UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2013

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from: _____________ to _____________

Commission file number: 333-178624

DNA PRECIOUS METALS, INC.

(Exact name of Registrant as Specified in its Charter)

| Nevada | | 37-1640902 |

(State or other jurisdiction of Incorporation) | | (I.R.S. Employer Identification No.) |

9125 rue Pascal Gagnon, Suite 204, Saint Leonard, Quebec, Canada HIP IZ4 |

| (ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) |

| |

(514) 852-2111 |

| (REGISTRANT’S TELEPHONE NUMBER) |

| |

Not Applicable |

| (FORMER NAME OR FORMER ADDRESS, IF CHANGES SINCE LAST REPORT) |

All correspondence to:

Tony J. Giuliano, CFO

DNA Precious Metals, Inc.

9125 Pascal Gagnon, Suite 204

Saint Leonard, Quebec, Canada H1P 1Z4

Office: (514) 852-2111

Fax: (514) 852-2221

Email: tony.giuliano@dnapreciousmetals.com

| Title of each class | | Name of each exchange on which registered |

| | | |

| Common Stock, $0.001 par value | | None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Acto Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act from their obligations under those Sections.

o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-Q or any amendment to this Form 10-Q. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | o | Non-accelerated Filer | o |

| | | | |

| Accelerated Filer | o | Smaller Reporting Company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant computed by reference to the price at which the common equity was last sold, or the average bid and asked price for such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter was approximately $13,632,000 (based on a sales price of $.25 per share, representing the sales price of the Company’s common stock on March 31, 2013).

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

o Yes o No

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer's classes of common stock as of the latest practicable date: 91,528,000 of common stock, $0.001 par value as of March 31, 2013.

DOCUMENTS INCORPORATED BY REFERENCE

None.

References to DNA Precious Metals, Inc., a Nevada corporation, are referred to herein as “we”, “our” or “us”, unless the context provides for otherwise.

DNA Precious Metals, Inc.

(An Exploration Stage Company)

The consolidated financial statements are unaudited. However, management of registrant believes that all necessary adjustments, including normal recurring adjustments, have been reflected to present fairly the financial position of registrant as at March 31, 2013 and the results of its operations and changes in its cash position for the three periods ended March 31, 2013 and 2012 and for the period from inception (June 2, 2006) through March 31, 2013.

MEASUREMENTS AND GLOSSARY

Conversion Table

For ease of reference in reviewing our business, we are providing you with conversion information and abbreviations:

| 1 acre | | = 0.4047 hectare | | 1 mile | | = 1.6093 kilometers |

| 1 foot | | = 0.3048 meter | | 1 troy ounce | | = 31.1035 grams |

| 1 gram per metric ton | | = 0.0292 troy ounce/ short ton | | 1 square mile | | = 2.59 square kilometers |

| 1 short ton (2000 pounds) | | = 0.9072 ton | | 1 square kilometer | | = 100 hectares |

| 1 ton | | = 1,000 kg or 2,204.6 lbs | | 1 kilogram | | = 2.204 pounds or 32.151 troy oz |

| 1 hectare | | = 10,000 square meters | | 1 hectare | | = 2.471 acres |

The following abbreviations may be used herein:

| Au | | = gold | | m2 | | = square meter |

| G | | = gram | | m3 | | = cubic meter |

| g/t | | = grams per ton | | Mg | | = milligram |

| Ha | | = hectare | | mg/m3 | | = milligrams per cubic meter |

| Km | | = kilometer | | T or t | | = ton |

| Km2 | | = square kilometers | | Oz | | = troy ounce |

| Kg | | = kilogram | | Ppb | | = parts per billion |

| M | | = meter | | Ma | | = million years |

Mining Terms

The following mining terms are used throughout this filing:

| | a) | SEC Industry Guide 7 Definitions |

| exploration stage | An “exploration stage” prospect is one which is not in either the development or production stage. |

| | |

| development stage | A “development stage” project is one which there is ongoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study. |

| | |

mineralized material | The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction. |

| | |

| probable reserve | The term “probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. |

| production stage | A “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. |

| | |

| proven reserve | The term “proven reserve” refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

| | |

| reserve | The term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing). A reserve includes adjustments to the in-situ tons and grade to include diluting materials and allowances for losses that might occur when the material is mined. |

| alteration | Any change in the mineral composition of a rock brought about by physical or chemical means. |

| | |

| assay | A measure of the valuable mineral content. |

| | |

| dip | The angle that a structural surface, a bedding or fault plane, makes with the horizontal, measured perpendicular to the strike of the structure. |

| | |

| disseminated | Where minerals occur as scattered particles in the rock. |

| | |

| fault | A surface or zone of rock fracture along which there has been displacement. |

| | |

feasibility study | A comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production. |

| | |

| formation | A distinct layer of sedimentary rock of similar composition. |

| | |

| geochemistry | The study of the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water and the atmosphere. |

| geophysics | The study of the mechanical, electrical and magnetic properties of the earth’s crust. |

| | |

geophysical surveys | A survey method used primarily in the mining industry as an exploration tool, applying the methods of physics and engineering to the earth’s surface. |

| | |

| geotechnical | The study of ground stability. |

| | |

| grade | Quantity of metal per unit weight of host rock. |

| heap leach | A mineral processing method involving the crushing and stacking of an ore on an impermeable liner upon which solutions are sprayed to dissolve metals i.e. gold, copper, etc.; the solutions containing the metals are then collected and treated to recover the metals. |

| host rock | The rock in which a mineral or an ore body may be contained. |

| | |

| in-situ | In its natural position. |

| | |

| lithology | The character of the rock described in terms of its structure, color, mineral composition, grain size and arrangement of tits component parts, all those visible features that in the aggregate impart individuality to the rock. |

| | |

mapped or geological mapping | The recording of geologic information including rock units and the occurrence of structural features and mineral deposits on maps. |

| | |

| mineral | A naturally occurring inorganic crystalline material having a definite chemical composition. |

| | |

| mineralization | A natural accumulation or concentration in rocks or soil of one or more potentially economic minerals, also the process by which minerals are introduced or concentrated in a rock. |

| | |

| outcrop | That part of a geologic formation or structure that appears at the surface of the earth. |

| | |

open pit or open cut | Surface mining in which the ore is extracted from a pit or quarry, the geometry of the pit may vary with the characteristics of the ore body. |

| | |

| ore | Mineral bearing rock that can be mined and treated profitably under current or immediately foreseeable economic conditions. |

| | |

| ore body | A mostly solid and fairly continuous mass of mineralization estimated to be economically mineable. |

| | |

| ore grade | The average weight of the valuable metal or mineral contained in a specific weight of ore i.e. grams per ton of ore. |

| | |

| oxide | Gold bearing ore which results from the oxidation of near surface sulfide ore. |

| | |

preliminary assessment | A study that includes an economic analysis of the potential viability of Mineral Resources taken at an early stage of the project prior to the completion of a preliminary feasibility study. |

| | |

| QA/QC | Quality Assurance/Quality Control is the process of controlling and assuring data quality for assays and other exploration and mining data. |

| quartz | A mineral composed of silicon dioxide, SiO2 (silica). |

| rock | Indurated naturally occurring mineral matter of various compositions. |

| | |

sampling analytical variance/ precision | An estimate of the total error induced by sampling, sample preparation and analysis. |

| | |

| sediment | Particles transported by water, wind or ice. |

| | |

sedimentary rock | Rock formed at the earth’s surface from solid particles, whether mineral or organic, which have been moved from their position of origin and re-deposited. |

| strike | The direction or trend that a structural surface, e.g. a bedding or fault plane, takes as it intersects the horizontal. |

| | |

| strip | To remove overburden in order to expose ore. |

| | |

| tailings | The residue from an ore crushing plant. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this quarterly report on Form 10-Q contain or may contain forward-looking statements that are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Generally, the words “believes”, “anticipates,” “may,” “will,” “should,” “expect,” “intend,” “estimate,” “continue,” and similar expressions or comparable terminology are intended to identify forward-looking statements which include, but are not limited to, statements concerning the our expectations regarding our working capital requirements, financing requirements, business prospects, and other statements of expectations, beliefs, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to, economic, political and market conditions and fluctuations, government and industry regulation, interest rate risk, U.S. and global competition, and other factors. Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider all of the material risks in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. Readers should carefully review this quarterly report in its entirety, including but not limited to our financial statements and the notes thereto. Except for our ongoing obligations to disclose material information under the federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events.

