UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22468

Ashmore Funds

(Exact name of registrant as specified in charter)

c/o Ashmore Investment Advisors Limited

61 Aldwych

London WC2B 4AE

England

(Address of principal executive offices) (Zip code)

Corporation Service Company

84 State Street

Boston, MA 20109

(Name and address of agent for service)

Registrant’s telephone number, including area code: 011-44-20-3077-6000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2022

Explanatory Note: The Registrant is filing this amendment to its Certified Shareholder Report on Form N-CSR filed with the U.S. Securities and Exchange Commission on December 30, 2022 (the “Report”), to include a revised Initial Investment line graph within the Portfolio Managers’ Report specific to Ashmore Emerging Markets Frontier Equity Fund in response to Item 1 (Reports to Stockholders) that adds an appropriate broad-based securities market index. Except as noted, this amendment does not amend, update or change any other information or disclosures contained in the Report.

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1)

ASHMORE FUNDS

ANNUAL FINANCIAL STATEMENTS

October 31, 2022

(THIS PAGE INTENTIONALLY LEFT BLANK)

ASHMORE FUNDS

TABLE OF CONTENTS

Ashmore Investment Management (US) Corporation is the Distributor for Ashmore Funds.

This material is authorized for use only when preceded or accompanied by the current Ashmore Funds’ prospectus. Investors should consider the investment objectives, principal risks, charges and expenses of these Funds carefully before investing. This and other information is contained in the Funds’ prospectus. Please read the prospectus carefully before you invest or send money.

A Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

The performance data quoted in this report represents past performance. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted in this report. For performance information current to the most recent month-end, please call (866) 876-8294.

An investment in a Fund is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Funds.

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT

For the period November 1, 2021 to October 31, 2022

Overview

In Q4 2021, global markets leapt and fell, and got back on their feet again, as the world went from winning against the (COVID-19) Delta variant to worrying about the Omicron variant in the space of five short weeks. The shadow of rising inflation and a change of heart at the Federal Reserve System (the “Fed”) provided further obstacles. Thus, in our view, it is nothing short of astonishing that global equities managed to clock their best quarterly return of 2021 in Q4, at 7.5% for the MSCI World Index. That said, Fund performance was concentrated in a few winning Russell trades during Q4, and returns were uneven between indices: US growth stocks ended the year on a tear (NASDAQ +11.1% in Q4 2021), but US small cap stocks only managed to return 1.9% for the Russell 2000 Index. European stocks were helped by the year-end rally in financials and energy stocks (Euro Stoxx 50 +6.2%). Emerging Markets (“EM”) underperformed the MSCI Emerging Markets Net, returning -1.7% amid huge disparity in performance between countries: strong returns from Taiwan, Mexico and South Africa contrasted with drawdowns from Russia, Brazil and China.

In Q1 2022, the Russian invasion of Ukraine dramatically altered the economic, political and investment landscapes, not just in terms of the immediate market implications for Q1 2022 returns, but also with regard to the enormous adjustments that central banks had to make to control increased inflation dynamics. The Russia-Ukraine war triggered a sharp sell-off in risk assets, a significant rise in energy prices and other commodities, and a brief move to lower US Treasury yields, before inflationary concerns and market expectations surrounding central bank rate hikes ultimately reasserted their influence and pushed yields higher. A weak start to the year for global equity markets in January and February was further compounded by the Russian war in Ukraine. Global equity markets did, however, try to stage a recovery in the latter half of March 2022. This followed the Fed’s first and widely anticipated rate hike of a new tightening cycle. It came with reassurances from Fed Chair Jerome Powell that the US economy was strong enough to handle higher rates and that the probability of recession was not particularly elevated. In contrast to the difficulties in other markets, the commodities space was the big winner over the period, boosted by frantic hedging against supply risk. In response to the Russian attack on Ukraine, the US and Europe announced the most severe round of economic sanctions ever dealt to a significant commercial partner. This included measures to freeze the part of the Central Bank of Russia’s (“CBR”) FX reserves that are held under their own jurisdiction, which amounts to circa two-thirds of the CBR’s reserves. The impact on financial assets has been severe: Russian onshore debt and equity markets have stopped functioning and payments to offshore investors have been blocked by the CBR, trapping foreign investors’ assets onshore. The asset freeze on CBR assets offshore limits Russia’s ability to defend the ruble. Just as importantly, it is our view that the sanctions make it quasi impossible for Western companies to trade and settle transactions with Russian counter-parties, shutting down the flow of important products out of Russia - at the exclusion of oil and gas products that have remained exempt for the time being. For this reason, the market has been focused on the importance of both Russia and Ukraine in the supply of strategic commodities such as oil, gas, and coal as well as cereals, minerals and fertilisers.

Q2 2022 was another tough quarter for bonds and stocks, which rounded up an equally tough first half (“H1”). Analysts at Deutsche Bank made the point that this was the worst H1 performance for US Treasuries since 1788, and the worst H1 return for the S&P 500 Index since 1962, not far behind the 1932 H1 decline. At the start of the quarter, fears of inflation and higher Fed Funds rates pummelled bond and equity markets as the war in Ukraine sent commodity prices through the roof. The roll-out of harsh COVID-19 lockdown measures in China did not help sentiment. Markets initially bottomed and rebounded in May, but heavy losses returned in June, when 2-year US Treasury yields soared by 80 basis points (“bps”) in the first two weeks, the Fed delivered a greater-than-expected 75 bps hike, and global equities fell by 11%. The combined effect of Fed hikes and lower asset prices amounted to a sharp tightening in financial conditions, with real economic consequences for companies and households.

After a positive start in July, two consecutive monthly declines in stock prices in August and September sent global equity indices down for a third negative consecutive quarter for the first time since the global financial crisis - when equity indices fell for five consecutive quarters. What stands out this year is the concurrent fall in global bond prices, where global indices (e.g., the Bloomberg Barclays Global Aggregate Index) fell for the fifth consecutive quarter in September, against just two back-to-back negative quarters in the middle of 2008. The market correction was driven by a combination of upside surprises in inflation, two consecutive 75 bps rate hikes by the Fed coupled with unrelenting hawkish guidance, and a fall in business confidence indicators across developed markets. A misjudged budget in the UK and a fire sale in UK government bonds (“Gilts”) heaped more pressure on core government bonds towards the end of the quarter.

1

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

Portfolio Overview

Ashmore Emerging Markets Total Return Fund

The Ashmore Emerging Markets Total Return Fund (the “Fund”) seeks to achieve its objective by investing principally in the debt instruments of sovereign, quasi-sovereign, and corporate issuers, which may be denominated in any currency, including the local currency of the issuer. The Fund tactically allocates assets between external debt, corporate debt and local currency.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -30.74% (net of fees) versus -20.71% for the composite 50% JP Morgan Emerging Markets Bond Index Global Diversified, 25% JP Morgan Government Bond Index - Emerging Markets Global Diversified, 25% JP Morgan Emerging Local Markets Index Plus. Security selection within local currency and external debt detracted from performance. The Fund’s off benchmark allocation to corporate debt was the largest detractor from performance over the period. Russia was the main contributor to the Fund’s relative performance. China and Ukraine were amongst the largest detractors from the Fund’s relative performance.

The Russian invasion of Ukraine, supported by Belarus, created an extremely challenging environment for asset price performance, as both Russia and Belarus were subject to an extreme package of economic sanctions. The sanctions had the immediate impact of restricting trading and settlement of Russian and Belarussian bonds, with both countries ultimately excluded from the entire JP Morgan family of bond indices effective March 31, 2022, with all bond prices being written down to zero. Russia nevertheless continued to make coupon payments on its USD denominated debt obligations, although the US government prevented Russia from making a bond principal payment out of foreign currency reserves held by the Central Bank of Russia at US financial institutions, forcing the Russian government to either pay the maturity out of the diminished pool of liquid and accessible FX reserves or default on the bond.

