Washington, D.C. 20549

Item 1. Reports to Stockholders.

LoCorr Funds seek to provide investments that, over time, will have low correlation to traditional asset classes – such as stocks and bonds. We believe that adding low correlating investments to portfolios can significantly reduce the overall portfolio risk while enhancing returns. Correlation measures the degree to which the returns of two investments move together over time. LoCorr offers products that provide the potential for positive returns in rising or falling markets and are designed to resist correlation with traditional stock, bond and commodity investments. In this annual report, LoCorr Funds are reporting on three mutual funds: LoCorr Managed Futures Strategy Fund, LoCorr Long/Short Commodities Strategy Fund and LoCorr Long/Short Equity Fund (collectively, the “Funds”). LoCorr Funds did launch another Fund – LoCorr Spectrum Income Fund – that will be reported in the next semi-annual report.

LoCorr Managed Futures Strategy Fund

The LoCorr Managed Futures Strategy Fund (the “Managed Futures Fund” or the “Fund”) seeks capital appreciation as its primary investment objective with managing volatility as a secondary objective. The Managed Futures Fund attempts to achieve its objective by investing in two main strategies – a Managed Futures strategy and a Fixed Income strategy.

Managed Futures Strategy

The Managed Futures Fund invests up to 25% of its total assets into a portfolio of globally diversified managed futures positions. The Fund accesses the returns of certain trading programs of Millburn Ridgefield Corporation (“Millburn”) and Crabel Capital Management, LLC (“Crabel”) via its investment in a total return swap agreement. The Fund uses Millburn and Crabel to execute its Managed Futures strategy. Millburn was founded in 1971 and manages about $1.4 billion in assets. The Managed Futures Fund accesses returns generated by Millburn’s Diversified Program (“MDP”), a commodity pool which commenced operations in 1977. MDP systematically invests in about 120 futures markets with long and short positions in sectors such as currencies, interest rates, stock indices and commodities (agricultural, energy and metals). The Managed Futures Fund also allocates capital via the swap to Crabel’s Multi-Product program, a short-term trend following strategy that commenced trading in March 1998. Crabel’s program was added to complement Millburn’s longer-term trend strategy in an attempt to improve the Fund’s risk-adjusted returns.

The Fund’s Futures strategy was unprofitable for the year as losses from trading interest rate futures, currency forwards, and energy and metal futures outpaced the sizable gain from trading equity futures and a lesser gain from trading agricultural and soft commodities.

During the year, market participants were encouraged by the gradual, but persistent, improvement in U.S. economic conditions; by signs that China’s growth, while transitioning to a slower pace, would be solid; by at least a modest improvement in European growth dynamics; by continued monetary ease worldwide for most of 2013; and by evidence that some grudging progress was being made on the banking and fiscal problems that have plagued developed economies in recent years.

However, this underlying positive current was interrupted frequently by policy concerns, and political and social disruptions and their ensuing economic uncertainties. On the monetary policy front, the on again-off again talk of Fed tapering; the moves toward a more restrictive policy by the People’s Bank of China (PBOC) starting around midyear and the interest rate changes by many central banks to influence their currencies frequently disrupted interest rate and currency markets. U.S. fiscal policy events that influenced market activity included: sequestration at the start of the year, the October government shutdown and the December budget agreement. Political and social tensions were rampant worldwide and included: Spanish scandals; Italy elections; Cypriot economic collapse; social unrest in Turkey, Indonesia, Thailand, Brazil, and South Africa; and armed conflict in Syria, Egypt, Iraq and Iran.

Interest rate trading was volatile and unprofitable in 2013. As the year began, the market was still focused on deflation concerns and persistent ease of monetary policy, and long interest rate futures positions were profitable. In May, however, Chairman Bernanke and other Fed officials raised the prospects of “tapering” the Fed’s policy of quantitative ease (QE). In response, yields on U.S. notes and bonds reversed abruptly and moved sharply higher. Thereafter, the uncertain timing of the QE taper led to unsettled trading conditions. Consequently, long positions in notes and bonds generated losses.

Equity prices were buoyed by the improving worldwide economic outlook and long positions in U.S., Japanese, European, Australian and Canadian equity futures were highly profitable. On the other hand, the policy tightening in China and the sharp fall in the yen led to losses from trading Chinese, Korean and Singaporean equity futures.

Foreign exchange markets were volatile without sustained direction this year. Large changes in interest rates of developed markets and uncertainty about QE influenced currency movements. In addition, several countries took steps to weaken their currencies, while others took steps to support their currencies. Finally, the group of commodity currencies was buffeted by the uncertainty around Chinese growth dynamics. Consequently, losses were sustained in trading the U.S. dollar. Non-dollar cross rate trading was fractionally unprofitable.

Energy trading was marginally unprofitable. Metal trading was fractionally unprofitable as gains from trading copper fell short of losses from long lead and zinc positions and from trading precious metals. The small profits from trading soft and agricultural commodities were due to short positions in sugar, coffee, wheat and soybean oil, and to trading of soybeans.

Fixed Income Strategy

The Managed Futures Fund invests most of its remaining assets in a Fixed Income strategy comprised of investment grade corporate and government agency securities. Nuveen Asset Management (“Nuveen”) is the sub-adviser for this strategy – a short duration, high quality portfolio.

The Fund’s Fixed Income strategy allocation outperformed the Barclays Capital 1-5 Year Government/Credit Bond Index for the 1 year period ending 12/31/2013 by 0.42%. Interest rates rose during the period as a result of stronger economic growth, a “pull forward” of Federal Reserve tapering expectations and persistent outflows from longer-term investment-grade fixed income funds. Credit-related and securitized sectors were supported by strong credit fundamentals and outperformed government securities.

With our macro outlook calling for continued moderate domestic growth and strong corporate earnings, we positioned the Fund’s Fixed Income strategy with an emphasis on a diversified core portfolio of short duration investment-grade corporate and securitized debt while maintaining a significant underweight to the Treasury and agency segments of the market. Within the investment-grade credit space, our security selection added value as the Fund was overweight to financials, an industry sector that outperformed the broad credit market amid ongoing improvement in credit fundamentals. In addition, our exposure to short duration residential mortgage products within the structured space performed well as these market sectors were supported by strong housing fundamentals and investor demand for high-quality short duration paper.

We remain relatively constructive on the trajectory of the economy and expect the Federal Reserve to continue to gradually withdraw accommodation in 2014. Although the process of normalizing monetary policy appears to be a lengthy one, we expect rates to be pressured higher as they move closer to fair value levels. At the same time, as the economy continues to improve, corporate and securitized fundamentals should remain strong and may be supportive of current valuations. In this environment, we expect that credit and securitized sectors could continue to perform better than Treasuries, although by a smaller margin as gains may be driven by income as opposed to spread tightening. Against this backdrop, we remain focused on income generation and interest rate risk management. We expect to maintain the Fund’s overweight to corporate bonds, although less so than in recent periods. Because our bias is to be strategically defensive with our interest rate positioning, we maintained the Fund’s duration shorter than its benchmark at year end.

LoCorr Long/Short Commodities Strategy Fund

The LoCorr Long/Short Commodities Strategy Fund (the “Long/Short Commodities Fund” or the “Fund”) was created to provide investors with access to a commodities futures strategy in a mutual fund structure. Historically, investors have primarily accessed exposure to commodities in long-only funds, funds that rely on commodity price increases to generate positive returns. Of course, commodity prices don’t always appreciate and occasionally experience sharp declines. The Long/Short Commodities Fund has the ability to profit while commodity prices increase or decrease.

The Long/Short Commodities Fund’s primary investment objective is capital appreciation in rising and falling commodities markets. The Long/Short Commodities Fund attempts to achieve its investment objective by investing in two primary strategies – a Commodities strategy and a Fixed Income strategy.

Commodities Strategy

The Long/Short Commodities Fund invests up to 25% of its total assets into a portfolio of globally diversified commodity futures positions. The Long/Short Commodities Fund accesses returns generated by Millburn’s Commodity Program (“Milcom”), a commodity pool which commenced operations in 2005. The Fund accesses the Millburn returns via its investment in a total return swap agreement. The Fund uses Millburn to execute its Commodities strategy as manager of the swap’s reference index. Milcom systematically invests in about 50 futures markets with long and short positions in sectors such as energy, metals, softs, grains and livestock.

The Fund was unprofitable due to losses from trading energy, metal and soft commodity futures. Grain trading was fractionally positive and livestock trading was nearly flat. Spread trading was quite profitable across all sectors.

The global and domestic dynamics discussed above influenced commodity prices during the year. Energy prices were buffeted by conflicting forces in 2013. Underpinning prices was the overall improvement in growth, particularly in the developed world, and the turmoil that continues to envelop the Middle East. Weighing down prices was the impact of the shale oil revolution, and the transition in China to a less manufacturing focused growth model. In this environment, trading of crude oil, Reformulated Gasoline Blendstock for Oxygen Blending gasoline, London gas oil, heating oil and natural gas were unprofitable. Gains from energy spread trading offset most of these other energy sector losses.

In light of the disturbances listed above, metal prices were volatile in 2013. Prices started the year firm, fell after the first quarter, especially when Chinese and U.S. monetary policies tightened, and fluctuated erratically thereafter. Consequently, long positions and subsequent trading of zinc, lead, tin, gold, silver, palladium and platinum produced sizable losses. On the other hand, short copper positions were slightly profitable.

Trading of soft commodities produced a loss. Short cocoa trades, long lumber and Orange Juice positions, and trading of cotton and London sugar generated losses that outpaced the profits from short coffee and sugar positions. Spread trading of softs countered virtually all of these other soft sector losses.

Grain trading was profitable thanks to short soybean oil and wheat trades, and long trades in soybean and rapeseed. These gains slightly outweighed losses from trading oats, rice and maize. Grain spread trading added significantly to the profits. Livestock trading was marginally positive due to gains from spread trading.

Fixed Income Strategy

The Fund’s fixed income portfolio was sub-advised by Galliard Capital Management for most of the year until being replaced by Nuveen in late November. Nuveen will use a similar Fixed Income strategy as described above in the LoCorr Managed Futures Strategy Fund. The Long/Short Commodities Fund’s Fixed Income strategy lagged its benchmark, the Barclays Capital 1-5 Year Government/Credit Index, by 0.33% for the year ending 12/31/2013. Underperformance during the period was driven by overweight allocations in non-U.S. Treasury sectors relative to the benchmark. In particular, allocations to Agency Mortgage-Backed Securities, Commercial Mortgage-Backed Securities and Asset-Backed Securities (“ABS”) were a drag on performance, as was an allocation to Treasury Inflation Protected Securities (“TIPS”). Additionally, the longer term bonds underperformed shorter term bonds as prices dropped and yield rose on the longer end of the yield curve.

Nuveen’s outlook is described above. Because our bias is to be strategically defensive with our interest rate positioning, we reduced the Fund’s duration to be about 2.5 years at year end, which is modestly short to the benchmark and our mortgage focus is on security types with stable prepayment profiles with little to no extension risk.

LoCorr Long/Short Equity Fund

LoCorr Long/Short Equity Fund (the “Long/Short Equity Fund” or the “Fund”) is the newest addition to LoCorr Funds. Launched in May 2013, the Fund’s objective is long-term capital appreciation with reduced volatility compared to traditional broad-based equity market indices as a secondary objective. Consistent with the “low correlation” our Funds seek, long/short equity funds have the ability to provide positive returns when equity markets are rising yet they can provide downside protection when equity prices are declining.

