UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22468

Ashmore Funds

(Exact name of registrant as specified in charter)

c/o Ashmore Investment Management Limited

61 Aldwych

London WC2B 4AE

England

(Address of principal executive offices) (Zip code)

Corporation Service Company

84 State Street

Boston, MA 20109

(Name and address of agent for service)

Registrant’s telephone number, including area code: 011-44-20-3077-6000

Date of fiscal year end: October 31, 2011

Date of reporting period: October 31, 2011

Item 1. Reports to Stockholders.

ASHMORE FUNDS

ANNUAL FINANCIAL STATEMENTS

October 31, 2011

(THIS PAGE INTENTIONALLY LEFT BLANK)

ASHMORE FUNDS

TABLE OF CONTENTS

This material is authorized for use only when preceded or accompanied by the current Ashmore Funds prospectuses. Investors should consider the investment objectives, risks, charges and expenses of these Funds carefully before investing. This and other information is contained in the Funds’ prospectus. Please read the prospectus carefully before you invest or send money.

A Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

An investment in a Fund is not a deposit of a bank and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Funds.

ASHMORE FUNDS

INVESTMENT MANAGERS REPORT (DATED DECEMBER 2011)

For the period December 8, 2010 to October 31, 2011

Overview

While financial assets in general have rebounded from the lows experienced in the first quarter of 2009, the underlying problems in the global economy remain largely unresolved.

After strong positive US data in Q4 2010, the market held three broad consensus views going into 2011. The first was that the US would continue its healthy growth rate. The second was that Europe as a whole would struggle and finally (a view that we did not share), that Emerging Markets inflation would be a major problem. Looking back over the period, these three views have been broadly proven to be incorrect. US growth in Q1 and Q2 2011 was hugely disappointing and it was quickly realised that the strong performance in Q4 2010 was largely due to the US Federal Reserve’s second round of quantitative easing. The US has much deleveraging to do, particularly at the household level. Lending has been poor, with banks still working through their own re-capitalisation issues. Large businesses in the US have been able to finance themselves via retained earnings and by accessing the capital markets, but small businesses are finding access to capital very difficult. The US consumer is being squeezed and this is likely to get worse as the US Government is forced to think about increasing taxes and reigning in fiscal spending in the coming years.

The European sovereign debt crisis has also been at the forefront of investors’ minds. Both Ireland and Portugal were forced to accept financial assistance from the EU and IMF, while the Greece saga has been rumbling on for a couple of years now. At the time of writing, Italy became the next country investors focussed on given its sheer debt size. Indeed, Italy is too big to be allowed to default and too big to bail out. Regime change was also brought about in Greece and Italy, as Prime Ministers Papandreou and Berlusconi agreed to step down and unelected technocrats were installed to form a new governing cabinet.

German growth was strong in early 2011 – so much so that the European Central Bank raised rates twice in the year. Towards the end of Q2 and in the early part of Q3 2011, markets experienced three big shocks. The first was the suggestion that Greek bondholders voluntarily accept a 21% haircut; the second was the disagreement by Congress over an extension of the US debt ceiling, indeed, the US came to within 12 hours of running out of cash; finally, there was S&P’s decision to downgrade the US by one notch. These three events have caused huge volatility and a fall in confidence. While the market cried out for a big policy response, they were given nothing more than small piecemeal solutions. These included the US Federal Reserve announcing that rates will be kept low until 2014, the central banks of US, Europe, UK, Japan and Switzerland all providing liquidity to European banks, and the ECB turning dovish and hinting that rates will be cut.

Towards the end of the period, the EU finally came up with a package aimed at solving Greece’s problem and stopping contagion. However, the initial euphoria died down once investors quickly realised a) that the announcement lacked any material detail and b) that the measures wouldn’t cover Italy should it go down the same route as Greece.

Recovery has been very strong in Emerging Markets countries, some of which now face inflationary pressure. After over a decade of major (central bank) reserve accumulation by Emerging Markets central banks, the buffer provided by having large reserves has largely worked. Central banks now need to use interest rates but also exchange rate appreciation to stem inflation and export it to developed countries (who need it). Indeed to date, over 30 Emerging Markets central banks have raised interest rates, with many such as India and Brazil raising rates more than once. If Emerging Markets growth continues, particularly if it can be sustained at high levels without excessive inflationary pressure (for which major infrastructure spending would be advised), it is hoped that these economies can replace the global demand no longer being provided by the developed world consumer.

2

ASHMORE FUNDS

INVESTMENT MANAGERS REPORT (DATED DECEMBER 2011)

Portfolio Overview

Ashmore Emerging Markets Corporate Debt Fund

The Ashmore Emerging Markets Corporate Debt Fund (“the Fund”) seeks to achieve its objective by investing principally in debt instruments of Corporate issuers, which may be denominated in any currency, including the local currency of the issuer. Emerging Markets corporate debt had a mixed period. Risk aversion resulting from panic over the ability of Western Europe to avoid defaults and concerns over a hard landing in China affected Emerging Markets corporate bonds over the period. Fundamentals and technicals have diverged significantly. Generally, companies continued to deliver strong results and are well-placed to ride out even a medium-term credit crunch from the bank market, having learned the lessons of 2008. Global commodity players are naturally experiencing some reticence from their customers. Banks in particular are beginning to repurchase their bonds at distressed prices, although industrial companies are more cautious about their liquidity position for now; they generally also see better and longer-term returns from their core business. At the end of the period, the Fund’s largest country position was in the United Arab Emirates. This overweight position was the strongest performer over the period. The Fund also held overweight positions to both China and Kazakhstan; these two countries were the largest detractors to performance over the period. Kazakhstan is a high beta credit which has historically sold off in times of risk aversion. China, meanwhile, sold off on concerns over a possible hard landing for it economy. The Fund held a number of other “off benchmark” positions which were generally positive for performance.

Ashmore Emerging Markets Local Currency Bond Fund

The Ashmore Emerging Markets Local Currency Bond Fund (“the Fund”) seeks to achieve its objective by investing principally in debt instruments of Sovereign and Quasi- Sovereign issuers of Emerging Market Countries that are denominated in the local currency of the issuer. Like Emerging Markets currencies, Emerging Markets local currency bonds offer a compelling long term investment case. The Fund offers the prospect of currency appreciation coupled with a yield pick-up. However, the past period was a challenging one for Emerging Market local bonds due to external factors. While fundamentals in Emerging Markets remained strong, investors have sought to divest as risk aversion spiked. Indeed, many investors unwound positions and repatriated assets back to the US dollar. Policy makers have found themselves in a tricky position in which they must ensure that growth remains positive, that inflation doesn’t get out of control and that their currencies don’t fall too far. That said, they do at least have the tools to do this, using both fiscal and monetary policy. The Fund broadly maintained its largest regional exposure through the period which was concentrated in Asia and Latin America - two regions that have strong domestic economies. The Fund’s portfolio will continue to be managed on a top-down macro basis with a medium to long term investment horizon. The Fund’s largest country position was Mexico, which contributed positively to the Fund’s performance. The largest country contributor to the Funds performance was Hungary where the Fund held an underweight position. The Fund’s investments in Indonesia were the largest country detractor over the period.

Ashmore Emerging Markets Local Currency Fund

The Ashmore Emerging Markets Local Currency Fund (“the Fund”) seeks to achieve its objective by investing principally in derivatives and other instruments that mature in less than one year (“short-dated instruments”) and provide investment exposure to local currencies of Emerging Market Countries. The Fund also has the flexibility to invest in longer-dated derivative instruments. The Fund may also invest in debt instruments of any maturity issued by Sovereigns and Quasi-Sovereigns and denominated in the local currency of the issuer. The market environment has been a supportive one for investors in Emerging Markets currencies. Over the past year, Emerging Markets central banks have used a number of tools to manage their market cycles and ensure that domestic markets do not overheat. Interest rates have been increased in over 30 countries, while a number have used additional tools including increases to bank reserve requirements. Whilst global risk appetite has had a collateral effect on Emerging Markets currency exposure, overall, performance has been strong as investors sought the relative safety of Emerging Markets currencies. At the time of writing, Emerging Market local currencies markets have shown a sharp reversal in performance. That said, we believe they now offer strong short term upside potential plus long term potential outperformance versus G10 currencies. Country allocation is key and heavily dependent on policy diversity. The Fund is positioned with a strong bias towards Asia given its growth dynamics with a lesser emphasis on those countries that are heavily reliant on the Eurozone for trade. At the end of the period, the Fund’s largest country exposure was Mexico. This detracted from performance. The Fund’s overweight position to Brazil was the strongest contributor to performance. India was the largest detractor as the market was concerned about stubbornly high inflation and the current account deficit.

