united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22483

Copeland Trust

(Exact name of Registrant as specified in charter)

Eight Tower Bridge, 161 Washington St., Suite #1325 Conshohocken, PA 19428

(Address of principal executive offices) (Zip code)

Ultimus Fund Solutions, LLC, 80 Arkay Drive Suite 10, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: (631) 470-2619

Date of fiscal year end: 11/30

Date of reporting period: 5/31/23

Item 1. Reports to Stockholders.

| | | |

| | | |

| | | |

| | Copeland | |

| | Dividend Growth Fund | |

| | Class A Shares: CDGRX | |

| | Class C Shares: CDCRX | |

| | Class I Shares: CDIVX | |

| | | |

| | Copeland | |

| | Smid Cap Dividend Growth Fund | |

| | Class A Shares: CSDGX | |

| | Class I Shares: CSMDX | |

| | | |

| | Copeland | |

| | International Small Cap Fund | |

| | Class A Shares: CISAX | |

| | Class I Shares: CSIIX | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Semi-Annual Report | |

| | May 31, 2023 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Investor Information: 1-888-9-COPELAND | |

| | | |

| | This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of the Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. | |

| | | |

| | Distributed by Northern Lights Distributors, LLC | |

| | Member FINRA | |

| | | |

Copeland Dividend Growth Fund

Semi-Annual Report

May 31, 2023

Dear Fellow Shareholders:

Copeland Capital Management is pleased to review the performance of the Dividend Growth Fund from December 1, 2022 through May 31, 2023. Unless otherwise stated herein, all data and statistics that follow are as of May 31, 2023.

During the six-month period, the Fund fell 2.2%, lagging the 3.3% advance registered by the S&P 500 Index. As the period unfolded, market advances were led by a handful of mega-cap technology stocks while the lion’s share of equities showed little or no gains. To wit, the NASDAQ Composite Index rose 13.3% during the period while the S&P 500 Equal Weight Index fell 5.3%. The bifurcated market environment was fostered by investor belief that technology shares are best positioned to grow earnings amidst a broader softening in corporate profitability. The recent frenzy surrounding artificial intelligence added fuel to the rally. Amidst the current backdrop, we are pleased that the Fund return has outpaced that of the S&P 500 Equal Weight Index.

Our stock selection in the Health Care sector of the market bolstered Fund returns while those in the Information Technology sector, despite rising over 14% on average, were a drag. Broadcom (AVGO, 2.2% of holdings at period end) was the top performing holding, advancing over 48% during the period. The semiconductor and software provider has a long history of successfully acquiring and integrating a wide range of technology companies. Additions immediately undergo cost-cutting measures that boost profitability and underlying cash flows. A broad suite of product offerings allows for cross selling to their customer base. Dividends and cash flow per share have advanced at a 12% and 19% rate, respectively, over the past three years. Further advances in 2023 are expected. Reflective of our strong relative performance in the Health Care sector, West Pharmaceutical (WST, 1.3% of holdings at period end) rose 43% during the period. The company provides medical supplies to the pharmaceutical, biotechnology, and generic drug industries. A broad customer base insulates West from the fortunes of any particular buyer, providing a strong underpinning for the toolmaker. Regulatory oversight of the medical manufacturing process discourages customer switching and provides a wide economic moat.

On the downside, Fund holding Truist Financial (TFC, 0.0% of holdings at period end) was a poor performer in the Fund, dipping roughly 38.2% during the period. The Charlotte, NC based regional bank came under pressure amidst a broader crisis in the banking sector. The failures of Silicon Valley Bank and Signature Bank, in March 2023, represent the second and third largest bankruptcies in U.S. history. Unrealized bond losses, incurred as the U.S. Federal Reserve (the “Fed”) sharply lifted interest rates, precipitated liquidity concerns which led depositors to flee the banks in question. While we do not believe that Truist will suffer a similar fate, we elected to exit the shares out of an abundance of caution and the likelihood that liquidity concerns will linger for some time. Chemical manufacturer Albemarle (ALB, 1.4% of holdings at period end) was also a laggard, falling 20.0% during the period. The company is the world’s largest producer of lithium for use in electric vehicle batteries and other applications. Lithium prices rose as high as $75,000 per ton in 2022, bolstered by anticipated demand for electric vehicle batteries. Slowing demand to start 2023 pushed prices down substantially, putting pressure on Albemarle shares. We anticipate that lithium prices will regain their footing as the year progresses and demand

growth outstrips supply. Growth could average 20% per year as electric vehicle adoption continues to expand and the company invests to expand production capacity.

The narrow market leadership of large technology stocks and the weakness felt among some cyclical stocks in the first half of 2023, reflects the economic pressures that are currently developing due to the impact of sharply higher interest rates implemented this year. Despite this, inflation remains stubbornly high, with the most recent Core Consumer Price Index reading rising 5.3% in May versus the prior year. This elevated reading, relative to the 2% rate targeted by the Fed, may induce further rate hikes in the months ahead. In fact, a combination of historic fiscal stimulus passed in recent years coupled with a rebound in the housing sector and accelerating investment in AI are all helping to forestall the widely forecast recession, making the Fed’s next moves all the more difficult to predict.

Amidst this challenging backdrop, we find the strong business models and market positions afforded by dividend growth securities to be of particular appeal. Those companies able to grow earnings, cash flows and dividends amidst the various headwinds and tailwinds described above will be the focus of our portfolio selection, aiding the Fund’s attempt to deliver strong risk adjusted returns.

Thank you for the confidence you have placed in Copeland and for your investment in the Copeland Dividend Growth Fund.

The views in this report are those of the Funds’ management. This report contains certain forward - looking statements about factors that may affect the performance of the Funds in the future. These statements are based on the Funds’ management’s predictions and expectations concerning certain future events such as the performance of the economy as a whole and of specific industry sectors. Management believes these forward- looking statements are reasonable, although they are inherently uncertain and difficult to predict. The views and opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed. The Fund holdings discussed herein are for informational purposes only and should not be perceived as investment recommendations by Copeland Capital Management. Holdings are subject to change, may not represent current holdings and are subject to risk. Performance data quoted here represents past performance. Past performance is no guarantee of future results. The return quoted reflects fee waivers and expense reimbursements in effect and would have been lower in their absence. Current performance may be lower or higher than the performance quoted above. The risks of investing in the Copeland Funds vary from fund to fund; to see the risks of investing in an individual fund, please refer to that fund’s latest prospectus.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses. The S&P 500® Index is a market-capitalization-weighted index of the stocks of 500 leading companies in major industries of the U.S. economy. The Nasdaq Composite is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange. The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight - or 0.2% of the index total at each quarterly rebalance.

1788-NLD-07122023

| Copeland SMID Cap Dividend Growth Fund |

| Semi-Annual Report |

| May 31, 2023 |

Dear Fellow Shareholders:

Copeland Capital Management is pleased to review the performance of the Copeland SMID Cap Dividend Growth Fund from December 1, 2022 through May 31, 2023. Unless otherwise stated herein, all data and statistics that follow are as of May 31, 2023.

During the six-month period, the Fund returned -1.4%, beating the -5.7% decline in the Russell 2500 Index. The period began with great volatility; however that was substantially mitigated as the market stabilized towards the end of May. A decline in December to end calendar 2022 was followed by a double-digit gain in January, only to be upset by the banking turmoil that dominated fears in the latter part of the first quarter of 2023. The benchmarks ultimately bottomed out late in March. Though the crisis led to the demise of a handful of poorly managed banks that suffered from a flight of deposits, the vast majority survived, even as their stocks finished the period sharply lower. Investors’ attention soon shifted from this pessimism to excitement as a frenzy surrounding artificial intelligence (AI) added fuel to a Technology sector rally. Large capitalization equities were benefited most from the higher weight of Technology in the S&P 500 Index, leading to outperformance relative to smaller stocks. Amidst the shifting moods, our dividend growth stocks outperformed the indices on the downside and participated fully in the rebounds, thereby aiding the performance outcome for the period.

The Fund benefited substantially from the decline among Financials stocks, as higher quality lenders demonstrated their resilience by raising their dividend at an average rate of 9% during the period. In fact, Bank OZK (OZK, 1.4% of holdings at period end), extending its streak of 51 sequential quarterly hikes, raised its dividend twice, resulting in 13% growth year over year. Our Healthcare stocks also aided performance, as Covid-19 fears faded and labor shortages among nurses abated. Lemaitre Vascular (LMAT, 1.8%) saw demand for its vascular implants and devices accelerate as medical procedures rebounded, leading to better operating leverage on its expanding sales force, boosting profit expectations and the stock. The company’s 12% dividend increase was its 13th consecutive year of delivering double-digit growth. The Fund’s top performing stocks were dominated by Technology holdings, which rebounded from a tough 2022 when the highest growth stocks fell out of favor. Notably, Universal Display Corporation (OLED, 1.6% of holdings at period end), the leading supplier of technology patents and materials to the OLED display market, raised its dividend for the sixth year in a row, this time by a healthy 17%. The company was aided by the rebound in sentiment towards electronics suppliers, amid signs of growing penetration of OLED displays into the TV and tablet markets.

