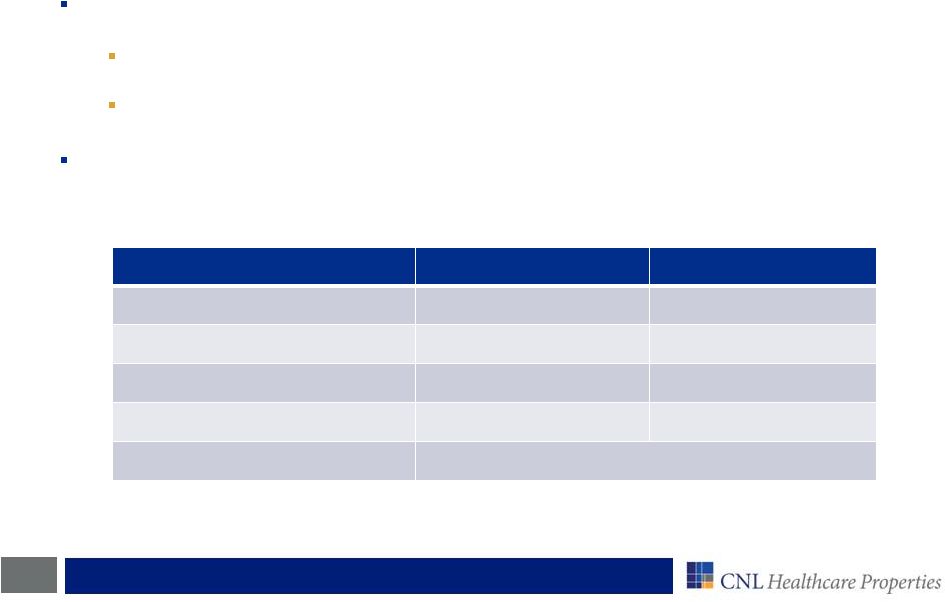

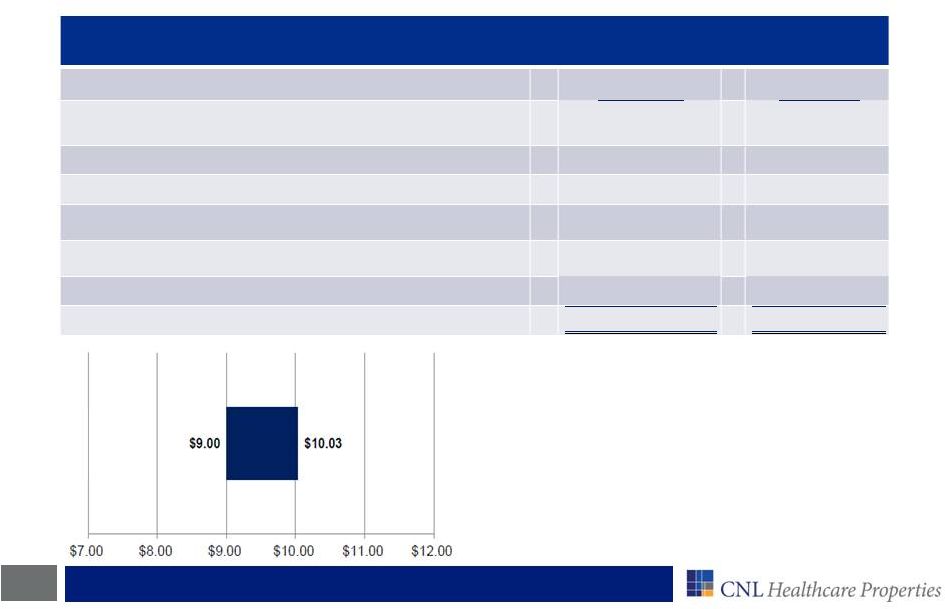

22 Offering Summary Maximum Offering Size $3 billion in common stock Offering Price Per Share $10.58 Minimum Investment $5,000 for individuals, $4,000 for qualified plans Asset Focus Senior housing, medical office, post-acute care, acute care and other income-producing assets Geographic Diversification United States, with the opportunity for limited international acquisitions Return Objective Income & Growth Distributions Cash, stock or combination of the two Distribution Payment Schedule Declared monthly and paid quarterly Distribution Reinvestment Price $10.06 (Approximately 95% of the current offering price per share) Redemption Price Per Share The lesser of the then estimated net asset value, or stockholder’s purchase price Exit Strategy On or before June 27, 2018, the board of directors will consider liquidity event options Suitability Standards $250,000 net worth (excluding home, furnishings and personal automobiles) or $70,000 net worth and $70,000 annual gross income. (Some states, including but not limited to AL, CA, IA, KS, KY, MA, ME, MI, MO, ND, NE, NJ, OH, OR, PA and TN have additional standards. See the “Suitability Standards” section of the prospectus.) See the "Risk Factors" section of this presentation and in the prospectus for additional information about the REIT's distributions, Distribution Reinvestment Plan and Amended and Restated Redemption Plan. 1 There is no assurance these objectives will be met. 3 For the six months ended June 30, 2014, approximately 51 percent of distributions were funded by offering proceeds and 49 percent were covered by operating cash flow. For the year ended Dec. 31, 2013, approximately 87 percent of distributions were funded by offering proceeds and 13 percent were covered by operating cash flow. For the years ended Dec. 31, 2011 and 2012, the REIT’s first two years of operations, distributions were not covered by operating cash flow and were 100 percent funded by offering proceeds. The interest of later investors in our common stock will be diluted as a result of our stock distribution policy. 3 In no event will more than 5 percent of the outstanding shares be redeemed in any 12-month period. The REIT may suspend, terminate or reduce the redemption plan at any time. Non-traded REITs are illiquid. There are significant restrictions and limitations on your ability to have all or any portion of your shares redeemed. 1 2 2 3 1 |