The Registrant is filing this amendment to its Form N-CSR for the year ended November 30, 2022, originally filed with the U.S. Securities and Exchange Commission effective as of February 21, 2023 (Accession Number: 0000894189-23-001210). The purpose of this amendment is solely to include certain updated information in Item 4 and updated certification language and updated signature dates. This Form N-CSR/A does not otherwise modify the disclosures therein in any way.

MainGate MLP Fund

Class A (AMLPX)

Class C (MLCPX)

Class I (IMLPX)

6075 Poplar Avenue, Suite 720 | Memphis, TN 38119 | 855.MLP.FUND (855.657.3863) | www.maingatefunds.com

Annual Report

November 30, 2022

ANNUAL REPORT 2022 • 3

Table of Contents

MainGate mlp fund

Dear Shareholder,

The MainGate MLP Fund (“Fund”) had the following average annual total returns for its fiscal year ended November 30, 2022 compared to the S&P 500 Index and the Alerian MLP Total Return Index.

| | Inception | | 1 | | 5 | | 10 | | Since | |

| | Date | | Year | | Year | | Year | | Inception | |

| | | | | | | | | | | |

| MainGate MLP Fund – Class A without load | 2/17/11 | | 43.28% | | 5.06% | | 3.17% | | 3.81% | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| MainGate MLP Fund – Class A with 5.75% | 2/17/11 | | 35.14% | | 3.83% | | 2.56% | | 3.29% | |

| maximum front-end load | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| MainGate MLP Fund – Class I | 2/17/11 | | 43.74% | | 5.31% | | 3.42% | | 4.07% | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| S&P 500 Index | 2/17/11 | | -9.21% | | 10.98% | | 13.34% | | 12.10% | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Alerian MLP Total Return Index | 2/17/11 | | 42.25% | | 6.06% | | 2.15% | | 3.18% | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| MainGate MLP Fund – Class C without load | 3/31/14 | | 42.25% | | 4.24% | | –– | | -0.45% | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| MainGate MLP Fund – Class C with 1.00% | 3/31/14 | | 41.25% | | 4.24% | | –– | | -0.45% | |

| Contingent Deferred Sales Charge | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| S&P 500 Index | 3/31/14 | | -9.21% | | 10.98% | | –– | | 12.10% | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Alerian MLP Total Return Index | 3/31/14 | | 42.25% | | 6.06% | | –– | | 3.18% | |

| | | | | | | | | | | |

Expense Ratios (Gross/Net): A Shares = 1.69%/1.69% | C Shares = 2.44%/2.44% | I Shares = 1.44%/1.44%. Net expense ratios represent the percentages paid by investors and reflect a 0.00% deferred income tax expense which represents the performance impact of accrued deferred tax liabilities across the Fund, not individual share classes, for the fiscal year ended November 30, 2022 (the Fund did not have a current tax expense or benefit due to a valuation allowance). The Fund’s adviser has contractually agreed to cap the Fund’s total annual operating expenses (excluding brokerage fees and commissions; Class A 12b-1 fees; borrowing costs; taxes, such as Deferred Income Tax Expense; and extraordinary expenses) at 1.50% through March 31, 2024. The performance data shown For Class C with load reflects the Class C maximum deferred sales charge of 1.00%. Deferred income tax expense/(benefit) represents an estimate of the Fund’s potential tax expense/(benefit) if it were to recognize the unrealized gains/(losses) in the portfolio. An estimate of deferred income tax expense/(benefit) depends upon the Fund’s net investment income/(loss) and realized and unrealized gains/(losses) on its portfolio, which may vary greatly on a daily, monthly and annual basis depending on the nature of the Fund’s investments and their performance. An estimate of deferred income tax expenses/(benefit) cannot be reliably predicted from year to year.

The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the information quoted. To obtain performance information current to the most recent month-end please call 855.MLP.FUND (855.657.3863). Performance data shown for Class A shares with load reflects the maximum sales charge of 5.75%. Performance data shown for Class C shares with load reflects the maximum deferred sales charge of 1.00%. Performance data shown for Class I shares does not reflect the deduction of a sales load or fee. Performance data shown “Without Load” does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

ANNUAL REPORT 2022 • 5

Happy New Year!

Midstream enjoyed a happy 2022 with the Alerian MLP TR Index (AMZX)1 rising +30.9%, and our outlook for this year as well as our review of some historical analogies has us optimistic going in to 2023.

The Fed’s actions to move interest rates higher have unleashed many ramifications. One of the more important ones in our opinion has been to dispel fantastical notions and “business models” that could only be dreamed up at zero percent interest rates. As it relates to Midstream, we believe a more balanced opinion of the future use of traditional hydrocarbons is at hand, and that allows for a more logical discussion of valuation2 prospects. Our new investor discussions are much more rooted in hard assets and cash flows3, which is a similar tone to other cycles when the high of the speculative bubble wears off.

From almost all perspectives, we believe Midstream valuation screens as inexpensive, which in and of itself gives investors a margin of safety to begin their analysis. As of 12/31/22, the Alerian is valued at 5.5x price to distributable cash flow per unit (DCF/u)4 and sports a 15.5% free cash flow (FCF) 5 yield. The 2023e yield6 on the index is 7.5%, is covered 2.12x (or a 47% payout ratio), and is estimated to grow 5.6%7. Valuation to us remains much more a function of fund flows, or a lack thereof. But, as we discussed last quarter, we believe improving fund flow is just a matter of time, and we’ll dive deeper into this topic in the “Active Allocation” section. Assuming no change in valuation, yield plus growth provides a 13.1% starting point for potential expected total return. This framework does not take into account potential positive effects from buybacks, which could be a ~$5 billion tailwind in 20238. We don’t believe there are other areas of the market that offer such a healthy proposition.

Hopefully, the tumult of global energy markets is more benign than in recent years, but because energy is such a strong component of global GDP, market dynamics will always give it airtime. There is a growing consensus of a recession in 2023. We’re not going to dissect whether its timing is first half versus second half, when will the markets acknowledge it or have they already, or when each country takes its turn in a rolling fashion. No one knows, and we won’t try to predict.

To balance this potential negative economic narrative with a positive offset, though, we are cautiously bullish on China’s return to the world economic stage. The nation has remained in lock-down longer than most people will acknowledge — essentially, they never left 2020 as the U.S. and other global countries did — and this is reflected from an energy demand perspective where they remain at COVID lows. Any return to GDP growth pushes oil demand higher and is supportive of global supply/ demand balance, and demand could surprise to the upside. The full re-opening of China’s borders to outside travel by its citizens may prove to be the ignition to this thesis9.

(1) Alerian MLP Index: A capitalization-weighted index of the most prominent energy Master Limited Partnerships. Visit http://www.alerian.com/ indices/amz-index for more information, including performance. You cannot invest directly in an index. (2) Valuation: The process of determining the current worth of an asset or a company. (3) Cash Flow: A measurement of the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income. (4) Price to Distributable Cash Flow (P/DCF): Market cap of the MLP divided by a full year of distributable cash flow, which is measured as earnings before interest, taxes, depreciation and amortization (EBITDA) available to pay unitholders after reserving for maintenance capital expenditures and payment of interest expense. (5) Free Cash Flow: A measure of financial performance calculated as operating cash flow minus capital expenditures. (6) Yield: Refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value. (7) Distribution and dividend estimates sourced from Bloomberg. LP. (8) Wells Fargo Securities, “Midstream Monthly Outlook”, January 6, 2023. Actual share repurchases may vary significantly.

(9) https://www.reuters.com/world/china/china-reopens-borders-final-farewell-zero-covid-2023-01-08/.

