UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23112

JANUS DETROIT STREET TRUST

(Exact name of registrant as specified in charter)

151 Detroit Street, Denver, Colorado 80206-4805

(Address of principal executive offices)(Zip code)

| | |

(Name and Address of Agent for

Service) | | Copy to: |

Kathyrn L. Santoro 151 Detroit Street Denver, Colorado 80206-4805 | | Eric S. Purple Stradley Ronon Stevens & Young LLP 1250 Connecticut Avenue, N.W., Suite 500 Washington, D.C. 20036 |

Registrant’s telephone number, including area code: 303-333-3863

Date of fiscal year end: October 31

Date of reporting period: October 31, 2016

| Item 1: | Report to Shareholders. |

ANNUAL REPORT

October 31, 2016

Janus Small Cap Growth Alpha ETF

Janus Detroit Street Trust

Table of Contents

Janus Small Cap Growth Alpha ETF (unaudited)

INVESTMENT OBJECTIVE

Janus Small Cap Growth Alpha ETF seeks investment results that correspond generally, before fees and expenses, to the performance of its underlying index, the Janus Small Cap Growth Alpha Index. It pursues its investment objective by using a passive index-based approach, normally investing at least 80% of its net assets in securities that comprise its underlying index.

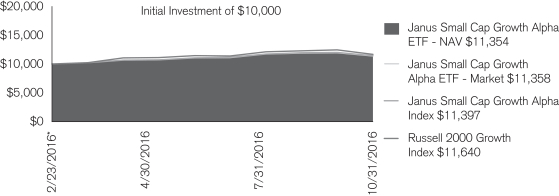

PERFORMANCE OVERVIEW

| • | | Against a backdrop of relatively high consumer confidence and low rates, small-cap stocks registered solid double-digit gains for the period February 23, 2016 through October 31, 2016. Improving data enabled stocks to recover during the spring after volatility early in the year amid concerns about global growth before the UK’s surprise decision to leave the European Union in June 2016. However, stocks again proved resilient through the end of the period, although markets retreated over the course of October as investors exhibited pre-election apprehension despite a stream of relatively solid economic data. |

| • | | During the period, the Janus Small Cap Growth Alpha ETF (JSML) returned 13.54% (based on NAV); its primary benchmark, the Janus Small Cap Growth Alpha Index, returned 13.97%, and its secondary benchmark, the Russell 2000 Growth Index, returned 16.40%. The underperformance relative to the secondary benchmark was concentrated in March 2016 performance; the remainder of the term saw outperformance relative to the benchmark. |

| • | | JSML seeks investment results that correspond generally, before fees and expenses, to the performance of its primary benchmark. The strategy seeks to provide risk-adjusted outperformance by identifying top-tier small-cap companies with some of the strongest fundamentals that the adviser believes can deliver sustainable growth in a variety of market environments. |

| | |

| | Janus Detroit Street Trust ½ 1 |

Janus Small Cap Growth Alpha ETF (unaudited)

Fund At A Glance

October 31, 2016

| | | | |

| 5 Largest Equity Holdings – (% of Net Assets) | |

Arista Networks, Inc. | | | | |

Communications Equipment | | | 3.2% | |

Ubiquiti Networks, Inc. | | | | |

Communications Equipment | | | 2.4% | |

SYNNEX Corp. | | | | |

Electronic Equipment & Instruments | | | 2.3% | |

Rollins, Inc. | | | | |

Commercial Services & Supplies | | | 2.2% | |

AMERCO | | | | |

Road & Rail | | | 2.0% | |

| | | | |

| | | 12.1% | |

| | | | |

| Sector Allocation – (% of Net Assets) | |

Consumer, Non-cyclical | | | 29.8% | |

Technology | | | 18.0% | |

Consumer, Cyclical | | | 13.7% | |

Industrial | | | 11.9% | |

Financial | | | 11.9% | |

Communications | | | 10.7% | |

Basic Materials | | | 2.0% | |

Energy | | | 1.9% | |

Investment Companies | | | 0.1% | |

| | | | |

| | | 100.0% | |

Janus Small Cap Growth Alpha ETF (unaudited)

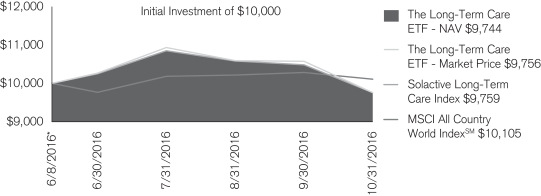

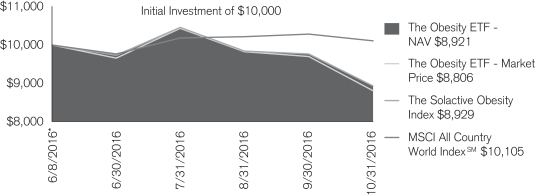

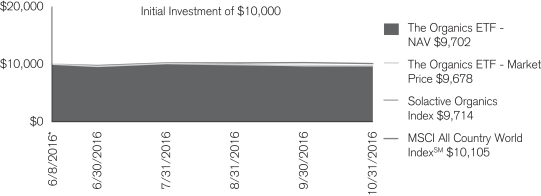

Performance

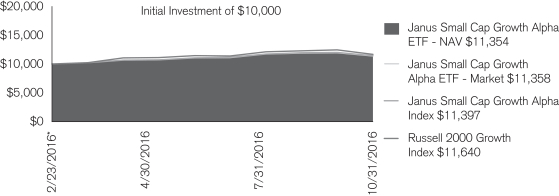

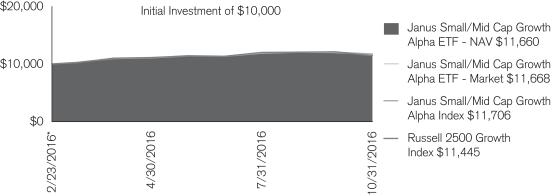

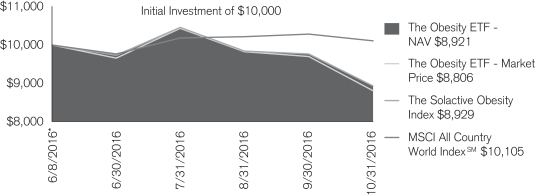

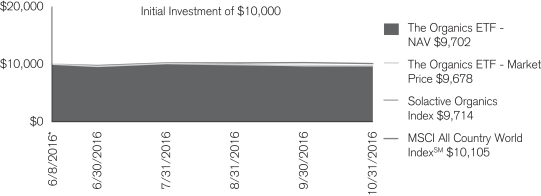

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the life of the Fund. Performance calculations are as of the end of each month. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | |

| Cumulative Total Return for the period ended October 31, 2016 |

| | | Since

Inception* |

Janus Small Cap Growth Alpha ETF – NAV | | 13.54% |

Janus Small Cap Growth Alpha ETF – Market Price | | 13.58% |

Janus Small Cap Growth Alpha Index | | 13.97% |

Russell 2000® Growth Index | | 16.40% |

The estimated annual gross expense ratio per the prospectus dated February 22, 2016 is 0.50%.

| * | The Fund commenced operations on February 23, 2016. |

The inception date of Janus Small Cap Growth Alpha Index (JSMLID) is December 31, 2015.

Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. Investment returns and principal value will vary; there may be a gain or loss when shares are sold. For the most recent month-end performance call 877.33JANUS (52687) or visit janus.com/ETFs.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Market returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. Eastern time (when NAV is normally determined for most ETFs), and do not represent the returns you would receive if you traded shares at other times. Ordinary brokerage commissions apply and will reduce returns.

ETF shares are not individually redeemable and owners of the shares may acquire those shares from the Fund and tender those shares for redemption to the Fund in creation units only.

There are risks involved with investing, including possible loss of principal. Performance depends upon the investment performance of the underlying index in which it invests. Smaller capitalization companies may be less stable and more susceptible to adverse developments, and their securities may be more volatile and less liquid than larger capitalization companies.

There is no assurance that the rules-based proprietary index methodology will select securities that individually, or in the aggregate, outperform the broader small-capitalization universes.

The ETF is new and has less than one year of operating history.

Returns include reinvestment of dividends and capital gains.

Janus Small Cap Alpha Index is designed to systematically identify small-capitalization stocks that are poised for sustainable growth (Smart Growth®) by evaluating each company’s performance in three critical areas: growth, profitability, and capital efficiency. Janus uses a proprietary methodology to score stocks based on a wide range of fundamental measures and selects the top 10% (“top-tier”) of such eligible stocks. Stocks are market cap-weighted within sectors with a 3% maximum position size; sectors are weighted to align with the Janus Venture Fund. Janus Mutual funds distributed by Janus Distributors LLC.

| | |

| | Janus Detroit Street Trust ½ 3 |

Janus Small Cap Growth Alpha ETF (unaudited)

Performance

Russell 2000® Growth Index measures the performance of those Russell 2000® companies with higher price-to-book ratios and higher forecasted growth values.

