THIS PAGE INTENTIONALLY BLANK

2 | MainGate mlp fund

MainGate MLP Fund

Class A (AMLPX)

Class C (MLCPX)

Class I (IMLPX)

6075 Poplar Avenue, Suite 720 | Memphis, TN 38119 | 855.MLP.FUND (855.657.3863) | www.maingatefunds.com

Semi-Annual Report

May 31, 2018

semi - annual report 2018 • 3

Table of Contents

| 5 |

| | |

| 7 |

| | |

| 7 |

| | |

| 8 |

| | |

| 9 |

| | |

| 9 |

| | |

| 10 |

| | |

| 10 |

| | |

| 11 |

| | |

| 12 |

| | |

| 13 |

| | |

| 14 |

| | |

| 15 |

| | |

| 21 |

| | |

| 21 |

| | |

| 24 |

| | |

| 25 |

MainGate mlp fund

The MainGate MLP Fund had the following performance as of May 31, 2018.

| | c u m u l a t i v e r e t u r n s | | | a v e r a g e a n n u a l r e t u r n s | |

| | | | | | |

| | Inception

Date | | Fiscal

YTD | | Since

Inception | | 1

Year | | 5

Year | | Since

Inception |

| MainGate MLP Fund – Class A without load | 2/17/11 | | | 5.01 | % | | | 27.52 | % | | | -4.70 | % | | | -0.45 | % | | | 3.39 | % |

| MainGate MLP Fund – Class A with 5.75% maximum front-end load | 2/17/11 | | | -0.99 | % | | | 20.19 | % | | | -10.14 | % | | | -1.63 | % | | | 2.56 | % |

| MainGate MLP Fund – Class I | 2/17/11 | | | 5.14 | % | | | 29.90 | % | | | -4.50 | % | | | -0.20 | % | | | 3.66 | % |

| S&P 500 Index | 2/17/11 | | | 3.16 | % | | | 135.37 | % | | | 14.38 | % | | | 12.98 | % | | | 12.47 | % |

| MainGate MLP Fund – Class C without load | 3/31/14 | | | 4.73 | % | | | -18.18 | % | | | -5.33 | % | | | N/A | | | -4.70 | % |

| MainGate MLP Fund – Class C with 1.00% Contingent Deferred Sales Charge | 3/31/14 | | | 3.73 | % | | | -18.18 | % | | | -6.21 | % | | | N/A | | | -4.70 | % |

| S&P 500 Index | 3/31/14 | | | 3.16 | % | | | 135.37 | % | | | 14.38 | % | | | N/A | | | 11.53 | % |

Expense Ratios (Gross/Net): A Shares = 1.66%/1.66% | C Shares = 2.41%/2.41% | I Shares = 1.41%/1.41%. Net expense ratios represent the percentages paid by investors and reflect a 0.00% deferred income tax expense which represents the performance impact of accrued deferred tax liabilities across the Fund, not individual share classes, for the fiscal year ended November 30, 2017 (the Fund did not have a current tax expense or benefit due to a valuation allowance). The Fund’s adviser has contractually agreed to cap the Fund’s total annual operating expenses (excluding brokerage fees and commissions; Class A 12b-1 fees; borrowing costs; taxes, such as Deferred Income Tax Expense; and extraordinary expenses) at 1.50% through March 31, 2019. The performance data shown For Class C with load reflects the Class C maximum deferred sales charge of 1.00%. Deferred income tax expense/(benefit) represents an estimate of the Fund’s potential tax expense/(benefit) if it were to recognize the unrealized gains/(losses) in the portfolio. An estimate of deferred income tax expense/(benefit) depends upon the Fund’s net investment income/(loss) and realized and unrealized gains/(losses) on its portfolio, which may vary greatly on a daily, monthly and annual basis depending on the nature of the Fund’s investments and their performance. An estimate of deferred income tax expenses/(benefit) cannot be reliably predicted from year to year.

The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the information quoted. To obtain performance information current to the most recent month-end please call 855.MLP.FUND (855.657.3863). Performance data shown for Class A shares with load reflects the maximum sales charge of 5.75%. Performance data shown for Class C shares with load reflects the maximum deferred sales charge of 1.00%. Performance data shown for Class I shares does not reflect the deduction of a sales load or fee. Performance data shown “Without Load” does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The Fund is up 5.14% fiscal year to date for class I, and 5.01% and 4.73% for each load-waived class A and C shares, respectively. The broader equity market represented by the S&P 500 has returned 3.16%. The MLP equity market has experienced volatility so far this year with MLP investor sentiment weaker than the operating results for midstream energy MLPs. During the first calendar quarter of 2018, the portfolio’s Distributable Cash Flow per unit increased on average by more than 10% year over year, yet valuations are cheaper than this time last year.

As of 6/30/18, MLPs, as represented by the Alerian MLP Index, have a 8.0% annual yield and a consensus estimated annual Distributable Cash Flow growth of approximately 5.6%.

MLP valuations trade meaningfully below the five-year average, with the Price to Distributable Cash Flow (P/DCF) multiple standing at 8.4x compared to the 12.5x five year average1, which requires a 48.8% increase to achieve the average valuation level.

(1) Source: Wells Fargo Securities Equity Research, “MLP Monthly”, pg. 20 July 6, 2018, presenting data from partnership reports and Wells Fargo Securities, LLC estimates.

semi - annual report 2018 • 5

| MLP Valuation Metrics | | Current | | 5-Year

Average | | Premium

(Discount) | | 10-Year

Average | | Premium

(Discount) | |

| Midstream MLP Yield | | 9.0% | | 7.0% | | (22.4%) | | 7.2% | | (20.0%) | |

| Price-to-DCF | | 8.4x | | 12.5x | | (33.1%) | | 11.7x | | (28.4%) | |

| EV-to-EBITDA | | 10.4x | | 13.0x | | (20.1%) | | 12.5x | | (17.0%) | |

| Midstream Spread-to-10-year Treasury – discount (premium) | | 615 | | 476 | | — | | 462 | | — | |

| Midstream Spread-to-investment grade bonds – discount (premium) | | 416 | | 228 | | — | | 184 | | — | |

| Midstream Spread-to-high yield bonds – discount (premium) | | 288 | | 124 | | — | | (2) | | — | |

Source: Wells Fargo Securities Equity Research, “MLP Monthly”, pg. 20 July 6, 2018, presenting data from partnership reports and Wells Fargo Securities, LLC estimates.

Source notes, “Midstream MLPs exclude Upstream, Non-Traditional, Coal and Marine subsectors. P/DCF and

EV/EBITDA are based on median 2019 estimates for Current column. EV/EBITDA adjusted to reflect % of cash flow to GP.”

The Fund’s portfolio has balanced exposure to potential MLP total return factors. We look forward to the opportunities that lie ahead and we thank you for your support.

| Sincerely, | |

| | |

|  |

| | |

| Geoffrey P. Mavar, Chairman | Matthew G. Mead, CEO |

Past performance is not a guarantee of future results.

Opinions expressed are those of Chickasaw Capital Management, LLC and are subject to change, are not guaranteed, and should not be considered investment advice.

The information contained in this report is authorized for use when preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible. The Fund is nondiversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual security price volatility than a diversified fund. The Fund invests in Master Limited Partnerships (MLPs) which concentrate investments in the energy sector and are subject to the risks of energy prices and demand and the volatility of commodity investments. Damage to facilities and infrastructure of MLPs may significantly affect the value of an investment and may incur environmental costs and liabilities due to the nature of their business. MLPs are subject to significant regulation and may be adversely affected by changes in the regulatory environment. Investments in smaller companies involve additional risks, such as limited liquidity and greater volatility. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. MLPs are subject to certain risks inherent in the structure of MLPs, including complex tax structure risks, limited ability for election or removal of management, limited voting rights, potential dependence on parent companies or sponsors for revenues to satisfy obligations, and potential conflicts of interest between partners, members and affiliates.

Midstream MLPs: Those MLPs involved primarily in the gathering, storage and transportation of oils and gases.

Yield: Refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value.

Price to Distributable Cash Flow (P/DCF): Market cap of the MLP divided by a full year of distributable cash flow, which is measured as earnings before interest, taxes, depreciation and amortization (EBITDA) available to pay unitholders after reserving for maintenance capital expenditures and payment of interest expense.

