united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22483

Copeland Trust

(Exact name of Registrant as specified in charter)

Eight Tower Bridge, 161 Washington St., Suite #1325 Conshohocken, PA 19428

(Address of principal executive offices) (Zip code)

Gemini Fund Services, LLC, 80 Arkay Drive Suite 10, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: (631) 470-2619

Date of fiscal year end: 11/30

Date of reporting period: 5/31/20

Item 1. Reports to Stockholders.

| | | |

| | | |

| | Copeland

Risk Managed

Dividend Growth Fund Copeland

International Risk Managed

Dividend Growth Fund Copeland

SMID Cap

Dividend Growth Fund | |

| | | |

| | Semi-Annual Report May 31, 2020 | |

| | | |

| | Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website www.copelandfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you. You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling the Fund at 1-888-9-COPELAND (1-888-926-7352) or by contacting your financial intermediary. Your election to receive reports in paper will apply to all Copeland Funds you hold directly or through your financial intermediary. Investor Information: 1-888-9-COPELAND This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of the Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. Distributed by Northern Lights Distributors, LLC

Member FINRA | |

Copeland Risk Managed Dividend Growth Fund

Semi-Annual Report

May 31, 2020

Dear Fellow Shareholders,

Copeland Capital Management is pleased to review the performance of the Copeland Risk Managed Dividend Growth Fund from December 1, 2019 through May 31, 2020. Unless otherwise stated herein, all data and statistics that follow are as of May 31, 2020.

During the six-month period, the Fund fell -10.38%, lagging the -2.1% retreat posted by the S&P 500 Index. While the Fund performed in line with the benchmark over the first four months of the period, the U.S. outbreak of the Coronavirus precipitated a sharp downturn in the equity market during the month of March. All nine of our proprietary sector signals registered a negative reading as we moved into April, leading the Fund to rein in its overall equity exposure level to 50%. Defying all expectations, the market staged a sharp V-shaped rally of over +18% during the months of April and May. As such the entire performance shortfall for the Fund relative to the broader S&P 500 Index was attributable to our cash position over the closing two months of the period.

Our stock selection in the Financials sector of the market bolstered Fund returns while those in the Energy sector were a drag. Financials constituent MarketAxess Holdings (MKTX, 1.5% of holdings) was the top performing holding, advancing strongly during the period. This electronic fixed-income trading platform provider posted strong first quarter earnings results bolstered by high volatility across most segments of the bond market, share gains on its open trading platform and demand for a simplified liquidity provider platform from the large number of people working from home. More recently, aggregate bond trading volumes during the month of May surged 48% versus the prior year as all four major product lines registered market share gains. A second standout performer, Consumer Discretionary constituent Tractor Supply (TSCO, 1.1% of holdings), also rose sharply during the period. The largest rural lifestyle retailer in the U.S. followed up a strong first quarter earnings report with robust interim second quarter guidance. The company forecast record sales growth of 24% to 29% fueled by same-store sales growth of 20% to 25% including substantial growth in the e-commerce business. As an essential, needs-based retailer Tractor Supply has remained open throughout the pandemic and has filled the void left by other retailers which have been forced to shutter.

On the downside, Fund holding Diamondback Energy (FANG, 0.0% of holdings) was the worst performer in the Fund, falling steeply while we held a position in the shares. The oil and gas exploration company was sharply impacted by an unfolding oil price war between Russia and Saudi Arabia which triggered a halving of the price of West Texas Intermediate (“WTI”) crude oil from $61 per barrel to start the year to under $30 per barrel during the month of March. Amidst fears surrounding a potential dividend cut we elected to exit our position in the shares. Aarons (AAN, 0.0% of holdings) was also a laggard, falling sharply while we held a position in the shares. The lease-to-own retailer of furniture, electronics, computers and appliances reported solid earnings in February, however weaker than expected guidance weighed upon the shares. The company unveiled expectations for a same-store sales decline of between 2% and 4% in the upcoming quarter. Brick and mortar EBITDA* in the coming year was expected to fall by $36 million or roughly 20%. In light of the unfolding challenges in the retail space, highlighted by many stores being forced to close, we opted to exit our position during the period.

Coming off a robust gain of over 31% during 2019, the equity market began 2020 in fine fashion. Unemployment remained at record lows, the economy continued to expand at a healthy pace and corporate earnings plumbed record levels. Things began to take a turn for the worse in late February and over the course of March as the Coronavirus spread to Europe and ultimately the United States. Widespread stay at home orders were implemented, stores and restaurants were closed, airline travel ground to a halt and for the first time ever a self-inflicted recession was necessary in an attempt to keep the populace safe. When all was said and done, the market had suffered its fastest 30% decline in history, falling 34% from an all-time high in late February to a low for the year on March 23, 2020.

From the aforementioned market low to the period close at the end of May, the market ricocheted higher by a sharp 36%. Spurring the market was unprecedented fiscal and monetary stimulus which instilled confidence that government and monetary authorities will do whatever is necessary to engineer an economic recovery. Said optimism surrounding a V-shaped economic recovery, initial success in reopening parts of the country, and hopefulness surrounding an eventual Coronavirus vaccine and development of effective treatments coalesced to push the market higher. Despite a 15% decline in first quarter 2020 S&P 500 Index earnings and expectations for a steeper decline in the current quarter, the market appears to be increasingly pricing towards what we believe may be a quick rebound over the latter half of the year and into 2021. According to the Bureau of Labor Statistics, the unemployment rate, which leapt from 4.4% in February to 14.7% in March, improved to 13.3% in the month of May as the economy regained 2.5 million jobs. Retail sales jumped 17.7% in May, the largest sequential increase since 1992.

As the period drew to a close, the Fund maintained a 50% invested position as each of our proprietary signals continues to flash a negative reading given the magnitude of the recent downdraft. The market appears to be pricing in a seamless recovery in the months ahead. That said, the risk of a second wave of the Coronavirus pandemic remains. Unemployment and stimulus benefits, which have helped fuel the unfolding recovery, are set to expire in July. In our opinion, economic activity, while starting to rebound, is unlikely to attain pre-virus levels for years to come as certain market segments remain hampered over the long term.

Irrespective of near-term market trends, we at Copeland remain intently focused on the long-term prospects of companies held in the Fund, with a particular emphasis on the capacity of each to continue to grow the dividend over time. We continue to favor companies that we believe retain noteworthy competitive advantages in their respective industries, are cash generative, and are overseen by managements with capital allocation discipline and an eye on the shareholder. Given the magnitude of the recent market snapback and the unprecedented uncertainty present today, we take solace in our defensive positioning at present. As the economy ultimately regains its footing, we look forward to expanding our investment profile in an attempt to capitalize upon the potential gains afforded by a carefully selected portfolio of dividend growth equities.

Thank you for the confidence you have placed in Copeland and for your investment in the Copeland Risk Managed Dividend Growth Fund.

The views and opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed. The Fund holdings discussed herein are for informational purposes only and should not be perceived as investment recommendations by Copeland Capital Management. Holdings are subject to change, may not represent current holdings and are subject to risk. Performance data quoted here represents past performance. Past performance is no guarantee of future results. The return quoted reflects fee waivers and expense reimbursements in effect and would have been lower in their absence. Current performance may be lower or higher than the performance quoted above. The risks of investing in the Copeland Funds vary from fund to fund; to see the risks of investing in an individual fund, please refer to that fund’s latest prospectus.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses. The S&P 500® Index is a market-capitalization-weighted index of the stocks of 500 leading companies in major industries of the U.S. economy.

| * | EBITDA is an acronym for “Earnings Before Interest, Taxes, Depreciation and Amortization.” |

1131-NLD-7/21/2020

Copeland International Risk Managed Dividend Growth Fund

Semi-Annual Report

May 31, 2020

Dear Fellow Shareholders,

Copeland Capital Management is pleased to review the performance of the Copeland International Risk Managed Dividend Growth Fund from December 1, 2019 through May 31, 2020. Unless otherwise stated herein, all data and statistics that follow are as of May 31, 2020.

The Class I shares of the Copeland International Risk Managed Dividend Growth Fund delivered a return of -13.1% during the semi-annual period ended May 31, 2020, which compared to a -11.7% return recorded by the Fund’s benchmark, the MSCI World ex-US Index. Although non-US equity markets have rebounded sharply from the March 2020 lows related to the Coronavirus, the Fund remains in a defensive position. Our quantitative sector signals continue to indicate an above-average risk for market declines. The primary Fund objective remains the preservation of principal during challenging market conditions, while also providing upside exposure to the international equity asset class during stable to rising markets.

The minor shortfall in relative performance during the first half of the Fund’s fiscal year is a result of its allocation to cash and fixed-income investments. The Fund was fully invested in equities at the outset of the period, and then shifted to a 50% allocation to cash/fixed income following the sharp sell-off in equity markets in the first three months of 2020. Accordingly, while the Fund’s dividend growth methodology contributed to more resilient performance during the three-month sell-off ending in March (the Fund returned -19.7% vs. the -23.3% decline for the MSCI ex-US World Index), retaining only half of the overall exposure to equities during the market rebound in April and May proved to be a headwind for relative performance.

The Fund benefited from favorable stock selection during the semi-annual period, with noteworthy contributions in the Industrials, Basic Materials, and Consumer Staples sectors of the market. Offsetting the boost from these segments was lagging performance within the Health Care sector, the strongest performing area of the market during the six-month period. Among Industrial holdings, relative performance was boosted by holdings RELX (1.06% of holdings), a UK-based commercial services company, and Secom (0.99% of holdings), the Japanese security services company. Both proved economically resilient during the Coronavirus related weakness in demand. In contrast, holdings in the civil aerospace industry, Safran (0.0% of holdings) in France, and MTU Aero Engines (0.69% of holdings) in Germany, detracted from performance due to the collapse in air travel. Within the Basic Materials sector, all holdings outperformed the market during the period, with relative performance most favorable in Croda International (0.88% of holdings) in the U.K., and Denmark’s Novozymes (0.96% of holdings), ingredients companies both enjoying stable end-market demand from their customers. Consumer Staples holding Cosmos Pharmaceutical (0.82% of holdings), a Japanese drug store retailer, was the primary driver of contribution within the sector, as traffic and same-store sales comparisons fared well during the slowdown. Balancing this out was the lagging performance of global brewer Heineken (0.0% of holdings) in the Netherlands, which suffered a material decline in on-trade demand from the broad economic lockdowns around the world. On a final note, while in general it was challenging to keep up with the overall performance of the Health Care sector, Fund holdings in Ireland domiciled devices giant Medtronic (1.0%) and German hospital operator Fresenius (0.9%) detracted from relative performance due to declines in elective medical procedures during the global lockdown.