One cannot invest directly in an index. Index performance does not reflect Fund performance. Holdings subject to change.

The index provider is Janus Index & Calculation Services LLC (“Janus Index”). Janus Index maintains the indices and calculates the index levels and performance shown or discussed, but does not manage actual assets. Janus Index receives compensation in connection with licensing its indices to third parties including the provision of any related data.

Janus Capital Management LLC is the investment adviser and ALPS Distributors, Inc. is the distributor. ALPS is not affiliated with Janus.

Janus Small Cap Growth Alpha ETF (unaudited)

Disclosure of Fund Expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include creation and redemption fees or brokerage charges and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other ETFs. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based upon an investment of $1,000 invested at the beginning of the period and held for the six-months indicated, unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based upon the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to determine the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Additionally, for an analysis of the fees associated with an investment or other similar funds, please visit www.finra.org/fundanalyzer.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as creation and redemption fees, or brokerage charges. These fees are fully described in the Fund’s prospectus. Therefore, the hypothetical examples are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | | Hypothetical

(5% return before expenses) | |

Beginning

Account

Value

(5/1/16) | | Ending

Account

Value

(10/31/16) | | | Expenses

Paid During

Period

(5/1/16 - 10/31/16)† | | | Beginning

Account

Value

(5/1/16) | | | Ending

Account

Value

(10/31/16) | | | Expenses

Paid During

Period

(5/1/16 - 10/31/16)† | | | Net Annualized

Expense Ratio

(5/1/16 - 10/31/16) | |

| $1,000.00 | | $ | 1,061.60 | | | $ | 2.59 | | | $ | 1,000.00 | | | $ | 1,022.62 | | | $ | 2.54 | | | | 0.50% | |

| † | Expenses Paid During Period is equal to the Net Annualized Expense Ratio multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

| | |

| | Janus Detroit Street Trust ½ 5 |

Janus Small Cap Growth Alpha ETF

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Janus Detroit Street Trust and Shareholders of Janus Small Cap Growth Alpha ETF:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Janus Small Cap Growth Alpha ETF (one of the funds constituting Janus Detroit Street Trust, hereafter referred to as the “Fund”) at October 31, 2016, and the results of its operations, the changes in its net assets and the financial highlights for the period February 23, 2016 (commencement of operations) through October 31, 2016, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at October 31, 2016 by correspondence with the custodian, provides a reasonable basis for our opinion.

Denver, Colorado

December 21, 2016

Janus Small Cap Growth Alpha ETF

Schedule of Investments

October 31, 2016

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks – 99.9% | | | | | | |

| Aerospace & Defense – 2.1% | | | | | | |

Astronics Corp.* | | | 413 | | | | $15,289 | |

HEICO Corp. | | | 840 | | | | 56,750 | |

TASER International, Inc.* | | | 728 | | | | 16,293 | |

| | | | | | | | |

| | | | | | | 88,332 | |

| Air Freight & Logistics – 0.0% | | | | | | |

Radiant Logistics, Inc.* | | | 675 | | | | 1,688 | |

| Airlines – 0.7% | | | | | | |

Virgin America, Inc.* | | | 524 | | | | 28,479 | |

| Auto Components – 2.1% | | | | | | |

Dorman Products, Inc.* | | | 500 | | | | 32,120 | |

Drew Industries, Inc. | | | 355 | | | | 31,790 | |

Fox Factory Holding Corp.* | | | 538 | | | | 11,675 | |

Gentherm, Inc.* | | | 526 | | | | 14,807 | |

Strattec Security Corp. | | | 51 | | | | 1,810 | |

| | | | | | | | |

| | | | | | | 92,202 | |

| Beverages – 0.6% | | | | | | |

Boston Beer Co., Inc. - Class A* | | | 69 | | | | 10,712 | |

National Beverage Corp.* | | | 357 | | | | 16,865 | |

| | | | | | | | |

| | | | | | | 27,577 | |

| Biotechnology – 3.1% | | | | | | |

Acorda Therapeutics, Inc.* | | | 1,051 | | | | 18,603 | |

BioSpecifics Technologies Corp.* | | | 160 | | | | 6,942 | |

Enanta Pharmaceuticals, Inc.* | | | 434 | | | | 10,208 | |

Insys Therapeutics, Inc.* | | | 1,631 | | | | 17,631 | |

Ligand Pharmaceuticals, Inc.* | | | 475 | | | | 45,472 | |

MiMedx Group, Inc.* | | | 2,507 | | | | 22,337 | |

PDL BioPharma, Inc. | | | 3,771 | | | | 12,143 | |

| | | | | | | | |

| | | | | | | 133,336 | |

| Building Products – 1.5% | | | | | | |

AAON, Inc. | | | 733 | | | | 21,954 | |

CSW Industrials, Inc.* | | | 217 | | | | 6,716 | |

Patrick Industries, Inc.* | | | 212 | | | | 12,158 | |

Trex Co., Inc.* | | | 406 | | | | 21,847 | |

| | | | | | | | |

| | | | | | | 62,675 | |

| Capital Markets – 1.2% | | | | | | |

Artisan Partners Asset Management, Inc. - Class A | | | 347 | | | | 9,022 | |

Diamond Hill Investment Group, Inc. | | | 28 | | | | 5,096 | |

HFF, Inc. - Class A | | | 315 | | | | 8,388 | |

Houlihan Lokey, Inc. | | | 100 | | | | 2,437 | |

KCG Holdings, Inc. - Class A* | | | 714 | | | | 9,111 | |

Moelis & Co. - Class A | | | 170 | | | | 4,318 | |

Westwood Holdings Group, Inc. | | | 73 | | | | 3,763 | |

WisdomTree Investments, Inc. | | | 1,129 | | | | 9,687 | |

| | | | | | | | |

| | | | | | | 51,822 | |

| Chemicals – 1.8% | | | | | | |

Balchem Corp. | | | 533 | | | | 40,455 | |

Chase Corp. | | | 156 | | | | 10,662 | |

Core Molding Technologies, Inc.* | | | 131 | | | | 2,282 | |

Innospec, Inc. | | | 404 | | | | 24,341 | |

| | | | | | | | |

| | | | | | | 77,740 | |

| Commercial Banks – 2.7% | | | | | | |

Allegiance Bancshares, Inc.* | | | 106 | | | | 2,793 | |

Bankwell Financial Group, Inc. | | | 62 | | | | 1,529 | |

Commerce Union Bancshares, Inc. | | | 63 | | | | 1,276 | |

CU Bancorp* | | | 146 | | | | 3,431 | |

Eagle Bancorp, Inc.* | | | 278 | | | | 13,664 | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements.

| | |

| | Janus Detroit Street Trust ½ 7 |

Janus Small Cap Growth Alpha ETF

Schedule of Investments

October 31, 2016

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks – (continued) | | | | | | |

