united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-22483 |

| Copeland Trust |

| (Exact name of registrant as specified in charter) |

| Eight Tower Bridge, 161 Washington St., Suite #1325 Conshohocken, PA 19428 |

| (Address of principal executive offices) | (Zip code) |

| Ultimus Fund Solutions, LLC, 80 Arkay Drive Suite 10, Hauppauge, NY 11788 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | (631) 470-2619 | |

| Date of fiscal year end: | 11/30 | |

| | | |

| Date of reporting period: | 5/31/24 | |

Item 1. Reports to Stockholders.

Copeland SMID Cap Dividend Growth Fund

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Copeland SMID Cap Dividend Growth Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class IFootnote Reference* | $48 | 0.95%Footnote Reference** |

* During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund's investment adviser, Copeland Capital Management, LLC. If the agreement is not extended in the future, expenses could be higher.

** Annualized.

How did the Fund perform during the reporting period?

During the six-month period ended May 31, 2024, Class I shares of the Fund rose 10.7%, lagging the 15.0% advance registered by the Russell 2500 Index and 16.0% of the Russell 3000 Index. The equity market rally was aided by growing enthusiasm for technology stocks exposed to artificial intelligence (AI). The concentrated leadership of such stocks was noteworthy within both large and small capitalization benchmarks, while dividend growth securities unsurprisingly failed to keep pace with the frothy market environment. More broadly, the equity market continues to benefit from the dual tailwinds of strong economic data and softening inflation figures. At period end, U.S unemployment of 4.0% remained low relative to historical levels. Core CPI growth moderated to 3.4% in May, well below the 3.9% rate witnessed at period outset in December. While ongoing economic resilience has led the U.S. Federal Reserve to hold its target rate steady at a range of 5.25% to 5.50%, the prospects for rate cuts have improved as inflation moderated, aiding the enthusiasm for stocks. Stock selection in the Consumer Discretionary sector of the market bolstered Fund returns while those in the Information Technology sector were a headwind. Dick’s Sporting Goods (DKS, 2.1% of holdings) was a top performing holding as earnings beat expectations during the period. While concerns abound that consumers are moderating their spending in this category, the company is executing impressively as shown by growing market share, rising sales and margins maintained at a much higher level than were possible before the pandemic. Meanwhile, Concentrix Corporation (CNXC, 1.2%) retreated as investors assume the company will be harmed by the emergence of new technologies developed using AI. The company provides customer experience outsourcing, including call centers, which will be impacted by new technologies. However, we believe the recent slowdown in sales is temporary and that the company will remain a leader in offering tools to clients as they look to cut costs of customer interactions.

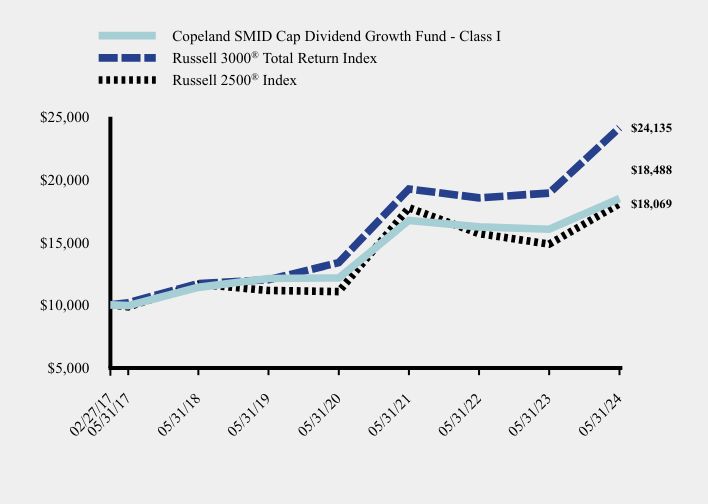

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Copeland SMID Cap Dividend Growth Fund - Class I | Russell 3000® Total Return Index | Russell 2500® Index |

|---|

| 02/27/17 | $10,000 | $10,000 | $10,000 |

| 05/31/17 | $9,940 | $10,175 | $9,848 |

| 05/31/18 | $11,397 | $11,708 | $11,649 |

| 05/31/19 | $12,107 | $12,000 | $11,149 |

| 05/31/20 | $12,156 | $13,375 | $11,060 |

| 05/31/21 | $16,739 | $19,249 | $17,746 |

| 05/31/22 | $16,222 | $18,540 | $15,684 |

| 05/31/23 | $16,038 | $18,917 | $14,847 |

| 05/31/24 | $18,488 | $24,135 | $18,069 |

Average Annual* Total Returns

| 6 Months | 1 Year | 5 years | Since Inception (2/27/2017) |

|---|

| Copeland SMID Cap Dividend Growth Fund - Class I | 10.69% | 15.28% | 8.84% | 8.84% |

Russell 3000® Total Return Index | 15.99% | 27.58% | 15.00% | 12.91% |

Russell 2500® Index | 15.04% | 21.70% | 10.14% | 8.50% |

* Total returns for periods less than 1 year are not annualized.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$160,406,973

- Number of Portfolio Holdings71

- Advisory Fee (net of waivers)$218,160

- Portfolio Turnover9%

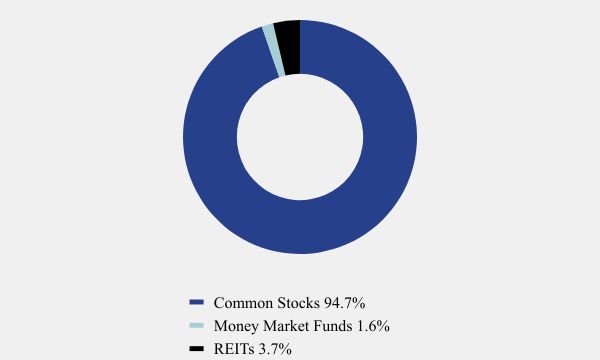

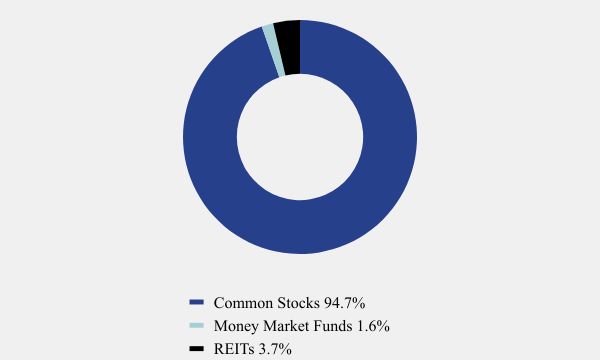

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 94.7% |

| Money Market Funds | 1.6% |

| REITs | 3.7% |

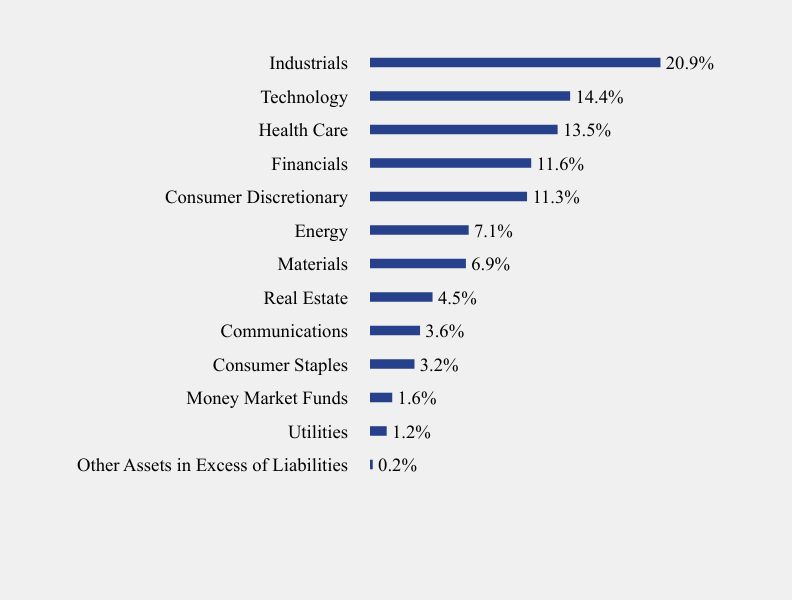

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.2% |

| Utilities | 1.2% |

| Money Market Funds | 1.6% |

| Consumer Staples | 3.2% |

| Communications | 3.6% |

| Real Estate | 4.5% |

| Materials | 6.9% |

| Energy | 7.1% |

| Consumer Discretionary | 11.3% |

| Financials | 11.6% |

| Health Care | 13.5% |

| Technology | 14.4% |

| Industrials | 20.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Ensign Group, Inc. (The) | 2.2% |

| Dick's Sporting Goods, Inc. | 2.1% |

| Encompass Health Corporation | 2.1% |

| Carlisle Companies, Inc. | 2.1% |

| Reliance, Inc. | 2.0% |

| Hamilton Lane, Inc., Class A | 2.0% |

| Casey's General Stores, Inc. | 2.0% |

| Tetra Tech, Inc. | 2.0% |

| LeMaitre Vascular, Inc. | 1.9% |

| Booz Allen Hamilton Holding Corporation | 1.9% |

No material changes occured during the six months ended May 31, 2024.

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Copeland SMID Cap Dividend Growth Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

Copeland SMID Cap Dividend Growth Fund - Class I (CSMDX)

Semi-Annual Shareholder Report - May 31, 2024

Copeland SMID Cap Dividend Growth Fund

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Copeland SMID Cap Dividend Growth Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class AFootnote Reference* | $60 | 1.20%Footnote Reference** |

* During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund's investment adviser, Copeland Capital Management, LLC. If the agreement is not extended in the future, expenses could be higher.

** Annualized.

How did the Fund perform during the reporting period?

