6075 Poplar Avenue, Suite 720 | Memphis, TN 38119 | 855.MLP.FUND (855.657.3863) | www.maingatefunds.com

May 31, 2015 │ unaudited

| | | | | |

| Assets | | | | |

| Investments in unaffiliated issuers at fair value (cost $1,094,689,791) | | $ | 1,351,526,188 | |

| Investments in affiliated issuer at fair value (Note 8) (cost $23,443,617) | | $ | 28,479,000 | |

| Cash | | | 47,666,902 | |

| Receivable for investments sold | | | 16,325,830 | |

| Receivable for Fund shares sold | | | 2,823,543 | |

| Prepaid expenses | | | 192,631 | |

| Total assets | | | 1,447,014,094 | |

| Liabilities | | | | |

| Payable to Adviser | | | 1,428,593 | |

| Payable for investments purchased | | | 1,255,620 | |

| Deferred tax liability, net | | | 86,613,074 | |

| Payable for Fund shares redeemed | | | 1,191,779 | |

| Accrued expenses and other liabilities | | | 656,805 | |

| Total liabilities | | | 91,145,871 | |

| | | | | |

| Net assets | | $ | 1,355,868,223 | |

| | | | | |

| Net Assets Consist of | | | | |

| Additional paid-in capital | | $ | 1,207,442,377 | |

| Undistributed net investment loss, net of deferred taxes | | | (10,440,038 | ) |

| Accumulated realized loss, net of deferred taxes | | | (5,865,637 | ) |

| Net unrealized appreciation on investments, net of deferred taxes | | | 164,731,521 | |

| Net assets | | $ | 1,355,868,223 | |

| | | | | | | | | | | | | |

| Unlimited shares authorized, no par value | | Class A | | | Class C | | | Class I | |

| Net assets | | $ | 198,218,532 | | | $ | 38,643,049 | | | $ | 1,119,006,642 | |

| Shares issued and outstanding | | | 15,181,289 | | | | 2,957,048 | | | | 84,623,355 | |

| Net asset value, redemption price and minimum offering price per share | | $ | 13.06 | | | $ | 13.07 | | | $ | 13.22 | |

| Maximum offering price per share ($13.06/0.9425) | | $ | 13.85 | | | | NA | | | | NA | |

December 1, 2014 – May 31, 2015 │ unaudited

| | | | | |

| Investment Income | | | | |

| Distributions received from master limited partnerships (includes $587,840 from affiliated issuer (Note 8)) | | $ | 23,725,673 | |

| Less: return of capital on distributions | | | (22,776,810 | ) |

| Distribution income from master limited partnerships | | | 948,863 | |

| Dividends from common stock | | | 5,125,869 | |

| Total Investment Income | | | 6,074,732 | |

| | | | | |

| Expenses | | | | |

| Advisory fees | | | 7,516,882 | |

| Administrator fees | | | 356,404 | |

| Transfer agent expense | | | 213,046 | |

| Registration fees | | | 120,170 | |

| Reports to shareholders | | | 96,361 | |

| Professional fees | | | 49,600 | |

| Custodian fees and expenses | | | 33,633 | |

| Trustees’ fees | | | 30,169 | |

| Compliance fees | | | 24,650 | |

| Insurance expense | | | 18,767 | |

| Fund accounting fees | | | 687 | |

| Franchise tax expense | | | 106 | |

| 12b-1 shareholder servicing fee - Class A | | | 233,900 | |

| 12b-1 shareholder servicing fee - Class C | | | 159,488 | |

| Other expenses | | | 9,104 | |

| Total Expenses | | | 8,862,967 | |

| Plus: expense recoupment by Adviser | | | 394,137 | |

| Net Expenses | | | 9,257,104 | |

| Net Investment Loss, before Deferred Taxes | | | (3,182,372 | ) |

| Deferred tax benefit | | | 1,897,174 | |

| Net Investment Loss | | | (1,285,198 | ) |

| Realized and Unrealized Gain (Loss) on Investments | | | | |

| Net realized loss on investments in unaffiliated issuers, before income taxes | | | (10,623,193 | ) |

| Deferred tax benefit | | | 3,927,489 | |

| Net realized loss on investments in unaffiliated issuers | | | (6,695,704 | ) |

| Net change in unrealized appreciation of investments in unaffiliated issuers, before income taxes | | | 16,646,398 | |

| Net change in unrealized appreciation of investments in affiliated issuer, before income taxes | | | 1,584,000 | |

| Deferred tax expense | | | (6,729,541 | ) |

| Net change in unrealized appreciation of investments | | | 11,500,857 | |

| Net Realized and Unrealized Gain on Investments | | | 4,805,153 | |

| Increase in Net Assets Applicable to Shareholders Resulting from Operations | | $ | 3,519,955 | |

| | |

12 │ MainGate mlp fund | See Accompanying Notes to the Financial Statements. |

| | | | | | | | | |

| | | December 1, 2014 – May 31, 2015 | | | Year Ended November 30, 2014 | |

| Operations | | unaudited | | | | |

| Net investment loss, net of deferred taxes | | $ | (1,285,198 | ) | | $ | (4,196,564 | ) |

| Net realized gain (loss) on investments, net of deferred taxes | | | (6,695,704 | ) | | | 1,776,044 | |

| Net change in unrealized appreciation of investments, net of deferred taxes | | | 11,500,857 | | | | 92,631,633 | |

| Net increase in net assets resulting from operations | | | 3,519,955 | | | | 90,211,113 | |

| | | | | | | | | |

| Dividends and Distributions to Class A Shareholders | | | | | | | | |

| Net investment income | | | — | | | | (734,199 | ) |

| Return of capital | | | (4,594,858 | ) | | | (7,384,671 | ) |

| Dividends and Distributions to Class C Shareholders | | | | | | | | |

| Net investment income | | | — | | | | (36,075 | ) |

| Return of capital | | | (786,994 | ) | | | (361,111 | ) |

| Dividends and Distributions to Class I Shareholders | | | | | | | | |

| Net investment income | | | — | | | | (2,739,744 | ) |

| Return of capital | | | (23,782,682 | ) | | | (27,556,716 | ) |

| Total dividends and distributions to Fund shareholders | | | (29,164,534 | ) | | | (38,812,516 | ) |

| | | | | | | | | |

| Capital Share Transactions (Note 9) | | | | | | | | |

| Proceeds from shareholder subscriptions | | | 451,276,965 | | | | 868,768,425 | |

| Dividend reinvestments | | | 24,396,050 | | | | 32,210,786 | |

| Payments for redemptions | | | (211,888,188 | ) | | | (305,483,060 | ) |

| Net increase in net assets from capital share transactions | | | 263,784,827 | | | | 595,496,151 | |

| Total increase in net assets | | | 238,140,248 | | | | 646,894,748 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of period | | | 1,117,727,975 | | | | 470,833,227 | |

| End of period | | $ | 1,355,868,223 | | | $ | 1,117,727,975 | |

| Undistributed net investment loss at the end of the period, net of income taxes | | $ | (10,440,038 | ) | | $ | (9,154,840 | ) |

| | |

| See Accompanying Notes to the Financial Statements. | SEMI-ANNUAL REPORT 2015 • 13 |

| | | | | | | | | | | | | | | | | | | | | |

Per Share Data(2) | | December 1, 2014

– May 31, 2015

unaudited | | | Year Ended

November 30,

2014 | | | Year Ended

November 30,

2013 | | | Year Ended

November 30,2012 | | | February 17, 2011(1)

