| | | Ticker Symbols | |

| | Investor Class | Institutional Class | IS Class |

| | | | |

| Jackson Square | [Not available | [Not available | |

| All-Cap Growth Fund | for purchase] | for purchase] | JSSSX |

| | | | |

| Jackson Square | [Not available | | |

| Global Growth Fund | for purchase] | JSPTX | JSPUX |

| | | | |

| Jackson Square | | | |

| Large-Cap Growth Fund | JSPJX | JSPIX | DPLGX |

| | | | |

| Jackson Square | [Not available | [Not available | |

| Select 20 Growth Fund | for purchase] | for purchase] | DPCEX |

| | | | |

| Jackson Square | | | |

| SMID-Cap Growth Fund | JSMVX | JSMTX | DCGTX |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.jspfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-844-577-3863 or by sending an e-mail request to info@jspfunds.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 1-844-577-3863 or send an email request to info@jspfunds.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with a Fund.

Annual Report

| www.jspfunds.com | October 31, 2020 |

(This Page Intentionally Left Blank.)

Jackson Square Funds

October 31, 2020

Dear Shareholders:

Jackson Square Partners, LLC (“Jackson Square”), a U.S. registered investment adviser, is the adviser to the Jackson Square All-Cap Growth Fund, Jackson Square Global Growth Fund, Jackson Square Large-Cap Growth Fund, Jackson Square Select 20 Growth Fund, and Jackson Square SMID-Cap Growth Fund.

After significant positive absolute returns in the equity market over the past several years, we saw continued market strength as measured by the entire fiscal period but with extreme volatility during several months in 2020 brought about by the COVID-19 global pandemic. The volatility was primarily a function of fundamental concerns of investors assessing the economic damage brought by the impacts of COVID-19. Such a disruption in economic activity by both the virus itself and by mitigation efforts by authorities worldwide (e.g. economic shutdowns, restrictions on gatherings and travel) caused a significant market sell off in the early spring, only to reverse to a strong recovery throughout the following months as mitigation efforts and the potential for better treatments and vaccine candidates become more promising. Before COVID-19, investors were already struggling with accurately predicting the pace of global economic recovery and assessing external factors that threaten economic fundamentals, such as central bank actions and fiscal policy debates across the globe. However, the decade-long market strength has been fueled at least partly by a supportive condition of low interest rates and a lack of geopolitical shocks. The pandemic is certainly a unique and unprecedented global development in modern times, but the fiscal period ended with investors more focused on the potential economic recovery outlook in 2021 and beyond than in wallowing in the hard and soft costs of the virus to the global economy. Within this backdrop, investors have leaned toward equities as a preferred asset allocation choice resulting in a strong U.S. equity market with only minor pullbacks.

Soon after the fiscal year ended October 31, 2020, the post-election period was not without drama as President Trump is challenging the results of President-Elect Joseph Biden’s victory, and there remains some concern for disruption to what is normally an orderly Presidential transition. However, the financial markets do not appear to be factoring in any particular risk of national crisis. Despite the unusual external factors brought in 2020 in the form of a global pandemic and the President contending election results, and any other macro events or circumstances that may arise, we remain consistent in our long-term investment philosophy:

We want to own what we view as strong secular-growth companies with solid business models and competitive positions that we believe can grow market share and have the potential to deliver shareholder value in a variety of market environments.

Jackson Square All-Cap Growth Fund

All-Cap Growth Fund

Within the Fund

For the fiscal year ended Oct. 31, 2020, All-Cap Growth Fund IS Class shares gained 27.81%. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the Russell 3000® Growth Index, rose 28.20%. For complete, annualized performance of All-Cap Growth Fund, please see the table on page 4.

Strong relative performance in information technology outperformed weak relative performance in consumer discretionary. On a stock-specific level, the following were the most significant contributors and detractors during the period.

Twilio, Inc. Class A, a cloud communications platform, was a contributor to performance during the period. We believe that instant digital communication with customers and employees across any medium in any geography is a hugely complex problem that businesses increasingly need to solve, and we believe Twilio, as the leading communications-as-a-service platform, at multiples the size of its next largest competitor, will be the primary beneficiary of that trend. The addressable market is tens of billions of procurement dollars and essentially untapped with Twilio’s still negligible penetration, which we believe is set to expand meaningfully and drive consistently high revenue growth for many years.

Coupa Software, Inc., a cloud-based enterprise software-as-a-service platform addressing business spend management, was a contributor to performance during the period. The brand is relatively nascent but is rapidly inflecting from “cool but risky startup”, nibbling at the heels of sleepy incumbents SAP and Oracle, to the gold standard for procurement organizations within the enterprise. We believe Coupa is the next horizontal software category killer and is very early on a long journey of disrupting a giant spend management total addressable market with rapid topline growth and healthy unit economics supporting high terminal profitability. Additionally, the company is rapidly approaching $2 trillion of customer spend running through its platform with aspirations to be the mousetrap for businesses to consolidate and optimize payment to suppliers.

SailPoint Technologies, Inc., a software company focusing on identity governance, was a contributor to performance during the period. COVID-19 proved to be a demand tailwind as best-of-breed identity governance became a strategic priority during lockdown, driving a sharp acceleration in billings. We believe recent results reinforce our thesis which continues to focus on SAIL’s dominant competitive lead and long growth runway against a sea of inferior legacy competition in a cybersecurity category that is becoming increasingly vital. The business model also continues to shift from on-premise perpetual licenses to subscription-as-a-service which we believe will improve the visibility of key financial metrics and therefore decrease the stock’s implied cost of capital over time.

Airbus SE, a European civil and defense aircraft manufacturer was a detractor from performance during the period. Although the stock began to recover from its sharp decline in March, it lagged the broader market index as investors continued to be cautious about travel related names. Investors’ debate has shifted to the medium term demand for new aircraft as Airbus has now mapped out a reasonable near term crisis management plan. We believe the company can significantly raise production rates in 2022 and 2023 and is significantly undervalued on that potential.

Jackson Square All-Cap Growth Fund

Amazon.com, Inc., a global e-commerce and technology service provider, was a detractor during the period but for purely technical reasons. The stock significantly outperformed the benchmark during the period, but our average weight in the stock was underweight. While we do not explicitly manage to the benchmark and individual stock weights are merely a residual effect of our bottom up, stock specific fundamental analysis, we would expect our weight in the position to increase as the stock has performed better than most stocks and because of our increased conviction in the fundamentals and valuation of the company.

Liberty TripAdvisor Holdings, Inc., a travel website providing travel advice and planning features, detracted from performance during the period. The company’s hotel segment has struggled amid competitive headwinds, including increased challenges from Google’s search practices. We exited the stock to redeploy capital elsewhere.

Jackson Square All-Cap Growth Fund

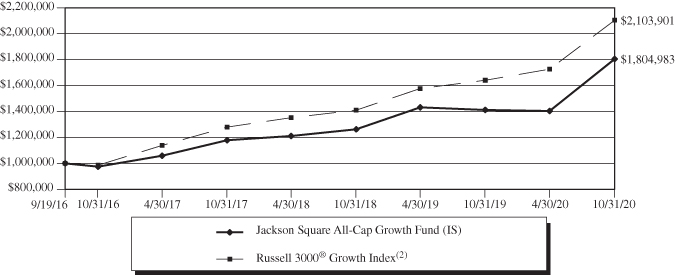

Value of $1,000,000 Investment (Unaudited)

The chart assumes an initial investment of $1,000,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-844-577-3863. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of October 31, 2020

| | 1 year | 3 year | Since Inception(1) |

| IS Class | 27.81% | 15.26% | 15.43% |

Russell 3000® Growth Index(2) | 28.20% | 18.01% | 19.81% |

| (1) | The IS Class commenced operations on September 19, 2016. |

| (2) | The Russell 3000® Growth Index measures the growth segment of the U.S. equity universe. It includes those Russell 3000® Index. companies with higher price-to-book ratios and higher forecasted growth values. One cannot invest directly in an Index. |

The following is expense information for the All-Cap Growth Fund (the “Fund”) as disclosed in the most recent prospectus dated February 28, 2020: Gross Expenses: 2.47%, Net Expenses: 0.90%. Jackson Square Partners, LLC (the “Adviser”) has contractually agreed to waive its management fees and pay Fund expenses in order to ensure the Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, shareholder servicing fees, acquired fund fees and expenses, brokerage commissions, leverage, interest, taxes, and extraordinary expenses) do not exceed 0.90% of the average daily net assets of the Fund. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieve without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite, but cannot be terminated through at least February 28, 2021. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Board of Trustees (the “Board”) or the Adviser.

