201

THIS PAGE INTENTIONALLY BLANK

MainGate MLP Fund

Class A

Class I

6075 Poplar Avenue, Suite 402 | Memphis, TN 38119 | 855.MLP.FUND (855.657.3863) | www.maingatefunds.com

Semi-Annual Report

May 31, 2011

Table of Contents

| Letter to Shareholders | 5 |

| Hypothetical Growth of a $10,000 Investment in Class A Shares | 7 |

| Average Annual Returns | 7 |

| Expense Example | 8 |

| Allocation of Portfolio Assets | 9 |

| Schedule of Investments | 9 |

| Statement of Assets and Liabilities | 10 |

| Statement of Operations | 10 |

| Statement of Changes in Net Assets | 11 |

| Financial Highlights: Class A Shares | 12 |

| Financial Highlights: Class I Shares | 12 |

| Notes to Financial Statements | 13 |

| Additional Information | 17 |

| Board Approval of Advisory Agreement | 18 |

| Privacy Policy | 20 |

| Fund Service Providers | 21 |

Dear Shareholders,

Thank you for your commitment to the MainGate MLP Fund. The outlook for the master limited partnership (“MLP”) market remains bright, in our opinion. As you know, the Fund’s investment objective is to generate total return. We believe that in the current environment, MLPs offer the opportunity to generate total return for the Fund from two potential sources; (1) yield, and (2) growth.

Review

We believe the average MLP may grow its distribution at a 4-5% rate over the next year. With steady valuations, the MLP market could offer the possibility of attractive total returns supported by a healthy yield.

The MLP capital markets have been very healthy during 2011, with MLPs raising in excess of $11 billion of equity through 51 offerings and $13 billion of debt through 27 offerings year to date as of July 1, 2011. This compares to $14.2 billion of equity and $20.6 billion of debt raised for all of 2010.

We believe that capital markets activities have typically supported MLP growth efforts through strategies such as organic growth projects and mergers & acquisitions (“M&A”). MLP M&A activity has been healthy with 53 announced transactions worth over $14 billion through July 1, 2011.

There have been five MLP Initial Public Offerings that have raised in excess of $900 million through July 1, 2011. The Fund is an investor in Tesoro Logistics, LP (TLLP) which conducted its IPO on April 20, 2011. Tesoro is a Crude/Refined Products Pipelines and Storage MLP in which the Fund held a 5% portfolio position as of May 31, 2011.

Outlook

MLP yields are competitively positioned compared to other income assets. As of July 1, 2011, MLPs, as measured by holdings in the Alerian MLP Index, enjoyed an average yield of 6.17%, which is approximately 300 basis points (3.00%) higher than the yield of the 10 year U.S. Treasury based on our estimates.

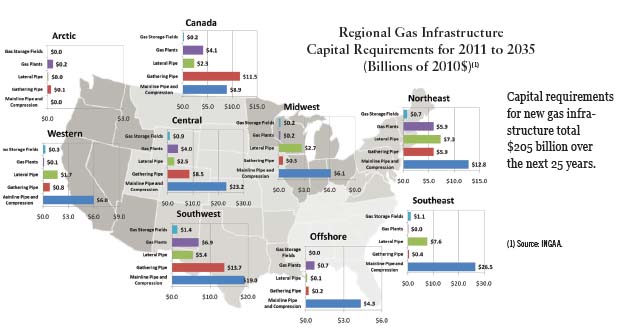

MLP distribution growth expectations remain quite visible. The INGAA Foundation, Inc. released its much anticipated study in June 2011 that outlined the need for an additional $205 billion of new gas infrastructure through 2035.

INGAA expects over $8 billion of average annual expenditure for gas infrastructure through 2035. New infrastructure is expected to be constructed for gas storage, gathering and processing, and mainline gas transmission pipelines.

Semi-Annual Report 2011●5

The Fund has exposure to sectors which may benefit from new infrastructure investment opportunities including the Natural Gas/Natural Gas Liquid Pipelines and Storage sector. We believe that our two largest positions, Williams Partners, LP (WPZ) and Enterprise Product Partners, LP (EPD) are well positioned to potentially benefit from future growth opportunities. In addition, the Fund has exposure to the Natural Gas Gathering/Processing sector with our two largest positions being Copano Energy, LLC (CPNO) and Crosstex Energy, Inc. (XTXI) as of May 31, 2011. We believe an environment supported by the need for additional energy infrastructure could provide an attractive investment climate for the Fund in the years ahead.

Sincerely,

|  |

| Geoffrey P. Mavar, Chairman | Matthew G. Mead, CEO |

Past performance is not a guarantee of future results.

Opinions expressed are those of MainGate and are subject to change, are not guaranteed, and should not be considered investment advice.

The information contained in this report is authorized for use when preceded or accompanied by a prospectus.

Basis point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument.

Mutual fund investing involves risk. Principal loss is possible. The Fund is nondiversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund. The Fund will invest in Master Limited Partnerships (MLPs) which concentrate investments in the natural resource sector and are subject to the risks of energy prices and demand and the volatility of commodity investments. Damage to facilities and infrastructure of MLPs may significantly affect the value of an investment and may incur environmental costs and liabilities due to the nature of their business. MLPs are subject to significant regulation and may be adversely affected by changes in the regulatory environment. Investments in smaller companies involve additional risks, such as limited liquidity and greater volatility. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. MLPs are subject to certain risks inherent in the structure of MLPs, including complex tax structure risks, limited ability for election or removal of management, limited voting rights, potential dependence on parent companies or sponsors for revenues to satisfy obligations, and potential conflicts of interest between partners, members and affiliates.

Earnings growth for a Fund holding does not guarantee a corresponding increase in the market value of the holding or the Fund.

