UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23112

JANUS DETROIT STREET TRUST

(Exact name of registrant as specified in charter)

151 Detroit Street, Denver, Colorado 80206-4805

(Address of principal executive offices)(Zip code)

| | |

(Name and Address of Agent for Service) | | Copy to: |

| |

Byron D. Hittle 151 Detroit Street

Denver, Colorado 80206-4805 | | Eric S. Purple

Stradley Ronon Stevens & Young, LLP 1250 Connecticut Avenue, N.W., Suite 500

Washington, D.C. 20036 |

Registrant’s telephone number, including area code: 303-333-3863

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

Item 1. Report to Shareholders.

ANNUAL REPORT

October 31, 2018

Janus Henderson Small Cap Growth Alpha ETF

Janus Detroit Street Trust

Table of Contents

Janus Henderson Small Cap Growth Alpha ETF (unaudited)

INVESTMENT OBJECTIVE

Janus Henderson Small Cap Growth Alpha ETF (JSML) seeks investment results that correspond generally, before fees and expenses, to the performance of its underlying index, the Janus Small Cap Growth Alpha Index. It pursues its investment objective by using a passive index-based approach, normally investing at least 80% of its net assets in securities that comprise its underlying index.

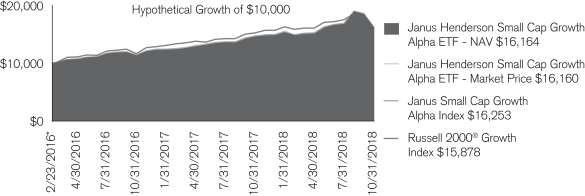

PERFORMANCE OVERVIEW

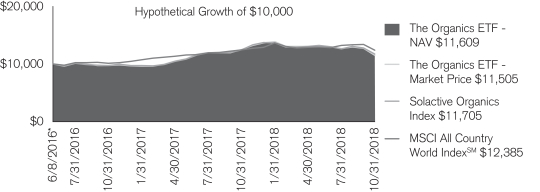

| • | | U.S. small-cap equities were up for the period, but were volatile. The anticipation that corporate tax reform would help boost future earnings for small-cap companies helped drive returns into January. However, concerns over inflation and faster-than-expected interest rate hikes created volatility, as did fears about protectionist trade policies. The market was led by a narrow subset of consumer Internet, medical technology and Software as a Service companies. Many of these stocks trade at extremely high valuations or are yet to produce earnings. Consumer staples, health care and information technology were the top-performing sectors within the Russell 2000® Growth Index, while energy and materials lagged. |

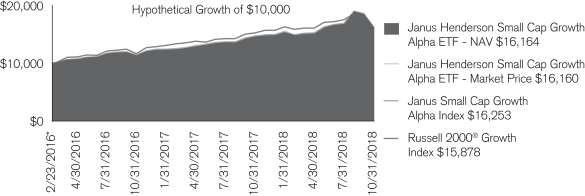

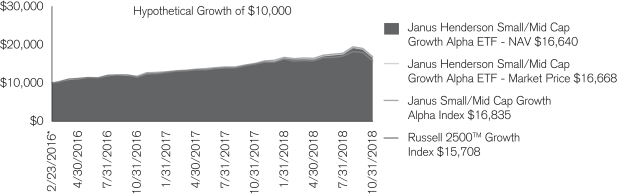

| • | | During the period, JSML returned 10.52% (based on NAV); its primary benchmark, the Janus Small Cap Growth Alpha Index, returned 10.44%, and its secondary benchmark, the Russell 2000 Growth Index, returned 4.13%. |

| • | | JSML seeks investment results that correspond generally, before fees and expenses, to the performance of its primary benchmark. The strategy seeks to provide risk-adjusted outperformance by identifying top-tier small-cap companies with some of the strongest fundamentals that the advisor believes can deliver sustainable growth in a variety of market environments. |

| | |

| | Janus Detroit Street Trust ½ 1 |

Janus Henderson Small Cap Growth Alpha ETF (unaudited)

Fund At A Glance

October 31, 2018

| | | | |

| 5 Largest Equity Holdings – (% of Net Assets) | |

Ubiquiti Networks, Inc. | | | | |

Communications Equipment | | | 3.7% | |

Etsy, Inc. | | | | |

Internet & Catalog Retail | | | 3.1% | |

NuVasive, Inc. | | | | |

Health Care Equipment & Supplies | | | 2.8% | |

Trade Desk, Inc. | | | | |

Software | | | 2.7% | |

Inogen, Inc. | | | | |

Health Care Equipment & Supplies | | | 2.5% | |

| | | | |

| | | 14.8% | |

| | | | |

| Sector Allocation – (% of Net Assets) | |

Consumer, Non-cyclical | | | 29.8% | |

Communications Services | | | 18.4% | |

Industrial | | | 14.8% | |

Consumer, Cyclical | | | 14.3% | |

Technology | | | 10.2% | |

Financial | | | 9.9% | |

Investment Company Securities | | | 6.2% | |

Basic Materials | | | 1.5% | |

Energy | | | 1.1% | |

| | | | |

| | | 106.2% | |

Holdings are subject to change without notice.

Janus Henderson Small Cap Growth Alpha ETF (unaudited)

Performance

| | | | |

| Average Annual Total Return for the periods ended October 31, 2018 |

| | | One Year | | Since

Inception* |

Janus Henderson Small Cap Growth Alpha ETF – NAV | | 10.52% | | 19.56% |

Janus Henderson Small Cap Growth Alpha ETF – Market Price | | 10.76% | | 19.55% |

Janus Small Cap Growth Alpha Index | | 10.44% | | 19.81% |

Russell 2000® Growth Index | | 4.13% | | 18.77% |

Total annual expense ratio as stated in the February 28, 2018 prospectus: 0.50%.

Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. Investment returns and principal value will vary; there may be a gain or loss when shares are sold. For the most recent month-end performance call 800.668.0434 or visit janushenderson.com/performance.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Market returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. Eastern time (when NAV is normally determined for most ETFs), and do not represent the returns you would receive if you traded shares at other times. Ordinary brokerage commissions apply and will reduce returns.

ETF shares are not individually redeemable and owners of the shares may acquire those shares from the Fund and tender those shares for redemption to the Fund in Creation Units only.

Investing involves risk, including the possible loss of principal and fluctuation of value.

Performance depends on that of the underlying index.

See the prospectus for a more complete discussion of objectives, risks and expenses.

Returns include reinvestment of dividends and capital gains. Returns greater than one year are annualized. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

See Financial Highlights for actual expense ratios during the reporting period.

There is no assurance the stated objective(s) will be met.

See Notes to Schedule of Investments and Other Information for index definitions.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

The index provider is Janus Index and Calculation Services LLC (“Janus Index”). Janus Index maintains the indices and calculates the index levels and performance shown or discussed, but does not manage actual assets. Janus index receives compensation in connection with licensing its indices to third parties including the provision of any related data.

| * | The Fund commenced operations on February 23, 2016. |

| | |

| | Janus Detroit Street Trust ½ 3 |

Janus Henderson Small Cap Growth Alpha ETF (unaudited)

Disclosure of Fund Expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include creation and redemption fees or brokerage charges and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other ETFs. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based upon an investment of $1,000 invested at the beginning of the period and held for the six-months indicated, unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based upon the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to determine the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Additionally, for an analysis of the fees associated with an investment or other similar funds, please visit www.finra.org/fundanalyzer.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as creation and redemption fees, or brokerage charges. These fees are fully described in the Fund’s prospectus. Therefore, the hypothetical examples are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | | Hypothetical

(5% return before expenses) | | | | |

Beginning

Account

Value

(5/1/18) | | Ending

Account

Value

(10/31/2018) | | | Expenses

Paid During

Period

(5/1/18 - 10/31/2018)† | | | Beginning

Account

Value

(5/1/18) | | | Ending

Account

Value

(10/31/2018) | | | Expenses

Paid During

Period

(5/1/18 - 10/31/2018)† | | | Net Annualized

Expense Ratio

(5/1/18 - 10/31/2018) | |

| $1,000.00 | | $ | 1,066.20 | | | $ | 2.60 | | | $ | 1,000.00 | | | $ | 1,022.68 | | | $ | 2.55 | | | | 0.50% | |

| † | Expenses Paid During Period is equal to the Net Annualized Expense Ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

Janus Henderson Small Cap Growth Alpha ETF

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Janus Detroit Street Trust and Shareholders of Janus Henderson Small Cap Growth Alpha ETF:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Janus Henderson Small Cap Growth Alpha ETF (one of the funds constituting Janus Detroit Street Trust, referred to hereafter as the “Fund”) as of October 31, 2018, the related statement of operations for the year ended October 31, 2018, the statements of changes in net assets for each of the two years in the period ended October 31, 2018, including the related notes, and the financial highlights for each of the two years in the period ended October 31, 2018 and for the period February 23, 2016 (commencement date) through October 31, 2016 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended October 31, 2018 and the financial highlights for each of the two years in the period ended October 31, 2018 and for the period February 23, 2016 (commencement date) through October 31, 2016 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31, 2018 by correspondence with the custodian and transfer agent. We believe that our audits provide a reasonable basis for our opinion.