Distributable Cash Flow: Calculated as net income plus depreciation and other non-cash items, less maintenance capital expenditure requirements.

Enterprise Value to EBITDA (EV/EBITDA): A measurement of value, calculated as a company’s market value, divided by its Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA).

S&P 500 Index: A broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The Alerian MLP Index: A capitalization-weighted index of the 50 most prominent energy Master Limited Partnerships.

You cannot invest directly in an index.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please refer to the schedule of investments for a complete listing of Fund holdings.

The Fund does not receive the same tax benefits of a direct investment in an MLP.

The Fund is subject to U.S. federal income tax on its taxable income at rates applicable to corporations (currently at a maximum rate of 35%) as well as state and local income taxes.

The Fund accrues deferred income taxes for future tax liabilities associated with the portion of MLP distributions considered to be a tax-deferred return of capital and for any net operating gains as well as capital appreciation of its investments. This deferred tax liability is reflected in the daily NAV and as a result the Fund’s after-tax performance could differ significantly from the underlying assets even if the pre-tax performance is closely tracked.

The potential tax benefits from investing in MLPs depend on MLPs being treated as partnerships for federal income tax purposes.

If the MLP is deemed to be a corporation then its income would be subject to federal taxation, reducing the amount of cash available for distribution to the Fund which could result in a reduction of the Fund’s value.

The MainGate MLP Fund is distributed by Quasar Distributors, LLC.

6 | MainGate mlp fund

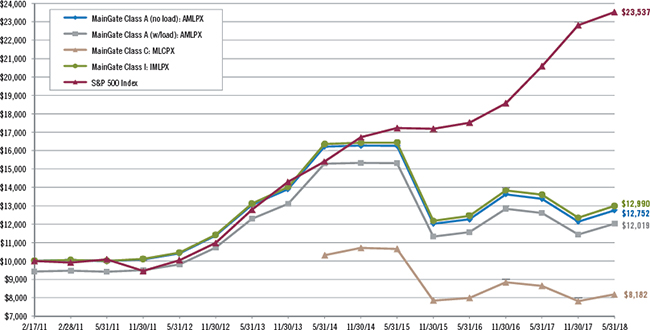

Hypothetical Growth of a $10,000 Investment | unaudited

This chart illustrates the performance of a hypothetical $10,000 investment made in each share class as of its inception date (2/17/11 for Class A and Class I and 3/31/14 for Class C). Assumes reinvestment of dividends and capital gains. This chart does not imply any future performance.

Average Annual Returns | May 31, 2018

| | | 1 Year | | 5 Year | | Since Inception | | Inception Date |

| Class A (without sales load) | | | -4.70 | % | | | -0.45 | % | | | 3.39 | % | | 2/17/11 |

| Class A (with sales load) | | | -10.14 | % | | | -1.63 | % | | | 2.56 | % | | 2/17/11 |

| Class C | | | -5.33 | % | | | n/a | | | | -4.70 | % | | 3/31/14 |

| Class C (with CDSC) | | | -6.21 | % | | | n/a | | | | -4.70 | % | | 3/31/14 |

| Class I | | | -4.50 | % | | | -0.20 | % | | | 3.66 | % | | 2/17/11 |

| S&P 500 Index | | | 14.38 | % | | | 12.98 | % | | | 12.47 | % | | 2/17/11 |

| S&P 500 Index | | | 14.38 | % | | | n/a | | | | 11.53 | % | | 3/31/14 |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855.MLP.FUND (855.657.3863) or by visiting www.maingatefunds.com.

Class A (with sales load) performance reflects the maximum sales charge of 5.75%. Class C (with CDSC) performance reflects the 1.00% contingent deferred sales charge. Class I is not subject to a sales charge or CDSC.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. You cannot invest directly in an index.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares.

semi - annual report 2018 • 7

Expense Example | unaudited

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from December 1, 2017 to May 31, 2018.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or exchange fees. Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | Beginning

Account Value

(12/01/17) | | Ending

Account Value

(05/31/18) | | Expenses Paid

During Period (1)

(12/01/17 – 05/31/18) | | Net Annualized

Expense Ratio (2) |

| | | | | | | | |

| Class A Actual | $1,000.00 | | $1,041.77 | | $8.50 | | 1.67% |

Class A Hypothetical

(5% return before expenses) | $1,000.00 | | $1,016.60 | | $8.40 | | 1.67% |

| Class C Actual | $1,000.00 | | $1,053.23 | | $12.28 | | 2.42% |

Class C Hypothetical

(5% return before expenses) | $1,000.00 | | $1,012.86 | | $12.14 | | 2.42% |

| Class I Actual | $1,000.00 | | $1,044.32 | | $7.24 | | 1.42% |

Class I Hypothetical

(5% return before expenses) | $1,000.00 | | $1,017.85 | | $7.14 | | 1.42% |

| | (1) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182 days (the number of days in the most recent period)/365 days (to reflect the period), for Class A, Class C and Class I. |

| | (2) | Annualized expense ratio excludes current and deferred income and franchise tax expense. |

8 | MainGate mlp fund

Allocation of Portfolio Assets

May 31, 2018 | unaudited

(expressed as a percentage of total investments)

| Natural Gas/Natural Gas Liquid Pipelines and Storage* | 41.3% | |

| Crude/Refined Products Pipelines and Storage* | 38.9% |

| Natural Gas Gathering/Processing* | 19.8% | *Master Limited Partnerships and Related Companies |

Schedule of Investments | May 31, 2018 | unaudited

Master Limited Partnerships and Related Companies: 98.0%(1) | | Shares | | | Fair Value | |

Crude/Refined Products Pipelines and Storage: 40.5%(1) | | | | | | |

United States: 40.5%(1) | | | | | | |

| BP Midstream Partners, L.P. | | | 2,000,000 | | | $ | 42,740,000 | |

| Buckeye Partners, L.P. | | | 2,100,000 | | | | 75,705,000 | |

| Genesis Energy, L.P. - Class A | | | 5,000,000 | | | | 109,800,000 | |

| Magellan Midstream Partners, L.P. | | | 950,000 | | | | 66,405,000 | |

| MPLX, L.P. | | | 1,000,000 | | | | 35,910,000 | |

| Phillips 66 Partners, L.P. | | | 1,100,000 | | | | 57,530,000 | |

| Plains All American Pipeline, L.P. | | | 2,000,000 | | | | 47,000,000 | |

| Plains GP Holdings, L.P. - Class A | | | 2,600,000 | | | | 63,882,000 | |

SemGroup Corporation - Class A(2) | | | 3,000,000 | | | | 75,900,000 | |

| Shell Midstream Partners, L.P. | | | 3,300,000 | | | | 73,887,000 | |

| Valero Energy Partners, L.P. | | | 600,000 | | | | 24,594,000 | |

| | | | | | | | 673,353,000 | |

Natural Gas/Natural Gas Liquid Pipelines and Storage: 38.1%(1) | | | | | | | | |

United States: 38.1%(1) | | | | | | | | |

| Dominion Midstream Partners, L.P. | | | 1,323,000 | | | | 16,934,400 | |

Energy Transfer Equity, L.P.(2) | | | 7,900,000 | | | | 136,512,000 | |

| Energy Transfer Partners, L.P. | | | 3,450,000 | | | | 65,515,500 | |

| Enterprise Products Partners, L.P. | | | 4,600,000 | | | | 132,940,000 | |

EQT GP Holdings, L.P.(2) | | | 1,250,000 | | | | 30,975,000 | |

| EQT Midstream Partners, L.P. | | | 500,000 | | | | 27,915,000 | |

Western Gas Equity Partners, L.P.(2) | | | 2,075,000 | | | | 76,152,500 | |

| Western Gas Partners, L.P. | | | 950,000 | | | | 49,086,500 | |

Williams Companies, Inc.(2) | | | 3,600,000 | | | | 96,696,000 | |

| | | | | | | | 632,726,900 | |

Natural Gas Gathering/Processing: 19.4%(1) | | | | | | | | |

United States: 19.4%(1) | | | | | | | | |

| Antero Midstream Partners, L.P. | | | 1,750,000 | | | | 52,937,500 | |

| Enlink Midstream Partners, L.P. | | | 2,568,000 | | | | 43,912,800 | |

Enlink Midstream, LLC(2) | | | 5,500,000 | | | | 96,250,000 | |

Targa Resources Corporation(2) | | | 2,650,000 | | | | 128,869,500 | |

| | | | | | | | 321,969,800 | |

| Total Master Limited Partnerships and Related Companies (Cost $1,385,735,798) | | | | | | $ | 1,628,049,700 | |