The Alerian MLP Index is a composite of the 50 most prominent energy Master Limited Partnerships. You cannot invest directly in an index.

The MainGate MLP Fund is distributed by Quasar Distributors, LLC.

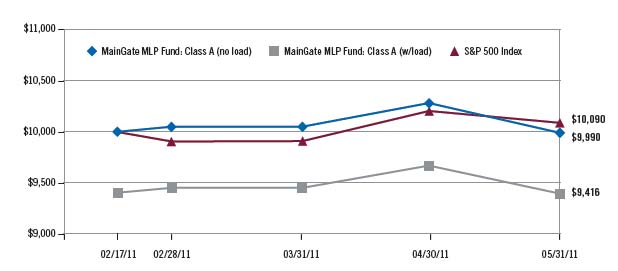

Hypothetical Growth of a $10,000 Investment in Class A Shares

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund as of the Fund’s inception date on 2/17/11. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. |

Average Annual Returns

May 31, 2011 | unaudited

| | 1 Year | 5 Year | Since Inception* | Inception Date |

| Class A (without sales load) | n/a | n/a | -0.10% | 2/17/11 |

| Class A (with sales load) | n/a | n/a | -5.84% | 2/17/11 |

| Class I | n/a | n/a | 0.00% | 2/17/11 |

| S&P 500 Index | n/a | n/a | 0.90% | 2/17/11 |

*Periods of one year or less in length are cumulative.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent quarter end may be obtained by calling 855.MLP.FUND (855.657.3863) or by visiting www.maingatefunds.com.

Class A and Class I shares were first available on February 17, 2011.

Class A performance has been restated to reflect the maximum sales charge of 5.75%. Class I is not subject to a sales charge.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. You cannot invest directly in an index.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares.

Semi-Annual Report 2011● 7

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and

held for the entire period from February 17, 2011 (commencement of operations) to May 31, 2011.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect current and deferred income tax expense or any transactional costs, such as sales charges (loads) or exchange fees. Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these current and deferred income tax expense and transaction costs were included, your costs would have been higher.

| | Beginning Account Value (02/17/2011) | Ending Account Value (05/31/2011) | Expenses Paid During Period(1) (02/17/11 – 05/31/11) | Annualized Expense Ratio(2) |

| Class A Actual | $1,000 | $999.00 | $4.98 | 1.75% |

Class A Hypothetical (5% return before expenses) | $1,000 | $1,009.26 | $5.01 | 1.75% |

| Class I Actual | $1,000 | $1,000.00 | $4.27 | 1.50% |

Class I Hypothetical (5% return before expenses) | $1,000 | $1,009.97 | $4.30 | 1.50% |

(1) Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 104 days (the number of days in the most recent period)/365 days (to reflect the period).

(2) Annualized expense ratio excludes current and deferred income tax expense.

Schedule of Investments | May 31, 2011 | unaudited

Master Limited Partnerships and Related Companies, United States: 96.3%(1) | | Shares | | | Fair Value | |

Crude/Refined Products Pipelines and Storage: 25.9%(1) | | | | | | |

| Buckeye Partners, L.P. | | | 530 | | | $ | 33,629 | |

| Genesis Energy, L.P. | | | 3,070 | | | | 84,210 | |

Kinder Morgan, Inc.(3) | | | 600 | | | | 17,574 | |

Kinder Morgan Management, LLC(2) | | | 531 | | | | 34,627 | |

| Magellan Midstream Partners, L.P. | | | 785 | | | | 46,362 | |

| Plains All American Pipeline, L.P. | | | 1,610 | | | | 100,206 | |

| Sunoco Logistics Partners, L.P. | | | 425 | | | | 35,955 | |

| Tesoro Logistics, L.P | | | 3,500 | | | | 86,940 | |

| | | | | | | | 439,503 | |

| | | | | | | | | |

Natural Gas/Natural Gas Liquid Pipelines and Storage: 33.6%(1) | | | | | |

| El Paso Pipeline Partners, L.P. | | | 2,830 | | | $ | 97,267 | |

| Energy Transfer Equity, L.P. | | | 2,345 | | | | 98,818 | |

| Energy Transfer Partners, L.P. | | | 335 | | | | 15,916 | |

| Enterprise Products Partners, L.P. | | | 3,180 | | | | 132,415 | |

| Niska Gas Storage Partners LLC | | | 800 | | | | 15,528 | |

| ONEOK Partners, L.P. | | | 545 | | | | 45,420 | |

| Spectra Energy Partners, L.P. | | | 960 | | | | 30,720 | |

| Williams Partners, L.P. | | | 2,550 | | | | 134,946 | |

| | | | | | | | 571,030 | |

Natural Gas Gathering/Processing: 34.9% (1) | | | | | | | | |

| Copano Energy, LLC | | | 4,020 | | | $ | 134,911 | |

Crosstex Energy, Inc.(3) | | | 10,490 | | | | 118,432 | |

| Crosstex Energy, L.P. | | | 960 | | | | 17,597 | |

| Eagle Rock Energy Partners, L.P. | | | 4,600 | | | | 53,452 | |

| MarkWest Energy Partners, L.P. | | | 1,045 | | | | 49,658 | |

| Regency Energy Partners, L.P. | | | 3,240 | | | | 81,616 | |

Targa Resources Corp.(3) | | | 2,450 | | | | 85,554 | |

| Targa Resources Partners, L.P. | | | 1,485 | | | | 51,322 | |

| | | | | | | | 592,542 | |

Propane: 1.9%(1) | | | | | | | | |

| Inergy, L.P. | | | 850 | | | $ | 31,527 | |

| | | | | | | | | |

| Total Master Limited Partnerships and Related Companies (Cost $1,532,724) | | | | | | $ | 1,634,602 | |

Total Investments: 96.3%(1) (Cost $1,532,724) | | | | | | $ | 1,634,602 | |

Assets in Excess of Other Liabilities: 3.7%(1) | | | | | | | 62,964 | |

Net Assets Applicable to Common Stockholders: 100.0%(1) | | | | | | $ | 1,697,566 | |

(1) Calculated as a percentage of net assets applicable to com mon stockholders. (2) Security distributions are paid-in-kind. (3) MLP general partner interest.