– November 30, 2011 | |

| Net Asset Value, beginning of period | | $ | 13.39 | | | $ | 12.00 | | | $ | 10.37 | | | $ | 9.76 | | | $ | — | |

| Public offering price | | | — | | | | — | | | | — | | | | — | | | | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net investment loss(3) | | | (0.02 | ) | | | (0.09 | ) | | | (0.06 | ) | | | (0.06 | ) | | | (0.05 | ) |

| Net realized and unrealized gain on investments | | | 0.01 | | | | 2.11 | | | | 2.32 | | | | 1.30 | | | | 0.13 | |

| Total increase from investment operations | | | (0.01 | ) | | | 2.02 | | | | 2.26 | | | | 1.24 | | | | 0.08 | |

| Less Distributions to Shareholders | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | (0.06 | ) | | | — | | | | — | | | | — | |

| Return of capital | | | (0.32 | ) | | | (0.57 | ) | | | (0.63 | ) | | | (0.63 | ) | | | (0.32 | ) |

| Total distributions to shareholders | | | (0.32 | ) | | | (0.63 | ) | | | (0.63 | ) | | | (0.63 | ) | | | (0.32 | ) |

| Net Asset Value, end of period | | $ | 13.06 | | | $ | 13.39 | | | $ | 12.00 | | | $ | 10.37 | | | $ | 9.76 | |

| Total Investment Return | | | (0.10 | )%(4) | | | 17.01 | % | | | 22.22 | % | | | 12.89 | % | | | 0.80 | %(4) |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | $ | 198,218,532 | | | $ | 175,523,649 | | | $ | 127,777,305 | | | $ | 27,756,364 | | | $ | 1,769,297 | |

Ratio of waiver (recoupment) to average net assets(5) | | | (0.07 | )% | | | (0.05 | )% | | | 0.04 | % | | | 0.41 | % | | | 9.31 | % |

Ratio of net deferred income and franchise tax (benefit) expense to average net assets(6,7) | | | 0.08 | %(4) | | | 7.19 | % | | | 9.69 | % | | | 6.01 | % | | | 8.53 | %(4) |

Ratio of expenses (including net deferred and franchise tax expense) to average net assets before (waiver) recoupment(5,6,7) | | | 1.73 | % | | | 8.89 | % | | | 11.48 | % | | | 8.17 | % | | | 19.59 | % |

Ratio of expenses (including net deferred and franchise tax expense) to average net assets after (waiver) recoupment(5,6,7) | | | 1.80 | % | | | 8.94 | % | | | 11.44 | % | | | 7.76 | % | | | 10.28 | % |

Ratio of expenses (excluding net deferred and franchise tax expense) to average net assets before (waiver) recoupment(5,6,7) | | | 1.65 | % | | | 1.70 | % | | | 1.79 | % | | | 2.16 | % | | | 11.06 | % |

Ratio of expenses (excluding net deferred and franchise tax expense) to average net assets after (waiver) recoupment(5,6,7) | | | 1.72 | % | | | 1.75 | % | | | 1.75 | % | | | 1.75 | % | | | 1.75 | % |

Ratio of net investment loss (including net deferred tax benefit and franchise tax expense) to average net assets before waiver (recoupment) (5,7,8) | | | (0.49 | )% | | | (0.64 | )% | | | (0.58 | )% | | | (1.04 | )% | | | (9.99 | )% |

Ratio of net investment loss (including net deferred tax benefit and franchise tax expense) to average net assets after waiver (recoupment) (5,7,8) | | | (0.56 | )% | | | (0.69 | )% | | | (0.54 | )% | | | (0.63 | )% | | | (0.68 | )% |

Ratio of net investment loss (excluding net deferred tax benefit and franchise tax expense) to average net assets before waiver (recoupment) (5,7,8) | | | (0.64 | )% | | | (1.07 | )% | | | (0.99 | )% | | | (1.29 | )% | | | (10.27 | )% |

Ratio of net investment loss (excluding net deferred tax benefit and franchise tax expense) to average net assets after waiver (recoupment) (5,7,8) | | | (0.71 | )% | | | (1.12 | )% | | | (0.95 | )% | | | (0.88 | )% | | | (0.97 | )% |

Portfolio turnover rate(9) | | | 38.67 | %(4) | | | 57.83 | % | | | 90.59 | % | | | 106.26 | % | | | 175.43 | %(4) |

| (1) | Commencement of operations. |

| (2) | Information presented relates to a Class A share outstanding for the entire period. |

| (3) | Calculated using average shares outstanding method. |

| (5) | For periods less than one full year all income and expenses are annualized, except net deferred and franchise tax expense. |

| (6) | For the period from December 1, 2014 to May 31, 2015, the Fund accrued $2,802,052 in net deferred tax expense, of which $435,952 is attributable to Class A. For the year ended November 30, 2014, the Fund accrued $51,671,889 in net deferred tax expense, of which $12,226,299 is attributable to Class A. For the year ended November 30, 2013, the Fund accrued $29,149,971 in net deferred tax expense, of which $8,448,503 is attributable to Class A. For the year ended November 30, 2012, the Fund accrued $4,517,743 in net deferred tax expense, of which $741,282 is attributable to Class A. For the period from February 17, 2011 to November 30, 2011, the Fund accrued $370,357 in net deferred tax expense, of which $42,955 is attributable to Class A. |

| (7) | For the period from December 1, 2014 to May 31, 2015, the Fund accrued $106 in franchise tax expense, of which $16 is attributable to Class A. For the year ended November 30, 2014, the Fund accrued $113,535 in franchise tax expense, of which $21,899 is attributable to Class A. For the year ended November 30, 2013, the Fund accrued $37,430 in franchise tax expense, of which $10,848 is attributable to Class A. |

| (8) | For the period from December 1, 2014 to May 31, 2015, the Fund accrued $1,897,174, in net deferred tax benefit, of which $295,168 is attributable to Class A. For the year ended November 30, 2014, the Fund accrued $3,704,675, in net deferred tax benefit, of which $748,704 is attributable to Class A. For the year ended November 30, 2013, the Fund accrued $1,263,406 in net deferred tax benefit, of which $366,172 is attributable to Class A. For the year ended November 30, 2012, the Fund accrued $192,859 in net deferred tax benefit, of which $31,645 is attributable to Class A. For the period from February 17, 2011 to November 30, 2011, the Fund accrued $12,291 in net deferred tax benefit, of which $1,426 is attributable to Class A. |