PART 1I - FINANCIAL INFORMATION

ITEM 1 - FINANCIAL STATEMENTS

DNA PRECIOUS METALS, INC.

(AN EXPLORATION STAGE COMPANY)

INDEX TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| Condensed Consolidated Financial Statements: | |

| 9 |

| 10 |

| 11 |

| 12 |

| DNA PRECIOUS METALS, INC. |

| (An Exploration Stage Company) |

|

| MARCH 31, 2013 (Unaudited) AND DECEMBER 31, 2012 |

| | | IN US$ | |

| ASSETS | | (Unaudited) | | | | |

| | | MARCH 31, | | | DECEMBER 31, | |

| | | 2013 | | | 2012 | |

| CURRENT ASSETS | | | | | | |

| Cash | | $ | 629,964 | | | $ | 598,938 | |

| Prepaid expenses and deposits | | | 4,369 | | | | 4,422 | |

| Total current assets | | | 634,333 | | | | 603,360 | |

| | | | | | | | | |

| Fixed assets, net | | | 1,634,617 | | | | 1,318,343 | |

| | | | | | | | | |

| Other Asset | | | | | | | | |

| Mining rights | | | 15,000 | | | | 15,000 | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | 2,283,950 | | | $ | 1,936,703 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | | | | | | | | |

| | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | |

| Accounts payable and accrued expenses | | $ | 293,704 | | | $ | 78,784 | |

| Liability for stock to be issued | | | - | | | | 232,000 | |

| Total current liabilities | | | 293,704 | | | | 310,784 | |

| | | | | | | | | |

| LONG TERM LIABILITIES | | | | | | | | |

| Promissory note | | | - | | | | 502,550 | |

| | | | | | | | | |

| TOTAL LIABILITIES | | | 293,704 | | | | 813,334 | |

| | | | | | | | | |

| STOCKHOLDERS' EQUITY (DEFICIT) | | | | | | | | |

| Preferred stock, $0.001 par value, 10,000,000 shares authorized | | | | | | | | |

| Nil shares issued and outstanding | | | - | | | | - | |

| Common stock, $0.001 par value, 150,000,000 shares authorized | | | | | | | | |

| 91,528,000 and 83,024,000 shares issued and outstanding, respectively | | | 91,528 | | | | 83,024 | |

| Additional paid in capital | | | 5,296,022 | | | | 2,800,976 | |

| Deferred compensation | | | (750,000 | ) | | | - | |

| Deficits accumulated during the exploration stage | | | (2,657,888 | ) | | | (1,773,047 | ) |

| Accumulated other comprehensive income (loss) | | | 10,584 | | | | 12,416 | |

| Total stockholders' equity (deficit) | | | 1,990,246 | | | | 1,123,369 | |

| | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | | $ | 2,283,950 | | | $ | 1,936,703 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

| DNA PRECIOUS METALS, INC. |

| (AN EXPLORATION STAGE COMPANY) |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS |

| FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012 |

| IN US$ |

| (Unaudited) |

| | | | | | | | | JUNE 2, 2006 | |

| | | THREE MONTHS ENDED | | | (INCEPTION) | |

| | | MARCH 31, | | | THROUGH | |

| | | 2013 | | | 2012 | | | MARCH 31, 2013 | |

| | | | | | | | | | |

| REVENUE | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | |

| COST OF REVENUES | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| GROSS PROFIT | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | | | | | |

| Engineering costs | | | 27,583 | | | | 135,924 | | | | 811,950 | |

| Wages and related expenses | | | 610,778 | | | | 47,938 | | | | 1,212,639 | |

| Professional fees | | | 83,063 | | | | 50,352 | | | | 419,801 | |

| Rent | | | 5,151 | | | | 3,965 | | | | 40,840 | |

| Depreciation | | | 1,392 | | | | - | | | | 2,084 | |

| General and administrative | | | 32,072 | | | | 38,734 | | | | 144,006 | |

| Total operating expenses | | | 760,039 | | | | 276,913 | | | | 2,631,320 | |

| | | | | | | | | | | | | |

| OTHER (INCOME) EXPENSE | | | | | | | | | | | | |

| Interest expense, net | | | (198 | ) | | | - | | | | 9,852 | |

| Loss on conversion of promissory note | | | 125,000 | | | | - | | | | 125,000 | |

| Mining tax credits | | | - | | | | - | | | | (108,284 | ) |

| Total other (income) expense | | | 124,802 | | | | - | | | | 26,568 | |

| | | | | | | | | | | | | |

| NET INCOME (LOSS) | | $ | (884,841 | ) | | $ | (276,913 | ) | | $ | (2,657,888 | ) |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING | | | 85,698,044 | | | | 76,100,000 | | | | 51,699,688 | |

| | | | | | | | | | | | | |

| NET (LOSS) PER SHARE | | $ | (0.01 | ) | | $ | (0.00 | ) | | $ | (0.05 | ) |

| | | | | | | | | | | | | |

| COMPREHENSIVE LOSS | | | | | | | | | | | | |

| Net loss | | $ | (884,841 | ) | | $ | (276,913 | ) | | $ | (2,657,888 | ) |

| Currency translation adjustment | | | (1,832 | ) | | | 11,677 | | | | 10,584 | |

| Total comprehensive loss | | | (886,673 | ) | | | (265,236 | ) | | | (2,647,304 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

IN US $

| | | | | | | | | JUNE 2, 2006 | |

| | | THREE MONTHS ENDED | | | (INCEPTION) | |

| | | MARCH 31, | | | THROUGH | |

| | | 2013 | | | 2012 | | | MARCH 31, 2013 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | | |

| Net (loss) | | $ | (884,841 | ) | | $ | (276,913 | ) | | $ | (2,657,888 | ) |

| | | | | | | | | | | | | |

| Adjustments to reconcile net (loss) | | | | | | | | | | | | |

| to net cash (used in) operating activities: | | | | | | | | | | | | |

| Depreciation | | | 1,392 | | | | - | | | | 2,084 | |

| Non-cash wages upon issuance of shares | | | 500,000 | | | | - | | | | 500,000 | |

| Loss on conversion of promissory note | | | 125,000 | | | | | | | | 125,000 | |

| Common shares issued for services | | | - | | | | - | | | | 408,000 | |

| | | | | | | | | | | | | |

| Change in assets and liabilities | | | | | | | | | | | | |

| (Increase) decrease in prepaid expenses | | | (39 | ) | | | - | | | | (11,594 | ) |

| Increase (decrease) in accounts payable and accrued expenses | | | 215,918 | | | | (34,008 | ) | | | 301,957 | |

| Total adjustments | | | 842,271 | | | | (34,008 | ) | | | 1,325,447 | |

| Net cash (used in) operating activities | | | (42,570 | ) | | | (310,921 | ) | | | (1,332,441 | ) |

| | | | | | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | | | | | |

| Acquisition of fixed assets | | | (317,666 | ) | | | (27,012 | ) | | | (1,626,493 | ) |

| Net cash (used in) investing activities | | | (317,666 | ) | | | (27,012 | ) | | | (1,626,493 | ) |

| | | | | | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | | | | | |

| Proceeds received from promissory note | | | - | | | | - | | | | 491,650 | |

| Cash received for common stock and liability for stock to be issued | | | 394,000 | | | | - | | | | 3,087,000 | |