| Commercial Banks – (continued) | | | | | | |

Fidelity Southern Corp. | | | 215 | | | | $ 3,919 | |

First Business Financial Services, Inc. | | | 72 | | | | 1,357 | |

First Foundation, Inc.* | | | 134 | | | | 3,315 | |

Franklin Financial Network, Inc.* | | | 88 | | | | 2,869 | |

Hilltop Holdings, Inc.* | | | 814 | | | | 20,106 | |

Home BancShares, Inc. | | | 1,161 | | | | 24,973 | |

Live Oak Bancshares, Inc. | | | 244 | | | | 3,892 | |

Old Line Bancshares, Inc. | | | 90 | | | | 1,772 | |

Opus Bank | | | 230 | | | | 4,612 | |

People’s Utah Bancorp | | | 147 | | | | 2,947 | |

ServisFirst Bancshares, Inc. | | | 217 | | | | 11,748 | |

Stonegate Bank | | | 106 | | | | 3,672 | |

TriCo Bancshares | | | 189 | | | | 4,975 | |

Triumph Bancorp, Inc.* | | | 150 | | | | 2,790 | |

| | | | | | | | |

| | | | | | | 115,640 | |

| Commercial Services & Supplies – 2.2% | | | | | | |

Rollins, Inc. | | | 3,023 | | | | 93,169 | |

| Communications Equipment – 5.7% | | | | | | |

Arista Networks, Inc.* | | | 1,635 | | | | 138,566 | |

Clearfield, Inc.* | | | 333 | | | | 5,578 | |

Ubiquiti Networks, Inc.* | | | 1,932 | | | | 101,295 | |

| | | | | | | | |

| | | | | | | 245,439 | |

| Computers & Peripherals – 0.8% | | | | | | |

CPI Card Group, Inc. | | | 1,304 | | | | 7,172 | |

Super Micro Computer, Inc.* | | | 1,149 | | | | 27,231 | |

| | | | | | | | |

| | | | | | | 34,403 | |

| Construction & Engineering – 0.4% | | | | | | |

Argan, Inc. | | | 206 | | | | 11,711 | |

NV5 Global, Inc.* | | | 144 | | | | 4,119 | |

| | | | | | | | |

| | | | | | | 15,830 | |

| Consumer Finance – 0.7% | | | | | | |

Credit Acceptance Corp.* | | | 168 | | | | 30,929 | |

| Distributors – 0.5% | | | | | | |

Core-Mark Holding Co., Inc. | | | 668 | | | | 23,614 | |

| Diversified Consumer Services – 0.7% | | | | | | |

Grand Canyon Education, Inc.* | | | 680 | | | | 29,675 | |

| Diversified Financial Services – 0.6% | | | | | | |

Morningstar, Inc. | | | 356 | | | | 25,144 | |

| Electrical Equipment – 0.6% | | | | | | |

AZZ, Inc. | | | 359 | | | | 19,117 | |

Thermon Group Holdings, Inc.* | | | 447 | | | | 8,193 | |

| | | | | | | | |

| | | | | | | 27,310 | |

| Electronic Equipment & Instruments – 5.1% | | | | | | |

Fitbit, Inc. - Class A * | | | 3,875 | | | | 51,383 | |

Mesa Laboratories, Inc. | | | 87 | | | | 10,983 | |

Methode Electronics, Inc. | | | 872 | | | | 27,206 | |

OSI Systems, Inc.* | | | 448 | | | | 31,418 | |

SYNNEX Corp. | | | 939 | | | | 96,285 | |

| | | | | | | | |

| | | | | | | 217,275 | |

| Energy Equipment & Services – 0.3% | | | | | | |

Atwood Oceanics, Inc. | | | 435 | | | | 3,319 | |

Dril-Quip, Inc.* | | | 252 | | | | 11,970 | |

| | | | | | | | |

| | | | | | | 15,289 | |

| Equity Real Estate Investment Trusts (REITs) – 1.1% | | | | | | |

Chesapeake Lodging Trust | | | 497 | | | | 10,790 | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements.

Janus Small Cap Growth Alpha ETF

Schedule of Investments

October 31, 2016

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks – (continued) | | | | | | |

| Equity Real Estate Investment Trusts (REITs) – (continued) | | | | | | |

CoreSite Realty Corp. | | | 281 | | | | $ 20,721 | |

Pebblebrook Hotel Trust | | | 596 | | | | 14,471 | |

Sutherland Asset Management | | | 73 | | | | 978 | |

| | | | | | | | |

| | | | | | | 46,960 | |

| Food & Staples Retailing – 0.9% | | | | | | |

Natural Grocers by Vitamin Cottage, Inc.* | | | 173 | | | | 2,055 | |

PriceSmart, Inc. | | | 233 | | | | 21,191 | |

United Natural Foods, Inc.* | | | 387 | | | | 16,154 | |

| | | | | | | | |

| | | | | | | 39,400 | |

| Food Products – 1.8% | | | | | | |

Amplify Snack Brands, Inc.* | | | 574 | | | | 8,317 | |

Blue Buffalo Pet Products, Inc.* | | | 1,507 | | | | 37,856 | |

Cal-Maine Foods, Inc. | | | 336 | | | | 12,986 | |

J&J Snack Foods Corp. | | | 143 | | | | 17,468 | |

| | | | | | | | |

| | | | | | | 76,627 | |

| Health Care Equipment & Supplies – 6.5% | | | | | | |

Abaxis, Inc. | | | 513 | | | | 24,491 | |

Anika Therapeutics, Inc.* | | | 337 | | | | 14,949 | |

Cantel Medical Corp. | | | 950 | | | | 67,668 | |

Entellus Medical, Inc.* | | | 429 | | | | 8,773 | |

Glaukos Corp.* | | | 752 | | | | 25,117 | |

Globus Medical, Inc. - Class A * | | | 1,635 | | | | 36,183 | |

Inogen, Inc.* | | | 458 | | | | 24,581 | |

Neogen Corp.* | | | 856 | | | | 45,103 | |

Zeltiq Aesthetics, Inc.* | | | 903 | | | | 29,889 | |

| | | | | | | | |

| | | | | | | 276,754 | |

| Health Care Providers & Services – 4.3% | | | | | | |

Aceto Corp. | | | 675 | | | | 12,373 | |

Air Methods Corp.* | | | 868 | | | | 22,959 | |

Chemed Corp. | | | 369 | | | | 52,184 | |

Diplomat Pharmacy, Inc.* | | | 1,512 | | | | 35,033 | |

National Research Corp. - Class A | | | 657 | | | | 10,085 | |

Premier, Inc. - Class A * | | | 1,080 | | | | 34,387 | |

US Physical Therapy, Inc. | | | 285 | | | | 16,216 | |

| | | | | | | | |

| | | | | | | 183,237 | |

| Health Care Technology – 3.0% | | | | | | |

Evolent Health, Inc. - Class A * | | | 972 | | | | 20,461 | |

Inovalon Holdings, Inc. - Class A * | | | 1,544 | | | | 20,998 | |

Veeva Systems, Inc. - Class A * | | | 2,204 | | | | 85,625 | |

| | | | | | | | |

| | | | | | | 127,084 | |

| Hotels, Restaurants & Leisure – 4.0% | | | | | | |

BJ’s Restaurants, Inc.* | | | 349 | | | | 12,599 | |

Cheesecake Factory, Inc. | | | 694 | | | | 36,914 | |

Chuy’s Holdings, Inc.* | | | 242 | | | | 6,873 | |

Dave & Buster’s Entertainment, Inc.* | | | 603 | | | | 24,934 | |

Fiesta Restaurant Group, Inc.* | | | 388 | | | | 10,243 | |

Habit Restaurants, Inc. - Class A * | | | 259 | | | | 3,665 | |

Lindblad Expeditions Holdings, Inc.* | | | 662 | | | | 5,422 | |

Nathan’s Famous, Inc.* | | | 60 | | | | 3,198 | |

Papa John’s International, Inc. | | | 534 | | | | 40,290 | |

Popeyes Louisiana Kitchen, Inc.* | | | 307 | | | | 16,388 | |

Wingstop, Inc. | | | 415 | | | | 11,105 | |

| | | | | | | | |

| | | | | | | 171,631 | |

| Household Durables – 1.7% | | | | | | |

Bassett Furniture Industries, Inc. | | | 157 | | | | 3,603 | |

GoPro, Inc. - Class A * | | | 1,485 | | | | 18,978 | |

Installed Building Products, Inc.* | | | 454 | | | | 15,005 | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements.

| | |

| | Janus Detroit Street Trust ½ 9 |

Janus Small Cap Growth Alpha ETF

Schedule of Investments

October 31, 2016

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks – (continued) | | | | | | |