As we look to the remainder of 2020, we expect market trends to be driven by the conflicting forces of unprecedented global Central Bank stimulus, substantially greater even than what occurred during the 2008 financial crisis, and the unquantifiable macroeconomic consequences of the global Coronavirus pandemic. While we are encouraged by many of the initial signs of recovery around the world, with the majority of global gross domestic product (“GDP”) driven by personal consumption, we do not believe a sustainable economic expansion is possible until consumers feel safe to return to life as normal. This could be dependent upon the development of a vaccine and effective treatments, or more simply a function of successful testing and efforts to control the spread of the virus. Regardless, given the rise in global equity share prices since the March lows, by far the sharpest and most sizable market rebound in the modern era, we believe that current investor expectations may be vulnerable to disappointment.

In the face of the current market backdrop, we at Copeland remain as focused as ever on the long-term fundamental potential of the companies held in the Fund, as guided by what we view as the prospects for each to deliver continued dividend growth over time. Our investment approach favors cash-generative businesses with what we believe are decided competitive advantages versus industry peers, and management commitment to capital allocation discipline. When overall market conditions improve, as guided by our quantitative risk management techniques, the Fund will seek increased equity exposure in a diversified mix of dividend-growth stocks in favorable sectors of the market.

Thank you for your confidence in Copeland Capital Management, and for your investment in the Copeland International Risk Managed Dividend Growth Fund.

The views and opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed. The Fund holdings discussed herein are for informational purposes only and should not be perceived as investment recommendations by Copeland Capital Management. Holdings are subject to change, may not represent current holdings and are subject to risk. Performance data quoted here represents past performance. Past performance is no guarantee of future results. The return quoted reflects fee waivers and expense reimbursements in effect and would have been lower in their absence. Current performance may be lower or higher than the performance quoted above. The risks of investing in the Copeland Funds vary from fund to fund; to see the risks of investing in an individual fund, please refer to that fund’s latest prospectus.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses. The MSCI World ex-US® Index measures the performance of global equity markets, excluding the United States.

1131-NLD-7/21/2020

Copeland SMID Cap Dividend Growth Fund

Semi-Annual Report

May 31, 2020

Dear Fellow Shareholders,

Copeland Capital Management is pleased to review the performance of the Copeland SMIDCap Dividend Growth Fund from December 1, 2019 through May 31, 2020. Unless otherwise stated herein, all data and statistics that follow are as of May 31, 2020.

During the six-month period, Class I shares of the Fund delivered a -9.19% return, versus the -11.72% decline posted by the Russell 2500 Index. The long bull market ended during the period as the Coronavirus spread across the globe, with severe negative consequences from both a health and market perspective. The market decline was incredibly swift and deep as the benchmark declined more than 40% in a little over a month from mid-February through mid-March. Governments and the health care industry were called to action, with their powerful response enabling a remarkable stock market recovery that continued through the period’s end. SMID Cap equities were more significantly impaired than their larger cap counterparts during the decline, and while they fully participated in the rebound, the result was still a deficit for the period as described above. Domestically, unprecedented fiscal and monetary stimulus was quickly enacted that supported many terminated employees and impaired businesses, while the Federal Reserve stepped in to ensure that bond markets and banks kept the lending markets functioning. Meanwhile the selfless actions of health care industry front-line workers in combination with progress on the scientific front have led to improved outcomes for patients, and optimism that a vaccine may be available quickly enough to avoid moredire economic consequences.

Our stock selection in the Financial sector most significantly aided Fund returns. MarketAxess Holdings (MKTX, 1.7% of Fund holdings), the leading electronic bond trading platform, outperformed after reporting strong first quarter earnings results, backed by elevated interest rate spread volatility, the best access to liquidity for traders working from home and continuing share gains on their open trading platform that allows both buy and sell-side bond investors to interface directly. Strong monthly volume growth continued in April and May. The company also announced an impressive 18% dividend hike, which we believe demonstrates confidence from management. MSCI Inc. (MSCI, 0.0%), a leading equity index provider, also performed well, recovering strongly after an initial pandemic-driven drop. The stability of MSCI’s business model, even during volatile periods, with more than 80% of revenues driven by index subscriptions, was on display during the latter part of the period as they reported solid first quarter results. MSCI was sold from the Fund during the period as its market capitalization exceeded our parameters, which are guided by the characteristics of the Russell 2500 SMID Cap benchmark. Finally, Discover Financial Services (DFS, 1.4%) was a leading performer during the period, shortly after our purchase near the depths of the pandemic driven market correction. Given Discover’s emphasis on the highest credit quality customers, in combination with the fiscal stimulus, we believe that the company is well-positioned to manage through the current employment downturn with manageable losses and adequate dividend coverage.

The Coronavirus pandemic has had significant implications for the Health Care sector, leading to widely diverging fortunes among industries. While governments flooded the biotechnology and pharmaceutical industry with investment in an effort to accelerate the development of therapeutics and vaccines to battle the virus, many facilities, devices and services companies were impeded as non-essential, non-Coronavirus related medical procedures were cancelled. The Fund’s dividend growth focus leads us largely into the latter group, while dividends are virtually non-existent among development stage, smaller capitalization, biotechnology stocks. As a result, stock selection was a headwind in the sector during the period. Cantel

Medical (CMD, 1.2%), a leading provider of sterilization equipment and supplies used in dental offices, colonoscopy procedures and dialysis centers, was severely impacted as procedures were cancelled and facilities closed to slow the virus’ spread or to allow facilities to handle Coronavirus patients. Similarly, U.S. Physical Therapy Inc. (USPH, 1.0%), a leading provider of physical therapy services, was forced to close most of its facilities leading to significant layoffs among its employees. Not all dividend growing health care companies were impaired, however. Holdings such as Resmed Inc. (RMD, 1.9%), which sells respiratory assist devices, Quest Diagnostics (DGX, 1.7%), which performs laboratory testing services, and Luminex Corp (LMNX, 1.1%), which produces the diagnostic tests that are used in these labs to diagnose respiratory illnesses, were all significant beneficiaries of virus related spending.

As we look to the remainder of 2020, we expect market trends to be driven by the conflicting forces of unprecedented global Central Bank stimulus, substantially greater even than what occurred during the 2008 financial crisis, and the unquantifiable macroeconomic consequences of the global pandemic. While we are encouraged by many of the initial signs of recovery around the world, with the majority of global gross domestic product (“GDP”) driven by personal consumption, we do not believe a sustainable economic expansion is possible until consumers feel safe to return to life as normal. This could be dependent upon the development of a vaccine and development of effective treatments, or more simply a function of successful testing and efforts to control the spread of the virus.

In the face of the current uncertain market backdrop,we at Copeland remain intently focused on the long -term prospects of the companies held in the Fund, with an emphasis on the capacity of each to continue to grow its dividend over time. We continue to favor companies that we believe retain noteworthy competitive advantages in their respective industries, are cash generative, and are overseen by managements with capital allocation discipline and an eye on the shareholder. We believe this approach puts the Fund in the best position in seeking to outperform the market while taking on less risk.

Thank you for the confidence you have placed in Copeland and for your investment in the Copeland SMID Cap Dividend Growth Fund.

The views and opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed. The Fund holdings discussed herein are for informational purposes only and should not be perceived as investment recommendations by Copeland Capital Management. Holdings are subject to change, may not represent current holdings and are subject to risk. Performance data quoted here represents past performance. Past performance is no guarantee of future results. The return quoted reflects fee waivers and expense reimbursements in effect and would have been lower in their absence. Current performance may be lower or higher than the performance quoted above. The risks of investing in the Copeland Funds vary from fund to fund; to see the risks of investing in an individual fund, please refer to that fund’s latest prospectus.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses. The Russell 2500 Index is comprised of the bottom 2500 companies in the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

