UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

First Trust/Confluence Small Cap Value Fund

FOVAX | Class A

ANNUAL SHAREHOLDER REPORT | OCTOBER 31, 2024

This annual shareholder report contains important information about the First Trust/Confluence Small Cap Value Fund (the “Fund”) for the year of November 1, 2023 to October 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FOVAX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust/Confluence Small Cap Value Fund - Class A | $176 | 1.60% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

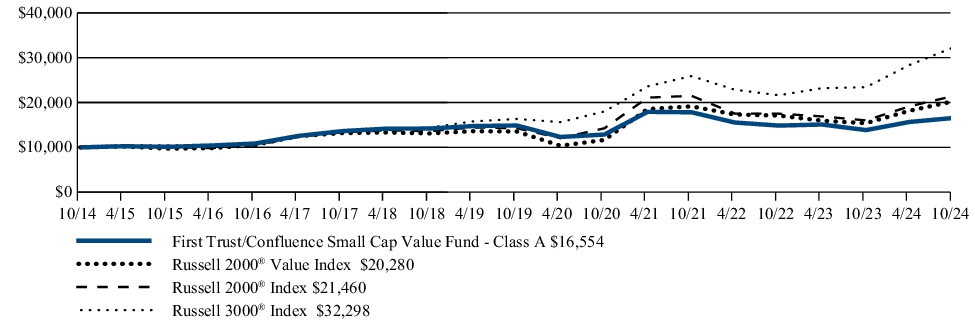

The Fund’s Class A returned 19.54% (without sales charge) for the 12 months ended October 31, 2024. The Fund’s Class A underperformed its benchmark, the Russell 2000® Index, which returned 34.07% for the same Period.

The Period began on the heels of the last interest rate hike by the Federal Reserve (the “Fed”) and the signal that rate cuts were probable over the ensuing year. The Fed did not disappoint as the rate of inflation continued to decline and provided the Fed the cover to begin cutting the Federal Funds target rate, which commenced in September 2024 with a 50 basis points cut. By the end of the Period, the Fed had swung to a more accommodative policy following very aggressive interest rate hikes that started in mid-2022. The policy shift and avoidance of a recession while employment remained solid provided a nice tailwind for equities following a couple of tough years for small caps. The Fund benefited from the backdrop and produced strong results for the Period.

The relative underperformance was impacted by the strong beta-driven rally, which tends to benefit the highly cyclical and/or leveraged businesses, as well as declines from a few of the Fund’s holdings, primarily in the Consumer Staples and Consumer Discretionary sectors. Recall that our philosophy is focused on quality businesses that are conservatively financed trading at attractive valuations and does so in a concentrated manner. This will result in some differences from time to time based on the sentiment of the market and/or the performance of a few underlying names in the Fund’s portfolio. The philosophy has historically provided less volatility and good downside protection albeit with the expected tracking error. Tracking error can be good or bad over the short run but over the long run it has been additive. We remain committed to our philosophy and process as our focus on fundamental research has shown to be successful over the long term.

FUND PERFORMANCE (October 31, 2014 to October 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

INVESTMENT PERFORMANCE OF $10,000

| Average Annual Total Returns (as of October 31, 2024) | 1 Year | 5 Year | 10 Year |

| First Trust/Confluence Small Cap Value Fund - Class A (w/max 5.50% sales charge) | 12.98% | 1.02% | 4.58% |

| First Trust/Confluence Small Cap Value Fund - Class A (without sales charge) | 19.54% | 2.17% | 5.17% |

| Russell 2000® Value Index | 31.77% | 8.42% | 7.33% |

| Russell 2000® Index | 34.07% | 8.50% | 7.94% |

| Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Visit www.ftportfolios.com/MF/FOVAX for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor.

KEY FUND STATISTICS (As of October 31, 2024)

| Fund net assets | $21,692,431 |

| Total number of portfolio holdings | 31 |

| Total advisory fee paid | $5,067 |

| Portfolio turnover rate | 17% |

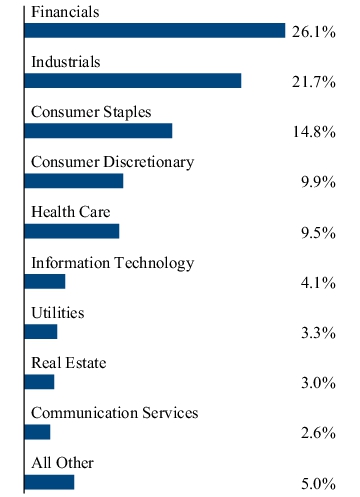

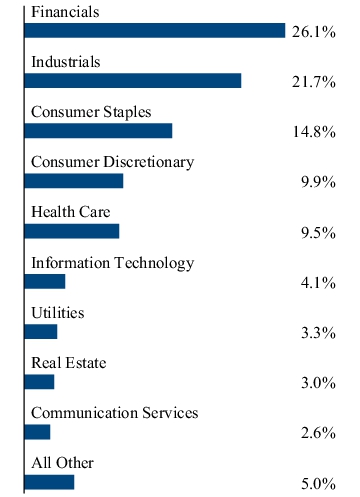

WHAT DID THE FUND INVEST IN? (As of October 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Baldwin Insurance (The) Group, Inc. | 5.3% |

| Hagerty, Inc., Class A | 4.7% |

| Sapiens International Corp., N.V. | 4.1% |

| RBC Bearings, Inc. | 3.9% |

| Gates Industrial Corp. PLC | 3.9% |

| J&J Snack Foods Corp. | 3.9% |

| I3 Verticals, Inc., Class A | 3.9% |

| Hayward Holdings, Inc. | 3.9% |

| Brown & Brown, Inc. | 3.8% |

| John Bean Technologies Corp. | 3.7% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/MF/FOVAX to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust/Confluence Small Cap Value Fund

FOVCX | Class C

ANNUAL SHAREHOLDER REPORT | OCTOBER 31, 2024

This annual shareholder report contains important information about the First Trust/Confluence Small Cap Value Fund (the “Fund”) for the year of November 1, 2023 to October 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FOVCX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust/Confluence Small Cap Value Fund - Class C | $257 | 2.35% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

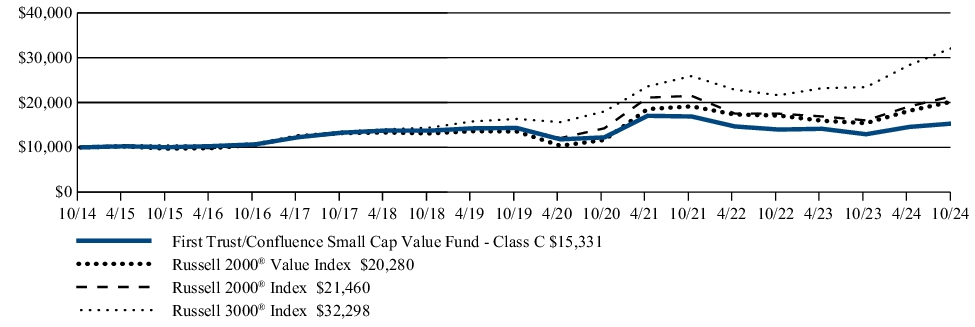

The Fund’s Class C returned 18.64% (without sales charge) for the 12 months ended October 31, 2024. The Fund’s Class C underperformed its benchmark, the Russell 2000® Index, which returned 34.07% for the same Period.

The Period began on the heels of the last interest rate hike by the Federal Reserve (the “Fed”) and the signal that rate cuts were probable over the ensuing year. The Fed did not disappoint as the rate of inflation continued to decline and provided the Fed the cover to begin cutting the Federal Funds target rate, which commenced in September 2024 with a 50 basis points cut. By the end of the Period, the Fed had swung to a more accommodative policy following very aggressive interest rate hikes that started in mid-2022. The policy shift and avoidance of a recession while employment remained solid provided a nice tailwind for equities following a couple of tough years for small caps. The Fund benefited from the backdrop and produced strong results for the Period.

The relative underperformance was impacted by the strong beta-driven rally, which tends to benefit the highly cyclical and/or leveraged businesses, as well as declines from a few of the Fund’s holdings, primarily in the Consumer Staples and Consumer Discretionary sectors. Recall that our philosophy is focused on quality businesses that are conservatively financed trading at attractive valuations and does so in a concentrated manner. This will result in some differences from time to time based on the sentiment of the market and/or the performance of a few underlying names in the Fund’s portfolio. The philosophy has historically provided less volatility and good downside protection albeit with the expected tracking error. Tracking error can be good or bad over the short run but over the long run it has been additive. We remain committed to our philosophy and process as our focus on fundamental research has shown to be successful over the long term.