| Household Durables – (continued) | | | | | | |

LGI Homes, Inc.* | | | 303 | | | | $ 9,017 | |

New Home Co., Inc.* | | | 299 | | | | 2,996 | |

Taylor Morrison Home Corp. - Class A* | | | 438 | | | | 7,472 | |

Universal Electronics, Inc.* | | | 209 | | | | 14,662 | |

| | | | | | | | |

| | | | | | | 71,733 | |

| Insurance – 1.4% | | | | | | |

AmTrust Financial Services, Inc. | | | 1,411 | | | | 37,236 | |

Atlas Financial Holdings, Inc.* | | | 99 | | | | 1,698 | |

Federated National Holding Co. | | | 114 | | | | 2,042 | |

HCI Group, Inc. | | | 86 | | | | 2,331 | |

Heritage Insurance Holdings, Inc. | | | 242 | | | | 2,853 | |

State National Cos., Inc. | | | 350 | | | | 3,581 | |

United Insurance Holdings Corp. | | | 180 | | | | 2,610 | |

Universal Insurance Holdings, Inc. | | | 290 | | | | 6,177 | |

| | | | | | | | |

| | | | | | | 58,528 | |

| Internet Software & Services – 3.5% | | | | | | |

GrubHub, Inc.* | | | 2,012 | | | | 76,677 | |

GTT Communications, Inc.* | | | 875 | | | | 19,688 | |

Match Group, Inc.* | | | 987 | | | | 17,825 | |

NIC, Inc. | | | 1,558 | | | | 35,756 | |

| | | | | | | | |

| | | | | | | 149,946 | |

| IT Services – 5.9% | | | | | | |

Blackhawk Network Holdings, Inc.* | | | 1,330 | | | | 45,818 | |

Cardtronics PLC - Class A* | | | 1,068 | | | | 53,400 | |

ExlService Holdings, Inc.* | | | 791 | | | | 34,828 | |

Luxoft Holding, Inc.* | | | 502 | | | | 26,606 | |

NeuStar, Inc. - Class A* | | | 1,287 | | | | 28,893 | |

Syntel, Inc. | | | 3,059 | | | | 61,486 | |

| | | | | | | | |

| | | | | | | 251,031 | |

| Leisure Equipment & Products – 0.7% | | | | | | |

Malibu Boats, Inc. - Class A* | | | 259 | | | | 3,800 | |

MCBC Holdings, Inc. | | | 268 | | | | 2,985 | |

Smith & Wesson Holding Corp.* | | | 810 | | | | 21,408 | |

| | | | | | | | |

| | | | | | | 28,193 | |

| Life Sciences Tools & Services – 2.5% | | | | | | |

Cambrex Corp.* | | | 732 | | | | 29,500 | |

INC Research Holdings, Inc. - Class A* | | | 1,216 | | | | 55,571 | |

Luminex Corp.* | | | 992 | | | | 20,663 | |

| | | | | | | | |

| | | | | | | 105,734 | |

| Machinery – 0.9% | | | | | | |

Greenbrier Cos., Inc. | | | 391 | | | | 12,317 | |

Lydall, Inc.* | | | 237 | | | | 11,080 | |

Proto Labs, Inc.* | | | 366 | | | | 16,360 | |

| | | | | | | | |

| | | | | | | 39,757 | |

| Media – 0.2% | | | | | | |

New Media Investment Group, Inc. | | | 648 | | | | 9,331 | |

| Mortgate Real Estate Investment Trusts (REITs) – 0.1% | | | | | | |

Cherry Hill Mortgage Investment Corp. | | | 62 | | | | 1,002 | |

Owens Realty Mortgage, Inc. | | | 85 | | | | 1,551 | |

| | | | | | | | |

| | | | | | | 2,553 | |

| Oil, Gas & Consumable Fuels – 1.3% | | | | | | |

Cheniere Energy Partners LP Holdings LLC | | | 1,554 | | | | 30,987 | |

Evolution Petroleum Corp. | | | 221 | | | | 1,702 | |

RSP Permian, Inc.* | | | 682 | | | | 24,620 | |

| | | | | | | | |

| | | | | | | 57,309 | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements.

Janus Small Cap Growth Alpha ETF

Schedule of Investments

October 31, 2016

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks – (continued) | | | | | | |

| Paper & Forest Products – 0.7% | | | | | | |

KapStone Paper and Packaging Corp. | | | 1,628 | | | | $ 29,532 | |

| Personal Products – 0.3% | | | | | | |

Natural Health Trends Corp. | | | 87 | | | | 2,030 | |

USANA Health Sciences, Inc.* | | | 92 | | | | 11,822 | |

| | | | | | | | |

| | | | | | | 13,852 | |

| Pharmaceuticals – 2.5% | | | | | | |

Akorn, Inc.* | | | 2,871 | | | | 68,760 | |

Collegium Pharmaceutical, Inc.* | | | 536 | | | | 8,024 | |

Lannett Co., Inc.* | | | 840 | | | | 18,396 | |

Phibro Animal Health Corp. - Class A | | | 422 | | | | 10,951 | |

| | | | | | | | |

| | | | | | | 106,131 | |

| Professional Services – 2.4% | | | | | | |

Barrett Business Services, Inc. | | | 100 | | | | 4,483 | |

Exponent, Inc. | | | 360 | | | | 20,610 | |

Insperity, Inc. | | | 296 | | | | 22,259 | |

RPX Corp.* | | | 686 | | | | 6,695 | |

TriNet Group, Inc.* | | | 973 | | | | 18,263 | |

WageWorks, Inc.* | | | 507 | | | | 29,888 | |

| | | | | | | | |

| | | | | | | 102,198 | |

| Real Estate Management & Development – 0.2% | | | | | | |

Marcus & Millichap, Inc.* | | | 311 | | | | 7,287 | |

| Road & Rail – 2.8% | | | | | | |

AMERCO | | | 272 | | | | 87,690 | |

Knight Transportation, Inc. | | | 1,108 | | | | 32,409 | |

| | | | | | | | |

| | | | | | | 120,099 | |

| Semiconductors & Semiconductor Equipment – 1.1% | | | | | | |

Ambarella, Inc.* | | | 776 | | | | 47,623 | |

| Software – 10.8% | | | | | | |

ACI Worldwide, Inc.* | | | 2,767 | | | | 50,138 | |

Ebix, Inc. | | | 767 | | | | 42,952 | |

Ellie Mae, Inc.* | | | 788 | | | | 83,441 | |

Fleetmatics Group PLC* | | | 926 | | | | 55,467 | |

Globant SA* | | | 817 | | | | 35,540 | |

Paycom Software, Inc.* | | | 1,413 | | | | 73,094 | |

Pegasystems, Inc. | | | 1,802 | | | | 55,682 | |

Qualys, Inc.* | | | 835 | | | | 31,104 | |

Rapid7, Inc.* | | | 994 | | | | 14,244 | |

Tangoe, Inc.* | | | 931 | | | | 7,988 | |

VASCO Data Security International, Inc.* | | | 949 | | | | 13,049 | |

| | | | | | | | |

| | | | | | | 462,699 | |

| Specialty Retail – 2.6% | | | | | | |

Boot Barn Holdings, Inc.* | | | 381 | | | | 4,877 | |

Five Below, Inc.* | | | 790 | | | | 29,688 | |

Francesca’s Holdings Corp.* | | | 579 | | | | 9,304 | |

Genesco, Inc.* | | | 299 | | | | 16,086 | |

Hibbett Sports, Inc.* | | | 323 | | | | 12,549 | |

Lithia Motors, Inc. - Class A | | | 338 | | | | 28,994 | |

Sportsman’s Warehouse Holdings, Inc.* | | | 610 | | | | 5,612 | |

Winmark Corp. | | | 59 | | | | 6,310 | |

| | | | | | | | |

| | | | | | | 113,420 | |

| Textiles, Apparel & Luxury Goods – 2.5% | | | | | | |

Columbia Sportswear Co. | | | 1,006 | | | | 56,980 | |

G-III Apparel Group Ltd.* | | | 660 | | | | 17,239 | |

Steven Madden Ltd.* | | | 884 | | | | 29,526 | |

Superior Uniform Group, Inc. | | | 208 | | | | 3,700 | |

| | | | | | | | |

| | | | | | | 107,445 | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements.

| | |

| | Janus Detroit Street Trust ½ 11 |

Janus Small Cap Growth Alpha ETF

Schedule of Investments

October 31, 2016

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks – (continued) | | | | | | |

| Thrifts & Mortgage Finance – 0.8% | | | | | | |

BofI Holding, Inc.* | | | 523 | | | | $ 9,743 | |

Essent Group Ltd.* | | | 770 | | | | 20,359 | |

HomeStreet, Inc.* | | | 205 | | | | 5,648 | |

| | | | | | | | |

| | | | | | | | 35,750 | |

Total Common Stocks (cost $4,425,285) | | | | | | | 4,279,412 | |

| Investment Companies – 0.1% | | | | | | |

State Street Institutional U.S. Government Money Market Fund (cost $3,870) | | | 3,870 | | | | 3,870 | |

Total Investments (total cost $4,429,155) – 100.0% | | | | | | | 4,283,282 | |

Liabilities, net of Cash, Receivables, and Other Assets – (0.0)% | | | | | | | (1,480) | |

Net Assets – 100% | | | | | | | $4,281,802 | |

Summary of Investments by Country – (Long Positions) (unaudited)

| | | | | | | | |

| Country | | Value | | | % of

Investment

Securities | |

| United States | | | $4,112,269 | | | | 96.0 | % |

| Ireland | | | 55,467 | | | | 1.3 | |

| United Kingdom | | | 53,400 | | | | 1.3 | |

| Luxembourg | | | 35,540 | | | | 0.8 | |

Switzerland | | | 26,606 | | | | 0.6 | |

Total | | | $4,283,282 | | | | 100.0 | % |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements.

Janus Small Cap Growth Alpha ETF

Notes to Schedule of Investments and Other Information

| | |

| LLC | | Limited Liability Company |

| |

| LP | | Limited Partnership |

| |

| PLC | | Public Limited Company |

| * | Non-income producing security. |

The following is a summary of the inputs that were used to value the Fund’s investments in securities and other financial instruments as of October 31, 2016. See Notes to Financial Statements for more information.