Denver, Colorado

December 20, 2018

We have served as the auditor of one or more investment companies in Janus Henderson Funds since 1990.

| | |

| | Janus Detroit Street Trust ½ 5 |

Janus Henderson Small Cap Growth Alpha ETF

Schedule of Investments

October 31, 2018

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks – 100.1% | | | | | | |

| Aerospace & Defense – 2.4% | | | | | | |

HEICO Corp. | | | 7,340 | | | | $615,312 | |

| Airlines – 1.7% | | | | | | |

Allegiant Travel Co. | | | 997 | | | | 113,797 | |

Hawaiian Holdings, Inc. | | | 3,142 | | | | 108,745 | |

Spirit Airlines, Inc.* | | | 4,224 | | | | 219,226 | |

| | | | | | | | |

| | | | | | | 441,768 | |

| Auto Components – 1.9% | | | | | | |

American Axle & Manufacturing Holdings, Inc.* | | | 5,470 | | | | 82,980 | |

Dorman Products, Inc.* | | | 1,629 | | | | 128,707 | |

Fox Factory Holding Corp.* | | | 1,852 | | | | 99,508 | |

Gentherm, Inc.* | | | 1,784 | | | | 77,854 | |

Horizon Global Corp.* | | | 1,223 | | | | 6,861 | |

LCI Industries | | | 1,232 | | | | 85,439 | |

| | | | | | | | |

| | | | 481,349 | |

| Automobiles – 0.2% | | | | | | |

Winnebago Industries, Inc. | | | 1,546 | | | | 42,608 | |

| Beverages – 0.3% | | | | | | |

National Beverage Corp.* | | | 761 | | | | 70,354 | |

| Biotechnology – 1.1% | | | | | | |

BioSpecifics Technologies Corp.* | | | 1,940 | | | | 118,864 | |

MiMedx Group, Inc.*,# | | | 29,556 | | | | 172,016 | |

| | | | | | | | |

| | | | 290,880 | |

| Building Products – 3.1% | | | | | | |

AAON, Inc. | | | 3,233 | | | | 111,506 | |

American Woodmark Corp.* | | | 1,087 | | | | 65,698 | |

Apogee Enterprises, Inc. | | | 1,746 | | | | 63,031 | |

Builders FirstSource, Inc.* | | | 7,098 | | | | 87,873 | |

Continental Building Products, Inc.* | | | 2,289 | | | | 63,657 | |

Patrick Industries, Inc.* | | | 1,521 | | | | 66,179 | |

PGT Innovations, Inc.* | | | 3,142 | | | | 63,657 | |

Simpson Manufacturing Co., Inc. | | | 2,864 | | | | 163,477 | |

Universal Forest Products, Inc. | | | 3,815 | | | | 107,850 | |

| | | | | | | | |

| | | | 792,928 | |

| Capital Markets – 1.8% | | | | | | |

Cohen & Steers, Inc. | | | 2,173 | | | | 83,422 | |

Diamond Hill Investment Group, Inc. | | | 161 | | | | 27,721 | |

Evercore, Inc. - Class A | | | 1,905 | | | | 155,619 | |

Hamilton Lane, Inc. - Class A | | | 1,079 | | | | 41,412 | |

Houlihan Lokey, Inc. | | | 1,595 | | | | 65,682 | |

Moelis & Co. - Class A | | | 2,124 | | | | 85,725 | |

Pzena Investment Management, Inc. - Class A | | | 815 | | | | 8,199 | |

| | | | | | | | |

| | | | 467,780 | |

| Chemicals – 2.0% | | | | | | |

Balchem Corp. | | | 4,050 | | | | 379,282 | |

Chase Corp. | | | 1,184 | | | | 127,683 | |

| | | | | | | | |

| | | | 506,965 | |

| Commercial Banks – 3.5% | | | | | | |

Ameris Bancorp | | | 2,207 | | | | 94,658 | |

Bankwell Financial Group, Inc. | | | 365 | | | | 11,067 | |

Byline Bancorp, Inc.* | | | 1,685 | | | | 37,070 | |

Eagle Bancorp, Inc.* | | | 1,598 | | | | 78,574 | |

Equity Bancshares, Inc. - Class A* | | | 736 | | | | 26,562 | |

FB Financial Corp. | | | 1,430 | | | | 52,166 | |

First Foundation, Inc.* | | | 2,066 | | | | 33,490 | |

Franklin Financial Network, Inc.* | | | 671 | | | | 22,747 | |

Hilltop Holdings, Inc. | | | 4,400 | | | | 87,560 | |

Independent Bank Group, Inc. | | | 1,415 | | | | 81,943 | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements.

Janus Henderson Small Cap Growth Alpha ETF

Schedule of Investments

October 31, 2018

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks – (continued) | | | | | | |

| Commercial Banks – (continued) | | | | | | |

Live Oak Bancshares, Inc. | | | 1,654 | | | | $ 30,434 | |

Metropolitan Bank Holding Corp.* | | | 383 | | | | 14,117 | |

National Commerce Corp.* | | | 963 | | | | 35,727 | |

Nicolet Bankshares, Inc.* | | | 451 | | | | 24,083 | |

People’s Utah Bancorp | | | 867 | | | | 29,053 | |

Preferred Bank | | | 710 | | | | 36,501 | |

RBB Bancorp | | | 769 | | | | 16,595 | |

Seacoast Banking Corp. of Florida* | | | 2,194 | | | | 57,724 | |

ServisFirst Bancshares, Inc. | | | 2,471 | | | | 88,907 | |

TriState Capital Holdings, Inc.* | | | 1,348 | | | | 33,997 | |

| | | | | | | | |

| | | | 892,975 | |

| Commercial Services & Supplies – 1.2% | | | | | | |

Healthcare Services Group, Inc. | | | 4,560 | | | | 185,091 | |

Multi-Color Corp. | | | 1,270 | | | | 67,513 | |

Viad Corp. | | | 1,261 | | | | 60,389 | |

| | | | | | | | |

| | | | 312,993 | |

| Communications Equipment – 5.5% | | | | | | |

Acacia Communications, Inc.* | | | 6,485 | | | | 223,538 | |

Applied Optoelectronics, Inc.* | | | 3,151 | | | | 61,854 | |

Casa Systems, Inc.* | | | 13,802 | | | | 198,749 | |

Ubiquiti Networks, Inc.# | | | 10,154 | | | | 945,236 | |

| | | | | | | | |

| | | | 1,429,377 | |

| Computers & Peripherals – 0.2% | | | | | | |

USA Technologies, Inc.* | | | 9,445 | | | | 54,781 | |

| Construction & Engineering – 0.9% | | | | | | |

Argan, Inc. | | | 962 | | | | 42,347 | |

Comfort Systems USA, Inc. | | | 2,302 | | | | 123,111 | |

Construction Partners, Inc. - Class A* | | | 737 | | | | 6,663 | |

NV5 Global, Inc.* | | | 777 | | | | 60,660 | |

| | | | | | | | |

| | | | 232,781 | |

| Diversified Financial Services – 0.3% | | | | | | |

FGL Holdings* | | | 9,973 | | | | 78,787 | |

| Electrical Equipment – 0.2% | | | | | | |

TPI Composites, Inc.* | | | 2,130 | | | | 53,804 | |

| Electronic Equipment & Instruments – 1.8% | | | | | | |

Control4 Corp.* | | | 4,171 | | | | 116,454 | |

Methode Electronics, Inc. | | | 5,902 | | | | 174,699 | |

Napco Security Technologies, Inc.* | | | 2,993 | | | | 42,111 | |

PC Connection, Inc. | | | 4,268 | | | | 141,442 | |

| | | | | | | | |

| | | | 474,706 | |

| Energy Equipment & Services – 0.3% | | | | | | |

Cactus, Inc. - Class A* | | | 858 | | | | 28,709 | |

Liberty Oilfield Services, Inc. - Class A | | | 1,599 | | | | 30,349 | |

Smart Sand, Inc.* | | | 947 | | | | 2,623 | |

Solaris Oilfield Infrastructure, Inc. - Class A* | | | 603 | | | | 7,959 | |

| | | | | | | | |

| | | | 69,640 | |

| Equity Real Estate Investment Trusts (REITs) – 1.6% | | | | | | |

CareTrust, Inc. | | | 2,181 | | | | 38,517 | |

Easterly Government Properties, Inc. | | | 1,640 | | | | 29,799 | |

Four Corners Property Trust, Inc. | | | 1,803 | | | | 47,022 | |

Independence Realty Trust, Inc. | | | 2,355 | | | | 23,338 | |

Jernigan Capital, Inc. | | | 520 | | | | 10,176 | |

National Storage Affiliates Trust | | | 1,535 | | | | 40,877 | |

Retail Opportunity Investments Corp. | | | 3,058 | | | | 53,790 | |

STAG Industrial, Inc. | | | 2,824 | | | | 74,723 | |

Summit Hotel Properties, Inc. | | | 2,842 | | | | 32,740 | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements.

| | |

| | Janus Detroit Street Trust ½ 7 |

Janus Henderson Small Cap Growth Alpha ETF

Schedule of Investments

October 31, 2018

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks – (continued) | | | | | | |

| Equity Real Estate Investment Trusts (REITs) – (continued) | | | | | | |

Terreno Realty Corp. | | | 1,578 | | | | $ 59,065 | |

| | | | | | | | |

| | | | 410,047 | |

Food & Staples Retailing – 0.8% | | | | | |

Sprouts Farmers Market, Inc.* | | | 2,084 | | | | 56,039 | |

Calavo Growers, Inc. | | | 288 | | | | 27,936 | |

Hostess Brands, Inc.* | | | 1,637 | | | | 17,025 | |

Pilgrim’s Pride Corp.* | | | 4,084 | | | | 72,123 | |

Sanderson Farms, Inc. | | | 373 | | | | 36,700 | |

| | | | | | | | |

| | | | 209,823 | |

| Health Care Equipment & Supplies – 10.8% | | | | | | |

Anika Therapeutics, Inc.* | | | 3,885 | | | | 138,928 | |

Cutera, Inc.* | | | 3,685 | | | | 74,806 | |

Glaukos Corp.* | | | 9,382 | | | | 543,593 | |

Heska Corp.* | | | 1,995 | | | | 199,939 | |

Inogen, Inc.* | | | 3,442 | | | | 652,500 | |

LeMaitre Vascular, Inc. | | | 5,180 | | | | 138,306 | |

NuVasive, Inc.* | | | 12,979 | | | | 729,030 | |

Tactile Systems Technology, Inc.* | | | 4,878 | | | | 319,411 | |

| | | | | | | | |

| | | | 2,796,513 | |

| Health Care Providers & Services – 3.6% | | | | | | |

AMN Healthcare Services, Inc.* | | | 12,645 | | | | 640,090 | |

National Research Corp. - Class A | | | 6,566 | | | | 249,836 | |

Psychemedics Corp. | | | 1,468 | | | | 25,690 | |

| | | | | | | | |

| | | | 915,616 | |

| Health Care Technology – 1.9% | | | | | | |

Simulations Plus, Inc. | | | 4,623 | | | | 93,431 | |

Tabula Rasa HealthCare, Inc.* | | | 5,387 | | | | 397,991 | |

| | | | | | | | |

| | | | 491,422 | |

| Hotels, Restaurants & Leisure – 2.1% | | | | | | |

Bojangles’, Inc.* | | | 1,809 | | | | 28,600 | |

Choice Hotels International, Inc. | | | 2,769 | | | | 203,245 | |

Chuy’s Holdings, Inc.* | | | 827 | | | | 20,154 | |

Dave & Buster’s Entertainment, Inc. | | | 1,926 | | | | 114,693 | |

Papa John’s International, Inc.# | | | 1,546 | | | | 84,319 | |

Wingstop, Inc. | | | 1,432 | | | | 89,672 | |

| | | | | | | | |

| | | | 540,683 | |

| Household Durables – 1.8% | | | | | | |

Cavco Industries, Inc.* | | | 445 | | | | 89,271 | |

Century Communities, Inc.* | | | 1,474 | | | | 31,278 | |

Hooker Furniture Corp. | | | 578 | | | | 16,918 | |

Installed Building Products, Inc.* | | | 1,545 | | | | 47,061 | |

iRobot Corp.* | | | 1,340 | | | | 118,148 | |

LGI Homes, Inc.* | | | 1,107 | | | | 47,369 | |

M/I Homes, Inc.* | | | 1,401 | | | | 33,862 | |

New Home Co., Inc.* | | | 1,024 | | | | 7,301 | |

TopBuild Corp.* | | | 1,744 | | | | 79,561 | |

| | | | | | | | |

| | | | 470,769 | |

| Insurance – 0.8% | | | | | | |

Goosehead Insurance, Inc. - Class A * | | | 631 | | | | 21,631 | |

Health Insurance Innovations, Inc. - Class A * | | | 662 | | | | 32,372 | |

Investors Title Co. | | | 86 | | | | 15,652 | |

Kingstone Companies, Inc. | | | 496 | | | | 8,432 | |

Kinsale Capital Group, Inc. | | | 988 | | | | 58,993 | |

Universal Insurance Holdings, Inc. | | | 1,625 | | | | 68,217 | |

| | | | | | | | |

| | | | 205,297 | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements.

Janus Henderson Small Cap Growth Alpha ETF

Schedule of Investments

October 31, 2018

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks – (continued) | | | | | | |

| Interactive Media & Services – 5.7% | | | | | | |

Cargurus, Inc.* | | | 14,188 | | | | $ 630,231 | |

Cars.com, Inc.* | | | 11,146 | | | | 291,022 | |

Match Group, Inc.*,# | | | 10,705 | | | | 553,663 | |

| | | | | | | | |

| | | | 1,474,916 | |

| Internet & Catalog Retail – 3.9% | | | | | | |

Duluth Holdings, Inc. - Class B* | | | 1,428 | | | | 43,883 | |

Etsy, Inc.* | | | 18,712 | | | | 795,634 | |

Liberty Expedia Holdings, Inc. - Class A* | | | 2,810 | | | | 122,010 | |

Nutrisystem, Inc. | | | 1,445 | | | | 51,384 | |

| | | | | | | | |

| | | | 1,012,911 | |

| IT Services – 0.9% | | | | | | |

Hackett Group, Inc. | | | 4,708 | | | | 96,373 | |

NIC, Inc. | | | 10,639 | | | | 141,605 | |

| | | | | | | | |

| | | | 237,978 | |

| Leisure Equipment & Products – 0.5% | | | | | | |

Johnson Outdoors, Inc. - Class A | | | 436 | | | | 32,835 | |

Malibu Boats, Inc. - Class A* | | | 1,005 | | | | 40,401 | |

Marine Products Corp. | | | 1,689 | | | | 34,405 | |

MCBC Holdings, Inc.* | | | 916 | | | | 27,187 | |

| | | | | | | | |

| | | | 134,828 | |

| Life Sciences Tools & Services – 1.8% | | | | | | |

Cambrex Corp.* | | | 8,854 | | | | 471,830 | |

| Machinery – 1.0% | | | | | | |

Lydall, Inc.* | | | 1,078 | | | | 32,200 | |

Omega Flex, Inc. | | | 624 | | | | 37,752 | |

Proto Labs, Inc.* | | | 1,673 | | | | 199,840 | |

| | | | | | | | |

| | | | 269,792 | |

| Media – 0.6% | | | | | | |

AMC Networks, Inc. - Class A* | | | 2,230 | | | | 130,634 | |

Entravision Communications Corp. - Class A | | | 3,164 | | | | 15,630 | |

| | | | | | | | |

| | | | 146,264 | |

| Metals & Mining – 1.9% | | | | | | |

Warrior Met Coal, Inc. | | | 6,637 | | | | 185,836 | |

Worthington Industries, Inc. | | | 7,466 | | | | 312,676 | |

| | | | | | | | |

| | | | 498,512 | |

| Mortgate Real Estate Investment Trusts (REITs) – 0.2% | | | | | | |

Cherry Hill Mortgage Investment Corp. | | | 724 | | | | 12,967 | |

Granite Point Mortgage Trust, Inc. | | | 2,000 | | | | 37,220 | |

| | | | | | | | |

| | | | 50,187 | |

| Multiline Retail – 1.1% | | | | | | |

Ollie’s Bargain Outlet Holdings, Inc.* | | | 3,053 | | | | 283,624 | |

| Oil, Gas & Consumable Fuels – 0.1% | | | | | | |

Alta Mesa Resources, Inc. – Class A* | | | 4,087 | | | | 12,874 | |

| Paper & Forest Products – 1.7% | | | | | | |

KapStone Paper and Packaging Corp. | | | 12,276 | | | | 429,660 | |

| Personal Products – 0.0% | | | | | | |

Natural Health Trends Corp. | | | 189 | | | | 4,298 | |

| Pharmaceuticals – 5.0% | | | | | | |

Mallinckrodt PLC* | | | 22,150 | | | | 555,079 | |

Phibro Animal Health Corp. - Class A | | | 5,358 | | | | 229,965 | |

Prestige Consumer Healthcare, Inc.* | | | 13,770 | | | | 497,923 | |

| | | | | | | | |

| | | | 1,282,967 | |

| Professional Services – 2.7% | | | | | | |

BG Staffing, Inc. | | | 623 | | | | 16,098 | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements.

