Brian R. Wiedmeyer, President

c/o U.S. Bancorp Fund Services, LLC

Principal Street High Income Municipal Fund

A Class Shares — GSTFX

Institutional Class Shares — GSTAX

Investor Class Shares — GSTEX

Principal Street Short Term Municipal Fund

Institutional Class Shares — PSTYX

Investor Class Shares — PSTEX

Annual Report

| https://principalstreetfunds.com | August 31, 2023 |

(This Page Intentionally Left Blank.)

PRINCIPAL STREET FUNDS

Dear Investors,

We are pleased to present you with our Principal Street High Income Municipal Fund (“High Income Fund”) (share classes GSTAX/GSTEX/GSTFX) and Principal Street Short Term Municipal Fund (“Short Term Fund”) (share classes PSTYX/PSTEX) annual shareholder report for the fiscal year ended August 31, 2023 (hereafter: the reporting period).

MARKET UPDATE

Inflation and Rising7 Interest Rates Continue to Drive Performance

Municipal bond performance so far in 2023 has been a bit listless with rates continuing to rise – but at a much slower pace. Interest rates have risen an additional 50-100 basis points over the reporting period. Importantly, inflation has moderated and continues to decline. This should lead to a moderation of interest rate fluctuations at least to some of the volatility of the last few years. Once inflation expectations have embedded themselves within a market, they are difficult to shake off, the process takes time. Outflows were significant across the board as municipal bond funds continue to see outflows, but again at a much more moderated pace than the prior year.

Fears of a potentially severe economic downturn are receding and the fundamentals of underlying municipal credit remains strong. State and local governments continue to reap the rewards of Federal pandemic stimulus programs. We expect the financial strength of municipalities to remain supported over the next several years, and we are focusing on credits that will endure any downturn in the economic cycle. One of the many benefits of most municipal credits is that they are not highly correlated to the general business cycle. This does not mean the market is immune to volatility or defaults, but that volatility may present the best buying opportunities, and we constantly strive to position the fund properly in order to take advantage of such opportunities. This is where we concentrate our efforts.

HIGH INCOME FUND PORTFOLIO UPDATE

The High Income Fund delivered on its primary goal of providing high levels of tax-exempt income and strong relative performance, while operating in a challenging market environment for US fixed income in general, and municipal bonds specifically, during the reporting period.

The high yield municipal bond market had continued net outflows as has the High Income Fund. The outflows were minor, but a bit disappointing. We believe overall volatility has been greatly mitigated and that the Fund is poised to gain assets as our longer term performance track record continues to be repaired. At the end of the reporting period, the High Income Fund’s AUM was approximately $275 million.

For the reporting period, the High Income Fund’s total return was -2.94% (GSTAX). As of August 31, 2023, the Institutional Class had a one-year distribution yield of 6.32%, which we view as very strong compared to our peers.

Performance, Yields & Expense Ratios as of August 31, 2023

| | | | Annualized | | |

| | | | Since | | Expense |

| | 1-Year | 5-Year | Inception | Distribution | Ratio(5) |

| Share Class | Return | Return | (9/15/17) | Yield | (Gross/Net) |

Institutional (GSTAX)(1) | -2.94% | -0.93% | 0.74% | 6.32% | 1.04% / 1.00% |

Investor (GSTEX)(2) | -3.81% | -1.64% | 0.27% | 5.77% | 1.54% / 1.50% |

A Class (GSTFX)(3)(4) | | | | | |

| (with sales load) | -6.16% | -1.90% | -0.12% | 6.09% | 1.27% / 1.23% |

A Class (GSTFX)(3) | | | | | |

| (without sales load) | -4.02% | -1.45% | 0.26% | 6.09% | 1.27% / 1.23% |

| Bloomberg High Yield | | | | | |

| Municipal Bond Index | 0.52% | 2.37% | 3.05% | N/A | N/A |

PRINCIPAL STREET FUNDS

Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-877-914-7343. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Distribution Yield is the latest monthly dividend rate times 12, divided by the latest month-end NAV.

| (1) | Inception date for the Institutional Class was September 15, 2017. |

| (2) | Inception date for the Investor Class was March 23, 2020. Performance for the Investor Class prior to the inception of the class is based on the performance of the Institutional Class, adjusted for the higher expenses applicable to the Investor Class. |

| (3) | Inception date for the A Class was February 15, 2022. Performance for the A Class prior to the inception of the class is based on the performance of the Institutional Class, adjusted for the higher expenses applicable to the A Class. |

| (4) | Reflects the maximum front-end sales load of 2.25%. |

| (5) | As of December 29, 2022, the date of the High Income Fund’s most recent prospectus, expense ratios for the Fund were as follows: |

| | Institutional Class | Gross Expenses: 0.93%; Net Expenses: 0.90% |

| | Investor Class | Gross Expenses: 1.45%; Net Expenses: 1.42% |

| | A Class | Gross Expenses: 1.34%; Net Expenses: 1.27% |

Principal Street Partners, LLC (the “Adviser”) has contractually agreed to reduce its management fees, and may reimburse the Fund for its operating expenses, in order to ensure that Total Annual Fund Operating Expenses (excluding certain expenses such as Rule 12b-1 fees, taxes, leverage/borrowing interest, interest expense, dividends paid on short sales, brokerage commissions and other transactional expenses, acquired fund fees and expenses (“AFFE”), or extraordinary expenses (“Excluded Expenses”)) do not exceed 0.80% of the Fund’s average daily net assets. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and/or expense payment was made, if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite, but cannot be terminated through at least December 29, 2023. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser.

SHORT TERM FUND PORTFOLIO UPDATE

The Short Term Fund was launched on April 27, 2022 and compliments the high yield strategy of the High Income Fund in that it is a short duration (< 3 years) and high grade (90% investment grade or greater) offering. The Fund is designed to minimize price volatility both in the absolute and relative to its peers. During the reporting period the Adviser is satisfied that the Short Term Fund performed as designed.

For the reporting period, the Fund’s total return was 2.36% (PSTYX), while the Fund’s benchmark, the Bloomberg 3-Year Municipal Bond Index returned 1.12%. As of August 31, 2023, the Institutional Class had a one-year distribution yield of 3.42%, which we view as very strong compared to our peers.

In the brief time since inception the Short Term Fund has existed in what is best described as a challenging market environment. Over the last 18 months the municipal bond market has seen significant rate and flow volatility. Short term municipal rates have increased 50-100 basis points over the last 12 months and that is after a period where rates already rose 100-200 basis points with some sectors widening even further (e.g. Diversified Financials, and AMT Airports). The relative performance of the Short Term Fund has met our expectations. The Fund has seen AUM grow from $28 million to $53 million as of period end, which is encouraging considering the degree of outflows from municipal bond mutual funds during that time.

PRINCIPAL STREET FUNDS

Performance, Yields & Expense Ratios as of August 31, 2023

| | | Annualized | | |

| | | Since | | Expense |

| | 1-Year | Inception | Distribution | Ratio(1) |

| Share Class | Return | (4/27/22) | Yield | (Gross/Net) |

| Institutional (PSTYX) | 2.36% | 2.52% | 3.61% | 1.09% / 0.71% |

| Investor (PSTEX) | 1.87% | 2.09% | 3.37% | 1.37% / 0.95% |

| Bloomberg 3-Year Municipal Bond Index | 1.12% | 1.45% | N/A | N/A |

Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-877-914-7343. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Distribution Yield is the latest monthly dividend rate times 12, divided by the latest month-end NAV.

SEC Yield is based on the hypothetical annualized earning power (investment income only) of the Fund’s portfolio securities during the period indicated. Subsidized yields reflect fee waivers in effect. Without such waivers, yields would be reduced. Unsubsidized yields do not reflect fee waivers in effect.

| (1) | As of December 29, 2022, the date of the Short Term Fund’s most recent prospectus, expense ratios for the Fund were as follows: |

| | Institutional Class | Gross Expenses: 4.41%; Net Expenses: 0.70% |

| | Investor Class | Gross Expenses: 5.60%; Net Expenses: 0.95% |

Principal Street Partners, LLC (the “Adviser”) has contractually agreed to reduce its management fees, and may reimburse the Fund for its operating expenses, in order to ensure that Total Annual Fund Operating Expenses (excluding certain expenses such as Rule 12b-1 fees, taxes, leverage/borrowing interest, interest expense, dividends paid on short sales, brokerage commissions and other transactional expenses, acquired fund fees and expenses, or extraordinary expenses) do not exceed 0.70% of the Fund’s average daily net assets. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and/or expense payment was made, if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expense Limitation Agreement is indefinite but cannot be terminated through at least December 29, 2023. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser.

LOOKING AHEAD

We believe the volatility in the fixed income markets is quieting down, bonds in general are looking more attractive based on the income levels now available. Our relative performance continues to get better as we work out of prior defaulted bonds and continue to work to diversify the portfolio. We expect these conditions are ripe for strong performance to increase assets and drive better absolute performance in the asset class. Again, we thought that might have been 2023, but looks like those days are moving to 2024. We maintain our focus and flexibility to take advantage of the opportunities the markets present for our investors.

Sincerely,

Troy Willis, Charlie Pulire

PRINCIPAL STREET FUNDS

Must be preceded or accompanied by a prospectus.

Opinions expressed are subject to change, are not intended to be a forecast of future events, a guarantee of future results, nor investment advice. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Diversification does not assure a profit or protect against a loss in a declining market.

The Principal Street High Income Municipal Fund’s and Principal Street Short Term Municipal Fund’s primary investment objectives are to provide current income exempt from regular federal income tax. Income may be subject to state or local tax.

The Bloomberg High Yield Municipal Bond Index covers the high yield portion of the USD-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds. One cannot invest directly in an Index.

The Bloomberg 3-Year Municipal Bond Index measures the performance of USD-denominated long-term, tax-exempt bond market with maturities of 1-3 years, including state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds. One cannot invest directly in an Index.

