investment Vehicles L+7.20% (7.33%) 4/20/2029 2,000,000 1,943,004 1,936,060 0.5% Venture CDO, Ltd. 20-39A E Diversified Investment Vehicles L+7.63% (7.75%) 4/15/2033 4,995,000 4,960,547 4,921,690 1.2% Venture CLO 43, Ltd. 21-43A E (f) Diversified Investment Vehicles L+7.15% (7.27%) 4/15/2034 3,000,000 2,913,224 2,901,049 0.7% Wind River CLO, Ltd. 14-2A FR Diversified Investment Vehicles L+7.87% (7.99%) 1/15/2031 3,000,000 2,495,442 2,488,676 0.6% Zais CLO 13, Ltd. 19-13A D1 (f) Diversified Investment Vehicles L+4.52% (4.64%) 7/15/2032 3,000,000 2,721,522 2,818,422 0.7% Subtotal Collateralized Securities 78,043,443$ 79,101,755$ 19.8% TOTAL INVESTMENTS 1,085,169,753$ 1,088,337,163$ 273.0% (a) The majority of the investments bear interest at a rate that may be determined by reference to London Interbank Offered Rate ("LIBOR" or "L"), Secured Overnight Financing Rate (“SOFR” or “S”), or Prime ("P"), and which reset daily, monthly, quarterly, or semiannually. For each, the Company has provided the spread over the relevant reference rate and the current interest rate in effect at December 31, 2021. Certain investments are subject to reference rate floors. For fixed rate loans, a spread above a reference rate is not applicable. For floating rate securities the all-in rate is disclosed within parentheses. (b) The Company's investment or a portion thereof is pledged as collateral under the Citi Credit Facility. Individual investments can be divided into parts which are pledged to separate credit facilities. (c) Percentages are based on members' capital as of December 31, 2021. (d) The Company has various unfunded commitments to portfolio companies. See note 7 Commitments and Contingencies. (e) The Company’s investment or a portion thereof is held through a total return swap agreement with J.P. Morgan. (f) The Company's investment or a portion thereof is pledged as collateral under the CIBC Credit Facility. Individual investments can be divided into parts which are pledged to separate credit facilities.

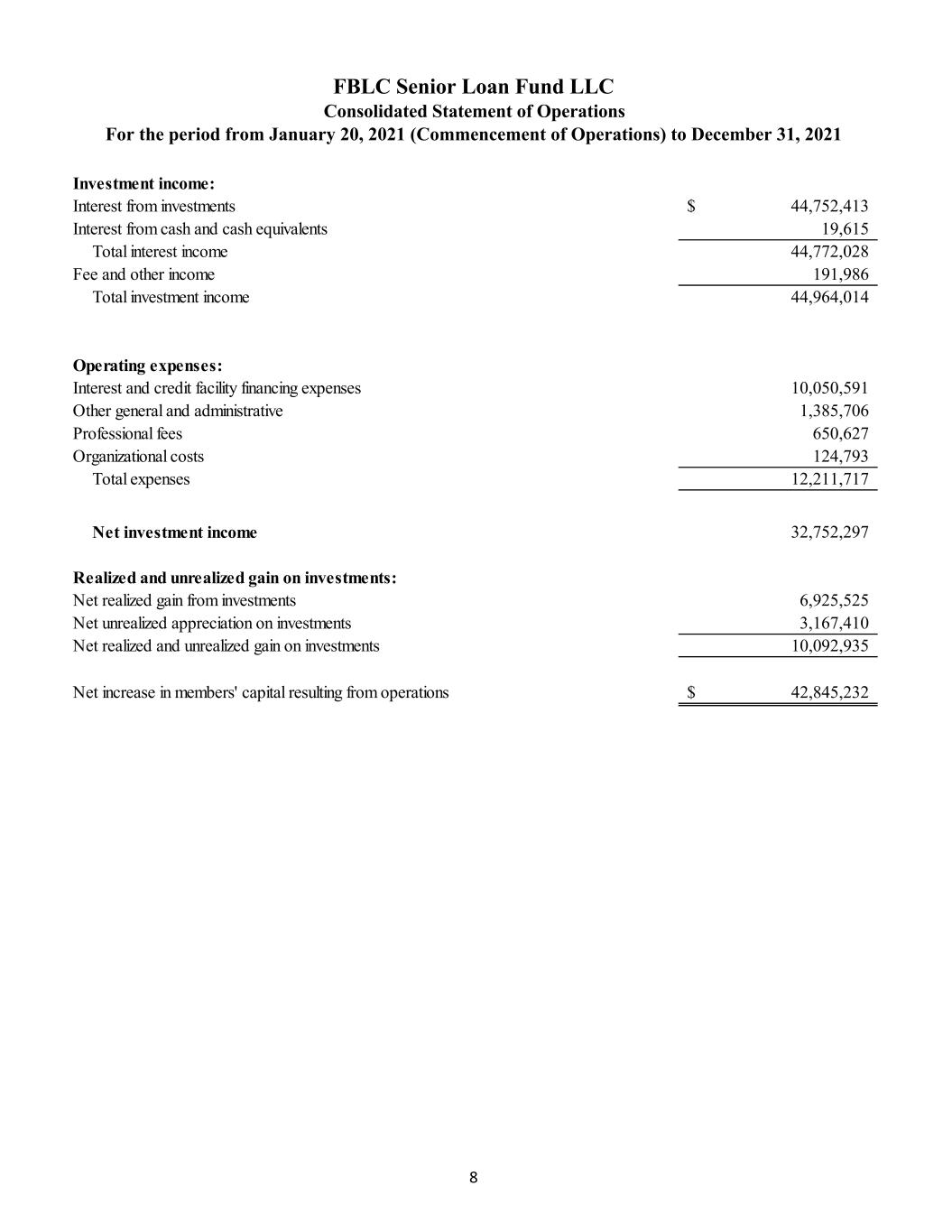

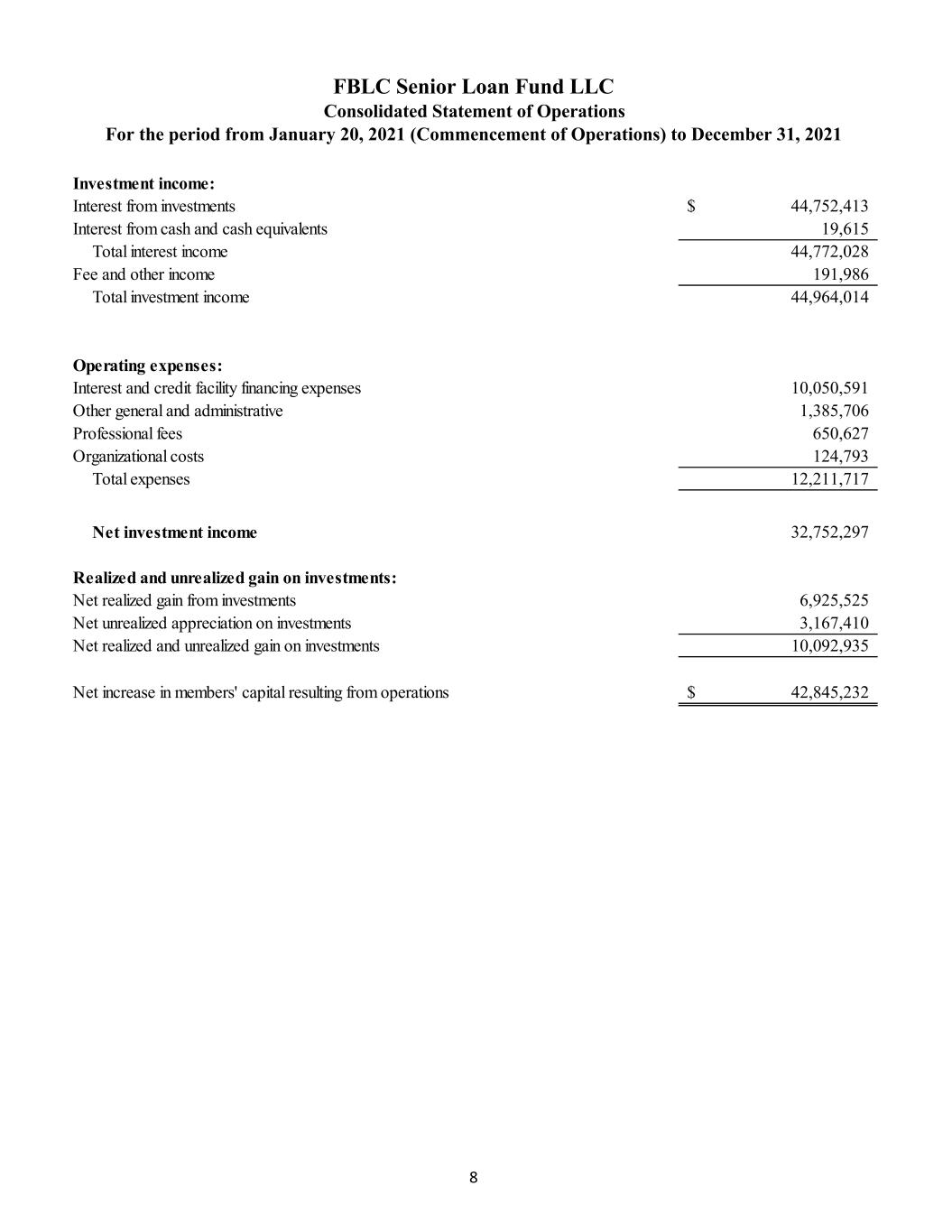

FBLC Senior Loan Fund LLC Consolidated Statement of Operations For the period from January 20, 2021 (Commencement of Operations) to December 31, 2021 8 Investment income: Interest from investments 44,752,413$ Interest from cash and cash equivalents 19,615 Total interest income 44,772,028 Fee and other income 191,986 Total investment income 44,964,014 Operating expenses: Interest and credit facility financing expenses 10,050,591 Other general and administrative 1,385,706 Professional fees 650,627 Organizational costs 124,793 Total expenses 12,211,717 Net investment income 32,752,297 Realized and unrealized gain on investments: Net realized gain from investments 6,925,525 Net unrealized appreciation on investments 3,167,410 Net realized and unrealized gain on investments 10,092,935 Net increase in members' capital resulting from operations 42,845,232$

