UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22525

Managed Portfolio Series

(Exact name of Registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Brian R. Wiedmeyer, President

Managed Portfolio Series

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Ave, 5th Fl

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 765-6844

Registrant’s telephone number, including area code

Date of fiscal year end: September 30, 2020

Date of reporting period: September 30, 2020

Item 1. Reports to Stockholders.

C S C A X

September 30, 2020

Cove Street Capital

Small Cap Value Fund

Ticker : CSCAX | Cusip : 56166Y875

Annual Report

2 0 2 0

NOTE

Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund (defined herein) or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website (www.covestreetfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-866-497-0097 or by sending an e-mail request to mtynan@covestreetcapital.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-866-497-0097 or send an e-mail request to mtynan@covestreetcapital.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary.

www.CoveStreetFunds.com | 866-497-0097

C S C A X

2 0 2 0

(This Page Intentionally Left Blank)

Annual Report 2020

Cove Street Capital Small Cap Value Fund

C S C A X

Table of

Contents

| Letter to Shareholders | 4 |

| Performance | 8 |

| Expense Example | 9 |

| Holdings Presentation | 10 |

| Annual Schedule of Investments | 11 |

| Financial Statements | 13 |

| Financial Highlights | 16 |

| Notes to Financials | 17 |

| Appendix | 25 |

www.CoveStreetFunds.com

866-497-0097

| | Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund |

GREETINGS FELLOW SHAREHOLDER:

Yes, we are still practicing the art of value investing, a discipline that has succeeded in demonstrating this calendar year that skepticism and prudence have not proven highly remunerative. But it’s certainly been a “heckuva” lot better than the first quarter of calendar year 2020.

So as we enter the calendar fourth quarter, we remain EVER incredulous on many fronts as to what is happening around us, and while one is always contemplating change, rethinking positions, and attempting to make money free of marketing labels, we don’t see a lot of intellectual reasons to completely swap out an investment process and philosophical underpinnings that have a history of demonstrated success. Pay a fair price for a great business, buy decent assets at distressed prices, find people who are stealing with you versus stealing from you, think long-term, don’t over diversify, don’t spend all your time doing what everyone else is doing, and don’t panic at the bottom of the cycle.

While we will point to some versions of communal insanity—or outrageous anecdotes that should be screaming “caution!”—we will also point to the annoyance that it is our largest positions that are watching paint dry, and thus we are borderline bullish on our own relative and absolute performance, a circumstance that is not always the case.

As usual we start with our detractors. Phibro Animal Health (Ticker: PAHC, -33.4%) is a manufacturer of products sold into the livestock industry around the world, and the company has recently been in the middle of a perfect storm. First off, the African Swine Flu that is plaguing China’s pork production has decimated the company’s business in China. Next, as a result of the U.S. protein processing facilities being closed or shut down due to COVID, demand for PAHC’s nutritional supplements and medicated feed additives has been reduced. Finally, the FDA has—out of the blue—decided to try to ban one of its main pork products—Carbadox. It’s fair to say that we have been early. Given all of those headwinds, it is not a surprise that PAHC’s stock has been under pressure. However, there have been positive happenings relating to all three of the aforementioned issues and thus we view them as transient. The stock trades at a material discount to our estimate of intrinsic value and we have been buying more as the price has fallen.

Also in the “not a performer, but a newsmaker” pile was WPX Energy (Ticker: WPX, -23.2%), which announced a deal late in the quarter to merge with Devon Energy (Ticker: DVN) on a stock for stock basis. This is a defensive move for both companies in case there is a further need for an extended hunkering down in a period of low oil prices. This is a complementary deal in a number of ways, with solid management and asset value on both sides, and room for large expense cuts, but there is only ONE critical variable in energy investing—the price of the commodity. This will create a larger company at the close of the deal, which will limit our future exposure. The search for a replacement is underway.

Macquarie Infrastructure (Ticker: MIC, -12.8%) owns and operates a variety of energy infrastructure assets including oil import terminals, aviation refueling operations, and a Hawaiian utility. Macquarie, a multinational investment bank, externally manages the company. In October of 2019, management announced that it was pursuing strategic alternatives for the company, including a potential sale. MIC’s marquee assets are oil product storage terminals outside of New York City and on the lower portion of the Mississippi River. In the first half of 2020, the fall in oil prices created unprecedented demand for storage. However, the company’s aviation and Hawaii divisions witnessed significant declines in revenue as a result of Coronavirus induced declines in travel. Despite these near-term challenges, the company has a unique set of assets that would be highly attractive to infrastructure funds, which are sitting on billions of dry powder that is waiting to be deployed.

Moving to our top contributors—E.W. Scripps, Class A (Ticker: SSP, 31.8%) is a legacy broadcast television company that has benefited from a number of interesting organic and inorganic upgrades after a dramatic price drop earlier in the year due to the expected decline in advertising revenue. In response, the company invested aggressively in digital properties shown Over-The-Air (OTT)—which is not as easy as it looks—offering advertisers a rapidly-growing national audience of cord-cutters. They also sold their private podcasting business Midroll Media to Sirius XM (Ticker: SIRI) for a significant premium and announced a “transformative” deal to buy ION Media Networks (Ticker: ION) to turbocharge their OTT offerings with backing from Berkshire Hathaway.

Letter to Shareholders (continued) (unaudited) | Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund |

Despite the recent increase in market price, our analysis suggests that the stock trades at a material discount to the sum of its parts. As such, we believe there is a substantial enough margin of safety to continue holding the stock.

Compass Minerals International (Ticker: CMP, 23.0%) produces and sells de-icing and industrial salts, specialty plant nutrition and chemical products. The stock rebounded in the quarter thanks to no news in particular, except that the company maintained most of its annual guidance due to a minimal impact on their end markets from COVID related issues. We view the company as grossly mispriced due to a misunderstanding by the market of the micronutrient and specialty fertilizer business CMP has, and an overemphasis on short-term issues such as the general variability of winter weather.

Millicom International Cellular (Ticker: TIGO, 16.0%) is the leading cable and wireless provider in Colombia and Central America. The company has focused on its pole position in the quickly growing cable triple play markets of Colombia, Bolivia, and Guatemala after shedding valuable but disparate African media assets under the direction of a CEO who hails from Liberty Global (Ticker: LBTYA). This past quarter’s good performance was mostly due to a stable Colombian Peso exchange rate against the US Dollar as well as lower COVID infections seen across most of TIGO’s South American markets. COVID has induced various government mandates to continue to provide wireless service to non- paying customers in certain countries, along with the closure of all brick and mortar retail locations across various jurisdictions, and thus created a downward pull on overall subscribers and margins. Looking past short-term noise, we still see a severely undervalued stock that is continuing to develop into a premier Latin American cable/telecom player, and one that trades at a valuation reserved for declining telephone-focused entities—not growing cable/wired connectivity centric organizations with excellent returns.

Axalta Coating Systems (Ticker: AXTA) is an excellent coatings company with excellent return and cashflow characteristics that simply “grew out of small cap” quickly from the March 2020 lows. A short, but happy result.