Basis Points are a unit of measure used to describe the percentage change in the value of financial instruments or the rate change in an index or other benchmark. One basis point is equivalent to 0.01% (1/100th of a percent) or 0.0001 in decimal form.

High-yield fixed income securities or “junk bonds” are fixed-income securities held by the Fund that are rated below investment grade are subject to additional risk factors such as increased possibility of default, illiquidity of the security, and changes in value based on public perception of the issuer. The municipal market is volatile and can be significantly affected by adverse tax, legislative or political changes and the financial condition of the issuers of municipal securities. Income from tax-exempt funds may be subject to state and local taxes and a portion of income may be subject to the federal and/or state alternative minimum tax for certain investors. Federal income tax rules will apply to any capital gains distribution.

Distributions are not guaranteed and a company’s future ability to make distributions may be limited.

Mutual Fund investing involves risk. Principal loss is possible. Variable and floating rate securities provide for a periodic adjustment in the interest rate paid on the obligations. Fixed-income securities may be subject to interest rate, credit, liquidity, prepayment and extension risks. Interest rates may go up resulting in a decrease in the value of the fixed-income securities held by the Funds.

Principal Street Partners, LLC is the Investment Adviser to the Principal Street High Income Municipal Fund and the Principal Street Short Term Municipal Fund, which are distributed by Quasar Distributors, LLC.

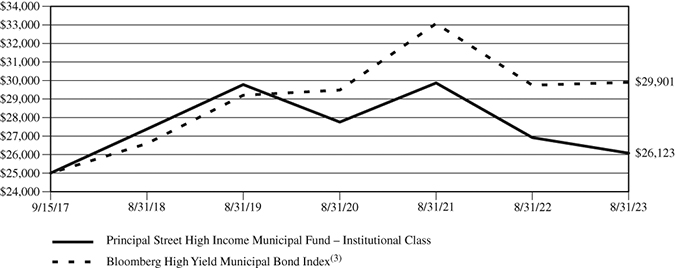

PRINCIPAL STREET HIGH INCOME MUNICIPAL FUND

Value of $25,000 Investment (Unaudited)

The chart assumes an initial investment of $25,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-877-914-7343. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of August 31, 2023

| | 1-Year | 3-Year | 5-Year | Since Inception(1) |

| Institutional Class | -2.94% | -2.00% | -0.93% | 0.74% |

| Investor Class | -3.81% | -2.64% | -1.39% | 0.27% |

A Class (with sales load)(2) | -6.16% | -3.43% | -1.90% | -0.12% |

| A Class (without sales load) | -4.02% | -2.69% | -1.45% | 0.26% |

Bloomberg High Yield Municipal Bond Index(3) | 0.52% | 0.47% | 2.37% | 3.05% |

| (1) | Period since the Fund’s inception. The Institutional Class, Investor Class, and A Class commenced operations on September 15, 2017, March 23, 2020, and February 16, 2022, respectively. Performance for the Investor Class and A Class prior to the inception of the Investor Class and A Class is based on the performance of the Institutional Class, adjusted for the higher expenses applicable to the Investor Class and A Class. |

| (2) | Reflects a sales load of 2.25%. |

| (3) | The Bloomberg High Yield Municipal Bond Index covers the high yield portion of the USD-denominated long-term tax-exempt bond market. The Index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds. One cannot invest directly in an Index. |

PRINCIPAL STREET HIGH INCOME MUNICIPAL FUND

The following is expense information for the Principal Street High Income Municipal Fund as disclosed in the Fund’s most recent prospectus dated December 29, 2022:

| Institutional Class | Gross Expenses: 0.93%; Net Expenses: 0.90%. |

| Investor Class | Gross Expenses: 1.45%; Net Expenses: 1.42%. |

| A Class | Gross Expenses: 1.34%; Net Expenses: 1.27%. |

Principal Street Partners, LLC (the “Adviser”) has contractually agreed to reduce its management fees, and may reimburse the Fund for its operating expenses, in order to ensure that Total Annual Fund Operating Expenses (excluding certain expenses such as Rule 12b-1 fees, taxes, leverage/borrowing interest, interest expense, dividends paid on short sales, brokerage commissions and other transactional expenses, acquired fund fees and expenses, or extraordinary expenses) do not exceed 0.80% of the Fund’s average daily net assets. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and/or expense payment was made, if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expense Limitation Agreement is indefinite but cannot be terminated through at least December 29, 2023. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser.

PRINCIPAL STREET SHORT TERM MUNICIPAL FUND

Value of $25,000 Investment (Unaudited)

The chart assumes an initial investment of $25,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-877-914-7343. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of August 31, 2023

| | 1-Year | Since Inception(1) |

| Institutional Class | 2.36% | 2.52% |

| Investor Class | 1.87% | 2.09% |

Bloomberg 3-Year Municipal Bond Index(2) | 1.12% | 1.45% |

| (1) | Period since the Fund’s inception. The Institutional Class and Investor Class both commenced operations on April 27, 2022. |

| (2) | The Bloomberg 3-Year Municipal Bond Index measures the performance of USD-denominated long-term, tax-exempt bond market with maturities of 1-3 years, including state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds. One cannot invest directly in an Index. |

PRINCIPAL STREET SHORT TERM MUNICIPAL FUND

The following is expense information for the Principal Street Short Term Municipal Fund as disclosed in the Fund’s most recent prospectus dated December 29, 2022:

| Institutional Class | Gross Expenses: 4.41%; Net Expenses: 0.70%. |

| Investor Class | Gross Expenses: 5.60%; Net Expenses: 0.95%. |

Principal Street Partners, LLC (the “Adviser”) has contractually agreed to reduce its management fees, and may reimburse the Fund for its operating expenses, in order to ensure that Total Annual Fund Operating Expenses (excluding certain expenses such as Rule 12b-1 fees, taxes, leverage/borrowing interest, interest expense, dividends paid on short sales, brokerage commissions and other transactional expenses, acquired fund fees and expenses, or extraordinary expenses) do not exceed 0.70% of the Fund’s average daily net assets. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and/or expense payment was made, if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expense Limitation Agreement is indefinite but cannot be terminated through at least December 29, 2023. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser.

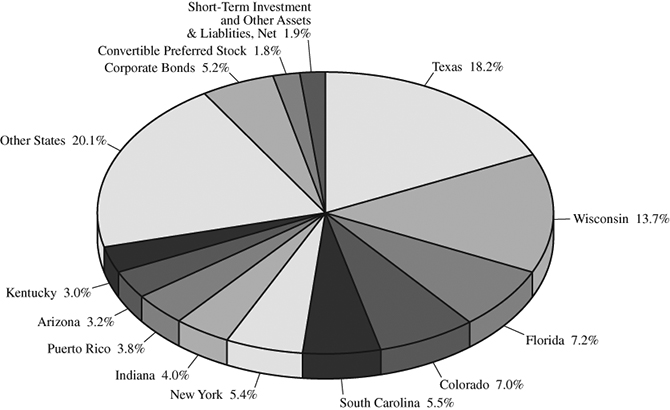

PRINCIPAL STREET HIGH INCOME MUNICIPAL FUND

Allocation of Portfolio(1) (Unaudited)

As of August 31, 2023

(% of Net Assets)

Top Ten Holdings(1) (Unaudited)

As of August 31, 2023

(% of Net Assets)

| | Sunland Medical Foundation, 12.000%, 10/20/2024 | 3.6% | |

| | Wisconsin Public Finance Authority, 7.050%, 9/1/2046 | 3.3% | |

| | Wisconsin Public Finance Authority, 7.375%, 1/1/2050 | 3.2% | |

| | Falmouth Solid Waste Disposal Facilities Revenue, 8.500%, 6/1/2040 | 3.0% | |

| | Angelina & Neches River Authority, 7.500%, 12/1/2045 | 2.9% | |

| | Atoka Industrial Development Authority, 8.000%, 8/1/2039 | 2.5% | |

| | Port Beaumont Navigation District, 8.000%, 2/1/2039 | 2.5% | |

| | Erie Tobacco Asset Securitization Corp., 0.000%, 6/1/2060 | 2.4% | |

| | Children’s Trust Fund, 0.000%, 5/15/2057 | 2.4% | |

| | South Carolina Jobs-Economic Development Authority, 7.750%, 10/1/2057 | 2.4% | |

| | (1) | Fund holdings and allocations are subject to change at any time and are not recommendations to buy or sell any security. |

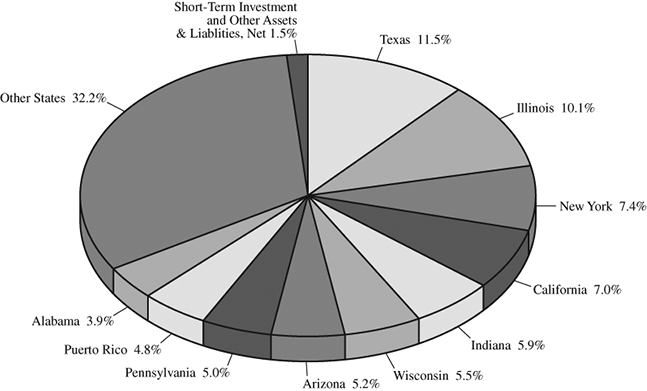

PRINCIPAL STREET SHORT TERM MUNICIPAL FUND

Allocation of Portfolio(1) (Unaudited)

As of August 31, 2023

(% of Net Assets)

Top Ten Holdings(1) (Unaudited)

As of August 31, 2023

(% of Net Assets)

| | Metropolitan Pier & Exposition Authority, 7.000%, 7/1/2026 | 3.3% | |

| | Port Authority of New York & New Jersey, 5.000%, 7/15/2027 | 2.6% | |

| | Wisconsin Public Finance Authority, 5.750%, 6/1/2025 | 2.5% | |

| | Texas Municipal Gas Acquisition and Supply Corp. I, 6.250%, 12/15/2026 | 2.3% | |

| | Metropolitan Transportation Authority, 5.000%, 11/15/2030 | 1.9% | |

| | Black Belt Energy Gas District, 5.250%, 02/01/2053 | 1.9% | |

| | Tennessee Energy Acquisition Corp., 5.250%, 9/1/2024 | 1.9% | |

| | Indiana Finance Authority, 4.50%, 12/15/2046 | 1.9% | |

| | Build NYC Resource Corp., 7.625%, 2/1/2026 | 1.9% | |

| | Maricopa County Industrial Development Authority, 4.000%, 7/1/2029 | 1.8% | |

| | (1) | Fund holdings and allocations are subject to change at any time and are not recommendations to buy or sell any security. |

PRINCIPAL STREET FUNDS

Expense Example (Unaudited)

August 31, 2023

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, interest expense, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (March 1, 2023 – August 31, 2023).