In our view, the Communist Party congress in China turned out to be a disappointment as President Xi effectively packed the Standing Committee (China’s top leadership body) with a loyal following. He now has absolute power in the country, doing away with previous checks and balances inherited in the system. The President defended the Zero Covid Policy, which remains in place officially, though some actual relaxation was noted in the face of a spiraling number of cases with very low levels of mortality. China risk assets all sold off during October, especially already weak bonds from the property sector, generating significant negative alpha. Evidence of softening industrial activity in China, with manufacturing Purchase Managers Index (“PMI”) surprising to the downside, exacerbated concerns about the stability of the property sector. After many months of relative inaction, the Chinese government announced the establishment of a fund that is aimed at supporting a number of developers with the aim of restoring liquidity to the sector and ensuring the completion of housing units already under development. The Chinese government appears to be backing away from its 5.5% growth target for 2022 following the release of Gross Domestic Product (“GDP”) figures for the first half of the year showing just 2.5% year-on-year (“yoy”) growth.

In Ukraine, the government unsurprisingly launched a consent solicitation to suspend debt repayment on its Eurobonds until August 2024. At the same time, the G7 and the Paris Club announced the suspension of Ukraine’s debt service through 2023. The announcements were the inevitable result of the ongoing war and the impact it has had on the Ukrainian economy.

Ashmore Emerging Markets Local Currency Bond Fund

The Ashmore Emerging Markets Local Currency Bond Fund (the “Fund”) seeks to achieve its objective by investing principally in the debt instruments of sovereign and quasi-sovereign issuers of emerging market countries that are denominated in the local currency of the issuer. The Fund’s returns are driven by emerging market currency appreciation, interest rate positioning and credit worthiness.

Over the period, the Fund’s institutional class outperformed its benchmark, returning -17.49% (net of fees) versus -20.27% for the JP Morgan Government Bond Index - Emerging Markets Global Diversified. Allocations to the Russian Ruble, Polish Zloty and Brazilian Real were the main contributors to the Fund’s relative performance. Allocations to the Ukrainian Hryvnia and Chinese Yuan were the main detractors from the Fund’s relative performance.

Russian local markets remain disrupted by sanctions. The Central Bank of Russia cut policy rates to 7.5% from 9.5% over the quarter as inflation cooled (August yoy print came in at 14.3% against a print of 17.1% for June). The portfolio managed to reduce its off-benchmark holdings over the quarter, generating a mark-to-market gain.

2

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

A significant concern remains regarding the impact of Poland’s rule of law dispute with the EU, which has held up more than EUR 35bn in COVID-19 recovery grants and loans. Poland’s A- rating with stable outlook was affirmed by Standard and Poor (“S&P”) at the end of third quarter, with the rating agency highlighting the country’s strong external and government balance sheets and its “competitive and diversified” economy.

The Ukrainian Hryvnia was fixed higher over the third quarter (-25.4%) ending at 36.87/USD.

In China, economic indicators presented a mixed bag, with manufacturing Purchase Managing Index (“PMI”) back in expansionary territory but a lagging services sector. As the property sector challenges persist, the government announced additional new initiatives to encourage home purchases and to provide additional funding and support to the sector at the end of Q3, and followed up after the National Party Congress in mid-October with another round of policy support announcements.

Ashmore Emerging Markets Corporate Income Fund

The Ashmore Emerging Markets Corporate Income Fund (the “Fund”) seeks to achieve its objective by investing principally in the debt instruments of corporate issuers, which may be denominated in any currency, including the local currency of the issuer.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -29.15% (net of fees) versus -18.06% for the JP Morgan CEMBI Broad Diversified. Russia was the main contributor to the Fund’s relative performance. China and Ukraine were amongst the largest detractors from the Fund’s relative performance.

The Russian invasion of Ukraine, supported by Belarus, created an extremely challenging environment for asset price performance, as both Russia and Belarus were subject to an extreme package of economic sanctions. The sanctions had the immediate impact of restricting trading and settlement of Russian and Belarussian bonds, with both countries ultimately excluded from the entire JP Morgan family of bond indices effective March 31st 2022, with all bond prices being written down to zero. Russia nevertheless continued to make coupon payments on its USD denominated debt obligations, although the US government prevented Russia from making a bond principal payment out of foreign currency reserves held by the Central Bank of Russia at US financial institutions, forcing the Russian government to either pay the maturity out of the diminished pool of liquid and accessible FX reserves or default on the bond.

Evidence of softening industrial activity in China, with manufacturing Purchase Managers Index (“PMI”) surprising to the downside, exacerbated concerns about the stability of the property sector. After many months of relative inaction, the Chinese government announced the establishment of a fund that is aimed at supporting a number of developers with the aim of restoring liquidity to the sector and ensuring the completion of housing units already under development. The Chinese government appears to be backing away from its 5.5% growth target for 2022 following the release of GDP figures for the first half of the year showing just 2.5% yoy growth.

In Ukraine, the government unsurprisingly launched a consent solicitation to suspend debt repayment on its Eurobonds until August 2024. At the same time, the G7 and the Paris Club announced the suspension of Ukraine’s debt service through 2023. The announcements were the inevitable result of the ongoing war and the impact it has had on the Ukrainian economy.

Ashmore Emerging Markets Short Duration Fund

The Ashmore Emerging Markets Short Duration Fund (the “Fund”) seeks to achieve its objective by investing principally in short-term debt instruments of, and derivative instruments related to, Sovereign, Quasi-Sovereign and Corporate issuers of EM countries denominated exclusively in Hard Currencies (i.e., the U.S. dollar or any currency of a nation in the G-7). The Fund normally seeks to maintain a weighted average portfolio duration of between 1 and 3 years. The Fund has no restrictions on individual security duration.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -31.54% (net of fees) versus -11.56% for the JP Morgan CEMBI Broad Diversified 1-3 Year. Russia was the main contributor to the Fund’s relative performance. Positions in China, Brazil and Ukraine were amongst the largest detractors from the Fund’s relative performance.

3

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

The Russian invasion of Ukraine, supported by Belarus, created an extremely challenging environment for asset price performance, as both Russia and Belarus were subject to an extreme package of economic sanctions. The sanctions had the immediate impact of restricting trading and settlement of Russian and Belarussian bonds, with both countries ultimately excluded from the entire JP Morgan family of bond indices effective March 31, 2022, with all bond prices being written down to zero. Russia nevertheless continued to make coupon payments on its USD denominated debt obligations, although the US government prevented Russia from making a bond principal payment out of foreign currency reserves held by the Central Bank of Russia at US financial institutions, forcing the Russian government to either pay the maturity out of the diminished pool of liquid and accessible FX reserves or default on the bond.

Evidence of softening industrial activity in China, with manufacturing PMI surprising to the downside, exacerbated concerns about the stability of the property sector. After many months of relative inaction, the Chinese government announced the establishment of a fund that is aimed at supporting a number of developers with the aim of restoring liquidity to the sector and ensuring the completion of housing units already under development. The Chinese government appears to be backing away from its 5.5% growth target for 2022 following the release of GDP figures for the first half of the year showing just 2.5% yoy growth.

Profit taking in Brazil has extended following outperformance in the first quarter. The main negative contributor were security selections with exposure to Telecom, Airlines and Building Materials resulting in negative alpha. Politics took a front seat in the third quarter in the run-up to presidential elections slated for October, with concerns that fiscal stimulus and social spending would be increased to bolster the incumbent. Former President Lula da Silva won the majority of the votes in the election run-off against incumbent Bolsonaro, albeit by the slimmest margin in the recent history of the country. Lula pledged to re-unite the country, but it appears that he will govern with a fragmented Congress and against a sizeable pro-Bolsonaro block. In our view, he will need to form ad-hoc coalitions with Centrist parties in order to achieve his political agenda. He is expected to appoint a market-friendly economic team, and to push for an ambitious social agenda within the confines of limited fiscal space.

In Ukraine, the government unsurprisingly launched a consent solicitation to suspend debt repayment on its Eurobonds until August 2024. At the same time, the G7 and the Paris Club announced the suspension of Ukraine’s debt service through 2023. The announcements were the inevitable result of the ongoing war and the impact it has had on the Ukrainian economy.