Fund performance was held back in the Consumer Discretionary sector, where Domino’s Pizza (DPZ, 1.2% of holdings at period end) and Advanced Auto Parts (AAP, 0.0% of holdings at period end) lagged the rebounding sentiment towards the space, despite fears of a developing recession. DPZ suffered from high labor costs and the return of patrons to dining in restaurants, after having widely favored delivery during the pandemic. We expect the tough comparisons to pass in coming quarters and their take-out and delivery services to become an increasingly attractive, low-cost option as pressures on the consumer intensify. AAP failed to capitalize on the recovery in driving activity and the aging of America’s car fleet, which has led to greater demand for auto parts repair services. The Fund sold the stock as management failed to deliver an increase in the dividend this spring, reflecting its poor execution and deterioration in

cash flows. Finally, TTEC Holdings (TTEC, 0.8% of holdings at period end) lagged the enthusiasm for Technology sector stocks as the call center outsourcing operator needs to prove to the market that it can meet the challenge of a rapidly changing technological and economic environment. The attention paid to AI was a headwind in the period, as the technology is both a risk and an opportunity for the company to deliver the most relevant and efficient customer experiences.

The narrow market leadership of large technology stocks, and weakness felt among some cyclical stocks in the first half of 2023, reflects the economic pressures that are currently developing due to the impact of sharply higher interest rates implemented this year. Despite this, inflation remains stubbornly high, with the most recent Core Consumer Price Index reading rising 5.3% in May versus the prior year. This elevated reading, relative to the 2% rate targeted by the U.S. Federal Reserve (the “Fed”), may induce further rate hikes in the months ahead. In fact, a combination of historic fiscal stimulus passed in recent years coupled with a rebound in the housing sector and accelerating investment in AI are all helping to forestall the widely forecast recession, making the Fed’s next moves all that more difficult to predict.

Amidst this challenging backdrop, we find the strong business models and market positions afforded by dividend growth securities to be of particular appeal. Those companies able to grow earnings, cash flows and dividends amidst the various headwinds and tailwinds described above will be the focus of our portfolio selection, aiding the Fund’s attempt to deliver strong risk adjusted returns.

Thank you for the confidence you have placed in Copeland and for your investment in the Copeland SMID Cap Dividend Growth Fund.

The views in this report are those of the Funds’ management. This report contains certain forward - looking statements about factors that may affect the performance of the Funds in the future. These statements are based on the Funds’ management’s predictions and expectations concerning certain future events such as the performance of the economy as a whole and of specific industry sectors. Management believes these forward- looking statements are reasonable, although they are inherently uncertain and difficult to predict. The views and opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed. The Fund holdings discussed herein are for informational purposes only and should not be perceived as investment recommendations by Copeland Capital Management. Holdings are subject to change, may not represent current holdings and are subject to risk. Performance data quoted here represents past performance. Past performance is no guarantee of future results. The return quoted reflects fee waivers and expense reimbursements in effect and would have been lower in their absence. Current performance may be lower or higher than the performance quoted above. The risks of investing in the Copeland Funds vary from fund to fund; to see the risks of investing in an individual fund, please refer to that fund’s latest prospectus.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses. The Russell 2500 Index is comprised of the bottom 2500 companies in the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. The S&P 500® Index is a market-capitalization-weighted index of the stocks of 500 leading companies in major industries of the U.S. economy.

1788-NLD-07122023

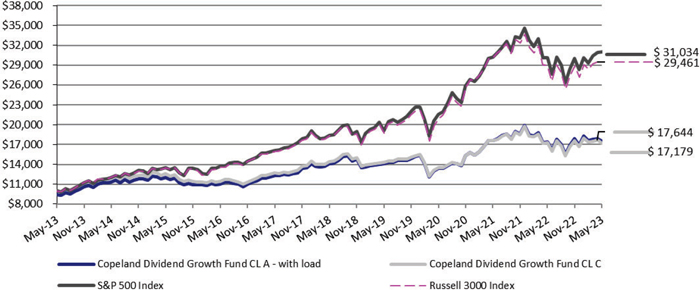

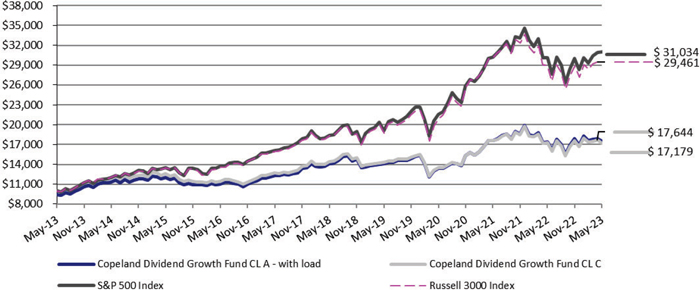

| Copeland Dividend Growth Fund |

| Portfolio Review (Unaudited) |

| May 31, 2013 through May 31, 2023 |

Performance of a $10,000 Investment (as of May 31, 2023)

| Average Annualized | | | | |

| Total Returns as of | | | | |

| May 31, 2023 | Six Months | One Year | Five Year | Ten Year |

| Copeland Dividend Growth Fund: | | | | |

| Class A | | | | |

| Without sales charge | (2.23)% | 0.17% | 4.40% | 6.36% |

| With sales charge + | (7.84)% | (5.56)% | 3.18% | 5.73% |

| Class C | (2.57)% | (0.62)% | 3.63% | 5.56% |

| Class I | (2.17)% | 0.27% | 4.56% | 6.53% |

| S&P 500 Index | 3.33% | 2.92% | 11.01% | 11.99% |

| Russell 3000 Index | 2.38% | 2.03% | 10.07% | 11.45% |

| + | Adjusted for initial maximum sales charge of 5.75%. |

The S&P 500 Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark.

The Russell 3000 Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. The performance and returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption of Fund shares. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the adviser not waived its fees and reimbursed a portion of the Fund’s expenses. For performance information current to the most recent month-end please call toll-free 1-888-9-COPELAND (1-888-926-7352). Additional information can be found by visiting our website, www.copelandfunds.com. The Fund’s gross annual operating expense ratio, as stated in the current prospectus, is 1.99%, 2.74%, and 1.76%, for Class A, Class C, and Class I shares, respectively, and its net annual operating expense ratio is 1.20%, 1.95%, and 1.05%, for Class A, Class C, and Class I shares, respectively. These ratios can fluctuate and may differ from the expense ratios disclosed in the Financial Highlights section of this report. The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, until at least March 31, 2024, to ensure that total annual fund operating expenses after fee deferral and/or reimbursement (exclusive of any taxes, leverage interest, borrowing interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expense on securities sold short, acquired fund fees and expenses or extraordinary expenses such as litigation) will not exceed 1.20%, 1.95% and 1.05% for Class A, Class C and Class I shares, respectively, subject to possible recoupment from the Fund in future years on a rolling three year basis (within the three years after the fees have been deferred or reimbursed) if such recoupment can be achieved without exceeding the lesser of the expense limitation in effect at the time of the deferral and at the time of the repayment.

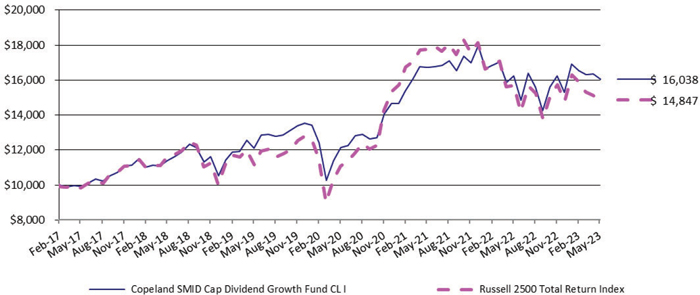

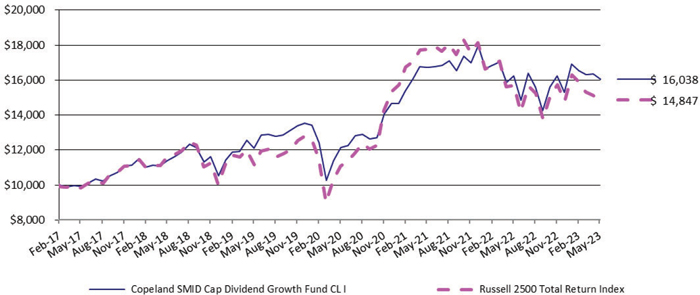

| Copeland SMID Cap Dividend Growth Fund |

| Portfolio Review (Unaudited) |

| February 27, 2017* through May 31, 2023 |

Performance of a $10,000 Investment (as of May 31, 2023)

| | | | | Since | Since |

| Total Returns as of | | | | Inception | Inception |

| May 31, 2023 | Six Months | One Year | Five Year | Class I * | Class A * |

| Copeland SMID Cap Dividend Growth Fund: | | | | | |

| Class I | (1.35)% | (1.14)% | 7.07% | 7.84% | — |

| Class A | | | | | |

| Without sales charge | (1.43)% | (1.36)% | — | — | 7.47% |

| With sales charge + | (7.08)% | (7.02)% | — | — | 5.99% |

| Russell 2500 Total Return Index | (5.71)% | (5.34)% | 4.97% | 6.52% | 6.49% |

| * | Class I shares commenced operations February 27, 2017. Class A commenced operations February 11, 2019 |

| + | Adjusted for initial maximum sales charge of 5.75%. |

The Russell 2500 Total Return Index is comprised of the smallest 2500 companies in the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. Investors cannot invest directly in an index or benchmark.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. The performance and returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption of Fund shares. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the adviser not waived its fees and reimbursed a portion of the Fund’s expenses. For performance information current to the most recent month-end please call toll-free 1-888-9-COPELAND (1-888-926-7352). Additional information can be found by visiting our website, www.copelandfunds.com. The Fund’s gross annual operating expense ratio, as stated in the current prospectus is 2.03% and 1.73% for Class A and Class I shares, respectively, and its net annual operating expense ratio is 1.20% and 0.95% for Class A and Class I shares, respectively. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report. The Fund’s adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, until at least March 31, 2024, to ensure that total annual fund operating expenses after fee deferral and/or reimbursement (exclusive of any taxes, leverage interest, borrowing interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expense on securities sold short, acquired fund fees and expenses or extraordinary expenses such as litigation) will not exceed 1.20% and 0.95% for Class A and Class I shares, respectively, subject to possible recoupment from the Fund in future years on a rolling three year basis (within the three years after the fees have been deferred or reimbursed) if such recoupment can be achieved without exceeding the lesser of the expense limitation in effect at the time of the deferral and at the time of the repayment.