1131-NLD-7/21/2020

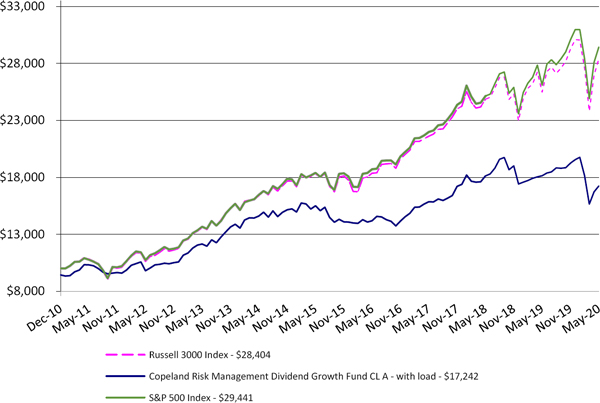

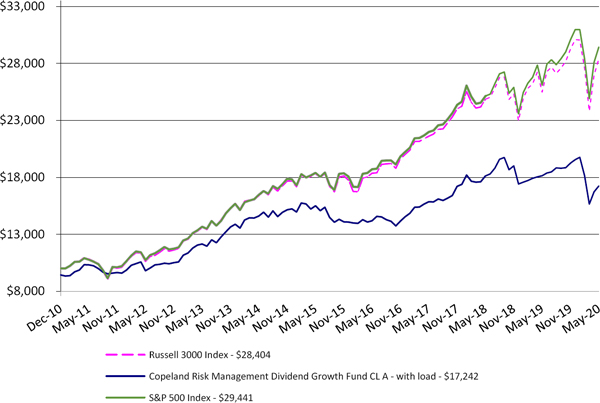

| Copeland Risk Managed Dividend Growth Fund |

| Portfolio Review (Unaudited) |

| December 28, 2010* through May 31, 2020 |

Performance of a $10,000 Investment (as of May 31, 2020)

| Average Annualized | | | | Since | Since | Since |

| Total Returns as of | Six | | | Inception | Inception | Inception |

| May 31, 2020 | Months | One Year | Five Year | Class A* | Class C* | Class I* |

| Copeland Risk Managed | | | | | | |

| Dividend Growth Fund: | | | | | | |

| Class A | | | | | | |

| Without sales charge | (10.38)% | (4.91)% | 2.15% | 6.62% | — | — |

| With sales charge+ | (15.54)% | (10.38)% | 0.94% | 5.95% | — | — |

| Class C | (10.62)% | (5.60)% | 1.40% | — | 6.33% | — |

| Class I | (10.21)% | (4.75)% | 2.32% | — | — | 6.10% |

| S&P 500 Index | (2.10)% | 12.84% | 9.86% | 12.14% | 13.18% | 12.36% |

| Russell 3000 Index | (2.91)% | 11.46% | 9.17% | 11.72% | 12.85% | 11.88% |

| * | Class A shares commenced operations on December 28, 2010. Class C commenced operations on January 5, 2012. Class I commenced operations March 1, 2013. |

| + | Adjusted for initial maximum sales charge of 5.75%. |

The S&P 500 Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark.

The Russell 3000 Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. The performance and returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption of Fund shares. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the adviser not waived its fees and reimbursed a portion of the Fund’s expenses. For performance information current to the most recent month-end please call toll-free 1-888-9-COPELAND (1-888-926-7352). Additional information can be found by visiting our website, www.copelandfunds.com. The Fund’s gross annual operating expense ratio, as stated in the current prospectus, is 1.74%, 2.49%, and 1.58%,for Class A, Class C, and Class I shares, respectively, and its net annual operating expense ratio is 1.45%, 2.20%, and 1.30%, for Class A, Class C, and Class I shares, respectively. These ratios can fluctuate and may differ from the expense ratios disclosed in the Financial Highlights section of this report. The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until March 31, 2021, to ensure that total annual fund operating expenses after fee deferral and/or reimbursement (exclusive of any taxes, leverage interest, borrowing interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expense on securities sold short, acquired fund fees and expenses or extraordinary expenses such as litigation) will not exceed 1.45%, 2.20% and 1.30% of Class A, Class C and Class I shares, respectively, subject to possible recoupment from the Fund in future years on a rolling three year basis (within the three years after the fees have been deferred or reimbursed) if such recoupment can be achieved without exceeding the lesser of the expense limitation in effect at the time of the deferral and at the time of the repayment.

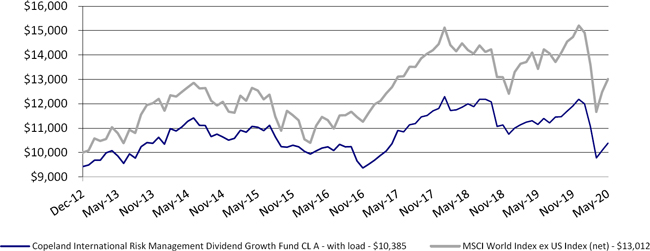

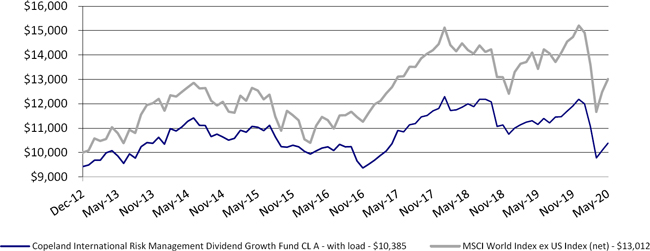

| Copeland International Risk Managed Dividend Growth Fund |

| Portfolio Review (Unaudited) |

| December 17, 2012* through May 31, 2020 |

Performance of a $10,000 Investment (as of May 31, 2020)

| Average Annualized | | | | |

| Total Returns as of | | | | Since |

| May 31, 2020 | Six Months | One Year | Five Year | Inception* |

| Copeland International Risk Managed | | | | |

| Dividend Growth Fund: | | | | |

| Class A | | | | |

| Without sales charge | (12.78)% | (6.86)% | (1.21)% | 1.31% |

| With sales charge+ | (17.81)% | (12.22)% | (2.36)% | 0.51% |

| Class C | (13.05)% | (7.48)% | (1.95)% | 0.57% |

| Class I | (12.70)% | (6.69)% | (1.08)% | 1.43% |

| MSCI World ex US Index (net) | (11.69)% | (3.12)% | 0.74% | 3.60% |

| * | The Fund commenced operations December 17, 2012. |

| + | Adjusted for initial maximum sales charge of 5.75%. |

The MSCI World ex US Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets excluding holdings in the United States and is net any withholding taxes. Investors cannot invest directly in an index or benchmark.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. The performance and returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption of Fund shares. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the adviser not waived its fees and reimbursed a portion of the Fund’s expenses. For performance information current to the most recent month-end please call toll-free 1-888-9-COPELAND (1-888-926-7352). Additional information can be found by visiting our website, www.copelandfunds.com. The Fund’s gross annual operating expense ratio, as stated in the current prospectus is 2.43%, 3.18%, and 2.16%, for Class A, Class C, and Class I shares, respectively, and its net annual operating expense ratio is 1.60%, 2.35%, and 1.45% for its Class A, Class C, and Class I shares, respectively. These ratios can fluctuate and may differ from the expense ratios disclosed in the Financial Highlights section of this report. The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until March 31, 2021, to ensure that total annual fund operating expenses after fee deferral and/or reimbursement (exclusive of any taxes, leverage interest, borrowing interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expense on securities sold short, acquired fund fees and expenses or extraordinary expenses such as litigation) will not exceed 1.60%, 2.35%, and 1.45% of Class A, Class C and Class I shares, respectively, subject to possible recoupment from the Fund in future years on a rolling three year basis (within the three years after the fees have been deferred or reimbursed) if such recoupment can be achieved without exceeding the lesser of the expense limitation in effect at the time of the deferral and at the time of the repayment.

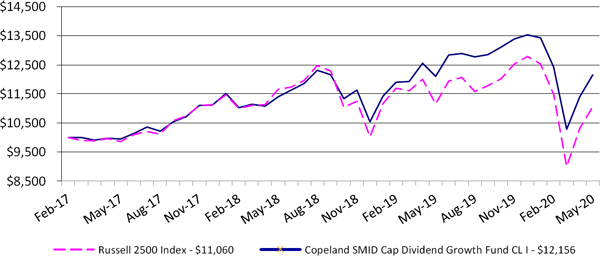

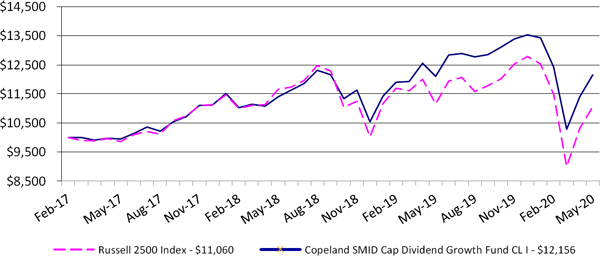

| Copeland SMID Cap Dividend Growth Fund |

| Portfolio Review (Unaudited) |

| February 27, 2017* through May 31, 2020 |

Performance of a $10,000 Investment (as of May 31, 2020)

| | | | Since | Since |

| Total Returns as of | | | Inception | Inception |

| May 31, 2020 | Six Months | One Year | Class I* | Class A* |

| Copeland SMID Cap Dividend Growth Fund: | | | | |

| Class I | (9.19)% | 0.41% | 6.18% | — |

| Class A | | | | |

| Without sales charge | (9.30)% | 0.06% | — | 3.08% |

| With sales charge+ | (14.53)% | (5.66)% | — | (1.53)% |

| Russell 2500 Index | (11.72)% | (0.80)% | 3.14% | (1.84)% |

| * | Class I shares commenced operations February 27, 2017. Class A commenced operations February 11, 2019 |

| + | Adjusted for initial maximum sales charge of 5.75%. |

The Russell 2500 Index is comprised of the smallest 2500 companies in the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. Investors cannot invest directly in an index or benchmark.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. The performance and returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption of Fund shares. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the adviser not waived its fees and reimbursed a portion of the Fund’s expenses. For performance information current to the most recent month-end please call toll-free 1-888-9-COPELAND (1-888-926-7352). Additional information can be found by visiting our website, www.copelandfunds.com. The Fund’s gross annual operating expense ratio, as stated in the current prospectus is 3.04% and 1.18% for Class A and Class C shares, respectively, and its net annual operating expense ratio is 1.20% and 0.95% for Class A and Class I shares, respectively. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report. The Fund’s adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, until at least March 31, 2021, to ensure that total annual fund operating expenses after fee deferral and/or reimbursement (exclusive of any taxes, leverage interest, borrowing interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expense on securities sold short, acquired fund fees and expenses or extraordinary expenses such as litigation) will not exceed 1.20% and 0.95% of Class A and Class I shares, respectively, subject to possible recoupment from the Fund in future years on a rolling three year basis (within the three years after the fees have been deferred or reimbursed) if such recoupment can be achieved without exceeding the lesser of the expense limitation in effect at the time of the deferral and at the time of the repayment.