Yelp (Ticker: YELP) a review app and website was in the midst of major operating changes when the Coronavirus struck. The company was at the beginning of a process to increase margins by reducing staff, relocating offices, and implementing self-service options for customers. In addition, the company was ramping up sales to larger clients outside of their traditional small business focus. YELP’s CEO, Jeremy Stoppelman has always been a major question mark and remains CEO despite the addition of three new board members. Although the company continues to have a massive base of users that would be attractive to a large number of acquirers, the Coronavirus has likely significantly elongated the time it will take Yelp to achieve its margin and growth objectives. As a consequence, we took a reasonable lump and sold our position.

Spectrum Brands Holdings (Ticker: SPB) has finally started to hit its stride in a COVID-impacted world after suffering through tariffs, self-inflicted operational issues, and some poor capital allocation. While its Hardware and Home Improvement segment has been hurt a little by lockdowns, SPB’s pet, garden, and small home appliance businesses have been doing quite well. As sales have improved, so have margins and cash flows. The stock appreciated in the quarter, approached our estimate of intrinsic value, and we sold our position to allocate to other opportunities.

Patterson Companies (Ticker: PDCO) is a distributor of dental and animal health products and services. Both of PDCO’s core markets are stable three-company oligopolies with significant barriers to entry. The company’s animal health division was growing until recently when dairy prices reduced demand for production of animal products. Patterson’s dental business has improved markedly, but margins remain below prior levels due to the rise of larger dental groups with greater purchasing power and competition from online sellers. In the first half of 2020, the majority of U.S. dental offices were closed due to the Coronavirus, resulting in weak dental sales. Despite the weakness in dental and production of animal sales, PDCO’s stock rose significantly to a value that embedded several years of operational improvement thereby prompting us to sell our position.

Global Indemnity Group (Ticker: GBLI) is an odd fish of an insurance company that is a good example of why sometimes it takes “time and focus” to be able to take advantage of a situation. Saul Fox is the Founder, Chairman, and majority voting and economic owner of the company which has morphed its way over the course of a decade into a decently profitable specialty insurance company. While Saul was an early partner at private equity firm KKR and certainly has skin in the game here, it was not clear to us that GBLI was built for making other people money versus being a holding tank entity for the wealth of one very successful guy. So we watched for years...and it stayed very cheap to its tangible book value. Recently, GBLI put out a press release detailing some large changes in its corporate structure whose impact is not self-evident unless you have been paying attention. What we see is that the legal structures of the company have been “restacked” in a partnership format, which enables “$10 to $15 per share” of capital to be transferred up to the holding company.

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Letter to Shareholders (continued) (unaudited) |

This set of events also enables the capital to be dividend-ed out to shareholders on a tax-free basis as a return of capital, leaving a quite nice specialty insurance company in a very strong environment for writing insurance, whose real returns on equity will be greatly improved now that the overcapitalization is gone. The structural changes are a set of facts. Mr. Fox’s state of mind remains a mystery until further notice or press release. Our research suggests there is a high likelihood of a positive “non-market” event.

Another new position in the quarter was KBR (Ticker: KBR) a firm providing professional services including consulting, engineering, and operations support to both the defense and energy industries. The company has been slowly transforming away from its traditional focus on engineering, procurement, and construction (EPC) work on large energy projects into a government/defense department focused contractor. KBR’s CEO has wound down operations on the less predictable, profitable, and sustainable EPC contracts and acquired a major asset—Centauri LLC—that operates in higher end defense cyberwarfare and space capabilities functional areas. Through the Centauri deal, the company is now over 80% leveraged to long-dated (5-10 year) contracts with various government agencies, including NASA, NOAA and various arms of the national intelligence complex. Our research indicates that KBR is at an inflection point in both earnings power stability and cash flow generation, which should provide for a healthy upside.

We have followed Landec (Ticker: LNDC) for almost 20 years—and frankly have never liked the math of an agricultural business which sells hothouse tomatoes and packaged salads and vegetables. What has changed is that their “afterthought” business—Lifecore Biomedical—has grown up to be a material ball of goods as a fully integrated Contract Development and Manufacturing Organization (CDMO). This grows, has high margins, and generates solid free cashflow. What was also necessary was a complete change-out of the Board of Directors and the replacement of the CEO, who unwisely kept the focus on their food business. We expect the food businesses to be sold and the CDMO to emerge as the public gem with a complete re- rating of the stock price.

PQ Group Holdings (Ticker: PQG) is a specialty chemical company that is like a “public/private” company given that almost 70% is still owned by its investment sponsors, which tends to limit interest by large investment firms. We have been successful several times with this structure. This is another company we watched for several years, spent a day in the labs with the new management team, and then bought a large block of stock a year later from what seems to be a forced seller at a lot lower price. This is a collection of high margin, high return, high free cashflow businesses that have demonstrated resiliency in the current economic environment and we expect to profit from deleveraging, internal portfolio re-positioning, and re-rerating of valuation to “specialty chemical” levels.

A “new” purchase (second time around) during the quarter was Tapestry (Ticker: TPR), a holding company that owns accessible luxury brands Coach, Stuart Weitzman, and Kate Spade. Our research indicates that there is a tremendous amount of upside in the stock if the company can get back to 75% of what it was in fiscal year 2019. As the retail world continues to thaw, Coach should return to being the company’s cash cow and any improvement in Kate Spade and Stuart Weitzman will be helpful. In the meantime, the company has a very healthy balance sheet and is in the middle of an aggressive cost-cutting plan that should yield better margins and returns irrespective of how fast sales rebound. In addition, due to recent management departures and a board that does not have much retail experience, there is a leadership vacuum that could attract potential suitors.

We see an enormous bifurcation between “stocks that are moving” and “undervalued businesses that happen to be publicly traded.” As such, we have been steadily upping our commitment to said investments. The present period reminds us of late 1999, or early 2000, when enthusiasm for the future became unhinged from some basic economic realities and “basis” investing principles upon which we have built a career and client wealth were regarded as quaint and fringe ideas. Similarly to today, it was an “odd” period because while we seemed “bearish” on the world at large, there was such a dichotomy of what was popular and what wasn’t that paradoxically, there were a perfectly reasonable set of attractive investments. And we made them. And fortunately, things changed for our benefit in a hurry. It remains a historical fact that the best environment for value investing is where other’s interest in value investing is at negligible levels. I believe we have arrived at this station.

Julius Caesar noted in Commentarii de Bello Civili, “Inusitatis atque incognitis rebus magis confidamus vehementiusque exterreamur.” (“The unusual and the unknown make us either overconfident or overly fearful.”) And that things around us change a lot more than the behavior of human beings. We aren’t changing groups. Nothing is perfect and as a firm, we are not as resistant to change and rethink as some paragraphs in this Letter, and its predecessors might suggest. But we have a North Star as far an investment approach and as a culture of people. From time to time, discipline can seem like an anchor. But as we have all seen, things change. And as we saw in March, you need to be prepared and “be there” when it happens.

Best Regards,

Jeffrey Bronchick, CFA | Principal, Portfolio Manager

Shareholder, Cove Street Capital Small Cap Value Fund

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Letter to Shareholders (continued) (unaudited) |

The information provided herein represents the opinions of Cove Street Capital, LLC and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions expressed are subject to change at any time.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk. Please refer to the Schedule of Investments for a complete list of holdings.