During the six-month period ended May 31, 2024, Class A shares of the Fund rose 10.6%, lagging the 15.0% advance registered by the Russell 2500 Index and 16.0% of the Russell 3000 Index. The equity market rally was aided by growing enthusiasm for technology stocks exposed to artificial intelligence (AI). The concentrated leadership of such stocks was noteworthy within both large and small capitalization benchmarks, while dividend growth securities unsurprisingly failed to keep pace with the frothy market environment. More broadly, the equity market continues to benefit from the dual tailwinds of strong economic data and softening inflation figures. At period end, U.S unemployment of 4.0% remained low relative to historical levels. Core CPI growth moderated to 3.4% in May, well below the 3.9% rate witnessed at period outset in December. While ongoing economic resilience has led the U.S. Federal Reserve to hold its target rate steady at a range of 5.25% to 5.50%, the prospects for rate cuts have improved as inflation moderated, aiding the enthusiasm for stocks. Stock selection in the Consumer Discretionary sector of the market bolstered Fund returns while those in the Information Technology sector were a headwind. Dick’s Sporting Goods (DKS, 2.1% of holdings) was a top performing holding as earnings beat expectations during the period. While concerns abound that consumers are moderating their spending in this category, the company is executing impressively as shown by growing market share, rising sales and margins maintained at a much higher level than were possible before the pandemic. Meanwhile, Concentrix Corporation (CNXC, 1.2%) retreated as investors assume the company will be harmed by the emergence of new technologies developed using AI. The company provides customer experience outsourcing, including call centers, which will be impacted by new technologies. However, we believe the recent slowdown in sales is temporary and that the company will remain a leader in offering tools to clients as they look to cut costs of customer interactions.

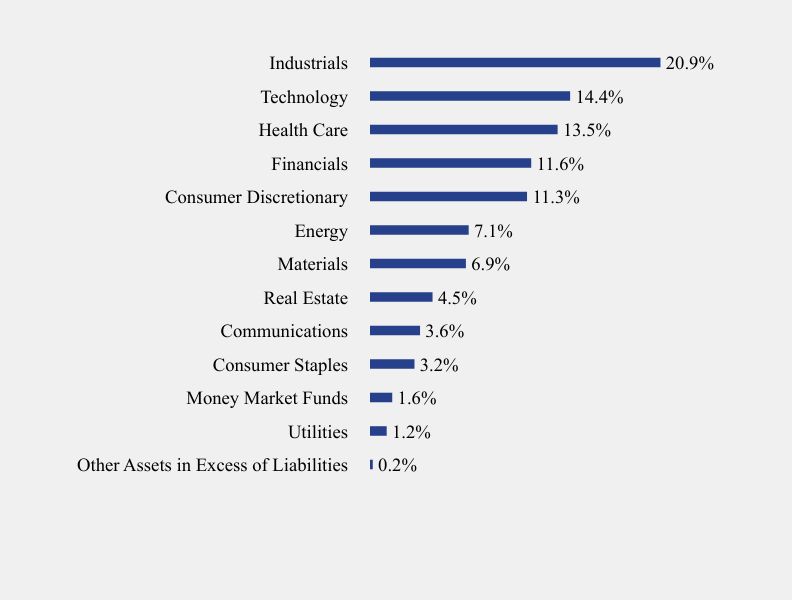

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Copeland SMID Cap Dividend Growth Fund - Class A | Russell 3000® Total Return Index | Russell 2500® Index |

|---|

| 02/11/19 | $9,423 | $10,000 | $10,000 |

| 05/31/19 | $9,796 | $10,163 | $9,841 |

| 05/31/20 | $9,802 | $11,328 | $9,762 |

| 05/31/21 | $13,471 | $16,302 | $15,663 |

| 05/31/22 | $13,021 | $15,702 | $13,843 |

| 05/31/23 | $12,843 | $16,021 | $13,104 |

| 05/31/24 | $14,761 | $20,440 | $15,948 |

Average Annual* Total Returns

| 6 months | 1 Year | 5 Years | Since Inception (2/11/2019) |

|---|

| Copeland SMID Cap Dividend Growth Fund - Class A | | | | |

| Without Load | 10.57% | 14.94% | 8.55% | 8.84% |

| With Load | 4.22% | 8.32% | 7.27% | 7.63% |

Russell 3000® Total Return Index | 15.99% | 27.58% | 15.00% | 14.45% |

Russell 2500® Index | 15.04% | 21.70% | 10.14% | 9.21% |

* Total returns for periods less than 1 year are not annualized.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$160,406,973

- Number of Portfolio Holdings71

- Advisory Fee (net of waivers)$218,160

- Portfolio Turnover9%

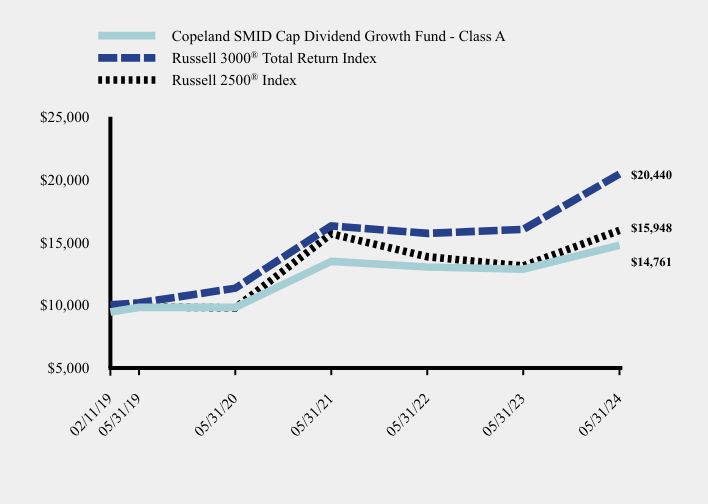

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 94.7% |

| Money Market Funds | 1.6% |

| REITs | 3.7% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.2% |

| Utilities | 1.2% |

| Money Market Funds | 1.6% |

| Consumer Staples | 3.2% |

| Communications | 3.6% |

| Real Estate | 4.5% |

| Materials | 6.9% |

| Energy | 7.1% |

| Consumer Discretionary | 11.3% |

| Financials | 11.6% |

| Health Care | 13.5% |

| Technology | 14.4% |

| Industrials | 20.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Ensign Group, Inc. (The) | 2.2% |

| Dick's Sporting Goods, Inc. | 2.1% |

| Encompass Health Corporation | 2.1% |

| Carlisle Companies, Inc. | 2.1% |

| Reliance, Inc. | 2.0% |

| Hamilton Lane, Inc., Class A | 2.0% |

| Casey's General Stores, Inc. | 2.0% |

| Tetra Tech, Inc. | 2.0% |

| LeMaitre Vascular, Inc. | 1.9% |

| Booz Allen Hamilton Holding Corporation | 1.9% |

No material changes occured during the six months ended May 31, 2024.

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Copeland SMID Cap Dividend Growth Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

Copeland SMID Cap Dividend Growth Fund - Class A (CSDGX)

Semi-Annual Shareholder Report - May 31, 2024

Copeland Dividend Growth Fund

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Copeland Dividend Growth Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class AFootnote Reference* | $60 | 1.20%Footnote Reference** |

* During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund's investment adviser, Copeland Capital Management, LLC. If the agreement is not extended in the future, expenses could be higher.

** Annualized.

How did the Fund perform during the reporting period?

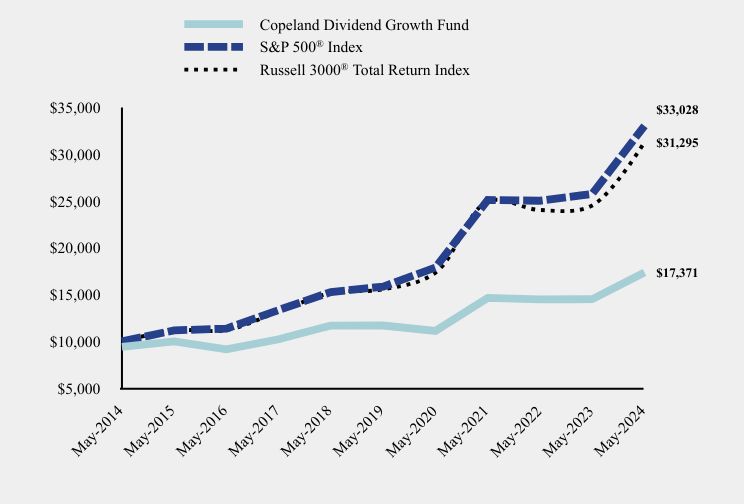

During the six-month period ended May 31, 2024, Class A shares of the Fund rose 11.5%, lagging the 16.0% advance registered by the Russell 3000 Index and 16.4% of the S&P 500 Index. As the period unfolded, market advances were led by a handful of mega-cap technology stocks while dividend growth securities failed to keep pace with the frothy market environment. To wit, the NASDAQ Composite Index rose 18% during the period while the NASDAQ Dividend Achievers Index climbed a more muted 11.1%. Widespread optimism surrounding the financial boost that artificial intelligence will provide to technology behemoths propelled that segment of the market higher. More broadly, the equity market continues to benefit from the dual tailwinds of strong economic data and softening inflation figures. At period end, U.S. unemployment of 4.0% remained low relative to historical levels. Core CPI growth moderated to 3.4% in May, well below the 3.9% rate witnessed at period outset in December. Ongoing economic strength has allowed the U.S. Federal Reserve to hold its target rate steady at a range of 5.25% to 5.50% as the monetary strives to push inflation closer to its long-term target rate of two percent. Our stock selection in the Consumer Staples sector of the market bolstered Fund returns while those in the Information Technology sector, despite rising 14% on average, were a drag. Costco (COST, 2.1% of holdings) was a top performing holding, advancing over 40% during the period. The membership based, warehouse retailer has grown earnings by over 15% annually over the past five years, including those marred by the pandemic. A strategy of offering compelling values by focusing on a limited number of SKUs has driven consistent share gains at the retailer. On the downside, Fund holding Starbucks (SBUX, 0.0% of holdings) was the worst performer in the Fund, dipping roughly 26% during the period. In early May, the coffee behemoth posted weaker than expected quarterly results and lowered forward guidance. Comparable store sales in the company’s two largest markets, the U.S. and China, both contracted. The recent setback and a murky future under new CEO Laxman Narasimhan drove us to exit the shares in favor of more compelling opportunities.

