Securian AM Dynamic Managed Volatility Fund

Institutional Class Shares – VVMIX

Securian AM Managed Volatility Equity Fund

Institutional Class Shares – VMEIX

Securian AM Real Asset Income Fund

Institutional Class Shares – VSDIX

Annual Report

| www.securianamfunds.com | August 31, 2020 |

SECURIAN AM FUNDS

September 25, 2020

Securian AM Dynamic Managed Volatility Fund

Managers:

Craig Stapleton, CFA; Jeremy Gogos, CFA; Merlin Erickson

Securian Asset Management

FUND PERFORMANCE UPDATE

For the period beginning September 1, 2019 and ending August 31, 2020, the Dynamic Managed Volatility Fund (the “Fund”) Institutional Class returned 14.76%, underperforming the Dynamic Managed Volatility Benchmark return of 16.20%.

The Fund had a realized volatility, as measured by its standard deviation of daily returns, of 11.82%, compared to the Fund’s custom benchmark realized volatility of 19.64%. The benchmark is a custom benchmark for the Fund developed by Securian Asset Management.

For comparison, the S&P 500 Index (dividend adjusted), which the Fund uses as a broad-based securities market index, was up 21.94% with a volatility of 33.19% over the same period.

STRATEGY UPDATE

In terms of volatility, this period truly is a tale of two polar opposites. The first half of the period, September of 2019 through most of February 2020, was rather calm, despite troubling underlying geopolitical and economic fundamentals. As we highlighted in our last semi-annual letter, late 2019 saw weakening economic data globally, declining corporate earnings in the U.S., and continued U.S.-China trade conflict. Equity volatility of the S&P 500 began the period at 21.0% (September 1, 2019), and thanks to the Federal Reserve (Fed) easing monetary policy, volatility drifted lower, ranging between 5.0% to 14.5% for October 2019 through mid-February 2020. As such, the Fund equity exposure began this period at 30.8%, was increased as volatility dropped, and ranged between 42.0% and 80.1% from October 2019 through mid-February 2020.

As is widely known, the second half of the period—mid-February 2020 through the end of August 2020—was one of the most volatile and unusual periods in the history of U.S. equity markets. The global lockdown intended to slow the spread of coronavirus had a dramatic economic impact, the full extent of which still isn’t known. March of 2020 proved to be the most volatile calendar month in the S&P 500’s history, seeing 93.4% realized volatility. For context, in the most volatile month from the Great Financial Crisis (GFC)—October of 2008—the S&P 500 realized 80.8% volatility. Because of this extreme volatility, the Fund’s equity exposure was steadily reduced from 72.5% on February 20 to 19.5% on March 16. Ultimately, the Dynamic Managed Volatility blended benchmark of 60% S&P 500 Index/40% Bloomberg Barclays U.S. Aggregate Bond Index drew down -21.6% peak-to-trough in the coronavirus panic; the Fund saw a drawdown of -15.0%.

Thanks to massive intervention from both the Fed and the Federal government, the equity market stabilized, and volatility declined steadily throughout April and May, and apart from a brief pullback in June, the market relentlessly rallied for the rest of the period. The volatility of the S&P 500 closed out this period at 8.2%, and so the Fund’s equity exposure ended the period at 76%.

MARKET SECTOR UPDATE

The record domestic economic expansion finally came to an end in this period, with February of 2020 as the 128th and final month of uninterrupted growth in the U.S. The coronavirus lockdowns ushered in a period of

SECURIAN AM FUNDS

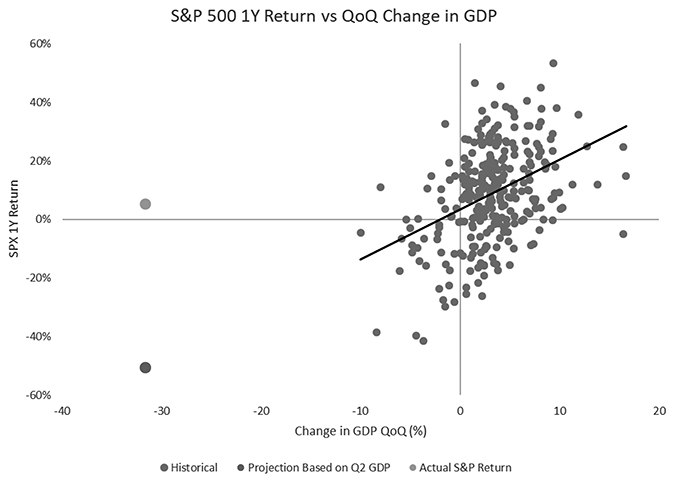

economic contraction unprecedented in the modern era. First quarter of 2020 saw Gross Domestic Product (GDP) shrink -5.0% quarter-over-quarter, and second quarter saw a -31.7% quarter-over-quarter reduction of the same. For context, in the depths of the Great Financial Crisis, the fourth quarter of 2008 saw GDP decline -8.4% quarter-over-quarter.

The historical relationship between this quarter-over-quarter change in GDP, and the S&P 500 trailing 1-year return, is depicted below. The blue dots show the S&P 500 trailing 1-year return vs quarter-over-quarter change in GDP for the second quarter of 1947 through first quarter of 2020. The red dot shows the S&P 500 return implied by extending the best fit line, defined as the line that best expresses the relationship between the points in the scatter plot, to the known -31.7 decrease in GDP for second quarter 2020 GDP. The green dot shows the actual S&P 500 return.

Source: Bloomberg

This is an absurd dislocation of equity valuations from the real economy, even by modern standards. Some other basic market facts we found extremely worrisome:

| | • | Five technology-related companies—Apple, Amazon, Microsoft, Google, and Facebook—now comprise 24.5% of the S&P 500’s total market capitalization, and over 50% of the Nasdaq. This S&P 500 concentration makes any standard equity portfolio very brittle and overexposed to single name risk. |

| | | |

| | • | Over the course of 2019, three of the four quarters saw S&P company earnings decline year-over-year. Fourth quarter 2019’s earnings growth was only 0.9%. As these results were coming to light, and as the coronavirus began to spread outside of China, the S&P made a new record high on February 19, 2020. |

| | | |

| | • | In response to the coronavirus lockdowns, the Federal Reserve cut its policy rate 150 basis points (bps) over the course of 10 days, taking it all the way to 0. In addition, it introduced multiple new programs meant to bolster the economy. Unfortunately, the Fed (technically through the Treasury) is now purchasing corporate bonds to support asset prices, which is not only outside of the Fed’s mandate, but is also a philosophical travesty in a supposedly free market. These new programs have exploded the Fed’s balance sheet, from $4.2 trillion pre-coronavirus, to $7.0 trillion at the end of the period. |

SECURIAN AM FUNDS

| | • | Global negative-yielding debt hit a new record of $16.2 trillion on August 10, 2020. |

| | | |

| | • | In response to the Fed’s implicit promise to support risk asset prices by any means necessary, the S&P 500 aggressively rallied off of its March 23, 2020 low. Its drawdown to that point was -33.9%. Over the next 103 days, it rallied 51.5% to surpass its previous high. This rally is unmatched in the last 87 years; only periods from 1932 and 1933 saw a larger S&P 500 price appreciation in the same number of business days. The same can be said about the 56.5% return the S&P turned in for March 23 through the official end of this period. |

Finally, consider the following YTD returns:

| | | Long | Low | | | |

| | Silver | Treasuries | Volatility | | | |

| Returns | (in USD) | (Bloomberg | Equity | S&P 500 | Russell 2000 | Nasdaq |

| |

| | (MSCI USA | | | |

| |

| Long Treasury) | Min Vol Index) | | | |

| 01/01/2020 | | | | | | |

| to | 57.64% | 20.88% | 0.53% | 9.74% | -5.54% | 39.56% |

| 08/31/2020 | | | | | | |

Source: Bloomberg

This mosaic of dramatic tech stock outperformance, most other equity sectors lagging significantly, and silver—often considered an inflation hedge—appreciating 57.6% when the Fed’s rate policy and liquidity injections are the main supports underneath the market, was troubling.

The punchline is, quite simply, we are living through a very dysfunctional market.

OUTLOOK

The coronavirus continues to spread throughout the world population, with about 25 million cases globally, and 6 million cases in the U.S., as of the end of this period. Each state is attempting to return to their pre-COVID normal, but essentially all are still operating at a reduced capacity. Weekly initial jobless claims have been running above the peak of the Great Financial Crisis for almost six months, and the unemployment rate was at 8.4%. The third quarter 2020 earnings decline for the S&P 500 is currently estimated at -21.8% year-over-year. Despite this context, the S&P 500 set yet another new record high one day before the end of this period.

Essentially all fundamental equity valuation metrics—trailing Price-Earnings (PE) ratio, forward PE ratio, market capitalization to GDP, equity dividend yield, etc.—are at, or near, historic extremes. Also of note is that, because of the highly contentious political climate, the initial fiscal stimulus Congress had passed in response to the coronavirus has now run out. Currently, the Democrats and Republicans are nowhere near agreement on the size or scope of the second round of stimulus; presumably, both sides believe they can blame the other for this failure to deliver more stimulus, and consequently pick up votes in the looming election. Even the election itself is extreme; this election will likely have the highest percentage of absentee ballots ever, and the current Administration has attempted to sow doubt in the integrity of the election in multiple ways.