3

ASHMORE FUNDS

INVESTMENT MANAGERS REPORT (DATED DECEMBER 2011)

Ashmore Emerging Markets Sovereign Debt Fund

The Ashmore Emerging Markets Sovereign Debt Fund (“the Fund”) seeks to achieve its objective by investing principally in debt instruments of Sovereign and Quasi-Sovereign issuers of Emerging Market Countries that are denominated in any Hard Currency. Historically, Emerging Markets Sovereign debt has typically been the most developed, stable, and least risky asset class in Emerging Market fixed income. Prior to the recent volatility, Emerging Markets sovereign bonds saw spreads narrow and trade broadly in line with US Treasuries, that is, they tended to perform around risk events. More recently, market movements have seen spreads come off somewhat, however, this has provided excellent trading opportunities, particularly in the higher beta countries. The Fund has favoured Brazil, Russia and Indonesia as its main country exposures although recently, exposure to Russia was reduced due to commodity price weakness. Brazil is the Fund’s largest country exposure, a position that was overweight and slightly detracted from performance. The Fund may also seek to benefit from positions taken in quasi sovereign bonds where it can achieve higher yields and this was evident by its off benchmark position in the United Arab Emirates. Higher beta positions in Argentina and Ukraine proved to be a negative contributor to performance although the Fund’s exposure at the end of the period was relatively modest.

Ashmore Emerging Markets Total Return Fund

The Ashmore Emerging Markets Total Return Fund (“the Fund”) seeks to achieve its objective by investing principally in debt instruments of Sovereign, Quasi-Sovereign, and Corporate issuers, which may be denominated in any currency, including the local currency of the issuer. The Fund tactically allocates assets between external debt, corporate debt and local currency. Asset allocation has been managed actively, reducing risk when the market is in risk off mode. As such, the Fund ended the period with its largest exposure in external debt. This is typically the most resilient Emerging Markets fixed income asset class in times of risk aversion. Emerging Markets local currency and local currency debt has historically tended to sell off as investors unwind positions and repatriate assets back to the US dollar. As such, exposure to the asset class was reduced. However, the long term case for investing in Emerging Markets currencies remains convincing given the growth dynamics in the US versus Emerging Markets. That said, bouts of risk aversion will always be negative for the asset class, and could provide attractive buying opportunities. Emerging Markets corporates are businesses that typically operate in growth sectors and have low levels of leverage. That said, Emerging Markets corporates have sold off over the period even though most of these businesses continue to perform well. The Total Return Fund allows the Investment Team to be dynamic in their investment decisions and to position the portfolio not only for longer-term outperformance, but also seek to take advantage of shorter-term mispricing via tactical trading. The Fund’s largest exposure was to Brazil where it held a mixture of external debt, local currency and corporate bonds. This proved to be a negative contributor to the Fund’s performance. Kazakhstan was the largest detractor where the fund was overweight, principally in corporate and quasi sovereign bonds. On a positive note, United Arab Emirates, a big overweight was the largest positive contributor. Other positives included Egypt (benchmark weight) and Czech Republic (overweight).

Ashmore Emerging Markets Equity Fund

The Ashmore Emerging Markets Equity Fund, launched on June 22, 2011, seeks to achieve its objective by investing principally in equity securities and equity-related investments of Emerging Market Issuers, which may be denominated in any currency, including the local currency of the issuer. Since then the performance of Emerging Markets equities has been driven by global risk aversion, especially in September 2011. The Fund had its largest regional concentration in Asia followed by Latin America. Asia benefits from a cluster of strong exporting countries while Latin America has the advantage of housing commodities businesses, particularly in Brazil. Emerging Markets equities have historically tended to be correlated to developed world equities and, as is the case during this review period, technical’s seem to outweigh fundamentals in determining performance. In Brazil, China, Russia and Korea, valuations are most compelling. At the stock level, we have sought to take advantage of low valuations created by panic selling. Overall, the environment for Emerging Markets equities has become more supportive and valuations have been compelling. At the end of the period, the largest country position (and overweight) in the Fund was Brazil, but this proved to be a negative over the period. The largest positive country contributor was the Fund’s investments in China, where the fund was slightly underweight.

4

ASHMORE FUNDS

INVESTMENT MANAGERS REPORT (DATED DECEMBER 2011)

Ashmore Emerging Markets Small-Cap Equity Fund

The Ashmore Emerging Markets Small-Cap Equity Fund, launched on October 4, 2011, seeks to achieve its objective by investing principally in equity securities and equity-related investments of Small-Capitalization Emerging Market Issuers, which may be denominated in any currency, including the local currency of the issuer. Emerging Markets equities showed signs of recovering from oversold levels during October 2011 on hopes that Europeans would succeed in putting together a package to address the sovereign debt crisis in Europe. Small caps mirrored this trend, although they trailed their larger cap peers during October. Chile, Brazil, Poland, Malaysia and Korea were among markets that outperformed. However, Thailand, Colombia, India and Egypt were among those that lagged. Industrials and consumer discretionary names, especially those in China led overall performance. Financials began to recover, while IT exposures faltered during the period.

Global events have driven risk premiums to extreme levels, creating opportunities to invest in excellent companies with strong growth prospects at attractive prices. As Chinese small caps have been particularly hard hit, we have increased exposure to Chinese companies. We continue to focus on the domestic secular growth story in Emerging Markets and emerging global competitors. We believe technology provides attractive investment opportunities, as companies benefit from growing demand for tablets and smartphones in Emerging Markets as well as developed markets. Exposures favour plays that are less dependent on developed markets, including China, Southeast Asia and Brazil.

Ashmore Investment Management Limited

This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Funds and market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of Ashmore Investment Management Limited as at the date indicated and are subject to change at any time based upon economic, market, or other conditions and Ashmore Investment Management Limited undertakes no obligation to update the views expressed herein. Any discussions of specific securities or markets should not be considered a recommendation to buy or sell or invest in those securities or markets. The views expressed above may not be relied upon as investment advice or as an indication of the Funds’ trading intent. Information about the Funds’ holdings, asset allocation or country diversification is historical and is not an indication of future portfolio composition, which may vary. Direct investment in any index is not possible. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses applicable to mutual fund investments. In addition, the returns do not reflect certain charges that an investor in the Funds may pay. If these additional fees were reflected, performance would have been lower.

5

IMPORTANT INFORMATION ABOUT THE FUNDS

The following disclosure provides important information regarding each Fund’s Average Annual Total Return table and Cumulative Returns chart, which appears on each Fund’s individual page in this Shareholder Report. Please refer to this information when reviewing the table and chart for a Fund.

On each individual Fund Summary page in this Annual Report (“Shareholder Report”), the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that all dividend and capital gain distributions were reinvested. Returns do not reflect the deduction of taxes that a shareholder would pay on (i) Fund distributions or (ii) the redemption of Fund shares. The Cumulative Returns Chart reflects only Institutional Class performance. Performance for Class A and Class C shares is typically lower than Institutional Class performance due to the lower expenses paid by Institutional Class shares. Except for the load-waived performance for the Class A and C shares of Ashmore Emerging Markets Corporate Debt Fund, Ashmore Emerging Markets Local Currency Bond Fund, Ashmore Emerging Markets Local Currency Fund, Ashmore Emerging Markets Sovereign Debt Fund and Ashmore Emerging Markets Total Return Fund, performance shown is net of fees and expenses. The load-waived performance for Class A and Class C shares does not reflect the sales charges shareholders of those classes may pay in connection with a purchase or redemption of Class A and Class C shares. The load-waived performance of those share classes is relevant only to shareholders who purchase Class A or Class C shares on a load-waived basis. The figures in the line graph are calculated at net asset value and assume the investment of $1,000,000 at the end of the month that the Institutional Class of the Fund commenced operations. Each Fund measures its performance against a broad-based securities market index (“benchmark index”). Each benchmark index does not take into account fees, expenses or taxes.