The actual expense ratio applicable to investors, as disclosed in the Financial Highlights for the fiscal year ended October 31, 2020, was 0.90% for the IS Class.

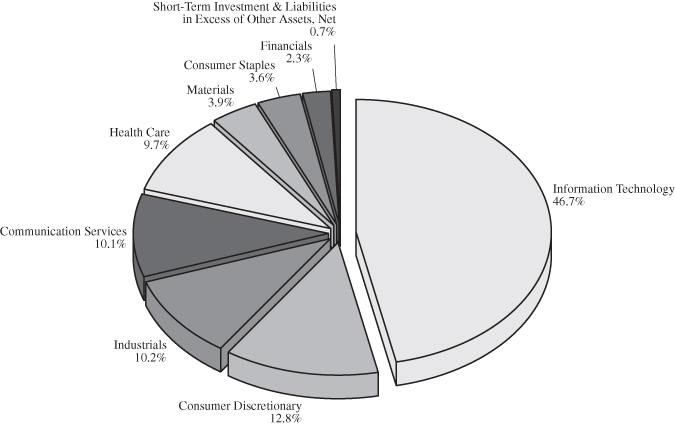

Jackson Square All-Cap Growth Fund

Sector Allocation(1) (Unaudited)

As of October 31, 2020

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

As of October 31, 2020

(% of Net Assets)

| | Microsoft | | | 8.9 | % |

| | Ball | | | 3.9 | % |

| | Wix.com | | | 3.6 | % |

| | Grocery Outlet Holding | | | 3.6 | % |

| | Visa – Class A | | | 3.4 | % |

| | New York Times – Class A | | | 3.3 | % |

| | Coupa Software | | | 3.1 | % |

| | Amazon.com | | | 3.1 | % |

| | Twilio – Class A | | | 2.9 | % |

| | ServiceNow | | | 2.9 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Jackson Square Global Growth Fund

Global Growth Fund

Within the Fund

For the fiscal year ended Oct. 31, 2020, Jackson Square Global Growth Fund IS and Institutional Class shares gained 16.20% and 16.17%, respectively. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the MSCI All Country World Index, rose 4.89%. For complete, annualized performance of Jackson Square Global Growth Fund, please see the table on page 8.

Strong relative performance in information technology outperformed weak relative performance in health care. On a stock-specific level, the following were the most significant contributors and detractors during the period.

Wix.com Ltd., a cloud-based web development platform, was contributor to performance during the period. The impact of COVID-19 brought the need for more small and medium businesses to go online and expanded Wix.com’s reach. We believe the growth opportunity remains attractive, due in part to the fact that there are over 400 million small and medium size businesses that are the company’s target market--the majority of which have yet to obtain an online presence. We believe such a presence is becoming more necessary given the COVID-19-driven disruption and challenges to the physical presence of many companies, along with the need to accurately and efficiently market online to customers.

Farfetch Limited Class A, a UK-based online retail business selling multi-brand digital luxury goods in over 100 countries, was a contributor to performance during the period. Following a difficult 2019 for the company, we went through an extensive re-underwriting of the position and determined that Farfetch remains in the best position to capitalize on the luxury industry moving online over the next several years. While we have expected this to play out in a linear fashion over many years as brands reassess their distribution strategies, we believe COVID-19 has accelerated this shift. Given 90% of luxury purchases are in store and the vast majority of demand is derived from cross-border travel, we believe the company is in the enviable position of having the best platform for the brands to utilize as demand migrates online. The stock continues to outperform following a strong earnings report that highlighted growth is accelerating. In addition, the company continues to sign on new brands to the platform. We remain constructive on the risk/reward profile at these price levels and would note the balance sheet is well capitalized to absorb temporary disruptions.

MercadoLibre, Inc., a top online retailer in Latin America, was a contributor to performance during the period. Third-party data sources showed continued acceleration across its ecommerce and payments platforms with strong momentum in monthly users and transaction volumes. We believe the data highlights that the company remains well positioned to benefit from the secular growth of e-commerce within the region and further accelerated by COVID impacts.

Airbus SE, a European civil and defense aircraft manufacturer was a detractor from performance during the period. Although the stock began to recover from its sharp decline in March, it lagged the broader market index as investors continued to be cautious about travel related names. Investors’ debate has shifted to the medium term demand for new aircraft as Airbus has now mapped out a reasonable near term crisis management plan. We believe the company can significantly raise production rates in 2022 and 2023 and is significantly undervalued on that potential.

Haemonetics Corporation, an automated blood collection device company, was a detractor from performance during the period. We believe that several items contributed to its underperformance, including: (i) neutral intra-quarter commentary on COVID-19’s near-term fundamental impact, (ii) significant forced selling during an index rebalance, and (iii) potential threats of competing plasma therapies to the company’s customers given

Jackson Square Global Growth Fund

Argenx’s earlier-than-expected Phase III readout of its FcRn antagonist solution designed to treat myasthenia gravis (MG). After a deeper dive into competitive threats, we believe too much long-term uncertainty existed around several paths for competing therapies to disrupt the company’s customers, and therefore its fundamentals, so we decided to move on for a higher confidence new idea.

InterContinental Hotels Group PLC, an owner and operator of hotels, was a detractor from performance during the period. Intercontinental Hotel Group (IHG), a pure play hotel franchisor, has been adversely impacted by the COVID-19 virus as travel and hotel stays have declined materially. The hotel franchise model is a pro-cyclical structure that requires very little capital for IHG to grow in normal times. However, in a severe adverse economic travel environment, like the current situation, the health of the franchises becomes un-analyzable (balance sheets; loan covenants etc.). Given our lack of conviction in the overall health of the IHG ecosystem, we have decided to sell our position and redeploy the capital into higher conviction travel names.

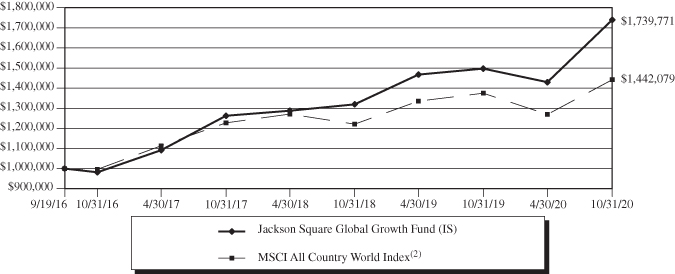

Jackson Square Global Growth Fund

Value of $1,000,000 Investment (Unaudited)

The chart assumes an initial investment of $1,000,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-844-577-3863. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of October 31, 2020

| | 1 year | 3 year | Since Inception(1) |

| IS Class | 16.20% | 11.27% | 14.40% |

| Institutional Class | 16.17% | 11.27% | 14.38% |

MSCI All Country World Index(2) | 4.89% | 5.52% | 9.30% |

| (1) | Inception date of each class was September 19, 2016. |

| (2) | The MSCI All Country World Index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed emerging markets. One cannot invest directly in an Index. |

The following is expense information for the Jackson Square Global Growth Fund (the “Fund”) as disclosed in the Fund’s most recent prospectus dated February 28, 2020: Institutional Class – Gross Expenses: 2.11%, Net Expenses: 1.15%; IS Class – Gross Expenses: 2.01%, Net Expenses: 1.05%. The Adviser has contractually agreed to waive its management fees and pay Fund expenses in order to ensure the Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, shareholder servicing fees, acquired fund fees and expenses, brokerage commissions, leverage, interest, taxes, and extraordinary expenses) do not exceed 1.05% of the average daily net assets of the Fund. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieve without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite, but cannot be terminated through at least February 28, 2021. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Board or the Adviser.

The actual expense ratio applicable to investors, as disclosed in the Financial Highlights for the fiscal year ended October 31, 2020, was 1.05% and 1.05% for the IS Class and Institutional Class, respectively.