| Net cash provided by financing activities | | | 394,000 | | | | - | | | | 3,578,650 | |

| | | | | | | | | | | | | |

| Effect of foreign currency | | | (2,738 | ) | | | 20,620 | | | | 10,248 | |

| | | | | | | | | | | | | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | | | 31,026 | | | | (317,313 | ) | | | 629,964 | |

| | | | | | | | | | | | | |

| CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD | | | 598,938 | | | | 556,674 | | | | - | |

| | | | | | | | | | | | | |

| CASH AND CASH EQUIVALENTS - END OF PERIOD | | $ | 629,964 | | | $ | 239,361 | | | $ | 629,964 | |

| | | | | | | | | | | | | |

| SUPPLEMENTAL NONCASH INVESTING AND FINANCING ACTIVITIES | | | | | | | | | |

| Common stock issued for subscriptions receivable | | $ | - | | | $ | - | | | $ | - | |

| SUPPLEMENTAL CASH FLOW INFORMATION: | | | | | | | | | | | | |

| Cash paid during the period for: | | | | | | | | | | | | |

| Interest | | $ | - | | | $ | - | | | $ | 6,964 | |

| Income taxes | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | |

| SUPPLEMENTAL NONCASH ACTIVITY | | | | | | | | | | | | |

| Common stock issued for mining rights | | $ | - | | | $ | - | | | $ | 15,000 | |

| Conversion of promissory note to common stock | | $ | 627,550 | | | $ | - | | | $ | 627,550 | |

| Deferred compensation for common stock | | $ | 750,000 | | | $ | - | | | $ | 750,000 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS MARCH 31, 2013 AND 2012

(Unaudited)

| NOTE 1- | ORGANIZATION AND BASIS OF PRESENTATION |

The unaudited consolidated financial statements included herein have been prepared, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate to make the information presented not misleading. It is suggested that these condensed consolidated financial statements be read in conjunction with the December 31, 2012 audited financial statements and the accompanying notes thereto. While management believes the procedures followed in preparing these condensed consolidated financial statements are reasonable, the accuracy of the amounts are in some respects dependent upon the facts that will exist, and procedures that will be accomplished by the Company later in the year.

On June 2, 2006, Celtic Capital, Inc. was incorporated in the State of Nevada. On October 20, 2008, Celtic Capital, Inc. changed its name to Entertainment Educational Arts Inc. On May 12, 2010, the Company changed its name to DNA Precious Metals, Inc. (the “Company”). On October 29, 2010, the Company formed DNA Canada Inc., a Canadian federally incorporated company, as a wholly-owned subsidiary. The Company will operate all of its exploration operations through this Canadian entity.

The Company is an exploration stage company that is in the business of identifying mineral claim rights in Canada and the United States. The Company has conducted minimal business to date.

The Company’s primary goal is to identify and acquire premium gold (Au) and silver (Ag) properties to create an international mining company. The mineralized properties that the Company will focus on acquiring, will have easy accessibility, transportation infrastructures in place on the property and most importantly, will have the potential to be brought into production quickly.

On June 9, 2011, the Company acquired 10 mining claims in the Montauban Mining Project located in the Montauban and Chavigny townships near Grondines-West in the Portneuf County of Quebec, Canada (the “Property”). Presently, the Company is working on the construction of a processing mill and build-out of the infrastructure.

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

(Unaudited)

Going Concern

The condensed consolidated financial statements have been prepared on a going concern basis. The going concern basis of presentation assumes that the Company will continue in operation for the foreseeable future and be able to realize its assets and discharge its liabilities and commitments in the normal course of business. The Company has not generated revenues since inception and has generated losses totaling $884,841 and $276,913 for the three-months ended March 31, 2013 and 2012, respectively, and losses of $2,657,888 since the Company’s inception on June 2, 2006. The Company has had very little operating history to date.

The Company’s continuation as a going concern is dependent upon, amongst other things, continued financial support from its shareholders, attaining a satisfactory revenue level, attainment of profitable operations and the generation of cash from operations and the ability to secure new financing arrangements and new capital to carry out its business plan. These matters are dependent on a number of items outside of the Company’s control and there exists material uncertainties that may cast significant doubt about the Company’s ability to continue as a going concern.

The Company can give no assurance that it will achieve profitability or be capable of sustaining profitable operations. These consolidated financial statements do not include any adjustments relating to the recoverability and classification of the carrying amounts of assets or the amount and classification of liabilities that might result if the Company is unable to continue as a going concern. These factors raise substantial doubt regarding the ability of the Company to continue as a going concern.

The Company has recently, from September 2012 to January 2013, raised $2,357,000 of capital through the subscription of 9,428,000 shares as a result of an S-1 registration statement. The Company also raised, from June to December 2011, $670,000 of capital through the subscription of 3,350,000 shares. These raises of funds went towards furthering the Company’s business plan while the most recent raise also went towards work the construction of a processing mill and build-out of the infrastructure.

During the fourth quarter of fiscal 2012, the Company commenced construction on the processing mill in which mining operations will be conducted. The structure of the mill was completed in the first quarter of fiscal 2013 but is not as yet in service pending acquisition of mill processing equipment.

Effective July 1, 2009, the Company adopted the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 105-10, Generally Accepted Accounting Principles – Overall (“ASC 105-10”). ASC 105-10 establishes the FASB Accounting Standards Codification (the “Codification”) as the source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in conformity with U.S. GAAP. Rules and interpretive releases of the SEC under authority of federal securities laws are also sources of authoritative U.S. GAAP for Securities and Exchange Commission (“SEC”) registrants.

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

(Unaudited)

All guidance contained in the Codification carries an equal level of authority. The Codification superseded all existing non-SEC accounting and reporting standards. All other non-grandfathered, non-SEC accounting literature not included in the Codification is non-authoritative. The FASB will not issue new standards in the form of Statements, FASB Positions or Emerging Issue Task Force Abstracts. Instead, it will issue Accounting Standards Updates (“ASUs”). The FASB will not consider ASUs as authoritative in their own right. ASUs will serve only to update the Codification, provide background information about the guidance and provide the bases for conclusions on the change(s) in the Codification. References made to FASB guidance throughout this document have been updated for the Codification.

| NOTE 2- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Exploration Stage Company

The Company is an exploration stage company as defined in ASC 915. The Company has made capital investments on the Property. The construction of the processing mill structure was commenced in the fourth quarter of fiscal 2012 and completed in the first quarter of fiscal 2013. Also, significant infrastructure work related to the processing mill has been completed.

Presently, the infrastructure construction includes the foundation, a 16,000 sq/ft steel structure building and water and power supply installations. The Company has completed all the access infrastructural work to the future site where the milling facilities will be located.

On September 14, 2012, the Company received the Certificate of Authorization, from the Quebec Provincial Government, to process the mining residues on the Montauban Mine Property. The Certificate of Authorization issued to the Company allows for the construction and installation of equipment facilities to recuperate mica (muscovite) and the precious metals from the mining residues (tailings) located on the property.

Consequently, the primary objective will be to recuperate the mica and precious metals from the mining residues. The recuperation of the precious metals from the mining residues will be less expensive than traditional mining operations primarily because the mining residues have already been crushed and grinded by prior mining companies.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Principles of Consolidation

The condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary, DNA Canada Inc. All intercompany transactions and accounts have been eliminated on consolidation.

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

(Unaudited)

Currency Translation

The Company’s functional is the Canadian dollar and its reporting currency is the United States dollar. Transactions denominated in the functional currency are converted into United States dollars using the exchange rate in effect at the date of the transaction or the average rate for the period in the case of revenue and expense transactions. Monetary assets and liabilities are re-valued into the reporting currency at each balance sheet date using the exchange rate in effect at the balance sheet date, with any resulting exchange gains or losses being credited or charged to accumulated other comprehensive income (loss). Non-monetary assets and liabilities are recorded in the reporting currency using the exchange rate in effect at the date of the transaction and are not revalued for subsequent changes in exchange rates.