The Fund’s initial sub-adviser, Millennium Asset Management, focuses on small and micro-cap stocks as the core long holdings. Millennium may also look to short individual stocks and hold bear ETFs to seek to mitigate volatility and to profit when prices decline.

During the Fund’s abbreviated period ending on December 31, 2013, the Fund’s net long exposure ranged from 77% to 94%. The Fund’s Class I shares were up 15% from May 10, 2013 through December 31, 2013.

The equity markets were weak from the launch of the Long/Short Equity Fund in May through the end of June due to fears of the Federal Reserve changing its easing stance, and continuing concerns of slower growth in China. The congressional stalemate over addressing budgetary items added to market concerns in the August to November timeframe. Between August and December there were four different equity market corrections of 4 - 5% each. Each corrective phase ended with the recognition of the underlying strength of the U.S. economy.

The portfolio was positioned to benefit from growth in the U.S. with exposure to the continuing expansion of the U.S. economy. This exposure benefited the Fund during 2013, and also drove short term underperformance when the market corrections focused on selling economically sensitive equities.

In the last few months of 2013, the Fund performed exceptionally well due to the Fund’s exposure to growth of the U.S. economy and the outperformance of small cap stocks. Short positions have been focused on market sectors and different issues that have become overvalued due to over-enthusiastic valuations.

Thank you for investing in LoCorr Funds.

It is not possible to invest directly into an index.

Correlation measures how much the returns of two investments move together over time. Duration is a commonly used measure of the potential volatility of the price of the debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Barclays Capital 1-5 Year Government/Credit Index is an unmanaged index considered representative of performance of short-term U.S. corporate bonds and U.S. government bonds with maturities from one to five years.

The opinions expressed in the letter are those of the fund manager, are subject to change, are not guaranteed and should not be considered investment advice.

Must be preceded or accompanied by a prospectus. Fund holdings and sector allocation are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings please refer to the Schedule of Investments included in this report.

Mutual fund investing involves risk. Principal loss is possible. The Funds are non-diversified, meaning they may invest their assets in fewer individual holdings than a diversified fund. Therefore, the Funds are more exposed to individual stock volatility than a diversified fund. The Funds invest in foreign investments and foreign currencies which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Funds may make short sales of securities, which involves the risk that losses may exceed the original amount invested. Investing in commodities may subject the Funds to greater risks and volatility as commodity prices may be influenced by a variety of factors including unfavorable weather, environmental factors, and changes in government regulations. The Funds may invest in derivative securities, which derive their performance from the performance of an underlying asset, index, interest rate or currency exchange rate. Derivatives can be volatile and involve various types and degrees of risks, and, depending upon the characteristics of a particular derivative, suddenly can become illiquid. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in Asset Backed, Mortgage Backed, and Collateralized Mortgage Backed Securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments.

Diversification does not assure a profit nor protect against loss in a declining market.

Past performance is not a guarantee of future results.

The LoCorr Managed Futures Strategy Fund, LoCorr Long/Short Commodities Strategy Fund and LoCorr Long/Short Equity Fund are distributed by Quasar Distributors, LLC.

LoCorr Managed Futures Strategy Fund

Rate of Return — For the period ended December 31, 2013 (Unaudited)

| | | | | | | | | | | Average Annual | |

| | | Inception Date | | 6 Month | | 1 Year | | Since Inception | |

| LoCorr Managed Futures Strategy Fund - Class A (without maximum load) | | | 3/22/11 | | 1.28 | % | | | -5.53 | % | | | -6.54 | % | |

| LoCorr Managed Futures Strategy Fund - Class A (with maximum load) | | | 3/22/11 | | -4.55 | % | | | -11.01 | % | | | -8.51 | % | |

| LoCorr Managed Futures Strategy Fund - Class C | | | 3/24/11 | | 1.06 | % | | | -6.07 | % | | | -7.21 | % | |

| LoCorr Managed Futures Strategy Fund - Class I | | | 3/24/11 | | 1.52 | % | | | -5.28 | % | | | -6.31 | % | |

| Barclays CTA Index | | | | | -0.45 | % | | | -1.46 | % | | | -2.06 | %1 | |

| S&P 500 Total Return Index | | | | | 16.31 | % | | | 32.39 | % | | | 15.73 | %2 | |

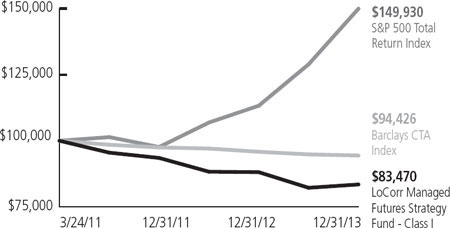

$100,000 investment in the

LoCorr Managed Futures Strategy Fund – Class I

For the period ended December 31, 2013 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund’s Class I shares since inception. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The Fund imposes a 1.00% redemption fee on shares held for less than 30 days. Performance data does not reflect the redemption fee. If it had, return would be reduced.

The S&P 500 Total Return Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries. The Barclays CTA Index is a leading industry benchmark of representative performance of commodity trading advisors.

One cannot invest directly in an index.

1 Since inception return as of March 31, 2011.

2 Since inception return as of March 24, 2011.

LoCorr Long/Short Commodities Strategy Fund

Rate of Return — For the period ended December 31, 2013 (Unaudited)

| | | | | | | | | | | Average Annual | |

| | | Inception Date | | 6 Month | | | 1 Year | | Since Inception | |

| LoCorr Long/Short Commodities Strategy Fund - Class A (without maximum load) | | | 1/1/12 | | -3.03 | % | | | -8.36 | % | | | -12.41 | % | |

| LoCorr Long/Short Commodities Strategy Fund - Class A (with maximum load) | | | 1/1/12 | | -8.58 | % | | | -13.63 | % | | | -14.96 | % | |

| LoCorr Long/Short Commodities Strategy Fund - Class C | | | 1/1/12 | | -3.33 | % | | | -9.05 | % | | | -13.15 | % | |

| LoCorr Long/Short Commodities Strategy Fund - Class I | | | 1/1/12 | | -2.90 | % | | | -8.11 | % | | | -12.23 | % | |

| Morningstar Long/Short Commodity Index | | | | | 2.35 | % | | | 5.40 | % | | | -3.43 | %1 | |

| S&P 500 Total Return Index | | | | | 16.31 | % | | | 32.39 | % | | | 23.89 | %1 | |

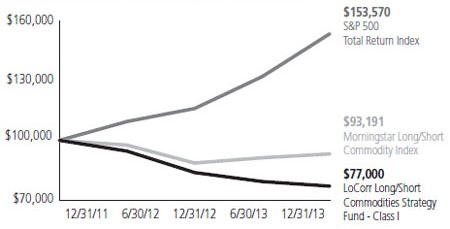

$100,000 investment in the

LoCorr Long/Short Commodities Strategy Fund – Class I

For the period ended December 31, 2013 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund’s Class I shares since inception. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The Fund imposes a 1.00% redemption fee on shares held for less than 30 days. Performance data does not reflect the redemption fee. If it had, return would be reduced.

The S&P 500 Total Return Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries. The Morningstar Long/Short Commodity Index is a fully collateralized commodity futures index that uses the momentum rule to determine if each commodity is held long, short, or flat.

One cannot invest directly in an index.

1 Since inception returns as of January 1, 2012.

LoCorr Long/Short Equity Fund

Rate of Return — For the period ended December 31, 2013 (Unaudited)

| | | Inception Date | | 6 Month | | Since Inception1 | |

| LoCorr Long/Short Equity Fund - Class A (without maximum load) | | | 5/10/13 | | 17.14 | % | | | 14.80 | % | |

| LoCorr Long/Short Equity Fund - Class A (with maximum load) | | | 5/10/13 | | 10.38 | % | | | 8.20 | % | |

| LoCorr Long/Short Equity Fund - Class C | | | 5/10/13 | | 16.77 | % | | | 14.20 | % | |

| LoCorr Long/Short Equity Fund - Class I | | | 5/10/13 | | 17.35 | % | | | 15.00 | % | |

| Russell 2000 Total Return Index | | | | | 19.82 | % | | | 20.41 | % | |

| S&P 500 Total Return Index | | | | | 16.31 | % | | | 14.70 | % | |

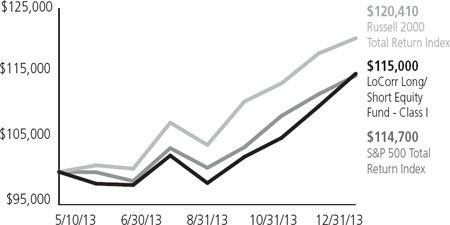

$100,000 investment in the

LoCorr Long/Short Equity Fund - Class I

For the period ended December 31, 2013 (Unaudited)

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund’s Class I shares since inception. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance. Performance will vary from class to class based on differences in class-specific expenses and sales charges. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The Fund imposes a 1.00% redemption fee on shares held for less than 30 days. Performance data does not reflect the redemption fee. If it had, return would be reduced.

The S&P 500 Total Return Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries. The Russell 2000 Total Return Index measures the performance of the small-cap segment of the U.S. equity universe.

One cannot invest directly in an index.

1 Cumulative total return since inception of May 10, 2013.

| |

LoCorr Managed Futures Strategy Fund - Consolidated Schedule of Investments | 9 |

| |

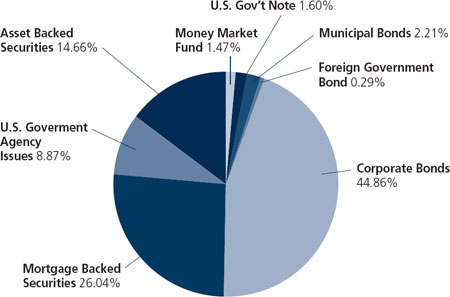

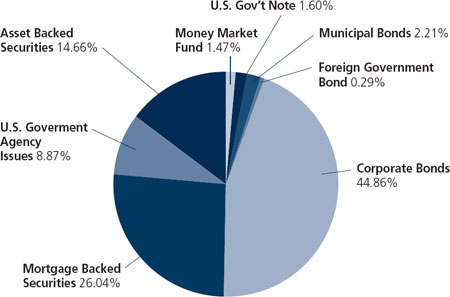

LoCorr Managed Futures Strategy Fund

Composition of Consolidated Investment Portfolio1

December 31, 2013 (Unaudited)

