SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant¨

Filed by a Party other than the Registrantþ

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| þ | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

Voya Prime Rate Trust

(Name of Registrant as Specified In Its Charter)

Saba Capital Management, L.P.

Saba Capital CEF Opportunities 1, Ltd.

Boaz R. Weinstein

Aditya Bindal

Peter Borish

Karen Caldwell

Charles Clarvit

Ketu Desai

Kieran Goodwin

Andrew Kellerman

Neal Neilinger

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| þ | No fee required. |

| | |

| o | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| | | |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | | |

| | 5) | Total fee paid: |

| | | |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| | 1) | Amount Previously Paid: |

| | | |

| | | |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | | |

| | 3) | Filing Party: |

| | | |

On June 16, 2020, representatives of Saba Capital Management, L.P. (“Saba”) gave a presentation to representatives of Institutional Shareholder Services Inc. regarding Voya Prime Rate Trust (the “ISS Presentation”). A copy of the ISS Presentation is filed herewith asExhibit 1.

Exhibit 1

VOYA PRIME RATE TRUST (PPR) A PRESENTATION TO INSTITUIONAL SHAREHOLDER SERVICES INC. June 16, 2020

PAGE 2 Saba Capital Strictly Private and Confidential Summary Total Shareholder Return Peer Group Rankings Performance vs. Benchmark Morningstar Analysis Distribution Yield Voya Fund Flows Corporate Governance Shareholder Proposals Election of Directors Termination of Investment Manager Saba’s Slate of Qualified Independent Nominees As the largest investor in PPR, Saba’s interests are aligned with all shareholders. PPR’s performance has been substantially worse than its benchmark and peer group. PPR has taken unprecedented steps to entrench itself; violating key corporate governance principles that attempt to silence the voice of shareholders. Saba’s slate of nominees are qualified and independent.

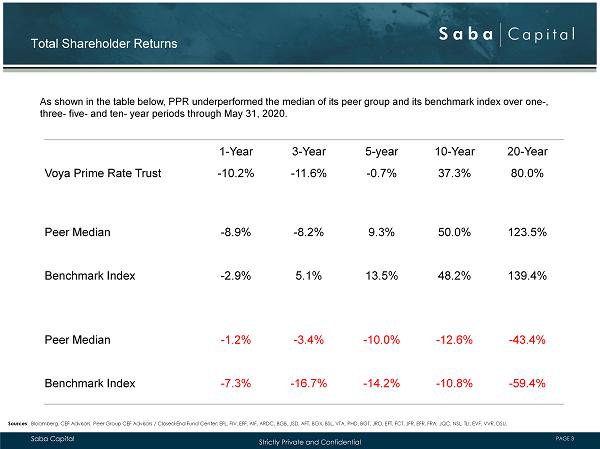

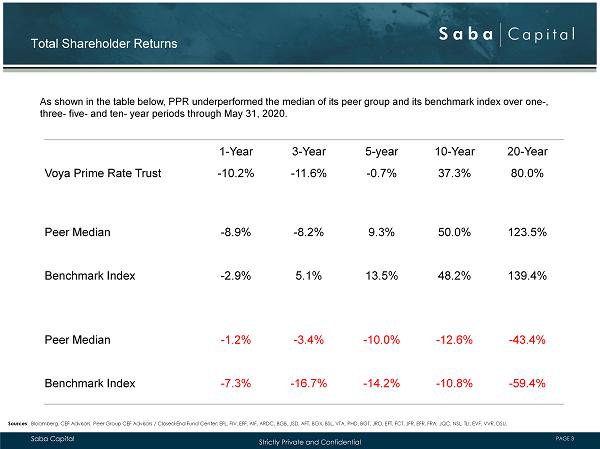

PAGE 3 Saba Capital Strictly Private and Confidential Total Shareholder Returns 1 - Year 3 - Year 5 - year 10 - Year 20 - Year Voya Prime Rate Trust - 10.2% - 11.6% - 0.7% 37.3% 80.0% Peer Median - 8.9% - 8.2% 9.3% 50.0% 123.5% Benchmark Index - 2.9% 5.1% 13.5% 48.2% 139.4% Peer Median - 1.2% - 3.4% - 10.0% - 12.6% - 43.4% Benchmark Index - 7.3% - 16.7% - 14.2% - 10.8% - 59.4% Sources : Bloomberg, CEF Advisors, Peer Group CEF Advisors / Closed - End Fund Center : EFL, FIV, EFF, AIF, ARDC, BGB, JSD, AFT, BGX, BSL, VTA, PHD, BGT, JRO, EFT, FCT, JFR, EFR, FRA, JQC, NSL, TLI, EVF, VVR, DSU . As shown in the table below, PPR underperformed the median of its peer group and its benchmark index over one - , three - five - and ten - year periods through May 31, 2020.