| Copeland Risk Managed Dividend Growth Fund |

| PORTFOLIO OF INVESTMENTS (Unaudited) |

| May 31, 2020 |

| Shares | | | Security | | Market Value | |

| | | | | | | |

| | | | | COMMON STOCK - 55.3% | | | | |

| | | | | AEROSPACE/DEFENSE - 0.9% | | | | |

| | 1,905 | | | Lockheed Martin Corp. | | $ | 739,978 | |

| | | | | | | | | |

| | | | | BANKS - 1.9% | | | | |

| | 7,100 | | | JPMorgan Chase & Co. | | | 690,901 | |

| | 20,801 | | | Trust Financial Corp. | | | 765,061 | |

| | | | | | | | 1,455,962 | |

| | | | | CHEMICALS - 1.4% | | | | |

| | 1,676 | | | Air Products and Chemicals, Inc. | | | 405,005 | |

| | 1,762 | | | Ecolab, Inc. | | | 374,566 | |

| | 602 | | | Sherwin-Williams Co. | | | 357,498 | |

| | | | | | | | 1,137,069 | |

| | | | | COMMERCIAL SERVICES - 2.4% | | | | |

| | 9,191 | | | Booz Allen Hamilton Holding Corp. | | | 733,074 | |

| | 2,303 | | | MarketAxess Holdings, Inc. | | | 1,171,283 | |

| | | | | | | | 1,904,357 | |

| | | | | COMPUTERS - 2.0% | | | | |

| | 3,875 | | | Accenture PLC | | | 781,277 | |

| | 2,540 | | | Apple, Inc. | | | 807,568 | |

| | | | | | | | 1,588,845 | |

| | | | | DISTRIBUTION/WHOLESALE - 1.1% | | | | |

| | 20,870 | | | Fastenal Co. | | | 861,096 | |

| | | | | | | | | |

| | | | | DIVERSIFIED FINANCIAL SERVICES - 3.3% | | | | |

| | 1,544 | | | BlackRock, Inc. | | | 816,220 | |

| | 21,290 | | | Discover Financial Services | | | 1,011,488 | |

| | 3,931 | | | Visa, Inc. | | | 767,488 | |

| | | | | | | | 2,595,196 | |

| | | | | ELECTRIC - 2.4% | | | | |

| | 64,080 | | | Algonquin Power & Utilities Corp. | | | 897,120 | |

| | 3,751 | | | NextEra Energy, Inc. | | | 958,606 | |

| | | | | | | | 1,855,726 | |

| | | | | ENVIRONMENTAL CONTROL - 1.9% | | | | |

| | 9,079 | | | Tetra Tech, Inc. | | | 716,333 | |

| | 8,557 | | | Waste Connections, Inc. | | | 804,700 | |

| | | | | | | | 1,521,033 | |

| | | | | FOOD - 2.1% | | | | |

| | 12,002 | | | Calavo Growers, Inc. | | | 702,237 | |

| | 5,293 | | | McCormick & Co., Inc. | | | 927,122 | |

| | | | | | | | 1,629,359 | |

| | | | | HEALTHCARE PRODUCTS - 2.4% | | | | |

| | 6,357 | | | Medtronic PLC | | | 626,673 | |

| | 3,605 | | | ResMed Inc | | | 579,756 | |

| | 4,137 | | | Steris PLC | | | 686,287 | |

| | | | | | | | 1,892,716 | |

| | | | | HEALTHCARE SERVICES - 3.7% | | | | |

| | 1,307 | | | Chemed Corp. | | | 625,413 | |

| | 9,186 | | | Encompass Health Corp. | | | 672,875 | |

| | 7,312 | | | Quest Diagnostics, Inc. | | | 864,863 | |

| | 2,322 | | | UnitedHealth Group, Inc. | | | 707,862 | |

| | | | | | | | 2,871,013 | |

| | | | | HOUSEWARES - 1.0% | | | | |

| | 10,060 | | | Church & Dwight Co., Inc. | | | 755,204 | |

| | | | | | | | | |

| | | | | INSURANCE - 0.9% | | | | |

| | 7,061 | | | Allstate Corp. | | | 690,636 | |

| | | | | | | | | |

| | | | | INTERNET - 1.0% | | | | |

| | 6,825 | | | CDW Corp. | | | 756,961 | |

| | | | | | | | | |

| | | | | MEDIA - 3.0% | | | | |

| | 437 | | | Cable One, Inc. | | | 824,571 | |

| | 18,730 | | | Comcast Corp. | | | 741,708 | |

| | 2,499 | | | FactSet Research Systems, Inc. | | | 768,467 | |

| | | | | | | | 2,334,746 | |

The accompanying notes are an integral part of these financial statements.

| Copeland Risk Managed Dividend Growth Fund |

| PORTFOLIO OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2020 |

| Shares | | | Security | | | | | | Market Value | |

| | | | | | | | | | | |

| | | | | COMMON STOCK - 55.3% (Continued) | | | | | | | | |

| | | | | OIL & GAS - 1.2% | | | | | | | | |

| | 12,565 | | | Phillips 66 | | | | | | $ | 983,337 | |

| | | | | | | | | | | | | |

| | | | | PHARMACEUTICALS - 0.9% | | | | | | | | |

| | 4,966 | | | Zoetis, Inc. | | | | | | | 692,211 | |

| | | | | | | | | | | | | |

| | | | | REAL ESTATE INVESTMENT TRUSTS - 2.8% | | | | | | | | |

| | 4,777 | | | Alexandria Real Estate Equities, Inc. | | | | | | | 734,320 | |

| | 2,978 | | | American Tower Corp. | | | | | | | 768,830 | |

| | 1,012 | | | Equinix, Inc. | | | | | | | 706,002 | |

| | | | | | | | | | | | 2,209,152 | |

| | | | | RETAIL - 7.3% | | | | | | | | |

| | 4,965 | | | Casey’s General Stores, Inc. | | | | | | | 793,059 | |

| | 2,239 | | | Costco Wholesale Corp. | | | | | | | 690,664 | |

| | 3,952 | | | Dollar General Corp. | | | | | | | 756,848 | |

| | 1,885 | | | Domino’s Pizza, Inc. | | | | | | | 727,308 | |

| | 3,039 | | | Home Depot, Inc. | | | | | | | 755,131 | |

| | 5,823 | | | Ross Stores, Inc. | | | | | | | 564,598 | |

| | 7,522 | | | Starbucks Corp. | | | | | | | 586,641 | |

| | 7,163 | | | Tractor Supply Co. | | | | | | | 874,029 | |

| | | | | | | | | | | | 5,748,278 | |

| | | | | SEMICONDUCTORS - 2.9% | | | | | | | | |

| | 2,698 | | | Broadcom, Inc. | | | | | | | 785,846 | |

| | 6,443 | | | Texas Instruments, Inc. | | | | | | | 765,042 | |

| | 8,244 | | | Xilinx, Inc. | | | | | | | 758,036 | |

| | | | | | | | | | | | 2,308,924 | |

| | | | | SHIPBUILDING - 0.9% | | | | | | | | |

| | 3,583 | | | Huntington Ingalls Industries, Inc. | | | | | | | 716,206 | |

| | | | | | | | | | | | | |

| | | | | SOFTWARE - 4.9% | | | | | | | | |

| | 6,770 | | | Broadridge Financial Solutions, Inc. | | | | | | | 819,847 | |

| | 2,786 | | | Intuit, Inc. | | | | | | | 808,832 | |

| | 4,068 | | | Microsoft Corp. | | | | | | | 745,461 | |

| | 2,167 | | | MSCI, Inc. | | | | | | | 712,618 | |

| | 10,426 | | | Paychex, Inc. | | | | | | | 753,591 | |

| | | | | | | | | | | | 3,840,349 | |

| | | | | TELECOMMUNICATIONS - 0.8% | | | | | | | | |

| | 4,957 | | | Motorola Solutions, Inc. | | | | | | | 670,831 | |

| | | | | | | | | | | | | |

| | | | | TRANSPORTATION - 1.0% | | | | | | | | |

| | 4,580 | | | Union Pacific Corp. | | | | | | | 777,959 | |

| | | | | | | | | | | | | |

| | | | | WATER - 1.2% | | | | | | | | |

| | 7,335 | | | American Water Works Co., Inc. | | | | | | | 931,545 | |

| | | | | | | | | | | | | |

| | | | | TOTAL COMMON STOCK (Cost - $42,140,475) | | | | | | | 43,468,689 | |

| | | | | | | | | | | | | |

| Principal | | | | | Interest | | Maturity | | | | |

| Amount | | | | | Rate % | | Date | | | | |

| | | | | U.S GOVERNMENT OBLIGATIONS - 43.8% | | | | | | | | |

| $ | 33,750,000 | | | U.S Treasury Note | | 1.500 | | 10/31/2021 | | $ | 34,378,858 | |

| | | | | TOTAL U.S GOVERNMENT OBLIGATIONS (Cost - $34,358,989) | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 99.1% (Cost - $76,499,464) | | | | | | $ | 77,847,547 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 0.9% | | | | | | | 682,398 | |

| | | | | NET ASSETS - 100.0% | | | | | | $ | 78,529,945 | |

PLC - Public Limited Company

| Portfolio Composition as of May 31, 2020 | |

| | |

| Sector | | Percent of Net Assets | |

| Information Technology | | | 12.7 | % |

| Financials | | | 8.4 | % |

| Health Care | | | 6.9 | % |

| Industrials | | | 5.9 | % |

| Consumer Discretionary | | | 5.5 | % |

| Consumer Staples | | | 4.9 | % |

| Utilities | | | 3.5 | % |

| Real Estate | | | 2.8 | % |

| Communication Services | | | 2.0 | % |

| Materials | | | 1.4 | % |

| Energy | | | 1.3 | % |

| US Treasury Note | | | 43.8 | % |

| Other Assets in Excess of Liabilities | | | 0.9 | % |

| Net Assets | | | 100.0 | % |

The accompanying notes are an integral part of these financial statements.