Comprehensive Income (Loss)

The Company adopted ASC 220-10, “Reporting Comprehensive Income,” (formerly SFAS No. 130). ASC 220-10 requires the reporting of comprehensive income in addition to net income from operations.

Comprehensive income is a more inclusive financial reporting methodology that includes disclosure of information that historically has not been recognized in the calculation of net income.

Cash and Cash Equivalents

The Company considers all highly liquid debt instruments and other short-term investments with maturity of three months or less, when purchased, to be cash equivalents.

The Company maintains cash and cash equivalent balances at one major Canadian bank.

Exploration Tax Credits

The Company is entitled to certain exploration tax credits for the exploration expenditures they have incurred from the Canadian federal government and the government of the Province of Quebec. Qualifying expenditures include exploration costs, salaries, building expenditures and infrastructure and equipment expenditures to conduct the activities of the Company. During the year ended December 31, 2012, the Company received $108,284 in tax credits for expenditures incurred from June 2011 through March 2012. In addition, the Company has submitted approximately CDN.$590,000 in credits for expenditures through December 31, 2012. The Company’s policy is to record the tax credits when received rather than applied for. Research tax credits must be reviewed and approved by the tax authorities and it is possible that the amounts granted will differ from the amounts applied for.

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

(Unaudited)

Fixed Assets

Fixed assets are stated at cost, less accumulated depreciation. Depreciation will be provided using the straight-line method over the estimated useful lives of the related assets when those assets are placed into service. Costs of maintenance and repairs will be charged to expense as incurred.

Trade and Other Payables

Trade and other payables and accrued liabilities are obligations to pay for goods or services that have been acquired in the normal course of business. Trade and other payables and accrued liabilities are classified as current liabilities if payment is due within one year or less. If not, they are presented as non-current liabilities.

Recoverability of Long-Lived Assets

Although the Company does not have any long-lived assets at this point, for any long-lived assets acquired in the future, the Company will review their recoverability on a periodic basis whenever events and changes in circumstances have occurred which may indicate a possible impairment. The assessment for potential impairment will be based primarily on the Company’s ability to recover the carrying value of its long-lived assets from expected future cash flows from its operations on an undiscounted basis. If such assets are determined to be impaired, the impairment recognized is the amount by which the carrying value of the assets exceeds the fair value of the assets. Fixed assets to be disposed of by sale will be carried at the lower of the then current carrying value or fair value less estimated costs to sell.

Fair Value of Financial Instruments

The carrying amount reported in the condensed consolidated balance sheets for cash and cash equivalents, accounts payable, and accrued expenses approximate fair value because of the immediate or short-term maturity of these financial instruments. The Company does not utilize derivative instruments.

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

(Unaudited)

Income Taxes

The Company uses the liability method of accounting for income taxes under which deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted or substantially enacted tax rates in effect for the year in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized as part of the provision for income taxes in the period that includes the enactment date. Deferred tax liabilities are always provided for in full. Deferred tax assets are recognized to the extent that it is probable that they will be able to be utilized against future taxable income. Deferred tax assets and liabilities are offset only when the Company has a right and intention to set off current tax assets and liabilities from the same taxation authority. Valuation allowances are established, when necessary, to reduce deferred tax assets to amounts that are expected to be realized.

Revenue Recognition

The Company will generate revenues from the sale of precious metals mined from its Property. Revenue from the sale of precious metals, namely gold, silver and mica, will be recognized upon delivery of the precious metals, collection is probable, the fee is fixed or determinable and the Company has transferred to the buyer the significant risks and rewards of ownership of the precious metals supplied. Significant risks and rewards are generally considered to be transferred to the buyer when the customer has taken undisputed delivery of the precious metals.

Loss Per Share of Common Stock

Basic net loss per share (“Basic EPS”) is computed by dividing net loss available to common shareholders by the weighted average number of common shares outstanding for the period.

Diluted earnings per share is computed by dividing adjusted net income available to common shareholders by the weighted average number of common shares outstanding adjusted for the effects of all dilutive common share issuances. Dilutive common share issuances shall be deemed to have been converted into ordinary shares at the beginning of the period.

For the purpose of calculating diluted earnings per share, the Company shall assume the exercise of dilutive stock options and warrants. The assumed proceeds from these instruments shall be regarded as having been received from the issue of common shares at the average market price of common shares during the period. Dilutive common share issuances are not included in the computation of diluted earnings per share when the Company reports a loss because to do so would be anti-dilutive for the periods presented. The following is a reconciliation of the computation for basic and diluted EPS:

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

| | | March 31, | | | March 31, | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| Net profit (loss) | | $ | (884,841 | ) | | $ | (276,913 | ) |

| | | | | | | | | |

| Weighted-average common shares | | | | | | | | |

| outstanding (Basic) | | | 85,698,044 | | | | 76,100,000 | |

| | | | | | | | | |

| Weighted-average common stock | | | | | | | | |

| Equivalents | | | | | | | | |

| Stock options | | | - | | | | - | |

| Warrants | | | - | | | | - | |

| | | | | | | | | |

| Weighted-average common shares | | | | | | | | |

| outstanding (Diluted) | | | 85,698,044 | | | | 76,100,000 | |

Uncertainty in Income Taxes

Under ASC 740-10-25 recognition and measurement of uncertain income tax positions is required using a “more-likely-than-not” approach. Management evaluates their tax positions on an annual and quarterly basis, and has determined that as of March 31, 2013, no additional accrual for income taxes is necessary.

The Company has performed a review of its material tax positions. During the three months ended March 31, 2013, the Company did not recognize any amounts for interest and penalties with respect to any unrecognized tax benefits.

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

(Unaudited)

Recent Issued Accounting Standards

In May 2011, FASB issued Accounting Standards Update (ASU) No. 2011-04, Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. FASB ASU 2011-04 amends and clarifies the measurement and disclosure requirements of FASB ASC 820 resulting in common requirements for measuring fair value and for disclosing information about fair value measurements, clarification of how to apply existing fair value measurement and disclosure requirements, and changes to certain principles and requirements for measuring fair value and disclosing information about fair value measurements. The new requirements are effective for fiscal years beginning after December 15, 2011. The Company plans to adopt this amended guidance on October 1, 2012 and at this time does not anticipate that it will have a material impact on the Company’s results of operations, cash flows or financial position.

In June 2011, FASB issued ASU No. 2011-05, Presentation of Comprehensive Income, which amends the disclosure and presentation requirements of Comprehensive Income. Specifically, FASB ASU No. 2011-05 requires that all non-owner changes in stockholders’ equity be presented either in 1) a single continuous statement of comprehensive income or 2) two separate but consecutive statements, in which the first statement presents total net income and its components, and the second statement presents total other comprehensive income and its components. These new presentation requirements, as currently set forth, are effective for the Company beginning October 1, 2012, with early adoption permitted. The Company plans to adopt this amended guidance on October 1, 2012 and at this time does not anticipate that it will have a material impact on the Company’s results of operations, cash flows or financial position.

In September 2011, FASB issued ASU 2011-08, Testing Goodwill for Impairment, which amended goodwill impairment guidance to provide an option for entities to first assess qualitative factors to determine whether the existence of events or circumstances leads to a determination that it is more likely than not that the fair value of a reporting unit is less than its carrying amount. After assessing the totality of events and circumstances, if an entity determines that it is not more likely than not that the fair value of a reporting unit is less than its carrying amount, performance of the two-step impairment test is no longer required. This guidance is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011, with early adoption permitted. Adoption of this guidance is not expected to have any impact on the Company’s results of operations, cash flows or financial position.