Total Investments: 98.0% (Cost $1,385,735,798)(1) | | | | | | $ | 1,628,049,700 | |

Other Assets in Excess of Liabilities: 2.0%(1) | | | | | | | 32,515,299 | |

Net Assets Applicable to Common Stockholders: 100.0%(1) | | | | | | $ | 1,660,564,999 | |

| | (1) | Calculated as a percentage of net assets applicable to common stockholders. |

| | (2) | MLP general partner interest. |

semi - annual report 2018 • 9

Statement of Assets and Liabilities | unaudited May 31, 2018

| Assets | |

| Investments at fair value (cost $1,385,735,798) | $1,628,049,700 |

| Cash | 34,165,474 |

| Receivable for Fund shares sold | 2,138,566 |

| Prepaid expenses | 135,478 |

| Total assets | 1,664,489,218 |

| Liabilities | |

| Payable to Adviser | 1,779,954 |

| Payable for Fund shares redeemed | 1,395,079 |

| Payable for 12b-1 distribution fee | 146,096 |

| Payable to Trustees | 23,868 |

| Payable to Custodian | 16,303 |

| Accrued expenses and other liabilities | 562,919 |

| Total liabilities | 3,924,219 |

| Net assets | $1,660,564,999 |

| | |

| Net Assets Consist of | |

| Additional paid-in capital | $1,826,967,499 |

| Undistributed net investment loss, net of deferred taxes | (43,105,747) |

| Accumulated realized loss, net of deferred taxes | (348,215,564) |

| Net unrealized appreciation on investments, net of deferred taxes | 224,918,811 |

| Net assets | $1,660,564,999 |

| Unlimited shares authorized, no par value | Class A | Class C | Class I |

| Net assets | $116,635,464 | $63,447,739 | $1,480,481,796 |

| Shares issued and outstanding | 13,966,252 | 7,780,054 | 173,071,924 |

| Net asset value, redemption price and minimum offering price per share | $8.35 | $8.16 | $8.55 |

| Maximum offering price per share ($8.35/0.9425) | $8.86 | NA | NA |

Statement of Operations | unaudited December 1, 2017 – May 31, 2018

| Investment Income | |

| Distributions received from master limited partnerships | $46,052,123 |

| Less: return of capital on distributions from master limited partnerships | (46,052,123) |

| Distribution income received in excess of return of capital from master limited partnerships | — |

| Dividends from common stock | 4,055,683 |

| Total Investment Income | 4,055,683 |

| | |

| Expenses | |

| Advisory fees | 10,412,271 |

| Administrator fees | 571,647 |

| Transfer agent expense | 352,835 |

| Reports to shareholders | 161,128 |

| Insurance expense | 72,507 |

| Registration fees | 63,566 |

| Custodian fees and expenses | 53,852 |

| Professional fees | 51,936 |

| Trustees’ fees | 47,868 |

| Compliance fees | 34,626 |

| Franchise tax expense | 30,338 |

| Fund accounting fees | 599 |

| 12b-1 distribution fee - Class A | 167,448 |

| 12b-1 distribution fee - Class C | 311,240 |

| Other expenses | 6,966 |

| Total Expenses | 12,338,827 |

| Net Investment Loss, before taxes | (8,283,144) |

Current and deferred tax benefit/(expense)(1) | — |

| Net Investment Loss, net of taxes | (8,283,144) |

| Realized and Unrealized Loss on Investments | |

| Net realized loss on investments, before taxes | (72,788,994) |

Current and deferred tax benefit/(expense)(1) | — |

| Net realized loss on investments, net of taxes | (72,788,994) |

| Net change in unrealized appreciation on investments, before taxes | 157,433,126 |

Deferred tax benefit/(expense)(1) | — |

| Net change in unrealized appreciation on investments, net of taxes | 157,433,126 |

| Net Realized and Unrealized Gain on Investments | 84,644,132 |

| Increase in Net Assets Applicable to Shareholders Resulting from Operations | $76,360,988 |

| (1) | Any tax benefit/(expense) was fully offset by a 100% valuation allowance recorded as of May 31, 2018. |

10 | MainGate mlp fund

Statements of Changes in Net Assets

| Operations | December 1, 2017 – May 31, 2018 | unaudited | Year Ended November 30, 2017 |

| Net investment loss, net of deferred tax benefit | $(8,283,144) | | $(17,839,534) | |

| Net realized loss on investments, net of deferred tax benefit | (72,788,994) | | (50,547,890) | |

| Net change in unrealized appreciation (depreciation) of investments, net of deferred tax benefit/(expense) | 157,433,126 | | (146,042,628) | |

| Net increase (decrease) in net assets resulting from operations | 76,360,988 | | (214,430,052) | |

| | | | | |

| Dividends and Distributions to Class A Shareholders | | | | |

| Return of capital | (4,995,510) | | (12,592,849) | |

| Dividends and Distributions to Class C Shareholders | | | | |

| Return of capital | (2,391,240) | | (4,756,618) | |

| Dividends and Distributions to Class I Shareholders | | | | |

| Return of capital | (54,870,592) | | (107,559,876) | |

| Total dividends and distributions to Fund shareholders | (62,257,342) | | (124,909,343) | |

| | | | | |

| Capital Share Transactions (Note 8) | | | | |

| Proceeds from shareholder subscriptions | 537,639,540(1) | | 913,896,842(2) | |

| Dividend reinvestments | 51,348,839 | | 99,540,657 | |

| Payments for redemptions | (549,785,069)(1) | | (885,522,118)(2) | |

| Net increase in net assets from capital share transactions | 39,203,310 | | 127,915,381 | |

| Total increase (decrease) in net assets | 53,306,956 | | (211,424,014) | |

| | | �� | | |

| Net Assets | | | | |

| Beginning of period | 1,607,258,043 | | 1,818,682,057 | |

| End of period | $1,660,564,999 | | $1,607,258,043 | |

| Undistributed net investment loss at the end of the period, net of deferred taxes | $(43,105,747) | | $(34,822,603) | |

| (1) | Includes $1,563,103 of exchanges from Class A to I. |

| (2) | Includes $4,193,353 of exchanges from Class A to I. |

SEMI - ANNUAL REPORT 2018 • 11

Financial Highlights: Class A Shares

Per Share Data(1) | December 1,

2017 – May 31,

2018 | unaudited | Year Ended

November 30,

2017 | Year Ended

November 30,

2016 | Year Ended

November 30,

2015 | Year Ended

November 30,

2014 | Year Ended

November 30,

2013 |

| Net Asset Value, beginning of year | $8.25 | $9.89 | $9.38 | $13.39 | $12.00 | $10.37 |

| | | | | | | |

| Income from Investment Operations | | | | | | |

Net investment loss(2) | (0.04) | (0.11) | (0.06) | (0.03) | (0.09) | (0.06) |

| Net realized and unrealized gain (loss) on investments | 0.46 | (0.90) | 1.20 | (3.35) | 2.11 | 2.32 |

| Total increase (decrease) from investment operations | 0.42 | (1.01) | 1.14 | (3.38) | 2.02 | 2.26 |

| Less Distributions to Shareholders | | | | | | |

| Net investment income | — | — | — | — | (0.06) | — |

| Return of capital | (0.32) | (0.63) | (0.63) | (0.63) | (0.57) | (0.63) |

| Total distributions to shareholders | (0.32) | (0.63) | (0.63) | (0.63) | (0.63) | (0.63) |

| Net Asset Value, end of period | $8.35 | $8.25 | $9.89 | $9.38 | $13.39 | $12.00 |

| Total Investment Return | 5.01%(3) | (10.86)% | 13.32% | (26.13)% | 17.01% | 22.22% |

| | | | | | | |

| Supplemental Data and Ratios | | | | | | |

| Net assets, end of period | $116,635,464 | $140,857,758 | $209,297,676 | $186,564,276 | $175,523,649 | $127,777,305 |