Ashmore Emerging Markets Active Equity Fund

The Ashmore Emerging Markets Active Equity Fund (the “Fund”) seeks to achieve its objective by investing principally in equity securities and equity-related investments of emerging market issuers, which may be denominated in any currency, including the local currency of the issuer.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -33.40% (net of fees) versus -31.03% for the MSCI Emerging Markets Net.

Several of our best stock performers were concentrated in Brazil and India, in part reflecting the strong domestic operating environments in both countries. In Brazil, our holding in Hypera, a domestic focused leading pharmaceutical company, performed well. The business continues to take market share, the product pipeline is strong and margin pressure is expected to recede when policy rates ease. High quality apparel retailer, Lojas Renner, which targets middle to upper income consumers less sensitive to higher inflation, also supported performance. Our holding in Banco do Brasil benefitted from strong results, with net income growth up 55% yoy, 20% ahead of market expectations. In India, private banks HDFC and Axis both benefitted from strong loan growth and corporate strategies that focused on expansion in the higher fee retail segment of the market.

However, the above positives were offset by performance detractors primarily in China. This reflected the largely indiscriminate domestic sell off driven by depressed investor sentiment. Our holdings in pan Asia insurer, AIA, diversified financials, China International Capital, and e-commerce giant, Alibaba, all performed poorly.

Our exposure to Xpeng, an EV manufacturer, saw particularly volatile performance given its sensitivity to expectations of domestic economic growth, despite the company reporting revenue up almost 100% over the year, and ahead of market expectations. Meanwhile, our decision to be prudent ahead of the polarized Brazilian Presidential election and not to hold Petrobras was penalized as the company made notably strong dividend payouts.

4

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

Ashmore Emerging Markets Small-Cap Equity Fund

The Ashmore Emerging Markets Small-Cap Equity Fund (the “Fund”) seeks to achieve its objective by investing at least 80% of its net assets in equity securities and equity-related investments of small-capitalization emerging market issuers, which may be denominated in any currency, including the local currency of the issuer.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -33.21% (net of fees) versus -23.42% for the MSCI Emerging Markets Small Cap Net.

Several of our best stock performers were concentrated in Brazil, including our holding in two leading software companies, Totvs and Sinqia. In the former, the company benefitted from strong revenue growth while the later has seen recent acquisitions and margin expansion from product consolidation push returns higher. Additional performance was generated by Arezzo, a premium footwear retailer that delivered excellent results that were ahead of market expectations.

From a company perspective, Poya International was the top performing stock. The Taiwanese specialty retailer offers a wide variety of products including cosmetics, personal care and household merchandise. The company benefits from economies of scale and management has stated their desire for significant store expansion by 2025.

The primary detractors from performance came from the cyclical segment market and suffered on the broad-based sell down notably in technology stocks. This includes our position in Hansol Chemical and Hana Materials, two South Korean companies in the semiconductor value chain. In Taiwan, Parade Technologies, a fabless supplier of integrated circuits for display and high-speed interfaces, and eCloudvalley, a managed service provider for cloud services, weighed on performance.

Ashmore Emerging Markets Frontier Equity Fund

The Ashmore Emerging Markets Frontier Equity Fund (the “Fund”) seeks to achieve its objective by investing principally in equity securities and equity-related investments of Frontier Market issuers, which may be denominated in any currency, including the local currency of the issuer.

Over the period, the Fund’s institutional class outperformed its benchmark, returning -15.78% (net of fees) versus -16.91% for the MSCI Frontier Markets + Select EM Countries Capped Index Net TR.

A contributor to the Fund’s relative performance was security selection in the UAE. Notably, Abu Dhabi Islamic Bank and Emaar Properties had strong returns. In the former, the company benefitted from high loan growth and fee income in addition to expanding Net Interest Margin (“NIMs”). Management increased guidance, and determined that? Return on Equity (“ROE”) could approach 20%. In the latter, the company benefitted from high real estate demand and increased rents. Staying in the GCC, Al Hammadi Holding, a Saudi Arabian healthcare company, saw a significant increase in profit in the first half of 2022 and contributed to the Fund’s outperformance.

From an issuer perspective, Fertiglobe, an Egyptian based export-focused nitrogen fertilizer platform that has been supported by higher urea and ammonia prices, was the largest contributor to performance.

Kazakhstan was the largest detractor from performance. The year began with political unrest after the government removed energy price caps. The impact was immediate and the country experienced a drastic rise in fuel prices. With a heavy-handed response, the government restored order. However, weak performance continued throughout the period.

In addition, heightened risk aversion was driven by uncertainty surrounding Western economic sanctions relating to the Russia / Ukraine conflict and whether those sanctions would be expanded to include ‘friends of Russia.” The Fund’s holdings in Kaspi, a financial technology services firm, and Halyk Savings Bank, underperformed.

5

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

Ashmore Emerging Markets Equity Fund

The Ashmore Emerging Markets Equity Fund (the “Fund”) seeks to achieve its objective by investing principally in equity securities and equity-related investments of emerging market issuers, which may be denominated in any currency, including the local currency of the issuer.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -38.85% (net of fees) versus -31.03% for the MSCI Emerging Markets Net.

Several of our best stock performers were concentrated in Brazil and India, in part reflecting the strong domestic operating environments in both countries. In Brazil, our holding in Totvs, a leading software provider benefited from strong revenue growth. Arezzo, a premium footwear retailer, delivered excellent results that were ahead of market expectations, while our holding in energy company Petrobras continued to perform well given notably strong dividend payouts to minority shareholders.

Meanwhile, in India, private banks HDFC and ICICI both benefitted from strong loan growth and corporate strategies that focused on expansion in the higher fee retail segment of the market. Our investment in generics pharmaceutical company Granules performed well on improving margins as well as improving free cash flow generation.

The primary performance detractors were focused in China. Our holding in Beijing Oriental, a high-quality provider of water proofing materials to the real estate sector, struggled given the ongoing challenges in the sector. Depressed investor sentiment towards China in general weighed on our holdings in gaming company Netease, leading pan Asia insurer AIA and e-commerce company JD.Com. In the latter case, this was despite ongoing evidence of market share gains from Alibaba. Indeed, we believe our zero-weight exposure to Alibaba went someway to offset the above negatives.

Ashmore Emerging Markets Equity ESG Fund

The Ashmore Emerging Markets Equity ESG Fund (the “Fund”) seeks to achieve its objective by investing principally in equity securities and equity-related investments of Emerging Market Issuers, which may be denominated in any currency, including the local currency of the issuer, focusing on issuers that the Investment Manager believes satisfy the Environmental, Social, and Governance (“ESG”) Criteria.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -40.10% (net of fees) versus -31.03% for the MSCI Emerging Markets Net.

In Brazil, our holding in Totvs, a leading software provider benefited from strong revenue growth, while Arezzo, a premium footwear retailer, delivered results that were ahead of market expectations. Hapvida, a vertically integrated health care operator, benefitted from growth in the corporate and individual segment of the market which drove revenue higher.

Meanwhile, in India, private banks HDFC and Industrial Credit and Investment Corporation of India (“ICICI”) both benefitted from strong loan growth and corporate strategies that focused on expansion in the higher fee retail segment of the market. Our investment in generics pharmaceutical company Granules performed well on improving margins as well as improving free cash flow generation.

The primary performance detractors were focused in China. Our holding in Beijing Oriental, a high quality provider of water proofing materials to the real estate sector, struggled given the ongoing challenges in the sector. Depressed investor sentiment towards China in general weighed on our holdings in gaming company Tencent, leading pan Asia insurer AIA and e-commerce company JD.Com. In the latter case, this was despite ongoing evidence of market share gains from Alibaba. Indeed, we believe our zero weight exposure to Alibaba went someway to offset the above negatives.