See Accompanying Notes to the Financial Statements.

Semi-Annual Report 2011● 9

Statement of Assets and Liabilities

May 31, 2011 | unaudited

| Assets | | | |

| Investments at fair value (cost $1,532,724) | | $ | 1,634,602 | |

| Cash and cash equivalents | | | 101,650 | |

| Receivable from Advisor (Note 4) | | | 188,852 | |

| Deferred offering costs | | | 40,108 | |

| Total assets | | | 1,965,212 | |

| | | | | |

| Liabilities | | | | |

| Deferred tax liability | | | 38,164 | |

| Accrued expenses and other liabilities | | | 229,482 | |

| Total liabilities | | | 267,646 | |

| Net assets applicable to common stockholders | | $ | 1,697,566 | |

| | | | | |

| Net Assets Applicable to Common Stockholders Consist of | | | | |

| Additional paid-in capital | | $ | 1,635,299 | |

| Undistributed net investment loss, net of income taxes | | | (689 | ) |

| Accumulated realized loss, net of income taxes | | | (208 | ) |

| Net unrealized gain on investments, net of income taxes | | | 63,164 | |

| Net assets applicable to common stockholders | | $ | 1,697,566 | |

Unlimited shares authorized | | Class A | | | Class I | |

| Net assets | | $ | 4,996 | | | $ | 1,692,570 | |

| Shares issued and outstanding | | | 500 | | | | 169,175 | |

Net asset value, redemption price and minimum offering price per share | | $ | 9.99 | | | $ | 10.00 | |

Maximum offering price per share ($9.99/0.9425) | | $ | 10.60 | | | NA | |

Statement of Operations

February 17, 2011(1) – May 31, 2011 | unaudited

| Investment Income | | | |

| Distributions received from master limited partnerships | | $ | 1,167 | |

| Less: return of capital on distributions | | | (1,050 | ) |

| Distribution income from master limited partnerships | | | 117 | |

| Dividends from common stock | | | 94 | |

| Total Investment Income | | | 211 | |

Expenses | | | | |

| Professional fees | | | 39,341 | |

| Registration fees | | | 26,030 | |

| Offering costs | | | 15,768 | |

| Administrator fees | | | 13,699 | |

| Reports to stockholders | | | 12,566 | |

| Trustees’ fees | | | 10,767 | |

| Transfer agent expense | | | 10,197 | |

| Insurance expense | | | 4,233 | |

| Advisory fees | | | 1,099 | |

| Custodian fees and expenses | | | 721 | |

| 12b-1 shareholder servicing fee - Class A | | | 3 | |

| Other expenses | | | 5,665 | |

| Total Expenses | | | 140,089 | |

| Less: expense reimbursement by Advisor | | | (138,767 | ) |

| Net Expenses | | | 1,322 | |

| Net Investment Loss, before Income Taxes | | | (1,111 | ) |

| Deferred tax benefit | | | 422 | |

| Net Investment Loss | | | (689 | ) |

| | | | | |

| Realized and Unrealized Gain (Loss) on Investments | | | | |

| Net realized loss on investments, before income taxes | | | (336 | ) |

| Deferred tax benefit | | | 128 | |

| Net realized loss on investments | | | (208 | ) |

| Net change in unrealized appreciation of investments, before income taxes | | | 101,878 | |

| Deferred tax expense | | | (38,714 | ) |

| Net change in unrealized appreciation of investments | | | 63,164 | |

| Net Realized and Unrealized Gain on Investments | | | 62,956 | |

Increase in Net Assets Applicable to Common Stockholders Resulting from Operations | | $ | 62,267 | |

(1) Commencement of operations.

See Accompanying Notes to the Financial Statements.

Statement of

Changes in Net Assets

Operations | February 17, 2011(1) – May 31, 2011 unaudited | |

| | | |

| Net investment loss | | $ | (689 | ) |

| Net realized loss on investments | | | (208 | ) |

| Net change in unrealized appreciation of investments | | | 63,164 | |

Net increase in net assets applicable to common stockholders resulting from operations | | | 62,267 | |

Capital Share Transactions(Note 8) | | | | |

| Proceeds from shareholder subscriptions | | | 1,635,299 | |

Net increase in net assets applicable to common stockholders from capital share transactions | | | 1,635,299 | |

| Total increase in net assets applicable to common stockholders | | | 1,697,566 | |

Net Assets | | | | |

| Beginning of period | | | — | |

| End of period | | $ | 1,697,566 | |

Undistributed net investment loss at the end of the period, net of income taxes | | $ | (689 | ) |

(1) Commencement of operations.

See Accompanying Notes to the Financial Statements.

