Reinhart Mid Cap PMV Fund

Investor Class Shares – RPMMX

Advisor Class Shares – RPMVX

Institutional Class Shares – RPMNX

Reinhart Genesis PMV Fund

Investor Class Shares – RPMAX

Advisor Class Shares – RPMFX

Reinhart International PMV Fund

Advisor Class Shares – RPMYX

Annual Report

| www.ReinhartFunds.com | May 31, 2023 |

Reinhart Mid Cap PMV Fund (Unaudited)

June 23, 2023

Fellow Shareholders,

The Reinhart Mid Cap PMV Fund – Advisor Class (the “Fund”) returned -9.56% for the twelve-month period ended May 31, 2023, roughly in line with the Russell Midcap Value Index’s return of -9.49%. After a strong year of performance in calendar 2022, the performance during the period was frustrating and largely due to our position in Signature Bank (SBNY), which was put into receivership by regulators on Sunday, March 12th. We were exceedingly disappointed in the FDIC’s decision to close the bank. The outcome struck us as somewhat arbitrary and unnecessarily reactionary. Given the significant impact it had on our performance, we will provide a higher level of detail on our thinking behind the position.

SBNY got caught up in the current panic surrounding banks that brought down Silicon Valley Bank (SIVB) a few days prior. Investors looked for the next bank to go under, unfortunately, and we believe unfairly, keyed in on SBNY despite the bank being materially different from SIVB. SBNY did not have near the levels of held-to-maturity securities on its balance sheet as compared with SIVB, nor did it have severe securities losses with which to contend. SBNY had also released an intra-quarter update on the Wednesday prior to being put into receivership (March 8th) that showed growth in deposits year to date. Unlike SIVB, which had already been seeing massive deposit outflows, SBNY’s deposits were stable.

What SBNY did have was a high concentration (90%+) of large (>$250K) and therefore uninsured deposits – mostly commercial – which has become the hot button issue in this banking crisis. We have always known this about SBNY but understood this aspect of their unique and commercially focused business model. Historically we have looked for banks with diverse retail deposit bases and a significant portion of smaller, sticky checking accounts where the switching costs are high, and the customers are slower to chase yield. Not because we thought the lack thereof would become an existential risk for any bank, but because it had historically been a more profitable approach. But once we researched Signature extensively, we liked its unique, lean business model of focusing on commercial customers, keeping an efficient cost base without the expense-heavy retail branch network, and luring elite bankers away from competitors with attractive compensation packages structured to align incentives with shareholders. The proof was in the pudding, as SBNY had consistently delivered return on equity and book value growth well above peers, not to mention a pristine credit underwriting track record over multiple cycles.

Despite many misleading media headlines, Signature’s digital currency practice did not hold any digital currency assets on its balance sheet and made zero digital currency loans. But with the stock price falling and short sellers and internet chat rooms conspiring to push SBNY under, depositors got spooked and perception became reality over the few days following SIVB’s failure – deposits flowed out that Friday afternoon and into the weekend such that regulators felt it was enough to step in. We should note that the other banks in our portfolio are well diversified in their deposit bases and have also managed their securities books prudently over the last several years. Nevertheless, we will remain diligent in assessing all financial risks in our holdings, knowing this mistake is an opportunity to learn and improve the process.

Moving aside from Financials, Communication Services were a positive contributor driven by strong results from Live Nation Entertainment and Interpublic Group. Live Nation is a newer position for us and one that we view as right in our “wheelhouse.” This is a company with a rock-solid competitive advantage driven by scale and network effects in the live-music ecosystem such that it has 75% market share in the U.S. We were able to purchase this normally expensive name when it was temporarily out of favor due to misdirected frustration over the Taylor

Reinhart Mid Cap PMV Fund (Unaudited)

Swift ticketing firestorm. Ultimately, we expect any resulting governmental action to have minimal (or even positive) impact on LYV’s business. In addition, National Instruments Corporation was a positive standout, driven by Emerson’s attractive buyout offer above our Private Market Value estimate.

We remain confident in our long-term, quality-oriented discipline and expect to achieve attractive results going forward and over the long term. This is especially true as uncertainty and volatility continue to manifest in the stock market.

Thank you for your confidence in Reinhart Partners.

Sincerely,

Josh Wheeler

Portfolio Manager, Reinhart Partners, LLC

Must be preceded or accompanied by a prospectus.

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. There can be no guarantee that any strategy will be successful. Principal loss is possible. Investing in medium-sized companies involves greater risk than those associated with investing in large company stocks, such as business risk, significant stock price fluctuations and illiquidity. The Fund’s value investments are subject to the risk that their intrinsic values may not be recognized by the broad market or that their prices may decline.

Opinions expressed are those of the fund manager and are subject to change, are not guaranteed and should not be considered a recommendation to buy or sell any security.

| • | Russell Midcap Value Index: an unmanaged equity index which measures the performance of mid-sized U.S. companies classified by Russell as ‘value’. It is not possible to invest directly into an index. |

| | |

| • | Private Market Value (PMV): the estimated price per share of a stock that a corporate buyer or private equity firm would be willing to pay to buyout and control the entire company. |

Fund holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security. Please refer to the Schedule of Investments in this report for a complete list of fund holdings.

Quasar Distributors, LLC, Distributor.

Reinhart Mid Cap PMV Fund

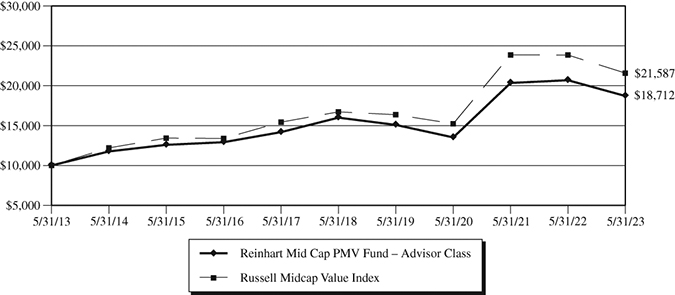

Value of $10,000 Investment (Unaudited)

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-774-3863. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of May 31, 2023

| | 1-Year | 3-Year | 5-Year | 10-Year | Since Inception(1) |

| Investor Class | -9.77% | 11.18% | 2.93% | 6.20% | 8.03% |

| Advisor Class | -9.56% | 11.45% | 3.19% | 6.47% | 8.29% |

| Institutional Class | -9.54% | 11.58% | 3.31% | 6.61% | 8.44% |

Russell Midcap Value Index(2) | -9.49% | 12.31% | 5.24% | 8.00% | 10.13% |

| (1) | Period from Fund inception through May 31, 2023. The Advisor and Investor Class commenced operations on June 1, 2012, and the Institutional Class commenced operations on September 29, 2017. Performance shown for the Institutional Class prior to the inception of the Institutional Class is based on the performance of the Advisor Class, adjusted for the lower expenses applicable to the Institutional Class. |

| (2) | The Russell Midcap Value Index measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. This index cannot be invested in directly. |

The following is expense information for the Reinhart Mid Cap PMV Fund as disclosed in the Fund’s most recent prospectus dated September 28, 2022:

| Investor Class Gross Expense Ratio – 1.52% | Net Expense Ratio – 1.30% |

| Advisor Class Gross Expense Ratio – 1.27% | Net Expense Ratio – 1.05% |

| Institutional Class Gross Expense Ratio – 1.12% | Net Expense Ratio – 0.90% |

Reinhart Mid Cap PMV Fund

Reinhart Partners, LLC (the “Adviser” or “Reinhart”) has contractually agreed to waive its management fees and pay Fund expenses in order to ensure that Total Annual Fund Operating Expenses (excluding acquired fund fees and expenses (“AFFE”), leverage/borrowing interest, interest expense, taxes, brokerage commissions, and extraordinary expenses) do not exceed 1.30% of the average daily net assets of the Investor Class, 1.05% of the average daily net assets of the Advisor Class and 0.90% of the average daily net assets of the Institutional Class. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made, if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and the expense limit in effect at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite in term and cannot be terminated through at least September 28, 2028. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser, with the consent of the Board.

The actual net expense ratios applicable to investors, as disclosed in the Financial Highlights for the year ended May 31, 2023, was 1.30%, 1.05% and 0.90% for the Investor Class, Advisor Class and Institutional Class, respectively.