In July 2012, the FASB issued ASU 2012-02, Intangibles – Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment, on testing for indefinite-lived intangible assets for impairment. The new guidance provides an entity to simplify the testing for a drop in value of intangible assets such as trademarks, patents, and distribution rights. The amended standard reduces the cost of accounting for indefinite-lived intangible assets, especially in cases where the likelihood of impairment is low. The changes permit businesses and other organizations to first use subjective criteria to determine if an intangible asset has lost value. The amendments to U.S. GAAP will be effective for fiscal years starting after September 15, 2012. The Company’s adoption of this accounting guidance does not have a material impact on the consolidated financial statements and related disclosures.

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

(Unaudited)

There were other updates recently issued, most of which represented technical corrections to the accounting literature or application to specific industries and are not expected to have a material impact on the Company’s financial position, results of operations or cash flows.

| NOTE 3- | STOCKHOLDERS’ EQUITY (DEFICIT) |

Preferred Stock

The Company was established on June 2, 2006 with 10,000,000 shares of preferred stock authorized with a par value of $0.001. The Company has not issued any preferred stock.

Common Stock

The Company was established on June 2, 2006 with 100,000,000 shares of common stock authorized with a par value of $0.001. On December 8, 2011, the Company amended the authorized stock to 150,000,000 shares.

At incorporation, the Company issued 40,000,000 shares of common stock to the Company’s founders at par value of $40,000 for services rendered by the founder.

In November 2010, the Company issued 20,000,000 shares of common stock for $60,000 to investors ($0.003 per share – 33 investors).

In 2011, the Company issued:

| | · | 5,000,000 shares of common stock on June 9, 2011 to acquire mining rights at a value of $15,000 which represented a per share value of $0.003 which was the price used in the November 2010 private placement. There was no change in the valuation of the Company from November 2010 to June 2011, therefore the same price was used; |

| | · | 5,000,000 shares of common stock on June 13, 2011 to board members for services at a value of $15,000 which represented a per share value of $0.003 which was the price used in the November 2010 private placement. There was no change in the valuation of the Company from November 2010 to June 2011, therefore the same price was used; |

| | · | 1,000,000 shares of common stock on June 13, 2011 for payment of interest on the promissory note of $3,000 which represented a per share value of $0.003 which was the price used in the November 2010 private placement. There was no change in the valuation of the Company from November 2010 to June 2011, therefore the same price was used; |

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

(Unaudited)

| | · | 3,350,000 shares of common stock from June 27, 2011 through October 20, 2011 for cash under a private placement. The Company issued the private placement at $0.20 per share to reflect the recent activity. There was no independent valuation report. The Company raised $670,000 for the shares of common stock. |

| | · | 1,500,000 shares of common stock on September 19, 2011 under employment agreements for a value of $300,000. The $0.20 value is the same value the Company used in raising funds under their private placement, and there were no changes to that value; and |

| | · | 250,000 shares of common stock on October 20, 2011 to a consultant who assisted on the engineering of the building for a value of $0.20 per share amounting to $50,000. The $0.20 value is the same value the Company used in raising funds under their private placement, and there were no changes to that value |

The methodologies, approaches and assumptions that the Company used are consistent with the American Institute of Certified Public Accountants, “Practice Guide on Valuation of Privately-Held Company Equity Securities Issued as Compensation”, considering numerous objective and subjective factors to determine common stock fair market value at each issuance date, including but not limited to the following factors: (a) arm’s length private transactions; (b) shares issued for cash as a basis to determine the value for shares issued for services to non-related third parties; and (c) fair value of service provided to non-related third parties as a basis to determine value per share. With respect to the sale of the securities identified above, the Company relied on the exemption provisions of Section 4(2), Regulation S or Section 3(a) 10 of the Securities Act of 1933, as amended. The sale was made to a sophisticated or accredited investor, as defined in Rule 502, or were issued pursuant to a specific exemption.

In 2012, the Company issued:

| | · | 6,924,000 shares of common stock from September 1, 2012 to December 31, 2012 for $1,731,000 through an S-1 registration statement at $0.25 per share. |

In 2013, the Company issued:

| | · | 1,576,000 shares of common stock from January 1, 2013 to February 28, 2013 for $394,000 through an S-1 registration statement at $0.25 per share. The shares were issued to thirteen different shareholders. |

| | · | 928,000 shares of common stock to nine different shareholders who purchased $232,000 through an S-1 registration statement at $0.25 per share at the end of December 2012. These shares were reflected as a liability for stock to be issued at December 31, 2012. The balance as of March 31, 2013 is $0. |

| | · | 2,500,000 shares of common stock on March 4, 2013 pursuant to an executed agreement with 754 2542 Canada Inc. to convert all amounts owing them, CDN$500,000 face value of the promissory note at $0.20 per share. The original promissory note executed between the parties was dated May 13, 2011. |

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

(Unaudited)

| | · | 5,000,000 shares of common stock on March 15, 2013 to new Officers of the Company, pursuant to employment agreements, for value at $0.25 per share representing a total compensation expense of $1,250,000. 2,000,000 shares, valued at $500,000, vest immediately and 3,000,000 shares, valued at $750,000, vest quarterly over one year and are reflected as deferred compensation as of March 31, 2013. |

| | · | 1,500,000 shares of common stock were cancelled on March 28, 2013. |

As of March 31, 2013, the Company has 91,528,000 shares of common stock issued and outstanding.

Stock Options and Warrants

As of March 31, 2013, the Company has not issued any stock options or warrants.

Fixed assets consist of the following as of March 31, 2013 and December 31, 2012:

Estimated | | | | (Unaudited) | | |

Useful Lives | | | | March 31, | | December 31, |

| | | (Years) | | 2012 | | 2012 |

| Building | | 15 | | $ 1,342,044 | | $ | 1,154,284 | |

| Land | | | | 221,970 | | | 93,953 | |

| Computers | | 5 | | 4,445 | | | 2,556 | |

| Equipment | | 5 | | 43,115 | | | 43,115 | |

| Vehicle | | 5 | | 25,127 | | | 25,127 | |

| Subtotal | | | | 1,636,701 | | | 1,319,035 | |

| Less: accumulated depreciation | | | | (2,084) | | | (692) | |

| Fixed assets, net | | | | $ 1,634,617 | | $ | 1,318,343 | |

As of March 31, 2013, only the computers and vehicle have been placed into service. Depreciation for the three-months ended March 31, 2013 and 2012 was $1,392 and $0, respectively.

| NOTE 5- | PROVISION FOR INCOME TAXES |

As of March 31, 2013, there is no provision for income taxes, current or deferred.

| Net operating losses | | $ | 903,682 | |

| Valuation allowance | | | (903,682 | ) |

| | | | | |

| | | $ | - | |

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

(Unaudited)

At March 31, 2013, the Company had a net operating loss carry forward in the amount of $2,657,888, available to offset future taxable income through 2033. The Company has established a valuation allowance equal to the full amount of the deferred tax assets due to the uncertainty of the utilization of the operating losses in future periods.

A reconciliation of the Company’s effective tax rate as a percentage of income before taxes and the federal statutory rate for the three-month periods ended March 31, 2013 and 2012 is summarized below:

| | | | | |

| | | | | |

| Federal statutory rate | | | (34.0 | )% | |

| State income taxes, net of federal benefits | | | 0.0 | | |

| Valuation allowance | | | 34.0 | | |

| | | | 0% | | |

The Company entered into a promissory note with an investor on May 13, 2011 in the amount of CDN$500,000 that matures on May 31, 2014. The note had a default interest rate of 5% per annum should repayment not occur by the maturity date and the Company be in default of the promissory note agreement. In connection with the promissory note, the Company issued 1,000,000 shares of stock valued at CDN$3,000 in June 2011 for prepaid interest.