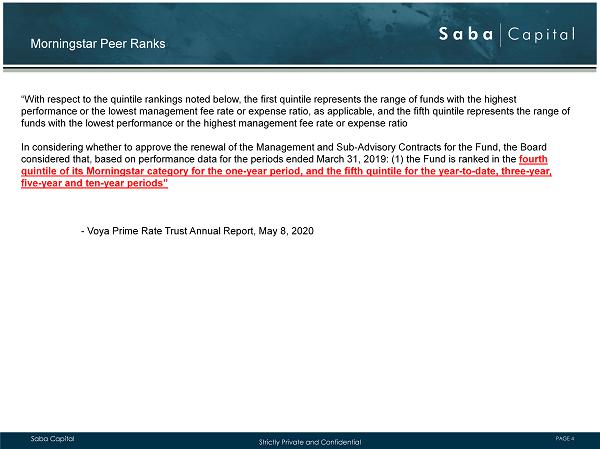

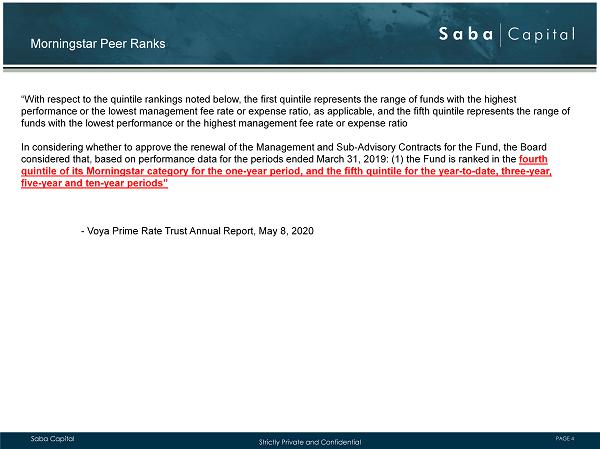

PAGE 4 Saba Capital Strictly Private and Confidential Morningstar Peer Ranks “With respect to the quintile rankings noted below, the first quintile represents the range of funds with the highest performance or the lowest management fee rate or expense ratio, as applicable, and the fifth quintile represents the range of funds with the lowest performance or the highest management fee rate or expense ratio In considering whether to approve the renewal of the Management and Sub - Advisory Contracts for the Fund, the Board considered that, based on performance data for the periods ended March 31, 2019: (1) the Fund is ranked in the fourth quintile of its Morningstar category for the one - year period, and the fifth quintile for the year - to - date, three - year, five - year and ten - year periods” - Voya Prime Rate Trust Annual Report, May 8, 2020