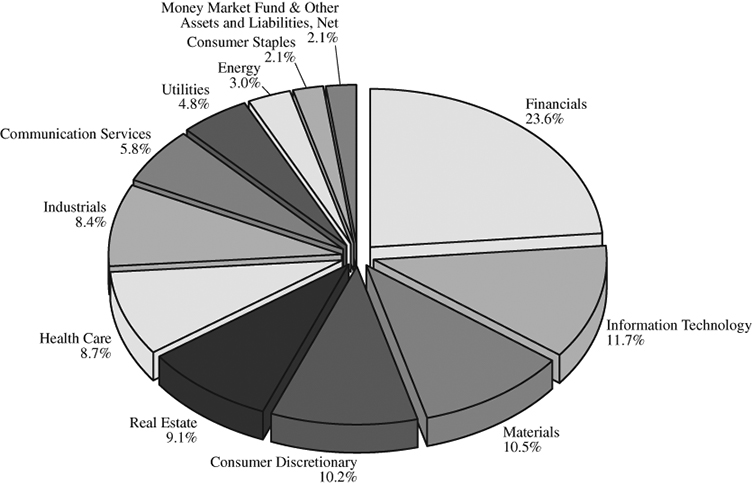

Reinhart Mid Cap PMV Fund

Allocation of Portfolio Net Assets(1) (Unaudited)

May 31, 2023

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

May 31, 2023

(% of Net Assets)

| SS&C Technologies Holdings | 3.8% |

| TransUnion | 3.5% |

| Live Nation Entertainment | 3.5% |

| Charles River Laboratories International | 3.1% |

| Intercontinental Exchange | 3.1% |

| Affiliated Managers Group | 3.1% |

| White Mountains Insurance Group | 3.1% |

| Global Payments | 3.0% |

| Baker Hughes, Class A | 3.0% |

| Encompass Health | 2.9% |

| (1) | Fund Holdings and Sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Reinhart Genesis PMV Fund (Unaudited)

June 23, 2023

Fellow Shareholders,

The Reinhart Genesis PMV Fund – Advisor Class (the “Fund”) generated a return of +6.97% for the twelve-month period ended May 31, 2023. Meanwhile, the portfolio’s Russell 2500 benchmark declined -5.34% over the same period – equating to outperformance of over 1200 basis points. The Genesis PMV strategy has historically done well during periods of volatility, and the last twelve months were no different as we were pleased to have provided the downside protection. However, two notable M&A events in the period deserve special attention.

In mid-December, private equity firm Advent International offered to acquire Maxar, the largest holding in the portfolio, for a 130% premium to its prior close. The stock has been one of the most volatile in the portfolio over the last few years due to delays in the launch of its satellite constellation. We had substantial conviction in the long-term value of Maxar but also understood there was an above-average level of risk in the path toward realizing that value. While we believe Advent is getting a bargain in this deal (and Advent, with significant expertise in this industry, surely agrees), we also believe the price is reasonable given the risks inherent in Maxar’s crucial upcoming satellite launch. In any event, this was a positive outcome and contributed significantly to the outperformance during the period.

The next event worth highlighting is the banking crisis which unfolded in early March. While the significant weight in bank stocks was a detractor from results in aggregate, we are pleased that each of the portfolio’s bank holdings performed in-line with or better than the average bank stock within the benchmark.

Given our focus on high-quality businesses, we are often asked why we invest in banks at all – aren’t they highly competitive, commodity businesses? Contrary to popular opinion, we believe banking can be a good business. Unlike most any other business, we believe the competitive advantage of high-quality banks tends to rest on the liability side of the balance sheet. The inconvenience of changing banks drives switching costs. A good deposit base, with a strong core of small and sticky consumer checking accounts, takes decades to build and is difficult to replicate. Such a deposit base tends to be stable and carry a low cost of funds which allows the bank to achieve its desired loan spreads without taking too much credit risk. Speaking of credit risk, we also focus deeply on the underwriting ethos that exists within the banks in the portfolio. How do we get comfortable with a bank’s underwriting skill? Bank credit underwriting culture is extremely difficult to change. We look for banks that have weathered previous downturns well, particularly the Great Financial Crisis.

A good example of a bank that epitomizes the above advantages is long-time holding First Citizens (FCNCA). Based in North Carolina with its founding traced back to the late 1800s, FCNCA has many branches spread out across North and South Carolina. The company has built a granular, robust deposit base with a disproportionate percentage of noninterest-bearing checking accounts and a cost of funds half that of its peers. Conservative underwriting has produced a track record of low credit losses across cycles, including a pristine record in 2008-09. The bank has grown tangible book value at a compound annual growth rate of 11% over the past 15 years. As a result of their uniquely robust deposit base, strong credit quality and a history of astutely executing FDIC-assisted acquisitions, First Citizens was able to take advantage of the challenging banking environment when competitors were unable. In late March, First Citizens announced a definitive agreement to acquire the most attractive pieces of the former Silicon Valley Bank with terms (e.g., FDIC backstops) and a valuation so compelling that the stock price increased materially following the announcement of the deal.

On the downside, the Healthcare sector was the only notably difficult area for the portfolio. Sotera Health was a significant detractor as it lost a key lawsuit related to chemical emissions from one of its plants in Illinois. While this outcome was within our range of possibilities, we did not believe it was a likely conclusion. Unsurprisingly

Reinhart Genesis PMV Fund (Unaudited)

market participants seemed to assume this worst-case scenario is upheld. While a second case on this issue went in the company’s favor, the damage was done. In addition, contract research organization Syneos Health reported shockingly poor book-to-bill numbers in early November.

Thank you for your confidence in Reinhart Partners.

Sincerely,

Matt Martinek, CFA

Portfolio Manager, Reinhart Partners, LLC

Must be preceded or accompanied by a prospectus.

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. There can be no guarantee that any strategy will be successful. Principal loss is possible. Investing in medium-sized companies involves greater risk than those associated with investing in large company stocks, such as business risk, significant stock price fluctuations and illiquidity. The Fund’s value investments are subject to the risk that their intrinsic values may not be recognized by the broad market or that their prices may decline.

Opinions expressed are those of the fund manager and are subject to change, are not guaranteed and should not be considered a recommendation to buy or sell any security.

Basis point (bp) is a unit equal to 1/100th of 1% and is used to denote the change in a financial instrument.

| • | Russell 2500 Index: an unmanaged equity index which measures the performance of the 2,500 smallest companies in the Russell 3000 Index. It is not possible to invest directly into an index. |

| | |

| • | Russell 2500 Value Index: an unmanaged equity index which measures the performance of smid-cap companies classified by Russell as ‘value’. It is not possible to invest directly into an index. |

| | |

| • | Private Market Value (PMV): the estimated price per share of a stock that a corporate buyer or private equity firm would be willing to pay to buyout and control the entire company. |

Fund holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security. Please refer to the Schedule of Investments in this report for a complete list of fund holdings.

Quasar Distributors, LLC, Distributor.

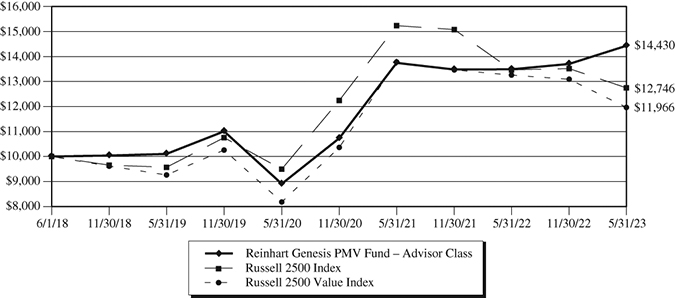

Reinhart Genesis PMV Fund

Value of $10,000 Investment (Unaudited)

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-774-3863. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of May 31, 2023

| | 1-Year | 3-Year | 5-Year | Since Inception(1) |

| Investor Class | 6.73% | 17.14% | 7.33% | 7.33% |

| Advisor Class | 6.97% | 17.45% | 7.61% | 7.61% |

Russell 2500 Index(2) | -5.34% | 10.31% | 4.97% | 4.97% |

Russell 2500 Value Index(3) | -9.73% | 13.52% | 3.65% | 3.65% |

| (1) | Inception date of the Fund was June 1, 2018. |

| (2) | The Russell 2500 Index measures the performance of the small to mid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500 Index is a subset of the Russell 3000 Index. It includes approximately 2,500 of the smallest securities based on a combination of their market cap and current index membership. This index cannot be invested in directly. |

| (3) | The Russell 2500 Value Index measures the performance of the small to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500 companies that are considered more value oriented relative to the overall market as defined by Russell’s leading style methodology. This index cannot be invested in directly. |

The following is expense information for the Reinhart Genesis PMV Fund as disclosed in the Fund’s most recent prospectus dated September 28, 2022:

| Investor Class Gross Expense Ratio – 1.52% | Net Expense Ratio – 1.20% |

| Advisor Class Gross Expense Ratio – 1.27% | Net Expense Ratio – 0.95% |

Reinhart Genesis PMV Fund

Reinhart Partners, LLC (the “Adviser” or “Reinhart”) has contractually agreed to waive its management fees and pay Fund expenses in order to ensure that Total Annual Fund Operating Expenses (excluding AFFE, leverage/borrowing interest, interest expense, taxes, brokerage commissions, and extraordinary expenses) do not exceed 1.20% of the average daily net assets of the Investor Class and 0.95% of the average daily net assets of the Advisor Class. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made, if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and the expense limit in effect at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite in term and cannot be terminated through at least September 28, 2025. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser, with the consent of the Board.