| | |

| | Janus Detroit Street Trust ½ 9 |

Janus Henderson Small Cap Growth Alpha ETF

Schedule of Investments

October 31, 2018

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks – (continued) | | | | | | |

| Professional Services – (continued) | | | | | | |

Insperity, Inc. | | | 2,593 | | | | $ 284,841 | |

Korn/Ferry International | | | 3,549 | | | | 160,202 | |

TriNet Group, Inc.* | | | 4,369 | | | | 205,299 | |

Willdan Group, Inc.* | | | 554 | | | | 16,731 | |

| | | | | | | | |

| | | | 683,171 | |

| Real Estate Management & Development – 0.3% | | | | | | |

Consolidated-Tomoka Land Co. | | | 148 | | | | 8,572 | |

HFF, Inc. - Class A | | | 1,062 | | | | 39,029 | |

RMR Group, Inc. - Class A | | | 407 | | | | 30,883 | |

| | | | | | | | |

| | | | 78,484 | |

| Road & Rail – 0.9% | | | | | | |

Saia, Inc.* | | | 1,588 | | | | 99,822 | |

Schneider National, Inc. - Class B | | | 5,818 | | | | 127,239 | |

| | | | | | | | |

| | | | 227,061 | |

| Semiconductors & Semiconductor Equipment – 2.1% | | | | | | |

Advanced Energy Industries, Inc.* | | | 6,253 | | | | 269,067 | |

FormFactor, Inc.* | | | 11,810 | | | | 144,554 | |

Ichor Holdings, Ltd.*,# | | | 3,896 | | | | 69,154 | |

Ultra Clean Holdings, Inc.* | | | 6,221 | | | | 65,445 | |

| | | | | | | | |

| | | | 548,220 | |

| Software – 12.4% | | | | | | |

Alarm.com Holdings, Inc.* | | | 7,623 | | | | 339,071 | |

Avalara, Inc.*,# | | | 10,625 | | | | 356,150 | |

Ebix, Inc. | | | 5,031 | | | | 288,327 | |

Globant SA* | | | 5,741 | | | | 295,547 | |

Hortonworks, Inc.* | | | 13,004 | | | | 232,251 | |

Paylocity Holding Corp.* | | | 8,435 | | | | 554,939 | |

Qualys, Inc.* | | | 6,237 | | | | 444,324 | |

Trade Desk, Inc. - Class A* | | | 5,661 | | | | 699,416 | |

| | | | | | | | |

| | | | 3,210,025 | |

| Specialty Retail – 2.6% | | | | | | |

Asbury Automotive Group, Inc.* | | | 999 | | | | 65,035 | |

At Home Group, Inc.* | | | 3,110 | | | | 85,027 | |

Boot Barn Holdings, Inc.* | | | 1,372 | | | | 33,861 | |

Camping World Holdings, Inc. - Class A# | | | 1,811 | | | | 31,059 | |

Floor & Decor Holdings, Inc. - Class A* | | | 4,760 | | | | 121,761 | |

Lithia Motors, Inc. - Class A | | | 1,138 | | | | 101,373 | |

MarineMax, Inc.* | | | 1,106 | | | | 25,173 | |

Penske Automotive Group, Inc. | | | 4,159 | | | | 184,576 | |

Winmark Corp. | | | 186 | | | | 28,586 | |

| | | | | | | | |

| | | | 676,451 | |

| Textiles, Apparel & Luxury Goods – 0.1% | | | | | | |

Superior Group of Companies, Inc. | | | 753 | | | | 13,095 | |

| Thrifts & Mortgage Finance – 1.4% | | | | | | |

Axos Financial, Inc.* | | | 2,920 | | | | 88,651 | |

Bridgewater Bancshares, Inc.* | | | 1,268 | | | | 14,075 | |

FS Bancorp, Inc.# | | | 174 | | | | 7,854 | |

Greene County Bancorp, Inc. | | | 401 | | | | 12,860 | |

Merchants Bancorp | | | 1,337 | | | | 30,751 | |

Meridian Bancorp, Inc. | | | 2,510 | | | | 39,759 | |

NMI Holdings, Inc. - Class A* | | | 3,062 | | | | 64,731 | |

PennyMac Financial Services, Inc. | | | 1,171 | | | | 23,408 | |

Sterling Bancorp, Inc. | | | 2,466 | | | | 25,523 | |

Walker & Dunlop, Inc. | | | 1,458 | | | | 61,178 | |

| | | | | | | | |

| | | | 368,790 | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements.

Janus Henderson Small Cap Growth Alpha ETF

Schedule of Investments

October 31, 2018

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks – (continued) | | | | | | |

| Tobacco – 0.1% | | | | | | |

Vector Group, Ltd. | | | 2,501 | | | | $ 33,813 | |

| Trading Companies & Distributors – 1.3% | | | | | | |

BMC Stock Holdings, Inc.* | | | 4,167 | | | | 69,755 | |

EnviroStar, Inc. | | | 692 | | | | 28,753 | |

Foundation Building Materials, Inc.* | | | 2,656 | | | | 25,312 | |

GMS, Inc.* | | | 2,546 | | | | 41,856 | |

SiteOne Landscape Supply, Inc.* | | | 2,509 | | | | 170,712 | |

| | | | | | | | |

| | | | | | | | 336,388 | |

Total Common Stocks (cost $29,782,355) | | | | | | | 25,836,097 | |

Investment Companies – 6.1% | | | | | | | | |

| Investments Purchased with Cash Collateral from Securities Lending – 6.1% | | | | | | |

Janus Henderson Cash Collateral Fund LLC, 2.1443%¥,£ (cost $1,591,064) | | | 1,591,064 | | | | 1,591,064 | |

Total Investments (total cost $31,373,419) – 106.2% | | | | | | | 27,427,161 | |

Liabilities, net of Cash, Receivables and Other Assets – (6.2%) | | | | | | | (1,611,591) | |

Net Assets – 100% | | | | | | | $25,815,570 | |

Summary of Investments by Country – (Long Positions) (unaudited)

| | | | | | | | |

| Country | | Value | | | % of Investment

Securities | |

United States | | | $27,131,614 | | | | 98.9% | |

Argentina | | | 295,547 | | | | 1.1 | |

Total | | | $27,427,161 | | | | 100.0% | |

Schedules of Affiliated Investments – (% of Net Assets)

| | | | | | | | | | | | | | | | |

| | | Dividend Income | | | Realized

Gain/(Loss) | | | Change in

Unrealized

Appreciation/

(Depreciation) | | | Value at

10/31/18 | |

Investment Companies – 6.1% | | | | | | | | | | | | | | | | |

Investments Purchased with Cash Collateral from Securities Lending – 6.1% | | | | | | | | | | | | | |

Janus Henderson Cash Collateral Fund LLC, 2.1443%¥ | | | $73,430D | | | | $ — | | | | $ — | | | | $1,591,064 | |

| | | | |

| | | Share Balance

at 10/31/17 | | | Purchases | | | Sales | | | Share

Balance at

10/31/18 | |

Investment Companies – 6.1% | | | | | | | | | | | | | | | | |

Investments Purchased with Cash Collateral from Securities Lending – 6.1% | | | | | | | | | | | | | |

Janus Henderson Cash Collateral Fund LLC, 2.1443%¥ | | | 396,201 | | | | 11,566,709 | | | | (10,371,846) | | | | 1,591,064 | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements.

| | |

| | Janus Detroit Street Trust ½ 11 |

Janus Henderson Small Cap Growth Alpha ETF

Notes to Schedule of Investments and Other Information

October 31, 2018

| | |

| |

Janus Small

Cap Growth

Alpha Index | | Janus Small Cap Growth Alpha Index is designed to systematically identify small-capitalization stocks that are poised for sustainable growth (Smart Growth®) by evaluating each company’s performance in three critical areas: growth, profitability, and capital efficiency. A proprietary methodology is used to score stocks based on a wide range of fundamental measures and selects the top 10% (“top-tier”) of such eligible stocks. Stocks are market cap-weighted within sectors with a 3% maximum position size; sectors are weighted to align with the Janus Henderson Venture Fund. |

| |

Russell 2000®

Growth Index | | Russell 2000® Growth Index reflects the performance of U.S. small-cap equities with higher price-to-book ratios and higher forecasted growth values. |

| |

| LLC | | Limited Liability Company |

| |

| PLC | | Public Limited Company |

| * | Non-income producing security. |

| # | Loaned security; a portion of the security is on loan at October 31, 2018. |

| ¥ | Rate shown is the 7-day yield as of October 31, 2018. |

| £ | The Fund may invest in certain securities that are considered affiliated companies. As defined by the Investment Company Act of 1940, as amended, an affiliated company is one in which the Fund owns 5% or more of the outstanding voting securities, or a company which is under common ownership or control. |

| D | Net of income paid to the securities lending agent and rebates paid to the borrowing counterparties. |

The following is a summary of the inputs that were used to value the Fund’s investments in securities and other financial instruments as of October 31, 2018. See Notes to Financial Statements for more information.

Valuation Inputs Summary

| | | | | | | | | | | | |

| | | Level 1 -

Quoted Prices | | | Level 2 -

Other Significant

Observable Inputs | | | Level 3 -

Significant

Unobservable Inputs | |

Assets | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | |

Common Stocks | | $ | 25,836,097 | | | $ | — | | | $ | — | |

Investment Companies | | | — | | | | 1,591,064 | | | | — | |

| | | | |

Total Assets | | $ | 25,836,097 | | | $ | 1,591,064 | | | $ | — | |

Janus Henderson Small Cap Growth Alpha ETF

Statement of Assets and Liabilities

October 31, 2018

| | | | |

Assets: | | | | |

Unaffiliated investments, at value(1)(2) | | $ | 25,836,097 | |

Affiliated investments, at value(3) | | | 1,591,064 | |

Receivables: | | | | |

Dividends | | | 2,253 | |

Affiliated securities lending income, net | | | 4,607 | |

Total Assets | | | 27,434,021 | |

Liabilities: | | | | |

Collateral on securities loaned (Note 2) | | | 1,591,064 | |

Payables: | | | | |

Due to custodian | | | 11,148 | |

Management fees | | | 16,239 | |

Total Liabilities | | | 1,618,451 | |

Net Assets | | $ | 25,815,570 | |

Net Assets Consists of: | | | | |

Capital (par value and paid-in surplus) | | $ | 30,269,518 | |

Total distributable earnings (loss) | | | (4,453,948) | |

Total Net Assets | | $ | 25,815,570 | |

Net Assets | | $ | 25,815,570 | |

Shares outstanding, $0.001 Par Value (unlimited shares authorized) | | | 652,000 | |

Net Asset Value Per Share | | $ | 39.59 | |

| (1) | Includes cost of $29,782,355. |

| (2) | Includes $1,566,630 of securities on loan. See Note 2 in Notes to Financial Statements. |

| (3) | Includes cost of $1,591,064. |

See Notes to Financial Statements.

| | |

| | Janus Detroit Street Trust ½ 13 |

Janus Henderson Small Cap Growth Alpha ETF

Statement of Operations

For the year ended October 31, 2018

| | | | |

Investment Income: | | | | |

Dividends | | $ | 100,601 | |

Affiliated securities lending income, net | | | 73,430 | |

Total Investment Income | | | 174,031 | |

Expenses: | | | | |

Management Fees | | | 87,221 | |

Total Expenses | | | 87,221 | |

Net Investment Income/(Loss) | | | 86,810 | |

Net Realized Gain/(Loss) on Investments: | | | | |

Investments and foreign currency transactions | | $ | 2,491,406 | |

Total Net Realized Gain/(Loss) on Investments | | $ | 2,491,406 | |

Change in Unrealized Net Appreciation/Depreciation: | | | | |

Investments and foreign currency translations | | $ | (4,687,297) | |

Total Change in Unrealized Net Appreciation/Depreciation | | $ | (4,687,297) | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | $ | (2,109,081) | |

See Notes to Financial Statements.

Janus Henderson Small Cap Growth Alpha ETF

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended

October 31, 2018 | | | Year Ended

October 31, 2017 | |

Operations: | | | | | | | | |

Net investment income/(loss) | | $ | 86,810 | | | $ | 28,851 | |

Net realized gain/(loss) on investments | | | 2,491,406 | | | | 775,153 | |

Change in unrealized net appreciation/depreciation | | | (4,687,297) | | | | 886,912 | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | | (2,109,081) | | | | 1,690,916 | |

Dividends and Distributions to Shareholders: | | | | | | | | |

Dividends and Distributions | | | (87,999) | | | | N/A | |

Dividends from Net Investment Income(1) | | | N/A | | | | (46,606) | |

Net Decrease from Dividends and Distributions to Shareholders | | | (87,999) | | | | (46,606) | |

Capital Share Transactions | | | 18,929,291 | | | | 3,157,247 | |

Net Increase/(Decrease) in Net Assets | | | 16,732,211 | | | | 4,801,557 | |

Net Assets: | | | | | | | | |

Beginning of period | | | 9,083,359 | | | | 4,281,802 | |

End of period(2) | | $ | 25,815,570 | | | $ | 9,083,359 | |

| (1) | The requirement to disclose dividends and distributions paid to shareholders from net investment income and/or net realized gain from investment transactions was eliminated by the U.S. Securities and Exchange Commission (“SEC”) in 2018. |

| (2) | Net assets – End of period includes undistributed (overdistributed) net investment income of $5,687 as of October 31, 2017. The requirement to disclose undistributed (overdistributed) net investment income was eliminated by the SEC in 2018. |

See Notes to Financial Statements.

| | |

| | Janus Detroit Street Trust ½ 15 |

Janus Henderson Small Cap Growth Alpha ETF

Financial Highlights

| | | | | | | | | | | | | | |

| For a share outstanding during each year or period ended October 31 | | 2018 | | | 2017 | | | 2016(1) | |

| | Net Asset Value, Beginning of Period | | | $36.05 | | | | $28.17 | | | | $24.83 | |

| | Income/(Loss) from Investment Operations: | | | | | | | | | | | | |

| | Net investment income/(loss)(2) | | | 0.20 | | | | 0.13 | | | | 0.26 | |

| | Net realized and unrealized gain/(loss) | | | 3.57 | | | | 7.97 | | | | 3.10 | |

| | Total from Investment Operations | | | 3.77 | | | | 8.10 | | | | 3.36 | |

| | Less Dividends and Distributions: | | | | | | | | | | | | |

| | Dividends (from net investment income) | | | (0.23) | | | | (0.22) | | | | (0.02) | |

| | Total Dividends and Distributions | | | (0.23) | | | | (0.22) | | | | (0.02) | |

| | Net Asset Value, End of Period | | | $39.59 | | | | $36.05 | | | | $28.17 | |

| | Total Return* | | | 10.49%(3) | | | | 28.86% | | | | 13.54% | |

| | Net assets, End of Period (in thousands) | | | $25,816 | | | | $9,083 | | | | $4,282 | |

| | Average Net Assets for the Period (in thousands) | | | $17,444 | | | | $7,068 | | | | $3,247 | |

| | Ratios to Average Net Assets**: | | | | | | | | | | | | |

| | Ratio of Gross Expenses | | | 0.50% | | | | 0.50% | | | | 0.50% | |

| | Ratio of Net Investment Income/(Loss) | | | 0.50% | | | | 0.41% | | | | 1.37% | |

| | Portfolio Turnover Rate(4) | | | 84% | | | | 117% | | | | 86% | |

| * | Total return not annualized for periods of less than one full year. |

| ** | Annualized for periods of less than one full year. |

| (1) | Period from February 23, 2016 (commencement of operations) through October 31, 2016. |

| (2) | Per share amounts are calculated based on average shares outstanding during the year or period. |

| (3) | The return includes adjustments in accordance with generally accepted accounting principles required at period end date. |

| (4) | Portfolio turnover rate excludes securities received or delivered from in-kind processing of creation or redemptions. |

See Notes to Financial Statements.

Janus Henderson Small Cap Growth Alpha ETF

Notes to Financial Statements

1. Organization and Significant Accounting Policies

Janus Henderson Small Cap Growth Alpha ETF (the “Fund”) is a series fund. The Fund is part of Janus Detroit Street Trust (the “Trust”), which is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and therefore has applied the specialized accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946. The Trust offers seven Funds each of which represent shares of beneficial interest in a separate portfolio of securities and other assets with its own objective and policies. The Fund seeks investment results that correspond generally, before fees and expenses, to the performance of its underlying index, the Janus Small Cap Growth Alpha Index (the “Underlying Index”). The Fund is classified as diversified, as defined in the 1940 Act.

Unlike shares of traditional mutual funds, shares of the Fund are not individually redeemable and may only be purchased or redeemed directly from the Fund at net asset value (“NAV”) in large increments called “Creation Units” (25,000 or more shares per Creation Unit) through certain participants, known as “Authorized Participants.” The Fund will issue or redeem Creation Units in exchange for portfolio securities and/or cash. Except when aggregated in Creation Units, Fund shares are not redeemable securities of the Fund. Shares of the Fund are listed and trade on The NASDAQ Stock Market LLC (“NASDAQ”) and individual investors can purchase or sell shares in much smaller increments and for cash in the secondary market through a broker. These transactions, which do not involve the Fund, are made at market prices that may vary throughout the day and differ from the Fund’s NAV. As a result, you may pay more than NAV (a premium) when you purchase shares, and receive less than NAV (a discount) when you sell shares, in the secondary market.

An Authorized Participant may hold of record more than 25% of the outstanding shares of the Fund. From time to time, Authorized Participants may be a beneficial and/or legal owner of the Fund, may be affiliated with an index provider, may be deemed to have control of the Fund and/or may be able to affect the outcome of matters presented for a vote of the shareholders of the Fund. Authorized Participants may execute an irrevocable proxy granting the Distributor or an affiliate of Janus Capital Management LLC (“Janus Capital” or “Janus”) power to vote or abstain from voting such Authorized Participant’s beneficially or legally owned shares of the Fund. In such cases, the agent shall mirror vote (or abstain from voting) such shares in the same proportion as all other beneficial owners of the Fund.

The following accounting policies have been followed by the Fund and are in conformity with accounting principles generally accepted in the United States of America.

Investment Valuation

Securities held by the Fund are valued in accordance with policies and procedures established by and under the supervision of the Trustees (the “Valuation Procedures”). Equity securities, including shares of exchange-traded funds, traded on a domestic securities exchange are generally valued at the closing prices on the primary market or exchange on which they trade. If such price is lacking for the trading period immediately preceding the time of determination, such securities are valued at their current bid price. Equity securities that are traded on a foreign exchange are generally valued at the closing prices on such markets. In the event that there is no current trading volume on a particular security in such foreign exchange, the bid price from the primary exchange is generally used to value the security. Securities that are traded on the over-the-counter (“OTC”) markets are generally valued at their closing or latest bid prices as available. Foreign securities and currencies are converted to U.S. dollars using the applicable exchange rate in effect at the close of the New York Stock Exchange (“NYSE”). The Fund will determine the market value of individual securities held by it by using prices provided by one or more approved professional pricing services or, as needed, by obtaining market quotations from independent broker-dealers. Most debt securities are valued in accordance with the evaluated bid price supplied by the pricing service that is intended to reflect market value. The evaluated bid price supplied by the pricing service is an evaluation that may consider factors such as security prices, yields, maturities and ratings. Certain short-term securities maturing within 60 days or less may be evaluated and valued on an amortized cost basis provided that the amortized cost determined approximates market value. Securities for which market quotations or evaluated prices are not readily available or are deemed by Janus Capital to be unreliable are valued at fair value determined in good faith under the Valuation Procedures. Circumstances in which fair value pricing may be utilized include, but are not limited to: (i) a significant event that may affect the securities of a single issuer, such as a merger, bankruptcy, or significant issuer-specific development; (ii) an event that may affect an entire market, such as a natural disaster or significant governmental action; (iii) a nonsignificant event such as a market closing early or not opening, or a security trading halt; and (iv) pricing of a nonvalued security and a restricted or nonpublic security. Special valuation considerations may apply with respect to “odd-lot” fixed-income transactions which, due to their small size, may receive evaluated prices by pricing services which reflect a large block trade and not what actually could be obtained for the odd-lot position.

| | |

| | Janus Detroit Street Trust ½ 17 |

Janus Henderson Small Cap Growth Alpha ETF

Notes to Financial Statements

Valuation Inputs Summary

FASB ASC 820, Fair Value Measurements and Disclosures (“ASC 820”), defines fair value, establishes a framework for measuring fair value, and expands disclosure requirements regarding fair value measurements. This standard emphasizes that fair value is a market-based measurement that should be determined based on the assumptions that market participants would use in pricing an asset or liability and establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. These inputs are summarized into three broad levels:

Level 1 – Unadjusted quoted prices in active markets the Fund has the ability to access for identical assets or liabilities.

Level 2 – Observable inputs other than unadjusted quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Assets or liabilities categorized as Level 2 in the hierarchy generally include: debt securities fair valued in accordance with the evaluated bid or ask prices supplied by a pricing service; securities traded on OTC markets and listed securities for which no sales are reported that are fair valued at the latest bid price (or yield equivalent thereof) obtained from one or more dealers transacting in a market for such securities or by a pricing service approved by the Fund’s Trustees; and certain short-term debt securities with maturities of 60 days or less that are fair valued at amortized cost. Other securities that may be categorized as Level 2 in the hierarchy include, but are not limited to, preferred stocks, bank loans, swaps, investments in unregistered investment companies, options, and forward contracts.

Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available.

There have been no significant changes in valuation techniques used in valuing any such positions held by the Fund since the beginning of the fiscal year.

The inputs or methodology used for fair valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of inputs used as of October 31, 2018 to fair value the Fund’s investments in securities and other financial instruments is included in the “Valuation Inputs Summary” in the Notes to Schedule of Investments and Other Information.

There were no transfers between Level 1, Level 2 and Level 3 of the fair value hierarchy during the period. The Fund recognizes transfers between the levels as of the beginning of the fiscal year.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded as soon as the Fund is informed of the dividend, if such information is obtained subsequent to the ex-dividend date. Dividends from foreign securities may be subject to withholding taxes in foreign jurisdictions. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Indemnifications

In the normal course of business, the Fund may enter into contracts that contain provisions for indemnification of other parties against certain potential liabilities. The Fund’s maximum exposure under these arrangements is unknown, and would involve future claims that may be made against the Fund that have not yet occurred. Currently, the risk of material loss from such claims is considered remote.

Foreign Currency Translations

The Fund does not isolate that portion of the results of operations resulting from the effect of changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held at the date

Janus Henderson Small Cap Growth Alpha ETF

Notes to Financial Statements

of the financial statements. Net unrealized appreciation or depreciation of investments and foreign currency translations arise from changes in the value of assets and liabilities, including investments in securities held at the date of the financial statements, resulting from changes in the exchange rates and changes in market prices of securities held.

Currency gains and losses are also calculated on payables and receivables that are denominated in foreign currencies. The payables and receivables are generally related to foreign security transactions and income translations.

Foreign currency-denominated assets and forward currency contracts may involve more risks than domestic transactions, including currency risk, counterparty risk, political and economic risk, regulatory risk and equity risk. Risks may arise from unanticipated movements in the value of foreign currencies relative to the U.S. dollar.

Dividends and Distributions

The Fund generally declares and distributes dividends of net investment income quarterly. Net realized capital gains (if any) are distributed annually. The Fund may treat a portion of the amount paid to redeem shares as a distribution of investment company taxable income and realized capital gains that are reflected in the NAV. This practice, commonly referred to as “equalization,” has no effect on the redeeming shareholder or a Fund’s total return, but may reduce the amounts that would otherwise be required to be paid as taxable dividends to the remaining shareholders. It is possible that the Internal Revenue Service (IRS) could challenge the Fund’s equalization methodology or calculations, and any such challenge could result in additional tax, interest, or penalties to be paid by the Fund.

The Fund may make certain investments in real estate investment trusts (“REITs”) which pay dividends to their shareholders based upon funds available from operations. It is quite common for these dividends to exceed the REITs’ taxable earnings and profits, resulting in the excess portion of such dividends being designated as a return of capital. If the Fund distributes such amounts, such distributions could constitute a return of capital to shareholders for federal income tax purposes.

Federal Income Taxes

The Fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income in accordance with the requirements of Subchapter M of the Internal Revenue Code. Management has analyzed the Fund’s tax positions taken for all open federal income tax years, generally a three-year period, and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

On December 22, 2017, the Tax Cuts and Jobs Act was signed into law. Currently, Management does not believe the bill will have a material impact on the Fund’s intention to continue to qualify as a regulated investment company, which is generally not subject to U.S. federal income tax.