For periods prior to the inception date of the Class A and Class C shares (if applicable), performance information shown is based on the performance of the Fund’s Institutional Class shares, adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively. The Class A and C shares of the Ashmore Emerging Markets Corporate Debt, Ashmore Emerging Markets Local Currency Bond, Ashmore Emerging Markets Local Currency, Ashmore Emerging Markets Sovereign Debt and Ashmore Emerging Markets Total Return Funds were first offered in May 2011.

A Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

An investment in a Fund is not a deposit of a bank and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Funds.

The following disclosure provides important information regarding each Fund’s Expense Example, which appears on each Fund’s individual page in this Shareholder Report. Please refer to this information when reviewing the Expense Example for a Fund.

EXPENSE EXAMPLE

Fund Expenses

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, May 1, 2011 or inception date (if later), through October 31, 2011.

6

IMPORTANT INFORMATION ABOUT THE FUNDS (CONTINUED)

Actual Expenses

The information in the table under the heading “Actual Performance” provides information based on actual performance and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the appropriate column for your share class, in the row titled “Expenses Paid” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical Performance” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the information under the heading “Hypothetical Performance” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

7

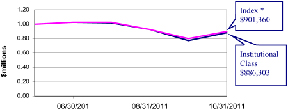

Ashmore Emerging Markets Corporate Debt Fund

Ashmore Emerging Markets Corporate Debt Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of Corporate issuers, which may be denominated in any currency, including the local currency of the issuer.

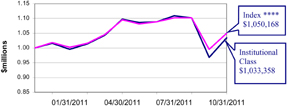

Please refer to page 6 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return chart.

| | |

| Average Annual Total Return For The Period Ended October 31, 2011 | | Fund Inception |

| | December 8, 2010 |

| |

Ashmore Emerging Markets Corporate Debt Fund Institutional Class | | 0.27% |

| |

Ashmore Emerging Markets Corporate Debt Fund Retail Class A (load-waived)* | | 0.07% |

| |

Ashmore Emerging Markets Corporate Debt Fund Retail Class A (unadjusted)* | | -3.94%** |

| |

Ashmore Emerging Markets Corporate Debt Fund Retail Class C (load-waived)* | | -0.59% |

| |

Ashmore Emerging Markets Corporate Debt Fund Retail Class C (unadjusted)* | | -1.59%** |

| |

JP Morgan CEMBI BD*** | | 3.22% |

| | | | | | | | | | |

| Cumulative Returns Through October 31, 2011 (% of NAV) | | | | | | Top 5 Country Exposures as of Oct 31, 2011 (% of NAV) | |

| | | | |

| | | | | | United Arab Emirates | | | 12.55 | % |

| | | | | China | | | 10.95 | % |

| | | | | Brazil | | | 10.82 | % |

| | | | | Kazakhstan | | | 8.16 | % |

| | | | | Mexico | | | 5.16 | % |

| | | | | | | | | |

| | | | | Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above | |

| | | | | |

All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares.

*For periods prior to the inception date of the Class A and Class C shares, performance information shown is based on the performance of the Fund’s Institutional Class shares, adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively.

** Unadjusted Performance accounts for a maximum sales load of 4% for class A shares and maximum deferred sales charge of 1% for class C shares.

***The index for the Fund is the JP Morgan Corporate Emerging Markets Bond Index Broad Diversified.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualised. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund has been in existence for less than one year; cumulative performance may not be indicative of the Fund’s long-term potential. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 6 herein for an explanation of the Expense Example information presented below.

| | | | | | | | | | | | | | |

| | | Expense Example |

| | | | | | | | | | | | | | |

| | | Actual Performance | | | | Hypothetical Performance |

| | | Institutional | | | | | | | | Institutional | | | | |

| | Class | | Class A | | Class C | | | | Class | | Class A | | Class C |

| | | | | | | |

Beginning Account Value*

(05/01/2011) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | | |

Ending Account Value

(10/31/2011) | | $948.20 | | $945.60 | | $942.20 | | | | $1,019.31 | | $1,016.63 | | $1,013.12 |

| | | | | | | |

| Expense Ratio | | 1.17% | | 1.45% | | 2.20% | | | | 1.17% | | 1.45% | | 2.20% |

| | | | | | | |

| Expenses Paid† | | $5.75 | | $6.61 | | $10.01 | | | | $5.96 | | $6.85 | | $10.37 |

*Beginning account value for Institutional Class dated 05/01/2011. Beginning account value for Class A and C dated 05/12/2011

† Expenses are equal to the Fund’s annualized expenses ratio multiplied by the average account value over the period, multiplied by 184/365 for Institutional Class (to reflect the one-half year period) and 171/365 for Class A and Class C (to reflect the period since inception date of 5/12/2011 for Class A and Class C shares). The Fund’s Class A and Class C hypothetical expenses reflect an amount as if each class had been in operation for the entire fiscal half year. Hypothetical expenses are based on the Fund’s actual annualized expense ratios and assumed rate of 5 percent per year before expenses.

Unaudited

|

Share Class Information Institutional Class Launch Date: December 8, 2010 Minimum Initial Investment:

$1,000,000 ISIN: US044825049 CUSIP: 044820504 BLOOMBERG: AEMCDBT US Retail Class A Launch Date: May 12, 2011 Minimum Initial Investment:

$1,000 ISIN: US0448206039 CUSIP: 044820603 BLOOMBERG: AEMCDBA US Retail Class C Launch Date: May 12, 2011 Minimum Initial Investment:

$1,000 ISIN: US0448207029 CUSIP: 044820702 BLOOMBERG: AEMCDBC US All sources are Ashmore unless

otherwise indicated |

8

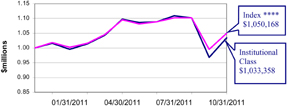

Ashmore Emerging Markets Local Currency Bond Fund

Ashmore Emerging Markets Local Currency Bond Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of Sovereign and Quasi-Sovereign issuers of Emerging Market Countries that are denominated in the local currency of the issuer.

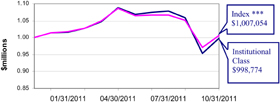

Please refer to page 6 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return chart.

| | |

| Average Annual Total Return For The Period Ended October 31, 2011 | | Fund Inception December 8, 2010 |

| |

| |

Ashmore Emerging Markets Local Currency Bond Fund Institutional Class | | 3.35% |

| |

Ashmore Emerging Markets Local Currency Bond Fund Retail Class A (load-waived)* | | 3.18% |

| |

Ashmore Emerging Markets Local Currency Bond Fund Retail Class A (unadjusted)* | | -0.95%** |

| |

Ashmore Emerging Markets Local Currency Bond Fund Retail Class C (load-waived)* | | 2.41% |

| |

Ashmore Emerging Markets Local Currency Bond Fund Retail Class C (unadjusted)* | | 1.39%** |

| |

JP Morgan GBI-EM GD*** | | 5.02% |

| | | | | | | | | | |

Cumulative Returns Through October 31, 2011 (% of net assets) | | | | | | Top 5 Country Exposures as of Oct 31, 2011 (% of NAV) | |

| | | | |

| | | | | | Malaysia | | | 14.15 | % |

| | | | | Brazil | | | 13.83 | % |

| | | | | Mexico | | | 13.39 | % |

| | | | | South Africa | | | 10.13 | % |

| | | | | Indonesia | | | 9.94 | % |

| | | | | Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above | |

| | | | |

All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares.

*For periods prior to the inception date of the Class A and Class C shares, performance information shown is based on the performance of the Fund’s Institutional Class shares, adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively.

** Unadjusted Performance accounts for a maximum sales load of 4% for class A shares and maximum deferred sales charge of 1% for class C shares.