6 | MainGate mlp fund

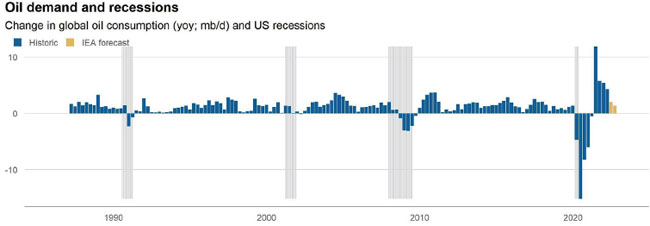

We also think investors may be overly cautious on global oil demand in their mental recession calculators. The below chart from Morgan Stanley shows the relative inelasticity of global demand during recessions, save for the 2020 time period. Even analyzing the 2008 recession, which we haven’t found anyone predicting a repeat of, there was only a peak decline of 2 million barrels per day (MMBpd), or less than 2% of global demand10. Conversely, even taking into account the potential for a global recession, the International Energy Agency (IEA)11 is predicting global demand growth from 100 MMBpd to 102 MMBpd in 202312. Humans tend to suffer from “recency bias” thereby extrapolating the most recent experiences, positively or negatively, when making future decisions. In this case we believe a longer-term perspective is warranted.

Oil Demand and Recessions

Change in global oil consumption (yoy; mb/d) and US recessions

IEA, Morgan Stanley Research, “The Oil Manual”, 4/21/22

As we would see in any year, we do expect to see some puts and takes in the near-term fundamental picture for U.S. hydrocarbons. We strongly consider market forecasts expressing somewhat negative views as temporary. We see higher natural gas storage levels in the U.S. for 2023 due to increasing domestic production and the tapering of U.S. LNG export growth that we have seen over the last few years. This is already having its effect on price as increasing supply and a warmer start to the year are driving prices back down to the $4 per million British thermal units (MMBtu) level. This is less than half the highs seen last summer when U.S. inventories were below the 5-year average and global natural gas prices were spiking due to Europe’s rush to fill inventories ahead of winter. However, as we move through the year, we expect the global storage injection to consistently keep the pressure on U.S. exports, particularly when the Freeport LNG export facility comes back on line, and we expect U.S. demand, ex-LNG exports, to remain relatively inelastic, in line with history.

(10) Morgan Stanley, “The Oil Manual”, 4/1/22. (11) International Energy Agency (IEA): An autonomous organization which works to ensure reliable, affordable and clean energy for its 29 member countries and beyond. IEA’s four main areas of focus are: energy security, economic development, environmental awareness, and engagement worldwide. (12) International Energy Agency (IEA), “Oil Market Report”, December 2022.

ANNUAL REPORT 2022 • 7

Natural Gas Liquids (NGLs) are somewhat over-supplied in the near term due to lower petrochemical demand. These customers continue to work through the inventories built during the global recovery of 2021-2022, as well as some cracker downtime affecting their ability to consume NGLs. That said, China is a large consumer of NGLs, and as their economy picks up steam, they could be an important driver that balances this market.

As it relates to Midstream, the financial statements are largely agnostic as to whether there are short-term recessionary indicators from volumes. First, Midstream assets remain highly contracted with take or pay contracts. Second, they will benefit from inflation escalators that initiated in earnest mid-2022 and should continue to be a tailwind through 2023. Third, as discussed, the distributions are better protected than any other point in our history of analyzing the industry. Lastly, again, Midstream equity valuation is highly attractive from a historical perspective.

Active Allocation

In previous newsletters over the past few years, we have touched on not just the fundamental reasons to remain allocated or to consider an allocation to Midstream, but also some of the other unique characteristics that separate the sector from other market opportunities. We’ll be a little more overt this quarter, and discuss why we see opportunities for the sector to potentially deliver allocation alpha.

Assessing long-term trends from a few different angles can provide a useful starting point. Returning to recency bias, we believe investors have forgotten the 2000-2011 return period for Midstream where the AMZX outperformed the S&P 500 TR Index (SPXT)13 for 12 straight years. There are similarities between the post-Internet bubble period and the current one, with both periods exhibiting a market rotation away from the technology sector. Should the tech sector rotation continue in 2023, Midstream could be in a similarly favorable position to where things were in the early 2000s from a relative performance standpoint. That period’s sector rotation was a catalyst for the next 10+ years of Midstream’s outperformance of the broader market. Given the low absolute valuation of Midstream today, if we see a steady march higher on the valuation front, plus factor in the attractive yield, and consider modest growth in DCF/u over the intermediate term, those potential total return ingredients could lead to a very competitive return profile relative to the broader market.

Midstream’s assets continue to be vital for world energy security and are not a fad. The industry’s history of operating mission critical infrastructure assets and a favorable outlook for their usage over a multi-decade period we believe make this is a worthy analog to the investment environment found 20+ years ago. Also favorable to history, Midstream in 2023 is a much broader group of public, large-cap companies than the one that was present in 2000, thus making it an attractive option for allocators looking for strong potential total returns in a sector with good trading liquidity.

We’ve Been Here Before

Bloomberg, LP and VettaFi LLC at 12/31/22.

(13) S&P 500: A free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States.

8 | MainGate mlp fund

Energy as a percentage of the S&P 500 remains well below its long-term history, currently 5.3% versus an 8.3% average since 1990. For those considering an Energy allocation, we believe Midstream should play a leading role as it exhibits less cash flow volatility, consistent cash flow growth, and a strong potential total return set-up.

Energy Weight within the S&P 500 Index

Bloomberg, LP at 12/31/22.

Scarcity Value

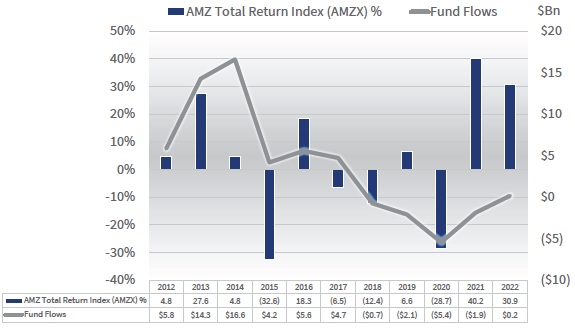

The sector remains under-owned institutionally, though well held by the current owners, with much of the volatility coming from market participants who are renters not owners. The good news is we estimate the sector experienced $160 million of net positive inflows from passive and active funds in 2022, which was the first net inflow year since 2017. While there was $950 million of active fund outflows there was $1.11 billion of inflows to passive products to create the net positive14. Recent fund flow trend history shows fund flows tend to follow performance, both up and down, and continued net positive flows could bode well for Midstream.

Midstream Fund Flows

Morningstar, 12/31/22.

(14) Morningstar, 12/31/2022.

ANNUAL REPORT 2022 • 9

Adding a tailwind to fund flows, we allude back to our equity repurchase comments from earlier where there could be nearly $5 billion of incremental demand just from corporate repurchase programs in 202315. While we described the sector as having good liquidity, if it skews more heavily to the buyside we do not believe it takes a strong amount of fund flows to catalyze performance.

Profits

Capital seeks investments with increasing profit potential. Looking back over 2022, the consensus estimated the AMZX’s DCF/u growth at the start of the year was 4.6% versus the 14.7% pace that is estimated for 2022 ahead of year-end earnings reports16. The 2023e DCF/u growth is currently 4.0%, and we would place odds on that number also increasing through the coming year, potentially repeating 2022, as we believe the sellside remains cautious in their modeling.

Contrast this to the S&P 500 where we believe analysts and strategists could continue to mark down 2023 earnings per share (EPS) estimates at least through this quarter. Tech sector job cuts are higher than any other time since the pandemic17, and recent announcements from Amazon Inc (AMZN)18 and other companies of increased job cuts seem to be a leading indicator of further corporate belt tightening. Additionally, Morgan Stanley estimates inflation was a tailwind to corporate profits, and if one takes the view that it could be moderating, that would be an additional broader corporate profit pressure the market is not considering19.