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Copeland Dividend Growth Fund | S&P 500® Index | Russell 3000® Total Return Index |

|---|

| May-2014 | $9,427 | $10,000 | $10,000 |

| May-2015 | $10,008 | $11,181 | $11,186 |

| May-2016 | $9,156 | $11,372 | $11,211 |

| May-2017 | $10,236 | $13,359 | $13,194 |

| May-2018 | $11,699 | $15,281 | $15,181 |

| May-2019 | $11,703 | $15,859 | $15,560 |

| May-2020 | $11,128 | $17,895 | $17,344 |

| May-2021 | $14,644 | $25,109 | $24,960 |

| May-2022 | $14,488 | $25,034 | $24,040 |

| May-2023 | $14,513 | $25,766 | $24,529 |

| May-2024 | $17,371 | $33,028 | $31,295 |

Average Annual* Total Returns

| 6 months | 1 Year | 5 Years | 10 Years |

|---|

| Copeland Dividend Growth Fund | | | | |

| Without Load | 11.50% | 19.69% | 8.22% | 6.30% |

| With Load | 5.08% | 12.79% | 6.94% | 5.68% |

S&P 500® Index | 16.35% | 28.19% | 15.80% | 12.69% |

Russell 3000® Total Return Index | 15.99% | 27.58% | 15.00% | 12.09% |

* Total returns for periods less than 1 year are not annualized.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$39,571,330

- Number of Portfolio Holdings69

- Advisory Fee (net of waivers)$0

- Portfolio Turnover21%

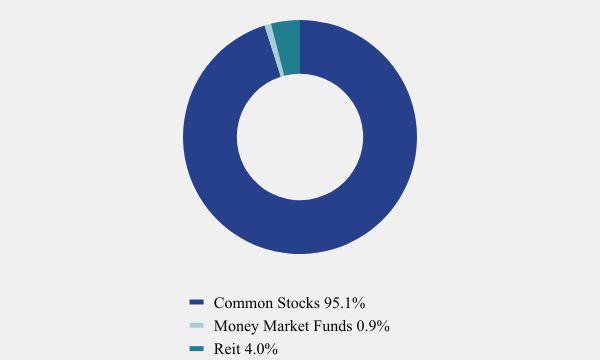

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 95.1% |

| Money Market Funds | 0.9% |

| Reit | 4.0% |

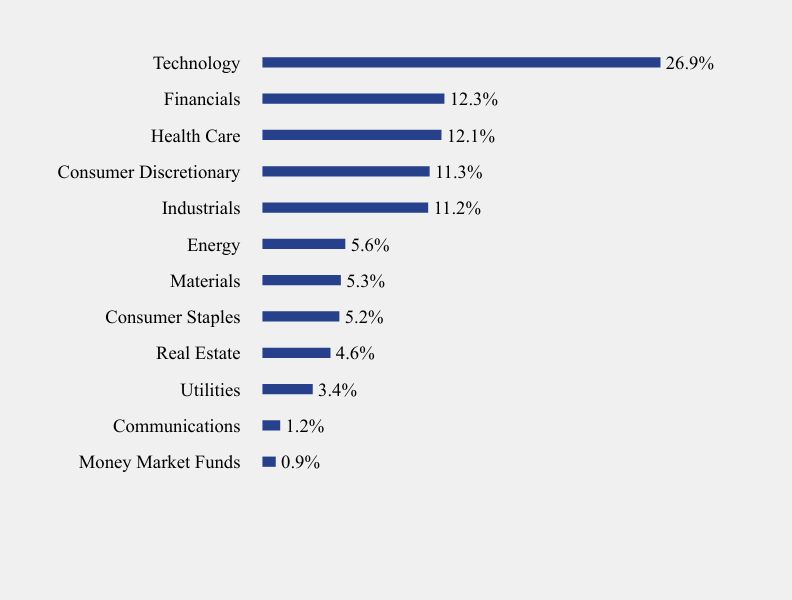

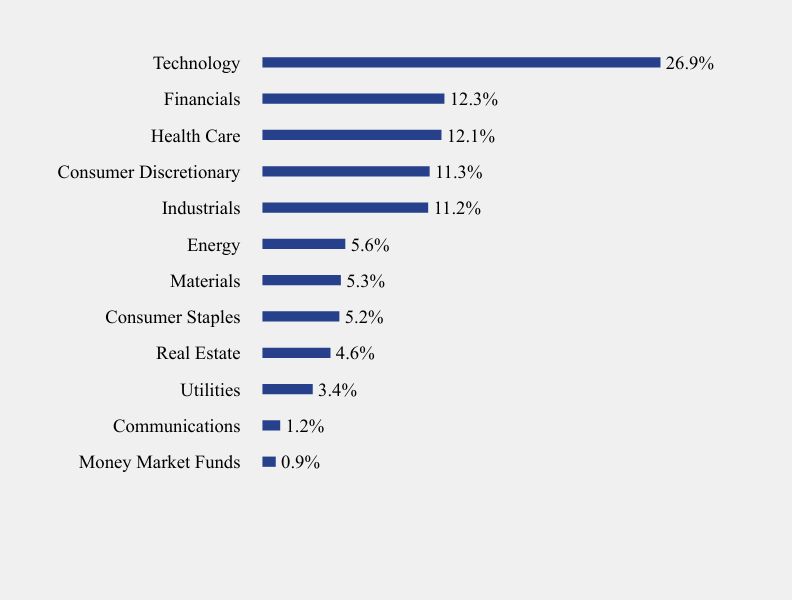

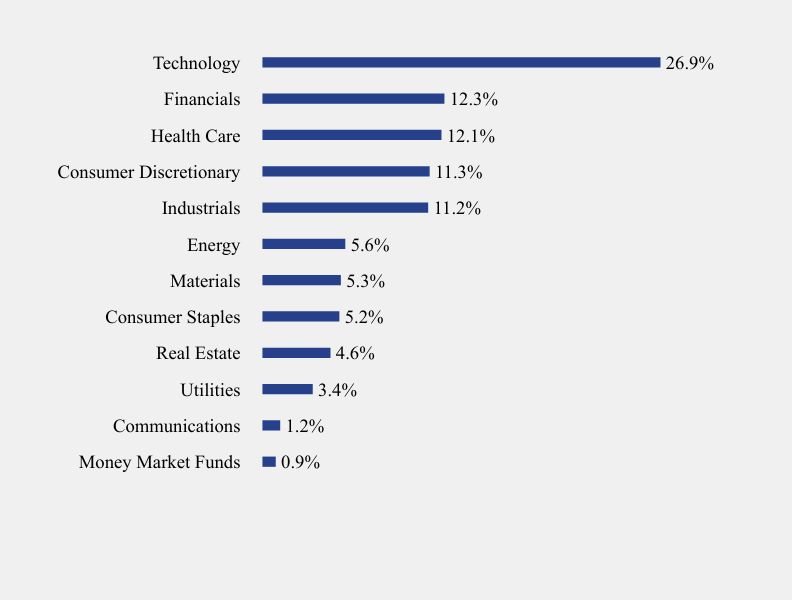

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Money Market Funds | 0.9% |

| Communications | 1.2% |

| Utilities | 3.4% |

| Real Estate | 4.6% |

| Consumer Staples | 5.2% |

| Materials | 5.3% |

| Energy | 5.6% |

| Industrials | 11.2% |

| Consumer Discretionary | 11.3% |

| Health Care | 12.1% |

| Financials | 12.3% |

| Technology | 26.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Costco Wholesale Corporation | 2.2% |

| NextEra Energy, Inc. | 2.1% |

| Motorola Solutions, Inc. | 2.1% |

| Microsoft Corporation | 1.9% |

| Apple, Inc. | 1.9% |

| Broadcom, Inc. | 1.9% |

| Ensign Group, Inc. (The) | 1.9% |

| Monolithic Power Systems, Inc. | 1.9% |

| Domino's Pizza, Inc. | 1.8% |

| Amphenol Corporation, Class A | 1.7% |

No material changes occured during the six months ended May 31, 2024.

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Copeland Dividend Growth Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

Copeland Dividend Growth Fund - Class A (CDGRX )

Semi-Annual Shareholder Report - May 31, 2024

Copeland Dividend Growth Fund

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Copeland Dividend Growth Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class CFootnote Reference* | $98 | 1.95%Footnote Reference** |

* During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund's investment adviser, Copeland Capital Management, LLC. If the agreement is not extended in the future, expenses could be higher.

** Annualized.

How did the Fund perform during the reporting period?

During the six-month period ended May 31, 2024, Class C shares of the Fund rose 11.1%, lagging the 16.0% advance registered by the Russell 3000 Index and 16.4% of the S&P 500 Index. As the period unfolded, market advances were led by a handful of mega-cap technology stocks while dividend growth securities failed to keep pace with the frothy market environment. To wit, the NASDAQ Composite Index rose 18% during the period while the NASDAQ Dividend Achievers Index climbed a more muted 11.1%. Widespread optimism surrounding the financial boost that artificial intelligence will provide to technology behemoths propelled that segment of the market higher. More broadly, the equity market continues to benefit from the dual tailwinds of strong economic data and softening inflation figures. At period end, U.S. unemployment of 4.0% remained low relative to historical levels. Core CPI growth moderated to 3.4% in May, well below the 3.9% rate witnessed at period outset in December. Ongoing economic strength has allowed the U.S. Federal Reserve to hold its target rate steady at a range of 5.25% to 5.50% as the monetary strives to push inflation closer to its long-term target rate of two percent. Our stock selection in the Consumer Staples sector of the market bolstered Fund returns while those in the Information Technology sector, despite rising 14% on average, were a drag. Costco (COST, 2.1% of holdings) was a top performing holding, advancing over 40% during the period. The membership based, warehouse retailer has grown earnings by over 15% annually over the past five years, including those marred by the pandemic. A strategy of offering compelling values by focusing on a limited number of SKUs has driven consistent share gains at the retailer. On the downside, Fund holding Starbucks (SBUX, 0.0% of holdings) was the worst performer in the Fund, dipping roughly 26% during the period. In early May, the coffee behemoth posted weaker than expected quarterly results and lowered forward guidance. Comparable store sales in the company’s two largest markets, the U.S. and China, both contracted. The recent setback and a murky future under new CEO Laxman Narasimhan drove us to exit the shares in favor of more compelling opportunities.