***The index for the Fund is the JP Morgan Global Bond Index — Emerging Markets Global Diversified.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualised. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund has been in existence for less than one year; cumulative performance may not be indicative of the Fund’s long-term potential. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 6 herein for an explanation of the Expense Example information presented below.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Expense Example | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Performance | | | | | Hypothetical Performance | |

| | | Institutional | | | | | | | | | | | Institutional | | | | | | | |

| | | Class | | | | Class A | | | | Class C | | | | | | Class | | | | Class A | | | | Class C | |

| | | | | | | |

Beginning Account Value*

(05/01/2011) | | | $1,000.00 | | | | $1,000.00 | | | | $1,000.00 | | | | | | $1,000.00 | | | | $1,000.00 | | | | $1,000.00 | |

| | | | | | | |

Ending Account Value

(10/31/2011) | | | $941.00 | | | | $964.00 | | | | $ 959.90 | | | | | | $1,020.32 | | | | $1,017.57 | | | | $1,014.05 | |

| | | | | | | |

| Expense Ratio | | | 0.97% | | | | 1.25% | | | | 2.00% | | | | | | 0.97% | | | | 1.25% | | | | 2.00% | |

| | | | | | | |

| Expenses Paid† | | | $4.75 | | | | $5.75 | | | | $9.18 | | | | | | $4.94 | | | | $5.91 | | | | $9.44 | |

*Beginning account value for Institutional Class dated 05/01/2011. Beginning account value for Class A and C dated 05/12/2011

† Expenses are equal to the Fund’s annualized expenses ratio multiplied by the average account value over the period, multiplied by 184/365 for Institutional Class (to reflect the one-half year period) and 171/365 for Class A and Class C (to reflect the period since inception date of 5/12/2011 for Class A and Class C shares). The Fund’s Class A and Class C hypothetical expenses reflect an amount as if each class had been in operation for the entire fiscal half year. Hypothetical expenses are based on the Fund’s actual annualized expense ratios and assumed rate of 5 percent per year before expenses.

Unaudited

|

Share Class Information Institutional Class Launch Date: December 8, 2010 Minimum Initial Investment:

$1,000,000 ISIN: US0448202079 CUSIP: 044820207 BLOOMBERG: ELBIX US TICKER: ELBIX Retail Class A Launch Date: May 12, 2011 Minimum Initial Investment: $1,000 ISIN: US0448208761 CUSIP: 044820876 BLOOMBERG: ELBAX US TICKER: FLBAX Retail Class C Launch Date: May 12, 2011 Minimum Initial Investment: $1,000 ISIN: US0448208688 CUSIP: 044820868 BLOOMBERG: ELBCX US TICKER: ELBCX All sources are Ashmore unless otherwise indicated |

9

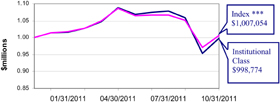

Ashmore Emerging Markets Local Currency Fund

Ashmore Emerging Markets Local Currency Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in derivatives and other instruments that mature in less than one year (“short-dated instruments”) and provide investment exposure to local currencies of Emerging Market Countries. The Fund also has the flexibility to invest in longer-dated derivative instruments. The Fund may also invest in debt instruments of any maturity issued by Sovereigns and Quasi-Sovereigns and denominated in the local currency of the issuer.

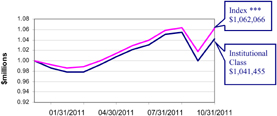

Please refer to page 6 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return chart.

| | |

| Average Annual Total Return For The Period Ended October 31, 2011 | | Fund Inception |

| | December 8, 2010 |

| |

Ashmore Emerging Markets Local Currency Fund Institutional Class | | -0.12% |

| |

Ashmore Emerging Markets Local Currency Fund Retail Class A (load-waived)* | | -0.56% |

| |

Ashmore Emerging Markets Local Currency Fund Retail Class A (unadjusted)* | | -4.54%** |

| |

Ashmore Emerging Markets Local Currency Fund Retail Class C (load-waived)* | | -1.17% |

| |

Ashmore Emerging Markets Local Currency Fund Retail Class C (unadjusted)* | | -2.16%** |

| |

JP Morgan ELMI+*** | | 0.70% |

| | | | | | | | |

| Cumulative Returns Through October 31, 2011 (% of net assets) | | | | Top 5 Country Exposures as of October 31, 2011 | |

| | | |

| | | | Mexico | | | 13.49 | % |

| | | | Singapore | | | 10.99 | % |

| | | | Poland | | | 9.09 | % |

| | | | Czech Republic | | | 7.31 | % |

| | | | India | | | 7.19 | % |

| | | | Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above | |

All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares.

*For periods prior to the inception date of the Class A and Class C shares, performance information shown is based on the performance of the Fund’s Institutional Class shares, adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively.

** Unadjusted Performance accounts for a maximum sales load of 4% for class A shares and maximum deferred sales charge of 1% for class C shares.

***The index for the Fund is the JP Morgan Emerging Local Markets Index Plus.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualised. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund has been in existence for less than one year; cumulative performance may not be indicative of the Fund’s long-term potential. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 6 herein for an explanation of the Expense Example information presented below.

| | | | | | | | | | | | | | |

| | | Expense Example |

| | | | | | | | | | | | | | |

| | | Actual Performance | | | | Hypothetical Performance |

| | | Institutional | | | | | | | | Institutional | | | | |

| | Class | | Class A | | Class C | | | | Class | | Class A | | Class C |

| | | | | | | |

Beginning Account Value*

(05/01/2011) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | | |

Ending Account Value

(10/31/2011) | | $918.30 | | $938.80 | | $935.40 | | | | $1,020.82 | | $1,018.04 | | $1,014.52 |

| | | | | | | |

| Expense Ratio | | 0.87% | | 1.15% | | 1.90% | | | | 0.87% | | 1.15% | | 1.90% |

| | | | | | | |

| Expenses Paid† | | $4.21 | | $5.22 | | $8.61 | | | | $4.43 | | $5.44 | | $8.97 |

*Beginning account value for Institutional Class dated 05/01/2011. Beginning account value for Class A and C dated 05/12/2011

† Expenses are equal to the Fund’s annualized expenses ratio multiplied by the average account value over the period, multiplied by 184/365 for Institutional Class (to reflect the one-half year period) and 171/365 for Class A and Class C (to reflect the period since inception date of 5/12/2011 for Class A and Class C shares). The Fund’s Class A and Class C hypothetical expenses reflect an amount as if each class had been in operation for the entire fiscal half year. Hypothetical expenses are based on the Fund’s actual annualized expense ratios and assumed rate of 5 percent per year before expenses.

Unaudited

|

Share Class Information Institutional Class Launch Date: December 8, 2010 Minimum Initial Investment:

$1,000,000 ISIN: US0448201089 CUSIP: 044820108 BLOOMBERG: ECYIX US TICKER ECYIX Retail Class A Launch Date: May 12, 2011 Minimum Initial Investment:

$1,000 ISIN: US0448208019 CUSIP: 044820 801 BLOOMBERG: ECYAX US TICKER ECYAX Retail Class C Launch Date: May 12, 2011 Minimum Initial Investment:

$1,000 ISIN: US0448208845 CUSIP: 044820 884 BLOOMBERG: ECYCX US TICKER ECYCX All sources are Ashmore unless otherwise indicated |

10

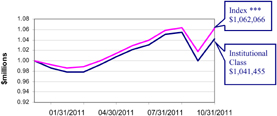

Ashmore Emerging Markets Sovereign Debt Fund

The Ashmore Emerging Markets Sovereign Debt Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of Sovereign and Quasi-Sovereign issuers of Emerging Market Countries that are denominated in any Hard Currency

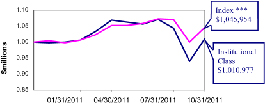

Please refer to page 6 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return chart.

| | |

| Average Annual Total Return For The Period Ended October 31, 2011 | | Fund Inception |

| | December 8, 2010 |

| |

Ashmore Emerging Markets Sovereign Debt Fund Institutional Class | | 4.15% |

| |

Ashmore Emerging Markets Sovereign Debt Fund Retail Class A (load-waived)* | | 3.77% |

| |

Ashmore Emerging Markets Sovereign Debt Fund Retail Class A (unadjusted)* | | -0.38%** |

| |

Ashmore Emerging Markets Sovereign Debt Fund Retail Class C (load-waived)* | | 3.07% |

| |

Ashmore Emerging Markets Sovereign Debt Fund Retail Class C (unadjusted)* | | 2.04%** |

| |

JP Morgan EMBI GD*** | | 6.21% |

| | | | | | | | |

Cumulative Returns Through October 31, 2011 (% of net assets) | | | | Top 5 Country Exposures as of Oct 31, 2011 | |

| | | |

| | | | Brazil | | | 8.30 | % |

| | | | Russia | | | 7.80 | % |

| | | | Indonesia | | | 7.31 | % |

| | | | Philippines | | | 6.97 | % |

| | | | Mexico | | | 6.83 | % |

| | | | | | | | |

| | | | Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above | |

| | | |

All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares.

