SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registranto

Filed by a Party other than the Registrantx

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

Voya Prime Rate Trust

(Name of Registrant as Specified In Its Charter)

Saba Capital Management, L.P.

Saba Capital CEF Opportunities 1, Ltd.

Boaz R. Weinstein

Aditya Bindal

Peter Borish

Karen Caldwell

Charles Clarvit

Ketu Desai

Kieran Goodwin

Andrew Kellerman

Neal Neilinger

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| x | No fee required. |

| | |

| o | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | | |

| | 5) | Total fee paid: |

| | | |

| | | |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | | |

| | | |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | | |

| | 3) | Filing Party: |

| | | |

| | | |

| | | |

| | 4) | Date Filed: |

FELLOW SHAREHOLDERS

ASK VOYA WHY THEY KEEP CUTTING YOUR DISTRIBUTIONS AND KEEP UNDERPERFORMING THEIR PEERS!

As a shareholder you are likely focused on two things - the distribution you receive each year and the price of your investment. Unfortunately Voya and the Board have been failing in both departments.

In 2013 shareholders received $0.44 in distributions. After declines each year, the distributions have dropped to a projected $0.18 per year. If you own 1,000 shares, this means you are receiving $260 dollars less per year. Even worse, the price of your investment has declined by 19% in 2020, despite the market recovery.

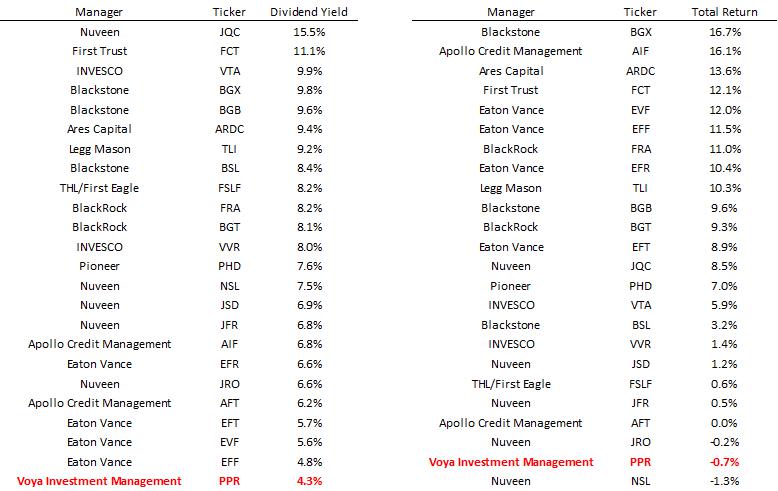

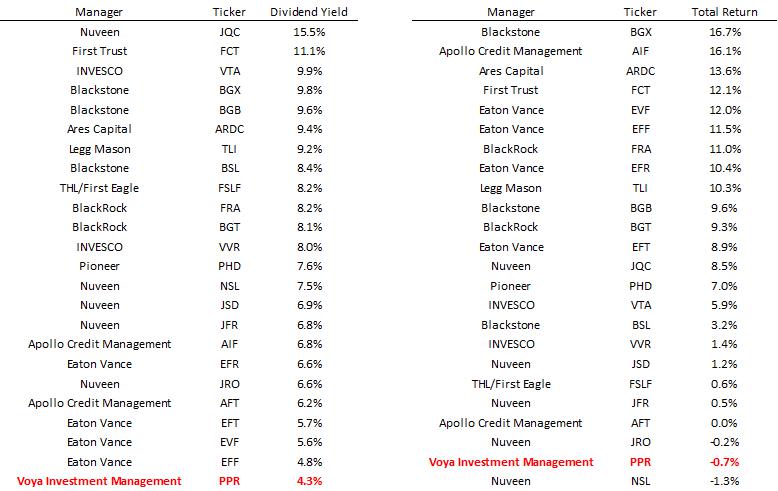

For comparison, here are all of the Funds in PPR’s investment category that have existed for at least five years. You can see that PPR’s distribution yieldiis the worst, and Voya’s performanceiiis second to worst.

You are probably wondering why the Board, mandated to protect your investment, hasn’t made critical changes. It could ask Voya to take a management fee cut. It could merge PPR into a nearly identical Voya open-ended fund – a step recently taken by BlackRock for two of its funds as a way to immediately raise the share price to full net asset value, and lower the expense ratio.

Unlike you, there isn’t a single Board member that has a dime invested in PPR. They don’t lose any money when Voya underperforms and they don’t pay Voya’s high fees each year like you do. The Trustees are paid hundreds of thousands of dollars each year to sit on the boards of PPR and dozens of other Voya funds.

Passing our proposals can help fix decades of underperformance by reducing fees and expenses and quickly increasing the share price of PPR to its net asset value. Voya’s assertion that a tender will hurt investors is untrue. Narrowing the discount to NAV will benefit all shareholders by raising the share price. Voya loses out on charging you their bloated fees which is why they are trying so hard to obscure the facts.

As the largest investor in PPR, our interests are fully aligned with yours.

Please vote the GOLD proxy card today so we can increase the share price of PPR in the short-term and long-term.

i Bloomberg 12month indicated dividend yield, CEF Advisors Loan Participation Category

ii Bloomberg, performance based on price per share, CEF Advisors Loan Participation Category, 5/29/2015-5/29/2020