6

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

Ashmore Emerging Markets Short Duration Select Fund

The Ashmore Emerging Markets Short Duration Select Fund (the “Fund”) seeks to achieve its objective by investing principally in in short-term debt instruments of, and derivative instruments related to, Sovereign, Quasi-Sovereign and Corporate issuers of Emerging Market Countries denominated exclusively in Hard Currencies (i.e., the U.S. dollar or any currency of a nation in the G-7). The Fund normally seeks to maintain a weighted average portfolio duration of between 1 and 3 years and an Investment Grade weighted average credit rating.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -12.16% (net of fees) versus -10.85% for the JP Morgan CEMBI Broad Diversified 1-3 Year. Positions in Russia were amongst the main contributors to the Fund’s relative performance. Positions in China and Poland were amongst the largest detractors from the Fund’s relative performance.

The Russian invasion of Ukraine, supported by Belarus, created an extremely challenging environment for asset price performance, as both Russia and Belarus were subject to an extreme package of economic sanctions. The sanctions had the immediate impact of restricting trading and settlement of Russian and Belarussian bonds, with both countries ultimately excluded from the entire JP Morgan family of bond indices effective March 31, 2022, with all bond prices being written down to zero. Russia nevertheless continued to make coupon payments on its USD denominated debt obligations, although the US government prevented Russia from making a bond principal payment out of foreign currency reserves held by the Central Bank of Russia at US financial institutions, forcing the Russian government to either pay the maturity out of the diminished pool of liquid and accessible FX reserves or default on the bond.

In our view, the Communist Party congress in China turned out to be a disappointment as President Xi effectively packed the Standing Committee (China’s top leadership body) with a loyal following. He now has absolute power in the country, doing away with previous checks and balances inherited in the system. The President defended the Zero Covid Policy, which remains in place officially, though some actual relaxation was noted in the face of a spiraling number of cases with very low levels of mortality. China risk assets all sold off during October, especially already weak bonds from the property sector, generating significant negative alpha. Evidence of softening industrial activity in China, with manufacturing Purchase Managers Index (“PMI”) surprising to the downside, exacerbated concerns about the stability of the property sector. After many months of relative inaction, the Chinese government announced the establishment of a fund that is aimed at supporting a number of developers with the aim of restoring liquidity to the sector and ensuring the completion of housing units already under development. The Chinese government appears to be backing away from its 5.5% growth target for 2022 following the release of GDP figures for the first half of the year showing just 2.5% year-on-year (“yoy”) growth.

Poland has had to cope with high inflation from food and energy prices as well as dealing with an influx of refugees from war torn neighbouring Ukraine. Security selection in the property sector contributed to underperformance in Poland.

Ashmore Emerging Markets Investment Grade Income Fund

The Ashmore Emerging Markets Investment Grade Income (the “Fund”) seeks to achieve its objective by investing principally in debt instruments of, and derivative instruments related to, Sovereigns, Quasi-Sovereigns and Corporate issuers of Emerging Market Countries and EM Supra-Nationals denominated exclusively in Hard Currencies (i.e., the U.S. dollar or any currency of a nation in the G-7). The Fund has no restrictions on individual security duration.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -21.02% (net of fees) versus -18.26% for the JP Morgan CEMBI Investment Grade Broad Diversified. Positions in Russia were amongst the largest country contributors to the Fund’s relative performance. Positions in Ukraine and Mexico detracted from the Fund’s performance.

The Russian invasion of Ukraine, supported by Belarus, created an extremely challenging environment for asset price performance, as both Russia and Belarus were subject to an extreme package of economic sanctions. The sanctions had the immediate impact of restricting trading and settlement of Russian and Belarussian bonds, with both countries ultimately excluded from the entire JP Morgan family of bond indices effective March 31, 2022, with all bond prices being written down to zero. Russia nevertheless

7

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

continued to make coupon payments on its USD denominated debt obligations, although the US government prevented Russia from making a bond principal payment out of foreign currency reserves held by the Central Bank of Russia at US financial institutions, forcing the Russian government to either pay the maturity out of the diminished pool of liquid and accessible FX reserves or default on the bond.

Economic data was mixed in Mexico, where the government presented an ambitious 2023 Economic Package to Congress, with aggressive revenue forecasts and continued support for Andrés Manuel López Obrador’s (“AMLO’s”) social spending programmes and key infrastructure projects. Longer duration sovereign and Pemex bonds were challenged with moves in US Treasury yields.

In Ukraine, the government unsurprisingly launched a consent solicitation to suspend debt repayment on its Eurobonds until August 2024. At the same time, the G7 and the Paris Club announced the suspension of Ukraine’s debt service through 2023. The announcements were the inevitable result of the ongoing war and the impact it has had on the Ukrainian economy.

Ashmore Emerging Markets Corporate Income ESG Fund

The Ashmore Emerging Markets Corporate Income ESG Fund (the “Fund”) seeks to achieve its objective by investing principally in debt instruments of Corporate issuers, which may be denominated principally in Hard Currencies (i.e., the U.S. dollar or any currency of a nation in the G-7), focusing on issuers that the Investment Manager believes satisfy the ESG Criteria.

The Fund commenced operations on 26 February 2021. Over the period, the Fund’s institutional class underperformed its benchmark, returning -27.56% (net of fees) versus -18.06% for the JP Morgan CEMBI Broad Diversified. Security selection in Jamaica and Qatar contributed to the Fund’s relative performance. China, Mexico and Brazil were the largest detractors from the Fund’s relative performance.

Qatar continued to benefit from increased prices on natural gas and oil exports, and an additional push is expected to come from the upcoming World Cup. Moody’s reported that the current oil price boost will likely lead to a significant improvement in the fiscal and external positions of GCC sovereigns, with Qatar to benefit among the most among its peers in the region.

In our view, the Communist Party congress in China turned out to be a disappointment as President Xi effectively packed the Standing Committee (China’s top leadership body) with a loyal following. He now has absolute power in the country, doing away with previous checks and balances inherited in the system. The President defended the Zero Covid Policy, which remains in place officially, though some actual relaxation was noted in the face of a spiraling number of cases with very low levels of mortality. China risk assets all sold off during October, especially already weak bonds from the property sector, generating significant negative alpha. Evidence of softening industrial activity in China, with manufacturing Purchase Managers Index (“PMI”) surprising to the downside, exacerbated concerns about the stability of the property sector. After many months of relative inaction, the Chinese government announced the establishment of a fund that is aimed at supporting a number of developers with the aim of restoring liquidity to the sector and ensuring the completion of housing units already under development. The Chinese government appears to be backing away from its 5.5% growth target for 2022 following the release of GDP figures for the first half of the year showing just 2.5% year-on-year (“yoy”) growth.

Economic data was mixed in Mexico, where the government presented an ambitious 2023 Economic Package to Congress, with aggressive revenue forecasts and promises to maintain AMLO’s social spending programmes and key infrastructure projects. Longer duration sovereign and Pemex bonds were challenged with moves in US Treasury yields.

Profit taking in Brazil has extended following outperformance in the first quarter. The main negative contributor were security selections with exposure to Telecom, Airlines and Building Materials resulting in negative alpha. Politics took a front seat in the third quarter in the run-up to presidential elections slated for October, with concerns that fiscal stimulus and social spending would be increased to bolster the incumbent. Former President Lula da Silva won the majority of the votes in the election run-off against incumbent Bolsonaro, albeit by the slimmest margin in the recent history of the country. Lula pledged to re-unite the country, but it appears that he will govern with a fragmented Congress and against a sizeable pro-Bolsonaro block. In our view, he will need to form ad-hoc coalitions with Centrist parties in order to achieve his political agenda. He is expected to appoint a market-friendly economic team, and to push for an ambitious social agenda within the confines of limited fiscal space.

8

GLOSSARY OF TERMS

MSCI World Index: A broad global equity index that represents large and mid-cap equity performance across all 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country.

Russell 2000 Index: A stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index.

MSCI Emerging Markets Net (“MSCI EM Net”): A free float-adjusted market capitalization index that is designed to measure equity market performance in the global Emerging Markets.

S&P 500 Index: Measures the value of the stocks of the 500 largest corporations by market capitalization listed on the New York Stock Exchange or Nasdaq.