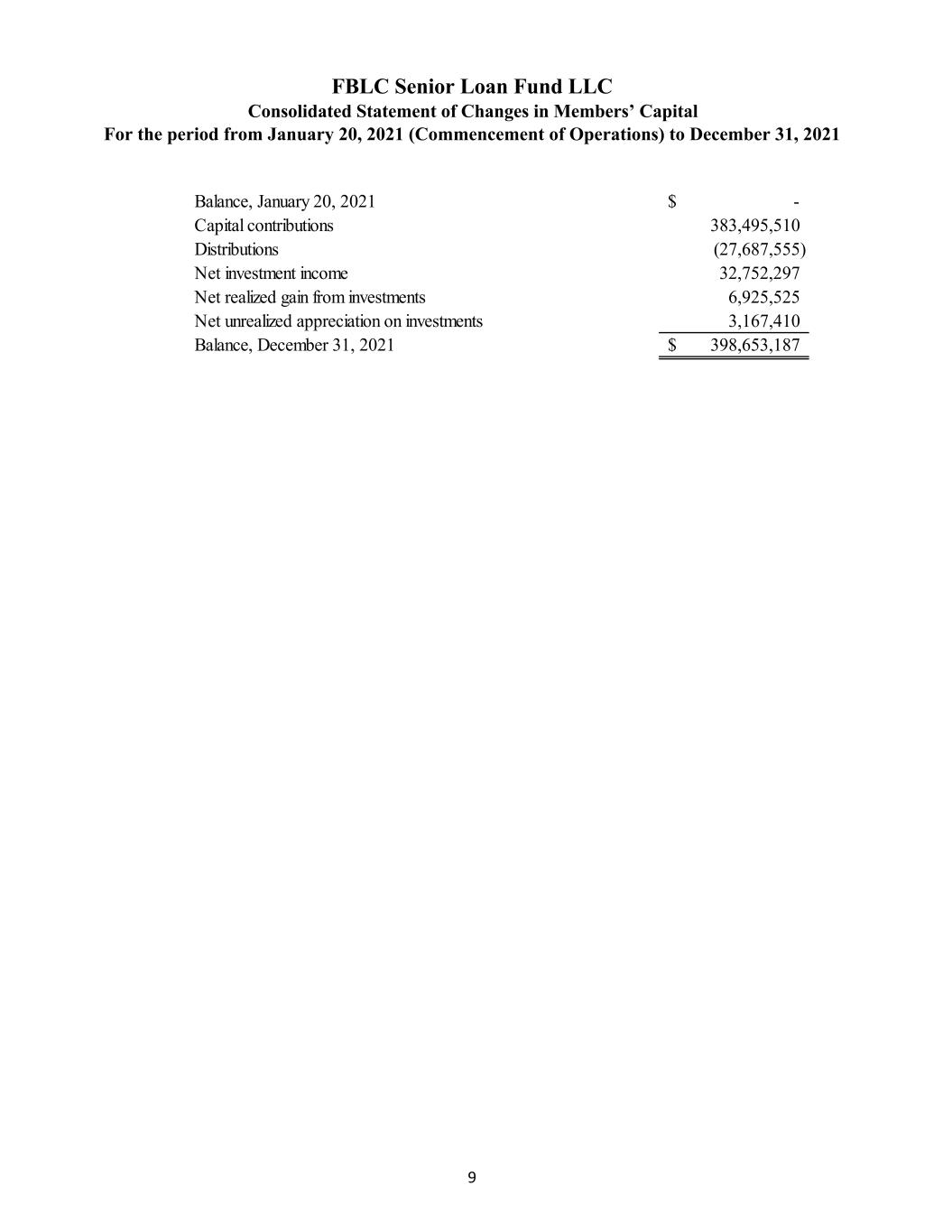

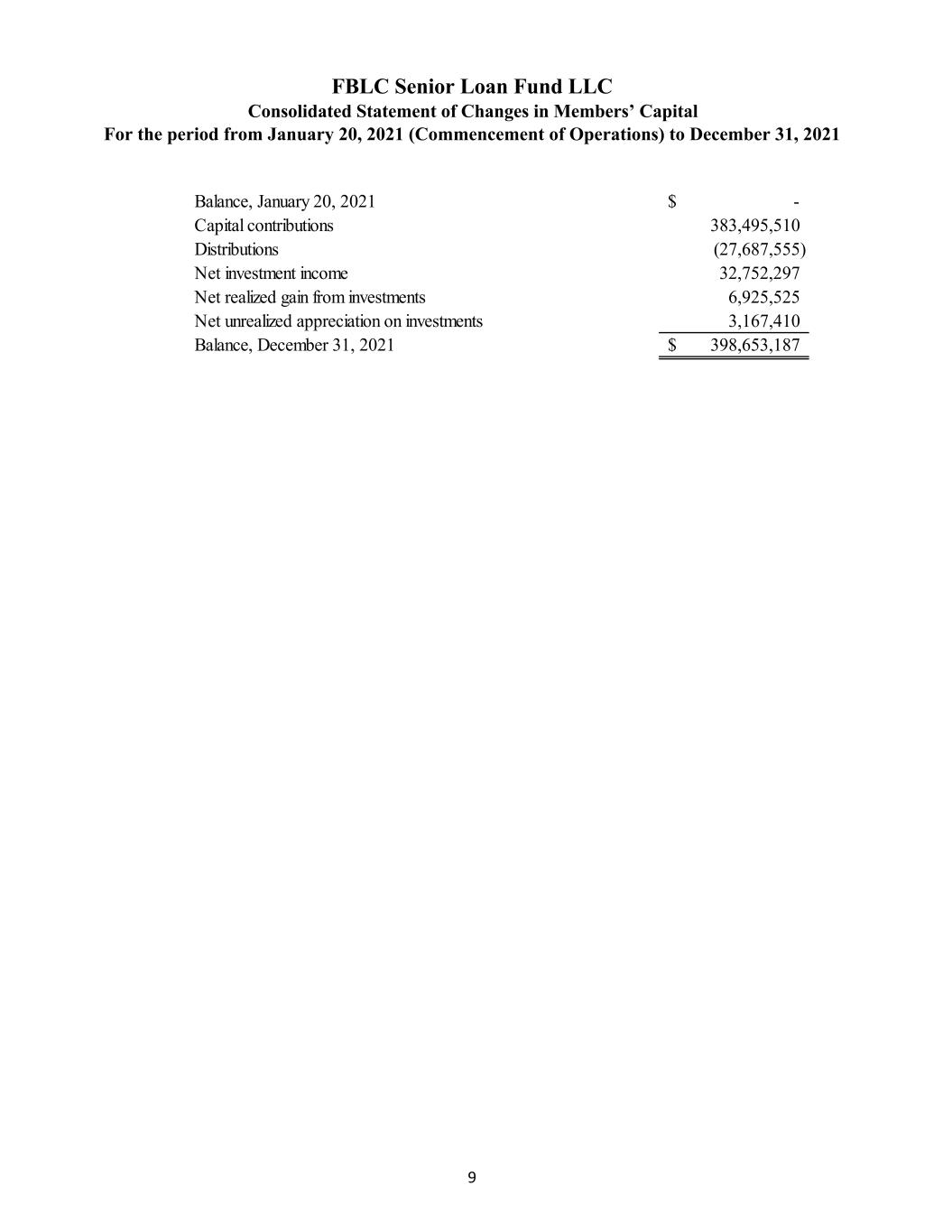

FBLC Senior Loan Fund LLC Consolidated Statement of Changes in Members’ Capital For the period from January 20, 2021 (Commencement of Operations) to December 31, 2021 9 Balance, January 20, 2021 -$ Capital contributions 383,495,510 Distributions (27,687,555) Net investment income 32,752,297 Net realized gain from investments 6,925,525 Net unrealized appreciation on investments 3,167,410 Balance, December 31, 2021 398,653,187$