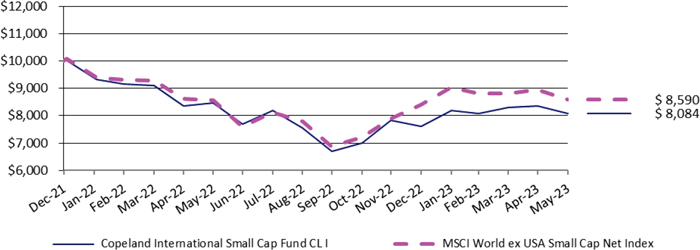

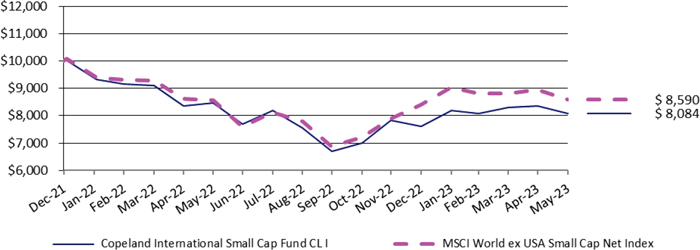

| Copeland International Small Cap Fund |

| Portfolio Review (Unaudited) |

| December 28, 2021* through May 31, 2023 |

Performance of a $10,000 Investment (as of May 31, 2023)

| Total Returns as of | | | Since |

| May 31, 2023 | Six Months | One Year | Inception* |

| Copeland International Small Cap Fund: | | | |

| Class I | 3.37% | (4.56)% | (13.90)% |

| Class A | | | |

| Without sales charge | 3.37% | (4.56)% | (13.90)% |

| With sales charge + | (2.61)% | (10.08)% | (17.41)% |

| MSCI World ex USA Small Cap Net Index | 8.86% | 0.22% | (12.97)% |

| * | The Fund commenced operations December 28, 2021. |

| + | Adjusted for initial maximum sales charge of 5.75%. |

The MSCI World ex USA Small Cap Net Index captures small cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States). With 2,555 constituents, the index covers approximately 14% of the free float-adjusted market capitalization in each country.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. The performance and returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption of Fund shares. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the adviser not waived its fees and reimbursed a portion of the Fund’s expenses. For performance information current to the most recent month-end please call toll-free 1-888-9-COPELAND (1-888-926-7352). Additional information can be found by visiting our website, www.copelandfunds.com. The Fund’s gross annual operating expense ratio, as stated in the current prospectus is 34.90% and 28.11% for Class A and Class I shares, respectively, and its net annual operating expense ratio is 1.23% and 0.98% for Class A and Class I shares, respectively. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report. The Fund’s adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, until at least March 31, 2024, to ensure that total annual fund operating expenses after fee deferral and/or reimbursement (exclusive of any taxes, leverage interest, borrowing interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expense on securities sold short, acquired fund fees and expenses or extraordinary expenses such as litigation) will not exceed 1.23% and 0.98% for Class A and Class I shares, respectively, subject to possible recoupment from the Fund in future years on a rolling three year basis (within the three years after the fees have been deferred or reimbursed) if such recoupment can be achieved without exceeding the lesser of the expense limitation in effect at the time of the deferral and at the time of the repayment.

| COPELAND DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

May 31, 2023 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.7% | | | | |

| | | | | APPAREL & TEXTILE PRODUCTS - 0.9% | | | | |

| | 3,830 | | | NIKE, Inc., Class B | | $ | 403,146 | |

| | | | | | | | | |

| | | | | ASSET MANAGEMENT - 5.5% | | | | |

| | 2,246 | | | Ameriprise Financial, Inc. | | | 670,363 | |

| | 963 | | | BlackRock, Inc. | | | 633,221 | |

| | 13,179 | | | Brookfield Infrastructure Corporation, Class A | | | 607,552 | |

| | 8,151 | | | Hamilton Lane, Inc., Class A | | | 553,534 | |

| | | | | | | | 2,464,670 | |

| | | | | BEVERAGES - 1.4% | | | | |

| | 2,653 | | | Constellation Brands, Inc., Class A | | | 644,599 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 1.6% | | | | |

| | 4,258 | | | Zoetis, Inc. | | | 694,097 | |

| | | | | | | | | |

| | | | | CABLE & SATELLITE - 1.1% | | | | |

| | 770 | | | Cable One, Inc. | | | 471,109 | |

| | | | | | | | | |

| | | | | CHEMICALS - 4.1% | | | | |

| | 2,332 | | | Air Products and Chemicals, Inc. | | | 627,635 | |

| | 3,188 | | | Albemarle Corporation | | | 616,974 | |

| | 2,589 | | | Sherwin-Williams Company (The) | | | 589,722 | |

| | | | | | | | 1,834,331 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 2.9% | | | | |

| | 5,177 | | | Insperity, Inc. | | | 573,197 | |

| | 5,092 | | | Waste Connections, Inc. | | | 695,822 | |

| | | | | | | | 1,269,019 | |

| | | | | CONSTRUCTION MATERIALS - 1.2% | | | | |

| | 2,460 | | | Carlisle Companies, Inc. | | | 522,602 | |

| | | | | | | | | |

| | | | | DATA CENTER REIT - 1.3% | | | | |

| | 792 | | | Equinix, Inc. | | | 590,476 | |

| COPELAND DIVIDEND GROWTH FUND | |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) | |

| May 31, 2023 | |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.7% (Continued) | | | | |

| | | | | ELECTRIC UTILITIES - 1.5% | | | | |

| | 9,242 | | | NextEra Energy, Inc. | | $ | 678,917 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 2.6% | | | | |

| | 7,253 | | | Amphenol Corporation, Class A | | | 547,239 | |

| | 7,574 | | | Otis Worldwide Corporation | | | 602,209 | |

| | | | | | | | 1,149,448 | |

| | | | | ENGINEERING & CONSTRUCTION - 1.3% | | | | |

| | 4,258 | | | Tetra Tech, Inc. | | | 585,347 | |

| | | | | | | | | |

| | | | | FOOD - 1.4% | | | | |

| | 37,333 | | | Utz Brands, Inc. | | | 614,128 | |

| | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 6.7% | | | | |

| | 12,195 | | | Encompass Health Corporation | | | 756,334 | |

| | 8,322 | | | Ensign Group, Inc. (The) | | | 737,412 | |

| | 1,840 | | | UnitedHealth Group, Inc. | | | 896,522 | |

| | 5,926 | | | US Physical Therapy, Inc. | | | 605,341 | |

| | | | | | | | 2,995,609 | |

| | | | | HOUSEHOLD PRODUCTS - 1.6% | | | | |

| | 5,712 | | | Inter Parfums, Inc. | | | 717,427 | |

| | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 1.4% | | | | |

| | 7,766 | | | Morgan Stanley | | | 634,948 | |

| | | | | | | | | |

| | | | | INSURANCE - 1.3% | | | | |

| | 5,306 | | | Allstate Corporation (The) | | | 575,436 | |

| | | | | | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 4.1% | | | | |

| | 5,434 | | | Churchill Downs, Inc. | | | 738,046 | |

| | 1,904 | | | Domino’s Pizza, Inc. | | | 551,874 | |

| | 5,905 | | | Starbucks Corporation | | | 576,564 | |

| | | | | | | | 1,866,484 | |

| | | | | | | | | |

The accompanying notes are an intergral part of these financial statements.

| COPELAND DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2023 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.7% (Continued) | | | | |

| | | | | LEISURE PRODUCTS - 1.3% | | | | |

| | 7,574 | | | Brunswick Corporation | | $ | 571,837 | |

| | | | | | | | | |

| | | | | MACHINERY - 1.0% | | | | |

| | 2,075 | | | Nordson Corporation | | | 452,205 | |

| | | | | | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 5.6% | | | | |

| | 2,567 | | | Danaher Corporation | | | 589,435 | |

| | 3,102 | | | ResMed, Inc. | | | 653,871 | |

| | 3,402 | | | STERIS plc | | | 680,297 | |

| | 1,754 | | | West Pharmaceutical Services, Inc. | | | 586,941 | |

| | | | | | | | 2,510,544 | |

| | | | | OFFICE REIT - 0.9% | | | | |

| | 3,701 | | | Alexandria Real Estate Equities, Inc. | | | 419,915 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 5.0% | | | | |

| | 6,461 | | | Diamondback Energy, Inc. | | | 821,516 | |

| | 21,780 | | | Northern Oil and Gas, Inc. | | | 651,440 | |

| | 3,723 | | | Pioneer Natural Resources Company | | | 742,515 | |

| | | | | | | | 2,215,471 | |

| | | | | PUBLISHING & BROADCASTING - 1.2% | | | | |

| | 3,808 | | | Nexstar Media Group, Inc. | | | 574,703 | |

| | | | | | | | | |

| | | | | REAL ESTATE SERVICES - 1.3% | | | | |

| | 37,483 | | | eXp World Holdings, Inc. | | | 576,863 | |

| | | | | | | | | |

| | | | | RESIDENTIAL REIT - 1.2% | | | | |

| | 8,237 | | | Equity LifeStyle Properties, Inc. | | | 520,331 | |

| | | | | | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 4.4% | | | | |

| | 3,231 | | | Casey’s General Stores, Inc. | | | 729,076 | |

| | 1,198 | | | Costco Wholesale Corporation | | | 612,849 | |

| | 3,102 | | | Dollar General Corporation | | | 623,781 | |

| | | | | | | | 1,965,706 | |

The accompanying notes are an intergral part of these financial statements.