Commodity Prices

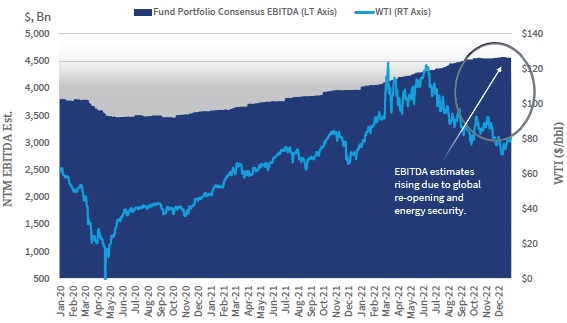

Notice we’ve gotten this far without any discussion of commodity prices and correlations20. We note 2022 offered some insights regarding commodity prices and Midstream equity behavior that were unique. First, the daily correlation between the AMZX and WTI crude oil moderated to 48%21 which is more in line with historical data. Second, as expected, the price of WTI did not have a noticeable impact on Midstream cash flow statements. As shown in the graphic below, what was interesting was how Midstream profit estimates and total return within the Fund’s portfolio continue to increase even as WTI decreased through the end of the year. This could potentially show a sentiment shift.

NTM EBITDA vs. WTI Evolution

Bloomberg, LP at 12/31/22

All figures shown for current Fund portfolio weights and holdings. EBITDA is the consensus estimate at

each point in time for the weighted sum of each portfolio holding for the next twelve months (NTM).

(15) Wells Fargo Securities, “Midstream Monthly Outlook”, January 6, 2023. Actual share repurchases may vary significantly. (16) Distributable Cash Flow (DCF) Growth Rate refers to the estimated 2022 weighted average Distributable Cash Flow (DCF) growth rate. This is not a forecast of the portfolio’s future performance. DCF growth rate for the portfolio’s holdings does not guarantee a corresponding increase in the market value of the holding or the portfolio. Distributable Cash Flow (DCF) data is CCM-calculated consensus of Wall Street estimates. (17) https://www.wsj.com/articles/tech-layoffs-are-happening-faster-than-at-any-time-during-the-pandemic-11672705089. (18) https://www.wsj.com/articles/amazon-to-lay-off-over-17-000-workers-more-than-first-planned-11672874304. (19) Morgan Stanley, “Weekly Warm-Up: Can the Consensus be Right?”, 1/9/2023. (20) Correlation: The measure of the relationship between two data sets of variables. (21) Bloomberg, LP.

10 | MainGate mlp fund

Speaking of sentiment, the heightened interest in the sector coincided with the re-introduction of the energy security theme post-Russia’s invasion of Ukraine. One of the pushbacks we received at that time was, while acknowledging the stronger setup for Midstream companies in this new commodity regime, the high price of oil at the time may have delivered a pause to not “chase” returns. In hindsight, the generalist concern was partly right since oil declined later in 2022; however, the total return for the AMZX increased. We continue to believe Midstream investors should focus on the resilient, fee-based cash flows, low valuation, and positive long term trends, while paying less attention to commodity price levels which, coincidentally are currently lower now than when Russia launched its attack.

Conclusion

Thank you to our investors. Hopefully the discussion has reinforced your confidence in the long-term return potential for Midstream. Even after two strong years of total return, the current allocation environment for Midstream is one of the healthiest we have seen. Company operating fundamentals look solid and valuations are on the low end of the historical range. For new allocators, come on in — the water is fine! For both sets of investors, we wish you good investment returns in 2023, and look forward to seeing you on the road this year.

Sincerely,

|  | |

| | | |

| Geoffrey P. Mavar, Chairman | Matthew G. Mead, CEO | |

Past performance is not a guarantee of future results.

Opinions expressed are those of Chickasaw Capital Management, LLC and are subject to change, are not guaranteed, and should not be considered investment advice.

The information contained in this report is authorized for use when preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible. The Fund is nondiversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual security price volatility than a diversified fund. The Fund invests in Master Limited Partnerships (MLPs) which concentrate investments in the energy sector and are subject to the risks of energy prices and demand and the volatility of commodity investments. Damage to facilities and infrastructure of MLPs may significantly affect the value of an investment and may incur environmental costs and liabilities due to the nature of their business. MLPs are subject to significant regulation and may be adversely affected by changes in the regulatory environment. Investments in smaller companies involve additional risks, such as limited liquidity and greater volatility. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. MLPs are subject to certain risks inherent in the structure of MLPs, including complex tax structure risks, limited ability for election or removal of management, limited voting rights, potential dependence on parent companies or sponsors for revenues to satisfy obligations, and potential conflicts of interest between partners, members and affiliates.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time (each, an “index”) are provided for your information only. Reference to this index does not imply that the portfolio will achieve returns, volatility or other results similar to the index. The composition of the index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change over time. Indices are unmanaged. The figures for the indices do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices.

The Alerian MLP Index is a composite of the most prominent energy Master Limited Partnerships that provides investors with an unbiased, comprehensive benchmark for this emerging asset class. The index, which is calculated using a float-adjusted, capitalization-weighted methodology, is disseminated real-time on a price-return basis (NYSE: AMZ), and the corresponding total-return index is disseminated daily (NYSE: AMZX). Relevant data points such as dividend yield are also published daily. For index values, constituents, and announcements regarding constituent changes, please visit www.alerian.com.

“Alerian MLP Index”, “AlerianMLP Total Return Index”, “AMZ” and “AMZX” are service marks of GKD Index Partners, LLC d/b/a Alerian (“Alerian”) and their use is granted under a license from Alerian. Alerian does not guarantee the accuracy and/or completeness of the Alerian MLP Index or any data included therein and Alerian shall have no liability for any errors, omissions, interruptions or defects therein. Alerian makes no warranty, express or implied, representations or promises, as to results to be obtained by Licensee, or any other person or entity from the use of the Alerian MLP Index or any data included therein. Alerian makes no express or implied warranties, representations or promises, regarding the originality, merchantability, suitability, non-infringement, or fitness for a particular purpose or use with respect to the Alerian MLP Index or any data included therein. Without limiting any of the foregoing, in no event shall Alerian have any liability for any indirect, special, incidental, or consequential damages (including lost profits), arising out of the Alerian MLP Index or any data included therein, even if notified of the possibility of such damages.

The Energy MLP Classification Standard (“EMCS”) was developed by and is the exclusive property (and a service mark) of GKD Index Partners, LLC d/b/a Alerian (“Alerian”) and its use is granted under a license from Alerian. Alerian makes no warranties, express or implied, or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and hereby expressly disclaims all warranties of originality, accuracy, completeness, merchantability, suitability, non-infringement, or fitness for a particular purpose with respect to any such standard or classification. No warranty is given that the standard or classification will conform to any description thereof or be free of omissions, errors, interruptions, or defects. Without limiting any of the foregoing, in no event shall Alerian have any liability for any indirect, special, incidental, or consequential damages (including lost profits), arising out of any such standard or classification, even if notified of the possibility of such damages.

ANNUAL REPORT 2022 • 11

DJIA Total Return Index tracks the total return of The Dow Jones Industrial Average, a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. Dividends are reinvested. The DJIA was invented by Charles Dow back in 1896.

NASDAQ is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

The NYSE FANG+ Index is an equal-dollar weighted index designed to represent a segment of the technology and consumer discretionary sectors consisting of highly-traded growth stocks of technology and tech-enabled companies such as Facebook, Apple, Amazon, Netflix, and Alphabet’s Google.

S&P 500 Total Return Index tracks the total return of the S&P 500 Index, an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. Dividends are reinvested. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/ return characteristics of the large cap universe.

Cash Flow is a revenue or expense stream that changes a cash account over a given period. Cash inflows usually arise from one of three activities - financing, operations or investing – although this also occurs as a result of donations or gifts in the case of personal finance. Cash outflows result from expenses or investments. This holds true for both business and personal finance. Cash flow can be attributed to a specific project, or to a business as a whole. Cash flow can be used as an indication of a company’s financial strength.

Distributable Cash Flow (DCF) is calculated as net income plus depreciation and other noncash items, less maintenance capital expenditure requirements. Distributable cash flow (DCF) data is CCM calculated consensus of Wall Street estimates. The estimated consensus weighted average distributable cash flow (DCF) per unit growth rate for the AMZ and the Fund’s portfolio incorporates market expectations by using the average annual growth rate using rolling-forward 24-month data. DCF growth rate is not a forecast of the portfolio’s future performance. DCF growth rate for the portfolio’s holdings does not guarantee a corresponding increase in the market value of the holding or the portfolio.