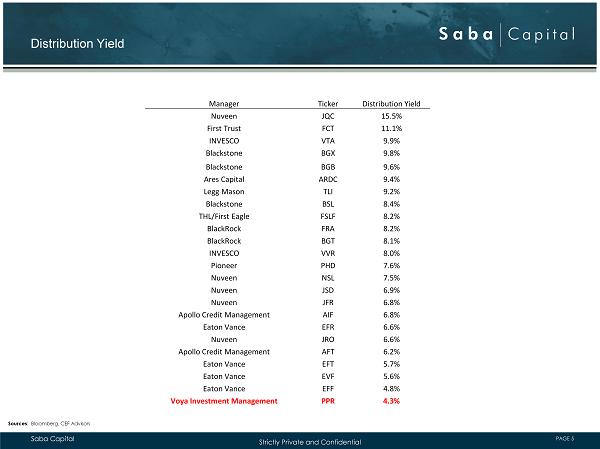

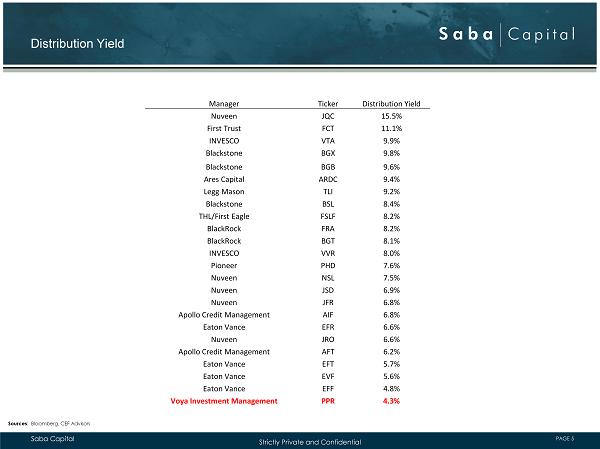

PAGE 5 Saba Capital Strictly Private and Confidential Distribution Yield Sources : Bloomberg, CEF Advisors Manager Ticker Distribution Yield Nuveen JQC 15.5% First Trust FCT 11.1% INVESCO VTA 9.9% Blackstone BGX 9.8% Blackstone BGB 9.6% Ares Capital ARDC 9.4% Legg Mason TLI 9.2% Blackstone BSL 8.4% THL/First Eagle FSLF 8.2% BlackRock FRA 8.2% BlackRock BGT 8.1% INVESCO VVR 8.0% Pioneer PHD 7.6% Nuveen NSL 7.5% Nuveen JSD 6.9% Nuveen JFR 6.8% Apollo Credit Management AIF 6.8% Eaton Vance EFR 6.6% Nuveen JRO 6.6% Apollo Credit Management AFT 6.2% Eaton Vance EFT 5.7% Eaton Vance EVF 5.6% Eaton Vance EFF 4.8% Voya Investment Management PPR 4.3%

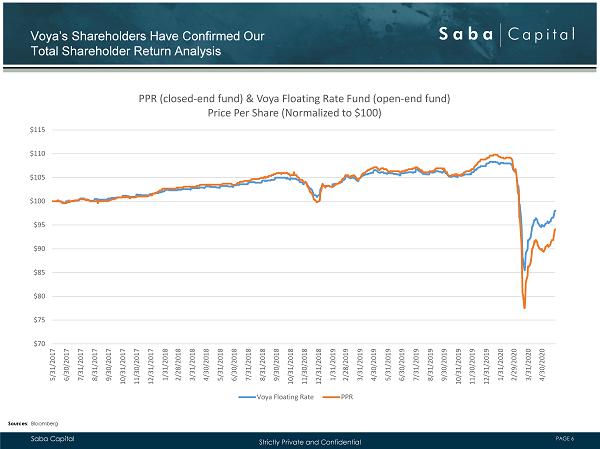

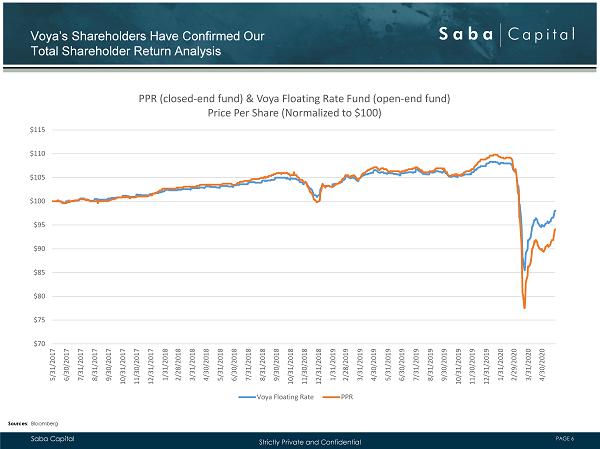

PAGE 6 Saba Capital Strictly Private and Confidential Voya’s Shareholders Have Confirmed Our Total Shareholder Return Analysis $70 $75 $80 $85 $90 $95 $100 $105 $110 $115 5/31/2017 6/30/2017 7/31/2017 8/31/2017 9/30/2017 10/31/2017 11/30/2017 12/31/2017 1/31/2018 2/28/2018 3/31/2018 4/30/2018 5/31/2018 6/30/2018 7/31/2018 8/31/2018 9/30/2018 10/31/2018 11/30/2018 12/31/2018 1/31/2019 2/28/2019 3/31/2019 4/30/2019 5/31/2019 6/30/2019 7/31/2019 8/31/2019 9/30/2019 10/31/2019 11/30/2019 12/31/2019 1/31/2020 2/29/2020 3/31/2020 4/30/2020 PPR (closed - end fund) & Voya Floating Rate Fund (open - end fund) Price Per Share (Normalized to $100) Voya Floating Rate PPR Sources : Bloomberg

PAGE 7 Saba Capital Strictly Private and Confidential - 50,000,000 100,000,000 150,000,000 200,000,000 250,000,000 5/31/2017 6/30/2017 7/31/2017 8/31/2017 9/30/2017 10/31/2017 11/30/2017 12/31/2017 1/31/2018 2/28/2018 3/31/2018 4/30/2018 5/31/2018 6/30/2018 7/31/2018 8/31/2018 9/30/2018 10/31/2018 11/30/2018 12/31/2018 1/31/2019 2/28/2019 3/31/2019 4/30/2019 5/31/2019 6/30/2019 7/31/2019 8/31/2019 9/30/2019 10/31/2019 11/30/2019 12/31/2019 1/31/2020 2/29/2020 3/31/2020 4/30/2020 5/31/2020 Shares Outstanding Voya Floating Rate PPR Voya’s Shareholders Have Confirmed Our Total Shareholder Return Analysis Sources : Bloomberg

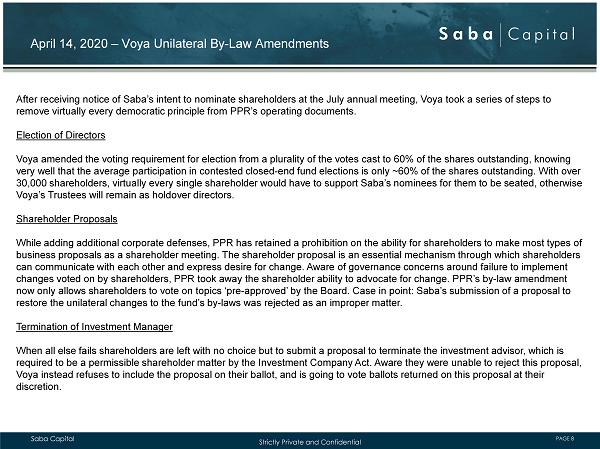

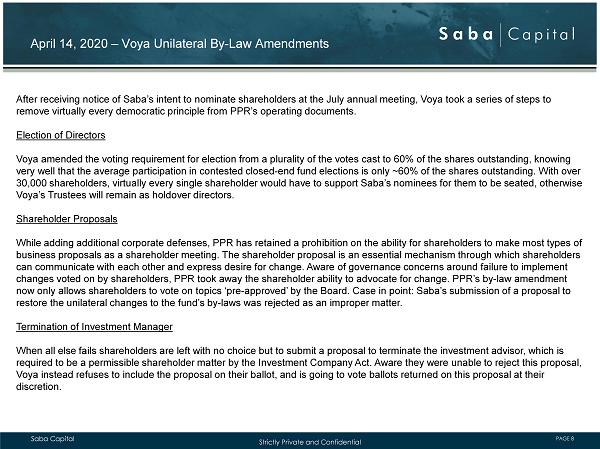

PAGE 8 Saba Capital Strictly Private and Confidential April 14, 2020 – Voya Unilateral By - Law Amendments After receiving notice of Saba’s intent to nominate shareholders at the July annual meeting, Voya took a series of steps to remove virtually every democratic principle from PPR’s operating documents. Election of Directors Voya amended the voting requirement for election from a plurality of the votes cast to 60% of the shares outstanding, k nowing very well that the average participation in contested closed - end fund elections is only ~60% of the shares outstanding. With ove r 30,000 shareholders, virtually every single shareholder would have to support Saba’s nominees for them to be seated, otherwis e Voya’s Trustees will remain as holdover directors. Shareholder Proposals While adding additional corporate defenses, PPR has retained a prohibition on the ability for shareholders to make most types of business proposals as a shareholder meeting. The shareholder proposal is an essential mechanism through which shareholders can communicate with each other and express desire for change. Aware of governance concerns around failure to implement changes voted on by shareholders, PPR took away the shareholder ability to advocate for change. PPR’s by - law amendment now only allows shareholders to vote on topics ‘pre - approved’ by the Board. Case in point: Saba’s submission of a proposal to restore the unilateral changes to the fund’s by - laws was rejected as an improper matter. Termination of Investment Manager When all else fails shareholders are left with no choice but to submit a proposal to terminate the investment advisor, which is required to be a permissible shareholder matter by the Investment Company Act. Aware they were unable to reject this proposal , Voya instead refuses to include the proposal on their ballot, and is going to vote ballots returned on this proposal at their discretion.