| COPELAND DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2023 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.7% (Continued) | | | | |

| | | | | RETAIL - DISCRETIONARY - 2.3% | | | | |

| | 1,626 | | | Home Depot, Inc. (The) | | $ | 460,890 | |

| | 5,306 | | | Ross Stores, Inc. | | | 549,807 | |

| | | | | | | | 1,010,697 | |

| | | | | SEMICONDUCTORS - 7.2% | | | | |

| | 1,241 | | | Broadcom, Inc. | | | 1,002,678 | |

| | 1,369 | | | Monolithic Power Systems, Inc. | | | 670,687 | |

| | 9,371 | | | Power Integrations, Inc. | | | 809,654 | |

| | 4,899 | | | Universal Display Corporation | | | 721,770 | |

| | | | | | | | 3,204,789 | |

| | | | | SOFTWARE - 3.3% | | | | |

| | 1,498 | | | Intuit, Inc. | | | 627,842 | |

| | 2,567 | | | Microsoft Corporation | | | 842,977 | |

| | | | | | | | 1,470,819 | |

| | | | | SPECIALTY FINANCE - 2.7% | | | | |

| | 15,832 | | | Air Lease Corporation | | | 601,933 | |

| | 5,712 | | | Discover Financial Services | | | 586,851 | |

| | | | | | | | 1,188,784 | |

| | | | | TECHNOLOGY HARDWARE - 4.1% | | | | |

| | 5,477 | | | Apple, Inc. | | | 970,798 | |

| | 3,081 | | | Motorola Solutions, Inc. | | | 868,596 | |

| | | | | | | | 1,839,394 | |

| | | | | TECHNOLOGY SERVICES - 14.2% | | | | |

| | 2,139 | | | Accenture PLC, Class A | | | 654,363 | |

| | 7,638 | | | Booz Allen Hamilton Holding Corporation | | | 768,230 | |

| | 3,765 | | | Broadridge Financial Solutions, Inc. | | | 552,401 | |

| | 4,086 | | | CDW Corporation | | | 701,525 | |

| | 1,155 | | | FactSet Research Systems, Inc. | | | 444,548 | |

| | 4,172 | | | Jack Henry & Associates, Inc. | | | 637,857 | |

| | 1,540 | | | MSCI, Inc. | | | 724,616 | |

| | 9,114 | | | TransUnion | | | 656,026 | |

| | 2,460 | | | Verisk Analytics, Inc. | | | 539,011 | |

| | 3,252 | | | Visa, Inc., Class A | | | 718,790 | |

| | | | | | | | 6,397,367 | |

The accompanying notes are an intergral part of these financial statements.

| COPELAND DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2023 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.7% (Continued) | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 0.9% | | | | |

| | 2,503 | | | JB Hunt Transport Services, Inc. | | $ | 417,926 | |

| | | | | | | | | |

| | | | | WHOLESALE - DISCRETIONARY - 1.2% | | | | |

| | 1,690 | | | Pool Corporation | | | 534,429 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $38,103,636) | | | 44,583,573 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 99.7% (Cost $38,103,636) | | $ | 44,583,573 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 0.3% | | | 133,211 | |

| | | | | NET ASSETS - 100.0% | | $ | 44,716,784 | |

| MSCI | - Morgan Stanley Capital International |

| PLC | - Public Limited Company |

| REIT | - Real Estate Investment Trust |

| Porfolio Composition as of May 31, 2023 (Unaudited) |

| Sector * | | Percent of Net Assets | |

| Technology | | | 29.2 | % |

| Health Care | | | 14.0 | % |

| Financials | | | 11.0 | % |

| Consumer Discretionary | | | 9.9 | % |

| Consumer Staples | | | 8.9 | % |

| Industrials | | | 8.8 | % |

| Materials | | | 5.3 | % |

| Energy | | | 5.0 | % |

| Real Estate | | | 4.8 | % |

| Communications | | | 2.4 | % |

| Utilities | | | 1.5 | % |

| Liabilities in Excess of Other Assets | | | (0.8 | )% |

| Net Assets | | | 100.0 | % |

| * | No industry represents more than 25% of the Fund’s assets. |

The accompanying notes are an intergral part of these financial statements.

| COPELAND SMID CAP DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2023 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 95.5% | | | | |

| | | | | ASSET MANAGEMENT - 5.0% | | | | |

| | 18,914 | | | Brookfield Infrastructure Corporation, Class A | | $ | 871,935 | |

| | 10,433 | | | Cohen & Steers, Inc. | | | 567,660 | |

| | 11,054 | | | Hamilton Lane, Inc., Class A | | | 750,677 | |

| | 40,101 | | | Kennedy-Wilson Holdings, Inc. | | | 618,758 | |

| | | | | | | | 2,809,030 | |

| | | | | BANKING - 4.1% | | | | |

| | 22,755 | | | Bank OZK | | | 786,868 | |

| | 39,077 | | | Home BancShares, Inc. | | | 838,983 | |

| | 11,009 | | | Prosperity Bancshares, Inc. | | | 629,495 | |

| | | | | | | | 2,255,346 | |

| | | | | BIOTECH & PHARMA - 1.2% | | | | |

| | 20,899 | | | Perrigo Company plc | | | 667,932 | |

| | | | | | | | | |

| | | | | CABLE & SATELLITE - 1.3% | | | | |

| | 1,152 | | | Cable One, Inc. | | | 704,828 | |

| | | | | | | | | |

| | | | | CHEMICALS - 2.2% | | | | |

| | 33,700 | | | Element Solutions, Inc. | | | 604,241 | |

| | 3,296 | | | Quaker Houghton | | | 625,613 | |

| | | | | | | | 1,229,854 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 6.0% | | | | |

| | 18,210 | | | ABM Industries, Inc. | | | 804,154 | |

| | 27,875 | | | GFL Environmental, Inc. | | | 1,007,403 | |

| | 7,393 | | | Insperity, Inc. | | | 818,553 | |

| | 3,840 | | | UniFirst Corporation | | | 657,062 | |

| | | | | | | | 3,287,172 | |

| | | | | CONSTRUCTION MATERIALS - 1.2% | | | | |

| | 3,168 | | | Carlisle Companies, Inc. | | | 673,010 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 4.2% | | | | |

| | 11,809 | | | BWX Technologies, Inc. | | | 712,319 | |

| | 14,658 | | | Cognex Corporation | | | 805,605 | |

| | 3,136 | | | Littelfuse, Inc. | | | 802,941 | |

| | | | | | | | 2,320,865 | |

The accompanying notes are an intergral part of these financial statements.

| COPELAND SMID CAP DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2023 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 95.5% (Continued) | | | | |

| | | | | ENGINEERING & CONSTRUCTION - 1.5% | | | | |

| | 5,953 | | | Tetra Tech, Inc. | | $ | 818,359 | |

| | | | | | | | | |

| | | | | FORESTRY, PAPER & WOOD PRODUCTS - 0.8% | | | | |

| | 5,505 | | | UFP Industries, Inc. | | | 429,941 | |

| | | | | | | | | |

| | | | | GAS & WATER UTILITIES - 1.3% | | | | |

| | 5,569 | | | Chesapeake Utilities Corporation | | | 711,161 | |

| | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 8.2% | | | | |

| | 1,504 | | | Chemed Corporation | | | 802,790 | |

| | 15,394 | | | Encompass Health Corporation | | | 954,736 | |

| | 11,713 | | | Ensign Group, Inc. (The) | | | 1,037,889 | |

| | 5,729 | | | Quest Diagnostics, Inc. | | | 759,952 | |

| | 9,185 | | | US Physical Therapy, Inc. | | | 938,248 | |

| | | | | | | | 4,493,615 | |

| | | | | HOUSEHOLD PRODUCTS - 1.7% | | | | |

| | 7,393 | | | Inter Parfums, Inc. | | | 928,561 | |

| | | | | | | | | |

| | | | | INDUSTRIAL REIT - 1.4% | | | | |

| | 12,129 | | | Terreno Realty Corporation | | | 743,871 | |

| | | | | | | | | |

| | | | | INSURANCE - 2.5% | | | | |

| | 6,401 | | | Globe Life, Inc. | | | 660,455 | |

| | 2,272 | | | Kinsale Capital Group, Inc. | | | 688,371 | |

| | | | | | | | 1,348,826 | |

| | | | | INTERNET MEDIA & SERVICES - 1.3% | | | | |

| | 14,274 | | | Shutterstock, Inc. | | | 710,417 | |

| | | | | | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 6.3% | | | | |

| | 7,681 | | | Churchill Downs, Inc. | | | 1,043,233 | |

| | 2,272 | | | Domino’s Pizza, Inc. | | | 658,539 | |

| | 19,522 | | | Travel + Leisure Company | | | 711,967 | |

| | 5,089 | | | Wingstop, Inc. | | | 1,014,543 | |

| | | | | | | | 3,428,282 | |

The accompanying notes are an intergral part of these financial statements.