Semi-Annual Report 2011● 11

Financial Highlights:

Class A Shares

Per Common Share Data(2) | February 17, 2011(1) – May 31, 2011 unaudited |

| Net Asset Value, beginning of period | | $ | — | |

| Public offering price | | | 10.00 | |

| Income from Investment Operations | | | | |

Net investment loss(3) | | | (0.03 | ) |

| Net realized and unrealized gain on investments | | | 0.02 | |

| Total increase from investment operations | | | (0.01 | ) |

| Net Asset Value, end of period | | $ | 9.99 | |

| Total Investment Return | | | (0.10 | )%(4) |

Supplemental Data and Ratios | | | | |

| Net assets applicable to common stockholders, end of period | | $ | 4,996 | |

Ratio of expenses (including net deferred income tax expense) to average net assets before waiver(5,6) | | | 203.03 | % |

Ratio of expenses (including net deferred income tax expense) to average net assets after waiver(5,6) | | | 45.14 | % |

Ratio of expenses (excluding net deferred income tax expense) to average net assets before waiver(5,6) | | | 159.61 | % |

Ratio of expenses (excluding net deferred income tax expense) to average net assets after waiver(5,6) | | | 1.72 | % |

Ratio of net investment loss (including net deferred income tax expense) to average net assets before waiver(5,6) | | | (202.79 | )% |

Ratio of net investment loss (including net deferred income tax expense) to average net assets after waiver(5,6) | | | (44.90 | )% |

Ratio of net investment loss (excluding net deferred income tax expense) to average net assets before waiver(5,6) | | | (159.37 | )% |

Ratio of net investment loss (excluding net deferred income tax expense) to average net assets after waiver(5,6) | | | (148 | )% |

Portfolio turnover rate(7) | | | 1.16 | %(4) |

| (1) | Commencement of operations. |

| (2) | Information presented relates to a share of common stock outstanding for the entire period. |

| (3) | Calculated using average shares outstanding method. |

| (4) | Not Annualized. |

| (5) | For periods less than one full year all income and expenses are annualized. |

| (6) | For the period from February 17, 2011 to May 31, 2011, the Fund accrued $38,164 in net deferred tax expense, of which $610 is attributable to Class A. |

| (7) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

Financial Highlights:

Class I Shares

Per Common Share Data(2) | February 17, 2011(1) – May 31, 2011 unaudited |

| Net Asset Value, beginning of period | | $ | — | |

| Public offering price | | | 10.00 | |

| Income from Investment Operations | | | | |

Net investment loss(3) | | | (0.02 | ) |

| Net realized and unrealized gain on investments | | | 0.02 | |

| Total increase from investment operations | | | 0.00 | |

| Net Asset Value, end of period | | $ | 10.00 | |

| Total Investment Return | | | 0.00 | %(4) |

| Supplemental Data and Ratios | | | | |

| Net assets applicable to common stockholders, end of period | | $ | 1,692,570 | |

Ratio of expenses (including net deferred income tax expense) to average net assets before waiver(5,6) | | | 202.81 | % |

Ratio of expenses (including net deferred income tax expense) to average net assets after waiver(5,6) | | | 44.92 | % |

Ratio of expenses (excluding net deferred income tax expense) to average net assets before waiver(5,6) | | | 159.39 | % |

Ratio of expenses (excluding net deferred income tax expense) to average net assets after waiver(5,6) | | | 1.50 | % |

Ratio of net investment loss (including net deferred income tax expense) to average net assets before waiver(5,6) | | | (202.57 | )% |

Ratio of net investment loss (including net deferred income tax expense) to average net assets after waiver(5,6) | | | (44.68 | )% |

Ratio of net investment loss (excluding net deferred income tax expense) to average net assets before waiver(5,6) | | | (159.15 | )% |

Ratio of net investment loss (excluding net deferred income tax expense) to average net assets after waiver(5,6) | | | (1.26 | )% |

Portfolio turnover rate(7) | | | 1.16 | %(4) |

| (1) | Commencement of operations. |

| (2) | Information presented relates to a share of common stock outstanding for the entire period. |

| (3) | Calculated using average shares outstanding method. |

| (4) | Not Annualized. |

| (5) | For periods less than one full year all income and expenses are annualized. |

| (6) | For the period from February 17, 2011 to May 31, 2011, the Fund accrued $38,164 in net deferred tax expense, of which $37,554 is attributable to Class I. |

| (7) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

See Accompanying Notes to the Financial Statements.

Notes to

Financial Statements

May 31, 2011 | unaudited

1. Organization

MainGate MLP Fund (the “Fund”), a series of MainGate Trust (the “Trust”), is registered under the Investment Company Act of 1940 as an open-end, non-diversified investment company and was established under the laws of Delaware by an Agreement and Declaration of Trust dated November 3, 2010. The Fund’s investment objective is total return. The Fund commenced operations on February 17, 2011.

The Fund offers two classes of shares, Class A and Class I. Class A shares are subject to a 5.75% front-end sales charge. Class I shares have no sales charge.

2. Significant Accounting Policies

A. Use of Estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, recognition of distribution income and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

B. Investment Valuation. The Fund uses the following valuation methods to determine fair value as either current market value for investments for which market quotations are available, or if not available, fair value, as determined in good faith pursuant to such policies and procedures as may be approved by the Trust’s Board of Trustees (“Board of Trustees”) from time to time. The valuation of the portfolio securities of the Fund currently includes the following processes:

| • | Equity Securities: Securities listed on a securities exchange or an automated quotation system for which quotations are readily available, including securities traded over the counter, will be valued at the last quoted sale price on the principal exchange on which they are traded on the valuation date (or at approximately 4:00 p.m. Eastern Time if a security’s principal exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. |

| • | Fixed Income Securities: Debt and fixed income securities will be priced by independent, third-party pricing agents approved by the Board of Trustees. These third-party pricing agents will employ methodologies that they believe are appropriate, including actual market transactions, broker-dealer supplied valuations, matrix pricing, or other electronic data processing techniques. These techniques generally consider such factors as security prices, yields, maturities, call features, ratings and developments relating to specific securities in arriving at valuations. Debt obligations with remaining maturities of sixty days or less will be valued at their amortized cost, which approximates fair market value. |

| • | Foreign Securities: Foreign securities are often principally traded on markets that close at different hours than U.S. markets. Such securities will be valued at their most recent closing prices on the relevant principal exchange even if the close of that exchange is earlier than the time of the Fund’s net asset value (“NAV”) calculation. However, securities traded in foreign markets which remain open as of the time of the NAV calculation will be valued at the most recent sales price as of the time of the NAV calculation. In addition, prices for certain foreign securities may be obtained from the Fund’s approved pricing sources. The Adviser must also monitor for the occurrence of significant events that may cast doubts on the reliability of previously obtained market prices for foreign securities held by the Fund. The prices for foreign securities will be reported in local currency and converted to U.S. dollars using currency exchange rates. Exchange rates will be provided daily by recognized independent pricing agents. The exchange rates used for the conversion will be captured as of the London close each day. |

C. Security Transactions, Investment Income andExpenses. Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on a specific identified cost basis. Interest income is recognized on the accrual basis, including amortization of premiums and accretion of discounts. Distributions are recorded on the ex-dividend date. Distributions received from the Fund’s investments in master limited partnerships (“MLPs”) generally are comprised of ordinary income, capital gains and return of capital from the MLP. The Fund records investment income on the ex-date of the distributions. For financial statement purposes, the Fund uses return of capital and income estimates to allocate the dividend income received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded, as the actual character of these distributions is not known until after the fiscal year end of the Fund.

The Fund estimates the allocation of investment income and return of capital for the distributions received from MLPs within the Statement of Operations. The Fund has estimated approximately 10% of the distributions to be from investment income with the remaining balance to be return of capital.

Semi-Annual Report 2011● 13

Expenses are recorded on the accrual basis. The Fund expensed organizational costs as incurred and amortizes offering costs over a one-year period from the commencement of operations. These costs consisted of legal fees pertaining to the Fund’s shares offered for sale, preparing the initial registration statement and printing the prospectus, and SEC and state registration fees. For the period February 17, 2011 (commencement of operations) through May 31, 2011, $15,768 has been amortized and listed in the Statement of Operations.

D. Dividends and Distributions to Stockholders. Dividends and distributions to common stockholders will be recorded on the ex-dividend date. The character of dividends and distributions to common stockholders made during the period may differ from their ultimate characterization for federal income tax purposes. For the period February 17, 2011 (commencement of operations) to May 31, 2011, the Fund did not pay any distributions to shareholders.

E. Federal Income Taxation. The Fund, taxed as a corporation, is obligated to pay federal and state income tax on its taxable income. Currently, the maximum marginal regular federal income tax rate for a corporation is 35%. The Fund may be subject to a 20% federal alternative minimum tax on its federal alternative minimum taxable income to the extent that its alternative minimum tax exceeds its regular federal income tax.

The Fund invests its assets primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Fund reports its allocable share of the MLP’s taxable income in computing its own taxable income. The Fund’s tax expense or benefit is included in the Statement of Operations based on the component of income or gains (losses) to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is recognized if, based on the weight of available evidence, it is more likely than not that some portion or all of the deferred income tax asset will not be realized.

The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes as an income tax expense on the Statement of Operations. As of May 31, 2011, the Fund did not have interest or penalties associated with underpayment of income taxes.

The Fund has reviewed all open tax years and major jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on a tax return. Generally, tax returns are open for examination by tax authorities for a period of three years from the date such returns were filed.

F. Cash and Cash Equivalents. The Fund considers all highly liquid investments purchased with initial maturity equal to or less than three months to be cash equivalents.

G. Cash Flow Information. The Fund intends to make quarterly distributions from investments, which include the amount received as cash distributions from MLPs and common stock dividends. These activities will be reported in the Statements of Changes in Net Assets.

H. Indemnifications. Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Trust may enter into contracts that provide general indemnification to other parties. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred, and may not occur. However, the Trust has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

I. Recent Accounting Pronouncement. In May 2011, the FASB issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements” in GAAP and the International Financial Reporting Standards (“IFRSs”). ASU No. 2011-04 amends FASB ASC Topic 820, Fair Value Measurements and Disclosures, to establish common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP and IFRSs. ASU No. 2011-04 is effective for fiscal years beginning after December 15, 2011 and for interim periods within those fiscal years. Management is currently evaluating these amendments and does not believe they will have a material impact on the Fund’s financial statements.

3. Fair Value Measurements

Various inputs that are used in determining the fair value of the Fund’s investments are summarized in the three broad levels listed below:

| • | Level 1: quoted prices in active markets for identical securities |

| • | Level 2: other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3: significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

These inputs are summarized in the three broad levels that follow.

| | | | | | Fair Value Measurements at Reporting Date Using: | |

Description | | Fair Value at May 31, 2011 | | | Quoted Prices in Active Markets for IdenticalAssets (Level 1) | | | Significant Other Observable Inputs (Level 2) | | | Significant Unobservable Inputs (Level 3) | |

| Equity Securities | | | | | | | | | | | | |

Master Limited Partnerships and and Related Companies(1) | | $ | 1,634,602 | | | $ | 1,634,602 | | | $ | — | | | $ | — | |

| Total | | $ | 1,634,602 | | | $ | 1,634,602 | | | $ | — | | | $ | — | |

(1) All other industry classifications are identified in the Schedule of Investments.

The Fund did not hold Level 2 or Level 3 investments at any time during the period February 17, 2011 (commencement of operations) May 31, 2011. There were no significant transfers into and out of Level 1 and Level 2 during the current period presented. It is the Fund’s policy to record transfers between Level 1 and Level 2 at the end of the reporting period.