Mutual fund investing involves risk. Principal loss is possible. There is no assurance that the investment process will consistently lead to successful results. Value investing involves risks and uncertainties and does not guarantee better performance or lower costs than other investment methodologies. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. Concentration of assets in a single or small number of issuers, may reduce diversification and result in increased volatility.

Quotational risk is the potential for gains or losses based upon volatility in the trading price of a security, which in the near-term do not reflect fluctuations in the intrinsic value of the security’s interest in the underlying assets but are the manifestation of other dynamics in the market.

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Free Cash Flow represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets.

The Cove Street Small Cap Value Fund is distributed by Quasar Distributors, LLC.

Institutional Class Performance (unaudited) | Annual Report 2020 — CSCAXCove Street Capital Small Cap Value Fund |

Rates of Return (%) as of September 30, 2020 |

Value of $10,000 Investment as of September 30, 2020 |

| (1) | The Institutional Class commenced operations on October 3, 2001. The performance results for the Institutional Class reflect the performance of the Investor Class shares from September 30, 1998 through October 2, 2001. The Investor Class subsequently closed, effective November 25, 2015. |

| (2) | The Russell 2000® Index is a market capitalization‐weighted index comprised of the 2,000 smallest companies listed on the Russell 3000® Index, which contains the 3,000 largest companies in the U.S. based on market capitalization. One cannot invest directly in an Index. |

| (3) | The Russell 2000® Value Index measures the performance of the small cap value segment of U.S. equity securities. It includes those Russell 2000® Index companies with lower price‐to‐book ratios and lower forecasted growth values. One cannot invest directly in an Index. |

| Returns for periods greater than one year are annualized. |

| Past performance does not guarantee future results. Graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Expense Example September 30, 2020 (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include but are not limited to, redemption fees, broker commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2020 – September 30, 2020).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs may have been higher.

| | BEGINNING ACCOUNT VALUE (4/01/2020) | ENDING ACCOUNT VALUE (9/30/2020) | EXPENSES PAID DURING PERIOD (1) 4/1/2020 - 9/30/2020 |

| | | | |

Institutional Class Actual (2) | $1,000.00 | $1,218.40 | $6.60 |

| | | | |

| | | | |

Institutional Class Hypothetical

(5% annual return before expenses) | $1,000.00 | $1,019.05 | $6.01 |

| | | | |

| | | | |

| (1) | Expenses are equal to the Fund's annualized expense ratio for the most recent six-month period of 1.19%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| (2) | Based on the actual return for the six-month period ended September 30, 2020 of 21.84%. |

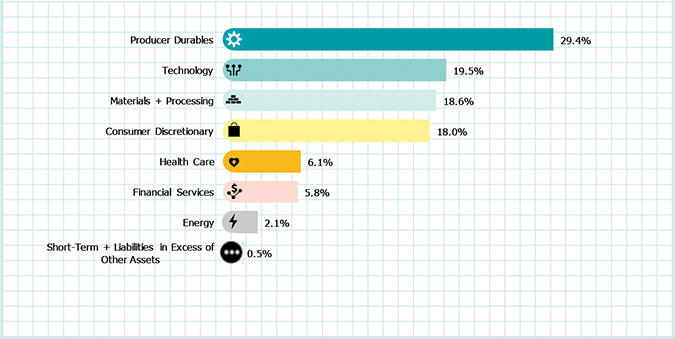

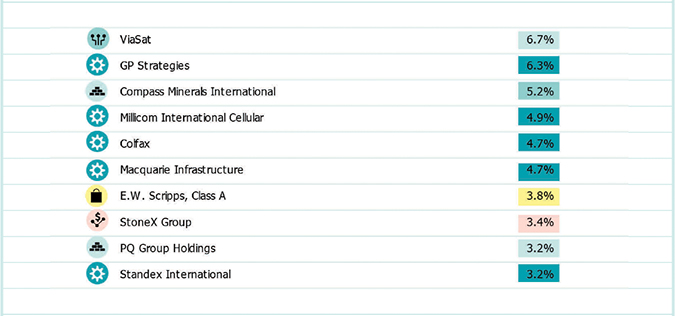

Holdings Presentation September 30, 2020 (unaudited) | Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund |

Sector Allocation (1) (% of net assets) as of September 30, 2020

Top 10 Equity Holdings(1) (% of net assets) as of September 30, 2020

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Schedule of Investments September 30, 2020 |

| | | | Shares | | | Value | |

| COMMON STOCKS - 96.8% | | | | | | |

| | | | | | | |

| Consumer Discretionary - 15.3% | | | | | | |

| Apex Global Brands, Inc. * (a) (d) | | | 7,899 | | | $ | 39,795 | |

| Apex Global Brands, Inc. * | | | 23,714 | | | | 143,944 | |

| Cinemark Holdings, Inc. | | | 70,000 | | | | 700,000 | |

| E.W. Scripps, Class A | | | 250,000 | | | | 2,860,000 | |

| Liberty TripAdvisor Holdings, Inc. * | | | 300,000 | | | | 519,000 | |

| Six Flags Entertainment Corp. | | | 80,000 | | | | 1,624,000 | |

| Skechers U.S.A., Inc. * | | | 72,400 | | | | 2,187,928 | |

| Tapestry, Inc. | | | 100,000 | | | | 1,563,000 | |

| TEGNA | | | 150,000 | | | | 1,762,500 | |

| | | | | | | | | 11,400,167 | |

| Energy - 2.1% | | | | | | | | |

| WPX Energy * | | | 326,300 | | | | 1,598,870 | |

| | | | | | | | | | |

| Financial Services - 5.8% | | | | | | | | |

| Global Indemnity Group | | | 84,500 | | | | 1,756,755 | |

| StoneX Group, Inc. * | | | 50,000 | | | | 2,558,000 | |

| | | | | | | | | 4,314,755 | |

| Health Care - 6.1% | | | | | | | | |

| Avanos Medical, Inc. * | | | 50,000 | | | | 1,661,000 | |

| Capital Senior Living Corp. * | | | 498,155 | | | | 312,941 | |

| Phibro Animal Health Corp. | | | 106,300 | | | | 1,849,620 | |

| Viemed Healthcare * | | | 85,000 | | | | 734,400 | |

| | | | | | | | | 4,557,961 | |

| Materials & Processing - 18.6% | | | | | | | | |

| Acuity Brands, Inc. | | | 10,000 | | | | 1,023,500 | |

| Compass Minerals International | | | 64,900 | | | | 3,851,815 | |

| GCP Applied Technologies, Inc. * | | | 80,000 | | | | 1,676,000 | |

| Landec Corp. * | | | 114,100 | | | | 1,109,052 | |

| Mueller Water Products, Inc. | | | 120,000 | | | | 1,246,800 | |

| Northern Technologies International | | | 86,919 | | | | 721,428 | |

| PQ Group Holdings, Inc. * | | | 234,300 | | | | 2,403,918 | |

| UFP Technologies * | | | 44,400 | | | | 1,839,048 | |

| | | | | | | | | 13,871,561 | |

Producer Durables - 29.4%

| | | | | | | | |

| AZZ | | | | 57,100 | | | | 1,948,252 | |

| Colfax * | | | 111,900 | | | | 3,509,184 | |

| DLH Holdings * | | | 68,900 | | | | 499,525 | |

| GP Strategies * | | | 487,202 | | | | 4,696,627 | |

| Heritage-Crystal Clean * | | | 138,200 | | | | 1,844,970 | |

| KBR, Inc. | | | 82,600 | | | | 1,846,936 | |

| Macquarie Infrastructure | | | 130,000 | | | | 3,495,700 | |

| Standex International Corp. | | | 40,000 | | | | 2,368,000 | |

| Transcat * | | | 58,000 | | | | 1,699,400 | |

| | | | | | | | | 21,908,594 | |

See Notes to Financial Statements.