| (9) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

| | |

14 │ MainGate mlp fund | See Accompanying Notes to the Financial Statements. |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | |

| | | December 1, 2014– | | | March 31, 2014(1)– | |

| | | May 31, 2015 | | | November 30, 2014 | |

Per Share Data(2) | | unaudited | | | | |

| Net Asset Value, beginning of period | | $ | 13.45 | | | $ | — | |

| Public offering price | | | — | | | | 13.00 | |

| | | | | | | | | |

| Income from Investment Operations | | | | | | | | |

Net investment loss(3) | | | (0.07 | ) | | | (0.14 | ) |

| Net realized and unrealized gain on investments | | | 0.01 | | | | 1.06 | |

| Total increase from investment operations | | | (0.06 | ) | | | 0.92 | |

| Less Distributions to Shareholders | | | | | | | | |

| Net investment income | | | — | | | | (0.04 | ) |

| Return of capital | | | (0.32 | ) | | | (0.43 | ) |

| Total distributions to shareholders | | | (0.32 | ) | | | (0.47 | ) |

| Net Asset Value, end of period | | $ | 13.07 | | | $ | 13.45 | |

| Total Investment Return | | | (0.47 | )%(4) | | | 7.09 | %(4) |

| | | | | | | | | |

| Supplemental Data and Ratios | | | | | | | | |

| Net assets, end of period | | $ | 38,643,049 | | | $ | 25,987,231 | |

Ratio of waiver (recoupment) to average net assets(5) | | | (0.07 | )% | | | (0.05 | )% |

Ratio of net deferred income and franchise tax (benefit) expense to average net assets(6,7) | | | 0.08 | %(4) | | | 2.10 | %(4) |

Ratio of expenses (including net deferred and franchise tax expense) to average net assets before (waiver) recoupment(5,6,7) | | | 2.48 | % | | | 4.55 | % |

Ratio of expenses (including net deferred and franchise tax expense) to average net assets after (waiver) recoupment(5,6,7) | | | 2.55 | % | | | 4.60 | % |

Ratio of expenses (excluding net deferred and franchise tax expense) to average net assets before (waiver) recoupment(5,6,7) | | | 2.40 | % | | | 2.45 | % |

Ratio of expenses (excluding net deferred and franchise tax expense) to average net assets after (waiver) recoupment(5,6,7) | | | 2.47 | % | | | 2.50 | % |

Ratio of net investment loss (including net deferred tax benefit and franchise tax expense) to average net assets before waiver (recoupment)(5,7,8) | | | (1.24 | )% | | | (1.58 | )% |

Ratio of net investment loss (including net deferred tax benefit and franchise tax expense) to average net assets after waiver (recoupment)(5,7,8) | | | (1.31 | )% | | | (1.63 | )% |

Ratio of net investment loss (excluding net deferred tax benefit and franchise tax expense) to average net assets before waiver (recoupment)(5,7,8) | | | (1.39 | )% | | | (1.90 | )% |

Ratio of net investment loss (excluding net deferred tax benefit and franchise tax expense) to average net assets after waiver (recoupment)(5,7,8) | | | (1.46 | )% | | | (1.95 | )% |

Portfolio turnover rate(9) | | | 38.67 | %(4) | | | 57.83 | % |

| (1) | Commencement of operations. |

| (2) | Information presented relates to a Class C share outstanding for the entire period. |

| (3) | Calculated using average shares outstanding method. |

| (5) | For periods less than one full year all income and expenses are annualized, except net deferred and franchise tax expense. |

| (6) | For the period from December 1, 2014 to May 31, 2015, the Fund accrued $2,802,052 in net deferred tax expense, of which $74,315 is attributable to Class C. For the period from March 31, 2014 to November 30, 2014, the Fund accrued $20,001,167 in net deferred tax expense, of which $265,741 is attributable to Class C. |

| (7) | For the period ended December 1, 2014 to May 31, 2015, the Fund accrued $106 in franchise tax expense, of which $3 is attributable to Class C. For the period from Match 31, 2014 to November 30, 2014, the Fund accrued $113,535 in franchise tax expense, of which $1,508 is attributable to Class C. |

| (8) | For the period ended December 1, 2014 to May 31, 2015, the Fund accrued $1,897,174 in net deferred tax benefit, of which $50,316 is attributable to Class C. For the period from March 31, 2014 to November 30, 2014, the Fund accrued $3,226,113 in net deferred tax benefit, of which $42,863 is attributable to Class C. |

| (9) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

| | |

| See Accompanying Notes to the Financial Statements. | SEMI-ANNUAL REPORT 2015 • 15 |

| | | | | | | | | | | | | | | | | | | | | |

Per Share Data(2) | | December 1, 2014

– May 31, 2015

unaudited | | | Year Ended

November 30,

2014 | | | Year Ended

November 30,

2013 | | | Year Ended

November 30,

2012 | | | February 17, 2011(1)

– November 30,

2011 | |

| Net Asset Value, beginning of period | | $ | 13.54 | | | $ | 12.10 | | | $ | 10.42 | | | $ | 9.79 | | | $ | — | |

| Public offering price | | | — | | | | — | | | | — | | | | — | | | | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net investment loss(3) | | | (0.01 | ) | | | (0.06 | ) | | | (0.03 | ) | | | (0.04 | ) | | | (0.03 | ) |

| Net realized and unrealized gain on investments | | | 0.01 | | | | 2.13 | | | | 2.34 | | | | 1.30 | | | | 0.14 | |

| Total increase from investment operations | | | (0.00 | ) | | | 2.07 | | | | 2.31 | | | | 1.26 | | | | 0.11 | |

| Less Distributions to Shareholders | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | (0.06 | ) | | | — | | | | — | | | | — | |

| Return of capital | | | (0.32 | ) | | | (0.57 | ) | | | (0.63 | ) | | | (0.63 | ) | | | (0.32 | ) |

| Total distributions to shareholders | | | (0.32 | ) | | | (0.63 | ) | | | (0.63 | ) | | | (0.63 | ) | | | (0.32 | ) |

| Net Asset Value, end of period | | $ | 13.22 | | | $ | 13.54 | | | $ | 12.10 | | | $ | 10.42 | | | $ | 9.79 | |

| Total Investment Return | | | (0.02 | )%(4) | | | 17.29 | % | | | 22.60 | % | | | 13.06 | % | | | 1.10 | %(4) |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | $ | 1,119,006,642 | | | $ | 916,217,095 | | | $ | 343,055,922 | | | $ | 90,274,137 | | | $ | 24,126,166 | |

Ratio of waiver (recoupment) to average net assets(5) | | | (0.07 | )% | | | (0.05 | )% | | | 0.04 | % | | | 0.41 | % | | | 9.31 | % |