In light of the dramatic uncertainty facing the United States over the next few months, we anticipate equity volatility to rise from where it currently is, and equity valuations to struggle.

SECURIAN AM FUNDS

One final point we will highlight is that, going forward, we believe fixed income assets will likely be less effective hedges to equity losses in volatile time periods. For example, in the coronavirus selloff, the US 10-year Treasury future returned 7.50% on a rolling 3-month basis, as of March 23, 2020. The corresponding rate move was -1.13%. The current 10-year Treasury rate was only 0.72% at the end of the period. Thus, in the next equity selloff, we believe that Treasuries simply do not have nearly as much room to rally. We view this as yet another reason to be cautious in one’s portfolio construction.

As always, we will continue to use our volatility metrics to inform the equity allocation of the Fund. We will aim to de-risk when we believe volatility will be high, and aim to re-risk when we believe volatility will be low.

SECURIAN AM FUNDS

September 30, 2020

Securian AM Managed Volatility Equity Fund

Managers:

Craig Stapleton, CFA; Jeremy Gogos, CFA; Merlin Erickson

Securian Asset Management

FUND PERFORMANCE UPDATE

For the period September 1, 2019 and ending August 31, 2020, the Managed Volatility Equity Fund (the “Fund”) Institutional Class returned -2.76%, compared to the secondary benchmark return of -1.70%.

The Fund had a realized volatility, as measured by its standard deviation of daily returns, of 11.17%, as compared to the benchmark realized volatility of 23.29% for the same period.

For comparison, the S&P 500 Index (dividend adjusted), which the Fund uses as a broad-based securities market index, was up 21.94% with a volatility of 33.19%, and the MSCI All Cap World Index (“MSCI ACWI”) was up 17.15% with a realized volatility of 26.23% over the same period.

STRATEGY UPDATE

In terms of volatility, this period truly is a tale of two polar opposites. The first half of the period, September of 2019 through most of February 2020, was rather calm, despite troubling underlying geopolitical and economic fundamentals. As we highlighted in our last semi-annual letter, late 2019 saw weakening economic data globally, declining corporate earnings in the U.S., and continued U.S.-China trade conflict. Equity volatility began the period at 21.00% (September 1, 2019), and thanks to the Federal Reserve (Fed) easing monetary policy, volatility drifted lower, ranging between 5.00% to 14.50% for October 2019 through mid-February 2020. As such, the Fund equity exposure began this period at 97.5%, and was maintained between 97.0% and 100.0% from October 2019 through mid-February 2020.

As is widely known, the second half of the period—mid-February 2020 through the end of August 2020—was one of the most volatile and unusual periods in the history of U.S. equity markets. The global lockdown intended to slow the spread of coronavirus had a dramatic economic impact, the full extent of which still isn’t known. March of 2020 proved to be the most volatile calendar month in the S&P 500’s history, seeing 93.4% realized volatility. For context, in the most volatile month from the Great Financial Crisis (GFC)—October of 2008—the S&P 500 realized 80.8% volatility. International markets fared similarly through the initial coronavirus panic; European and Asian indexes drew down approximately 30-40% from mid-February to mid-March, with quite elevated volatility. For 02/15/2020 – 03/18/2020.

| 02/15/20 – | | | | Hang Seng |

| 03/18/20 | EuroStoxx 50 | FTSE 100 (UK) | Nikkei 225 (Japan) | (Hong Kong) |

| Return (%) | -37.94 | -31.26 | -29.75 | -19.28 |

| Volatility (%) | 55.64 | 49.82 | 31.96 | 28.70 |

Source: Bloomberg

SECURIAN AM FUNDS

Because of this extreme volatility, the Fund’s equity exposure was steadily reduced from 99.3% on February 20 to 23.6% on March 18. Ultimately, the MSCI ACWI benchmark drew down -33.70% peak-to-trough in the coronavirus panic; the Fund saw a drawdown of -14.06%.

Thanks to massive intervention from both the Fed and the Federal government, the equity market stabilized, and volatility declined steadily throughout April and May, and apart from a brief pullback in June, the market relentlessly rallied for the rest of the period. Volatility closed out this period at 8.19%, and so the Fund’s equity exposure ended the period at 96.8%.

Another obvious strategy point to address is the large underperformance of the Fund relative to the benchmark for this period. Managed Volatility is a global equity strategy that targets a 10% realized volatility over a full market cycle, and seeks to mitigate severe equity drawdowns. The strategy was very successful in that latter objective. Again, peak to trough, the MSCI ACWI lost -33.70% and the Fund lost -14.06%, a differential of 19.64%. In the subsequent rally, which was overwhelmingly driven by technology stocks, being underweight equity in general, and being more diversified within equity (i.e. lower IT sector exposure), hampered short-term performance significantly. We comment on this current market situation later in this letter; suffice to say for now that we view the extreme gap in “growth vs value” performance that manifested itself, and the resulting index overconcentration in tech stocks, will revert in the future, and so we believe Managed Volatility Equity’s performance will normalize with the broader market.

MARKET SECTOR UPDATE

The record domestic economic expansion finally came to an end in this period, with February of 2020 as the 128th and final month of uninterrupted growth in the U.S. The coronavirus lockdowns ushered in a period of economic contraction unprecedented in the modern era. First quarter of 2020 saw Gross Domestic Product (GDP) shrink -5.0% quarter-over-quarter, and second quarter saw a -31.7% quarter-over-quarter reduction of the same. For context, in the depths of the Great Financial Crisis, the fourth quarter of 2008 saw GDP decline -8.4% quarter-over-quarter.

The historical relationship between this quarter-over-quarter change in GDP, and the S&P 500 trailing 1-year return, is depicted below. The blue dots show the S&P 500 trailing 1-year return vs quarter-over-quarter change in GDP for the second quarter 1947 through first quarter 2020. The red dot shows the S&P 500 return implied by extending the best fit line to the known -31.7 decrease in GDP for second quarter GDP. The green dot shows the actual S&P 500 return.

SECURIAN AM FUNDS

Source: Bloomberg

This is an absurd dislocation of equity valuations from the real economy, even by modern standards. Some other basic market facts we found extremely worrisome:

| | • | Five technology-related companies—Apple, Amazon, Microsoft, Google, and Facebook—now comprise 24.5% of the S&P 500’s total market capitalization, and over 50% of the Nasdaq. This concentration makes any standard equity portfolio very brittle and overexposed to single name risk. |

| | | |

| | • | Over the course of 2019, three of the four quarters saw S&P company earnings decline year-over-year. Fourth quarter 2019’s earnings growth was only 0.9%. As these results were coming to light, and as the coronavirus began to spread outside of China, the S&P made a new record high on February 19, 2020. |

| | | |

| | • | In response to the coronavirus lockdowns, the Federal Reserve cut its policy rate 150 basis points (bps) over the course of 10 days, taking it all the way to 0. In addition, it introduced multiple new programs meant to bolster the economy. Unfortunately, the Fed (technically through the Treasury) is now purchasing corporate bonds to support asset prices, which is not only outside of the Fed’s mandate, but is also a philosophical travesty in a supposedly free market. These new programs have exploded the Fed’s balance sheet, from $4.2 trillion pre-coronavirus, to $7.0 trillion at the end of the period. |

| | | |

| | • | Global negative-yielding debt hit a new record of $16.2 trillion on August 10, 2020. |

| | | |

| | • | In response to the Fed’s implicit promise to support risk asset prices by any means necessary, the S&P 500 aggressively rallied off of its March 23, 2020 low. Its drawdown to that point was -33.9%. Over the next 103 days, it rallied 51.5% to surpass its previous high. This rally is unmatched in the last 87 years; only periods from 1932 and 1933 saw a larger S&P 500 price appreciation in the same number of business days. The same can be said about the 56.5% return the S&P turned in for March 23 through the official end of this period. |

SECURIAN AM FUNDS

Finally, consider the following YTD returns:

| | | Long | Low | | | |

| | Silver | Treasuries | Volatility | | | |

| Returns | (in USD) | (Bloomberg | Equity | S&P 500 | Russell 2000 | Nasdaq |

| |

| | (MSCI USA | | | |

| |

| Long Treasury) | Min Vol Index) | | | |

| 01/01/2020 | | | | | | |

| to | 57.64% | 20.88% | 0.53% | 9.74% | -5.54% | 39.56% |

| 08/31/2020 | | | | | | |

Source: Bloomberg

This mosaic of dramatic tech stock outperformance, most other equity sectors lagging significantly, and silver—often considered an inflation hedge—appreciating 57.6% when the Fed’s rate policy and liquidity injections are the main supports underneath the market, was troubling.

The punchline is, quite simply, we are living through a very dysfunctional market.

OUTLOOK

The coronavirus continues to spread throughout the world population, with about 25 million cases globally, and 6 million cases in the U.S., as of the end of this period. Each state is attempting to return to their pre-COVID normal, but essentially all are still operating at a reduced capacity. Weekly initial jobless claims have been running above the peak of the Great Financial Crisis for almost six months, and the unemployment rate was at 8.4%. The third quarter 2020 earnings decline for the S&P 500 is currently estimated at -21.8% year-over-year. Despite this context, the S&P 500 set yet another new record high one day before the end of this period.