2. Other Investments and Strategies

Additional Investment Risk

The financial crisis in both the U.S. and global economies over the past several years has resulted, and may continue to result, in a significant decline in the value and liquidity of many securities of issuers worldwide in the equity and fixed income/credit markets. In response to the crisis, the United States and certain foreign governments, along with the U.S. Federal Reserve and certain foreign central banks, took steps to support the financial markets. The withdrawal of this support, a failure of measures put in place to respond to the crisis, or investor perception that such efforts were not sufficient could each negatively affect financial markets generally, and the value and liquidity of specific securities. In addition, policy and legislative changes in the United States and in other countries continue to impact many aspects of financial regulation. The effect of these changes on the markets, and the practical implications for market participants, including the Fund, may not be fully known for some time and could limit or preclude the Fund’s ability to achieve its investment objective. Therefore, it is important to understand that the value of your investment may fall, sometimes sharply, and you could lose money.

The enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) provided for widespread regulation of financial institutions, consumer financial products and services, broker-dealers, OTC derivatives, investment advisers, credit rating agencies, and mortgage lending, which expanded federal oversight in the financial sector, including the investment management industry. Certain provisions of the Dodd-Frank Act remain pending and will be implemented through future rulemaking. Therefore, the ultimate impact of the Dodd-Frank Act and the regulations under the Dodd-Frank Act on the Fund and the investment management industry as a whole, is not yet certain.

| | |

| | Janus Detroit Street Trust ½ 19 |

Janus Henderson Small Cap Growth Alpha ETF

Notes to Financial Statements

Counterparties

Fund transactions involving a counterparty are subject to the risk that the counterparty or a third party will not fulfill its obligation to the Fund (“counterparty risk”). Counterparty risk may arise because of the counterparty’s financial condition (i.e., financial difficulties, bankruptcy, or insolvency), market activities and developments, or other reasons, whether foreseen or not. A counterparty’s inability to fulfill its obligation may result in significant financial loss to the Fund. The Fund may be unable to recover its investment from the counterparty or may obtain a limited recovery, and/or recovery may be delayed. The extent of the Fund’s exposure to counterparty risk with respect to financial assets and liabilities approximates its carrying value. See the “Offsetting Assets and Liabilities” section of this Note for further details.

The Fund may be exposed to counterparty risk through participation in various programs, including, but not limited to, lending its securities to third parties, cash sweep arrangements whereby the Fund’s cash balance is invested in one or more types of cash management vehicles, as well as investments in, but not limited to, repurchase agreements, and derivatives, including various types of swaps, futures and options. The Fund intends to enter into financial transactions with counterparties that Janus Capital believes to be creditworthy at the time of the transaction. There is always the risk that Janus Capital’s analysis of a counterparty’s creditworthiness is incorrect or may change due to market conditions. To the extent that the Fund focuses its transactions with a limited number of counterparties, it will have greater exposure to the risks associated with one or more counterparties.

Offsetting Assets and Liabilities

The Fund presents gross and net information about transactions that are either offset in the financial statements or subject to an enforceable master netting arrangement or similar agreement with a designated counterparty, regardless of whether the transactions are actually offset in the Statement of Assets and Liabilities.

Deutsche Bank AG acts as securities lending agent and a limited purpose custodian or subcustodian to receive and disburse cash balances and cash collateral, hold short-term investments, hold collateral, and perform other custodian functions in accordance with the Agency Securities Lending and Repurchase Agreement. For financial reporting purposes, the Fund does not offset financial instruments’ payables and receivables and related collateral on the Statement of Assets and Liabilities. Securities on loan will be continuously secured by collateral which may consist of cash, U.S. Government securities, domestic and foreign short-term debt instruments, letters of credit, time deposits, repurchase agreements, money market mutual funds or other money market accounts, or such other collateral as permitted by the SEC. The value of the collateral must be at least 102% of the market value of the loaned securities that are denominated in U.S. dollars and 105% of the market value of the loaned securities that are not denominated in U.S. dollars. Upon receipt of cash collateral, Janus Capital intends to invest the cash collateral in a cash management vehicle for which Janus Capital serves as investment adviser, Janus Henderson Cash Collateral Fund LLC. Loaned securities and related collateral are marked-to-market each business day based upon the market value of the loaned securities at the close of business, employing the most recent available pricing information. Collateral levels are then adjusted based on this mark-to-market evaluation.

The following table presents gross amounts of recognized assets and/or liabilities and the net amounts after deducting collateral that has been pledged by counterparties or has been pledged to counterparties (if applicable). For corresponding information grouped by type of instrument, see the Fund’s Schedule of Investments.

Offsetting of Financial Assets and Derivative Assets

| | | | | | | | | | | | | | | | | | |

| Counterparty | | | Gross Amounts of Recognized Assets | | | Offsetting Asset or Liability(a) | | | Collateral

Pledged(b) | | | Net Amount | |

| | Deutsche Bank AG | | | $ | 1,566,630 | | | $ | — | | | $ | (1,566,630) | | | $ | — | |

| (a) | Represents the amount of assets or liabilities that could be offset with the same counterparty under master netting or similar agreements that management elects not to offset on the Statement of Assets and Liabilities. |

| (b) | Collateral pledged is limited to the net outstanding amount due to/from an individual counterparty. The actual collateral amounts pledged may exceed these amounts and may fluctuate in value. |

Real Estate Investing

The Fund may invest in equity securities of real estate-related companies to the extent such securities are included in the Underlying Index. Such companies may include those in the real estate industry or real estate-related industries. These securities may include common stocks, preferred stocks, and other equity securities, including, but not limited to, mortgage-backed securities, real estate-backed securities, securities of REITs and similar REIT-like entities. A REIT is a

Janus Henderson Small Cap Growth Alpha ETF

Notes to Financial Statements

trust that invests in real estate-related projects, such as properties, mortgage loans, and construction loans. REITs are generally categorized as equity, mortgage, or hybrid REITs. A REIT may be listed on an exchange or traded OTC.

Securities Lending

Under procedures adopted by the Trustees, the Fund may seek to earn additional income by lending securities to qualified parties. Deutsche Bank AG acts as securities lending agent and a limited purpose custodian or subcustodian to receive and disburse cash balances and cash collateral, hold short-term investments, hold collateral, and perform other custodian functions. The Fund may lend portfolio securities in an amount equal to up to 1/3 of its total assets as determined at the time of the loan origination. There is the risk of delay in recovering a loaned security or the risk of loss in collateral rights if the borrower fails financially. In addition, Janus Capital makes efforts to balance the benefits and risks from granting such loans. All loans will be continuously secured by collateral which may consist of cash, U.S. Government securities, domestic and foreign short-term debt instruments, letters of credit, time deposits, repurchase agreements, money market mutual funds or other money market accounts, or such other collateral as permitted by the SEC. If the Fund is unable to recover a security on loan, the Fund may use the collateral to purchase replacement securities in the market. There is a risk that the value of the collateral could decrease below the cost of the replacement security by the time the replacement investment is made, resulting in a loss to the Fund.

Upon receipt of cash collateral, Janus Capital may invest it in affiliated or non-affiliated cash management vehicles, whether registered or unregistered entities, as permitted by the 1940 Act and rules promulgated thereunder. Janus Capital currently intends to invest the cash collateral in a cash management vehicle for which Janus Capital serves as investment adviser, Janus Henderson Cash Collateral Fund LLC. An investment in Janus Henderson Cash Collateral Fund LLC is generally subject to the same risks that shareholders experience when investing in similarly structured vehicles, such as the potential for significant fluctuations in assets as a result of the purchase and redemption activity of the securities lending program, a decline in the value of the collateral, and possible liquidity issues. Such risks may delay the return of the cash collateral and cause the Fund to violate its agreement to return the cash collateral to a borrower in a timely manner. As adviser to the Fund and Janus Henderson Cash Collateral Fund LLC, Janus Capital has an inherent conflict of interest as a result of its fiduciary duties to both the Fund and Janus Henderson Cash Collateral Fund LLC. Additionally, Janus Capital receives an investment advisory fee of 0.05% for managing Janus Henderson Cash Collateral Fund LLC, but it may not receive a fee for managing certain other affiliated cash management vehicles in which the Fund may invest, and therefore may have an incentive to allocate preferred investment opportunities to investment vehicles for which it is receiving a fee.

The value of the collateral must be at least 102% of the market value of the loaned securities that are denominated in U.S. dollars and 105% of the market value of the loaned securities that are not denominated in U.S. dollars. Loaned securities and related collateral are marked-to-market each business day based upon the market value of the loaned securities at the close of business, employing the most recent available pricing information. Collateral levels are then adjusted based on this mark-to-market evaluation.