| Copeland International Risk Managed Dividend Growth Fund |

| PORTFOLIO OF INVESTMENTS (Unaudited) |

| May 31, 2020 |

| Shares | | | Security | | Market Value | |

| | | | | | | |

| | | | | COMMON STOCK - 55.2% | | | | |

| | | | | AEROSPACE / DEFENSE - 0.7% | | | | |

| | 301 | | | MTU Aero Engines AG * | | $ | 48,750 | |

| | | | | | | | | |

| | | | | APPAREL - 0.6% | | | | |

| | 3,900 | | | Shenzhou International Group Holdings Ltd. | | | 46,933 | |

| | | | | | | | | |

| | | | | BANKS - 4.0% | | | | |

| | 4,572 | | | DNB ASA | | | 62,402 | |

| | 3,000 | | | Hang Seng Bank Ltd. | | | 46,079 | |

| | 983 | | | Ringkjoebing Landbobank A/S * | | | 68,627 | |

| | 1,353 | | | Toronto-Dominion Bank | | | 57,734 | |

| | 3,600 | | | United Overseas Bank Ltd. | | | 49,841 | |

| | | | | | | | 284,683 | |

| | | | | BEVERAGES - 0.9% | | | | |

| | 1,821 | | | Diageo PLC | | | 63,601 | |

| | | | | | | | | |

| | | | | CHEMICALS - 3.7% | | | | |

| | 969 | | | Croda International PLC | | | 62,408 | |

| | 1,873 | | | Itaconix PLC | | | 52,278 | |

| | 1,239 | | | Novozymes AS | | | 67,820 | |

| | 700 | | | Shin-Etsu Chemical Co. Ltd. | | | 82,062 | |

| | | | | | | | 264,568 | |

| | | | | COMMERCIAL SERVICES - 3.8% | | | | |

| | 2,316 | | | Experian PLC | | | 81,313 | |

| | 12,592 | | | QinetiQ Group PLC | | | 46,268 | |

| | 3,210 | | | RELX PLC | | | 74,793 | |

| | 800 | | | Secom Co. Ltd. | | | 69,510 | |

| | | | | | | | 271,884 | |

| | | | | COMPUTERS - 2.9% | | | | |

| | 325 | | | Accenture PLC | | | 65,527 | |

| | 840 | | | Logitech International SA | | | 49,966 | |

| | 520 | | | Obic Co. Ltd. | | | 90,437 | |

| | | | | | | | 205,930 | |

| | | | | COSMETICS/PERSONAL CARE - 1.7% | | | | |

| | 800 | | | Kao Corp. | | | 64,466 | |

| | 1,167 | | | Unilever NV | | | 60,433 | |

| | | | | | | | 124,899 | |

| | | | | DIVERSIFIED FINANCIAL SERVICES - 0.8% | | | | |

| | 4,479 | | | Close Brothers Group PLC | | | 60,049 | |

| | | | | | | | | |

| | | | | ELECTRIC - 1.0% | | | | |

| | 1,872 | | | Fortis, Inc. | | | 71,795 | |

| | | | | | | | | |

| | | | | ELECTRONICS - 0.9% | | | | |

| | 1,000 | | | Nidec Corp. | | | 61,620 | |

| | | | | | | | | |

| | | | | FOOD - 2.1% | | | | |

| | 545 | | | Kerry Group PLC | | | 67,666 | |

| | 736 | | | Nestle SA | | | 80,004 | |

| | | | | | | | 147,670 | |

| | | | | GAS - 0.7% | | | | |

| | 1,094 | | | Rubis SCA | | | 52,538 | |

The accompanying notes are an integral part of these financial statements.

| Copeland International Risk Managed Dividend Growth Fund |

| PORTFOLIO OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2020 |

| Shares | | | Security | | Market Value | |

| | | | | | | |

| | | | | COMMON STOCK - 55.2% (Continued) | | | | |

| | | | | HAND/MACHINE TOOLS - 0.8% | | | | |

| | 6,500 | | | Techtronic Industries Co. Ltd. | | $ | 56,709 | |

| | | | | | | | | |

| | | | | HEALTHCARE PRODUCTS - 2.0% | | | | |

| | 703 | | | Medtronic PLC | | | 69,302 | |

| | 462 | | | Steris PLC | | | 76,641 | |

| | | | | | | | 145,943 | |

| | | | | HEALTHCARE SERVICES - 0.9% | | | | |

| | 1,286 | | | Fresenius SE & Co. KGaA | | | 62,299 | |

| | | | | | | | | |

| | | | | INSURANCE - 3.0% | | | | |

| | 8,600 | | | AIA Group Ltd. | | | 70,574 | |

| | 687 | | | Helvetia Holding AG | | | 61,308 | |

| | 1,963 | | | Tokio Marine Holdings, Inc. | | | 85,261 | |

| | | | | | | | 217,143 | |

| | | | | INTERNET - 1.1% | | | | |

| | 1,500 | | | Tencent Holdings Ltd. | | | 81,239 | |

| | | | | | | | | |

| | | | | MACHINERY-DIVERSIFIED - 1.7% | | | | |

| | 1,277 | | | Atlas Copco AB - A Shares | | | 50,534 | |

| | 580 | | | Spirax-Sarco Engineering PLC | | | 71,259 | |

| | | | | | | | 121,793 | |

| | | | | MEDIA - 1.8% | | | | |

| | 3,566 | | | Quebecor, Inc. | | | 78,095 | |

| | 680 | | | Wolters Kluwer NV | | | 54,383 | |

| | | | | | | | 132,478 | |

| | | | | OIL & GAS - 1.2% | | | | |

| | 998 | | | DCC PLC | | | 83,804 | |

| | | | | | | | | |

| | | | | PACKAGING & CONTAINERS - 0.7% | | | | |

| | 522 | | | Vidrala SA | | | 50,024 | |

| | | | | | | | | |

| | | | | PHARMACEUTICALS - 4.2% | | | | |

| | 1,597 | | | Dechra Pharmaceuticals PLC | | | 55,146 | |

| | 1,182 | | | Novo Nordisk AS | | | 77,941 | |

| | 248 | | | Roche Holding AG | | | 86,185 | |

| | 1,350 | | | Shionogi & Co. Ltd. | | | 80,138 | |

| | | | | | | | 299,410 | |

| | | | | PIPELINES - 0.7% | | | | |

| | 1,585 | | | Enbridge, Inc. | | | 51,350 | |

| | | | | | | | | |

| | | | | REAL ESTATE - 2.8% | | | | |

| | 4,911 | | | Hufvudstaden AB | | | 63,369 | |

| | 596 | | | LEG Immobilien AG | | | 74,732 | |

| | 2,800 | | | Relo Group, Inc. | | | 64,122 | |

| | | | | | | | 202,223 | |

| | | | | RETAIL - 2.6% | | | | |

| | 1,721 | | | Alimentation Couche-Tard, Inc. | | | 53,665 | |

| | 400 | | | Cosmos Pharmaceutical Corp. | | | 57,595 | |

| | 2,322 | | | Dollarama, Inc. | | | 78,419 | |

| | | | | | | | 189,679 | |

| | | | | SEMICONDUCTORS - 0.7% | | | | |

| | 162 | | | Broadcom, Inc. | | | 47,186 | |

The accompanying notes are an integral part of these financial statements.

| Copeland International Risk Managed Dividend Growth Fund |

| PORTFOLIO OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2020 |

| Shares | | | Security | | | | | | Market Value | |

| | | | | | | | | | | |

| | | | | COMMON STOCK - 55.2% (Continued) | | | | | | | | |

| | | | | SOFTWARE - 3.1% | | | | | | | | |

| | 418 | | | Dassault Systemes SE | | | | | | $ | 71,514 | |

| | 672 | | | SimCorp AS | | | | | | | 74,358 | |

| | 479 | | | Temenos Group AG | | | | | | | 73,709 | |

| | | | | | | | | | | | 219,581 | |

| | | | | STORAGE WAREHOUSING - 0.8% | | | | | | | | |

| | 6,857 | | | Safestore Holdings PLC | | | | | | | 56,879 | |

| | | | | | | | | | | | | |

| | | | | TELECOMMUNICATIONS - 0.9% | | | | | | | | |

| | 2,300 | | | KDDI Corp. | | | | | | | 67,204 | |

| | | | | | | | | | | | | |

| | | | | TRANSPORTATION - 1.5% | | | | | | | | |

| | 893 | | | Canadian National Railway Co. | | | | | | | 76,624 | |

| | 1,600 | | | Keisei Electric Railway Co. Ltd. | | | | | | | 31,390 | |

| | | | | | | | | | | | 108,014 | |

| | | | | WATER - 0.9% | | | | | | | | |

| | 4,443 | | | Pennon Group PLC | | | | | | | 63,043 | |

| | | | | | | | | | | | | |

| | | | | TOTAL COMMON STOCK (Cost - $4,043,280) | | | | | | | 3,960,921 | |

| | | | | | | | | | | | | |

| Principal | | | | | Interest | | Maturity | | | | |

| Amount | | | | | Rate % | | Date | | | | |

| | | | | U.S GOVERNMENT OBLIGATIONS - 39.8% | | | | | | | | |

| $ | 2,807,000 | | | U.S Treasury Note | | 1.500 | | 10/31/2021 | | $ | 2,859,302 | |

| | | | | TOTAL U.S GOVERNMENT OBLIGATIONS (Cost - $2,857,513) | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 95.0% (Cost - $6,900,793) | | | | | | $ | 6,820,223 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 5.0% | | | | | | | 355,367 | |

| | | | | NET ASSETS - 100.00% | | | | | | $ | 7,175,590 | |

PLC - Public Limited Company

| Portfolio Composition as of May 31, 2020 | |

| | |

| Country | | Percent of Net Assets | |

| US Treasury Note | | | 39.8 | % |

| Japan | | | 10.5 | % |

| Unitrd Kingdom | | | 9.3 | % |

| Canada | | | 6.5 | % |

| Ireland | | | 5.1 | % |

| Switzerland | | | 4.9 | % |

| Denmark | | | 4.0 | % |

| Germany | | | 2.6 | % |

| Hong Kong | | | 2.4 | % |

| China | | | 1.8 | % |

| France | | | 1.7 | % |

| United States | | | 1.7 | % |

| Sweden | | | 1.6 | % |

| Noway | | | 0.9 | % |

| Netherlands | | | 0.8 | % |

| Spain | | | 0.7 | % |

| Singapore | | | 0.7 | % |

| Other Assets in Excess of Liabilities | | | 5.0 | % |

| Net Assets | | | 100.0 | % |

| | | | | |

| Sector | | Percent of Net Assets | |

| US Treasury Note | | | 39.8 | % |

| Industrials | | | 11.2 | % |

| Financials | | | 7.8 | % |

| Health Care | | | 7.1 | % |

| Information Technology | | | 6.6 | % |

| Consumer Staples | | | 6.2 | % |

| Materials | | | 4.5 | % |

| Real Estate | | | 3.6 | % |

| Communication Services | | | 3.2 | % |

| Utilities | | | 2.6 | % |

| Consumer Discretionary | | | 1.7 | % |

| Energy | | | 0.7 | % |

| Other Assets in Excess of Liabilities | | | 5.0 | % |

| Net Assets | | | 100.0 | % |

The accompanying notes are an integral part of these financial statements.