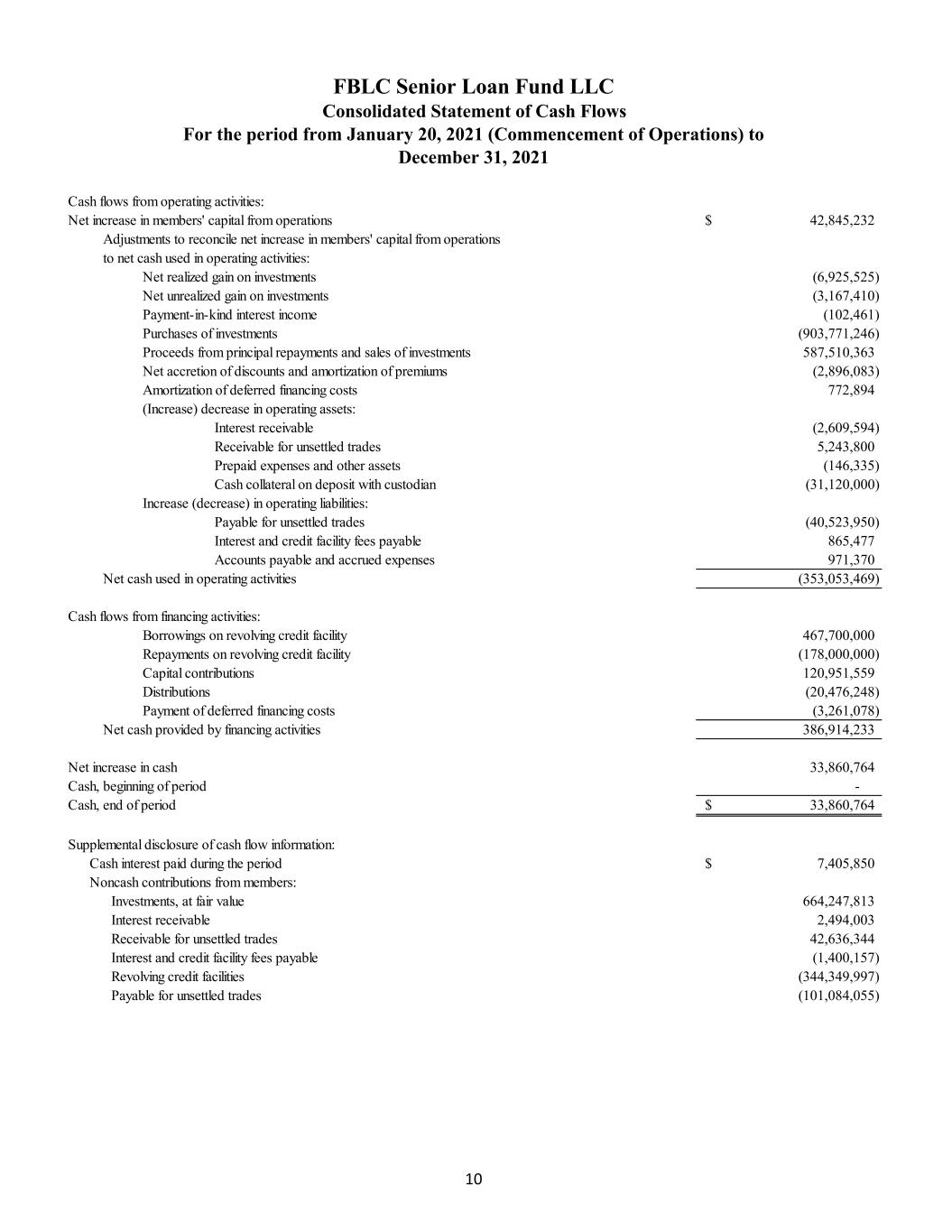

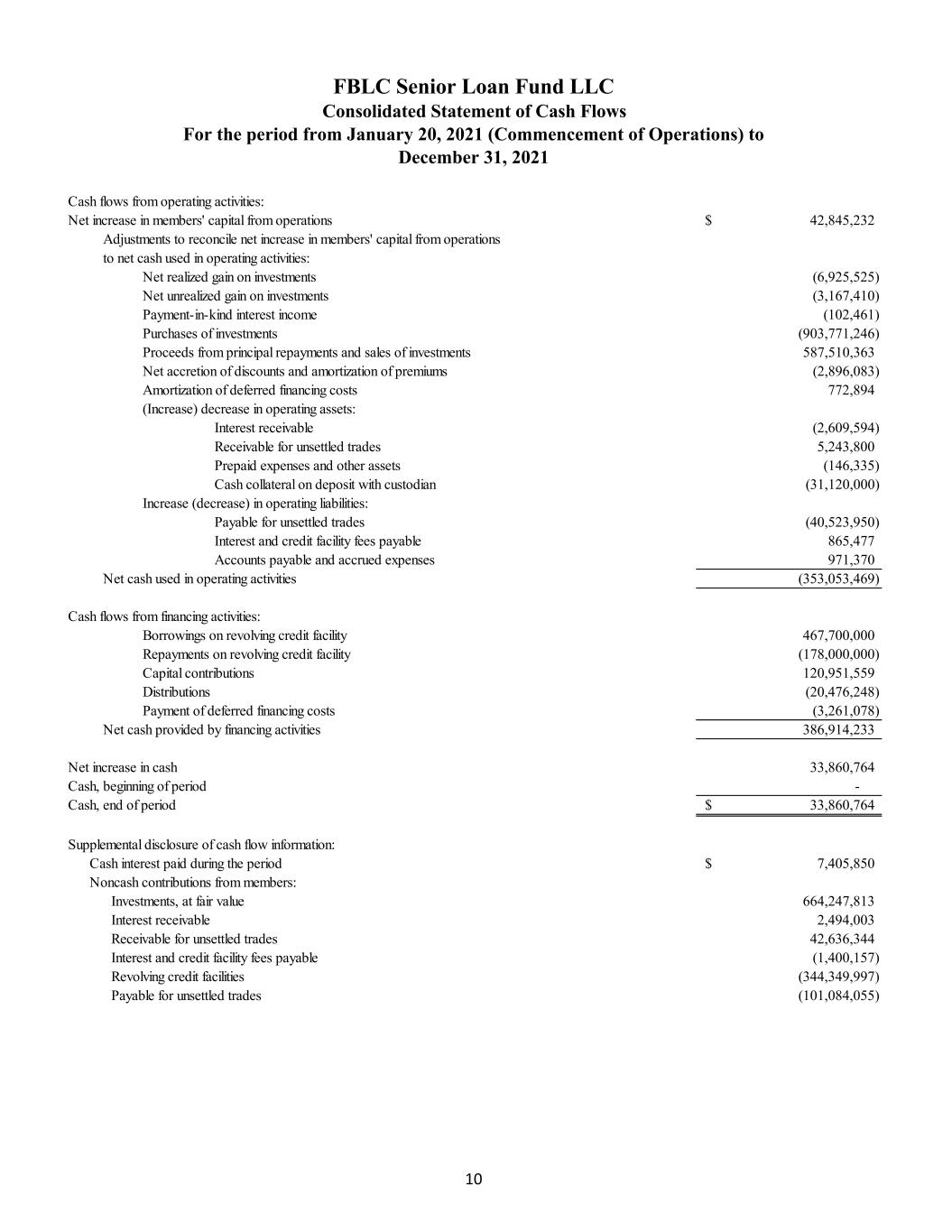

FBLC Senior Loan Fund LLC Consolidated Statement of Cash Flows For the period from January 20, 2021 (Commencement of Operations) to December 31, 2021 10 Cash flows from operating activities: Net increase in members' capital from operations 42,845,232$ Adjustments to reconcile net increase in members' capital from operations to net cash used in operating activities: Net realized gain on investments (6,925,525) Net unrealized gain on investments (3,167,410) Payment-in-kind interest income (102,461) Purchases of investments (903,771,246) Proceeds from principal repayments and sales of investments 587,510,363 Net accretion of discounts and amortization of premiums (2,896,083) Amortization of deferred financing costs 772,894 (Increase) decrease in operating assets: Interest receivable (2,609,594) Receivable for unsettled trades 5,243,800 Prepaid expenses and other assets (146,335) Cash collateral on deposit with custodian (31,120,000) Increase (decrease) in operating liabilities: Payable for unsettled trades (40,523,950) Interest and credit facility fees payable 865,477 Accounts payable and accrued expenses 971,370 Net cash used in operating activities (353,053,469) Cash flows from financing activities: Borrowings on revolving credit facility 467,700,000 Repayments on revolving credit facility (178,000,000) Capital contributions 120,951,559 Distributions (20,476,248) Payment of deferred financing costs (3,261,078) Net cash provided by financing activities 386,914,233 Net increase in cash 33,860,764 Cash, beginning of period - Cash, end of period 33,860,764$ Supplemental disclosure of cash flow information: Cash interest paid during the period 7,405,850$ Noncash contributions from members: Investments, at fair value 664,247,813 Interest receivable 2,494,003 Receivable for unsettled trades 42,636,344 Interest and credit facility fees payable (1,400,157) Revolving credit facilities (344,349,997) Payable for unsettled trades (101,084,055)

FBLC Senior Loan Fund LLC Notes to Consolidated Financial Statements For the period from January 20, 2021 (Commencement of Operations) to December 31, 2021 11 Note 1. Organization BDCA Senior Loan Fund LLC, (the “Company”), a Delaware limited liability company, was formed on December 7, 2020, under and pursuant to the Limited Liability Company Act of the State of Delaware (the “Act”) upon the filing of the Certificate of Formation in the office of the Secretary of State of the State of Delaware. Effective January 24, 2022, the name of the Company was changed from BDCA Senior Loan Fund LLC to FBLC Senior Loan Fund LLC. Pursuant to the Company’s Limited Liability Company Agreement (the “Agreement”), the purpose and business of the Company shall be (i) to make investments, either directly or indirectly through subsidiaries or other persons, in portfolio companies primarily through senior secured loans, and to a lesser extent, mezzanine loans, unsecured loans, bonds and equity of predominantly private U.S. middle-market companies, including broadly syndicated loans, and (ii) to engage in any other lawful acts or activities as the Company’s board of managers (the “Board”) deems reasonably necessary or advisable for which limited liability companies may be organized under the Act. The Company’s members are Franklin BSP Lending Corporation (“FBLC”) and Cliffwater Corporate Lending Fund (“CCLF”, collectively the “Members”). FBLC and CCLF each appoint two members to the four‐person Board. All material decisions with respect to the Company, including those involving its investment portfolio, require unanimous approval of a quorum of the Board. Quorum is defined as (i) the presence of two members of the Board; provided that at least one individual is present that was elected, designated or appointed by each member; (ii) the presence of three members of the Board; provided that the individual that was elected, designated or appointed by the member with only one individual present shall be entitled to cast two votes on each matter; and (iii) the presence of four members of the Board; provided that two individuals are present that were elected, designated or appointed by each member. On January 20, 2021, the Company entered into an Administrative and Loan Servicing Agreement (the “Administrative Agreement”) with Benefit Street Partners, LLC, a Delaware limited liability company (the “Administrator”), to perform certain duties as described in the Administrative Agreement. The Company has the ability to organize, acquire, transfer, or otherwise dispose of interests in subsidiaries or alternative investment vehicles. The Company utilizes two subsidiaries: BDCA-CB Funding, LLC (“CB Funding”), a Delaware limited liability company, and BDCA SLF Funding LLC (“SLF Funding”), a Delaware limited liability company (collectively, the “Subsidiaries”). The Company accepted its first capital commitments and commenced operations on January 20, 2021. As part of its initial contribution to the Company, FBLC contributed $751.8 million of assets including $664.2 million of investments and $42.4 million of cash as well as $446.9 million worth of liabilities including the Citi Revolving Credit Facility (as defined below) debt of $344.4 million in exchange for $304.9 million of equity in the Company. Note 2. Significant Accounting Policies Basis of presentation: The consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) as detailed in the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”). The Company qualifies as an investment company, as defined in FASB ASC Topic 946, Financial Services — Investment Companies (“ASC Topic 946”), and therefore is applying specialized accounting and reporting guidance in ASC Topic 946. Use of estimates: The preparation of the consolidated financial statements in conformity with GAAP requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Valuation of investments: The Company applies fair value to its investments in accordance with ASC Topic 820 — Fair Value Measurements and Disclosure (“ASC Topic 820”). ASC Topic 820 defines fair value, establishes a framework used to measure fair value and requires disclosures for fair value measurements, including the categorization of financial instruments into a three- level hierarchy based on the transparency of valuation inputs. See Note 3 for further discussion regarding the Company’s fair value measurements and hierarchy.