On March 4, 2013, 754 2542 Canada Inc. executed an agreement with the Company whereby 754 2542 Canada Inc. agreed to accept 2,500,000 shares of common stock in satisfaction of all amounts due and owing 754 2542 Canada Inc. pursuant to the promissory note executed between the parties on May 13, 2011. As a result, the promissory note has been converted, and the Company recorded a loss on conversion of this note of $125,000 in the condensed consolidated statement of operations for the three months ended March 31, 2013.

On August 3, 2012, the Company entered into a promissory note with a non-related individual in the amount of CDN$200,000 maturing on November 16, 2014. The note bears interest at 12% per annum. The lender retained the first $7,000 for interest at closing thereby funding the Company net proceeds of $193,000. The note was repaid in full on November 30, 2012.

| NOTE 7- | FAIR VALUE MEASUREMENTS |

The Company adopted certain provisions of ASC Topic 820. ASC 820 defines fair value, provides a consistent framework for measuring fair value under generally accepted accounting principles and expands fair value financial statement disclosure requirements. ASC 820’s valuation techniques are based on observable and unobservable inputs. Observable inputs reflect readily obtainable data from independent sources, while unobservable inputs reflect our market assumptions. ASC 820 classifies these inputs into the following hierarchy:

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

(Unaudited)

Level 1 inputs: Quoted prices for identical instruments in active markets.

Level 2 inputs: Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 inputs: Instruments with primarily unobservable value drivers.

The following table represents the fair value hierarchy for those financial assets and liabilities measured at fair value on a recurring basis as of March 31, 2013:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | | | | | | | | | | |

| Cash and cash equivalents | | | 629,964 | | | | - | | | | - | | | | 629,964 | |

| NOTE 8- | MINING EXPENDITURES |

During 2012 the Company incurred significant expenses related to the process of obtaining the Quebec Provincial government authorization permit for the extraction of the precious metals in the tailings residue on the Montauban Mine Property. In addition, Laboratoire LTM was mandated to prepare the final modified process mill blueprints and mining circuit extraction plans. The Company incurred a total expense of CDN$78,060 for their work during this period.

Solmatech was mandated to characterize the environment on the Montauban Mine Property and, more specifically, conduct soil tests on the future site of mining operations by the Company. The Company incurred a total expense of CDN$48,937 for their work during this period.

Groupe Alphard was mandated to prepare the geotech process and restoration of the mining residue park. The Company incurred a total expense of CDN$48,937 for their work.

SCEB Inc. was hired as the environment and engineer specialist to overlook and coordinate the entire authorization permit process. The Company incurred a total expense of CDN$95,002 for their work.

From August 2012 to December 2012, the Company incurred significant expenses related to the infrastructure build-out, equipment purchase and construction of the processing mill facility. Deschesnes Construction and Demolition was hired to complete the civil construction of the steel structure building for CDN$470,000. The Company incurred a total expense of CDN$370,000 for their work and has a balance payable of CDN$5,000 as of March 31, 2013.

DNA PRECIOUS METALS, INC.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

(Unaudited)

A company 9216-9499 Quebec Inc. was hired as the electrical contractor. Their mandate included the installation of the main power source line to the building facility and all electrical work inside the milling facility. Included in the mandate is the wiring of the entire building, installation of heating and air conditioning system, lighting supply, installation of ventilation system and complete electrical set-up of all milling equipment. The Company incurred a total expense of CDN$347,350 for their work.

Also during this time period, Terra Innovation was mandated to design the milling site layout and overlook the construction work of the milling site and Forage DynamiTech was hired to dynamite the rock in order to expand the milling site area. The Company incurred a total expense of CDN$50,000 and CDN$28,205, respectively, for their work during this period.

Transport Alain Carrier Inc. was mandated, for the period from January 1, 2012 to December 31, 2012, to continue infrastructural and construction work. During this period, Transport Alain Carrier Inc. completed the restoration of access roads on the Monatuban Mine Property and built an additional access road leading to the future mining operations site. Transport Alain Carrier Inc. was also involved in the work associated with the expansion of the milling site area. The Company incurred a total expense of CDN$69,652 for their work during this period. From January 1, 2013 to present, the Company incurred additional expenses related to the infrastructure build-out, equipment purchase and construction of the processing mill facility. The Company incurred an additional expense of CDN$23,423 for their work on the construction site during this period.

In August 2012, the Company signed a contract with Universal Steel Buildings, and their affiliate Steel Building Accessories, for an additional sixty linear feet expansion of the initial purchased steel structure building. The steel structure extension purchased brought the total square foot layout capacity to 16,000 sq/ft from the initial 10,000 sq/ft layout. The Company incurred a total expense of US$124,570 for fiscal year 2012. The final payment for this work was made on October 26, 2012.

ITEM 2 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations discusses significant factors that have affected our financial position and operations during the three month periods ended March 31, 2013 and 2012. This discussion also includes events that occurred after the end of the last fiscal year end and contains both historical and forward-looking statements.

When used in this discussion, the words “expect(s)”, “feel(s)”,”believe(s)”, “will”, “may”, “anticipate(s)” “intend(s)” and similar expressions are intended to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, which could cause actual results to differ materially from those projected.

Background

We are a Nevada corporation organized on June 2, 2006. We were originally incorporated under the name Celtic Capital, Inc. On October 20, 2008, we changed our name to Entertainment Education Arts, Inc. On May 12, 2010, we changed our name to DNA Precious Metals, Inc. to more accurately reflect our new business plan.

Our Business

We are an exploration stage mining company initially involved in the business of processing tailings from previously extracted ore. Our business objective is to identify proven reserves of gold, silver and other base metals, construct a mill, build out the Property’s infrastructure and place the mine into production. Our Montauban Mining Project is located in the Montauban and Chavigny townships near Grondines-West in Portneauf County, Quebec, Canada (the “Property”). The Property does not contain any known ore reserves according to the definition of ore reserves under Industry Guide 7 promulgated by the Securities and Exchange Commission (“SEC”) as well as various SEC mining related leases. Further work is required on the Property before a final determination may be made regarding the economic and legal feasibility of a mining venture relative to the Property. There is no assurance that a commercially viable deposit will be proven through our exploration efforts. The funds expended on our properties may be unsuccessful in delineating ore reserves that meet the criteria established under SEC guidelines.

THE PROPERTY

On June 9, 2011, we acquired the Montauban Property from Company 9215-8062 Quebec Inc. in exchange for the issuance of 5,000,000 shares of our common stock. The previous claim owner, Rocmec Mining Inc., exchanged its ten claims to Forage Magma Inc. for drilling equipment it needed at the time. Soon thereafter, Forage Magma Inc. sold those claims to 9215-8062 Quebec Inc. The ten claims were registered in the Quebec Government files directly from Forage Magma to 9215-8062 Quebec Inc.

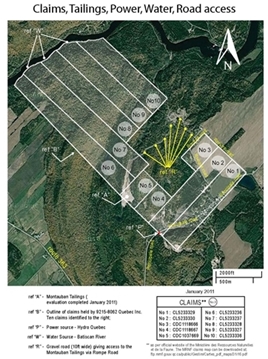

No royalty payments are due in connection with the acquisition of the mining claims. We have paid the administrative fees of the mining claims in Quebec through March 31, 2013. Thereafter, we will be required to pay, every two years, $452 in administrative fees for all of the mining claims.

We are also required to allocate resources to each of the claims. The Quebec Ministry of Resources requires us to incur $19,750 in expenses directly related to the development of our mining claims.

We currently have a credit of approximately $76,800 which we can allocate amongst the ten mining claims. The credit is attributable to work that we have already completed on several of the mining claims

MINING HISTORY

The Montauban Tailings under study, known as the “recent tailings”, were produced by Anacon Lead Mines Ltd. between 1948 and 1955 and are situated within one kilometer northwest of the village. Reported production from this period amounted to over 87 million pounds of zinc, 34 million pounds of lead, close to 17,000 ounces of gold and over 2.6 million ounces of silver, extracted from a total of 1,375,371 tons of ore processed.