FUND PERFORMANCE (October 31, 2014 to October 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

INVESTMENT PERFORMANCE OF $10,000

| Average Annual Total Returns (as of October 31, 2024) | 1 Year | 5 Year | 10 Year |

| First Trust/Confluence Small Cap Value Fund - Class C (w/max 1.00% contingent deferred sales charge) | 17.64% | 1.38% | 4.37% |

| First Trust/Confluence Small Cap Value Fund - Class C (without sales charge) | 18.64% | 1.38% | 4.37% |

| Russell 2000® Value Index | 31.77% | 8.42% | 7.33% |

| Russell 2000® Index | 34.07% | 8.50% | 7.94% |

| Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Visit www.ftportfolios.com/MF/FOVCX for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor.

KEY FUND STATISTICS (As of October 31, 2024)

| Fund net assets | $21,692,431 |

| Total number of portfolio holdings | 31 |

| Total advisory fee paid | $5,067 |

| Portfolio turnover rate | 17% |

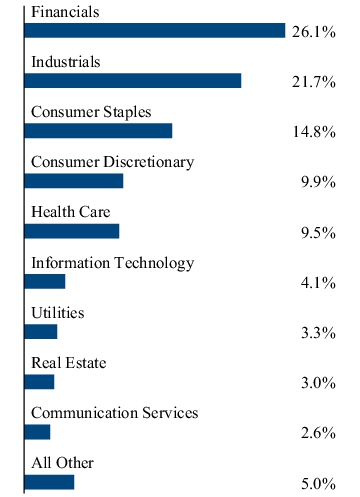

WHAT DID THE FUND INVEST IN? (As of October 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Baldwin Insurance (The) Group, Inc. | 5.3% |

| Hagerty, Inc., Class A | 4.7% |

| Sapiens International Corp., N.V. | 4.1% |

| RBC Bearings, Inc. | 3.9% |

| Gates Industrial Corp. PLC | 3.9% |

| J&J Snack Foods Corp. | 3.9% |

| I3 Verticals, Inc., Class A | 3.9% |

| Hayward Holdings, Inc. | 3.9% |

| Brown & Brown, Inc. | 3.8% |

| John Bean Technologies Corp. | 3.7% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/MF/FOVCX to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust/Confluence Small Cap Value Fund

FOVIX | Class I

ANNUAL SHAREHOLDER REPORT | OCTOBER 31, 2024

This annual shareholder report contains important information about the First Trust/Confluence Small Cap Value Fund (the “Fund”) for the year of November 1, 2023 to October 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FOVIX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust/Confluence Small Cap Value Fund - Class I | $148 | 1.35% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund’s Class I returned 19.87% for the 12 months ended October 31, 2024. The Fund’s Class I underperformed its benchmark, the Russell 2000® Index, which returned 34.07% for the same Period.

The Period began on the heels of the last interest rate hike by the Federal Reserve (the “Fed”) and the signal that rate cuts were probable over the ensuing year. The Fed did not disappoint as the rate of inflation continued to decline and provided the Fed the cover to begin cutting the Federal Funds target rate, which commenced in September 2024 with a 50 basis points cut. By the end of the Period, the Fed had swung to a more accommodative policy following very aggressive interest rate hikes that started in mid-2022. The policy shift and avoidance of a recession while employment remained solid provided a nice tailwind for equities following a couple of tough years for small caps. The Fund benefited from the backdrop and produced strong results for the Period.

The relative underperformance was impacted by the strong beta-driven rally, which tends to benefit the highly cyclical and/or leveraged businesses, as well as declines from a few of the Fund’s holdings, primarily in the Consumer Staples and Consumer Discretionary sectors. Recall that our philosophy is focused on quality businesses that are conservatively financed trading at attractive valuations and does so in a concentrated manner. This will result in some differences from time to time based on the sentiment of the market and/or the performance of a few underlying names in the Fund’s portfolio. The philosophy has historically provided less volatility and good downside protection albeit with the expected tracking error. Tracking error can be good or bad over the short run but over the long run it has been additive. We remain committed to our philosophy and process as our focus on fundamental research has shown to be successful over the long term.

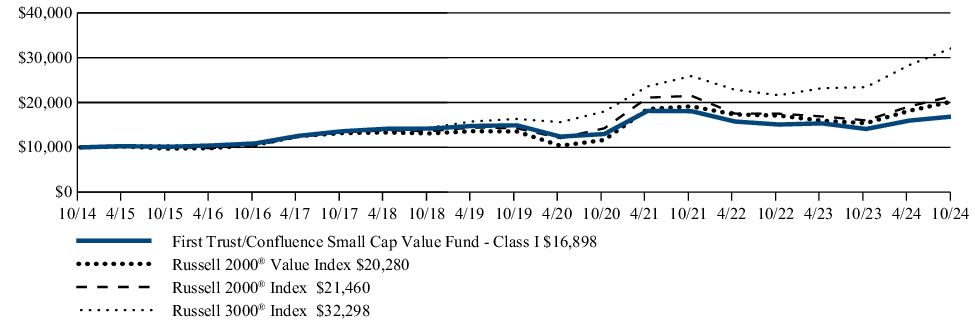

FUND PERFORMANCE (October 31, 2014 to October 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

INVESTMENT PERFORMANCE OF $10,000

| Average Annual Total Returns (as of October 31, 2024) | 1 Year | 5 Year | 10 Year |

| First Trust/Confluence Small Cap Value Fund - Class I | 19.87% | 2.54% | 5.39% |

| Russell 2000® Value Index | 31.77% | 8.42% | 7.33% |

| Russell 2000® Index | 34.07% | 8.50% | 7.94% |

| Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Visit www.ftportfolios.com/MF/FOVIX for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor.

KEY FUND STATISTICS (As of October 31, 2024)

| Fund net assets | $21,692,431 |

| Total number of portfolio holdings | 31 |

| Total advisory fee paid | $5,067 |

| Portfolio turnover rate | 17% |

WHAT DID THE FUND INVEST IN? (As of October 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Baldwin Insurance (The) Group, Inc. | 5.3% |

| Hagerty, Inc., Class A | 4.7% |

| Sapiens International Corp., N.V. | 4.1% |

| RBC Bearings, Inc. | 3.9% |

| Gates Industrial Corp. PLC | 3.9% |

| J&J Snack Foods Corp. | 3.9% |

| I3 Verticals, Inc., Class A | 3.9% |

| Hayward Holdings, Inc. | 3.9% |

| Brown & Brown, Inc. | 3.8% |

| John Bean Technologies Corp. | 3.7% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/MF/FOVIX to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Short Duration High Income Fund

FDHAX | Class A

ANNUAL SHAREHOLDER REPORT | OCTOBER 31, 2024

This annual shareholder report contains important information about the First Trust Short Duration High Income Fund (the “Fund”) for the year of November 1, 2023 to October 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FDHAX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Short Duration High Income Fund - Class A | $131 | 1.25% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund’s Class A returned 10.31% (without sales charge) for the 12 months ended October 31, 2024. The Fund’s Class A underperformed its blended benchmark, which consists of the following two indexes: 50% of the Morningstar® LSTA® US Leveraged Loan Index and 50% of the ICE BofA US High Yield Constrained Index. The blended benchmark returned 13.52% for the same Period (10.56% for the Morningstar® LSTA® US Leveraged Loan Index and 16.49% for the ICE BofA US High Yield Constrained Index).

The following key factors impacted Fund performance relative to the blended benchmark during the Period:

Credit Quality: Performance across the credit quality spectrum was mixed during the Period but lower quality assets generally outperformed. The Fund benefited from an overweight allocation to higher-quality assets rated BBB. Conversely, the Fund’s overweight allocation to assets rated B, its underweight allocation to assets rated BB, and its overweight allocation to assets rated CCC and below were detractors to Fund performance.

Asset Type: The Fund’s senior loan allocation detracted from performance relative to the blended benchmark as loans underperformed bonds during the Period. The Fund began the Period with a 63.69% allocation to loans and ended the Period with a 32.92% allocation to loans. Additionally, the Fund’s net cash position was a headwind to performance.