PAGE 9 Saba Capital Strictly Private and Confidential Saba’s Proposals Tender for 40% of Shares Outstanding Saba’s proposal for a 40% tender reflects significantly less than the amount of redemptions submitted in the previously mentioned Voya open - end fund over the last year. If less than 40% of shareholders submit their shares, then the size of the tender will be reduced accordingly. Termination of Advisory Agreement As a result of their relationship with Voya, the Board has previously lacked the leverage to negotiate a reduction in the adv iso ry fee charged to PPR shareholders. Upon termination, the Board will be allowed to thoughtfully review all investment advisors. Given that average actively manag ed mutual fund fees are ~60bps, we are confident the Board will be able to find a thoughtful and capable manager for significant ly less than what Voya is currently charging.

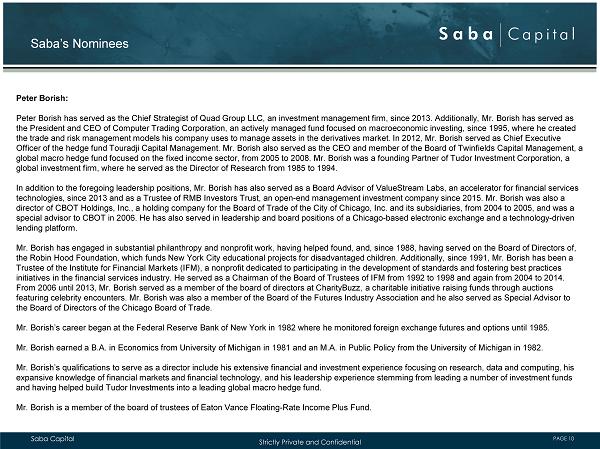

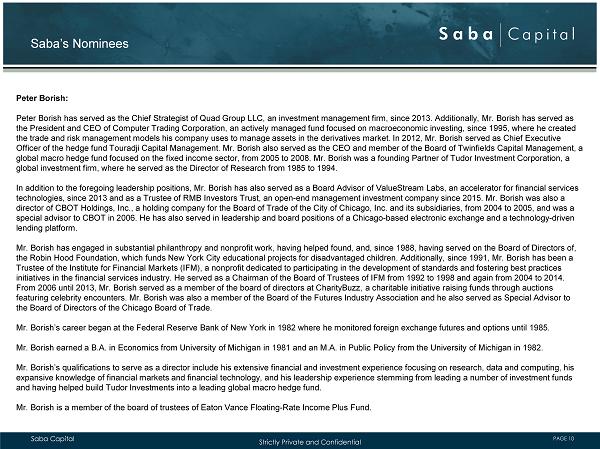

PAGE 10 Saba Capital Strictly Private and Confidential Saba’s Nominees Peter Borish: Peter Borish has served as the Chief Strategist of Quad Group LLC, an investment management firm, since 2013. Additionally, M r. Borish has served as the President and CEO of Computer Trading Corporation, an actively managed fund focused on macroeconomic investing, since 199 5, where he created the trade and risk management models his company uses to manage assets in the derivatives market. In 2012, Mr. Borish served as Chief Executive Officer of the hedge fund Touradji Capital Management. Mr. Borish also served as the CEO and member of the Board of Twinfield s C apital Management, a global macro hedge fund focused on the fixed income sector, from 2005 to 2008. Mr. Borish was a founding Partner of Tudor Inv est ment Corporation, a global investment firm, where he served as the Director of Research from 1985 to 1994. In addition to the foregoing leadership positions, Mr. Borish has also served as a Board Advisor of ValueStream Labs, an acce ler ator for financial services technologies, since 2013 and as a Trustee of RMB Investors Trust, an open - end management investment company since 2015. Mr. Bori sh was also a director of CBOT Holdings, Inc., a holding company for the Board of Trade of the City of Chicago, Inc. and its subsidiaries, fro m 2004 to 2005, and was a special advisor to CBOT in 2006. He has also served in leadership and board positions of a Chicago - based electronic exchange and a technology - driven lending platform . Mr . Borish has engaged in substantial philanthropy and nonprofit work, having helped found, and, since 1988, having served on t he Board of Directors of, the Robin Hood Foundation, which funds New York City educational projects for disadvantaged children. Additionally, since 199 1, Mr. Borish has been a Trustee of the Institute for Financial Markets (IFM), a nonprofit dedicated to participating in the development of standards and fostering best practices initiatives in the financial services industry. He served as a Chairman of the Board of Trustees of IFM from 1992 to 1998 and ag ain from 2004 to 2014. From 2006 until 2013, Mr. Borish served as a member of the board of directors at CharityBuzz, a charitable initiative raising fu nds through auctions featuring celebrity encounters. Mr. Borish was also a member of the Board of the Futures Industry Association and he also ser ved as Special Advisor to the Board of Directors of the Chicago Board of Trade. Mr. Borish’s career began at the Federal Reserve Bank of New York in 1982 where he monitored foreign exchange futures and opt ion s until 1985. Mr. Borish earned a B.A. in Economics from University of Michigan in 1981 and an M.A. in Public Policy from the University of Mi chigan in 1982. Mr. Borish’s qualifications to serve as a director include his extensive financial and investment experience focusing on rese arc h, data and computing, his expansive knowledge of financial markets and financial technology, and his leadership experience stemming from leading a numb er of investment funds and having helped build Tudor Investments into a leading global macro hedge fund . Mr. Borish is a member of the board of trustees of Eaton Vance Floating - Rate Income Plus Fund.

PAGE 11 Saba Capital Strictly Private and Confidential Saba’s Nominees Karen Caldwell: Karen Caldwell has served as the Chief Financial Officer of Reform Alliance since 2019. Previously, Ms. Caldwell served as th e C hief Financial Officer and Treasurer of the NHP Foundation, a non for profit dedicated to increasing housing affordability, from 2018 to 2019. From 2016 to 2018, Ms. Caldwell served as the Chief Financial Officer and Executive Vice President of the New York City Housing Authority. Prior to such posi tio n, she served as the president of Hanseatic Management Services, Inc., an asset management company, from 2015 to 2016. Prior to Hanseatic, Ms. Cal dwe ll served as a managing director of Alternative Investments at Amundi Investments, LLC, an investment advisement firm, from 2008 to 2014. Fr om 1994 until 2008, Ms. Caldwell served as the Group Senior Vice President and Co - Head of Rates and Portfolio Management of ABN AMRO/LaSalle Bank Corpor ation Treasury. Ms. Caldwell also served as the Vice President of Foreign Exchange Trading and Sales at JPMorgan Chase from 1982 until 1994. Ms. Caldwell served as a member of the board of directors and on the Audit Committee of the Chicago Housing Authority from 20 14 until 2015. Ms. Caldwell earned a B.S. in Accounting from Florida A&M University, and an MBA in Finance & Marketing from Northwestern Uni ver sity, Kellogg School of Management. Ms. Caldwell’s qualifications to serve as a director include her extensive experience as senior management in various busines ses and decades of leadership experience in top financial institutions . Kieran Goodwin: Kieran Goodwin is the founder of Hidden Truth, a mobile application game. Previously, he served as the co - founder and Portfolio Manager of Panning Capital Management, LLC, a hedge fund with $2.5 billion AUM at its peak, from 2012 to 2019. Prior to Panning, from 2004 to 20 10, Mr. Goodwin served as partner and Head of Trading of King Street Capital Management, an investment management firm. From 2002 to 2004, Mr. Goodwin ser ved as a Managing Director in UBS Principal Finance. Prior to UBS, Mr. Goodwin was a Managing Director in Fixed Income at Merrill Lync h a nd from 1991 until 1997 he was a trader in interest rate and credit derivatives at Smith Barney, Citigroup and Salomon Brothers. Mr. Goodwin earned a B.A. in Computer Science from Duke University in 1991. Mr. Goodwin’s qualifications to serve as a director include his experience as a founder of an investment company and his exte nsi ve knowledge and experience in the finance and investment spaces.