ACTUAL EXPENSES

For each class, the first line of each table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

For each class, the second line of each table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of each table for each class is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs may have been higher.

HIGH INCOME MUNICIPAL FUND

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (03/01/2023) | (08/31/2023) | (03/01/2023 to 08/31/2023) |

Institutional Actual(2)(3) | $1,000.00 | $1,016.40 | $4.88 |

Institutional Hypothetical(4) (5% return before expenses) | $1,000.00 | $1,020.37 | $4.89 |

(1) | Expenses for the Institutional Class are equal to the annualized expense ratio for the most recent six-month period of 0.96%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

(2) | Based on the actual Institutional Class return for the six-month period ended August 31, 2023 of 1.64%. |

(3) | Excluding interest expense, the actual expenses would be $4.07. |

(4) | Excluding interest expense, the hypothetical expenses would be $4.08. |

PRINCIPAL STREET FUNDS

Expense Example (Unaudited) – Continued

August 31, 2023

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(5) |

| | (03/01/2023) | (08/31/2023) | (03/01/2023 to 08/31/2023) |

Investor Actual(6)(7) | $1,000.00 | $1,010.90 | $7.40 |

Investor Hypothetical(8) (5% return before expenses) | $1,000.00 | $1,017.85 | $7.43 |

(5) | Expenses for the Investor Class are equal to the annualized expense ratio for the most recent six-month period of 1.46%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

(6) | Based on the actual Investor Class return for the six-month period ended August 31, 2023 of 1.09%. |

(7) | Excluding interest expense, the actual expenses would be $6.59. |

(8) | Excluding interest expense, the hypothetical expenses would be $6.61. |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(9) |

| | (03/01/2023) | (08/31/2023) | (03/01/2023 to 08/31/2023) |

A Class Actual(10)(11) | $1,000.00 | $1,005.30 | $6.12 |

A Class Hypothetical(12) (5% return before expenses) | $1,000.00 | $1,019.11 | $6.16 |

(9) | Expenses for the A Class are equal to the annualized expense ratio for the most recent six-month period of 1.21%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

(10) | Based on the actual A Class return for the six-month period ended August 31, 2023 of 0.53%. |

(11) | Excluding interest expense, the actual expenses would be $5.31. |

(12) | Excluding interest expense, the hypothetical expenses would be $5.35. |

SHORT TERM MUNICIPAL FUND

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (03/01/2023) | (08/31/2023) | (03/01/2023 to 08/31/2023) |

Institutional Actual(2)(3) | $1,000.00 | $1,014.80 | $3.55 |

Institutional Hypothetical(4) (5% return before expenses) | $1,000.00 | $1,021.68 | $3.57 |

(1) | Expenses for the Institutional Class are equal to the annualized expense ratio for the most recent six-month period of 0.70%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

(2) | Based on the actual Institutional Class return for the six-month period ended August 31, 2023 of 1.48%. |

(3) | Excluding interest expense, the actual expenses would be $3.55. |

(4) | Excluding interest expense, the hypothetical expenses would be $3.57. |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(5) |

| | (03/01/2023) | (08/31/2023) | (03/01/2023 to 08/31/2023) |

Investor Actual(6)(7) | $1,000.00 | $1,013.50 | $4.82 |

Investor Hypothetical(8) (5% return before expenses) | $1,000.00 | $1,020.42 | $4.84 |

(5) | Expenses for the Investor Class are equal to the annualized expense ratio for the most recent six-month period of 0.95%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

(6) | Based on the actual Investor Class return for the six-month period ended August 31, 2023 of 1.35%. |

(7) | Excluding interest expense, the actual expenses would be $4.82. |

(8) | Excluding interest expense, the hypothetical expenses would be $4.84. |

PRINCIPAL STREET HIGH INCOME MUNICIPAL FUND

Schedule of Investments

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 91.1% | | | | | | |

| | | | | | | |

| Arizona — 3.2% | | | | | | |

| Arizona Industrial Development Authority | | | | | | |

| (Obligor: Empower College Prep) | | | | | | |

| 6.000%, 07/01/2049 | | $ | 1,000,000 | | | $ | 960,642 | |

| (Obligor: Legacy Cares, Inc.) | | | | | | | | |

7.750%, Series A, 07/01/2050 (3) | | | 1,600,000 | | | | 160,000 | |

6.000%, Series A, 07/01/2051 (3) | | | 540,000 | | | | 54,000 | |

6.750%, Series C, 07/01/2030 (3) | | | 2,000,000 | | | | 200,000 | |

| La Paz County Industrial Development Authority | | | | | | | | |

| (Obligor: Imperial Valley Gateway Center) | | | | | | | | |

| 7.000%, 12/01/2040 | | | 1,535,000 | | | | 549,666 | |

| Maricopa County Industrial Development Authority | | | | | | | | |

| (Obligor: Christian Care Surprise) | | | | | | | | |

| 6.000%, 01/01/2048 | | | 1,595,000 | | | | 1,122,016 | |

| Pima County Industrial Development Authority | | | | | | | | |

| (Obligor: La Posada Park Centre) | | | | | | | | |

6.625%, 05/15/2031 (1) | | | 2,000,000 | | | | 1,977,859 | |

| Sierra Vista Industrial Development Authority | | | | | | | | |

| (Obligor: Georgetown Community Development Authority) | | | | | | | | |

0.000%, Series A, 10/01/2056 (1),(4),(5) | | | 1,000,000 | | | | 874,927 | |

0.000%, Series A, 10/01/2056 (1),(4),(5) | | | 2,200,000 | | | | 1,557,243 | |

| 6.250%, Series B, 10/01/2036 | | | 1,500,000 | | | | 1,210,252 | |

| | | | | | | | 8,666,605 | |

| California — 0.4% | | | | | | | | |

| California Pollution Control Financing Authority | | | | | | | | |

| (Obligor: CalPlant I) | | | | | | | | |

7.000%, 10/31/2023 (3),(8) | | | 1,000,000 | | | | 50,000 | |

7.500%, 07/01/2032 (3),(8) | | | 5,065,000 | | | | 658,450 | |

8.000%, 07/01/2039 (3),(8) | | | 3,845,000 | | | | 192,250 | |

7.500%, 12/01/2039 (3),(8) | | | 2,500,000 | | | | 125,000 | |

| | | | | | | | 1,025,700 | |

| Colorado — 7.0% | | | | | | | | |

| Aurora Highlands Community Authority Board | | | | | | | | |

| 5.750%, 12/01/2051 | | | 4,000,000 | | | | 3,563,614 | |

| Banning Lewis Ranch Metropolitan District No. 8 | | | | | | | | |

| 4.875%, 12/01/2051 | | | 2,500,000 | | | | 1,869,670 | |

| Canyon Pines Metropolitan District | | | | | | | | |

| 5.250%, Series A-1, 12/01/2051 | | | 2,000,000 | | | | 1,693,576 | |

| Cascade Ridge Metropolitan District | | | | | | | | |

| 5.000%, 12/01/2051 | | | 1,000,000 | | | | 821,361 | |

See Notes to the Financial Statements

PRINCIPAL STREET HIGH INCOME MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 91.1% (Continued) | | | | | | |

| | | | | | | |

| Colorado — 7.0% (Continued) | | | | | | |

| Cottonwood Hollow Residential Metropolitan District | | | | | | |

| 5.000%, 12/01/2051 | | $ | 750,000 | | | $ | 598,672 | |

| Four Corners Business Improvement District | | | | | | | | |

| 6.000%, 12/01/2052 | | | 1,000,000 | | | | 904,122 | |

| Grandview Reserve Metropolitan District No. 3 | | | | | | | | |

| 6.250%, Series A, 12/01/2052 | | | 1,500,000 | | | | 1,395,653 | |

| 9.000%, Series B, 12/15/2052 | | | 1,000,000 | | | | 955,893 | |

| Ledge Rock Center Commercial Metropolitan District | | | | | | | | |

7.000%, Series A, 11/01/2052 (1) | | | 1,000,000 | | | | 982,796 | |

7.375%, Series A, 11/01/2052 (1) | | | 1,000,000 | | | | 983,393 | |

| Legato Community Authority | | | | | | | | |

| 8.250%, Series B, 12/15/2051 | | | 2,000,000 | | | | 1,782,006 | |

| Peak Metropolitan District No. 3 | | | | | | | | |

| 7.500%, Series A-1, 12/01/2052 | | | 1,500,000 | | | | 1,480,498 | |

| Verve Metropolitan District No. 1 | | | | | | | | |

| 6.750%, 12/01/2052 | | | 1,500,000 | | | | 1,373,778 | |

| Waters’ Edge Metropolitan District No. 2 | | | | | | | | |

| 5.000%, 12/01/2051 | | | 1,000,000 | | | | 818,993 | |

| | | | | | | | 19,224,025 | |

| Florida — 7.2% | | | | | | | | |

| Capital Trust Agency, Inc. | | | | | | | | |

| (Obligor: Tallahassee NHHI) | | | | | | | | |

7.000%, Series A, 12/01/2045 (3) | | | 150,000 | | | | 49,125 | |

7.125%, Series A, 12/01/2050 (3) | | | 2,000,000 | | | | 655,000 | |

| (Obligor: Tapestry Senior Housing Walden) | | | | | | | | |

7.000%, Series A, 07/01/2052 (3) | | | 2,200,000 | | | | 484,000 | |

| (Obligor: Tuscan Gardens of Palm Coast Obligated Group) | | | | | | | | |

6.500%, Series A, 10/01/2032 (3) | | | 1,090,000 | | | | 577,700 | |

6.750%, Series A, 10/01/2037 (3) | | | 1,290,000 | | | | 683,700 | |

7.000%, Series A, 10/01/2040 (3) | | | 1,525,000 | | | | 808,250 | |

7.000%, Series A, 10/01/2049 (3) | | | 1,700,000 | | | | 901,000 | |

| (Obligor: Voans SW Florida Healthcare) | | | | | | | | |

10.000%, 06/30/2024 (3) | | | 7,950,000 | | | | 5,803,500 | |

| Florida Development Finance Corp. | | | | | | | | |

| (Obligor: Cabana at Jensen Dunes) | | | | | | | | |

12.000%, Series B, 11/15/2056 (1),(2) | | | 5,025,000 | | | | 5,273,738 | |

| Lake County | | | | | | | | |

| (Obligor: Village Veranda at Lady Lake Obligated Group) | | | | | | | | |

7.125%, Series A1, 01/01/2052 (3) | | | 5,800,000 | | | | 4,524,000 | |

| | | | | | | | 19,760,013 | |

See Notes to the Financial Statements

PRINCIPAL STREET HIGH INCOME MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 91.1% (Continued) | | | | | | |

| | | | | | | |

| Illinois — 2.1% | | | | | | |

| Illinois Finance Authority | | | | | | |

| (Obligor: Aim Art in Motion) | | | | | | |

| 5.000%, Series A, 07/01/2051 | | $ | 3,000,000 | | | $ | 2,112,694 | |

| 5.000%, Series B, 07/01/2024 | | | 305,000 | | | | 294,309 | |

| (Obligor: Plymouth Place) | | | | | | | | |

| 6.500%, Series A, 05/15/2047 | | | 1,000,000 | | | | 1,008,821 | |

| (Obligor: Roosevelt University) | | | | | | | | |

6.125%, Series A, 04/01/2049 (1) | | | 2,500,000 | | | | 2,302,222 | |

| | | | | | | | 5,718,046 | |

| Indiana — 4.0% | | | | | | | | |

| Anderson Industrial Economic Development Revenue | | | | | | | | |

| (Obligor: Anderson University, Inc.) | | | | | | | | |

| 6.000%, 10/01/2042 | | | 1,000,000 | | | | 908,220 | |

| Evansville Manufacturing Housing Revenue | | | | | | | | |

| (Obligor: Evansville RCF LP) | | | | | | | | |

5.450%, 01/01/2038 (3) | | | 1,500,000 | | | | 1,195,645 | |

| Goshen Manufacturing Housing Revenue | | | | | | | | |

| (Obligor: Green Oaks Of Goshen, LLC) | | | | | | | | |

| 5.000%, Series A, 08/01/2041 | | | 1,500,000 | | | | 1,188,585 | |

| Indiana Finance Authority | | | | | | | | |

| (Obligor: Brightmark Plastics Renewal) | | | | | | | | |

7.000%, 03/01/2039 (8) | | | 6,160,000 | | | | 4,595,197 | |

| Indiana Housing & Community Development Authority | | | | | | | | |

| (Obligor: Vita Of New Whiteland, LLC) | | | | | | | | |

| 6.750%, 01/01/2043 | | | 500,000 | | | | 485,773 | |

| Valparaiso Manufactured Housing Revenue | | | | | | | | |

| (Obligor: Green Oaks of Valparaiso) | | | | | | | | |

| 5.375%, 12/01/2041 | | | 3,500,000 | | | | 2,672,546 | |

| | | | | | | | 11,045,966 | |

| Iowa — 1.2% | | | | | | | | |

| Iowa Finance Authority | | | | | | | | |

| (Obligor: Riserville Holdings) | | | | | | | | |

5.000%, 12/01/2051 (8) | | | 3,575,000 | | | | 2,682,008 | |

| (Obligor: Sunrise Manor) | | | | | | | | |

| 5.000%, 09/01/2051 | | | 1,000,000 | | | | 726,348 | |

| | | | | | | | 3,408,356 | |

See Notes to the Financial Statements

PRINCIPAL STREET HIGH INCOME MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 91.1% (Continued) | | | | | | |

| | | | | | | |

| Kentucky — 3.0% | | | | | | |

| Falmouth Solid Waste Disposal Facilities Revenue | | | | | | |

| (Obligor: Texas Bluegrass Biofuels, LLC) | | | | | | |

8.500%, 06/01/2040 (1) | | $ | 8,875,000 | | | $ | 8,163,886 | |

| | | | | | | | | |

| Louisiana — 0.8% | | | | | | | | |

| Louisiana Public Facilities Authority | | | | | | | | |

| (Obligor: Grambling High Foundation) | | | | | | | | |

6.375%, Series A, 06/01/2052 (1) | | | 770,000 | | | | 732,534 | |

| (Obligor: Jefferson Rise Charter School) | | | | | | | | |

6.000%, Series A, 06/01/2037 (1) | | | 480,000 | | | | 455,016 | |

6.250%, Series A, 06/01/2052 (1) | | | 1,000,000 | | | | 932,013 | |

| | | | | | | | 2,119,563 | |

| Maine — 1.3% | | | | | | | | |

| Maine Finance Authority | | | | | | | | |

| (Obligor: Go Lab Madison, LLC) | | | | | | | | |

8.000%, 12/01/2051 (8) | | | 5,500,000 | | | | 3,577,066 | |

| | | | | | | | | |

| Maryland — 0.2% | | | | | | | | |

| Maryland Economic Development | | | | | | | | |

| (Obligor: Consol Marine Terminals) | | | | | | | | |

| 5.750%, 09/01/2025 | | | 500,000 | | | | 504,167 | |

| | | | | | | | | |

| Massachusetts — 0.4% | | | | | | | | |

| Massachusetts Development Finance Agency | | | | | | | | |

| (Obligor: Ascentria Care Alliance) | | | | | | | | |

| 5.000%, 07/01/2051 | | | 1,250,000 | | | | 975,625 | |

| | | | | | | | | |

| Michigan — 0.4% | | | | | | | | |

| Michigan Finance Authority | | | | | | | | |

| (Obligor: Aquinas College) | | | | | | | | |

| 5.000%, 05/01/2046 | | | 1,435,000 | | | | 1,165,449 | |

| | | | | | | | | |

| Mississippi — 1.6% | | | | | | | | |

| Mississippi Development Bank | | | | | | | | |

| 3.625%, 11/01/2036 | | | 1,000,000 | | | | 892,640 | |

| Tunica County | | | | | | | | |

| 6.000%, 10/01/2040 | | | 4,055,000 | | | | 3,575,849 | |

| | | | | | | | 4,468,489 | |

| New Jersey — 0.0% | | | | | | | | |

| New Jersey Economic Development Authority | | | | | | | | |

| (Obligor: Kintock Obligated Group) | | | | | | | | |

| 7.000%, 09/01/2047 | | | 65,000 | | | | 63,597 | |

See Notes to the Financial Statements

PRINCIPAL STREET HIGH INCOME MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 91.1% (Continued) | | | | | | |

| | | | | | | |

| New York — 5.4% | | | | | | |

| Build NYC Resource Corp. | | | | | | |

| (Obligor: Voices of Community Activists) | | | | | | |

| 7.625%, Series A-1, 02/01/2053 | | $ | 1,815,000 | | | $ | 1,782,471 | |

7.625%, Series A-2, 02/01/2026 (1) | | | 1,690,000 | | | | 1,684,165 | |

| 8.125%, Series B, 02/01/2026 | | | 300,000 | | | | 296,950 | |

| Erie Tobacco Asset Securitization Corp. | | | | | | | | |

0.000%, 06/01/2055 (4) | | | 6,000,000 | | | | 411,965 | |

0.000%, 06/01/2060 (4) | | | 115,000,000 | | | | 6,628,290 | |

| New York Counties Tobacco Trust IV | | | | | | | | |

0.000%, Series F, 06/01/2060 (4) | | | 50,000,000 | | | | 3,082,110 | |

| Ulster County Capital Resource Corp. | | | | | | | | |

| (Obligor: Woodland Pond) | | | | | | | | |

| 5.250%, 09/15/2047 | | | 550,000 | | | | 404,420 | |

| 5.250%, 09/15/2053 | | | 920,000 | | | | 650,234 | |

| | | | | | | | 14,940,605 | |

| Ohio — 1.4% | | | | | | | | |

| Southern Ohio Port Authority | | | | | | | | |

| (Obligor: PureCycle Ohio) | | | | | | | | |

7.000%, Series A, 12/01/2042 (8) | | | 2,600,000 | | | | 1,921,299 | |

| Washington County Hospital Revenue | | | | | | | | |

| (Obligor: Marietta Area Healthcare) | | | | | | | | |

| 6.375%, 12/01/2037 | | | 1,000,000 | | | | 986,877 | |

| 6.625%, 12/01/2042 | | | 1,000,000 | | | | 1,000,213 | |

| | | | | | | | 3,908,389 | |

| Oklahoma — 2.8% | | | | | | | | |

| Atoka Industrial Development Authority | | | | | | | | |

| (Obligor: Gladieux Metals Recycling) | | | | | | | | |

8.000%, 08/01/2039 (8) | | | 6,900,000 | | | | 6,924,823 | |

| 8.000%, Series A, 08/01/2039 | | | 750,000 | | | | 752,698 | |

| | | | | | | | 7,677,521 | |

| Pennsylvania — 2.4% | | | | | | | | |

| Pennsylvania Economic Development Financing Authority | | | | | | | | |

| (Obligor: Consol Energy) | | | | | | | | |

9.000%, Series A, 04/01/2051 (8),(9) | | | 4,000,000 | | | | 4,429,050 | |

| (Obligor: Tapestry Moon) | | | | | | | | |

6.500%, Series A, 12/01/2038 (3) | | | 2,950,000 | | | | 1,124,688 | |

6.750%, Series A, 12/01/2053 (3) | | | 2,650,000 | | | | 1,010,313 | |

| | | | | | | | 6,564,051 | |

See Notes to the Financial Statements

PRINCIPAL STREET HIGH INCOME MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 91.1% (Continued) | | | | | | |

| | | | | | | |

| Puerto Rico — 3.8% | | | | | | |

| Children’s Trust Fund | | | | | | |

0.000%, 05/15/2057 (4) | | $ | 42,000,000 | | | $ | 2,921,083 | |

0.000%, Series B, 05/15/2057 (4) | | | 120,000,000 | | | | 6,602,016 | |

| Commonwealth of Puerto Rico | | | | | | | | |

0.000%, 11/01/2051 (4) | | | 2,397,090 | | | | 997,789 | |

| | | | | | | | 10,520,888 | |

| South Carolina — 5.5% | | | | | | | | |

| City of Hardeeville | | | | | | | | |

| 4.000%, 05/01/2052 | | | 900,000 | | | | 618,826 | |

| South Carolina Jobs-Economic Development Authority | | | | | | | | |

| (Obligor: AAC East) | | | | | | | | |

7.000%, Series A, 05/01/2039 (8) | | | 3,500,000 | | | | 2,758,030 | |

| (Obligor: CR River Park) | | | | | | | | |

| 7.750%, Series A, 10/01/2057 | | | 6,150,000 | | | | 6,542,968 | |

| (Obligor: Jasper Pellets) | | | | | | | | |

7.000%, Series A, 11/01/2038 (3), (8) | | | 1,500,000 | | | | 1,425,000 | |

| (Obligor: Last Step Recycling, LLC) | | | | | | | | |

6.500%, Series A, 06/01/2051 (3),(8) | | | 2,000,000 | | | | 1,478,185 | |

| (Obligor: Repower S. Berkeley) | | | | | | | | |

6.000%, 02/01/2035 (3),(8) | | | 1,000,000 | | | | 400,000 | |

| (Obligor: Upstate Senior Living Obligated Group) | | | | | | | | |

| 4.000%, 11/15/2027 | | | 50,000 | | | | 48,254 | |

| (Obligor: Virtus Academy) | | | | | | | | |

| 5.000%, Series A, 06/15/2051 | | | 1,330,000 | | | | 1,011,076 | |

| 5.000%, Series A, 06/15/2056 | | | 1,100,000 | | | | 817,443 | |

| | | | | | | | 15,099,782 | |

| Tennessee — 1.2% | | | | | | | | |

| Knox County Industrial Development Board | | | | | | | | |

| (Obligor: TomPaul Knoxville, LLC) | | | | | | | | |

9.500%, 11/01/2052 (1),(8) | | | 1,000,000 | | | | 994,092 | |

| Metropolitan Government Nashville & | | | | | | | | |

| Davidson County Health & Educational Facilities Board | | | | | | | | |

| (Obligor: Trousdale Foundation Obligated Group) | | | | | | | | |

7.500%, Series B-1, 04/01/2049 (3) | | | 1,140,000 | | | | 11,400 | |

| Shelby County Health Educational & Housing Facilities Board | | | | | | | | |

| (Obligor: Luke Obligated Group) | | | | | | | | |

| 5.750%, Series A, 10/01/2059 | | | 3,000,000 | | | | 2,171,122 | |

| | | | | | | | 3,176,614 | |

See Notes to the Financial Statements

PRINCIPAL STREET HIGH INCOME MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 91.1% (Continued) | | | | | | |

| | | | | | | |

| Texas — 18.2% | | | | | | |

| Angelina & Neches River Authority | | | | | | |

| (Obligor: Jefferson Enterprises Energy) | | | | | | |

7.500%, 12/01/2045 (8) | | $ | 11,900,000 | | | $ | 8,055,983 | |

| Arlington Higher Education Finance Corp. | | | | | | | | |

| (Obligor: Odyssey 2020 Academy) | | | | | | | | |

| 6.125%, 02/15/2053 | | | 500,000 | | | | 478,668 | |

| (Obligor: The Magellan School) | | | | | | | | |

6.375%, 06/01/2062 (1) | | | 1,000,000 | | | | 1,012,222 | |

| Brazoria County Industrial Development Corp. | | | | | | | | |

| (Obligor: Gladieux Metals Recycling) | | | | | | | | |

9.000%, 03/01/2039 (8) | | | 4,275,000 | | | | 4,477,264 | |

9.000%, Series A, 03/01/2039 (8) | | | 3,330,000 | | | | 3,487,553 | |

7.000%, Series B, 03/01/2039 (8) | | | 1,250,000 | | | | 1,148,380 | |

| Calhoun County Navigation Industrial Development Authority | | | | | | | | |

| (Obligor: Max Midstream Texas, LLC) | | | | | | | | |

3.625%, Series A, 07/01/2026 (8) | | | 1,500,000 | | | | 1,373,330 | |

| 6.500%, Series B, 07/01/2026 | | | 1,000,000 | | | | 936,238 | |

| Jefferson County Industrial Development Corp. | | | | | | | | |

| (Obligor: TRP Crude Marketing) | | | | | | | | |

| 7.750%, 04/01/2039 | | | 900,000 | | | | 790,325 | |

| Kountze Economic Development Corp. | | | | | | | | |

| (Obligor: Allegiant Industrial) | | | | | | | | |

15.000%, 11/01/2027 (1) | | | 3,550,000 | | | | 4,082,697 | |

| New Hope Cultural Education Facilities Finance Corp. | | | | | | | | |

| (Obligor: Buckingham Senior Living Obligated Group) | | | | | | | | |

2.000%, Series B, 11/15/2061 (5) | | | 2,341,998 | | | | 926,302 | |

| (Obligor: Outlook at Windhaven) | | | | | | | | |

| 6.500%, Series A, 10/01/2033 | | | 1,500,000 | | | | 1,449,478 | |

| (Obligor: Sanctuary LTC, LLC) | | | | | | | | |

| 6.500%, Series A-2, 01/01/2031 | | | 2,500,000 | | | | 1,913,033 | |

| Port Beaumont Navigation District | | | | | | | | |

| (Obligor: Allegiant Industrial Island) | | | | | | | | |

8.000%, 02/01/2039 (1),(8) | | | 7,285,000 | | | | 6,902,865 | |

| San Antonio Education Facilities Corp. | | | | | | | | |

| (Obligor: Hallmark University) | | | | | | | | |

| 5.000%, Series A, 10/01/2041 | | | 840,000 | | | | 700,079 | |

| 5.000%, Series A, 10/01/2051 | | | 1,000,000 | | | | 770,645 | |

| 5.250%, Series B, 10/01/2028 | | | 350,000 | | | | 340,545 | |

See Notes to the Financial Statements

PRINCIPAL STREET HIGH INCOME MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 91.1% (Continued) | | | | | | |

| | | | | | | |

| Texas — 18.2% (Continued) | | | | | | |

| Tarrant County Cultural Education Facilities Finance Corp. | | | | | | |

| (Obligor: MRC Senior Living Fort Worth) | | | | | | |

| 6.875%, 11/15/2055 | | $ | 2,600,000 | | | $ | 2,348,321 | |

| 6.750%, Series A, 11/15/2051 | | | 5,000,000 | | | | 4,481,855 | |

| (Obligor: CC Young Memorial Home) | | | | | | | | |

6.375%, Series B, 02/15/2041 (3) | | | 550,000 | | | | 302,500 | |

| Woodloch Health Facilities Development Corp. | | | | | | | | |

| (Obligor: Senior Care Living VII) | | | | | | | | |

6.750%, Series A1, 12/01/2051 (1),(3) | | | 6,375,000 | | | | 3,825,000 | |

| | | | | | | | 49,803,283 | |

| Utah — 0.8% | | | | | | | | |

| Utah Charter School Finance Authority | | | | �� | | | | |

| (Obligor: Rockwell Charter High School) | | | | | | | | |

| 5.375%, Series A, 07/15/2042 | | | 905,000 | | | | 765,820 | |

| 5.500%, Series A, 07/15/2047 | | | 1,460,000 | | | | 1,225,938 | |

| 6.625%, Series B, 07/15/2047 | | | 300,000 | | | | 259,679 | |

| | | | | | | | 2,251,437 | |

| Washington — 0.8% | | | | | | | | |

| Washington State Housing Finance Commission | | | | | | | | |

| (Obligor: Eliseo Obligated Group) | | | | | | | | |

| 4.000%, Series A, 01/01/2057 | | | 2,000,000 | | | | 1,331,776 | |

| (Obligor: Lutheran Retirement Home Obligated Group) | | | | | | | | |

| 5.000%, Series A, 07/01/2038 | | | 1,075,000 | | | | 864,063 | |

| | | | | | | | 2,195,839 | |

| West Virginia — 2.3% | | | | | | | | |

| West Virginia Economic Development Authority | | | | | | | | |

| (Obligor: Entsorga West Virginia) | | | | | | | | |

8.750%, 02/01/2036 (3),(8) | | | 1,000,000 | | | | 800,000 | |

| (Obligor: Empire Trimodal Terminal) | | | | | | | | |

| 7.625%, 12/01/2040 | | | 6,800,000 | | | | 5,422,974 | |

| | | | | | | | 6,222,974 | |

| Wisconsin — 13.7% | | | | | | | | |

| Wisconsin Health & Educational Facilities Authority | | | | | | | | |

| (Obligor: Chiara Communities, Inc.) | | | | | | | | |

| 7.000%, Series C, 07/01/2043 | | | 505,000 | | | | 362,906 | |

| 7.500%, Series C, 07/01/2053 | | | 2,500,000 | | | | 1,813,793 | |

See Notes to the Financial Statements

PRINCIPAL STREET HIGH INCOME MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 91.1% (Continued) | | | | | | |