Bloomberg Barclays Global Aggregate Index: A flagship measure of global investment grade debt from a multitude local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

JP Morgan Emerging Markets Bond Index Global Diversified: A uniquely weighted USD-denominated Emerging Markets sovereign index. It provides full coverage of the Emerging Markets asset class with representative countries, investable instruments (sovereign and quasi-sovereign), and transparent rules. It limits the weights of those index countries with larger debt stocks by only including specified portions of these countries’ eligible current face amounts of debt outstanding.

JP Morgan Government Bond Index - Emerging Markets Global Diversified (“JP Morgan GBI-EM GD”): A comprehensive global local emerging markets index, and consists of regularly traded, liquid fixed-rate, domestic currency government bonds to which international investors can gain exposure.

JP Morgan Emerging Local Markets Index Plus: Tracks total returns for local currency denominated money market instruments in 23 Emerging Markets.

JP Morgan CEMBI: Tracks the performance of US dollar-denominated bonds issued by emerging market corporate entities.

JP Morgan CEMBI Broad Diversified (“JP Morgan CEMBI BD”): Consists of an investable universe of corporate bonds and tracks total returns of USD-denominated debt instruments issued by corporate entities in Emerging Markets countries.

JP Morgan CEMBI Investment Grade Broad Diversified (“JP Morgan CEMBI IG BD”): A sub index of the JPM CEMBI BD which contains instruments that carry an investment grade rating.

JP Morgan CEMBI Broad Diversified 1-3 Year (“JP Morgan CEMBI BD 1-3 Year”): A sub index of the JPM CEMBI BD which contains instruments that have a maturity greater than 1 year and less than 3 years.

JP Morgan CEMBI Broad Diversified Investment Grade 1-3 Year (“JP Morgan CEMBI BD IG 1-3 Year”): A sub index of the JPM CEMBI BD which contains investment grade instruments that have a maturity greater than 1 year and less than 3 years.

BofA Merrill Lynch 1-3 Year US Treasury Index: A subset of The BofA Merrill Lynch US Treasury Index including all securities with a remaining term to final maturity less than 3 years.

MSCI Emerging Markets Small Cap Net (“MSCI EM Small Cap Net”): A free float-adjusted market capitalization index that is designed to measure small cap equity market performance in the global Emerging Markets.

MSCI Frontier Markets + Select EM Countries Capped Index Net TR (“MSCI FR + Select EM”): A customised benchmark that is designed to measure equity market performance of constituent companies in each of the MSCI Frontiers Market Index (50%) and emerging markets crossover markets (50%), which are the Philippines, Qatar, United Arab Emirates, Peru, Colombia, Argentina, Egypt, Pakistan and Kuwait, together with a country cap of 15%.

9

GLOSSARY OF TERMS (CONTINUED)

Net Interest Margin (“NIMs”): The amount of money that a bank is earning in interest on loans compared to the amount it is paying in interest on deposits.

Basis points (“bps”): A unit of measure used in finance to describe the percentage change in the value of financial instruments or the rate change in an index or other benchmark.

Gross Domestic Product (“GDP”): Measures the monetary value of final goods and services—that is, those that are bought by the final user—produced in a country in a given period of time.

Purchase Managers Index (“PMI”): Is a survey-based indicator of business conditions, which includes individual measures (‘sub-indices’) of business output, new orders, employment, costs, selling prices, exports, purchasing activity, supplier performance, backlogs of orders and inventories of both inputs, etc.

Return on Equity (“ROE”): Is the measure of a company’s net income divided by its shareholders’ equity.

10

IMPORTANT INFORMATION ABOUT THE FUNDS

Ashmore Investment Advisors Limited

This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Funds and market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of Ashmore Investment Advisors Limited as of the date indicated and are subject to change at any time based upon economic, market, or other conditions and Ashmore Investment Advisors Limited undertakes no obligation to update the views expressed herein. Any discussions of specific securities or markets should not be considered a recommendation to buy or sell or invest in those securities or markets. The views expressed above may not be relied upon as investment advice or as an indication of the Funds’ trading intent. Information about the Funds’ holdings, asset allocation or country diversification is historical and is not an indication of future portfolio composition, which may vary. Direct investment in any index is not possible. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses applicable to mutual fund investments. In addition, the returns do not reflect certain charges that an investor in the Funds may pay. If these additional fees were reflected, the performance shown would have been lower.

The following disclosure provides important information regarding each Fund’s Average Annual Total Return table and Cumulative Returns chart, which appear on each Fund’s individual page in this report (the “Shareholder Report” or the “Report”). Please refer to this information when reviewing the table and chart for a Fund.

On each individual Fund Summary page in this Report, the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that all dividend and capital gain distributions were reinvested. Returns do not reflect the deduction of taxes that a shareholder would pay on (i) Fund distributions or (ii) the redemption of Fund shares. The Cumulative Returns Chart reflects only Institutional Class performance. Performance for Class A and Class C shares is typically lower than Institutional Class performance due to the lower expenses paid by Institutional Class shares. Except for the load-waived performance for the Class A and C shares of each Fund (as applicable), performance shown is net of fees and expenses. The load-waived performance for Class A and Class C shares does not reflect the sales charges shareholders of those classes may pay in connection with a purchase or redemption of Class A and Class C shares. The load-waived performance of those share classes is relevant only to shareholders who purchased Class A or Class C shares on a load-waived basis. The figures in the line graph are calculated at net asset value and assume the investment of $1,000,000 at the beginning of the first full month following the inception of the Institutional Class. Each Fund measures its performance against a broad-based securities market index (“benchmark index”). Each benchmark index does not take into account fees, expenses or taxes.

For periods prior to the inception date of the Class A and Class C shares (if applicable), performance information shown is based on the performance of the Fund’s Institutional Class shares, adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively.

A Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

The expenses shown are for the fiscal year and may differ from the current prospectus.

11

IMPORTANT INFORMATION ABOUT THE FUNDS (CONTINUED)

The following disclosure provides important information regarding each Fund’s Expense Example, which appears on each Fund’s individual page in this Shareholder Report. Please refer to this information when reviewing the Expense Example for a Fund.

EXPENSE EXAMPLE

Fund Expenses

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in Dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, from May 1, 2022 or the inception date (if later), through October 31, 2022.

Actual Expenses

The information in the table under the heading “Actual Performance” provides information based on actual performance and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the appropriate column for your share class, in the row titled “Expenses Paid” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical Performance” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the information under the heading “Hypothetical Performance” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

12

Ashmore Emerging Markets Total Return Fund

FUND SUMMARY (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ashmore Emerging Markets Total Return Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of sovereign, quasi-sovereign, and corporate issuers of Emerging Market countries, which may be denominated in any currency, including the local currency of the issuer. The Fund tactically allocates assets between external debt, corporate debt and local currency. | | | | | | | | Share class information INSTITUTIONAL CLASS Launch date: December 8, 2010 Minimum initial investment: $1,000,000 ISIN: US0448204059 CUSIP: 044820405 BLOOMBERG: EMKIX US TICKER: EMKIX RETAIL CLASS A Launch date: May 12, 2011 Minimum initial investment: $1,000 ISIN: US0448208357 CUSIP: 044820835 BLOOMBERG: EMKAX US TICKER: EMKAX RETAIL CLASS C Launch date: May 12, 2011 Minimum initial investment: $1,000 ISIN: US0448208274 CUSIP: 044820827 BLOOMBERG: EMKCX US TICKER: EMKCX All sources are Ashmore unless otherwise indicated. |