1 As a percentage of total investments.

Consolidated Schedule of Investments

December 31, 2013

| | | | | | | | | | | |

| | | Maturity Date | | Coupon Rate | | Principal Amount | | Value | |

| ASSET BACKED SECURITIES: 12.36% | | | | | | | | | | |

| 321 Henderson Receivables I LLC, 2004-A A1 (Acquired 02/08/2013, Cost, $529,626) (a)(c) | | 09/15/2045 | | 0.52 | % | | $ | 556,403 | | $ | 539,634 | |

| AEP Texas Central Transition Funding III LLC, 2012-1 A1 | | 12/01/2018 | | 0.88 | % | | | 1,409,453 | | | 1,411,587 | |

| Ally Auto Receivables Trust, 2012-3 A2 | | 01/15/2015 | | 0.70 | % | | | 34,820 | | | 34,823 | |

| American Express Credit Account Master Trust | | | | | | | | | | | | |

| Series 2009-2 A (c) | | 03/15/2017 | | 1.42 | % | | | 150,000 | | | 151,125 | |

| Series 2012-2 A | | 03/15/2018 | | 0.68 | % | | | 2,500,000 | | | 2,504,507 | |

| AmeriCredit Automobile Receivables Trust, 2012-1 A3 | | 09/08/2016 | | 1.23 | % | | | 2,765,000 | | | 2,771,371 | |

| Atlantic City Electric Transition Funding LLC | | | | | | | | | | | | |

| Series 2002-1 A3 | | 07/20/2017 | | 4.91 | % | | | 78,738 | | | 81,085 | |

| Series 2003-1 A3 | | 10/20/2020 | | 5.05 | % | | | 1,100,000 | | | 1,212,832 | |

| BA Credit Card Trust, 2007-A6 A6 (c) | | 09/15/2016 | | 0.23 | % | | | 1,000,000 | | | 999,913 | |

| Cabela’s Master Credit Card Trust | | | | | | | | | | | | |

| Series 2010-2A A2 (Acquired 12/27/2012 and 02/08/2013, Cost, $2,293,030) (a)(c) | | 09/15/2018 | | 0.87 | % | | | 2,275,000 | | | 2,290,682 | |

| Series 2012-1A A1 (Acquired 05/08/2012 and 07/23/2012, Cost, $1,515,762) (a) | | 02/18/2020 | | 1.63 | % | | | 1,500,000 | | | 1,513,192 | |

| California Republic Auto Receivables Trust 2013-2 A2 | | 03/15/2019 | | 1.23 | % | | | 1,000,000 | | | 999,249 | |

| Capital One Multi-Asset Execution Trust, 2007-A2 A2 (c) | | 12/15/2019 | | 0.25 | % | | | 2,000,000 | | | 1,984,548 | |

| Carfinance Capital Auto Trust 2013-1A A (Acquired 05/21/2013, Cost, $1,629,861) (a) | | 07/17/2017 | | 1.65 | % | | | 1,629,896 | | | 1,626,297 | |

CenterPoint Energy Restoration Bond Co. LLC, 2009-1 A2 (Acquired 08/25/2011, 05/10/2013 and 05/15/2013, Cost, $1,901,902) (a) | | 08/15/2019 | | 3.46 | % | | | 1,792,000 | | | 1,905,534 | |

| CenterPoint Energy Transition Bond Co. IV LLC, 2012-1 A1 | | 04/15/2018 | | 0.90 | % | | | 2,461,750 | | | 2,462,085 | |

| Citibank Omni Master Trust, 2009-A14A A14 (Acquired 08/22/2013, Cost, $1,522,280) (a)(c) | | 08/15/2018 | | 2.92 | % | | | 1,500,000 | | | 1,522,658 | |

| Discover Card Execution Note Trust | | | | | | | | | | | | |

| Series 2011-A3 A (c) | | 03/15/2017 | | 0.38 | % | | | 1,000,000 | | | 1,000,286 | |

| Series 2012-A1 A1 | | 08/15/2017 | | 0.81 | % | | | 700,000 | | | 702,450 | |

| Series 2013-A1 A1 (c) | | 08/17/2020 | | 0.47 | % | | | 1,000,000 | | | 1,003,255 | |

| Dryrock Issuance Trust, 2012-2 A | | 08/15/2018 | | 0.64 | % | | | 1,500,000 | | | 1,495,953 | |

| Entergy Texas Restoration Funding LLC, 2009-A A1 | | 02/01/2016 | | 2.12 | % | | | 1,345,688 | | | 1,356,066 | |

| Fifth Third Auto Trust, 2013-A B | | 04/15/2019 | | 1.21 | % | | | 1,500,000 | | | 1,485,969 | |

| Ford Credit Auto Owner Trust, 2013-B A3 | | 10/15/2017 | | 0.57 | % | | | 3,000,000 | | | 3,003,519 | |

| GE Capital Credit Card Master Note Trust, 2011-1 A (c) | | 01/15/2017 | | 0.72 | % | | | 250,000 | | | 250,044 | |

The accompanying notes are an integral part of these consolidated financial statements.

| |

10 | LoCorr Managed Futures Strategy Fund - Consolidated Schedule of Investments (continued) |

| |

| | | | | | | | | | | | | |

| | | Maturity Date | | Coupon Rate | | Principal Amount | | Value | |

ASSET BACKED SECURITIES (continued) | | | | | | | | | | | | |

Gracechurch Card Funding PLC, 2012-1A A1 (Acquired 03/02/2012 and 05/15/2013, Cost, $1,451,020) (a)(b)(c) | | 02/15/2017 | | 0.87 | % | | $ | 1,450,000 | | $ | 1,455,549 | |

| HLSS Servicer Advance Receivables Backed Notes | | | | | | | | | | | | |

| Series 2013-T1 A1 (Acquired 01/16/2013, Cost, $1,000,000) (a) | | 01/15/2044 | | 0.90 | % | | | 1,000,000 | | | 1,000,000 | |

| Series 2013-T2 A2 (Acquired 05/17/2013, Cost, $2,249,998) (a) | | 05/16/2044 | | 1.15 | % | | | 2,250,000 | | | 2,238,300 | |

| Series 2013-T1 D2 (Acquired 01/16/2013, Cost, $750,000) (a) | | 01/16/2046 | | 3.23 | % | | | 750,000 | | | 749,400 | |

| Invitation Homes 2013-SFR1 Trust A (c) | | 12/17/2030 | | 1.31 | % | | | 1,250,000 | | | 1,251,633 | |

| Newcastle Investment Trust, 2011-MH1 A (Acquired 10/24/2012, Cost, $323,013) (a) | | 12/10/2033 | | 2.45 | % | | | 319,941 | | | 323,034 | |

| Nissan Auto Lease Trust, 2012-A A3 | | 05/15/2015 | | 0.98 | % | | | 1,099,140 | | | 1,100,586 | |

| Penarth Master Issuer PLC, 2012-1A A1 (Acquired 02/08/2013, Cost, $1,664,405) (a)(b)(c) | | 03/18/2016 | | 0.74 | % | | | 1,660,000 | | | 1,661,298 | |

Porsche Financial Auto Securitization Trust, 2011-1 A4 (Acquired 12/13/2011, Cost, $653,935) (a) | | 12/17/2018 | | 1.19 | % | | | 652,924 | | | 654,356 | |

| SMART Trust/Australia, 2012-2USA A3B (Acquired 02/08/2013, Cost, $1,006,169) (a)(b)(c) | | 10/14/2016 | | 1.12 | % | | | 1,000,000 | | | 1,004,201 | |

| United States Small Business Administration, 2008-10B 1 | | 09/10/2018 | | 5.73 | % | | | 109,384 | | | 117,527 | |

| TOTAL ASSET BACKED SECURITIES (Cost $45,888,577) | | | | | | | | | | | 45,864,548 | |

| | | | | | | | | | | | | |

| CORPORATE BONDS: 37.82% | | | | | | | | | | | | |

| Administrative and Support and Waste Management and Remediation Services: 0.23% | | | | | | | | | | | | |

| Waste Management, Inc. | | 09/01/2016 | | 2.60 | % | | | 840,000 | | | 867,024 | |

| | | | | | | | | | | | | |

| Construction: 0.41% | | | | | | | | | | | | |

| Transocean, Inc. (b) | | 10/15/2017 | | 2.50 | % | | | 1,500,000 | | | 1,515,891 | |

| | | | | | | | | | | | | |

| Finance and Insurance: 15.12% | | | | | | | | | | | | |

| Aflac Inc. | | 02/15/2017 | | 2.65 | % | | | 1,750,000 | | | 1,805,841 | |

| Allied World Assurance Co., Ltd. (b) | | 08/01/2016 | | 7.50 | % | | | 1,500,000 | | | 1,721,997 | |

| American Express Credit Corp. | | 09/19/2016 | | 2.80 | % | | | 1,000,000 | | | 1,044,880 | |

| American International Group, Inc. | | 09/15/2016 | | 4.88 | % | | | 1,500,000 | | | 1,647,490 | |

| Australia & New Zealand Banking Group Ltd. (Acquired 11/15/2011, Cost, $995,930) (a)(b) | | 11/23/2016 | | 2.40 | % | | | 1,000,000 | | | 1,035,400 | |

| Bank Of America, N.A. | | 11/14/2016 | | 1.13 | % | | | 4,475,000 | | | 4,480,083 | |

| Barclays Bank PLC (b) | | 09/22/2016 | | 5.00 | % | | | 1,000,000 | | | 1,100,944 | |

| B.A.T. International Finance P.L.C. (Acquired 06/06/2012, Cost, $995,160) (a)(b) | | 06/07/2017 | | 2.13 | % | | | 1,000,000 | | | 1,011,213 | |

| Berkshire Hathaway Inc. | | 08/15/2016 | | 2.20 | % | | | 860,000 | | | 888,291 | |

| BP Capital Markets P.L.C. (b) | | 11/01/2016 | | 2.25 | % | | | 1,000,000 | | | 1,034,861 | |

| Citigroup, Inc. | | 12/15/2015 | | 4.59 | % | | | 3,465,000 | | | 3,702,748 | |

| Citigroup, Inc. | | 11/21/2017 | | 6.13 | % | | | 1,000,000 | | | 1,152,709 | |

| Credit Agricole SA (Acquired 10/01/2012, Cost, $1,503,784) (a)(b) | | 10/01/2017 | | 3.00 | % | | | 1,500,000 | | | 1,551,841 | |

Daimler Finance North America LLC (Acquired 01/04/2012 and 04/10/2012, Cost, $1,003,003) (a) | | 01/09/2015 | | 2.30 | % | | | 1,000,000 | | | 1,013,893 | |

| Deutsche Bank AG (b) | | 09/01/2017 | | 6.00 | % | | | 1,000,000 | | | 1,142,172 | |

| Fifth Third Bancorp | | 06/01/2018 | | 4.50 | % | | | 1,000,000 | | | 1,066,373 | |

| General Electric Capital Corp. | | 04/27/2017 | | 2.30 | % | | | 1,820,000 | | | 1,870,729 | |

| General Electric Capital Corp. | | 05/01/2018 | | 5.63 | % | | | 1,500,000 | | | 1,722,552 | |

| Goldman Sachs Group, Inc./The | | 09/01/2017 | | 6.25 | % | | | 4,135,000 | | | 4,733,996 | |

| Hartford Financial Services Group, Inc./The | | 03/30/2015 | | 4.00 | % | | | 1,000,000 | | | 1,038,893 | |

| Health Care REIT, Inc. | | 04/01/2019 | | 4.13 | % | | | 1,500,000 | | | 1,579,440 | |

| ING Bank N.V. (Acquired 02/29/2012 and 10/23/2012, Cost, $1,529,064) (a)(b) | | 03/07/2017 | | 3.75 | % | | | 1,500,000 | | | 1,579,830 | |

| JPMorgan Chase & Co. | | 10/01/2015 | | 5.15 | % | | | 3,105,000 | | | 3,318,621 | |

| Morgan Stanley | | 02/25/2016 | | 1.75 | % | | | 1,565,000 | | | 1,586,010 | |

| Morgan Stanley (c) | | 10/18/2016 | | 0.70 | % | | | 1,000,000 | | | 991,764 | |

| Nomura Holdings, Inc. (b) | | 09/13/2016 | | 2.00 | % | | | 1,250,000 | | | 1,260,334 | |

| Nordea Bank AB (Acquired 02/12/2013, Cost, $1,045,518) (a)(b) | | 03/20/2017 | | 3.13 | % | | | 1,000,000 | | | 1,045,681 | |

| Private Export Funding Corp. | | 05/15/2015 | | 4.55 | % | | | 750,000 | | | 793,519 | |

| Private Export Funding Corp. | | 02/15/2017 | | 1.38 | % | | | 780,000 | | | 787,309 | |

| Rabobank Nederland (b) | | 01/19/2017 | | 3.38 | % | | | 1,000,000 | | | 1,052,890 | |

| Royal Bank of Scotland Group Public Limited Co./The (b) | | 09/18/2015 | | 2.55 | % | | | 1,000,000 | | | 1,022,757 | |

| Simon Property Group L.P. | | 03/01/2017 | | 5.88 | % | | | 1,000,000 | | | 1,121,547 | |

| UBS AG (b) | | 12/20/2017 | | 5.88 | % | | | 872,000 | | | 1,000,643 | |

| Ventas Realty LP / Ventas Capital Corp. | | 11/30/2015 | | 3.13 | % | | | 1,000,000 | | | 1,039,989 | |

| Vornado Realty L.P. | | 04/01/2015 | | 4.25 | % | | | 815,000 | | | 840,455 | |

| Wellpoint, Inc. | | 01/15/2018 | | 1.88 | % | | | 1,250,000 | | | 1,236,014 | |

| Wells Fargo & Co. | | 06/15/2016 | | 3.68 | % | | | 1,000,000 | | | 1,064,744 | |

| | | | | | | | | | | | 56,088,453 | |

The accompanying notes are an integral part of these consolidated financial statements.