Valuation Inputs Summary

| | | | | | | | | | | | |

| | | Level 1 -

Quoted Prices | | | Level 2 -

Other Significant

Observable Inputs | | | Level 3 -

Significant

Unobservable Inputs | |

Assets | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | |

Common Stocks | | $ | 4,279,412 | | | $ | — | | | $ | — | |

Investment Companies | | | — | | | | 3,870 | | | | — | |

| | | | |

Total Assets | | $ | 4,279,412 | | | $ | 3,870 | | | $ | — | |

| | |

| | Janus Detroit Street Trust ½ 13 |

Janus Small Cap Growth Alpha ETF

Statement of Assets and Liabilities

October 31, 2016

| | | | |

Assets: | | | | |

Investments, at cost | | $ | 4,429,155 | |

Investments, at value | | | 4,283,282 | |

Receivables: | | | | |

Dividends | | | 384 | |

Total Assets | | | 4,283,666 | |

Liabilities: | | | | |

Payables: | | | | |

Management fees | | | 1,864 | |

Total Liabilities | | | 1,864 | |

Net Assets | | $ | 4,281,802 | |

Net Assets Consists of: | | | | |

Capital (par value and paid-in surplus) | | $ | 4,514,252 | |

Undistributed net investment income/(loss) | | | 23,855 | |

Undistributed net realized gain/(loss) from investments and foreign currency transactions | | | (110,432) | |

Unrealized net appreciation/(depreciation) on investments and foreign currency translations | | | (145,873) | |

Total Net Assets | | $ | 4,281,802 | |

Net Assets | | $ | 4,281,802 | |

Shares outstanding, $0.001 Par Value (unlimited shares authorized) | | | 152,000 | |

Net Asset Value Per Share | | $ | 28.17 | |

See Notes to Financial Statements.

Janus Small Cap Growth Alpha ETF

Statement of Operations

For the period ended October 31, 2016(1)

| | | | |

Investment Income: | | | | |

Dividends | | $ | 41,792 | |

Foreign tax withheld | | | (15) | |

Total Investment Income | | | 41,777 | |

Expenses: | | | | |

Management fees | | | 11,160 | |

Total Expenses | | | 11,160 | |

Net Investment Income/(Loss) | | | 30,617 | |

Net Realized Gain/(Loss) on Investments: | | | | |

Investments and foreign currency transactions | | $ | 428,953 | |

Total Net Realized Gain/(Loss) on Investments | | $ | 428,953 | |

Change in Unrealized Net Appreciation/Depreciation: | | | | |

Investments and foreign currency translations | | | (145,873) | |

Total Change in Unrealized Net Appreciation/Depreciation | | $ | (145,873) | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | $ | 313,697 | |

| (1) | Period from February 23, 2016 (commencement of operations) through October 31, 2016. |

See Notes to Financial Statements.

| | |

| | Janus Detroit Street Trust ½ 15 |

Janus Small Cap Growth Alpha ETF

Statement of Changes in Net Assets

| | | | |

| | | Period Ended October 31, 2016(1) | |

Operations: | | | | |

Net investment income/(loss) | | $ | 30,617 | |

Net realized gain/(loss) on investments | | | 428,953 | |

Change in unrealized net appreciation/depreciation | | | (145,873) | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | | 313,697 | |

Dividends and Distributions to Shareholders: | | | | |

Dividends from Net Investment Income | | | (2,185) | |

Capital Share Transactions | | | 3,970,290 | |

Net Increase/(Decrease) in Net Assets | | | 4,281,802 | |

Net Assets: | | | | |

Beginning of period | | | — | |

End of period | | $ | 4,281,802 | |

| |

| | | | |

Undistributed Net Investment Income/(Loss) | | $ | 23,855 | |

| (1) | Period from February 23, 2016 (commencement of operations) through October 31, 2016. |

See Notes to Financial Statements.

Janus Small Cap Growth Alpha ETF

Financial Highlights

| | | | | | |

| For a share outstanding during the period ended October 31 | | 2016(1) | |

| | Net Asset Value, Beginning of Period | | | $24.83 | |

| | Income/(Loss) from Investment Operations: | | | | |

| | Net investment income/(loss)(2) | | | 0.26 | |

| | Net realized and unrealized gain/(loss) | | | 3.10 | |

| | Total from Investment Operations | | | 3.36 | |

| | Less Dividends and Distributions: | | | | |

| | Dividends (from net investment income) | | | (0.02) | |

| | Total Dividends and Distributions | | | (0.02) | |

| | Net Asset Value, End of Period | | | $28.17 | |

| | Total Return* | | | 13.54% | |

| | Net assets, End of year (in thousands) | | | $4,282 | |

| | Average Net Assets for the Period (in thousands) | | | $3,247 | |

| | Ratios to Average Net Assets**: | | | | |

| | Ratio of Gross Expenses | | | 0.50% | |

| | Ratio of Net Investment Income/(Loss) | | | 1.37% | |

| | Portfolio Turnover Rate(3) | | | 86% | |

| * | Total return not annualized for periods of less than one full year. |

| ** | Annualized for periods of less than one full year. |

| (1) | Period from February 23, 2016 (commencement of operations) through October 31, 2016. |

| (2) | Per share amounts are calculated based on average shares outstanding during the year or period. |

| (3) | Portfolio turnover rate excludes securities received or delivered from in-kind processing of creation or redemptions. |

See Notes to Financial Statements.

| | |

| | Janus Detroit Street Trust ½ 17 |

Janus Small Cap Growth Alpha ETF

Notes to Financial Statements

1. Organization and Significant Accounting Policies

Janus Small Cap Growth Alpha ETF (the “Fund”) is a series fund. The Fund is part of Janus Detroit Street Trust (the “Trust”), which is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and therefore has applied the specialized accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946. The financial statements include information for the period from February 23, 2016 (commencement of operations) through October 31, 2016. The Trust offers eight Funds each of which represent shares of beneficial interest in a separate portfolio of securities and other assets with its own objective and policies. The Fund seeks investment results that correspond generally, before fees and expenses, to the performance of its underlying index, the Janus Small Cap Growth Alpha Index (the “Underlying Index”). The Fund is classified as diversified, as defined in the 1940 Act.

Unlike shares of traditional mutual funds, shares of the Fund are not individually redeemable and may only be purchased or redeemed directly from the Fund at net asset value (“NAV”) in large increments called “Creation Units” (50,000 or more shares per Creation Unit) through certain participants, known as “Authorized Participants.” The Fund will issue or redeem Creation Units in exchange for portfolio securities included in the Fund’s Underlying Index and/or cash. Except when aggregated in Creation Units, Fund shares are not redeemable securities of the Fund. Shares of the Fund are listed and trade on The NASDAQ Stock Market LLC (“NASDAQ”) and individual investors can purchase or sell shares in much smaller increments and for cash in the secondary market through a broker. These transactions, which do not involve the Fund, are made at market prices that may vary throughout the day and differ from the Fund’s NAV. As a result, you may pay more than NAV (at a premium) when you purchase shares, and receive less than NAV (at a discount) when you sell shares, in the secondary market.

An Authorized Participant may hold of record more than 25% of the outstanding shares of the Fund. From time to time, Authorized Participants may be a beneficial and/or legal owner of the Fund, may be affiliated with an index provider, may be deemed to have control of the Fund and/or may be able to affect the outcome of matters presented for a vote of the shareholders of the Fund. Authorized Participants may execute an irrevocable proxy granting the Distributor or an affiliate of Janus Capital power to vote or abstain from voting such Authorized Participant’s beneficially or legally owned shares of the Fund. In such cases, the agent shall mirror vote (or abstain from voting) such shares in the same proportion as all other beneficial owners of the Fund.

The following accounting policies have been followed by the Fund and are in conformity with accounting principles generally accepted in the United States of America.

Investment Valuation

Securities held by the Fund are valued in accordance with policies and procedures established by and under the supervision of the Trustees (the “Valuation Procedures”). Equity securities traded on a domestic securities exchange are generally valued at the closing prices on the primary market or exchange on which they trade. If such price is lacking for the trading period immediately preceding the time of determination, such securities are valued at their current bid price. Equity securities that are traded on a foreign exchange are generally valued at the closing prices on such markets. In the event that there is no current trading volume on a particular security in such foreign exchange, the bid price from the primary exchange is generally used to value the security. Securities that are traded on the over-the-counter (“OTC”) markets are generally valued at their closing or latest bid prices as available. Foreign securities and currencies are converted to U.S. dollars using the applicable exchange rate in effect at the close of the New York Stock Exchange (“NYSE”). The Fund will determine the market value of individual securities held by it by using prices provided by one or more approved professional pricing services or, as needed, by obtaining market quotations from independent broker-dealers. Most debt securities are valued in accordance with the evaluated bid price supplied by the pricing service that is intended to reflect market value. The evaluated bid price supplied by the pricing service is an evaluation that may consider factors such as security prices, yields, maturities and ratings. Certain short-term securities maturing within 60 days or less may be evaluated and valued on an amortized cost basis provided that the amortized cost determined approximates market value. Securities for which market quotations or evaluated prices are not readily available or are deemed unreliable are valued at fair value determined in good faith under the Valuation Procedures. Circumstances in which fair value pricing may be utilized include, but are not limited to: (i) a significant event that may affect the securities of a single issuer, such as a merger, bankruptcy, or significant issuer-specific development; (ii) an event that may affect an entire market, such as a natural disaster or significant governmental action; (iii) a nonsignificant event such as a market closing early or not opening, or a security trading halt; and (iv) pricing of a nonvalued security and a restricted or nonpublic security. Special valuation considerations may apply with respect to “odd-lot” fixed-income transactions which, due to their

Janus Small Cap Growth Alpha ETF

Notes to Financial Statements

small size, may receive evaluated prices by pricing services which reflect a large block trade and not what actually could be obtained for the odd-lot position.