Ratio of net deferred income and franchise tax (benefit) expense to average net assets(6,7) | | | 0.08 | %(4) | | | 6.15 | % | | | 9.69 | % | | | 6.01 | % | | | 8.53 | %(4) |

Ratio of expenses (including net deferred and franchise tax expense) to average net assets before (waiver) recoupment(5,6,7) | | | 1.48 | % | | | 7.60 | % | | | 11.23 | % | | | 7.92 | % | | | 19.34 | % |

Ratio of expenses (including net deferred and franchise tax expense) to average net assets after (waiver) recoupment(5,6,7) | | | 1.55 | % | | | 7.65 | % | | | 11.19 | % | | | 7.51 | % | | | 10.03 | % |

Ratio of expenses (excluding net deferred and franchise tax expense) to average net assets before (waiver) recoupment(5,6,7) | | | 1.40 | % | | | 1.45 | % | | | 1.54 | % | | | 1.91 | % | | | 10.81 | % |

Ratio of expenses (excluding net deferred and franchise tax expense) to average net assets after (waiver) recoupment(5,6,7) | | | 1.47 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % |

Ratio of net investment loss (including net deferred tax benefit and franchise tax expense) to average net assets before waiver (recoupment) (5,7,8) | | | (0.24 | )% | | | (0.40 | )% | | | (0.33 | )% | | | (0.79 | )% | | | (9.74 | )% |

Ratio of net investment loss (including net deferred tax benefit and franchise tax expense) to average net assets after waiver (recoupment) (5,7,8) | | | (0.31 | )% | | | (0.45 | )% | | | (0.29 | )% | | | (0.38 | )% | | | (0.43 | )% |

Ratio of net investment loss (excluding net deferred tax benefit and franchise tax expense) to average net assets before waiver (recoupment) (5,7,8) | | | (0.39 | )% | | | (0.84 | )% | | | (0.74 | )% | | | (1.04 | )% | | | (10.02 | )% |

Ratio of net investment loss (excluding net deferred tax benefit and franchise tax expense) to average net assets after waiver (recoupment) (5,7,8) | | | (0.46 | )% | | | (0.89 | )% | | | (0.70 | )% | | | (0.63 | )% | | | (0.72 | )% |

Portfolio turnover rate(9) | | | 38.67 | %(4) | | | 57.83 | % | | | 90.59 | % | | | 106.26 | % | | | 175.43 | %(4) |

| (1) | Commencement of operations. |

| (2) | Information presented relates to a Class I share outstanding for the entire period. |

| (3) | Calculated using average shares outstanding method. |

| (5) | For periods less than one full year all income and expenses are annualized, except net deferred and franchise tax expense. |

| (6) | For the period from December 1, 2014 to May 31, 2015, the Fund accrued $2,802,052 in net deferred tax expense, of which $2,291,785 is attributable to Class I. For the year ended November 30, 2014, the Fund accrued $51,671,889 in net deferred tax benefit, of which $39,179,849 is attributable to Class I. For the year ended November 30, 2013, the Fund accrued $29,149,971 in net deferred tax expense, of which $20,701,468 is attributable to Class I. For the year ended November 30, 2012, the Fund accrued $4,517,743 in net deferred tax expense, of which $3,776,461 is attributable to Class I. For the period from February 17, 2011 to November 30, 2011, the Fund accrued $370,357 in net deferred tax expense, of which $327,402 is attributable to Class I. |

| (7) | For the period from December 1, 2014 to May 31, 2015, the Fund accrued $106 in franchise tax expense, of which $87 is attributable to Class I. For the year ended November 30, 2014, the Fund accrued $113,535 in franchise tax expense, of which $90,128 is attributable to Class I. For the year ended November 30, 2013, the Fund accrued $37,430 in franchise tax expense, of which $26,582 is attributable to Class I. |

| (8) | For the period from December 1, 2014 to May 31, 2015, the Fund accrued $1,897,174 in net deferred tax benefit, of which $1,551,690 is attributable to Class I. For the year ended November 30, 2014, the Fund accrued $3,704,675 in net deferred tax benefit, of which $2,913,108 is attributable to Class I. For the year ended November 30, 2013, the Fund accrued $1,263,406 in net deferred tax benefit, of which $897,234 is attributable to Class I. For the year ended November 30, 2012, the Fund accrued $192,859 in net deferred tax benefit, of which $161,214 is attributable to Class I. For the period from February 17, 2011 to November 30, 2011, the Fund accrued $12,291 in net deferred tax benefit, of which $10,865 is attributable to Class I. |

| (9) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

| | |

16 │ MainGate mlp fund | See Accompanying Notes to the Financial Statements. |

May 31, 2015│unaudited

1. Organization

MainGate MLP Fund (the “Fund”), a series of MainGate Trust (the “Trust”), is registered under the Investment Company Act of 1940 as an open-end, non-diversified investment company. The Trust was established under the laws of Delaware by an Agreement and Declaration of Trust dated November 3, 2010. The Fund’s investment objective is total return. Class A and Class I commenced operations on February 17, 2011. Class C commenced operations on March 31, 2014.

The Fund offers three classes of shares, Class A, Class C and Class I. Class A shares are subject to a maximum 5.75% front-end sales charge. Class C shares have no front-end sales charge, but are subject to a 1.00% contingent deferred sales charge. Class I shares have no sales charge. Class A shareholders pay Rule 12b-1 fees at the annual rate of 0.25% of average daily net assets. Class C shareholders pay Rule 12b-1 fees at the annual rate of 1.00% of average daily net assets.

2. Significant Accounting Policies

A. Use of Estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the recognition of distribution income and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

B. Investment Valuation. The Fund uses the following valuation methods to determine fair value as either current market value for investments for which market quotations are available, or if not available, a fair value, as determined in good faith pursuant to such policies and procedures as may be approved by the Trust’s Board of Trustees (“Board of Trustees”) from time to time. The valuation of the portfolio securities of the Fund currently includes the following processes:

| • | Equity Securities: Securities listed on a securities exchange or an automated quotation system for which quotations are readily available, including securities traded over the counter, will be valued at the last quoted sale price on the principal exchange on which they are traded on the valuation date (or at approximately 4:00 p.m. Eastern Time if a security’s principal exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. |

| • | Fixed Income Securities: Debt and fixed income securities will be priced by independent, third-party pricing agents approved by the Board of Trustees. These third-party pricing agents will employ methodologies that they believe are appropriate, including actual market transactions, broker-dealer supplied valuations, matrix pricing, or other electronic data processing techniques. These techniques generally consider such factors as security prices, yields, maturities, call features, ratings and developments relating to specific securities in arriving at valuations. Debt obligations with remaining maturities of sixty days or less will be valued at their amortized cost, which approximates fair market value. |

| • | Foreign Securities: Foreign securities are often principally traded on markets that close at different hours than U.S. markets. Such securities will be valued at their most recent closing prices on the relevant principal exchange even if the close of that exchange is earlier than the time of the Fund’s net asset value (“NAV”) calculation. However, securities traded in foreign markets which remain open as of the time of the NAV calculation will be valued at the most recent sales price as of the time of the NAV calculation. In addition, prices for certain foreign securities may be obtained from the Fund’s approved pricing sources. The Adviser also monitors for the occurrence of significant events that may cast doubts on the reliability of previously obtained market prices for foreign securities held by the Fund. The prices for foreign securities will be reported in local currency and converted to U.S. dollars using currency exchange rates. Exchange rates will be provided daily by recognized independent pricing agents. The exchange rates used for the conversion will be captured as of the London close each day. |