| |

LoCorr Managed Futures Strategy Fund - Consolidated Schedule of Investments (continued) | 11 |

| |

| | | | | | | | | | | | | |

| | | Maturity Date | | Coupon Rate | | Principal Amount | | Value | |

CORPORATE BONDS (continued) | | | | | | | | | | | | |

| Health Care and Social Assistance: 0.93% | | | | | | | | | | | | |

| Catholic Health Initiatives | | 11/01/2017 | | 1.60 | % | | $ | 1,900,000 | | $ | 1,841,571 | |

| Quest Diagnostics Inc. | | 11/01/2015 | | 5.45 | % | | | 1,500,000 | | | 1,616,765 | |

| | | | | | | | | | | | 3,458,336 | |

| Information: 2.48% | | | | | | | | | | | | |

| AT&T Inc. | | 02/12/2016 | | 0.90 | % | | | 945,000 | | | 940,198 | |

| DIRECTV Holdings LLC / DIRECTV Financing Co., Inc. | | 03/15/2015 | | 3.55 | % | | | 500,000 | | | 516,483 | |

| DIRECTV Holdings LLC / DIRECTV Financing Co., Inc. | | 02/15/2016 | | 3.13 | % | | | 1,000,000 | | | 1,040,223 | |

| NBCUniversal Media, LLC | | 04/30/2015 | | 3.65 | % | | | 750,000 | | | 779,999 | |

| Qwest Corp. | | 10/01/2014 | | 7.50 | % | | | 300,000 | | | 314,891 | |

| Time Warner Cable Inc. | | 07/01/2018 | | 6.75 | % | | | 2,000,000 | | | 2,242,876 | |

| Tyco International Finance S.A. (b) | | 10/15/2015 | | 3.38 | % | | | 1,000,000 | | | 1,037,554 | |

| Verizon Communications, Inc. | | 11/02/2015 | | 0.70 | % | | | 1,250,000 | | | 1,246,513 | |

| Vodafone Group Public Limited Co. (b) | | 09/15/2015 | | 5.00 | % | | | 1,000,000 | | | 1,069,287 | |

| | | | | | | | | | | | 9,188,024 | |

| Management of Companies and Enterprises: 1.51% | | | | | | | | | | | | |

| BHP Billiton Finance (USA) Ltd. (b) | | 02/24/2017 | | 1.63 | % | | | 1,015,000 | | | 1,017,751 | |

| BNP Paribas (b) | | 08/20/2018 | | 2.70 | % | | | 1,750,000 | | | 1,782,814 | |

| Capital One Financial Corp. | | 09/01/2016 | | 6.15 | % | | | 1,000,000 | | | 1,118,482 | |

| Macy’s Retail Holdings, Inc. | | 12/01/2016 | | 5.90 | % | | | 1,500,000 | | | 1,682,517 | |

| | | | | | | | | | | | 5,601,564 | |

| Manufacturing: 9.50% | | | | | | | | | | | | |

| ACTAVIS, Inc. | | 10/01/2017 | | 1.88 | % | | | 1,500,000 | | | 1,484,356 | |

| Anheuser-Busch Companies LLC | | 10/15/2016 | | 5.05 | % | | | 1,500,000 | | | 1,668,758 | |

| Boeing Capital Corp. | | 08/15/2018 | | 2.90 | % | | | 1,250,000 | | | 1,300,389 | |

| Cisco Systems, Inc. | | 03/14/2017 | | 3.15 | % | | | 1,285,000 | | | 1,359,773 | |

| ConAgra Foods, Inc. | | 01/25/2018 | | 1.90 | % | | | 1,500,000 | | | 1,472,498 | |

| Covidien International Finance S.A. (b) | | 05/29/2015 | | 1.35 | % | | | 1,000,000 | | | 1,007,336 | |

| Dow Chemical Co./The | | 02/15/2016 | | 2.50 | % | | | 1,290,000 | | | 1,329,473 | |

| Dr Pepper Snapple Group, Inc. | | 01/15/2016 | | 2.90 | % | | | 1,000,000 | | | 1,037,849 | |

| Eastman Chemical Co. | | 06/01/2017 | | 2.40 | % | | | 2,000,000 | | | 2,021,432 | |

| ECOLAB Inc. | | 12/08/2017 | | 1.45 | % | | | 1,500,000 | | | 1,465,831 | |

| EMC Corp. | | 06/01/2018 | | 1.88 | % | | | 1,750,000 | | | 1,730,120 | |

| Ford Motor Credit Company LLC | | 01/17/2017 | | 1.50 | % | | | 1,500,000 | | | 1,499,328 | |

| Heineken N.V. (Acquired 10/02/2012, Cost, $996,700) (a)(b) | | 10/01/2017 | | 1.40 | % | | | 1,000,000 | | | 981,073 | |

| Hershey Co./The | | 11/01/2016 | | 1.50 | % | | | 1,000,000 | | | 1,008,744 | |

| Hewlett-Packard Co. | | 12/01/2020 | | 3.75 | % | | | 1,500,000 | | | 1,496,727 | |

| Intel Corp. | | 10/01/2016 | | 1.95 | % | | | 750,000 | | | 770,998 | |

| Kellogg Co. | | 05/21/2018 | | 3.25 | % | | | 1,500,000 | | | 1,559,953 | |

| Lorillard Tobacco Co. | | 08/21/2017 | | 2.30 | % | | | 1,500,000 | | | 1,503,307 | |

| Motorola Solutions, Inc. | | 11/15/2017 | | 6.00 | % | | | 1,250,000 | | | 1,421,819 | |

| Phillips 66 | | 05/01/2017 | | 2.95 | % | | | 1,500,000 | | | 1,560,585 | |

| Procter & Gamble Co./The | | 08/15/2016 | | 1.45 | % | | | 800,000 | | | 811,674 | |

| Reynolds American Inc. | | 10/30/2015 | | 1.05 | % | | | 1,800,000 | | | 1,805,724 | |

| Samsung Electronics America, Inc. (Acquired 04/18/2013, Cost, $2,030,211) (a) | | 04/10/2017 | | 1.75 | % | | | 2,000,000 | | | 1,987,192 | |

| Thermo Fisher Scientific Inc. | | 08/15/2016 | | 2.25 | % | | | 1,150,000 | | | 1,176,081 | |

| Toyota Motor Credit Corp. | | 05/22/2017 | | 1.75 | % | | | 790,000 | | | 793,726 | |

| Zoetis, Inc. | | 02/01/2018 | | 1.88 | % | | | 1,000,000 | | | 991,782 | |

| | | | | | | | | | | | 35,246,528 | |

| Mining, Quarrying, and Oil and Gas Extraction: 3.29% | | | | | | | | | | | | |

| Anadarko Petroleum Corp. | | 09/15/2017 | | 6.38 | % | | | 1,000,000 | | | 1,148,069 | |

| Ensco PLC (b) | | 03/15/2016 | | 3.25 | % | | | 1,575,000 | | | 1,644,371 | |

| Freeport-McMoRan Copper & Gold Inc. | | 03/01/2017 | | 2.15 | % | | | 1,500,000 | | | 1,509,774 | |

| Noble Holding International, Ltd. (b) | | 08/01/2015 | | 3.45 | % | | | 1,150,000 | | | 1,192,446 | |

| Occidental Petroleum Corp. | | 02/15/2018 | | 1.50 | % | | | 425,000 | | | 415,384 | |

| Petrobras International Finance Co. (b) | | 02/06/2015 | | 2.88 | % | | | 830,000 | | | 842,452 | |

| Rio Tinto Finance (USA) PLC (b) | | 08/21/2017 | | 1.63 | % | | | 1,505,000 | | | 1,504,402 | |

| Teck Resources Ltd. (b) | | 08/15/2017 | | 3.85 | % | | | 2,000,000 | | | 2,115,078 | |

| Xstrata Finance (Canada) Ltd. (Acquired 02/14/2012 and 03/12/2013, Cost, $1,818,784) (a)(b) | | 01/15/2017 | | 3.60 | % | | | 1,750,000 | | | 1,825,371 | |

| | | | | | | | | | | | 12,197,347 | |

The accompanying notes are an integral part of these consolidated financial statements.