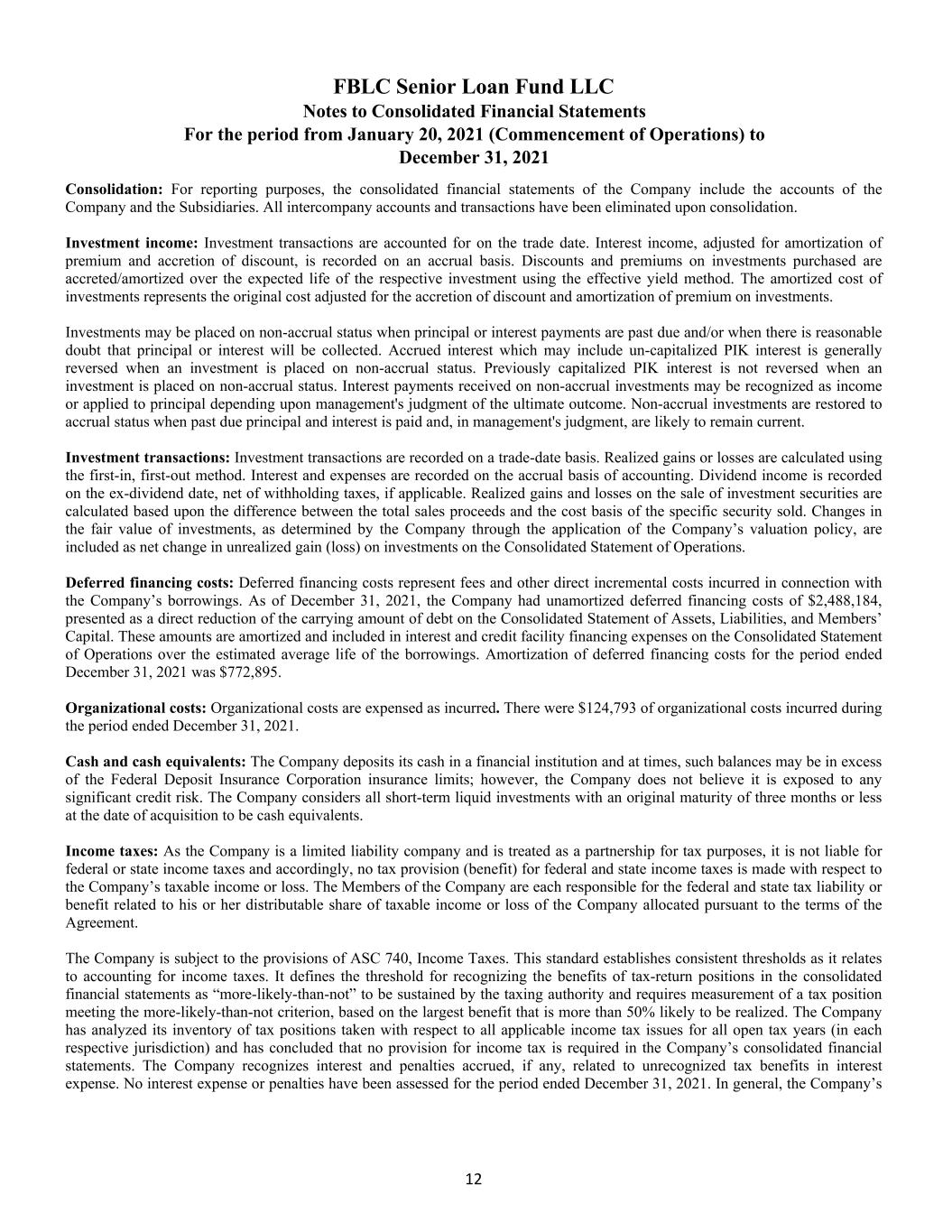

FBLC Senior Loan Fund LLC Notes to Consolidated Financial Statements For the period from January 20, 2021 (Commencement of Operations) to December 31, 2021 12 Consolidation: For reporting purposes, the consolidated financial statements of the Company include the accounts of the Company and the Subsidiaries. All intercompany accounts and transactions have been eliminated upon consolidation. Investment income: Investment transactions are accounted for on the trade date. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on an accrual basis. Discounts and premiums on investments purchased are accreted/amortized over the expected life of the respective investment using the effective yield method. The amortized cost of investments represents the original cost adjusted for the accretion of discount and amortization of premium on investments. Investments may be placed on non-accrual status when principal or interest payments are past due and/or when there is reasonable doubt that principal or interest will be collected. Accrued interest which may include un-capitalized PIK interest is generally reversed when an investment is placed on non-accrual status. Previously capitalized PIK interest is not reversed when an investment is placed on non-accrual status. Interest payments received on non-accrual investments may be recognized as income or applied to principal depending upon management's judgment of the ultimate outcome. Non-accrual investments are restored to accrual status when past due principal and interest is paid and, in management's judgment, are likely to remain current. Investment transactions: Investment transactions are recorded on a trade-date basis. Realized gains or losses are calculated using the first-in, first-out method. Interest and expenses are recorded on the accrual basis of accounting. Dividend income is recorded on the ex-dividend date, net of withholding taxes, if applicable. Realized gains and losses on the sale of investment securities are calculated based upon the difference between the total sales proceeds and the cost basis of the specific security sold. Changes in the fair value of investments, as determined by the Company through the application of the Company’s valuation policy, are included as net change in unrealized gain (loss) on investments on the Consolidated Statement of Operations. Deferred financing costs: Deferred financing costs represent fees and other direct incremental costs incurred in connection with the Company’s borrowings. As of December 31, 2021, the Company had unamortized deferred financing costs of $2,488,184, presented as a direct reduction of the carrying amount of debt on the Consolidated Statement of Assets, Liabilities, and Members’ Capital. These amounts are amortized and included in interest and credit facility financing expenses on the Consolidated Statement of Operations over the estimated average life of the borrowings. Amortization of deferred financing costs for the period ended December 31, 2021 was $772,895. Organizational costs: Organizational costs are expensed as incurred. There were $124,793 of organizational costs incurred during the period ended December 31, 2021. Cash and cash equivalents: The Company deposits its cash in a financial institution and at times, such balances may be in excess of the Federal Deposit Insurance Corporation insurance limits; however, the Company does not believe it is exposed to any significant credit risk. The Company considers all short-term liquid investments with an original maturity of three months or less at the date of acquisition to be cash equivalents. Income taxes: As the Company is a limited liability company and is treated as a partnership for tax purposes, it is not liable for federal or state income taxes and accordingly, no tax provision (benefit) for federal and state income taxes is made with respect to the Company’s taxable income or loss. The Members of the Company are each responsible for the federal and state tax liability or benefit related to his or her distributable share of taxable income or loss of the Company allocated pursuant to the terms of the Agreement. The Company is subject to the provisions of ASC 740, Income Taxes. This standard establishes consistent thresholds as it relates to accounting for income taxes. It defines the threshold for recognizing the benefits of tax-return positions in the consolidated financial statements as “more-likely-than-not” to be sustained by the taxing authority and requires measurement of a tax position meeting the more-likely-than-not criterion, based on the largest benefit that is more than 50% likely to be realized. The Company has analyzed its inventory of tax positions taken with respect to all applicable income tax issues for all open tax years (in each respective jurisdiction) and has concluded that no provision for income tax is required in the Company’s consolidated financial statements. The Company recognizes interest and penalties accrued, if any, related to unrecognized tax benefits in interest expense. No interest expense or penalties have been assessed for the period ended December 31, 2021. In general, the Company’s

FBLC Senior Loan Fund LLC Notes to Consolidated Financial Statements For the period from January 20, 2021 (Commencement of Operations) to December 31, 2021 13 tax positions for open tax years remain subject to examination by the tax authorities in the jurisdictions in which the Company operates. Recent accounting pronouncements: In March 2020, the FASB issued ASU 2021-04, Reference Rate Reform (“ASU 2021-04”). The amendments in ASU 2021-04 provide optional expedients and exceptions for applying GAAP to contracts, hedging relationships, and other transactions affected by reference rate reform if certain criteria are met. The standard is effective as of March 12, 2020 through December 31, 2022. The Company is currently evaluating the impact of the optional guidance on the Company’s consolidated financial statements and disclosures. The Company did not utilize the optional expedients and exceptions provided by ASU 2021-04 during the period ended December 31, 2021. Impact of COVID-19 Pandemic: The COVID-19 pandemic has resulted in governments around the world implementing a broad suite of measures to help control the spread of the virus, including quarantines, travel restrictions and business curtailments and others. The emergence of COVID-19 has created economic and financial disruptions that during the year adversely affected, and may continue to affect, our business, financial condition, liquidity and certain of our portfolio companies’ results of operations and liquidity. The extent to which the COVID-19 pandemic will continue to affect our business, financial condition, liquidity and certain of our portfolio companies’ results of operations and liquidity will depend on future developments, which are highly uncertain and cannot be predicted. Given the unprecedented nature of the COVID-19 exigency and the fiscal and monetary response designed to mitigate strain to businesses and the economy, the operating environment of certain of our portfolio companies is evolving rapidly. We have been in frequent communication with management, as well as the private equity sponsors, of our portfolio companies in order to understand the impact of the COVID-19 pandemic on their particular businesses and assess their ability to meet their obligations. As a result of the business disruptions affecting certain of our portfolio companies, we may be required to reduce the future amount of distributions to our members. We continue to closely monitor our investment portfolio in order to be positioned to respond appropriately. Note 3. Fair Value of Financial Instruments The Company values all investments in accordance with ASC Topic 820. ASC Topic 820 requires disclosures about assets and liabilities that are measured and reported at fair value. As defined in ASC Topic 820, fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Where available, fair value is based on observable market prices or parameters or derived from such prices or parameters. Where observable prices or inputs are not available, valuation models are applied. These valuation models involve some level of management estimation and judgment, the degree of which is dependent on the price transparency for the assets or liabilities and the assets’ or liabilities’ complexity. ASC Topic 820 establishes a hierarchal disclosure framework which prioritizes and ranks the level of market price observability of inputs used in measuring investments at fair value. Market price observability is affected by a number of factors, including the type of investment and the characteristics specific to the investment. Investments with readily available active quoted prices or for which fair value can be measured from actively quoted prices generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value. Based on the observability of the inputs used in the valuation techniques, the Company is required to provide disclosures on fair value measurements according to the fair value hierarchy. The fair value hierarchy ranks the observability of the inputs used to determine fair values. Investments carried at fair value are classified and disclosed in one of the following three categories: • Level 1 — Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities at the measurement date. • Level 2 — Valuations based on inputs other than quoted prices in active markets, including quoted prices for similar assets or liabilities, which are either directly or indirectly observable.

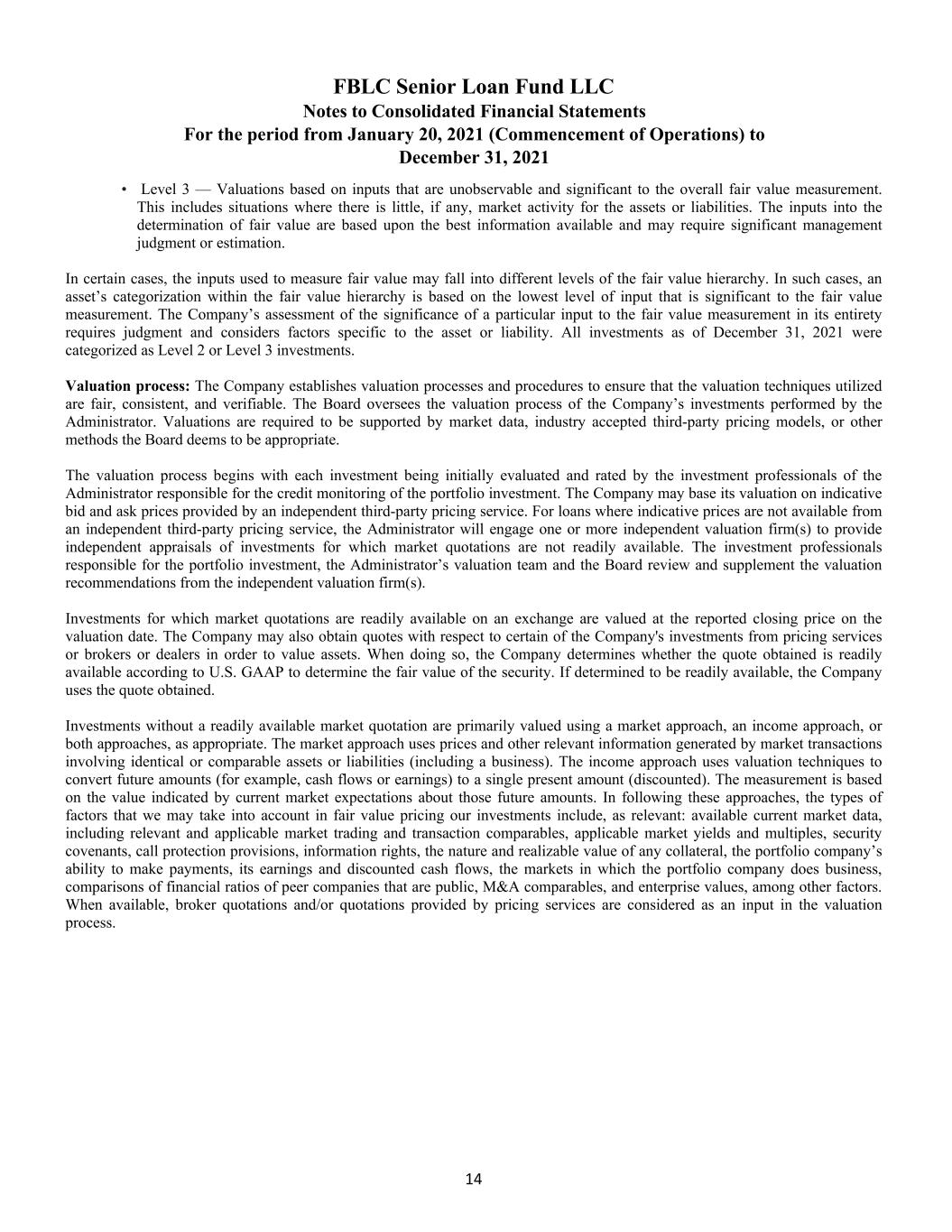

FBLC Senior Loan Fund LLC Notes to Consolidated Financial Statements For the period from January 20, 2021 (Commencement of Operations) to December 31, 2021 14 • Level 3 — Valuations based on inputs that are unobservable and significant to the overall fair value measurement. This includes situations where there is little, if any, market activity for the assets or liabilities. The inputs into the determination of fair value are based upon the best information available and may require significant management judgment or estimation. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an asset’s categorization within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the asset or liability. All investments as of December 31, 2021 were categorized as Level 2 or Level 3 investments. Valuation process: The Company establishes valuation processes and procedures to ensure that the valuation techniques utilized are fair, consistent, and verifiable. The Board oversees the valuation process of the Company’s investments performed by the Administrator. Valuations are required to be supported by market data, industry accepted third-party pricing models, or other methods the Board deems to be appropriate. The valuation process begins with each investment being initially evaluated and rated by the investment professionals of the Administrator responsible for the credit monitoring of the portfolio investment. The Company may base its valuation on indicative bid and ask prices provided by an independent third-party pricing service. For loans where indicative prices are not available from an independent third-party pricing service, the Administrator will engage one or more independent valuation firm(s) to provide independent appraisals of investments for which market quotations are not readily available. The investment professionals responsible for the portfolio investment, the Administrator’s valuation team and the Board review and supplement the valuation recommendations from the independent valuation firm(s). Investments for which market quotations are readily available on an exchange are valued at the reported closing price on the valuation date. The Company may also obtain quotes with respect to certain of the Company's investments from pricing services or brokers or dealers in order to value assets. When doing so, the Company determines whether the quote obtained is readily available according to U.S. GAAP to determine the fair value of the security. If determined to be readily available, the Company uses the quote obtained. Investments without a readily available market quotation are primarily valued using a market approach, an income approach, or both approaches, as appropriate. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities (including a business). The income approach uses valuation techniques to convert future amounts (for example, cash flows or earnings) to a single present amount (discounted). The measurement is based on the value indicated by current market expectations about those future amounts. In following these approaches, the types of factors that we may take into account in fair value pricing our investments include, as relevant: available current market data, including relevant and applicable market trading and transaction comparables, applicable market yields and multiples, security covenants, call protection provisions, information rights, the nature and realizable value of any collateral, the portfolio company’s ability to make payments, its earnings and discounted cash flows, the markets in which the portfolio company does business, comparisons of financial ratios of peer companies that are public, M&A comparables, and enterprise values, among other factors. When available, broker quotations and/or quotations provided by pricing services are considered as an input in the valuation process.