Sector/Industry: Relative to the blended benchmark, the primary contributors to the Fund’s performance were its selection within the Materials sector, its underweight allocation to, and selection in, the Telecommunication Services sector, and its underweight allocation to the Energy sector. Conversely, the Fund’s overweight allocation to, and selection in, the Software & Services, Insurance, Pharmaceuticals, Biotechnology and Life Sciences Tools & Services sectors were the primary detractors to the Fund’s performance.

U.S. Treasury Rates: 10-Year U.S. Treasury yields declined by 65 basis points (“bps”) to 4.28% after entering the Period at a high of 4.93% and bouncing off a low of 3.62%. Falling Treasury rates are generally a tailwind to fixed income assets.

Spreads, Yields and Prices: Loan spreads over the Secured Overnight Financing Rate compressed by 100 bps to S+444 bps. While loan spreads ended the Period below the long-term average of S+516 bps (December 1997 – October 2024), yields of 9.09% remain well above the long-term average of 6.99% (January 1999 – October 2024) driven by elevated base rates. Loan prices increased by $2.14 to $96.90 and remain at a discount to par ($100). High-yield bond spreads over treasuries compressed by 157 bps to T+288 bps. While high-yield bond spreads ended the Period below the long-term average of T+530 bps (December 1996 – October 2024), a yield-to-worst of 7.33% remains compelling. High-yield bond prices increased by $9.41 to $95.72 and remain at a discount to par ($100).

Defaults: The Fund experienced zero defaults during the Period, compared to 15 defaults in the Morningstar® LSTA® US Leveraged Loan Index and 7 defaults in the JP Morgan High-Yield Bond Universe. Since the Fund’s inception, the Fund experienced 12 defaults, compared to 484 combined in both indexes over the same timeframe. The loan and high-yield bond market default rates fell from 1.43% and 1.76%, respectively, at the beginning of the Period to 0.73% and 0.55%, respectively, at the end of the Period, remaining below the long-term averages of 2.63% and 2.93%, respectively, dating back to 1999. The avoidance of defaults generally benefits performance.

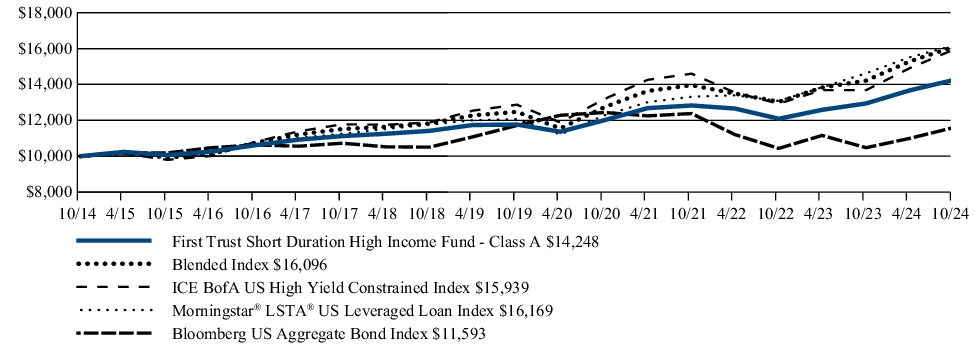

FUND PERFORMANCE (October 31, 2014 to October 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

INVESTMENT PERFORMANCE OF $10,000

| Average Annual Total Returns (as of October 31, 2024) | 1 Year | 5 Year | 10 Year |

| First Trust Short Duration High Income Fund - Class A (w/max 3.50% sales charge) | 6.47% | 3.22% | 3.24% |

| First Trust Short Duration High Income Fund - Class A (without sales charge) | 10.31% | 3.96% | 3.60% |

| Blended Index(1) | 13.52% | 5.23% | 4.87% |

| ICE BofA US High Yield Constrained Index | 16.49% | 4.37% | 4.77% |

| Morningstar® LSTA® US Leveraged Loan Index | 10.56% | 6.02% | 4.92% |

| Bloomberg US Aggregate Bond Index | 10.55% | (0.23)% | 1.49% |

| (1) | The Blended Index return is a 50/50 split between the ICE BofA US High Yield Constrained Index and the Morningstar® LSTA® US Leveraged Loan Index returns. |

Visit www.ftportfolios.com/MF/FDHAX for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of October 31, 2024)

| Fund net assets | $73,890,945 |

| Total number of portfolio holdings | 175 |

| Total advisory fee paid | $393,401 |

| Portfolio turnover rate | 64% |

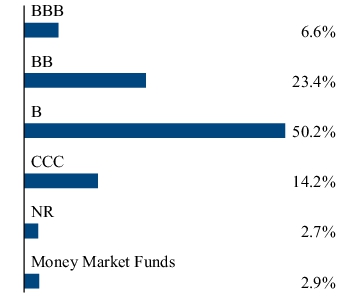

WHAT DID THE FUND INVEST IN? (As of October 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of net assets and total investments, respectively, of the Fund.

| Corporate Bonds and Notes | 51.9% |

| Senior Floating-Rate Loan Interests | 31.3% |

| Foreign Corporate Bonds and Notes | 11.2% |

| Money Market Funds | 2.8% |

| Common Stocks | 0.0% |

| Rights | 0.0% |

| Net Other Assets and Liabilities | 2.8% |

Any amount shown as 0.0% represents less than 0.1%

(1) The ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher. "NR" indicates no rating. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/MF/FDHAX to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Short Duration High Income Fund

FDHCX | Class C

ANNUAL SHAREHOLDER REPORT | OCTOBER 31, 2024

This annual shareholder report contains important information about the First Trust Short Duration High Income Fund (the “Fund”) for the year of November 1, 2023 to October 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FDHCX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Short Duration High Income Fund - Class C | $209 | 2.00% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund’s Class C returned 9.45% (without sales charge) for the 12 months ended October 31, 2024. The Fund’s Class C underperformed its blended benchmark, which consists of the following two indexes: 50% of the Morningstar® LSTA® US Leveraged Loan Index and 50% of the ICE BofA US High Yield Constrained Index. The blended benchmark returned 13.52% for the same Period (10.56% for the Morningstar® LSTA® US Leveraged Loan Index and 16.49% for the ICE BofA US High Yield Constrained Index).

The following key factors impacted Fund performance relative to the blended benchmark during the Period:

Credit Quality: Performance across the credit quality spectrum was mixed during the Period but lower quality assets generally outperformed. The Fund benefited from an overweight allocation to higher-quality assets rated BBB. Conversely, the Fund’s overweight allocation to assets rated B, its underweight allocation to assets rated BB, and its overweight allocation to assets rated CCC and below were detractors to Fund performance.

Asset Type: The Fund’s senior loan allocation detracted from performance relative to the blended benchmark as loans underperformed bonds during the Period. The Fund began the Period with a 63.69% allocation to loans and ended the Period with a 32.92% allocation to loans. Additionally, the Fund’s net cash position was a headwind to performance.

Sector/Industry: Relative to the blended benchmark, the primary contributors to the Fund’s performance were its selection within the Materials sector, its underweight allocation to, and selection in, the Telecommunication Services sector, and its underweight allocation to the Energy sector. Conversely, the Fund’s overweight allocation to, and selection in, the Software & Services, Insurance, Pharmaceuticals, Biotechnology and Life Sciences Tools & Services sectors were the primary detractors to the Fund’s performance.

U.S. Treasury Rates: 10-Year U.S. Treasury yields declined by 65 basis points (“bps”) to 4.28% after entering the Period at a high of 4.93% and bouncing off a low of 3.62%. Falling Treasury rates are generally a tailwind to fixed income assets.

Spreads, Yields and Prices: Loan spreads over the Secured Overnight Financing Rate compressed by 100 bps to S+444 bps. While loan spreads ended the Period below the long-term average of S+516 bps (December 1997 – October 2024), yields of 9.09% remain well above the long-term average of 6.99% (January 1999 – October 2024) driven by elevated base rates. Loan prices increased by $2.14 to $96.90 and remain at a discount to par ($100). High-yield bond spreads over treasuries compressed by 157 bps to T+288 bps. While high-yield bond spreads ended the Period below the long-term average of T+530 bps (December 1996 – October 2024), a yield-to-worst of 7.33% remains compelling. High-yield bond prices increased by $9.41 to $95.72 and remain at a discount to par ($100).

Defaults: The Fund experienced zero defaults during the Period, compared to 15 defaults in the Morningstar® LSTA® US Leveraged Loan Index and 7 defaults in the JP Morgan High-Yield Bond Universe. Since the Fund’s inception, the Fund experienced 12 defaults, compared to 484 combined in both indexes over the same timeframe. The loan and high-yield bond market default rates fell from 1.43% and 1.76%, respectively, at the beginning of the Period to 0.73% and 0.55%, respectively, at the end of the Period, remaining below the long-term averages of 2.63% and 2.93%, respectively, dating back to 1999. The avoidance of defaults generally benefits performance.

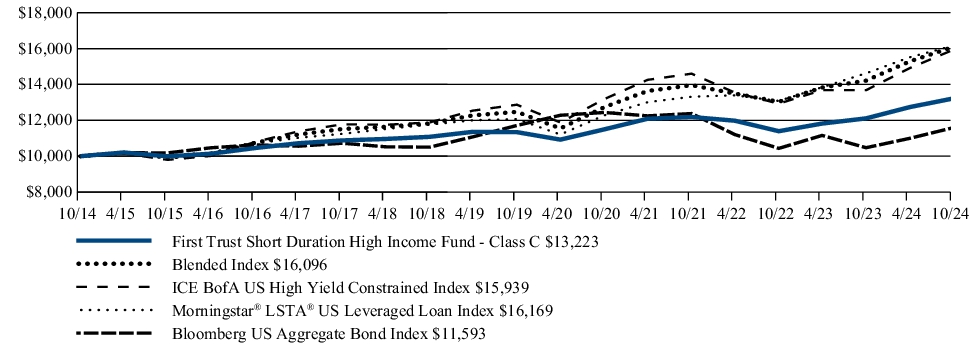

FUND PERFORMANCE (October 31, 2014 to October 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

INVESTMENT PERFORMANCE OF $10,000

| Average Annual Total Returns (as of October 31, 2024) | 1 Year | 5 Year | 10 Year |

| First Trust Short Duration High Income Fund - Class C (w/max 1.00% contingent deferred sales charge) | 8.45% | 3.17% | 2.83% |

| First Trust Short Duration High Income Fund - Class C (without sales charge) | 9.45% | 3.17% | 2.83% |

| Blended Index(1) | 13.52% | 5.23% | 4.87% |

| ICE BofA US High Yield Constrained Index | 16.49% | 4.37% | 4.77% |

| Morningstar® LSTA® US Leveraged Loan Index | 10.56% | 6.02% | 4.92% |

| Bloomberg US Aggregate Bond Index | 10.55% | (0.23)% | 1.49% |

| (1) | The Blended Index return is a 50/50 split between the ICE BofA US High Yield Constrained Index and the Morningstar® LSTA® US Leveraged Loan Index returns. |

Visit www.ftportfolios.com/MF/FDHCX for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of October 31, 2024)

| Fund net assets | $73,890,945 |

| Total number of portfolio holdings | 175 |

| Total advisory fee paid | $393,401 |

| Portfolio turnover rate | 64% |

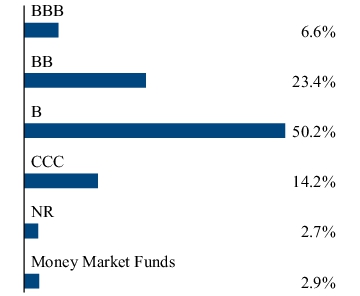

WHAT DID THE FUND INVEST IN? (As of October 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of net assets and total investments, respectively, of the Fund.

| Corporate Bonds and Notes | 51.9% |

| Senior Floating-Rate Loan Interests | 31.3% |

| Foreign Corporate Bonds and Notes | 11.2% |

| Money Market Funds | 2.8% |

| Common Stocks | 0.0% |

| Rights | 0.0% |

| Net Other Assets and Liabilities | 2.8% |

Any amount shown as 0.0% represents less than 0.1%

(1) The ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher. "NR" indicates no rating. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/MF/FDHCX to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Short Duration High Income Fund

FDHIX | Class I

ANNUAL SHAREHOLDER REPORT | OCTOBER 31, 2024

This annual shareholder report contains important information about the First Trust Short Duration High Income Fund (the “Fund”) for the year of November 1, 2023 to October 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FDHIX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Short Duration High Income Fund - Class I | $105 | 1.00% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund’s Class I returned 10.58% for the 12 months ended October 31, 2024. The Fund’s Class I underperformed its blended benchmark, which consists of the following two indexes: 50% of the Morningstar® LSTA® US Leveraged Loan Index and 50% of the ICE BofA US High Yield Constrained Index. The blended benchmark returned 13.52% for the same Period (10.56% for the Morningstar® LSTA® US Leveraged Loan Index and 16.49% for the ICE BofA US High Yield Constrained Index, respectively).

The following key factors impacted Fund performance relative to the blended benchmark during the Period:

Credit Quality: Performance across the credit quality spectrum was mixed during the Period but lower quality assets generally outperformed. The Fund benefited from an overweight allocation to higher-quality assets rated BBB. Conversely, the Fund’s overweight allocation to assets rated B, its underweight allocation to assets rated BB, and its overweight allocation to assets rated CCC and below were detractors to Fund performance.

Asset Type: The Fund’s senior loan allocation detracted from performance relative to the blended benchmark as loans underperformed bonds during the Period. The Fund began the Period with a 63.69% allocation to loans and ended the Period with a 32.92% allocation to loans. Additionally, the Fund’s net cash position was a headwind to performance.

Sector/Industry: Relative to the blended benchmark, the primary contributors to the Fund’s performance were its selection within the Materials sector, its underweight allocation to, and selection in, the Telecommunication Services sector, and its underweight allocation to the Energy sector. Conversely, the Fund’s overweight allocation to, and selection in, the Software & Services, Insurance, Pharmaceuticals, Biotechnology and Life Sciences Tools & Services sectors were the primary detractors to the Fund’s performance.

U.S. Treasury Rates: 10-Year U.S. Treasury yields declined by 65 basis points (“bps”) to 4.28% after entering the Period at a high of 4.93% and bouncing off a low of 3.62%. Falling Treasury rates are generally a tailwind to fixed income assets.

Spreads, Yields and Prices: Loan spreads over the Secured Overnight Financing Rate compressed by 100 bps to S+444 bps. While loan spreads ended the Period below the long-term average of S+516 bps (December 1997 – October 2024), yields of 9.09% remain well above the long-term average of 6.99% (January 1999 – October 2024) driven by elevated base rates. Loan prices increased by $2.14 to $96.90 and remain at a discount to par ($100). High-yield bond spreads over treasuries compressed by 157 bps to T+288 bps. While high-yield bond spreads ended the Period below the long-term average of T+530 bps (December 1996 – October 2024), a yield-to-worst of 7.33% remains compelling. High-yield bond prices increased by $9.41 to $95.72 and remain at a discount to par ($100).

Defaults: The Fund experienced zero defaults during the Period, compared to 15 defaults in the Morningstar® LSTA® US Leveraged Loan Index and 7 defaults in the JP Morgan High-Yield Bond Universe. Since the Fund’s inception, the Fund experienced 12 defaults, compared to 484 combined in both indexes over the same timeframe. The loan and high-yield bond market default rates fell from 1.43% and 1.76%, respectively, at the beginning of the Period to 0.73% and 0.55%, respectively, at the end of the Period, remaining below the long-term averages of 2.63% and 2.93%, respectively, dating back to 1999. The avoidance of defaults generally benefits performance.

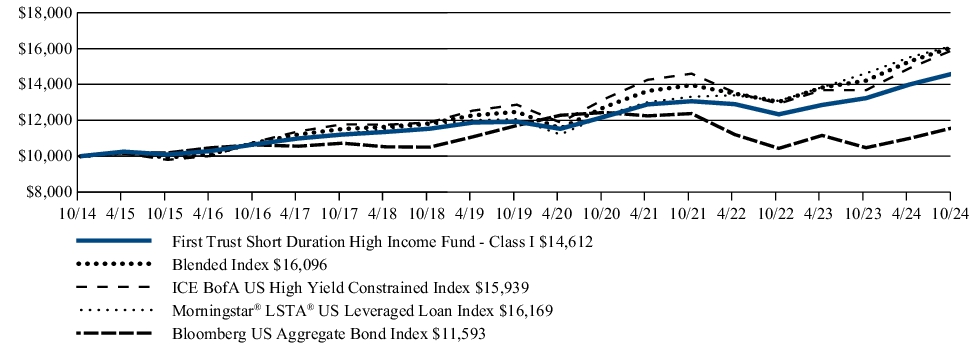

FUND PERFORMANCE (October 31, 2014 to October 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

INVESTMENT PERFORMANCE OF $10,000

| Average Annual Total Returns (as of October 31, 2024) | 1 Year | 5 Year | 10 Year |

| First Trust Short Duration High Income Fund - Class I | 10.58% | 4.20% | 3.87% |

| Blended Index(1) | 13.52% | 5.23% | 4.87% |

| ICE BofA US High Yield Constrained Index | 16.49% | 4.37% | 4.77% |

| Morningstar® LSTA® US Leveraged Loan Index | 10.56% | 6.02% | 4.92% |

| Bloomberg US Aggregate Bond Index | 10.55% | (0.23)% | 1.49% |

| (1) | The Blended Index return is a 50/50 split between the ICE BofA US High Yield Constrained Index and the Morningstar® LSTA® US Leveraged Loan Index returns. |

Visit www.ftportfolios.com/MF/FDHIX for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of October 31, 2024)

| Fund net assets | $73,890,945 |

| Total number of portfolio holdings | 175 |

| Total advisory fee paid | $393,401 |

| Portfolio turnover rate | 64% |

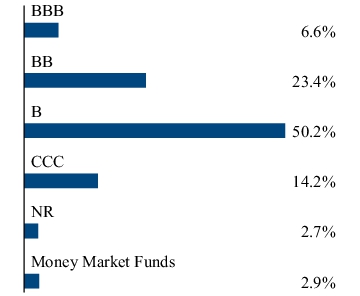

WHAT DID THE FUND INVEST IN? (As of October 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of net assets and total investments, respectively, of the Fund.

| Corporate Bonds and Notes | 51.9% |

| Senior Floating-Rate Loan Interests | 31.3% |

| Foreign Corporate Bonds and Notes | 11.2% |

| Money Market Funds | 2.8% |

| Common Stocks | 0.0% |

| Rights | 0.0% |

| Net Other Assets and Liabilities | 2.8% |

Any amount shown as 0.0% represents less than 0.1%

(1) The ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher. "NR" indicates no rating. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/MF/FDHIX to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Managed Municipal Fund

CWAIX | Class I

ANNUAL SHAREHOLDER REPORT | OCTOBER 31, 2024

This annual shareholder report contains important information about the First Trust Managed Municipal Fund (the “Fund”) for the year of November 1, 2023 to October 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/CWAIX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Managed Municipal Fund - Class I | $59 | 0.56% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund’s Class I returned 10.38% for the 12 months ended October 31, 2024. The Fund’s Class I outperformed its benchmark, the Bloomberg Municipal Bond 5-15 Year Index, which returned 8.10% for the same Period.

The following key factors impacted the Fund’s performance relative to the benchmark during the Period:

Credit Rating: The Fund’s selection of non-rated municipal bonds and selection and allocation of AA and A rated bonds were the primary contributors to the Fund’s outperformance relative to the benchmark. No credit rating category was a material negative contributor to the Fund’s performance during the Period.

Yield Curve Positioning/Duration: Relative to the benchmark, the Fund’s allocation to bonds in the 18+ years to maturity and 16-18 years to maturity were the primary contributors to the Fund’s outperformance. The allocation and selection in 8-10 years to maturity, 6-8 years to maturity and 4-6 years to maturity were secondary contributors. The allocation and selection to bonds with maturities of 12-14 years and the selection of bonds with maturities 0-2 years were the primary detractors to the Fund’s performance. The allocation to bonds 2-4 years to maturity was a secondary negative detractor to the Fund’s performance. Examining effective duration, the Fund’s allocation and selection of bonds with an effective duration of 7-10 years and 3-5 years were the primary contributors to the Fund’s outperformance while the selection of bonds with an effective duration of 5-7 years was a secondary contributor to the Fund’s outperformance. Bond selection with an effective duration in 0-2 years and the allocation to bonds with an effective duration of 2-4 years were the primary detractors to the Fund’s performance.

Interest Rate Hedge: The use of U.S. Treasury futures to hedge interest rate risk was a moderately negative contributor to the Fund’s performance.

Sector/Industry: The selection of Special Tax bonds, Local General Obligation, Education and the allocation and selection in Health Care and State General Obligation sectors were the leading contributors to the Fund’s outperformance. The Fund’s allocation and selection of housing bonds was a modest detractor to the Fund’s performance.

These key factors impacted the Fund’s performance during the Period:

U.S. Treasury Rate Trends: U.S. Treasury rates declined all along the yield curve. During the Period, 10-Year and 30-Year U.S. Treasury yields decreased by approximately 65 basis points (“bps”) and 62 bps, respectively, to 4.28% and 4.47%. As a reminder, the price of a bond moves inversely to a given change in yield, so lower yields resulted in higher U.S. Treasury bond prices.

Industry Fund Inflows/Outflows: Industry-wide mutual fund and exchange-traded fund flows have been distinctly positive year-to-date. According to data collected by LSEG Lipper and JP Morgan, year-to-date inflows were tracking approximately $33.8 billion with approximately $19.7 billion inflows into investment grade funds and $14.2 billion of inflows into high yield funds. In general, fund inflows would indicate more demand for municipal securities which could support bond prices while fund outflows would signal less demand for municipal securities which could reduce bond prices.

Primary Market Supply: New issue municipal bond supply has been significantly higher year-to-date, as of October 31, 2024, compared to the same period of 2023. Through October 31, 2024, year-to-date issuance increased approximately 38% to $442 billion. Historically speaking, larger than historical average municipal bond supply could require higher yields to increase or support municipal bond demand while less supply might result in lower yields given a consistent level of demand. Actual market experience could vary from historical norms.

Credits Spreads and Trends: According to data analyzed from Bloomberg, municipal credit spreads declined year-over-year. From, October 31, 2023 to October 31, 2024, municipal bond credit spreads for bonds rated AA, A, BBB, and high yield decreased by approximately 4 bps, 19 bps, 26 bps, and 26 bps, respectively.

Changes in Municipal Bond Yields: Looking at the Refinitiv/TM3 AAA municipal yield curve over the past year, municipal yields have declined significantly, with 10-Year and 30-Year AAA municipal yields declining by 60 bps and 70 bps, respectively, to 3.01% and 3.87% as of October 31, 2024.

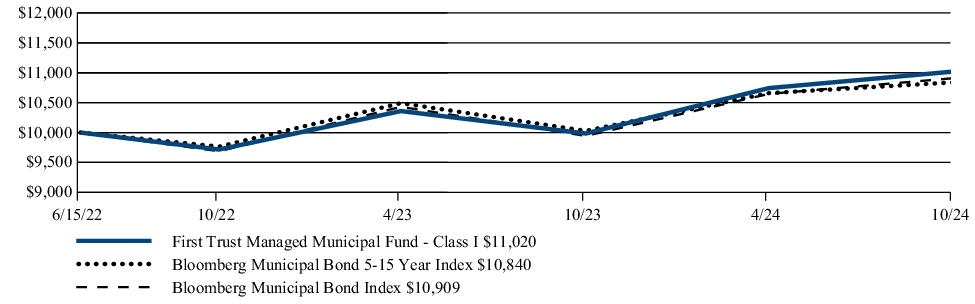

FUND PERFORMANCE (June 15, 2022 to October 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

INVESTMENT PERFORMANCE OF $10,000

| Average Annual Total Returns (as of October 31, 2024) | 1 Year | Since

Inception

(6/15/22) |

| First Trust Managed Municipal Fund - Class I | 10.38% | 4.17% |

| Bloomberg Municipal Bond 5-15 Year Index | 8.10% | 3.45% |

| Bloomberg Municipal Bond Index | 9.70% | 3.73% |

Visit www.ftportfolios.com/MF/CWAIX for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor.

Performance in municipal bond investment strategies can be impacted from the benefits of purchasing odd lot positions. The impact of these investments can be particularly meaningful when funds have limited assets under management and may not be a sustainable source of performance as a fund grows in size.

KEY FUND STATISTICS (As of October 31, 2024)

| Fund net assets | $75,310,420 |

| Total number of portfolio holdings | 141 |

| Total advisory fee paid | $150,489 |

| Portfolio turnover rate | 28% |

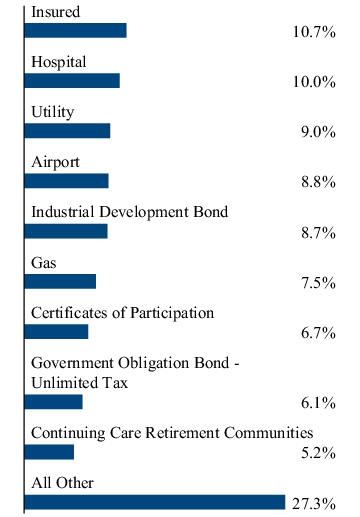

WHAT DID THE FUND INVEST IN? (As of October 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| AAA | 5.1 |

| AA | 34.6 |

| A | 29.4 |

| BBB | 15.5 |

| BB | 2.4 |

| B | 0.7 |

| Not Rated | 12.3 |

(1) The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund’s prospectus, and any applicable supplements at www.ftportfolios.com/fund-documents/MF/CWAIX or upon request at 1-800-621-1675 or info@ftportfolios.com.

Effective June 14, 2024, the investment advisor’s agreement to waive management fees in the amount of 0.15% of the Fund’s average daily net assets was terminated.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/MF/CWAIX to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Preferred Securities

and Income Fund

FPEAX | Class A

ANNUAL SHAREHOLDER REPORT | OCTOBER 31, 2024

This annual shareholder report contains important information about the First Trust Preferred Securities and Income Fund (the “Fund”) for the year of November 1, 2023 to October 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FPEAX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Preferred Securities and Income Fund - Class A | $155 | 1.41%(1) |

| (1) | The ratio reflects extraordinary legal expenses of 0.01%, which are not included in the expense cap. |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund’s Class A returned 20.44% (without sales charge) for the 12 months ended October 31, 2024. The Fund’s Class A underperformed its benchmark, a blended benchmark consisting of a 30/30/30/10 blend of the ICE BofA Core Plus Fixed Rate Preferred Securities Index, the ICE BofA US Investment Grade Institutional Capital Securities Index, the ICE USD Contingent Capital Index and the ICE BofA US High Yield Institutional Capital Securities Index, which returned 20.56% for the same Period.

The performance of the Fund was primarily driven by security selection within variable rate securities during the bullish Period. Many of these securities were trading at deep discounts to par to start the Period but pulled towards par during the Period as resilient economic data and disinflation drove spreads tighter across the market. This was most pronounced within shorter duration securities that are approaching their first call dates. Other factors that contributed to the Fund’s performance were as follows:

Better security selection and overweight allocation to newly issued securities in 2024;

Security selection within global banks including U.S. Global Systematically Important Banks, European banks and high-quality Emerging Market Banks;

Security selection in insurance, utilities and energy pipelines.

There were a few factors that detracted from relative performance compared to the benchmark. This included the Fund’s underweight to longer duration (10+ year) securities, including fixed rate coupon security structures. These securities outperformed as rates moved lower during the Period. Other factors that detracted from relative performance were as follows:

Underweight allocation and security selection within regional and super regional banks;

Overweight allocation to Federal Farm Credit Banks;

Underweight allocation to consumer finance.

Despite the economic resilience experienced through the tightening cycle to date, the Fund maintains a conservative stance as it relates to credit. Specifically, this includes underweighting potentially higher beta parts of the market, including consumer finance, regional banks and real estate investment trusts.

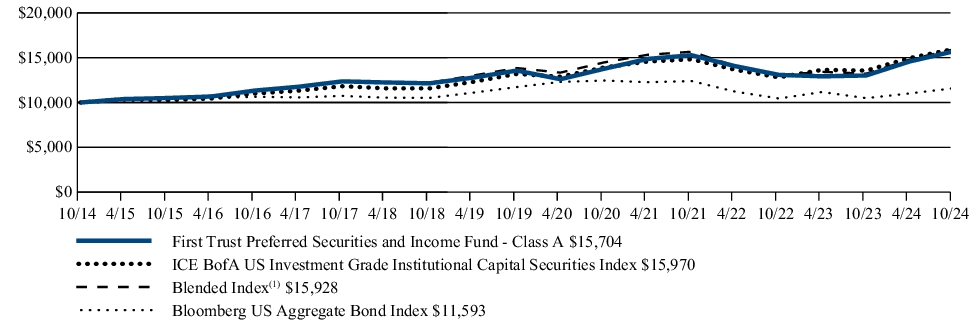

FUND PERFORMANCE (October 31, 2014 to October 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

INVESTMENT PERFORMANCE OF $10,000

| Average Annual Total Returns (as of October 31, 2024) | 1 Year | 5 Year | 10 Year |

| First Trust Preferred Securities and Income Fund - Class A (w/max 4.50% sales charge) | 15.02% | 2.00% | 4.14% |

| First Trust Preferred Securities and Income Fund - Class A (without sales charge) | 20.44% | 2.94% | 4.62% |

| ICE BofA US Investment Grade Institutional Capital Securities Index | 17.82% | 3.90% | 4.79% |

| Blended Index(1) | 20.56% | 2.84% | 4.76% |

| Bloomberg US Aggregate Bond Index | 10.55% | (0.23)% | 1.49% |

| (1) | The Blended Index consists of a 30/30/30/10 blend of the ICE BofA Core Plus Fixed Rate Preferred Securities Index, the ICE BofA US Investment Grade Institutional Capital Securities Index, the ICE USD Contingent Capital Index and the ICE BofA US High Yield Institutional Capital Securities Index. |

Visit www.ftportfolios.com/MF/FPEAX for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor.

KEY FUND STATISTICS (As of October 31, 2024)

| Fund net assets | $234,020,431 |

| Total number of portfolio holdings | 185 |

| Total advisory fee paid | $1,732,894 |

| Portfolio turnover rate | 43% |

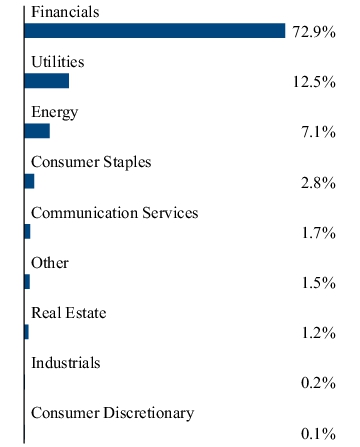

WHAT DID THE FUND INVEST IN? (As of October 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Bank of America Corp., Series TT | 2.6% |

| Wells Fargo & Co., Series L | 2.1% |

| Barclays PLC | 1.8% |

| JPMorgan Chase & Co., Series NN | 1.8% |

| Energy Transfer, L.P., Series G | 1.7% |

| Intesa Sanpaolo S.p.A. | 1.7% |

| Lloyds Banking Group PLC | 1.5% |

| Toronto-Dominion Bank (The) | 1.5% |

| Bank of Montreal | 1.5% |

| Global Atlantic Fin Co. | 1.4% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/MF/FPEAX to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Preferred Securities

and Income Fund

FPECX | Class C

ANNUAL SHAREHOLDER REPORT | OCTOBER 31, 2024

This annual shareholder report contains important information about the First Trust Preferred Securities and Income Fund (the “Fund”) for the year of November 1, 2023 to October 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FPECX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Preferred Securities and Income Fund - Class C | $237 | 2.16%(1) |

| (1) | The ratio reflects extraordinary legal expenses of 0.01%, which are not included in the expense cap. |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund’s Class C returned 19.57% (without sales charge) for the 12 months ended October 31, 2024. The Fund’s Class C underperformed its benchmark, a blended benchmark consisting of a 30/30/30/10 blend of the ICE BofA Core Plus Fixed Rate Preferred Securities Index, the ICE BofA US Investment Grade Institutional Capital Securities Index, the ICE USD Contingent Capital Index and the ICE BofA US High Yield Institutional Capital Securities Index, which returned 20.56% for the same Period.

The performance of the Fund was primarily driven by security selection within variable rate securities during the bullish Period. Many of these securities were trading at deep discounts to par to start the Period but pulled towards par during the Period as resilient economic data and disinflation drove spreads tighter across the market. This was most pronounced within shorter duration securities that are approaching their first call dates. Other factors that contributed to the Fund’s performance were as follows:

Better security selection and overweight allocation to newly issued securities in 2024;

Security selection within global banks including U.S. Global Systematically Important Banks, European banks and high-quality Emerging Market Banks;

Security selection in insurance, utilities and energy pipelines.

There were a few factors that detracted from relative performance compared to the benchmark. This included the Fund’s underweight to longer duration (10+ year) securities, including fixed rate coupon security structures. These securities outperformed as rates moved lower during the Period. Other factors that detracted from relative performance were as follows:

Underweight allocation and security selection within regional and super regional banks;

Overweight allocation to Federal Farm Credit Banks;

Underweight allocation to consumer finance.

Despite the economic resilience experienced through the tightening cycle to date, the Fund maintains a conservative stance as it relates to credit. Specifically, this includes underweighting potentially higher beta parts of the market, including consumer finance, regional banks and real estate investment trusts.

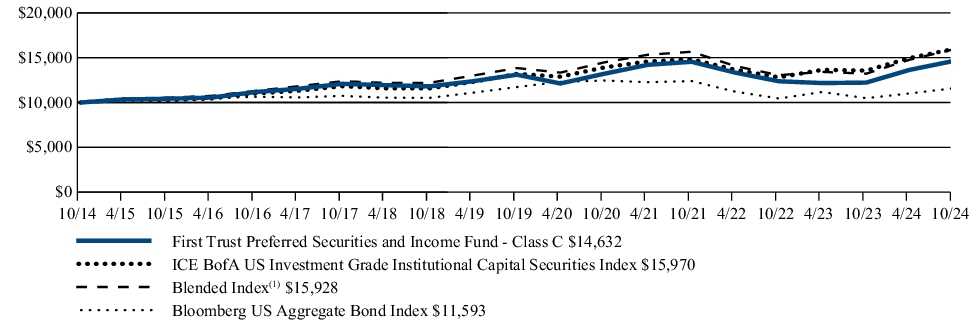

FUND PERFORMANCE (October 31, 2014 to October 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

INVESTMENT PERFORMANCE OF $10,000

| Average Annual Total Returns (as of October 31, 2024) | 1 Year | 5 Year | 10 Year |

| First Trust Preferred Securities and Income Fund - Class C (w/max 1.00% contingent deferred sales charge) | 18.57% | 2.21% | 3.88% |

| First Trust Preferred Securities and Income Fund - Class C (without sales charge) | 19.57% | 2.21% | 3.88% |

| ICE BofA US Investment Grade Institutional Capital Securities Index | 17.82% | 3.90% | 4.79% |

| Blended Index(1) | 20.56% | 2.84% | 4.76% |

| Bloomberg US Aggregate Bond Index | 10.55% | (0.23)% | 1.49% |

| (1) | The Blended Index consists of a 30/30/30/10 blend of the ICE BofA Core Plus Fixed Rate Preferred Securities Index, the ICE BofA US Investment Grade Institutional Capital Securities Index, the ICE USD Contingent Capital Index and the ICE BofA US High Yield Institutional Capital Securities Index. |

Visit www.ftportfolios.com/MF/FPECX for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor.

KEY FUND STATISTICS (As of October 31, 2024)

| Fund net assets | $234,020,431 |

| Total number of portfolio holdings | 185 |

| Total advisory fee paid | $1,732,894 |

| Portfolio turnover rate | 43% |

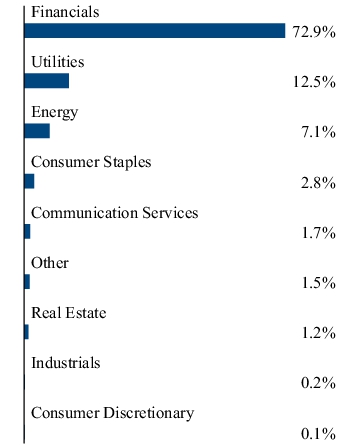

WHAT DID THE FUND INVEST IN? (As of October 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Bank of America Corp., Series TT | 2.6% |

| Wells Fargo & Co., Series L | 2.1% |

| Barclays PLC | 1.8% |

| JPMorgan Chase & Co., Series NN | 1.8% |

| Energy Transfer, L.P., Series G | 1.7% |

| Intesa Sanpaolo S.p.A. | 1.7% |

| Lloyds Banking Group PLC | 1.5% |

| Toronto-Dominion Bank (The) | 1.5% |

| Bank of Montreal | 1.5% |

| Global Atlantic Fin Co. | 1.4% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/MF/FPECX to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Preferred Securities

and Income Fund

FPEFX | Class F

ANNUAL SHAREHOLDER REPORT | OCTOBER 31, 2024

This annual shareholder report contains important information about the First Trust Preferred Securities and Income Fund (the “Fund”) for the year of November 1, 2023 to October 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FPEFX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Preferred Securities and Income Fund - Class F | $145 | 1.31%(1) |

| (1) | The ratio reflects extraordinary legal expenses of 0.01%, which are not included in the expense cap. |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund’s Class F returned 20.63% for the 12 months ended October 31, 2024. The Fund’s Class F outperformed its benchmark, a blended benchmark consisting of a 30/30/30/10 blend of the ICE BofA Core Plus Fixed Rate Preferred Securities Index, the ICE BofA US Investment Grade Institutional Capital Securities Index, the ICE USD Contingent Capital Index and the ICE BofA US High Yield Institutional Capital Securities Index, which returned 20.56% for the same Period.

The performance of the Fund was primarily driven by security selection within variable rate securities during the bullish Period. Many of these securities were trading at deep discounts to par to start the Period but pulled towards par during the Period as resilient economic data and disinflation drove spreads tighter across the market. This was most pronounced within shorter duration securities that are approaching their first call dates. Other factors that contributed to the Fund’s performance were as follows:

Better security selection and overweight allocation to newly issued securities in 2024;

Security selection within global banks including U.S. Global Systematically Important Banks, European banks and high-quality Emerging Market Banks;

Security selection in insurance, utilities and energy pipelines.

There were a few factors that detracted from relative performance compared to the benchmark. This included the Fund’s underweight to longer duration (10+ year) securities, including fixed rate coupon security structures. These securities outperformed as rates moved lower during the Period. Other factors that detracted from relative performance were as follows:

Underweight allocation and security selection within regional and super regional banks;

Overweight allocation to Federal Farm Credit Banks;

Underweight allocation to consumer finance.

Despite the economic resilience experienced through the tightening cycle to date, the Fund maintains a conservative stance as it relates to credit. Specifically, this includes underweighting potentially higher beta parts of the market, including consumer finance, regional banks and real estate investment trusts.

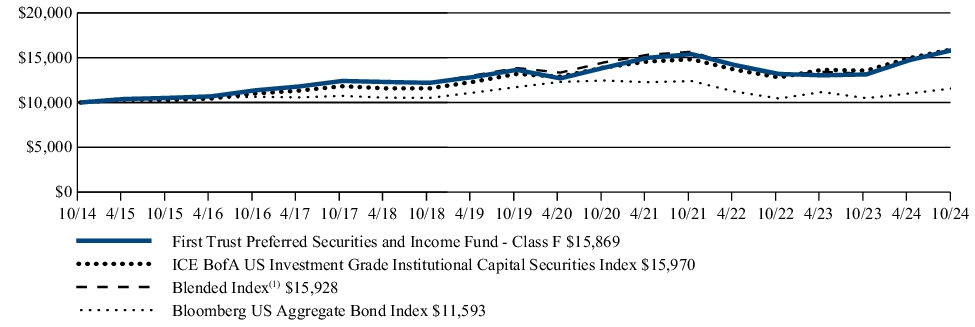

FUND PERFORMANCE (October 31, 2014 to October 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

INVESTMENT PERFORMANCE OF $10,000

| Average Annual Total Returns (as of October 31, 2024) | 1 Year | 5 Year | 10 Year |

| First Trust Preferred Securities and Income Fund - Class F | 20.63% | 3.04% | 4.73% |

| ICE BofA US Investment Grade Institutional Capital Securities Index | 17.82% | 3.90% | 4.79% |

| Blended Index(1) | 20.56% | 2.84% | 4.76% |

| Bloomberg US Aggregate Bond Index | 10.55% | (0.23)% | 1.49% |

| (1) | The Blended Index consists of a 30/30/30/10 blend of the ICE BofA Core Plus Fixed Rate Preferred Securities Index, the ICE BofA US Investment Grade Institutional Capital Securities Index, the ICE USD Contingent Capital Index and the ICE BofA US High Yield Institutional Capital Securities Index. |

Visit www.ftportfolios.com/MF/FPEFX for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor.

KEY FUND STATISTICS (As of October 31, 2024)

| Fund net assets | $234,020,431 |

| Total number of portfolio holdings | 185 |

| Total advisory fee paid | $1,732,894 |

| Portfolio turnover rate | 43% |

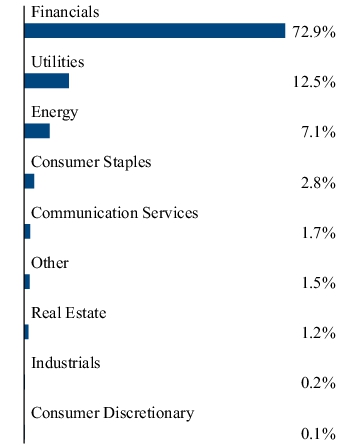

WHAT DID THE FUND INVEST IN? (As of October 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Bank of America Corp., Series TT | 2.6% |

| Wells Fargo & Co., Series L | 2.1% |

| Barclays PLC | 1.8% |

| JPMorgan Chase & Co., Series NN | 1.8% |

| Energy Transfer, L.P., Series G | 1.7% |

| Intesa Sanpaolo S.p.A. | 1.7% |

| Lloyds Banking Group PLC | 1.5% |

| Toronto-Dominion Bank (The) | 1.5% |

| Bank of Montreal | 1.5% |

| Global Atlantic Fin Co. | 1.4% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/MF/FPEFX to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Preferred Securities

and Income Fund

FPEIX | Class I

ANNUAL SHAREHOLDER REPORT | OCTOBER 31, 2024

This annual shareholder report contains important information about the First Trust Preferred Securities and Income Fund (the “Fund”) for the year of November 1, 2023 to October 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FPEIX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Preferred Securities and Income Fund - Class I | $117 | 1.06%(1) |

| (1) | The ratio reflects extraordinary legal expenses of 0.01%, which are not included in the expense cap. |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund’s Class I returned 20.92% for the 12 months ended October 31, 2024. The Fund’s Class I outperformed its benchmark, a blended benchmark consisting of a 30/30/30/10 blend of the ICE BofA Core Plus Fixed Rate Preferred Securities Index, the ICE BofA US Investment Grade Institutional Capital Securities Index, the ICE USD Contingent Capital Index and the ICE BofA US High Yield Institutional Capital Securities Index, which returned 20.56% for the same Period.

The performance of the Fund was primarily driven by security selection within variable rate securities during the bullish Period. Many of these securities were trading at deep discounts to par to start the Period but pulled towards par during the Period as resilient economic data and disinflation drove spreads tighter across the market. This was most pronounced within shorter duration securities that are approaching their first call dates. Other factors that contributed to the Fund’s performance were as follows:

Better security selection and overweight allocation to newly issued securities in 2024;

Security selection within global banks including U.S. Global Systematically Important Banks, European banks and high-quality Emerging Market Banks;

Security selection in insurance, utilities and energy pipelines.

There were a few factors that detracted from relative performance compared to the benchmark. This included the Fund’s underweight to longer duration (10+ year) securities, including fixed rate coupon security structures. These securities outperformed as rates moved lower during the Period. Other factors that detracted from relative performance were as follows:

Underweight allocation and security selection within regional and super regional banks;

Overweight allocation to Federal Farm Credit Banks;

Underweight allocation to consumer finance.

Despite the economic resilience experienced through the tightening cycle to date, the Fund maintains a conservative stance as it relates to credit. Specifically, this includes underweighting potentially higher beta parts of the market, including consumer finance, regional banks and real estate investment trusts.

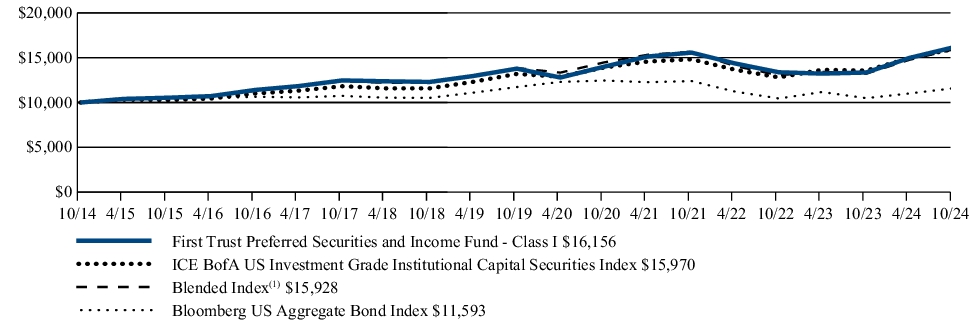

FUND PERFORMANCE (October 31, 2014 to October 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

INVESTMENT PERFORMANCE OF $10,000

| Average Annual Total Returns (as of October 31, 2024) | 1 Year | 5 Year | 10 Year |

| First Trust Preferred Securities and Income Fund - Class I | 20.92% | 3.22% | 4.91% |

| ICE BofA US Investment Grade Institutional Capital Securities Index | 17.82% | 3.90% | 4.79% |

| Blended Index(1) | 20.56% | 2.84% | 4.76% |

| Bloomberg US Aggregate Bond Index | 10.55% | (0.23)% | 1.49% |

| (1) | The Blended Index consists of a 30/30/30/10 blend of the ICE BofA Core Plus Fixed Rate Preferred Securities Index, the ICE BofA US Investment Grade Institutional Capital Securities Index, the ICE USD Contingent Capital Index and the ICE BofA US High Yield Institutional Capital Securities Index. |

Visit www.ftportfolios.com/MF/FPEIX for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of October 31, 2024)

| Fund net assets | $234,020,431 |

| Total number of portfolio holdings | 185 |

| Total advisory fee paid | $1,732,894 |

| Portfolio turnover rate | 43% |

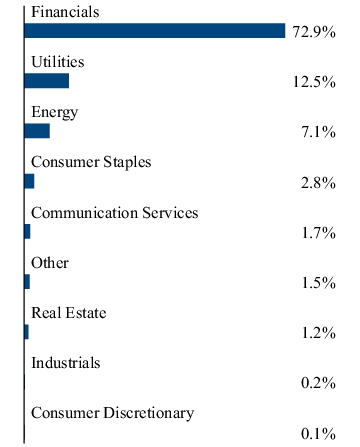

WHAT DID THE FUND INVEST IN? (As of October 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Bank of America Corp., Series TT | 2.6% |

| Wells Fargo & Co., Series L | 2.1% |

| Barclays PLC | 1.8% |

| JPMorgan Chase & Co., Series NN | 1.8% |

| Energy Transfer, L.P., Series G | 1.7% |

| Intesa Sanpaolo S.p.A. | 1.7% |

| Lloyds Banking Group PLC | 1.5% |

| Toronto-Dominion Bank (The) | 1.5% |

| Bank of Montreal | 1.5% |

| Global Atlantic Fin Co. | 1.4% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/MF/FPEIX to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

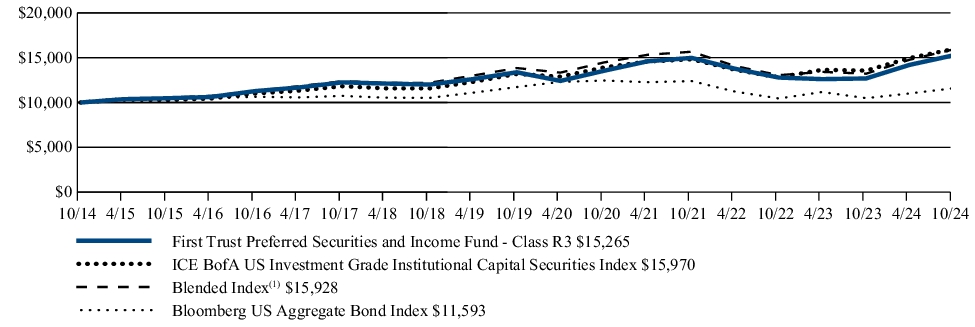

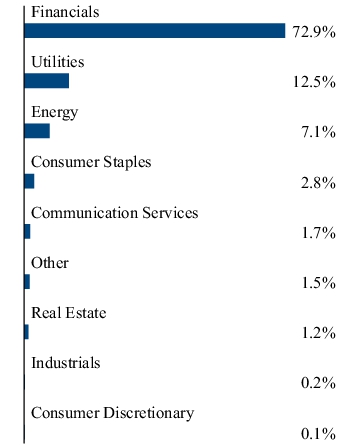

First Trust Preferred Securities

and Income Fund

FPERX | Class R3

ANNUAL SHAREHOLDER REPORT | OCTOBER 31, 2024

This annual shareholder report contains important information about the First Trust Preferred Securities and Income Fund (the “Fund”) for the year of November 1, 2023 to October 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FPERX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)