| |

12 | LoCorr Managed Futures Strategy Fund - Consolidated Schedule of Investments (continued) |

| |

| | | | | | | | | | | | | |

| | | Maturity Date | | Coupon Rate | | Principal Amount | | Value | |

CORPORATE BONDS (continued) | | | | | | | | | | | | |

| Professional, Scientific, and Technical Services: 0.76% | | | | | | | | | | | | |

| Asciano Finance Ltd. (Acquired 05/24/2012 and 06/27/2013, Cost, $2,017,538) (a)(b) | | 09/23/2015 | | 3.13 | % | | $ | 2,000,000 | | $ | 2,045,260 | |

| Computer Sciences Corp. | | 09/15/2015 | | 2.50 | % | | | 750,000 | | | 765,538 | |

| | | | | | | | | | | | 2,810,798 | |

| Real Estate and Rental and Leasing: 0.25% | | | | | | | | | | | | |

| Penske Truck Leasing Co. LP / PTL Finance Corp. (Acquired 05/14/2012, Cost, $904,074) (a) | | 05/11/2015 | | 3.13 | % | | | 900,000 | | | 925,632 | |

| | | | | | | | | | | | | |

| Retail Trade: 1.03% | | | | | | | | | | | | |

| Sherwin-Williams Co./The | | 12/15/2017 | | 1.35 | % | | | 1,640,000 | | | 1,596,886 | |

| Tesco PLC (Acquired 07/17/2013, Cost, $2,234,879) (a)(b) | | 11/15/2017 | | 5.50 | % | | | 2,000,000 | | | 2,216,952 | |

| | | | | | | | | | | | 3,813,838 | |

| Transportation and Warehousing: 1.03% | | | | | | | | | | | | |

| GATX Corp. | | 07/30/2018 | | 2.38 | % | | | 2,000,000 | | | 2,003,308 | |

| Spectra Energy Partners, LP | | 09/25/2018 | | 2.95 | % | | | 915,000 | | | 927,467 | |

| Vale Overseas Ltd. (b) | | 01/11/2016 | | 6.25 | % | | | 825,000 | | | 898,219 | |

| | | | | | | | | | | | 3,828,994 | |

| Utilities: 0.85% | | | | | | | | | | | | |

| Exelon Generation Co., LLC | | 10/01/2019 | | 5.20 | % | | | 2,000,000 | | | 2,155,346 | |

| Sempra Energy | | 04/01/2017 | | 2.30 | % | | | 1,000,000 | | | 1,012,953 | |

| | | | | | | | | | | | 3,168,299 | |

| Wholesale Trade: 0.43% | | | | | | | | | | | | |

| Express Scripts Holding Co | | 11/15/2016 | | 3.50 | % | | | 1,500,000 | | | 1,585,824 | |

| | | | | | | | | | | | | |

| TOTAL CORPORATE BONDS (Cost $139,857,949) | | | | | | | | | | | 140,296,552 | |

| | | | | | | | | | | | | |

| MORTGAGE BACKED SECURITIES: 21.95% | | | | | | | | | | | | |

| American Tower Trust I, 2013-1-2 (Acquired 03/06/2013, Cost, $1,830,000) (a) | | 03/15/2043 | | 1.55 | % | | | 1,830,000 | | | 1,786,043 | |

| Bear Stearns Commercial Mortgage Securities Trust | | | | | | | | | | | | |

| Series 2006-PWR12 A4 (c) | | 09/11/2038 | | 5.71 | % | | | 2,235,000 | | | 2,443,081 | |

| Series 2005-PWR10 A4 (c) | | 12/11/2040 | | 5.41 | % | | | 2,250,000 | | | 2,387,131 | |

| CD 2005-CD1 Commercial Mortgage Trust, 2005-CD1 A4 (c) | | 07/15/2044 | | 5.22 | % | | | 255,000 | | | 270,368 | |

| COMM 2012-CCRE2 Mortgage Trust, 2012-CR2 A1 | | 08/15/2045 | | 0.82 | % | | | 2,192,471 | | | 2,184,310 | |

| COMM 2012-CCRE4 Mortgage Trust, 2012-CR4 A2 | | 10/15/2045 | | 1.80 | % | | | 2,000,000 | | | 1,978,822 | |

| COMM 2012-LC4 Mortgage Trust, 2012-LC4 A1 | | 12/10/2044 | | 1.16 | % | | | 635,560 | | | 637,393 | |

| Commercial Mortgage Trust, 2007-GG11 A4 | | 12/10/2049 | | 5.74 | % | | | 1,250,000 | | | 1,395,954 | |

| CSMC Trust | | | | | | �� | | | | | | |

| Series 2013-6 1A1 (Acquired 07/24/2013, Cost, $2,833,428) (a)(c) | | 07/25/2028 | | 2.50 | % | | | 2,903,289 | | | 2,822,052 | |

| Series 2013-IVR4 A3 (Acquired 06/12/2013, Cost, $2,988,475) (a)(c) | | 07/25/2043 | | 3.00 | % | | | 2,941,281 | | | 2,973,452 | |

| DBUBS 2011-LC3 Mortgage Trust, A2 | | 08/10/2044 | | 3.64 | % | | | 1,990,000 | | | 2,090,553 | |

| Extended Stay America Trust | | | | | | | | | | | | |

| Series 2013-ESFL A2FL (Acquired 01/24/2013, Cost, $1,565,000) (a)(c) | | 12/05/2031 | | 0.87 | % | | | 1,565,000 | | | 1,567,319 | |

| Series 2013-ESFL A1FL (Acquired 01/24/2013, Cost, $785,000) (a)(c) | | 12/05/2031 | | 0.97 | % | | | 785,000 | | | 786,900 | |

| Fannie Mae-Aces | | | | | | | | | | | | |

| Series 2009-M1 A1 | | 07/25/2019 | | 3.40 | % | | | 482,817 | | | 505,433 | |

| Series 2012-M8 ASQ1 | | 12/25/2019 | | 1.17 | % | | | 1,296,729 | | | 1,300,572 | |

| Fannie Mae Connecticut Avenue Securities 2013-CO1 M1 (c) | | 10/25/2023 | | 2.17 | % | | | 2,194,141 | | | 2,204,157 | |

| Fannie Mae Pool | | 01/01/2016 | | 2.67 | % | | | 380,012 | | | 379,934 | |

| Fannie Mae Pool | | 02/01/2021 | | 3.50 | % | | | 121,459 | | | 127,665 | |

| Fannie Mae Pool | | 06/01/2021 | | 3.50 | % | | | 161,542 | | | 169,770 | |

| Fannie Mae Pool | | 08/01/2021 | | 3.00 | % | | | 425,557 | | | 441,320 | |

| Fannie Mae Pool | | 09/01/2021 | | 3.00 | % | | | 504,924 | | | 523,674 | |

| Fannie Mae Pool | | 11/01/2021 | | 3.00 | % | | | 961,957 | | | 997,647 | |

| Fannie Mae Pool | | 12/01/2025 | | 3.50 | % | | | 625,359 | | | 654,379 | |

| Fannie Mae Pool | | 09/01/2026 | | 3.50 | % | | | 619,329 | | | 648,009 | |

| Fannie Mae Pool (c) | | 10/01/2033 | | 2.55 | % | | | 1,405,985 | | | 1,496,929 | |

| FDIC Commercial Mortgage Trust | | | | | | | | | | | | |

| Series 2011-C1 A (Acquired 06/06/2012, Cost, $225,927) (a)(c) | | 04/25/2031 | | 1.84 | % | | | 224,554 | | | 225,697 | |

| Series 2012-C1 A (Acquired 05/10/2012, Cost, $640,282) (a)(c) | | 05/25/2035 | | 0.84 | % | | | 640,282 | | | 641,171 | |

| FDIC Guaranteed Notes Trust | | | | | | | | | | | | |

| Series 2010-S4 A (Acquired 02/24/2012, Cost, $739,690) (a)(c) | | 12/04/2020 | | 0.72 | % | | | 736,618 | | | 741,175 | |

| Series 2010-S1 2A (Acquired 03/01/2012, Cost, $870,453) (a) | | 04/25/2038 | | 3.25 | % | | | 855,490 | | | 883,824 | |

| Series 2010-S1 1A (Acquired 11/18/2011, Cost, $526,846) (a)(c) | | 02/25/2048 | | 0.72 | % | | | 527,670 | | | 528,903 | |

The accompanying notes are an integral part of these consolidated financial statements.

| |

LoCorr Managed Futures Strategy Fund - Consolidated Schedule of Investments (continued) | 13 |

| |

| | | | | | | | | | | | | |

| | | Maturity Date | | Coupon Rate | | Principal Amount | | Value | |

MORTGAGE BACKED SECURITIES (continued) | | | | | | | | | | | | |

| FHLMC Multifamily Structured Pass Through Certificates | | | | | | | | | | | | |

| Series K501 A1 | | 06/25/2016 | | 1.34 | % | | $ | 485,381 | | $ | 489,419 | |

| Series K703 A1 | | 01/25/2018 | | 1.87 | % | | | 605,857 | | | 616,986 | |

| Series K709 A1 | | 10/25/2018 | | 1.56 | % | | | 1,569,408 | | | 1,581,427 | |

| Fosse Master Issuer PLC, 2011-1A A2 (Acquired 09/30/2011 and 06/27/2012, Cost, $1,072,026) (a)(b)(c) | | 10/19/2054 | | 1.67 | % | | | 1,071,796 | | | 1,077,066 | |

| Freddie Mac REMICS, 3855 HE | | 02/15/2026 | | 2.50 | % | | | 57,292 | | | 58,711 | |

| FREMF Mortgage Trust 2013-KF02 (Acquired 11/01/2013, Cost, $1,498,865) (a)(c) | | 12/25/2045 | | 3.16 | % | | | 1,498,865 | | | 1,514,105 | |

| GS Mortgage Securities Corp. II, 2005-GG4 A4A | | 07/10/2039 | | 4.75 | % | | | 246,769 | | | 255,638 | |

| GS Mortgage Securities Trust | | | | | | | | | | | | |

| Series 2010-C2 A1 (Acquired 04/11/2012, Cost, $1,468,366) (a) | | 12/10/2043 | | 3.85 | % | | | 1,383,564 | | | 1,459,077 | |

| Series 2011-GC5 A2 | | 08/10/2044 | | 3.00 | % | | | 1,715,000 | | | 1,783,739 | |

| Series 2007-GG10 A4 (c) | | 08/10/2045 | | 5.80 | % | | | 2,275,000 | | | 2,498,105 | |

| Holmes Master Issuer PLC, 2012-1A A2 (Acquired 01/18/2012, Cost, $886,994) (a)(b)(c) | | 10/15/2054 | | 1.89 | % | | | 886,994 | | | 897,929 | |

| JPMorgan Chase Commercial Mortgage Securities Trust | | | | | | | | | | | | |

| Series 2013 - FL3 A2 (Acquired 04/24/2013, Cost, $2,805,000) (a)(c) | | 04/15/2028 | | 0.87 | % | | | 2,805,000 | | | 2,792,742 | |

| Series 2013-JWRZ A (Acquired 05/22/2013, Cost, $2,960,000) (a)(c) | | 04/15/2030 | | 0.95 | % | | | 2,960,000 | | | 2,946,440 | |

| Series 2010-C1 A1 (Acquired 12/30/2011, Cost, $1,474,124) (a) | | 06/15/2043 | | 3.85 | % | | | 1,413,801 | | | 1,459,986 | |

| Series 2005 - LPD5 A4 (c) | | 12/15/2044 | | 5.20 | % | | | 250,000 | | | 266,359 | |

| Series 2011-C3 A1 (Acquired 09/20/2011, Cost, $333,385) (a) | | 02/15/2046 | | 1.87 | % | | | 331,729 | | | 333,105 | |

| Series 2007-CIBC18 A3 | | 06/12/2047 | | 5.45 | % | | | 200,473 | | | 202,772 | |

| Series 2007-CIBC20 A4 (c) | | 02/12/2051 | | 5.79 | % | | | 1,400,000 | | | 1,569,407 | |

| Morgan Stanley Capital I Trust | | | | | | | | | | | | |

| Series 2008-TOP29 A4 (c) | | 01/11/2043 | | 6.28 | % | | | 1,250,000 | | | 1,442,504 | |

| Series 2011-C1 A2 (Acquired 09/20/2011 and 06/28/2012, Cost, $2,268,396) (a) | | 09/17/2047 | | 3.88 | % | | | 2,150,000 | | | 2,259,007 | |

| Motel 6 Trust, 2012-MTL6 A2 (Acquired 11/02/2012, Cost, $1,999,992) (a) | | 10/05/2025 | | 1.95 | % | | | 2,000,000 | | | 1,979,888 | |

| NCUA Guaranteed Notes Trust | | | | | | | | | | | | |

| Series 2010-R2 1A (c) | | 11/06/2017 | | 0.54 | % | | | 2,435,381 | | | 2,438,425 | |

| Series 2011-R1 1A (c) | | 01/08/2020 | | 0.62 | % | | | 107,088 | | | 107,399 | |