The cash collateral invested by Janus Capital is disclosed in the Schedule of Investments (if applicable). Income earned from the investment of the cash collateral, net of rebates paid to, or fees paid by, borrowers and less the fees paid to the lending agent are included as “Affiliated securities lending income, net” on the Statement of Operations. As of October 31, 2018, securities lending transactions accounted for as secured borrowings with an overnight and continuous contractual maturity are $1,566,630 for equity securities. Gross amounts of recognized liabilities for securities lending (collateral received) as of October 31, 2018 is $1,591,064, resulting in the net amount due to the counterparty of $24,434.

3. Investment Advisory Agreements and Other Transactions with Affiliates

Under its unitary fee structure, the Fund pays Janus Capital a management fee in return for providing certain investment advisory, supervisory, and administrative services to the Fund, including the costs of transfer agency, custody, fund administration, legal, audit, and other services. Janus Capital’s fee structure is designed to pay substantially all of the Fund’s expenses. However, the Fund bears other expenses which are not covered under the management fee which may vary and affect the total level of expenses paid by shareholders, such as distribution fees (if any), brokerage expenses or commissions, interest, dividends, taxes, litigation expenses, acquired fund fees and expenses (if any), and extraordinary expenses. The Fund’s management fee is calculated daily and paid monthly. For the fiscal year ended October 31, 2018, the Fund’s contractual management fee rate (expressed as an annual rate) was 0.50% of the Fund’s average daily net assets.

State Street Bank and Trust Company (“State Street”) provides certain fund administration services to the Fund, including services related to the Fund’s accounting, including calculating the daily NAV, audit, tax, and reporting obligations,

| | |

| | Janus Detroit Street Trust ½ 21 |

Janus Henderson Small Cap Growth Alpha ETF

Notes to Financial Statements

pursuant to an agreement with Janus Capital, on behalf of the Fund. As compensation for such services, Janus Capital pays State Street a fee based on a percentage of the Fund’s assets, with a minimum flat fee, for certain services. Janus Capital serves as administrator to the Fund, providing oversight and coordination of the Fund’s service providers, recordkeeping and other administrative services. Janus Capital does not receive any additional compensation, beyond the unitary fee, for serving as administrator. State Street also serves as transfer agent for the shares of the Fund.

Due to an administrative oversight by its administrator, the Fund’s Distribution and Servicing Plan, pursuant to Rule 12b-1 under the 1940 Act that was originally approved at the time of the Fund’s formation (“Initial Rule 12b-1 Plan”), could be viewed to have expired on or about February 11, 2017. The Initial Rule 12b-1 Plan was never implemented, and 12b-1 fees were not charged, prior to its potential expiration. At an in-person meeting held on July 18, 2018, the Fund’s Board of Trustees (“Board”) approved a new Rule 12b-1 Plan (the “Plan”) with respect to the Fund, with terms that are substantively identical to the Initial Rule 12b-1 Plan. Because the Fund has commenced operations, the Plan must also be approved by the Fund’s shareholders prior to implementation. At this time, Janus Capital does not intend to seek shareholder approval for implementation of the Plan. The Plan would permit compensation in connection with the distribution and marketing of Fund shares and/or the provision of certain shareholder services. The Plan would permit the Fund to pay ALPS Distributors, Inc. (the “Distributor”) or its designee, a fee for the sale and distribution and/or shareholder servicing of the shares at an annual rate of up to 0.25% of average daily net assets of the Fund. Under the terms of the Plan, the Trust would be authorized to make payments to the Distributor or its designee for remittance to retirement plan service providers, broker-dealers, bank trust departments, financial advisors, and other financial intermediaries, as compensation for distribution and/or shareholder services performed by such entities for their customers who are investors in the Fund. However, implementation of the Plan and imposition of the 12b-1 fee would require prior approval by Fund shareholders via proxy vote. Janus Capital does not anticipate seeking such approval at this time. Because 12b-1 fees are paid out of the fund assets on an ongoing basis, to the extent that such a fee is authorized by shareholders in the future, over time they will increase the cost of an investment in the Fund. If implemented, the Plan fee may cost an investor more than other types of sales charges.

As of October 31, 2018, Janus Capital owned 2,000 shares or 0.31% of the Fund.

The Fund is permitted to purchase or sell securities (“cross-trade”) between itself and other funds or accounts managed by Janus Capital in accordance with Rule 17a-7 under the Investment Company Act of 1940 (“Rule 17a-7”), when the transaction is consistent with the investment objectives and policies of the Fund and in accordance with the Internal Cross Trade Procedures adopted by the Trust’s Board of Trustees. These procedures have been designed to ensure that any cross-trade of securities by the Fund from or to another fund or account that is or could be considered an affiliate of the Fund under certain limited circumstances by virtue of having a common investment adviser, common Officer, or common Trustee complies with Rule 17a-7. Under these procedures, each cross-trade is effected at the current market price to save costs where allowed. During the year ended October 31, 2018, the Fund engaged in cross trades amounting to $290,785 in purchases and $1,133,070 in sales, resulting in a net realized gain of $36,471. The net realized gain is included within the “Net Realized Gain/(Loss) on Investments” section of the Fund’s Statement of Operations.

Any purchases and sales, realized gains/losses and recorded dividends from affiliated investments during the year ended October 31, 2018 can be found in a table located in the Schedule of Investments.

4. Federal Income Tax

The tax components of capital shown in the table below represent: (1) distribution requirements the Fund must satisfy under the income tax regulations; (2) losses or deductions the Fund may be able to offset against income and gains realized in future years; and (3) unrealized appreciation or depreciation of investments for federal income tax purposes.

Other book to tax differences primarily consist of derivatives, and foreign currency contract adjustments. The Fund has elected to treat gains and losses on forward foreign currency contracts as capital gains and losses, if applicable. Other foreign currency gains and losses on debt instruments are treated as ordinary income for federal income tax purposes pursuant to Section 988 of the Internal Revenue Code.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Undistributed

Ordinary Income | | | Undistributed

Long-Term Gains | | | Accumulated

Capital Losses | | | Late-Year

Ordinary Loss | | | Post-October

Capital Loss | | | Other Book to Tax Differences | | | Net Tax Appreciation/ (Depreciation) | |

| $ | 3,169 | | | $ | — | | | $ | (493,274) | | | $ | — | | | $ | — | | | $ | — | | | $ | (3,963,843) | |

Janus Henderson Small Cap Growth Alpha ETF

Notes to Financial Statements

Accumulated capital losses noted below represent net capital loss carryovers, as of October 31, 2018, that may be available to offset future realized capital gains and thereby reduce future taxable gains distributions. The following table shows these capital loss carryovers.

| | | | | | | | | | |

Capital Loss Carryover Schedule

For the year ended October 31, 2018

No Expiration | | | Accumulated Capital Losses | |

| Short-Term | | | Long-Term | |

| $ | (342,113) | | | $ | (151,161) | | | $ | (493,274) | |

The aggregate cost of investments and the composition of unrealized appreciation and depreciation of investment securities for federal income tax purposes as of October 31, 2018 are noted below. The primary differences between book and tax appreciation or depreciation of investments are wash sale loss deferrals and investments in partnerships.

| | | | | | | | | | | | | | |

| Federal Tax Cost | | | Unrealized Appreciation | | | Unrealized (Depreciation) | | | Net Tax Appreciation/

(Depreciation) | |

| $ | 31,391,004 | | | $ | 307,910 | | | $ | (4,271,753) | | | $ | (3,963,843) | |

Income and capital gains distributions are determined in accordance with income tax regulations that may differ from accounting principles generally accepted in the United States of America. These differences are due to differing treatments for items such as net short-term gains, deferral of wash sale losses, foreign currency transactions, passive foreign investment companies, net investment losses, in-kind transactions and capital loss carryovers. Certain permanent differences such as tax returns of capital and net investment losses noted below have been reclassified to capital.

| | | | | | | | | | | | | | |

| For the year ended October 31, 2018: | |

| Distributions | | | | |

| From Ordinary Income | | | From Long-Term Capital Gain | | | Tax Return of Capital | | | Net Investment Loss | |

| $ | 87,999 | | | $ | — | | | $ | — | | | $ | — | |

|

| For the year ended October 31, 2017: | |

| Distributions | | | | |

| From Ordinary Income | | | From Long-Term Capital Gain | | | Tax Return of Capital | | | Net Investment Loss | |

| $ | 46,606 | | | $ | — | | | $ | — | | | $ | — | |