Valuation Inputs Summary

FASB ASC 820, Fair Value Measurements and Disclosures (“ASC 820”), defines fair value, establishes a framework for measuring fair value, and expands disclosure requirements regarding fair value measurements. This standard emphasizes that fair value is a market-based measurement that should be determined based on the assumptions that market participants would use in pricing an asset or liability and establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. These inputs are summarized into three broad levels:

Level 1 – Unadjusted quoted prices in active markets the Fund has the ability to access for identical assets or liabilities.

Level 2 – Observable inputs other than unadjusted quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Assets or liabilities categorized as Level 2 in the hierarchy generally include: debt securities fair valued in accordance with the evaluated bid or ask prices supplied by a pricing service; securities traded on OTC markets and listed securities for which no sales are reported that are fair valued at the latest bid price (or yield equivalent thereof) obtained from one or more dealers transacting in a market for such securities or by a pricing service approved by the Fund’s Trustees; and certain short-term debt securities with maturities of 60 days or less that are fair valued at amortized cost. Other securities that may be categorized as Level 2 in the hierarchy include, but are not limited to, preferred stocks, bank loans, swaps, investments in unregistered investment companies, options, and forward contracts.

Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available.

There have been no significant changes in valuation techniques used in valuing any such positions held by the Fund since the beginning of the fiscal year.

The inputs or methodology used for fair valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of inputs used as of October 31, 2016 to fair value the Fund’s investments in securities and other financial instruments is included in the “Valuation Inputs Summary” in the Notes to Schedule of Investments and Other Information.

There were no transfers between Level 1, Level 2 and Level 3 of the fair value hierarchy during the period. The Fund recognizes transfers between the levels as of the beginning of the fiscal year.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded as soon as the Fund is informed of the dividend, if such information is obtained subsequent to the ex-dividend date. Dividends from foreign securities may be subject to withholding taxes in foreign jurisdictions. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Indemnifications

In the normal course of business, the Fund may enter into contracts that contain provisions for indemnification of other parties against certain potential liabilities. The Fund’s maximum exposure under these arrangements is unknown, and would involve future claims that may be made against the Fund that have not yet occurred. Currently, the risk of material loss from such claims is considered remote.

| | |

| | Janus Detroit Street Trust ½ 19 |

Janus Small Cap Growth Alpha ETF

Notes to Financial Statements

Foreign Currency Translations

The Fund does not isolate that portion of the results of operations resulting from the effect of changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held at the date of the financial statements. Net unrealized appreciation or depreciation of investments and foreign currency translations arise from changes in the value of assets and liabilities, including investments in securities held at the date of the financial statements, resulting from changes in the exchange rates and changes in market prices of securities held.

Currency gains and losses are also calculated on payables and receivables that are denominated in foreign currencies. The payables and receivables are generally related to foreign security transactions and income translations.

Foreign currency-denominated assets and forward currency contracts may involve more risks than domestic transactions, including currency risk, counterparty risk, political and economic risk, regulatory risk and equity risk. Risks may arise from unanticipated movements in the value of foreign currencies relative to the U.S. dollar.

Dividends and Distributions

The Fund generally declares and distributes dividends of net investment income quarterly. Net realized capital gains (if any) are distributed annually. The Fund may treat a portion of the amount paid to redeem shares as a distribution of investment company taxable income and realized capital gains that are reflected in the NAV. This practice, commonly referred to as “equalization,” has no effect on the redeeming shareholder or a Fund’s total return, but may reduce the amounts that would otherwise be required to be paid as taxable dividends to the remaining shareholders. It is possible that the Internal Revenue Service (IRS) could challenge the Fund’s equalization methodology or calculations, and any such challenge could result in additional tax, interest, or penalties to be paid by the Fund.

The Fund may make certain investments in real estate investment trusts (“REITs”) which pay dividends to their shareholders based upon funds available from operations. It is quite common for these dividends to exceed the REITs’ taxable earnings and profits, resulting in the excess portion of such dividends being designated as a return of capital. If the Fund distributes such amounts, such distributions could constitute a return of capital to shareholders for federal income tax purposes.

Federal Income Taxes

The Fund intends to qualify as a regulated investment company and distribute all of its taxable income in accordance with the requirements of Subchapter M of the Internal Revenue Code. Management has analyzed the Fund’s tax positions taken for all open federal income tax years, generally a three-year period, and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

2. Other Investments and Strategies

Additional Investment Risk

The financial crisis in both the U.S. and global economies over the past several years has resulted, and may continue to result, in a significant decline in the value and liquidity of many securities of issuers worldwide in the equity and fixed income/credit markets. In response to the crisis, the United States and certain foreign governments, along with the U.S. Federal Reserve and certain foreign central banks, took steps to support the financial markets. The withdrawal of this support, a failure of measures put in place to respond to the crisis, or investor perception that such efforts were not sufficient could each negatively affect financial markets generally, and the value and liquidity of specific securities. In addition, policy and legislative changes in the United States and in other countries continue to impact many aspects of financial regulation. The effect of these changes on the markets, and the practical implications for market participants, including the Fund, may not be fully known for some time. As a result, it may also be unusually difficult to identify both investment risks and opportunities, which could limit or preclude the Fund’s ability to achieve its investment objective. Therefore, it is important to understand that the value of your investment may fall, sometimes sharply, and you could lose money.

The enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) provided for widespread regulation of financial institutions, consumer financial products and services, broker-dealers, OTC derivatives, investment advisers, credit rating agencies, and mortgage lending, which expanded federal oversight in the financial sector, including the investment management industry. Certain provisions of the Dodd-Frank Act remain pending and will be implemented through future rulemaking. Therefore, the ultimate impact of the Dodd-Frank Act and the regulations under the Dodd-Frank Act on the Fund and the investment management industry as a whole, is not yet certain.

Janus Small Cap Growth Alpha ETF

Notes to Financial Statements

A number of countries in the European Union (“EU”) have experienced, and may continue to experience, severe economic and financial difficulties. In particular, many EU nations are susceptible to economic risks associated with high levels of debt, notably due to investments in sovereign debt of countries such as Greece, Italy, Spain, Portugal, and Ireland. Many non-governmental issuers, and even certain governments, have defaulted on, or been forced to restructure, their debts. Many other issuers have faced difficulties obtaining credit or refinancing existing obligations. Financial institutions have in many cases required government or central bank support, have needed to raise capital, and/or have been impaired in their ability to extend credit. As a result, financial markets in the EU experienced extreme volatility and declines in asset values and liquidity. Responses to these financial problems by European governments, central banks, and others, including austerity measures and reforms, may not work, may result in social unrest, and may limit future growth and economic recovery or have other unintended consequences. Further defaults or restructurings by governments and others of their debt could have additional adverse effects on economies, financial markets, and asset valuations around the world. Greece, Ireland, and Portugal have already received one or more “bailouts” from other Eurozone member states, and it is unclear how much additional funding they will require or if additional Eurozone member states will require bailouts in the future. The risk of investing in securities in the European markets may also be heightened due to the referendum in which the United Kingdom voted to exit the EU (known as “Brexit”). One or more other countries may also abandon the euro and/ or withdraw from the EU, placing its currency and banking system in jeopardy.

Certain areas of the world have historically been prone to and economically sensitive to environmental events such as, but not limited to, hurricanes, earthquakes, typhoons, flooding, tidal waves, tsunamis, erupting volcanoes, wildfires or droughts, tornadoes, mudslides, or other weather-related phenomena. Such disasters, and the resulting physical or economic damage, could have a severe and negative impact on the Fund’s investment portfolio and, in the longer term, could impair the ability of issuers in which the Fund invests to conduct their businesses as they would under normal conditions. Adverse weather conditions may also have a particularly significant negative effect on issuers in the agricultural sector and on insurance companies that insure against the impact of natural disasters.