C. Security Transactions, Investment Income and Expenses. Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on a specific identified cost basis. Interest income is recognized on the accrual basis, including amortization of premiums and accretion of discounts. Distributions are recorded on the ex-dividend date. Distributions received from the Fund’s investments in master limited partnerships (“MLPs”) generally are comprised of ordinary income, capital gains and return of capital from the MLP. Dividends received from the Fund’s investments in MLP general partner interests generally are comprised of ordinary income. The Fund records investment income on the ex-date of the distributions. For financial statement purposes, the Fund uses return of capital and income estimates to allocate the dividend income received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded, as the actual character of these distributions is not known until after the fiscal year end of the Fund.

The Fund estimates the allocation of investment income and return of capital for the distributions received from MLPs within the Statement of Operations. The Fund estimates 100% of the distributions from MLPs to be return of capital. Any adjustments to the prior year estimates are recorded in the current period Statement of Operations after actual allocations are known.

Expenses are recorded on the accrual basis.

| | |

| | SEMI-ANNUAL REPORT 2015 • 17 |

D. Dividends and Distributions to Shareholders. Dividends and distributions to shareholders are recorded on the ex-dividend date. The character of dividends and distributions to shareholders made during the period may differ from their ultimate characterization for federal income tax purposes. For the period ended May 31, 2015, the Fund’s dividends and distributions were expected to be comprised of 100% return of capital. The tax character of distributions paid for the period ended May 31, 2015 will be determined in early 2016.

E. Federal Income Taxation. The Fund, taxed as a corporation, is obligated to pay federal and state income tax on its taxable income. Currently, the maximum marginal regular federal income tax rate for a corporation is 35%. The Fund may be subject to a 20% federal alternative minimum tax on its federal alternative minimum taxable income to the extent that its alternative minimum tax exceeds its regular federal income tax.

The Fund invests its assets primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Fund reports its allocable share of the MLP’s taxable income in computing its own taxable income. The Fund’s tax expense or benefit is included in the Statement of Operations based on the component of income or gains (losses) to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is recognized if, based on the weight of available evidence, it is more likely than not that some portion or all of the deferred income tax asset will not be realized.

The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes as an income tax expense on the Statement of Operations. For the period ended May 31, 2015, the Fund did not have interest or penalties associated with underpayment of income taxes.

F. Cash Distribution Information. The Fund intends to make quarterly distributions from investments, which include the amount received as cash distributions from MLPs and common stock dividends. These activities will be reported in the Statements of Changes in Net Assets.

G. Indemnifications. Under the Fund’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts that provide general indemnification to other parties. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred, and may not occur. However, the Fund has not had prior claims or losses pursuant to these contracts.

3. Fair Value Measurements

Various inputs that are used in determining the fair value of the Fund’s investments are summarized in the three broad levels listed below:

| • | Level 1: quoted prices in active markets for identical securities |

| • | Level 2: other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3: significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

These inputs are summarized in the three broad levels that follow.

| | | | | | | | | | | | | | | | | | | |

| | | | Fair Value Measurements at Reporting Date Using: | |

| | | | | |

| | | | Fair Value at | | | Quoted Prices in Active Markets for Identical Assets | | | Significant Other Observable Inputs | | | Significant Unobservable Inputs | |

| | Description | | | May 31, 2015 | | | (Level 1) | | | (Level 2) | | | (Level 3) | |

| | Equity Securities | | | | | | | | | | | | | | | | |

| | Master Limited Partnerships and and Related Companies(1) | | $ | 1,380,005,188 | | | $ | 1,380,005,188 | | | $ | — | | | $ | — | |

| | Total | | $ | 1,380,005,188 | | | $ | 1,380,005,188 | | | $ | — | | | $ | — | |

| | (1) | All other industry classifications are identified in the Schedule of Investments. |

The Fund did not hold Level 2 or Level 3 investments at any time during the period from December 1, 2014 to May 31, 2015. There were no transfers into and out of all Levels during the current period presented. It is the Fund’s policy to record transfers between all Levels as of the end of the reporting period.

4. Concentrations of Risk

The Fund’s investment objective is to seek to generate total return. The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets, plus any borrowings for investment purposes, in MLP interests.

5. Agreements and Related Party Transactions

The Trust has entered into an Investment Advisory Agreement (the “Agreement”) with Chickasaw Capital Management, LLC (the “Adviser”). Under the terms of the Agreement, the Fund pays the Adviser a fee, payable at the end of each calendar month, at an annual rate equal to 1.25% of the average daily net assets of the Fund.

The Adviser has agreed to waive its advisory fee and/or reimburse certain operating expenses of the Fund, until at least March 31, 2016, but only to the extent necessary so that the Fund’s total annual expenses, excluding brokerage fees and commissions; borrowing costs (such as (a) interest and (b) dividend expenses on securities sold short); taxes, including deferred and franchise tax expense; any indirect expenses, such as acquired fund fees and expenses; Class A 12b-1 fees, Class C 12b-1 fees, and extraordinary expenses, do not exceed 1.50% of the average daily net assets of each class of the Fund. Any payment by the Adviser of the Fund’s operating, organizational and offering expenses are subject to repayment by the Fund in the three fiscal years following the fiscal year in which the payment was made; provided that the Fund is able to make the repayment without exceeding the 1.50% expense limitation.

Waived fees and reimbursed Fund expenses, including prior year expenses, are subject to potential recoupment by year of expiration. The Adviser’s waived fees and reimbursed expenses that are subject to potential recoupment are as follows:

| | | | | | | | | | | | | | | | | | | |

| | | | Amount | | | Amount | | | Amount Subject to | | | Expiration | |

| | Fiscal Year Incurred | | | Waived | | | Recouped (1) | | | Potential Recoupment | | | Date | |

| | November 30, 2012 | | $ | 112,128 | | | $ | 112,128 | | | $ | 0 | | | | November 30, 2015 | |

| | November 30, 2013 | | | 190,901 | | | | 190,901 | | | | 0 | | | | November 30, 2016 | |

| | November 30, 2014 | | | 91,108 | | | | 91,108 | | | | 0 | | | | November 30, 2017 | |

| | Total | | $ | 394,137 | | | $ | 394,137 | | | $ | 0 | | | | | |

| | (1) | Amount recouped was in compliance with the Expense Limitation Agreement, and did not cause the total Fund’s total operating expense ratio (excluding certain expenses, taxes and fees as set forth in the Agreement) to exceed 1.50%. |

| | |

| | SEMI-ANNUAL REPORT 2015 • 19 |

Certain Trustees and Officers of the Trust/Fund are also Officers of the Adviser.

The Fund has entered into a Rule 12b-1 distribution agreement with Quasar Distributors, LLC (“Quasar”). Class A shareholders pay Rule 12b-1 fees at the annual rate of 0.25% of average daily net assets. Class C shareholders pay Rule 12b-1 fees at the annual rate of 1.00% of average daily net assets. For the period from December 1, 2015 to May 31, 2015, 12b-1 distribution expenses of $233,900 and $159,488 were accrued by Class A and Class C shares, respectively.

The Fund has engaged U.S. Bancorp Fund Services, LLC to serve as the Fund’s administrator. The Fund pays the administrator a monthly fee computed at an annual rate of 0.10% of the first $75,000,000 of the Fund’s average daily net assets, 0.08% on the next $250,000,000 of average daily net assets and 0.05% on the balance of the Fund’s average daily net assets, with a minimum annual fee of $64,000, imposed upon the Fund reaching certain asset levels.

U.S. Bancorp Fund Services, LLC serves as the Fund’s transfer agent, dividend paying agent, and agent for the automatic dividend reinvestment plan. The Fund pays the transfer agent a $45,000 flat fee, imposed upon the Fund reaching certain asset levels, plus transaction and other out-of-pocket charges.

U.S. Bank, N.A. serves as the Fund’s custodian. The Fund pays the custodian a monthly fee computed at an annual rate of 0.0075% of the first $250 million of fair value and 0.0050% of the balance, with a minimum annual fee of $4,800, imposed upon Fund reaching certain asset levels.

6. Income Taxes

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amount of assets and liabilities for financial reporting and tax purposes. A valuation allowance is recognized if, based on the weight of available evidence, it is more likely than not that some portion or all of a deferred income tax asset will not be realized. From time to time, as new information becomes available, the Fund will modify its estimates or assumption regarding the deferred tax liabilities or assets. Components of the Fund’s deferred tax assets and liabilities as of May 31, 2015, are as follows:

| | | | | |

| Deferred tax assets: | | | | |

| Net operating loss carryforward (tax basis) | | $ | 15,699,755 | |

| Capital loss carryforward (tax basis) | | | 2,083,006 | |

| Other | | | 21,673 | |

| Total deferred tax assets | | | 17,804,434 | |

| Less: Deferred tax liabilities: | | | | |

| Unrealized gain on investment securities (tax basis), net | | | (104,417,508 | ) |

| Net deferred tax asset (liability) | | $ | (86,613,074 | ) |

The net operating loss carryforward is available to offset future taxable income. The Fund has the following net operating loss and capital loss carryforward amounts:

| | | | | | | | |

| Fiscal Year Ended Net Operating Loss | | Amount | | | Expiration | |

| November 30, 2014 | | $ | 10,076,544 | | | November 30, 2034 | |

| November 30, 2015 | | | 32,425,161 | | | November 30, 2035 | |

| Total Fiscal Year Ended Net Operating Loss | | $ | 42,501,705 | | | | |

| Fiscal Year Ended Net Capital Loss | | Amount | | | Expiration | |

| November 30, 2015 | | $ | 5,655,088 | | | November 30, 2020 | |

| Total Fiscal Year Ended Net Capital Loss | | $ | 5,655,088 | | | | |

For corporations, capital losses can only be used to offset capital gains and connot be used to offset ordinary income. The capital loss may be carried forward for 5 years and, accordingly, would begin to expire as of November 30, 2020. The net operating loss can be carried forward for 20 years and, accordingly, would begin to expire as of November 30, 2034.

Total income tax expense (current and deferred) differs from the amount computed by applying the federal statutory income tax rate of 35% to net investment income and realized and unrealized gains (losses) on investments before taxes for the period ended May 31, 2015, as follows:

| | | | | |

| Total Tax Expense (Benefit) | | | | |

| Tax Expense (Benefit) at Statutory Rates | | $ | 1,548,691 | |

| State Income Tax Expense (Net of Federal Benefit) | | | 81,160 | |

Tax Expense (Benefit) on Permanent Items(1) | | | (724,973 | ) |

| Total tax expense | | $ | 904,878 | |

| (1) | Permanent Items are made up of dividends received deductions. |

At May 31, 2015, the Fund did not have a current tax expense or benefit.

At May 31, 2015, the tax cost basis of investments was $1,099,253,129 and gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows:

| | | | | |

| Gross unrealized appreciation | | $ | 284,251,099 | |

| Gross unrealized depreciation | | | (3,499,040 | ) |

| Net unrealized appreciation | | $ | 280,752,059 | |

The differences between book-basis and tax-basis unrealized appreciation (depreciation) are primarily due to timing differences of income recognition from the MLP investments.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on U.S. tax returns and state tax returns filed or expected to be filed since inception of the Fund. The November 30, 2013 federal tax return is currently under examination by the Internal Revenue Service. The tax periods since inception remain subject to examination by the tax authorities in the United States. Due to the nature of the Fund’s investments, the Fund may be required to file income tax returns in several states. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

7. Investment Transactions

For the period ended May 31, 2015, the Fund purchased (at cost) and sold securities (proceeds) in the amount of $1,074,201,996 and $504,764,465 (excluding short-term securities), respectively.

8. Investments in Affiliates

If a Fund’s holding represents ownership of 5% or more of the voting securities of a company, the company is deemed to be an affiliate as defined in the 1940 Act. The Fund had the following transactions during the period ended May 31, 2015 with affiliated companies:

| | | | | |

| VTTI Energy Partners, L.P. | | | | |

| Balance of shares held November 30, 2014 | | | 1,100,000 | |

| Gross purchases and additions | | | — | |

| Gross sales and reductions | | | — | |

| Balance of shares held May 31, 2015 | | | 1,100,000 | |

| Fair value May 31, 2015 | | $ | 28,479,000 | |

| Distributions from investments in affiliated issuers | | $ | 587,840 | |

| Net realized gain (loss) from investments in affiliated issuers | | $ | — | |

9. Share Transactions

Transactions of shares of the Fund were as follows:

| | | | | | | | | | | | | | | | | | | |

| | | | December 1, 2014 – May 31, 2015 | | | Year Ended November 30, 2014 | |

| | Class A Shares | | | Amount | | | Shares | | | Amount | | | Shares | |

| | Sold | | $ | 60,756,140 | | | | 4,694,590 | | | $ | 177,115,613 | | | | 13,139,871 | |

| | Dividends Reinvested | | | 3,754,828 | | | | 287,605 | | | | 6,288,377 | | | | 474,573 | |

| | Redeemed | | | (37,583,246 | ) | | | (2,911,533 | ) | | | (153,683,482 | ) | | | (11,152,771 | ) |

| | Net Increase | | $ | 26,927,722 | | | | 2,070,662 | | | $ | 29,720,508 | | | | 2,461,673 | |

| | | | | | | | | | | | | | |

| | | | December 1, 2014 – May 31, 2015 | | | March 31, 2014 (commencement of operations) – November 30, 2014 | |

| | Class C Shares | | | Amount | | | Shares | | | Amount | | | Shares | |

| | Sold | | $ | 14,086,706 | | | | 1,081,274 | | | $ | 26,974,384 | | | | 1,929,203 | |

| | Dividends Reinvested | | | 728,892 | | | | 55,675 | | | | 322,819 | | | | 23,497 | |

| | Redeemed | | | (1,453,557 | ) | | | (112,172 | ) | | | (280,588 | ) | | | (20,429 | ) |

| | Net Increase | | $ | 13,362,041 | | | | 1,024,777 | | | $ | 27,016,615 | | | | 1,932,271 | |

| | | | | | | | | | | | | | |

| | | | December 1, 2014 – May 31, 2015 | | | Year Ended November 30, 2014 | |

| | Class I Shares | | | Amount | | | Shares | | | Amount | | | Shares | |

| | Sold | | $ | 376,434,119 | | | | 28,674,625 | | | $ | 664,678,428 | | | | 48,580,239 | |

| | Dividends Reinvested | | | 19,912,330 | | | | 1,506,838 | | | | 25,599,590 | | | | 1,899,323 | |

| | Redeemed | | | (172,851,385 | ) | | | (13,235,101 | ) | | | (151,518,990 | ) | | | (11,157,949 | ) |

| | Net Increase | | $ | 223,495,064 | | | | 16,946,362 | | | $ | 538,759,028 | | | | 39,321,613 | |

10. Subsequent Events

The Fund has adopted standards which establish general standards of accounting for disclosure of events that occur after the Statement of Assets and Liabilities date, but before the financial statements are issued. The Fund has performed an evaluation of subsequent events through the date the financial statements were issued.

| | |

| | SEMI-ANNUAL REPORT 2015 • 21 |

May 31, 2015│unaudited

Trustee and Officer Compensation

The Fund does not compensate any of its trustees who are interested persons nor any of its officers. For the period ended May 31, 2015, the aggregate compensation paid by the Fund to the independent trustees was $30,000. The Fund did not pay any special compensation to any of its trustees or officers. The Fund’s Statement of Additional Information includes additional information about the trustees and is available on the Fund’s Web site at www.maingatefunds.com or the SEC’s Web site at www.sec.gov.

Cautionary Note Regarding Forward-Looking Statements

This report contains “forward-looking statements” as defined under the U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to materially differ from the Fund’s historical experience and its present expectations or projections indicated in any forward-looking statements. These risks include, but are not limited to, changes in economic and political conditions; regulatory and legal changes; MLP industry risk; concentration risk; energy sector risk; commodities risk; MLP and other tax risks, such as deferred tax assets and liabilities risk; and other risks discussed in the Fund’s filings with the SEC. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Fund undertakes no obligation to update or revise any forward-looking statements made herein. There is no assurance that the Fund’s investment objectives will be attained.

Proxy Voting Policies

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities owned by the Fund and information regarding how the Fund voted proxies relating to the portfolio of securities during the 12-month period ended June 30, 2015 are available to shareholders without charge by visiting the SEC’s Web site at www.sec.gov.

Form N-Q

The Fund files its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the SEC on Form N-Q. The Fund’s Form N-Q and statement of additional information are available without charge by visiting the SEC’s Web site at www.sec. gov. In addition, you may review and copy the Fund’s Form N-Q at the SEC’s Public Reference Room in Washington D.C. You may obtain information on the operation of the Public Reference Room by calling (800) SEC-0330.

Householding

In an effort to decrease costs, the Fund intends to reduce the number of duplicate prospectuses, annual and semi-annual reports, proxy statements and other similar documents you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders that the Transfer Agent reasonably believes are from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 855. MLP.FUND (855.657.3863) to request individual copies of these documents. Once the Transfer Agent receives notice to stop householding, the Transfer Agent will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

May 31, 2015│unaudited

The Board of Trustees oversees the management of MainGate MLP Fund (the “Fund”) and, as required by law, determines annually whether to approve the continuance of the Fund’s management agreement with its investment advisor, Chickasaw Capital Management LLC (the “Advisor”). The Board of Trustees requests and evaluates all information that it deems reasonably necessary under the circumstances in connection with this annual management agreement review.

At the Trustees’ in-person meeting held on January 12, 2015, the Trustees, including the Trustees who are not “interested persons” (as that term is defined in the Investment Company Act of 1940, as amended) of the Trust or of the Advisor (collectively, the “Independent Trustees”), met to consider the renewal of the Fund’s management agreement with the Advisor for an additional year. All Trustees were present. In advance of this meeting, each Trustee received and reviewed the following materials compiled by the Fund’s administrator, U.S. Bancorp Fund Services, LLC: (i) a letter sent by Trust counsel to the Advisor requesting information that the Independent Trustees likely would consider in determining whether to renew the Fund’s advisory agreement, and the Advisor’s responses, including, among other information, an analysis of the management fees paid by, and the expense ratio of, the Fund compared to its peer group and the average expense ratio of the Fund’s Morningstar group, an analysis of the Advisor’s profitability with respect to its management of the Fund, any changes in advisory personnel, and ideas for future growth for the Fund; (ii) a report by the Advisor describing the Fund’s performance versus the performance of its peers and benchmark index for periods ending November 30, 2014; (iii) the Advisor’s Form ADV; and (iv) a copy of the Advisor’s agreement to continue capping certain operating expenses of the Fund through March 31, 2016. The Trustees also interviewed members of the Advisor’s management, including two of the Fund’s portfolio managers and the Advisor’s chief compliance officer.

Some of the factors that figured particularly in the Trustees’ deliberations are listed below, although individual Trustees may have evaluated this information differently, ascribing different weights to various factors. Because the Fund’s management agreement is reviewed and considered by the Board on an annual basis, the Trustees’ determinations may be based, in part, on their consideration of the management agreement in previous years.

A. Nature, Extent, and Quality of Services: The Trustees considered that the Advisor provides three experienced portfolio managers to manage the Fund. They noted that Messrs. Mavar and Mead, two of the Portfolio Managers of the Fund and Principals of the Advisor, have been investing clients’ assets in MLPs on a discretionary basis since 1996. The Trustees also noted that the Advisor employs a full time chief compliance officer.

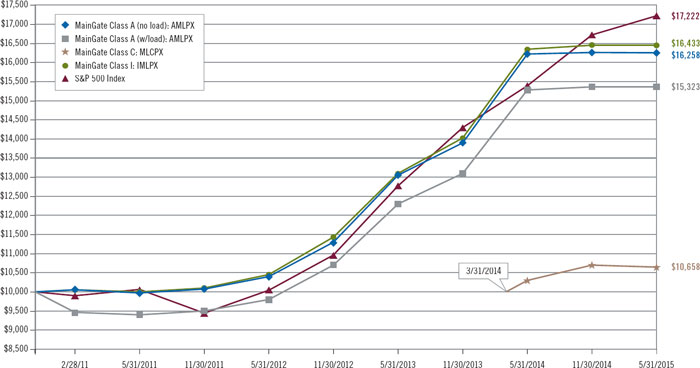

B. Fund Performance. The Trustees noted that the returns for the Fund’s Class I shares had outperformed the returns of its peer MLP mutual funds for the year-to-date, one-year, three-year and since inception periods ended November 30, 2014. The Trustees noted that the Fund’s year-to-date and one-year performance as of November 30, 2014 had outperformed its benchmark, the S&P 500 Index. They noted that the Fund’s returns were net of management fees, expenses and deferred tax liability, while the S&P 500 includes no deductions for fees, expenses or taxes.

C. Fee Rate. The Trustees considered that the Fund’s 1.25% advisory fee (without reduction for the expense cap) was higher than the advisory fee of the Fund’s MLP peers, but determined that the higher advisory fee was justified based on the expertise and experience of the portfolio managers provided by the Advisor to implement the Fund’s MLP strategy and the Fund’s outperformance of its peers. The Board considered that the advisory fee charged by the Advisor to the Fund is higher than the average advisory fee charged by the Advisor to its private accounts, but determined that the Fund’s higher advisory fee was justified in light of the additional reporting and regulatory requirements applicable to the Advisor on behalf of the Fund. The Board also considered that the Advisor voluntarily had agreed to cap the Fund’s operating expenses since its inception through March 31, 2016.

D. Economies of Scale and Profitability. The Trustees considered the Advisor’s representation that it has only recently begun to realize a profit, but has not yet recouped all waived advisory fees, from managing the Fund. The Trustees considered a profitability analysis prepared by the Advisor, which estimated the Advisor’s profitability from its management of the Fund. The Independent Trustees determined that the Advisor’s profitability from managing the Fund, both before and after deduction of marketing expenses, was not excessive.

E. Collateral Benefits to the Advisor. The Board considered the Advisor’s representation that it does not enter into any soft dollar arrangements using Fund brokerage commissions to compensate brokers that provide research services to the Advisor, and that the Advisor had not engaged an affiliated broker-dealer to execute portfolio transactions for the Fund.

After reviewing all of the foregoing, and based upon all of the above-mentioned factors and their related conclusions, with no single factor or conclusion being determinative and with each Trustee not necessarily attributing the same weight to each factor, the Trustees, including all of the Independent Trustees voting separately, unanimously determined that the advisory fees paid by the Fund are reasonable, based on the nature and quality of advisory services provided by the Advisor, and unanimously voted to approve the continuation of the management agreement with the Advisor on behalf of the Fund for an additional year.

| | |

| | SEMI-ANNUAL REPORT 2015 • 23 |

The following is a description of the Fund’s policies regarding disclosure of nonpublic personal information that you provide to the Fund or that the Fund collects from other sources. In the event that you hold shares of the Fund through a broker-dealer or other financial intermediary, the privacy policy of your financial intermediary would govern how your nonpublic personal information would be shared with nonaffiliated third parties.

Categories of Information the Fund Collects. The Fund collects the following nonpublic personal information about you:

| | • | Information the Fund receives from you on applications or other forms, correspondence, or conversations (such as your name, address, phone number, social security number, and date of birth); and |

| | • | Information about your transactions with the Fund, its affiliates, or others (such as your account number and balance, payment history, cost basis information, and other financial information). |

Categories of Information the Fund Discloses. The Fund does not disclose any nonpublic personal information about its current or former shareholders to unaffiliated third parties, except as required or permitted by law. The Fund is permitted by law to disclose all of the information it collects, as described above, to service providers (such as the Fund’s custodian, administrator, transfer agent, accountant and legal counsel) to process your transactions and otherwise provide services to you.

Confidentiality and Security. The Fund restricts access to your nonpublic personal information to those persons who require such information to provide products or services to you. The Fund maintains physical, electronic, and procedural safeguards that comply with federal standards to guard your nonpublic personal information.

Disposal of Information. The Fund, through its transfer agent, has taken steps to reasonably ensure that the privacy of your nonpublic personal information is maintained at all times, including in connection with the disposal of information that is no longer required to be maintained by the Fund. Such steps shall include, whenever possible, shredding paper documents and records prior to disposal, requiring off-site storage vendors to shred documents maintained in such locations prior to disposal, and erasing and/or obliterating any data contained on electronic media in such a manner that the information can no longer be read or reconstructed.

May 31, 2015

Board of Trustees

Geoffrey P. Mavar*, Chairman of the Board

Robert A. Reed, Lead Independent Trustee

David C. Burns, Independent Trustee

Moss W. Davis, Independent Trustee

Marshall K. Gramm, Independent Trustee

Matthew G. Mead*, Interested Trustee

Barry A. Samuels, Independent Trustee

Darrison N. Wharton, Independent Trustee

Officers

Matthew G. Mead*, President and Chief Executive Officer

Geoffrey P. Mavar*, Treasurer and Chief Financial Officer

Gerard Scarpati, Chief Compliance Officer

Debra McAdoo*, Secretary

Investment Adviser

Chickasaw Capital Management, LLC

6075 Poplar Avenue, Suite 720, Memphis, TN 38119

Distributor

Quasar Distributors, LLC

615 East Michigan Street, Milwaukee, WI 53202

Custodian

U.S. Bank, N.A.

1555 N. River Center Drive, Suite 302, Milwaukee, WI 53212

Transfer Agent

U.S. Bancorp Fund Services, LLC

615 East Michigan Street, 3rd Floor, Milwaukee, WI 53202

Administrator

U.S. Bancorp Fund Services, LLC

777 East Wisconsin Street, 5th Floor, Milwaukee, WI 53202

Legal Counsel

Thompson Coburn LLP

One U.S. Bank Plaza, St. Louis, MO 63101

Independent Registered Public Accounting Firm

Cohen Fund Audit Services, Ltd.

1350 Euclid Avenue, Suite 800, Cleveland, OH 44115

*Employed by Chickasaw Capital Management, LLC.

| | |

| | SEMI-ANNUAL REPORT 2015 • 25 |

Notes

Notes

| | |

| Mutual fund investing involves risk. Principal loss is possible. | Must be preceded or accompanied by a prospectus. |

| | |

BACK COVER │ NOT PART OF REPORT | Quasar Distributors, LLC, distributor. |