The actual net expense ratios applicable to investors, as disclosed in the Financial Highlights for the year ended May 31, 2023, was 1.20% and 0.95% for the Investor Class and Advisor Class, respectively.

Reinhart Genesis PMV Fund

Allocation of Portfolio Net Assets(1) (Unaudited)

May 31, 2023

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

May 31, 2023

(% of Net Assets)

| First Citizens BancShares, Class A | 5.9% |

| Insperity | 4.9% |

| Lantheus Holdings | 4.8% |

| frontdoor | 4.1% |

| Hillman Solutions | 3.8% |

| Air Lease, Class A | 3.7% |

| ACI Worldwide | 3.6% |

| Grand Canyon Education | 3.5% |

| U-Haul Holding, Series N | 3.3% |

| Assured Guaranty | 3.2% |

| (1) | Fund Holdings and Sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Reinhart International PMV Fund (Unaudited)

June 23, 2023

Fellow Shareholders,

The Reinhart International PMV Fund – Advisor Class (the “Fund”) was up 3.76% for the twelve-months ended May 31, 2023, handily outperforming the -0.49% return for the Morningstar Global ex-US Target Market Exposure Index benchmark. Overall, as we conclude the first year of the Fund’s existence, we are pleased to have provided the downside protection. Outperformance for the fiscal year was achieved amidst a volatile global stock market punctuated by high inflation, economic choppiness, a geopolitical-based economic stand-off with China and, of course, the war in Ukraine which has severely impacted the supply and cost of energy for much of Europe. Periods of elevated volatility have historically been a time during which our Private Market Value (PMV) investment philosophy has tended to shine for our U.S.-focused funds. We are happy to see a similar outcome with our new International PMV strategy.

Moving onto the specific performance drivers, portfolio results were led by the Consumer Discretionary and Financial sectors. Within Consumer, Boyd Group, Mercari and B&M European Value Retail were positive standouts. One of three large players in the North American auto collision service center market, Boyd (Canada) has been able to meet strong demand by utilizing its labor supply advantages. This has also enabled the company to raise prices to recoup costs increases and defend profitability. Expectations for Mercari’s earnings results were low given the difficult economic backdrop. But the Japanese online marketplace operator effectively managed costs in the quarter, highlighted emerging success with its fledgling payments ecosystem venture and pointed to improving end market demand for the rest of the year. B&M, a U.K.-based discount retailer, is gaining share and benefitting from consumers trading down as inflation pressures household budgets.

The Financial sector was boosted by Bank of Ireland (benefitting from higher interest rates), France-based Human Resources and Payments servicer Edenred (strong labor market, inflation beneficiary) and Canadian company Element Fleet Management (reopening, pent-up demand, recovering auto production).

On the flip side, the Real Estate, Healthcare and Consumer Staples sectors were detractors over the period – each largely due to one stock. Cushman & Wakefield, a U.K. based commercial real estate broker, declined sharply as market participants reacted to a significant decline in the company’s margins and earnings as higher interest rates caused a sharp slowdown in property sales. We are confident Cushman’s reputation, relationships and scale will allow it to win market share from smaller competitors when the market turns around.

Within the Healthcare sector, Germany-based lab test provider SYNLAB was a detractor as the company had several disappointing quarters in a row with head-scratching (non) explanations from management that caused us to lose faith in the quality of the business. Hence, we sold the position. As always, there will be inevitability be mistakes along the way, and our goal is to recognize those as quickly as possible and minimize the impact on the portfolio. Speaking of mistakes, China Feihe – a leading Chinese infant formula seller – has been a headache ever since we invested at the inception of the fund due to unanticipated inventory destocking mixed with fierce price competition from lower-priced products. We are sticking with the holding for now, as we like the company’s leading market position in a growth industry and the stock’s compelling valuation.

The elevated stock market volatility of the past twelve months has presented an opportunity to invest in great businesses at favorable prices. We have continued to reallocate capital across the portfolio to take advantage of the day-to-day swings in market prices. We never attempt to predict market direction, but we are confident the durability of the businesses in the International PMV portfolio will continue to shine through in a still uncertain global economic environment.

Reinhart International PMV Fund (Unaudited)

Thank you for your confidence in Reinhart Partners.

Sincerely,

Matt Martinek, CFA

Portfolio Manager, Reinhart Partners, LLC

Must be preceded or accompanied by a prospectus.

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. There can be no guarantee that any strategy will be successful. Principal loss is possible. Investing in small and medium-sized companies involves greater risk than those associated with investing in large company stocks, such as business risk, significant stock price fluctuations and illiquidity. The Fund’s value investments are subject to the risk that their intrinsic values may not be recognized by the broad market or that their prices may decline. Investments in securities of foreign issuers involve risks not ordinarily associated with investments insecurities and instruments of U.S. issuers, including risks relating to political, social, and economic developments abroad, differences between U.S. and foreign regulatory and accounting requirements, tax risks, and market practices, as well as fluctuations in foreign currencies.

Opinions expressed are those of the fund manager and are subject to change, are not guaranteed and should not be considered a recommendation to buy or sell any security.

| • | Morningstar Global ex-US Target Market Exposure Index is a rules based, float market capitalization-weighted index designed to cover 85% of the equity float-adjusted market capitalization of the Global equity markets. This Index does not incorporate Environmental, Social, or Governance (ESG) criteria. It is not possible to invest directly into an index. |

| | |

| • | Private Market Value (PMV): the estimated price per share of a stock that a corporate buyer or private equity firm would be willing to pay to buyout and control the entire company. |

Fund holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security. Please refer to the Schedule of Investments in this report for a complete list of fund holdings.

Quasar Distributors, LLC, Distributor.

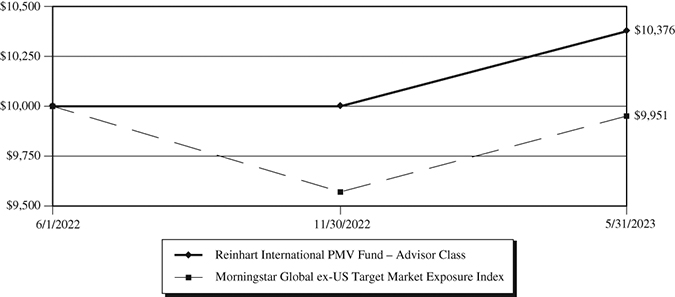

Reinhart International PMV Fund

Value of $10,000 Investment (Unaudited)

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-774-3863. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of May 31, 2023

| | Since Inception(1) |

| Advisor Class | 3.76% |

Morningstar Global ex-US Target Market Exposure Index(2) | -0.49% |

| (1) | Inception date of the Fund was June 1, 2022. |

| (2) | Morningstar Global ex-US Target Market Exposure Index is a rules based, float market capitalization-weighted index designed to cover 85% of the equity float-adjusted market capitalization of the Global equity markets. This Index does not incorporate Environmental, Social, or Governance (ESG) criteria. This index cannot be invested in directly. |

The following is expense information for the Reinhart International PMV Fund as disclosed in the Fund’s most recent prospectus dated May 20, 2022:

| Advisor Class Gross Expense Ratio – 5.96% | Net Expense Ratio – 0.95% |

Reinhart Partners, LLC (the “Adviser” or “Reinhart”) has contractually agreed to waive its management fees and pay Fund expenses in order to ensure that Total Annual Fund Operating Expenses (excluding front-end or contingent deferred loads, taxes, leverage/borrowing interest, interest expense, dividends paid on short sales, brokerage commissions, AFFE, expenses incurred in connection with any merger or reorganization, or extraordinary expenses such as litigation) do not exceed 0.95% of the average daily net assets of the Advisor Class. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the date such fee waiver and expense payment was made, if such recoupment can be achieved without

Reinhart International PMV Fund

exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and the expense limit in effect at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite in term and cannot be terminated through at least September 28, 2025. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser, with the consent of the Board.

The actual net expense ratio applicable to investors, as disclosed in the Financial Highlights for the year ended May 31, 2023, was 0.95%.