*For periods prior to the inception date of the Class A and Class C shares, performance information shown is based on the performance of the Fund’s Institutional Class shares, adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively.

** Unadjusted Performance accounts for a maximum sales load of 4% for class A shares and maximum deferred sales charge of 1% for class C shares.

***The index for the Fund is the JP Morgan Emerging Markets Bond Index Global Diversified.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualised. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund has been in existence for less than one year; cumulative performance may not be indicative of the Fund’s long-term potential. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 6 herein for an explanation of the Expense Example information presented below.

| | | | | | | | | | | | | | | | | | |

| | | Expense Example |

| | | | | | | | | | | | | | | | | | |

| | | |

| | | Actual Performance | | | | Hypothetical Performance |

| | | Institutional | | | | | | | | | | Institutional | | | | |

| | | Class | | | | Class A | | | Class C | | | | Class | | Class A | | Class C |

| | | | | | | |

Beginning Account Value*

(05/01/2011) | | | $1,000.00 | | | | $1,000.00 | | | $1,000.00 | | | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | | |

Ending Account Value

(10/31/2011) | | | $1,034.00 | | | | $1,022.60 | | | $1,019.00 | | | | $1,020.57 | | $1,017.80 | | $1,014.29 |

| | | | | | | |

| Expense Ratio | | | 0.92% | | | | 1.20% | | | 1.95% | | | | 0.92% | | 1.20% | | 1.95% |

| | | | | | | |

| Expenses Paid† | | | $4.72 | | | | $5.69 | | | $9.22 | | | | $4.69 | | $5.67 | | $9.20 |

*Beginning account value for Institutional Class dated 05/01/2011. Beginning account value for Class A and C dated 05/12/2011

† Expenses are equal to the Fund’s annualized expenses ratio multiplied by the average account value over the period, multiplied by 184/365 for Institutional Class (to reflect the one-half year period) and 171/365 for Class A and Class C (to reflect the period since inception date of 5/12/2011 for Class A and Class C shares). The Fund’s Class A and Class C hypothetical expenses reflect an amount as if each class had been operation in for the entire fiscal half year. Hypothetical expenses are based on the Fund’s actual annualized expense ratios and assumed rate of 5 percent per year before expenses.

Unaudited

|

Share Class Information Institutional Class Launch Date: December 8, 2010 Minimum Initial Investment:

$1,000,000 ISIN: US0448203069 CUSIP: 044820306 BLOOMBERG: AEMSOVD US Retail Class A Launch Date: May 12, 2011 Minimum Initial Investment:

$1,000 ISIN: US0448208506 CUSIP: 044820850 BLOOMBERG: EAMSODA US Retail Class C Launch Date: May 12, 2011 Minimum Initial Investment:

$1,000 ISIN: US0448208431 CUSIP: 044820843 BLOOMBERG: AEMSODC US All sources are Ashmore unless otherwise indicated |

11

Ashmore Emerging Markets Total Return Fund

The Ashmore Emerging Markets Total Return Fund is a daily dealing U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of Sovereign, Quasi-Sovereign, and Corporate issuers, which may be denominated in any currency, including the local currency of the issuer.

Please refer to page 6 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return chart.

| | |

| Average Annual Total Return For The Period Ended October 31, 2011 | | Fund Inception |

| | December 8, 2010 |

| |

Ashmore Emerging Markets Total Return Fund Institutional Class | | 1.11% |

| |

Ashmore Emerging Markets Total Return Fund Retail Class A (load-waived)* | | 0.94% |

| |

Ashmore Emerging Markets Total Return Fund Retail Class A (unadjusted)* | | -3.09%** |

| |

Ashmore Emerging Markets Total Return Fund Retail Class C (load-waived)* | | 0.21% |

| |

Ashmore Emerging Markets Total Return Fund Retail Class C (unadjusted)* | | -0.79%** |

| |

50/25/25 Composite Benchmark** | | 4.60% |

| | | | | | | | |

| Cumulative Returns Through October 31, 2011 (% of net assets) | | | | Top 5 Country Exposures as of Oct 31, 2011 (% of NAV) | |

| | | | Brazil | | | 12.14 | % |

| | | | Mexico | | | 8.65 | % |

| | | | United Arab Emirates | | | 8.00 | % |

| | | | Russia | | | 5.36 | % |

| | | | Kazakhstan | | | 4.83 | % |

| | | | Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above | |

| | | |

All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares.

*For periods prior to the inception date of the Class A and Class C shares, performance information shown is based on the performance of the Fund’s Institutional Class shares, adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively.

** Unadjusted Performance accounts for a maximum sales load of 4% for class A shares and maximum deferred sales charge of 1% for class C shares.

***The index for the Fund is 50% JP Morgan Emerging Markets Bond Index, 25% JP Morgan Emerging Local Markets Index +, 25% JPMorgan Global Bond Index-Emerging Markets Global Diversified .

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualised. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund has been in existence for less than one year; cumulative performance may not be indicative of the Fund’s long-term potential. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 6 herein for an explanation of the Expense Example information presented below.

| | | | | | | | | | | | | | |

| | | Expense Example |

|

|

| | | Actual Performance | | | | Hypothetical Performance |

| | Institutional

Class | | Class A | | Class C | | | | Institutional

Class | | Class A | | Class C |

| | | | | | | |

Beginning Account Value*

(05/01/2011) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | | |

Ending Account Value

(10/31/2011) | | $946.30 | | $956.00 | | $952.10 | | | | $1,020.06 | | $1,017.33 | | $1,013.82 |

| | | | | | | |

| Expense Ratio | | 1.02% | | 1.30% | | 2.05% | | | | 1.02% | | 1.30% | | 2.05% |

| | | | | | | |

| Expenses Paid† | | $5.00 | | $5.96 | | $9.37 | | | | $5.19 | | $6.14 | | $9.67 |

*Beginning account value for Institutional Class dated 05/01/2011. Beginning account value for Class A and C dated 05/12/2011

† Expenses are equal to the Fund’s annualized expenses ratio multiplied by the average account value over the period, multiplied by 184/365 for Institutional Class (to reflect the one-half year period) and 171/365 for Class A and Class C (to reflect the period since inception date of 5/12/2011 for Class A and Class C shares). The Fund’s Class A and Class C hypothetical expenses reflect an amount as if each class had been in operation for the entire fiscal half year. Hypothetical expenses are based on the Fund’s actual annualized expense ratios and assumed rate of 5 percent per year before expenses.

Unaudited

|

Share Class Information Institutional Class Launch Date: 8 December 2010 Minimum Initial Investment:

$1,000,000 ISIN: US0448204059 CUSIP: 044820405 BLOOMBERG: EMKIX US TICKER EMKIX Retail Class A Launch Date: May 12, 2011 Minimum Initial Investment:

$1,000 ISIN: US0448208357 CUSIP: 044820835 BLOOMBERG: EMKAX US TICKER: EMKAX Retail Class C Launch Date: May 12, 2011 Minimum Initial Investment:

$1,000 ISIN: US0448208274 CUSIP: 044820827 BLOOMBERG: EMKCX US TICKER: EMKCX All sources are Ashmore unless otherwise indicated |

12

Ashmore Emerging Markets Equity Fund

Ashmore Emerging Markets Equity Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in equity securities and equity-related investments of Emerging Market issuers which may be denominated in any currency, including the local currency of the issuer

Please refer to page 6 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return chart.

| | |

| Average Annual Total Return For The Period Ended October 31, 2011 | | Fund Inception June 22, 2011 |

| |

Ashmore Emerging Markets Equity Fund Institutional Class | | -11.37% |

| |

MSCI EM NET* | | -9.86% |

| | | | | | | | |

| Cumulative Returns Through October 31, 2011 (% of net assets) | | | | Top 5 Country Exposures as of Oct 31, 2011 (% of NAV) | |

| | | | Brazil | | | 18.20 | % |

| | | | China | | | 16.88 | % |

| | | | South Korea | | | 16.43 | % |

| | | | Taiwan | | | 10.05 | % |

| | | | Russian Federation | | | 9.31 | % |

| | | | | | | | |

| | | | Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above | |

All Fund returns are net of fees and expenses.

*The index for the Fund is the Morgan Stanley Capital Index Emerging Markets Net.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualised. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund has been in existence for less than one year; cumulative performance may not be indicative of the Fund’s long-term potential. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 6 herein for an explanation of the Expense Example information presented below.

| | | | | | |

Expense Example |

| | | | | | |

| | | |

| | | Actual Performance | | | | Hypothetical Performance |

| | | Institutional Class | | | | Institutional Class |

| | | |

Beginning Account Value

(06/22/2011 ) | | $1,000.00 | | | | $1,000.00 |

| | | |

Ending Account Value

(10/31/2011 ) | | $886.30 | | | | $1,013.75 |

| | | |

Expense Ratio | | 1.17% | | | | 1.17% |

| | | |

Expenses Paid† | | $3.96 | | | | $4.23 |

† Expenses are equal to the Fund’s annualized expenses ratio multiplied by the average account value over the period, multiplied by 131/365 to reflect the period since inception date of 6/22/2011

Unaudited

Share Class

Information

Institutional Class

Launch Date:

June 22, 2011

Minimum Initial Investment:

$1,000,000

ISIN:

US0448208191

CUSIP:

044820819

BLOOMBERG:

ASEMEIN US

All sources are Ashmore

unless otherwise indicated

13

Ashmore Emerging Markets Small-Cap Equity Fund

Ashmore Emerging Markets Small-Cap Equity Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in equity securities and equity-related investments of Small-Capitalization Emerging Market Issuers, which may be denominated in any currency, including the local currency of the issuer. The Fund currently defines a Small-Capitalization issuer as an issuer with a market capitalization of $2 billion or less at the time of investment.

Please refer to page 6 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return chart.

| | |

| Average Total Return For The Period Ended October 31, 2011 | | Fund Inception

October 4, 2011 |

| |

Ashmore Emerging Markets Small-Cap Equity Fund Institutional Class | | 15.80% |

| |

MSCI EM Small-Cap* | | 12.87% |

All Fund returns are net of fees and expenses.

*The index for the Fund is the Morgan Stanley Capital Index Emerging Markets Small-Cap

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualised. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund has been in existence for less than one year; cumulative performance may not be indicative of the Fund’s long-term potential. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 6 herein for an explanation of the Expense Example information presented below.

Top 5 Country Exposures as of Oct 31, 2011 (% of NAV)

| | |

China | | 18.46% |

South Korea | | 14.93% |

Taiwan | | 14.25% |

Brazil | | 12.71% |

India | | 8.54% |

Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above

| | | | | | |

Expense Example |

|

| | | Actual Performance | | | | Hypothetical Performance |

| | | |

| | | Institutional Class | | | | Institutional Class |

| | | |

Beginning Account Value

(10/04/2011 ) | | $1,000.00 | | | | $1,000.00 |

| | | |

Ending Account Value

(10/31/2011 ) | | $1,158.00 | | | | $1,002.57 |

| | | |

Expense Ratio | | 1.52% | | | | 1.52% |

| | | |

Expenses Paid† | | $1.21 | | | | $1.13 |

† Expenses are equal to the Fund’s annualized expenses ratio multiplied by the average account value over the period, multiplied by 27/365 to reflect the period since inception date of 10/04/2011

Unaudited

Share Class

Information

Institutional Class

Launch Date:

October 4, 2011

Minimum Initial Investment:

$1,000,000

ISIN:

US0448201162

CUSIP:

044820116

All sources are Ashmore

unless otherwise indicated

14

(THIS PAGE INTENTIONALLY LEFT BLANK)

15

ASHMORE FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

As of October 31, 2011

| | | | | | | | | | |

| | | Ashmore

Emerging Markets

Corporate Debt

Fund | | Ashmore

Emerging Markets

Local Currency

Bond Fund |

ASSETS: | | | | | | | | | | |

Investments in securities, at value | | | $ | 11,355,763 | | | | $ | 34,567,042 | |

Investments in fully funded total return swaps, at value | | | | — | | | | | 7,352,230 | |

Cash | | | | 353,540 | | | | | 19,071,908 | |

Cash held at broker (restricted $481,000, $1,280,000, and $593,500, respectively) | | | | — | | | | | 481,000 | |

Foreign currency, at value | | | | 1,452 | | | | | 11,872 | |

Unrealized appreciation on interest rate swap contracts | | | | — | | | | | 367,232 | |

Unrealized appreciation on forward foreign currency exchange contracts | | | | 15,341 | | | | | 1,175,289 | |

Receivable for securities and currencies sold | | | | — | | | | | 4,242,561 | |

Receivable for fund shares sold | | | | — | | | | | 174,287 | |

Receivable from Investment Manager | | | | 22,998 | | | | | 38,444 | |

Interest and dividends receivable | | | | 239,034 | | | | | 801,142 | |

Tax reclaims receivable | | | | — | | | | | 8,079 | |

Other assets | | | | — | | | | | — | |

Total Assets | | | | 11,988,128 | | | | | 68,291,086 | |

LIABILITIES: | | | | | | | | | | |

Unrealized depreciation on interest rate swap contracts | | | | — | | | | | 3,280 | |

Unrealized depreciation on forward foreign currency exchange contracts | | | | 62,363 | | | | | 1,052,993 | |

Payable for securities and currencies purchased | | | | — | | | | | 4,242,560 | |

Distributions payable | | | | 17,742 | | | | | 50,602 | |

Investment Manager fee payable | | | | 11,356 | | | | | 50,041 | |

Trustees’ fees payable | | | | 1,905 | | | | | 1,905 | |

Other liabilities | | | | 68,497 | | | | | 73,187 | |

Total Liabilities | | | | 161,863 | | | | | 5,474,568 | |

Net Assets | | | $ | 11,826,265 | | | | $ | 62,816,518 | |

NET ASSETS: | | | | | | | | | | |

Paid in capital | | | $ | 12,545,567 | | | | $ | 63,319,557 | |

Undistributed (distributions in excess of) net investment income (loss) | | | | 31,289 | | | | | (344,026 | ) |

Accumulated net realized gain (loss) | | | | 66,323 | | | | | (26,826 | ) |

Net unrealized appreciation (depreciation) | | | | (816,914 | ) | | | | (132,187 | ) |

Net Assets | | | $ | 11,826,265 | | | | $ | 62,816,518 | |

| | | | | | | | | | | |

Net Assets: | | | | | | | | | | |

Class A | | | $ | 934 | | | | $ | 285,653 | |

Class C | | | | 931 | | | | | 955 | |

Institutional Class | | | | 11,824,400 | | | | | 62,529,910 | |

| | | | | | | | | | | |

Shares Issued and Outstanding (no par value, unlimited shares authorized): | | | | | | | | | | |

Class A | | | | 103 | | | | | 30,283 | |

Class C | | | | 102 | | | | | 101 | |

Institutional Class | | | | 1,253,909 | | | | | 6,404,928 | |

| | | | | | | | | | | |

Net Asset Value and Redemption Price Per Share (Net Asset Per Share Outstanding): | | | | | | | | | | |

Class A | | | $ | 9.09 | | | | $ | 9.43 | |

Class C | | | | 9.09 | | | | | 9.43 | |

Institutional Class | | | | 9.43 | | | | | 9.76 | |

Cost of Investments in securities | | | $ | 12,124,819 | | | | $ | 35,537,379 | |

Cost of Investments in fully funded total return swaps | | | $ | — | | | | $ | 6,973,000 | |

Cost of Foreign currency held | | | $ | 1,442 | | | | $ | 12,054 | |

See accompanying notes to the financial statements.