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Schedule of Investments (continued) September 30, 2020 |

| | | | Shares

| | | | Value

| |

| COMMON STOCKS (continued) - 96.8% | | | | | | | | |

| | | | | | | | | |

| Technology - 19.5% | | | | | | | | |

| Avid Technology * | | | 250,000 | | | | 2,140,000 | |

| CommVault Systems, Inc. * | | | 45,000 | | | | 1,836,000 | |

| Great Elm Capital Group * (b) | | | 798,810 | | | | 1,885,192 | |

| Millicom International Cellular | | | 120,000 | | | | 3,633,600 | |

| ViaSat * | | | 146,100 | | | | 5,024,379 | |

| | | | | | | | | 14,519,171 | |

| | | | | | | | | | |

| Total Common Stocks (Cost $79,201,000) | | | | | | | 72,171,079 | |

| | | | | | | | | | |

| SUBORDINATED NOTES - 2.7% | | | | | | | | |

| | | | | | | | |

| Consumer Discretionary - 2.7% | | Par | | | | | |

| Apex Global Brands, Inc. | | | | | | | | |

| 10.75%, (3 month LIBOR + 8.75%, minimum of 10.75%), 11/02/2021 (d) (e) | | | | | |

| Total Subordinated Notes (Cost $5,254,570) | | $ | 5,382,155 | | | | 2,018,308 | |

| | | | | | | | | | |

| WARRANTS - 0.0% | | Shares | | | | | |

| | | | | | | | | |

| Consumer Discretionary - 0.0% | | | | | | | | |

| Apex Global Brands, Inc. (Expires 08/11/24, Exercise Price $126.60) * (c) | | | 1,975 | | | | – | |

| Apex Global Brands, Inc. (Expires 12/07/24, Exercise Price $67.50) * (c) | | | 5,926 | | | | – | |

| Total Warrants (Cost $446,040) | | | | | | | – | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENT - 0.6% | | | | | | | | |

| Invesco Treasury Obligations Portfolio, Institutional Class, 0.01% ^ | | | | | | | – | |

| Total Short-Term Investment (Cost $484,567) | | | 484,567 | | | | 484,567 | |

| | | | | | | | | | |

| Total Investments - 100.1% (Cost $85,386,177) | | | | | | | 74,673,954 | |

| Liabilities in Excess of Other Assets (0.1)% | | | | | | | (75,489 | ) |

| Total Net Assets - 100.0% | | | | | | $ | 74,598,465 | |

| * | | Non-income producing security | | | | | | | | |

| | | | |

| # | | As of September 30, 2020, the Fund had a significant portion of its assets invested in the Producer Durables sector. See Note 8 in Notes to Financial Statements. | |

| | | | |

| (a) | | Security is restricted from resale and considered illiquid. Restricted securities have been fair valued in accordance with procedures approved by the Board of Trustees and have a total fair value $39,795, which represents less than 0.1% of net assets. See Notes 2 and 3 in Notes to Financial Statements. | |

| | | | |

| (b) | | Security is considered illiquid by an independent pricing service and is categorized in Level 1 of the fair value hierarchy. This Level 1 illiquid security has a total fair value of $1,885,192, which represents 2.5% of net assets. See Notes 2 and 3 in Notes to Financial Statements. | |

| | | | |

| (c) | | Security is considered illiquid and is categorized in Level 2 of the fair value hierarchy. These Level 2 illiquid securities have a total fair value of $0, which represents 0.0% of total net assets. See Notes 2 and 3 in Notes to Financial Statements. | |

| | | | |

| (d) | | Security is considered illiquid and is categorized in Level 3 of the fair value hierarchy. These Level 3 illiquid securities have a total fair value of $2,058,103, which represents 2.8% of total net assets. See Notes 2 and 3 in Notes to Financial Statements. | |

| | | | | | | | |

| (e) | | Variable rate security. The rate shown is the rate in effect as of September 30, 2020. | | | | | |

| | | | |

| ^ | | The rate of shown is the annualized seven day effective yield as of September 30, 2020. | |

| | | | |

| | | See Notes to Financial Statements. | |

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Statement of Assets and Liabilities September 30, 2020 |

| ASSETS: | | | |

Investments, at value (Cost: $85,386,177) | | $ | 74,673,954 | |

| Dividends and interest receivable | | | 109,741 | |

| Receivable for capital shares sold | | | 55,961 | |

| Receivable for investment securities sold | | | 4,061 | |

| Prepaid expenses | | | 19,342 | |

| Total assets | | | 74,863,059 | |

| | | | | |

| LIABILITIES: | | | | |

| Reserve for interest, including paid-in-kind | | | 84,333 | |

| Payable to investment adviser | | | 53,609 | |

| Payable for capital shares redeemed | | | 40,957 | |

| Payable for transfer agent fees & expenses | | | 23,621 | |

| Payable for fund administration & accounting fees | | | 20,422 | |

| Payable for compliance fees | | | 3,751 | |

| Payable for trustee fees | | | 2,957 | |

| Payable for custody fees | | | 2,201 | |

| Accrued expenses | | | 32,743 | |

| | | | | |

| Total liabilities | | $

| 264,594 | |

| | | | | |

| NET ASSETS | | $ | 74,598,465 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | |

| 87,545,340 | |

| Total accumulated loss | | | (12,946,875 | ) |

| Net Assets | | $ | 74,598,465 | |

| | | | | |

Shares issued and outstanding (1) | | | 2,706,768 | |

| | | | | |

Net asset value, redemption price and offering price per share (2) | | $ | 27.56 | |

| | | | | |

| | | | | |

| (1) Unlimited shares authorized without par value. | | | | |

| | | | | |

| (2) A redemption fee of 2.00% is assessed against shares redeemed within 60 days of purchase. | | | | |

| See Notes to Financial Statements. |

Statement of Operations for the Year Ended September 30, 2020 | Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund |

| INVESTMENT INCOME: | | | |

| Dividend income (Less: Foreign taxes withheld of $24,196) | | $ | 1,605,239 | |

| Interest income | | | 394,161 | |

| Payment-In-Kind interest | | | 239,297 | |

| Total investment income | | | 2,238,697 | |

| | | | | |

| EXPENSES: | | | | |

| Investment adviser fees (See Note 4) | | | 894,968 | |

| Transfer agent fees & expenses (See Note 4) | | | 99,060 | |

| Fund administration & accounting fees (See Note 4) | | | 83,478 | |

| Federal & state registration fees | | | 29,157 | |

| Postage & printing fees | | | 28,151 | |

| Audit fees | | | 19,496 | |

| Custody fees (See Note 4) | | | 15,361 | |

| Compliance fees (See Note 4) | | | 14,620 | |

| Trustee fees | | | 12,946 | |

| Legal fees | | | 5,732 | |

| Insurance expense | | | 1,775 | |

| Other Expenses | | | 37,846 | |

| Total expenses before interest | | | 1,242,590 | |

| Interest expense (See Note 9) | | | 462 | |

| Total expenses before waiver | | | 1,243,052 | |

| Adviser recoupment (See Note 4) | | | 540 | |

| Less: waiver from investment adviser (See Note 4) | | | (540 | ) |

| Net expenses | | | 1,243,052 | |

| | | | | |

| NET INVESTMENT INCOME | | | 995,645 | |

| | | | | |

| REALIZED AND UNREALIZED LOSS ON INVESTMENTS: | | | | |

| Net realized loss on investments | | | (2,300,035 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | (22,559,977 | ) |

| Net realized and unrealized loss on investments | | | (24,860,012 | ) |

| | | | | |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (23,864,367 | ) |

| See Notes to Financial Statements. |

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Statements of Changes in Net Assets September 30, 2020 |

| | | Year Ended September 30, 2020 | | | Year Ended September 30, 2019 | |

| | | | | | | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 995,645 | | | $ | 844,641 | |

| Net realized loss on investments | | | (2,300,035 | ) | | | (765,277 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | (22,559,977 | ) | | | (6,982,211 | ) |

| Net decrease in net assets from operations | | | (23,864,367 | ) | | | (6,902,847 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 24,829,692 | | | | 16,061,993 | |

| Proceeds from reinvestments of distributions | | | 872,970 | | | | 3,432,948 | |

| Payments for shares redeemed | | | (47,690,472 | ) | | | (35,570,654 | ) |

| Redemption fees | | | 1,717 | | | | 1,656 | |

| Decrease in net assets resulting from capital share transactions | | | (21,986,093 | ) | | | (16,074,057 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | (995,461 | ) | | | (3,973,004 | ) |

| | | | | | | | | |

| TOTAL DECREASE IN NET ASSETS | | | (46,845,921 | ) | | | (26,949,908 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 121,444,386 | | | | 148,394,294 | |

| End of year | | $ | 74,598,465 | | | $ | 121,444,386 | |

| See Notes to Financial Statements. |

Financial Highlights (for a Fund Share Outstanding Throughout the Years) | Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund |

| | | Year Ended September 30, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| PER SHARE DATA: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 34.89 | | | $ | 37.51 | | | $ | 36.49 | | | $ | 34.21 | | | $ | 31.66 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.35 | | | | 0.24 | | | | (0.04 | ) | | | (0.18 | ) | | | (0.15) | (1)

|

| Net realized and unrealized gain (loss) on investments | | | (7.40 | ) | | | (1.84 | ) | | | 2.10 | | | | 2.92 | | | | 4.33 | |

| Total from investment operations | | | (7.05 | ) | | | (1.60 | ) | | | 2.06 | | | | 2.74 | | | | 4.18 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.28 | ) | | | - | | | | - | | | | - | | | | - | |

| From net realized gains | | | - | | | | (1.02 | ) | | | (1.04 | ) | | | (0.46 | ) | | | (1.63 | ) |

| Total distributions | | | (0.28 | ) | | | (1.02 | ) | | | (1.04 | ) | | | (0.46 | ) | | | (1.63 | ) |

| Paid-in capital from redemption fees | | | - | (2) | | | - | (2) | | | - | (2) | | | - | (2) | | | - | (2)

|

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 27.56 | | | $ | 34.89 | | | $ | 37.51 | | | $ | 36.49 | | | $ | 34.21 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | -20.43 | % | | | -4.26 | % | | | 5.92 | % | | | 8.17 | % | | | 13.63 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in millions) | | $ | 74.6 | | | $ | 121.4 | | | $ | 148.4 | | | $ | 147.4 | | | $ | 119.7 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver/recoupment | | | 1.18 | % | | | 1.22 | % | | | 1.16 | % | | | 1.20 | % | | | 1.38 | % |

| After expense waiver/recoupment | | | 1.18 | % | | | 1.23 | % | | | 1.16 | % | | | 1.20 | % | | | 1.22 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss) to | | | | | | | | | | | | | | | | | | | | |

| average net assets: | | | | | | | | | | | | | | | | | | | | |

| After expense waiver/recoupment | | | 0.95 | % | | | 0.65 | % | | | (0.11 | )% | | | (0.59 | )% | | | (0.45 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 70 | % | | | 53 | % | | | 59 | % | | | 48 | % | | | 85 | % |

| (1) | Per share amounts are calculated using the average shares outstanding method. |

| (2) | Amount per share is less than $0.01. |

| See Notes to Financial Statements. |

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Notes to Financial Statements September 30, 2020 |

Managed Portfolio Series (the “Trust”) was organized as a Delaware statutory trust on January 27, 2011. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Cove Street Capital Small Cap Value Fund (the “Fund”) is a diversified series with its own investment objectives and policies within the Trust. The investment objective of the Fund is capital appreciation. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services – Investment Companies. The Fund commenced operations on September 30, 1998 and currently offers Institutional Class shares. The Fund may issue an unlimited number of shares of beneficial interest, with no par value.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Security Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 3.

Federal Income Taxes – The Fund complies with the requirements of subchapter M of the Internal Revenue Code of 1986, as amended, as necessary to qualify as a regulated investment company and distributes substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Fund. Therefore, no federal income tax or excise tax provision is required. As of and during the year ended September 30, 2020, the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. As of and during the year ended September 30, 2020, the Fund did not have liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statement of Operations. As of and during the year ended September 30, 2020, the Fund did not incur any interest or penalties. The Fund is not subject to examination by U.S. tax authorities for tax years prior to the year ended September 30, 2017.

Security Transactions, Income, and Distributions – The Fund follows industry practice and records security transactions on the trade date. Realized gains and losses on sales of securities are calculated on the basis of identified cost. Dividend income is recorded on the ex-dividend date and interest income and expense is recorded on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. Interest paid-in-kind is recorded using the interest method. The Fund will establish a reserve for interest receivable when it becomes probable that the interest will not be collected, and the amount of uncollectible interest can be reasonably estimated. Discounts and premiums on securities purchased are amortized over the expected life of the respective securities using the constant yield method.

The Fund may utilize earnings and profits distributed to shareholders on redemptions of shares as part of the dividend paid deduction. The Fund distributes substantially all net investment income and net realized capital gains, if any, at least annually. Distributions to shareholders are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, GAAP requires that they be reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund. There were no reclassifications needed for the year ended September 30, 2020.

Notes to Financial Statements (continued) September 30, 2020 | Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund |

Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates..

Allocation of Expenses – Expenses associated with a specific fund in the Trust are charged to that fund. Common Trust expenses are typically allocated evenly between the funds of the Trust, or by other equitable means.

Illiquid or Restricted Securities – A security may be considered illiquid if it lacks a readily available market. Securities are generally considered liquid if they can be sold or disposed of in the ordinary course of business within seven days at approximately the price at which the security is valued by the Fund. Illiquid securities may be valued under methods approved by the Board of Trustees (the “Board”) as reflecting fair value. The Fund will not hold more than 15% of the value of its net assets in illiquid securities. Certain restricted securities may be considered illiquid. Restricted securities are often purchased in private placement transactions, are not registered under the Securities Act of 1933, may have contractual restrictions on resale, and may be valued under methods approved by the Board as reflecting fair value. At September 30, 2020, the Fund had investments in illiquid securities with a total value of $3,943,295 or 5.3% of total net assets.

Information concerning illiquid securities, including restricted securities considered to be illiquid, is as follows:

Security | | Par/Shares | | Date Acquired | | Cost Basis | |

Apex Global Brands, Inc. Notes | | $ | 5,431,977 | | Aug. 2018 | | $ | 5,254,570 | |

Apex Global Brands, Inc. | | | 7,899 | | Aug. 2017 | | $ | 828,794 | |

Apex Global Brands, Inc. Warrant (08/11/24) | | | 1,975 | | Aug. 2017 | | $ | 171,207 | |

Apex Global Brands, Inc. Warrant (12/07/24) | | | 5,926 | | Dec. 2017 | | $ | 274,833 | |

Great Elm Capital Group | | | 798,810 | | Jun. 2019 to Jul. 2019 | | $ | 3,049,605 | |

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in valuation techniques and related inputs during the period and expanded disclosure of valuation Levels for major security types. These inputs are summarized in the three broad Levels listed below:

| | Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | | |

| | Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | | |

| | Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Notes to Financial Statements (continued) September 30, 2020 |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis. The Fund’s investments are carried at fair value.

Equity Securities – Equity securities that are primarily traded on a national securities exchange are valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and ask prices, or last trade. Securities traded primarily in the Nasdaq Global Market System for which market quotations are readily available are valued using the Nasdaq Official Closing Price (“NOCP”). If the NOCP is not available, such securities are valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and ask prices, or last trade. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. If the market for a particular security is not active, and the mean between bid and ask prices, or last trade is used, these securities are categorized in Level 2 of the fair value hierarchy.

Short-Term Investments – Investments in other mutual funds, including money market funds, are valued at their net asset value per share. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Debt Securities – Convertible bonds and subordinated notes held by the Fund may be valued at fair value on the basis of valuations furnished by an independent pricing service which utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. These bonds and notes are categorized in Level 2 of the fair value hierarchy. Due to market data not being readily available, the subordinated notes may be valued using a market approach, as approved by the Board. When the market approach is used to value certain debt instruments, they typically are categorized in Level 3 of the fair value hierarchy.

Securities for which market quotations are not readily available, or if the closing price does not represent fair value, are valued following procedures approved by the Board. These procedures consider many factors, including the type of security, size of holding, trading volume, liquidity, and news events. There can be no assurance that the Fund could obtain the fair value assigned to a security if they were to sell the security at approximately the time at which the Fund determines its net asset value per share. The Board has established a Valuation Committee to administer, implement, and oversee the fair valuation process, and to make fair value decisions when necessary. The Board regularly reviews reports that describe any fair value determinations and methods.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s securities as of September 30, 2020:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 72,131,284 | | | | - | | | $ | 39,795 | | | $ | 72,171,079 | |

| Subordinated Notes | | | - | | | | - | | | $ | 2,018,308 | | | $ | 2,018,308 | |

| Warrants | | | - | | | | - | | | | - | | | | - | |

| Short-Term Investment | | $ | 484,567 | | | | - | | | | - | | | $ | 484,567 | |

| Total Investments in Securities | | $ | 72,615,851 | | | | - | | | $ | 2,058,103 | | | $ | 74,673,954 | |

Continued on next page.

Notes to Financial Statements (continued) September 30, 2020 | Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund |

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

| | Investments in Securities |

Balance as of September 30, 2019 | | $ | 96,375 | |

Accrued discounts/premiums | | | - | |

Realized losses | | | - | |

Change in net unrealized appreciation/depreciation | | | (56,580 | ) |

Net sales | | | - | |

Transfers into and/or out of Level 3* | | | 2,018,308 | |

Balance as of September 30, 2020 | | $ | 2,058,103 | |

Change in unrealized appreciation/depreciation during the year for Level 3 investments held at September 30, 2020 | | $ | (3,483,367 | ) |

*The reason for the transfer into Level 3 was due to a change in valuation technique from an income approach to a market approach.

The Level 3 investments as of September 30, 2020, represented 2.8% of the Fund’s net assets. Refer to the Schedule of Investments for further information on the classification of investments.

The following provides information regarding the valuation technique, unobservable input used, and other information related to the fair value of the Level 3 investment as of September 30, 2020:

Security Type | Fair Value as of September 30, 2020 | Valuation Technique | Unobservable Input (a) | Range/Weighted Average |

| Common Stocks | $39,795 | Consensus Pricing | Discount for lack of marketability | 17% |

| Subordinated Notes | $2,018,308 | Market Approach | Likelihood of issuer to complete transaction | 0%-75% |

| Subordinated Notes | $2,018,308 | Market Approach | Multiples of similar companies | 0.4x-2.2x |

(a) A change to the unobservable input may result in a significant change to the value of the investment as follows:

| Unobservable Input | Impact to Value if Input Increases | Input to Value if Input Decreases |

| Discount for lack of marketability | Decrease | Increase |

| Likelihood of issuer to complete transaction | Increase | Decrease |

| Multiples of similar companies | Increase | Decrease |

4. Investment Advisory Fee and Other Transactions With Affiliates

The Trust has an agreement with Cove Street Capital, LLC (the “Adviser”) to furnish investment advisory services to the Fund. Pursuant to an Investment Advisory Agreement between the Trust and the Adviser, the Adviser is entitled to receive, on a monthly basis, an annual advisory fee equal to 0.85% of the Fund's average daily net assets.

The Fund’s Adviser has contractually agreed to waive a portion or all of its management fees and/or reimburse the Fund for its expenses to ensure that total annual operating expenses (excluding acquired fund fees and expenses, interest, taxes, brokerage commissions and extraordinary expenses) do not exceed 1.25% of the average daily net assets. Fees waived and expenses reimbursed by the Adviser may be recouped by the Adviser for a period of thirty-six months following the month during which such waiver or reimbursement was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the expense reimbursement occurred and at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite in term, but cannot be terminated within a year after the effective date of the Fund’s prospectus.

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Notes to Financial Statements (continued) September 30, 2020 |

After that date, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board or the Adviser, with the consent of the Board. Total fee recoupment in the fiscal year ended September 30, 2020, was $540, which represented fee waivers occurring during the current fiscal year. As of September 30, 2020, the Fund has no previously waived fees or reimbursed expenses subject to potential recovery.

U.S. Bancorp Fund Services, LLC (the “Administrator”), doing business as U.S. Bank Global Fund Services, acts as the Fund’s Administrator, Transfer Agent, and Fund Accountant. U.S. Bank N.A. (the “Custodian”) serves as the custodian to the Fund. The Custodian is an affiliate of the Administrator. The Administrator performs various administrative and accounting services for the Fund. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Custodian; coordinates the payment of the Fund’s expenses and reviews the Fund’s expense accruals. The officers of the Trust, including the Chief Compliance Officer, are employees of the Administrator. As compensation for its services, the Administrator is entitled to a monthly fee at an annual rate based upon the average daily net assets of the Fund, subject to annual minimums. Fees paid by the Fund for administration and accounting, transfer agency, custody and compliance services for the year ended September 30, 2020, are disclosed in the Statement of Operations.

Quasar Distributors, LLC (“Quasar”) acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. Effective March 31, 2020, Foreside Financial Group, LLC (“Foreside”) acquired Quasar from U.S. Bancorp. As a result of the acquisition, Quasar became a wholly-owned broker-dealer subsidiary of Foreside and is no longer affiliated with U.S. Bancorp. The Board has approved a new Distribution Agreement to enable Quasar to continue serving as the Fund’s distributor.

5. Capital Share Transactions

| Transactions in shares of the Fund were as follows: | | For the Year Ended September 30, 2020 | | | For the Year Ended September 30, 2019 | |

| Institutional Class: | | | | | | |

| Shares sold | | | 891,912 | | | | 470,738 | |

| Shares issued to holders in reinvestment of distributions | | | 23,205 | | | | 99,189 | |

| Shares redeemed | | | (1,689,623 | ) | | | (1,044,331 | ) |

| Net decrease in shares outstanding | | | (774,506 | ) | | | (474,404 | ) |

6. Investment Transactions

The aggregate purchases and sales, excluding Short-Term investments, by the Fund for the year ended September 30, 2020, were as follows:

| | | Purchases | | | Sales | |

U.S. Government Securities | | $ | - | | | $ | - | |

Other Securities | | $ | 70,650,834 | | | $ | 87,540,958 | |

Continued on next page.

Notes to Financial Statements (continued) September 30, 2020 | Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund |

7. Income Tax Information

The aggregate gross unrealized appreciation and depreciation of securities held by the Fund and the total cost of securities for federal income tax purposes at September 30, 2020, were as follows:

| Aggregate Gross Appreciation | Aggregate Gross Depreciation | Net Depreciation | Federal Income Tax Cost |

| $8,744,764 | $(20,888,846) | $(12,144,082) | $86,818,036 |

Any difference between book-basis and tax-basis unrealized appreciation would be attributable primarily to the tax deferral of losses on wash sales in the Fund.

At September 30, 2020, the Fund’s components of distributable earnings on a tax-basis were as follows:

Undistributed Ordinary Income | Undistributed Long- Term Capital Gain | Other Accumulated Losses | Unrealized Depreciation | Total Accumulated Loss |

| $775,190 | $- | $(1,577,983) | $(12,144,082) | $(12,946,875) |

A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital, and ordinary losses which occur during the portion of a Fund’s taxable year subsequent to October 31 and December 31, respectively. For the taxable year ended September 30, 2020, the Fund did not defer any qualified late year losses. As of September 30, 2020, the Fund had a short- term capital loss carryforward $1,577,983, which will be permitted to be carried over for an unlimited period.

The tax character of distributions paid for the year ended September 30, 2020, were as follows:

| | Ordinary Income* | Long Term Capital Gains | Total |

| Amount in Dollars | $995,461 | $- | $995,461 |

| Amount per Share | $0.27581 | $- | $0.27581 |

The tax character of distributions paid for the year ended September 30, 2019 were as follows:

| | Ordinary Income* | Long Term Capital Gains | Total |

| Amount in Dollars | $159,360 | $3,813,644 | $3,973,004 |

| Amount per Share | $0.04073 | $0.97476 | $1.01549 |

*For federal income tax purposes, distributions of short-term capital gains are treated as ordinary income distributions.

Continued on next page.

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Notes to Financial Statements (continued) September 30, 2020 |

As of September 30, 2020, the Fund had a significant portion of its assets invested in the producer durables sector. The producer durables sector may be affected by changes in supply and demand, government regulation, world events, and economic conditions.

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of September 30, 2020, there were no shareholders owning more than 25% of the Fund's outstanding shares.

The Fund has established an unsecured line of credit (“LOC”) in the amount of $10,000,000, 15% of gross market value of the Fund, or 33.33% of the fair value of the Fund’s unencumbered assets, whichever is less. The LOC matures unless renewed on July 23, 2021. This LOC is intended to provide short-term financing, if necessary, subject to certain restrictions and covenants in connection with shareholder redemptions and other short-term liquidity needs of the Fund. The LOC is with the Custodian. Interest is charged at the prime rate which was 3.25% as of September 30, 2020. The interest rate during the year was 3.25%. The Fund has authorized the Custodian to charge any of the Fund’s accounts for any missed payments. The weighted average interest rate paid on outstanding borrowings for the Fund was 3.25%. For the year ended September 30, 2020, the Fund’s LOC activity was as follows:

LOC Agent | Average Borrowings | Amount Outstanding as of September 30, 2020 | Interest Expense | Maximum Borrowing | Date of Maximum Borrowing |

| U.S. Bank N.A. | $13,970 | $ - | $462 | $1,964,000 | 9/1/2020 |

The global outbreak of COVID-19 (commonly referred to as “coronavirus”) has disrupted economic markets and the prolonged economic impact is uncertain. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn adversely affect the value and liquidity of the Fund's investments, impair the Fund's ability to satisfy redemption requests, and negatively impact the Fund's performance.

End of Notes to Financial Statements.

Appendix

Appendix Contents

Report of Independent Registered Public Accounting Firm

Additional Information

Privacy Notice

Report of Independent Registered Public Accounting Firm | Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund |

To the Shareholders of Cove Street Capital Small Cap Value

Fund and Board of Trustees of Managed Portfolio Series

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Cove Street Capital Small Cap Value Fund (the “Fund”), a series of Managed Portfolio Series, as of September 30, 2020, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements���). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2020, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2020, by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2011.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

November 24, 2020

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Additional Information (unaudited) |

Name, Address and Year of Birth | Position(s) Held with the Trust | Term of Office and Length of Time Served | Number of Portfolios in Trust Overseen by Trustee | Principal Occupation(s) During the Past Five Years | Other Directorships Held by Trustee During the Past Five Years |

| Independent Trustees |

Leonard M. Rush, CPA 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1946 | Lead Independent Trustee and Audit Committee Chairman | Indefinite Term; Since April 2011 | 37 | Retired, Chief Financial Officer, Robert W. Baird & Co. Incorporated (2000-2011). | Independent Trustee, ETF Series Solutions (49 Portfolios) (2012-Present); Director, Anchor Bancorp Wisconsin, Inc. (2011-2013) |

David A. Massart 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1967 | Trustee and Valuation Committee Chairman | Indefinite Term; Since April 2011 | 37 | Co-Founder and Chief Investment Strategist, Next Generation Wealth Management, Inc. (2005-present). | Independent Trustee, ETF Series Solutions (49 Portfolios) (2012-Present) |

David M. Swanson 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1957 | Trustee

| Indefinite Term; Since April 2011 | 37 | Founder and Managing Principal, SwanDog Strategic Marketing, LLC (2006-present). | Independent Trustee, ALPS Variable Investment Trust (7 Portfolios) (2006-Present); Independent Trustee, RiverNorth Opportunities Closed-End Fund (2015-Present);Independent Trustee, RiverNorth Funds (3 Portfolios) (2018-Present); RiverNorth Managed Duration Municipal Income Fund Inc. (1 Portfolio) (2019 to present); RiverNorth Marketplace Lending Corporation (1 Portfolio) (2018 to present); RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. (1 Portfolio) (2018 to present); RiverNorth Opportunities Fund, Inc. (1 Portfolio) (2013 to present); RiverNorth Opportunistic Municipal Income Fund, Inc. (1 Portfolio) (2018 to present) |

Additional Information (continued) (unaudited) | Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund |

Name, Address and Year of Birth | Position(s) Held with the Trust | Term of Office and Length of Time Served | Number of Portfolios in Trust Overseen by Trustee | Principal Occupation(s) During the Past Five Years | Other Directorships Held by Trustee During the Past Five Years |

Robert J. Kern* 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1958 | Chairman, and Trustee | Indefinite Term; Since January 2011 | 37 | Retired (July 2018 – present); Executive Vice President, U.S. Bancorp Fund Services, LLC (1994-2018). | None |

* Mr. Kern became an Independent Trustee on July 6, 2020. Previously he was an Interested Trustee. |

| Officers |

Brian R. Wiedmeyer 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1973 | President and Principal Executive Officer | Indefinite Term, Since November 2018 | N/A | Vice President, U.S. Bancorp Fund Services, LLC (2005-present). | N/A |

Deborah Ward 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1966 | Vice President, Chief Compliance Officer and Anti-Money Laundering Officer | Indefinite Term; Since April 2013 | N/A | Senior Vice President, U.S. Bancorp Fund Services, LLC (2004-present). | N/A |

Benjamin Eirich 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1981 | Treasurer, Principal Financial Officer and Vice President | Indefinite Term; Since August 2019 (Treasurer); Since November 2018 (Vice President) | N/A | Assistant Vice President, U.S. Bancorp Fund Services, LLC (2008-present). | N/A |

Thomas A. Bausch, Esq. 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1979 | Secretary | Indefinite Term; Since November 2017 | N/A | Vice President, U.S. Bancorp Fund Services, LLC (2016-Present); Associate, Godfrey & Kahn S.C. (2012-2016). | N/A |

Douglas Schafer 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1970 | Assistant Treasurer and Vice President | Indefinite Term; Since May 2016 (Assistant Treasurer); Since November 2018 (Vice President) | N/A | Assistant Vice President, U.S. Bancorp Fund Services, LLC (2002-present). | N/A |

Michael J. Cyr II 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1992 | Assistant Treasurer and Vice President | Indefinite Term; Since August 2019 | N/A | Officer, U.S. Bancorp Fund Services, LLC (2013-present). | N/A |

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Additional Information (continued) (unaudited) |

Statement Regarding the Fund’s Liquidity Risk Management Program

Pursuant to Rule 22e-4 under the Investment Company Act of 1940, the Trust, on behalf of the Cove Street Capital Small Cap Value Fund (the “Fund”), has adopted and implemented a written liquidity risk management program (the “Program”) that includes policies and procedures reasonably designed to comply with the requirements of Rule 22e-4, including: (i) assessment, management and periodic review of liquidity risk; (ii) classification of portfolio holdings; (iii) establishment of a highly liquid investment minimum (“HLIM”), as applicable; (iv) limitation on illiquid investments; and (v) redemptions in-kind. The Trust’s Board of Trustees (the “Board”) has approved the designation of Cove Street Capital, LLC (“Cove Street”) as the administrator of the Program (the “Program Administrator”). Personnel of Cove Street or its affiliates conduct the day-to-day operation of the Program pursuant to policies and procedures administered by the Program Administrator.

In accordance with Rule 22e-4, the Board reviewed a report prepared by the Program Administrator (the “Report”) regarding the operation of the Program and its adequacy and effectiveness of implementation for the period June 1, 2019, through December 31, 2019 (the “Reporting Period”). No significant liquidity events impacting the Fund during the Reporting Period or material changes to the Program were noted in the Report.

Under the Program, Cove Street manages and periodically reviews the Fund’s liquidity risk, including consideration of applicable factors specified in Rule 22e-4 and the Program. Liquidity risk is defined as the risk that the Fund could not meet shareholder redemption requests without significant dilution of remaining shareholders’ interests in the Fund. In general, this risk was managed during the Reporting Period by monitoring the degree of liquidity of the Fund’s investments, limiting the amount of the Fund’s illiquid investments, and utilizing various risk management tools and facilities available to the Fund for meeting shareholder redemptions, among other means. In the Report, Cove Street provided its assessment that, based on the information considered in its review, the Program remains reasonably designed to manage the Fund’s liquidity risk and the Fund’ s investment strategy remains appropriate for an open-end fund.

Pursuant to the Program, the Program Administrator oversaw the classification of each of the Fund’s portfolio investments as highly liquid, moderately liquid, less liquid or illiquid during the Reporting Period, including in connection with recording investment classifications on Form N-PORT. Cove Street’s process of determining the degree of liquidity of the Fund’s investments is supported by one or more third-party liquidity assessment vendors.

The Fund qualified as a “primarily highly liquid fund” as defined in the Program during the Reporting Period. Accordingly, the Fund was not required to establish a HLIM or comply with the related Program provisions during the Reporting Period.

During the Reporting Period, the Fund’s investments were monitored for compliance with the 15% limitation on illiquid investments pursuant to the Program and in accordance with Rule 22e-4.

The Report noted that the Fund’s did not have redemptions in-kind during the Reporting Period. The Report concluded: (i) the Program was implemented and operated effectively to achieve the goal of assessing and managing the Fund’s liquidity risk during the Reporting Period; and (ii) the Fund was able to meet requests for redemption without significant dilution of remaining investors’ interests in the Fund during the Reporting Period.

Annual Report 2020 — CSCAX Cove Street Capital Small Cap Value Fund | Additional Information (continued) (unaudited) |

Availability of Fund Portfolio Information

The Fund files complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q or Part F of Form N-PORT (beginning with filings after March 31, 2020). The Fund’s Form N-Q or Part F of Form N-PORT are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. For information on the Public Reference Room call 1-800-SEC-0330. In addition, the Fund’s Form N-Q or Part F of Form N-PORT is available without charge upon request by calling 1-866-497-0097.

Availability of Fund Proxy Voting Information

A description of the Fund’s Proxy Voting Policies and Procedures is available without charge, upon request, by calling 1-866-497-0097. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (1) without charge, upon request, by calling 1- 888-621-9258, or (2) on the SEC’s website at www.sec.gov.

Fund Distribution Information

For the fiscal year ended September 30, 2020, certain dividends paid by the Fund may be reported as qualified dividend income and may be eligible for taxation at capital gain rates. The percentage of dividends declared from ordinary income designated as qualified dividend income was 100.00% for the Fund. For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the fiscal year ended September 30, 2020 was 100.00% for the Fund. The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(c) was 0.00%.