| COPELAND SMID CAP DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2023 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 95.5% (Continued) | | | | |

| | | | | LEISURE PRODUCTS - 1.5% | | | | |

| | 11,169 | | | Brunswick Corporation | | $ | 843,260 | |

| | | | | | | | | |

| | | | | MACHINERY - 3.3% | | | | |

| | 3,584 | | | Nordson Corporation | | | 781,061 | |

| | 7,521 | | | Standex International Corporation | | | 1,024,285 | |

| | | | | | | | 1,805,346 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 3.5% | | | | |

| | 15,778 | | | LeMaitre Vascular, Inc. | | | 991,489 | |

| | 4,705 | | | STERIS plc | | | 940,859 | |

| | | | | | | | 1,932,348 | |

| | | | | OIL & GAS PRODUCERS - 5.7% | | | | |

| | 6,305 | | | Chord Energy Corporation | | | 901,867 | |

| | 9,505 | | | Civitas Resources, Inc. | | | 634,934 | |

| | 15,682 | | | Matador Resources Company | | | 689,538 | |

| | 30,596 | | | Northern Oil and Gas, Inc. | | | 915,126 | |

| | | | | | | | 3,141,465 | |

| | | | | PUBLISHING & BROADCASTING - 1.3% | | | | |

| | 4,673 | | | Nexstar Media Group, Inc. | | | 705,249 | |

| | | | | | | | | |

| | | | | REAL ESTATE SERVICES - 1.4% | | | | |

| | 50,374 | | | eXp World Holdings, Inc. | | | 775,256 | |

| | | | | | | | | |

| | | | | RESIDENTIAL REIT - 1.2% | | | | |

| | 16,322 | | | NexPoint Residential Trust, Inc. | | | 669,855 | |

| | | | | | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 1.6% | | | | |

| | 3,840 | | | Casey’s General Stores, Inc. | | | 866,496 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 1.1% | | | | |

| | 14,562 | | | Monro, Inc. | | | 602,430 | |

| | | | | | | | | |

| | | | | SEMICONDUCTORS - 6.6% | | | | |

| | 8,759 | | | Entegris, Inc. | | | 921,884 | |

| | 16,770 | | | Kulicke & Soffa Industries, Inc. | | | 886,798 | |

The accompanying notes are an intergral part of these financial statements.

| COPELAND SMID CAP DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2023 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 95.5% (Continued) | | | | |

| | | | | SEMICONDUCTORS - 6.6% (Continued) | | | | |

| | 10,529 | | | Power Integrations, Inc. | | $ | 909,706 | |

| | 6,081 | | | Universal Display Corporation | | | 895,914 | |

| | | | | | | | 3,614,302 | |

| | | | | SPECIALTY FINANCE - 1.4% | | | | |

| | 19,490 | | | Air Lease Corporation | | | 741,010 | |

| | | | | | | | | |

| | | | | STEEL - 1.9% | | | | |

| | 4,353 | | | Reliance Steel & Aluminum Company | | | 1,021,562 | |

| | | | | | | | | |

| | | | | TECHNOLOGY SERVICES - 9.3% | | | | |

| | 9,025 | | | Booz Allen Hamilton Holding Corporation | | | 907,734 | |

| | 5,569 | | | Broadridge Financial Solutions, Inc. | | | 817,083 | |

| | 1,920 | | | FactSet Research Systems, Inc. | | | 738,989 | |

| | 5,185 | | | Jack Henry & Associates, Inc. | | | 792,735 | |

| | 3,168 | | | Morningstar, Inc. | | | 648,490 | |

| | 10,145 | | | TransUnion | | | 730,237 | |

| | 14,210 | | | TTEC Holdings, Inc. | | | 450,741 | |

| | | | | | | | 5,086,009 | |

| | | | | TELECOMMUNICATIONS - 1.3% | | | | |

| | 12,225 | | | Cogent Communications Holdings, Inc. | | | 752,082 | |

| | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 1.6% | | | | |

| | 4,993 | | | Landstar System, Inc. | | | 875,672 | |

| | | | | | | | | |

| | | | | TRANSPORTATION EQUIPMENT - 1.3% | | | | |

| | 15,170 | | | Allison Transmission Holdings, Inc. | | | 717,541 | |

| | | | | | | | | |

| | | | | WHOLESALE - DISCRETIONARY - 1.3% | | | | |

| | 2,208 | | | Pool Corporation | | | 698,237 | |

The accompanying notes are an intergral part of these financial statements.

| COPELAND SMID CAP DIVIDEND GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2023 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 95.5% (Continued) | | | | |

| | | | | WHOLESALE - DISCRETIONARY - 1.3% (Continued) | | | | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $50,718,093) | | $ | 52,409,190 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 95.5% (Cost $50,718,093) | | $ | 52,409,190 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 4.5% | | | 2,512,111 | |

| | | | | NET ASSETS - 100.0% | | $ | 54,921,301 | |

| PLC | - Public Limited Company |

| REIT | - Real Estate Investment Trust |

| Porfolio Composition as of May 31, 2023 (Unaudited) |

| Sector | | Percent of Net Assets | |

| Industrials | | | 17.9 | % |

| Technology | | | 15.8 | % |

| Financials | | | 13.0 | % |

| Health Care | | | 12.9 | % |

| Consumer Discretionary | | | 10.2 | % |

| Materials | | | 6.1 | % |

| Energy | | | 5.7 | % |

| Communications | | | 5.2 | % |

| Real Estate | | | 4.0 | % |

| Consumer Staples | | | 3.3 | % |

| Utilities | | | 1.3 | % |

| Other Assets in Excess of Liabilities | | | 4.6 | % |

| Net Assets | | | 100.0 | % |

The accompanying notes are an intergral part of these financial statements.

| COPELAND INTERNATIONAL SMALL CAP FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2023 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.0% | | | | |

| | | | | Australia - 3.4% | | | | |

| | 533 | | | Lifestyle Communities Ltd. | | $ | 5,200 | |

| | 2,543 | | | Steadfast Group Ltd. | | | 9,802 | |

| | | | | | | | 15,002 | |

| | | | | Belgium - 2.8% | | | | |

| | 236 | | | Azelis Group N.V.(a) | | | 5,790 | |

| | 82 | | | Montea N.V. | | | 6,665 | |

| | | | | | | | 12,455 | |

| | | | | Canada - 11.6% | | | | |

| | 142 | | | Brookfield Infrastructure Corporation | | | 6,554 | |

| | 168 | | | Canadian Apartment Properties REIT | | | 6,069 | |

| | 414 | | | Freehold Royalties Ltd. | | | 4,269 | |

| | 531 | | | InterRent Real Estate Investment Trust | | | 5,136 | |

| | 152 | | | Stella-Jones, Inc. | | | 6,725 | |

| | 60 | | | TMX Group Ltd. | | | 6,530 | |

| | 79 | | | Toromont Industries Ltd. | | | 6,110 | |

| | 114 | | | Tourmaline Oil Corporation | | | 4,766 | |

| | 682 | | | Whitecap Resources, Inc. | | | 4,667 | |

| | | | | | | | 50,826 | |

| | | | | Cayman Islands - 2.2% | | | | |

| | 10,983 | | | Bosideng International Holdings Ltd. | | | 4,560 | |

| | 6,995 | | | Fu Shou Yuan International Group Ltd.(a) | | | 5,102 | |

| | | | | | | | 9,662 | |

| | | | | Denmark - 1.8% | | | | |

| | 187 | | | Sydbank A/S(a) | | | 7,837 | |

| | | | | | | | | |

| | | | | France - 2.6% | | | | |

| | 76 | | | ARGAN S.A. | | | 5,696 | |

| | 19 | | | Virbac S.A. | | | 5,801 | |

| | | | | | | | 11,497 | |

| | | | | Germany - 3.5% | | | | |

| | 195 | | | AIXTRON S.E. | | | 6,063 | |

| | 297 | | | Hensoldt A.G. | | | 9,476 | |

| | | | | | | | 15,539 | |

The accompanying notes are an intergral part of these financial statements.

| COPELAND INTERNATIONAL SMALL CAP FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2023 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.0% (Continued) | | | | |

| | | | | Greece - 2.2% | | | | |

| | 552 | | | OPAP S.A.(a) | | $ | 9,424 | |

| | | | | | | | | |

| | | | | Israel - 0.7% | | | | |

| | 2,312 | | | Bezeq The Israeli Telecommunication Corp Ltd.(a) | | | 2,893 | |

| | | | | | | | | |

| | | | | Italy - 6.2% | | | | |

| | 110 | | | Interpump Group SpA | | | 5,936 | |

| | 3,722 | | | Iren SpA | | | 7,440 | |

| | 158 | | | Recordati Industria Chimica e Farmaceutica SpA | | | 6,890 | |

| | 253 | | | Stevanato Group SpA | | | 6,808 | |

| | | | | | | | 27,074 | |

| | | | | Japan - 28.9% | | | | |

| | 258 | | | Asics Corporation | | | 6,891 | |

| | 201 | | | BayCurrent Consulting, Inc.(a) | | | 7,346 | |

| | 907 | | | Chiba Bank Ltd. (The)(a) | | | 5,658 | |

| | 50 | | | Cosmos Pharmaceutical Corporation | | | 4,750 | |

| | 660 | | | Elan Corporation | | | 4,096 | |

| | 99 | | | Fujimi, Inc. | | | 6,353 | |

| | 249 | | | FULLCAST Holdings Company Ltd. | | | 3,961 | |

| | 106 | | | Hamamatsu Photonics KK | | | 5,387 | |

| | 223 | | | Information Services International-Dentsu Ltd. | | | 8,043 | |

| | 437 | | | Internet Initiative Japan, Inc. | | | 8,599 | |

| | 298 | | | JCU Corporation | | | 7,389 | |

| | 1,406 | | | Mitsubishi UFJ Lease & Finance Company Ltd. | | | 7,626 | |

| | 253 | | | Nakanishi, Inc. | | | 5,332 | |

| | 355 | | | Nippon Gas Company Ltd. | | | 4,919 | |

| | 113 | | | Nissan Chemical Corporation | | | 4,901 | |

| | 222 | | | Rohto Pharmaceutical Company Ltd. | | | 4,729 | |

| | 266 | | | Shoei Company Ltd. | | | 4,971 | |

| | 227 | | | Strike Company Ltd.(a) | | | 5,613 | |

| | 163 | | | Taiyo Yuden Company Ltd. | | | 5,060 | |

| | 247 | | | Takeuchi Manufacturing Company Ltd. | | | 6,623 | |

| | 784 | | | Zeon Corporation | | | 8,106 | |

| | | | | | | | 126,353 | |

The accompanying notes are an intergral part of these financial statements.