Reinhart International PMV Fund

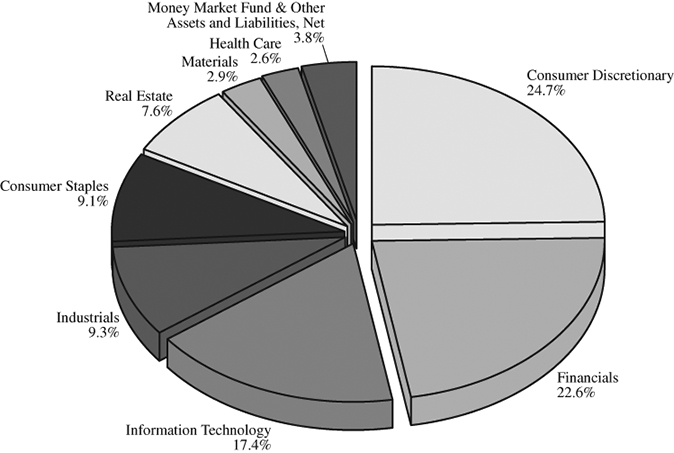

Allocation of Portfolio Net Assets(1) (Unaudited)

May 31, 2023

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

May 31, 2023

(% of Net Assets)

| Mercari | 4.3% |

| B&M European Value Retail SA | 4.3% |

| Capgemini SE | 3.7% |

| Edenred | 3.6% |

| Jeronimo Martins SGPS SA | 3.4% |

| Element Fleet Management | 3.2% |

| Taiwan Semiconductor Manufacturing – ADR | 3.1% |

| Coway | 3.1% |

| London Stock Exchange Group plc | 3.0% |

| Bank of Ireland Group plc | 3.0% |

| (1) | Fund Holdings and Sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Reinhart Funds

Expense Examples (Unaudited)

May 31, 2023

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, which may include but are not limited to, sales charges (loads) on purchases; and (2) ongoing costs, including management fees, distribution (12b-1) fees, shareholder servicing fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (December 1, 2022 – May 31, 2023).

ACTUAL EXPENSES

For each class, the first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs may have been higher.

Reinhart Mid Cap PMV Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (12/1/2022) | (5/31/2023) | (12/1/2022 – 5/31/2023) |

Investor Class Actual(2) | $1,000.00 | $ 905.30 | $6.18 |

| Investor Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,018.45 | $6.54 |

| | | | |

Advisor Class Actual(2) | $1,000.00 | $ 905.90 | $4.99 |

| Advisor Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,019.70 | $5.29 |

| | | | |

Institutional Class Actual(2) | $1,000.00 | $ 907.00 | $4.28 |

| Institutional Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.44 | $4.53 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for most recent six-month period of 1.30%, 1.05%, 0.90%, for the Investor Class, Advisor Class and Institutional Class, respectively, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended May 31, 2023, of -9.47%, -9.41% and -9.30% for the Investor Class, Advisor Class and Institutional Class, respectively. |

Reinhart Funds

Expense Examples (Unaudited) – Continued

May 31, 2023

Reinhart Genesis PMV Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (12/1/2022) | (5/31/2023) | (12/1/2022 – 5/31/2023) |

Investor Class Actual(2) | $1,000.00 | $1,052.20 | $6.14 |

| Investor Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,018.95 | $6.04 |

| | | | |

Advisor Class Actual(2) | $1,000.00 | $1,053.00 | $4.86 |

| Advisor Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.19 | $4.78 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for most recent six-month period of 1.20% and 0.95% for the Investor Class and Advisor Class, respectively, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended May 31, 2023, of 5.22% and 5.30% for the Investor Class and Advisor Class, respectively. |

Reinhart International PMV Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(3) |

| | (12/1/2022) | (5/31/2023) | (12/1/2022 – 5/31/2023) |

Advisor Class Actual(4) | $1,000.00 | $1,037.60 | $4.83 |

| Advisor Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.19 | $4.78 |

| (3) | Expenses are equal to the Fund’s annualized expense ratio for most recent six-month period of 0.95%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| (4) | Based on the actual returns for the six-month period ended May 31, 2023, of 3.76%. |

Reinhart Mid Cap PMV Fund

Schedule of Investments

May 31, 2023

Description | | Shares | | | Value | |

| COMMON STOCKS – 97.9% | | | | | | |

| | | | | | | |

| Communication Services – 5.8% | | | | | | |

| Interpublic Group of Companies | | | 88,145 | | | $ | 3,278,112 | |

| Live Nation Entertainment* | | | 61,805 | | | | 4,940,692 | |

| | | | | | | | 8,218,804 | |

| Consumer Discretionary – 10.2% | | | | | | | | |

| Allison Transmission Holdings | | | 75,340 | | | | 3,563,582 | |

| Leslie’s* | | | 274,460 | | | | 2,601,881 | |

| LKQ | | | 64,660 | | | | 3,410,815 | |

| TransUnion | | | 69,870 | | | | 5,029,242 | |

| | | | | | | | 14,605,520 | |

| Consumer Staples – 2.1% | | | | | | | | |

| BJ’s Wholesale Club Holdings* | | | 48,940 | | | | 3,066,091 | |

| | | | | | | | | |

| Energy – 3.0% | | | | | | | | |

| Baker Hughes, Class A | | | 155,170 | | | | 4,228,383 | |

| | | | | | | | | |

| Financials – 23.6% | | | | | | | | |

| Affiliated Managers Group | | | 31,840 | | | | 4,428,626 | |

| American Financial Group | | | 27,320 | | | | 3,067,216 | |

| BOK Financial | | | 46,341 | | | | 3,768,450 | |

| Global Payments | | | 44,455 | | | | 4,342,809 | |

| Intercontinental Exchange | | | 41,915 | | | | 4,440,894 | |

| Loews | | | 33,365 | | | | 1,868,440 | |

| M&T Bank Corp. | | | 25,775 | | | | 3,071,349 | |

| Northern Trust | | | 31,505 | | | | 2,265,840 | |

| Progressive | | | 16,110 | | | | 2,060,630 | |

| White Mountains Insurance Group | | | 3,233 | | | | 4,378,096 | |

| | | | | | | | 33,692,350 | |

| Health Care – 8.7% | | | | | | | | |

| Charles River Laboratories International* | | | 22,970 | | | | 4,441,938 | |

| Encompass Health | | | 67,687 | | | | 4,197,948 | |

| Zimmer Biomet Holdings | | | 29,170 | | | | 3,714,508 | |

| | | | | | | | 12,354,394 | |

| Industrials – 8.4% | | | | | | | | |

| Insperity | | | 25,255 | | | | 2,796,233 | |

| Snap-on | | | 12,985 | | | | 3,231,447 | |

| Stanley Black & Decker | | | 25,500 | | | | 1,911,735 | |

| U-Haul Holding, Series N | | | 86,885 | | | | 4,021,907 | |

| | | | | | | | 11,961,322 | |

See Notes to the Financial Statements

Reinhart Mid Cap PMV Fund

Schedule of Investments – Continued

May 31, 2023

Description | | Shares | | | Value | |

| COMMON STOCKS – 97.9% (Continued) | | | | | | |

| | | | | | | |

| Information Technology – 11.7% | | | | | | |

| Cognizant Technology Solutions, Class A | | | 65,545 | | | $ | 4,095,907 | |

| Fidelity National Financial | | | 108,490 | | | | 3,703,849 | |

| Sensata Technologies Holding plc | | | 80,680 | | | | 3,349,834 | |

| SS&C Technologies Holdings | | | 99,815 | | | | 5,485,832 | |

| | | | | | | | 16,635,422 | |

| Materials – 10.5% | | | | | | | | |

| Avantor* | | | 188,230 | | | | 3,753,306 | |

| Eagle Materials | | | 25,150 | | | | 4,097,689 | |

| FMC | | | 33,960 | | | | 3,534,557 | |

| Sealed Air | | | 95,555 | | | | 3,616,757 | |

| | | | | | | | 15,002,309 | |

| Real Estate – 9.1% | | | | | | | | |

| Americold Realty Trust – REIT | | | 141,970 | | | | 4,159,721 | |

| Camden Property Trust – REIT | | | 33,125 | | | | 3,460,568 | |

| Ventas – REIT | | | 68,020 | | | | 2,934,383 | |

| Weyerhaeuser – REIT | | | 85,730 | | | | 2,457,022 | |

| | | | | | | | 13,011,694 | |

| Utilities – 4.8% | | | | | | | | |

| UGI | | | 102,670 | | | | 2,871,680 | |

| Vistra | | | 168,410 | | | | 4,036,788 | |

| | | | | | | | 6,908,468 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $126,622,085) | | | | | | | 139,684,757 | |

| | | | | | | | | |

| MONEY MARKET FUND – 2.1% | | | | | | | | |

| First American Treasury Obligations Fund, Class X, 5.01%^ | | | | | | | | |

| (Cost $3,035,376) | | | 3,035,376 | | | | 3,035,376 | |

| Total Investments – 100.0% | | | | | | | | |

| (Cost $129,657,461) | | | | | | | 142,720,133 | |

| Other Assets and Liabilities, Net – 0.0% | | | | | | | (49,218 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 142,670,915 | |

| * | Non-income producing security. |

| ^ | The rate shown is the annualized seven-day effective yield as of May 31, 2023. |