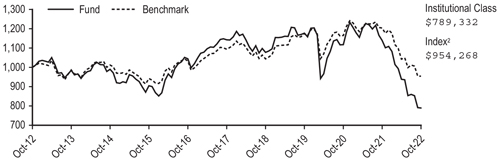

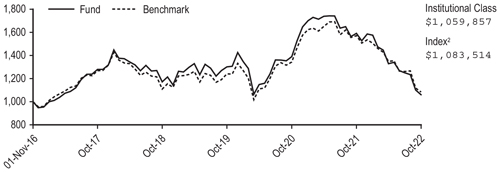

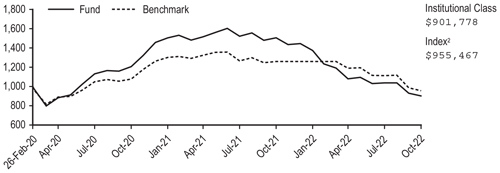

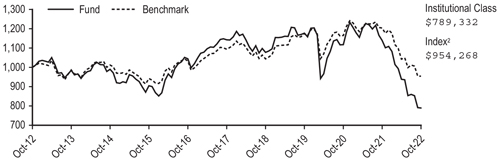

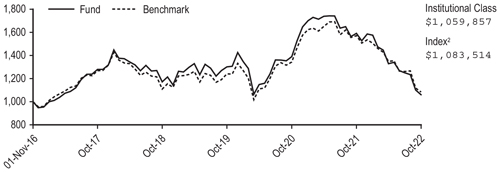

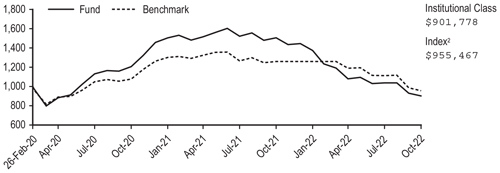

Please refer to page 1 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart. | | | | | | |

Average Annual Total Return For The Period Ended Oct 31, 2022 | | 1 Year | | 5 Year | | 10 Year | | |

Institutional Class | | | | | | | | | | | | | | | | | | | -30.74% | | | | | -7.14% | | | | | -2.34% | | | | | | |

Retail Class A (load-waived) | | | | | | | | | | | | | | | | | | | -30.79% | | | | | -7.33% | | | | | -2.56% | 3 | | | | | |

Retail Class A (unadjusted)1 | | | | | | | | | | | | | | | | | | | -33.60% | | | | | -8.08% | | | | | -2.96% | 3 | | | | | |

Retail Class C (load-waived) | | | | | | | | | | | | | | | | | | | -31.39% | | | | | -8.05% | | | | | -3.15% | 3 | | | | | |

Retail Class C (unadjusted)1 | | | | | | | | | | | | | | | | | | | -32.05% | | | | | -8.05% | | | | | -3.15% | 3 | | | | | |

50/25/25 Composite Benchmark2 | | | | | | | | | | | | | | | | | | | -20.71% | | | | | -2.69% | | | | | -0.47% | | | | | | |

Cumulative Returns Through Oct 31, 2022 (% of NAV) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares.

1Unadjusted Performance accounts for a maximum sales load of 4% for Class A shares and maximum deferred sales charge of 1% for the 1 year return for the Class C shares. 2The index for the Fund is 50% JP Morgan Emerging Markets Bond Index Global Diversified, 25% JP Morgan Emerging Local Markets Index Plus, and 25% JP Morgan Government Bond Index-Emerging Markets Global Diversified. 3Class C Shares performance reflects conversion to Class A Shares after eight years.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-855-274-6673. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 2 herein for an explanation of the Expense Example information presented below.

| | | | | | | | | | | | | | |

| | | | |

Expense example | | Actual performance | | | | Hypothetical performance |

| | | | | | | | |

| | | Institutional Class | | Class A | | Class C | | | | Institutional Class | | Class A | | Class C |

| | | | | | | | |

Beginning Account Value (5/1/2022) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | | | |

Ending Account Value (10/31/2022) | | $840.30 | | $840.60 | | $836.80 | | | | $1,020.11 | | $1,018.85 | | $1,015.07 |

| | | | | | | | |

Expense Ratio (Gross / Net) | | 1.19% / 1.01% | | 1.44% / 1.26% | | 2.19% / 2.01% | | | | 1.19% / 1.01% | | 1.44% / 1.26% | | 2.19% / 2.01% |

| | | | | | | | |

Expenses Paid* | | $4.68 | | $5.85 | | $9.31 | | | | $5.14 | | $6.41 | | $10.21 |

*Expenses are equal to the Fund’s annualized expense ratios for the period May 1, 2022 through October 31, 2022, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). As such, these may differ from the prospectus.

13

Ashmore Emerging Markets Local Currency Bond Fund

FUND SUMMARY (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ashmore Emerging Markets Local Currency Bond Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of sovereign and quasi-sovereign issuers of Emerging Market countries that are denominated in the local currency of the issuer. | | | | | | | | Share class information INSTITUTIONAL CLASS Launch date: December 8, 2010 Minimum initial investment: $1,000,000 ISIN: US0448202079 CUSIP: 044820207 BLOOMBERG: ELBIX US TICKER: ELBIX RETAIL CLASS A Launch date: May 12, 2011 Minimum initial investment: $1,000 ISIN: US0448208761 CUSIP: 044820876 BLOOMBERG: ELBAX US TICKER: ELBAX RETAIL CLASS C Launch date: May 12, 2011 Minimum initial investment: $1,000 ISIN: US0448208688 CUSIP: 044820868 BLOOMBERG: ELBCX US TICKER: ELBCX All sources are Ashmore unless otherwise indicated. |

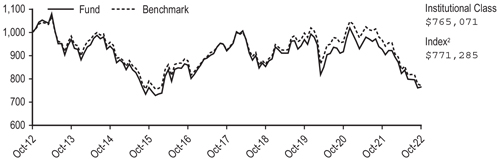

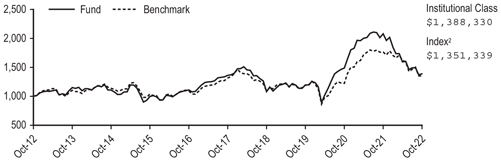

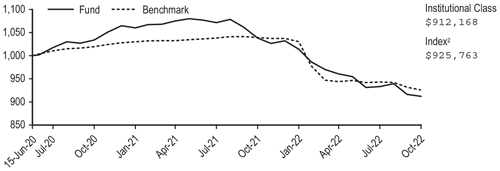

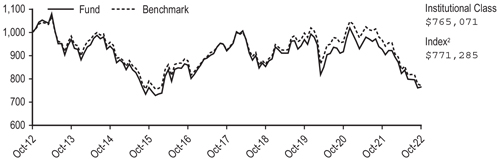

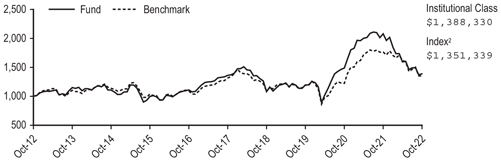

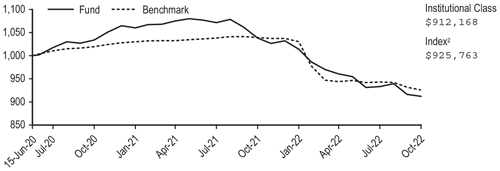

Please refer to page 1 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart. | | | | | | |

Average Annual Total Return For The Period Ended Oct 31, 2022 | | 1 Year | | 5 Year | | 10 Year | | |

Institutional Class | | | | | | | | | | | | | | | | | | | -17.49% | | | | | -3.64% | | | | | -2.64% | | | | | | |

Retail Class A (load-waived) | | | | | | | | | | | | | | | | | | | -17.75% | | | | | -3.85% | | | | | -2.88% | 3 | | | | | |

Retail Class A (unadjusted)1 | | | | | | | | | | | | | | | | | | | -21.05% | | | | | -4.63% | | | | | -3.27% | 3 | | | | | |

Retail Class C (load-waived) | | | | | | | | | | | | | | | | | | | -18.30% | | | | | -4.58% | | | | | -3.47% | 3 | | | | | |

Retail Class C (unadjusted)1 | | | | | | | | | | | | | | | | | | | -19.11% | | | | | -4.58% | | | | | -3.47% | 3 | | | | | |

JP Morgan GBI-EM GD2 | | | | | | | | | | | | | | | | | | | -20.27% | | | | | -3.54% | | | | | -2.56% | | | | | | |

Cumulative Returns Through Oct 31, 2022 (% of NAV) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares.