| Series 2011-R2 1A (c) | | 02/06/2020 | | 0.57 | % | | | 2,864,922 | | | 2,882,111 | |

| Series 2011-R3 1A (c) | | 03/11/2020 | | 0.57 | % | | | 3,444,075 | | | 3,444,075 | |

| Series 2010-R1 1A (c) | | 10/07/2020 | | 0.62 | % | | | 345,420 | | | 347,279 | |

| Sequoia Mortgage Trust, 2013-1 1A1 (c) | | 02/25/2043 | | 1.45 | % | | | 1,453,194 | | | 1,427,785 | |

| Springleaf Mortgage Loan Trust | | | | | | | | | | | | |

| Series 2013-1A A (Acquired 04/03/2013, Cost, $2,199,735) (a)(c) | | 06/25/2058 | | 1.27 | % | | | 2,199,910 | | | 2,194,388 | |

| Series 2012-3A A (Acquired 10/18/2012, Cost, $717,835) (a)(c) | | 12/25/2059 | | 1.57 | % | | | 717,930 | | | 715,103 | |

| Series 2013-3A A (Acquired 10/04/2013, Cost, $1,931,253) (a)(c) | | 09/25/2057 | | 1.87 | % | | | 1,931,508 | | | 1,931,321 | |

| Structured Agency Credit Risk Debt Notes 2013-dn2 M1 (c) | | 11/25/2023 | | 1.62 | % | | | 1,949,107 | | | 1,944,622 | |

| WIMC Capital Trust, 2012-A A1 (Acquired 06/21/2012, Cost, $730,140) (a) | | 10/16/2050 | | 4.55 | % | | | 730,148 | | | 740,218 | |

| TOTAL MORTGAGE BACKED SECURITIES (Cost $81,774,483) | | | | | | | | | | | 81,450,775 | |

| | | | | | | | | | | | | |

| MUNICIPAL BONDS: 1.86% | | | | | | | | | | | | |

| County of Hamilton OH Sewer System Revenue | | 12/01/2016 | | 1.23 | % | | | 825,000 | | | 819,910 | |

| Louisiana Local Government Environmental Facilities & Community Development Authority | | 02/01/2018 | | 1.52 | % | | | 1,017,051 | | | 1,023,316 | |

| Metropolitan Council, (Minneapolis - St. Paul Metropolitan Area), State of Minnesota | | 09/01/2017 | | 1.20 | % | | | 2,020,000 | | | 1,998,487 | |

| Metropolitan Government of Nashville & Davidson County TN | | 07/01/2017 | | 1.21 | % | | | 1,500,000 | | | 1,478,025 | |

| State of Ohio | | 08/01/2017 | | 3.33 | % | | | 1,500,000 | | | 1,582,260 | |

| TOTAL MUNICIPAL BONDS (Cost $6,986,735) | | | | | | | | | | | 6,901,998 | |

| | | | | | | | | | | | | |

| FOREIGN GOVERNMENT BOND: 0.25% | | | | | | | | | | | | |

| Hydro-Quebec (b) | | 06/30/2016 | | 2.00 | % | | | 900,000 | | | 924,120 | |

| TOTAL FOREIGN GOVERNMENT BOND (Cost $911,466) | | | | | | | | | | | 924,120 | |

| | | | | | | | | | | | | |

| U.S. GOVERNMENT AGENCY ISSUES: 5.05% | | | | | | | | | | | | |

| Federal Home Loan Mortgage Corp. | | 08/20/2014 | | 1.00 | % | | | 6,000,000 | | | 6,031,272 | |

| Federal Home Loan Mortgage Corp. | | 08/27/2014 | | 1.00 | % | | | 3,000,000 | | | 3,017,445 | |

| Federal Home Loan Mortgage Corp. | | 09/10/2015 | | 1.75 | % | | | 1,000,000 | | | 1,023,317 | |

| Federal Home Loan Mortgage Corp. | | 08/25/2016 | | 2.00 | % | | | 1,500,000 | | | 1,551,168 | |

| Federal National Mortgage Association | | 05/15/2014 | | 2.50 | % | | | 1,500,000 | | | 1,513,125 | |

| Federal National Mortgage Association | | 10/30/2014 | | 0.63 | % | | | 1,060,000 | | | 1,063,904 | |

| Federal National Mortgage Association | | 12/19/2014 | | 0.75 | % | | | 3,500,000 | | | 3,518,865 | |

| Federal National Mortgage Association | | 07/28/2015 | | 2.38 | % | | | 1,000,000 | | | 1,031,606 | |

| TOTAL U.S. GOVERNMENT AGENCY ISSUES (Cost $18,684,217) | | | | | | | | | | | 18,750,702 | |

The accompanying notes are an integral part of these consolidated financial statements.

| |

14 | LoCorr Managed Futures Strategy Fund - Consolidated Schedule of Investments (continued) |

| |

| | | | | | | | | | | | |

| | | Maturity Date | | Coupon Rate | | Principal Amount | | Value | |

| U.S. GOVERNMENT NOTE: 1.35% | | | | | | | | | | |

| United States Treasury Note | | 10/15/2015 | | 0.25 | % | | $ | 5,000,000 | | $ | 4,993,555 | |

| TOTAL U.S. GOVERNMENT NOTE (Cost $4,996,406) | | | | | | | | | | | 4,993,555 | |

| | | | | | | | | | | | | |

| SHORT TERM INVESTMENTS: 3.66% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| U.S. GOVERNMENT AGENCY ISSUES: 2.43% | | | | | | | | | | | | |

| Federal Home Loan Banks | | 03/04/2014 | | 0.13 | % | | | 5,000,000 | | | 4,999,955 | |

| Federal Home Loan Mortgage Corp. | | 03/21/2014 | | 0.30 | % | | | 4,000,000 | | | 4,001,844 | |

| TOTAL U.S. GOVERNMENT AGENCY ISSUES | | | | | | | | | | | 9,001,799 | |

| | | | | | | | | | | | | |

| MONEY MARKET FUND: 1.23% | | | | | | | Shares | | | | |

| Fidelity Institutional Money Market Portfolio - Class I , 0.03% (d) | | | | | | | | 4,584,729 | | | 4,584,729 | |

| TOTAL MONEY MARKET FUND | | | | | | | | | | | 4,584,729 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS (Cost $13,574,632) | | | | | | | | | | | 13,586,528 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (Cost $312,674,465): 84.30% | | | | | | | | | | | 312,768,778 | |

| Other Assets in Excess of Liabilities: 15.70% (e) | | | | | | | | | | | 58,247,034 | |

| TOTAL NET ASSETS: 100.00% | | | | | | | | | | $ | 371,015,812 | |

(a) Restricted security as defined in Rule 144(a) under the Securities Act of 1933 and determined to be liquid. Purchased in a private placement transaction; resale to the public may require registration or may extend only to qualified institutional buyers. At December 31, 2013, the fair value of these securities total $70,960,384 which represents 19.13% of total net assets.

(b) Foreign issued security.

(c) Variable rate security. The rate reported is the rate in effect as of December 31, 2013.

(d) The rate quoted is the annualized seven-day effective yield as of December 31, 2013.

(e) Includes assets pledged as collateral for swap contracts.

The accompanying notes are an integral part of these consolidated financial statements.

| |

LoCorr Managed Futures Strategy Fund - Consolidated Schedule of Swap Contracts | 15 |

| |

Consolidated Schedule of Swap Contracts

December 31, 2013

LONG TOTAL RETURN SWAP CONTRACTS

This investment is a holding of LCMFS Fund Limited. See Note 1.

| | | | | | | | | |

| | | | | | | Unrealized | | |

| | | | | | | Appreciation | | |

| Termination Date | | Reference Index | | Notional | | | | Counterparty |

| | LoCorr Managed Futures Index^ | | | | | | Deutsche Bank AG |

^Comprised of a proprietary basket of Commodity Trading Advisors’ (“CTA”) Programs investing in various futures, forwards, and currency derivative contracts and other similar investments. See Notes 2 and 3.

*Unrealized depreciation is a payable on the Fund’s consolidated statement of assets and liabilities.

The accompanying notes are an integral part of these consolidated financial statements.

| |

16 | LoCorr Long/Short Commodities Strategy Fund - Consolidated Schedule of Investments |

| |

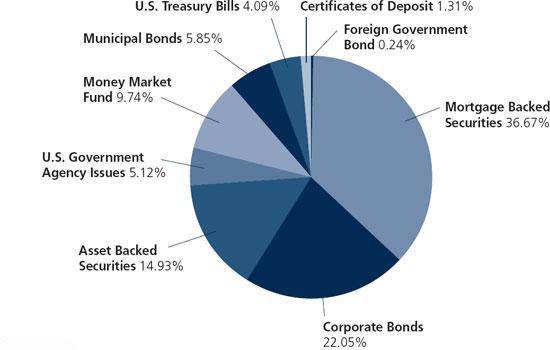

LoCorr Long/Short Commodities Strategy Fund

Composition of Consolidated Investment Portfolio1

December 31, 2013 (Unaudited)

1 As a percentage of total investments.

Consolidated Schedule of Investments

December 31, 2013

| | | | | | | | | | | |

| | | Maturity Date | | Coupon Rate | | Principal Amount | | Value | |

| ASSET BACKED SECURITIES: 12.66% | | | | | | | | | | |

| Ally Auto Receivables Trust | | | | | | | | | | |

| Series 2012-4 A3 | | 01/17/2017 | | 0.59 | % | | $ | 25,000 | | $ | 25,022 | |

| Series 2012-5 A3 | | 03/15/2017 | | 0.62 | % | | | 50,000 | | | 50,027 | |

| AmeriCredit Automobile Receivables Trust | | | | | | | | | | | | |

| Series 2012-3 A2 | | 12/08/2015 | | 0.71 | % | | | 5,764 | | | 5,765 | |

| Series 2012-5 A2 | | 01/08/2016 | | 0.51 | % | | | 17,747 | | | 17,740 | |

| Series 2013-2 A2 | | 11/08/2016 | | 0.53 | % | | | 42,606 | | | 42,596 | |

| Series 2012-4 A3 | | 06/08/2017 | | 0.67 | % | | | 25,000 | | | 24,991 | |

| Series 2013-1 A3 | | 10/10/2017 | | 0.61 | % | | | 45,000 | | | 44,921 | |

| Series 2013-3 A3 | | 04/09/2018 | | 0.92 | % | | | 50,000 | | | 50,028 | |

| Capital Auto Receivables Asset Trust | | | | | | | | | | | | |

| Series 2013-2 A1 | | 07/20/2015 | | 0.77 | % | | | 25,000 | | | 25,024 | |

| Series 2013-1 A2 | | 07/20/2016 | | 0.62 | % | | | 50,000 | | | 49,991 | |

| CarMax Auto Owner Trust, 2012-3 A3 | | 07/17/2017 | | 0.52 | % | | | 25,000 | | | 24,984 | |

| Citibank Credit Card Issuance Trust 2013-A11 (c) | | 02/07/2018 | | 0.41 | % | | | 100,000 | | | 100,028 | |

| CNH Equipment Trust | | | | | | | | | | | | |

| Series 2012-B A3 | | 09/15/2017 | | 0.86 | % | | | 15,000 | | | 15,043 | |

| Series 2012-C A3 | | 12/15/2017 | | 0.57 | % | | | 25,000 | | | 24,972 | |

| Series 2012-D A3 | | 04/16/2018 | | 0.65 | % | | | 50,000 | | | 50,040 | |

| Fifth Third Auto Trust, 2013-A A3 | | 09/15/2017 | | 0.61 | % | | | 50,000 | | | 49,893 | |

| Ford Credit Auto Owner Trust 2013-B A3 | | 10/15/2017 | | 0.57 | % | | | 50,000 | | | 50,059 | |

| GE Equipment Midticket LLC 2012-1 A3 | | 05/23/2016 | | 0.60 | % | | | 25,000 | | | 24,986 | |

| GE Equipment Small Ticket LLC Series 2012-1A A3 (Acquired 05/22/2012, | | | | | | | | | | | | |

| Cost, $14,997) (a) | | 09/21/2015 | | 1.04 | % | | | 15,000 | | | 15,047 | |

| GE Equipment Transportation LLC 2012-2 A3 | | 07/25/2016 | | 0.62 | % | | | 30,000 | | | 29,997 | |

| Honda Auto Receivables Owner Trust | | | | | | | | | | | | |

| Series 2012-4 A3 | | 08/18/2016 | | 0.52 | % | | | 25,000 | | | 25,025 | |

| Series 2013-2 A3 | | 02/16/2017 | | 0.53 | % | | | 50,000 | | | 49,984 | |

The accompanying notes are an integral part of these consolidated financial statements.

| |

LoCorr Long/Short Commodities Strategy Fund - Consolidated Schedule of Investments (continued) | 17 |

| |

| | | | | | | | | | | |

| | | Maturity Date | | Coupon Rate | | Principal Amount | | Value | |

ASSET BACKED SECURITIES (continued) | | | | | | | | | | |

| Hyundai Auto Receivables Trust | | | | | | | | | | |

| Series 2012-B A3 | | 09/15/2016 | | 0.62 | % | | $ | 24,770 | | $ | 24,804 | |

| Series 2013-B A3 | | 09/15/2017 | | 0.71 | % | | | 50,000 | | | 50,048 | |

| John Deere Owner Trust 2013-A A3 | | 03/15/2017 | | 0.60 | % | | | 50,000 | | | 50,023 | |

| Mercedes-Benz Auto Lease Trust 2013-A A3 | | 02/15/2016 | | 0.59 | % | | | 50,000 | | | 50,031 | |

| Mercedes-Benz Auto Receivables Trust 2012-1 A2 | | 03/16/2015 | | 0.37 | % | | | 6,352 | | | 6,352 | |

| Navistar Financial Owner Trust, 2012-A A2 (Acquired 06/26/2012, Cost, $4,452) (a) | | 03/18/2015 | | 0.85 | % | | | 4,452 | | | 4,452 | |

| Nissan Auto Receivables Owner Trust, 2013-A A3 | | 05/15/2017 | | 0.50 | % | | | 50,000 | | | 49,973 | |

| Santander Drive Auto Receivables Trust | | | | | | | | | | | | |

| Series 2013-4 A2 | | 09/15/2016 | | 0.89 | % | | | 24,155 | | | 24,195 | |

| Series 2013-1 A3 | | 06/15/2017 | | 0.62 | % | | | 25,000 | | | 24,983 | |

| Series 2013-2 A3 | | 09/15/2017 | | 0.70 | % | | | 40,000 | | | 40,010 | |

| Series 2013-3 A3 | | 10/16/2017 | | 0.70 | % | | | 50,000 | | | 49,956 | |

| Small Business Administration Participation Certificates, 2012-20K 1 | | 11/01/2032 | | 2.09 | % | | | 23,771 | | | 22,058 | |

| Toyota Auto Receivables Owner Trust, 2013-A A3 | | 01/17/2017 | | 0.55 | % | | | 50,000 | | | 49,999 | |

| World Omni Auto Receivables Trust | | | | | | | | | | | | |

| Series 2012-A A3 | | 02/15/2017 | | 0.64 | % | | | 25,000 | | | 25,049 | |

| Series 2012-B A3 | | 06/15/2017 | | 0.61 | % | | | 25,000 | | | 25,032 | |

| Series 2013-A A3 | | 04/16/2018 | | 0.64 | % | | | 75,000 | | | 74,975 | |

| TOTAL ASSET BACKED SECURITIES (Cost $1,369,683) | | | | | | | | | | | 1,368,103 | |

| | | | | | | | | | | | | |

| CORPORATE BONDS: 18.69% | | | | | | | | | | | | |

| Construction: 0.14% | | | | | | | | | | | | |

| ABB Treasury Center (USA), Inc. (Acquired 06/19/2012, Cost, $15,322) (a) | | 06/15/2016 | | 2.50 | % | | | 15,000 | | | 15,427 | |

| | | | | | | | | | | | | |

| Finance and Insurance: 8.59% | | | | | | | | | | | | |

| American Express Co. | | 05/22/2018 | | 1.55 | % | | | 20,000 | | | 19,528 | |

| American Express Credit Corp. | | 09/19/2016 | | 2.80 | % | | | 20,000 | | | 20,898 | |

| Bank of America Corp. | | 08/01/2016 | | 6.50 | % | | | 30,000 | | | 33,872 | |

| Bank of New York Mellon Corp./The | | 07/28/2016 | | 2.30 | % | | | 20,000 | | | 20,656 | |

| Bank of Nova Scotia/The (b) | | 07/15/2016 | | 1.38 | % | | | 30,000 | | | 30,330 | |

| BB&T Corp. | | 03/22/2017 | | 2.15 | % | | | 15,000 | | | 15,166 | |

| BB&T Corp. | | 08/15/2017 | | 1.60 | % | | | 20,000 | | | 19,821 | |

| Boston Properties Limited Partnership | | 06/01/2015 | | 5.00 | % | | | 10,000 | | | 10,580 | |

| BP Capital Markets P.L.C. (b) | | 05/05/2017 | | 1.85 | % | | | 20,000 | | | 20,201 | |

| Caterpillar Financial Services Corp. | | 02/17/2015 | | 4.75 | % | | | 15,000 | | | 15,715 | |

| Caterpillar Financial Services Corp. | | 05/29/2015 | | 1.10 | % | | | 10,000 | | | 10,081 | |

| Charles Schwab Corp./The | | 09/01/2017 | | 6.38 | % | | | 23,000 | | | 26,267 | |

| Citigroup, Inc. (c) | | 04/01/2014 | | 1.24 | % | | | 2,000 | | | 2,004 | |

| Citigroup, Inc. | | 11/21/2017 | | 6.13 | % | | | 25,000 | | | 28,818 | |

| Dragon 2012 LLC | | 03/12/2024 | | 1.97 | % | | | 22,133 | | | 21,471 | |

| ERP Operating Limited Partnership (Equity Residential only) | | 09/15/2014 | | 5.25 | % | | | 25,000 | | | 25,796 | |

| General Electric Capital Corp. | | 12/11/2015 | | 1.00 | % | | | 10,000 | | | 10,080 | |

| General Electric Capital Corp. | | 01/09/2017 | | 2.90 | % | | | 30,000 | | | 31,319 | |

| Goldman Sachs Group, Inc./The | | 01/15/2015 | | 5.13 | % | | | 35,000 | | | 36,560 | |

| Helios Leasing I LLC | | 05/29/2024 | | 2.02 | % | | | 22,192 | | | 21,528 | |

| Helios Leasing I LLC | | 07/24/2024 | | 1.73 | % | | | 22,653 | | | 21,633 | |

| Helios Leasing I LLC | | 09/28/2024 | | 1.56 | % | | | 22,620 | | | 21,353 | |

| John Deere Capital Corp. | | 06/29/2015 | | 0.95 | % | | | 15,000 | | | 15,110 | |

| John Deere Capital Corp. | | 04/13/2017 | | 5.50 | % | | | 15,000 | | | 16,801 | |

| JPMorgan Chase & Co. | | 08/15/2017 | | 2.00 | % | | | 20,000 | | | 20,287 | |

| JPMorgan Chase & Co. | | 01/15/2018 | | 6.00 | % | | | 25,000 | | | 28,787 | |

| KeyBank National Association | | 11/01/2017 | | 5.70 | % | | | 27,000 | | | 30,337 | |

| Kimco Realty Corp. | | 02/01/2018 | | 4.30 | % | | | 30,000 | | | 32,278 | |

| Liberty Property Limited Partnership | | 10/01/2017 | | 6.63 | % | | | 25,000 | | | 28,628 | |

| Morgan Stanley | | 03/22/2017 | | 4.75 | % | | | 30,000 | | | 32,740 | |

| MSN 41079 and 41084 Ltd. (b) | | 07/13/2024 | | 1.72 | % | | | 22,647 | | | 21,607 | |

| New York Life Global Funding (Acquired 10/09/2012, Cost, $20,621) (a) | | 05/04/2015 | | 3.00 | % | | | 20,000 | | | 20,639 | |

| Phoenix 2012 LLC | | 07/03/2024 | | 1.61 | % | | | 23,020 | | | 21,884 | |

| PNC Funding Corp. | | 09/19/2016 | | 2.70 | % | | | 10,000 | | | 10,431 | |

| Realty Income Corp. | | 09/15/2016 | | 5.95 | % | | | 15,000 | | | 16,669 | |

| Royal Bank of Canada (b) | | 09/19/2017 | | 1.20 | % | | | 25,000 | | | 24,771 | |

| Royal Bank of Canada (b) | | 10/01/2018 | | 2.00 | % | | | 10,000 | | | 9,948 | |

| Safina Ltd. (b) | | 01/15/2022 | | 1.55 | % | | | 21,873 | | | 21,435 | |

| Simon Property Group, L.P. | | 08/15/2014 | | 5.63 | % | | | 25,000 | | | 25,592 | |

The accompanying notes are an integral part of these consolidated financial statements.