| | | | | | | |

| Wisconsin — 13.7% (Continued) | | | | | | |

| Wisconsin Public Finance Authority | | | | | | |

| (Obligor: Austin FBO LLC) | | | | | | |

7.050%, Series A, 09/01/2046 (8) | | $ | 9,250,000 | | | $ | 8,975,185 | |

| (Obligor: Cedars Obligated Group) | | | | | | | | |

| 5.500%, 05/01/2039 | | | 1,210,000 | | | | 1,019,582 | |

| 5.750%, 05/01/2054 | | | 7,950,000 | | | | 6,375,572 | |

| (Obligor: Coral Academy of Science) | | | | | | | | |

5.875%, Series A, 06/01/2052 (1) | | | 600,000 | | | | 575,471 | |

| (Obligor: Discovery Charter School) | | | | | | | | |

6.625%, Series A, 06/01/2052 (1) | | | 900,000 | | | | 850,914 | |

| (Obligor: Dreamhouse ‘Ewa Beach) | | | | | | | | |

5.750%, Series A, 06/01/2025 (1) | | | 675,000 | | | | 675,463 | |

7.500%, Series A, 06/01/2025 (1) | | | 1,000,000 | | | | 970,411 | |

| (Obligor: Explore Academy) | | | | | | | | |

| 6.125%, Series A, 02/01/2048 | | | 1,550,000 | | | | 1,331,240 | |

| (Obligor: Million Air Two Obligated Group) | | | | | | | | |

7.125%, Series B, 06/01/2041 (8) | | | 2,885,000 | | | | 2,522,409 | |

| (Obligor: Noorda College of Osteopathic Medicine) | | | | | | | | |

6.500%, 06/01/2045 (1) | | | 2,745,000 | | | | 2,333,627 | |

| (Obligor: Proton International Alabama LLC) | | | | | | | | |

6.850%, Series A, 10/01/2047 (3) | | | 400,000 | | | | 240,000 | |

| (Obligor: Shining Rock Classical) | | | | | | | | |

| 6.000%, Series A, 06/15/2052 | | | 900,000 | | | | 821,036 | |

| (Obligor: Trinity Regional Hospital) | | | | | | | | |

7.375%, Series A-1, 01/01/2050 (2),(3) | | | 12,425,000 | | | | 8,753,413 | |

| | | | | | | | 37,621,022 | |

| Total Municipal Bonds | | | | | | | | |

| (Cost $309,920,676) | | | | | | | 249,868,958 | |

| | | | | | | | | |

| CORPORATE BONDS — 5.2% | | | | | | | | |

| CalPlant I, LLC | | | | | | | | |

9.500%, 08/21/2024 (1),(2),(3) | | | 3,000,000 | | | | 3,000,000 | |

| LSC Estero Prime | | | | | | | | |

12.000%, 04/30/2024 (2) | | | 1,250,000 | | | | 1,250,000 | |

| Sunland Medical Foundation | | | | | | | | |

12.000%, 10/20/2024 (2),(3) | | | 10,000,000 | | | | 10,000,000 | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $14,156,544) | | | | | | | 14,250,000 | |

See Notes to the Financial Statements

PRINCIPAL STREET HIGH INCOME MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Shares | | | Value | |

| CONVERTIBLE PREFERRED STOCK — 1.8% | | | | | | |

Next Renewable Fuels, Series A (2) | | | 7 | | | $ | 5,083,502 | |

| Total Convertible Preferred Stock | | | | | | | | |

| (Cost $5,083,650) | | | | | | | 5,083,502 | |

| | | | | | | | | |

| SHORT TERM INVESTMENT — 0.1% | | | | | | | | |

First American Government Obligations Fund, Class X, 5.25% (6) | | | 443,310 | | | | 443,310 | |

| Total Short Term Investment | | | | | | | | |

| (Cost $443,310) | | | | | | | 443,310 | |

Total Investments(7) — 98.2% | | | | | | | | |

| (Cost $329,604,180) | | | | | | | 269,645,770 | |

| Other Assets & Liabilities, Net — 1.8% | | | | | | | 5,129,432 | |

| Total Net Assets — 100.0% | | | | | | $ | 274,775,202 | |

| (1) | Security purchased within the terms of a private placement memorandum, exempt from registration under Rule 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “qualified institutional buyers.” As of August 31, 2023, the total value of these investments was $51,142,724 or 18.6% of total net assets. |

| (2) | Security is categorized in Level 3 of the fair value hierarchy. These Level 3 securities have a total fair value of $33,360,653, which represents 12.1% of total net assets. See Note 3 in Notes to the Financial Statements. |

| (3) | Security in default at August 31, 2023. |

| (4) | Zero coupon bonds make no periodic interest payments, but are issued at discounts from par value. |

| (5) | Step-up bond; the interest rate shown is the rate in effect as of August 31, 2023. |

| (6) | The rate shown is the annualized seven day effective yield as of August 31, 2023. |

| (7) | All securities in this Fund have been pledged as collateral for a secured line of credit. |

| (8) | Security subject to the Alternative Minimum Tax (“AMT”). As of August 31, 2023, the total value of securities subject to the AMT was $72,818,519 or 26.5% of net assets. |

| (9) | Adjustable rate security. The rate shown represents the rate in effect as of August 31, 2023. |

See Notes to the Financial Statements

PRINCIPAL STREET SHORT TERM MUNICIPAL FUND

Schedule of Investments

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 98.5% | | | | | | |

| | | | | | | |

| Alabama — 3.9% | | | | | | |

| Black Belt Energy Gas District | | | | | | |

5.250%, Series C-1, 02/01/2053 (6) | | $ | 500,000 | | | $ | 518,627 | |

| 5.250%, Series F, 12/01/2025 | | | 1,000,000 | | | | 1,021,236 | |

| Houston County Health Care Authority | | | | | | | | |

| 5.000%, Series A, 10/01/2030 | | | 100,000 | | | | 101,158 | |

| Russell County Public Building Authority | | | | | | | | |

| 4.500%, 01/01/2033 | | | 425,000 | | | | 425,265 | |

| | | | | | | | 2,066,286 | |

| Arizona — 5.2% | | | | | | | | |

| Maricopa County Industrial Development Authority | | | | | | | | |

4.000%, Series B, 07/01/2029 (1) | | | 1,000,000 | | | | 950,937 | |

| Maricopa County Union High School District No. 210 | | | | | | | | |

| 4.000%, Series A, 07/01/2026 | | | 150,000 | | | | 150,059 | |

| Pima County | | | | | | | | |

| 4.000%, 07/01/2024 | | | 205,000 | | | | 205,102 | |

| Pima County Industrial Development Authority | | | | | | | | |

| (Obligor: La Posada Park Centre) | | | | | | | | |

5.125%, Series B-3, 11/15/2029 (1) | | | 500,000 | | | | 492,027 | |

5.625%, Series B-3, 11/15/2030 (1) | | | 500,000 | | | | 494,576 | |

| (Obligor: PLC Charter Schools) | | | | | | | | |

| 5.250%, 12/01/2026 | | | 475,000 | | | | 470,232 | |

| | | | | | | | 2,762,933 | |

| California — 7.0% | | | | | | | | |

| California Community Choice Financing Authority | | | | | | | | |

| 5.000%, Series A-1, 12/01/2053 | | | 900,000 | | | | 927,289 | |

| California Enterprise Development Authority | | | | | | | | |

| (Obligor: Rocklin Academy) | | | | | | | | |

4.000%, Series A, 06/01/2036 (1) | | | 500,000 | | | | 445,442 | |

| California Health Facilities Financing Authority | | | | | | | | |

| (Obligor: City of Hope) | | | | | | | | |

| 5.000%, Series A, 11/15/2023 | | | 175,000 | | | | 175,166 | |

| California Municipal Finance Authority | | | | | | | | |

4.000%, 07/15/2029 (5) | | | 100,000 | | | | 98,762 | |

| California School Finance Authority | | | | | | | | |

| (Obligor: Hawking STEAM Charter Schools) | | | | | | | | |

5.000%, 07/01/2025 (1) | | | 400,000 | | | | 403,158 | |

| California Statewide Communities Development Authority | | | | | | | | |

| 4.250%, Series C, 09/02/2032 | | | 500,000 | | | | 488,965 | |

See Notes to the Financial Statements

PRINCIPAL STREET SHORT TERM MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 98.5% (Continued) | | | | | | |

| | | | | | | |

| California — 7.0% (Continued) | | | | | | |

| Merced Wastewater System Revenue | | | | | | |

| 5.000%, 10/01/2023 | | $ | 125,000 | | | $ | 125,153 | |

| North Natomas Community Facilities District No. 4 | | | | | | | | |

| 5.250%, Series E, 09/01/2024 | | | 150,000 | | | | 150,755 | |

| Palomar Community College District | | | | | | | | |

0.000%, Series B, 08/01/2029 (2) | | | 100,000 | | | | 80,608 | |

| San Ysidro School District | | | | | | | | |

| 4.000%, 08/01/2029 | | | 130,000 | | | | 130,076 | |

| Santa Barbara County | | | | | | | | |

| 4.500%, Series A-2, 12/01/2023 | | | 400,000 | | | | 400,338 | |

| Southern California Logistics Airport Authority | | | | | | | | |

| 4.500%, 12/01/2031 | | | 300,000 | | | | 302,194 | |

| | | | | | | | 3,727,906 | |

| Colorado — 1.3% | | | | | | | | |

| Board of Water Commissioners City & County of Denver | | | | | | | | |

| 4.000%, Series A, 12/15/2025 | | | 175,000 | | | | 175,066 | |

| Denver City & County Airport Revenue | | | | | | | | |

5.000%, Series A, 12/01/2032 (5) | | | 300,000 | | | | 316,742 | |

6.125%, Series C, 11/15/2025 (5) | | | 190,000 | | | | 198,207 | |

| | | | | | | | 690,015 | |

| Connecticut — 0.3% | | | | | | | | |

| West Haven Public Housing Authority | | | | | | | | |

| (Obligor: Meadow Landing I) | | | | | | | | |

5.300%, Series A, 01/01/2024 (5) | | | 140,000 | | | | 139,559 | |

| | | | | | | | | |

| Florida — 2.0% | | | | | | | | |

| Capital Trust Agency, Inc. | | | | | | | | |

| (Obligor: Voans SW Florida Healthcare) | | | | | | | | |

10.000%, 06/30/2024 (1),(3) | | | 750,000 | | | | 547,500 | |

| Miami-Dade County Industrial Development Authority | | | | | | | | |

| (Obligor: Pinecrest Academy) | | | | | | | | |

| 5.000%, 09/15/2024 | | | 450,000 | | | | 450,877 | |

| (Obligor: Academir Charter Schools) | | | | | | | | |

| 6.750%, 07/01/2029 | | | 100,000 | | | | 96,014 | |

| | | | | | | | 1,094,391 | |

| Georgia — 1.1% | | | | | | | | |

| Augusta Water & Sewer Revenue | | | | | | | | |

| 4.000%, 10/01/2031 | | | 580,000 | | | | 580,097 | |

See Notes to the Financial Statements

PRINCIPAL STREET SHORT TERM MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 98.5% (Continued) | | | | | | |

| | | | | | | |

| Idaho — 1.6% | | | | | | |

| Kootenai County School District No. 271 Coeur d’Alene | | | | | | |

| 4.000%, Series B, 09/15/2024 | | $ | 850,000 | | | $ | 850,415 | |

| | | | | | | | | |

| Illinois — 10.1% | | | | | | | | |

| Blue Island | | | | | | | | |

| 4.750%, 12/01/2024 | | | 100,000 | | | | 100,048 | |

| Chicago Board of Education | | | | | | | | |

| 5.250%, 12/01/2023 | | | 135,000 | | | | 135,348 | |

| Chicago O’Hare International Airport | | | | | | | | |

| 5.250%, 01/01/2033 | | | 650,000 | | | | 650,646 | |

| 5.000%, Series A, 01/01/2032 | | | 500,000 | | | | 500,326 | |

5.000%, Series B, 01/01/2031 (5) | | | 240,000 | | | | 240,068 | |

4.000%, Series B, 01/01/2027 (5) | | | 250,000 | | | | 249,999 | |

| Illinois | | | | | | | | |

| 6.000%, 11/01/2026 | | | 350,000 | | | | 364,325 | |

| Illinois Finance Authority | | | | | | | | |

| (Obligor: Plymouth Place) | | | | | | | | |

| 5.250%, Series B-2, 11/15/2027 | | | 500,000 | | | | 497,547 | |

| Illinois Sales Tax Revenue | | | | | | | | |

| 5.000%, 06/15/2025 | | | 325,000 | | | | 325,271 | |

| Metropolitan Pier & Exposition Authority | | | | | | | | |

| 7.000%, 07/01/2026 | | | 1,665,000 | | | | 1,758,695 | |

| Sales Tax Securitization Corp. | | | | | | | | |

| 5.000%, Series A, 01/01/2030 | | | 200,000 | | | | 217,606 | |

| Villa Park | | | | | | | | |

| 4.000%, 12/15/2028 | | | 350,000 | | | | 350,122 | |

| | | | | | | | 5,390,001 | |

| Indiana — 5.9% | | | | | | | | |

| GCS School Building Corp. One | | | | | | | | |

| 4.000%, 07/15/2025 | | | 800,000 | | | | 800,178 | |

| Indiana Finance Authority | | | | | | | | |

| (Obligor: Earlham College) | | | | | | | | |

| 5.000%, 10/01/2032 | | | 765,000 | | | | 765,210 | |

| (Obligor: Fulcrum Centerpoint, LLC) | | | | | | | | |

4.500%, 12/15/2046 (5) | | | 1,000,000 | | | | 998,582 | |

| University of Southern Indiana Foundation | | | | | | | | |

| 4.500%, 10/01/2024 | | | 575,000 | | | | 575,807 | |

| | | | | | | | 3,139,777 | |

See Notes to the Financial Statements

PRINCIPAL STREET SHORT TERM MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 98.5% (Continued) | | | | | | |

| | | | | | | |

| Iowa — 1.2% | | | | | | |

| PEFA, Inc. | | | | | | |

| 5.000%, 09/01/2049 | | $ | 630,000 | | | $ | 636,139 | |

| | | | | | | | | |

| Kansas — 0.7% | | | | | | | | |

| Johnson County Park & Recreation District | | | | | | | | |

| 4.000%, Series A, 09/01/2024 | | | 110,000 | | | | 110,016 | |

| Topeka | | | | | | | | |

| (Obligor: Congregational Home) | | | | | | | | |

| 5.125%, Series B, 12/01/2026 | | | 250,000 | | | | 246,902 | |

| | | | | | | | 356,918 | |

| Massachusetts — 0.8% | | | | | | | | |

| Massachusetts Development Finance Agency | | | | | | | | |

| (Obligor: Provident Commonwealth) | | | | | | | | |

| 5.000%, 10/01/2029 | | | 150,000 | | | | 153,203 | |

| Massachusetts Educational Financing Authority | | | | | | | | |

4.375%, 07/01/2024 (5) | | | 175,000 | | | | 175,021 | |

| North Reading | | | | | | | | |

| 5.000%, 05/15/2030 | | | 120,000 | | | | 120,161 | |

| | | | | | | | 448,385 | |

| Michigan — 1.3% | | | | | | | | |

| Detroit School District | | | | | | | | |

| 5.250%, Series C, 05/01/2025 | | | 490,000 | | | | 500,266 | |

| Healthsource Saginaw, Inc. | | | | | | | | |

| 4.000%, 05/01/2027 | | | 80,000 | | | | 80,041 | |

| Michigan Finance Authority | | | | | | | | |

| (Obligor: Trinity Health Corp.) | | | | | | | | |

| 5.000%, Series MI-2, 12/01/2044 | | | 100,000 | | | | 102,091 | |

| | | | | | | | 682,398 | |

| Mississippi — 1.0% | | | | | | | | |

| Natchez | | | | | | | | |

| 4.500%, 09/01/2025 | | | 545,000 | | | | 549,958 | |

| | | | | | | | | |

| Missouri — 2.2% | | | | | | | | |

| Jackson County | | | | | | | | |

| 4.250%, 12/01/2023 | | | 595,000 | | | | 595,336 | |

| Missouri Development Finance Board | | | | | | | | |

| 5.000%, Series A, 06/01/2024 | | | 400,000 | | | | 400,520 | |

| 5.000%, Series A, 06/01/2027 | | | 200,000 | | | | 200,153 | |

| | | | | | | | 1,196,009 | |

See Notes to the Financial Statements

PRINCIPAL STREET SHORT TERM MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 98.5% (Continued) | | | | | | |

| | | | | | | |

| New Jersey — 2.9% | | | | | | |

| New Jersey Economic Development Authority | | | | | | |

| 5.000%, Series UU, 06/15/2034 | | $ | 755,000 | | | $ | 762,423 | |

| New Jersey Housing & Mortgage Finance Agency | | | | | | | | |

| 4.000%, Series I, 04/01/2033 | | | 785,000 | | | | 786,037 | |

| | | | | | | | 1,548,460 | |

| New Mexico — 0.7% | | | | | | | | |

| Dona Ana County | | | | | | | | |

| 4.000%, 05/01/2028 | | | 395,000 | | | | 395,100 | |

| | | | | | | | | |

| New York — 7.4% | | | | | | | | |

| Build NYC Resource Corp. | | | | | | | | |

| (Obligor: Voices of Community Activists) | | | | | | | | |

7.625%, Series A-2, 02/01/2026 (1) | | | 1,000,000 | | | | 996,547 | |

| Hudson | | | | | | | | |

| 4.000%, 04/15/2028 | | | 95,000 | | | | 95,055 | |

| Metropolitan Transportation Authority | | | | | | | | |

| 4.000%, Series B, 11/15/2028 | | | 125,000 | | | | 125,014 | |

| 5.000%, Series C-1, 11/15/2030 | | | 1,000,000 | | | | 1,031,819 | |

| New York State Dormitory Authority | | | | | | | | |

| (Obligor: St John’s University) | | | | | | | | |

| 4.000%, Series A, 07/01/2033 | | | 100,000 | | | | 103,674 | |

| Port Authority of New York & New Jersey | | | | | | | | |

5.000%, Series 223, 07/15/2027 (5) | | | 1,320,000 | | | | 1,381,763 | |

| Schenectady Metroplex Development Authority | | | | | | | | |

| 5.000%, 09/15/2023 | | | 200,000 | | | | 200,086 | |

| | | | | | | | 3,933,958 | |

| North Carolina — 2.1% | | | | | | | | |

| North Carolina Capital Facilities Finance Agency | | | | | | | | |

| (Obligor: Arc of North Carolina) | | | | | | | | |

| 5.000%, Series A, 10/01/2027 | | | 100,000 | | | | 100,062 | |

| North Carolina Medical Care Commission | | | | | | | | |

| (Obligor: Lutheran Aging Services) | | | | | | | | |

| 5.000%, Series C, 03/01/2024 | | | 395,000 | | | | 394,656 | |

| (Obligor: Wake Forest Baptist) | | | | | | | | |

| 5.000%, Series B, 12/01/2024 | | | 650,000 | | | | 650,570 | |

| | | | | | | | 1,145,288 | |

See Notes to the Financial Statements

PRINCIPAL STREET SHORT TERM MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 98.5% (Continued) | | | | | | |

| | | | | | | |

| North Dakota — 0.7% | | | | | | |

| Williston | | | | | | |

| 4.000%, Series B, 05/01/2024 | | $ | 365,000 | | | $ | 365,049 | |

| | | | | | | | | |

| Ohio — 0.3% | | | | | | | | |

| Riversouth Authority | | | | | | | | |

| 5.000%, Series A, 06/01/2024 | | | 185,000 | | | | 185,215 | |

| | | | | | | | | |

| Oklahoma — 0.9% | | | | | | | | |

| Norman Regional Hospital Authority | | | | | | | | |

| (Obligor: Norman Regional Hospital Authority) | | | | | | | | |

| 5.000%, 09/01/2025 | | | 235,000 | | | | 234,782 | |

| Tulsa County Industrial Authority | | | | | | | | |

| (Obligor: Montereau Obligated Group) | | | | | | | | |

| 5.000%, 11/15/2023 | | | 230,000 | | | | 230,263 | |

| | | | | | | | 465,045 | |

| Oregon — 0.7% | | | | | | | | |

| Portland Water Revenue | | | | | | | | |

| 5.000%, 10/01/2024 | | | 350,000 | | | | 350,258 | |

| | | | | | | | | |

| Pennsylvania — 5.0% | | | | | | | | |

| Butler County Hospital Authority | | | | | | | | |

| (Obligor: Butler Health System) | | | | | | | | |

| 5.000%, 07/01/2028 | | | 300,000 | | | | 294,279 | |

| Lycoming County Authority | | | | | | | | |

| (Obligor: Lycoming College) | | | | | | | | |

| 4.500%, Series S2, 11/01/2035 | | | 500,000 | | | | 495,792 | |

| Montgomery County Higher Education and Health Authority | | | | | | | | |

| (Obligor: Gwynedd Mercy University) | | | | | | | | |

| 5.000%, Series UU1, 05/01/2029 | | | 240,000 | | | | 244,888 | |

| Montgomery County Industrial Development Authority | | | | | | | | |

| (Obligor: Foulkeways at Gwynedd) | | | | | | | | |

| 5.000%, 12/01/2025 | | | 230,000 | | | | 233,387 | |

| Northeastern Pennsylvania Hospital and Education Authority | | | | | | | | |

| (Obligor: Kings College) | | | | | | | | |

| 5.000%, 05/01/2025 | | | 600,000 | | | | 600,026 | |

| Philadelphia Authority for Industrial Development | | | | | | | | |

| (Obligor: Russell Byers Charter School) | | | | | | | | |

| 5.000%, Series A, 05/01/2030 | | | 770,000 | | | | 774,469 | |

| | | | | | | | 2,642,841 | |

See Notes to the Financial Statements

PRINCIPAL STREET SHORT TERM MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 98.5% (Continued) | | | | | | |

| | | | | | | |

| Puerto Rico — 4.8% | | | | | | |

| Children’s Trust Fund | | | | | | |

| 5.500%, 05/15/2039 | | $ | 620,000 | | | $ | 620,072 | |

| Commonwealth of Puerto Rico | | | | | | | | |

0.000%, Series A, 07/01/2024 (2) | | | 487,180 | | | | 469,488 | |

| Puerto Rico Electric Power Authority | | | | | | | | |

5.000%, Series PP, 07/01/2024 (3) | | | 140,000 | | | | 140,022 | |

5.000%, Series PP, 07/01/2025 (3) | | | 385,000 | | | | 385,061 | |

5.000%, Series UU, 07/01/2024 (3) | | | 745,000 | | | | 749,436 | |

5.250%, Series VV, 07/01/2026 (3) | | | 200,000 | | | | 197,289 | |

| | | | | | | | 2,561,368 | |

| Rhode Island — 0.4% | | | | | | | | |

| Rhode Island Health and Educational Building Corp. | | | | | | | | |

| (Obligor: Providence College) | | | | | | | | |

| 5.000%, Series B, 11/01/2023 | | | 200,000 | | | | 200,212 | |

| | | | | | | | | |

| South Carolina — 1.2% | | | | | | | | |

| South Carolina Jobs-Economic Development Authority | | | | | | | | |

| (Obligor: Kiawah Life Plan Village, Inc.) | | | | | | | | |

| 5.250%, Series B-2, 11/15/2028 | | | 500,000 | | | | 499,061 | |

| (Obligor: Upstate Senior Living) | | | | | | | | |

| 4.000%, 11/15/2027 | | | 175,000 | | | | 168,890 | |

| | | | | | | | 667,951 | |

| Tennessee — 3.2% | | | | | | | | |

| Greeneville | | | | | | | | |

| 4.000%, 06/01/2029 | | | 165,000 | | | | 173,321 | |

| Tennessee Energy Acquisition Corp. | | | | | | | | |

| 5.250%, Series A, 09/01/2024 | | | 1,000,000 | | | | 1,008,805 | |

| 5.000%, Series C, 02/01/2027 | | | 500,000 | | | | 500,797 | |

| | | | | | | | 1,682,923 | |

| Texas — 11.5% | | | | | | | | |

| Arlington Higher Education Finance Corp. | | | | | | | | |

| (Obligor: Wayside Schools) | | | | | | | | |

| 5.000%, Series A, 08/15/2027 | | | 200,000 | | | | 200,065 | |

| Bacliff Municipal Utility District | | | | | | | | |

| 4.500%, 09/01/2029 | | | 340,000 | | | | 340,183 | |

| Converse | | | | | | | | |

| 4.000%, 02/01/2032 | | | 550,000 | | | | 544,929 | |

| Dallas Housing Finance Corp. | | | | | | | | |

| (Obligor: Ash Creek Housing, LLC) | | | | | | | | |

5.000%, 07/01/2026 (6) | | | 500,000 | | | | 510,227 | |

See Notes to the Financial Statements

PRINCIPAL STREET SHORT TERM MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 98.5% (Continued) | | | | | | |

| | | | | | | |

| Texas — 11.5% (Continued) | | | | | | |

| Denton County Fresh Water Supply District No. 7 | | | | | | |

| 4.000%, 02/15/2028 | | $ | 135,000 | | | $ | 135,015 | |

| Georgetown | | | | | | | | |

| 4.000%, 08/15/2025 | | | 175,000 | | | | 175,056 | |

| Gray County | | | | | | | | |

| (Obligor: Clarendon College) | | | | | | | | |

| 5.000%, 09/01/2023 | | | 235,000 | | | | 235,000 | |

| Harris County Cultural Education Facilities Finance Corp. | | | | | | | | |

| (Obligor: Brazos Presbyterian Obligated Group) | | | | | | | | |

| 5.000%, Series A, 01/01/2033 | | | 285,000 | | | | 260,090 | |

| Harris County Municipal Utility District No. 167 | | | | | | | | |

| 4.000%, 09/01/2031 | | | 100,000 | | | | 99,999 | |

| Harris County Municipal Utility District No. 278 | | | | | | | | |

| 4.000%, 09/01/2037 | | | 200,000 | | | | 193,805 | |

| Katy Independent School District | | | | | | | | |

| 4.000%, 02/15/2025 | | | 160,000 | | | | 160,085 | |

| Kountze Economic Development Corp. | | | | | | | | |

| (Obligor: Allegiant Industrial, LLC) | | | | | | | | |

15.000%, 11/01/2027 (1) | | | 100,000 | | | | 115,006 | |

| Liberty Community Development Corp. | | | | | | | | |

| 4.000%, 03/01/2028 | | | 200,000 | | | | 200,008 | |

| Mansfield Independent School District | | | | | | | | |

| 4.000%, 02/15/2024 | | | 300,000 | | | | 300,128 | |

| Port Beaumont Navigation District | | | | | | | | |

| (Obligor: Allegiant Industrial Island) | | | | | | | | |

8.000%, 02/01/2039 (1), (5) | | | 280,000 | | | | 265,313 | |

| San Antonio | | | | | | | | |

| 5.000%, 02/01/2027 | | | 140,000 | | | | 140,160 | |

| San Antonio Education Facilities Corp. | | | | | | | | |

| (Obligor: Hallmark University, Inc.) | | | | | | | | |

| 5.250%, Series B, 10/01/2028 | | | 100,000 | | | | 97,299 | |

| Tarrant County Cultural Education Facilities Finance Corp. | | | | | | | | |

| (Obligor: Cumberland Rest, Inc.) | | | | | | | | |

| 5.000%, 10/01/2034 | | | 750,000 | | | | 753,115 | |

| Texas Municipal Gas Acquisition and Supply Corp. I | | | | | | | | |

| 6.250%, 12/15/2026 | | | 1,185,000 | | | | 1,227,158 | |

| Wise County | | | | | | | | |

| 5.000%, 08/15/2026 | | | 200,000 | | | | 206,960 | |

| | | | | | | | 6,159,601 | |

See Notes to the Financial Statements

PRINCIPAL STREET SHORT TERM MUNICIPAL FUND

Schedule of Investments – Continued

August 31, 2023

Description | | Par | | | Value | |

| MUNICIPAL BONDS — 98.5% (Continued) | | | | | | |

| | | | | | | |

| Washington — 3.4% | | | | | | |

| Tobacco Settlement Authority | | | | | | |

5.000%, 06/01/2024 (3) | | $ | 480,000 | | | $ | 480,248 | |

| Washington Health Care Facilities Authority | | | | | | | | |

| (Obligor: Providence St. Joseph Health Care) | | | | | | | | |

| 5.000%, Series A, 10/01/2026 | | | 290,000 | | | | 290,074 | |

| Washington State Housing Finance Commission | | | | | | | | |

| (Obligor: Heron’s Key Obligation Group) | | | | | | | | |

6.000%, Series A, 07/01/2025 (1) | | | 555,000 | | | | 568,571 | |

| 4.750%, Series B-1, 07/01/2027 | | | 500,000 | | | | 499,622 | |

| | | | | | | | 1,838,515 | |

| Washington D.C. — 1.3% | | | | | | | | |