16

| | | | | | | | | | | | | | | | | | | | | | | |

Ashmore Emerging Markets Local Currency Fund | | Ashmore Emerging Markets

Sovereign Debt Fund | | Ashmore Emerging Markets

Total Return Fund | | Ashmore Emerging Markets

Equity Fund | | Ashmore Emerging Markets

Small-Cap

Equity Fund |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 1,880,118 | | | | $ | 29,608,942 | | | | $ | 91,163,360 | | | | $ | 8,721,795 | | | | $ | 11,519,927 | |

| | | — | | | | | — | | | | | 982,701 | | | | | — | | | | | — | |

| | | 20,606,199 | | | | | 935,533 | | | | | 8,338,176 | | | | | 161,292 | | | | | 124,102 | |

| | | 1,280,000 | | | | | — | | | | | 593,500 | | | | | — | | | | | — | |

| | | 76 | | | | | 13 | | | | | 169,747 | | | | | 13,979 | | | | | 2,134 | |

| | | — | | | | | — | | | | | 120,556 | | | | | — | | | | | — | |

| | | 1,047,699 | | | | | — | | | | | 372,736 | | | | | — | | | | | — | |

| | | 3,045,463 | | | | | 30,726 | | | | | 384,902 | | | | | 261,886 | | | | | — | |

| | | 300,000 | | | | | — | | | | | — | | | | | — | | | | | — | |

| | | 30,940 | | | | | 18,461 | | | | | 34,399 | | | | | 13,326 | | | | | 111,464 | |

| | | — | | | | | 454,506 | | | | | 1,795,344 | | | | | 11,000 | | | | | 3,199 | |

| | | — | | | | | — | | | | | — | | | | | — | | | | | — | |

| | | — | | | | | — | | | | | 8,777 | | | | | 30,449 | | | | | 43,986 | |

| | | 28,190,495 | | | | | 31,048,181 | | | | | 103,964,198 | | | | | 9,213,727 | | | | | 11,804,812 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | — | | | | | — | | | | | — | | | | | — | | | | | — | |

| | | 1,402,188 | | | | | 500 | | | | | 597,847 | | | | | — | | | | | — | |

| | | 3,045,463 | | | | | 420,119 | | | | | 645,629 | | | | | 278,592 | | | | | 60,762 | |

| | | — | | | | | 14,740 | | | | | 99,087 | | | | | — | | | | | — | |

| | | 27,788 | | | | | 11,063 | | | | | 83,502 | | | | | 8,062 | | | | | 12,029 | |

| | | 1,905 | | | | | 1,905 | | | | | 1,905 | | | | | 1,905 | | | | | 2,083 | |

| | | 68,736 | | | | | 65,035 | | | | | 79,751 | | | | | 77,023 | | | | | 153,527 | |

| | | 4,546,080 | | | | | 513,362 | | | | | 1,507,721 | | | | | 365,582 | | | | | 228,401 | |

| | $ | 23,644,415 | | | | $ | 30,534,819 | | | | $ | 102,456,477 | | | | $ | 8,848,145 | | | | $ | 11,576,411 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 24,076,023 | | | | $ | 30,353,246 | | | | $ | 106,845,995 | | | | $ | 10,033,827 | | | | $ | 10,000,000 | |

| | | 181,501 | | | | | (6,153 | ) | | | | 155,823 | | | | | 16,332 | | | | | — | |

| | | (4,414 | ) | | | | (11,028 | ) | | | | (364,664 | ) | | | | (860,798 | ) | | | | 33,374 | |

| | | (608,695 | ) | | | | 198,754 | | | | | (4,180,677 | ) | | | | (341,216 | ) | | | | 1,543,037 | |

| | $ | 23,644,415 | | | | $ | 30,534,819 | | | | $ | 102,456,477 | | | | $ | 8,848,145 | | | | $ | 11,576,411 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 939 | | | | $ | 1,017 | | | | $ | 508,645 | | | | $ | — | | | | $ | — | |

| | | 936 | | | | | 1,014 | | | | | 947 | | | | | — | | | | | — | |

| | | 23,642,540 | | | | | 30,532,788 | | | | | 101,946,885 | | | | | 8,848,145 | | | | | 11,576,411 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 100 | | | | | 101 | | | | | 54,292 | | | | | — | | | | | — | |

| | | 100 | | | | | 101 | | | | | 101 | | | | | — | | | | | — | |

| | | 2,527,286 | | | | | 3,055,829 | | | | | 10,727,540 | | | | | 1,004,382 | | | | | 1,000,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 9.38 | | | | $ | 10.04 | | | | $ | 9.37 | | | | $ | — | | | | $ | — | |

| | | 9.35 | | | | | 10.04 | | | | | 9.36 | | | | | — | | | | | — | |

| | | 9.35 | | | | | 9.99 | | | | | 9.50 | | | | | 8.81 | | | | | 11.58 | |

| | $ | 2,134,324 | | | | $ | 29,409,708 | | | | $ | 95,166,936 | | | | $ | 9,063,600 | | | | $ | 9,976,877 | |

| | $ | — | | | | $ | — | | | | $ | 1,041,079 | | | | $ | — | | | | $ | — | |

| | $ | 76 | | | | $ | 13 | | | | $ | 170,602 | | | | $ | 13,931 | | | | $ | 2,149 | |

See accompanying notes to the financial statements.

17

ASHMORE FUNDS

STATEMENTS OF OPERATIONS

For the Period Ended October 31, 2011

| | | | | | | | | | |

| | | Ashmore

Emerging Markets

Corporate Debt

Fund1 | | Ashmore

Emerging Markets

Local Currency

Bond Fund1 |

INVESTMENT INCOME: | | | | | | | | | | |

Interest, net of foreign tax withholdings* | | | $ | 826,248 | | | | $ | 1,661,051 | |

Dividends, net of foreign tax withholdings* | | | | — | | | | | — | |

Total Income | | | | 826,248 | | | | | 1,661,051 | |

EXPENSES: | | | | | | | | | | |

Investment Manager fees | | | | 113,326 | | | | | 370,967 | |

Administration fees | | | | 3,942 | | | | | 15,620 | |

Custody fees | | | | 5,176 | | | | | 12,795 | |

Professional fees | | | | 76,067 | | | | | 79,193 | |

Trustees’ fees | | | | 27,491 | | | | | 27,491 | |

Offering expenses and registration fees | | | | 115,856 | | | | | 118,146 | |

Organization expenses | | | | 31,000 | | | | | 31,000 | |

Insurance fees | | | | 11,000 | | | | | 11,000 | |

Printing fees | | | | 6,296 | | | | | 6,296 | |

Transfer agent fees - Institutional Class | | | | 1,816 | | | | | 2,414 | |

Distribution fees - Class A | | | | 1 | | | | | 100 | |

Distribution fees - Class C | | | | 5 | | | | | 5 | |

Other | | | | 11,553 | | | | | 21,663 | |

Total Expenses | | | | 403,529 | | | | | 696,690 | |

Less expenses reimbursed by the Investment Manager | | | | (288,226 | ) | | | | (317,796 | ) |

Net Expenses | | | | 115,303 | | | | | 378,894 | |

Net Investment Income (Loss) | | | | 710,945 | | | | | 1,282,157 | |

NET REALIZED AND UNREALIZED GAINS (LOSSES): | | | | | | | | | | |

NET REALIZED GAIN (LOSS) ON: | | | | | | | | | | |

Investments in securities | | | | 69,446 | | | | | (190,391 | ) |

Forward foreign currency exchange contracts | | | | 1,144 | | | | | (312,411 | ) |

Interest rate swap contracts | | | | — | | | | | 312,244 | |

Written options | | | | — | | | | | (12,992 | ) |

Foreign exchange transactions | | | | (5,797 | ) | | | | 82,487 | |

NET CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION) ON: | | | | | | | | | | |

Investments in securities | | | | (769,056 | ) | | | | (970,337 | ) |

Investments in fully funded total return swaps | | | | — | | | | | 379,230 | |

Forward foreign currency exchange contracts | | | | (47,022 | ) | | | | 122,296 | |

Interest rate swap contracts | | | | — | | | | | 363,952 | |

Foreign exchange translations | | | | (836 | ) | | | | (27,328 | ) |

Net Gain (Loss) | | | | (752,121 | ) | | | | (253,250 | ) |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | $ | (41,176 | ) | | | $ | 1,028,907 | |

* Foreign tax withholdings | | | $ | 2,799 | | | | $ | 12,164 | |

| 1 | The Fund was initially capitalized on November 19, 2010 and it commenced investment operations on December 8, 2010. |

| 2 | The Fund commenced investment operations on June 22, 2011. |

| 3 | The Fund commenced investment operations on October 4, 2011. |

See accompanying notes to the financial statements.