Ratio of waiver (recoupment) to average net assets(4) | — | — | — | (0.03)% | (0.05)% | 0.04% |

Ratio of net deferred income and franchise tax (benefit) expense to average net assets(5,6) | 0.00%‡ | 0.01% | — | (6.75)% | 7.19% | 9.69% |

Ratio of expenses (including net deferred and franchise tax (benefit) expense) to average net assets before (waiver) recoupment(4,5,6) | 1.67% | 1.66% | 1.67% | (5.08)% | 8.89% | 11.48% |

Ratio of expenses (including net deferred and franchise tax (benefit) expense) to average net assets after (waiver) recoupment(4,5,6) | 1.67% | 1.66% | 1.67% | (5.05)% | 8.94% | 11.44% |

Ratio of expenses (excluding net deferred and franchise tax (benefit) expense) to average net assets before (waiver) recoupment(4,5,6) | 1.67% | 1.65% | 1.67% | 1.66% | 1.70% | 1.79% |

Ratio of expenses (excluding net deferred and franchise tax (benefit) expense) to average net assets after (waiver) recoupment(4,5,6) | 1.67% | 1.65% | 1.67% | 1.69% | 1.75% | 1.75% |

Ratio of net investment loss (including net deferred tax benefit and franchise tax benefit (expense)) to average net assets before waiver (recoupment)(4,6,7) | (1.19)% | (1.12)% | (0.68)% | (0.22)% | (0.64)% | (0.58)% |

Ratio of net investment loss (including net deferred tax benefit and franchise tax benefit (expense)) to average net assets after waiver (recoupment)(4,6,7) | (1.19)% | (1.12)% | (0.68)% | (0.25)% | (0.69)% | (0.54)% |

Ratio of net investment loss (excluding net deferred tax benefit and franchise tax benefit (expense)) to average net assets before waiver (recoupment)(4,6,7) | (1.19)% | (1.11)% | (0.67)% | (0.56)% | (1.07)% | (0.99)% |

Ratio of net investment loss (excluding net deferred tax benefit and franchise tax benefit (expense)) to average net assets after waiver (recoupment)(4,6,7) | (1.19)% | (1.11)% | (0.67)% | (0.59)% | (1.12)% | (0.95)% |

Portfolio turnover rate(8) | 21.11%(3) | 19.35% | 24.63% | 57.63% | 57.83% | 90.59% |

‡ Less than one cent per share.

(1) Information presented relates to a share of Class A for the entire period. (2) Calculated using average shares outstanding method. (3) Not annualized. (4) For periods less than one full year all income and expenses are annualized. (5) For the period from December 1, 2017 to May 31, 2018, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2017, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2016, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2015, the Fund accrued $85,708,196 in net deferred tax benefit, of which $13,029,619 is attributable to Class A. For the year ended November 30, 2014, the Fund accrued $51,671,889 in net deferred tax expense, of which $12,226,299 is attributable to Class A. For the year ended November 30, 2013, the Fund accrued $29,149,971 in net deferred tax expense, of which $8,448,503 is attributable to Class A. (6) For the period from December 1, 2017 to May 31, 2018, the Fund accrued $30,338 in franchise tax expense, of which $2,439 is attributable to Class A. For the year ended November 30, 2017, the Fund accrued $148,000 in franchise tax expense, of which $14,756 is attributable to Class A. For the year ended November 30, 2016, the Fund accrued $55,653 in franchise tax expense, of which $7,370 is attributable to Class A. For the year ended November 30, 2015, the Fund accrued $100,618 in franchise tax expense, of which $15,296 is attributable to Class A. For the year ended November 30, 2014, the Fund accrued $113,535 in franchise tax expense, of which $21,899 is attributable to Class A. For the year ended November 30, 2013, the Fund accrued $37,430 in franchise tax expense, of which $10,848 is attributable to Class A. (7) For the period from December 1, 2017 to May 31, 2018, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2017, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2016, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2015, the Fund accrued $4,392,751 in net deferred tax benefit, of which $667,799 is attributable to Class A. For the year ended November 30, 2014, the Fund accrued $3,704,675, in net deferred tax benefit, of which $748,704 is attributable to Class A. For the year ended November 30, 2013, the Fund accrued $1,263,406 in net deferred tax benefit, of which $366,172 is attributable to Class A. (8) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

12 | MainGate mlp fund

Financial Highlights: Class C Shares

Per Share Data(2) | December 1,

2017 – May 31,

2018 | unaudited | Year Ended

November 30,

2017 | Year Ended

November 30,

2016 | Year Ended

November 30,

2015 | March 31, 2014(1)

– November 30,

2014 |

| Net Asset Value, beginning of period | $8.09 | $9.78 | $9.35 | $13.45 | $— |

| Public offering price | — | — | — | — | 13.00 |

| | | | | | |

| Income from Investment Operations | | | | | |

Net investment loss(3) | (0.07) | (0.17) | (0.13) | (0.12) | (0.14) |

| Net realized and unrealized gain (loss) on investments | 0.46 | (0.89) | 1.19 | (3.35) | 1.06 |

| Total increase (decrease) from investment operations | 0.39 | (1.06) | 1.06 | (3.47) | 0.92 |

| Less Distributions to Shareholders | | | | | |

| Net investment income | — | — | — | — | (0.04) |

| Return of capital | (0.32) | (0.63) | (0.63) | (0.63) | (0.43) |

| Total distributions to shareholders | (0.32) | (0.63) | (0.63) | (0.63) | (0.47) |

| Net Asset Value, end of period | $8.16 | $8.09 | $9.78 | $9.35 | $13.45 |

| Total Investment Return | 4.73%(4) | (11.51)% | 12.47% | (26.70)%(4) | 7.09%(4) |

| | | | | | |

| Supplemental Data and Ratios | | | | | |

| Net assets, end of period | $63,447,739 | $62,803,141 | $66,956,773 | $42,667,765 | $25,987,231 |

Ratio of waiver (recoupment) to average net assets(5) | — | — | — | (0.03)% | (0.05)% |

Ratio of net deferred income and franchise tax (benefit) expense to average net assets(6,7) | 0.00%‡ | 0.01% | — | (6.75)% | 2.10%(4) |

Ratio of expenses (including net deferred and franchise tax (benefit) expense) to average net assets before (waiver) recoupment(5,6,7) | 2.42% | 2.41% | 2.42% | (4.33)% | 4.55% |

Ratio of expenses (including net deferred and franchise tax (benefit) expense) to average net assets after (waiver) recoupment(5,6,7) | 2.42% | 2.41% | 2.42% | (4.30)% | 4.60% |

Ratio of expenses (excluding net deferred and franchise tax (benefit) expense) to average net assets before (waiver) recoupment(5,6,7) | 2.42% | 2.40% | 2.42% | 2.41% | 2.45% |

Ratio of expenses (excluding net deferred and franchise tax (benefit) expense) to average net assets after (waiver) recoupment(5,6,7) | 2.42% | 2.40% | 2.42% | 2.44% | 2.50% |

Ratio of net investment loss (including net deferred tax benefit and franchise tax benefit (expense)) to average net assets before waiver (recoupment)(5,7,8) | (1.94)% | (1.87)% | (1.43)% | (0.97)% | (1.58)% |

Ratio of net investment loss (including net deferred tax benefit and franchise tax benefit (expense)) to average net assets after waiver (recoupment)(5,7,8) | (1.94)% | (1.87)% | (1.43)% | (1.00)% | (1.63)% |

Ratio of net investment loss (excluding net deferred tax benefit and franchise tax benefit (expense)) to average net assets before waiver (recoupment)(5,7,8) | (1.94)% | (1.86)% | (1.42)% | (1.31)% | (1.90)% |

Ratio of net investment loss (excluding net deferred tax benefit and franchise tax benefit (expense)) to average net assets after waiver (recoupment)(5,7,8) | (1.94)% | (1.86)% | (1.42)% | (1.34)% | (1.95)% |

Portfolio turnover rate(9) | 21.11%(4) | 19.35% | 24.63% | 57.63% | 57.83% |

‡ Less than one cent per share.

(1) Commencement of operations. (2) Information presented relates to a share of Class C for the entire period. (3) Calculated using average shares outstanding method. (4) Not annualized. (5) For periods less than one full year all income and expenses are annualized. (6) For the period from December 1, 2017 to May 31, 2018, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2017, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2017, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2016, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2015, the Fund accrued $85,708,196 in net deferred tax benefit, of which $2,449,517 is attributable to Class C. For the period from March 31, 2014 to November 30, 2014, the Fund accrued $20,001,167 in net deferred tax expense, of which $265,741 is attributable to Class C. (7) For the period from December 1, 2017 to May 31, 2018, the Fund accrued $30,338 in franchise tax expense, of which $1,134 is attributable to Class C. For the year ended November 30, 2017, the Fund accrued $148,000 in franchise tax expense, of which $5,467 is attributable to Class C. For the year ended November 30, 2016, the Fund accrued $55,653 in franchise tax expense, of which $2,149 is attributable to Class C. For the year ended November 30, 2015, the Fund accrued $100,618 in franchise tax expense, of which $2,876 is attributable to Class C. For the period from March 31, 2014 to November 30, 2014, the Fund accrued $113,535 in franchise tax expense, of which $1,508 is attributable to Class C. (8) For the period from December 1, 2017 to May 31, 2018, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2017, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2016, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2015, the Fund accrued $4,392,751 in net deferred tax benefit, of which $125,544 is attributable to Class C. For the period from March 31, 2014 to November 30, 2014, the Fund accrued $3,226,113 in net deferred tax benefit, of which $42,863 is attributable to Class C. (9) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

SEMI - ANNUAL REPORT 2018 • 13

Financial Highlights: Class I Shares

Per Common Share Data(1) | December 1,

2017 – May 31,

2018 | unaudited | Year Ended

November 30,

2017 | Year Ended

November 30,

2016 | Year Ended

November 30,

2015 | Year Ended

November 30,

2014 | Year Ended

November 30,

2013 |

| Net Asset Value, beginning of year | $8.43 | $10.07 | $9.52 | $13.54 | $12.10 | $10.42 |

| | | | | | | |

| Income from Investment Operations | | | | | | |

Net investment income (loss)(2) | (0.04) | (0.08) | (0.04) | 0.00‡ | (0.06) | (0.03) |

| Net realized and unrealized gain (loss) on investments | 0.48 | (0.93) | 1.22 | (3.39) | 2.13 | 2.34 |

| Total increase (decrease) from investment operations | 0.44 | (1.01) | 1.18 | (3.39) | 2.07 | 2.31 |

| Less Distributions to Shareholders | | | | | | |

| Net investment income | — | — | — | — | (0.06) | — |

| Return of capital | (0.32) | (0.63) | (0.63) | (0.63) | (0.57) | (0.63) |

| Total distributions to shareholders | (0.32) | (0.63) | (0.63) | (0.63) | (0.63) | (0.63) |

| Net Asset Value, end of period | $8.55 | $8.43 | $10.07 | $9.52 | $13.54 | $12.10 |

| Total Investment Return | 5.14%(3) | (10.66)% | 13.55% | (25.91)% | 17.29% | 22.60% |

| | | | | | | |

| Supplemental Data and Ratios | | | | | | |

| Net assets, end of period | $1,480,481,796 | $1,403,597,144 | $1,542,427,608 | $1,025,394,539 | $913,217,095 | $343,055,922 |

Ratio of waiver (recoupment) to average net assets(4) | — | — | — | (0.03)% | (0.05)% | 0.04% |

Ratio of net deferred income and franchise tax (benefit) expense to average net assets(5,6) | 0.00%‡ | 0.01% | — | (6.75)% | 6.15% | 9.69% |

Ratio of expenses (including net deferred and franchise tax (benefit) expense) to average net assets before (waiver) recoupment(4,5,6) | 1.42% | 1.41% | 1.42% | (5.33)% | 7.60% | 11.23% |

Ratio of expenses (including net deferred and franchise tax (benefit) expense) to average net assets after (waiver) recoupment(4,5,6) | 1.42% | 1.41% | 1.42% | (5.30)% | 7.65% | 11.19% |

Ratio of expenses (excluding net deferred and franchise tax (benefit) expense) to average net assets before (waiver) recoupment(4,5,6) | 1.42% | 1.40% | 1.42% | 1.41% | 1.45% | 1.54% |

Ratio of expenses (excluding net deferred and franchise tax (benefit) expense) to average net assets after (waiver) recoupment(4,5,6) | 1.42% | 1.40% | 1.42% | 1.44% | 1.50% | 1.50% |

Ratio of net investment income (loss) (including net deferred tax benefit and franchise tax benefit (expense)) to average net assets before waiver (recoupment)(4,6,7) | (0.94)% | (0.87)% | (0.43)% | 0.03% | (0.40)% | (0.33)% |

Ratio of net investment income (loss) (including net deferred tax benefit and franchise tax benefit (expense)) to average net assets after waiver (recoupment)(4,6,7) | (0.94)% | (0.87)% | (0.43)% | 0.00% | (0.45)% | (0.29)% |

Ratio of net investment loss (excluding net deferred tax benefit and franchise tax benefit (expense)) to average net assets before waiver (recoupment)(4,6,7) | (0.94)% | (0.86)% | (0.42)% | (0.31)% | (0.84)% | (0.74)% |

Ratio of net investment loss (excluding net deferred tax benefit and franchise tax benefit (expense)) to average net assets after waiver (recoupment)(4,6,7) | (0.94)% | (0.86)% | (0.42)% | (0.34)% | (0.89)% | (0.70)% |

Portfolio turnover rate(8) | 21.11%(3) | 19.35% | 24.63% | 57.63% | 57.83% | 90.59% |

‡ Less than one cent per share.

(1) Information presented relates to a share of Class I for the entire period. (2) Calculated using average shares outstanding method. (3) Not annualized. (4) For periods less than one full year all income and expenses are annualized. (5) For the period from December 1, 2017 to May 31, 2018, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2017, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2016, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2015, the Fund accrued $85,708,196 in net deferred tax benefit, of which $70,229,060 is attributable to Class I. For the year ended November 30, 2014, the Fund accrued $51,671,889 in net deferred tax benefit, of which $39,179,849 is attributable to Class I. For the year ended November 30, 2013, the Fund accrued $29,149,971 in net deferred tax expense, of which $20,701,468 is attributable to Class I. (6) For the period from December 1, 2017 to May 31, 2018, the Fund accrued $30,338 in franchise tax expense, of which $26,765 is attributable to Class I. For the year ended November 30, 2017, the Fund accrued $148,000 in franchise tax expense, of which $127,777 is attributable to Class I. For the year ended November 30, 2016, the Fund accrued $55,653 in franchise tax expense, of which $46,134 is attributable to Class I. For the year ended November 30, 2015, the Fund accrued $100,618 in franchise tax expense, of which $82,446 is attributable to Class I. For the year ended November 30, 2014, the Fund accrued $113,535 in franchise tax expense, of which $90,128 is attributable to Class I. For the year ended November 30, 2013, the Fund accrued $37,430 in franchise tax expense, of which $26,582 is attributable to Class I. (7) For the period from December 1, 2017 to May 31, 2018, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2017, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2016, the Fund did not accrue a deferred tax expense or benefit. For the year ended November 30, 2015, the Fund accrued $4,392,751 in net deferred tax benefit, of which $3,599,408 is attributable to Class I. For the year ended November 30, 2014, the Fund accrued $3,704,675 in net deferred tax benefit, of which $2,913,108 is attributable to Class I. For the year ended November 30, 2013, the Fund accrued $1,263,406 in net deferred tax benefit, of which $897,234 is attributable to Class I. (8) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

14 | MainGate mlp fund

Notes to Financial Statements

May 31, 2018 | unaudited

1. Organization

MainGate MLP Fund (the “Fund”), a series of MainGate Trust (the “Trust”), is registered under the Investment Company Act of 1940 as an open-end, non-diversified investment company. The Trust was established under the laws of Delaware by an Agreement and Declaration of Trust dated November 3, 2010. The Fund’s investment objective is total return. Class A and Class I commenced operations on February 17, 2011. Class C commenced operations on March 31, 2014.