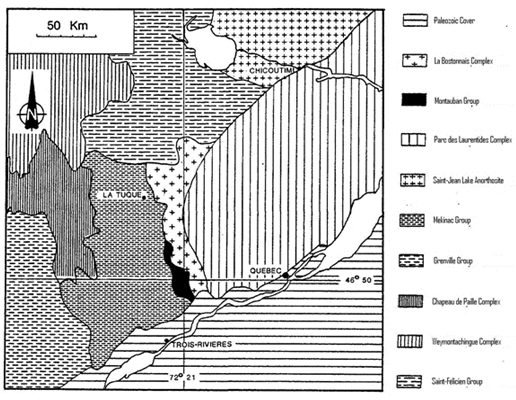

GEOLOGY

Regional geology is mostly comprised of three main rock groups: the basement crust, the supracrustal rocks and the intrusive rocks which were, respectively, identified as the Mekinac Group, the Montauban Group and the La Bostonnais Complex. The Montauban Deposit is a three-kilometer long mineralized formation with a geology that is fairly complex being located within an extensively folded sequence of amphibolite facies rocks that are sandwiched between intrusions of granodioritic to gabbroic composition. In the mine area, these metamorphic rocks strike roughly North-South and dip ±60° to the East.

DRILLING SUMMARY

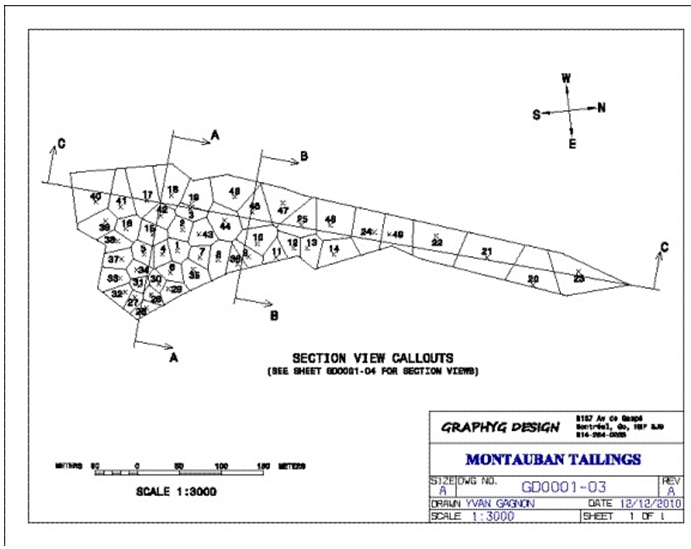

A systematical sampling program was developed to provide an accurate and homogeneous grid of data to estimate the Montauban Tailings potential. A 24 holes percussion drilling campaign was performed totaling 143.1 meters. This percussion drilling campaign was completing the previous 25 holes drilled earlier. A total of 49 holes, totaling 302.3 meters of drilling, were completed. No proven or indicated reserves were identified.

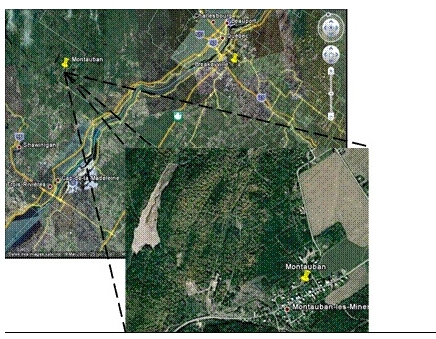

PROPERTY DESCRIPTION AND LOCATION

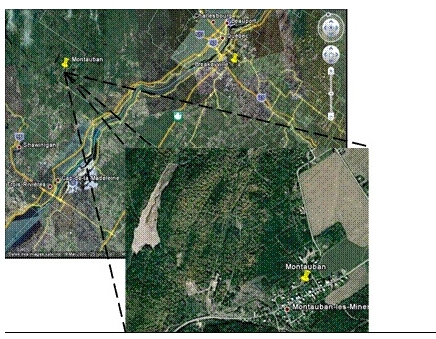

The Montauban Property is composed of 10 mining claims totaling 340.36 hectares located in the Montauban-les-Mines sector of the Notre-Dame-de-Montauban municipality, in the Montauban Township, Portneuf County, Province of Quebec. The property is located 120 km east of Quebec City and 80 km north of Trois-Rivières. The Montauban Tailings are located one kilometer west of Montauban-les-Mines with multiple land accesses. Manpower, water and electric power are easily available within the very same distance.

Figure I: Montauban Property Location Map

Pertinent data concerning the claims are presented in table I, these coming from the Quebec Government GESTIM website.

Table I: List of Claims

| Claim # | Range | Lot | Area |

| 1037669 | 1 | 42 | 12.55 |

| 1118666 | 1 | 41 | 11.49 |

| 1118667 | 1 | 41 | 12.32 |

| 5233236 | 1 | 47 | 46.40 |

| 5233237 | 1 | 46 | 48.80 |

| 5233327 | 1 | 44 | 44.20 |

| 5233328 | 1 | 45 | 43.30 |

| 5233329 | 1 | 39 | 40.50 |

| 5233330 | 1 | 40 | 40.50 |

| 5233336 | 1 | 43 | 40.30 |

| Total | | | 340.36 |

Figure II: Claim Reference Map

The Montauban Tailings are actually under the Quebec Provincial government responsibility since the site was declared orphan. There are no environmental liabilities as such. However, we are required to obtain necessary permits from the government authorities to realize any further field work having an impact on the environment, especially if remobilization of tailings is considered, as these are considered by the government authorities as toxic wastes.

ACCESS, CLIMATE, LOCAL INFRASTRUCTURES AND PHYSIOGRAPHY

The Montauban Municipality is accessible by route 363 from highway 40 linking Quebec City (120 km to the east) and Trois-Rivières (80 km to the southeast). Access to railway is also available less than 10 km to the northeast in Notre-Dame-des-Anges. The Montauban Tailings are located one kilometer west of Montauban-les-Mines with multiple land accesses.

From 1971 to 2000, Environment Canada Statistics reports daily average temperature of 18.8 °C in July and -14.2 °C for January. The extreme minimum temperature registered was of -45°C (February 23, 1972) and the extreme maximum temperature reached 36.7°C (August 1, 1975). The snow cover spreads from November to April, February being the month with the most important snow accumulation. The average yearly precipitation is 1138.8 mm, including rainfall (878.7 mm) and snowfall (260.2 mm). This data was collected at the Lac aux Sables station about 10 km to the northwest of Montauban.

Manpower, water and electric power are easily available within one-kilometer distance from the Montauban-les-Mines village. The region is rural, most of the farmers growing potatoes and corn. The equipment and personnel specialized in quarries are available within a 30 km radius from the Montauban Tailings in the surrounding municipalities (Notre-Dame-de-Montauban, St-Ubalde, Lac-aux-Sables, St-Casimir, St-Marc-des-Carrières and Ste-Thècle).

Argilitic and sandy plateaus forming the foothills of the Laurentides characterize the area’s physiography. The Montauban Property is limited to the North West by the Batiscan River which is the main effluent in the area draining most of the Property towards the south to the St-Lawrence River. The topography consists of numerous small hills reaching an altitude of up to 220 m above the sea level from the valleys standing in average at 160 m elevation.

HISTORY

The mining history of the area began in 1910 with the discovery of the Pb-Zn Montauban Deposit by Mr. Elzéar Gauthier. The exploitation of the numerous base metal zones of the Montauban Mine were performed over the years by a series of successive owners: Mr. E. Gauthier (1910-1911), Mr. P. Tétreault (1911-1914), the Weedon Mining Company (1914-1915), the Zinc Company Ltd. (1915-1921), the Tetreault Estate (1921-1924), the British Metal Corporation (1925-1929), the Tetreault Estate (1929-1937), the Siscoe Metals Ltd./War Time Metals Corporation (1942-1944), Anacon Lead Mines Ltd. (1948-1956) and the Ghysleau Mining Corporation Ltd. (1957-1966). In 1966, most of the installations were decommissioned, and the mining rights on the Anacon Property expired in 1972.