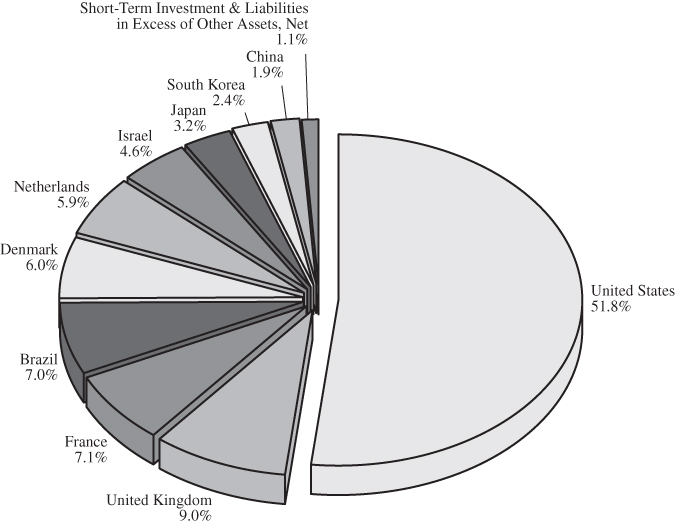

Jackson Square Global Growth Fund

Country Allocation(1) (Unaudited)

As of October 31, 2020

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

As of October 31, 2020

(% of Net Assets)

| | Microsoft | | | 6.5 | % |

| | Mastercard – Class A | | | 3.8 | % |

| | Wix.com | | | 3.6 | % |

| | New York Times – Class A | | | 3.6 | % |

| | Visa – Class A | | | 3.5 | % |

| | MercadoLibre | | | 3.4 | % |

| | Netflix | | | 3.2 | % |

| | Experian | | | 3.2 | % |

| | MonotaRO | | | 3.2 | % |

| | Farfetch – Class A | | | 3.2 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Jackson Square Large-Cap Growth Fund

Large-Cap Growth Fund

Within the Fund

For the fiscal year ended Oct. 31, 2020, Jackson Square Large-Cap Growth Fund IS, Institutional and Investor Classes shares gained 26.73%, 26.78% and 26.49%, respectively. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the Russell 1000® Growth Index, gained 29.22%. For complete, annualized performance of Large-Cap Growth Fund, please see the table on page 12.

Strong relative performance in information technology was unable to overcome weak relative performance in financials. On a stock-specific level, the following were the most significant contributors and detractors during the period.

Twilio, Inc. Class A, a cloud communications platform, was a contributor to performance during the period. We believe that instant digital communication with customers and employees across any medium in any geography is a hugely complex problem that businesses increasingly need to solve, and we believe Twilio, as the leading communications-as-a-service platform, at multiples the size of its next largest competitor, will be the primary beneficiary of that trend. The addressable market is tens of billions of procurement dollars and essentially untapped with Twilio’s still negligible penetration, which we believe is set to expand meaningfully and drive consistently high revenue growth for many years.

ServiceNow, Inc., a cloud-based software company focusing on core systems for IT departments, was a contributor to performance during the period. The company’s new management team led by CEO Bill McDermott delivered strong growth and profitability against fears of slowing performance during the management transition period. During the COVID-19 pandemic, the company also successfully stabilized and reaccelerated growth in a rapid time frame as they focused on rapidly digitizing large companies, a trend which is likely to lead to additional tailwinds in upcoming years. We believe the company’s growth will remain exceptionally strong for a software company of this scale driven by continued modernization of IT departments and continuing success expanding into HR, Finance, and other adjacent workflows.

PayPal Holdings Inc., a technology platform company that enables digital and mobile payments on behalf of consumers and merchants, was a contributor to performance during the period. The company noted marked acceleration for new users, retention, engagement, and volumes across their entire brand portfolio as COVID-19 effects have pulled forward consumer e-commerce demand across the globe. Third party data released in June has shown a significant acceleration in new application installs for both PayPal and Venmo, which have helped sustain the stock’s outperformance. We believe the strength across the portfolio highlights the reach, scale and technology of the company that is uniquely situated to capture market share of digital payments.

Constellation Brands, Inc. Class A, a producer and marketer of beer, wine, and spirits, was a detractor from performance during the period. Investors became concerned about the company’s leverage profile on the balance sheet as well as the Mexican government taking several unexpected anti-business initiatives which hurt Constellation. We sold our position in favor of more attractive opportunities.

CME Group Inc. Class A, a financial market company operating options and futures exchanges, was a detractor from performance during the period. CME’s stock underperformed the market during the period as a result of generally lower volumes on its futures exchange. Since the company’s costs base is relatively fixed, lower volumes directly lead to lower earnings and cash flows. Although we greatly admire the company’s business model and management team, we have decided to exit the position as we believe the probability of sustained lower volumes has increased as a result of global central bank intervention efforts, thereby reducing interest rate volatility and associated futures trading volumes.

Jackson Square Large-Cap Growth Fund

Dollar Tree, Inc., a chain of discount variety stores, was a detractor from performance during the period. We considered re-underwriting the position but ultimately concluded that this company requires a new management team to realize the substantial value creation opportunities related to a Family Dollar turnaround and expanding price tiers at Dollar Tree. Given our increased concerns of challenging fundamentals and management execution, we decided to redeploy assets elsewhere.

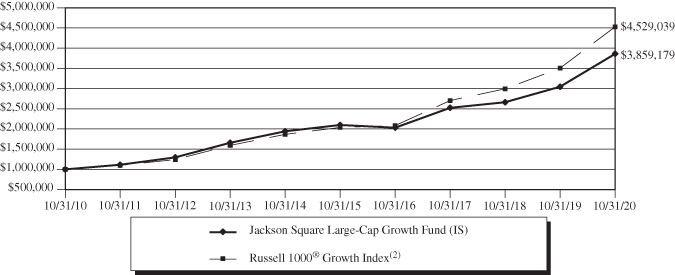

Jackson Square Large-Cap Growth Fund

Value of $1,000,000 Investment (Unaudited)

The chart assumes an initial investment of $1,000,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-844-577-3863. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of October 31, 2020

| | 1 year | 5 years | 10 years | Since Inception(1) |

| IS Class | 26.73% | 12.96% | 14.46% | 9.89% |

| Institutional Class | 26.78% | 12.94% | 14.39% | 9.81% |

| Investor Class | 26.49% | 12.67% | 14.11% | 9.54% |

Russell 1000® Growth Index(2) | 29.22% | 17.32% | 16.31% | 11.80% |

| (1) | The IS Class commenced operations on November 1, 2005, and the Institutional Class and Investor Class shares commenced operations on September 19, 2016. Performance for the Institutional Class and Investor Class prior to period inception of each class is based on the performance of the IS Class shares, adjusted for higher expenses applicable to each class’ shares. |

| (2) | The Russell 1000® Growth Index measures the performance of the large cap growth segment of the U.S. equity universe. It includes those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values. One cannot invest directly in an Index. |

The following is expense information for the Jackson Square Large-Cap Growth Fund (the “Fund”) as disclosed in the Fund’s most recent prospectus dated February 28, 2020: Investor Class – Gross Expenses: 1.16%, Net Expenses: 0.99%; Institutional Class – Gross Expenses: 0.91%, Net Expenses: 0.74%; IS Class – Gross Expenses: 0.80%, Net Expenses: 0.64%. The Adviser has contractually agreed to waive its management fees and pay Fund expenses in order to ensure the Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, shareholder servicing fees, acquired fund fees and expenses, brokerage commissions, leverage, interest, taxes, and extraordinary expenses) do not exceed 0.64% of the average daily net assets of the Fund. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieve without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite, but cannot be terminated through at least February 28, 2021. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Board or the Adviser.

The actual expense ratio applicable to investors, as disclosed in the Financial Highlights for the year ending October 31, 2020, was 0.64%, 0.64% and 0.89%, for the IS class, Institutional Class and Investor Class, respectively.

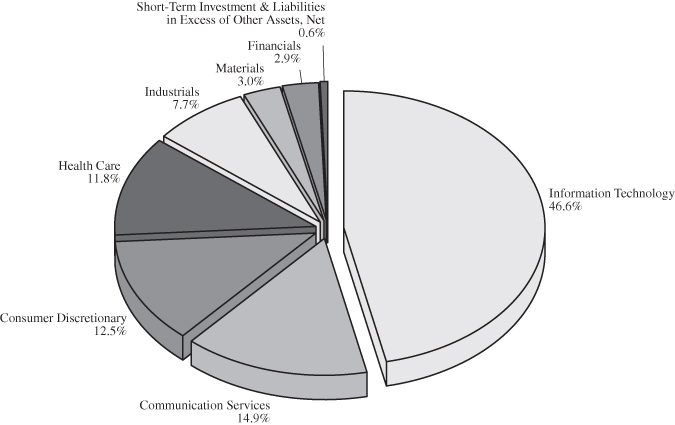

Jackson Square Large-Cap Growth Fund

Sector Allocation(1) (Unaudited)

As of October 31, 2020

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

As of October 31, 2020

(% of Net Assets)

| | Microsoft | | | 8.6 | % |

| | Amazon.com | | | 6.5 | % |

| | Visa – Class A | | | 5.5 | % |

| | Twilio – Class A | | | 5.1 | % |

| | ServiceNow | | | 4.8 | % |

| | Charter Communications – Class A | | | 4.7 | % |

| | Uber Technologies | | | 4.5 | % |

| | PayPal Holdings | | | 4.3 | % |

| | Mastercard – Class A | | | 4.1 | % |

| | Match Group | | | 3.8 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Jackson Square Select 20 Growth Fund

Select 20 Growth Fund

Within the Fund

For the fiscal year ended Oct. 31, 2020, Jackson Square Select 20 Fund IS Class shares gained 28.26%. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the Russell 3000® Growth Index, rose 28.20%. For complete, annualized performance of Jackson Square Select 20 Fund, please see the table on page 16.

Strong relative performance in information technology could not overcome the relative weak performance in consumer discretionary. On a stock-specific level, the following were the most significant contributors and detractors during the period.

Twilio, Inc. Class A, a cloud communications platform, was a contributor to performance during the period. We believe that instant digital communication with customers and employees across any medium in any geography is a hugely complex problem that businesses increasingly need to solve, and we believe Twilio, as the leading communications-as-a-service platform, at multiples the size of its next largest competitor, will be the primary beneficiary of that trend. The addressable market is tens of billions of procurement dollars and essentially untapped with Twilio’s still negligible penetration, which we believe is set to expand meaningfully and drive consistently high revenue growth for many years.

Coupa Software, Inc., a cloud-based enterprise software-as-a-service platform addressing business spend management, was a contributor to performance during the period. The brand is relatively nascent but is rapidly inflecting from “cool but risky startup”, nibbling at the heels of sleepy incumbents SAP and Oracle, to the gold standard for procurement organizations within the enterprise. We believe Coupa is the next horizontal software category killer and is very early on a long journey of disrupting a giant spend management total addressable market with rapid topline growth and healthy unit economics supporting high terminal profitability. Additionally, the company is rapidly approaching $2 trillion of customer spend running through its platform with aspirations to be the mousetrap for businesses to consolidate and optimize payment to suppliers.

Autodesk, Inc., a software company for the architecture, engineering, construction, manufacturing, media, and entertainment industries, was a contributor to performance during the period. Autodesk hosted an investor day with a bullish long-term outlook across its businesses and reiterated its medium-term financial outlook despite the challenging macro environment. Construction activity across key markets has also continued to rebound. Although we believe Autodesk’s shift in business model to cloud-based services and green-field growth opportunity in construction and manufacturing will continue to drive value over the long-term, we exited the stock to redeploy assets elsewhere.

Wyndham Hotels & Resorts, Inc., a franchised hotel chain, was a detractor from performance during the period. As an asset-lite hotel franchisor with ~85% of its earnings before interest, taxes, depreciation, and amortization generated in the U.S., the company’s earnings have been hit hard by COVID-19. We exited the stock to redeploy assets elsewhere.

CME Group Inc. Class A, a financial market company operating options and futures exchanges, was a detractor from performance during the period. CME’s stock underperformed the market during the period as a result of generally lower volumes on its futures exchange. Since the company’s costs base is relatively fixed, lower volumes directly lead to lower earnings and cash flows. Although we greatly admire the company’s business model and management team, we have decided to exit the position as we believe the probability of sustained lower volumes has increased as a result of global central bank intervention efforts, thereby reducing interest rate volatility and associated futures trading volumes.

Jackson Square Select 20 Growth Fund

Constellation Brands, Inc. Class A, a producer and marketer of beer, wine, and spirits, was a detractor from performance during the period. Investors became concerned about the company’s leverage profile on the balance sheet as well as the Mexican government taking several unexpected anti-business initiatives which hurt Constellation. We sold our position in favor of more attractive opportunities.

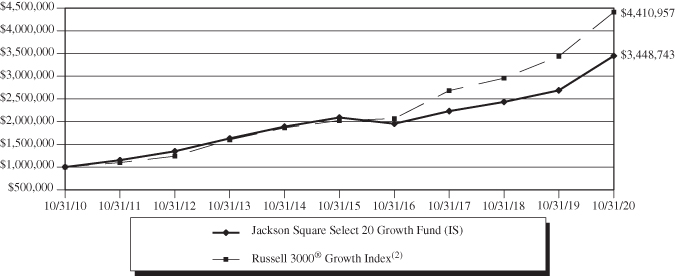

Jackson Square Select 20 Growth Fund

Value of $1,000,000 Investment (Unaudited)

The chart assumes an initial investment of $1,000,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-844-577-3863. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of October 31, 2020

| | 1 year | 5 years | 10 years | Since Inception(1) |

| IS Class | 28.26% | 10.52% | 13.18% | 4.46% |

Russell 3000® Growth Index(2) | 28.20% | 16.84% | 16.00% | 5.59% |

| (1) | The IS Class commenced operations on March 31, 2000. |

| (2) | The Russell 3000® Growth Index measures the growth segment of the U.S. equity universe. It includes those Russell 3000® Index composites with higher price-to-book ratios and higher forecasted growth values. One cannot invest directly in an Index. |

The following is expense information for the Select 20 Growth Fund (the “Fund”) as disclosed in the most recent prospectus dated February 28, 2020: Gross Expenses: 2.68%, Net Expenses: 0.87%. The Adviser has contractually agreed to waive its management fees and pay Fund expenses in order to ensure the Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, shareholder servicing fees, acquired fund fees and expenses, brokerage commissions, leverage, interest, taxes, and extraordinary expenses) do not exceed 0.87% of the average daily net assets of the Fund. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieve without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite, but cannot be terminated through at least February 28, 2021. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Board or the Adviser.

The actual expense ratio applicable to investors, as disclosed in the Financial Highlights for the fiscal year ended October 31, 2020, was 0.87% for the IS Class.

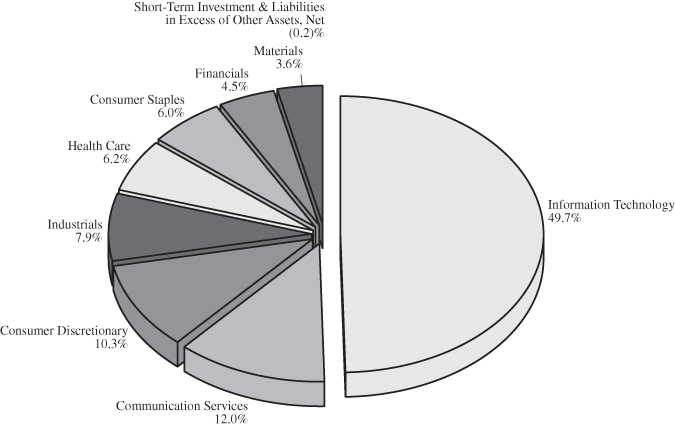

Jackson Square Select 20 Growth Fund

Sector Allocation(1) (Unaudited)

As of October 31, 2020

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

As of October 31, 2020

(% of Net Assets)

| | Microsoft | | | 10.7 | % |

| | Amazon.com | | | 6.9 | % |

| | LiveRamp Holdings | | | 6.5 | % |

| | Twilio – Class A | | | 6.2 | % |

| | Grocery Outlet Holding | | | 6.0 | % |

| | GCI Liberty – Class A | | | 5.4 | % |

| | Visa – Class A | | | 5.2 | % |

| | ServiceNow | | | 4.7 | % |

| | Elastic | | | 4.7 | % |

| | KKR & Co. – Class A | | | 4.5 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Jackson Square SMID-Cap Growth Fund

SMID-Cap Growth Fund

Within the Fund

For the fiscal year ended Oct. 31, 2020, SMID-Cap Growth Fund IS, Institutional and Investor Class shares gained 34.36%, 34.20% and 33.88%, respectively. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the Russell 2500® Growth Index, rose 21.71%. For complete, annualized performance of Jackson Square SMID-Cap Growth Fund, please see the table on page 20.

Strong relative performance in information technology was unable to overcome weak relative performance in health care. On a stock-specific level, the following were the most significant contributors and detractors during the period.

Wix.com Ltd., a cloud-based web development platform, was contributor to performance during the period. The impact of COVID-19 brought the need for more small and medium businesses to go online and expanded Wix.com’s reach. We believe the growth opportunity remains attractive, due in part to the fact that there are over 400 million small and medium size businesses that are the company’s target market--the majority of which have yet to obtain an online presence. We believe such a presence is becoming more necessary given the COVID-19-driven disruption and challenges to the physical presence of many companies, along with the need to accurately and efficiently market online to customers.

Farfetch Limited Class A, a UK-based online retail business selling multi-brand digital luxury goods in over 100 countries, was a contributor to performance during the period. Following a difficult 2019 for the company, we went through an extensive re-underwriting of the position and determined that Farfetch remains in the best position to capitalize on the luxury industry moving online over the next several years. While we have expected this to play out in a linear fashion over many years as brands reassess their distribution strategies, we believe COVID-19 has accelerated this shift. Given 90% of luxury purchases are in store and the vast majority of demand is derived from cross-border travel, we believe the company is in the enviable position of having the best platform for the brands to utilize as demand migrates online. The stock continues to outperform following a strong earnings report that highlighted growth is accelerating. In addition, the company continues to sign on new brands to the platform. We remain constructive on the risk/reward profile at these price levels and would note the balance sheet is well capitalized to absorb temporary disruptions.

Redfin Corporation, the web-based real estate database and brokerage service, was a contributor to performance during the period. The company’s digital capabilities, such as virtual tours and digital closing processes, allowed it to continue taking share in the tough COVID-19 environment. Furthermore, the residential real estate market is showing strong signs of recovery. We continue to believe there is ample opportunity in the long run for the company to gain market share as it disrupts the real estate brokerage market by streamlining the home buying and selling process and by emphasizing pricing and inventory transparency.

Liberty TripAdvisor Holdings, Inc., a travel website providing travel advice and planning features, detracted from performance during the period. The company’s hotel segment has struggled amid competitive headwinds, including increased challenges from Google’s search practices. We exited the stock to redeploy capital elsewhere.

Jackson Square SMID-Cap Growth Fund

J2 Global, Inc., a digital media ad platform and provider of cloud services to small and medium businesses, was a detractor from performance during the period. The stock declined on earnings and weaker guidance due to the deleterious impact of COVID-19, primarily on its advertising business. We exited the stock to redeploy capital elsewhere.

Wyndham Hotels & Resorts, Inc., a franchised hotel chain, was a detractor from performance during the period. As an asset-lite hotel franchisor with ~85% of its earnings before interest, taxes, depreciation, and amortization generated in the U.S., the company’s earnings have been hit hard by COVID-19. The stock significantly dislocated from our estimate of intrinsic business value in March and early spring allowing us to add to the position. It has since rebounded and we have trimmed it back as we monitor the risk/reward given the volatility and travel restrictions put in place due to COVID-19. We believe the company’s franchisees – mostly economy and midscale owners – are holding up much better than hotel peers in the upscale and luxury segment. While the situation remains fluid and the stock will remain volatile in the short-term, we remain patient long-term owners as we believe the risk/reward over a 3-5 year time horizon is compelling.

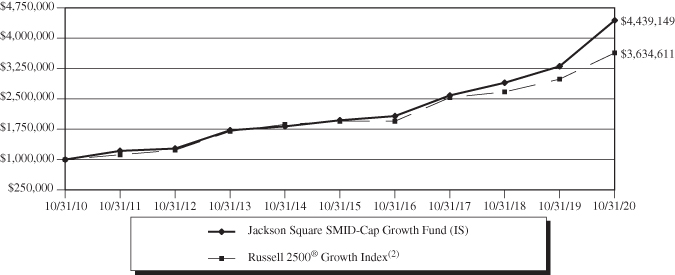

Jackson Square SMID-Cap Growth Fund

Value of $1,000,000 Investment (Unaudited)

The chart assumes an initial investment of $1,000,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-844-577-3863. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Returns as of October 31, 2020

| | 1 year | 5 years | 10 years | Since Inception(1) |

| IS Class | 34.36% | 17.64% | 16.07% | 12.50% |

| Institutional Class | 34.20% | 17.58% | 15.99% | 12.41% |

| Investor Class | 33.88% | 17.25% | 15.68% | 12.12% |

Russell 2500® Growth Index(2) | 21.71% | 13.30% | 13.77% | 10.27% |

| (1) | The IS Class commenced operations on December 1, 2003, the Institutional Class commenced operations on September 16, 2016 and the Investor Class commenced operations on September 19, 2016. Performance of the Institutional Class and Investor Class prior to inception of each class is based on the performance of the IS Class, adjusted for the higher expenses applicable to each class’ shares. |

| (2) | The Russell 2500® Growth Index measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500® companies with price-to-book ratios and higher forecasted growth values. One cannot invest directly in an Index. |

The following is expense information for the Jackson Square SMID-Cap Growth Fund (the “Fund”) as disclosed in the Fund’s most recent prospectus dated February 28, 2020: Investor Class – Gross/Net Expenses: 1.22%; Institutional Class – Gross/Net Expenses: 0.97%; IS Class – Gross/Net Expenses: 0.87%. The Adviser has contractually agreed to waive its management fees and pay Fund expenses in order to ensure the Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, shareholder servicing fees, acquired fund fees and expenses, brokerage commissions, leverage, interest, taxes, and extraordinary expenses) do not exceed 0.87% of the average daily net assets of the Fund. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieve without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite, but cannot be terminated through at least February 28, 2021. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Board or the Adviser.

The actual expense ratio applicable to investors, as disclosed in the Financial Highlights for the year ending October 31, 2020, was 0.87%, 0.95% and 1.22%, for the IS class, Institutional Class and Investor Class, respectively.

Jackson Square SMID-Cap Growth Fund

Sector Allocation(1) (Unaudited)

As of October 31, 2020

(% of Net Assets)

Top Ten Equity Holdings(1)(2) (Unaudited)

As of October 31, 2020

(% of Net Assets)

| | LiveRamp Holdings | | | 6.6 | % |

| | Grocery Outlet Holding | | | 5.8 | % |

| | Bio-Techne | | | 4.5 | % |

| | GCI Liberty – Class A | | | 4.3 | % |

| | Stitch Fix – Class A | | | 4.1 | % |

| | Wix.com | | | 3.9 | % |

| | Varonis Systems | | | 3.9 | % |

| | New York Times – Class A | | | 3.9 | % |

| | Papa John’s International | | | 3.7 | % |

| | Elastic | | | 3.6 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Short-term investments are not included. |

Jackson Square Funds

Expense Examples (Unaudited)

October 31, 2020

As a shareholder of a Fund, you incur two type of costs: (1) transactions costs, including brokerage commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees, shareholder servicing fees, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2020 – October 31, 2020).

ACTUAL EXPENSES

For each class, the first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only. Therefore, the second line of the tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds, In addition, if transactional costs were included, your costs may have been higher.

All-Cap Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (5/1/2020) | (10/31/2020) | (5/1/2020 to 10/31/2020) |

IS Class Actual(2) | $1,000.00 | $1,285.60 | $5.17 |

| IS Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.61 | $4.57 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.90% for the IS Class, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

| (2) | Based on the actual return for the six-month period ended October 31, 2020 of 28.56% for the IS Class. |

Jackson Square Funds

Expense Examples (Unaudited) – Continued

October 31, 2020

Global Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (5/1/2020) | (10/31/2020) | (5/1/2020 to 10/31/2020) |

IS Class Actual(2) | $1,000.00 | $1,216.80 | $5.85 |

| IS Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,019.86 | $5.33 |

| | | | |

Institutional Class Actual(2) | $1,000.00 | $1,216.50 | $5.85 |

| Institutional Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,019.86 | $5.33 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 1.05% and 1.05% for the IS Class and Institutional Class, respectively, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended October 31, 2020 of 21.68% and 21.65% for the IS Class and Institutional Class, respectively. |

Large-Cap Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(3) |

| | (5/1/2020) | (10/31/2020) | (5/1/2020 to 10/31/2020) |

IS Class Actual(4) | $1,000.00 | $1,214.80 | $3.56 |

| IS Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,021.92 | $3.25 |

| | | | |

Institutional Class Actual(4) | $1,000.00 | $1,214.10 | $3.56 |

| Institutional Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,021.92 | $3.25 |

| | | | |

Investor Class Actual(4) | $1,000.00 | $1,213.40 | $4.95 |

| Investor Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.66 | $4.52 |

| (3) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.64%, 0.64% and 0.89% for the IS Class, Institutional Class and Investor Class, respectively, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

| (4) | Based on the actual returns for the six-month period ended October 31, 2020 of 21.48%, 21.41% and 21.34% for the IS Class, Institutional Class and Investor Class, respectively. |

Jackson Square Funds

Expense Examples (Unaudited) – Continued

October 31, 2020

Select 20 Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (5/1/2020) | (10/31/2020) | (5/1/2020 to 10/31/2020) |

IS Class Actual(2) | $1,000.00 | $1,293.60 | $5.02 |

| IS Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.76 | $4.42 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.87% for the IS Class, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

| (2) | Based on the actual return for the six-month period ended October 31, 2020 of 29.36% for the IS Class. |

SMID-Cap Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(3) |

| | (5/1/2020) | (10/31/2020) | (5/1/2020 to 10/31/2020) |

IS Class Actual(4) | $1,000.00 | $1,370.90 | $5.18 |

| IS Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.76 | $4.42 |

| | | | |

Institutional Class Actual(4) | $1,000.00 | $1,370.00 | $5.66 |

| Institutional Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.36 | $4.82 |

| | | | |

Investor Class Actual(4) | $1,000.00 | $1,368.30 | $7.26 |

| Investor Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,019.00 | $6.19 |

| (3) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.87%, 0.95% and 1.22% for the IS Class, Institutional Class and Investor Class, respectively, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

| (4) | Based on the actual returns for the six-month period ended October 31, 2020 of 37.09%, 37.00% and 36.83% for the IS Class, Institutional Class and Investor Class, respectively. |

Jackson Square All-Cap Growth Fund

Schedule of Investments

October 31, 2020

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 99.3% | | | | | | |

| | | | | | | |

| Communication Services – 10.1% | | | | | | |

Alphabet – Class C* | | | 13 | | | $ | 21,073 | |

Bilibili* | | | 1,477 | | | | 65,978 | |

Charter Communications – Class A* | | | 313 | | | | 188,996 | |

GCI Liberty – Class A* | | | 304 | | | | 24,694 | |

Match Group* | | | 1,116 | | | | 130,326 | |

Netflix* | | | 107 | | | | 50,904 | |

New York Times – Class A | | | 5,952 | | | | 236,056 | |

| | | | | | | | 718,027 | |

| | | | | | | | | |

| Consumer Discretionary – 12.8% | | | | | | | | |

Amazon.com* | | | 72 | | | | 218,603 | |

Dunkin’ Brands Group | | | 974 | | | | 97,118 | |

Farfetch – Class A* | | | 3,939 | | | | 110,804 | |

Fiverr International* | | | 422 | | | | 61,789 | |

MercadoLibre* | | | 59 | | | | 71,629 | |

NIKE – Class B | | | 400 | | | | 48,032 | |

Papa John’s International | | | 484 | | | | 37,074 | |

Shake Shack – Class A* | | | 1,408 | | | | 95,068 | |

Starbucks | | | 349 | | | | 30,349 | |

Stitch Fix – Class A* | | | 3,909 | | | | 134,587 | |

| | | | | | | | 905,053 | |

| | | | | | | | | |

| Consumer Staples – 3.6% | | | | | | | | |

Grocery Outlet Holding* | | | 5,766 | | | | 253,819 | |

| | | | | | | | | |

| Financials – 2.3% | | | | | | | | |

KKR & Co. – Class A | | | 4,800 | | | | 163,920 | |

| | | | | | | | | |

| Health Care – 9.7% | | | | | | | | |

ABIOMED* | | | 162 | | | | 40,805 | |

DexCom* | | | 110 | | | | 35,154 | |

Illumina* | | | 295 | | | | 86,347 | |

Intuitive Surgical* | | | 178 | | | | 118,740 | |

IQVIA Holdings* | | | 821 | | | | 126,426 | |

Nevro* | | | 301 | | | | 44,912 | |

Silk Road Medical* | | | 783 | | | | 47,450 | |

Twist Bioscience* | | | 1,397 | | | | 107,066 | |

UnitedHealth Group | | | 260 | | | | 79,336 | |

| | | | | | | | 686,236 | |

See Notes to the Financial Statements

Jackson Square All-Cap Growth Fund

Schedule of Investments – Continued

October 31, 2020

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 99.3% (Continued) | | | | | | |

| | | | | | | |

| Industrials – 10.2% | | | | | | |

Airbus* (a)(b) | | | 1,710 | | | $ | 125,114 | |

Experian (a)(b) | | | 3,950 | | | | 144,705 | |

IHS Markit | | | 537 | | | | 43,427 | |

Safran* (a)(b) | | | 820 | | | | 86,493 | |

Uber Technologies* | | | 5,769 | | | | 192,742 | |

Waste Management | | | 1,188 | | | | 128,197 | |

| | | | | | | | 720,678 | |

| | | | | | | | | |

Information Technology – 46.7%# | | | | | | | | |

Adobe* | | | 160 | | | | 71,536 | |

Adyen* (a)(b) | | | 120 | | | | 201,689 | |

ASML Holding (a)(b) | | | 450 | | | | 162,811 | |

Autodesk* | | | 222 | | | | 52,290 | |

Bill.com Holdings* | | | 296 | | | | 29,600 | |

Coupa Software* | | | 825 | | | | 220,852 | |

Guidewire Software* | | | 216 | | | | 20,760 | |

LiveRamp Holdings* | | | 2,918 | | | | 192,851 | |

Logitech International (a)(b) | | | 356 | | | | 29,949 | |

Mastercard – Class A | | | 502 | | | | 144,897 | |

Microsoft | | | 3,098 | | | | 627,252 | |

Paycom Software* | | | 545 | | | | 198,429 | |

PayPal Holdings* | | | 998 | | | | 185,758 | |

SailPoint Technologies Holding* | | | 4,843 | | | | 201,033 | |

ServiceNow* | | | 406 | | | | 202,013 | |

Twilio – Class A* | | | 731 | | | | 203,927 | |

Varonis Systems* | | | 542 | | | | 62,639 | |

Visa – Class A | | | 1,329 | | | | 241,492 | |

Wix.com* | | | 1,034 | | | | 255,729 | |

| | | | | | | | 3,305,507 | |

| | | | | | | | | |

| Materials – 3.9% | | | | | | | | |

Ball | | | 3,115 | | | | 277,235 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $4,914,883) | | | | | | | 7,030,475 | |

See Notes to the Financial Statements

Jackson Square All-Cap Growth Fund

Schedule of Investments – Continued

October 31, 2020

Description | | Shares | | | Value | |

| | | | | | | |

| SHORT-TERM INVESTMENT – 1.9% | | | | | | |

| | | | | | | |

| Money Market Deposit Account – 1.9% | | | | | | |

U.S. Bank N.A., 0.02% (c) | | | | | | |

Total Money Market Deposit Account | | | 139,025 | | | $ | 139,025 | |

| TOTAL SHORT-TERM INVESTMENT | | | | | | | | |

| (Cost $139,025) | | | | | | | 139,025 | |

| Total Investments – 101.2% | | | | | | | | |

| (Cost $5,053,908) | | | | | | | 7,169,500 | |

| Liabilities in Excess of Other Assets – (1.2)% | | | | | | | (88,199 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 7,081,301 | |

| * | Non-income producing security. |

| (a) | Foreign Security. |

| (b) | Level 2 Security. |

| (c) | The Money Market Deposit Account (“MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of October 31, 2020. |

| # | As of October 31, 2020, the Fund had a significant portion of its assets invested in this sector and therefore is subject to additional risks. See Note 10 in Notes to the Financial Statements. |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Jackson Square Global Growth Fund

Schedule of Investments

October 31, 2020

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.9% | | | | | | |

| | | | | | | |

| Brazil – 7.0% | | | | | | |

Afya – Class A* | | | 9,457 | | | $ | 226,968 | |

Arco Platform – Class A* | | | 7,222 | | | | 246,126 | |

MercadoLibre* | | | 371 | | | | 450,413 | |

| | | | | | | | 923,507 | |

| | | | | | | | | |

| China – 1.9% | | | | | | | | |

Bilibili* | | | 5,545 | | | | 247,695 | |

| | | | | | | | | |

| Denmark – 6.0% | | | | | | | | |

DSV (a) | | | 2,510 | | | | 407,226 | |

Vestas Wind Systems (a) | | | 2,304 | | | | 395,283 | |

| | | | | | | | 802,509 | |

| | | | | | | | | |

| France – 7.1% | | | | | | | | |

Airbus* (a) | | | 4,363 | | | | 319,223 | |

LVMH Moet Hennessy Louis Vuitton (a) | | | 628 | | | | 294,372 | |

Safran* (a) | | | 3,137 | | | | 330,889 | |

| | | | | | | | 944,484 | |

| | | | | | | | | |

| Israel – 4.6% | | | | | | | | |

Fiverr International* | | | 959 | | | | 140,417 | |

Wix.com* | | | 1,918 | | | | 474,360 | |

| | | | | | | | 614,777 | |

| | | | | | | | | |

| Japan – 3.2% | | | | | | | | |

MonotaRO (a) | | | 7,587 | | | | 419,650 | |

| | | | | | | | | |

| Netherlands – 5.9% | | | | | | | | |

Adyen* (a) | | | 245 | | | | 411,781 | |

ASML Holding (a) | | | 1,012 | | | | 366,143 | |

| | | | | | | | 777,924 | |

| | | | | | | | | |

| South Korea – 2.4% | | | | | | | | |

Samsung Electronics (a) | | | 6,292 | | | | 316,271 | |

| | | | | | | | | |

| United Kingdom – 9.0% | | | | | | | | |

Experian (a) | | | 11,621 | | | | 425,724 | |

Farfetch – Class A* | | | 14,901 | | | | 419,165 | |

Intertek Group (a) | | | 4,848 | | | | 349,207 | |

| | | | | | | | 1,194,096 | |

See Notes to the Financial Statements

Jackson Square Global Growth Fund

Schedule of Investments – Continued

October 31, 2020

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.9% (Continued) | | | | | | |

| | | | | | | |

| United States – 51.8% | | | | | | |

Adobe* | | | 480 | | | $ | 214,608 | |

Aon | | | 1,316 | | | | 242,157 | |

Ball | | | 4,537 | | | | 403,793 | |

DexCom* | | | 781 | | | | 249,592 | |

Edwards Lifesciences* | | | 4,756 | | | | 340,958 | |

Guidewire Software* | | | 2,566 | | | | 246,618 | |

IHS Markit | | | 4,232 | | | | 342,242 | |

Illumina* | | | 953 | | | | 278,943 | |

Mastercard – Class A | | | 1,757 | | | | 507,140 | |

Match Group* | | | 3,224 | | | | 376,499 | |

Microsoft | | | 4,255 | | | | 861,510 | |

Netflix* | | | 902 | | | | 429,117 | |

New York Times – Class A | | | 11,894 | | | | 471,716 | |

ServiceNow* | | | 810 | | | | 403,032 | |

Snowflake – Class A* | | | 179 | | | | 44,754 | |

Twilio – Class A* | | | 1,082 | | | | 301,846 | |

Uber Technologies* | | | 10,480 | | | | 350,137 | |

UnitedHealth Group | | | 1,143 | | | | 348,775 | |

Visa – Class A | | | 2,532 | | | | 460,090 | |

| | | | | | | | 6,873,527 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $8,851,590) | | | | | | | 13,114,440 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT – 1.6% | | | | | | | | |

| | | | | | | | | |

| Money Market Deposit Account – 1.6% | | | | | | | | |

U.S. Bank N.A., 0.02% (b) | | | | | | | | |

Total Money Market Deposit Account | | | 216,715 | | | | 216,715 | |

| TOTAL SHORT-TERM INVESTMENT | | | | | | | | |

| (Cost $216,715) | | | | | | | 216,715 | |

| Total Investments – 100.5% | | | | | | | | |

| (Cost $9,068,305) | | | | | | | 13,331,155 | |

| Liabilities in Excess of Other Assets – (0.5)% | | | | | | | (70,911 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 13,260,244 | |

| * | | Non-income producing security. |

| (a) | | Level 2 Security. |

| (b) | | The Money Market Deposit Account (“MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of October 31, 2020. |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Jackson Square Global Growth Fund

Schedule of Investments – Continued

October 31, 2020

At October 31, 2020, the sector diversification for the Fund was as follows:

| | | % of |

| Sector | | Net Assets |

Information Technology# | | | 34.8 | % |

Industrials# | | | 25.2 | % |

Consumer Discretionary | | | 13.4 | % |

| Communication Services | | | 11.5 | % |

Health Care | | | 9.2 | % |

Materials | | | 3.0 | % |

Financials | | | 1.8 | % |

Short-Term Investment | | | 1.6 | % |

Liabilities in Excess of Other Assets | | | (0.5 | )% |

Total | | | 100.0 | % |

| # | As of October 31, 2020, the Fund had a significant portion of its assets invested in these sectors and therefore is subject to additional risks. See Note 10 in Notes to the Financial Statements. |

See Notes to the Financial Statements

Jackson Square Large-Cap Growth Fund

Schedule of Investments

October 31, 2020

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 99.4% | | | | | | |

| | | | | | | |

| Communication Services – 14.9% | | | | | | |

Alphabet – Class A* | | | 1,669 | | | $ | 2,697,287 | |

Charter Communications – Class A* | | | 6,357 | | | | 3,838,484 | |

Match Group* | | | 26,637 | | | | 3,110,669 | |

Netflix* | | | 5,205 | | | | 2,476,227 | |

| | | | | | | | 12,122,667 | |

| | | | | | | | | |

| Consumer Discretionary – 12.5% | | | | | | | | |

Amazon.com* | | | 1,730 | | | | 5,252,540 | |

NIKE – Class B | | | 24,455 | | | | 2,936,556 | |

Starbucks | | | 22,823 | | | | 1,984,688 | |

| | | | | | | | 10,173,784 | |

| | | | | | | | | |

| Financials – 2.9% | | | | | | | | |

KKR & Co. – Class A | | | 68,944 | | | | 2,354,438 | |

| | | | | | | | | |

| Health Care – 11.8% | | | | | | | | |

Edwards Lifesciences* | | | 38,123 | | | | 2,733,038 | |

Illumina* | | | 6,641 | | | | 1,943,821 | |

Intuitive Surgical* | | | 3,808 | | | | 2,540,240 | |

IQVIA Holdings* | | | 15,382 | | | | 2,368,674 | |

| | | | | | | | 9,585,773 | |

| | | | | | | | | |

| Industrials – 7.7% | | | | | | | | |

Uber Technologies* | | | 108,787 | | | | 3,634,573 | |

Waste Management | | | 23,914 | | | | 2,580,560 | |

| | | | | | | | 6,215,133 | |

| | | | | | | | | |

Information Technology – 46.6%# | | | | | | | | |

Adobe* | | | 4,089 | | | | 1,828,192 | |

Autodesk* | | | 11,313 | | | | 2,664,664 | |

Coupa Software* | | | 8,744 | | | | 2,340,769 | |

Mastercard – Class A | | | 11,645 | | | | 3,361,213 | |

Microsoft | | | 34,653 | | | | 7,016,193 | |

Paycom Software* | | | 8,510 | | | | 3,098,406 | |

PayPal Holdings* | | | 18,779 | | | | 3,495,335 | |

ServiceNow* | | | 7,915 | | | | 3,938,266 | |

Twilio – Class A* | | | 14,742 | | | | 4,112,576 | |

Visa – Class A | | | 24,588 | | | | 4,467,885 | |

Wix.com* | | | 6,296 | | | | 1,557,127 | |

| | | | | | | | 37,880,626 | |

See Notes to the Financial Statements

Jackson Square Large-Cap Growth Fund

Schedule of Investments – Continued

October 31, 2020

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 99.4% (Continued) | | | | | | |

| | | | | | | |

| Materials – 3.0% | | | | | | |

Ball | | | 27,307 | | | $ | 2,430,323 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $56,795,363) | | | | | | | 80,762,744 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT – 0.7% | | | | | | | | |

| | | | | | | | | |

| Money Market Deposit Account – 0.7% | | | | | | | | |

U.S. Bank N.A., 0.02% (a) | | | | | | | | |

Total Money Market Deposit Account | | | 525,096 | | | | 525,096 | |

| TOTAL SHORT-TERM INVESTMENT | | | | | | | | |

| (Cost $525,096) | | | | | | | 525,096 | |

| Total Investments – 100.1% | | | | | | | | |

| (Cost $57,320,459) | | | | | | | 81,287,840 | |

| Liabilities in Excess of Other Assets – (0.1)% | | | | | | | (49,355 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 81,238,485 | |

| * | | Non-income producing security. |

| # | | As of October 31, 2020, the Fund had a significant portion of its assets invested in this sector and therefore is subject to additional risks. See Note 10 in Notes to the Financial Statements. |

| (a) | | The Money Market Deposit Account (“MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of October 31, 2020. |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Jackson Square Select 20 Growth Fund

Schedule of Investments

October 31, 2020

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 100.2% | | | | | | |

| | | | | | | |

| Communication Services – 12.0% | | | | | | |

GCI Liberty – Class A* | | | 4,631 | | | $ | 376,176 | |

Match Group* | | | 2,171 | | | | 253,530 | |

New York Times – Class A | | | 5,317 | | | | 210,872 | |

| | | | | | | | 840,578 | |

| | | | | | | | | |

| Consumer Discretionary – 10.3% | | | | | | | | |

Amazon.com* | | | 160 | | | | 485,784 | |

Dollar General | | | 1,146 | | | | 239,181 | |

| | | | | | | | 724,965 | |

| | | | | | | | | |

| Consumer Staples – 6.0% | | | | | | | | |

Grocery Outlet Holding* | | | 9,652 | | | | 424,881 | |

| | | | | | | | | |

| Financials – 4.5% | | | | | | | | |

KKR & Co. – Class A | | | 9,179 | | | | 313,463 | |

| | | | | | | | | |

| Health Care – 6.2% | | | | | | | | |

Edwards Lifesciences* | | | 3,378 | | | | 242,169 | |

Nevro* | | | 1,319 | | | | 196,808 | |

| | | | | | | | 438,977 | |

| | | | | | | | | |

| Industrials – 7.9% | | | | | | | | |

Uber Technologies* | | | 9,234 | | | | 308,508 | |

Waste Management | | | 2,278 | | | | 245,819 | |

| | | | | | | | 554,327 | |

| | | | | | | | | |

Information Technology – 49.7%# | | | | | | | | |

Bill.com Holdings* | | | 3,054 | | | | 305,400 | |

Coupa Software* | | | 1,053 | | | | 281,888 | |

Elastic* | | | 3,249 | | | | 329,481 | |

LiveRamp Holdings* | | | 6,878 | | | | 454,567 | |

Microsoft | | | 3,705 | | | | 750,151 | |

ServiceNow* | | | 666 | | | | 331,382 | |

Twilio – Class A* | | | 1,569 | | | | 437,704 | |

Visa – Class A | | | 2,029 | | | | 368,690 | |

Wix.com* | | | 929 | | | | 229,760 | |

| | | | | | | | 3,489,023 | |

| | | | | | | | | |

| Materials – 3.6% | | | | | | | | |

Ball | | | 2,821 | | | | 251,069 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $4,407,316) | | | | | | | 7,037,283 | |

See Notes to the Financial Statements

Jackson Square Select 20 Growth Fund

Schedule of Investments – Continued

October 31, 2020

Description | | Shares | | | Value | |

| | | | | | | |

| SHORT-TERM INVESTMENT – 0.3% | | | | | | |

| | | | | | | |

| Money Market Deposit Account – 0.3% | | | | | | |

U.S. Bank N.A., 0.02% (a) | | | | | | |

Total Money Market Deposit Account | | | 24,906 | | | $ | 24,906 | |

| TOTAL SHORT-TERM INVESTMENT | | | | | | | | |

| (Cost $24,906) | | | | | | | 24,906 | |

| Total Investments – 100.5% | | | | | | | | |

| (Cost $4,432,222) | | | | | | | 7,062,189 | |

| Liabilities in Excess of Other Assets – (0.5)% | | | | | | | (37,418 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 7,024,771 | |

| * | | Non-income producing security. |

| # | | As of October 31, 2020, the Fund had a significant portion of its assets invested in this sector and therefore is subject to additional risks. See Note 10 in Notes to the Financial Statements. |

| (a) | | The Money Market Deposit Account (“MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of October 31, 2020. |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Jackson Square SMID-Cap Growth Fund

Schedule of Investments

October 31, 2020

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 94.1% | | | | | | |

| | | | | | | |

| Communication Services – 8.1% | | | | | | |

GCI Liberty – Class A* | | | 765,877 | | | $ | 62,212,189 | |

New York Times – Class A | | | 1,413,452 | | | | 56,057,506 | |

| | | | | | | | 118,269,695 | |

| | | | | | | | | |

| Consumer Discretionary – 18.4% | | | | | | | | |

Dunkin’ Brands Group | | | 275,286 | | | | 27,448,767 | |

Farfetch – Class A* | | | 1,718,590 | | | | 48,343,937 | |

Five Below* | | | 197,424 | | | | 26,324,516 | |

Fiverr International* | | | 112,317 | | | | 16,445,455 | |

Papa John’s International | | | 705,683 | | | | 54,055,318 | |

Stitch Fix – Class A* | | | 1,750,849 | | | | 60,281,731 | |

Wyndham Hotels & Resorts | | | 733,973 | | | | 34,137,084 | |

| | | | | | | | 267,036,808 | |

| | | | | | | | | |

| Consumer Staples – 5.8% | | | | | | | | |

Grocery Outlet Holding* | | | 1,910,430 | | | | 84,097,129 | |

| | | | | | | | | |

| Financials – 4.1% | | | | | | | | |

Carlyle Group | | | 894,097 | | | | 22,280,897 | |

LendingTree* | | | 116,169 | | | | 37,591,127 | |

| | | | | | | | 59,872,024 | |

| | | | | | | | | |

| Health Care – 17.5% | | | | | | | | |

ABIOMED* | | | 159,103 | | | | 40,074,863 | |

Bio-Techne | | | 261,973 | | | | 66,124,605 | |

HealthEquity* | | | 1,000,978 | | | | 51,540,357 | |

Nevro* | | | 265,146 | | | | 39,562,435 | |

Pacific Biosciences of California* | | | 1,555,589 | | | | 20,393,772 | |

Tandem Diabetes Care* | | | 335,837 | | | | 36,606,233 | |

| | | | | | | | 254,302,265 | |

| | | | | | | | | |

| Industrials – 5.0% | | | | | | | | |

Graco | | | 627,257 | | | | 38,827,208 | |

Lyft – Class A* | | | 1,507,690 | | | | 34,420,563 | |

| | | | | | | | 73,247,771 | |

| | | | | | | | | |

Information Technology – 30.3%# | | | | | | | | |

Anaplan* | | | 714,187 | | | | 39,530,250 | |

Bill.com Holdings* | | | 401,952 | | | | 40,195,200 | |

Dolby Laboratories – Class A | | | 127,504 | | | | 9,573,000 | |

Elastic* | | | 522,532 | | | | 52,989,970 | |

Guidewire Software* | | | 473,043 | | | | 45,464,163 | |

See Notes to the Financial Statements

Jackson Square SMID-Cap Growth Fund

Schedule of Investments – Continued

October 31, 2020

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 94.1% (Continued) | | | | | | |

| | | | | | | |

Information Technology – 30.3%# (Continued) | | | | | | |

LiveRamp Holdings* | | | 1,450,689 | | | $ | 95,876,036 | |

SailPoint Technologies Holding* | | | 1,068,140 | | | | 44,338,491 | |

Varonis Systems* | | | 486,156 | | | | 56,185,049 | |

Wix.com* | | | 227,705 | | | | 56,316,001 | |

| | | | | | | | 440,468,160 | |

| | | | | | | | | |

| Real Estate – 4.9% | | | | | | | | |

Equity Commonwealth – REIT | | | 1,462,687 | | | | 38,644,190 | |

Redfin* | | | 801,858 | | | | 33,493,609 | |

| | | | | | | | 72,137,799 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $1,041,397,217) | | | | | | | 1,369,431,651 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT – 6.7% | | | | | | | | |

| | | | | | | | | |

| Money Market Deposit Account – 6.7% | | | | | | | | |

U.S. Bank N.A., 0.02% (a) | | | 97,100,521 | | | | 97,100,521 | |