REIT – Real Estate Investment Trust

The Global Industry Classification Standard (“GICS”®) was developed by and is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Reinhart Genesis PMV Fund

Schedule of Investments

May 31, 2023

Description | | Shares | | | Value | |

| COMMON STOCKS – 96.7% | | | | | | |

| | | | | | | |

| Consumer Discretionary – 17.4% | | | | | | |

| Carter’s | | | 120,250 | | | $ | 7,475,942 | |

| frontdoor* | | | 390,105 | | | | 12,026,937 | |

| Gentex | | | 199,430 | | | | 5,237,032 | |

| Grand Canyon Education* | | | 99,400 | | | | 10,413,144 | |

| Hillman Solutions* | | | 1,368,000 | | | | 11,080,800 | |

| Thor Industries | | | 63,680 | | | | 4,984,234 | |

| | | | | | | | 51,218,089 | |

Financials# – 25.7% | | | | | | | | |

| 1st Source | | | 42,860 | | | | 1,762,832 | |

| Air Lease, Class A | | | 287,980 | | | | 10,949,000 | |

| Assured Guaranty | | | 182,000 | | | | 9,418,500 | |

| First American Financial | | | 105,000 | | | | 5,767,650 | |

| First Citizens BancShares, Class A | | | 14,030 | | | | 17,498,216 | |

| First Hawaiian | | | 430,490 | | | | 7,098,780 | |

| International Bancshares | | | 112,520 | | | | 4,806,854 | |

| LPL Financial Holdings | | | 11,500 | | | | 2,239,970 | |

| White Mountains Insurance Group | | | 5,100 | | | | 6,906,369 | |

| Wintrust Financial | | | 145,100 | | | | 9,224,007 | |

| | | | | | | | 75,672,178 | |

| Health Care – 12.1% | | | | | | | | |

| AdaptHealth* | | | 703,000 | | | | 7,367,440 | |

| Encompass Health | | | 93,920 | | | | 5,824,918 | |

| Lantheus Holdings* | | | 162,000 | | | | 14,027,580 | |

| Premier, Class A | | | 212,310 | | | | 5,307,750 | |

| Syneos Health, Class A* | | | 76,000 | | | | 3,161,600 | |

| | | | | | | | 35,689,288 | |

| Industrials – 17.5% | | | | | | | | |

| GMS* | | | 115,562 | | | | 7,318,541 | |

| GXO Logistics* | | | 165,000 | | | | 9,226,800 | |

| Insperity | | | 130,830 | | | | 14,485,498 | |

| MAXIMUS | | | 40,000 | | | | 3,238,400 | |

| TriNet Group* | | | 88,000 | | | | 7,820,560 | |

| U-Haul Holding, Series N | | | 208,187 | | | | 9,636,976 | |

| | | | | | | | 51,726,775 | |

See Notes to the Financial Statements

Reinhart Genesis PMV Fund

Schedule of Investments – Continued

May 31, 2023

Description | | Shares | | | Value | |

| COMMON STOCKS – 96.7% (Continued) | | | | | | |

| | | | | | | |

| Information Technology – 13.2% | | | | | | |

| ACI Worldwide* | | | 459,000 | | | $ | 10,469,790 | |

| ASGN* | | | 106,000 | | | | 6,935,580 | |

| Euronet Worldwide* | | | 75,000 | | | | 8,355,000 | |

| FormFactor* | | | 190,000 | | | | 5,945,100 | |

| PAR Technology* | | | 209,375 | | | | 7,238,094 | |

| | | | | | | | 38,943,564 | |

| Materials – 2.3% | | | | | | | | |

| Element Solutions | | | 374,000 | | | | 6,705,820 | |

| | | | | | | | | |

| Real Estate – 8.5% | | | | | | | | |

| Alexander & Baldwin – REIT | | | 486,836 | | | | 8,918,836 | |

| Marcus & Millichap | | | 286,060 | | | | 8,395,861 | |

| Ryman Hospitality Properties – REIT | | | 85,440 | | | | 7,837,411 | |

| | | | | | | | 25,152,108 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $265,563,135) | | | | | | | 285,107,822 | |

| | | | | | | | | |

| MONEY MARKET FUND – 3.5% | | | | | | | | |

| First American Treasury Obligations Fund, Class X, 5.01%^ | | | | | | | | |

| (Cost $10,358,754) | | | 10,358,754 | | | | 10,358,754 | |

| Total Investments – 100.2% | | | | | | | | |

| (Cost $275,921,889) | | | | | | | 295,466,576 | |

| Other Assets and Liabilities, Net – (0.2)% | | | | | | | (571,641 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 294,894,935 | |

| * | Non-income producing security. |

| # | As of May 31, 2023, the Fund had a significant portion of its assets invested in the financials sector. See Note 9 in the Notes to the Financial Statements. |

| ^ | The rate shown is the annualized seven-day effective yield as of May 31, 2023. |

REIT – Real Estate Investment Trust

The Global Industry Classification Standard (“GICS”®) was developed by and is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Reinhart International PMV Fund