| |

18 | LoCorr Long/Short Commodities Strategy Fund - Consolidated Schedule of Investments (continued) |

| |

| | | | | | | | | | | |

| | | Maturity Date | | Coupon Rate | | Principal Amount | | Value | |

CORPORATE BONDS (continued) | | | | | | | | | | |

| State Street Bank & Trust Co. | | 10/15/2018 | | 5.25 | % | | $ | 20,000 | | $ | 22,584 | |

| Tagua Leasing LLC | | 11/16/2024 | | 1.58 | % | | | 23,106 | | | 21,763 | |

| Travelers Companies, Inc./The | | 12/01/2015 | | 5.50 | % | | | 16,000 | | | 17,454 | |

| Ventas Realty LP / Ventas Capital Corp. | | 02/15/2018 | | 2.00 | % | | | 15,000 | | | 14,745 | |

| Vornado Realty L.P. | | 04/01/2015 | | 4.25 | % | | | 10,000 | | | 10,312 | |

| | | | | | | | | | | | 928,479 | |

| | | | | | | | | | | | | |

| Information: 1.09% | | | | | | | | | | | | |

| AT&T Inc. | | 05/15/2016 | | 2.95 | % | | | 10,000 | | | 10,427 | |

| AT&T Inc. | | 06/01/2017 | | 1.70 | % | | | 10,000 | | | 9,939 | |

| Comcast Corp. | | 06/15/2016 | | 4.95 | % | | | 8,000 | | | 8,735 | |

| DIRECTV Holdings LLC / DIRECTV Financing Co., Inc. | | 03/15/2017 | | 2.40 | % | | | 35,000 | | | 35,633 | |

| Oracle Corp. | | 04/15/2018 | | 5.75 | % | | | 13,000 | | | 15,022 | |

| Verizon Communications, Inc. | | 09/15/2016 | | 2.50 | % | | | 20,000 | | | 20,681 | |

| Walt Disney Co./The | | 09/15/2016 | | 5.63 | % | | | 15,000 | | | 16,841 | |

| | | | | | | | | | | | 117,278 | |

| | | | | | | | | | | | | |

| Management of Companies and Enterprises: 0.42% | | | | | | | | | | | | |

| BAE SYSTEMS Holdings, Inc. (Acquired 06/04/2012, Cost, $10,461) (a) | | 08/15/2015 | | 5.20 | % | | | 10,000 | | | 10,618 | |

| BHP Billiton Finance (USA) Ltd. (b) | | 02/24/2017 | | 1.63 | % | | | 35,000 | | | 35,095 | |

| | | | | | | | | | | | 45,713 | |

| | | | | | | | | | | | | |

| Manufacturing: 5.04% | | | | | | | | | | | | |

| AbbVie Inc. | | 11/06/2015 | | 1.20 | % | | | 20,000 | | | 20,203 | |

| Anheuser-Busch InBev Worldwide Inc. | | 07/15/2015 | | 0.80 | % | | | 15,000 | | | 15,075 | |

| Anheuser-Busch InBev Worldwide Inc. | | 02/15/2016 | | 2.88 | % | | | 15,000 | | | 15,615 | |

| Baxter International Inc. | | 01/15/2017 | | 1.85 | % | | | 10,000 | | | 10,108 | |

| Bemis Company, Inc. | | 08/01/2014 | | 5.65 | % | | | 20,000 | | | 20,559 | |

| Campbell Soup Co. | | 07/15/2017 | | 3.05 | % | | | 20,000 | | | 20,862 | |

| Chevron Corp. | | 12/05/2017 | | 1.10 | % | | | 10,000 | | | 9,780 | |

| Cintas Corp. No. 2 | | 06/01/2016 | | 2.85 | % | | | 15,000 | | | 15,472 | |

| Coca Cola Co./The | | 11/15/2017 | | 5.35 | % | | | 30,000 | | | 34,157 | |

| Covidien International Finance S.A. (b) | | 05/29/2015 | | 1.35 | % | | | 7,000 | | | 7,051 | |

| Diageo Capital PLC (b) | | 05/11/2017 | | 1.50 | % | | | 20,000 | | | 19,957 | |

| Eaton Corporation | | 11/02/2017 | | 1.50 | % | | | 35,000 | | | 34,312 | |

| ECOLAB Inc. | | 02/15/2015 | | 4.88 | % | | | 15,000 | | | 15,660 | |

| ECOLAB Inc. | | 12/08/2016 | | 3.00 | % | | | 15,000 | | | 15,716 | |

| E.I. du Pont de Nemours & Co. | | 03/15/2015 | | 4.75 | % | | | 14,000 | | | 14,682 | |

| General Mills, Inc. | | 03/17/2015 | | 5.20 | % | | | 25,000 | | | 26,359 | |

| Heineken N.V. (Acquired 10/02/2012, Cost, $9,983) (a)(b) | | 10/01/2015 | | 0.80 | % | | | 10,000 | | | 10,003 | |

| Ingredion Inc. | | 11/01/2015 | | 3.20 | % | | | 30,000 | | | 31,062 | |

| Intel Corp. | | 12/15/2017 | | 1.35 | % | | | 25,000 | | | 24,708 | |

| Kellogg Co. | | 05/17/2017 | | 1.75 | % | | | 40,000 | | | 39,953 | |

| Kraft Foods Group, Inc. | | 06/05/2017 | | 2.25 | % | | | 30,000 | | | 30,377 | |

| Lockheed Martin Corp. | | 09/15/2016 | | 2.13 | % | | | 10,000 | | | 10,260 | |

| Parker-Hannifin Corp. | | 05/15/2018 | | 5.50 | % | | | 10,000 | | | 11,328 | |

| Roper Industries, Inc. | | 11/15/2017 | | 1.85 | % | | | 15,000 | | | 14,870 | |

| SABMiller PLC (Acquired 08/15/2012, Cost, $15,023) (a)(b) | | 01/15/2014 | | 5.70 | % | | | 15,000 | | | 15,026 | |

| Thermo Fisher Scientific Inc. | | 06/01/2015 | | 5.00 | % | | | 10,000 | | | 10,590 | |

| Thermo Fisher Scientific Inc. | | 08/15/2016 | | 2.25 | % | | | 10,000 | | | 10,227 | |

| Toyota Motor Credit Corp. | | 01/12/2017 | | 2.05 | % | | | 10,000 | | | 10,220 | |

| United Technologies Corp. | | 06/01/2017 | | 1.80 | % | | | 30,000 | | | 30,462 | |

| | | | | | | | | | | | 544,654 | |

| | | | | | | | | | | | | |

| Mining, Quarrying, and Oil and Gas Extraction: 0.88% | | | | | | | | | | | | |

| Devon Energy Corp. | | 05/15/2017 | | 1.88 | % | | | 15,000 | | | 15,109 | |

| Rio Tinto Finance (USA) PLC (b) | | 03/22/2017 | | 2.00 | % | | | 10,000 | | | 10,049 | |

| Rio Tinto Finance (USA) PLC (b) | | 08/21/2017 | | 1.63 | % | | | 15,000 | | | 14,994 | |

| Schlumberger Norge AS (Acquired 07/24/2012 and 09/11/2012, Cost, $14,981) (a)(b) | | 08/01/2017 | | 1.25 | % | | | 15,000 | | | 14,661 | |

| Total Capital International SA (b) | | 06/28/2017 | | 1.55 | % | | | 15,000 | | | 15,003 | |

| XTO Energy Inc. | | 02/01/2014 | | 4.90 | % | | | 25,000 | | | 25,088 | |

| | | | | | | | | | | | 94,904 | |

| | | | | | | | | | | | | |

| Retail Trade: 0.37% | | | | | | | | | | | | |

| Sherwin-Williams Co./The | | 12/15/2014 | | 3.13 | % | | | 39,000 | | | 39,937 | |

The accompanying notes are an integral part of these consolidated financial statements.

| |

LoCorr Long/Short Commodities Strategy Fund - Consolidated Schedule of Investments (continued) | 19 |

| |

| | | | | | | | | | | |

| | | Maturity Date | | Coupon Rate | | Principal Amount | | Value | |

CORPORATE BONDS (continued) | | | | | | | | | | |

| Transportation and Warehousing: 0.71% | | | | | | | | | | |

| Canadian National Railway Co. (b) | | 06/01/2016 | | 5.80 | % | | $ | 20,000 | | $ | 22,067 | |

| Norfolk Southern Corp. | | 01/15/2016 | | 5.75 | % | | | 20,000 | | | 21,850 | |

| Union Pacific Corp. | | 01/15/2015 | | 4.88 | % | | | 25,000 | | | 26,114 | |

| VRG Linhas Aereas SA (b) | | 06/30/2014 | | 1.00 | % | | | 6,297 | | | 6,314 | |

| | | | | | | | | | | | 76,345 | |

| | | | | | | | | | | | | |

| Utilities: 1.45% | | | | | | | | | | | | |

| Atmos Energy Corp. | | 10/15/2014 | | 4.95 | % | | | 25,000 | | | 25,827 | |

| Avista Corp. | | 06/01/2018 | | 5.95 | % | | | 20,000 | | | 22,922 | |

| Commonwealth Edison Co. | | 04/15/2015 | | 4.70 | % | | | 20,000 | | | 21,006 | |

| Connecticut Light & Power Co./The | | 03/01/2017 | | 5.38 | % | | | 20,000 | | | 22,034 | |

| Southern California Edison Co. | | 09/15/2014 | | 4.15 | % | | | 15,000 | | | 15,392 | |

| Southern California Edison Co. | | 04/01/2015 | | 4.65 | % | | | 15,000 | | | 15,755 | |

| Wisconsin Electric Power Co. | | 04/01/2014 | | 6.00 | % | | | 11,000 | | | 11,147 | |

| Wisconsin Electric Power Co. | | 12/01/2015 | | 6.25 | % | | | 21,000 | | | 23,173 | |

| | | | | | | | | | | | 157,256 | |

| TOTAL CORPORATE BONDS (Cost $2,028,897) | | | | | | | | | | | 2,019,993 | |

| | | | | | | | | | | | | |

| MORTGAGE BACKED SECURITIES: 31.08% | | | | | | | | | | | | |

| Banc of America Commercial Mortgage Trust, 2006-2 A4 (c) | | 05/10/2045 | | 5.74 | % | | | 20,000 | | | 21,813 | |

| Bear Stearns Commercial Mortgage Securities Trust | | | | | | | | | | | | |

| Series 2006-PWR12 A4 (c) | | 09/11/2038 | | 5.71 | % | | | 25,000 | | | 27,328 | |

| Series 2006-PWR14 A4 | | 12/11/2038 | | 5.20 | % | | | 25,000 | | | 27,308 | |

| Series 2006-TOP24 A4 | | 10/12/2041 | | 5.54 | % | | | 25,000 | | | 27,322 | |

| Citigroup Commercial Mortgage Trust, 2006-C5 A4 | | 10/15/2049 | | 5.43 | % | | | 35,000 | | | 38,187 | |

| Commercial Mortgage Pass-Through Certificates Series 2012-CR3 A1 | | 10/17/2045 | | 0.67 | % | | | 20,013 | | | 19,877 | |

| Credit Suisse Commercial Mortgage Trust Series 2006-C1 A4 (c) | | 02/15/2039 | | 5.46 | % | | | 10,000 | | | 10,774 | |

| Fannie Mae-Aces | | | | | | | | | | | | |

| Series 2012-M17 ASQ2 | | 11/25/2015 | | 0.95 | % | | | 122,119 | | | 122,580 | |

| Series 2013-M3 ASQ2 | | 02/25/2016 | | 1.08 | % | | | 46,792 | | | 47,072 | |

| Series 2013-M1 ASQ2 | | 11/25/2016 | | 1.07 | % | | | 73,896 | | | 74,125 | |

| Series 2013-M7 ASQ2 | | 03/25/2018 | | 1.23 | % | | | 100,000 | | | 99,267 | |

| Fannie Mae Pool | | 06/01/2017 | | 1.49 | % | | | 25,000 | | | 25,274 | |

| Fannie Mae Pool | | 07/01/2017 | | 1.50 | % | | | 35,000 | | | 35,250 | |

| Fannie Mae Pool | | 09/01/2017 | | 1.27 | % | | | 50,000 | | | 50,054 | |

| Fannie Mae Pool | | 08/01/2022 | | 2.50 | % | | | 37,852 | | | 38,643 | |

| Fannie Mae Pool | | 09/01/2022 | | 2.50 | % | | | 78,039 | | | 79,671 | |

| Fannie Mae Pool | | 09/01/2022 | | 2.50 | % | | | 39,060 | | | 39,877 | |

| Fannie Mae Pool | | 10/01/2022 | | 2.50 | % | | | 61,103 | | | 62,382 | |

| Fannie Mae Pool | | 10/01/2022 | | 2.50 | % | | | 20,206 | | | 20,629 | |

| Fannie Mae Pool | | 11/01/2022 | | 2.50 | % | | | 103,533 | | | 105,701 | |

| Fannie Mae Pool | | 11/01/2022 | | 2.50 | % | | | 20,122 | | | 20,543 | |