Distribution Coverage Ratio is calculated as cash available to limited partners divided by cash distributed to limited partners. It gives an indication of an MLP’s ability to make dividend payments to limited partner investors from operating cash flows. MLPs with a coverage ratio of in excess of 1.0 times are able to meet their dividend payments without external financing.

Distributions are quarterly payments, similar to dividends, made to Limited Partner (LP) and General Partner (GP) investors. These amounts are set by the GP and are supported by an MLP’s operating cash flows.

EBITDA is earnings before interest rates taxes depreciation and amortization.

Free cash flow (FCF) is a measure of financial performance calculated as operating cash flow minus capital expenditures.

Growth Capital Expenditures or Growth CapEx or GCX refers to the aggregate of all capital expenditures undertake to further growth prospects and/ or expand operations and excludes any maintenance and regulatory capital expenditures.

Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

West Texas Intermediate (WTI), also known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing. This grade is described as light because of its relatively low density, and sweet because of its low sulfur content. It is the underlying commodity of Chicago Mercantile Exchange’s oil futures contracts.

Yield refers to the cash dividend or distribution divided by the share or unit price at a particular point in time.

This material is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell any security, product or service.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please refer to the schedule of investments for a complete listing of Fund holdings.

The Fund does not receive the same tax benefits of a direct investment in an MLP.

The Fund is subject to U.S. federal income tax on its taxable income at rates applicable to corporations (currently at a rate of 21%) as well as state and local income taxes.

The Fund accrues deferred income taxes for future tax liabilities associated with the portion of MLP distributions considered to be a tax-deferred return of capital and for any net operating gains as well as capital appreciation of its investments. This deferred tax liability is reflected in the daily NAV and as a result the Fund’s after-tax performance could differ significantly from the underlying assets even if the pre-tax performance is closely tracked.

The potential tax benefits from investing in MLPs depend on MLPs being treated as partnerships for federal income tax purposes.

If the MLP is deemed to be a corporation then its income would be subject to federal taxation, reducing the amount of cash available for distribution to the Fund which could result in a reduction of the Fund’s value.

The MainGate MLP Fund is distributed by Quasar Distributors, LLC.

12 | MainGate mlp fund

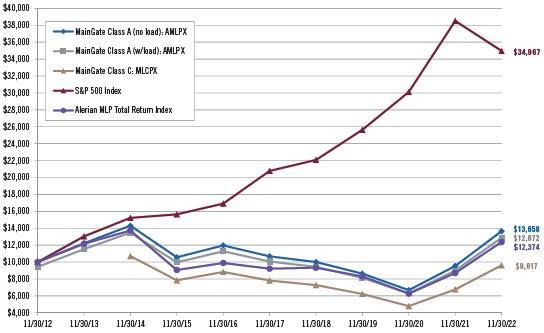

Hypothetical Growth of a $10,000 Investment | unaudited

|

| This chart illustrates the performance of a hypothetical $10,000 investment during the time period shown. Assumes reinvestment of dividends and capital gains. This chart does not imply any future performance. |

Hypothetical Growth of a $1,000,000 Investment | unaudited

|

| This chart illustrates the performance of a hypothetical $1,000,000 investment made in Class I shares during the time period shown. Assumes reinvestment of dividends and capital gains. This chart does not imply any future performance. |

ANNUAL REPORT 2022 • 13

Average Annual Returns | November 30, 2022 | unaudited

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception | | Inception Date |

| Class A (without sales load) | | 43.28% | | 5.06% | | 3.17% | | 3.81% | | 2/17/11 |

| Class A (with sales load) | | 35.14% | | 3.83% | | 2.56% | | 3.29% | | 2/17/11 |

| Class C | | 42.25% | | 4.24% | | NA | | -0.45% | | 3/31/14 |

| Class C (with CDSC) | | 41.25% | | 4.24% | | NA | | -0.45% | | 3/31/14 |

| Class I | | 43.74% | | 5.31% | | 3.42% | | 4.07% | | 2/17/11 |

| S&P 500 Index | | -9.21% | | 10.98% | | 13.34% | | 12.10% | | 2/17/11 |

| S&P 500 Index | | -9.21% | | 10.98% | | NA | | 11.51% | | 3/31/14 |

| Alerian MLP Total Return Index | | 42.25% | | 6.06% | | 2.15% | | 3.18% | | 2/17/11 |

| Alerian MLP Total Return Index | | 42.25% | | 6.06% | | NA | | -0.20% | | 3/31/14 |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855.MLP.FUND (855.657.3863) or by visiting www.maingatefunds.com.

Class A (with sales load) performance reflects the maximum sales charge of 5.75%. Class C (with CDSC) performance reflects the 1.00% contingent deferred sales charge. Class I is not subject to a sales charge or CDSC.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Alerian MLP Total Return Index is a capped, float-adjusted, capitaliziation-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities.

You cannot invest directly in an index.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares.

14 | MainGate mlp fund

Expense Example | unaudited

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from June 1, 2022 to November 30, 2022.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or exchange fees. Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Expenses Paid | | |

| | | Account Value | | Account Value | | During Period(1) | | Net Annualized |

| | | (06/01/22) | | (11/30/22) | | (06/01/22 – 11/30/22) | | Expense Ratio(2) |

| Class A Actual | | $1,000.00 | | $1,056.43 | | $8.71 | | 1.69% |

| Class A Hypothetical | | $1,000.00 | | $1,016.60 | | $8.54 | | 1.69% |

| (5% return before expenses) | | | | | | | | |

| Class C Actual | | $1,000.00 | | $1,047.77 | | $12.53 | | 2.44% |

| Class C Hypothetical | | $1,000.00 | | $1,012.84 | | $12.31 | | 2.44% |

| (5% return before expenses) | | | | | | | | |

| Class I Actual | | $1,000.00 | | $1,059.08 | | $7.43 | | 1.44% |

| Class I Hypothetical | | $1,000.00 | | $1,017.85 | | $7.28 | | 1.44% |

| (5% return before expenses) | | | | | | | | |

| (1) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 183 days (the number of days in the most recent period)/365 days (to reflect the period), for Class A, Class C and Class I. |

| (2) | Annualized expense ratio excludes current and deferred income and franchise tax expense. |

ANNUAL REPORT 2022 • 15

Allocation of Portfolio Assets

November 30, 2022 | unaudited

(expressed as a percentage of total investments)

Natural Gas Gathering/Processing* Natural Gas Gathering/Processing* | 42.6%

|

Crude/Refined Products Pipelines and Storage* Crude/Refined Products Pipelines and Storage* | 34.3% |

Natural Gas/Natural Gas Liquid Pipelines and Storage* Natural Gas/Natural Gas Liquid Pipelines and Storage* | 23.1% |

* Master Limited Partnerships and Related Companies

| Schedule of Investments | November 30, 2022 | | | | |

| | | | | |

| Master Limited Partnerships and Related Companies - 97.9%(1) | | Shares | | Fair Value | |

| Crude/Refined Products Pipelines and Storage - 33.6%(1) | | | | | |

| Canada - 0.4%(1) | | | | | |

| Enbridge, Inc. | | 80,000 | $3,303,200 | |

| United States - 33.2%(1) | | | | | |

| Genesis Energy, L.P. | | 1,675,000 | 17,704,750 | |

| Magellan Midstream Partners, L.P. | | 1,291,000 | 68,035,700 | |

| MPLX, L.P. | | 2,900,000 | 98,571,000 | |

| Phillips 66 | | 250,000 | 27,110,000 | |

| Plains All American Pipeline, L.P. | | 2,650,000 | 32,913,000 | |

| Plains GP Holdings, L.P. | | 2,575,000 | 34,067,250 | |

| | | | | 278,401,700 | |

| Total Crude/Refined Products Pipelines and Storage | | | 281,704,900 | |

| | | | | | |

| Natural Gas/Natural Gas Liquid Pipelines and Storage - 22.6%(1) | | | | | |

| Canada - 0.3%(1) | | | | | |

| TC Energy Corporation | | 60,000 | 2,668,800 | |

| United States - 22.3%(1) | | | | | |

| Cheniere Energy, Inc. | | 75,000 | 13,152,000 | |

| Energy Transfer, L.P. | | 6,925,000 | 86,839,500 | |

| Enterprise Products Partners, L.P. | | 2,175,000 | 53,961,750 | |

| Kinder Morgan, Inc. | | 419,000 | 8,011,280 | |

| ONEOK, Inc. | | 137,000 | 9,168,040 | |

| Williams Companies, Inc. | | 460,000 | 15,962,000 | |

| | | | | 187,094,570 | |

| Total Natural Gas/Natural Gas Liquid Pipelines and Storage | | | 189,763,370 | |

| | | | | | |

| Natural Gas Gathering/Processing - 41.7%(1) | | | | | |

| United States - 41.7%(1) | | | | | |

| Antero Midstream Corporation | | 725,000 | 8,214,250 | |

| Crestwood Equity Partners, L.P. | | 375,000 | 11,107,500 | |

| DCP Midstream, L.P. | | 1,150,000 | 45,241,000 | |

| Enlink Midstream, LLC | | 6,700,000 | 86,162,000 | |

| Targa Resources Corporation | | 1,300,000 | 96,707,000 | |

| Western Midstream Partners, L.P. | | 3,650,000 | 102,127,000 | |

| Total Natural Gas Gathering/Processing | | | 349,558,750 | |

| | | | | |

| Total Master Limited Partnerships and Related Companies (Cost $337,189,662) | | | 821,027,020 | |

| Total Investments - 97.9%(1) (Cost $337,189,662) | | | 821,027,020 | |

| Other Assets in Excess of Liabilities - 2.1%(1) | | | 17,247,161 | |

| Net Assets - 100.0%(1) | | | $838,274,181 | |

(1) Calculated as a percentage of net assets.

| 16 | MainGate mlp fund | The accompanying notes are an integral part of the financial statements. | |

Statement of Assets and Liabilities

November 30, 2022

| Assets | |

| Investments at fair value (cost $337,189,662) | $821,027,020 |

| Cash(1) | 17,926,054 |

| Receivable for Fund shares sold | 478,608 |

| Dividends receivable | 351,767 |

| Prepaid expenses | 77,795 |

| Total assets | 839,861,244 |

| Liabilities | |

| Payable for Fund shares redeemed | 249,063 |

Payable to Adviser(5)

| 846,459 |

Payable for 12b-1 distribution fee(5)

| 45,481 |

| Payable to Trustees | 24,000 |

Payable to Custodian(5)

| 8,308 |

| Accrued expenses and other liabilities | 413,752 |

| Total liabilities | 1,587,063 |

| | |

| Net assets | $838,274,181 |

| Commitments and Contingencies (See Note 5). | |

| | |

| Net Assets Consist of | |

| Additional paid-in capital | $1,033,421,179 |

| Total accumulated losses, net of deferred taxes | (195,146,998) |

| Net assets | $838,274,181 |

| (1) | Concentration Risk (See Note 4) |

| | (5)

| Related Party Transactions (See Note 5) |

| Unlimited shares authorized, no par value | Class A | Class C | Class I |

| Net assets | $36,109,479 | $19,980,563 | $782,184,139 |

| Shares issued and outstanding | 5,219,981 | 3,119,941 | 107,747,349 |

| Net asset value, redemption price and minimum offering price per share | $6.92 | $6.40 | $7.26 |

| Maximum offering price per share ($6.92/0.9425) | $7.34 | NA | NA |

Statement of Operations

Year Ended November 30, 2022

| Investment Income | |

| Distributions received from master limited partnerships | $42,550,953 |

| Less: return of capital on distributions from master limited partnerships | (42,550,953) |

| Distribution income received in excess of return of capital from master limited partnerships | — |

| Dividends from common stock(2,3) | 8,037,945 |

| Total Investment Income | 8,037,945 |

| (2) | The return of capital amount from C-Corporations was $6,559,950. (See Note 2) |

| | (3)

| Net of foreign withholding tax of $59,850. |

| Expenses | |

Advisory fees(5)

| 9,896,471 |

| Administrator fees | 549,838 |

| Insurance expense | 223,897 |

| Transfer agent expense | 203,617 |

| Professional fees | 139,257 |

| Trustees’ fees | 96,000 |

| Registration fees | 83,894 |

| Reports to shareholders | 78,761 |

| Compliance fees | 67,813 |

| Custodian fees and expenses | 46,472 |

| Franchise tax expense | 12,466 |

| Fund accounting fees | 1,841 |

| 12b-1 distribution fee - Class A | 84,509 |

| 12b-1 distribution fee - Class C | 188,537 |

| Other expenses | 374 |

| Total Expenses | 11,673,747 |

| Net Investment Loss, before taxes | (3,635,802) |

| Current and deferred tax benefit/(expense)(4) | — |

| Net Investment Loss, net of taxes | (3,635,802) |

| | |

| Realized and Unrealized Gain/(Loss) on Investments | |

| Net realized gain/(loss) on investments, before taxes | 62,162,401 |

| Current and deferred tax benefit/(expense)(4) | — |

| Net realized gain/(loss) on investments, net of taxes | 62,162,401 |

| Net change in unrealized appreciation/depreciation on investments, before taxes | 228,151,750 |

| Deferred tax benefit/(expense)(4) | — |

| Net change in unrealized appreciation/depreciation on investments, net of taxes | 228,151,750 |

| Net realized and unrealized gain/(loss) on investments | 290,314,151 |

| Increase in Net Assets Resulting from Operations | $286,678,349 |

| (4) | Any tax benefit/(expense) was fully offset by a valuation allowance recorded as of November 30, 2022. |

| | The accompanying notes are an integral part of the financial statements. | ANNUAL REPORT 2022 • 17 |

Statements of Changes in Net Assets

| Operations | | Year Ended November 30, 2022 | | Year Ended November 30, 2021 |

Net investment income/(loss), net of tax

| | $(3,635,802) | | $(10,146,785) |

| Net realized gain/(loss) on investments, net of tax | | 62,162,401 | | (18,854,705) |

| Net change in unrealized appreciation/depreciation on investments, net of deferred tax benefit/(expense) | | 228,151,750 | | 317,060,430 |

| Increase/(Decrease) in net assets resulting from operations | | 286,678,349 | | 288,058,940 |

| Dividends and Distributions to Class A Shareholders | | | | |

| Net investment income | | (325,794) | | (385,041) |

| Return of capital | | (1,846,166) | | (2,181,901) |

| Dividends and Distributions to Class C Shareholders | | | | |

| Net investment income | | (195,319) | | (233,611) |

| Return of capital | | (1,106,806) | | (1,323,793) |

| Dividends and Distributions to Class I Shareholders | | | | |

| Net investment income | | (6,838,738) | | (8,832,111) |

| Return of capital | | (38,752,847) | | (50,048,630) |

| Total dividends and distributions to Fund shareholders | | (49,065,670) | | (63,005,087) |

| Capital Share Transactions (Note 8) | | | | |

| Proceeds from shareholder subscriptions | | 113,304,189 | | 139,804,363 |

| Dividend reinvestments | | 40,671,841 | | 51,077,187 |

| Payments for redemptions | | (286,531,714) | | (475,247,699) |

| Increase/(Decrease) in net assets from capital share transactions | | (132,555,684) | | (284,366,149) |

| Total increase/(decrease) in net assets | | 105,056,995 | | (59,312,296) |

| Net Assets | | | | |

| Beginning of year | | 733,217,186 | | 792,529,482 |

| End of year | | $838,274,181 | | $733,217,186 |

18 | MainGate mlp fund The accompanying notes are an integral part of the financial statements.

Financial Highlights: Class A Shares

| | Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | |

| Per Share Data(1) | November 30, | November 30, | November 30, | November 30, | November 30, | |

| 2022 | 2021 | 2020 | 2019 | 2018 | |

| Net Asset Value, beginning of year | $5.15 | $3.91 | $5.65 | $7.17 | $8.25 | |

Income from Investment Operations | | | | | | |

| Net investment loss(2) | (0.04) | (0.07) | (0.06) | (0.05) | (0.09) | |

| Net realized and unrealized gain (loss) on investments | 2.21 | 1.71 | (1.22) | (0.84) | (0.36) | |

| Total increase (decrease) from investment operations | 2.17 | 1.64 | (1.28) | (0.89) | (0.45) | |

| Less Distributions to Shareholders | | | | | | |

| Net investment income | (0.06) | (0.06) | - | - | - | |

| Return of capital | (0.34) | (0.34) | (0.46) | (0.63) | (0.63) | |

| Total distributions to shareholders | (0.40) | (0.40) | (0.46) | (0.63) | (0.63) | |

| Net Asset Value, end of year | $6.92 | $5.15 | $3.91 | $5.65 | $7.17 | |

| Total Investment Return | 43.28% | 42.66% | (22.61)% | (13.71)% | (6.24)% | |

Supplemental Data and Ratios | | | | | | |

| Net assets, end of year | $36,109,479 | $30,569,903 | $28,693,359 | $60,839,754 | $93,423,336 | |

| Ratio of Expenses to Average Net Assets(3,4) | | | | | | |

| Net deferred income and franchise tax (benefit) expense | 0.00%‡ | 0.02% | 0.01% | 0.01% | 0.00%‡ | |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 1.69% | 1.68% | 1.72% | 1.69% | 1.66% | |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) after (waiver) recoupment | 1.69% | 1.68% | 1.72% | 1.69% | 1.66% | |

| Expenses (including net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 1.69% | 1.70% | 1.73% | 1.70% | 1.66% | |

| Net Fund Expenses(3,4) | 1.69% | 1.70% | 1.73% | 1.70% | 1.66% | |

| Ratio of Net Investment Income (Loss) to Average Net Assets(3,4) | | | | | | |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (0.67)% | (1.44)% | (1.32)% | (0.71)% | (1.05)% | |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) after waiver (recoupment) | (0.67)% | (1.44)% | (1.32)% | (0.71)% | (1.05)% | |

| Net investment income (loss) (including net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (0.67)% | (1.46)% | (1.33)% | (0.72)% | (1.05)% | |

| Net Investment Income (Loss)(3,4) | (0.67)% | (1.46)% | (1.33)% | (0.72)% | (1.05)% | |

| Portfolio turnover rate(5) | 3.26% | 20.80% | 36.65% | 66.39% | 44.57% | |

‡ Less than 0.01%.

(1) Information presented relates to a share of Class A for the entire year. (2) Calculated using average shares outstanding method. (3) For the year ended November 30, 2022, the Fund accrued $12,466 in franchise tax expense, of which $532 is attributable to Class A. For the year ended November 30, 2021, the Fund accrued $149,925 in franchise tax expense, of which $5,904 is attributable to Class A. For the year ended November 30, 2020, the Fund accrued $87,319 in franchise tax expense, of which $3,733 is attributable to Class A. For the year ended November 30, 2019, the Fund accrued $85,100 in franchise tax expense, of which $5,253 is attributable to Class A. For the year ended November 30, 2018, the Fund accrued $26,903 in franchise tax expense, of which $1,982 is attributable to Class A. (4) The Fund did not accrue a deferred tax expense or benefit. (5) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

The accompanying notes are an integral part of the financial statements. ANNUAL REPORT 2022 • 19

Financial Highlights: Class C Shares

| Per Share Data(1) | Year Ended

November 30,

2022 | Year Ended

November 30,

2021 | Year Ended

November 30,

2020 | Year Ended

November 30,

2019 | Year Ended

November 30,

2018 | |

| Net Asset Value, beginning of year | $4.82 | $3.72 | $5.43 | $6.97 | $8.09 | |

| Income from Investment Operations | | | | | | |

| Net investment loss(2) | (0.08) | (0.10) | (0.08) | (0.10) | (0.14) | |

| Net realized and unrealized gain (loss) on investments | 2.06 | 1.60 | (1.17) | (0.81) | (0.35) | |

| Total increase (decrease) from investment operations | 1.98 | 1.50 | (1.25) | (0.91) | (0.49) | |

| Less Distributions to Shareholders | | | | | | |

| Net investment income | (0.06) | (0.06) | - | - | - | |

| Return of capital | (0.34) | (0.34) | (0.46) | (0.63) | (0.63) | |

| Total distributions to shareholders | (0.40) | (0.40) | (0.46) | (0.63) | (0.63) | |

| Net Asset Value, end of year | $6.40 | $4.82 | $3.72 | $5.43 | $6.97 | |

| Total Investment Return | 42.25% | 41.02% | (22.99)% | (14.42)% | (6.88)% | |

Supplemental Data and Ratios | | | | | | |

| Net assets, end of year | $19,980,563 | $17,119,406 | $16,108,024 | $33,310,916 | $52,049,211 | |

| Ratio of Expenses to Average Net Assets(3,4) | | | | | | |

| Net deferred income and franchise tax (benefit) expense | 0.00%‡ | 0.02% | 0.01% | 0.01% | 0.00%‡ | |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 2.44% | 2.43% | 2.46% | 2.44% | 2.41% | |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) after (waiver) recoupment | 2.44% | 2.43% | 2.46% | 2.44% | 2.41% | |

| Expenses (including net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 2.44% | 2.45% | 2.47% | 2.45% | 2.41% | |

| Net Fund Expenses(3,4) | 2.44% | 2.45% | 2.47% | 2.45% | 2.41% | |

| Ratio of Net Investment Income (Loss) to Average Net Assets(3,4) | | | | | | |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (1.42)% | (2.19)% | (2.06)% | (1.46)% | (1.80)% | |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) after waiver (recoupment) | (1.42)% | (2.19)% | (2.06)% | (1.46)% | (1.80)% | |

| Net investment income (loss) (including net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (1.42)% | (2.21)% | (2.07)% | (1.47)% | (1.80)% | |

| Net Investment Income (Loss)(3,4) | (1.42)% | (2.21)% | (2.07)% | (1.47)% | (1.80)% | |

| Portfolio turnover rate(5) | 3.26% | 20.80% | 36.65% | 66.39% | 44.57% | |

‡ Less than 0.01%.

(1) Information presented relates to a share of Class C for the entire year. (2) Calculated using average shares outstanding method. (3) For the year ended November 30, 2022, the Fund accrued $12,466 in franchise tax expense, of which $297 is attributable to Class C. For the year ended November 30, 2021, the Fund accrued $149,925 in franchise tax expense, of which $3,367 is attributable to Class C. For the year ended November 30, 2020, the Fund accrued $87,319 in franchise tax expense, of which $2,149 is attributable to Class C. For the year ended November 30, 2019, the Fund accrued $85,100 in franchise tax expense, of which $2,996 is attributable to Class C. For the year ended November 30, 2018, the Fund accrued $26,903 in franchise tax expense, of which $1,007 is attributable to Class C. (4) The Fund did not accrue a deferred tax expense or benefit. (5) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

20 | MainGate mlp fund The accompanying notes are an integral part of the financial statements.

Financial Highlights: Class I Shares

| Per Share Data(1) | Year Ended

November 30,

2022 | Year Ended

November 30,

2021 | Year Ended

November 30,

2020 | Year Ended

November 30,

2019 | Year Ended

November 30,

2018 | |

| Net Asset Value, beginning of year | $5.37 | $4.06 | $5.83 | $7.36 | $8.43 | |

| Income from Investment Operations | | | | | | |

| Net investment loss(2) | (0.03) | (0.06) | (0.05) | (0.03) | (0.07) | |

| Net realized and unrealized gain (loss) on investments | 2.32 | 1.77 | (1.26) | (0.87) | (0.37) | |

| Total increase (decrease) from investment operations | 2.29 | 1.71 | (1.31) | (0.90) | (0.44) | |

| Less Distributions to Shareholders | | | | | | |

| Net investment income | (0.06) | (0.06) | - | - | - | |

| Return of capital | (0.34) | (0.34) | (0.46) | (0.63) | (0.63) | |

| Total distributions to shareholders | (0.40) | (0.40) | (0.46) | (0.63) | (0.63) | |

| Net Asset Value, end of year | $7.26 | $5.37 | $4.06 | $5.83 | $7.36 | |

| Total Investment Return | 43.74% | 42.82% | (22.42)% | (13.48)% | (5.98)% | |

Supplemental Data and Ratios |

| | | | | |

| Net assets, end of year | $782,184,139 | $685,527,877 | $747,728,099 | $967,800,549 | $1,220,133,792 | |

| Ratio of Expenses to Average Net Assets(3,4) | | | | | | |

| Net deferred income and franchise tax (benefit) expense | 0.00%‡ | 0.02% | 0.01% | 0.01% | 0.00%‡ | |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 1.44% | 1.43% | 1.46% | 1.44% | 1.41% | |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) after (waiver) recoupment | 1.44% | 1.43% | 1.46% | 1.44% | 1.41% | |

| Expenses (including net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 1.44% | 1.45% | 1.47% | 1.45% | 1.41% | |

| Net Fund Expenses(3,4) | 1.44% | 1.45% | 1.47% | 1.45% | 1.41% | |

| Ratio of Net Investment Income (Loss) to Average Net Assets(3,4) | | | | | | |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (0.42)% | (1.19)% | (1.07)% | (0.46)% | (0.80)% | |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) after waiver (recoupment) | (0.42)% | (1.19)% | (1.07)% | (0.46)% | (0.80)% | |

| Net investment income (loss) (including net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (0.42)% | (1.21)% | (1.08)% | (0.47)% | (0.80)% | |

| Net Investment Income (Loss)(3,4) | (0.42)% | (1.21)% | (1.08)% | (0.47)% | (0.80)% | |

| Portfolio turnover rate(5) | 3.26% | 20.80% | 36.65% | 66.39% | 44.57% | |

‡ Less than 0.01%.

(1) Information presented relates to a share of Class I for the entire year. (2) Calculated using average shares outstanding method. (3) For the year ended November 30, 2022, the Fund accrued $12,466 in franchise tax expense, of which $11,637 is attributable to Class I. For the year ended November 30, 2021, the Fund accrued $149,925 in franchise tax expense, of which $140,654 is attributable to Class I. For the year ended November 30, 2020, the Fund accrued $87,319 in franchise tax expense, of which $81,437 is attributable to Class I. For the year ended November 30, 2019, the Fund accrued $85,100 in franchise tax expense, of which $76,851 is attributable to Class I. For the year ended November 30, 2018, the Fund accrued $26,903 in franchise tax expense, of which $23,914 is attributable to Class I. (4) The Fund did not accrue a deferred tax expense or benefit. (5) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

The accompanying notes are an integral part of the financial statements. ANNUAL REPORT 2022 • 21

Notes to Financial Statements

November 30, 2022

1. Organization

MainGate MLP Fund (the “Fund”), a series of MainGate Trust (the “Trust”), is registered under the Investment Company Act of 1940 as an open-end, non-diversified investment company. The Trust was established under the laws of Delaware by an Agreement and Declaration of Trust dated November 3, 2010. The Fund’s investment objective is total return. Class A and Class I commenced operations on February 17, 2011. Class C commenced operations on March 31, 2014.

The Fund offers three classes of shares: Class A, Class C and Class I. Depending on the size of the initial purchase, Class A shares are subject to a maximum 5.75% front-end sales charge or a 1.00% contingent deferred sales charge if shares are redeemed within 18 months. Class C shares have no front-end sales charge, but are subject to a 1.00% contingent deferred sales charge within 12 months of redemption. Class I shares have no sales charge. Class A shareholders pay Rule 12b-1 fees at the annual rate of 0.25% of average daily net assets. Class C shareholders pay Rule 12b-1 fees at the annual rate of 1.00% of average daily net assets. For the year ended November 30, 2022, contingent deferred sales charges of $– and $317 were incurred by Class A and Class C shareholders, respectively.

2. Significant Accounting Policies

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Board Codification Topic 946 Financial Services— Investment Companies.

A. Use of Estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the recognition of distribution income and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

B. Investment Valuation. Fund investments are recognized at fair value, and subsequent changes in fair value are recognized in unrealized appreciation/(depreciation) on investments in the Statement of Operations. The Fund uses the following valuation methods to determine fair value as either current market value for investments for which market quotations are available, or if not available, a fair value, as determined in good faith pursuant to such policies and procedures as may be approved by the Trust’s Board of Trustees (“Board of Trustees”) from time to time. The valuation of the portfolio securities of the Fund currently includes the following processes:

| • | Equity Securities: Securities listed on a securities exchange or an automated quotation system for which quotations are readily available, including securities traded over the counter, will be valued at the last quoted sale price on the principal exchange on which they are traded on the valuation date (or at approximately 4:00 p.m. Eastern Time if a security’s principal exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. |

| • | Fixed Income Securities: Debt and fixed income securities will be priced by independent, third-party pricing agents approved by the Board of Trustees. These third-party pricing agents will employ methodologies that they believe are appropriate, including actual market transactions, broker-dealer supplied valuations, matrix pricing, or other electronic data processing techniques. These techniques generally consider such factors as security prices, yields, maturities, call features, ratings and developments relating to specific securities in arriving at valuations. Debt obligations with remaining maturities of sixty days or less will be valued at their amortized cost, which approximates fair market value. |

| • | Foreign Securities: Foreign securities are often principally traded on markets that close at different hours than U.S. markets. Such securities will be valued at their most recent closing prices on the relevant principal exchange even if the close of that exchange is earlier than the time of the Fund’s net asset value (“NAV”) calculation. However, securities traded in foreign markets which remain open as of the time of the NAV calculation will be valued at the most recent sales price as of the time of the NAV calculation. In addition, prices for certain foreign securities may be obtained from the Fund’s approved pricing sources. Chickasaw Capital Management, LLC (the “Adviser”) also monitors for the occurrence of significant events that may cast doubts on the reliability of previously obtained market prices for foreign securities held by the Fund. The prices for foreign securities will be reported in local currency and converted to U.S. dollars using currency exchange rates. Exchange rates will be provided daily by recognized independent pricing agents. The exchange rates used for the conversion will be captured as of the London close each day. |

C. Security Transactions, Investment Income and Expenses. Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on a specific identified cost basis. Interest income is recognized on the accrual basis, including amortization of premiums and accretion of discounts. Distributions are recorded on the ex-dividend date. Distributions received from the Fund’s investments in master limited partnerships (“MLPs”), including MLP general partnership interests, generally are comprised of ordinary income and return of capital. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations.

22 | MainGate mlp fund The accompanying notes are an integral part of the financial statements.

For financial statement purposes, the Fund uses return of capital and income estimates to allocate the distribution income received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded, as the actual character of these distributions is not known until after the fiscal year end of the Fund.

The Fund estimates the allocation of investment income and return of capital for the distributions received from MLPs within the Statement of Operations. For the year ended November 30, 2022, the Fund has estimated approximately 100% of the distributions from MLPs taxed as partnerships to be return of capital. Distributions from common stocks may also include income and return of capital. The Fund records the character of distributions received during the year based on estimates available. The characterization of distributions received by the Fund may be subsequently revised based on the information received from the MLPs and common stock after their tax reporting periods conclude.

Expenses are recorded on the accrual basis.

D. Dividends and Distributions to Shareholders. The Fund intends to make quarterly distributions from net income, which include the amount received as cash distributions from MLPs and common stock dividends. These activities are reported in the Statements of Changes in Net Assets.

Dividends and distributions to shareholders are recorded on the ex-dividend date. Dividends are reinvested in the Fund unless specifically instructed otherwise by a shareholder. The character of dividends and distributions to shareholders made during the period may differ from their ultimate characterization for federal income tax purposes. For the year ended November 30, 2022, the Fund’s dividends and distributions were expected to be comprised of 15% income and 85% return of capital. The tax character of distributions paid for the year ended November 30, 2022, will be determined in early 2023.

E. Federal Income Taxation. The Fund, taxed as a corporation, is obligated to pay federal and state income tax on its taxable income. Currently, the federal income tax rate for a corporation is 21%.

The Fund invests its assets primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Fund reports its allocable share of the MLP’s taxable income in computing its own taxable income. The Fund’s tax expense or benefit is included in the Statement of Operations based on the component of income or gains (losses) to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is recognized if, based on the weight of available evidence, it is more likely than not that some portion or all of the deferred income tax asset will not be realized.

The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes as an income tax expense on the Statement of Operations. For the year ended November 30, 2022, the Fund did not have interest or penalties associated with underpayment of income taxes.

F. Indemnifications. Under the Fund’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts that provide general indemnification to other parties. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred, and may not occur. However, the Fund has not had prior claims or losses pursuant to these contracts.

G. Cash. Cash consists of deposits held with a bank.

3. Fair Value Measurements

Various inputs that are used in determining the fair value of the Fund’s investments are summarized in the three broad levels listed below:

| • | Level 1: unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access |

| • | Level 2: other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3: significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

These inputs are summarized in the three broad levels that follow.

ANNUAL REPORT 2022 • 23

| | | | | Fair Value Measurements at Reporting Date Using: | |

| | | | | Quoted Prices in Active | | Significant Other | | Significant | |

| | | Fair Value at | | Markets for Identical | | Observable | | Unobservable | |

| Description | | November 30, 2022 | | Assets (Level 1) | | Inputs (Level 2) | | Inputs (Level 3) | |

| Equity Securities | | | | | | | | | |

| Master Limited Partnerships and and Related Companies(1) | | $821,027,020 | | $821,027,020 | | $ — | | $ — | |

| Total | | $821,027,020 | | $821,027,020 | | $ — | | $ — | |

(1) All other industry classifications are identified in the Schedule of Investments.

4. Concentration Risk

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets (plus any borrowings for investment purposes) in MLP interests under normal circumstances as determined in the prospectus. The investment objectives are included within the Schedule of Investments.

Credit Risk. The Fund maintains cash in bank accounts which, at times, may exceed United States Federally insured limits.

5. Agreements, Contingencies and Related Party Transactions

The Trust has entered into an Investment Advisory Agreement (the “Agreement”) with the Adviser. Under the terms of the Agreement, the Fund pays the Adviser a fee, payable at the end of each calendar month, at an annual rate equal to 1.25% of the average daily net assets of the Fund.

The Adviser has agreed to waive its advisory fee and/or reimburse certain operating expenses of the Fund, until at least March 31, 2024, but only to the extent necessary so that the Fund’s total annual expenses, excluding brokerage fees and commissions; borrowing costs (such as (a) interest and (b) dividend expenses on securities sold short); taxes, including deferred income tax expense/(benefit) and franchise taxes; any indirect expenses, such as acquired fund fees and expenses; Class A 12b-1 fees, Class C 12b-1 fees, and extraordinary expenses, do not exceed 1.50% of the average daily net assets of each class of the Fund. Any payment by the Adviser of the Fund’s operating, organizational and offering expenses are subject to repayment by the Fund in the three fiscal years following the fiscal year in which the payment was made; provided that the Fund is able to make the repayment without exceeding the 1.50% expense limitation.

Waived fees and reimbursed Fund expenses, including prior year expenses, are subject to potential recoupment by year of expiration. During the year ended November 30, 2022, the Fund did not waive or recoup expenses. At November 30, 2022, there were no prior year amounts subject to potential recoupment.

Certain Trustees and Officers of the Trust/Fund are also Officers of the Adviser or Vigilant Compliance, LLC (“Vigilant”).

The Fund has engaged Vigilant to provide compliance services including the appointment of the Fund’s Chief Compliance Officer. Effective October 1, 2015, the Fund pays Vigilant a monthly fee of $4,728 for net assets up to $1.7 billion, $5,228 for net assets between $1.7 billion and $2.0 billion, $5,728 for net assets between $2.0 billion and $2.5 billion, and $6,000 for net assets above $2.5 billion with each rate subject to a 2% annual increase.

Quasar Distributors, LLC (“Quasar”) serves as the Fund’s distributor. The Fund has adopted a plan of distribution under Rule 12b-1 of the Investment Company Act of 1940 (the “1940 Act”) applicable to Class A and Class C shares. Class A shareholders pay Rule 12b-1 fees at the annual rate of 0.25% of average daily net assets. Class C shareholders pay Rule 12b-1 fees at the annual rate of 1.00% of average daily net assets. For the year ended November 30, 2022, 12b-1 distribution expenses of $84,509 and $188,537 were accrued by Class A and Class C shares, respectively.

The Fund reimbursed the Adviser for fees paid to financial intermediaries such as banks, broker-dealers, financial advisers or other financial institutions for sub-transfer agency, sub-administration and other services that the financial intermediaries provided to their clients. The financial intermediaries are the record owners of the Fund on the Fund’s records through omnibus accounts, other group accounts, retirement plans or accounts traded through registered securities clearing agents. These fees are fees that the Fund is obligated to pay to such intermediaries, and the fees may vary based on, for example, the nature of services provided. The fees paid to such intermediaries by the Fund is only a portion of the full fee that is paid to the intermediaries, and the Adviser is obligated to pay the remaining amount. These amounts are included within 12b-1 distribution fees on the Statement of Operations.

24 | MainGate mlp fund

The Fund has engaged U.S. Bancorp Fund Services, LLC d/b/a U.S. Bank Global Fund Services (“Fund Services”) to provide administration and accounting services to the Fund. The Fund pays Fund Services a monthly fee computed at an annual rate of 0.10% of the first $75,000,000 of the Fund’s average daily net assets, 0.08% on the next $250,000,000 of average daily net assets and 0.05% on the balance of the Fund’s average daily net assets, with a minimum annual fee of $64,000 plus $12,000 per share class fee, imposed upon the Fund reaching certain asset levels.

Fund Services serves as the Fund’s transfer agent, dividend paying agent, and agent for the automatic dividend reinvestment plan. The Fund pays the transfer agent a $45,000 flat fee, imposed upon the Fund reaching certain asset levels, plus transaction and other out-of-pocket charges.

U.S. Bank, N.A. serves as the Fund’s custodian. The Fund pays the custodian a monthly fee computed at an annual rate of 0.0075% of the first $250 million of market value and 0.0050% of the balance, with a minimum annual fee of $4,800, imposed upon Fund reaching certain asset levels, plus transaction and other out-of-pocket charges.

6. Income Taxes

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Such temporary differences are principally: (i) taxes on unrealized gains/(losses), which are attributable to the temporary difference between fair market value and tax basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting and income tax purposes and (iii) the net tax benefit of accumulated net operating losses and capital loss carryforwards. Deferred tax assets and liabilities are measured using effective tax rates expected to apply to taxable income in the years such temporary differences are realized or otherwise settled. To the extent the Fund has a deferred tax asset, consideration is given to whether or not a valuation allowance is required. A valuation allowance is required if, based on the evaluation criterion provided by ASC 740, Income Taxes (ASC 740), it is more likely-than-not some portion or all of the deferred tax asset will not be realized. Among the factors considered in assessing the Fund’s valuation allowance are: the nature, frequency and severity of current and cumulative losses, forecasts of future profitability, the duration of the statutory carryforward periods, significant redemptions, and the associated risks that operating and capital loss carryforwards may expire unused.

At November 30, 2022, the Fund determined a valuation allowance was required.