Schedule of Investments

May 31, 2023

Description | | Shares | | | Value | |

| COMMON STOCKS – 96.2% | | | | | | |

| | | | | | | |

| Austria – 2.6% | | | | | | |

| BAWAG Group AG | | | 840 | | | $ | 36,673 | |

| | | | | | | | | |

| Canada – 14.9% | | | | | | | | |

| Boyd Group Services | | | 200 | | | | 36,246 | |

| CCL Industries | | | 600 | | | | 27,956 | |

| Constellation Software | | | 20 | | | | 40,781 | |

| Dollarama | | | 400 | | | | 24,333 | |

| Element Fleet Management | | | 3,000 | | | | 45,503 | |

| Granite Real Estate Investment Trust – REIT | | | 600 | | | | 35,209 | |

| Lumine Group* | | | 81 | | | | 1,193 | |

| | | | | | | | 211,221 | |

| Cayman Islands – 9.2% | | | | | | | | |

| China Feihe | | | 35,000 | | | | 20,356 | |

| JD Logistics* | | | 25,000 | | | | 39,993 | |

| NetEase – ADR | | | 400 | | | | 34,032 | |

| Silicon Motion Technology – ADR | | | 585 | | | | 35,826 | |

| | | | | | | | 130,207 | |

| France – 9.8% | | | | | | | | |

| Capgemini SE | | | 300 | | | | 52,337 | |

| Edenred | | | 800 | | | | 51,495 | |

| La Francaise des Jeux SAEM | | | 900 | | | | 34,795 | |

| | | | | | | | 138,627 | |

| Ireland – 3.0% | | | | | | | | |

| Bank of Ireland Group plc | | | 4,500 | | | | 42,524 | |

| | | | | | | | | |

| Italy – 2.9% | | | | | | | | |

| Buzzi Unicem SpA | | | 1,800 | | | | 41,236 | |

| | | | | | | | | |

| Japan – 7.0% | | | | | | | | |

| Hoya | | | 300 | | | | 37,611 | |

| Mercari* | | | 3,000 | | | | 61,201 | |

| | | | | | | | 98,812 | |

| Luxembourg – 4.2% | | | | | | | | |

| B&M European Value Retail SA | | | 9,500 | | | | 60,350 | |

| | | | | | | | | |

| Mexico – 2.8% | | | | | | | | |

| Bolsa Mexicana de Valores SAB de CV | | | 19,000 | | | | 39,946 | |

| | | | | | | | | |

| Netherlands – 1.9% | | | | | | | | |

| Euronext NV | | | 400 | | | | 26,690 | |

See Notes to the Financial Statements

Reinhart International PMV Fund

Schedule of Investments – Continued

May 31, 2023

Description | | Shares | | | Value | |

| COMMON STOCKS – 96.2% (Continued) | | | | | | |

| | | | | | | |

| Norway – 2.2% | | | | | | |

| Adevinta ASA* | | | 4,500 | | | $ | 31,490 | |

| | | | | | | | | |

| Portugal – 3.4% | | | | | | | | |

| Jeronimo Martins SGPS SA | | | 2,000 | | | | 48,333 | |

| | | | | | | | | |

| Republic of Korea – 3.1% | | | | | | | | |

| Coway | | | 1,200 | | | | 43,528 | |

| | | | | | | | | |

| Spain – 2.8% | | | | | | | | |

| Aena SME SA | | | 250 | | | | 39,227 | |

| | | | | | | | | |

| Sweden – 2.5% | | | | | | | | |

| Svenska Handelsbanken AB | | | 4,400 | | | | 34,836 | |

| | | | | | | | | |

| Taiwan, Province of China – 3.1% | | | | | | | | |

| Taiwan Semiconductor Manufacturing – ADR | | | 450 | | | | 44,366 | |

| | | | | | | | | |

| United Kingdom – 14.0% | | | | | | | | |

| Compass Group plc | | | 1,200 | | | | 32,885 | |

| Cushman & Wakefield plc* | | | 4,200 | | | | 33,306 | |

| International Distributions Services plc | | | 10,000 | | | | 24,546 | |

| London Stock Exchange Group plc | | | 400 | | | | 42,642 | |

| Nomad Foods* | | | 1,500 | | | | 25,575 | |

| UNITE Group plc – REIT | | | 3,600 | | | | 40,163 | |

| | | | | | | | 199,117 | |

| United States – 4.4% | | | | | | | | |

| Booking Holdings* | | | 10 | | | | 25,088 | |

| Euronet Worldwide* | | | 340 | | | | 37,876 | |

| | | | | | | | 62,964 | |

| Vietnam – 2.4% | | | | | | | | |

| Vietnam Dairy Products JSC | | | 12,200 | | | | 34,310 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $1,312,554) | | | | | | | 1,364,457 | |

See Notes to the Financial Statements

Reinhart International PMV Fund

Schedule of Investments – Continued

May 31, 2023

Description | | Shares | | | Value | |

| MONEY MARKET FUND – 5.6% | | | | | | |

| First American Treasury Obligations Fund, Class X, 5.01%^ | | | | | | |

| (Cost $79,228) | | | 79,228 | | | $ | 79,228 | |

| Total Investments – 101.8% | | | | | | | | |

| (Cost $1,391,782) | | | | | | | 1,443,685 | |

| Other Assets and Liabilities, Net – (1.8)% | | | | | | | (25,658 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 1,418,027 | |

| * | Non-income producing security. |

ADR – American Depositary Receipt

REIT – Real Estate Investment Trust

| ^ | The rate shown is the annualized seven-day effective yield as of May 31, 2023. |

The Global Industry Classification Standard (“GICS”®) was developed by and is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use.

At May 31, 2023, the sector diversification for the Fund was as follows:

| | % of | |

| Sector | Net Assets | |

| Consumer Discretionary | | | 24.7 | % | | |

| Financials | | | 22.6 | % | | |

| Information Technology | | | 17.4 | % | | |

| Industrials | | | 9.3 | % | | |

| Consumer Staples | | | 9.1 | % | | |

| Real Estate | | | 7.6 | % | | |

| Materials | | | 2.9 | % | | |

| Health Care | | | 2.6 | % | | |

| Money Market Fund | | | 5.6 | % | | |

| Other Assets and Liabilities, Net | | | (1.8 | )% | | |

| Total | | | 100.0 | % | | |

See Notes to the Financial Statements

Reinhart Funds

Statements of Assets and Liabilities

May 31, 2023

| | | Mid Cap | | | Genesis | | | International | |

| | | PMV Fund | | | PMV Fund | | | PMV Fund | |

| ASSETS: | | | | | | | | | |

| Investments, at value | | | | | | | | | |

| (cost $129,657,461, $275,921,889, and $1,391,782) | | $ | 142,720,133 | | | $ | 295,466,576 | | | $ | 1,443,685 | |

| Dividends & interest receivable | | | 144,290 | | | | 340,428 | | | | 2,355 | |

| Receivable for capital shares sold | | | 142,582 | | | | 557,960 | | | | — | |

| Foreign Currencies (cost $143) | | | — | | | | — | | | | 143 | |

| Receivable for foreign withholding tax reclaim | | | 1,357 | | | | — | | | | 610 | |

| Receivable due from investment adviser | | | — | | | | — | | | | 13,600 | |

| Prepaid expenses | | | 21,383 | | | | 29,204 | | | | 3,152 | |

| Total assets | | | 143,029,745 | | | | 296,394,168 | | | | 1,463,545 | |

| | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | |

| Payable for investment securities purchased | | | — | | | | 1,080,966 | | | | — | |

| Payable for capital shares redeemed | | | 128,550 | | | | 54,074 | | | | 155 | |

| Payable to investment adviser | | | 85,987 | | | | 184,700 | | | | — | |

| Payable for fund administration & accounting fees | | | 42,712 | | | | 65,588 | | | | 16,041 | |

| Payable for compliance fees | | | 2,921 | | | | 2,921 | | | | 2,921 | |

| Payable for transfer agent fees & expenses | | | 20,511 | | | | 13,326 | | | | 1,214 | |

| Payable for trustee fees | | | 66 | | | | 88 | | | | — | |

| Payable for custody fees | | | 1,900 | | | | 2,828 | | | | 1,700 | |

| Accrued distribution & shareholder service fees | | | 42,800 | | | | 59,671 | | | | 152 | |

| Accrued other fees | | | 33,383 | | | | 35,071 | | | | 23,335 | |

| Total liabilities | | | 358,830 | | | | 1,499,233 | | | | 45,518 | |

| NET ASSETS | | $ | 142,670,915 | | | $ | 294,894,935 | | | $ | 1,418,027 | |

| | | | | | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | | | | | |

| Paid-in capital | | $ | 127,551,433 | | | $ | 269,684,870 | | | $ | 1,360,439 | |

| Total distributable earnings | | | 15,119,482 | | | | 25,210,065 | | | | 57,588 | |

| Net Assets | | $ | 142,670,915 | | | $ | 294,894,935 | | | $ | 1,418,027 | |

| | | | | | | | | | | | | |

| Investor Class | | | | | | | | | | | | |

| Net Assets | | $ | 22,740,379 | | | $ | 19,283,987 | | | | — | |

Shares issued and outstanding(1) | | | 1,442,719 | | | | 1,547,297 | | | | — | |

| Net asset value, redemption price and offering price per share | | $ | 15.76 | | | $ | 12.46 | | | | — | |

| | | | | | | | | | | | | |

| Advisor Class | | | | | | | | | | | | |

| Net Assets | | $ | 116,102,812 | | | $ | 275,610,948 | | | $ | 1,418,027 | |

Shares issued and outstanding(1) | | | 7,369,272 | | | | 21,970,291 | | | | 138,214 | |

| Net asset value, redemption price and offering price per share | | $ | 15.75 | | | $ | 12.54 | | | $ | 10.26 | |

| | | | | | | | | | | | | |

| Institutional Class | | | | | | | | | | | | |

| Net Assets | | $ | 3,827,724 | | | | — | | | | — | |

Shares issued and outstanding(1) | | | 241,912 | | | | — | | | | — | |

| Net asset value, redemption price and offering price per share | | $ | 15.82 | | | | — | | | | — | |

| (1) | Unlimited shares authorized without par value. |

See Notes to the Financial Statements

Reinhart Funds

Statements of Operations

For the Year Ended May 31, 2023

| | | Mid Cap | | | Genesis | | | International | |

| | | PMV Fund | | | PMV Fund | | | PMV Fund | |

| INVESTMENT INCOME: | | | | | | | | | |

| Dividend income | | $ | 3,143,707 | | | $ | 3,176,495 | | | $ | 27,978 | |

| Interest income | | | 207,554 | | | | 458,437 | | | | 3,166 | |

| Less: foreign taxes withheld | | | — | | | | — | | | | (3,146 | ) |

| Total investment income | | | 3,351,261 | | | | 3,634,932 | | | | 27,998 | |

| | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | |

| Investment adviser fees (See Note 4) | | | 1,599,594 | | | | 2,595,883 | | | | 10,415 | |

| Fund administration & accounting fees (See Note 4) | | | 191,807 | | | | 248,246 | | | | 111,524 | |

| Transfer agent fees & expenses (See Note 4) | | | 85,008 | | | | 53,848 | | | | 10,089 | |

| Federal & state registration fees | | | 50,647 | | | | 39,401 | | | | 3,522 | |

| Custody fees (See Note 4) | | | 22,903 | | | | 23,161 | | | | 12,231 | |

| Trustee fees | | | 19,450 | | | | 19,530 | | | | 19,064 | |

| Audit fees | | | 18,761 | | | | 21,248 | | | | 20,254 | |

| Postage & printing fees | | | 17,744 | | | | 26,139 | | | | 1,002 | |

| Legal fees | | | 13,707 | | | | 13,707 | | | | 6,491 | |

| Compliance fees (See Note 4) | | | 11,665 | | | | 11,665 | | | | 11,672 | |

| Other fees | | | 6,305 | | | | 5,362 | | | | 4,422 | |

| Insurance fees | | | 3,308 | | | | 3,642 | | | | 570 | |

| Distribution & shareholder service fees (See Note 5): | | | | | | | | | | | | |

| Investor Class | | | 64,387 | | | | 44,978 | | | | — | |

| Advisor Class | | | 72,457 | | | | 182,093 | | | | 821 | |

| Total expenses before waivers | | | 2,177,743 | | | | 3,288,903 | | | | 212,077 | |

| Less: waiver from investment adviser (See Note 4) | | | (260,979 | ) | | | (648,042 | ) | | | (153,512 | ) |

| Less: waiver from administrator, | | | | | | | | | | | | |

| transfer agent and custodian (See Note 4) | | | — | | | | — | | | | (48,150 | ) |

| Net expenses | | | 1,916,764 | | | | 2,640,861 | | | | 10,415 | |

| NET INVESTMENT INCOME | | | 1,434,497 | | | | 994,071 | | | | 17,583 | |

| | | | | | | | | | | | | |

| REALIZED AND UNREALIZED | | | | | | | | | | | | |

| GAIN (LOSS) ON INVESTMENTS: | | | | | | | | | | | | |

| Net realized gain on: | | | | | | | | | | | | |

| Investments | | | 11,160,850 | | | | 15,731,419 | | | | 800 | |

| Payments from investment adviser on the | | | | | | | | | | | | |

| disposal of investments due to trade error | | | 546,665 | | | | — | | | | — | |

| Foreign currency translation | | | — | | | | — | | | | 305 | |

| Net change in unrealized | | | | | | | | | | | | |

| appreciation/depreciation on investments | | | | | | | | | | | | |

| Investments | | | (32,800,213 | ) | | | 1,458,186 | | | | 51,903 | |

| Foreign currency translation | | | — | | | | — | | | | (46 | ) |

| Net realized and unrealized gain (loss) on investments | | | (21,092,698 | ) | | | 17,189,605 | | | | 52,962 | |

| NET INCREASE (DECREASE) IN NET ASSETS | | | | | | | | | | | | |

| RESULTING FROM OPERATIONS | | $ | (19,658,201 | ) | | $ | 18,183,676 | | | $ | 70,545 | |

See Notes to the Financial Statements

Reinhart Mid Cap PMV Fund

Statements of Changes in Net Assets

| | | Year Ended | | | Year Ended | |

| | | May 31, 2023 | | | May 31, 2022 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 1,434,497 | | | $ | 2,287,134 | |

| Net realized gain on investments and payments from | | | | | | | | |

| investment adviser on the disposal of investments due to trade error | | | 11,707,515 | | | | 18,784,497 | |

| Net change in unrealized appreciation/depreciation on investments | | | (32,800,213 | ) | | | (17,249,632 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (19,658,201 | ) | | | 3,821,999 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Investor Class: | | | | | | | | |

| Proceeds from shares sold | | | 2,097,930 | | | | 6,805,015 | |

| Proceeds from reinvestment of distributions | | | 1,226,913 | | | | 164,757 | |

| Payments for shares redeemed | | | (2,762,638 | ) | | | (2,237,535 | ) |

| Increase in net assets from Investor Class transactions | | | 562,205 | | | | 4,732,237 | |

| Advisor Class: | | | | | | | | |

| Proceeds from shares sold | | | 12,673,968 | | | | 35,075,397 | |

| Proceeds from reinvestment of distributions | | | 6,875,088 | | | | 1,747,128 | |

| Payments for shares redeemed | | | (53,881,921 | ) | | | (32,268,119 | ) |

| Increase (decrease) in net assets from Advisor Class transactions | | | (34,332,865 | ) | | | 4,554,406 | |

| Institutional Class: | | | | | | | | |

| Proceeds from shares sold | | | 785,905 | | | | 12,598,242 | |

| Proceeds from reinvestment of distributions | | | 180,406 | | | | 437,449 | |

| Payments for shares redeemed | | | (28,676,877 | ) | | | (17,782,304 | ) |

| Decrease in net assets from Institutional Class transactions | | | (27,710,566 | ) | | | (4,746,613 | ) |

| Net increase (decrease) in net assets resulting from capital share transactions | | | (61,481,226 | ) | | | 4,540,030 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Net distributions to shareholders – Investor Class | | | (1,227,874 | ) | | | (165,916 | ) |

| Net distributions to shareholders – Advisor Class | | | (7,310,232 | ) | | | (1,885,093 | ) |

| Net distributions to shareholders – Institutional Class | | | (201,175 | ) | | | (461,132 | ) |

| Total distributions to shareholders | | | (8,739,281 | ) | | | (2,512,141 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (89,878,708 | ) | | | 5,849,888 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 232,549,623 | | | | 226,699,735 | |

| End of year | | $ | 142,670,915 | | | $ | 232,549,623 | |

See Notes to the Financial Statements

Reinhart Genesis PMV Fund

Statements of Changes in Net Assets

| | | Year Ended | | | Year Ended | |

| | | May 31, 2023 | | | May 31, 2022 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 994,071 | | | $ | 1,080,835 | |

| Net realized gain on investments | | | 15,731,419 | | | | 22,011,459 | |

| Net change in unrealized appreciation/depreciation on investments | | | 1,458,186 | | | | (28,764,118 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 18,183,676 | | | | (5,671,824 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Investor Class: | | | | | | | | |

| Proceeds from shares sold | | | 800,000 | | | | 2,020 | |

| Proceeds from reinvestment of distributions | | | 1,179,222 | | | | 750,468 | |

| Payments for shares redeemed | | | — | | | | (669 | ) |

| Increase in net assets from Investor Class transactions | | | 1,979,222 | | | | 751,819 | |

| Advisor Class: | | | | | | | | |

| Proceeds from shares sold | | | 76,161,974 | | | | 135,146,060 | |

| Proceeds from reinvestment of distributions | | | 16,463,865 | | | | 10,433,243 | |

| Payments for shares redeemed | | | (79,868,292 | ) | | | (58,412,524 | ) |

| Increase in net assets from Advisor Class transactions | | | 12,757,547 | | | | 87,166,779 | |

| Net increase in net assets resulting from capital share transactions | | | 14,736,769 | | | | 87,918,598 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Net distributions to shareholders – Investor Class | | | (1,179,223 | ) | | | (750,468 | ) |

| Net distributions to shareholders – Advisor Class | | | (17,199,714 | ) | | | (10,801,957 | ) |

| Total distributions to shareholders | | | (18,378,937 | ) | | | (11,552,425 | ) |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 14,541,508 | | | | 70,694,349 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 280,353,427 | | | | 209,659,078 | |

| End of year | | $ | 294,894,935 | | | $ | 280,353,427 | |

See Notes to the Financial Statements

Reinhart International PMV Fund

Statement of Changes in Net Assets

| | | Year Ended | |

| | | May 31, 2023 | |

| OPERATIONS: | | | |

| Net investment income | | $ | 17,583 | |

| Net realized gain on: | | | | |

| Investments | | | 800 | |

| Foreign currency translation | | | 305 | |

| Net change in unrealized appreciation/depreciation on investments | | | | |

| Investments | | | 51,903 | |

| Foreign currency translation | | | (46 | ) |

| Net increase in net assets resulting from operations | | | 70,545 | |

| | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | |

| Advisor Class: | | | | |

| Proceeds from shares sold | | | 1,354,518 | |

| Proceeds from reinvestment of distributions | | | 13,313 | |

| Payments for shares redeemed | | | (7,036 | ) |

| Net increase in net assets resulting from capital share transactions | | | 1,360,795 | |

| | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | |

| Total distributions to shareholders | | | (13,313 | ) |

| | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 1,418,027 | |

| | | | | |

| NET ASSETS: | | | | |

| Beginning of year | | | — | |

| End of year | | $ | 1,418,027 | |

See Notes to the Financial Statements

Reinhart Mid Cap PMV Fund

Financial Highlights

For a Fund share outstanding throughout each year.

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | May 31, 2023 | | | May 31, 2022 | | | May 31, 2021 | | | May 31, 2020 | | | May 31, 2019 | |

| Investor Class | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| PER SHARE DATA: | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 18.35 | | | $ | 18.23 | | | $ | 12.23 | | | $ | 13.76 | | | $ | 16.02 | |

| | | | | | | | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.10 | (1) | | | 0.12 | | | | 0.10 | | | | 0.09 | | | | 0.05 | |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | |

| on investments and payments from | | | | | | | | | | | | | | | | | | | | |

| investment adviser on the disposal of | | | | | | | | | | | | | | | | | | | | |

| investments due to trade error | | | (1.84 | ) | | | 0.14 | | | | 6.01 | | | | (1.54 | ) | | | (1.12 | ) |

| Total from investment operations | | | (1.74 | ) | | | 0.26 | | | | 6.11 | | | | (1.45 | ) | | | (1.07 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.12 | ) | | | (0.14 | ) | | | (0.11 | ) | | | (0.08 | ) | | | (0.02 | ) |

| Net realized gains | | | (0.73 | ) | | | — | | | | — | | | | — | | | | (1.17 | ) |

| Total distributions | | | (0.85 | ) | | | (0.14 | ) | | | (0.11 | ) | | | (0.08 | ) | | | (1.19 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 15.76 | | | $ | 18.35 | | | $ | 18.23 | | | $ | 12.23 | | | $ | 13.76 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | -9.77 | %(2) | | | 1.43 | % | | | 50.16 | % | | | -10.67 | % | | | -5.89 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in millions) | | $ | 22.7 | | | $ | 25.8 | | | $ | 21.0 | | | $ | 14.4 | | | $ | 17.0 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.41 | % | | | 1.48 | % | | | 1.57 | % | | | 1.58 | % | | | 1.52 | % |

| After expense waiver | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 0.47 | % | | | 0.57 | % | | | 0.38 | % | | | 0.33 | % | | | 0.18 | % |

| After expense waiver | | | 0.58 | % | | | 0.75 | % | | | 0.65 | % | | | 0.61 | % | | | 0.40 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 42 | % | | | 31 | % | | | 38 | % | | | 53 | % | | | 54 | % |

| (1) | Per share amounts calculated using the average shares method. |

| (2) | Net increase from payments by investment adviser on the disposal of investments due to trade error added 0.22% to this return (See Note 4). |

See Notes to the Financial Statements

Reinhart Mid Cap PMV Fund

Financial Highlights

For a Fund share outstanding throughout each year.

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | May 31, 2023 | | | May 31, 2022 | | | May 31, 2021 | | | May 31, 2020 | | | May 31, 2019 | |

| Advisor Class | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| PER SHARE DATA: | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 18.32 | | | $ | 18.22 | | | $ | 12.22 | | | $ | 13.75 | | | $ | 16.05 | |

| | | | | | | | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.14 | (1) | | | 0.19 | | | | 0.15 | | | | 0.12 | | | | 0.10 | |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | |

| on investments and payments from | | | | | | | | | | | | | | | | | | | | |

| investment adviser on the disposal of | | | | | | | | | | | | | | | | | | | | |

| investments due to trade error | | | (1.84 | ) | | | 0.12 | | | | 6.00 | | | | (1.53 | ) | | | (1.15 | ) |

| Total from investment operations | | | (1.70 | ) | | | 0.31 | | | | 6.15 | | | | (1.41 | ) | | | (1.05 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.14 | ) | | | (0.21 | ) | | | (0.15 | ) | | | (0.12 | ) | | | (0.08 | ) |

| Net realized gains | | | (0.73 | ) | | | — | | | | — | | | | — | | | | (1.17 | ) |

| Total distributions | | | (0.87 | ) | | | (0.21 | ) | | | (0.15 | ) | | | (0.12 | ) | | | (1.25 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 15.75 | | | $ | 18.32 | | | $ | 18.22 | | | $ | 12.22 | | | $ | 13.75 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | -9.56 | %(2) | | | 1.68 | % | | | 50.56 | % | | | -10.41 | % | | | -5.69 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in millions) | | $ | 116.1 | | | $ | 172.6 | | | $ | 167.3 | | | $ | 123.8 | | | $ | 157.9 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.20 | % | | | 1.16 | % | | | 1.24 | % | | | 1.25 | % | | | 1.22 | % |

| After expense waiver | | | 1.05 | % | | | 1.05 | % | | | 1.05 | % | | | 1.05 | % | | | 1.05 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 0.69 | % | | | 0.89 | % | | | 0.71 | % | | | 0.65 | % | | | 0.48 | % |

| After expense waiver | | | 0.84 | % | | | 1.00 | % | | | 0.90 | % | | | 0.86 | % | | | 0.65 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 42 | % | | | 31 | % | | | 38 | % | | | 53 | % | | | 54 | % |

| (1) | Per share amounts calculated using the average shares method. |

| (2) | Net increase from payments by investment adviser on the disposal of investments due to trade error added 0.22% to this return (See Note 4). |

See Notes to the Financial Statements

Reinhart Mid Cap PMV Fund

Financial Highlights

For a Fund share outstanding throughout each year.

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | May 31, 2023 | | | May 31, 2022 | | | May 31, 2021 | | | May 31, 2020 | | | May 31, 2019 | |

| Institutional Class | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| PER SHARE DATA: | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 18.40 | | | $ | 18.27 | | | $ | 12.25 | | | $ | 13.77 | | | $ | 16.06 | |

| | | | | | | | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.17 | (1) | | | 0.21 | | | | 0.16 | | | | 0.15 | | | | 0.12 | |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | |

| on investments and payments from | | | | | | | | | | | | | | | | | | | | |

| investment adviser on the disposal of | | | | | | | | | | | | | | | | | | | | |

| investments due to trade error | | | (1.88 | ) | | | 0.13 | | | | 6.02 | | | | (1.54 | ) | | | (1.15 | ) |

| Total from investment operations | | | (1.71 | ) | | | 0.34 | | | | 6.18 | | | | (1.39 | ) | | | (1.03 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.14 | ) | | | (0.21 | ) | | | (0.16 | ) | | | (0.13 | ) | | | (0.09 | ) |

| Net realized gains | | | (0.73 | ) | | | — | | | | — | | | | — | | | | (1.17 | ) |

| Total distributions | | | (0.87 | ) | | | (0.21 | ) | | | (0.16 | ) | | | (0.13 | ) | | | (1.26 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 15.82 | | | $ | 18.40 | | | $ | 18.27 | | | $ | 12.25 | | | $ | 13.77 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | -9.54 | %(2) | | | 1.87 | % | | | 50.75 | % | | | -10.28 | % | | | -5.57 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in millions) | | $ | 3.8 | | | $ | 34.1 | | | $ | 38.4 | | | $ | 30.5 | | | $ | 44.9 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.09 | % | | | 1.12 | % | | | 1.18 | % | | | 1.17 | % | | | 1.16 | % |

| After expense waiver | | | 0.90 | % | | | 0.90 | % | | | 0.90 | % | | | 0.90 | % | | | 0.90 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 0.80 | % | | | 0.93 | % | | | 0.77 | % | | | 0.73 | % | | | 0.54 | % |

| After expense waiver | | | 0.99 | % | | | 1.15 | % | | | 1.05 | % | | | 1.01 | % | | | 0.80 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 42 | % | | | 31 | % | | | 38 | % | | | 53 | % | | | 54 | % |

| (1) | Per share amounts calculated using the average shares method. |

| (2) | Net increase from payments by investment adviser on the disposal of investments due to trade error added 0.22% to this return (See Note 4). |

See Notes to the Financial Statements

Reinhart Genesis PMV Fund

Financial Highlights

For a Fund share outstanding throughout each year.

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | May 31, 2023 | | | May 31, 2022 | | | May 31, 2021 | | | May 31, 2020 | | | May 31, 2019 | |

| Investor Class | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| PER SHARE DATA: | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 12.55 | | | $ | 13.39 | | | $ | 8.71 | | | $ | 9.94 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.02 | | | | 0.03 | | | | 0.04 | | | | 0.02 | | | | 0.03 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 0.74 | | | | (0.30 | ) | | | 4.65 | | | | (1.20 | ) | | | 0.03 | (1) |

| Total from investment operations | | | 0.76 | | | | (0.27 | ) | | | 4.69 | | | | (1.18 | ) | | | 0.06 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.02 | ) | | | (0.06 | ) | | | (0.01 | ) | | | (0.01 | ) | | | (0.02 | ) |

| Net realized gains | | | (0.83 | ) | | | (0.51 | ) | | | — | | | | (0.04 | ) | | | (0.10 | ) |

| Total distributions | | | (0.85 | ) | | | (0.57 | ) | | | (0.01 | ) | | | (0.05 | ) | | | (0.12 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 12.46 | | | $ | 12.55 | | | $ | 13.39 | | | $ | 8.71 | | | $ | 9.94 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 6.73 | % | | | -2.09 | % | | | 53.82 | % | | | -12.00 | % | | | 0.69 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in millions) | | $ | 19.3 | | | $ | 17.3 | | | $ | 17.7 | | | $ | 10.3 | | | $ | 10.6 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |