UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number 811-22452 |

First Trust Series Fund

(Exact name of registrant as specified in charter) |

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code) |

| |

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service) |

Registrant’s telephone number, including area code: (630) 765-8000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

First Trust Preferred

Securities and Income Fund

Annual Report

For the Year Ended

October 31, 2021

First Trust Preferred Securities and Income Fund

Annual Report

October 31, 2021

Caution Regarding Forward-Looking Statements

This report contains certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”) and/or Stonebridge Advisors LLC (“Stonebridge” or the “Sub-Advisor”) and their respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,” “may,” “should,” “would” or other words that convey uncertainty of future events or outcomes.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of First Trust Preferred Securities and Income Fund (the “Fund”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Advisor and/or Sub-Advisor and their respective representatives only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Performance and Risk Disclosure

There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the Fund’s shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in the Fund. See “Risk Considerations” in the Additional Information section of this report for a discussion of certain other risks of investing in the Fund.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com or speak with your financial advisor. Investment returns and net asset value will fluctuate and Fund shares, when sold, may be worth more or less than their original cost.

The Advisor may also periodically provide additional information on Fund performance on the Fund’s web page at www.ftportfolios.com.

How to Read This Report

This report contains information that may help you evaluate your investment in the Fund. It includes details about the Fund and presents data and analysis that provide insight into the Fund’s performance and investment approach.

By reading the portfolio commentary by the portfolio management team of the Fund, you may obtain an understanding of how the market environment affected the Fund’s performance. The statistical information that follows may help you understand the Fund’s performance compared to that of relevant market benchmarks.

It is important to keep in mind that the opinions expressed by personnel of First Trust and Stonebridge are just that: informed opinions. They should not be considered to be promises or advice. The opinions, like the statistics, cover the period through the date on the cover of this report. The material risks of investing in the Fund are spelled out in the prospectus, the statement of additional information, this report and other Fund regulatory filings.

First Trust Preferred Securities and Income Fund

Annual Letter from the Chairman and CEO

October 31, 2021

Dear Shareholders,

First Trust is pleased to provide you with the annual report for the First Trust Preferred Securities and Income Fund (the “Fund”), which contains detailed information about the Fund for the twelve months ended October 31, 2021.

Inflation has arrived, and its entrance was grand, to say the least. The Consumer Price Index came in at 6.2% year-over-year in October 2021, according to data from the U.S. Bureau of Labor Statistics. The last time it topped the 6.0% mark was in December 1990 (6.1%), over 30 years ago. As is often the case with major shifts in the economy and markets, there is debate over what is truly behind them. For many months, as inflation was trending higher, Federal Reserve (the “Fed”) Chairman Jerome Powell held the view that the rising inflationary pressures largely stemmed from global supply chain bottlenecks induced by the coronavirus (“COVID-19”) pandemic. Perhaps the best example of this is the unprecedented backlog of container ships that have dropped anchor outside the California ports of Los Angeles and Long Beach. Together, these ports service 40% of all the container ships bound for the U.S. In normal times, no ships are anchored waiting to unload their goods. Shortages of trucks and drivers have also contributed to the slowdown at the ports.

The takeaway is that goods are not being delivered to warehouses and store shelves in a timely fashion and that is helping to drive prices higher for consumers. Simply put, inflation is the byproduct of too much money chasing too few goods. We’ll return to this axiom shortly. Chairman Powell originally believed the bottlenecks would be remedied relatively quickly as the global economy reopened and people went back to work. That, in turn, would allow inflationary pressures to dissipate, which has not happened. Around the end of October, Chairman Powell finally acknowledged that inflation will likely remain elevated through mid-2022. This realization is what motivated the Fed to announce that it would begin to taper its monthly bond buying program (quantitative easing) starting in November 2021. It has been purchasing roughly $80 billion of Treasuries and $40 billion of mortgage-backed securities in the open market every month since June 2020. The Fed will shave $15 billion off that combined total every month until the buying has ceased, which should be around mid-2022. If all goes to plan, the next stage in the evolution of the Fed’s monetary policy would involve initiating interest rate hikes.

While the supply chain bottlenecks have clearly played a role in the spike in inflation by limiting the amount of goods available to consume, the biggest contributing factor is likely the surge in the U.S. money supply, according to Brian Wesbury, Chief Economist at First Trust. M2 is a measure of the money supply that includes cash, checking deposits and liquid assets easily convertible to cash. The M2 measure of money has exploded by 36% since February 2020, well above the 6% pre-COVID-19 annualized norm. The trillions of dollars of stimulus distributed by the U.S. government to help backstop the economy during the pandemic has contributed to higher inflation. On Wednesday, November 10, 2021, President Joe Biden admitted that his $1.9 trillion COVID-19 stimulus package has done just that. Remember, too much money chasing too few goods leads to inflation. Keep in mind, President Biden has recently successfully navigated a $1.2 trillion bipartisan infrastructure bill through Congress and has another roughly $1.75 trillion Build Back Better Act (social spending) piece of legislation pending. That means there is at least another $1.2 trillion dollars flowing into the economy over the next few years, and maybe more.

Data from FactSet indicates that the number of S&P 500® Index companies mentioning inflation on their 2021 third quarter earnings call hit a 10-year high, according to Business Insider. To date, 285 of the 461 companies that have reported their results have cited concerns over rising inflation. The Materials, Consumer Staples and Energy sectors had the highest percentage of companies mentioned on these earnings calls at 90%, 88% and 86%, respectively. Suffice it to say, investors should add inflation to the list of criteria to assist them in positioning their portfolios moving forward.

Thank you for giving First Trust the opportunity to play a role in your financial future. We value our relationship with you and will report on the Fund again in six months.

Sincerely,

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust Advisors L.P.

First Trust Preferred Securities and Income Fund

“AT A GLANCE”

As of October 31, 2021 (Unaudited)

| Fund Statistics | |

| First Trust Preferred Securities and Income Fund | Net Asset

Value (NAV) |

| Class A (FPEAX) | $22.58 |

| Class C (FPECX) | $22.72 |

| Class F (FPEFX) | $22.87 |

| Class I (FPEIX) | $22.72 |

| Class R3 (FPERX) | $22.51 |

| Sector Allocation | % of Total

Investments |

| Financials | 74.6% |

| Energy | 8.3 |

| Utilities | 6.7 |

| Industrials | 4.2 |

| Consumer Staples | 3.3 |

| Real Estate | 2.1 |

| Communication Services | 0.8 |

| Total | 100.0% |

| Country Allocation | % of Total

Investments |

| United States | 52.1% |

| United Kingdom | 9.1 |

| Canada | 7.0 |

| France | 6.8 |

| Switzerland | 4.7 |

| Bermuda | 3.9 |

| Netherlands | 3.5 |

| Australia | 2.6 |

| Italy | 2.2 |

| Spain | 2.0 |

| Multinational | 1.2 |

| Mexico | 1.2 |

| Finland | 1.0 |

| Denmark | 1.0 |

| Japan | 0.8 |

| Germany | 0.4 |

| Sweden | 0.3 |

| Chile | 0.2 |

| Total | 100.0% |

| Credit Quality(1) | % of Total

Fixed-Income

Investments |

| A | 0.5% |

| A- | 0.4 |

| BBB+ | 10.5 |

| BBB | 22.5 |

| BBB- | 27.8 |

| BB+ | 22.4 |

| BB | 9.3 |

| BB- | 1.8 |

| B+ | 1.2 |

| B | 0.9 |

| Not Rated | 2.7 |

| Total | 100.0% |

| Top Ten Holdings | % of Total

Investments |

| Barclays PLC | 2.5% |

| AerCap Holdings N.V. | 2.1 |

| Emera, Inc., Series 16-A | 1.7 |

| Enbridge, Inc., Series 16-A | 1.6 |

| Wells Fargo & Co., Series L | 1.6 |

| Credit Suisse Group AG | 1.4 |

| Societe Generale S.A. | 1.3 |

| Credit Agricole S.A. | 1.2 |

| Highlands Holdings Bond Issuer Ltd./Highlands Holdings Bond Co-Issuer, Inc. | 1.2 |

| Lloyds Banking Group PLC | 1.2 |

| Total | 15.8% |

Dividend

Distributions | Class A Shares | Class C Shares | Class F

Shares | Class I Shares | Class R3

Shares |

| Current Monthly Distribution per Share(2) | $0.0853 | $0.0709 | $0.0871 | $0.0900 | $0.0805 |

| Current Distribution Rate on NAV(3) | 4.53% | 3.74% | 4.57% | 4.75% | 4.29% |

| (1) | The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including Standard & Poor’s Ratings Group, a division of the McGraw Hill Companies, Inc., Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change. |

| (2) | Most recent distribution paid or declared through October 31, 2021. Subject to change in the future. |

| (3) | Distribution rates are calculated by annualizing the most recent distribution paid or declared through the report date and then dividing by NAV as of October 31, 2021. Subject to change in the future. |

First Trust Preferred Securities and Income Fund

“AT A GLANCE” (Continued)

As of October 31, 2021 (Unaudited)

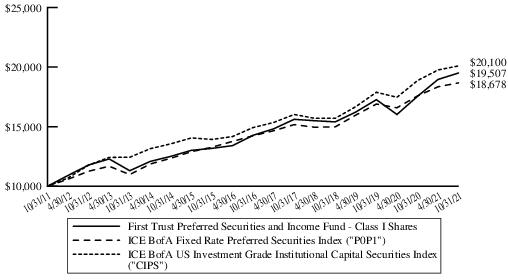

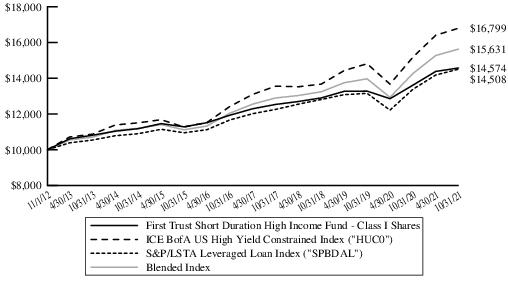

Performance of a $10,000 investment

This chart compares your Fund’s Class I performance to that of the ICE BofA Fixed Rate Preferred Securities Index and the ICE BofA US Investment Grade Institutional Capital Securities Index from 10/31/2011 through 10/31/2021.

First Trust Preferred Securities and Income Fund

“AT A GLANCE” (Continued)

As of October 31, 2021 (Unaudited)

| Performance as of October 31, 2021 |

| | A Shares

Inception

2/25/2011 | | | C Shares

Inception

2/25/2011 | | | F Shares

Inception

3/2/2011 | | | I Shares

Inception

1/11/2011 | | | R3 Shares

Inception

3/2/2011 |

Cumulative

Total Returns | w/o

sales

charge | | w/max

4.50%

sales

charge | | | w/o

sales

charge | | w/max 1.00% contingent deferred sales charge | | | w/o

sales

charge | | | w/o

sales

charge | | | w/o

sales

charge |

| 1 Year | 10.89% | | 5.92% | | | 10.11% | | 9.11% | | | 10.91% | | | 11.21% | | | 10.56% |

Average Annual

Total Returns | | | | | | | | | | | | | | | | | |

| 5 Years | 6.16% | | 5.19% | | | 5.44% | | 5.44% | | | 6.29% | | | 6.45% | | | 5.86% |

| 10 Years | 6.63% | | 6.14% | | | 5.87% | | 5.87% | | | 6.81% | | | 6.91% | | | 6.33% |

| Since Inception | 6.53% | | 6.07% | | | 5.78% | | 5.78% | | | 6.68% | | | 6.88% | | | 6.19% |

| 30-Day SEC Yield(4) | 3.29% | | | 2.71% | | | 3.60% | | | 3.73% | | | 3.25% |

| Performance as of October 31, 2021 (Continued) |

| | Blended

Index*(5)(6)(7) | P0P1*

ICE BofA

Fixed Rate

Preferred

Securities Index | CIPS*

ICE BofA

US Investment

Grade

Institutional

Capital

Securities

Index | Prior

Blended

Index*(8) |

Cumulative

Total Returns | w/o

sales

charge | w/o

sales

charge | w/o

sales

charge | w/o

sales

charge |

| 1 Year | 8.18% | 6.27% | 6.56% | 6.10% |

Average Annual

Total Returns | | | | |

| 5 Years | 6.76% | 5.59% | 6.14% | 5.87% |

| 10 Years | N/A | 6.45% | 7.23% | 6.86% |

| Since Inception | N/A | 6.45% | 6.85% | 6.66% |

* Since inception return is based on the Class I Shares inception date.

Performance figures assume reinvestment of all distributions and do not reflect the deduction of taxes that the shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if certain fees had not been waived and expenses reimbursed by the Advisor and Sub-Advisor. An index is a statistical composite that tracks a specific financial market or sector. Unlike the Fund, these indices do not actually hold a portfolio of securities and therefore do not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. The Fund’s past performance does not predict future performance.

Performance of share classes will vary due to differences in sales charges and expenses. Total return with sales charges includes payment of the maximum sales charge of 4.50% for Class A Shares, a contingent deferred sales charge (“CDSC”) of 1.00% for Class C Shares in year one and Rule 12b-1 service fees of 0.25% per year of average daily net assets for Class A Shares and combined Rule 12b-1 distribution and service fees of 1.00% per year of average daily net assets for Class C Shares. Class F, Class I and Class R3 Shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value. The Rule 12b-1 service fees are 0.15% of average daily net assets for Class F Shares and combined Rule 12b-1 distribution and service fees are 0.50% of average daily net assets for Class R3 Shares, while Class I Shares do not have these fees. Prior to December 15, 2011, the combined Rule 12b-1 distribution and service fees for Class R3 Shares were 0.75% of average daily net assets.

| (4) | 30-day SEC yield is calculated by dividing the net investment income per share earned during the most recent 30-day period by the maximum offering price per share on the last day of the period. The reported SEC yields are subsidized. The subsidized yields reflect the waiver and/or a reimbursement of Fund expenses, which has the effect of lowering the Fund’s expense ratio and generating a higher yield. |

| (5) | On July 6, 2021, the Fund’s benchmark changed from the Prior Blended Index to the Blended Index, because the Advisor believes that the Blended Index better reflects the investment strategies of the Fund. |

| (6) | The Blended Index consists of a 30/30/30/10 blend of the ICE BofA Core Plus Fixed Rate Preferred Securities Index, the ICE BofA US Investment Grade Institutional Capital Securities Index, the ICE USD Contingent Capital Index and the ICE BofA US High Yield Institutional Capital Securities Index. The Blended Index is intended to reflect the proportional market cap of each segment of the preferred and hybrid securities market. The indices do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Indices are unmanaged and an investor cannot invest directly in an index. The Blended Index returns are calculated by using the monthly returns of the four indices during each period shown above. At the beginning of each month the four indices are rebalanced to a 30/30/30/10 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Blended Index for each period shown above. |

| (7) | Since the ICE BofA Core Plus Fixed Rate Preferred Securities Index had an inception date March 31, 2012, and the ICE USD Contingent Capital Index had an inception date of December 31, 2013, the performance of the Blended Index is not available for all of the periods disclosed. |

| (8) | The Prior Blended Index consists of a 50/50 blend of the ICE BofA Fixed Rate Preferred Securities Index and the ICE BofA U.S. Capital Securities Index. The indices do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Indices are unmanaged and an investor cannot invest directly in an index. The Prior Blended Index returns are calculated by using the monthly returns of the two indices during each period shown above. At the beginning of each month the two indices are rebalanced to a 50/50 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Prior Blended Index for each period shown above. |

Portfolio Commentary

First Trust Preferred Securities and Income Fund

Annual Report

October 31, 2021 (Unaudited)

Advisor

First Trust Advisors L.P. (“First Trust” or the “Advisor”) serves as the investment advisor to the First Trust Preferred Securities and Income Fund (the “Fund”). First Trust is responsible for the ongoing monitoring of the Fund’s investment portfolio, managing the Fund’s business affairs and providing certain administrative services necessary for the management of the Fund.

Sub-Advisor

Stonebridge Advisors LLC (“Stonebridge” or the “Sub-Advisor”) is the investment sub-advisor to the Fund and is a registered investment advisor based in Wilton, Connecticut. Stonebridge specializes in the management of preferred and hybrid securities.

Stonebridge Advisors LLC Portfolio Management Team

Scott T. Fleming - Chief Executive Officer and President

Robert Wolf - Chief Investment Officer, Senior Vice President and Senior Portfolio Manager

Eric Weaver - Senior Vice President, Chief Strategist and Portfolio Manager

Annual Report Commentary

Market Recap

The 12-month period ended October 31, 2021 was a far less volatile period for the preferred and hybrid securities market relative to the prior year. The beginning of the period was marked by another major leg of the market rebound following the volatility in the spring of 2020 driven by the coronavirus (“COVID-19”) pandemic. A second major leg of the rebound largely concluded by the end of the 2020 calendar year and provided over 450 basis points (“bps”) of total return in the Fund’s Benchmark in the first two months of the period. The Benchmark (the “Benchmark”) is a 30%/30%/30%/10% blend of the ICE BofA US Investment Grade Institutional Capital Securities Index (“CIPS”), the ICE USD Contingent Capital Index (“CDLR”), the ICE BofA Core Plus Fixed Rate Preferred Securities Index (“P0P4”), and the ICE BofA US High Yield Institutional Capital Securities Index (“HIPS”), respectively. This time period coincided with President Joe Biden’s U.S. presidential election win, along with an anticipated increase in consumer spending and ending of the COVID-19 pandemic.

As the 2021 calendar year began, a number of headwinds surfaced, most notably a jump in Treasury yields. The 10-Year U.S. Treasury yield increased by over 80 bps in the first quarter of 2021. This led to some volatility in the preferred and hybrid securities market, with a larger pullback in the $25 par retail market compared to the $1,000 par institutional market.

U.S. Treasury yields rallied and consolidated over the following seven months of the 12-month period ended October 31, 2021. This rate environment was supportive of the preferred and hybrid market in general, leading to further yield spread tightening. From a credit perspective, U.S. and European banks reported very strong results over the course of the period, leading equity analysts to lift the 2021 fiscal year consensus earnings estimates by approximately 75% for U.S. banks and over 50% for European banks compared to beginning of year estimates. In addition to strong earnings, loan quality and capital trended well. Both the Federal Reserve (the “Fed”) and the European Central Bank echoed this strong performance by lifting restrictions on common equity distributions. Away from banks, other major sectors within preferreds, including insurance, utilities and real estate investment trusts demonstrated stable credit metrics and positive earnings trends, while rising oil prices provided a nice tail wind for the energy sector.

During the period, non-investment grade (“non-IG”) $1,000 par securities outperformed all other parts of the preferred and hybrid securities market, returning 13.13% (HIPS). European contingent convertible capital securities (“CoCos”) also performed well during the period, returning 8.61% (CDLR). The investment-grade (“IG”) $1,000 par market significantly underperformed their non-IG counterparts during the risk-on period, returning 6.58% (CIPS). The $25 par retail market was the most volatile market segment for the period, but still managed to return 7.73% (P0P4).

Performance Analysis

For the 12-month period ended October 31, 2021, the Fund’s I-shares produced a total return of 11.21%. This compares to a total return of 8.18% for the Fund’s Benchmark. The Fund’s outperformance compared to its Benchmark during the period was primarily a result of its overweight allocation and security selection to non-IG securities, security selection within non-U.S. bank contingent CoCos and security selection within IG securities. The Fund also benefited from its security selection within newly issued securities and $25 par retail securities.

After the announcement of multiple vaccines with proven efficacy against COVID-19 early in the period and the subsequent reopening of the U.S. economy, non-IG securities outperformed all other parts of the preferred and hybrid market. As a result, the yield between

Portfolio Commentary (Continued)

First Trust Preferred Securities and Income Fund

Annual Report

October 31, 2021 (Unaudited)

IG and non-IG securities compressed significantly. The Fund benefited from its better security selection and overweight allocation to non-IG securities relative to the Benchmark during the period. Specifically, the Fund’s holdings within U.S. pipelines, aircraft lessors and food and dairy issuers all added a substantial amount of alpha relative to the Benchmark.

Returns within the IG institutional segment of the market were also strong during the period, although they trailed all other segments of the $1,000 par institutional market. The Fund benefited from its superior security selection within its IG institutional holdings versus the Benchmark during the period. This was due to a combination of factors, including security selection within $1,000 par insurers, allocation to institutional floaters, which are not held in the Benchmark, and the Fund’s overweight allocation to higher reset variable rate securities. In general, the Fund has focused on remaining overweight to lower duration sensitive securities, such as shorter call securities and defensive variable rate securities, in order to offset the potential impact of rising interest rates.

With the reopening economy and increased inflation expectations, the 10-Year Treasury yield moved significantly higher during the period. This contributed to the elevated volatility within the $25 par retail market, which has a longer duration profile than the $1,000 par institutional market due to their overweight to fixed-for-life coupon structures. The Fund took advantage of the volatility during the period and outperformed significantly across both IG and non-IG retail holdings while still maintaining an underweight allocation relative to the Benchmark.

Another area of outperformance for the Fund was its superior security selection within non-U.S. bank CoCos. Similar to U.S. banks, non-U.S. banks benefited from improved economic conditions, generally resulting in better-than-expected earnings and lower loan loss provisions than previously forecasted. The Fund’s holdings in United Kingdom, French, Swiss and Italian banks drove the outperformance in this market segment.

Finally, the new issuance market in fiscal year 2021 proved to be significantly more competitive than during the second or third quarter of 2020, as the demand for yield drove down coupons and spreads on new deals. However, the Fund managed to outperform versus the Benchmark within the primary market over the same time period. The Fund selectively focused on newly issued securities with the best combination of credit, relative valuation and structure.

Market and Fund Outlook

Looking ahead, we believe preferreds offer better relative value than most other fixed income due to the high yields, combined with the high credit quality of the issuers and intermediate to low duration profile. At the same time, with investor demand for yield leading to a tightening to near fair value for preferreds, in our opinion, we expect income to be the biggest driver of returns over the next 12 months.

With credit fundamentals stable, and the market fairly valued, in our view, we believe that interest rate volatility is the biggest potential risk heading into 2022. In our opinion, active management is beneficial in the current environment where a number of potential catalysts exist that could lead to higher interest rates including uncertainty over the composition of the Fed’s board. We believe that a dovish tilt to the makeup of the Fed leadership could result in steepening of the yield curve. Other catalysts for rate volatility also persist, such as tapering of the Fed’s bond purchase program, inflationary pressures and potential increases in federal spending and taxation. Given the confluence of factors potentially affecting interest rates, we have selectively sought out value in preferreds across the entire yield curve but maintain a bias towards the shorter end along with securities that contain a component of rate protection, such as variable rate securities. We will also focus on improving the composition of the Fund by reducing exposure to higher risk security structures and targeting relative value swaps in favor of improving security structure combined with improved valuation.

First Trust Preferred Securities and Income Fund

Understanding Your Fund Expenses

October 31, 2021 (Unaudited)

As a shareholder of the First Trust Preferred Securities and Income Fund (the “Fund”), you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases of Class A Shares and contingent deferred sales charges on the lesser of purchase price or redemption proceeds of Class C Shares; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, if any, and other Fund expenses. This Example is intended to help you understand your ongoing costs of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held through the six-month period ended October 31, 2021.

Actual Expenses

The first three columns of the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the third column under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this six-month period.

Hypothetical Example for Comparison Purposes

The next three columns of the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads) or contingent deferred sales charges. Therefore, the hypothetical section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Actual Expenses | | Hypothetical

(5% Return Before Expenses) | |

| | Beginning

Account

Value

5/1/2021 | Ending

Account

Value

10/31/2021 | Expenses Paid

During Period

5/1/2021 -

10/31/2021 (a) | Beginning

Account

Value

5/1/2021 | | Ending

Account

Value

10/31/2021 | Expenses Paid

During Period

5/1/2021 -

10/31/2021 (a) | Annualized

Expense

Ratios (b) |

Class A

| $ 1,000.00 | $ 1,027.80 | $ 6.75 | $ 1,000.00 | | $ 1,018.55 | $ 6.72 | 1.32% |

Class C

| $ 1,000.00 | $ 1,024.30 | $ 10.41 | $ 1,000.00 | | $ 1,014.92 | $ 10.36 | 2.04% |

Class F

| $ 1,000.00 | $ 1,027.50 | $ 6.64 | $ 1,000.00 | | $ 1,018.65 | $ 6.61 | 1.30% |

Class I

| $ 1,000.00 | $ 1,028.90 | $ 5.27 | $ 1,000.00 | | $ 1,020.01 | $ 5.24 | 1.03% |

Class R3

| $ 1,000.00 | $ 1,026.20 | $ 8.43 | $ 1,000.00 | | $ 1,016.89 | $ 8.39 | 1.65% |

| (a) | Expenses are equal to the annualized expense ratios as indicated in the table multiplied by the average account value over the period (May 1, 2021 through October 31, 2021), multiplied by 184/365 (to reflect the six-month period). |

| (b) | These expense ratios reflect expense caps. |

First Trust Preferred Securities and Income Fund

Portfolio of Investments

October 31, 2021

| Shares | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| $25 PAR PREFERRED SECURITIES – 16.0% |

| | | Banks – 2.6% | | | | | | |

| 147 | | Atlantic Union Bankshares Corp., Series A

| | 6.88% | | (a) | | $4,125 |

| 17,250 | | Fifth Third Bancorp, Series A

| | 6.00% | | (a) | | 460,230 |

| 8,764 | | First Midwest Bancorp, Inc., Series A

| | 7.00% | | (a) | | 247,145 |

| 39,734 | | First Republic Bank, Series M

| | 4.00% | | (a) | | 968,715 |

| 21,018 | | JPMorgan Chase & Co., Series LL

| | 4.63% | | (a) | | 549,410 |

| 40,177 | | Pinnacle Financial Partners, Inc., Series B

| | 6.75% | | (a) | | 1,132,590 |

| 62,765 | | Signature Bank, Series A

| | 5.00% | | (a) | | 1,625,613 |

| 4,971 | | Texas Capital Bancshares, Inc., Series B

| | 5.75% | | (a) | | 132,030 |

| 27,348 | | Valley National Bancorp, Series B (b)

| | 5.50% | | (a) | | 707,766 |

| 10,424 | | Wells Fargo & Co., Series DD

| | 4.25% | | (a) | | 260,183 |

| 30,000 | | WesBanco, Inc., Series A (b)

| | 6.75% | | (a) | | 861,600 |

| 9,104 | | Western Alliance Bancorp, Series A (b)

| | 4.25% | | (a) | | 239,071 |

| 42,690 | | Wintrust Financial Corp., Series E (b)

| | 6.88% | | (a) | | 1,205,566 |

| | | | | 8,394,044 |

| | | Capital Markets – 1.1% | | | | | | |

| 25,553 | | Affiliated Managers Group, Inc.

| | 4.20% | | 09/30/61 | | 632,820 |

| 20,766 | | Apollo Global Management, Inc., Series B

| | 6.38% | | (a) | | 560,474 |

| 53,733 | | Carlyle Finance LLC

| | 4.63% | | 05/15/61 | | 1,396,252 |

| 39,115 | | KKR Group Finance Co., IX LLC

| | 4.63% | | 04/01/61 | | 1,026,182 |

| 3,597 | | Oaktree Capital Group LLC, Series A

| | 6.63% | | (a) | | 96,436 |

| | | | | 3,712,164 |

| | | Diversified Financial Services – 0.3% | | | | | | |

| 34,751 | | Equitable Holdings, Inc., Series A

| | 5.25% | | (a) | | 923,682 |

| | | Diversified Telecommunication Services – 0.4% | | | | | | |

| 38,862 | | Qwest Corp.

| | 6.50% | | 09/01/56 | | 997,587 |

| 5,477 | | Qwest Corp.

| | 6.75% | | 06/15/57 | | 144,100 |

| | | | | 1,141,687 |

| | | Electric Utilities – 0.9% | | | | | | |

| 35,878 | | Brookfield BRP Holdings Canada, Inc.

| | 4.63% | | (a) | | 898,923 |

| 28,651 | | Brookfield Infrastructure Finance ULC

| | 5.00% | | 05/24/81 | | 739,482 |

| 2,694 | | SCE Trust III, Series H (b)

| | 5.75% | | (a) | | 69,424 |

| 18,460 | | SCE Trust IV, Series J (b)

| | 5.38% | | (a) | | 462,608 |

| 7,414 | | SCE Trust V, Series K (b)

| | 5.45% | | (a) | | 191,874 |

| 27,160 | | Southern (The) Co.

| | 4.95% | | 01/30/80 | | 722,185 |

| | | | | 3,084,496 |

| | | Equity Real Estate Investment Trusts – 0.8% | | | | | | |

| 20,431 | | Agree Realty Corp., Series A

| | 4.25% | | (a) | | 501,581 |

| 272 | | DigitalBridge Group, Inc., Series I

| | 7.15% | | (a) | | 7,072 |

| 87 | | DigitalBridge Group, Inc., Series J

| | 7.13% | | (a) | | 2,286 |

| 27,351 | | Global Net Lease, Inc., Series A

| | 7.25% | | (a) | | 724,254 |

| 2,712 | | National Storage Affiliates Trust, Series A

| | 6.00% | | (a) | | 71,841 |

| 48,401 | | Public Storage, Series P

| | 4.00% | | (a) | | 1,226,481 |

| | | | | 2,533,515 |

| | | Food Products – 0.2% | | | | | | |

| 11,637 | | CHS, Inc., Series 2 (b)

| | 7.10% | | (a) | | 324,207 |

| 5,901 | | CHS, Inc., Series 3 (b)

| | 6.75% | | (a) | | 165,936 |

| 6,575 | | CHS, Inc., Series 4

| | 7.50% | | (a) | | 190,609 |

| | | | | 680,752 |

Page 8

See Notes to Financial Statements

First Trust Preferred Securities and Income Fund

Portfolio of Investments (Continued)

October 31, 2021

| Shares | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| $25 PAR PREFERRED SECURITIES (Continued) |

| | | Gas Utilities – 0.2% | | | | | | |

| 24,497 | | South Jersey Industries, Inc.

| | 5.63% | | 09/16/79 | | $655,050 |

| | | Independent Power & Renewable Electricity Producers – 0.2% | | | | | | |

| 21,958 | | Brookfield Renewable Partners L.P., Series 17

| | 5.25% | | (a) | | 581,228 |

| | | Insurance – 4.1% | | | | | | |

| 71,983 | | Aegon Funding Co., LLC

| | 5.10% | | 12/15/49 | | 1,939,222 |

| 83,465 | | American Equity Investment Life Holding Co., Series A (b)

| | 5.95% | | (a) | | 2,328,673 |

| 36,665 | | American Equity Investment Life Holding Co., Series B (b)

| | 6.63% | | (a) | | 1,049,719 |

| 4,822 | | AmTrust Financial Services, Inc.

| | 7.25% | | 06/15/55 | | 95,958 |

| 5,383 | | AmTrust Financial Services, Inc.

| | 7.50% | | 09/15/55 | | 107,660 |

| 28,000 | | Arch Capital Group Ltd., Series G

| | 4.55% | | (a) | | 726,600 |

| 10,593 | | Aspen Insurance Holdings Ltd.

| | 5.63% | | (a) | | 292,791 |

| 48,048 | | Aspen Insurance Holdings Ltd.

| | 5.63% | | (a) | | 1,271,350 |

| 32,729 | | Athene Holding Ltd., Series A (b)

| | 6.35% | | (a) | | 978,270 |

| 9,582 | | Axis Capital Holdings Ltd., Series E

| | 5.50% | | (a) | | 241,658 |

| 24,466 | | CNO Financial Group, Inc.

| | 5.13% | | 11/25/60 | | 660,582 |

| 73,827 | | Delphi Financial Group, Inc., 3 Mo. LIBOR + 3.19% (c)

| | 3.31% | | 05/15/37 | | 1,775,539 |

| 4,275 | | Global Indemnity Group LLC

| | 7.88% | | 04/15/47 | | 110,295 |

| 27,470 | | Globe Life, Inc.

| | 4.25% | | 06/15/61 | | 715,731 |

| 10,700 | | Phoenix Cos. (The), Inc.

| | 7.45% | | 01/15/32 | | 198,619 |

| 27,762 | | RenaissanceRe Holdings Ltd., Series G

| | 4.20% | | (a) | | 699,047 |

| | | | | 13,191,714 |

| | | Mortgage Real Estate Investment Trusts – 0.8% | | | | | | |

| 16,372 | | AGNC Investment Corp., Series C (b)

| | 7.00% | | (a) | | 415,522 |

| 30,561 | | AGNC Investment Corp., Series F (b)

| | 6.13% | | (a) | | 774,110 |

| 47,332 | | Annaly Capital Management, Inc., Series F (b)

| | 6.95% | | (a) | | 1,199,866 |

| 7,000 | | Annaly Capital Management, Inc., Series I (b)

| | 6.75% | | (a) | | 184,030 |

| | | | | 2,573,528 |

| | | Multi-Utilities – 0.8% | | | | | | |

| 19,117 | | Algonquin Power & Utilities Corp. (b)

| | 6.88% | | 10/17/78 | | 527,438 |

| 11,270 | | Algonquin Power & Utilities Corp., Series 19-A (b)

| | 6.20% | | 07/01/79 | | 314,771 |

| 29,776 | | Brookfield Infrastructure Partners L.P., Series 13

| | 5.13% | | (a) | | 753,035 |

| 35,444 | | Integrys Holding, Inc. (b)

| | 6.00% | | 08/01/73 | | 971,166 |

| | | | | 2,566,410 |

| | | Oil, Gas & Consumable Fuels – 1.3% | | | | | | |

| 3,965 | | Energy Transfer L.P., Series C (b)

| | 7.38% | | (a) | | 100,077 |

| 274 | | Energy Transfer L.P., Series D (b)

| | 7.63% | | (a) | | 6,861 |

| 98,078 | | Energy Transfer L.P., Series E (b)

| | 7.60% | | (a) | | 2,502,950 |

| 28,176 | | NuStar Energy L.P., Series A (b)

| | 8.50% | | (a) | | 690,594 |

| 1,283 | | NuStar Energy L.P., Series C (b)

| | 9.00% | | (a) | | 33,371 |

| 39,987 | | NuStar Logistics L.P., 3 Mo. LIBOR + 6.73% (c)

| | 6.86% | | 01/15/43 | | 1,008,872 |

| | | | | 4,342,725 |

| | | Real Estate Management & Development – 1.3% | | | | | | |

| 53,333 | | Brookfield Property Partners L.P., Series A

| | 5.75% | | (a) | | 1,301,859 |

| 10,209 | | Brookfield Property Partners L.P., Series A-1

| | 6.50% | | (a) | | 262,371 |

| 53,680 | | Brookfield Property Partners L.P., Series A2

| | 6.38% | | (a) | | 1,392,459 |

| 56,275 | | Brookfield Property Preferred L.P.

| | 6.25% | | 07/26/81 | | 1,397,308 |

| | | | | 4,353,997 |

| | | Trading Companies & Distributors – 0.6% | | | | | | |

| 26,662 | | Air Lease Corp., Series A (b)

| | 6.15% | | (a) | | 720,941 |

See Notes to Financial Statements

Page 9

First Trust Preferred Securities and Income Fund

Portfolio of Investments (Continued)

October 31, 2021

| Shares | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| $25 PAR PREFERRED SECURITIES (Continued) |

| | | Trading Companies & Distributors (Continued) | | | | | | |

| 42,181 | | WESCO International, Inc., Series A (b)

| | 10.63% | | (a) | | $1,324,483 |

| | | | | 2,045,424 |

| | | Wireless Telecommunication Services – 0.4% | | | | | | |

| 11,017 | | United States Cellular Corp.

| | 6.25% | | 09/01/69 | | 302,527 |

| 43,583 | | United States Cellular Corp.

| | 5.50% | | 06/01/70 | | 1,158,436 |

| | | | | 1,460,963 |

| | | Total $25 Par Preferred Securities

| | 52,241,379 |

| | | (Cost $49,046,403) | | | | | | |

| $100 PAR PREFERRED SECURITIES – 2.5% |

| | | Banks – 2.5% | | | | | | |

| 9,400 | | AgriBank FCB (b)

| | 6.88% | | (a) | | 1,022,250 |

| 32,500 | | CoBank ACB, Series F (b)

| | 6.25% | | (a) | | 3,388,125 |

| 27,000 | | CoBank ACB, Series G

| | 6.13% | | (a) | | 2,774,790 |

| 10,500 | | Farm Credit Bank of Texas (b) (d)

| | 6.75% | | (a) | | 1,139,250 |

| | | Total $100 Par Preferred Securities

| | 8,324,415 |

| | | (Cost $7,977,200) | | | | | | |

| $1,000 PAR PREFERRED SECURITIES – 2.2% |

| | | Banks – 2.0% | | | | | | |

| 1,127 | | Bank of America Corp., Series L

| | 7.25% | | (a) | | 1,614,112 |

| 3,353 | | Wells Fargo & Co., Series L

| | 7.50% | | (a) | | 5,096,459 |

| | | | | 6,710,571 |

| | | Diversified Financial Services – 0.2% | | | | | | |

| 500 | | Compeer Financial ACA (b) (d)

| | 6.75% | | (a) | | 531,250 |

| | | Total $1,000 Par Preferred Securities

| | 7,241,821 |

| | | (Cost $6,618,059) | | | | | | |

Par

Amount | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| CAPITAL PREFERRED SECURITIES – 76.0% |

| | | Banks – 34.9% | | | | | | |

| $1,400,000 | | Australia & New Zealand Banking Group Ltd. (b) (d) (e)

| | 6.75% | | (a) | | 1,611,323 |

| 600,000 | | Australia & New Zealand Banking Group Ltd. (b) (e) (f)

| | 6.75% | | (a) | | 690,567 |

| 2,300,000 | | Banco Bilbao Vizcaya Argentaria S.A., Series 9 (b) (e)

| | 6.50% | | (a) | | 2,472,500 |

| 600,000 | | Banco Mercantil del Norte S.A. (b) (d) (e)

| | 7.50% | | (a) | | 659,448 |

| 1,000,000 | | Banco Mercantil del Norte S.A. (b) (d) (e)

| | 7.63% | | (a) | | 1,099,520 |

| 1,100,000 | | Banco Mercantil del Norte S.A. (b) (d) (e)

| | 8.38% | | (a) | | 1,287,396 |

| 1,600,000 | | Banco Santander S.A. (b) (e)

| | 4.75% | | (a) | | 1,612,272 |

| 2,200,000 | | Banco Santander S.A. (b) (e) (f)

| | 7.50% | | (a) | | 2,384,881 |

| 2,200,000 | | Bank of Nova Scotia (The) (b)

| | 4.90% | | (a) | | 2,353,296 |

| 1,100,000 | | Barclays PLC (b) (e)

| | 4.38% | | (a) | | 1,084,930 |

| 1,700,000 | | Barclays PLC (b) (e)

| | 6.13% | | (a) | | 1,869,473 |

| 2,650,000 | | Barclays PLC (b) (e) (f)

| | 7.88% | | (a) | | 2,710,778 |

| 7,200,000 | | Barclays PLC (b) (e)

| | 8.00% | | (a) | | 8,032,500 |

| 650,000 | | BBVA Bancomer S.A. (b) (d) (e)

| | 5.88% | | 09/13/34 | | 707,840 |

| 1,500,000 | | BNP Paribas S.A. (b) (d) (e)

| | 6.63% | | (a) | | 1,625,625 |

| 1,700,000 | | BNP Paribas S.A. (b) (d) (e)

| | 7.38% | | (a) | | 1,951,932 |

| 1,921,000 | | Citigroup, Inc. (b)

| | 3.88% | | (a) | | 1,942,611 |

| 99,000 | | Citigroup, Inc. (b)

| | 5.90% | | (a) | | 102,713 |

| 725,000 | | Citigroup, Inc. (b)

| | 5.95% | | (a) | | 750,375 |

| 431,000 | | Citigroup, Inc., Series D (b)

| | 5.35% | | (a) | | 443,068 |

Page 10

See Notes to Financial Statements

First Trust Preferred Securities and Income Fund

Portfolio of Investments (Continued)

October 31, 2021

Par

Amount | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| CAPITAL PREFERRED SECURITIES (Continued) |

| | | Banks (Continued) | | | | | | |

| $1,780,000 | | Citigroup, Inc., Series P (b)

| | 5.95% | | (a) | | $1,922,400 |

| 262,000 | | Citigroup, Inc., Series T (b)

| | 6.25% | | (a) | | 302,269 |

| 1,072,000 | | Citigroup, Inc., Series W (b)

| | 4.00% | | (a) | | 1,097,460 |

| 1,140,000 | | Citigroup, Inc., Series Y (b)

| | 4.15% | | (a) | | 1,146,840 |

| 1,120,000 | | Citizens Financial Group, Inc., Series F (b)

| | 5.65% | | (a) | | 1,230,600 |

| 1,000,000 | | Citizens Financial Group, Inc., Series G (b)

| | 4.00% | | (a) | | 1,010,000 |

| 2,500,000 | | CoBank ACB, Series I (b)

| | 6.25% | | (a) | | 2,809,375 |

| 700,000 | | Comerica, Inc. (b)

| | 5.63% | | (a) | | 774,375 |

| 600,000 | | Commerzbank AG (b) (e) (f)

| | 7.00% | | (a) | | 646,992 |

| 2,600,000 | | Credit Agricole S.A. (b) (d) (e)

| | 6.88% | | (a) | | 2,871,050 |

| 2,800,000 | | Credit Agricole S.A. (b) (d) (e)

| | 7.88% | | (a) | | 3,103,030 |

| 3,285,000 | | Credit Agricole S.A. (b) (d) (e)

| | 8.13% | | (a) | | 3,943,409 |

| 400,000 | | Danske Bank A.S. (b) (e) (f)

| | 4.38% | | (a) | | 404,032 |

| 1,500,000 | | Danske Bank A.S. (b) (e) (f)

| | 6.13% | | (a) | | 1,592,813 |

| 1,050,000 | | Danske Bank A.S. (b) (e) (f)

| | 7.00% | | (a) | | 1,171,732 |

| 600,000 | | Farm Credit Bank of Texas, Series 3 (b) (d)

| | 6.20% | | (a) | | 660,000 |

| 1,100,000 | | Farm Credit Bank of Texas, Series 4 (b) (d)

| | 5.70% | | (a) | | 1,204,500 |

| 901,000 | | Fifth Third Bancorp, Series H (b)

| | 5.10% | | (a) | | 922,399 |

| 2,644,000 | | HSBC Holdings PLC (b) (e)

| | 6.38% | | (a) | | 2,879,832 |

| 470,000 | | Huntington Bancshares, Inc., Series G (b)

| | 4.45% | | (a) | | 503,488 |

| 1,930,000 | | ING Groep N.V. (b) (e)

| | 5.75% | | (a) | | 2,096,858 |

| 1,400,000 | | ING Groep N.V. (b) (e)

| | 6.50% | | (a) | | 1,538,257 |

| 900,000 | | ING Groep N.V. (b) (e) (f)

| | 6.88% | | (a) | | 922,500 |

| 1,954,000 | | Intesa Sanpaolo S.p.A. (b) (d) (e)

| | 7.70% | | (a) | | 2,186,037 |

| 1,749,000 | | JPMorgan Chase & Co., Series Q (b)

| | 5.15% | | (a) | | 1,800,123 |

| 594,000 | | JPMorgan Chase & Co., Series R (b)

| | 6.00% | | (a) | | 621,250 |

| 1,138,000 | | JPMorgan Chase & Co., Series V, 3 Mo. LIBOR + 3.32% (c)

| | 3.45% | | (a) | | 1,138,576 |

| 1,600,000 | | Lloyds Banking Group PLC (b) (e)

| | 6.75% | | (a) | | 1,829,736 |

| 3,400,000 | | Lloyds Banking Group PLC (b) (e)

| | 7.50% | | (a) | | 3,765,500 |

| 800,000 | | M&T Bank Corp. (b)

| | 3.50% | | (a) | | 788,000 |

| 500,000 | | Natwest Group PLC (b) (e)

| | 6.00% | | (a) | | 553,965 |

| 1,600,000 | | Natwest Group PLC (b) (e)

| | 8.00% | | (a) | | 1,878,024 |

| 2,800,000 | | Nordea Bank Abp (b) (d) (e)

| | 6.63% | | (a) | | 3,204,236 |

| 950,000 | | PNC Financial Services Group (The), Inc., Series T (b)

| | 3.40% | | (a) | | 939,313 |

| 1,000,000 | | Regions Financial Corp., Series D (b)

| | 5.75% | | (a) | | 1,106,250 |

| 200,000 | | Skandinaviska Enskilda Banken AB (b) (e) (f)

| | 5.13% | | (a) | | 212,371 |

| 3,900,000 | | Societe Generale S.A. (b) (d) (e)

| | 5.38% | | (a) | | 4,153,500 |

| 3,090,000 | | Societe Generale S.A. (b) (d) (e)

| | 7.88% | | (a) | | 3,412,287 |

| 200,000 | | Societe Generale S.A. (b) (d) (e)

| | 8.00% | | (a) | | 233,201 |

| 2,800,000 | | Standard Chartered PLC (b) (d) (e)

| | 4.30% | | (a) | | 2,695,756 |

| 1,500,000 | | Standard Chartered PLC (b) (d) (e)

| | 6.00% | | (a) | | 1,634,250 |

| 2,128,000 | | SVB Financial Group, Series D (b)

| | 4.25% | | (a) | | 2,138,374 |

| 800,000 | | Swedbank AB, Series NC5 (b) (e) (f)

| | 5.63% | | (a) | | 862,484 |

| 408,000 | | Texas Capital Bancshares, Inc. (b)

| | 4.00% | | 05/06/31 | | 425,240 |

| 828,000 | | Truist Financial Corp., Series P (b)

| | 4.95% | | (a) | | 900,657 |

| 3,100,000 | | UniCredit S.p.A. (b) (e) (f)

| | 8.00% | | (a) | | 3,393,089 |

| 750,000 | | UniCredit S.p.A. (b) (d)

| | 5.46% | | 06/30/35 | | 821,456 |

| 799,000 | | US Bancorp (b)

| | 3.70% | | (a) | | 797,841 |

| 2,112,000 | | Wells Fargo & Co., Series BB (b)

| | 3.90% | | (a) | | 2,152,920 |

| | | | | 113,791,695 |

| | | Capital Markets – 9.6% | | | | | | |

| 1,568,000 | | Apollo Management Holdings L.P. (b) (d)

| | 4.95% | | 01/14/50 | | 1,624,427 |

| 1,300,000 | | Bank of New York Mellon (The) Corp., Series G (b)

| | 4.70% | | (a) | | 1,417,910 |

| 2,260,000 | | Charles Schwab (The) Corp., Series G (b)

| | 5.38% | | (a) | | 2,488,825 |

See Notes to Financial Statements

Page 11

First Trust Preferred Securities and Income Fund

Portfolio of Investments (Continued)

October 31, 2021

Par

Amount | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| CAPITAL PREFERRED SECURITIES (Continued) |

| | | Capital Markets (Continued) | | | | | | |

| $3,150,000 | | Charles Schwab (The) Corp., Series I (b)

| | 4.00% | | (a) | | $3,245,760 |

| 2,430,000 | | Credit Suisse Group AG (b) (d) (e)

| | 5.25% | | (a) | | 2,530,237 |

| 500,000 | | Credit Suisse Group AG (b) (d) (e)

| | 6.25% | | (a) | | 539,005 |

| 2,300,000 | | Credit Suisse Group AG (b) (d) (e)

| | 6.38% | | (a) | | 2,509,875 |

| 250,000 | | Credit Suisse Group AG (b) (d) (e)

| | 7.50% | | (a) | | 273,125 |

| 4,100,000 | | Credit Suisse Group AG (b) (d) (e)

| | 7.50% | | (a) | | 4,368,550 |

| 1,028,000 | | EFG International AG (b) (e) (f)

| | 5.50% | | (a) | | 1,082,433 |

| 3,000,000 | | Goldman Sachs Group (The), Inc., Series Q (b)

| | 5.50% | | (a) | | 3,225,900 |

| 200,000 | | Goldman Sachs Group (The), Inc., Series R (b)

| | 4.95% | | (a) | | 211,000 |

| 685,000 | | Goldman Sachs Group (The), Inc., Series T (b)

| | 3.80% | | (a) | | 686,712 |

| 800,000 | | Goldman Sachs Group (The), Inc., Series U (b)

| | 3.65% | | (a) | | 796,000 |

| 1,064,000 | | Goldman Sachs Group (The), Inc., Series V (b)

| | 4.13% | | (a) | | 1,068,203 |

| 500,000 | | Morgan Stanley, Series H, 3 Mo. LIBOR + 3.61% (c)

| | 3.73% | | (a) | | 502,581 |

| 700,000 | | Morgan Stanley, Series M (b)

| | 5.88% | | (a) | | 800,739 |

| 2,400,000 | | UBS Group AG (b) (e) (f)

| | 6.88% | | (a) | | 2,713,500 |

| 960,000 | | UBS Group AG (b) (d) (e)

| | 7.00% | | (a) | | 1,038,667 |

| | | | | 31,123,449 |

| | | Consumer Finance – 1.1% | | | | | | |

| 1,963,000 | | American Express Co. (b)

| | 3.55% | | (a) | | 1,976,005 |

| 1,652,000 | | Capital One Financial Corp., Series M (b)

| | 3.95% | | (a) | | 1,682,975 |

| | | | | 3,658,980 |

| | | Diversified Financial Services – 3.1% | | | | | | |

| 2,500,000 | | American AgCredit Corp. (b) (d)

| | 5.25% | | (a) | | 2,556,250 |

| 1,500,000 | | Ares Finance Co., III LLC (b) (d)

| | 4.13% | | 06/30/51 | | 1,542,288 |

| 1,500,000 | | Capital Farm Credit ACA, Series 1 (b) (d)

| | 5.00% | | (a) | | 1,556,250 |

| 600,000 | | Compeer Financial ACA (b) (d)

| | 4.88% | | (a) | | 609,000 |

| 450,000 | | Depository Trust & Clearing (The) Corp., Series D (b) (d)

| | 3.38% | | (a) | | 455,344 |

| 2,265,000 | | Voya Financial, Inc. (b)

| | 5.65% | | 05/15/53 | | 2,375,215 |

| 843,000 | | Voya Financial, Inc., Series A (b)

| | 6.13% | | (a) | | 897,795 |

| | | | | 9,992,142 |

| | | Electric Utilities – 3.0% | | | | | | |

| 840,000 | | Duke Energy Corp. (b)

| | 4.88% | | (a) | | 893,760 |

| 4,756,000 | | Emera, Inc., Series 16-A (b)

| | 6.75% | | 06/15/76 | | 5,600,808 |

| 600,000 | | Enel S.p.A. (b) (d)

| | 8.75% | | 09/24/73 | | 678,870 |

| 1,260,000 | | Southern (The) Co., Series 21-A (b)

| | 3.75% | | 09/15/51 | | 1,283,260 |

| 1,302,000 | | Southern California Edison Co., Series E (b)

| | 6.25% | | (a) | | 1,310,421 |

| | | | | 9,767,119 |

| | | Energy Equipment & Services – 0.6% | | | | | | |

| 1,600,000 | | Transcanada Trust (b)

| | 5.50% | | 09/15/79 | | 1,750,000 |

| | | Food Products – 3.0% | | | | | | |

| 300,000 | | Dairy Farmers of America, Inc. (g)

| | 7.13% | | (a) | | 304,500 |

| 3,000,000 | | Land O’Lakes Capital Trust I (g)

| | 7.45% | | 03/15/28 | | 3,468,450 |

| 1,400,000 | | Land O’Lakes, Inc. (d)

| | 7.00% | | (a) | | 1,477,560 |

| 1,200,000 | | Land O’Lakes, Inc. (d)

| | 7.25% | | (a) | | 1,302,414 |

| 3,000,000 | | Land O’Lakes, Inc. (d)

| | 8.00% | | (a) | | 3,255,360 |

| | | | | 9,808,284 |

| | | Independent Power & Renewable Electricity Producers – 0.2% | | | | | | |

| 700,000 | | AES Andes S.A. (b) (d)

| | 6.35% | | 10/07/79 | | 726,404 |

Page 12

See Notes to Financial Statements

First Trust Preferred Securities and Income Fund

Portfolio of Investments (Continued)

October 31, 2021

Par

Amount | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| CAPITAL PREFERRED SECURITIES (Continued) |

| | | Insurance – 9.5% | | | | | | |

| $700,000 | | Allianz SE (b) (d)

| | 3.50% | | (a) | | $707,000 |

| 1,900,000 | | Asahi Mutual Life Insurance Co. (b) (f)

| | 6.50% | | (a) | | 2,036,819 |

| 600,000 | | Asahi Mutual Life Insurance Co. (b) (f)

| | 7.25% | | (a) | | 607,678 |

| 1,822,000 | | Assurant, Inc. (b)

| | 7.00% | | 03/27/48 | | 2,126,948 |

| 850,000 | | Assured Guaranty Municipal Holdings, Inc. (b) (d)

| | 6.40% | | 12/15/66 | | 944,323 |

| 2,900,000 | | AXIS Specialty Finance LLC (b)

| | 4.90% | | 01/15/40 | | 3,067,141 |

| 1,276,000 | | Enstar Finance LLC (b)

| | 5.75% | | 09/01/40 | | 1,347,775 |

| 1,000,000 | | Fortegra Financial Corp. (b) (g)

| | 8.50% | | 10/15/57 | | 1,262,962 |

| 3,200,000 | | Global Atlantic Fin Co. (b) (d)

| | 4.70% | | 10/15/51 | | 3,299,016 |

| 820,000 | | Hartford Financial Services Group (The), Inc., 3 Mo. LIBOR + 2.13% (c) (d)

| | 2.25% | | 02/12/47 | | 797,450 |

| 1,174,000 | | Kuvare US Holdings, Inc. (b) (d)

| | 7.00% | | 02/17/51 | | 1,255,986 |

| 300,000 | | La Mondiale SAM (b) (f)

| | 5.88% | | 01/26/47 | | 340,906 |

| 1,120,000 | | Lancashire Holdings Ltd. (b) (f)

| | 5.63% | | 09/18/41 | | 1,217,322 |

| 900,000 | | Liberty Mutual Group, Inc. (b) (d)

| | 4.13% | | 12/15/51 | | 923,661 |

| 2,700,000 | | Markel Corp. (b)

| | 6.00% | | (a) | | 2,973,375 |

| 1,400,000 | | Principal Financial Group, Inc., 3 Mo. LIBOR + 3.04% (c)

| | 3.17% | | 05/15/55 | | 1,393,725 |

| 2,000,000 | | QBE Insurance Group Ltd. (b) (d)

| | 5.88% | | (a) | | 2,190,000 |

| 1,100,000 | | QBE Insurance Group Ltd. (b) (d)

| | 7.50% | | 11/24/43 | | 1,218,250 |

| 2,100,000 | | QBE Insurance Group Ltd. (b) (f)

| | 6.75% | | 12/02/44 | | 2,350,583 |

| 301,000 | | QBE Insurance Group Ltd. (b) (f)

| | 5.88% | | 06/17/46 | | 337,403 |

| 646,000 | | Reinsurance Group of America, Inc., 3 Mo. LIBOR + 2.67% (c)

| | 2.78% | | 12/15/65 | | 628,430 |

| | | | | 31,026,753 |

| | | Multi-Utilities – 1.2% | | | | | | |

| 2,043,000 | | CenterPoint Energy, Inc., Series A (b)

| | 6.13% | | (a) | | 2,159,809 |

| 735,000 | | NiSource, Inc. (b)

| | 5.65% | | (a) | | 779,100 |

| 1,000,000 | | Sempra Energy (b)

| | 4.88% | | (a) | | 1,081,410 |

| | | | | 4,020,319 |

| | | Oil, Gas & Consumable Fuels – 6.3% | | | | | | |

| 300,000 | | Buckeye Partners L.P. (b)

| | 6.38% | | 01/22/78 | | 274,769 |

| 2,850,000 | | DCP Midstream L.P., Series A (b)

| | 7.38% | | (a) | | 2,864,250 |

| 1,552,000 | | DCP Midstream Operating L.P. (b) (d)

| | 5.85% | | 05/21/43 | | 1,450,173 |

| 2,132,000 | | Enbridge, Inc. (b)

| | 6.25% | | 03/01/78 | | 2,355,071 |

| 4,638,000 | | Enbridge, Inc., Series 16-A (b)

| | 6.00% | | 01/15/77 | | 5,130,463 |

| 2,276,000 | | Enbridge, Inc., Series 20-A (b)

| | 5.75% | | 07/15/80 | | 2,563,914 |

| 1,786,000 | | Energy Transfer L.P., 3 Mo. LIBOR + 3.02% (c)

| | 3.14% | | 11/01/66 | | 1,477,736 |

| 916,000 | | Energy Transfer L.P., Series F (b)

| | 6.75% | | (a) | | 942,335 |

| 271,000 | | Energy Transfer L.P., Series H (b)

| | 6.50% | | (a) | | 281,162 |

| 2,204,000 | | Enterprise Products Operating LLC, 3 Mo. LIBOR + 2.78% (c)

| | 2.90% | | 06/01/67 | | 2,052,839 |

| 1,196,000 | | Enterprise Products Operating LLC, Series D (b)

| | 4.88% | | 08/16/77 | | 1,181,566 |

| | | | | 20,574,278 |

| | | Trading Companies & Distributors – 2.7% | | | | | | |

| 6,410,000 | | AerCap Holdings N.V. (b)

| | 5.88% | | 10/10/79 | | 6,696,783 |

| 700,000 | | Air Lease Corp., Series B (b)

| | 4.65% | | (a) | | 725,375 |

| 1,330,000 | | Aircastle Ltd. (b) (d)

| | 5.25% | | (a) | | 1,369,900 |

| | | | | 8,792,058 |

| | | Transportation Infrastructure – 0.8% | | | | | | |

| 1,860,000 | | AerCap Global Aviation Trust (b) (d)

| | 6.50% | | 06/15/45 | | 1,997,649 |

See Notes to Financial Statements

Page 13

First Trust Preferred Securities and Income Fund

Portfolio of Investments (Continued)

October 31, 2021

Par

Amount | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| CAPITAL PREFERRED SECURITIES (Continued) |

| | | Transportation Infrastructure (Continued) | | | | | | |

| $500,000 | | BNSF Funding Trust I (b)

| | 6.61% | | 12/15/55 | | $572,025 |

| | | | | 2,569,674 |

| | | Total Capital Preferred Securities

| | 247,601,155 |

| | | (Cost $234,815,297) | | | | | | |

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| FOREIGN CORPORATE BONDS AND NOTES – 1.2% |

| | | Insurance – 1.2% | | | | | | |

| 3,597,666 | | Highlands Holdings Bond Issuer Ltd./Highlands Holdings Bond Co-Issuer, Inc. (d) (h)

| | 7.63% | | 10/15/25 | | 3,815,577 |

| | | (Cost $3,806,455) | | | | | | |

| CORPORATE BONDS AND NOTES – 0.3% |

| | | Insurance – 0.3% | | | | | | |

| 900,000 | | AmTrust Financial Services, Inc.

| | 6.13% | | 08/15/23 | | 909,487 |

| | | (Cost $908,810) | | | | | | |

| Total Investments – 98.2%

| | 320,133,834 |

| | (Cost $303,172,224) (i) | | |

| | Net Other Assets and Liabilities – 1.8%

| | 5,715,611 |

| | Net Assets – 100.0%

| | $325,849,445 |

|

| (a) | Perpetual maturity. |

| (b) | Fixed-to-floating or fixed-to-variable rate security. The interest rate shown reflects the fixed rate in effect at October 31, 2021. At a predetermined date, the fixed rate will change to a floating rate or a variable rate. |

| (c) | Floating or variable rate security. |

| (d) | This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A under the Securities Act of 1933, as amended (the “1933 Act”), and may be resold in transactions exempt from registration, normally to qualified institutional buyers. Pursuant to procedures adopted by the First Trust Series Fund’s (the “Trust”) Board of Trustees, this security has been determined to be liquid by First Trust Advisors L.P., (the “Advisor”). Although market instability can result in periods of increased overall market illiquidity, liquidity for each security is determined based on security specific factors and assumptions, which require subjective judgment. At October 31, 2021, securities noted as such amounted to $87,748,907 or 26.9% of net assets. |

| (e) | This security is a contingent convertible capital security which may be subject to conversion into common stock of the issuer under certain circumstances. At October 31, 2021, securities noted as such amounted to $96,041,318 or 29.5% of net assets. Of these securities, 3.9% originated in emerging markets, and 96.1% originated in foreign markets. |

| (f) | This security may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the 1933 Act. |

| (g) | This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A under the 1933 Act, and may be resold in transactions exempt from registration, normally to qualified institutional buyers (see Note 2C - Restricted Securities in the Notes to Financial Statements). |

| (h) | These notes are Senior Payment-in-kind (“PIK”) Toggle Notes whereby the issuer may, at its option, elect to pay interest on the notes (1) entirely in cash or (2) entirely in PIK interest. Interest paid in cash will accrue on the notes at a rate of 7.63% per annum (“Cash Interest Rate”) and PIK interest will accrue on the notes at a rate per annum equal to the Cash Interest Rate plus 75 basis points. For the fiscal year ended October 31, 2021, the Fund received $125,666 PIK interest distributions from Highlands Holdings Bond Issuer Ltd. |

| (i) | Aggregate cost for federal income tax purposes was $301,929,745. As of October 31, 2021, the aggregate gross unrealized appreciation for all investments in which there was an excess of value over tax cost was $18,782,419 and the aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value was $578,330. The net unrealized appreciation was $18,204,089. |

Page 14

See Notes to Financial Statements

First Trust Preferred Securities and Income Fund

Portfolio of Investments (Continued)

October 31, 2021

Valuation Inputs

A summary of the inputs used to value the Fund’s investments as of October 31, 2021 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

| | Total

Value at

10/31/2021 | Level 1

Quoted

Prices | Level 2

Significant

Observable

Inputs | Level 3

Significant

Unobservable

Inputs |

| $25 Par Preferred Securities: | | | | |

Insurance

| $ 13,191,714 | $ 11,013,938 | $ 2,177,776 | $ — |

Multi-Utilities

| 2,566,410 | 1,595,244 | 971,166 | — |

Other industry categories*

| 36,483,255 | 36,483,255 | — | — |

$100 Par Preferred Securities*

| 8,324,415 | — | 8,324,415 | — |

| $1,000 Par Preferred Securities: | | | | |

Banks

| 6,710,571 | 6,710,571 | — | — |

Diversified Financial Services

| 531,250 | — | 531,250 | — |

Capital Preferred Securities*

| 247,601,155 | — | 247,601,155 | — |

Foreign Corporate Bonds and Notes*

| 3,815,577 | — | 3,815,577 | — |

Corporate Bonds and Notes*

| 909,487 | — | 909,487 | — |

Total Investments

| $ 320,133,834 | $ 55,803,008 | $ 264,330,826 | $— |

| * | See Portfolio of Investments for industry breakout. |

See Notes to Financial Statements

Page 15

First Trust Preferred Securities and Income Fund

Statement of Assets and Liabilities

October 31, 2021

| ASSETS: | |

Investments, at value

(Cost $303,172,224)

| $ 320,133,834 |

Cash

| 1,919,728 |

| Receivables: | |

Interest

| 2,978,100 |

Fund shares sold

| 1,516,567 |

Investment securities sold

| 1,114,136 |

Dividends

| 144,571 |

Dividend reclaims

| 1,037 |

Total Assets

| 327,807,973 |

| LIABILITIES: | |

| Payables: | |

Fund shares redeemed

| 728,493 |

Investment securities purchased

| 604,846 |

Investment advisory fees

| 219,233 |

Distributions

| 116,004 |

Transfer agent fees

| 63,513 |

Administrative fees

| 62,507 |

12b-1 distribution and service fees

| 56,248 |

Audit and tax fees

| 42,181 |

Legal fees

| 24,933 |

Shareholder reporting fees

| 15,851 |

Registration fees

| 10,355 |

Custodian fees

| 7,525 |

Commitment and administrative agency fees

| 3,025 |

Financial reporting fees

| 771 |

Other liabilities

| 3,043 |

Total Liabilities

| 1,958,528 |

NET ASSETS

| $325,849,445 |

| NET ASSETS consist of: | |

Paid-in capital

| $ 318,967,628 |

Par value

| 143,562 |

Accumulated distributable earnings (loss)

| 6,738,255 |

NET ASSETS

| $325,849,445 |

| Maximum Offering Price Per Share: | |

| Class A Shares: | |

Net asset value and redemption price per share (Based on net assets of $56,364,533 and 2,496,442 shares of beneficial interest issued and outstanding)

| $22.58 |

Maximum sales charge (4.50% of offering price)

| 1.06 |

Maximum offering price to public

| $23.64 |

| Class C Shares: | |

Net asset value and redemption price per share (Based on net assets of $51,755,831 and 2,277,980 shares of beneficial interest issued and outstanding)

| $22.72 |

| Class F Shares: | |

Net asset value and redemption price per share (Based on net assets of $968,758 and 42,352 shares of beneficial interest issued and outstanding)

| $22.87 |

| Class I Shares: | |

Net asset value and redemption price per share (Based on net assets of $216,022,309 and 9,506,668 shares of beneficial interest issued and outstanding)

| $22.72 |

| Class R3 Shares: | |

Net asset value and redemption price per share (Based on net assets of $738,014 and 32,786 shares of beneficial interest issued and outstanding)

| $22.51 |

Page 16

See Notes to Financial Statements

First Trust Preferred Securities and Income Fund

Statement of Operations

For the Year Ended October 31, 2021

| INVESTMENT INCOME: | |

Interest

| $ 13,525,917 |

Dividends

| 3,904,703 |

Total investment income

| 17,430,620 |

| EXPENSES: | |

Investment advisory fees

| 2,513,218 |

| 12b-1 distribution and/or service fees: | |

Class A

| 123,368 |

Class C

| 555,371 |

Class F

| 1,492 |

Class R3

| 3,576 |

Transfer agent fees

| 261,465 |

Registration fees

| 137,754 |

Administrative fees

| 133,515 |

Shareholder reporting fees

| 63,875 |

Audit and tax fees

| 63,105 |

Custodian fees

| 46,936 |

Commitment and administrative agency fees

| 45,106 |

Legal fees

| 16,911 |

Trustees’ fees and expenses

| 15,208 |

Financial reporting fees

| 9,250 |

Expenses previously waived or reimbursed

| 4,014 |

Listing expense

| 3,508 |

Other

| 4,175 |

Total expenses

| 4,001,847 |

Fees waived and expenses reimbursed by the investment advisor

| (38,675) |

Net expenses

| 3,963,172 |

NET INVESTMENT INCOME (LOSS)

| 13,467,448 |

| NET REALIZED AND UNREALIZED GAIN (LOSS): | |

Net realized gain (loss) on investments

| 5,098,120 |

Net change in unrealized appreciation (depreciation) on investments

| 13,312,730 |

NET REALIZED AND UNREALIZED GAIN (LOSS)

| 18,410,850 |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS

| $ 31,878,298 |

See Notes to Financial Statements

Page 17

First Trust Preferred Securities and Income Fund

Statements of Changes in Net Assets

| | Year

Ended

10/31/2021 | | Year

Ended

10/31/2020 |

| OPERATIONS: | | | |

Net investment income (loss)

| $ 13,467,448 | | $ 13,480,783 |

Net realized gain (loss)

| 5,098,120 | | (6,794,753) |

Net change in unrealized appreciation (depreciation)

| 13,312,730 | | (4,571,180) |

Net increase (decrease) in net assets resulting from operations

| 31,878,298 | | 2,114,850 |

| DISTRIBUTIONS TO SHAREHOLDERS FROM INVESTMENT OPERATIONS: | | | |

Class A Shares

| (2,027,973) | | (1,900,896) |

Class C Shares

| (1,899,342) | | (2,196,229) |

Class F Shares

| (41,330) | | (93,664) |

Class I Shares

| (8,947,567) | | (8,585,113) |

Class R3 Shares

| (27,927) | | (33,529) |

Total distributions to shareholders from investment operations

| (12,944,139) | | (12,809,431) |

| DISTRIBUTIONS TO SHAREHOLDERS FROM RETURN OF CAPITAL: | | | |

Class A shares

| (221,139) | | (183,435) |

Class C shares

| (202,730) | | (209,421) |

Class F shares

| (4,407) | | (6,702) |

Class I shares

| (970,230) | | (827,127) |

Class R3 shares

| (2,998) | | (3,200) |

Total distributions to shareholders from return of capital

| (1,401,504) | | (1,229,885) |

| CAPITAL TRANSACTIONS: | | | |

Proceeds from shares sold

| 71,079,673 | | 110,162,679 |

Proceeds from shares reinvested

| 12,962,840 | | 12,278,896 |

Cost of shares redeemed

| (65,560,931) | | (99,832,324) |

Net increase (decrease) in net assets resulting from capital transactions

| 18,481,582 | | 22,609,251 |

Total increase (decrease) in net assets

| 36,014,237 | | 10,684,785 |

| NET ASSETS: | | | |

Beginning of period

| 289,835,208 | | 279,150,423 |

End of period

| $325,849,445 | | $289,835,208 |

Page 18

See Notes to Financial Statements

First Trust Preferred Securities and Income Fund

Financial Highlights

For a Share outstanding throughout each period

| Class A Shares | Year Ended October 31, |

| 2021 | | 2020 | | 2019 | | 2018 | | 2017 |

Net asset value, beginning of period

| $ 21.31 | | $ 22.07 | | $ 20.85 | | $ 22.39 | | $ 21.63 |

| Income from investment operations: | | | | | | | | | |

Net investment income (loss)

| 0.95 (a) | | 1.01 (a) | | 1.12 (a) | | 1.11 (a) | | 1.11 (a) |

Net realized and unrealized gain (loss)

| 1.34 | | (0.70) | | 1.25 | | (1.50) | | 0.80 |

Total from investment operations

| 2.29 | | 0.31 | | 2.37 | | (0.39) | | 1.91 |

| Distributions paid to shareholders from: | | | | | | | | | |

Net investment income

| (0.92) | | (0.98) | | (1.12) | | (1.13) | | (1.15) |

Return of capital

| (0.10) | | (0.09) | | (0.03) | | (0.02) | | — |

Total distributions

| (1.02) | | (1.07) | | (1.15) | | (1.15) | | (1.15) |

Net asset value, end of period

| $22.58 | | $21.31 | | $22.07 | | $20.85 | | $22.39 |

Total return (b)

| 10.89% | | 1.53% | | 11.75% | | (1.77)% | | 9.05% |

| Ratios to average net assets/supplemental data: | | | | | | | | | |

Net assets, end of period (in 000’s)

| $ 56,365 | | $ 43,802 | | $ 39,719 | | $ 36,262 | | $ 39,063 |

Ratio of total expenses to average net assets

| 1.33% | | 1.36% | | 1.41% | | 1.37% | | 1.36% |

Ratio of net expenses to average net assets

| 1.33% | | 1.36% | | 1.40% | | 1.37% | | 1.36% |

Ratio of net investment income (loss) to average net assets

| 4.22% | | 4.78% | | 5.27% | | 5.15% | | 5.11% |

Portfolio turnover rate

| 38% | | 46% | | 41% | | 33% | | 44% |

| (a) | Based on average shares outstanding. |

| (b) | Assumes reinvestment of all distributions for the period and does not include payment of the maximum sales charge of 4.50% or contingent deferred sales charge (CDSC). On purchases of $1 million or more, a CDSC of 1% may be imposed on certain redemptions made within twelve months of purchase. If the sales charges were included, total returns would be lower. These returns include Rule 12b-1 service fees of 0.25% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

See Notes to Financial Statements

Page 19

First Trust Preferred Securities and Income Fund

Financial Highlights (Continued)

For a Share outstanding throughout each period

| Class C Shares | Year Ended October 31, |

| 2021 | | 2020 | | 2019 | | 2018 | | 2017 |

Net asset value, beginning of period

| $ 21.43 | | $ 22.18 | | $ 20.93 | | $ 22.44 | | $ 21.67 |

| Income from investment operations: | | | | | | | | | |

Net investment income (loss)

| 0.79 (a) | | 0.87 (a) | | 0.98 (a) | | 0.97 (a) | | 0.96 (a) |

Net realized and unrealized gain (loss)

| 1.35 | | (0.71) | | 1.26 | | (1.50) | | 0.79 |

Total from investment operations

| 2.14 | | 0.16 | | 2.24 | | (0.53) | | 1.75 |

| Distributions paid to shareholders from: | | | | | | | | | |

Net investment income

| (0.77) | | (0.83) | | (0.96) | | (0.96) | | (0.98) |

Return of capital

| (0.08) | | (0.08) | | (0.03) | | (0.02) | | — |

Total distributions

| (0.85) | | (0.91) | | (0.99) | | (0.98) | | (0.98) |

Net asset value, end of period

| $22.72 | | $21.43 | | $22.18 | | $20.93 | | $22.44 |

Total return (b)

| 10.11% | | 0.84% | | 11.01% | | (2.37)% | | 8.27% |

| Ratios to average net assets/supplemental data: | | | | | | | | | |

Net assets, end of period (in 000’s)

| $ 51,756 | | $ 54,264 | | $ 57,898 | | $ 59,610 | | $ 64,462 |

Ratio of total expenses to average net assets

| 2.04% | | 2.07% | | 2.06% | | 2.02% | | 2.06% |

Ratio of net expenses to average net assets

| 2.04% | | 2.07% | | 2.06% | | 2.02% | | 2.06% |

Ratio of net investment income (loss) to average net assets

| 3.51% | | 4.09% | | 4.61% | | 4.50% | | 4.41% |

Portfolio turnover rate

| 38% | | 46% | | 41% | | 33% | | 44% |

| (a) | Based on average shares outstanding. |

| (b) | Assumes reinvestment of all distributions for the period and does not include payment of the maximum CDSC of 1%, charged on certain redemptions made within one year of purchase. If the sales charge was included, total returns would be lower. These returns include combined Rule 12b-1 distribution and service fees of 1% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

Page 20

See Notes to Financial Statements