Real Estate Investing

The Fund may invest in equity securities of real estate-related companies to the extent such securities are included in the Underlying Index. Such companies may include those in the real estate industry or real estate-related industries. These securities may include common stocks, preferred stocks, and other equity securities, including, but not limited to, mortgage-backed securities, real estate-backed securities, securities of REITs and similar REIT-like entities. A REIT is a trust that invests in real estate-related projects, such as properties, mortgage loans, and construction loans. REITs are generally categorized as equity, mortgage, or hybrid REITs. A REIT may be listed on an exchange or traded OTC.

3. Investment Advisory Agreements and Other Transactions with Affiliates

Under its unitary fee structure, the Fund pays Janus Capital Management LLC (“Janus Capital” or “Janus”) a management fee in return for providing certain investment advisory, supervisory, and administrative services to the Fund, including the costs of transfer agency, custody, fund administration, legal, audit, and other services. Janus Capital’s fee structure is designed to pay substantially all of the Fund’s expenses. However, the Fund bears other expenses which are not covered under the management fee which may vary and affect the total level of expenses paid by shareholders, such as distribution fees (if any), brokerage expenses or commissions, interest, dividends, taxes, litigation expenses, acquired fund fees and expenses (if any), and extraordinary expenses. The Fund’s management fee is calculated daily and paid monthly. The Fund’s contractual management fee rate (expressed as an annual rate) is 0.50% of the Fund’s average daily net assets.

State Street Bank and Trust Company (“State Street”) provides certain fund administration services to the Fund, including services related to the Fund’s accounting, including calculating the daily NAV, audit, tax, and reporting obligations, pursuant to an agreement with Janus Capital, on behalf of the Fund. As compensation for such services, Janus Capital pays State Street a fee based on a percentage of the Fund’s assets, with a minimum flat fee, for certain services. Janus Capital serves as administrator to the Fund, providing oversight and coordination of the Fund’s service providers, recordkeeping and other administrative services. Janus Capital does not receive any additional compensation, beyond the unitary fee, for serving as administrator. State Street also serves as transfer agent for the shares of the Fund.

The Trust has adopted a Distribution and Servicing Plan for shares of the Fund pursuant to Rule 12b-1 under the 1940 Act (the “Plan”). The Plan permits compensation in connection with the distribution and marketing of Fund shares and/or the provision of certain shareholder services. The Plan permits the Fund to pay ALPS Distributors, Inc. (the “Distributor”) or its designee, a fee for the sale and distribution and/or shareholder servicing of the shares at an annual rate of up to 0.25% of average daily net assets of the Fund. However, the Trustees have determined not to authorize payment under this Plan at this time. Under the terms of the Plan, the Trust is authorized to make payments to the

| | |

| | Janus Detroit Street Trust ½ 21 |

Janus Small Cap Growth Alpha ETF

Notes to Financial Statements

Distributor or its designee for remittance to retirement plan service providers, broker-dealers, bank trust departments, financial advisors, and other financial intermediaries, as compensation for distribution and/or shareholder services performed by such entities for their customers who are investors in the Fund. The 12b-1 fee may only be imposed or increased when the Trustees determine that it is in the best interests of shareholders to do so. Because these fees are paid out of the Fund’s assets on an ongoing basis, to the extent that a fee is authorized, over time they will increase the cost of an investment in the Fund. The Plan fee may cost an investor more than other types of sales charges.

As of October 31, 2016, Janus Capital owned 2,000 shares or 1.32% of the Fund.

The Fund is permitted to purchase or sell securities (“cross-trade”) between itself and other funds or accounts managed by Janus Capital in accordance with Rule 17a-7 under the Investment Company Act of 1940 (“Rule 17a-7”), when the transaction is consistent with the investment objectives and policies of the Fund and in accordance with the Internal Cross Trade Procedures adopted by the Trust’s Board of Trustees. These procedures have been designed to ensure that any cross-trade of securities by the Fund from or to another fund or account that is or could be considered an affiliate of the Fund under certain limited circumstances by virtue of having a common investment adviser, common officer, or common Trustee complies with Rule 17a-7. Under these procedures, each cross-trade is effected at the current market price to save costs where allowed. During the period ended October 31, 2016, the Fund engaged in cross trades amounting to $25,670 in purchases and $173,738 in sales, resulting in a net realized loss of $6,728. The net realized loss is included within the “Net Realized Gain/(Loss) on Investments” section of the Fund’s Statement of Operations.

4. Federal Income Tax

The tax components of capital shown in the table below represent: (1) distribution requirements the Fund must satisfy under the income tax regulations; (2) losses or deductions the Fund may be able to offset against income and gains realized in future years; and (3) unrealized appreciation or depreciation of investments for federal income tax purposes.

Other book to tax differences primarily consist of deferred compensation, derivatives, and foreign currency contract adjustments. The Fund has elected to treat gains and losses on forward foreign currency contracts as capital gains and losses, if applicable. Other foreign currency gains and losses on debt instruments are treated as ordinary income for federal income tax purposes pursuant to Section 988 of the Internal Revenue Code.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Loss Deferrals | | | | | | | |

Undistributed

Ordinary Income | | | Undistributed

Long-Term Gains | | | Accumulated

Capital Losses | | | Late-Year

Ordinary Loss | | | Post-October

Capital Loss | | | Other Book to Tax Differences | | | Net Tax

Appreciation/

(Depreciation) | |

| $ | 23,855 | | | $ | — | | | $ | (111,410) | | | $ | — | | | $ | — | | | $ | — | | | $ | (144,895) | |

Accumulated capital losses noted below represent net capital loss carryovers, as of October 31, 2016, that may be available to offset future realized capital gains and thereby reduce future taxable gains distributions. The following table shows these capital loss carryovers.

| | | | | | | | | | |

Capital Loss Carryover Schedule

For the period ended October 31, 2016

No Expiration | | | Accumulated

Capital Losses | |

| Short-Term | | | Long-Term | | |

| $ | (111,410) | | | $ | — | | | $ | (111,410) | |

The aggregate cost of investments and the composition of unrealized appreciation and depreciation of investment securities for federal income tax purposes as of October 31, 2016 are noted below.

Unrealized appreciation and unrealized depreciation in the table below exclude appreciation/depreciation on foreign currency translations. The primary difference between book and tax appreciation or depreciation of investments is wash sale deferrals.

| | | | | | | | | | | | | | |

| Federal Tax Cost | | | Unrealized Appreciation | | | Unrealized (Depreciation) | | | Net Tax Appreciation/

(Depreciation) | |

| $ | 4,428,177 | | | $ | 145,545 | | | $ | (290,440) | | | $ | (144,895) | |

Janus Small Cap Growth Alpha ETF

Notes to Financial Statements

Income and capital gains distributions are determined in accordance with income tax regulations that may differ from accounting principles generally accepted in the United States of America. These differences are due to differing treatments for items such as net short-term gains, deferral of wash sale losses, foreign currency transactions, passive foreign investment companies, net investment losses, in-kind transactions, and capital loss carryovers. Certain permanent differences such as tax returns of capital and net investment losses noted below have been reclassified to capital.

| | | | | | | | | | | | | | |

| For the period ended October 31, 2016 | |

| Distributions | | | | |

| From Ordinary Income | | | From Long-Term Capital Gains | | | Tax Return of Capital | | | Net Investment Loss | |

| $ | 2,185 | | | $ | — | | | $ | — | | | $ | — | |

Permanent book to tax basis differences may result in reclassifications between the components of net assets. These differences have no impact on the results of operations or net assets. The following reclassifications have been made to the Fund:

| | | | | | | | | | |

| Increase/(Decrease) to Capital | | | Increase/(Decrease) to Undistributed

Net Investment Income/Loss | | | Increase/(Decrease) to Undistributed

Net realized Gain/Loss | |

| $ | 543,962 | | | $ | (4,577) | | | $ | (539,385) | |

5. Capital Share Transactions

| | | | | | | | |

| | | Period Ended October 31, 2016(1) | |

| | | Shares | | | Amount | |

| Shares sold | | | 302,000 | | | $ | 8,101,071 | |

| Shares repurchased | | | (150,000) | | | | (4,130,781) | |

Net Increase/(Decrease) | | | 152,000 | | | $ | 3,970,290 | |

| (1) | Period from February 23, 2016 (commencement of operations) through October 31, 2016. |

6. Purchases and Sales of Investment Securities

For the period ended October 31, 2016, the aggregate cost of purchases and proceeds from sales of investment securities (excluding any short-term securities, short-term options contracts, and in-kind transactions) was as follows:

| | | | | | | | | | | | | | |

Purchases of Securities | | | Proceeds from Sales of Securities | | | Purchases of Long- Term U.S. Government Obligations | | | Proceeds from Sales of Long-Term U.S. Government Obligations | |

| $ | 2,920,090 | | | $ | 2,841,299 | | | $ | — | | | $ | — | |

For the period ended October 31, 2016, the cost of in-kind purchases and proceeds from in-kind sales, were as follows:

| | | | | | | | | | | | | | |

Purchases of Securities | | | Proceeds from Sales of Securities | | | Purchases of Long- Term U.S. Government Obligations | | | Proceeds from Sales of Long-Term U.S. Government Obligations | |

| $ | 8,044,585 | | | $ | 4,126,760 | | | $ | — | | | $ | — | |

During the period ended October 31, 2016, the Fund had net realized gain/(loss) of $544,197 from in-kind redemptions.