| Copeland SMID Cap Dividend Growth Fund |

| PORTFOLIO OF INVESTMENTS (Unaudited) |

| May 31, 2020 |

| Shares | | | Security | | Market Value | |

| | | | | | | |

| | | | | COMMON STOCK - 96.5% | | | | |

| | | | | AEROSPACE & DEFENSE - 1.2% | | | | |

| | 1,753 | | | HEICO Corp. | | $ | 176,632 | |

| | | | | | | | | |

| | | | | BANKS - 3.8% | | | | |

| | 7,809 | | | Bank OZK | | | 175,624 | |

| | 11,489 | | | Home BancShares, Inc. | | | 166,246 | |

| | 3,037 | | | Prosperity Bancshares, Inc. | | | 198,589 | |

| | | | | | | | 540,459 | |

| | | | | CHEMICALS - 1.5% | | | | |

| | 1,276 | | | Quaker Chemical Corp. | | | 218,005 | |

| | | | | | | | | |

| | | | | COMMERCIAL SERVICES - 4.9% | | | | |

| | 5,328 | | | Aaron’s, Inc. | | | 196,656 | |

| | 484 | | | MarketAxess Holdings, Inc. | | | 246,158 | |

| | 3,274 | | | Monro, Inc. | | | 180,397 | |

| | 457 | | | Morningstar, Inc. | | | 70,067 | |

| | | | | | | | 693,278 | |

| | | | | COMPUTERS - 1.5% | | | | |

| | 2,915 | | | Maximus, Inc. | | | 209,938 | |

| | | | | | | | | |

| | | | | DISTRIBUTION/WHOLESALE - 3.4% | | | | |

| | 8,186 | | | Core-Mark Holding Co., Inc. | | | 229,044 | |

| | 942 | | | Pool Corp. | | | 253,417 | |

| | | | | | | | 482,461 | |

| | | | | DIVERSIFIED FINANCIAL SERVICES - 4.3% | | | | |

| | 4,339 | | | Cohen & Steers, Inc. | | | 275,743 | |

| | 4,108 | | | Evercore, Inc. | | | 195,171 | |

| | 5,324 | | | Lazard Ltd. | | | 143,003 | |

| | | | | | | | 613,917 | |

| | | | | ELECTRIC - 1.9% | | | | |

| | 19,025 | | | Algonquin Power & Utilities Corp. | | | 266,350 | |

| | | | | | | | | |

| | | | | ELECTRICAL COMPONENTS & EQUIPMENT - 2.7% | | | | |

| | 1,100 | | | Littelfuse, Inc. | | | 178,739 | |

| | 1,354 | | | Universal Display Corp. | | | 198,496 | |

| | | | | | | | 377,235 | |

| | | | | ELECTRONICS - 1.5% | | | | |

| | 3,494 | | | Badger Meter, Inc. | | | 213,798 | |

| | | | | | | | | |

| | | | | ENGINEERING & CONSTRUCTION -1.1% | | | | |

| | 2,033 | | | Exponent, Inc. | | | 150,930 | |

| | | | | | | | | |

| | | | | ENVIRONMENTAL CONTROL - 1.9% | | | | |

| | 3,343 | | | Tetra Tech, Inc. | | | 263,763 | |

| | | | | | | | | |

| | | | | FOOD - 3.5% | | | | |

| | 3,290 | | | Calavo Growers, Inc. | | | 192,498 | |

| | 1,587 | | | J&J Snack Foods Corp. | | | 204,136 | |

| | 1,768 | | | Lamb Weston Holdings, Inc. | | | 106,186 | |

| | | | | | | | 502,820 | |

| | | | | GAS - 1.4% | | | | |

| | 6,101 | | | UGI Corp. | | | 194,256 | |

| | | | | | | | | |

| | | | | HAND/MACHINE TOOLS - 1.2% | | | | |

| | 1,311 | | | Snap-on, Inc. | | | 170,024 | |

| | | | | | | | | |

| | | | | HEALTHCARE PRODUCTS - 6.0% | | | | |

| | 3,872 | | | Cantel Medical Corp. | | | 162,934 | |

| | 4,798 | | | Luminex Corp. | | | 149,506 | |

| | 1,644 | | | ResMed, Inc. | | | 264,388 | |

| | 1,648 | | | STERIS PLC | | | 273,387 | |

| | | | | | | | 850,215 | |

The accompanying notes are an integral part of these financial statements.

| Copeland SMID Cap Dividend Growth Fund |

| PORTFOLIO OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2020 |

| Shares | | | Security | | Market Value | |

| | | | | | | |

| | | | | COMMON STOCK - 96.5% (Continued) | | | | |

| | | | | HEALTHCARE SERVICES - 8.0% | | | | |

| | 550 | | | Chemed Corp. | | $ | 263,180 | |

| | 3,217 | | | Encompass Health Corp. | | | 235,645 | |

| | 5,985 | | | Ensign Group, Inc. | | | 261,664 | |

| | 2,010 | | | Quest Diagnostics, Inc. | | | 237,743 | |

| | 1,904 | | | US Physical Therapy, Inc. | | | 141,163 | |

| | | | | | | | 1,139,395 | |

| | | | | HOUSEHOLD PRODUCTS - 1.6% | | | | |

| | 3,072 | | | Church & Dwight Co., Inc. | | | 230,615 | |

| | | | | | | | | |

| | | | | HOUSEWARES - 1.4% | | | | |

| | 2,710 | | | Toro Co. | | | 192,600 | |

| | | | | | | | | |

| | | | | INSURANCE - 1.2% | | | | |

| | 2,241 | | | Globe Life, Inc. | | | 172,602 | |

| | | | | | | | | |

| | | | | INTERNET - 1.3% | | | | |

| | 2,440 | | | Cogent Communications Holdings, Inc. | | | 186,709 | |

| | | | | | | | | |

| | | | | LEISURE TIME - 0.7% | | | | |

| | 1,850 | | | Brunswick Corp. | | | 101,768 | |

| | | | | | | | | |

| | | | | MACHINERY - CONSTRUCTION & MINING- 1.8% | | | | |

| | 4,113 | | | BWX Technologies, Inc. | | | 257,350 | |

| | | | | | | | | |

| | | | | MACHINERY - DIVERSIFIED - 3.7% | | | | |

| | 4,122 | | | Cognex Corp. | | | 233,882 | |

| | 1,560 | | | Nordson Corp. | | | 293,826 | |

| | | | | | | | 527,708 | |

| | | | | MEDIA - 4.7% | | | | |

| | 122 | | | Cable One, Inc. | | | 230,201 | |

| | 720 | | | FactSet Research Systems, Inc. | | | 221,407 | |

| | 2,470 | | | Nexstar Media Group, Inc. | | | 205,776 | |

| | | | | | | | 657,384 | |

| | | | | OIL & GAS - 1.4% | | | | |

| | 10,353 | | | Cabot Oil & Gas Corp. | | | 205,404 | |

| | | | | | | | | |

| | | | | PIPELINES - 1.1% | | | | |

| | 3,380 | | | Phillips 66 Partners LP | | | 151,018 | |

| | | | | | | | | |

| | | | | PRIVATE EQUITY - 1.2% | | | | |

| | 12,458 | | | Kennedy-Wilson Holdings, Inc. | | | 174,661 | |

| | | | | | | | | |

| | | | | REAL ESTATE INVESTMENT TRUSTS - 4.9% | | | | |

| | 1,594 | | | Alexandria Real Estate Equities, Inc. | | | 245,030 | |

| | 6,318 | | | Americold Realty Trust | | | 225,616 | |

| | 5,141 | | | NexPoint Residential Trust, Inc. | | | 164,409 | |

| | 839 | | | QTS Realty Trust, Inc. | | | 57,555 | |

| | | | | | | | 692,610 | |

| | | | | RETAIL - 6.4% | | | | |

| | 1,342 | | | Casey’s General Stores, Inc. | | | 214,358 | |

| | 617 | | | Domino’s Pizza, Inc. | | | 238,063 | |

| | 3,081 | | | MSC Industrial Direct Co., Inc. | | | 213,637 | |

| | 1,912 | | | Tractor Supply Co. | | | 233,302 | |

| | | | | | | | 899,360 | |

The accompanying notes are an integral part of these financial statements.