PAGE 12 Saba Capital Strictly Private and Confidential Saba’s Nominees Charles Clarvit: Charles I. Clarvit has served as Chief Executive Officer of Clarvit Capital Family Office, LLC, an investment firm, since 201 5. Previously, he served as Chief Executive Officer of Vinci Partners - US, an asset and wealth management firm headquartered in Brazil, where he worked from 2011 until 2015. From 2007 to 2011, Mr. Clarvit served as a Managing Director and the Co - Head of BlackRock Alternative Advisors (BAA), the firm’s fund of funds platform. During his tenure at BlackRock, Mr. Clarvit held significant portfolio management responsibilities and oversaw marketing stra teg y and client service for the fund of funds business on the BAA platform. Mr. Clarvit joined BlackRock following the acquisition of the fund of funds busin ess of Quellos Group, LLC, where he served as a Principal from 1998 to 2007, to create one of the largest fund of funds platforms in the world at the ti me of acquisition. At Quellos, Mr. Clarvit oversaw the Quellos Client Group and held significant portfolio management responsibilities. From 1985 to 1998, Mr. C lar vit was a Managing Director with CIBC Oppenheimer & Co., responsible for alternative investment strategies and private equity advisory services for U.S. pensions, endowments, offshore institutions and high net worth families. From 1978 to 1985 he was a Manager at IBM Corporation in a sys tem engineer and marketing capacity. Mr. Clarvit has served on the Advisory Board of Bridge Point Capital, a private equity firm based in New York City that speci ali zes in U.S./China cross - border healthcare investments, since 2019. Mr. Clarvit also serves on the Johns Hopkins University Board of Trustees and on t he Johns Hopkins Center for Financial Economics Advisory Boards for and the Johns Hopkins Innovation and Entrepreneurship Advisory Board. Mr. Clarvit is an angel investor and has served as the Chair of the Board of start - up AgeneBio, Inc., a company dedicated to developing innovative therapeutics for u nserved patients afflicted with neurological and psychiatric diseases, since 2014. Mr. Clarvit earned a B.A. in Social and Behavioral Sciences with a concentration in economics and statistics from Johns Hopki ns University in 1978. Mr. Clarvit’s qualifications to serve as a director include his decades of experience leading various asset and wealth manage men t platforms, his deep knowledge of portfolio management, and his expertise in financial service marketing Mr. Clarvit is a member of the board of trustees of Eaton Vance Floating - Rate Income Plus Fund.

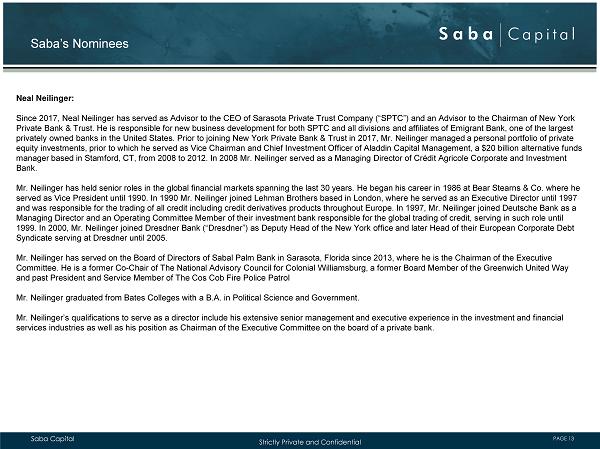

PAGE 13 Saba Capital Strictly Private and Confidential Saba’s Nominees Neal Neilinger: Since 2017, Neal Neilinger has served as Advisor to the CEO of Sarasota Private Trust Company (“SPTC”) and an Advisor to the Cha irman of New York Private Bank & Trust. He is responsible for new business development for both SPTC and all divisions and affiliates of Emigra nt Bank, one of the largest privately owned banks in the United States. Prior to joining New York Private Bank & Trust in 2017, Mr. Neilinger managed a p ers onal portfolio of private equity investments, prior to which he served as Vice Chairman and Chief Investment Officer of Aladdin Capital Management, a $ 20 billion alternative funds manager based in Stamford, CT, from 2008 to 2012. In 2008 Mr. Neilinger served as a Managing Director of Crédit Agricole Corp ora te and Investment Bank . Mr. Neilinger has held senior roles in the global financial markets spanning the last 30 years. He began his career in 1986 a t B ear Stearns & Co. where he served as Vice President until 1990. In 1990 Mr. Neilinger joined Lehman Brothers based in London, where he served as an Exec uti ve Director until 1997 and was responsible for the trading of all credit including credit derivatives products throughout Europe. In 1997, Mr. Neili nge r joined Deutsche Bank as a Managing Director and an Operating Committee Member of their investment bank responsible for the global trading of credit, se rvi ng in such role until 1999. In 2000, Mr. Neilinger joined Dresdner Bank (“Dresdner”) as Deputy Head of the New York office and later Head of their Eur opean Corporate Debt Syndicate serving at Dresdner until 2005 . Mr. Neilinger has served on the Board of Directors of Sabal Palm Bank in Sarasota, Florida since 2013, where he is the Chairm an of the Executive Committee. He is a former Co - Chair of The National Advisory Council for Colonial Williamsburg, a former Board Member of the Gree nwich United Way and past President and Service Member of The Cos Cob Fire Police Patrol Mr. Neilinger graduated from Bates Colleges with a B.A. in Political Science and Government . Mr. Neilinger’s qualifications to serve as a director include his extensive senior management and executive experience in the in vestment and financial services industries as well as his position as Chairman of the Executive Committee on the board of a private bank.

PAGE 14 Saba Capital Strictly Private and Confidential Saba’s Nominees Ketu Desai: Ketu Desai has served as the founding partner and Principal of i - squared Wealth Management, Inc., a private wealth investment management firm, since 2016. Previously, he served as Investment Analyst at Lighthouse Investment Partners, LLC (“Lighthouse”), a global investment fir m, from 2007 until 2016. Based out of Lighthouse’s NYC office, Mr. Desai helped manage Lighthouse’s credit funds, including the Lighthouse Credit Oppo rtu nities Fund and Lighthouse Credit Compass. At Lighthouse, Mr. Desai was also a member of the firm’s Relative Value committee, responsible for po rtfolio allocation decisions and risk management of fixed income, credit, event - driven, mortgage, and distressed strategies. Prior to joining Light house, Mr. Desai served as a M&A Investment Banking Analyst at Credit Suisse AG. Mr. Desai earned a B.A. in Economics from Stony Brook University, and a M.S. in Economics from New York University. Mr. Desai ha s also received an MBA from NYU Stern in Finance, Financial Instruments and Markets, and Entrepreneurship and Innovation. Mr. Desai’s qualifications to serve as a director include his investing and financial experience as well his background in ri sk management.

PAGE 15 Saba Capital Strictly Private and Confidential Saba’s Nominees Andrew Kellerman Andrew Kellerman has served as Partner and Head of Business Development of Saba Capital Management, L.P. since 2018. Prior to jo ining Saba, Mr. Kellerman served as a Managing Director and Head of Distribution for the Private Institutional Client group within Alex. Brow n & Sons where he was responsible for placement of boutique funds and private direct investments from 2017 to 2018. Prior to Alex. Brown, Mr. Kelle rma n served as a Managing Partner of Measure 8 Venture Partners, a diversified private capital fund focused on opportunities in emerging industries, fr om January 2017 to November 2017. Previously, Mr. Kellerman served as a Managing Director and Head of Business Development with Vertical Knowledge supply ing open source data and analytics for the defense, financial services, and commercial markets from 2014 - 2016. Prior to joining Vertical Knowledge, M r. Kellerman was employed with Deutsche Bank from 2002 through 2014, where he served as a Managing Director in Credit Derivatives from 2002 - 2006; U.S. Head of Synthetic CDO Sales from 2006 - 2009 and Head of Hedge Fund Credit Sales from 2009 through 2014. Mr. Kellerman’s additional experi ence includes FleetBoston Financial in Singapore where he was a Director in Asia Structured Finance, Presidio Capital also in Singapore whe re he served as Director in Structured Finance and First National Bank of Chicago where he served as VP, Head of EM Options Trading. Mr. Kellerman holds a Bachelor of Science in International Relations from Syracuse University. Mr. Kellerman’s qualifications to serve as a director include his extensive experience in the investment and financial servic es industries including his time as managing director of a large multinational investment bank. Aditya Bindal : Aditya Bindal has served as Chief Risk Officer of Saba Capital Management, L.P. since 2018, prior to which he served as Chief Ri sk Officer at Water Island Capital ("Water Island"), an event - driven investment firm with over $2.5 billion in AUM, from 2015 to 2018. Prior to join ing Water Island, from 2008 until 2015, Mr. Bindal served as Senior Risk Manager at Eton Park Capital Management, an investment firm with over $9 billion in AUM at its peak. Mr. Bindal began his career in 2005 at Bear Stearns as a risk associate and subsequently traded credit derivatives for the propri eta ry desk. Mr. Bindal received a Bachelor of Technology from Indian Institute of Technology, Kharagpur in India, a Masters from Purdue U niv ersity and a Ph.D. in Chemical Engineering from Rutgers University. Mr. Bindal's qualifications to serve as a director include his deep financial expertise and the senior financial management p osi tions he has held at multiple asset management firms.

PAGE 16 Saba Capital Strictly Private and Confidential Letters From Shareholders