In 1974, Muscocho Exploration Ltd. acquired the mining rights and performed over the following years numerous exploration programs leading to the definition of sufficient gold resources to start commercial gold production in 1983. The mine did produce gold and silver up to 1990 when production was stopped due to ore exhaustion. Over its production period, Muscocho processed 813,632 tonnes of ore producing 92,553 oz of gold and 323,376 oz of silver.

In 1981, a systematic sampling program was performed by Boville Resources Ltd. to evaluate the quantity and quality of mine tailings at Montauban-les-Mines, those tailings being the first period of exploitation between 1914 and 1944 located south of the access road to Montauban-les-Mines (Depatie (1982).

In 1999, Mirabel Resources Inc. performed a soil survey, a mag-VLF survey, some trenching and 18 diamond drill holes mostly on the south zone. In 2000-2001, more trenching and 17 short diamond drill holes were done on the north zone.

In 2003, Mirabel Resources Inc. performed limited gravimetrical tests on 4 samples equally split between core samples from former diamond drill holes and tailing samples of the “old tailings” taken close by the access road to Montauban-les-Mines (Bernard (2003)). The results showed that the gravimetric method gave good recoveries for the tailing samples but nothing significant for the rock samples.

The Montauban Tailings under study, known as the “recent tailings”, are located close to one kilometer north west of the village itself and that were produced from 1948 to 1955 by Anacon Lead Mines Ltd. Reported production from this period amounts to over 87 million pounds of zinc, 34 million pounds of lead, close to 17,000 ounces of gold and over 2.6 million ounces of silver, extracted from a total of 1,375,371 tons of ore processed.

GEOLOGY

Regional geology consists of three main rock groups: the basement crust, the supracrustal rocks and the intrusive rocks which were respectively identified as the Mekinac Group, the Montauban Group and the La Bostonnais Complex

The La Bostonnais Complex borders the Montauban Group to the East, an intrusive rocks complex formed of basic, tonalitic and felsic igneous rocks. To the West, the Montauban Group is in contact with the Mekinac Group mostly composed of charnockitic migmatites.

The Montauban deposit is distributed within numerous different zones along the strike length of the mineralization, from South to North we have the zones: South, Tétreault, A, C, North and Montauban. All zones are zinc bearing with the exception of the South and North zones which are gold bearing.

MONTAUBAN TAILINGS

The Montauban Tailings are covering a total area of 53,093 m² and amounts to a total volume of 250,750 m³. Since this volume is composed of tailings and that the water table is located within most of the blocks derived from each hole, the specific gravity of the material had to be evaluated to estimate the tonnage that is present on site. The estimation of the specific gravity was performed on the last drilling campaign 24 holes since no recovery evaluation is available from the first drilling campaign. Recovery of tailings in the sampling process averaged about 76% from the last percussion drilling campaign. Recoveries were ranging from 40 to 100 %, the lowest values being associated to the high water content of the deepest samples, the water table being at a depth of about 4.6 m (15 ft) within the pile of tailings. The averaged recovery was in the order of 81% (68 samples) for the upper portion of the tailings and it dropped to below 64% (27 samples) for the deeper portion (below the water table). The specific gravity is then estimated to be 1.71 g/cm³.

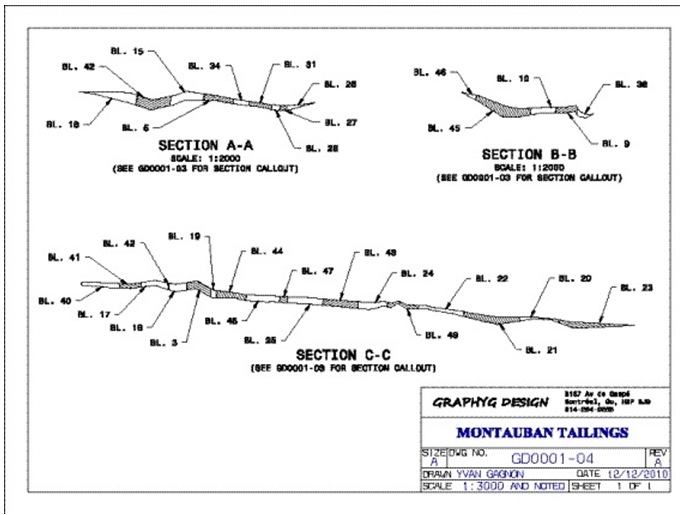

Montauban Tailings Hole Location Plan

The above graph shows the typical sections of the Montauban Tailings where it is clear that the drainage is towards the North (to the right on section C-C). It is also clear that the thickness is variable but not so thick compared to the value that should be reached if the whole production was to be still onsite. About 1.2 million tons were produced in the past; such a tonnage should be averaging over 13 meters in the Tailings pile. It is clear on site that an important fraction of the tailings was washed away through drainage.

Montauban Tailings Typical Sections

Figure X: Montauban Tailings View Looking South

A total of 49 blocks were defined from the two previous percussion-drilling campaigns. The drilling pattern is essentially regular with a hole each and every 30 meters on average. The block volumes were calculated with the help of the computer-modeling program that defined one polygon for each and every hole drilled. The perimeter of the tailings was mapped with the help of a GPS device, this perimeter is the limit where the surface meshing of the holes’ collars meets the meshing of the bottom of the holes. The block size is fairly regular averaging 8,740 tons, the smallest block being # 26 at 1,342 tons and the biggest one being # 21 at 24,334 tons.

To these metals one should add the mica content of the Montauban Tailings, the mica being mostly composed of the phlogopite type with some muscovite and minor amounts of biotite. The mica content is estimated to be at least 10 % of the total volume. The mica is an industrial mineral that is valued according to market conditions.

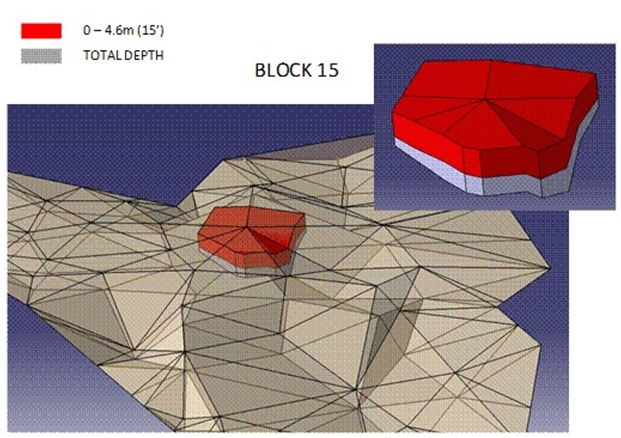

DRILLING RESULTS

The distribution of metals within the tailings is not homogeneous. It was demonstrated with the 49 holes drilled on the Montauban Tailings that recoveries dropped from 81 to less than 64 % below the 4,6 m (15 ft) horizon, which is more or less the location of the water table within the Tailings. The impact is seen on metal content when gold is 67 % richer over this horizon, silver is up 73 %, Copper also up 63 %, and the winner being lead with a jump of 149 %. The only one being evenly distributed is the zinc.

Example of Block 15 Showing Richer Upper Portion of Montauban Tailings

MILL CONSTRUCTION

We are constructing a mill to process mining residues. Our focus will be to produce gold and silver concentrate in addition to a saleable mica product. By extracting mica and producing the gold and silver concentrate, we will reduce the sulphide content of the tailings and thus lower the environmental cost for the closure at the end of the operation.