| Copeland SMID Cap Dividend Growth Fund |

| PORTFOLIO OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2020 |

| Shares | | | Security | | Market Value | |

| | | | | | | |

| | | | | COMMON STOCK - 96.5% (Continued) | | | | |

| | | | | SEMICONDUCTORS - 3.6% | | | | |

| | 1,723 | | | Cabot Microelectronics Corp. | | $ | 249,594 | |

| | 2,406 | | | Power Integrations, Inc. | | | 260,690 | |

| | | | | | | | 510,284 | |

| | | | | SHIPBUILDING - 1.3% | | | | |

| | 887 | | | Huntington Ingalls Industries, Inc. | | | 177,302 | |

| | | | | | | | | |

| | | | | SOFTWARE - 4.8% | | | | |

| | 1,957 | | | Broadridge Financial Solutions, Inc. | | | 236,993 | |

| | 1,323 | | | Jack Henry & Associates, Inc. | | | 239,278 | |

| | 2,548 | | | ManTech International Corp. | | | 198,082 | |

| | | | | | | | 674,353 | |

| | | | | TRANSPORTATION - 2.4% | | | | |

| | 1,421 | | | Landstar System, Inc. | | | 165,205 | |

| | 4,951 | | | Ryder System, Inc. | | | 169,621 | |

| | | | | | | | 334,826 | |

| | | | | WATER - 3.2% | | | | |

| | 2,408 | | | American States Water Co. | | | 197,480 | |

| | 2,033 | | | American Water Works Co., Inc. | | | 258,191 | |

| | | | | | | | 455,671 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCK (Cost - $13,333,067) | | | 13,665,701 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 96.5% (Cost - $13,333,067) | | $ | 13,665,701 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 3.5% | | | 494,264 | |

| | | | | NET ASSETS - 100.00% | | $ | 14,159,965 | |

PLC - Public Limited Company

LP - Limited Partnership

| Portfolio Composition as of May 31, 2020 | |

| | |

| Sector | | Percent of Net Assets | |

| Industrials | | | 15.8 | % |

| Information Technology | | | 15.7 | % |

| Health Care | | | 14.0 | % |

| Financials | | | 13.2 | % |

| Consumer Discretionary | | | 10.1 | % |

| Consumer Staples | | | 6.7 | % |

| Utilities | | | 6.5 | % |

| Real Estate | | | 6.1 | % |

| Communication Services | | | 4.4 | % |

| Energy | | | 2.5 | % |

| Materials | | | 1.5 | % |

| Other Assets in Excess of Liabilities | | | 3.5 | % |

| Net Assets | | | 100.0 | % |

The accompanying notes are an integral part of these financial statements.

| Copeland Trust |

| STATEMENTS OF ASSETS AND LIABILITIES (Unaudited) |

| May 31, 2020 |

| | | Copeland Risk | | | Copeland

International Risk | | | Copeland SMID | |

| | | Managed Dividend | | | Managed Dividend | | | Cap Dividend | |

| | | Growth Fund | | | Growth Fund | | | Growth Fund | |

| Assets: | | | | | | | | | | | | |

| Investments, at Cost | | $ | 76,499,464 | | | $ | 6,900,793 | | | $ | 13,333,067 | |

| Investments in Securities, at Market Value | | $ | 77,847,547 | | | $ | 6,820,223 | | | $ | 13,665,701 | |

| Cash | | | 817,590 | | | | 265,379 | | | | 584,970 | |

| Foreign Cash (Cost $0, $49,491, $0) | | | — | | | | 49,500 | | | | — | |

| Dividends and Interest Receivable | | | 119,294 | | | | 81,873 | | | | 31,438 | |

| Receivable for Securities Sold | | | — | | | | — | | | | 74,871 | |

| Due from Investment Adviser | | | — | | | | 1,059 | | | | — | |

| Receivable for Fund Shares Sold | | | 37,829 | | | | 1,207 | | | | — | |

| Prepaid Expenses and Other Assets | | | 78,332 | | | | 65,210 | | | | 52,734 | |

| Total Assets | | | 78,900,592 | | | | 7,284,451 | | | | 14,409,714 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Payable for Securities Purchased | | | — | | | | 81,453 | | | | 237,028 | |

| Payable for Fund Shares Redeemed | | | 155,387 | | | | 7,290 | | | | — | |

| Payable to Investment Adviser | | | 50,661 | | | | — | | | | 2,887 | |

| Accrued Distribution Fees | | | 49,483 | | | | 7,990 | | | | 16 | |

| Payable to Related Parties | | | 79,697 | | | | 1,664 | | | | 7,508 | |

| Accrued Expenses and Other Liabilities | | | 35,419 | | | | 10,464 | | | | 2,310 | |

| Total Liabilities | | | 370,647 | | | | 108,861 | | | | 249,749 | |

| | | | | | | | | | | | | |

| Net Assets | | $ | 78,529,945 | | | $ | 7,175,590 | | | $ | 14,159,965 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Composition of Net Assets: | | | | | | | | | | | | |

| At May 31, 2020, Net Assets consisted of: | | | | | | | | | | | | |

| Paid-in-Capital | | $ | 77,232,464 | | | $ | 9,664,277 | | | $ | 14,522,456 | |

| Accumulated Earnings (Loss) | | | 1,297,481 | | | | (2,488,687 | ) | | | (362,491 | ) |

| Net Assets | | $ | 78,529,945 | | | $ | 7,175,590 | | | $ | 14,159,965 | |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Copeland Trust |

| STATEMENTS OF ASSETS AND LIABILITIES (Unaudited) (Continued) |

| May 31, 2020 |

| | | | | | Copeland | | | | |

| | | Copeland Risk | | | International Risk | | | Copeland SMID | |

| | | Managed Dividend | | | Managed Dividend | | | Cap Dividend | |

| | | Growth Fund | | | Growth Fund | | | Growth Fund | |

| Class A Shares: | | | | | | | | | | | | |

| Net Assets | | $ | 20,756,741 | | | $ | 1,177,407 | | | $ | 40,760 | |

| Shares Outstanding (no par value; unlimited number of shares authorized) | | | 1,975,095 | | | | 108,653 | | | | 3,581 | |

| | | | | | | | | | | | | |

| Net Asset Value and Redemption Price Per Share* | | $ | 10.51 | | | $ | 10.84 | | | $ | 11.38 | |

| Offering Price Per Share (NAV/0.9425) Includes a Maximum Sales Charge of 5.75% | | $ | 11.15 | | | $ | 11.50 | | | $ | 12.08 | |

| | | | | | | | | | | | | |

| Class C Shares: | | | | | | | | | | | | |

| Net Assets | | $ | 16,774,266 | | | $ | 740,354 | | | | | |

| Shares Outstanding (no par value; unlimited number of shares authorized) | | | 1,662,998 | | | | 71,282 | | | | | |

| | | | | | | | | | | | | |

| Net Asset Value, Offering Price and Redemption Price Per Share* | | $ | 10.09 | | | $ | 10.39 | | | | | |

| | | | | | | | | | | | | |

| Class I Shares: | | | | | | | | | | | | |

| Net Assets | | $ | 40,998,938 | | | $ | 5,257,829 | | | $ | 14,119,205 | |

| Shares Outstanding (no par value; unlimited number of shares authorized) | | | 3,946,949 | | | | 486,410 | | | | 1,237,525 | |

| | | | | | | | | | | | | |

| Net Asset Value, Offering Price and Redemption Price Per Share* | | $ | 10.39 | | | $ | 10.81 | | | $ | 11.41 | |

| | | | | | | | | | | | | |

| * | The Funds charge a 1.00% fee on shares redeemed less than 30 days after purchase or if shares held less than 30 days are redeemed for failure to the Funds’ minimum balance requirement. |

The accompanying notes are an integral part of these financial statements.

| Copeland Trust |

| STATEMENTS OF OPERATIONS (Unaudited) |

| For the Six Months Ended May 31, 2020 |

| | | | | | Copeland | | | | |

| | | Copeland Risk | | | International Risk | | | Copeland SMID | |

| | | Managed Dividend | | | Managed Dividend | | | Cap Dividend | |

| | | Growth Fund | | | Growth Fund | | | Growth Fund | |

| Investment Income: | | | | | | | | | | | | |

| Dividend Income (Less $25,470, $26,860, and $1,270 Foreign Taxes Withholding, respectively) | | $ | 779,076 | | | $ | 75,331 | | | $ | 132,955 | |

| Interest Income | | | 108,065 | | | | (72 | ) | | | 4,279 | |

| Total Investment Income | | | 887,141 | | | | 75,259 | | | | 137,234 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Investment Advisory Fees | | | 511,500 | | | | 68,160 | | | | 48,161 | |

| Distribution Fees - Class C | | | 105,805 | | | | 5,621 | | | | — | |

| Distribution Fees - Class A | | | 35,757 | | | | 1,810 | | | | 51 | |

| Trustees’ Fees | | | 75,308 | | | | 7,269 | | | | 5,061 | |

| Administration Fees | | | 54,951 | | | | 4,449 | | | | 8,524 | |

| Chief Compliance Officer Fees | | | 38,240 | | | | 4,866 | | | | 4,876 | |

| Legal Fees | | | 37,283 | | | | 4,268 | | | | 1,915 | |

| Fund Accounting Fees | | | 28,316 | | | | 17,058 | | | | 17,945 | |

| Transfer Agent Fees | | | 23,695 | | | | 4,134 | | | | 5,616 | |

| Shareholder Service Fees- Class I | | | 21,013 | | | | 3,670 | | | | 1,812 | |

| Printing Expenses | | | 20,485 | | | | 1,549 | | | | 1,683 | |

| Insurance Expense | | | 15,024 | | | | 2,126 | | | | 168 | |

| Registration & Filing Fees | | | 19,842 | | | | 8,284 | | | | 2,941 | |

| Audit Fees | | | 9,558 | | | | 7,058 | | | | 4,374 | |

| Non-Rule 12B-1 Shareholder Service Fees | | | 9,150 | | | | 1,240 | | | | 487 | |

| Custody Fees | | | 7,225 | | | | 5,825 | | | | 6,857 | |

| Miscellaneous Expenses | | | 1,085 | | | | 183 | | | | 1,281 | |

| Total Expenses | | | 1,014,237 | | | | 147,570 | | | | 111,752 | |

| Less: Management Fees Waived by Adviser | | | (234,666 | ) | | | (51,928 | ) | | | (50,640 | ) |