Gains on in-kind transactions are not considered taxable for federal income tax purposes.

| | |

| | Janus Detroit Street Trust ½ 23 |

Janus Small Cap Growth Alpha ETF

Notes to Financial Statements

7. Subsequent Event

Management has evaluated whether any events or transactions occurred subsequent to October 31, 2016 and through the date of issuance of the Fund’s financial statements and determined that there were no material events or transactions that would require recognition or disclosure in the Fund’s financial statements other than the following:

On October 3, 2016, Janus Capital Group Inc. (“JCGI”), the direct parent of Janus Capital Management LLC, the investment adviser to the Fund (“Janus Capital”), and Henderson Group plc (“Henderson”) announced that they had entered into an Agreement and Plan of Merger (“Merger Agreement”) relating to the strategic combination of Henderson and JCGI (the “Merger”). Pursuant to the Merger Agreement, a newly formed, direct wholly-owned subsidiary of Henderson will merge with and into JCGI, with JCGI as the surviving corporation and a direct wholly-owned subsidiary of Henderson. The Merger is expected to close in the second quarter of 2017, subject to requisite shareholder and regulatory approvals.

The consummation of the Merger may be deemed to be an “assignment” (as defined in the Investment Company Act of 1940, as amended) of the advisory agreement between the Fund and Janus Capital. As a result, the consummation of the Merger will cause such advisory agreement to terminate automatically in accordance with its terms. On October 24, 2016, the Trustees approved, subject to approval of shareholders, a new investment advisory agreement between the Fund and post-Merger Janus Capital in order for Janus Capital to continue to provide advisory services to the Fund following the closing of the Merger. The new investment advisory agreement will have substantially similar terms as the corresponding current investment advisory agreement.

Shareholders of record as of December 20, 2016, are expected to receive a proxy statement, notice of special meeting of shareholders, and proxy card, containing detailed information regarding shareholder proposals with respect to these matters. The shareholder meeting is expected to be held on or about March 17, 2017.

Janus Small Cap Growth Alpha ETF

Additional Information (unaudited)

Proxy Voting Policies and Voting Record

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to its portfolio securities is available without charge: (i) upon request, by calling 1-800-525-0020 (toll free); (ii) on the Fund’s website at janus.com/proxyvoting; and (iii) on the SEC’s website at http://www.sec.gov. Additionally, information regarding the Fund’s proxy voting record for the period February 23, 2016 through June 30, 2016 is also available, free of charge, through Janus.com/proxyvoting and from the SEC’s website at http://www.sec.gov

Quarterly Portfolio Holdings

The Fund files its complete portfolio holdings (schedule of investments) with the SEC for the first and third quarters of each fiscal year on Form N-Q within 60 days of the end of such fiscal quarter. The Fund’s Form N-Q: (i) is available on the SEC’s website at http://www.sec.gov; (ii) may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. (information on the Public Reference Room may be obtained by calling 1-800-SEC-0330); and (iii) is available without charge, upon request, by calling Janus at 1-800-525-0020 (toll free).

Designation Requirements (unaudited)

For federal income tax purposes, the Fund designated the following for the period ended October 31, 2016:

| | | | |

| Dividends Received Deduction Percentage | | | 100% | |

| Qualified Dividend Income Percentage | | | 100% | |

Licensing Agreements

Janus Index & Calculation Services LLC (“Janus Index Services”) is the Index Provider for the Underlying Index. Janus Capital has entered into a license agreement with Janus Index Services to use the Underlying Index. Janus Index Services is affiliated with the Fund and Janus Capital. This affiliation may create potential conflicts for Janus Index Services as it may have an interest in the performance of the Fund, which could motivate it to alter the Underlying Index methodology for the Underlying Index. Janus Index Services has adopted procedures that it believes are reasonably designed to mitigate these and other potential conflicts.

Janus Index Services is the licensor of certain trademarks, service marks, and trade names. Neither Janus Index Services nor any of its affiliates make any representation or warranty, express or implied, to the owners of the Fund or any member of the public regarding the advisability of investing in securities generally or in the Fund particularly or the ability of the Underlying Index to track general market performance. The Underlying Index is determined, composed, and calculated by Janus Index Services without regard to Janus Capital or the Fund. Janus Index Services has no obligation to take the needs of Janus Capital or the owners of the Fund into consideration in determining, composing, or calculating the Underlying Index. Janus Index Services is not responsible for and has not participated in the determination of the timing of, prices at, or quantities of the Fund to be issued or in the determination or calculation of the equation by which the Fund is to be converted into cash.

ALTHOUGH JANUS INDEX SERVICES SHALL OBTAIN INFORMATION FOR INCLUSION IN OR FOR USE IN THE CALCULATION OF THE UNDERLYING INDEX FROM SOURCES WHICH IT CONSIDERS RELIABLE, IT DOES NOT GUARANTEE THE QUALITY, ACCURACY AND/OR THE COMPLETENESS OF THE UNDERLYING INDEX OR ANY DATA INCLUDED THEREIN AND SHALL HAVE NO LIABILITY FOR ERRORS OR OMISSIONS OF ANY KIND RELATED TO THE UNDERLYING INDEX OR DATA. JANUS INDEX SERVICES MAKES NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY JANUS CAPITAL, OWNERS OF THE FUND, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE UNDERLYING INDEX OR ANY DATA INCLUDED THEREIN IN CONNECTION WITH THE RIGHTS LICENSED TO JANUS CAPITAL FOR ANY OTHER USE. JANUS INDEX SERVICES MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE UNDERLYING INDEX OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL IT HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

Janus Capital does not guarantee the accuracy and/or the completeness of the Underlying Index or any data included therein, and Janus Capital shall have no liability for any errors, omissions or interruptions therein. Janus Capital makes no warranty, express or implied, as to results to be obtained by the Fund, owners of the shares of the Fund or any other person or entity from the use of the Underlying Index or any data included therein. Janus Capital makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to the Underlying Index or any data included therein. Without limiting any of the foregoing, in no event shall Janus Capital have any liability for any special, punitive, direct, indirect or consequential damages (including lost profits) arising out of matters relating to the use of the Underlying Index even if notified of the possibility of such damages.

| | |

| | Janus Detroit Street Trust ½ 25 |

Janus Small Cap Growth Alpha ETF

Board Considerations Regarding Approval of Investment Advisory Agreements (unaudited)

APPROVAL OF ADVISORY AGREEMENT DURING THE PERIOD FOR JANUS SMALL CAP GROWTH ALPHA ETF AND JANUS SMALL/MID CAP GROWTH ALPHA ETF

The Trustees of Janus Detroit Street Trust (the “Trust”), the majority of whom serve as “independent” Trustees (the “Independent Trustees”) met on February 3, 2016 to consider the proposed investment management agreement (the “Investment Management Agreement”) for Janus Small Cap Growth Alpha ETF and Janus Small/Mid Cap Growth Alpha ETF (each a “New Fund” and collectively, the “New Funds”). In the course of their consideration of the Investment Management Agreement, the Trustees met in executive session and were advised by their independent counsel. In this regard, the Board, including the Independent Trustees, evaluated the terms of the Investment Management Agreement and reviewed the duties and responsibilities of the Trustees in evaluating and approving such agreements. In considering approval of the Investment Management Agreement, the Board, including the Independent Trustees, reviewed the Board Materials and other information from counsel and from Janus Capital Management LLC, the investment adviser (the “Adviser”), including: (i) a copy of the form of Investment Management Agreement, with respect to the Adviser’s management of the assets of each New Fund; (ii) information describing the nature, quality and extent of the services that the Adviser will provide to the New Fund, and the fees the Adviser will charge to the New Funds; (iii) information concerning the Adviser’s financial condition, business, operations, portfolio management teams and compliance programs; (iv) information describing each New Fund’s anticipated advisory fee and operating expenses; (v) a copy of the Adviser’s current Form ADV; and (vi) a memorandum from counsel on the responsibilities of trustees in considering investment advisory arrangements under the 1940 Act. The Board also considered presentations made by, and discussions held with, representatives of the Adviser. The Board also received information comparing the advisory fees and expenses of the New Funds to those from fund complexes that were defined as competitors.