| COPELAND INTERNATIONAL SMALL CAP FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2023 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.0% (Continued) | | | | |

| | | | | Netherlands - 1.2% | | | | |

| | 81 | | | Euronext N.V. | | $ | 5,404 | |

| | | | | | | | | |

| | | | | Norway - 1.6% | | | | |

| | 171 | | | Kongsberg Gruppen ASA | | | 6,852 | |

| | | | | | | | | |

| | | | | Spain - 1.2% | | | | |

| | 81 | | | Viscofan S.A. | | | 5,409 | |

| | | | | | | | | |

| | | | | Sweden - 3.5% | | | | |

| | 523 | | | Bravida Holding A.B.(a) | | | 5,118 | |

| | 424 | | | Hufvudstaden A.B.(a) | | | 5,081 | |

| | 265 | | | Sagax A.B. | | | 5,244 | |

| | | | | | | | 15,443 | |

| | | | | Switzerland - 3.2% | | | | |

| | 94 | | | Logitech International S.A. | | | 6,012 | |

| | 291 | | | SIG Combibloc Group A.G. | | | 7,957 | |

| | | | | | | | 13,969 | |

| | | | | United Kingdom - 16.4% | | | | |

| | 1,572 | | | Advanced Medical Solutions Group plc | | | 4,385 | |

| | 1,171 | | | Bytes Technology Group plc | | | 7,423 | |

| | 1,509 | | | Chemring Group plc | | | 4,791 | |

| | 172 | | | Diploma plc(a) | | | 6,493 | |

| | 285 | | | Halma PLC(a) | | | 8,552 | |

| | 1,005 | | | Pets at Home Group PLC | | | 4,704 | |

| | 407 | | | RS GROUP plc | | | 4,031 | |

| | 1,421 | | | RWS Holdings plc | | | 4,021 | |

| | 850 | | | Treatt plc | | | 7,366 | |

| | 648 | | | UNITE Group PLC (The) | | | 7,228 | |

| | 334 | | | WH Smith plc | | | 6,531 | |

| | 506 | | | YouGov plc | | | 6,287 | |

| | | | | | | | 71,812 | |

| | | | | United States - 5.0% | | | | |

| | 142 | | | Air Lease Corporation | | | 5,399 | |

| | 94 | | | Inter Parfums, Inc. | | | 11,806 | |

The accompanying notes are an intergral part of these financial statements.

| COPELAND INTERNATIONAL SMALL CAP FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2023 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.0% (Continued) | | | | |

| | | | | United States - 5.0% (Continued) | | | | |

| | 32 | | | Universal Display Corporation | | $ | 4,716 | |

| | | | | | | | 21,921 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $437,106) | | | 429,372 | |

| | | | | | | | | |

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 1.8% | | | | |

| | | | | United States - 1.8% | | | | |

| | 139 | | | iShares MSCI EAFE Small-Cap ETF, EQUITY | | | 8,088 | |

| | | | | | | | | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS (Cost $8,095) | | | 8,088 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 99.8% (Cost $445,201) | | $ | 437,460 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 0.2% | | | 698 | |

| | | | | NET ASSETS - 100.0% | | $ | 438,158 | |

| EAFE | - Europe, Australasia and Far East |

| ETF | - Exchange-Traded Fund |

| MSCI | - Morgan Stanley Capital International |

| PLC | - Public Limited Company |

| REIT | - Real Estate Investment Trust |

| (a) | The value of this security has been determined in good faith under policies of the Board of Trustees. |

The accompanying notes are an intergral part of these financial statements.

| COPELAND INTERNATIONAL SMALL CAP FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2023 |

| Porfolio Composition * as of May 31, 2023 (Unaudited) |

| Country | | | |

| Japan | | | 28.9 | % |

| United Kingdom | | | 16.4 | % |

| Canada | | | 11.6 | % |

| Italy | | | 6.2 | % |

| United States | | | 5.0 | % |

| Germany | | | 3.5 | % |

| Sweden | | | 3.5 | % |

| Australia | | | 3.4 | % |

| Switzerland | | | 3.2 | % |

| Belgium | | | 2.8 | % |

| Other Countries | | | 13.7 | % |

| Exchange-Traded Fund | | | 1.8 | % |

| Total | | | 100.0 | % |

| * | Based on total value of investments as of May 31, 2023. |

Percentage may differ from Schedule of Investments which are based on Fund net assets.

The accompanying notes are an intergral part of these financial statements.

| Copeland Trust |

| STATEMENTS OF ASSETS AND LIABILITIES (Unaudited) |

| May 31, 2023 |

| | | | | | Copeland SMID | | | Copeland | |

| | | Copeland Dividend | | | Cap Dividend | | | International | |

| | | Growth Fund | | | Growth Fund | | | Small Cap Fund | |

| Assets: | | | | | | | | | | | | |

| Investments, at Cost | | $ | 38,103,636 | | | $ | 50,718,093 | | | $ | 445,201 | |

| Investments in Securities, at Market Value | | $ | 44,583,573 | | | $ | 52,409,190 | | | $ | 437,460 | |

| Cash | | | 11,709 | | | | 2,732,174 | | | | 4,600 | |

| Foreign Cash (Cost $0, $0, $14) | | | — | | | | — | | | | 109 | |

| Dividends and Interest Receivable | | | 62,267 | | | | 70,801 | | | | 1,140 | |

| Receivable for Securities Sold | | | — | | | | 384,394 | | | | — | |

| Receivable for Fund Shares Sold | | | — | | | | 54,649 | | | | — | |

| Prepaid Expenses and Other Assets | | | 93,020 | | | | 45,211 | | | | 7,473 | |

| Total Assets | | | 44,762,977 | | | | 55,696,419 | | | | 464,407 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Payable for Securities Purchased | | | — | | | | 736,925 | | | | — | |

| Payable for Fund Shares Redeemed | | | 15,544 | | | | 2,170 | | | | — | |

| Payable to Investment Adviser | | | — | | | | — | | | | 1,969 | |

| Accrued Audit Fees | | | 9,895 | | | | 8,812 | | | | 11,822 | |

| Accrued Distribution Fees | | | 11,169 | | | | 353 | | | | — | |

| Payable to Related Parties | | | 7,838 | | | | 7,840 | | | | 8,129 | |

| Other Accrued Expenses | | | 1,747 | | | | 19,018 | | | | 4,329 | |

| Total Liabilities | | | 46,193 | | | | 775,118 | | | | 26,249 | |

| | | | | | | | | | | | | |

| Net Assets | | $ | 44,716,784 | | | $ | 54,921,301 | | | $ | 438,158 | |

| | | | | | | | | | | | | |

| Composition of Net Assets: | | | | | | | | | | | | |

| At May 31, 2023, Net Assets consisted of: | | | | | | | | | | | | |

| Paid-in-Capital | | $ | 38,426,970 | | | $ | 54,586,963 | | | $ | 523,515 | |

| Accumulated Earnings/(Deficit) | | | 6,289,814 | | | | 334,338 | | | | (85,357 | ) |

| Net Assets | | $ | 44,716,784 | | | $ | 54,921,301 | | | $ | 438,158 | |

| | | | | | | | | | | | | |

| Class A Shares: | | | | | | | | | | | | |

| Net Assets | | $ | 13,906,700 | | | $ | 1,652,814 | | | $ | 8 | |

| | | | | | | | | | | | | |

| Shares Outstanding (no par value; unlimited number of shares authorized) | | | 1,216,742 | | | | 123,178 | | | | 1 | |

| | | | | | | | | | | | | |

| Net Asset Value and Redemption Price Per Share* | | $ | 11.43 | | | $ | 13.42 | | | $ | 7.86 | + |

| Offering Price Per Share (NAV/$0.9425) Includes a Maximum Sales Charge of 5.75% | | $ | 12.13 | | | $ | 14.24 | | | $ | 8.34 | |

| | | | | | | | | | | | | |

| Class C Shares: | | | | | | | | | | | | |

| Net Assets | | $ | 9,472,414 | | | | — | | | | — | |

| | | | | | | | | | | | | |

| Shares Outstanding (no par value; unlimited number of shares authorized) | | | 883,775 | | | | — | | | | — | |

| | | | | | | | | | | | | |

| Net Asset Value, Offering Price and Redemption Price Per Share* | | $ | 10.72 | | | | — | | | | — | |

| | | | | | | | | | | | | |

| Class I Shares: | | | | | | | | | | | | |

| Net Assets | | $ | 21,337,670 | | | $ | 53,268,487 | | | $ | 438,150 | |

| | | | | | | | | | | | | |

| Shares Outstanding (no par value; unlimited number of shares authorized) | | | 1,894,622 | | | | 3,945,490 | | | | 55,738 | |

| | | | | | | | | | | | | |

| Net Asset Value, Offering Price and Redemption Price Per Share* | | $ | 11.26 | | | $ | 13.50 | | | $ | 7.86 | |

| * | The Funds charge a 1.00% fee on shares redeemed less than 30 days after purchase or if shares held less than 30 days are redeemed for failure to maintain a balance that meets the minimum requirements listed in the Funds’ Prospectus. |

| + | NAV may not recalculate due to rounding. |

The accompanying notes are an integral part of these financial statements.

| Copeland Trust |

| STATEMENTS OF OPERATIONS (Unaudited) |

| For the Six Month Ended May 31, 2023 |

| | | | | | Copeland SMID | | | Copeland | |

| | | Copeland Dividend | | | Cap Dividend | | | International | |

| | | Growth Fund | | | Growth Fund | | | Small Cap Fund | |

| Investment Income: | | | | | | | | | | | | |

| Dividend Income | | $ | 419,397 | | | $ | 549,389 | | | $ | 5,523 | |

| Interest Income | | | — | | | | — | | | | 192 | |

| Less: Foreign Taxes Withholding | | | (3,155 | ) | | | (5,101 | ) | | | (1,197 | ) |

| Total Investment Income | | | 416,242 | | | | 544,288 | | | | 4,518 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Investment Advisory Fees | | | 178,608 | | | | 190,355 | | | | 1,523 | |

| Distribution Fees - Class C | | | 49,440 | | | | — | | | | — | |

| Distribution Fees - Class A | | | 18,043 | | | | 2,079 | | | | — | |

| Chief Compliance Officer Fees | | | 48,181 | | | | 51,423 | | | | 292 | |

| Trustees’ Fees | | | 25,438 | | | | 37,686 | | | | 478 | |

| Administration Fees | | | 22,685 | | | | 27,868 | | | | 13,020 | |

| Registration & Filing Fees | | | 17,502 | | | | 19,725 | | | | 201 | |

| Legal Fees | | | 19,102 | | | | 33,104 | | | | 223 | |

| Fund Accounting Fees | | | 15,511 | | | | 18,785 | | | | 16,389 | |

| Audit Fees | | | 10,203 | | | | 9,152 | | | | 5 ,822 | |

| Insurance Expense | | | 8,481 | | | | 6,564 | | | | 18 | |

| Custody Fees | | | 8,060 | | | | 16,608 | | | | 4,427 | |

| Transfer Agent Fees | | | 5,590 | | | | 22,698 | | | | 258 | |

| Shareholder Service Fees - Class I | | | 4,308 | | | | 12,528 | | | | — | |

| Non-Rule 12b-1 Shareholder Service Fees | | | 4,130 | | | | 332 | | | | — | |

| Printing Expense | | | 2,140 | | | | 5,038 | | | | 242 | |

| Miscellaneous Expenses | | | — | | | | — | | | | 439 | |

| Total Expenses | | | 437,422 | | | | 453,945 | | | | 43,332 | |

| Less: Fees Waived by Adviser | | | (132,268 | ) | | | (190,355 | ) | | | (1,523 | ) |

| Less: Other Expenses Reimbursed by Adviser | | | — | | | | (20,236 | ) | | | (39,893 | ) |

| Net Expenses | | | 305,154 | | | | 243,354 | | | | 1,916 | |

| Net Investment Income | | | 111,088 | | | | 300,934 | | | | 2,602 | |

| | | | | | | | | | | | | |

| Net Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions: | | | | | | | | | | | | |

| Net Realized Gain (Loss) on: | | | | | | | | | | | | |

| Securities | | | 1,778,976 | | | | (13,536 | ) | | | (7,454 | ) |

| Foreign Currency Transactions | | | — | | | | — | | | | 83 | |

| | | | 1,778,976 | | | | (13,536 | ) | | | (7,371 | ) |

| | | | | | | | | | | | | |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | | | | | |

| Securities | | | (3,034,581 | ) | | | (1,170,220 | ) | | | 15,382 | |

| Foreign Currency Transactions | | | — | | | | — | | | | (64 | ) |

| | | | (3,034,581 | ) | | | (1,170,220 | ) | | | 15,318 | |

| Net Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions: | | | (1,255,605 | ) | | | (1,183,756 | ) | | | 7,947 | |

| | | | | | | | | | | | | |

| Net Increase (Decrease) in Net Assets Resulting From Operations | | $ | (1,144,517 | ) | | $ | (882,822 | ) | | $ | 10,549 | |

The accompanying notes are an integral part of these financial statements.

| Copeland Dividend Growth Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the | | | For the | |

| | | Six Months Ended | | | Year Ended | |

| | | May 31, 2023 | | | November 30, 2022 | |

| | | (Unaudited) | | | | |

| Operations: | | | | | | | | |

| Net Investment Income | | $ | 111,088 | | | $ | 349,457 | |

| Net Realized Gain on Investments | | | 1,778,976 | | | | 906,824 | |

| Net Change in Unrealized Depreciation on investments | | | (3,034,581 | ) | | | (4,047,251 | ) |

| Net Decrease in Net Assets Resulting From Operations | | | (1,144,517 | ) | | | (2,790,970 | ) |

| | | | | | | | | |

| Distributions to Shareholders From: | | | | | | | | |

| Total Distributions Paid | | | | | | | | |

| Class A | | | (944,442 | ) | | | (2,057,408 | ) |

| Class C | | | (619,122 | ) | | | (1,592,846 | ) |

| Class I | | | (1,662,393 | ) | | | (3,889,176 | ) |

| Total Distributions to Shareholders | | | (3,225,957 | ) | | | (7,539,430 | ) |

| | | | | | | | | |

| Beneficial Interest Transactions: | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from Shares Issued | | | 118,016 | | | | 925,192 | |

| Distributions Reinvested | | | 888,358 | | | | 1,889,194 | |

| Cost of Shares Redeemed | | | (1,264,115 | ) | | | (2,772,802 | ) |

| Total Class A Shares | | | (257,741 | ) | | | 41,584 | |

| Class C | | | | | | | | |

| Proceeds from Shares Issued | | | 8,571 | | | | 16,948 | |

| Distributions Reinvested | | | 612,576 | | | | 1,568,802 | |

| Cost of Shares Redeemed | | | (839,598 | ) | | | (2,288,082 | ) |

| Redemption Fees | | | — | | | | 4 | |

| Total Class C Shares | | | (218,451 | ) | | | (702,328 | ) |

| Class I | | | | | | | | |

| Proceeds from Shares Issued | | | 191,648 | | | | 73,412 | |

| Distributions Reinvested | | | 1,631,212 | | | | 3,820,604 | |

| Cost of Shares Redeemed | | | (3,748,175 | ) | | | (6,614,708 | ) |

| Redemption Fees | | | 45 | | | | — | |

| Total Class I Shares | | | (1,925,270 | ) | | | (2,720,692 | ) |

| Total Beneficial Interest Transactions | | | (2,401,462 | ) | | | (3,381,436 | ) |

| | | | | | | | | |

| Decrease in Net Assets | | | (6,771,936 | ) | | | (13,711,836 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of Period | | | 51,488,720 | | | | 65,200,556 | |

| End of Period | | $ | 44,716,784 | | | $ | 51,488,720 | |

| | | | | | | | | |

| Share Activity: | | | | | | | | |

| Class A | | | | | | | | |

| Shares Issued | | | 10,568 | | | | 73,444 | |

| Distributions Reinvested | | | 78,269 | | | | 139,424 | |

| Shares Redeemed | | | (108,472 | ) | | | (224,571 | ) |

| Total Activity Class A Shares | | | (19,635 | ) | | | (11,703 | ) |

| Class C | | | | | | | | |

| Shares Issued | | | 807 | | | | 1,472 | |

| Distributions Reinvested | | | 57,357 | | | | 122,563 | |

| Shares Redeemed | | | (78,365 | ) | | | (196,711 | ) |

| Total Activity Class C Shares | | | (20,201 | ) | | | (72,676 | ) |

| Class I | | | | | | | | |

| Shares Issued | | | 17,037 | | | | 5,974 | |

| Distributions Reinvested | | | 146,035 | | | | 285,759 | |

| Shares Redeemed | | | (331,521 | ) | | | (544,731 | ) |

| Total Activity Class I Shares | | | (168,449 | ) | | | (252,998 | ) |

The accompanying notes are an integral part of these financial statements.

| Copeland SMID Cap Dividend Growth Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the | | | For the | |

| | | Six Months Ended | | | Year Ended | |

| | | May 31, 2023 | | | November 30, 2022 | |

| | | (Unaudited) | | | | |

| Operations: | | | | | | | | |

| Net Investment Income | | $ | 300,934 | | | $ | 558,873 | |

| Net Realized Loss on Investments | | | (13,536 | ) | | | (309,069 | ) |

| Net Change in Unrealized Depreciation on Investments | | | (1,170,220 | ) | | | (2,066,348 | ) |

| Net Decrease in Net Assets Resulting From Operations | | | (882,822 | ) | | | (1,816,544 | ) |

| | | | | | | | | |

| Distributions to Shareholders From: | | | | | | | | |

| Total Distributions Paid | | | | | | | | |

| Class A | | | (61,549 | ) | | | (13,327 | ) |

| Class I | | | (1,752,207 | ) | | | (2,360,113 | ) |

| Total Distributions to Shareholders | | | (1,813,756 | ) | | | (2,373,440 | ) |

| | | | | | | | | |

| Beneficial Interest Transactions: | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from Shares Issued | | | 249,743 | | | | 1,543,686 | |

| Distributions Reinvested | | | 57,815 | | | | 13,327 | |

| Cost of Shares Redeemed | | | (242,989 | ) | | | (127,520 | ) |

| Redemption Fees | | | 25 | | | | 19 | |

| Total Class A Shares | | | 64,594 | | | | 1,429,512 | |

| Class I | | | | | | | | |

| Proceeds from Shares Issued | | | 14,892,936 | | | | 21,843,716 | |

| Distributions Reinvested | | | 1,660,663 | | | | 2,131,974 | |

| Cost of Shares Redeemed | | | (8,277,665 | ) | | | (7,747,664 | ) |

| Redemption Fees | | | 767 | | | | 1,656 | |

| Total Class I Shares | | | 8,276,701 | | | | 16,229,682 | |

| | | | | | | | | |

| Total Beneficial Interest Transactions | | | 8,341,295 | | | | 17,659,194 | |

| | | | | | | | | |

| Increase in Net Assets | | | 5,644,717 | | | | 13,469,210 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of Period | | | 49,276,584 | | | | 35,807,374 | |

| End of Period | | $ | 54,921,301 | | | $ | 49,276,584 | |

| | | | | | | | | |

| Share Activity: | | | | | | | | |

| Class A | | | | | | | | |

| Shares Issued | | | 18,449 | | | | 113,959 | |

| Distributions Reinvested | | | 4,423 | | | | 869 | |

| Shares Redeemed | | | (18,011 | ) | | | (9,561 | ) |

| Total Activity Class A Shares | | | 4,861 | | | | 105,267 | |

| Class I | | | | | | | | |

| Shares Issued | | | 1,088,764 | | | | 1,540,114 | |

| Distributions Reinvested | | | 126,479 | | | | 138,530 | |

| Shares Redeemed | | | (615,082 | ) | | | (575,776 | ) |

| Total Activity Class I Shares | | | 600,161 | | | | 1,102,868 | |

The accompanying notes are an integral part of these financial statements.

| Copeland International Small Cap Fund |

| STATEMENT OF CHANGES IN NET ASSETS |

| | | For the | | | For the | |

| | | Six Months Ended | | | Period Ended | |

| | | May 31, 2023 | | | November 30, 2022 * | |

| | | (Unaudited) | | | | |

| Operations: | | | | | | | | |

| Net Investment Income | | $ | 2,602 | | | $ | 6,270 | |

| Net Realized Loss on Investments and Foreign Currency Transactions | | | (7,371 | ) | | | (70,567 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Transactions | | | 15,318 | | | | (23,093 | ) |

| Net Increase (Decrease) in Net Assets Resulting From Operations | | | 10,549 | | | | (87,390 | ) |

| | | | | | | | | |

| Distributions to Shareholders From: | | | | | | | | |

| Total Distributions Paid | | | | | | | | |

| Class I | | | (8,524 | ) | | | — | |

| Total Distributions to Shareholders | | | (8,524 | ) | | | — | |

| | | | | | | | | |

| Beneficial Interest Transactions: | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from Shares Issued | | | — | | | | 10 | |

| Total Class A Shares | | | — | | | | 10 | |

| Class I | | | | | | | | |

| Proceeds from Shares Issued | | | 114,999 | | | | 399,990 | |

| Distributions Reinvested | | | 8,524 | | | | — | |

| Cost of Shares Redeemed | | | — | | | | — | |

| Redemption Fees | | | — | | | | — | |

| Total Class I Shares | | | 123,523 | | | | 399,990 | |

| Total Beneficial Interest Transactions | | | 123,523 | | | | 400,000 | |

| | | | | | | | | |

| Increase in Net Assets | | | 125,548 | | | | 312,610 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of Period | | | 312,610 | | | | — | |

| End of Period | | $ | 438,158 | | | $ | 312,610 | |

| | | | | | | | | |

| Share Activity: | | | | | | | | |

| Class A | | | | | | | | |

| Shares Issued | | | — | | | | 1 | |

| Total Activity Class A Shares | | | — | | | | 1 | |

| Class I | | | | | | | | |

| Shares Issued | | | 14,601 | | | | 39,999 | |

| Distributions Reinvested | | | 1,138 | | | | — | |

| Total Activity Class I Shares | | | 15,739 | | | | 39,999 | |

| * | Fund commenced operations on December 28, 2021. |

The accompanying notes are an integral part of these financial statements.

| Copeland Dividend Growth Fund |

| FINANCIAL HIGHLIGHTS |

Certain information in the table below reflects financial results for one share of beneficial interest outstanding throughout each year/period presented.

| | | Class A | |

| | | Six Months | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | May 31, 2023 | | | November 30, 2022 | | | November 30, 2021 | | | November 30, 2020 | | | November 30, 2019 | | | November 30, 2018 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year/Period | | $ | 12.49 | | | $ | 14.59 | | | $ | 11.99 | | | $ | 14.25 | | | $ | 15.18 | | | $ | 14.38 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Increase (Decrease) From Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | | 0.03 | | | | 0.09 | | | | 0.04 | | | | 0.01 | | | | 0.10 | | | | 0.04 | |

| Net gain (loss) from securities (both realized and unrealized) | | | (0.31 | ) | | | (0.53 | ) | | | 2.56 | | | | (0.48 | ) | | | 0.05 | | | | 1.38 | |

| Other capital changes | | | — | | | | — | | | | — | | | | 0.73 | (d) | | | — | | | | — | |

| Total from operations | | | (0.28 | ) | | | (0.44 | ) | | | 2.60 | | | | 0.26 | | | | 0.15 | | | | 1.42 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.09 | ) | | | (0.02 | ) | | | — | | | | (0.09 | ) | | | (0.01 | ) | | | (0.03 | ) |

| Net realized gains | | | (0.69 | ) | | | (1.64 | ) | | | — | | | | (2.43 | ) | | | (1.07 | ) | | | (0.59 | ) |

| Total distributions | | | (0.78 | ) | | | (1.66 | ) | | | — | | | | (2.52 | ) | | | (1.08 | ) | | | (0.62 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Redemption fees (b) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year/Period | | $ | 11.43 | | | $ | 12.49 | | | $ | 14.59 | | | $ | 11.99 | | | $ | 14.25 | | | $ | 15.18 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return (c) | | | (2.23 | )% (f) | | | (3.91 | )% | | | 21.68 | % | | | 2.24 | % | | | 1.32 | % | | | 10.33 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year/period (in 000’s) | | $ | 13,907 | | | $ | 15,441 | | | $ | 18,212 | | | $ | 18,800 | | | $ | 36,870 | | | $ | 52,779 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| before reimbursement | | | 1.79 | % (e) | | | 1.99 | % | | | 1.93 | % | | | 2.13 | % | | | 1.74 | % | | | 1.71 | % |

| net of reimbursement | | | 1.20 | % (e) | | | 1.20 | % | | | 1.20 | % | | | 1.44 | % | | | 1.45 | % | | | 1.45 | % |

| Ratio of net investment income to average net asset | | | 0.55 | % (e) | | | 0.72 | % | | | 0.29 | % | | | 0.10 | % | | | 0.70 | % | | | 0.28 | % |

| Portfolio turnover rate | | | 19 | % (f) | | | 40 | % | | | 34 | % | | | 170 | % | | | 244 | % | | | 30 | % |

| (a) | Per share amounts are calculated using the average shares method, which more appropriately presents the per share data for the year/period. |

| (b) | Less than $0.01 per share. |

| (c) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. Had the Adviser not absorbed a portion of fund expenses, the total return would have been lower. Sales loads are not reflected in total return. |

| (d) | As required by SEC standard per share data calculation methodology, this represents a balancing figure derived from the other amounts in the financial highlights tables that captures all other changes affecting net asset value per share. |

The accompanying notes are an integral part of these financial statements.

| Copeland Dividend Growth Fund |

| FINANCIAL HIGHLIGHTS |

Certain information in the table below reflects financial results for one share of beneficial interest outstanding throughout each year/period presented.

| | | Class C | |

| | | Six Months | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | May 31, 2023 | | | November 30, 2022 | | | November 30, 2021 | | | November 30, 2020 | | | November 30, 2019 | | | November 30, 2018 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year/Period | | $ | 11.71 | | | $ | 13.85 | | | $ | 11.47 | | | $ | 13.73 | | | $ | 14.76 | | | $ | 14.06 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Increase (Decrease) From Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss (a) | | | (0.01 | ) | | | (0.01 | ) | | | (0.06 | ) | | | (0.07 | ) | | | (0.01 | ) | | | (0.07 | ) |

| Net gain (loss) from securities (both realized and unrealized) | | | (0.29 | ) | | | (0.49 | ) | | | 2.44 | | | | (0.30 | ) | | | 0.05 | | | | 1.36 | |

| Other capital changes | | | — | | | | — | | | | — | | | | 0.54 | (d) | | | — | | | | — | |

| Total from operations | | | (0.30 | ) | | | (0.50 | ) | | | 2.38 | | | | 0.17 | | | | 0.04 | | | | 1.29 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Net realized gains | | | (0.69 | ) | | | (1.64 | ) | | | — | | | | (2.43 | ) | | | (1.07 | ) | | | (0.59 | ) |

| Total distributions | | | (0.69 | ) | | | (1.64 | ) | | | — | | | | (2.43 | ) | | | (1.07 | ) | | | (0.59 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Redemption fees (b) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year/Period | | $ | 10.72 | | | $ | 11.71 | | | $ | 13.85 | | | $ | 11.47 | | | $ | 13.73 | | | $ | 14.76 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return (c) | | | (2.57 | )% (f) | | | (4.63 | )% | | | 20.75 | % | | | 1.51 | % | | | 0.54 | % | | | 9.55 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year/period (in 000’s) | | $ | 9,472 | | | $ | 10,586 | | | $ | 13,530 | | | $ | 15,401 | | | $ | 25,271 | | | $ | 32,597 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| before reimbursement | | | 2.54 | % (e) | | | 2.74 | % | | | 2.69 | % | | | 2.88 | % | | | 2.49 | % | | | 2.45 | % |