| Net Expenses | | | 779,571 | | | | 95,642 | | | | 61,112 | |

| Net Investment Income (Loss) | | | 107,570 | | | | (20,383 | ) | | | 76,122 | |

| | | | | | | | | | | | | |

| Net Realized and Unrealized Loss on Investments and Foreign Currencies: | | | | | | | | | | | | |

| Net Realized Gain (Loss) on: | | | | | | | | | | | | |

| Security Transactions and FX Loss on Securities | | | (3,227,902 | ) | | | (608,475 | ) | | | (760,430 | ) |

| Foreign Currency Transactions | | | — | | | | 2,315 | | | | — | |

| | | | (3,227,902 | ) | | | (606,160 | ) | | | (760,430 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | | | | | |

| Securities | | | (9,361,483 | ) | | | (1,448,865 | ) | | | (374,280 | ) |

| Foreign Currency Exchange Contracts | | | — | | | | 1,389 | | | | — | |

| | | | (9,361,483 | ) | | | (1,447,476 | ) | | | (374,280 | ) |

| Net Realized and Unrealized Loss on Investments and Foreign Currency Transactions | | | (12,589,385 | ) | | | (2,053,636 | ) | | | (1,134,710 | ) |

| | | | | | | | | | | | | |

| Net Decrease in Net Assets Resulting From Operations | | $ | (12,481,815 | ) | | $ | (2,074,019 | ) | | $ | (1,058,588 | ) |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Copeland Risk Managed Dividend Growth Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months | | | Year | |

| | | Ended | | | Ended | |

| | | May 31, 2020 | | | November 30, 2019 | |

| | | (Unaudited) | | | | |

| Operations: | | | | | | | | |

| Net Investment Income | | $ | 107,570 | | | $ | 888,564 | |

| Net Realized Gain (Loss) on Investments and Foreign Currency Transactions | | | (3,227,902 | ) | | | 25,079,273 | |

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Transactions | | | (9,361,483 | ) | | | (25,884,106 | ) |

| Net Increase (Decrease) in Net Assets Resulting From Operations | | | (12,481,815 | ) | | | 83,731 | |

| | | | | | | | | |

| Distributions to Shareholders From: | | | | | | | | |

| Total Distributions Paid | | | | | | | | |

| Class A | | | (6,494,529 | ) | | | (3,753,431 | ) |

| Class C | | | (4,425,567 | ) | | | (2,354,930 | ) |

| Class I | | | (11,471,495 | ) | | | (6,061,800 | ) |

| Total Distributions to Shareholders | | | (22,391,591 | ) | | | (12,170,161 | ) |

| | | | | | | | | |

| Beneficial Interest Transactions: | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from Shares Issued | | | 282,462 | | | | 1,578,190 | |

| Distributions Reinvested | | | 6,043,037 | | | | 3,503,569 | |

| Cost of Shares Redeemed | | | (12,449,158 | ) | | | (17,085,621 | ) |

| Redemption Fees | | | 3 | | | | 481 | |

| Total Class A Shares | | | (6,123,656 | ) | | | (12,003,381 | ) |

| Class C | | | | | | | | |

| Proceeds from Shares Issued | | | 153,672 | | | | 612,453 | |

| Distributions Reinvested | | | 4,347,840 | | | | 2,329,578 | |

| Cost of Shares Redeemed | | | (5,953,935 | ) | | | (7,724,642 | ) |

| Redemption Fees | | | 4 | | | | 79 | |

| Total Class C Shares | | | (1,452,419 | ) | | | (4,782,532 | ) |

| Class I | | | | | | | | |

| Proceeds from Shares Issued | | | 6,651,346 | | | | 15,245,576 | |

| Distributions Reinvested | | | 11,247,291 | | | | 5,921,432 | |

| Cost of Shares Redeemed | | | (25,711,282 | ) | | | (30,395,830 | ) |

| Redemption Fees | | | 1,529 | | | | 94 | |

| Total Class I Shares | | | (7,811,116 | ) | | | (9,228,728 | ) |

| Total Beneficial Interest Transactions | | | (15,387,191 | ) | | | (26,014,641 | ) |

| | | | | | | | | |

| Decrease in Net Assets | | | (50,260,597 | ) | | | (38,101,071 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of Period | | | 128,790,542 | | | | 166,891,613 | |

| End of Period | | $ | 78,529,945 | | | $ | 128,790,542 | |

| | | | | | | | | |

| Share Activity: | | | | | | | | |

| Class A | | | | | | | | |

| Shares Issued | | | 24,483 | | | | 119,196 | |

| Distributions Reinvested | | | 515,617 | | | | 256,296 | |

| Shares Redeemed | | | (1,153,029 | ) | | | (1,263,441 | ) |

| Total Class A Shares | | | (612,929 | ) | | | (887,949 | ) |

| Class C | | | | | | | | |

| Shares Issued | | | 13,572 | | | | 47,575 | |

| Distributions Reinvested | | | 384,765 | | | | 175,552 | |

| Shares Redeemed | | | (575,755 | ) | | | (590,670 | ) |

| Total Class C Shares | | | (177,418 | ) | | | (367,543 | ) |

| Class I | | | | | | | | |

| Shares Issued | | | 606,107 | | | | 1,158,415 | |

| Distributions Reinvested | | | 972,108 | | | | 437,975 | |

| Shares Redeemed | | | (2,350,630 | ) | | | (2,281,806 | ) |

| Total Class I Shares | | | (772,415 | ) | | | (685,416 | ) |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Copeland International Risk Managed Dividend Growth Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months | | | Year | |

| | | Ended | | | Ended | |

| | | May 31, 2020 | | | November 30, 2019 | |

| | | (Unaudited) | | | | |

| Operations: | | | | | | | | |

| Net Investment Income (Loss) | | $ | (20,383 | ) | | $ | 117,119 | |

| Net Realized Gain (Loss) on Investments and Foreign Currency Transactions | | | (606,160 | ) | | | (516,721 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Transactions | | | (1,447,476 | ) | | | 1,484,592 | |

| Net Increase (Decrease) in Net Assets Resulting From Operations | | | (2,074,019 | ) | | | 1,084,990 | |

| | | | | | | | | |

| Distributions to Shareholders From: | | | | | | | | |

| Total Distributions Paid | | | | | | | | |

| Class A | | | (205 | ) | | | — | |

| Class C | | | — | | | | — | |

| Class I | | | (38,873 | ) | | | — | |

| Total Distributions to Shareholders | | | (39,078 | ) | | | — | |

| | | | | | | | | |

| Beneficial Interest Transactions: | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from Shares Issued | | | 184,929 | | | | 233,434 | |

| Distributions Reinvested | | | 189 | | | | — | |

| Cost of Shares Redeemed | | | (379,318 | ) | | | (968,927 | ) |

| Redemption Fees | | | 16 | | | | 2 | |

| Total Class A Shares | | | (194,184 | ) | | | (735,491 | ) |

| Class C | | | | | | | | |

| Proceeds from Shares Issued | | | 13,900 | | | | 32,800 | |

| Distributions Reinvested | | | — | | | | — | |

| Cost of Shares Redeemed | | | (438,853 | ) | | | (569,051 | ) |

| Redemption Fees | | | — | | | | — | |

| Total Class C Shares | | | (424,953 | ) | | | (536,251 | ) |

| Class I | | | | | | | | |

| Proceeds from Shares Issued | | | 271,590 | | | | 1,576,191 | |

| Distributions Reinvested | | | 38,829 | | | | — | |

| Cost of Shares Redeemed | | | (5,980,933 | ) | | | (7,661,419 | ) |

| Redemption Fees | | | 2 | | | | — | |

| Total Class I Shares | | | (5,670,512 | ) | | | (6,085,228 | ) |

| Total Beneficial Interest Transactions | | | (6,289,649 | ) | | | (7,356,970 | ) |

| | | | | | | | | |

| Increase (Decrease) in Net Assets | | | (8,402,746 | ) | | | (6,271,980 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of Period | | | 15,578,336 | | | | 21,850,316 | |

| End of Period | | $ | 7,175,590 | | | $ | 15,578,336 | |

| | | | | | | | | |

| Share Activity: | | | | | | | | |

| Class A | | | | | | | | |

| Shares Issued | | | 14,914 | | | | 20,154 | |

| Distributions Reinvested | | | 15 | | | | — | |

| Shares Redeemed | | | (34,682 | ) | | | (82,592 | ) |

| Total Class A Shares | | | (19,753 | ) | | | (62,438 | ) |

| Class C | | | | | | | | |

| Shares Issued | | | 1,228 | | | | 2,962 | |

| Distributions Reinvested | | | — | | | | — | |

| Shares Redeemed | | | (44,147 | ) | | | (49,727 | ) |

| Total Class C Shares | | | (42,919 | ) | | | (46,765 | ) |

| Class I | | | | | | | | |

| Shares Issued | | | 22,840 | | | | 135,751 | |

| Distributions Reinvested | | | 3,111 | | | | — | |

| Shares Redeemed | | | (555,272 | ) | | | (656,259 | ) |

| Total Class I Shares | | | (529,321 | ) | | | (520,508 | ) |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Copeland SMID Cap Dividend Growth Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months | | | For the Period | |

| | | Ended | | | Ended | |

| | | May 31, 2020 | | | November 30, 2019 | |

| | | (Unaudited) | | | | |

| Operations: | | | | | | | | |

| Net Investment Income | | $ | 76,122 | | | $ | 47,797 | |

| Net Realized Gain (Loss) on Investments and Foreign Currency Transactions | | | (760,430 | ) | | | 130,998 | |

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Transactions | | | (374,280 | ) | | | 663,357 | |

| Net Increase (Decrease) in Net Assets Resulting From Operations | | | (1,058,588 | ) | | | 842,152 | |

| | | | | | | | | |

| Distributions to Shareholders From: | | | | | | | | |

| Total Distributions Paid | | | | | | | | |

| Class A | | | (646 | ) | | | — | |

| Class I | | | (187,956 | ) | | | (39,614 | ) |