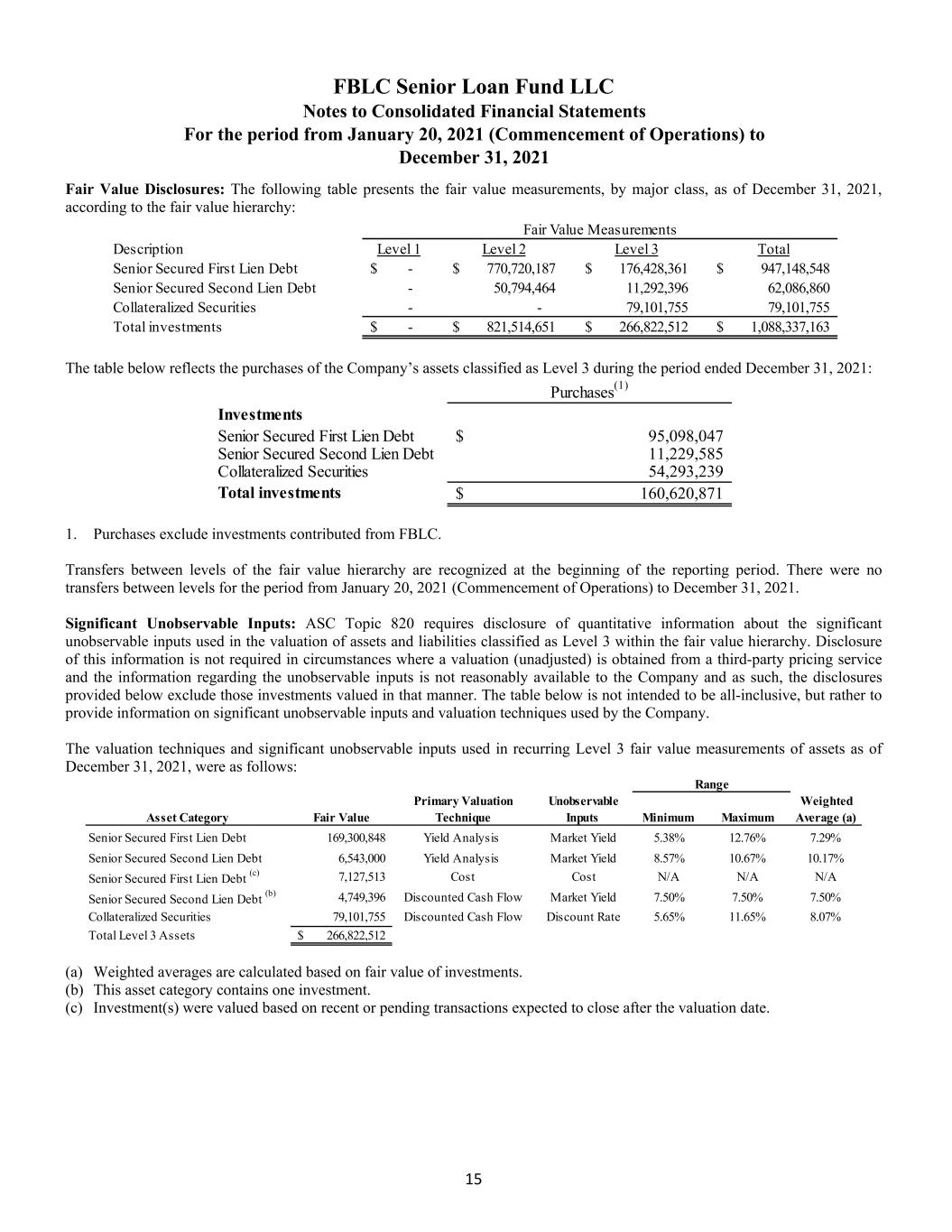

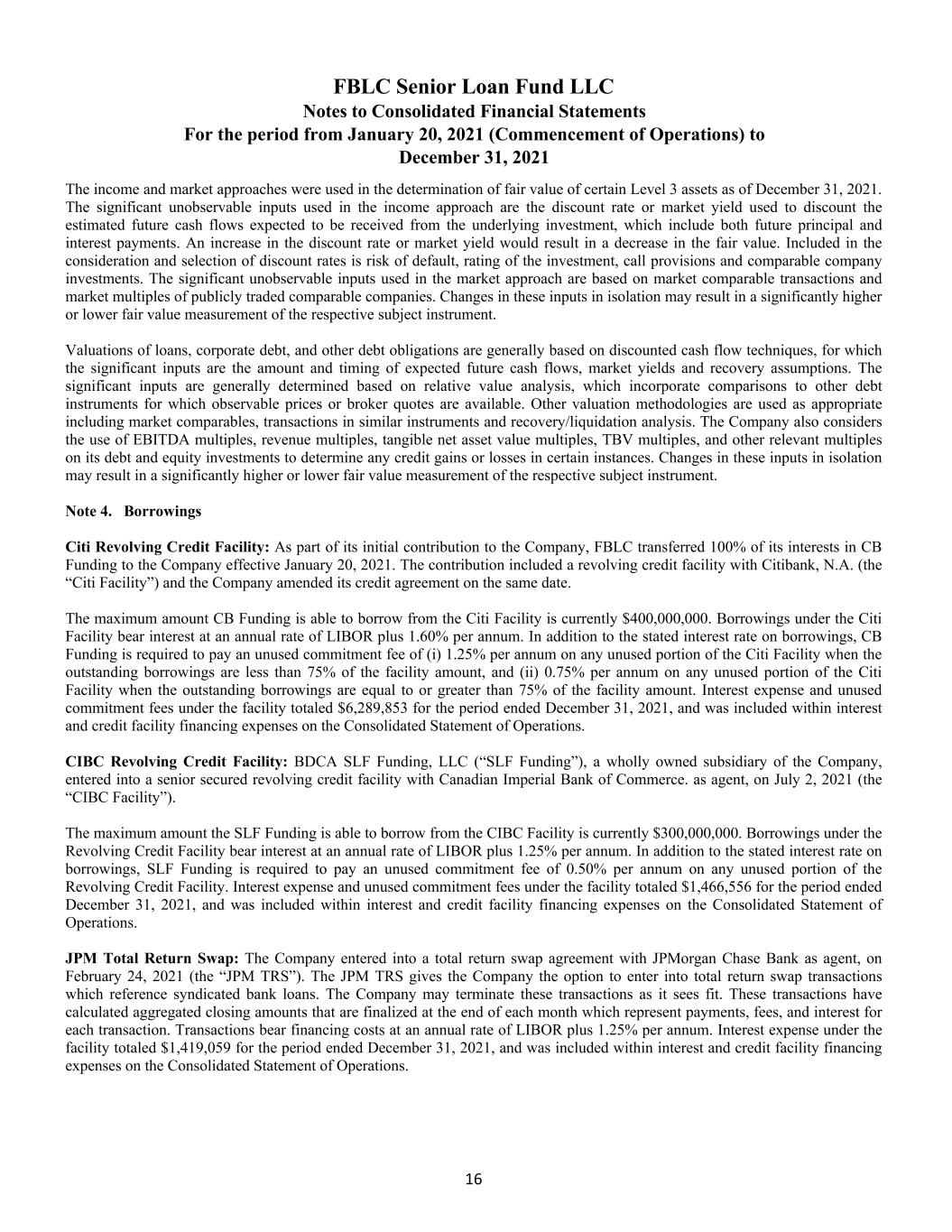

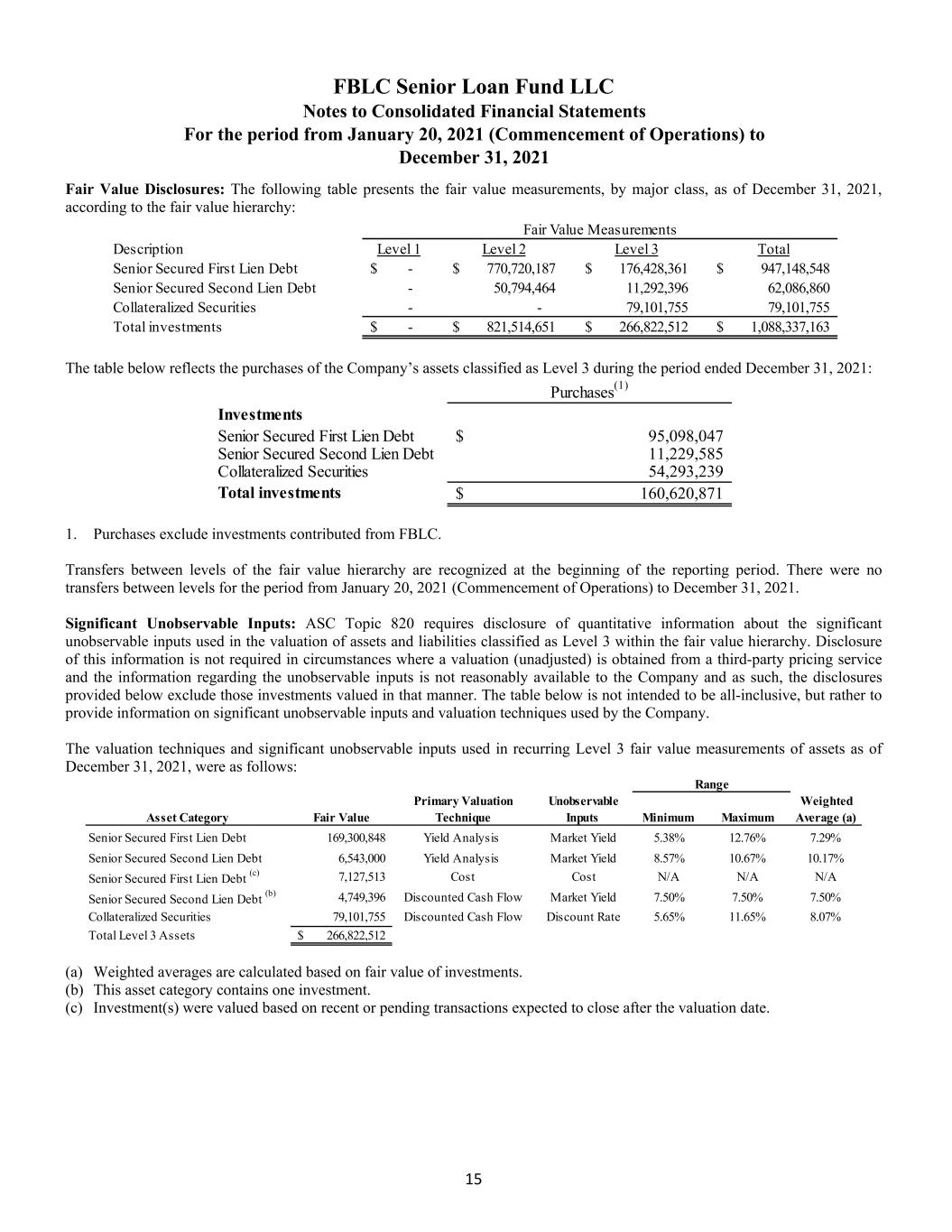

FBLC Senior Loan Fund LLC Notes to Consolidated Financial Statements For the period from January 20, 2021 (Commencement of Operations) to December 31, 2021 15 Fair Value Disclosures: The following table presents the fair value measurements, by major class, as of December 31, 2021, according to the fair value hierarchy: The table below reflects the purchases of the Company’s assets classified as Level 3 during the period ended December 31, 2021: 1. Purchases exclude investments contributed from FBLC. Transfers between levels of the fair value hierarchy are recognized at the beginning of the reporting period. There were no transfers between levels for the period from January 20, 2021 (Commencement of Operations) to December 31, 2021. Significant Unobservable Inputs: ASC Topic 820 requires disclosure of quantitative information about the significant unobservable inputs used in the valuation of assets and liabilities classified as Level 3 within the fair value hierarchy. Disclosure of this information is not required in circumstances where a valuation (unadjusted) is obtained from a third-party pricing service and the information regarding the unobservable inputs is not reasonably available to the Company and as such, the disclosures provided below exclude those investments valued in that manner. The table below is not intended to be all-inclusive, but rather to provide information on significant unobservable inputs and valuation techniques used by the Company. The valuation techniques and significant unobservable inputs used in recurring Level 3 fair value measurements of assets as of December 31, 2021, were as follows: (a) Weighted averages are calculated based on fair value of investments. (b) This asset category contains one investment. (c) Investment(s) were valued based on recent or pending transactions expected to close after the valuation date. Description Level 1 Level 2 Level 3 Total Senior Secured First Lien Debt -$ 770,720,187$ 176,428,361$ 947,148,548$ Senior Secured Second Lien Debt - 50,794,464 11,292,396 62,086,860 Collateralized Securities - - 79,101,755 79,101,755 Total investments -$ 821,514,651$ 266,822,512$ 1,088,337,163$ Fair Value Measurements Purchases(1) Investments Senior Secured First Lien Debt 95,098,047$ Senior Secured Second Lien Debt 11,229,585 Collateralized Securities 54,293,239 Total investments 160,620,871$ Primary Valuation Unobservable Weighted Asset Category Fair Value Technique Inputs Minimum Maximum Average (a) Senior Secured First Lien Debt 169,300,848 Yield Analysis Market Yield 5.38% 12.76% 7.29% Senior Secured Second Lien Debt 6,543,000 Yield Analysis Market Yield 8.57% 10.67% 10.17% Senior Secured First Lien Debt (c) 7,127,513 Cost Cost N/A N/A N/A Senior Secured Second Lien Debt (b) 4,749,396 Discounted Cash Flow Market Yield 7.50% 7.50% 7.50% Collateralized Securities 79,101,755 Discounted Cash Flow Discount Rate 5.65% 11.65% 8.07% Total Level 3 Assets 266,822,512$ Range