18

| | | | | | | | | | | | | | | | | | | | | | | |

Ashmore Emerging Markets Local Currency Fund1 | | Ashmore

Emerging Markets

Sovereign Debt

Fund1 | | Ashmore

Emerging Markets

Total Return

Fund1 | | Ashmore

Emerging Markets

Equity Fund2 | | Ashmore

Emerging Markets

Small-Cap Equity Fund3 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 104,035 | | | | $ | 502,243 | | | | $ | 2,928,850 | | | | $ | — | | | | $ | 22 | |

| | | — | | | | | — | | | | | — | | | | | 91,258 | | | | | 5,295 | |

| | | 104,035 | | | | | 502,243 | | | | | 2,928,850 | | | | | 91,258 | | | | | 5,317 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 197,253 | | | | | 84,170 | | | | | 467,685 | | | | | 37,579 | | | | | 12,029 | |

| | | 9,283 | | | | | 3,741 | | | | | 18,707 | | | | | 1,307 | | | | | 321 | |

| | | 6,534 | | | | | 2,550 | | | | | 14,290 | | | | | 1,113 | | | | | 360 | |

| | | 76,067 | | | | | 76,067 | | | | | 76,067 | | | | | 43,775 | | | | | 21,000 | |

| | | 27,491 | | | | | 27,491 | | | | | 27,491 | | | | | 9,865 | | | | | 2,083 | |

| | | 118,256 | | | | | 116,356 | | | | | 107,120 | | | | | 43,552 | | | | | 54,260 | |

| | | 31,000 | | | | | 31,000 | | | | | 31,000 | | | | | 31,000 | | | | | 31,000 | |

| | | 11,000 | | | | | 11,000 | | | | | 11,000 | | | | | — | | | | | — | |

| | | 6,296 | | | | | 6,296 | | | | | 8,296 | | | | | 2,500 | | | | | 2,000 | |

| | | 1,815 | | | | | 1,794 | | | | | 2,602 | | | | | 840 | | | | | — | |

| | | 1 | | | | | 1 | | | | | 507 | | | | | — | | | | | — | |

| | | 4 | | | | | 5 | | | | | 5 | | | | | — | | | | | — | |

| | | 17,809 | | | | | 9,774 | | | | | 27,257 | | | | | 2,822 | | | | | 600 | |

| | | 502,809 | | | | | 370,245 | | | | | 792,027 | | | | | 174,353 | | | | | 123,653 | |

| | | (301,223 | ) | | | | (284,198 | ) | | | | (314,416 | ) | | | | (136,121 | ) | | | | (111,464 | ) |

| | | 201,586 | | | | | 86,047 | | | | | 477,611 | | | | | 38,232 | | | | | 12,189 | |

| | | (97,551 | ) | | | | 416,196 | | | | | 2,451,239 | | | | | 53,026 | | | | | (6,872 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | (84,463 | ) | | | | (7,499 | ) | | | | (717,131 | ) | | | | (860,798 | ) | | | | 60,044 | |

| | | (2,401,486 | ) | | | | 1,610 | | | | | (898,453 | ) | | | | (5,684 | ) | | | | 4,331 | |

| | | — | | | | | — | | | | | 24,000 | | | | | — | | | | | — | |

| | | (2,858 | ) | | | | — | | | | | (2,988 | ) | | | | — | | | | | — | |

| | | 80,452 | | | | | 488 | | | | | 103,915 | | | | | 15,465 | | | | | (24,129 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | (254,206 | ) | | | | 199,234 | | | | | (4,003,576 | ) | | | | (341,805 | ) | | | | 1,543,050 | |

| | | — | | | | | — | | | | | (58,378 | ) | | | | — | | | | | — | |

| | | (354,489 | ) | | | | (500 | ) | | | | (225,111 | ) | | | | — | | | | | — | |

| | | — | | | | | — | | | | | 120,556 | | | | | — | | | | | — | |

| | | — | | | | | 20 | | | | | (14,168 | ) | | | | 589 | | | | | (13 | ) |

| | | (3,017,050 | ) | | | | 193,353 | | | | | (5,671,334 | ) | | | | (1,192,233 | ) | | | | 1,583,283 | |

| | $ | (3,114,601 | ) | | | $ | 609,549 | | | | $ | (3,220,095 | ) | | | $ | (1,139,207 | ) | | | $ | 1,576,411 | |

| | $ | — | | | | $ | 13,277 | | | | $ | 25,986 | | | | $ | 4,890 | | | | $ | — | |

See accompanying notes to the financial statements.

19

ASHMORE FUNDS

STATEMENTS OF CHANGES IN NET ASSETS

For the Period Ended October 31, 2011

| | | | | | | | | | |

| | | Ashmore

Emerging Markets

Corporate Debt

Fund1 | | Ashmore

Emerging Markets

Local Currency

Bond Fund1 |

INCREASE (DECREASE) IN NET ASSETS FROM: OPERATIONS: | | | | | | | | | | |

Net investment income (loss) | | | $ | 710,945 | | | | $ | 1,282,157 | |

Net realized gain (loss) | | | | 64,793 | | | | | (121,063 | ) |

Net change in unrealized appreciation (depreciation) | | | | (816,914 | ) | | | | (132,187 | ) |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | | (41,176 | ) | | | | 1,028,907 | |

| | | | | | | | | | | |

DISTRIBUTIONS TO CLASS A SHAREHOLDERS: | | | | | | | | | | |

From net investment income | | | | (37 | ) | | | | (416 | ) |

Tax return of capital | | | | — | | | | | (272 | ) |

| | | | | | | | | | | |

Total distributions to Class A shareholders | | | | (37 | ) | | | | (688 | ) |

DISTRIBUTIONS TO CLASS C SHAREHOLDERS: | | | | | | | | | | |

From net investment income | | | | (34 | ) | | | | (11 | ) |

Tax return of capital | | | | — | | | | | (8 | ) |

| | | | | | | | | | | |

Total distributions to Class C shareholders | | | | (34 | ) | | | | (19 | ) |

DISTRIBUTIONS TO INSTITUTIONAL CLASS SHAREHOLDERS: | | | | | | | | | | |

From net investment income | | | | (678,055 | ) | | | | (1,531,519 | ) |

Tax return of capital | | | | — | | | | | (1,033,846 | ) |

| | | | | | | | | | | |

Total distributions to Institutional Class shareholders | | | | (678,055 | ) | | | | (2,565,365 | ) |

| | | | | | | | | | | |

FUND SHARE TRANSACTIONS: | | | | | | | | | | |

Net increase in net assets resulting from Class A share transactions | | | | 1,025 | | | | | 301,326 | |

Net increase in net assets resulting from Class C share transactions | | | | 1,023 | | | | | 1,014 | |

Net increase in net assets resulting from Institutional Class share transactions | | | | 12,543,519 | | | | | 64,051,343 | |

| | | | | | | | | | | |

Net increase in net assets resulting from Fund share transactions | | | | 12,545,567 | | | | | 64,353,683 | |

Total Increase in Net Assets | | | | 11,826,265 | | | | | 62,816,518 | |

| | | | | | | | | | | |

NET ASSETS: | | | | | | | | | | |

Net assets at the beginning of the period | | | | — | | | | | — | |

| | | | | | | | | | | |

Net assets at the end of the period | | | $ | 11,826,265 | | | | $ | 62,816,518 | |

Undistributed (Distributions in excess of) Net Investment Income (Loss) | | | $ | 31,289 | | | | $ | (344,026 | ) |

| 1 | The Fund was initially capitalized on November 19, 2010 and it commenced investment operations on December 8, 2010. |

| 2 | The Fund commenced investment operations on June 22, 2011. |

| 3 | The Fund commenced investment operations on October 4, 2011. |

See accompanying notes to the financial statements.

20

| | | | | | | | | | | | | | | | | | | | | | | |

Ashmore Emerging Markets Local Currency Fund1 | | Ashmore

Emerging Markets

Sovereign Debt

Fund1 | | Ashmore

Emerging Markets

Total Return

Fund1 | | Ashmore

Emerging Markets

Equity Fund2 | | Ashmore

Emerging Markets

Small-Cap Equity Fund3 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | (97,551 | ) | | | $ | 416,196 | | | | $ | 2,451,239 | | | | $ | 53,026 | | | | $ | (6,872 | ) |

| | | (2,408,355) | | | | | (5,401 | ) | | | | (1,490,657 | ) | | | | (851,017 | ) | | | | 40,246 | |