Essentially all fundamental equity valuation metrics—trailing Price-Earnings (PE) ratio, forward PE ratio, market cap to GDP, equity dividend yield, etc.—are at, or near, historic extremes. Also of note is that, because of the highly contentious political climate, the initial fiscal stimulus Congress had passed in response to the coronavirus has now run out. Currently, the Democrats and Republicans are nowhere near agreement on the size or scope of the second round of stimulus; presumably, both sides believe they can blame the other for this failure to deliver more stimulus, and consequently pick up votes in the looming election. Even the election itself is extreme; this election will likely have the highest percentage of absentee ballots ever, and the current Administration has attempted to sow doubt in the integrity of the election in multiple ways.

In light of the dramatic uncertainty facing the United States over the next few months, we anticipate equity volatility to rise from where it currently is, and equity valuations to struggle.

One final point we will highlight is that, going forward, we believe fixed income assets will likely be less effective hedges to equity losses in volatile time periods. For example, in the coronavirus selloff, the US 10-year Treasury future returned 7.50% on a rolling 3-month basis, as of March 23, 2020. The corresponding rate move was -1.13%. The current 10-year rate was only 0.72% at the end of the period. Thus, in the next equity selloff, we believe that Treasuries simply do not have nearly as much room to rally. We view this as yet another reason to be cautious in one’s portfolio construction.

As always, we will continue to use our volatility metrics to inform the equity allocation of the Fund. We will aim to de-risk when we believe volatility will be high, and aim to re-risk when we believe volatility will be low.

SECURIAN AM FUNDS

September 30, 2020

Securian AM Real Asset Income Fund

Managers:

Joseph Betlej, CFA; Lowell Bolken, CFA; Craig Stapleton, CFA

Securian Asset Management

FUND PERFORMANCE UPDATE

For the 12-month period ending August 31, 2020, the return for the Securian AM Real Asset Income Fund’s (the “RAI Fund”) Institutional Class was -14.25%, underperforming the Morningstar U.S. Real Asset Total Return Index at -1.42%, and the RAI Fund secondary benchmark return of -10.04%. The RAI Fund secondary benchmark is a custom benchmark for the RAI Fund, developed by Securian Asset Management. For additional comparison, the S&P 500 Index (dividend adjusted) was up 21.94% during the same period. The RAI Fund’s dividend yield and volatility relative to the S&P 500 Index was consistent with expectations.

The reporting period can be divided into two categories: pre-COVID and post-COVID. On February 19, 2020, the S&P 500 index reached a then-record high Economic conditions were balanced as the global trade wars and disruption of global supply chains weighed on progress, but the consumer continued strong with solid employment markets, retail sales, and lower interest rates boosting the housing markets. However, beginning on February 20 (post-COVID), the broader market began its descent as an accelerating number of COVID cases outside of China and China’s third revision of coronavirus data inspired a fresh wave of risk-off sentiment. News and sentiment continued to turn negative, and the equity market downturn continued through March 23, 2020. The S&P 500 dropped 34% during that 23-day period, but energy, utilities, and real estate all had steeper declines as measured by the secondary custom benchmark’s sub-indices. Despite the real asset nature of energy and commercial real estate, the specter of a severe cessation of usage for both asset types inspired the accelerated sell-off. Utilities, historically regarded as a defensive play, also underperformed the broader market during this 23-day period, which was somewhat of a surprise. This market reaction challenged our efforts to defensively reposition by reducing energy infrastructure and REITs, while increasing utility exposure.

As the Federal Reserve (Fed) launched a massive Quantitative Easing (QE) program and the U.S. Congress passed the CAREs Act in March, the market sharply pivoted. The S&P 500 bounced back with a total return of +57% from March 23 through August 31. The reopening of economies state by state also drove a marked improvement in economic activity: the Atlanta Fed’s GDPNow model forecast for third quarter 2020 currently predicts 32% quarter over quarter growth, which almost mirrors the -32% actual GDP collapse in second quarter. This type of “V” recovery, as in past accelerated movements, tended to overwhelm high-yielding dividend equity stocks over the short term. The result was Fund underperformance during this post-COVID period. As the price of oil (West Texas Intermediate) spent two weeks below $20 (at one point was temporarily negative), our discipline directed us to underweight energy infrastructure, but oil then took a sharp turn upward in May by doubling in price over the course of 5 weeks. On the other hand, even though REITs as a group lagged the broader market as sectors such as retail (particularly theaters and restaurants) and healthcare continued to face operating uncertainties, our efforts to position the Fund to react to this dynamic were successful from the March 23 low. The fixed income portfolio contributed to underperformance, primarily due to the sharp pivot in the equity market in the last week in March, during which the portfolio was conservatively overweight versus the benchmark.

SECURIAN AM FUNDS

STRATEGY UPDATE

Pre-COVID, the portfolio was positioned for growth with overweight positions in REITs and infrastructure, and an underweight in fixed income. The portfolio added defensive securities post-COVID and portfolio holdings in energy infrastructure were reduced on concerns of poor capital discipline, as well as the impact expected from the decline in natural gas pricing.

Anticipating tailwinds from the Fed and the legislative stimulus, we reacted to this second phase of the Post-COVID environment, favoring better growth names in our target sectors. As states re-opened their economies, we rotated into REIT sectors with solid fundamentals that had been heavily discounted given the uncertainty, such as grocery-anchored shopping centers. We refined our focus on energy infrastructure companies to proven management teams that have restructured balance sheets and dialed-back spending plans, yet retained a path for stable income with growth upside. As our individual holdings of preferred securities were called, proceeds were used to fund this rotation to growth. Utilities remain part of our defensive equation, but holdings are subject to valuation discipline and growth potential.

OUTLOOK

Though the equity markets may be pricing in a return to normalcy, it is being supported by a compliant Federal Reserve that appears to be willing to step in as needs arise. Indeed, this may be what is feeding valuations. Unemployment remains elevated, segments of the economy are still closed and/or highly restricted with an uncertain reopening time frame, and timing for vaccine development and distribution is also uncertain. The post-COVID economy may forever be changed with work-from-home and its attendant technological advancements. Finally, the form and direction of the U.S. government may change within the coming months. Prediction of higher market volatility in this environment is hardly courageous.

With that backdrop, we are cautiously optimistic about growth in our sectors relative to where we have been. REITs are especially poised to benefit in many ways (e.g., data centers, wireless towers, warehouse logistics, etc.) that never would have been contemplated in 2019. Energy infrastructure and utilities are rapidly advancing their models to be more Environmental, Social, Governance (ESG)-friendly in an effort to adapt to a new generation of investors. Consistent with our long-term investment history, we expect to position the portfolio in quality companies with strong balance sheets, disciplined capital investment, and above average dividend coverage to position the portfolio for potentially better performance ahead.

Past performance is not a guarantee of future results.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings, please refer to the Schedule of Investments in this report.

Diversification does not assure a profit nor protect against loss in a declining market.

Mutual fund investing involves risk. Principal loss is possible. Investors should be aware of the risks involved with investing in a fund concentrating in a specific industry such as REITs or real estate securities. These include risks such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments. Investing in small and medium-sized companies involves greater risks than those associated with investing in large company stocks, such as business risk, significant stock price fluctuations and illiquidity. The Funds may invest in foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods. Investments in ETFs and ETNs are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares. MLPs are subject to certain risks inherent in the structure of MLPs, including complex tax structure risks, the limited ability for election or removal of management, limited voting

SECURIAN AM FUNDS

rights, potential dependence on parent companies or sponsors for revenues to satisfy obligations, and potential conflicts of interest between partners, members and affiliates. The Funds may also use options and future contracts, which have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities prices, interest rates and currency exchange rates. Covered calls may limit the upside potential of the underlying security. Interest payments on TIPS are unpredictable and will fluctuate as the principal and corresponding interest payments are adjusted for inflation. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in asset backed and mortgage backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Municipal securities are subject to adverse political or economic factors, including changes in the tax law. Derivatives involve special risks including leverage, correlation, counterparty, liquidity, operational, accounting and tax risks. These risks, in certain cases, may be greater than the risks presented by more traditional investments. The Funds may invest in illiquid securities which involve the risk that the securities will not be able to be sold at the time or prices desired by the fund, particularly during times of market turmoil.

The Dynamic Managed Volatility Benchmark is a custom benchmark created by Securian Asset Management, comprised of 60% S&P 500 Index and 40% Bloomberg Barclays U.S. Aggregate Index. The S&P 500 Index is an unmanaged, market-value weighted index of stocks, which is widely regarded as the standard for measuring large-cap U.S. stock market performance. The Bloomberg Barclays U.S. Aggregate Index is an unmanaged, market-value weighted index of bonds, which is widely regarded as the standard for measuring investment grade bond performance.

The Managed Volatility Equity Fund secondary benchmark is a custom benchmark created by Securian Asset Management, comprised of 60% S&P 500 Low Volatility Index; 20% S&P BMI International Developed Low Volatility Index; and 20% Bloomberg Barclays U.S. 3 Month Treasury Bellwether Index. The S&P 500 Low Volatility Index measures the performance of the 100 least volatile stocks in the S&P 500 Index based on their historical volatility. The S&P BMI International Developed Low Volatility Index measures the performance of the 200 least volatile stocks in the S&P Developed Market large/midcap universe. Constituents are weighted relative to the inverse of their corresponding volatility, with the least volatile stocks receiving the highest weights. The Bloomberg Barclays U.S. 3 Month Treasury Bellwether Index measures the performance of U.S. Treasury Bills with a maturity of less than three months.

The Real Asset Income Benchmark is the Morningstar® US Real Asset IndexSM, which is a broadly diversified index that meets the needs of real-asset investors. To maintain broad exposure and diversification, the index will maintain a weight allocation at each rebalance of: 40% Treasury Inflation-Protected Securities, or TIPS; 30% commodities; 15% real estate investment trusts, or REITs; 10% upstream commodity stocks; and 5% master limited partnerships, or MLPs.

The secondary Real Asset Income Benchmark is a custom benchmark created by Securian Asset Management, it is comprised of 54% FTSE NAREIT Equity REITs Index; 12% S&P 500 Utilities Index; 12% Alerian MLP Total Return Index; 12% Bloomberg Barclays Capital US Government Inflation Linked Bond Index; and 10% Wells Fargo Hybrid & Preferred REIT. Alerian MLP Total Return Index – a composite of the 50 most prominent energy Master Limited Partnerships (MLPs). Bloomberg Barclays Capital US Government Inflation Linked Bond Index – an index that includes publicly issued, U.S. Treasury inflation protected securities that have at least 1 year remaining to maturity of index rebalancing date, with an issue size equal to or in excess of $500 million. The S&P 500 Utilities Index – an index of those companies included in the S&P 500 that are classified as members of the GICS® utilities sector. Wells Fargo Hybrid & Preferred REIT Index – an index composed exclusively of preferred shares and depository shares designed to track the performance of preferred securities issued in the U.S. markets by Real Estate Investment Trusts (REITs). FTSE NAREIT Equity REITs Index – an index of publicly traded U.S. real estate equity securities.

The MSCI ACWI Index captures large and mid-cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. The Index covers approximately 85% of the global investable opportunity set. The returns are shown net of foreign dividend withholding taxes.

The Euro Stoxx 50 provides blue-chip representation of supersector leaders in the Eurozone. The index covers 50 stocks from 11 Eurozone countries: Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain.

The Nikkei 225 Index is a price-weighted index comprised of Japan’s top 225 blue-chip companies traded on the Tokyo Stock Exchange.

The Bloomberg Barclays U.S. Long Treasury Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury with 10 years or more to maturity.

The MSCI USA Minimum Volatility Index aims to reflect the performance characteristics of a minimum variance strategy applied to the large and mid-cap USA equity universe.

SECURIAN AM FUNDS

The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The NASDAQ Composite is calculated under a market capitalization weighted methodology index.

The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

The FTSE 100 Index is a market-capitalization weighted index of UK-listed blue-chip companies. The index is part of the FTSE UK Series and is designed to measure the performance of the 100 largest companies traded on the London Stock Exchange that pass screening for size and liquidity.

The Hang Seng Index is a market capitalization-weighted index of the largest companies that trade on the Hong Kong Exchange, covering approximately 65% of its total market capitalization.

Drawdown refers to the peak-to-trough decline during a specific period for an investment.

Trailing price-to-earnings ratio is a relative valuation multiple that is based on stock price divided by the trailing earnings per share for the past 12 months.

Forward price-to-earnings ratio is a relative valuation multiple that is based on stock price divided by the future forecasted earnings per share.

Market capitalization to GDP is a ratio used to determine whether an overall market is undervalued or overvalued compared to a historical average.

Standard deviation measures the dispersion of a set of data from its mean.

A basis point is a common unit of measurement for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01% (0.0001), and is used to denote percentage change in a financial instrument.

Dividend yield is calculated by annualizing the last quarterly dividend paid and dividing it by the current share price. The dividend yield is that of the securities held in the portfolio; it is not reflective of the yield distributed to shareholders.

Must be preceded or accompanied by a current prospectus.

Quasar Distributors, LLC, distributor.

Earnings growth is not a measure of the Fund’s future performance.

A stock may trade with more or less liquidity than a bond depending on the number of shares and bonds outstanding, the size of the company, and the demand for the securities. Silver is considered a commodity and liquidity is based on buying or selling an asset easily without disrupting price in a market. Treasury notes are guaranteed by the U.S. government and thus they are considered to be safer than other asset classes.

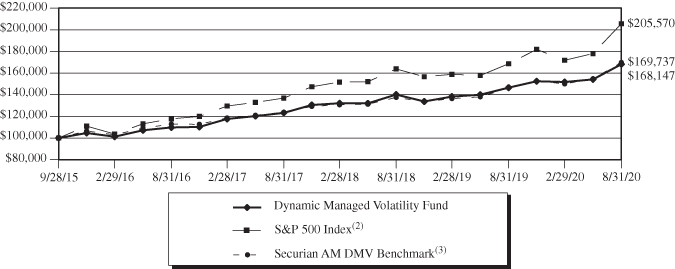

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Value of $100,000 Investment (Unaudited)

The chart assumes an initial investment of $100,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-824-1355. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return (%) – As of August 31, 2020 (Unaudited)

| | One Year | Three Years | Since Inception(1) |

| Dynamic Managed Volatility Fund | 14.76% | 10.92% | 11.13% |

S&P 500 Index(2) | 21.94% | 14.52% | 15.75% |

Securian AM DMV Benchmark(3) | 16.20% | 11.08% | 11.34% |

| (1) | September 28, 2015. |

| (2) | The Standard & Poor’s 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This Index cannot be invested in directly. |

| (3) | The Securian AM DMV Benchmark is comprised of 60% S&P 500 Index and 40% Bloomberg Barclays U.S. Aggregate Bond Index. This Index cannot be invested in directly. |

The following is expense information for the Securian AM Dynamic Managed Volatility Fund as disclosed in the Fund’s most recent prospectus dated December 29, 2019:

Gross Expenses: 0.99%; Net Expenses: 0.61%. Securian Asset Management, Inc. (the “Adviser” or “Securian AM”) has contractually agreed to waive its management fees and pay Fund expenses, in order to ensure that Total Annual Fund Operating Expenses (excluding acquired fund fees and expenses, leverage/borrowing, interest, interest expense, dividends paid on short sales, taxes, brokerage commissions and extraordinary expenses) do not exceed 0.55% of the average daily net assets of the Institutional Class. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and/or expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite, but cannot be terminated through at least December 29, 2020. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser.

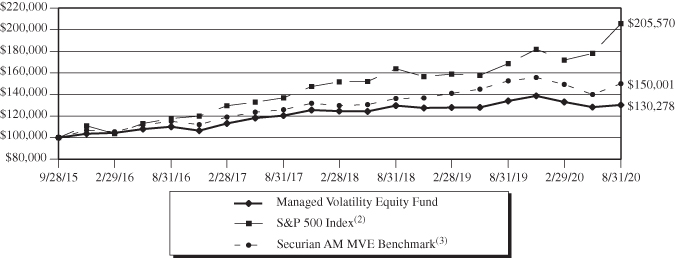

SECURIAN AM MANAGED VOLATILITY EQUITY FUND

Value of $100,000 Investment (Unaudited)

The chart assumes an initial investment of $100,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-824-1355. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return (%) – As of August 31, 2020 (Unaudited)

| | One Year | Three Years | Since Inception(1) |

| Managed Volatility Equity Fund | -2.76% | 2.66% | 5.52% |

S&P 500 Index(2) | 21.94% | 14.52% | 15.75% |

Securian AM MVE Benchmark(3) | -1.70% | 6.01% | 8.58% |

| (1) | September 28, 2015. |

| (2) | The Standard & Poor’s 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This Index cannot be invested in directly. |

| (3) | The Securian AM MVE Benchmark is comprised of 60% S&P 500 Low Volatility Index, 20% S&P BMI International Developed Low Volatility Index, and 20% Bloomberg Barclays U.S. 3 Month Treasury Bellwether Index. This Index cannot be invested in directly. |

The following is expense information for the Securian AM Managed Volatility Equity Fund as disclosed in the Fund’s most recent prospectus dated December 29, 2019:

Gross Expenses: 1.21%; Net Expenses: 0.72%. Securian Asset Management, Inc. (the “Adviser” or “Securian AM”) has contractually agreed to waive its management fees and pay Fund expenses, in order to ensure that Total Annual Fund Operating Expenses (excluding acquired fund fees and expenses, leverage/borrowing interest, interest expense, dividends paid on short sales, taxes, brokerage commissions and extraordinary expenses) do not exceed 0.55% of the average daily net assets of the Institutional Class. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and/or expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite but cannot be terminated through at least December 29, 2020. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser.

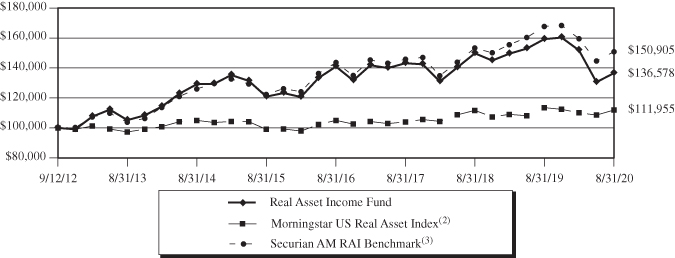

SECURIAN AM REAL ASSET INCOME FUND

Value of $100,000 Investment (Unaudited)

The chart assumes an initial investment of $100,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-824-1355. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return (%) – As of August 31, 2020 (Unaudited)

| | One Year | Three Years | Five Years | Since Inception(1) |

| Real Asset Income Fund | -14.25% | -1.57% | 2.47% | 3.99% |

Morningstar US Real Asset Index(2) | -1.42% | 2.47% | 2.47% | 1.43% |

Securian AM RAI Benchmark(3) | -10.04% | 1.16% | 4.28% | 5.30% |

| (1) | September 12, 2012. |

| (2) | The Morningstar US Real Asset Index is a diversified portfolio of four different asset classes that have historically displayed high sensitivity to inflation. These four asset classes are U.S. Treasury inflation-protected securities (“TIPS”), commodity futures-based strategies, real estate investment trusts (“REITs”), and inflation-sensitive equities such as upstream commodity stocks and master limited partnerships. This Index cannot be invested in directly. |

| (3) | The Securian AM RAI Benchmark is comprised of 54% FTSE NAREIT Equity REITs Index; 12% S&P 500 Utilities Index; 12% Alerian MLP Total Return Index; 12% Bloomberg Barclays Capital U.S. Government Inflation Linked Bond Index; and 10% Wells Fargo Hybrid & Preferred REIT Index. This Index cannot be invested in directly. |

The following is expense information for the Securian AM Real Asset Income Fund as disclosed in the Fund’s most recent prospectus dated December 29, 2019:

Gross Expenses: 1.04%; Net Expenses: 0.77%. Securian Asset Management, Inc. (the “Adviser” or “Securian AM”) has contractually agreed to waive its management fees and pay Fund expenses, in order to ensure that Total Annual Fund Operating Expenses (excluding acquired fund fees and expenses, leverage/borrowing interest, interest expense, dividends paid on short sales, taxes, brokerage commissions and extraordinary expenses) do not exceed 0.75% of the average daily net assets of the Institutional Class. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and/or expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite but cannot be terminated through at least December 29, 2020. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser.

SECURIAN AM FUNDS

Expense Examples (Unaudited)

August 31, 2020

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (March 1, 2020 – August 31, 2020).

ACTUAL EXPENSES

For each class, the first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Securian AM Dynamic Managed Volatility Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (3/1/2020) | (8/31/2020) | (3/1/2020 to 8/31/2020) |

Dynamic Managed Volatility Fund Actual(2) | $1,000.00 | $1,108.10 | $2.91 |

| Dynamic Managed Volatility Fund Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,022.37 | $2.80 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.55%, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended August 31, 2020 of 10.81%. |

SECURIAN AM FUNDS

Expense Examples (Unaudited) – Continued

August 31, 2020

Securian AM Managed Volatility Equity Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(3) |

| | (3/1/2020) | (8/31/2020) | (3/1/2020 to 8/31/2020) |

Managed Volatility Equity Fund Actual(4) | $1,000.00 | $ 979.30 | $2.74 |

| Managed Volatility Equity Fund Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,022.37 | $2.80 |

| (3) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.55%, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

| (4) | Based on the actual returns for the six-month period ended August 31, 2020 of -2.07%. |

Securian AM Real Asset Income Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(5) |

| | (3/1/2020) | (8/31/2020) | (3/1/2020 to 8/31/2020) |

Real Asset Income Fund Actual(6) | $1,000.00 | $ 899.60 | $3.58 |

| Real Asset Income Fund Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,021.37 | $3.81 |

| (5) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.75%, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

| (6) | Based on the actual returns for the six-month period ended August 31, 2020 of -10.04%. |

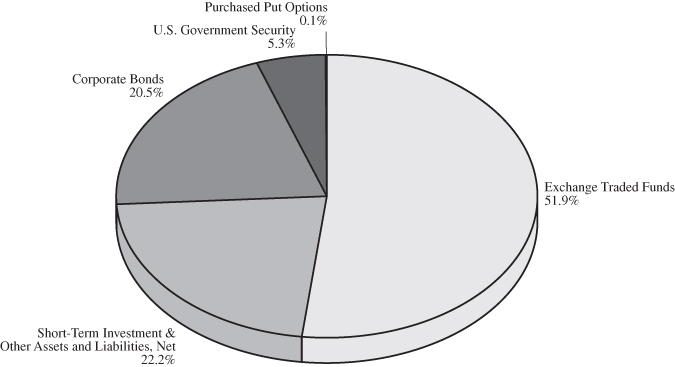

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Asset Allocation (Unaudited)

As of August 31, 2020(1)

(% of net assets)

Top Ten Holdings (Unaudited)

As of August 31, 2020(1)(2)

(% of net assets)

| iShares Core S&P 500 Fund | | | 42.6 | % |

| iShares iBoxx $ Investment Grade Corporate Bond Fund | | | 9.3 | % |

| U.S. Treasury Bond, 2.625%, 12/15/2021 | | | 5.3 | % |

| Takeda Pharmaceutical, 5.000%, 11/26/2028 | | | 0.9 | % |

| E*TRADE Financial, 2.950%, 08/24/2022 | | | 0.8 | % |

| Abbott Laboratories, 4.750%, 04/15/2043 | | | 0.6 | % |

| AT&T, 4.500%, 05/15/2035 | | | 0.5 | % |

| Sherwin-Williams, 3.950%, 01/15/2026 | | | 0.5 | % |

| Florida Gas Transmission, 4.350%, 07/15/2025 | | | 0.5 | % |

| Verizon Communications, 5.250%, 03/16/2037 | | | 0.5 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Short-term investments and derivatives are not included. |

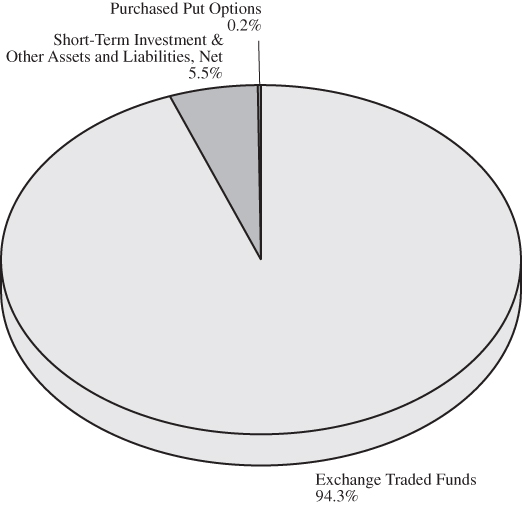

SECURIAN AM MANAGED VOLATILITY EQUITY FUND

Asset Allocation (Unaudited)

As of August 31, 2020(1)

(% of net assets)

Fund Holdings (Unaudited)

As of August 31, 2020(1)(2)

(% of net assets)

| iShares MSCI USA Minimum Volatility Fund | | | 32.7 | % |

| iShares MSCI EAFE Minimum Volatility Fund | | | 26.9 | % |

| iShares Core High Dividend Fund | | | 19.0 | % |

| iShares MSCI Emerging Markets Minimum Volatility Fund | | | 6.8 | % |

| iShares MSCI Germany Fund | | | 4.7 | % |

| iShares Short Maturity Bond Fund | | | 4.2 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Short-term investments and derivatives are not included. |

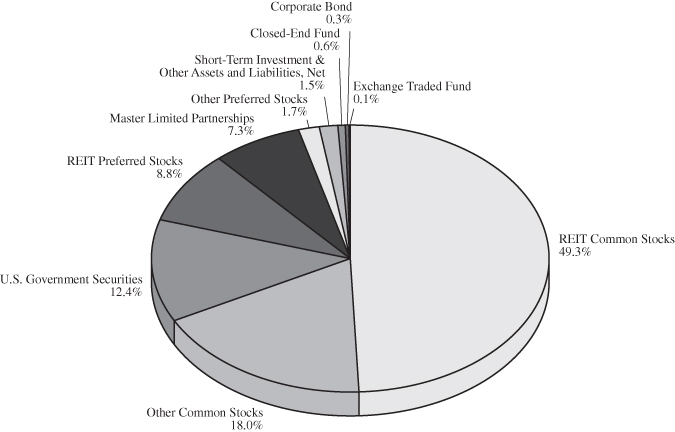

SECURIAN AM REAL ASSET INCOME FUND

Asset Allocation (Unaudited)

As of August 31, 2020(1)

(% of net assets)

Top Ten Holdings (Unaudited)

As of August 31, 2020(1)(2)

(% of net assets)

| Prologis | | | 2.9 | % |

| Digital Realty Trust | | | 2.9 | % |

| Equinix | | | 2.4 | % |

| U.S. Treasury Bond, 2.375%, 01/15/2025 | | | 2.4 | % |

| Crown Castle International | | | 2.4 | % |

| STAG Industrial | | | 2.1 | % |

| U.S. Treasury Bond, 0.125%, 07/15/2024 | | | 1.8 | % |

| Public Storage | | | 1.7 | % |

| U.S. Treasury Bond, 0.125%, 07/15/2024 | | | 1.7 | % |

| Welltower | | | 1.6 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Short-term investments are not included. |

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Schedule of Investments

August 31, 2020

| | | | | | Fair | |

| | | Shares | | | Value | |

| EXCHANGE TRADED FUNDS – 51.9% | | | | | | |

iShares Core S&P 500 Fund (a)(b) | | | 80,666 | | | $ | 28,295,213 | |

iShares iBoxx $ Investment Grade Corporate Bond Fund | | | 45,500 | | | | 6,169,800 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $22,820,471) | | | | | | | 34,465,013 | |

| | | | | | | | | |

| | | Par | | | | | |

| CORPORATE BONDS – 20.5% | | | | | | | | |

| | | | | | | | | |

| Airlines – 0.2% | | | | | | | | |

British Airways | | | | | | | | |

Series 2013-1 | | | | | | | | |

4.625%, 12/20/2025 (c) | | $ | 171,161 | | | | 164,177 | |

| | | | | | | | | |

| Banks – 1.5% | | | | | | | | |

Barclays | | | | | | | | |

4.375%, 01/12/2026 (d) | | | 200,000 | | | | 227,969 | |

JPMorgan Chase | | | | | | | | |

4.500%, 01/24/2022 | | | 250,000 | | | | 264,488 | |

PNC Bank | | | | | | | | |

2.450%, 07/28/2022 | | | 250,000 | | | | 259,556 | |

Synchrony Bank | | | | | | | | |

3.000%, 06/15/2022 | | | 250,000 | | | | 258,541 | |

| | | | | | | | 1,010,554 | |

| | | | | | | | | |

| Chemicals – 1.0% | | | | | | | | |

Sherwin-Williams | | | | | | | | |

3.950%, 01/15/2026 | | | 300,000 | | | | 342,440 | |

Yara International | | | | | | | | |

4.750%, 06/01/2028 (c)(d) | | | 250,000 | | | | 292,684 | |

| | | | | | | | 635,124 | |

| | | | | | | | | |

| Consumer Discretionary – 0.9% | | | | | | | | |

CBS | | | | | | | | |

3.500%, 01/15/2025 | | | 300,000 | | | | 331,401 | |

Harley-Davidson Financial Services | | | | | | | | |

3.550%, 05/21/2021 (c) | | | 250,000 | | | | 253,703 | |

| | | | | | | | 585,104 | |

| | | | | | | | | |

| Consumer Staples – 0.3% | | | | | | | | |

CVS Health | | | | | | | | |

6.943%, 01/10/2030 | | | 183,714 | | | | 218,217 | |

See Notes to the Financial Statements

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Schedule of Investments – Continued

August 31, 2020

| | | | | | Fair | |

| | | Par | | | Value | |

| CORPORATE BONDS – 20.5% (Continued) | | | | | | |

| | | | | | | |

| Diversified Financial Services – 2.8% | | | | | | |

American Express | | | | | | |

2.500%, 08/01/2022 | | $ | 250,000 | | | $ | 259,551 | |

Capital One Financial | | | | | | | | |

4.250%, 04/30/2025 | | | 250,000 | | | | 285,838 | |

E*TRADE Financial | | | | | | | | |

2.950%, 08/24/2022 | | | 500,000 | | | | 522,746 | |

First American Financial | | | | | | | | |

4.600%, 11/15/2024 | | | 200,000 | | | | 215,497 | |

Invesco Financial | | | | | | | | |

3.750%, 01/15/2026 (d) | | | 250,000 | | | | 282,143 | |

Total System Services | | | | | | | | |

4.800%, 04/01/2026 | | | 250,000 | | | | 294,938 | |

| | | | | | | | 1,860,713 | |

| Energy – 2.6% | | | | | | | | |

Florida Gas Transmission | | | | | | | | |

4.350%, 07/15/2025 (c) | | | 300,000 | | | | 341,935 | |

ONEOK | | | | | | | | |

4.000%, 07/13/2027 | | | 250,000 | | | | 261,509 | |

Phillips 66 | | | | | | | | |

4.650%, 11/15/2034 | | | 200,000 | | | | 243,668 | |

Valero Energy | | | | | | | | |

3.650%, 03/15/2025 | | | 300,000 | | | | 329,127 | |

4.350%, 06/01/2028 | | | 250,000 | | | | 285,269 | |

Williams Partners | | | | | | | | |

3.750%, 06/15/2027 | | | 250,000 | | | | 276,374 | |

| | | | | | | | 1,737,882 | |

| Health Care – 0.6% | | | | | | | | |

Abbott Laboratories | | | | | | | | |

4.750%, 04/15/2043 | | | 300,000 | | | | 415,744 | |

| | | | | | | | | |

| Industrial – 1.3% | | | | | | | | |

General Dynamics | | | | | | | | |

3.500%, 05/15/2025 | | | 250,000 | | | | 281,081 | |

Textron | | | | | | | | |

4.000%, 03/15/2026 | | | 250,000 | | | | 276,081 | |

Tyco Electronics Group | | | | | | | | |

3.700%, 02/15/2026 (d) | | | 250,000 | | | | 280,278 | |

| | | | | | | | 837,440 | |

See Notes to the Financial Statements

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Schedule of Investments – Continued

August 31, 2020

| | | | | | Fair | |

| | | Par | | | Value | |

| CORPORATE BONDS – 20.5% (Continued) | | | | | | |

| | | | | | | |

| Insurance – 2.8% | | | | | | |

Allied World Assurance Company Holdings | | | | | | |

4.350%, 10/29/2025 (d) | | $ | 250,000 | | | $ | 261,947 | |

Assured Guaranty US Holdings | | | | | | | | |

5.000%, 07/01/2024 | | | 200,000 | | | | 225,847 | |

Hanover Insurance Group | | | | | | | | |

4.500%, 04/15/2026 | | | 250,000 | | | | 281,365 | |

Horace Mann Educators | | | | | | | | |

4.500%, 12/01/2025 | | | 250,000 | | | | 275,572 | |

Liberty Mutual Group | | | | | | | | |

4.250%, 06/15/2023 (c) | | | 250,000 | | | | 274,633 | |

Manulife Financial | | | | | | | | |

4.150%, 03/04/2026 (d) | | | 250,000 | | | | 296,239 | |

Old Republic International | | | | | | | | |

4.875%, 10/01/2024 | | | 200,000 | | | | 223,491 | |

| | | | | | | | 1,839,094 | |

| | | | | | | | | |

| Pharmaceuticals – 0.9% | | | | | | | | |

Takeda Pharmaceutical | | | | | | | | |

5.000%, 11/26/2028 (d) | | | 500,000 | | | | 620,064 | |

| | | | | | | | | |

| Real Estate Investment Trusts – 1.7% | | | | | | | | |

Alexandria Real Estate Equities | | | | | | | | |

4.300%, 01/15/2026 | | | 200,000 | | | | 232,578 | |

Essex Portfolio | | | | | | | | |

3.500%, 04/01/2025 | | | 300,000 | | | | 332,146 | |

Healthcare Trust of America Holdings | | | | | | | | |

3.750%, 07/01/2027 | | | 250,000 | | | | 273,139 | |

Kimco Realty | | | | | | | | |

3.400%, 11/01/2022 | | | 250,000 | | | | 263,080 | |

| | | | | | | | 1,100,943 | |

| | | | | | | | | |

| Technology – 0.5% | | | | | | | | |

Hewlett Packard Enterprise | | | | | | | | |

4.900%, 10/15/2025 | | | 100,000 | | | | 115,679 | |

Juniper Networks | | | | | | | | |

4.500%, 03/15/2024 | | | 200,000 | | | | 224,942 | |

| | | | | | | | 340,621 | |

See Notes to the Financial Statements

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Schedule of Investments – Continued

August 31, 2020

| | | | | | Fair | |

| | | Par | | | Value | |

| CORPORATE BONDS – 20.5% (Continued) | | | | | | |

| | | | | | | |

| Telecommunications – 2.0% | | | | | | |

AT&T | | | | | | |

4.500%, 05/15/2035 | | $ | 300,000 | | | $ | 359,846 | |

Comcast | | | | | | | | |

4.650%, 07/15/2042 | | | 250,000 | | | | 324,079 | |

Verizon Communications | | | | | | | | |

5.250%, 03/16/2037 | | | 250,000 | | | | 340,010 | |

Vodafone Group | | | | | | | | |

4.125%, 05/30/2025 (d) | | | 250,000 | | | | 287,048 | |

| | | | | | | | 1,310,983 | |

| | | | | | | | | |

| Transportation – 1.1% | | | | | | | | |

Kansas City Southern | | | | | | | | |

4.300%, 05/15/2043 | | | 250,000 | | | | 259,189 | |

Penske Truck Leasing / PTL Finance | | | | | | | | |

3.300%, 04/01/2021 (c) | | | 200,000 | | | | 202,805 | |

3.900%, 02/01/2024 (c) | | | 250,000 | | | | 271,872 | |

| | | | | | | | 733,866 | |

| | | | | | | | | |

| Utilities – 0.3% | | | | | | | | |

Oglethorpe Power | | | | | | | | |

4.250%, 04/01/2046 | | | 200,000 | | | | 216,398 | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $12,093,099) | | | | | | | 13,626,924 | |

| | | | | | | | | |

| U.S. GOVERNMENT SECURITY – 5.3% | | | | | | | | |

| | | | | | | | | |

| U.S Treasury Bond – 5.3% | | | | | | | | |

2.625%, 12/15/2021 | | | | | | | | |

| Total U.S. Government Securities | | | | | | | | |

| (Cost $3,386,597) | | | 3,400,000 | | | | 3,508,574 | |

See Notes to the Financial Statements

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Schedule of Investments – Continued

August 31, 2020

| | | | | | | | | Fair | |

| | | Contracts | | | Notional | | | Value | |

| PURCHASED PUT OPTIONS – 0.1% | | | | | | | | | |

CBOE S&P 500 Index (e) | | | | | | | | | |

Expiration: September 2020, Exercise Price: $3,160 | | | 10 | | | $ | 3,160,000 | | | $ | 9,700 | |

Expiration: September 2020, Exercise Price: $3,175 | | | 10 | | | | 3,175,000 | | | | 10,300 | |

| | | | | | | | | | | | 20,000 | |

CBOE VIX Index (e) | | | | | | | | | | | | |

Expiration: October 2020, Exercise Price: $26 | | | 236 | | | | 613,600 | | | | 28,320 | |

Expiration: October 2020, Exercise Price: $27 | | | 236 | | | | 637,200 | | | | 37,760 | |

| | | | | | | | | | | | 66,080 | |

| Total Purchased Put Options | | | | | | | | | | | | |

| (Cost $193,383) | | | | | | | | | | | 86,080 | |

| | | | | | | | | | | | | |

| | | | | | | Shares | | | | | |

| SHORT-TERM INVESTMENT – 20.3% | | | | | | | | | | | | |

First American Government Obligations Fund, Class X, 0.07% (f) | | | | | | | | | | | | |

| (Cost $13,469,114) | | |

| | | | 13,469,114 | | | | 13,469,114 | |

| Total Investments – 98.1% | | | | | | | | | | | | |

| (Cost $51,962,664) | | | | | | | | | | | 65,155,705 | |

| Other Assets and Liabilities, Net – 1.9% | | | | | | | | | | | 1,283,281 | |

| Total Net Assets – 100.0% | | | | | | | | | | $ | 66,438,986 | |

| (a) | All or a portion of this security is designated as collateral for futures contracts. As of August 31, 2020, the fair value of collateral was $26,307,750. |

| (b) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (c) | Security purchased within the terms of a private placement memorandum, exempt from registration under Rule 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “qualified institutional buyers.” As of August 31, 2020, the fair value of these investments were $1,801,809, or 2.7% of total net assets. |

| (d) | Foreign Security. The Fund had $2,548,372 or 3.8% of net assets in foreign securities at August 31, 2020. |

| (e) | Held in connection with written option contracts. See Schedule of Written Options for further information. |

| (f) | The rate shown is the annualized seven-day effective yield as of August 31, 2020. |

See Notes to the Financial Statements

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Schedule of Open Futures Contracts

August 31, 2020

| Futures Contracts Purchased | | | | | |

| | Number of | | | | |

| | Contracts | Expiration | Notional | Fair | Unrealized |

Description | Purchased | Date | Amount | Value | Appreciation |

E-mini S&P 500 Index | 127 | September 2020 | $22,218,015 | $(34,925) | $1,323,663 |

| | | | | | |

| Futures Contracts Sold | | | | | |

| | Number of | | | | |

| | Contracts | Expiration | Notional | Fair | Unrealized |

Description | Sold | Date | Amount | Value | Depreciation |

Ultra U.S. Treasury Bond Futures | 3 | December 2020 | $ 478,310 | $(1,461) | $(1,461) |

U.S. Treasury 5 Year Note Futures | 25 | December 2020 | 3,150,780 | (1,427) | (1,427) |

| | | | | | $(2,888) |

Schedule of Written Options

August 31, 2020

| | | Contracts | Expiration | Notional | Exercise | Fair |

Description | Call/Put | Written | Date | Amount | Price | Value |

CBOE S&P 500 Index* | | | | | | |

(Premiums received $8,984) | Put | 10 | September 2020 | $2,820,000 | $2,820 | $2,950 |

CBOE S&P 500 Index* | | | | | | |

(Premiums received $8,127) | Put | 10 | September 2020 | 2,830,000 | 2,830 | 3,050 |

CBOE VIX Index* | | | | | | |

(Premiums received $28) | Put | 14 | October 2020 | 21,000 | 15 | 35 |

| | | | | | | $6,035 |

* | Held in connection with purchased option contracts. See Schedule of Investments for further information. |

See Notes to the Financial Statements

SECURIAN AM MANAGED VOLATILITY EQUITY FUND

Schedule of Investments

August 31, 2020

| | | | | | Fair | |

| | | Shares | | | Value | |

| EXCHANGE TRADED FUNDS – 94.3% | | | | | | |

iShares Core High Dividend Fund (a) | | | 69,707 | | | $ | 5,906,274 | |

iShares MSCI EAFE Minimum Volatility Fund (b) | | | 121,046 | | | | 8,336,438 | |

iShares MSCI Emerging Markets Minimum Volatility Fund | | | 38,086 | | | | 2,120,628 | |

iShares MSCI Germany Fund | | | 48,596 | | | | 1,462,740 | |

iShares MSCI USA Minimum Volatility Fund (a)(b) | | | 156,014 | | | | 10,161,192 | |

iShares Short Maturity Bond Fund | | | 26,125 | | | | 1,310,169 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $22,558,284) | | | | | | | 29,297,441 | |

| | | Contracts |

|

| Notional | | | | |

| PURCHASED PUT OPTIONS – 0.2% | | | | | | | | | |

CBOE S&P 500 Index (c) | | | | | | | | | |

Expiration: September 2020, Exercise Price: $3,160 | | | 7 | | | $ | 2,212,000 | | | | 6,790 | |

Expiration: September 2020, Exercise Price: $3,175 | | | 7 | | | | 2,222,500 | | | | 7,210 | |

| | | | | | | | | | | | 14,000 | |

CBOE VIX Index (c) | | | | | | | | | | | | |

Expiration: October 2020, Exercise Price: $26 | | | 117 | | | | 304,200 | | | | 14,040 | |

Expiration: October 2020, Exercise Price: $27 | | | 117 | | | | 315,900 | | | | 18,720 | |

| | | | | | | | | | | | 32,760 | |

| Total Purchased Put Options | | | | | | | | | | | | |

| (Cost $109,318) | | | | | | | | | | | 46,760 | |

| | | Shares | | | | |

| SHORT-TERM INVESTMENT – 1.0% | | | | | | |

First American Government Obligations Fund, Class X, 0.07% (d) | | | | | | |

| (Cost $309,948) | | | 309,948 | | | | 309,948 | |

| Total Investments – 95.5% | | | | | | | | |

| (Cost $22,977,550) | | | | | | | 29,654,149 | |

| Other Assets and Liabilities, Net – 4.5% | | | | | | | 1,413,521 | |

| Total Net Assets – 100.0% | | | | | | $ | 31,067,670 | |

| (a) | All or a portion of this security is designated as collateral for futures contracts. As of August 31, 2020, the fair value of the collateral was $10,725,894. |

| (b) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (c) | Held in connection with written option contracts. See Schedule of Written Options for further information. |

| (d) | The rate shown is the annualized seven-day effective yield as of August 31, 2020. |

| | |

See Notes to the Financial Statements

SECURIAN AM MANAGED VOLATILITY EQUITY FUND

Schedule of Open Futures Contracts

August 31, 2020

Futures Contracts Purchased

| | Number of | | | | |

| | Contracts | Expiration | Notional | Fair | Unrealized |

Description | Purchased | Date | Amount | Value | Appreciation |

E-mini S&P 500 Index | 12 | September 2020 | $2,099,340 | $(3,300) | $99,457 |

Schedule of Written Options

August 31, 2020

| | | Contracts | Expiration | Notional | Exercise | Fair |

Description | Call/Put | Written | Date | Amount | Price | Value |

CBOE S&P 500 Index* | | | | | | |

(Premiums received $6,289) | Put | 7 | September 2020 | $1,974,000 | $2,820 | $2,065 |

CBOE S&P 500 Index* | | | | | | |

(Premiums received $5,689) | Put | 7 | September 2020 | 1,981,000 | 2,830 | 2,135 |

CBOE VIX Index* | | | | | | |

(Premiums received $12) | Put | 6 | October 2020 | 9,000 | 15 | 15 |

| | | | | | | $4,215 |

* | Held in connection with purchased option contracts. See Schedule of Investments for further information. |

See Notes to the Financial Statements

SECURIAN AM REAL ASSET INCOME FUND

Schedule of Investments

August 31, 2020

| | | | | | Fair | |

| | | Shares | | | Value | |

| REIT COMMON STOCKS – 49.3% | | | | | | |

| | | | | | | |

| Health Care – 7.1% | | | | | | |

CareTrust REIT | | | 31,612 | | | $ | 612,324 | |

Healthcare Trust of America, Class A | | | 16,114 | | | | 425,249 | |

Healthpeak Properties | | | 37,113 | | | | 1,025,803 | |

National Health Investors | | | 6,281 | | | | 390,992 | |

OMEGA Healthcare Investors | | | 17,578 | | | | 544,391 | |

Physicians Realty Trust | | | 26,100 | | | | 473,715 | |

Ventas | | | 5,600 | | | | 230,776 | |

Welltower | | | 19,064 | | | | 1,096,561 | |

| | | | | | | | 4,799,811 | |

| | | | | | | | | |

| Hotels – 0.7% | | | | | | | | |

DiamondRock Hospitality | | | 13,100 | | | | 69,430 | |

Host Hotels & Resorts | | | 15,600 | | | | 175,188 | |

RLJ Lodging Trust | | | 12,500 | | | | 118,000 | |

Summit Hotel Properties | | | 15,600 | | | | 91,884 | |

| | | | | | | | 454,502 | |

| | | | | | | | | |

| Industrial – 5.4% | | | | | | | | |

Americold Realty Trust | | | 3,300 | | | | 126,555 | |

Industrial Logistics Properties Trust | | | 7,248 | | | | 156,340 | |

Prologis | | | 19,601 | | | | 1,996,558 | |

STAG Industrial | | | 43,084 | | | | 1,391,613 | |

| | | | | | | | 3,671,066 | |

| | | | | | | | | |

| Mortgage – 0.7% | | | | | | | | |

Blackstone Mortgage Trust, Class A | | | 16,247 | | | | 386,191 | |

Starwood Property Trust | | | 5,125 | | | | 79,950 | |

| | | | | | | | 466,141 | |

| | | | | | | | | |

| Multi-Family – 8.2% | | | | | | | | |

American Campus Communities | | | 6,600 | | | | 223,740 | |

Apartment Investment & Management Company, Class A | | | 503 | | | | 18,123 | |

AvalonBay Communities | | | 2,100 | | | | 331,926 | |

Camden Property Trust | | | 11,778 | | | | 1,071,091 | |

Douglas Emmett | | | 10,100 | | | | 281,992 | |

Essex Property Trust | | | 900 | | | | 194,859 | |

Independence Realty Trust | | | 27,600 | | | | 323,196 | |

Invitation Homes | | | 20,000 | | | | 572,600 | |

Mid-America Apartment Communities | | | 8,900 | | | | 1,042,368 | |

See Notes to the Financial Statements

SECURIAN AM REAL ASSET INCOME FUND

Schedule of Investments – Continued

August 31, 2020

| | | | | | Fair | |

| | | Shares | | | Value | |

| REIT COMMON STOCKS – 49.3% (Continued) | | | | | | |

| | | | | | | |

| Multi-Family – 8.2% (Continued) | | | | | | |

Sun Communities | | | 3,800 | | | $ | 566,504 | |

UDR | | | 27,000 | | | | 939,870 | |

| | | | | | | | 5,566,269 | |

| | | | | | | | | |

| Net Lease – 4.7% | | | | | | | | |

Agree Realty | | | 9,812 | | | | 656,619 | |

Easterly Government Properties | | | 14,800 | | | | 358,012 | |

Essential Properties Realty Trust | | | 19,400 | | | | 329,218 | |

Gaming and Leisure Properties | | | 2,074 | | | | 75,390 | |

National Retail Properties | | | 21,100 | | | | 747,784 | |

STORE Capital | | | 17,898 | | | | 483,962 | |

VICI Properties | | | 25,700 | | | | 574,138 | |

| | | | | | | | 3,225,123 | |

| | | | | | | | | |

| Office – 4.5% | | | | | | | | |

Alexandria Real Estate Equities | | | 2,500 | | | | 420,950 | |

Boston Properties | | | 6,600 | | | | 573,342 | |

Corporate Office Properties Trust | | | 22,810 | | | | 562,038 | |

Cousins Properties | | | 11,700 | | | | 349,245 | |

Highwoods Properties | | | 20,300 | | | | 756,378 | |

Hudson Pacific Properties | | | 17,200 | | | | 403,856 | |

| | | | | | | | 3,065,809 | |

| | | | | | | | | |

| Retail – 2.7% | | | | | | | | |

Brixmor Property Group | | | 16,000 | | | | 188,800 | |

Regency Centers | | | 18,400 | | | | 730,664 | |

Retail Opportunity Investments | | | 15,936 | | | | 177,368 | |

Simon Property Group | | | 6,000 | | | | 407,100 | |

Weingarten Realty Investors | | | 18,000 | | | | 314,460 | |

| | | | | | | | 1,818,392 | |

| | | | | | | | | |

| Specialty – 15.3% | | | | | | | | |

CatchMark Timber Trust, Class A | | | 31,190 | | | | 309,717 | |

CoreSite Realty | | | 2,000 | | | | 244,900 | |

Crown Castle International | | | 9,800 | | | | 1,599,850 | |

CyrusOne | | | 9,049 | | | | 755,863 | |

Digital Realty Trust | | | 12,712 | | | | 1,978,623 | |

Equinix | | | 2,075 | | | | 1,638,793 | |

Extra Space Storage | | | 5,043 | | | | 537,332 | |

Hannon Armstrong Sustainable Infrastructure Capital | | | 9,700 | | | | 411,862 | |

See Notes to the Financial Statements

SECURIAN AM REAL ASSET INCOME FUND

Schedule of Investments – Continued

August 31, 2020

| | | | | | Fair | |

| | | Shares | | | Value | |

| REIT COMMON STOCKS – 49.3% (Continued) | | | | | | |

| | | | | | | |

| Specialty – 15.3% (Continued) | | | | | | |

Jernigan Capital | | | 15,200 | | | $ | 262,048 | |

Life Storage | | | 5,600 | | | | 590,408 | |

Public Storage | | | 5,500 | | | | 1,168,200 | |

QTS Realty Trust, Class A | | | 7,300 | | | | 495,086 | |

Weyerhaeuser Company | | | 14,200 | | | | 430,402 | |

| | | | | | | | 10,423,084 | |

| Total REIT Common Stocks | | | | | | | | |

| (Cost $29,133,236) | | | | | | | 33,490,197 | |

| | | | | | | | | |

| OTHER COMMON STOCKS – 18.0% | | | | | | | | |

| | | | | | | | | |

| Energy – 3.5% | | | | | | | | |

Enbridge (a) | | | 12,700 | | | | 406,654 | |

Equitrans Midstream | | | 34,744 | | | | 357,168 | |

Kinder Morgan | | | 39,473 | | | | 545,517 | |

NRG Energy | | | 11,800 | | | | 406,038 | |

ONEOK | | | 5,000 | | | | 137,400 | |

Williams Companies | | | 25,000 | | | | 519,000 | |

| | | | | | | | 2,371,777 | |

| | | | | | | | | |

| Infrastructure – 1.2% | | | | | | | | |

Brookfield Infrastructure (a) | | | 4,602 | | | | 229,732 | |

Brookfield Infrastructure Partners (a) | | | 14,100 | | | | 614,055 | |

| | | | | | | | 843,787 | |

| | | | | | | | | |

| Telecommunications – 1.2% | | | | | | | | |

AT&T | | | 3,500 | | | | 104,335 | |

Verizon Communications | | | 11,500 | | | | 681,605 | |

| | | | | | | | 785,940 | |

| | | | | | | | | |

| Utilities – 12.1% | | | | | | | | |

AES | | | 37,600 | | | | 667,400 | |

Alliant Energy | | | 3,500 | | | | 189,525 | |

American Electric Power | | | 9,410 | | | | 741,790 | |

Brookfield Renewable (a) | | | 1,675 | | | | 85,291 | |

Brookfield Renewable Partners (a) | | | 5,300 | | | | 240,832 | |

CenterPoint Energy | | | 11,800 | | | | 236,826 | |

Clearway Energy, Class A | | | 9,300 | | | | 224,595 | |

CMS Energy | | | 5,500 | | | | 332,695 | |

Dominion Energy | | | 7,070 | | | | 554,571 | |

See Notes to the Financial Statements

SECURIAN AM REAL ASSET INCOME FUND

Schedule of Investments – Continued

August 31, 2020

| | | | | | Fair | |

| | | Shares | | | Value | |

| OTHER COMMON STOCKS – 18.0% (Continued) | | | | | | |

| | | | | | | |

| Utilities – 12.1% (Continued) | | | | | | |

DTE Energy | | | 4,047 | | | $ | 480,258 | |

Duke Energy | | | 5,500 | | | | 441,870 | |

Entergy | | | 8,000 | | | | 793,120 | |

Evergy | | | 6,536 | | | | 347,846 | |

Exelon | | | 19,300 | | | | 712,363 | |

FirstEnergy | | | 5,900 | | | | 168,681 | |

NextEra Energy Partners | | | 7,100 | | | | 428,272 | |

NiSource | | | 15,800 | | | | 350,128 | |

Pinnacle West Capital | | | 600 | | | | 44,010 | |

PPL | | | 5,200 | | | | 143,676 | |

Sempra Energy | | | 4,700 | | | | 581,155 | |

South Jersey Industries | | | 19,041 | | | | 421,758 | |

| | | | | | | | 8,186,662 | |

| Total Other Common Stocks | | | | | | | | |

| (Cost $10,553,795) | | | | | | | 12,188,166 | |

| | | Par | | | | |

| U.S. GOVERNMENT SECURITIES – 12.4% | | | | | | |