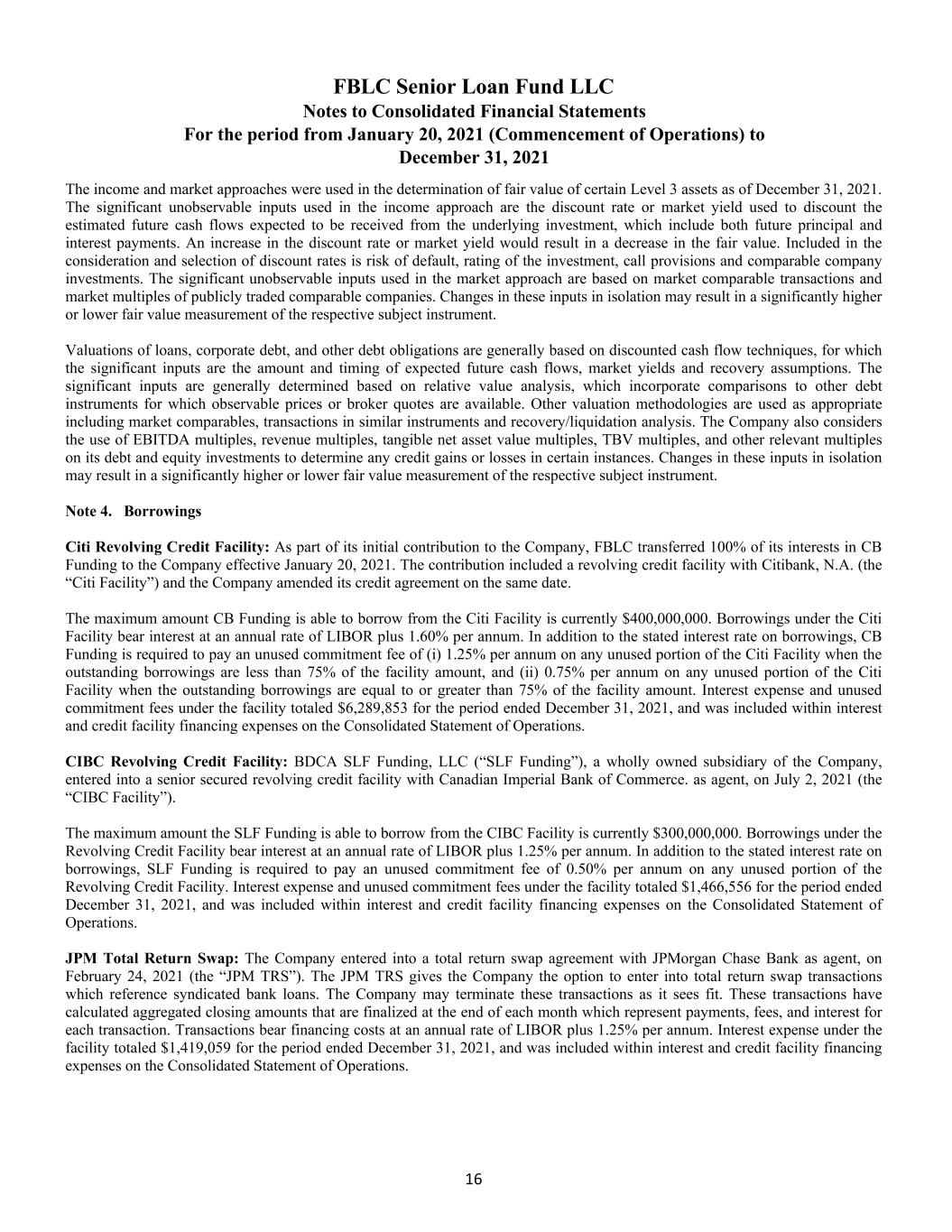

FBLC Senior Loan Fund LLC Notes to Consolidated Financial Statements For the period from January 20, 2021 (Commencement of Operations) to December 31, 2021 16 The income and market approaches were used in the determination of fair value of certain Level 3 assets as of December 31, 2021. The significant unobservable inputs used in the income approach are the discount rate or market yield used to discount the estimated future cash flows expected to be received from the underlying investment, which include both future principal and interest payments. An increase in the discount rate or market yield would result in a decrease in the fair value. Included in the consideration and selection of discount rates is risk of default, rating of the investment, call provisions and comparable company investments. The significant unobservable inputs used in the market approach are based on market comparable transactions and market multiples of publicly traded comparable companies. Changes in these inputs in isolation may result in a significantly higher or lower fair value measurement of the respective subject instrument. Valuations of loans, corporate debt, and other debt obligations are generally based on discounted cash flow techniques, for which the significant inputs are the amount and timing of expected future cash flows, market yields and recovery assumptions. The significant inputs are generally determined based on relative value analysis, which incorporate comparisons to other debt instruments for which observable prices or broker quotes are available. Other valuation methodologies are used as appropriate including market comparables, transactions in similar instruments and recovery/liquidation analysis. The Company also considers the use of EBITDA multiples, revenue multiples, tangible net asset value multiples, TBV multiples, and other relevant multiples on its debt and equity investments to determine any credit gains or losses in certain instances. Changes in these inputs in isolation may result in a significantly higher or lower fair value measurement of the respective subject instrument. Note 4. Borrowings Citi Revolving Credit Facility: As part of its initial contribution to the Company, FBLC transferred 100% of its interests in CB Funding to the Company effective January 20, 2021. The contribution included a revolving credit facility with Citibank, N.A. (the “Citi Facility”) and the Company amended its credit agreement on the same date. The maximum amount CB Funding is able to borrow from the Citi Facility is currently $400,000,000. Borrowings under the Citi Facility bear interest at an annual rate of LIBOR plus 1.60% per annum. In addition to the stated interest rate on borrowings, CB Funding is required to pay an unused commitment fee of (i) 1.25% per annum on any unused portion of the Citi Facility when the outstanding borrowings are less than 75% of the facility amount, and (ii) 0.75% per annum on any unused portion of the Citi Facility when the outstanding borrowings are equal to or greater than 75% of the facility amount. Interest expense and unused commitment fees under the facility totaled $6,289,853 for the period ended December 31, 2021, and was included within interest and credit facility financing expenses on the Consolidated Statement of Operations. CIBC Revolving Credit Facility: BDCA SLF Funding, LLC (“SLF Funding”), a wholly owned subsidiary of the Company, entered into a senior secured revolving credit facility with Canadian Imperial Bank of Commerce. as agent, on July 2, 2021 (the “CIBC Facility”). The maximum amount the SLF Funding is able to borrow from the CIBC Facility is currently $300,000,000. Borrowings under the Revolving Credit Facility bear interest at an annual rate of LIBOR plus 1.25% per annum. In addition to the stated interest rate on borrowings, SLF Funding is required to pay an unused commitment fee of 0.50% per annum on any unused portion of the Revolving Credit Facility. Interest expense and unused commitment fees under the facility totaled $1,466,556 for the period ended December 31, 2021, and was included within interest and credit facility financing expenses on the Consolidated Statement of Operations. JPM Total Return Swap: The Company entered into a total return swap agreement with JPMorgan Chase Bank as agent, on February 24, 2021 (the “JPM TRS”). The JPM TRS gives the Company the option to enter into total return swap transactions which reference syndicated bank loans. The Company may terminate these transactions as it sees fit. These transactions have calculated aggregated closing amounts that are finalized at the end of each month which represent payments, fees, and interest for each transaction. Transactions bear financing costs at an annual rate of LIBOR plus 1.25% per annum. Interest expense under the facility totaled $1,419,059 for the period ended December 31, 2021, and was included within interest and credit facility financing expenses on the Consolidated Statement of Operations.