1Unadjusted Performance accounts for a maximum sales load of 4% for Class A shares and maximum deferred sales charge of 1% for the 1 year return for the Class C shares. 2The index for the Fund is the JP Morgan Global Bond Index—Emerging Markets Global Diversified. 3Class C Shares performance reflects conversion to Class A Shares after eight years.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-855-274-6673. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 2 herein for an explanation of the Expense Example information presented below.

| | | | | | | | | | | | | | |

| | | | |

Expense example | | Actual performance | | | | Hypothetical performance |

| | | | | | | | |

| | | Institutional Class | | Class A | | Class C | | | | Institutional Class | | Class A | | Class C |

| | | | | | | | |

Beginning Account Value (5/1/2022) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | | | |

Ending Account Value (10/31/2022) | | $929.10 | | $927.40 | | $925.20 | | | | $1,020.32 | | $1,019.06 | | $1,015.27 |

| | | | | | | | |

Expense Ratio (Gross / Net) | | 3.02% / 0.97% | | 3.27% / 1.22% | | 4.03% / 1.97% | | | | 3.02% / 0.97% | | 3.27% / 1.22% | | 4.03% / 1.97% |

| | | | | | | | |

Expenses Paid* | | $4.72 | | $5.93 | | $9.56 | | | | $4.94 | | $6.21 | | $10.01 |

*Expenses are equal to the Fund’s annualized expense ratios for the period May 1, 2022 through October 31, 2022, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). As such, these may differ from the prospectus.

14

Ashmore Emerging Markets Corporate Income Fund

FUND SUMMARY (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ashmore Emerging Markets Corporate Income Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of Emerging Market corporate issuers, which may be denominated in any currency, including the local currency of the issuer. | | | | | | | Share class information INSTITUTIONAL CLASS Launch date: December 8, 2010 Minimum initial investment: $1,000,000 ISIN: US044825049 CUSIP: 044820504 BLOOMBERG: EMCIX US TICKER: EMCIX RETAIL CLASS A Launch date: May 12, 2011 Minimum initial investment: $1,000 ISIN: US0448206039 CUSIP: 044820603 BLOOMBERG: ECDAX US TICKER: ECDAX RETAIL CLASS C Launch date: May 12, 2011 Minimum initial investment: $1,000 ISIN: US0448207029 CUSIP: 044820702 BLOOMBERG: ECDCX US TICKER: ECDCX All sources are Ashmore unless otherwise indicated. |

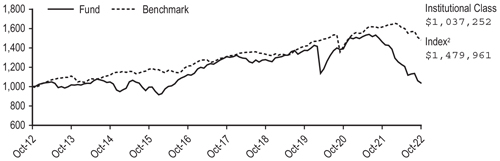

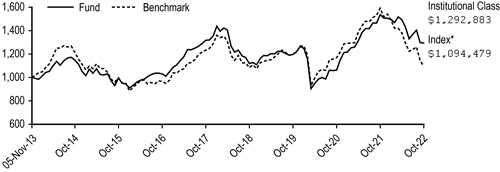

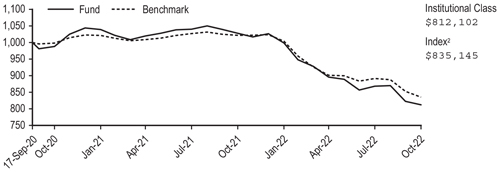

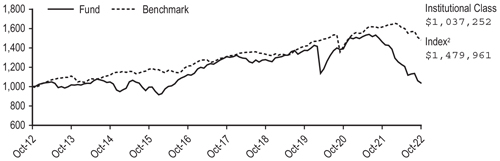

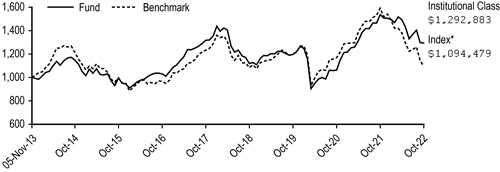

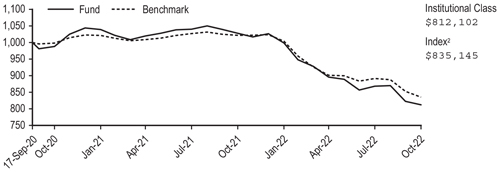

Please refer to page 1 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart. | | | | | |

Average Annual Total Return For The Period Ended Oct 31, 2022 | | | | | | 1 Year | | | 5 Year | | | 10 Year | | | | |

Institutional Class | | | | | | | | | | | | | | | | | | | -29.15% | | | | -4.56% | | | | 0.37% | | | | | |

Retail Class A (load-waived) | | | | | | | | | | | | | | | | | | | -29.30% | | | | -4.80% | | | | 0.11% | 3 | | | | |

Retail Class A (unadjusted)1 | | | | | | | | | | | | | | | | | | | -32.10% | | | | -5.58% | | | | -0.29% | 3 | | | | |

Retail Class C (load-waived) | | | | | | | | | | | | | | | | | | | -29.86% | | | | -5.50% | | | | -0.51% | 3 | | | | |

Retail Class C (unadjusted)1 | | | | | | | | | | | | | | | | | | | -30.52% | | | | -5.50% | | | | -0.51% | 3 | | | | |

JP Morgan CEMBI BD2 | | | | | | | | | | | | | | | | | | | -18.06% | | | | -0.20% | | | | 2.27% | | | | | |

Cumulative Returns Through Oct 31, 2022 (% of NAV) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares.

1Unadjusted Performance accounts for a maximum sales load of 4% for Class A shares and maximum deferred sales charge of 1% for the 1 year return for the Class C shares. 2The index for the Fund is the JP Morgan CEMBI Broad Diversified. 3Class C Shares performance reflects conversion to Class A Shares after eight years.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-855-274-6673. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 2 herein for an explanation of the Expense Example information presented below.

| | | | | | | | | | | | | | |

| | | | |

Expense example | | Actual performance | | | | Hypothetical performance |

| | | | | | | | |

| | | Institutional Class | | Class A | | Class C | | | | Institutional Class | | Class A | | Class C |

| | | | | | | | |

Beginning Account Value (5/1/2022) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | | | |

Ending Account Value (10/31/2022) | | $842.20 | | $841.50 | | $838.10 | | | | $1,020.92 | | $1,019.66 | | $1,015.88 |

| | | | | | | | |

Expense Ratio (Gross / Net) | | 1.10% / 0.85% | | 1.35% / 1.10% | | 2.10% / 1.85% | | | | 1.10% / 0.85% | | 1.35% / 1.10% | | 2.10% / 1.85% |

| | | | | | | | |

Expenses Paid* | | $3.95 | | $5.11 | | $8.57 | | | | $4.33 | | $5.60 | | $9.40 |

*Expenses are equal to the Fund’s annualized expense ratios for the period May 1, 2022 through October 31, 2022, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). As such, these may differ from the prospectus.

15

Ashmore Emerging Markets Short Duration Fund

FUND SUMMARY (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ashmore Emerging Markets Short Duration Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in short-term debt instruments of, and derivative instruments related to, sovereign, quasi-sovereign and corporate issuers of Emerging Markets countries denominated exclusively in hard currencies (i.e., the U.S. dollar or any currency of a nation in the G-7). The Fund normally seeks to maintain a weighted average portfolio duration of between 1 and 3 years. The Fund has no restrictions on individual security duration. | | | | | | | Share class information INSTITUTIONAL CLASS Launch date: June 24, 2014 Minimum initial investment: $1,000,000 ISIN: US0448206948 CUSIP: 044820694 BLOOMBERG: ESFIX US TICKER: ESFIX RETAIL CLASS A Launch date: September 23, 2014 Minimum initial investment: $1,000 ISIN: US0448207284 CUSIP: 044820728 BLOOMBERG: ESFAX US TICKER: ESFAX RETAIL CLASS C Launch date: June 13, 2017 Minimum initial investment: $1,000 ISIN: US0448207102 CUSIP: 044820710 BLOOMBERG: ESFCX US TICKER: ESFCX All sources are Ashmore unless otherwise indicated. |