The Fund offers three classes of shares, Class A, Class C and Class I. Class A shares are subject to a maximum 5.75% front-end sales charge and a 1.00% contingent deferred sales charge within 18 months of redemption. Class C shares have no front-end sales charge, but are subject to a 1.00% contingent deferred sales charge within 12 months of redemption. Class I shares have no sales charge. Class A shareholders pay Rule 12b-1 fees at the annual rate of 0.25% of average daily net assets. Class C shareholders pay Rule 12b-1 fees at the annual rate of 1.00% of average daily net assets. For the period ended May 31, 2018, contingent deferred sales charges of $ — and $7,007 were incurred by Class A and Class C shareholders, respectively.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Board Certification Topic 946 Financial Services – Investment Companies.

2. Significant Accounting Policies

A. Use of Estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the recognition of distribution income and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

B. Investment Valuation. The Fund uses the following valuation methods to determine fair value as either current market value for investments for which market quotations are available, or if not available, a fair value, as determined in good faith pursuant to such policies and procedures as may be approved by the Trust’s Board of Trustees (“Board of Trustees”) from time to time. The valuation of the portfolio securities of the Fund currently includes the following processes:

| • | Equity Securities: Securities listed on a securities exchange or an automated quotation system for which quotations are readily available, including securities traded over the counter, will be valued at the last quoted sale price on the principal exchange on which they are traded on the valuation date (or at approximately 4:00 p.m. Eastern Time if a security’s principal exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. |

| • | Fixed Income Securities: Debt and fixed income securities will be priced by independent, third-party pricing agents approved by the Board of Trustees. These third-party pricing agents will employ methodologies that they believe are appropriate, including actual market transactions, broker-dealer supplied valuations, matrix pricing, or other electronic data processing techniques. These techniques generally consider such factors as security prices, yields, maturities, call features, ratings and developments relating to specific securities in arriving at valuations. Debt obligations with remaining maturities of sixty days or less will be valued at their amortized cost, which approximates fair market value. |

| • | Foreign Securities: Foreign securities are often principally traded on markets that close at different hours than U.S. markets. Such securities will be valued at their most recent closing prices on the relevant principal exchange even if the close of that exchange is earlier than the time of the Fund’s net asset value (“NAV”) calculation. However, securities traded in foreign markets which remain open as of the time of the NAV calculation will be valued at the most recent sales price as of the time of the NAV calculation. In addition, prices for certain foreign securities may be obtained from the Fund’s approved pricing sources. The Adviser also monitors for the occurrence of significant events that may cast doubts on the reliability of previously obtained market prices for foreign securities held by the Fund. The prices for foreign securities will be reported in local currency and converted to U.S. dollars using currency exchange rates. Exchange rates will be provided daily by recognized independent pricing agents. The exchange rates used for the conversion will be captured as of the London close each day. |

C. Security Transactions, Investment Income and Expenses. Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on a specific identified cost basis. Interest income is recognized on the accrual basis, including amortization of premiums and accretion of discounts. Distributions are recorded on the ex-dividend date. Distributions received from the Fund’s investments in master limited partnerships (“MLPs”) generally are comprised of ordinary income and return of capital from the MLP. Dividends received from the Fund’s investments in MLP general partner interests generally are comprised of ordinary income. The Fund records investment income on the ex-date of the distributions. For financial statement purposes, the Fund uses return of capital and income estimates to allocate the distribution income received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded, as the actual character of these distributions is not known until after the fiscal year end of the Fund.

SEMI-ANNUAL REPORT 2018 • 15

The Fund estimates the allocation of investment income and return of capital for the distributions received from MLPs within the Statement of Operations. For the period ended May 31, 2018, the Fund has estimated approximately 100% of the distributions from MLPs taxed as partnerships to be return of capital. Distributions from common stock may also include income and return of capital. The Fund records the character of distributions received during the year based on estimates available. The characterization of distributions received by the Fund may be subsequently revised based on the information received from the MLPs and common stock after their tax reporting periods conclude.

Expenses are recorded on the accrual basis.

D. Dividends and Distributions to Shareholders. Dividends and distributions to shareholders are recorded on the ex-dividend date. The character of dividends and distributions to shareholders made during the period may differ from their ultimate characterization for federal income tax purposes. For the period ended May 31, 2018, the Fund’s dividends and distributions were expected to be comprised of 100% return of capital. The tax character of distributions paid for the period ended May 31, 2018, will be determined in early 2019.

E. Federal Income Taxation. The Fund, taxed as a corporation, is obligated to pay federal and state income tax on its taxable income. The Tax Cuts and Jobs Act (“TCJA”) was signed into law on December 22, 2017. The TCJA includes changes to the corporate income tax rate and alternative minimum tax (AMT) and modifications to the net operating loss (NOL) deduction. Prior to enactment, the highest marginal federal income tax rate was 35%. The TCJA reduced the corporate rate to a flat income tax rate of 21%. The change in the rate was reflected in the Fund’s NAV on December 22, 2017. The Fund may also be subject to a 20% AMT to the extent that their alternative minimum tax exceeds their regular federal income tax. For tax years beginning after December 31, 2017 the TCJA repealed the corporate AMT. The TCJA eliminated the NOL carryback ability and replaced the 20 year carryforward period with an indefinite carryforward period for any NOLs arising in tax years ending after December 31, 2017. The TCJA also established a limitation for any NOLs generated in tax years beginning after December 31, 2017 to the lesser of the aggregate of available NOLs or 80% of taxable income before any NOL utilization.

The Fund invests its assets primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Fund reports its allocable share of the MLP’s taxable income in computing its own taxable income. The Fund’s tax expense or benefit is included in the Statement of Operations based on the component of income or gains (losses) to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is recognized if, based on the weight of available evidence, it is more likely than not that some portion or all of the deferred income tax asset will not be realized.

The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes as an income tax expense on the Statement of Operations. For the period ended May 31, 2018, the Fund did not have interest or penalties associated with underpayment of income taxes.

F. Cash Distribution Information. The Fund intends to make quarterly distributions from investments, which include the amount received as cash distributions from MLPs and common stock dividends. These activities will be reported in the Statements of Changes in Net Assets.

G. Indemnifications. Under the Fund’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts that provide general indemnification to other parties. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred, and may not occur. However, the Fund has not had prior claims or losses pursuant to these contracts.

3. Fair Value Measurements

Various inputs that are used in determining the fair value of the Fund’s investments are summarized in the three broad levels listed below:

| • | Level 1: quoted prices in active markets for identical securities |

| • | Level 2: other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3: significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The Fund did not hold Level 2 or Level 3 investments at any time during the period from December 1, 2017 to May 31, 2018. There were no transfers into and out of all Levels during the current period presented. It is the Fund’s policy to record transfers between all Levels as of the end of the reporting period.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

These inputs are summarized in the three broad levels that follow.

16 | MainGate mlp fund

| | | | | | | | | |

| | | | | Fair Value Measurements at Reporting Date Using: |

| Description | | Fair Value at

May 31, 2018 | | Quoted Prices in Active

Markets for Identical

Assets (Level 1) | | Significant Other

Observable Inputs

Inputs (Level 2) | | Significant

Unobservable

Inputs (Level 3) |

| Equity Securities | | | | | | | | |

Master Limited Partnerships and and Related Companies(1) | | $1,628,049,700 | | $1,628,049,700 | | $ — | | $ — |

| Total | | $1,628,049,700 | | $1,628,049,700 | | $ — | | $ — |

(1) All other industry classifications are identified in the Schedule of Investments.

4. Concentrations of Risk

The Fund’s investment objective is to seek to generate total return. The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets, plus any borrowings for investment purposes, in MLP interests.

5. Agreements and Related Party Transactions

The Trust has entered into an Investment Advisory Agreement (the “Agreement”) with Chickasaw Capital Management, LLC (the “Adviser”). Under the terms of the Agreement, the Fund pays the Adviser a fee, payable at the end of each calendar month, at an annual rate equal to 1.25% of the average daily net assets of the Fund.

The Adviser has agreed to waive its advisory fee and/or reimburse certain operating expenses of the Fund, until at least March 31, 2019, but only to the extent necessary so that the Fund’s total annual expenses, excluding brokerage fees and commissions; borrowing costs (such as (a) interest and (b) dividend expenses on securities sold short); taxes, including deferred income tax expense/(benefit) and franchise taxes; any indirect expenses, such as acquired fund fees and expenses; Class A 12b-1 fees, Class C 12b-1 fees, and extraordinary expenses, do not exceed 1.50% of the average daily net assets of each class of the Fund. Any payment by the Adviser of the Fund’s operating, organizational and offering expenses are subject to repayment by the Fund in the three fiscal years following the fiscal year in which the payment was made; provided that the Fund is able to make the repayment without exceeding the 1.50% expense limitation.

Waived fees and reimbursed Fund expenses, including prior year expenses, are subject to potential recoupment by year of expiration. During the period from December 1, 2017, to May 31, 2018, the Fund did not waive or recoup expenses. At May 31, 2018, there were no prior year amounts subject to potential recoupment.

Certain Trustees and Officers of the Trust/Fund are also Officers of the Adviser.

The Fund has engaged Vigilant Compliance, LLC (“Vigilant”) to provide compliance services including the appointment of the Fund’s Chief Compliance Officer. Effective October 1, 2015, the Fund pays Vigilant a monthly fee of $4,823 for net assets between $1.0 billion and $1.7 billion, $5,333 for net assets between $1.7 billion and $2.0 billion, $5,843 for net assets between $2.0 billion and $2.5 billion, and $6,120 for net assets above $2.5 billion.

The Fund has entered into a Rule 12b-1 distribution agreement with Quasar Distributors, LLC (“Quasar”). Class A shareholders pay Rule 12b-1 fees at the annual rate of 0.25% of average daily net assets. Class C shareholders pay Rule 12b-1 fees at the annual rate of 1.00% of average daily net assets. For the period from December 1, 2017, to May 31, 2018, 12b-1 distribution expenses of $167,448 and $311,240 were accrued by Class A and Class C shares, respectively.

The Fund has engaged U.S. Bancorp Fund Services, LLC to serve as the Fund’s administrator. The Fund pays the administrator a monthly fee computed at an annual rate of 0.10% of the first $75,000,000 of the Fund’s average daily net assets, 0.08% on the next $250,000,000 of average daily net assets and 0.05% on the balance of the Fund’s average daily net assets, with a minimum annual fee of $64,000, imposed upon the Fund reaching certain asset levels.

U.S. Bancorp Fund Services, LLC serves as the Fund’s transfer agent, dividend paying agent, and agent for the automatic dividend reinvestment plan. The Fund pays the transfer agent a $45,000 flat fee, imposed upon the Fund reaching certain asset levels, plus transaction and other out-of-pocket charges.

U.S. Bank, N.A. serves as the Fund’s custodian. The Fund pays the custodian a monthly fee computed at an annual rate of 0.0075% of the first $250 million of market value and 0.0050% of the balance, with a minimum annual fee of $4,800, imposed upon Fund reaching certain asset levels, plus transaction and other out-of-pocket charges.

SEMI-ANNUAL REPORT 2018 • 17

6. Income Taxes

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Such temporary differences are principally: (i) taxes on unrealized gains/(losses), which are attributable to the temporary difference between fair market value and tax basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting and income tax purposes and (iii) the net tax benefit of accumulated net operating losses and capital loss carryforwards. Deferred tax assets and liabilities are measured using effective tax rates expected to apply to taxable income in the years such temporary differences are realized or otherwise settled. To the extent the Fund has a deferred tax asset, consideration is given to whether or not a valuation allowance is required. A valuation allowance is required if, based on the evaluation criterion provided by ASC 740, Income Taxes (ASC 740), it is more likely- than-not some portion or all of the deferred tax asset will not be realized. Among the factors considered in assessing the Fund’s valuation allowance are: the nature, frequency and severity of current and cumulative losses, forecasts of future profitability, the duration of the statutory carryforward periods, significant redemptions, and the associated risks that operating and capital loss carryforwards may expire unused.

At May 31, 2018, the Fund determined a valuation allowance was required.

Changes to the factors considered in assessing the Fund’s valuation allowance may result in the Fund revising its position as to the recoverability of its deferred tax assets which may result in a change to the valuation allowance at a later date.

Components of the Fund’s deferred tax assets and liabilities as of May 31, 2018, are as follows:

| | |

| Deferred tax assets: | |

| Net operating loss carryforward (tax basis) | $57,952,102 |

| Capital loss carryforward (tax basis) | 54,608,967 |

| Other | 24,489 |

| Total deferred tax assets | 112,585,558 |

| Valuation allowance | (44,197,266) |

| | |

| Less: Deferred tax liabilities: | |

| Unrealized gains on investment securities (tax basis) – net | (68,388,292) |

| Net deferred tax asset | $— |

The net operating loss carryforward is available to offset future taxable income. The Fund has the following net operating loss and capital loss carryforward amounts:

| | | | | |

| Fiscal Year Ended Net Operating Loss | | Amount | | Expiration |

| November 30, 2012 | | $782,951 | | November 30, 2032 |

| November 30, 2013 | | 1,530,154 | | November 30, 2033 |

| November 30, 2014 | | 7,977,319 | | November 30, 2034 |

| November 30, 2015 | | 39,297,898 | | November 30, 2035 |

| November 30, 2016 | | 62,681,569 | | November 30, 2036 |

| November 30, 2017 | | 77,956,625 | | November 30, 2037 |

| November 30, 2018 | | 60,357,435 | | Indefinite |

| Total Fiscal Year Ended Net Operating Loss | | $250,583,951 | | |

| | | | | |

| Fiscal Year Ended Net Capital Loss | | Amount | | Expiration |

| November 30, 2015 | | $16,220,624 | | November 30, 2020 |

| November 30, 2016 | | 146,278,454 | | November 30, 2021 |

| November 30, 2017 | | 18,645,662 | | November 30, 2022 |

| November 30, 2018 | | 54,983,549 | | November 30, 2023 |

| Total Fiscal Year Ended Net Capital Loss | | $236,128,289 | | |

For corporations, capital losses can only be used to offset capital gains and cannot be used to offset ordinary income. The capital loss may be carried forward for 5 years and, accordingly, would begin to expire as of November 30, 2020. The net operating loss prior to the TCJA can be carried forward for 20 years and, accordingly, would begin to expire as of November 30, 2032. Any NOLS arising in tax years ending after December 31, 2017 will have an indefinite carry forward period.

18 | MainGate mlp fund

Total income tax expense (current and deferred) differs from the amount computed by applying the federal statutory income tax rate of 21% to net investment income and realized and unrealized gains (losses) on investments before taxes for the period ended May 31, 2018, as follows:

| | | | | |

| Total Tax Expense (Benefit) | | Amount | | Rate |

| | | | | |

| Tax Expense (Benefit) at Statutory Rates | | $16,035,806 | | (21.00)% |

| State Income Tax Expense (Benefit) | | | | |

| (Net of Federal Benefit) | | 1,624,062 | | (2.13)% |

Tax Expense (Benefit) on Permanent Items(1) | | (523,369) | | 0.69% |

| Other | | 403,215 | | (0.53)% |

| Change in Federal/State Rate Due to Tax Reform | | 36,243,157 | | (47.46)% |

| Change in Valuation Allowance | | (53,782,871) | | 70.43% |

| Total Tax Expense (Benefit) | | $— | | 0.00% |

(1) Permanent Items are made up of dividends received deductions.

At May 31, 2018, the Fund did not have a current tax expense or benefit due to the use of a valuation allowance.

At May 31, 2018, the tax cost basis of investments was $1,332,339,831 and gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows:

| | | |

| Gross unrealized appreciation | | $355,333,156 |

| Gross unrealized depreciation | | (59,623,287) |

| Net unrealized appreciation | | $295,709,869 |

The differences between book-basis and tax-basis unrealized appreciation (depreciation) are primarily due to timing differences of income recognition from the MLP investments and wash sales on security transactions.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on U.S. tax returns and state tax returns filed or expected to be filed since inception of the Fund. No income tax returns are currently under examination. The tax years since 2014 remain subject to examination by the tax authorities in the United States. Due to the nature of the Fund’s investments, the Fund may be required to file income tax returns in several states. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

7. Investment Transactions

For the period ended May 31, 2018, the Fund purchased (at cost) and sold securities (proceeds) in the amount of $343,201,499 and $358,580,072 (excluding short-term securities), respectively.

SEMI-ANNUAL REPORT 2018 • 19

8. Share Transactions

Transactions of shares of the Fund were as follows:

| | | December 1, 2017 – May 31, 2018 | | Year Ended November 30, 2017 |

| | | | | | | | | |

| Class A Shares | | Amount | | Shares | | Amount | | Shares |

| Sold | | $21,094,669 | | 2,493,122 | | $57,099,187 | | 5,968,067 |

| Dividends Reinvested | | 4,123,435 | | 483,241 | | 10,829,204 | | 1,143,253 |

| Redeemed | | (49,587,369) | | (6,082,569) | | (104,199,800) | | (11,201,201) |

| Net Decrease | | $(24,369,265) | | (3,106,206) | | $(36,271,409) | | (4,089,881) |

| | | | | | | | | |

| | | December 1, 2017 – May 31, 2018 | | Year Ended November 30, 2017 |

| | | | | | | | | |

| Class C Shares | | Amount | | Shares | | Amount | | Shares |

| Sold | | $7,507,970 | | 900,334 | | $23,672,967 | | 2,528,783 |

| Dividends Reinvested | | 2,156,460 | | 260,105 | | 4,275,342 | | 462,252 |

| Redeemed | | (9,412,479) | | (1,140,148) | | (18,885,604) | | (2,074,183) |

| Net Increase | | $251,951 | | 20,291 | | $9,062,705 | | 916,852 |

| | | | | | | | | |

| | | December 1, 2017 – May 31, 2018 | | Year Ended November 30, 2017 |

| | | | | | | | | |

| Class I Shares | | Amount | | Shares | | Amount | | Shares |

| Sold | | $509,036,901 | | 59,641,278 | | $833,124,688 | | 85,329,359 |

| Dividends Reinvested | | 45,068,944 | | 5,203,184 | | 84,436,111 | | 8,826,924 |

| Redeemed | | (490,785,221) | | (58,202,112) | | (762,436,714) | | (80,886,570) |

| Net Increase | | $63,320,624 | | 6,642,350 | | $155,124,085 | | 13,269,713 |

9. Subsequent Events

The Fund has adopted standards which establish general standards of accounting for disclosure of events that occur after the Statement of Assets and Liabilities date, but before the financial statements are issued. The Fund has performed an evaluation of subsequent events through the date the financial statements were issued.

On July 24, 2018 the Fund declared a distribution payable of $0.1575 per share, to Class A shareholders, Class C shareholders, and Class I shareholders of record on July 23, 2018, and payable on July 25, 2018.

Additional Information | unaudited May 31, 2018

Trustee and Officer Compensation

The Fund does not compensate any of its trustees who are interested persons nor any of its officers. For the period ended May 31, 2018, the aggregate compensation paid by the Fund to the independent trustees was $48,000. The Fund did not pay any special compensation to any of its trustees or officers. The Fund’s Statement of Additional Information includes additional information about the trustees and is available on the Fund’s Web site at www.maingatefunds.com or the SEC’s Web site at www.sec.gov.

Cautionary Note Regarding Forward-Looking Statements

This report contains “forward-looking statements” as defined under the U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to materially differ from the Fund’s historical experience and its present expectations or projections indicated in any forward-looking statements. These risks include, but are not limited to, changes in economic and political conditions; regulatory and legal changes; MLP industry risk; concentration risk; energy sector risk; commodities risk; MLP and other tax risks, such as deferred tax assets and liabilities risk; and other risks discussed in the Fund’s filings with the SEC. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Fund undertakes no obligation to update or revise any forward-looking statements made herein. There is no assurance that the Fund’s investment objectives will be attained.

Proxy Voting Policies

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities owned by the Fund and information regarding how the Fund voted proxies relating to the portfolio of securities during the most recent 12-month period ended June 30 is available to shareholders without charge by visiting the SEC’s Web site at www.sec.gov.

Form N-Q

The Fund files its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the SEC on Form N-Q. The Fund’s Form N-Q and statement of additional information are available without charge by visiting the SEC’s Web site at www.sec.gov. In addition, you may review and copy the Fund’s Form N-Q at the SEC’s Public Reference Room in Washington D.C. You may obtain information on the operation of the Public Reference Room by calling (800) SEC-0330.

Householding

In an effort to decrease costs, the Fund intends to reduce the number of duplicate prospectuses, annual and semi-annual reports, proxy statements and other similar documents you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders that the Transfer Agent reasonably believes are from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 855.MLP.FUND (855.657.3863) to request individual copies of these documents. Once the Transfer Agent receives notice to stop householding, the Transfer Agent will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

Management Agreement Renewal | unaudited

The Board of Trustees of MainGate MLP Fund (the “Fund”) oversees the management of the Fund and, as required by law, determines annually whether to approve the continuance of the Fund’s management agreement (the “Management Agreement”) with its investment advisor, Chickasaw Capital Management LLC (the “Advisor”). The Board of Trustees requests and evaluates all information that it deems reasonably necessary under the circumstances in connection with this annual review.

At the Trustees’ in-person meeting held on January 22, 2018, the Trustees, including all of the Trustees who are not “interested persons” (as that term is defined in the Investment Company Act of 1940, as amended) of the Fund or of the Advisor, approved the continuation of the Fund’s Management Agreement for an additional year. In considering the renewal of the Management Agreement, the Trustees received and reviewed in advance of the meeting a variety of materials related to the Fund and the Advisor, including: (i) information about the advisory fees paid by, and the expense ratio of, the Fund compared to its peer group funds; (ii) information about the Fund’s performance versus its peers and benchmark index, and composite performance information for other accounts managed by the Advisor; (iii) the Advisor’s Form ADV, Parts 1A and 2A; (iv) the Advisor’s Balance Sheet as of November 30, 2017, Profit & Loss Statement for the period from January 1 through November 30, 2017, and the Advisor’s profitability analysis with respect to the Advisor’s relationship with the Fund for the period from January 1 through November 30, 2017; (v) a copy of the Fund’s Management Agreement; and (vi) an executed copy of the Advisor’s agreement to continue capping Fund operating expenses through March 31, 2019.

In considering the renewal of the Management Agreement and these materials, the Board was assisted by the Fund’s legal counsel, Thompson Coburn LLP. The Board also met in-person with senior executive officers of the Advisor and discussed with them the Advisor’s services and personnel, as well as the Fund’s fees, performance and peer group comparisons.

SEMI -ANNUAL REPORT 2018 • 21

Some of the factors that figured particularly in the Trustees’ deliberations are listed below, although individual Trustees may have evaluated this information differently, ascribing different weights to various factors. It is important to note that the Trustees’ consideration of the Advisor and the Management Agreement is an ongoing process. The Trustees meet at least quarterly to discuss and consider, among other things, the Advisor’s services with respect to the Fund. In considering whether to renew the Management Agreement, the Trustees took into account discussions with the Advisor’s management at prior meetings.

A. Nature, Extent, and Quality of Services: As part of their review, the Trustees examined the Advisor’s ability to provide high quality investment management services to the Fund. The Trustees considered that the Advisor’s services to the Fund include providing a continuous investment program for the Fund, adhering to the Fund’s investment restrictions, complying with applicable Fund policies and regulatory obligations, and voting proxies on behalf of the Fund. The Trustees also considered the qualifications and experience of the Advisor’s portfolio managers who are responsible for the day-to-day management of the Fund’s portfolio, along with the qualifications and experience of the Advisor’s research team.

The Trustees also considered the Advisor’s investment philosophy and research and decision-making processes, the Advisor’s ability to attract and retain capable research and advisory personnel, the capability of the Advisor’s senior management and staff, and the level of skill required to manage the Fund. In addition, the Trustees discussed with the Advisor information about the Advisor’s risk management process.

The Trustees also considered conditions that might affect the Advisor’s ability to provide high quality services to the Fund in the future under the Management Agreement, including the Advisor’s financial condition and operational stability. Based on the foregoing, the Trustees concluded that the Advisor’s investment process, research capabilities and philosophy remain well suited to the Fund given the Fund’s investment objectives and policies, and that the Advisor would be able to meet its reasonably foreseeable obligations under the Management Agreement and expense cap agreement.