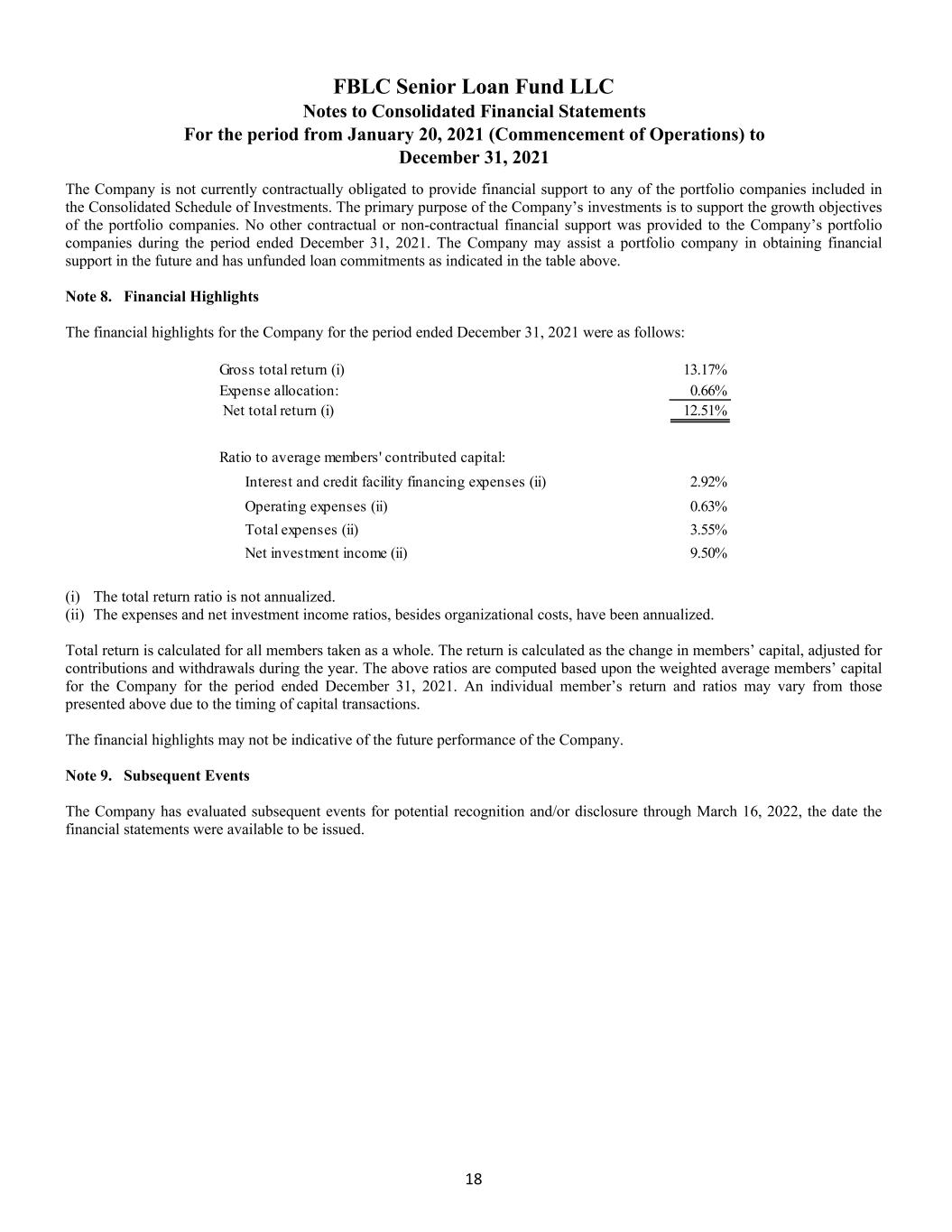

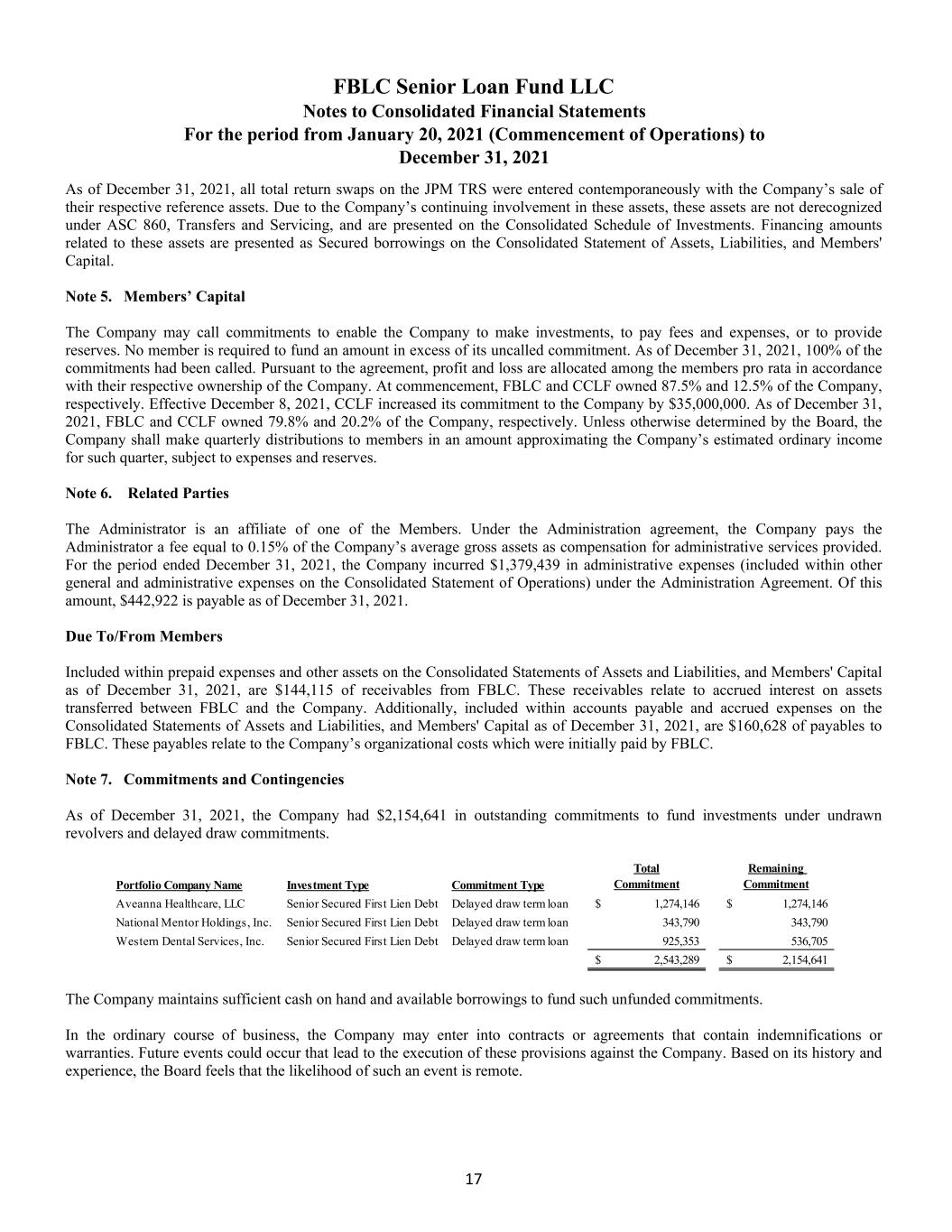

FBLC Senior Loan Fund LLC Notes to Consolidated Financial Statements For the period from January 20, 2021 (Commencement of Operations) to December 31, 2021 17 As of December 31, 2021, all total return swaps on the JPM TRS were entered contemporaneously with the Company’s sale of their respective reference assets. Due to the Company’s continuing involvement in these assets, these assets are not derecognized under ASC 860, Transfers and Servicing, and are presented on the Consolidated Schedule of Investments. Financing amounts related to these assets are presented as Secured borrowings on the Consolidated Statement of Assets, Liabilities, and Members' Capital. Note 5. Members’ Capital The Company may call commitments to enable the Company to make investments, to pay fees and expenses, or to provide reserves. No member is required to fund an amount in excess of its uncalled commitment. As of December 31, 2021, 100% of the commitments had been called. Pursuant to the agreement, profit and loss are allocated among the members pro rata in accordance with their respective ownership of the Company. At commencement, FBLC and CCLF owned 87.5% and 12.5% of the Company, respectively. Effective December 8, 2021, CCLF increased its commitment to the Company by $35,000,000. As of December 31, 2021, FBLC and CCLF owned 79.8% and 20.2% of the Company, respectively. Unless otherwise determined by the Board, the Company shall make quarterly distributions to members in an amount approximating the Company’s estimated ordinary income for such quarter, subject to expenses and reserves. Note 6. Related Parties The Administrator is an affiliate of one of the Members. Under the Administration agreement, the Company pays the Administrator a fee equal to 0.15% of the Company’s average gross assets as compensation for administrative services provided. For the period ended December 31, 2021, the Company incurred $1,379,439 in administrative expenses (included within other general and administrative expenses on the Consolidated Statement of Operations) under the Administration Agreement. Of this amount, $442,922 is payable as of December 31, 2021. Due To/From Members Included within prepaid expenses and other assets on the Consolidated Statements of Assets and Liabilities, and Members' Capital as of December 31, 2021, are $144,115 of receivables from FBLC. These receivables relate to accrued interest on assets transferred between FBLC and the Company. Additionally, included within accounts payable and accrued expenses on the Consolidated Statements of Assets and Liabilities, and Members' Capital as of December 31, 2021, are $160,628 of payables to FBLC. These payables relate to the Company’s organizational costs which were initially paid by FBLC. Note 7. Commitments and Contingencies As of December 31, 2021, the Company had $2,154,641 in outstanding commitments to fund investments under undrawn revolvers and delayed draw commitments. The Company maintains sufficient cash on hand and available borrowings to fund such unfunded commitments. In the ordinary course of business, the Company may enter into contracts or agreements that contain indemnifications or warranties. Future events could occur that lead to the execution of these provisions against the Company. Based on its history and experience, the Board feels that the likelihood of such an event is remote. Portfolio Company Name Investment Type Commitment Type Total Commitment Remaining Commitment Aveanna Healthcare, LLC Senior Secured First Lien Debt Delayed draw term loan 1,274,146$ 1,274,146$ National Mentor Holdings, Inc. Senior Secured First Lien Debt Delayed draw term loan 343,790 343,790 Western Dental Services, Inc. Senior Secured First Lien Debt Delayed draw term loan 925,353 536,705 2,543,289$ 2,154,641$

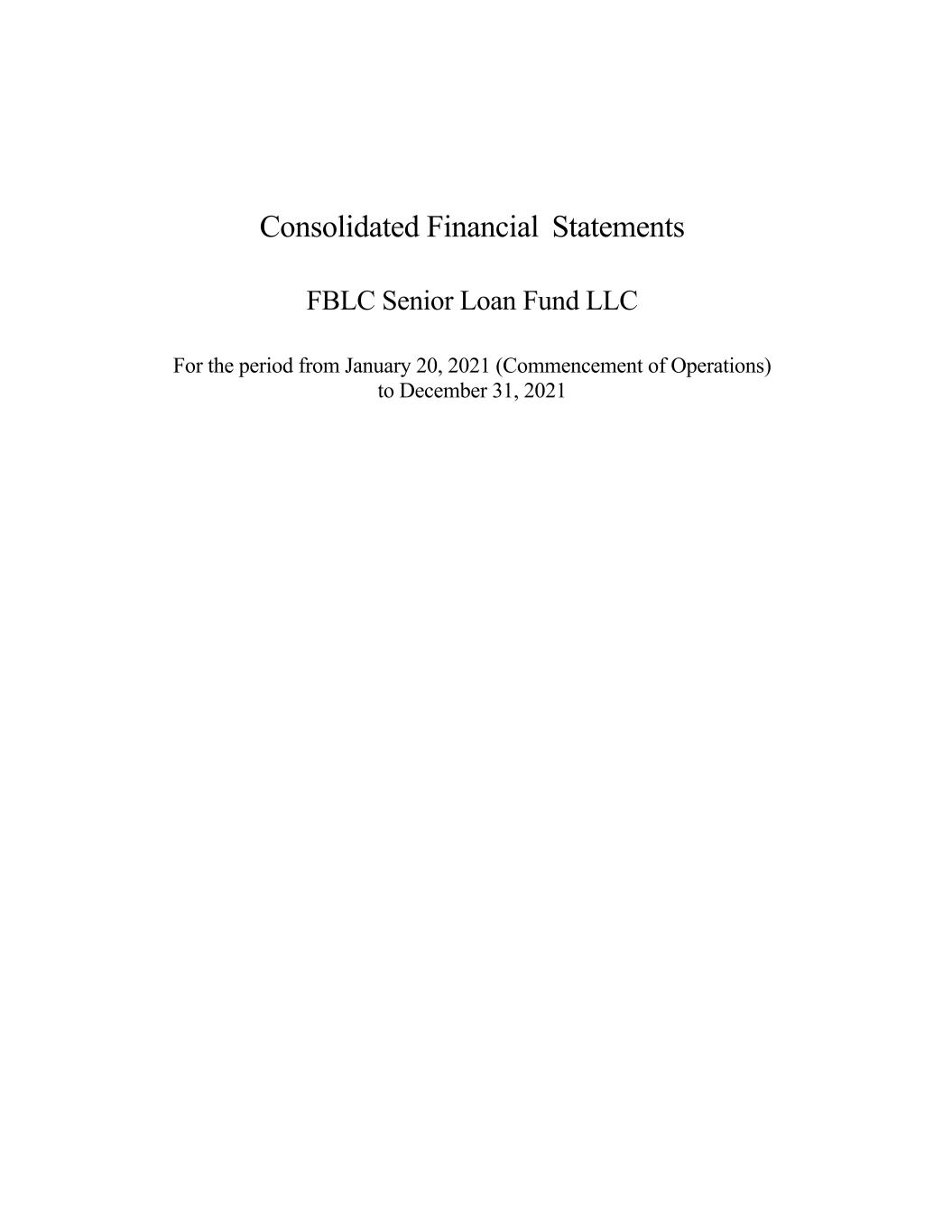

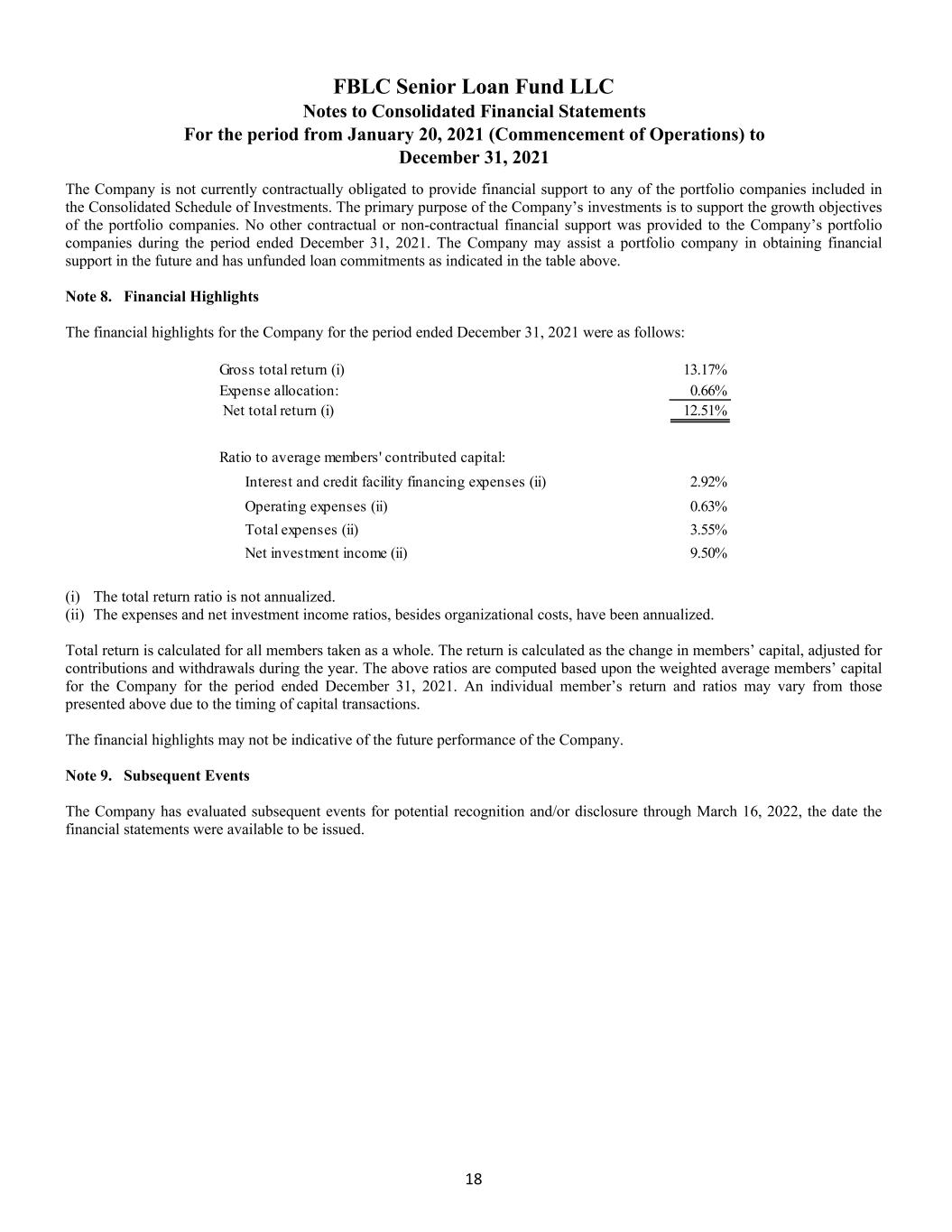

FBLC Senior Loan Fund LLC Notes to Consolidated Financial Statements For the period from January 20, 2021 (Commencement of Operations) to December 31, 2021 18 The Company is not currently contractually obligated to provide financial support to any of the portfolio companies included in the Consolidated Schedule of Investments. The primary purpose of the Company’s investments is to support the growth objectives of the portfolio companies. No other contractual or non-contractual financial support was provided to the Company’s portfolio companies during the period ended December 31, 2021. The Company may assist a portfolio company in obtaining financial support in the future and has unfunded loan commitments as indicated in the table above. Note 8. Financial Highlights The financial highlights for the Company for the period ended December 31, 2021 were as follows: (i) The total return ratio is not annualized. (ii) The expenses and net investment income ratios, besides organizational costs, have been annualized. Total return is calculated for all members taken as a whole. The return is calculated as the change in members’ capital, adjusted for contributions and withdrawals during the year. The above ratios are computed based upon the weighted average members’ capital for the Company for the period ended December 31, 2021. An individual member’s return and ratios may vary from those presented above due to the timing of capital transactions. The financial highlights may not be indicative of the future performance of the Company. Note 9. Subsequent Events The Company has evaluated subsequent events for potential recognition and/or disclosure through March 16, 2022, the date the financial statements were available to be issued. Gross total return (i) 13.17% Expense allocation: 0.66% Net total return (i) 12.51% Ratio to average members' contributed capital: Interest and credit facility financing expenses (ii) 2.92% Operating expenses (ii) 0.63% Total expenses (ii) 3.55% Net investment income (ii) 9.50%