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Copeland Dividend Growth Fund | S&P 500® Index | Russell 3000® Total Return Index |

|---|

| May-2014 | $10,000 | $10,000 | $10,000 |

| May-2015 | $10,537 | $11,181 | $11,186 |

| May-2016 | $9,571 | $11,372 | $11,211 |

| May-2017 | $10,617 | $13,359 | $13,194 |

| May-2018 | $12,041 | $15,281 | $15,181 |

| May-2019 | $11,964 | $15,859 | $15,560 |

| May-2020 | $11,294 | $17,895 | $17,344 |

| May-2021 | $14,738 | $25,109 | $24,960 |

| May-2022 | $14,480 | $25,034 | $24,040 |

| May-2023 | $14,390 | $25,766 | $24,529 |

| May-2024 | $17,092 | $33,028 | $31,295 |

Average Annual* Total Returns

| 6 Months | 1 Year | 5 years | 10 Years |

|---|

| Copeland Dividend Growth Fund | 11.10% | 18.77% | 7.39% | 5.51% |

S&P 500® Index | 16.35% | 28.19% | 15.80% | 12.69% |

Russell 3000® Total Return Index | 15.99% | 27.58% | 15.00% | 12.09% |

* Total returns for periods less than 1 year are not annualized.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$39,571,330

- Number of Portfolio Holdings69

- Advisory Fee (net of waivers)$0

- Portfolio Turnover21%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 95.1% |

| Money Market Funds | 0.9% |

| Reit | 4.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Money Market Funds | 0.9% |

| Communications | 1.2% |

| Utilities | 3.4% |

| Real Estate | 4.6% |

| Consumer Staples | 5.2% |

| Materials | 5.3% |

| Energy | 5.6% |

| Industrials | 11.2% |

| Consumer Discretionary | 11.3% |

| Health Care | 12.1% |

| Financials | 12.3% |

| Technology | 26.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Costco Wholesale Corporation | 2.2% |

| NextEra Energy, Inc. | 2.1% |

| Motorola Solutions, Inc. | 2.1% |

| Microsoft Corporation | 1.9% |

| Apple, Inc. | 1.9% |

| Broadcom, Inc. | 1.9% |

| Ensign Group, Inc. (The) | 1.9% |

| Monolithic Power Systems, Inc. | 1.9% |

| Domino's Pizza, Inc. | 1.8% |

| Amphenol Corporation, Class A | 1.7% |

No material changes occured during the six months ended May 31, 2024.

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Copeland Dividend Growth Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

Copeland Dividend Growth Fund - Class C (CDCRX )

Semi-Annual Shareholder Report - May 31, 2024

Copeland Dividend Growth Fund

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Copeland Dividend Growth Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class IFootnote Reference* | $53 | 1.05%Footnote Reference** |

* During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund's investment adviser, Copeland Capital Management, LLC. If the agreement is not extended in the future, expenses could be higher.

** Annualized.

How did the Fund perform during the reporting period?

During the six-month period ended May 31, 2024, Class I shares of the Fund rose 11.6%, lagging the 16.0% advance registered by the Russell 3000 Index and 16.4% of the S&P 500 Index. As the period unfolded, market advances were led by a handful of mega-cap technology stocks while dividend growth securities failed to keep pace with the frothy market environment. To wit, the NASDAQ Composite Index rose 18% during the period while the NASDAQ Dividend Achievers Index climbed a more muted 11.1%. Widespread optimism surrounding the financial boost that artificial intelligence will provide to technology behemoths propelled that segment of the market higher. More broadly, the equity market continues to benefit from the dual tailwinds of strong economic data and softening inflation figures. At period end, U.S. unemployment of 4.0% remained low relative to historical levels. Core CPI growth moderated to 3.4% in May, well below the 3.9% rate witnessed at period outset in December. Ongoing economic strength has allowed the U.S. Federal Reserve to hold its target rate steady at a range of 5.25% to 5.50% as the monetary strives to push inflation closer to its long-term target rate of two percent. Our stock selection in the Consumer Staples sector of the market bolstered Fund returns while those in the Information Technology sector, despite rising 14% on average, were a drag. Costco (COST, 2.1% of holdings) was a top performing holding, advancing over 40% during the period. The membership based, warehouse retailer has grown earnings by over 15% annually over the past five years, including those marred by the pandemic. A strategy of offering compelling values by focusing on a limited number of SKUs has driven consistent share gains at the retailer. On the downside, Fund holding Starbucks (SBUX, 0.0% of holdings) was the worst performer in the Fund, dipping roughly 26% during the period. In early May, the coffee behemoth posted weaker than expected quarterly results and lowered forward guidance. Comparable store sales in the company’s two largest markets, the U.S. and China, both contracted. The recent setback and a murky future under new CEO Laxman Narasimhan drove us to exit the shares in favor of more compelling opportunities.

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Copeland Dividend Growth Fund | S&P 500® Index | Russell 3000® Total Return Index |

|---|

| May-2014 | $10,000 | $10,000 | $10,000 |

| May-2015 | $10,645 | $11,181 | $11,186 |

| May-2016 | $9,756 | $11,372 | $11,211 |

| May-2017 | $10,919 | $13,359 | $13,194 |

| May-2018 | $12,499 | $15,281 | $15,181 |

| May-2019 | $12,532 | $15,859 | $15,560 |

| May-2020 | $11,937 | $17,895 | $17,344 |

| May-2021 | $15,717 | $25,109 | $24,960 |

| May-2022 | $15,579 | $25,034 | $24,040 |

| May-2023 | $15,621 | $25,766 | $24,529 |

| May-2024 | $18,738 | $33,028 | $31,295 |

Average Annual* Total Returns

| 6 Months | 1 Year | 5 years | 10 Years |

|---|

| Copeland Dividend Growth Fund | 11.63% | 19.95% | 8.38% | 6.48% |

S&P 500® Index | 16.35% | 28.19% | 15.80% | 12.69% |

Russell 3000® Total Return Index | 15.99% | 27.58% | 15.00% | 12.09% |

* Total returns for periods less than 1 year are not annualized.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$39,571,330

- Number of Portfolio Holdings69

- Advisory Fee (net of waivers)$0

- Portfolio Turnover21%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 95.1% |

| Money Market Funds | 0.9% |

| Reit | 4.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Money Market Funds | 0.9% |

| Communications | 1.2% |

| Utilities | 3.4% |

| Real Estate | 4.6% |

| Consumer Staples | 5.2% |

| Materials | 5.3% |

| Energy | 5.6% |

| Industrials | 11.2% |

| Consumer Discretionary | 11.3% |

| Health Care | 12.1% |

| Financials | 12.3% |

| Technology | 26.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Costco Wholesale Corporation | 2.2% |

| NextEra Energy, Inc. | 2.1% |

| Motorola Solutions, Inc. | 2.1% |

| Microsoft Corporation | 1.9% |

| Apple, Inc. | 1.9% |

| Broadcom, Inc. | 1.9% |

| Ensign Group, Inc. (The) | 1.9% |

| Monolithic Power Systems, Inc. | 1.9% |

| Domino's Pizza, Inc. | 1.8% |

| Amphenol Corporation, Class A | 1.7% |

No material changes occured during the six months ended May 31, 2024.

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Copeland Dividend Growth Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

Copeland Dividend Growth Fund - Class I (CDIVX )

Semi-Annual Shareholder Report - May 31, 2024

Copeland International Small Cap Fund

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Copeland International Small Cap Fund for the period of December 1, 2023 to May 31, 2024.You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class AFootnote Reference* | $59 | 1.19%Footnote Reference** |

* During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund's investment adviser, Copeland Capital Management, LLC. If the agreement is not extended in the future, expenses could be higher.

** Annualized.

How did the Fund perform during the reporting period?

During the six-month period ended May 31, 2024, Class A shares of the Fund returned 3.5%, lagging the 10.5% advance registered by the MSCI World ex USA Small Cap Net Index and 12.6% of the MSCI World ex USA Net Index. The equity market was supported by the continued strength of global economies, moderating inflation and the growing enthusiasm for technology stocks exposed to artificial intelligence (AI). Dividend growth securities unsurprisingly failed to keep pace with the frothy market environment. Strengthening economies were reflected in the May Purchasing Managers Index (PMI), with the index improving in the Eurozone to 47.3% and in Japan to 50.4%. Meanwhile, inflation continued to moderate across developed economies as Core CPI growth softened to 2.9% in the Eurozone and to 2.6% in Japan in May. Particularly in Japan, lower quality, cheaper companies have performed well during the rally. With the support of moderating inflation, the European Central Bank (ECB) cut its main interest rate from 4% to 3.75%. The Swiss National Bank lowered its main policy rate by 0.25 percentage points to 1.5%. Japan was the exception where in efforts to keep yen from depreciating further and lower inflationary pressures, the Bank of Japan raised its key interest rate from -0.1% to range of 0%-0.1% ending its negative interest rate policy. Except for Japan, the prospects for further rate cuts have improved as inflation moderates, aiding the enthusiasm for stocks. Our stock selection in the Energy sector was a benefit relative to the benchmark while the largest headwind was in the Information Technology sector. Veren Inc. (VRN-CA, 1.3% of holdings) was a top performing energy holding as cash flow beat expectations, and the company continues to expand its drilling, reduce debt and return excess cash to shareholders. Their new assets in the oil rich Montney and Duvernay regions of Canada also provide them with a long growth runway. Meanwhile, Aixtron SE (AIXA-DE, 0.0% of holdings) retreated due to the slowdown in sales of electric vehicles which negatively impacted the sale of equipment for producing silicon carbide-based semiconductors. Apple’s cancellation of their plans to develop the Micro LED Apple Watch also contributed to the de-rating, which we expect to be temporary.

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Copeland International Small Cap Fund - Class A | MSCI ACWI ex USA Index | MSCI WORLD ex USA Net (USD) |

|---|

| 12/28/21 | $9,425 | $10,000 | $10,000 |

| 05/31/22 | $7,983 | $8,954 | $8,990 |

| 05/31/23 | $7,619 | $8,828 | $9,128 |

| 05/31/24 | $7,882 | $10,306 | $10,815 |

Average Annual* Total Returns

| 6 months | 1 Year | Since Inception (12/28/2021) |

|---|

| Copeland International Small Cap Fund - Class A | | | |

| Without Load | 3.46% | 3.46% | |

| With Load | -2.50% | -2.50% | -9.36% |

| MSCI ACWI ex USA Index | 11.11% | 16.74% | 1.25% |

| MSCI WORLD ex USA Net (USD) | 12.56% | 18.48% | 3.29% |

* Total returns for periods less than 1 year are not annualized.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

What did the Fund invest in?

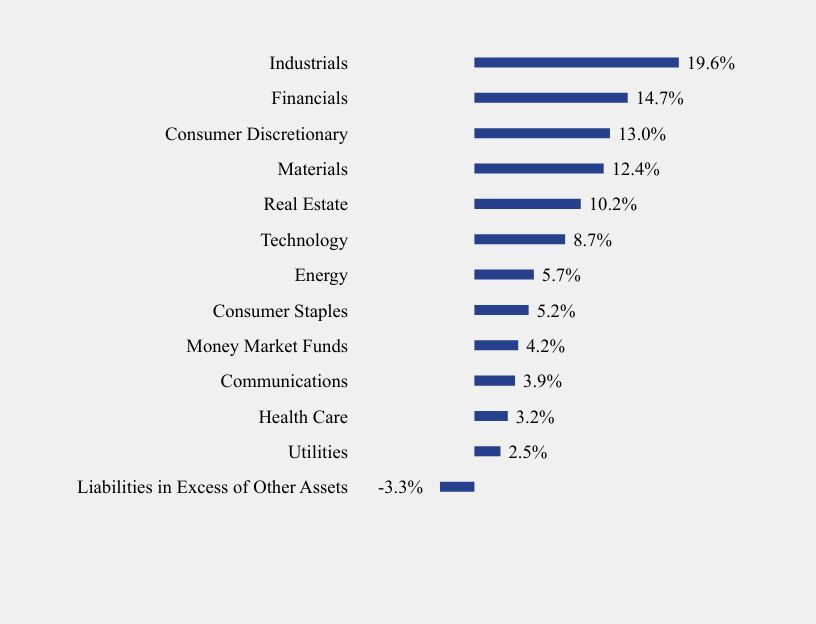

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -3.3% |

| Utilities | 2.5% |

| Health Care | 3.2% |

| Communications | 3.9% |

| Money Market Funds | 4.2% |

| Consumer Staples | 5.2% |

| Energy | 5.7% |

| Technology | 8.7% |

| Real Estate | 10.2% |

| Materials | 12.4% |

| Consumer Discretionary | 13.0% |

| Financials | 14.7% |

| Industrials | 19.6% |

- Net Assets$532,288

- Number of Portfolio Holdings72

- Advisory Fee (net of waivers)$0

- Portfolio Turnover28%

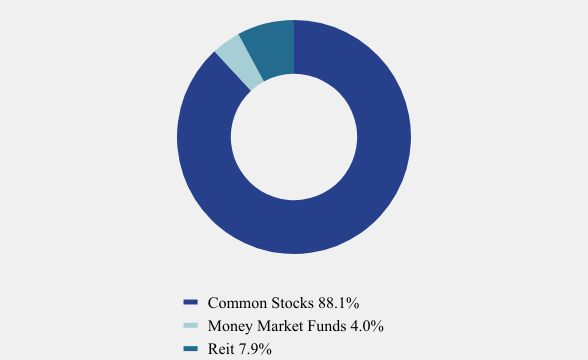

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 88.1% |

| Money Market Funds | 4.0% |

| Reit | 7.9% |

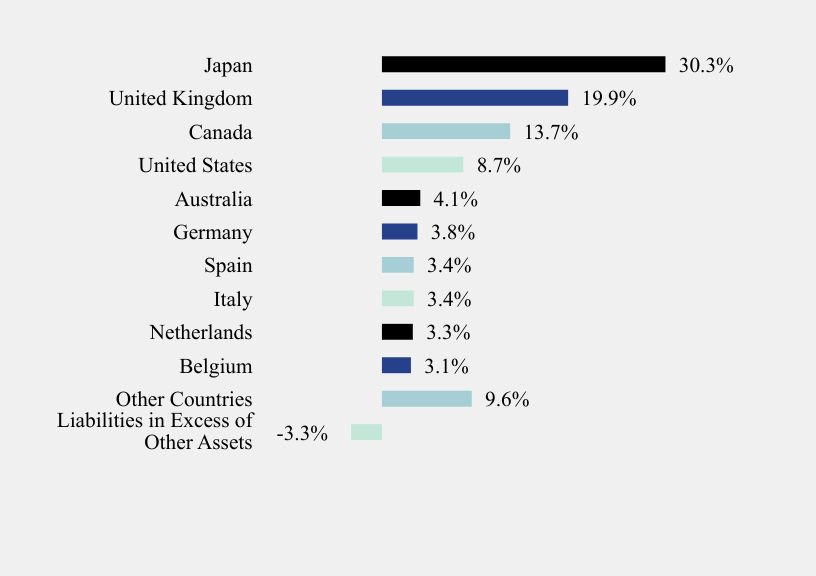

Country Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -3.3% |

| Other Countries | 9.6% |

| Belgium | 3.1% |

| Netherlands | 3.3% |

| Italy | 3.4% |

| Spain | 3.4% |

| Germany | 3.8% |

| Australia | 4.1% |

| United States | 8.7% |

| Canada | 13.7% |

| United Kingdom | 19.9% |

| Japan | 30.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Northern Institutional Treasury Portfolio | 4.2% |

| Chiba Bank Ltd. (The) | 2.4% |

| Asics Corporation | 2.3% |

| Air Lease Corporation | 2.1% |

| Diploma plc | 2.0% |

| Maruwa Company Ltd. | 2.0% |

| OPAP S.A. | 2.0% |

| JD Sports Fashion PLC | 1.9% |

| Recordati Industria Chimica e Farmaceutica SpA | 1.9% |

| TMX Group Ltd. | 1.8% |

No material changes occured during the six months ended May 31, 2024.

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Copeland International Small Cap Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

Copeland International Small Cap Fund - Class A (CISAX)

Semi-Annual Shareholder Report - May 31, 2024

Copeland International Small Cap Fund

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Copeland International Small Cap Fund for the period of December 1, 2023 to May 31, 2024.You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class IFootnote Reference* | $49 | 0.98%Footnote Reference** |

* During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund's investment adviser, Copeland Capital Management, LLC. If the agreement is not extended in the future, expenses could be higher.

** Annualized.

How did the Fund perform during the reporting period?

During the six-month period ended May 31, 2024, Class I shares of the Fund returned 3.5%, lagging the 10.5% advance registered by the MSCI World ex USA Small Cap Net Index and 12.6% of the MSCI World ex USA Net Index. The equity market was supported by the continued strength of global economies, moderating inflation and the growing enthusiasm for technology stocks exposed to artificial intelligence (AI). Dividend growth securities unsurprisingly failed to keep pace with the frothy market environment. Strengthening economies were reflected in the May Purchasing Managers Index (PMI), with the index iimproving in the Eurozone to 47.3% and in Japan to 50.4%. Meanwhile, inflation continued to moderate across developed economies as Core CPI growth softened to 2.9% in the Eurozone and to 2.6% in Japan in May. Particularly in Japan, lower quality, cheaper companies have performed well during the rally. With the support of moderating inflation, the European Central Bank (ECB) cut its main interest rate from 4% to 3.75%. The Swiss National Bank lowered its main policy rate by 0.25 percentage points to 1.5%. Japan was the exception where in efforts to keep yen from depreciating further and lower inflationary pressures, the Bank of Japan raised its key interest rate from -0.1% to range of 0%-0.1% ending its negative interest rate policy. Except for Japan, the prospects for further rate cuts have improved as inflation moderates, aiding the enthusiasm for stocks. Our stock selection in the Energy sector was a benefit relative to the benchmark while the largest headwind was in the Information Technology sector. Veren Inc. (VRN-CA, 1.3% of holdings) was a top performing energy holding as cash flow beat expectations, and the company continues to expand its drilling, reduce debt and return excess cash to shareholders. Their new assets in the oil rich Montney and Duvernay regions of Canada also provide them with a long growth runway. Meanwhile, Aixtron SE (AIXA-DE, 0.0% of holdings) retreated due to the slowdown in sales of electric vehicles which negatively impacted the sale of equipment for producing silicon carbide-based semiconductors. Apple’s cancellation of their plans to develop the Micro LED Apple Watch also contributed to the de-rating, which we expect to be temporary.

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Copeland International Small Cap Fund - Class I | MSCI ACWI ex US Small Cap Net TR | MSCI WORLD ex USA Net (USD) |

|---|

| 12/28/21 | $10,000 | $10,000 | $10,000 |

| 05/31/22 | $8,470 | $8,745 | $8,990 |

| 05/31/23 | $8,084 | $8,343 | $9,128 |

| 05/31/24 | $8,363 | $9,705 | $10,815 |

Average Annual* Total Returns

| 6 Months | 1 Year | Since Inception (12/28/2021) |

|---|

| Copeland International Small Cap Fund - Class I | 3.46% | 3.46% | |

| MSCI ACWI ex US Small Cap Net TR | 10.48% | 16.32% | |

| MSCI WORLD ex USA Net (USD) | 12.56% | 18.48% | 3.29% |

* Total returns for periods less than 1 year are not annualized.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -3.3% |

| Utilities | 2.5% |

| Health Care | 3.2% |

| Communications | 3.9% |

| Money Market Funds | 4.2% |

| Consumer Staples | 5.2% |

| Energy | 5.7% |

| Technology | 8.7% |

| Real Estate | 10.2% |

| Materials | 12.4% |

| Consumer Discretionary | 13.0% |

| Financials | 14.7% |

| Industrials | 19.6% |

- Net Assets$532,288

- Number of Portfolio Holdings72

- Advisory Fee (net of waivers)$0

- Portfolio Turnover28%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 88.1% |

| Money Market Funds | 4.0% |

| Reit | 7.9% |

Country Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -3.3% |

| Other Countries | 9.6% |

| Belgium | 3.1% |

| Netherlands | 3.3% |

| Italy | 3.4% |

| Spain | 3.4% |

| Germany | 3.8% |

| Australia | 4.1% |

| United States | 8.7% |

| Canada | 13.7% |

| United Kingdom | 19.9% |

| Japan | 30.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Northern Institutional Treasury Portfolio | 4.2% |

| Chiba Bank Ltd. (The) | 2.4% |

| Asics Corporation | 2.3% |

| Air Lease Corporation | 2.1% |

| Diploma plc | 2.0% |

| Maruwa Company Ltd. | 2.0% |

| OPAP S.A. | 2.0% |

| JD Sports Fashion PLC | 1.9% |

| Recordati Industria Chimica e Farmaceutica SpA | 1.9% |

| TMX Group Ltd. | 1.8% |

No material changes occured during the six months ended May 31, 2024.

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Copeland International Small Cap Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.copelandfunds.com/copeland-funds/product-literature. You can also request this information by contacting us at 1-888-926-7352.

Copeland International Small Cap Fund - Class I (CSIIX)

Semi-Annual Shareholder Report - May 31, 2024

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable to open-end investment companies.

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| | | |

| | | |

| | | |

| | Copeland | |

| | Dividend Growth Fund | |

| | Class A Shares: CDGRX | |

| | Class C Shares: CDCRX | |

| | Class I Shares: CDIVX | |

| | | |

| | Copeland | |

| | SMID Cap Dividend Growth Fund | |

| | Class A Shares: CSDGX | |

| | Class I Shares: CSMDX | |

| | | |

| | Copeland | |

| | International Small Cap Fund | |

| | Class A Shares: CISAX | |

| | Class I Shares: CSIIX | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Semi-Annual Report | |

| | May 31, 2024 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Investor Information: 1-888-9-COPELAND | |

| | | |

| | This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of the Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. | |

| | | |

| | Distributed by Northern Lights Distributors, LLC | |

| | Member FINRA | |

| | | |

| COPELAND DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.1% | | | | |

| | | | | ASSET MANAGEMENT - 4.2% | | | | |

| | 1,275 | | | Ameriprise Financial, Inc. | | $ | 556,678 | |

| | 12,717 | | | Brookfield Asset Management Ltd. | | | 499,015 | |

| | 4,773 | | | Hamilton Lane, Inc., Class A | | | 598,963 | |

| | | | | | | | 1,654,656 | |

| | | | | BANKING - 1.3% | | | | |

| | 2,635 | | | JPMorgan Chase & Company | | | 533,930 | |

| | | | | | | | | |

| | | | | BEVERAGES - 1.5% | | | | |

| | 2,410 | | | Constellation Brands, Inc., Class A | | | 603,054 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 3.1% | | | | |

| | 746 | | | Eli Lilly & Company | | | 611,974 | |

| | 3,716 | | | Zoetis, Inc. | | | 630,085 | |

| | | | | | | | 1,242,059 | |

| | | | | CHEMICALS - 2.5% | | | | |

| | 7,276 | | | Corteva, Inc. | | | 407,019 | |

| | 1,881 | | | Sherwin-Williams Company (The) | | | 571,448 | |

| | | | | | | | 978,467 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 1.5% | | | | |

| | 3,700 | | | Waste Connections, Inc. | | | 607,984 | |

| | | | | | | | | |

| | | | | CONSTRUCTION MATERIALS - 1.6% | | | | |

| | 1,523 | | | Carlisle Companies, Inc. | | | 637,056 | |

| | | | | | | | | |

| | | | | DATA CENTER REIT - 1.4% | | | | |

| | 731 | | | Equinix, Inc. | | | 557,738 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 2.0% | | | | |

| | 10,214 | | | NextEra Energy, Inc. | | | 817,324 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 4.9% | | | | |

| | 5,270 | | | Amphenol Corporation, Class A | | | 697,589 | |

| | 14,614 | | | Cognex Corporation | | | 665,229 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| COPELAND DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | ELECTRICAL EQUIPMENT - 4.9% (Continued) | | | | |

| | 5,504 | | | Otis Worldwide Corporation | | $ | 545,997 | |

| | | | | | | | 1,908,815 | |

| | | | | ENGINEERING & CONSTRUCTION - 1.5% | | | | |

| | 2,799 | | | Tetra Tech, Inc. | | | 586,363 | |

| | | | | | | | | |

| | | | | GAS & WATER UTILITIES - 1.4% | | | | |

| | 4,089 | | | American Water Works Company, Inc. | | | 534,719 | |

| | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 4.7% | | | | |

| | 6,047 | | | Ensign Group, Inc. (The) | | | 733,138 | |

| | 1,337 | | | UnitedHealth Group, Inc. | | | 662,310 | |

| | 4,399 | | | US Physical Therapy, Inc. | | | 451,205 | |

| | | | | | | | 1,846,653 | |

| | | | | INDUSTRIAL SUPPORT SERVICES - 1.1% | | | | |

| | 2,534 | | | WESCO International, Inc. | | | 454,828 | |

| | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 2.7% | | | | |

| | 5,644 | | | Morgan Stanley | | | 552,209 | |

| | 8,893 | | | Nasdaq, Inc. | | | 524,954 | |

| | | | | | | | 1,077,163 | |

| | | | | INSURANCE - 2.7% | | | | |

| | 3,218 | | | Allstate Corporation (The) | | | 539,079 | |

| | 1,384 | | | Kinsale Capital Group, Inc. | | | 530,930 | |

| | | | | | | | 1,070,009 | |

| | | | | LEISURE FACILITIES & SERVICES - 4.4% | | | | |

| | 3,948 | | | Churchill Downs, Inc. | | | 511,266 | |

| | 1,384 | | | Domino’s Pizza, Inc. | | | 703,875 | |

| | 2,197 | | | Marriott International, Inc., Class A | | | 507,880 | |

| | | | | | | | 1,723,021 | |

| | | | | LEISURE PRODUCTS - 1.1% | | | | |

| | 5,504 | | | Brunswick Corporation | | | 454,245 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| COPELAND DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | MACHINERY - 0.9% | | | | |

| | 1,508 | | | Nordson Corporation | | $ | 353,958 | |

| | | | | | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 4.3% | | | | |

| | 3,234 | | | ResMed, Inc. | | | 667,272 | |

| | 2,472 | | | STERIS plc | | | 550,959 | |

| | 1,508 | | | West Pharmaceutical Services, Inc. | | | 499,766 | |

| | | | | | | | 1,717,997 | |

| | | | | OFFICE REIT - 1.4% | | | | |

| | 4,711 | | | Alexandria Real Estate Equities, Inc. | | | 560,610 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 4.3% | | | | |

| | 2,970 | | | Cheniere Energy, Inc. | | | 468,636 | |

| | 3,296 | | | Diamondback Energy, Inc. | | | 656,761 | |

| | 13,417 | | | Northern Oil and Gas, Inc. | | | 549,158 | |

| | | | | | | | 1,674,555 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 1.3% | | | | |

| | 11,551 | | | Schlumberger Ltd. | | | 530,075 | |

| | | | | | | | | |

| | | | | PUBLISHING & BROADCASTING - 1.2% | | | | |

| | 2,845 | | | Nexstar Media Group, Inc. | | | 471,388 | |

| | | | | | | | | |

| | | | | REAL ESTATE SERVICES - 0.6% | | | | |

| | 20,040 | | | eXp World Holdings, Inc. | | | 224,648 | |

| | | | | | | | | |

| | | | | RESIDENTIAL REIT - 1.2% | | | | |

| | 7,524 | | | Equity LifeStyle Properties, Inc. | | | 472,281 | |

| | | | | | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 3.7% | | | | |

| | 1,819 | | | Casey’s General Stores, Inc. | | | 603,508 | |

| | 1,042 | | | Costco Wholesale Corporation | | | 843,906 | |

| | | | | | | | 1,447,414 | |

| | | | | RETAIL - DISCRETIONARY - 4.5% | | | | |

| | 1,508 | | | Home Depot, Inc. (The) | | | 504,984 | |

| | 4,462 | | | Ross Stores, Inc. | | | 623,609 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| COPELAND DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | RETAIL - DISCRETIONARY - 4.5% (Continued) | | | | |

| | 2,208 | | | Tractor Supply Company | | $ | 629,920 | |

| | | | | | | | 1,758,513 | |

| | | | | SEMICONDUCTORS - 6.9% | | | | |

| | 575 | | | Broadcom, Inc. | | | 763,917 | |

| | 995 | | | Monolithic Power Systems, Inc. | | | 731,952 | |

| | 8,037 | | | Power Integrations, Inc. | | | 610,892 | |

| | 3,560 | | | Universal Display Corporation | | | 625,492 | |

| | | | | | | | 2,732,253 | |

| | | | | SOFTWARE - 3.5% | | | | |

| | 1,088 | | | Intuit, Inc. | | | 627,167 | |

| | 1,866 | | | Microsoft Corporation | | | 774,632 | |

| | | | | | | | 1,401,799 | |

| | | | | SPECIALTY FINANCE - 1.4% | | | | |

| | 11,504 | | | Air Lease Corporation | | | 548,051 | |

| | | | | | | | | |

| | | | | STEEL - 1.2% | | | | |

| | 1,617 | | | Reliance, Inc. | | | 486,361 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 4.0% | | | | |

| | 3,980 | | | Apple, Inc. | | | 765,155 | |

| | 2,239 | | | Motorola Solutions, Inc. | | | 817,033 | |

| | | | | | | | 1,582,188 | |

| | | | | TECHNOLOGY SERVICES - 12.5% | | | | |

| | 1,555 | | | Accenture PLC, Class A | | | 438,961 | |

| | 2,006 | | | Automatic Data Processing, Inc. | | | 491,310 | |

| | 4,228 | | | Booz Allen Hamilton Holding Corporation | | | 643,544 | |

| | 2,736 | | | Broadridge Financial Solutions, Inc. | | | 549,307 | |

| | 2,970 | | | CDW Corporation | | | 664,152 | |

| | 1,119 | | | FactSet Research Systems, Inc. | | | 452,367 | |

| | 3,032 | | | Jack Henry & Associates, Inc. | | | 499,310 | |

| | 1,119 | | | MSCI, Inc. | | | 554,106 | |

| | 2,363 | | | Visa, Inc., Class A | | | 643,823 | |

| | | | | | | | 4,936,880 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| COPELAND DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 1.3% | | | | |

| | 3,187 | | | JB Hunt Transport Services, Inc. | | $ | 512,310 | |

| | | | | | | | | |

| | | | | WHOLESALE - DISCRETIONARY - 1.3% | | | | |

| | 1,461 | | | Pool Corporation | | | 531,147 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $29,142,843) | | | 39,230,512 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENT — 0.9% | | | | |

| | | | | MONEY MARKET FUND - 0.9% | | | | |

| | 354,157 | | | Northern Institutional Treasury Portfolio, 5.15% (Cost $354,157)(a) | | | 354,157 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 100.0% (Cost $29,497,000) | | $ | 39,584,669 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - 0.0% | | | (13,339 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 39,571,330 | |

| | | | | | | | | |

| LTD | - Limited Company |

| | |

| MSCI | - Morgan Stanley Capital International |

| | |

| PLC | - Public Limited Company |

| | |

| REIT | - Real Estate Investment Trust |

| | |

| (a) | Rate disclosed is the seven day effective yield as of May 31, 2024. |

The accompanying notes are an integral part of these financial statements.

| COPELAND SMID CAP DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.2% | | | | |

| | | | | AEROSPACE & DEFENSE - 2.5% | | | | |

| | 35,396 | | | Hexcel Corporation | | $ | 2,437,722 | |

| | 6,166 | | | Huntington Ingalls Industries, Inc. | | | 1,560,615 | |

| | | | | | | | 3,998,337 | |

| | | | | ASSET MANAGEMENT - 5.1% | | | | |

| | 65,586 | | | Brookfield Infrastructure Corporation, Class A | | | 2,259,438 | |

| | 37,077 | | | Cohen & Steers, Inc. | | | 2,606,142 | |

| | 25,466 | | | Hamilton Lane, Inc., Class A | | | 3,195,729 | |

| | | | | | | | 8,061,309 | |

| | | | | BANKING - 3.2% | | | | |

| | 17,152 | | | Bank OZK | | | 718,326 | |

| | 97,779 | | | Home BancShares, Inc. | | | 2,299,762 | |

| | 34,835 | | | Prosperity Bancshares, Inc. | | | 2,170,221 | |

| | | | | | | | 5,188,309 | |

| | | | | BIOTECH & PHARMA - 1.1% | | | | |

| | 62,864 | | | Perrigo Company plc | | | 1,730,646 | |

| | | | | | | | | |

| | | | | CHEMICALS - 1.4% | | | | |

| | 12,733 | | | Quaker Chemical Corporation | | | 2,309,130 | |

| | | | | | | | | |

| | | | | COMMERCIAL SUPPORT SERVICES - 3.3% | | | | |

| | 69,750 | | | GFL Environmental, Inc. | | | 2,195,033 | |

| | 16,096 | | | Insperity, Inc. | | | 1,524,613 | |

| | 9,610 | | | UniFirst Corporation | | | 1,524,146 | |

| | | | | | | | 5,243,792 | |

| | | | | CONSTRUCTION MATERIALS - 2.1% | | | | |

| | 7,928 | | | Carlisle Companies, Inc. | | | 3,316,202 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 4.4% | | | | |

| | 19,940 | | | BWX Technologies, Inc. | | | 1,837,072 | |

| | 57,098 | | | Cognex Corporation | | | 2,599,101 | |

| | 7,848 | | | Littelfuse, Inc. | | | 2,013,797 | |

| | 15,962 | | | Sensata Technologies Holding plc | | | 659,550 | |

| | | | | | | | 7,109,520 | |

The accompanying notes are an integral part of these financial statements.

| COPELAND SMID CAP DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.2% (Continued) | | | | |

| | | | | ENGINEERING & CONSTRUCTION - 1.9% | | | | |

| | 14,895 | | | Tetra Tech, Inc. | | $ | 3,120,354 | |

| | | | | | | | | |

| | | | | FORESTRY, PAPER & WOOD PRODUCTS - 1.4% | | | | |

| | 18,258 | | | UFP Industries, Inc. | | | 2,181,466 | |

| | | | | | | | | |

| | | | | GAS & WATER UTILITIES - 1.2% | | | | |

| | 16,817 | | | Chesapeake Utilities Corporation | | | 1,883,672 | |

| | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 8.4% | | | | |

| | 3,764 | | | Chemed Corporation | | | 2,086,649 | |

| | 38,519 | | | Encompass Health Corporation | | | 3,327,656 | |

| | 29,310 | | | Ensign Group, Inc. (The) | | | 3,553,545 | |

| | 14,334 | | | Quest Diagnostics, Inc. | | | 2,034,998 | |

| | 22,983 | | | US Physical Therapy, Inc. | | | 2,357,366 | |

| | | | | | | | 13,360,214 | |

| | | | | HOTEL REIT - 1.2% | | | | |

| | 19,139 | | | Ryman Hospitality Properties, Inc. | | | 2,010,934 | |

| | | | | | | | | |

| | | | | HOUSEHOLD PRODUCTS - 1.2% | | | | |

| | 16,016 | | | Inter Parfums, Inc. | | | 1,918,396 | |

| | | | | | | | | |

| | | | | INDUSTRIAL INTERMEDIATE PROD - 1.6% | | | | |

| | 10,250 | | | Valmont Industries, Inc. | | | 2,576,850 | |

| | | | | | | | | |

| | | | | INDUSTRIAL REIT - 1.3% | | | | |

| | 35,476 | | | Terreno Realty Corporation | | | 2,007,232 | |

| | | | | | | | | |

| | | | | INDUSTRIAL SUPPORT SERVICES - 1.7% | | | | |

| | 15,376 | | | WESCO International, Inc. | | | 2,759,838 | |

| | | | | | | | | |

| | | | | INSURANCE - 1.6% | | | | |

| | 6,807 | | | Kinsale Capital Group, Inc. | | | 2,611,301 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| COPELAND SMID CAP DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.2% (Continued) | | | | |

| | | | | INTERNET MEDIA & SERVICES - 1.3% | | | | |

| | 49,730 | | | Shutterstock, Inc. | | $ | 2,020,530 | |

| | | | | | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 6.5% | | | | |

| | 19,219 | | | Churchill Downs, Inc. | | | 2,488,861 | |

| | 5,686 | | | Domino’s Pizza, Inc. | | | 2,891,787 | |

| | 48,849 | | | Travel + Leisure Company | | | 2,146,425 | |

| | 7,688 | | | Wingstop, Inc. | | | 2,834,181 | |

| | | | | | | | 10,361,254 | |

| | | | | LEISURE PRODUCTS - 1.4% | | | | |

| | 27,948 | | | Brunswick Corporation | | | 2,306,548 | |

| | | | | | | | | |

| | | | | MACHINERY - 3.0% | | | | |

| | 8,969 | | | Nordson Corporation | | | 2,105,204 | |

| | 15,856 | | | Standex International Corporation | | | 2,667,137 | |

| | | | | | | | 4,772,341 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 4.1% | | | | |

| | 37,966 | | | LeMaitre Vascular, Inc. | | | 2,994,758 | |

| | 11,772 | | | STERIS plc | | | 2,623,743 | |

| | 50,531 | | | Stevanato Group SpA | | | 1,026,790 | |

| | | | | | | | 6,645,291 | |

| | | | | OIL & GAS PRODUCERS - 5.7% | | | | |

| | 11,291 | | | Chord Energy Corporation | | | 2,093,464 | |

| | 29,710 | | | Civitas Resources, Inc. | | | 2,185,468 | |

| | 39,240 | | | Matador Resources Company | | | 2,489,778 | |

| | 56,448 | | | Northern Oil and Gas, Inc. | | | 2,310,417 | |

| | | | | | | | 9,079,127 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 1.4% | | | | |

| | 69,670 | | | ChampionX Corporation | | | 2,272,635 | |

| | | | | | | | | |

| | | | | PUBLISHING & BROADCASTING - 1.2% | | | | |

| | 11,452 | | | Nexstar Media Group, Inc. | | | 1,897,482 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| COPELAND SMID CAP DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.2% (Continued) | | | | |

| | | | | REAL ESTATE SERVICES - 0.9% | | | | |

| | 126,848 | | | eXp World Holdings, Inc. | | $ | 1,421,966 | |

| | | | | | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 2.0% | | | | |

| | 9,610 | | | Casey’s General Stores, Inc. | | | 3,188,406 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 2.1% | | | | |

| | 15,055 | | | Dick’s Sporting Goods, Inc. | | | 3,427,120 | |

| | | | | | | | | |

| | | | | SELF-STORAGE REITS - 1.2% | | | | |

| | 44,044 | | | CubeSmart | | | 1,863,502 | |

| | | | | | | | | |

| | | | | SEMICONDUCTORS - 4.1% | | | | |

| | 41,962 | | | Kulicke & Soffa Industries, Inc. | | | 1,916,405 | |

| | 31,952 | | | Power Integrations, Inc. | | | 2,428,671 | |

| | 12,413 | | | Universal Display Corporation | | | 2,180,964 | |

| | | | | | | | 6,526,040 | |

| | | | | SOFTWARE - 1.4% | | | | |

| | 7,688 | | | Bentley Systems, Inc., Class B | | | 386,245 | |

| | 31,472 | | | Concentrix Corporation | | | 1,930,178 | |

| | | | | | | | 2,316,423 | |

| | | | | SPECIALTY FINANCE - 1.7% | | | | |

| | 56,457 | | | Air Lease Corporation | | | 2,689,611 | |

| | | | | | | | | |

| | | | | STEEL - 2.0% | | | | |

| | 10,891 | | | Reliance, Inc. | | | 3,275,795 | |

| | | | | | | | | |

| | | | | TECHNOLOGY SERVICES - 8.8% | | | | |

| | 19,540 | | | Booz Allen Hamilton Holding Corporation | | | 2,974,184 | |

| | 13,934 | | | Broadridge Financial Solutions, Inc. | | | 2,797,529 | |

| | 4,805 | | | FactSet Research Systems, Inc. | | | 1,942,469 | |

| | 12,973 | | | Jack Henry & Associates, Inc. | | | 2,136,394 | |

| | 7,928 | | | Morningstar, Inc. | | | 2,285,246 | |

| | 29,870 | | | TransUnion | | | 2,148,250 | |

| | | | | | | | 14,284,072 | |

The accompanying notes are an integral part of these financial statements.

| COPELAND SMID CAP DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.2% (Continued) | | | | |

| | | | | TELECOMMUNICATIONS - 1.1% | | | | |

| | 30,591 | | | Cogent Communications Holdings, Inc. | | $ | 1,811,599 | |

| | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 1.4% | | | | |

| | 12,493 | | | Landstar System, Inc. | | | 2,274,101 | |

| | | | | | | | | |

| | | | | TRANSPORTATION EQUIPMENT - 1.0% | | | | |

| | 21,302 | | | Allison Transmission Holdings, Inc. | | | 1,614,905 | |

| | | | | | | | | |

| | | | | WHOLESALE - DISCRETIONARY - 1.3% | | | | |

| | 5,526 | | | Pool Corporation | | | 2,008,976 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $148,012,379) | | | 157,445,226 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENT — 1.6% | | | | |

| | | | | MONEY MARKET FUND - 1.6% | | | | |

| | 2,572,848 | | | Northern Institutional Treasury Portfolio, 5.15% (Cost $2,572,848)(a) | | | 2,572,848 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 99.8% (Cost $150,585,227) | | $ | 160,018,074 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES- 0.2% | | | 388,899 | |

| | | | | NET ASSETS - 100.0% | | $ | 160,406,973 | |

| | | | | | | | | |

| PLC | - Public Limited Company |

| | |

| REIT | - Real Estate Investment Trust |

| | |

| (a) | Rate disclosed is the seven day effective yield as of May 31, 2024. |

The accompanying notes are an integral part of these financial statements.

| COPELAND INTERNATIONAL SMALL CAP FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.1% | | | | |

| | | | | Australia - 4.2% | | | | |

| | 787 | | | Lifestyle Communities Ltd. | | $ | 6,540 | |

| | 1,938 | | | Steadfast Group Ltd. | | | 7,146 | |

| | 3,528 | | | Ventia Services Group Pty Ltd. | | | 8,471 | |

| | | | | | | | 22,157 | |

| | | | | Belgium - 3.0% | | | | |

| | 98 | | | Montea N.V. | | | 8,937 | |

| | 246 | | | Warehouses De Pauw CVA | | | 7,209 | |

| | | | | | | | 16,146 | |

| | | | | Canada - 13.7% | | | | |

| | 202 | | | Brookfield Infrastructure Corporation | | | 6,963 | |

| | 126 | | | Granite Real Estate Investment Trust | | | 6,234 | |

| | 814 | | | InterRent Real Estate Investment Trust | | | 7,145 | |

| | 402 | | | PrairieSky Royalty Ltd. | | | 8,175 | |

| | 128 | | | Stella-Jones, Inc. | | | 7,643 | |

| | 358 | | | TMX Group Ltd. | | | 9,611 | |

| | 60 | | | Toromont Industries Ltd. | | | 5,242 | |

| | 136 | | | Tourmaline Oil Corporation | | | 6,748 | |

| | 799 | | | Veren, Inc. | | | 6,955 | |

| | 1,053 | | | Whitecap Resources, Inc. | | | 8,246 | |

| | | | | | | | 72,962 | |

| | | | | Cayman Islands - 1.3% | | | | |

| | 12,249 | | | Bosideng International Holdings Ltd. | | | 7,088 | |

| | | | | | | | | |

| | | | | Denmark - 1.4% | | | | |

| | 143 | | | Sydbank A/S(a) | | | 7,621 | |

| | | | | | | | | |

| | | | | Germany - 3.8% | | | | |

| | 104 | | | Hensoldt AG | | | 4,239 | |

| | 145 | | | KION Group A.G.(a) | | | 6,858 | |

| | 124 | | | Scout24 A.G. | | | 9,327 | |

| | | | | | | | 20,424 | |

| | | | | Greece - 2.0% | | | | |

| | 662 | | | OPAP S.A. | | | 10,521 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| COPELAND INTERNATIONAL SMALL CAP FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | Italy - 3.4% | | | | |

| | 172 | | | Interpump Group SpA | | $ | 8,111 | |

| | 188 | | | Recordati Industria Chimica e Farmaceutica SpA | | | 9,921 | |

| | | | | | | | 18,032 | |

| | | | | Japan - 30.2% | | | | |

| | 219 | | | Asics Corporation | | | 12,165 | |

| | 1,310 | | | Chiba Bank Ltd. (The)(a) | | | 12,520 | |

| | 59 | | | Cosmos Pharmaceutical Corporation | | | 4,756 | |

| | 101 | | | Goldwin, Inc. | | | 5,279 | |

| | 125 | | | Hamamatsu Photonics KK | | | 3,696 | |

| | 215 | | | Information Services International-Dentsu Ltd. | | | 7,047 | |

| | 448 | | | Internet Initiative Japan, Inc. | | | 6,311 | |

| | 345 | | | JCU Corporation | | | 8,085 | |

| | 769 | | | Kotobuki Spirits Company Ltd. | | | 8,506 | |

| | 179 | | | Kurita Water Industries Ltd. | | | 7,675 | |

| | 47 | | | Maruwa Company Ltd. | | | 10,558 | |

| | 1,032 | | | Mitsubishi UFJ Lease & Finance Company Ltd. | | | 6,850 | |

| | 231 | | | Monogatari Corporation (The) | | | 5,083 | |

| | 270 | | | Nichias Corporation(a) | | | 8,187 | |

| | 417 | | | Nippon Gas Company Ltd.(a) | | | 6,364 | |

| | 132 | | | Nissan Chemical Corporation | | | 3,670 | |

| | 200 | | | Nomura Real Estate Holdings, Inc.(a) | | | 5,156 | |

| | 377 | | | Plus Alpha Consulting | | | 4,494 | |

| | 400 | | | Rohto Pharmaceutical Company Ltd. | | | 7,052 | |

| | 430 | | | SMS Company Ltd. | | | 5,331 | |

| | 264 | | | Strike Co., Ltd. | | | 7,105 | |

| | 160 | | | Takeuchi Manufacturing Company Ltd.(a) | | | 6,243 | |

| | 939 | | | Zeon Corporation | | | 8,715 | |

| | | | | | | | 160,848 | |

| | | | | Netherlands - 3.2% | | | | |

| | 90 | | | Euronext N.V.(a) | | | 8,860 | |

| | 345 | | | Technip Energies N.V. | | | 8,345 | |

| | | | | | | | 17,205 | |

| | | | | Norway - 2.5% | | | | |

| | 413 | | | Borregaard ASA | | | 7,570 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| COPELAND INTERNATIONAL SMALL CAP FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | Norway - 2.5% (Continued) | | | | |

| | 64 | | | Kongsberg Gruppen ASA | | $ | 5,503 | |

| | | | | | | | 13,073 | |

| | | | | Spain - 3.4% | | | | |

| | 70 | | | Vidrala S.A. | | | 8,555 | |

| | 145 | | | Viscofan S.A. | | | 9,501 | |

| | | | | | | | 18,056 | |

| | | | | Sweden - 1.1% | | | | |

| | 225 | | | Sagax AB | | | 5,939 | |

| | | | | | | | | |

| | | | | Switzerland - 1.4% | | | | |

| | 59 | | | VZ Holding A.G. | | | 7,327 | |

| | | | | | | | | |

| | | | | United Kingdom - 20.0% | | | | |

| | 1,083 | | | Bytes Technology Group plc | | | 7,757 | |

| | 1,637 | | | Chemring Group plc | | | 8,080 | |

| | 7,654 | | | Coats Group plc | | | 8,410 | |

| | 73 | | | Croda International PLC | | | 4,265 | |

| | 206 | | | Diploma plc | | | 10,800 | |

| | 335 | | | Halma PLC(a) | | | 9,591 | |

| | 730 | | | Hilton Food Group plc | | | 8,385 | |

| | 6,299 | | | JD Sports Fashion PLC(a) | | | 10,355 | |

| | 740 | | | RS GROUP plc | | | 6,708 | |

| | 746 | | | Safestore Holdings plc | | | 8,623 | |

| | 1,270 | | | Treatt plc | | | 8,129 | |

| | 416 | | | UNITE Group PLC (The) | | | 4,963 | |

| | 271 | | | WH Smith plc | | | 3,980 | |

| | 494 | | | YouGov plc | | | 6,205 | |

| | | | | | | | 106,251 | |

| | | | | United States - 4.5% | | | | |

| | 232 | | | Air Lease Corporation | | | 11,052 | |

| | 51 | | | Inter Parfums, Inc. | | | 6,109 | |

| | 38 | | | Universal Display Corporation | | | 6,677 | |

| | | | | | | | 23,838 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| COPELAND INTERNATIONAL SMALL CAP FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | United States - 4.5% (Continued) | | | | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $507,850) | | $ | 527,488 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENT — 4.2% | | | | |

| | | | | MONEY MARKET FUND - 4.2% | | | | |

| | 22,257 | | | Northern Institutional Treasury Portfolio, 5.15% (Cost $22,257)(b) | | | 22,257 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 103.3% (Cost $530,107) | | $ | 549,745 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (3.3)% | | | (17,457 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 532,288 | |

| | | | | | | | | |

| AG/A.G. | - Aktiengesellschaf |

| | |

| A/S | - Anonim Sirketi |

| | |

| ASA | - Advanced Subscription Agreement |

| | |

| CVA | - Company Voluntary Arrangement |

| | |

| LTD | - Limited Company |

| | |

| N.V. | - Naamioze Vennootschap |

| | |

| S.A. | - Société Anonyme |

| | |

| SpA | - Societa Per Azione |

| | |

| (a) | The value of this security has been determined in good faith under policies of the Board of Trustees. |

| (b) | Rate disclosed is the seven day effective yield as of May 31, 2024. |

The accompanying notes are an integral part of these financial statements.

| Copeland Trust |

| STATEMENTS OF ASSETS AND LIABILITIES (Unaudited) |

| May 31, 2024 |

| | | | | | Copeland SMID | | | Copeland | |

| | | Copeland Dividend | | | Cap Dividend | | | International | |

| | | Growth Fund | | | Growth Fund | | | Small Cap Fund | |

| Assets: | | | | | | | | | | | | |

| Investments, at Cost | | $ | 29,497,000 | | | $ | 150,585,227 | | | $ | 530,107 | |

| Investments in Securities, at Market Value | | $ | 39,584,669 | | | $ | 160,018,074 | | | $ | 549,745 | |

| Foreign Cash (Cost $0, $0, $332) | | | — | | | | — | | | | 332 | |

| Dividends and Interest Receivable | | | 47,014 | | | | 245,555 | | | | 2,289 | |

| Receivable for Securities Sold | | | — | | | | 119,484 | | | | — | |

| Due from Investment Adviser | | | 7,402 | | | | — | | | | 7,464 | |

| Receivable for Fund Shares Sold | | | — | | | | 151,807 | | | | — | |

| Prepaid Expenses and Other Assets | | | 54,934 | | | | 102,755 | | | | 573 | |

| Total Assets | | | 39,694,019 | | | | 160,637,675 | | | | 560,403 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Payable for Securities Purchased | | | — | | | | 96,244 | | | | — | |

| Payable for Fund Shares Redeemed | | | 50,136 | | | | 58,305 | | | | — | |

| Payable to Investment Adviser | | | — | | | | 56,788 | | | | — | |

| Accrued Audit Fees | | | 9,969 | | | | 7,073 | | | | 7,837 | |

| Accrued Distribution Fees | | | 10,616 | | | | 518 | | | | — | |

| Payable to Related Parties | | | 17,583 | | | | 5,831 | | | | 9,835 | |

| Other Accrued Expenses | | | 34,385 | | | | 5,943 | | | | 10,443 | |

| Total Liabilities | | | 122,689 | | | | 230,702 | | | | 28,115 | |

| | | | | | | | | | | | | |

| Net Assets | | $ | 39,571,330 | | | $ | 160,406,973 | | | $ | 532,288 | |

| | | | | | | | | | | | | |

| Composition of Net Assets: | | | | | | | | | | | | |

| At May 31, 2024, Net Assets consisted of: | | | | | | | | | | | | |

| Paid-in-Capital | | $ | 27,227,938 | | | $ | 151,039,876 | | | $ | 613,800 | |