4. Concentrations of Risk

The Fund’s investment objective is to seek to generate total return. The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets, plus any borrowings for investment purposes, in MLP interests.

5. Agreements and Related Party Transactions

The Trust has entered into an Investment Advisory Agreement (the “Agreement”) with Chickasaw Capital Management, LLC (the “Adviser”). Under the terms of the Agreement, the Fund will pay the Adviser a fee, payable at the end of each calendar month, at an annual rate equal to 1.25% of the average daily net assets of the Fund.

The Adviser paid the initial organizational and offering expenses of the Fund. The Adviser has agreed to waive its advisory fee and/ or reimburse certain expenses of the Fund, until at least March 31, 2012, but only to the extent necessary so that the Fund’s total annual expenses, excluding brokerage fees and commissions; borrowing costs (such as (a) interest and (b) dividend expenses on securities sold short); taxes; any indirect expenses, such as acquired fund fees and expenses; 12b-1 fees, and extraordinary expenses, do not exceed 1.50% of the average daily net assets of each class of the Fund. Any payment by the Adviser of the Fund’s operating expenses is subject to repayment by the Fund in the three fiscal years following the fiscal year in which the payment was made; provided that the Fund is able to make the repayment without exceeding the 1.50% expense limitation. For the period from February 17, 2011 (commencement of perations) to May 31, 2011, the Adviser waived expenses in the amount of $189,951, which can be recouped on or before November 30, 2014. As of the release date of this report, the receivable of $188,852 has been paid to the Fund by the Adviser.

The Fund has entered into a Rule 12b-1 distribution agreement with Quasar Distributors, LLC (“Quasar”). Class A shareholders pay Rule 12b-1 fees to Quasar at the annual rate of 0.25% of average daily net assets. For the period from February 17, 2011 through May 31, 2011, 12b-1 distribution expenses of $3 were accrued by Class A shares.

The Fund has engaged U.S. Bancorp Fund Services, LLC to serve as the Fund’s administrator. The Fund pays the administrator a monthly fee computed at an annual rate of 0.10% of the first $75,000,000 of the Fund’s average daily net assets, 0.08% on the next $250,000,000 of average daily net assets and 0.05% on the balance of the Fund’s average daily net assets, with a minimum annual fee of $64,000, imposed upon the Fund reaching certain asset levels.

U.S. Bancorp Fund Services, LLC serves as the Fund’s transfer agent, dividend paying agent, and agent for the automatic dividend reinvestment plan. The Fund pays the transfer agent a $30,000 flat fee, imposed upon the Fund reaching certain asset levels, plus transaction and other out-of-pocket charges.

Semi-Annual Report 2011● 15

U.S. Bank, N.A. serves as the Fund’s custodian. The Fund pays the custodian a monthly fee computed at an annual rate of 0.0075% of the first $250 million of market value and 0.0050% of the balance, with a minimum annual fee of $4,800, imposed upon Fund reaching certain asset levels.

6. Income Taxes

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amount of assets and liabilities for financial reporting and tax purposes. Components of the Fund’s deferred tax assets and liabilities as of May 31, 2011, are as follows:

| Deferred tax assets: | | | |

| Net operating loss carryforward | | $ | 422 | |

| Capital loss carryforward | | | 128 | |

| Total deferred tax assets | | | 550 | |

| Less: Deferred tax liabilities: | | | | |

| Unrealized gain on investment securities | | | 38,714 | |

| Net deferred tax expense | | $ | 38,164 | |

Total income tax benefit (current and deferred) differs from the amount computed by applying the federal statutory income tax rate of 35% to net investment income and realized and unrealized gains (losses) on investments before taxes for the period February 17, 2011 (commencement of operations) to May 31, 2011, as follows:

| Application of statutory income tax rate | | $ | 35,151 | |

| State income taxes (net of federal benefit) | | | 3,013 | |

| Total tax expense | | $ | 38,164 | |

At May 31, 2011 the cost basis of investments was $1,532,724 and gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows:

| Gross unrealized appreciation | | $ | 104,827 | |

| Gross unrealized depreciation | | | (2,949 | ) |

| Net unrealized appreciation | | $ | 101,878 | |

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on U.S. tax returns and state tax returns filed since inception of the Fund. No income tax returns are currently under examination. The tax period ended May 31, 2011 remains subject to examination by the tax authorities in the United States. Due to the nature of the Fund’s investments, the Fund may be required to file income tax returns in several states. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

7. Investment Transactions

For the period February 17, 2011 (commencement of operations) to May 31, 2011, the Fund purchased (at cost) and sold securities (proceeds) in the amount of $1,539,701 and $5,591 (excluding short-term securities), respectively.

8. Common Stock

Transactions of shares of the Fund were as follows:

February 17, 2011(1) – May 31, 2011 |

| Class A Shares | Amount | Shares |

| Sold | $5,000 | 500 |

| Redeemed | — | — |

Net Increase | $5,000 | 500 |

Class I Shares | Amount | Shares |

| Sold | $1,630,299 | 169,175 |

| Redeemed | — | — |

| Net Increase | $1,630,299 | 169,175 |

(1) Commencement of operations.

The Fund has adopted standards which establish general standards of accounting for disclosure of events that occur after the Statement of Assets & Liabilities date, but before the financial statements are issued. The Fund has performed an evaluation of subsequent events through the date the financial statements were issued and has not identified any such events that require disclosure.

Additional Information

May 31, 2011 | unaudited

Trustee and Officer Compensation

The Fund does not compensate any of its trustees who are interested persons nor any of its officers. For the period ended May 31, 2011 the Fund incurred but did not pay any fees to its independent trustees. The Fund did not pay any special compensation to any of its trustees or officers. The Fund’s Statement of Additional Information includes additional information about the trustees and is available on the Fund’s Web site at www.maingatefunds.com or the SEC’s Web site at www.sec.gov.

Cautionary Note Regarding

Forward-Looking Statements

This report contains “forward-looking statements” as defined under the U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to materially differ from the Fund’s historical experience and its present expectations or projections indicated in any forward-looking statements. These risks include, but are not limited to, changes in economic and political conditions; regulatory and legal changes; MLP industry risk; leverage risk; valuation risk; interest rate risk; tax risk; and other risks discussed in the Fund’s filings with the SEC. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Fund undertakes no obligation to update or revise any forward-looking statements made herein. There is no assurance that the Fund’s investment objectives will be attained.

Proxy Voting Policies

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities owned by the Fund and information regarding how the Fund voted proxies relating to the portfolio of securities during the period since inception through June 30, 2011 will available to stockholders by visiting the SEC’s Web site at www.sec.gov.

Form N-Q

The Fund files its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the SEC on Form N-Q. The Fund’s Form N-Q and statement of additional information are available without charge by visiting the SEC’s Web site at www. sec.gov. In addition, you may review and copy the Fund’s Form N-Q at the SEC’s Public Reference Room in Washington D.C. You may obtain information on the operation of the Public Reference Room by calling (800) SEC-0330.

Semi-Annual Report 2011● 17

Board Approval of

Advisory Agreement

May 31, 2011 | unaudited

On January 10, 2011, the Board of Trustees of the Trust met in person to discuss, among other items, the approval of the Investment Advisory Agreement (the “Advisory Agreement”) between the Trust and the Adviser, pursuant to which the Adviser would serve as investment adviser to the Fund. The Trustees reviewed a memorandum from legal counsel, which described the Independent Trustees’ duties and voting requirements when considering whether to approve the Advisory Agreement, pursuant to Section 15(c) of the 1940 Act. Counsel reminded the Trustees that consideration of whether to approve an advisory contract is among the most important duties in general assigned to mutual fund trustees and, in particular, to independent trustees. The Board then reviewed a draft prospectus outlining the Fund’s advisory fee and other expenses, principal investment strategies and principal risks, and other information.

The Trustees acknowledged that they had reviewed the following materials provided to them in advance of the meeting: (i) the proposed Advisory Agreement and expense cap side letter, pursuant to which the Adviser had agreed to cap certain operating expenses of the Fund at 1.50% of its average daily net assets during the Fund’s initial year of operations; (ii) information provided by the Adviser to the Board, including a description of advisory services to be provided to the Fund, qualifications of the Adviser’s portfolio managers, expected profitability from managing the Fund and ideas for future growth of the Fund; (iii) a summary of the Adviser’s Supervisory Procedures Manual, includes its Code of Ethics and Proxy Voting Policy, (iv) Adviser’s Form ADV Part I and II and accompanying schedules; (v) the Adviser’s balance sheet for November 30, 2010 and income statement for the period January 1 to November 30, 2010, and (vi) performance returns of the Adviser’s “MLP Composite” (the “Composite”) for the period October 31, 2006 to September 30, 2010, including a certification provided by ACA Compliance Group - Beacon Verification Services, which verified the Composite’s performance returns. The Trustees noted that the Composite includes returns on a gross-of-fees basis for the Adviser’s private accounts that invest in master limited partnerships (“MLPs”) and MLP affiliates listed on U.S. exchanges, and that are managed by the Adviser using an MLP investment strategy substantially similar to the strategy that the Adviser will use to manage the Fund.

After their review, the Trustees discussed the following factors: (a) Nature, extent, and quality of the services to be provided by the Adviser. The Trustees reviewed the responses from the Adviser as to the resources that it will provide to the Fund, and considered the adequacy of such resources in light of the expected growth in the levels of Fund assets. The Trustees considered that the Adviser would provide three portfolio managers to manage the Fund. They noted that although the portfolio managers have no experience managing a mutual fund, two of the portfolio managers have substantial experience investing clients’ assets in MLPs on a discretionary basis since 1996. Because the Adviser manages a number of accounts using a strategy similar to the one that it will use to manage the Fund, the Trustees sought assurances from the Adviser that trades would be allocated fairly among the Fund and the Adviser’s other accounts. The Adviser’s principals assured the Board that trades would be effected in compliance with the Adviser’s trade allocation policy. The Trustees also noted that the Trust’s Chief Compliance Officer had reviewed the Adviser’s compliance program and determined that it appears reasonably designed to prevent violations of federal securities laws by the Fund. Based on their review, the Trustees determined that the Adviser’s resources appear adequate to manage the Fund.

(b) Investment performance of the Adviser. The Trustees reviewed the performance of the Adviser’s MLP Composite. They noted that the Advisor’s MLP Composite had positive returns since its inception on October 31, 2006 (except 2008), and that the MLP Composite had substantially outperformed its benchmark (the S&P 500 Principal Only Index) for the year-to-date, one-year, three-year and since inception periods ended November 30, 2010.

(c) Cost of the services to be provided and profits to be realized by the Adviser and its affiliates from their relationships with the Fund. The Trustees confirmed that the advisory fee charged by the Adviser to its private client accounts is comparable to the advisory fee to be charged to the Fund. The Trustees noted that the Fund’s advisory fee of 1.25% of its average daily net assets was higher than the fee charged by a typical equity mutual fund advisers, and slightly higher than advisory fees charged by other MLP mutual fund advisers. The Trustees determined that the fee was reasonable based on the amount of time and level of expertise required to execute the Adviser’s unique MLP investment strategy, and also based on the Adviser’s agreement to cap certain operating expenses of the Fund at 1.50% through its initial fiscal year. They noted that the expense cap was voluntary, and that the Fund’s total operating expenses (after fee waivers and reimbursements) would be comparable to total expense ratios of other MLP open end funds. They also noted that the Adviser reported that it did not expect the Advisory Agreement to be profitable in the Fund’s first year of operations due to the Adviser’s obligation to waive its fees and pay expenses of the Fund. The Trustees noted that the Adviser’s balance sheet and income statement as of November 30, 2010 showed sufficient equity and income for the Adviser to meet this obligation to cap the Fund’s expenses.

(d) Extent to which economies of scale would be realized as the Fund grows and whether fee levels reflect these economies of scale for the benefit of fund investors. The Trustees noted that the Fund was a start-up investment company and, as such, would not realize economies of scale until its assets have grown.

(e) No “soft dollar” arrangements or affiliated brokerage commissions. The Trustees noted that the Adviser does not expect to enter into any so-called “soft dollar arrangements” using Fund brokerage commissions, nor does the Adviser anticipate using its affiliated broker-dealer to execute the Fund’s portfolio transactions.

After reviewing all of the foregoing, the Trustees noted that they had received and evaluated such information as they deemed necessary to make their decision. The Trustees noted that they had taken into account a number of factors that they believed, in light of the legal advice provided by counsel to the Trust, and their own business judgement, to be relevant. As a result, the Trustees (including the Independent Trustees voting separately), unanimously determined that the advisory fee to be paid to the Adviser (after fee waivers and reimbursements by the Adviser) was reasonable and they approved the Advisory Agreement and Expense Side Cap Letter.

Semi-Annual Report 2011● 19

Privacy Policy

The following is a description of the Fund’s policies regarding disclosure of nonpublic personal information that you provide to the Fund or that the Fund collects from other sources. In the event that you hold shares of the Fund through a broker-dealer or other financial intermediary, the privacy policy of your financial intermediary would govern how your nonpublic personal information would be shared with nonaffiliated third parties.

Categories of Information the Fund Collects. The Fund collects the following nonpublic personal information about you:

| • | Information the Fund receives from you on applications or other forms, correspondence, or conversations (such as your name, address, phone number, social security number, and date of birth); and |

| • | Information about your transactions with the Fund, its affiliates, or others (such as your account number and balance, payment history, cost basis information, and other financial information). |

Categories of Information the Fund Discloses. The Fund does not disclose any nonpublic personal information about its current or former shareholders to unaffiliated third parties, except as required or permitted by law. The Fund is permitted by law to disclose all of the information it collects, as described above, to service providers (such as the Fund’s custodian, administrator, transfer agent, accountant and legal counsel) to process your transactions and otherwise provide services to you.

Confidentiality and Security. The Fund restricts access to your nonpublic personal information to those persons who require such information to provide products or services to you. The Fund maintains physical, electronic, and procedural safeguards that comply with federal standards to guard your nonpublic personal information.

Disposal of Information. The Fund, through its transfer agent, has taken steps to reasonably ensure that the privacy of your nonpublic personal information is maintained at all times, including in connection with the disposal of information that is no longer required to be maintained by the Fund. Such steps shall include, whenever possible, shredding paper documents and records prior to disposal, requiring off-site storage vendors to shred documents maintained in such locations prior to disposal, and erasing and/or obliterating any data contained on electronic media in such a manner that the information can no longer be read or reconstructed.

Fund Service Providers

May 31, 2011 | unaudited

Board of Trustees

Geoffrey P. Mavar*, Chairman of the Board

David C. Burns, Independent Trustee

Moss W. Davis, Independent Trustee

Marshall K. Gramm, Independent Trustee

Matthew G. Mead*, Interested Trustee

Robert A. Reed, Lead Independent Trustee

Barry A. Samuels, Independent Trustee

Darrison N. Wharton, Independent Trustee

Officers

Matthew G. Mead*, President and Chief Executive Officer

Geoffrey P. Mavar*, Treasurer and Chief Financial Officer

Salvatore Faia, Chief Compliance Officer

Debra McAdoo*, Secretary

Investment Advisor

Chickasaw Capital Management, LLC

6075 Poplar Avenue, Suite 402, Memphis, TN 38119

Distributor

Quasar Distributors, LLC

615 East Michigan Street, Milwaukee, WI 53202

Custodian

U.S. Bank, N.A.

1555 N. River Center Drive, Suite 302, Milwaukee, WI 53212

Transfer Agent

U.S. Bancorp Fund Services, LLC

615 East Michigan Street, 3rd Floor, Milwaukee, WI 53202

Administrator

U.S. Bancorp Fund Services, LLC

777 East Wisconsin Street, 5th Floor, Milwaukee, WI 53202

Legal Counsel

Thompson Couburn LLP

One U.S. Bank Plaza, St. Louis, MO 63101

Independent Registered Public Accounting Firm

Cohen Fund Audit Services, Ltd.

800 Westpoint Parkway, Suite 1100, Westlake, OH 44145

*Employed by Chickasaw Capital Management, LLC.

Semi-Annual Report 2011● 21

Notes

BACK COVER | NOT PART OF REPORT

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

Not Applicable.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President and Chief Financial Officer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable. |

(2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) MainGate MLP Fund

By (Signature and Title) /s/ Matthew G. Mead

Matthew G. Mead, President & Chief Executive Officer

Date August 3, 2011

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title) /s/ Matthew G. Mead

Matthew G. Mead, President & Chief Executive Officer

Date August 3, 2011 ��

By (Signature and Title) /s/ Geoffrey P. Mavar

Geoffrey P. Mavar, Treasurer & Chief Financial Officer

Date August 3, 2011

3