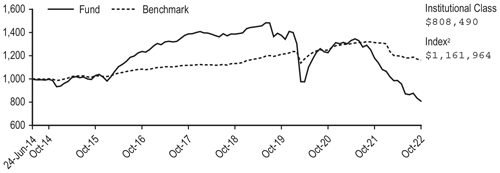

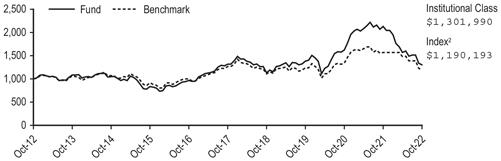

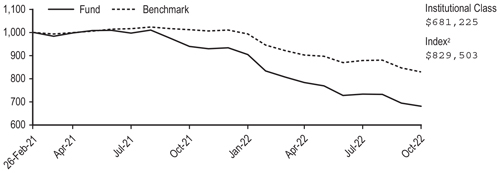

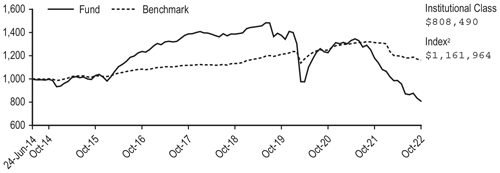

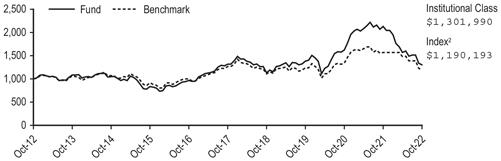

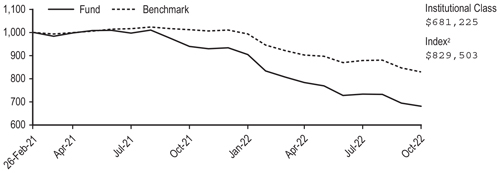

Please refer to page 1 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart. | | | | | |

Average Annual Total Return For The Period Ended Oct 31, 2022 | | | | | | 1 Year | | | 5 Year | | | Since incpt1 | | | | |

Institutional Class | | | | | | | | | | | | | | | | | | | -31.54% | | | | -10.27% | | | | -2.51% | | | | | |

Retail Class A (load-waived) | | | | | | | | | | | | | | | | | | | -31.54% | | | | -10.48% | | | | -2.74% | | | | | |

Retail Class A (unadjusted)1 | | | | | | | | | | | | | | | | | | | -33.12% | | | | -11.20% | | | | -3.23% | | | | | |

Retail Class C (load-waived) | | | | | | | | | | | | | | | | | | | -32.29% | | | | -11.21% | | | | -9.68% | | | | | |

Retail Class C (unadjusted)1 | | | | | | | | | | | | | | | | | | | -32.92% | | | | -11.21% | | | | -9.68% | | | | | |

JP Morgan CEMBI BD 1-3 Year2 | | | | | | | | | | | | | | | | | | | -11.56% | | | | 0.78% | | | | 1.81% | | | | | |

Cumulative Returns Through Oct 31, 2022 (% of NAV) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Class A is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares.

1Unadjusted Performance accounts for a maximum sales load of 2.25% for Class A shares and maximum deferred sales charge of 1% for the 1 year return for the Class C shares. 2The index for the Fund is the JP Morgan CEMBI Broad Diversified 1-3 Year. Since inception returns are from the inception of the Institutional Class.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-855-274-6673. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 2 herein for an explanation of the Expense Example information presented below.

| | | | | | | | | | | | | | |

| | | | |

Expense example | | Actual performance | | | | Hypothetical performance |

| | | | | | | | |

| | | Institutional Class | | Class A | | Class C | | | | Institutional Class | | Class A | | Class C |

| | | | | | | | |

Beginning Account Value (5/1/2022) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | | | |

Ending Account Value (10/31/2022) | | $818.60 | | $819.30 | | $814.60 | | | | $1,023.24 | | $1,021.98 | | $1,018.20 |

| | | | | | | | |

Expense Ratio (Gross / Net) | | 0.69% / 0.39% | | 0.94% / 0.64% | | 1.69% / 1.39% | | | | 0.69% / 0.39% | | 0.94% / 0.64% | | 1.69% / 1.39% |

| | | | | | | | |

Expenses Paid* | | $1.79 | | $2.93 | | $6.36 | | | | $1.99 | | $3.26 | | $7.07 |

*Expenses are equal to the Fund’s annualized expense ratios for the period May 1, 2022 through October 31, 2022, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). As such, these may differ from the prospectus.

16

Ashmore Emerging Markets Active Equity Fund

FUND SUMMARY (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ashmore Emerging Markets Active Equity Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in equity securities and equity-related investments of Emerging Market issuers, which may be denominated in any currency, including the local currency of the issuer. | | | | | | | Share class information INSTITUTIONAL CLASS Launch date: November 1, 2016 Minimum initial investment: $1,000,000 ISIN: US0448205957 CUSIP: 044820595 BLOOMBERG: EMQIX US TICKER: EMQIX RETAIL CLASS A Launch date: November 1, 2016 Minimum initial investment: $1,000 ISIN: US0448206294 CUSIP: 044820629 BLOOMBERG: EMQAX US TICKER: EMQAX RETAIL CLASS C Launch date: November 1, 2016 Minimum initial investment: $1,000 ISIN: US0448206112 CUSIP: 044820611 BLOOMBERG: EMQCX US TICKER: EMQCX All sources are Ashmore unless otherwise indicated. |

Please refer to page 1 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart. | | | | | |

Average Annual Total Return For The Period Ended Oct 31, 2022 | | | | | | 1 Year | | | 5 Year | | | Since incpt1 | | | | |

Institutional Class | | | | | | | | | | | | | | | | | | | -33.40% | | | | -3.70% | | | | 0.97% | | | | | |

Retail Class A (load-waived) | | | | | | | | | | | | | | | | | | | -33.53% | | | | -3.93% | | | | 0.74% | | | | | |

Retail Class A (unadjusted)1 | | | | | | | | | | | | | | | | | | | -37.04% | | | | -4.95% | | | | -0.15% | | | | | |

Retail Class C (load-waived) | | | | | | | | | | | | | | | | | | | -34.05% | | | | -4.67% | | | | 0.00% | | | | | |

Retail Class C (unadjusted)1 | | | | | | | | | | | | | | | | | | | -34.53% | | | | -4.67% | | | | 0.00% | | | | | |

MSCI EM Net2 | | | | | | | | | | | | | | | | | | | -31.03% | | | | -3.09% | | | | 1.35% | | | | | |

Cumulative Returns Through Oct 31, 2022 (% of NAV) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares.

1Unadjusted Performance accounts for a maximum sales load of 5.25% for Class A shares and maximum deferred sales charge of 1% for the 1 year return for the Class C shares. 2The index for the Fund is the MSCI Emerging Markets Net.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-855-274-6673. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 2 herein for an explanation of the Expense Example information presented below.

| | | | | | | | | | | | | | |

| | | | |

Expense example | | Actual performance | | | | Hypothetical performance |

| | | | | | | | |

| | | Institutional Class | | Class A | | Class C | | | | Institutional Class | | Class A | | Class C |

| | | | | | | | |

Beginning Account Value (5/1/2022) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | | | |

Ending Account Value (10/31/2022) | | $797.80 | | $796.60 | | $793.60 | | | | $1,020.06 | | $1,018.80 | | $1,015.02 |

| | | | | | | | |

Expense Ratio (Gross / Net) | | 1.29% / 1.02% | | 1.54% / 1.27% | | 2.32% / 2.02% | | | | 1.29% / 1.02% | | 1.54% / 1.27% | | 2.32% / 2.02% |

| | | | | | | | |

Expenses Paid* | | $4.62 | | $5.75 | | $9.13 | | | | $5.19 | | $6.46 | | $10.26 |

*Expenses are equal to the Fund’s annualized expense ratios for the period May 1, 2022 through October 31, 2022, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). As such, these may differ from the prospectus.

17

Ashmore Emerging Markets Small-Cap Equity Fund

FUND SUMMARY (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |