V-Shares US Leadership Diversity ETF

(Ticker: VDNI)

V-Shares MSCI World ESG Materiality

and Carbon Transition ETF

(Ticker: VMAT)

Annual Report

| www.v-shares.com | October 31, 2023 |

(This Page Intentionally Left Blank.)

V-SHARES US LEADERSHIP DIVERSITY ETF

Letter to Shareholders

Dear Fellow Shareholders,

Thank you for this opportunity to report on the strategy, performance and outlook of the V-Shares US Leadership Diversity ETF (the “Fund” or ticker “VDNI”).

VDNI Strategy

The V-Shares US Leadership Diversity ETF (VDNI) invests in domestic companies (US) exhibiting broad ethnic and gender representation for Directors and Named Executive Officers (NEO) as determined by the index provider. The Fund seeks to track the investment results of the ISS ESG U.S. Diversity Index Total Return (Ticker ISSDIVUT).

At V-Square, we believe that Diversification and Diversity have more in common than their Latin root; they both carry value. Human capital is a capital, a key driving force of any business, that too enjoys the benefits of diversification. Diversity at the senior leadership level is a foreteller of a healthy company culture, which in turn strengthens the levers and drivers of sustainable corporate performance.

As such, VDNI’s investment approach focus on constituents exhibiting both broad ethnic and gender representation for board directors and named executive officers (NEOs). Minimum requirements of the investment universe for VDNI include a combined minimum of three distinct ethnically diverse individuals and three distinct women among directors or NEOs, as well as a 35 percent combined minimum of women or ethnically diverse directors. Small-, middle-, and large-capitalization U.S. companies are selected from the ISS ESG Director & Executive Diversity dataset.

VDNI Performance

For the year ended October 31, 2023, the V-Shares US Leadership Diversity ETF (ticker VDNI) returned 11.76% while the ISS ESG U.S. Diversity Index Total Return (Ticker ISSDIVUT) returned 12.02%.

The tracking error was maintained tight over the period and the portfolio’s performance was in line with equity markets. The portfolio’s cash was maintained at a minimal level.

V-Square thanks you for your trust and confidence in our stewardship.

Sincerely,

|  |

| Mamadou-Abou Sarr | Habib Moudachirou |

| President | Chief Investment Officer |

V-SHARES US LEADERSHIP DIVERSITY ETF

Must be preceded or accompanied by a prospectus.

The ISS ESG U.S. Diversity Index is a free float-adjusted market capitalization weighted equity index designed to reflect the equity performance of U.S. companies that exhibit broad ethnic and gender representation for Directors and Named Executive Officers, as determined by the Index Provider. The Index is calculated, administered, and published by Solactive AG. One cannot invest directly in an index.

Tracking Error refers to the divergence, calculated as standard deviation percentage difference, between the price behavior of a position or portfolio and the price behavior of a benchmark.

A Basis Point is a unit of measure used to describe the percentage change in the value of financial instruments or the rate change in an index or other benchmark. One basis point is equivalent to 0.01% (1/100th of a percent) or 0.0001 in decimal form.

Investing involves risk. Principal loss is possible.

As with all ETFs, shares may be bought and sold in the secondary market at market prices. Although it is expected that the market price of shares will approximate the Fund’s NAV, there may be times when the market price of shares is more than the NAV intra-day (premium) or less than the NAV intra-day (discount) due to supply and demand of shares or during periods of market volatility.

A strategy or emphasis on environmental, social and governance factors ("ESG") may limit the investment opportunities available to a portfolio. Therefore, the portfolio may underperform or perform differently than other portfolios that do not have an ESG investment focus.

Passive Investment Risk. The Fund is not actively managed and therefore the Fund generally will not sell a security due to current or projected underperformance of a security, industry or sector, unless that security is removed from the Underlying Index, or the selling of the security is otherwise required upon a rebalancing of the Underlying Index.

Methodology Risk. The Index Provider relies on various sources of information to assess the criteria of issuers included in the Underlying Index, including information that may be based on assumptions and estimates. Neither the Fund nor the Index Provider can offer assurances that Underlying Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or that the included issuers will provide the Fund with the market exposure it seeks.

Distributed by Quasar Distributors, LLC.

V-SHARES MSCI WORLD ESG MATERIALITY AND CARBON TRANSITION ETF

Letter to Shareholders

Dear Fellow Shareholders,

Thank you for this opportunity to report on the strategy, performance and outlook of the V-Shares MSCI World ESG Materiality and Carbon Transition ETF (the “Fund” or ticker “VMAT”).

VMAT Strategy

The V-Shares MSCI World ESG Materiality and Carbon Transition ETF (VMAT) invests in companies in developed markets countries, including the United States and Canada, that are assessed to be sector leaders based on a set of environmental, social, and governance (“ESG”) key issues that are aligned with the “Materiality Map” of the Sustainability Accounting Standard Board (“SASB”) and in the global transition to low carbon emissions.

V-Square believe that investors increasingly recognize that material environmental, social and governance (ESG) matters may have a direct financial impact on companies’ balance sheets and investment portfolios as vectors of risks and opportunities. Out of the plethora of ESG data, VMAT focuses on financially material ESG issues to seek to drive better performance.

The Fund tracks an index which is designed to represent the performance of companies which are assessed to be sector leaders based on a set of relevant key issues scores that are aligned with SASB’s Materiality Map. The index excludes companies involved in Controversial Weapons, Tobacco-related businesses, Thermal Coal mining, Thermal Coal power generation and unconventional Oil and Gas. Also, it excludes companies that fail to comply with the United Nations Global Compact Principles and companies with Low Carbon Transition (LCT) category of Asset Stranding.

VMAT Performance

For the year ended October 31, 2023, the V-Shares MSCI World ESG Materiality and Carbon Transition ETF (ticker VMAT) returned 17.38% while the MSCI World ESG Materiality and Carbon Transition Select Index (Ticker MXESGMTN) returned 17.47%.

The tracking error was maintained tight over the period and the portfolio’s performance was in line with equity markets. The portfolio does not make any sector bet and looks to be sector neutral vis-à-vis its benchmark. The portfolio’s cash was maintained at a minimal level.

V-Square thanks you for your trust and confidence in our stewardship.

Sincerely,

|  |

| Mamadou-Abou Sarr | Habib Moudachirou |

| President | Chief Investment Officer |

V-SHARES MSCI WORLD ESG MATERIALITY AND CARBON TRANSITION ETF

Must be preceded or accompanied by a prospectus.

The MSCI World ESG Materiality and Carbon Transition Select Index is designed to invest in developed market countries, including the United States and Canada, that are assessed to be sector leaders based on a set of Environmental, Social and Governance (ESG) key issues that are aligned with the SASB’s Materiality framework and seeks to minimize carbon transition risk and capture opportunities through companies’ operations and business model. One cannot invest directly in an index.

Tracking Error refers to the divergence, calculated as standard deviation percentage difference, between the price behavior of a position or portfolio and the price behavior of a benchmark.

A Basis Point is a unit of measure used to describe the percentage change in the value of financial instruments or the rate change in an index or other benchmark. One basis point is equivalent to 0.01% (1/100th of a percent) or 0.0001 in decimal form.

Investing involves risk. Principal loss is possible.

As with all ETFs, shares may be bought and sold in the secondary market at market prices. Although it is expected that the market price of shares will approximate the Fund’s NAV, there may be times when the market price of shares is more than the NAV intra-day (premium) or less than the NAV intra-day (discount) due to supply and demand of shares or during periods of market volatility.

A strategy or emphasis on environmental, social and governance factors ("ESG") may limit the investment opportunities available to a portfolio. Therefore, the portfolio may underperform or perform differently than other portfolios that do not have an ESG investment focus.

The Fund is classified as “non-diversified”, which means the Fund may invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund.

Passive Investment Risk. The Fund is not actively managed and therefore the Fund generally will not sell a security due to current or projected underperformance of a security, industry or sector, unless that security is removed from the Underlying Index, or the selling of the security is otherwise required upon a rebalancing of the Underlying Index.

Methodology Risk. The Index Provider relies on various sources of information to assess the criteria of issuers included in the Underlying Index, including information that may be based on assumptions and estimates. Neither the Fund nor the Index Provider can offer assurances that Underlying Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or that the included issuers will provide the Fund with the market exposure it seeks.

Distributed by Quasar Distributors, LLC.

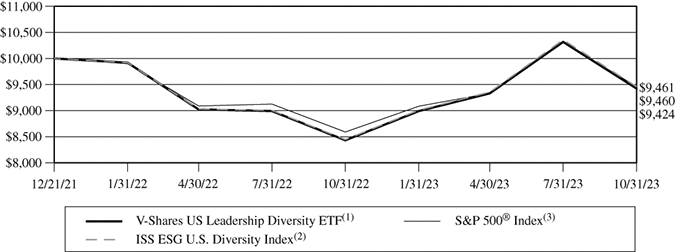

V-SHARES US LEADERSHIP DIVERSITY ETF

Value of $10,000 Investment (Unaudited)

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-312-872-7281. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return (%) – as of October 31, 2023 (Unaudited)

| | | Since |

| | 1 Year | Inception(1) |

| V-Shares US Leadership Diversity ETF – Market | 11.73% | -3.14% |

| V-Shares US Leadership Diversity ETF – NAV | 11.76% | -3.14% |

ISS ESG U.S. Diversity Index(2) | 12.02% | -2.93% |

S&P 500® Index(3) | 10.14% | -2.93% |

(1) | The US Leadership Diversity ETF commenced operations on December 21, 2021. |

(2) | The ISS ESG U.S. Diversity Index (the “Index”) is a free float-adjusted market capitalization weighted equity index designed to reflect the equity performance of U.S. companies that exhibit broad ethnic and gender representation for Directors and Named Executive Officers, as determined by the Index Provider. The Index is calculated, administered, and published by Solactive AG. One cannot invest directly in an index. |

(3) | The S&P 500® Index is a stock market index based on the market capitalizations of 500 leading companies publicly traded in the U.S. stock market, as determined by Standard & Poor’s. One cannot invest directly in an index. |

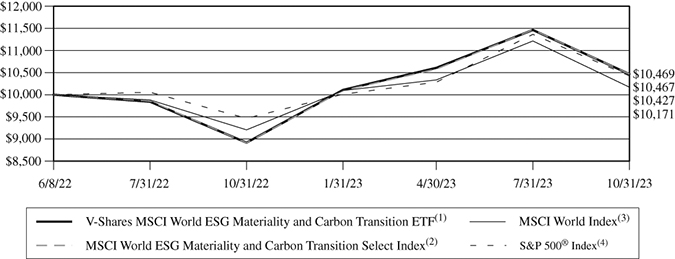

V-SHARES MSCI WORLD ESG MATERIALITY AND CARBON TRANSITION ETF

Value of $10,000 Investment (Unaudited)

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-312-872-7281. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return (%) – as of October 31, 2023 (Unaudited)

| | | Since |

| | 1 Year | Inception(1) |

| V-Shares MSCI World ESG Materiality and | | |

| Carbon Transition ETF – Market | 16.78% | 3.31% |

| V-Shares MSCI World ESG Materiality and | | |

| Carbon Transition ETF – NAV | 17.38% | 3.32% |

MSCI World ESG Materiality and Carbon Transition Select Index(2) | 17.47% | 3.34% |

MSCI World Index(3) | 10.48% | 1.22% |

S&P 500® Index(4) | 10.14% | 3.04% |

(1) | The V-Shares MSCI World ESG Materiality and Carbon Transition ETF commenced operations on June 8, 2022. |

(2) | The MSCI World ESG Materiality and Carbon Transition Select Index is designed to invest in developed market countries, including the United States and Canada, and in companies that are assessed to be sector leaders based on a set of Environmental, Social and Governance (ESG) key issues that are aligned with the SASB’s Materiality framework and seeks to minimize carbon transition risk and capture opportunities through companies’ operations and business model. One cannot invest directly in an index. |

(3) | The MSCI World Index is a global stock market index that tracks the performance of large and mid-cap companies across 23 developed countries. One cannot invest directly in an index. |

(4) | The S&P 500® Index is a stock market index based on the market capitalizations of 500 leading companies publicly traded in the U.S. stock market, as determined by Standard & Poor’s. One cannot invest directly in an index. |

V-SHARES

Expense Examples (Unaudited)

October 31, 2023

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including brokerage commission on purchases and sales of Fund shares, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2023 – October 31, 2023).

ACTUAL EXPENSES

The first line of each table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLES FOR COMPARISON PURPOSES

The second line of each table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of each table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs may have been higher.

V-Shares US Leadership Diversity ETF

| | Beginning | Ending | |

| | Account Value | Account Value | Expenses Paid(1) |

| | 05/01/2023 | 10/31/2023 | (05/01/2023 to 10/31/2023) |

Actual(2) | $1,000.00 | $1,009.90 | $1.47 |

| Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,023.74 | $1.48 |

(1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.29%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

(2) | Based on the actual return for the six-month period ended October 31, 2023 of 0.99%. |

V-Shares MSCI World ESG Materiality and Carbon Transition ETF

| | Beginning | Ending | |

| | Account Value | Account Value | Expenses Paid(3) |

| | 05/01/2023 | 10/31/2023 | (05/01/2023 to 10/31/2023) |

Actual(4) | $1,000.00 | $ 986.80 | $1.95 |

| Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,023.24 | $1.99 |

(3) | Expenses are equal to the annualized expense ratio for the period from inception through October 31, 2023 of 0.39%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the period since inception. |

(4) | Based on the actual return for the period since inception through October 31, 2023 of -1.32%. |

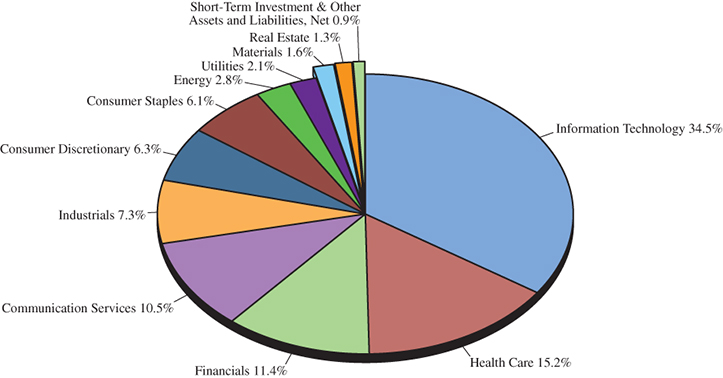

V-SHARES US LEADERSHIP DIVERSITY ETF

Sector Allocation(1) (Unaudited)

as of October 31, 2023

(% of net assets)

Top Ten Equity Holdings(1) (Unaudited)

as of October 31, 2023

(% of net assets)

| Apple, Inc. | 9.8% |

| Microsoft Corp. | 9.6% |

| Alphabet, Inc., Class A & C | 5.4% |

| NVIDIA Corp. | 3.8% |

| Meta Platforms, Inc. | 2.6% |

| UnitedHealth Group, Inc. | 1.9% |

| Eli Lilly & Co. | 1.8% |

| Johnson & Johnson | 1.5% |

| Visa, Inc. – Class A | 1.5% |

| Proctor & Gamble Co. | 1.4% |

(1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

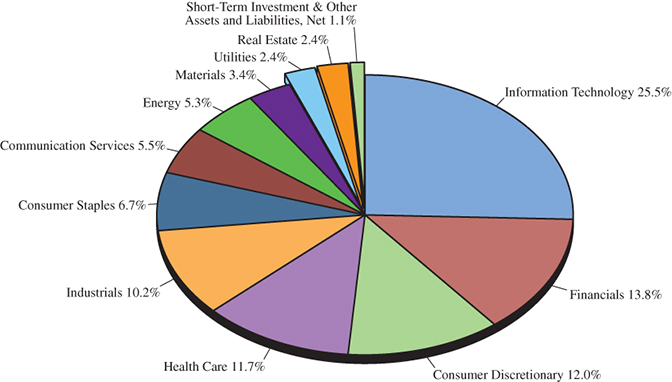

V-SHARES MSCI WORLD ESG MATERIALITY AND CARBON TRANSITION ETF

Sector Allocation(1) (Unaudited)

as of October 31, 2023

(% of net assets)

Top Ten Equity Holdings(1) (Unaudited)

as of October 31, 2023

(% of net assets)

| Microsoft Corp. | 10.8% |

| NVIDIA Corp. | 6.1% |

| Amazon.com, Inc. | 5.8% |

| UnitedHealth Group, Inc. | 2.1% |

| Proctor and Gamble Co. | 1.7% |

| Novo Nordisk AS | 1.4% |

| salesforce.com, Inc. | 1.2% |

| Coca-Cola Co. | 1.0% |

| Shell PLC | 1.0% |

| Intel Corp. | 0.9% |

(1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments

October 31, 2023

| | | Shares | | | Value | |

| COMMON STOCKS — 99.1% | | | | | | |

| | | | | | | |

| Communication Services — 10.5% | | | | | | |

| Alphabet, Inc. – Class A (a) | | | 264 | | | $ | 32,758 | |

| Alphabet, Inc. – Class C (a) | | | 231 | | | | 28,944 | |

| AT&T, Inc. | | | 315 | | | | 4,851 | |

| Bumble, Inc. (a) | | | 3 | | | | 40 | |

| Cinemark Holdings, Inc. (a) | | | 4 | | | | 66 | |

| Electronic Arts, Inc. | | | 12 | | | | 1,485 | |

| Frontier Communications Parent, Inc. (a) | | | 10 | | | | 179 | |

| Integral Ad Science Holding Corp. (a) | | | 2 | | | | 23 | |

| Liberty Latin America Ltd. (a) | | | 1 | | | | 7 | |

| Liberty Latin America Ltd. (a) | | | 6 | | | | 41 | |

| Live Nation Entertainment, Inc. (a) | | | 7 | | | | 560 | |

| Match Group, Inc. (a) | | | 12 | | | | 415 | |

| Meta Platforms, Inc. – Class A (a) | | | 98 | | | | 29,525 | |

| Omnicom Group, Inc. | | | 9 | | | | 674 | |

| Paramount Global | | | 22 | | | | 239 | |

| Pinterest, Inc. (a) | | | 26 | | | | 777 | |

| Scholastic Corp. | | | 1 | | | | 37 | |

| Take-Two Interactive Software, Inc. (a) | | | 7 | | | | 936 | |

| TEGNA, Inc. | | | 10 | | | | 145 | |

| TKO Group Holdings, Inc. | | | 2 | | | | 164 | |

| T-Mobile US, Inc. (a) | | | 25 | | | | 3,597 | |

| Verizon Communications, Inc. | | | 186 | | | | 6,534 | |

| Walt Disney (a) | | | 81 | | | | 6,609 | |

| Warner Bros Discovery, Inc. (a) | | | 98 | | | | 974 | |

| Ziff Davis, Inc. (a) | | | 2 | | | | 121 | |

| Total Communication Services | | | | | | | 119,701 | |

| | | | | | | | | |

| Consumer Discretionary — 6.3% | | | | | | | | |

| Academy Sports & Outdoors, Inc. | | | 3 | | | | 135 | |

| Adtalem Global Education, Inc. (a) | | | 2 | | | | 104 | |

| Airbnb, Inc. (a) | | | 17 | | | | 2,011 | |

| AutoZone, Inc. (a) | | | 1 | | | | 2,477 | |

| Bath & Body Works, Inc. | | | 10 | | | | 297 | |

| Best Buy, Inc. | | | 9 | | | | 601 | |

| Booking Holdings, Inc. (a) | | | 2 | | | | 5,579 | |

| BorgWarner, Inc. | | | 10 | | | | 369 | |

| Burlington Stores, Inc. (a) | | | 3 | | | | 363 | |

| CarMax, Inc. (a) | | | 6 | | | | 367 | |

| Chewy, Inc. (a) | | | 4 | | | | 77 | |

| Choice Hotels International, Inc. | | | 2 | | | | 221 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Consumer Discretionary — 6.3% (Continued) | | | | | | |

| Coursera, Inc. (a) | | | 4 | | | $ | 69 | |

| Cracker Barrel Old Country Store, Inc. | | | 1 | | | | 66 | |

| Darden Restaurants, Inc. | | | 5 | | | | 728 | |

| Deckers Outdoor Corp. (a) | | | 1 | | | | 597 | |

| Dick’s Sporting Goods, Inc. | | | 2 | | | | 214 | |

| Duolingo, Inc. (a) | | | 1 | | | | 146 | |

| eBay, Inc. | | | 24 | | | | 942 | |

| EVgo, Inc. (a) | | | 4 | | | | 8 | |

| Expedia Group, Inc. (a) | | | 6 | | | | 572 | |

| Fisker, Inc. (a) | | | 7 | | | | 32 | |

| Five Below, Inc. (a) | | | 2 | | | | 348 | |

| Foot Locker, Inc. | | | 4 | | | | 84 | |

| Gap, Inc. | | | 10 | | | | 128 | |

| General Motors | | | 61 | | | | 1,720 | |

| Goodyear Tire & Rubber (a) | | | 13 | | | | 155 | |

| H&R Block, Inc. | | | 7 | | | | 287 | |

| Hanesbrands, Inc. | | | 16 | | | | 67 | |

| Harley-Davidson, Inc. | | | 6 | | | | 161 | |

| Home Depot, Inc. | | | 45 | | | | 12,810 | |

| Kohl’s Corp. | | | 5 | | | | 113 | |

| Krispy Kreme, Inc. | | | 2 | | | | 26 | |

| LCI Industries | | | 1 | | | | 108 | |

| Lear Corp. | | | 2 | | | | 260 | |

| Leggett & Platt, Inc. | | | 6 | | | | 141 | |

| Leslie’s, Inc. (a) | | | 7 | | | | 35 | |

| Levi Strauss & Co. – Class A | | | 4 | | | | 55 | |

| LKQ Corp. | | | 11 | | | | 483 | |

| Lowe’s, Inc. | | | 27 | | | | 5,145 | |

| Macy’s, Inc. | | | 12 | | | | 146 | |

| Marriott International, Inc. – Class A | | | 12 | | | | 2,263 | |

| Mattel, Inc. (a) | | | 16 | | | | 305 | |

| McDonald’s Corp. | | | 32 | | | | 8,388 | |

| Newell Brands, Inc. | | | 18 | | | | 121 | |

| NIKE, Inc. – Class A | | | 55 | | | | 5,651 | |

| Papa John’s International, Inc. | | | 1 | | | | 65 | |

| Peloton Interactive, Inc. (a) | | | 13 | | | | 62 | |

| Petco Health & Wellness Co., Inc. (a) | | | 4 | | | | 14 | |

| Phinia, Inc. | | | 2 | | | | 52 | |

| Planet Fitness, Inc. – Class A (a) | | | 4 | | | | 221 | |

| Playa Hotels & Resorts NV (a) | | | 6 | | | | 43 | |

| QuantumScape Corp. (a) | | | 11 | | | | 57 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Consumer Discretionary — 6.3% (Continued) | | | | | | |

| Ralph Lauren Corp. | | | 1 | | | $ | 113 | |

| RH (a) | | | 1 | | | | 218 | |

| Royal Caribbean Cruises (a) | | | 9 | | | | 763 | |

| Sabre Corp. (a) | | | 13 | | | | 46 | |

| Shake Shack, Inc. (a) | | | 2 | | | | 112 | |

| Six Flags Entertainment Corp. (a) | | | 3 | | | | 60 | |

| Starbucks Corp. | | | 50 | | | | 4,612 | |

| Steven Madden Ltd. | | | 4 | | | | 131 | |

| Stride, Inc. (a) | | | 2 | | | | 110 | |

| Sweetgreen, Inc. (a) | | | 3 | | | | 31 | |

| Tapestry, Inc. | | | 11 | | | | 303 | |

| TJX, Inc. | | | 51 | | | | 4,492 | |

| Topgolf Callaway Brands Corp. (a) | | | 6 | | | | 73 | |

| Tractor Supply | | | 5 | | | | 963 | |

| Udemy, Inc. (a) | | | 3 | | | | 27 | |

| Ulta Beauty, Inc. (a) | | | 2 | | | | 763 | |

| Victoria’s Secret & Co. (a) | | | 3 | | | | 54 | |

| Visteon Corp. (a) | | | 1 | | | | 115 | |

| Warby Parker, Inc. (a) | | | 3 | | | | 39 | |

| Wayfair, Inc. (a) | | | 3 | | | | 128 | |

| Whirlpool Corp. | | | 2 | | | | 209 | |

| Wingstop, Inc. | | | 2 | | | | 366 | |

| Wolverine World Wide, Inc. | | | 3 | | | | 24 | |

| Yum China Holdings, Inc. | | | 18 | | | | 946 | |

| Yum! Brands, Inc. | | | 13 | | | | 1,571 | |

| Total Consumer Discretionary | | | | | | | 71,758 | |

| | | | | | | | | |

| Consumer Staples — 6.1% | | | | | | | | |

| Altria Group, Inc. | | | 80 | | | | 3,214 | |

| Archer-Daniels-Midland Co. | | | 25 | | | | 1,789 | |

| Beyond Meat, Inc. (a) | | | 2 | | | | 12 | |

| Bunge Ltd. | | | 6 | | | | 636 | |

| Campbell Soup Co. | | | 9 | | | | 364 | |

| Casey’s General Stores, Inc. | | | 2 | | | | 544 | |

| Clorox | | | 5 | | | | 589 | |

| Coca-Cola | | | 172 | | | | 9,716 | |

| Conagra Brands, Inc. | | | 22 | | | | 602 | |

| Constellation Brands, Inc. | | | 7 | | | | 1,639 | |

| Coty, Inc. (a) | | | 16 | | | | 150 | |

| Dollar General Corp. | | | 9 | | | | 1,071 | |

| elf Beauty, Inc. (a) | | | 2 | | | | 185 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Consumer Staples — 6.1% (Continued) | | | | | | |

| Energizer Holdings, Inc. | | | 3 | | | $ | 95 | |

| Estee Lauder Companies, Inc. | | | 9 | | | | 1,160 | |

| Fresh Del Monte Produce, Inc. | | | 2 | | | | 50 | |

| General Mills, Inc. | | | 26 | | | | 1,696 | |

| Herbalife Nutrition Ltd. (a) | | | 4 | | | | 57 | |

| Hormel Foods Corp. | | | 13 | | | | 423 | |

| Kellanova | | | 11 | | | | 555 | |

| Kimberly-Clark Corp. | | | 15 | | | | 1,795 | |

| Kraft Heinz | | | 34 | | | | 1,070 | |

| Kroger | | | 31 | | | | 1,406 | |

| McCormick, Inc. | | | 11 | | | | 703 | |

| Molson Coors Beverage | | | 8 | | | | 462 | |

| Mondelez International, Inc. | | | 60 | | | | 3,973 | |

| Nu Skin Enterprises, Inc. – Class A | | | 2 | | | | 38 | |

| Olaplex Holdings, Inc. (a) | | | 5 | | | | 7 | |

| PepsiCo, Inc. | | | 61 | | | | 9,960 | |

| Philip Morris International, Inc. | | | 68 | | | | 6,063 | |

| PriceSmart, Inc. | | | 2 | | | | 125 | |

| Procter & Gamble | | | 105 | | | | 15,753 | |

| Spectrum Brands Holdings, Inc. | | | 1 | | | | 75 | |

| Target Corp. | | | 21 | | | | 2,327 | |

| TreeHouse Foods, Inc. (a) | | | 2 | | | | 83 | |

| Tyson Foods, Inc. – Class A | | | 13 | | | | 603 | |

| United Natural Foods, Inc. (a) | | | 2 | | | | 29 | |

| Walgreens Boots Alliance, Inc. | | | 31 | | | | 653 | |

| WK Kellogg Co. (a) | | | 2 | | | | 20 | |

| Total Consumer Staples | | | | | | | 69,692 | |

| | | | | | | | | |

| Energy — 2.8% | | | | | | | | |

| California Resources Corp. | | | 3 | | | | 158 | |

| ChampionX Corp. | | | 9 | | | | 277 | |

| Chevron Corp. | | | 78 | | | | 11,367 | |

| ConocoPhillips | | | 55 | | | | 6,534 | |

| Diamondback Energy, Inc. | | | 7 | | | | 1,122 | |

| Halliburton Co. | | | 39 | | | | 1,534 | |

| HF Sinclair Corp. | | | 7 | | | | 388 | |

| Marathon Petroleum Corp. | | | 20 | | | | 3,025 | |

| Occidental Petroleum Corp. | | | 31 | | | | 1,916 | |

| PBF Energy, Inc. – Class A | | | 5 | | | | 238 | |

| Pioneer Natural Resources Co. | | | 10 | | | | 2,390 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Energy — 2.8% (Continued) | | | | | | |

| Targa Resources Corp. | | | 9 | | | $ | 752 | |

| Valero Energy Corp. | | | 17 | | | | 2,159 | |

| Total Energy | | | | | | | 31,860 | |

| | | | | | | | | |

| Financials — 11.4% | | | | | | | | |

| Affirm Holdings, Inc. (a) | | | 9 | | | | 158 | |

| Aflac, Inc. | | | 25 | | | | 1,953 | |

| Allstate Corp. | | | 12 | | | | 1,538 | |

| American Express Co. | | | 26 | | | | 3,797 | |

| Annaly Capital Management, Inc. | | | 21 | | | | 328 | |

| Aon | | | 9 | | | | 2,786 | |

| Apollo Global Management, Inc. | | | 18 | | | | 1,394 | |

| Associated Banc-Corp | | | 6 | | | | 97 | |

| Assurant, Inc. | | | 2 | | | | 298 | |

| Assured Guaranty Ltd. | | | 3 | | | | 187 | |

| AvidXchange Holdings, Inc. (a) | | | 5 | | | | 43 | |

| Bank of America Corp. | | | 309 | | | | 8,139 | |

| Bank of Hawaii Corp. | | | 2 | | | | 99 | |

| Bank of New York Mellon Corp. | | | 34 | | | | 1,445 | |

| BankUnited, Inc. | | | 4 | | | | 87 | |

| Berkshire Hills Bancorp, Inc. | | | 1 | | | | 20 | |

| BlackRock, Inc. | | | 7 | | | | 4,286 | |

| Block, Inc. (a) | | | 23 | | | | 926 | |

| Brighthouse Financial, Inc. (a) | | | 3 | | | | 136 | |

| Cadence Bank | | | 8 | | | | 169 | |

| Capital One Financial Corp. | | | 17 | | | | 1,722 | |

| Cathay General Bancorp | | | 4 | | | | 136 | |

| CBOE Global Markets, Inc. | | | 5 | | | | 819 | |

| Charles Schwab Corp. | | | 62 | | | | 3,226 | |

| Citigroup, Inc. | | | 83 | | | | 3,278 | |

| Columbia Banking System, Inc. | | | 9 | | | | 177 | |

| Comerica, Inc. | | | 6 | | | | 236 | |

| CVB Financial Corp. | | | 6 | | | | 94 | |

| Discover Financial Services | | | 12 | | | | 985 | |

| East West Bancorp, Inc. | | | 6 | | | | 322 | |

| Eastern Bankshares, Inc. | | | 8 | | | | 88 | |

| Employers Holdings, Inc. | | | 2 | | | | 76 | |

| Enact Holdings, Inc. | | | 1 | | | | 28 | |

| Encore Capital Group, Inc. (a) | | | 1 | | | | 38 | |

| Enterprise Financial Services Corp. | | | 1 | | | | 35 | |

| Equitable Holdings, Inc. | | | 16 | | | | 425 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Financials — 11.4% (Continued) | | | | | | |

| FactSet Research Systems, Inc. | | | 2 | | | $ | 864 | |

| Fidelity National Information Services, Inc. | | | 26 | | | | 1,277 | |

| Fifth Third Bancorp | | | 30 | | | | 711 | |

| First BanCorp | | | 8 | | | | 107 | |

| First Hawaiian, Inc. | | | 6 | | | | 108 | |

| First Horizon Corp. | | | 23 | | | | 247 | |

| First Merchants Corp. | | | 2 | | | | 55 | |

| Fiserv, Inc. (a) | | | 27 | | | | 3,071 | |

| Franklin Resources, Inc. | | | 13 | | | | 296 | |

| Fulton Financial Corp. | | | 7 | | | | 91 | |

| Genworth Financial, Inc. (a) | | | 21 | | | | 126 | |

| Global Payments, Inc. | | | 12 | | | | 1,275 | |

| Globe Life, Inc. | | | 4 | | | | 465 | |

| Goldman Sachs Group, Inc. | | | 15 | | | | 4,554 | |

| Hanover Insurance Group, Inc. | | | 1 | | | | 117 | |

| Hartford Financial Services Group, Inc. | | | 14 | | | | 1,028 | |

| Hope Bancorp, Inc. | | | 5 | | | | 44 | |

| Huntington Bancshares, Inc. | | | 63 | | | | 608 | |

| Intercontinental Exchange, Inc. | | | 25 | | | | 2,686 | |

| International Bancshares Corp. | | | 2 | | | | 88 | |

| Janus Henderson Group | | | 7 | | | | 161 | |

| Kemper Corp. | | | 2 | | | | 80 | |

| KeyCorp | | | 41 | | | | 419 | |

| Lemonade, Inc. (a) | | | 2 | | | | 22 | |

| Lincoln National Corp. | | | 7 | | | | 152 | |

| M&T Bank Corp. | | | 7 | | | | 789 | |

| Marqeta, Inc. (a) | | | 19 | | | | 98 | |

| Marsh & McLennan Cos, Inc. | | | 22 | | | | 4,172 | |

| Mastercard, Inc. – Class A | | | 37 | | | | 13,925 | |

| MetLife, Inc. | | | 28 | | | | 1,680 | |

| MGIC Investment Corp. | | | 13 | | | | 219 | |

| Moody’s Corp. | | | 7 | | | | 2,156 | |

| Morgan Stanley | | | 58 | | | | 4,108 | |

| Morningstar, Inc. | | | 1 | | | | 253 | |

| MSCI, Inc. | | | 3 | | | | 1,415 | |

| Nasdaq, Inc. | | | 15 | | | | 744 | |

| Northern Trust Corp. | | | 9 | | | | 593 | |

| OFG Bancorp | | | 2 | | | | 59 | |

| Old National Bancorp | | | 13 | | | | 178 | |

| Pacific Premier Bancorp, Inc. | | | 4 | | | | 76 | |

| PayPal Holdings, Inc. (a) | | | 50 | | | | 2,590 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Financials — 11.4% (Continued) | | | | | | |

| PNC Financial Services Group, Inc. | | | 18 | | | $ | 2,060 | |

| Popular, Inc. | | | 3 | | | | 195 | |

| PRA Group, Inc. (a) | | | 2 | | | | 25 | |

| Primerica, Inc. | | | 2 | | | | 382 | |

| Principal Financial Group, Inc. | | | 11 | | | | 744 | |

| ProAssurance Corp. | | | 2 | | | | 34 | |

| PROG Holdings, Inc. (a) | | | 2 | | | | 55 | |

| Prudential Financial, Inc. | | | 16 | | | | 1,463 | |

| Radian Group, Inc. | | | 6 | | | | 152 | |

| Raymond James Financial, Inc. | | | 8 | | | | 764 | |

| Regions Financial Corp. | | | 41 | | | | 596 | |

| Reinsurance Group of America, Inc. | | | 2 | | | | 299 | |

| Remitly Global, Inc. (a) | | | 5 | | | | 135 | |

| Robinhood Markets, Inc. (a) | | | 25 | | | | 229 | |

| SiriusPoint Ltd. (a) | | | 4 | | | | 39 | |

| SOFI TECHNOLOGIES INC COM (a) | | | 34 | | | | 257 | |

| State Street Corp. | | | 16 | | | | 1,034 | |

| Synchrony Financial | | | 20 | | | | 561 | |

| Synovus Financial Corp. | | | 6 | | | | 156 | |

| T Rowe Price Group, Inc. | | | 10 | | | | 905 | |

| Toast, Inc. (a) | | | 14 | | | | 224 | |

| Triumph Financial, Inc. (a) | | | 1 | | | | 62 | |

| Truist Financial Corp. | | | 58 | | | | 1,645 | |

| Unum Group | | | 8 | | | | 391 | |

| Upstart Holdings, Inc. (a) | | | 3 | | | | 72 | |

| US Bancorp | | | 65 | | | | 2,072 | |

| Visa, Inc. – Class A | | | 72 | | | | 16,926 | |

| Washington Federal, Inc. | | | 3 | | | | 74 | |

| Webster Financial Corp. | | | 7 | | | | 266 | |

| Wells Fargo & Co. | | | 167 | | | | 6,642 | |

| Zions Bancorp | | | 7 | | | | 216 | |

| Total Financials | | | | | | | 129,953 | |

| | | | | | | | | |

| Health Care — 15.2% | | | | | | | | |

| 23andMe Holding Co. (a) | | | 11 | | | | 9 | |

| Abbott Laboratories | | | 76 | | | | 7,186 | |

| AbbVie, Inc. | | | 78 | | | | 11,012 | |

| Accolade, Inc. (a) | | | 2 | | | | 13 | |

| Agilent Technologies, Inc. | | | 13 | | | | 1,344 | |

| Agios Pharmaceuticals, Inc. (a) | | | 2 | | | | 42 | |

| Akero Therapeutics, Inc. (a) | | | 1 | | | | 12 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Health Care — 15.2% (Continued) | | | | | | |

| Align Technology, Inc. (a) | | | 3 | | | $ | 554 | |

| Alignment Healthcare, Inc. (a) | | | 4 | | | | 28 | |

| Alnylam Pharmaceuticals, Inc. (a) | | | 5 | | | | 759 | |

| AMN Healthcare Services, Inc. (a) | | | 2 | | | | 152 | |

| Amphastar Pharmaceuticals, Inc. (a) | | | 1 | | | | 45 | |

| Apollo Medical Holdings, Inc. (a) | | | 1 | | | | 31 | |

| Arcus Biosciences, Inc. (a) | | | 2 | | | | 31 | |

| Avantor, Inc. (a) | | | 28 | | | | 488 | |

| Baxter International, Inc. | | | 23 | | | | 746 | |

| Biogen, Inc. (a) | | | 6 | | | | 1,425 | |

| Blueprint Medicines Corp. (a) | | | 2 | | | | 118 | |

| Boston Scientific Corp. (a) | | | 63 | | | | 3,225 | |

| Bridgebio Pharma, Inc. (a) | | | 5 | | | | 130 | |

| Bristol-Myers Squibb | | | 94 | | | | 4,844 | |

| Cardinal Health, Inc. | | | 12 | | | | 1,092 | |

| Centene Corp. (a) | | | 25 | | | | 1,725 | |

| Cerevel Therapeutics Holdings, Inc. (a) | | | 2 | | | | 47 | |

| Cigna Group | | | 13 | | | | 4,020 | |

| CVS Health Corp. | | | 57 | | | | 3,934 | |

| Cytek Biosciences, Inc. (a) | | | 4 | | | | 17 | |

| Danaher Corp. | | | 29 | | | | 5,569 | |

| DaVita, Inc. (a) | | | 3 | | | | 232 | |

| Denali Therapeutics, Inc. (a) | | | 4 | | | | 75 | |

| Edwards Lifesciences Corp. (a) | | | 27 | | | | 1,720 | |

| Elanco Animal Health, Inc. (a) | | | 21 | | | | 185 | |

| Elevance Health, Inc. | | | 10 | | | | 4,501 | |

| Eli Lilly & Co. | | | 37 | | | | 20,494 | |

| Embecta Corp. | | | 2 | | | | 30 | |

| Enovis Corp. (a) | | | 2 | | | | 92 | |

| Envista Holdings Corp. (a) | | | 8 | | | | 186 | |

| FibroGen, Inc. (a) | | | 3 | | | | 2 | |

| Fortrea Holdings, Inc. (a) | | | 4 | | | | 114 | |

| Gilead Sciences, Inc. | | | 56 | | | | 4,398 | |

| Guardant Health, Inc. (a) | | | 4 | | | | 104 | |

| Henry Schein, Inc. (a) | | | 6 | | | | 390 | |

| Hims & Hers Health, Inc. (a) | | | 5 | | | | 30 | |

| ICU Medical, Inc. (a) | | | 1 | | | | 98 | |

| IDEXX Laboratories, Inc. (a) | | | 4 | | | | 1,598 | |

| Illumina, Inc. (a) | | | 7 | | | | 766 | |

| Intuitive Surgical, Inc. (a) | | | 16 | | | | 4,196 | |

| IQVIA Holdings, Inc. (a) | | | 8 | | | | 1,447 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Health Care — 15.2% (Continued) | | | | | | |

| iRhythm Technologies, Inc. (a) | | | 1 | | | $ | 79 | |

| Johnson & Johnson | | | 116 | | | | 17,207 | |

| Karuna Therapeutics, Inc. (a) | | | 1 | | | | 167 | |

| Laboratory Corporation of America Holdings | | | 4 | | | | 799 | |

| McKesson Corp. | | | 6 | | | | 2,732 | |

| Medtronic PLC | | | 58 | | | | 4,092 | |

| Mirati Therapeutics, Inc. (a) | | | 2 | | | | 111 | |

| Myriad Genetics, Inc. (a) | | | 4 | | | | 62 | |

| Option Care Health, Inc. (a) | | | 7 | | | | 194 | |

| Organon & Co. | | | 11 | | | | 163 | |

| Owens & Minor, Inc. (a) | | | 3 | | | | 43 | |

| Penumbra, Inc. (a) | | | 2 | | | | 382 | |

| PerkinElmer, Inc. | | | 5 | | | | 414 | |

| Pfizer, Inc. | | | 249 | | | | 7,609 | |

| Quest Diagnostics, Inc. | | | 4 | | | | 520 | |

| Recursion Pharmaceuticals, Inc. (a) | | | 5 | | | | 26 | |

| Regeneron Pharmaceuticals, Inc. (a) | | | 5 | | | | 3,899 | |

| Relay Therapeutics, Inc. (a) | | | 3 | | | | 20 | |

| ResMed, Inc. | | | 6 | | | | 847 | |

| Stryker Corp. | | | 14 | | | | 3,783 | |

| Teladoc Health, Inc. (a) | | | 6 | | | | 99 | |

| Tenet Healthcare Corp. (a) | | | 4 | | | | 215 | |

| Thermo Fisher Scientific, Inc. | | | 17 | | | | 7,561 | |

| Ultragenyx Pharmaceutical, Inc. (a) | | | 2 | | | | 71 | |

| United Therapeutics Corp. (a) | | | 2 | | | | 446 | |

| UnitedHealth Group, Inc. | | | 41 | | | | 21,957 | |

| Ventyx Biosciences, Inc. (a) | | | 1 | | | | 14 | |

| Vertex Pharmaceuticals, Inc. (a) | | | 11 | | | | 3,983 | |

| Viatris, Inc. | | | 53 | | | | 472 | |

| Vir Biotechnology, Inc. (a) | | | 4 | | | | 32 | |

| Waters Corp. (a) | | | 3 | | | | 716 | |

| Xencor, Inc. (a) | | | 2 | | | | 35 | |

| Zentalis Pharmaceuticals, Inc. (a) | | | 2 | | | | 33 | |

| Zimmer Biomet Holdings, Inc. | | | 10 | | | | 1,044 | |

| Zoetis, Inc. | | | 21 | | | | 3,297 | |

| Total Health Care | | | | | | | 172,380 | |

| | | | | | | | | |

| Industrials — 7.3% | | | | | | | | |

| 3M Co. | | | 25 | | | | 2,274 | |

| A O Smith Corp. | | | 5 | | | | 349 | |

| ABM Industries, Inc. | | | 3 | | | | 118 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Industrials — 7.3% (Continued) | | | | | | |

| Advanced Drainage Systems, Inc. | | | 3 | | | $ | 320 | |

| AGCO Corp. | | | 2 | | | | 229 | |

| Alaska Air Group, Inc. (a) | | | 6 | | | | 190 | |

| American Airlines Group, Inc. (a) | | | 28 | | | | 312 | |

| Apogee Enterprises, Inc. | | | 1 | | | | 43 | |

| Arcosa, Inc. | | | 2 | | | | 138 | |

| ASGN, Inc. (a) | | | 2 | | | | 167 | |

| Automatic Data Processing, Inc. | | | 18 | | | | 3,928 | |

| Axon Enterprise, Inc. (a) | | | 3 | | | | 613 | |

| AZEK Co., Inc. (a) | | | 6 | | | | 157 | |

| Barnes Group, Inc. | | | 2 | | | | 42 | |

| Boeing (a) | | | 26 | | | | 4,858 | |

| Boise Cascade | | | 1 | | | | 94 | |

| Booz Allen Hamilton Holding Corp. | | | 6 | | | | 720 | |

| Broadridge Financial Solutions, Inc. | | | 6 | | | | 1,024 | |

| Chart Industries, Inc. (a) | | | 2 | | | | 232 | |

| CSG Systems International, Inc. | | | 2 | | | | 94 | |

| Cummins, Inc. | | | 6 | | | | 1,298 | |

| Deere & Co. | | | 12 | | | | 4,384 | |

| Delta Air Lines, Inc. | | | 28 | | | | 875 | |

| Donaldson Co, Inc. | | | 5 | | | | 288 | |

| Eaton Corp. | | | 18 | | | | 3,742 | |

| Emerson Electric Co. | | | 25 | | | | 2,224 | |

| ExlService Holdings, Inc. (a) | | | 10 | | | | 261 | |

| FedEx Corp. | | | 11 | | | | 2,641 | |

| Fluence Energy, Inc. (a) | | | 2 | | | | 35 | |

| Fortive Corp. | | | 16 | | | | 1,044 | |

| Fortune Brands Home & Security, Inc. | | | 5 | | | | 279 | |

| Forward Air Corp. | | | 2 | | | | 129 | |

| FTI Consulting, Inc. (a) | | | 2 | | | | 425 | |

| FuelCell Energy, Inc. (a) | | | 17 | | | | 19 | |

| Genpact Ltd. | | | 8 | | | | 268 | |

| GEO Group (a) | | | 6 | | | | 52 | |

| Granite Construction, Inc. | | | 2 | | | | 81 | |

| Greenbrier, Inc. | | | 1 | | | | 35 | |

| Griffon Corp. | | | 2 | | | | 80 | |

| Hillenbrand, Inc. | | | 3 | | | | 114 | |

| Honeywell International, Inc. | | | 30 | | | | 5,499 | |

| IDEX Corp. | | | 3 | | | | 574 | |

| Jacobs Solutions, Inc. | | | 6 | | | | 800 | |

| JetBlue Airways Corp. (a) | | | 15 | | | | 56 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Industrials — 7.3% (Continued) | | | | | | |

| Joby Aviation, Inc. (a) | | | 13 | | | $ | 69 | |

| Johnson Controls International | | | 30 | | | | 1,471 | |

| KBR, Inc. | | | 6 | | | | 349 | |

| Kennametal, Inc. | | | 4 | | | | 92 | |

| L3Harris Technologies, Inc. | | | 8 | | | | 1,435 | |

| Landstar System, Inc. | | | 1 | | | | 165 | |

| Legalzoom.com, Inc. (a) | | | 4 | | | | 40 | |

| Lennox International, Inc. | | | 1 | | | | 371 | |

| Lincoln Electric Holdings, Inc. | | | 2 | | | | 350 | |

| Lyft, Inc. (a) | | | 13 | | | | 119 | |

| ManpowerGroup, Inc. | | | 2 | | | | 140 | |

| Masco Corp. | | | 9 | | | | 469 | |

| Matson, Inc. | | | 2 | | | | 174 | |

| Matthews International Corp. | | | 1 | | | | 35 | |

| Montrose Environmental Group, Inc. (a) | | | 1 | | | | 23 | |

| Nordson Corp. | | | 2 | | | | 425 | |

| Norfolk Southern Corp. | | | 10 | | | | 1,908 | |

| Northrop Grumman Corp. | | | 7 | | | | 3,300 | |

| nVent Electric PLC | | | 8 | | | | 385 | |

| Otis Worldwide Corp. | | | 19 | | | | 1,467 | |

| Owens Corning | | | 4 | | | | 453 | |

| Pentair PLC | | | 8 | | | | 465 | |

| Regal Rexnord Corp. | | | 3 | | | | 355 | |

| Republic Services, Inc. | | | 9 | | | | 1,336 | |

| Rockwell Automation, Inc. | | | 5 | | | | 1,314 | |

| Ryder System, Inc. | | | 2 | | | | 195 | |

| Saia, Inc. (a) | | | 1 | | | | 358 | |

| Science Applications International Corp. | | | 2 | | | | 218 | |

| Stanley Black & Decker, Inc. | | | 7 | | | | 595 | |

| Stericycle, Inc. (a) | | | 4 | | | | 165 | |

| TaskUS, Inc. (a) | | | 1 | | | | 9 | |

| Toro | | | 4 | | | | 323 | |

| Trane Technologies PLC | | | 10 | | | | 1,903 | |

| TransUnion | | | 8 | | | | 351 | |

| TriNet Group, Inc. (a) | | | 2 | | | | 206 | |

| Trinity Industries, Inc. | | | 4 | | | | 83 | |

| Uber Technologies, Inc. (a) | | | 85 | | | | 3,679 | |

| Union Pacific Corp. | | | 27 | | | | 5,606 | |

| United Parcel Service, Inc. – Class B | | | 32 | | | | 4,520 | |

| United Rentals, Inc. | | | 3 | | | | 1,219 | |

| Veralto Corp. (a) | | | 9 | | | | 621 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Industrials — 7.3% (Continued) | | | | | | |

| Waste Management, Inc. | | | 19 | | | $ | 3,122 | |

| Westinghouse Air Brake Technologies Corp. | | | 7 | | | | 742 | |

| WW Grainger, Inc. | | | 2 | | | | 1,460 | |

| XPO, Inc. (a) | | | 5 | | | | 379 | |

| Total Industrials | | | | | | | 83,569 | |

| | | | | | | | | |

| Information Technology — 34.5% (b) | | | | | | | | |

| Accenture – Class A | | | 29 | | | | 8,617 | |

| ACI Worldwide, Inc. (a) | | | 5 | | | | 102 | |

| Adobe, Inc. (a) | | | 20 | | | | 10,640 | |

| ADTRAN Holdings, Inc. | | | 3 | | | | 20 | |

| Advanced Micro Devices, Inc. (a) | | | 71 | | | | 6,994 | |

| Akamai Technologies, Inc. (a) | | | 7 | | | | 723 | |

| Amkor Technology, Inc. | | | 4 | | | | 83 | |

| Amplitude, Inc. (a) | | | 2 | | | | 20 | |

| Analog Devices, Inc. | | | 23 | | | | 3,619 | |

| ANSYS, Inc. (a) | | | 4 | | | | 1,113 | |

| Apple, Inc. | | | 657 | | | | 112,195 | |

| AppLovin Corp. (a) | | | 6 | | | | 219 | |

| Arista Networks, Inc. (a) | | | 10 | | | | 2,004 | |

| Aspen Technology, Inc. (a) | | | 1 | | | | 178 | |

| Atlassian Corp. (a) | | | 6 | | | | 1,084 | |

| Avnet, Inc. | | | 4 | | | | 185 | |

| Axcelis Technologies, Inc. (a) | | | 2 | | | | 255 | |

| Belden, Inc. | | | 1 | | | | 71 | |

| BILL Holdings, Inc. (a) | | | 4 | | | | 365 | |

| Blackline, Inc. (a) | | | 2 | | | | 98 | |

| Box, Inc. (a) | | | 6 | | | | 149 | |

| Broadcom, Inc. | | | 18 | | | | 15,144 | |

| Cadence Design Systems, Inc. (a) | | | 12 | | | | 2,878 | |

| CCC Intelligent Solutions Holdings, Inc. (a) | | | 6 | | | | 65 | |

| CDW Corp. | | | 6 | | | | 1,202 | |

| Cisco Systems, Inc. | | | 181 | | | | 9,436 | |

| Cognex Corp. | | | 8 | | | | 288 | |

| Cognizant Technology Solutions Corp. – Class A | | | 23 | | | | 1,483 | |

| Coherent Corp. (a) | | | 5 | | | | 148 | |

| CommVault Systems, Inc. (a) | | | 2 | | | | 131 | |

| Corning, Inc. | | | 37 | | | | 990 | |

| Corsair Gaming, Inc. (a) | | | 1 | | | | 13 | |

| DigitalOcean Holdings, Inc. (a) | | | 2 | | | | 41 | |

| Dolby Laboratories, Inc. | | | 2 | | | | 162 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Information Technology — 34.5% (b) (Continued) | | | | | | |

| Dropbox, Inc. – Class A (a) | | | 12 | | | $ | 316 | |

| DXC Technology Co. (a) | | | 11 | | | | 222 | |

| Elastic NV (a) | | | 3 | | | | 225 | |

| Enfusion, Inc. (a) | | | 1 | | | | 8 | |

| Envestnet, Inc. (a) | | | 2 | | | | 74 | |

| F5, Inc. (a) | | | 2 | | | | 303 | |

| Fastly, Inc. (a) | | | 4 | | | | 59 | |

| Flex Ltd. (a) | | | 20 | | | | 514 | |

| Freshworks, Inc. (a) | | | 5 | | | | 90 | |

| Gartner, Inc. (a) | | | 3 | | | | 996 | |

| Gen Digital, Inc. | | | 27 | | | | 450 | |

| GoDaddy, Inc. (a) | | | 6 | | | | 439 | |

| Guidewire Software, Inc. (a) | | | 4 | | | | 361 | |

| Hewlett Packard Enterprise | | | 57 | | | | 877 | |

| HP, Inc. | | | 44 | | | | 1,159 | |

| HubSpot, Inc. (a) | | | 2 | | | | 848 | |

| Insight Enterprises, Inc. (a) | | | 2 | | | | 287 | |

| Intuit, Inc. | | | 12 | | | | 5,939 | |

| Jamf Holding Corp. (a) | | | 2 | | | | 32 | |

| Juniper Networks, Inc. | | | 14 | | | | 377 | |

| Keysight Technologies, Inc. (a) | | | 8 | | | | 976 | |

| KLA Corp. | | | 6 | | | | 2,818 | |

| Kyndryl Holdings, Inc. (a) | | | 9 | | | | 132 | |

| Lam Research Corp. | | | 6 | | | | 3,529 | |

| Littelfuse, Inc. | | | 1 | | | | 217 | |

| MACOM Technology Solutions Holdings, Inc. (a) | | | 2 | | | | 141 | |

| Micron Technology, Inc. | | | 49 | | | | 3,277 | |

| Microsoft Corp. | | | 324 | | | | 109,547 | |

| MKS Instruments, Inc. | | | 2 | | | | 131 | |

| Model N, Inc. (a) | | | 1 | | | | 24 | |

| NetApp, Inc. | | | 10 | | | | 728 | |

| NetScout Systems, Inc. (a) | | | 3 | | | | 65 | |

| New Relic, Inc. (a) | | | 2 | | | | 173 | |

| NVIDIA Corp. | | | 105 | | | | 42,818 | |

| Okta, Inc. (a) | | | 6 | | | | 404 | |

| PagerDuty, Inc. (a) | | | 4 | | | | 81 | |

| Palo Alto Networks, Inc. (a) | | | 13 | | | | 3,159 | |

| Power Integrations, Inc. | | | 2 | | | | 139 | |

| PowerSchool Holdings, Inc. (a) | | | 3 | | | | 60 | |

| Progress Software Corp. | | | 2 | | | | 103 | |

| QUALCOMM, Inc. | | | 50 | | | | 5,450 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Information Technology — 34.5% (b) (Continued) | | | | | | |

| Rapid7, Inc. (a) | | | 2 | | | $ | 93 | |

| salesforce.com, Inc. (a) | | | 43 | | | | 8,636 | |

| Samsara, Inc. (a) | | | 4 | | | | 92 | |

| Seagate Technology Holdings PLC | | | 9 | | | | 614 | |

| Semtech Corp. (a) | | | 3 | | | | 42 | |

| ServiceNow, Inc. (a) | | | 9 | | | | 5,237 | |

| Silicon Laboratories, Inc. (a) | | | 1 | | | | 92 | |

| Synaptics, Inc. (a) | | | 2 | | | | 167 | |

| TD SYNNEX Corp. | | | 2 | | | | 183 | |

| TE Connectivity Ltd. | | | 15 | | | | 1,768 | |

| Teledyne Technologies, Inc. (a) | | | 2 | | | | 749 | |

| Texas Instruments, Inc. | | | 40 | | | | 5,680 | |

| Thoughtworks Holding, Inc. (a) | | | 3 | | | | 10 | |

| Viasat, Inc. (a) | | | 4 | | | | 74 | |

| VMware, Inc. (a) | | | 9 | | | | 1,311 | |

| Workday, Inc. (a) | | | 8 | | | | 1,694 | |

| Zuora, Inc. (a) | | | 6 | | | | 44 | |

| Total Information Technology | | | | | | | 394,749 | |

| | | | | | | | | |

| Materials — 1.6% | | | | | | | | |

| Air Products and Chemicals, Inc. | | | 10 | | | | 2,824 | |

| Albemarle Corp. | | | 5 | | | | 634 | |

| Amcor PLC | | | 66 | | | | 587 | |

| AptarGroup, Inc. | | | 3 | | | | 367 | |

| Ashland, Inc. | | | 2 | | | | 153 | |

| Avery Dennison Corp. | | | 3 | | | | 522 | |

| Axalta Coating Systems Ltd. (a) | | | 9 | | | | 236 | |

| Ball Corp. | | | 14 | | | | 674 | |

| Cabot Corp. | | | 2 | | | | 133 | |

| Carpenter Technology Corp. | | | 2 | | | | 125 | |

| CF Industries Holdings, Inc. | | | 9 | | | | 718 | |

| Chemours | | | 6 | | | | 145 | |

| Cleveland-Cliffs, Inc. (a) | | | 22 | | | | 369 | |

| Dow, Inc. | | | 32 | | | | 1,547 | |

| Eastman Chemical | | | 5 | | | | 374 | |

| Ginkgo Bioworks Holdings, Inc. (a) | | | 50 | | | | 69 | |

| International Flavors & Fragrances, Inc. | | | 11 | | | | 752 | |

| International Paper | | | 16 | | | | 540 | |

| LyondellBasell Industries | | | 11 | | | | 992 | |

| Martin Marietta Materials, Inc. | | | 3 | | | | 1,227 | |

| Newmont Corp. | | | 35 | | | | 1,311 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Materials — 1.6% (Continued) | | | | | | |

| Reliance Steel & Aluminum Co. | | | 2 | | | $ | 509 | |

| Sealed Air Corp. | | | 6 | | | | 185 | |

| Sherwin-Williams | | | 11 | | | | 2,620 | |

| Westrock Co. | | | 11 | | | | 395 | |

| Total Materials | | | | | | | 18,008 | |

| | | | | | | | | |

| Real Estate — 1.3% | | | | | | | | |

| Alexander & Baldwin, Inc. | | | 4 | | | | 63 | |

| American Tower Corp. | | | 20 | | | | 3,563 | |

| Apartment Income REIT Corp. | | | 7 | | | | 204 | |

| Broadstone Net Lease, Inc. | | | 7 | | | | 99 | |

| Camden Property Trust | | | 4 | | | | 340 | |

| CBRE Group, Inc. (a) | | | 14 | | | | 971 | |

| Compass, Inc. (a) | | | 13 | | | | 26 | |

| Cushman & Wakefield PLC (a) | | | 8 | | | | 59 | |

| DigitalBridge Group, Inc. | | | 7 | | | | 111 | |

| Douglas Emmett, Inc. | | | 7 | | | | 78 | |

| Equinix, Inc. | | | 4 | | | | 2,918 | |

| Essex Property Trust, Inc. | | | 2 | | | | 428 | |

| Hudson Pacific Properties, Inc. | | | 6 | | | | 27 | |

| Jones Lang LaSalle, Inc. (a) | | | 2 | | | | 256 | |

| Marcus & Millichap, Inc. | | | 1 | | | | 29 | |

| Opendoor Technologies, Inc. (a) | | | 21 | | | | 40 | |

| Public Storage | | | 7 | | | | 1,671 | |

| Realty Income Corp. | | | 29 | | | | 1,374 | |

| Retail Opportunity Investments Corp. | | | 5 | | | | 59 | |

| RLJ Lodging Trust | | | 7 | | | | 66 | |

| Ryman Hospitality Properties, Inc. | | | 2 | | | | 171 | |

| Tanger Factory Outlet Centers, Inc. | | | 4 | | | | 90 | |

| Ventas, Inc. | | | 17 | | | | 722 | |

| Veris Residential, Inc. | | | 4 | | | | 54 | |

| Vornado Realty Trust | | | 7 | | | | 134 | |

| Welltower, Inc. | | | 21 | | | | 1,756 | |

| Xenia Hotels & Resorts, Inc. | | | 5 | | | | 58 | |

| Total Real Estate | | | | | | | 15,367 | |

| | | | | | | | | |

| Utilities — 2.1% | | | | | | | | |

| AES Corp. | | | 29 | | | | 432 | |

| Ameren Corp. | | | 11 | | | | 833 | |

| American Electric Power Co, Inc. | | | 22 | | | | 1,662 | |

| Avangrid, Inc. | | | 3 | | | | 90 | |

| CenterPoint Energy, Inc. | | | 28 | | | | 753 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Utilities — 2.1% (Continued) | | | | | | |

| CMS Energy Corp. | | | 13 | | | $ | 706 | |

| Consolidated Edison, Inc. | | | 16 | | | | 1,405 | |

| Edison International | | | 17 | | | | 1,072 | |

| Entergy Corp. | | | 9 | | | | 860 | |

| Eversource Energy | | | 16 | | | | 861 | |

| Exelon Corp. | | | 44 | | | | 1,713 | |

| FirstEnergy Corp. | | | 25 | | | | 890 | |

| Hawaiian Electric Industries, Inc. | | | 4 | | | | 52 | |

| IDACORP, Inc. | | | 2 | | | | 189 | |

| NiSource, Inc. | | | 18 | | | | 453 | |

| Northwest Natural Holding Co. | | | 1 | | | | 37 | |

| NRG Energy, Inc. | | | 10 | | | | 424 | |

| Ormat Technologies, Inc. | | | 2 | | | | 123 | |

| PG&E Corp. (a) | | | 70 | | | | 1,141 | |

| Portland General Electric Co. | | | 4 | | | | 160 | |

| PPL Corp. | | | 32 | | | | 786 | |

| Public Service Enterprise Group, Inc. | | | 22 | | | | 1,356 | |

| Sempra Energy | | | 28 | | | | 1,961 | |

| Southern Co. | | | 48 | | | | 3,231 | |

| Southwest Gas Holdings, Inc. | | | 3 | | | | 176 | |

| WEC Energy Group, Inc. | | | 14 | | | | 1,139 | |

| Xcel Energy, Inc. | | | 24 | | | | 1,422 | |

| Total Utilities | | | | | | | 23,927 | |

| Total Common Stocks | | | | | | | | |

| (Cost $1,193,072) | | | | | | | 1,130,964 | |

See Notes to the Financial Statements

V-SHARES US LEADERSHIP DIVERSITY ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENTS — 0.8% | | | | | | |

| | | | | | | |

| Money Market Funds — 0.8% | | | | | | |

| First American Government Obligations Fund – Class X, 5.28% (c) | | | 8,593 | | | $ | 8,593 | |

| Total Money Market Funds | | | | | | | 8,593 | |

| Total Short-Term Investments | | | | | | | | |

| (Cost $8,593) | | | | | | | 8,593 | |

| Total Investments — 99.9% | | | | | | | | |

| (Cost $1,201,665) | | | | | | | 1,139,557 | |

| Other Assets in Excess of Liabilities — 0.1% | | | | | | | 825 | |

| Total Net Assets — 100.0% | | | | | | $ | 1,140,382 | |

Percentages are stated as a percent of net assets.

PLC – Public Limited Company

| (a) | Non-income producing security. |

| (b) | As of October 31, 2023, the Fund had a significant portion of its assets invested in this sector and therefore is subject to additional risks. See Note 8 in Notes to Financial Statements. |

| (c) | The rate shown represents the 7-day effective yield as of October 31, 2023. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

See Notes to the Financial Statements

V-SHARES MSCI WORLD ESG MATERIALITY AND CARBON TRANSITION ETF

Schedule of Investments

October 31, 2023

| | | Shares | | | Value | |

| COMMON STOCKS — 98.9% | | | | | | |

| | | | | | | |

| Communication Services — 5.5% | | | | | | |

| AT&T, Inc. | | | 1,065 | | | $ | 16,401 | |

| BT Group PLC | | | 2,182 | | | | 2,985 | |

| Charter Communications, Inc. (a) | | | 16 | | | | 6,445 | |

| Comcast Corp. | | | 450 | | | | 18,581 | |

| Deutsche Telekom | | | 322 | | | | 6,969 | |

| Electronic Arts, Inc. | | | 48 | | | | 5,942 | |

| Interpublic Group, Inc. | | | 174 | | | | 4,942 | |

| KDDI Corp. | | | 100 | | | | 2,963 | |

| Nintendo | | | 200 | | | | 8,216 | |

| Orange | | | 695 | | | | 8,162 | |

| SoftBank Group Corp. | | | 200 | | | | 8,087 | |

| Telstra Group | | | 1,434 | | | | 3,459 | |

| T-Mobile US, Inc. (a) | | | 64 | | | | 9,207 | |

| Verizon Communications, Inc. | | | 485 | | | | 17,038 | |

| Walt Disney (a) | | | 239 | | | | 19,499 | |

| Total Communication Services | | | | | | | 138,896 | |

| | | | | | | | | |

| Consumer Discretionary — 12.0% | | | | | | | | |

| Adidas | | | 28 | | | | 4,948 | |

| Airbnb, Inc. (a) | | | 53 | | | | 6,269 | |

| Amadeus IT Group | | | 5 | | | | 284 | |

| Amazon.com, Inc. (a) | | | 1,104 | | | | 146,932 | |

| Aptiv PLC (a) | | | 55 | | | | 4,796 | |

| Aristocrat Leisure Ltd. | | | 123 | | | | 3,001 | |

| Bayerische Motoren Werke | | | 28 | | | | 2,594 | |

| Booking Holdings, Inc. (a) | | | 6 | | | | 16,737 | |

| Bridgestone Corp. | | | 200 | | | | 7,484 | |

| Evolution | | | 24 | | | | 2,131 | |

| Expedia Group, Inc. (a) | | | 28 | | | | 2,668 | |

| Flutter Entertainment (a) | | | 36 | | | | 5,630 | |

| Hasbro, Inc. | | | 93 | | | | 4,199 | |

| Kering | | | 9 | | | | 3,645 | |

| LKQ Corp. | | | 87 | | | | 3,821 | |

| LVMH Moet Hennessy Louis Vuitton SE | | | 29 | | | | 20,675 | |

| Oriental Land | | | 200 | | | | 6,414 | |

| Pool Corp. | | | 17 | | | | 5,368 | |

| Prosus NV (a) | | | 241 | | | | 6,733 | |

| Sekisui House Ltd. | | | 400 | | | | 7,763 | |

| Sony Group Corp. | | | 200 | | | | 16,409 | |

| Toyota Motor Corp. | | | 600 | | | | 10,261 | |

See Notes to the Financial Statements

V-SHARES MSCI WORLD ESG MATERIALITY AND CARBON TRANSITION ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Consumer Discretionary — 12.0% (Continued) | | | | | | |

| Tractor Supply | | | 22 | | | $ | 4,236 | |

| Vail Resorts, Inc. | | | 26 | | | | 5,519 | |

| VF Corp. | | | 282 | | | | 4,154 | |

| Total Consumer Discretionary | | | | | | | 302,671 | |

| | | | | | | | | |

| Consumer Staples — 6.7% | | | | | | | | |

| Anheuser-Busch InBev SA/NV | | | 109 | | | | 6,179 | |

| Archer-Daniels-Midland Co. | | | 86 | | | | 6,155 | |

| Coca-Cola | | | 440 | | | | 24,856 | |

| Coca-Cola Europacific Partners PLC | | | 110 | | | | 6,436 | |

| Diageo PLC | | | 313 | | | | 11,801 | |

| General Mills, Inc. | | | 118 | | | | 7,698 | |

| J Sainsbury PLC | | | 1,225 | | | | 3,825 | |

| Keurig Dr Pepper, Inc. | | | 236 | | | | 7,158 | |

| McCormick, Inc. | | | 108 | | | | 6,901 | |

| PepsiCo, Inc. | | | 140 | | | | 22,859 | |

| Procter & Gamble | | | 284 | | | | 42,609 | |

| Target Corp. | | | 62 | | | | 6,869 | |

| Unilever PLC | | | 336 | | | | 15,855 | |

| Total Consumer Staples | | | | | | | 169,201 | |

| | | | | | | | | |

| Energy — 5.3% | | | | | | | | |

| Baker Hughes | | | 134 | | | | 4,612 | |

| BP PLC | | | 2,557 | | | | 15,595 | |

| Cameco Corp. | | | 186 | | | | 7,601 | |

| Cheniere Energy, Inc. | | | 39 | | | | 6,490 | |

| Enbridge, Inc. | | | 294 | | | | 9,411 | |

| Eni | | | 75 | | | | 1,223 | |

| Equinor | | | 208 | | | | 6,972 | |

| Halliburton Co. | | | 127 | | | | 4,996 | |

| Kinder Morgan, Inc. | | | 333 | | | | 5,395 | |

| Phillips 66 | | | 70 | | | | 7,985 | |

| Schlumberger | | | 140 | | | | 7,792 | |

| Shell PLC | | | 753 | | | | 24,181 | |

| TC Energy Corp. | | | 190 | | | | 6,537 | |

| TotalEnergies | | | 291 | | | | 19,440 | |

| Woodside Energy Group Ltd. | | | 258 | | | | 5,596 | |

| Total Energy | | | | | | | 133,826 | |

| | | | | | | | | |

| Financials — 13.8% | | | | | | | | |

| 3i Group PLC | | | 250 | | | | 5,869 | |

| AIA Group Ltd. | | | 1,600 | | | | 13,873 | |

See Notes to the Financial Statements

V-SHARES MSCI WORLD ESG MATERIALITY AND CARBON TRANSITION ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Financials — 13.8% (Continued) | | | | | | |

| Allianz | | | 38 | | | $ | 8,873 | |

| Australia & New Zealand Banking Group Ltd. | | | 403 | | | | 6,305 | |

| Aviva PLC (a) | | | 658 | | | | 3,175 | |

| AXA | | | 267 | | | | 7,889 | |

| Baloise Holding | | | 67 | | | | 9,586 | |

| Banco Bilbao Vizcaya Argentaria | | | 1,749 | | | | 13,720 | |

| Banco Santander | | | 2,379 | | | | 8,716 | |

| Bank of America Corp. | | | 679 | | | | 17,885 | |

| Bank of Montreal | | | 103 | | | | 7,775 | |

| Bank of Nova Scotia | | | 177 | | | | 7,159 | |

| Barclays PLC | | | 4,957 | | | | 7,916 | |

| BNP Paribas | | | 185 | | | | 10,616 | |

| Canadian Imperial Bank of Commerce | | | 185 | | | | 6,518 | |

| CBOE Global Markets, Inc. | | | 41 | | | | 6,719 | |

| Citigroup, Inc. | | | 205 | | | | 8,095 | |

| Commonwealth Bank of Australia | | | 166 | | | | 10,149 | |

| Dai-ichi Life Holdings, Inc. | | | 300 | | | | 6,291 | |

| Deutsche Boerse | | | 27 | | | | 4,429 | |

| FactSet Research Systems, Inc. | | | 16 | | | | 6,910 | |

| Fidelity National Information Services, Inc. | | | 101 | | | | 4,960 | |

| Hong Kong Exchanges & Clearing Ltd. | | | 200 | | | | 7,029 | |

| HSBC Holdings PLC | | | 1,668 | | | | 11,988 | |

| ING Groep PLC | | | 515 | | | | 6,548 | |

| Insurance Australia Group Ltd. | | | 1,029 | | | | 3,694 | |

| Intact Financial Corp. | | | 41 | | | | 5,754 | |

| Intercontinental Exchange, Inc. | | | 63 | | | | 6,769 | |

| Intesa Sanpaolo | | | 3,168 | | | | 8,226 | |

| KBC Group | | | 51 | | | | 2,798 | |

| Lloyds Banking Group PLC | | | 4,087 | | | | 1,981 | |

| London Stock Exchange Group PLC | | | 47 | | | | 4,722 | |

| Manulife Financial Corp. | | | 505 | | | | 8,781 | |

| MetLife, Inc. | | | 90 | | | | 5,401 | |

| Moody’s Corp. | | | 16 | | | | 4,928 | |

| Morgan Stanley | | | 136 | | | | 9,632 | |

| Muenchener Rueckversicherungs-Gesellschaft | | | 16 | | | | 6,401 | |

| National Australia Bank Ltd. | | | 202 | | | | 3,588 | |

| Nordea Bank Abp | | | 493 | | | | 5,176 | |

| ORIX Corp. | | | 500 | | | | 8,964 | |

| Prudential PLC | | | 350 | | | | 3,643 | |

| S&P Global, Inc. | | | 26 | | | | 9,082 | |

| Tokio Marine Holdings, Inc. | | | 200 | | | | 4,415 | |

See Notes to the Financial Statements

V-SHARES MSCI WORLD ESG MATERIALITY AND CARBON TRANSITION ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Financials — 13.8% (Continued) | | | | | | |

| Toronto-Dominion Bank | | | 188 | | | $ | 10,490 | |

| UBS Group | | | 550 | | | | 12,825 | |

| Westpac Banking Corp. | | | 355 | | | | 4,630 | |

| Zurich Insurance Group | | | 18 | | | | 8,517 | |

| Total Financials | | | | | | | 349,410 | |

| | | | | | | | | |

| Health Care — 11.7% | | | | | | | | |

| Agilent Technologies, Inc. | | | 60 | | | | 6,202 | |

| Alcon, Inc. | | | 80 | | | | 5,698 | |

| AmerisourceBergen Corp. | | | 31 | | | | 5,740 | |

| AstraZeneca PLC | | | 172 | | | | 21,393 | |

| Biogen, Inc. (a) | | | 15 | | | | 3,563 | |

| Bio-Techne Corp. | | | 64 | | | | 3,496 | |

| Cardinal Health, Inc. | | | 37 | | | | 3,367 | |

| Centene Corp. (a) | | | 84 | | | | 5,794 | |

| Cigna Group | | | 35 | | | | 10,822 | |

| Cooper Companies, Inc. | | | 17 | | | | 5,300 | |

| Daiichi Sankyo Co Ltd. | | | 200 | | | | 5,095 | |

| Danaher Corp. | | | 77 | | | | 14,786 | |

| Dexcom, Inc. (a) | | | 52 | | | | 4,619 | |

| Edwards Lifesciences Corp. (a) | | | 86 | | | | 5,480 | |

| Eisai | | | 100 | | | | 5,257 | |

| Elevance Health, Inc. | | | 27 | | | | 12,152 | |

| Fisher & Paykel Healthcare Corp Ltd. | | | 193 | | | | 2,336 | |

| Fortrea Holdings, Inc. (a) | | | 28 | | | | 795 | |

| Fresenius Medical Care | | | 85 | | | | 2,814 | |

| Genmab (a) | | | 13 | | | | 3,664 | |

| Gilead Sciences, Inc. | | | 126 | | | | 9,896 | |

| HCA Healthcare, Inc. | | | 23 | | | | 5,201 | |

| Humana, Inc. | | | 15 | | | | 7,855 | |

| IDEXX Laboratories, Inc. (a) | | | 11 | | | | 4,394 | |

| Illumina, Inc. (a) | | | 23 | | | | 2,517 | |

| Intuitive Surgical, Inc. (a) | | | 39 | | | | 10,227 | |

| IQVIA Holdings, Inc. (a) | | | 30 | | | | 5,425 | |

| Laboratory Corporation of America Holdings | | | 28 | | | | 5,592 | |

| Lonza Group | | | 9 | | | | 3,133 | |

| Merck | | | 16 | | | | 2,407 | |

| Mettler-Toledo International, Inc. (a) | | | 4 | | | | 3,941 | |

| Novo Nordisk AS | | | 370 | | | | 35,473 | |

| QIAGEN NV (a) | | | 112 | | | | 4,158 | |

| ResMed, Inc. | | | 28 | | | | 3,954 | |

See Notes to the Financial Statements

V-SHARES MSCI WORLD ESG MATERIALITY AND CARBON TRANSITION ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Health Care — 11.7% (Continued) | | | | | | |

| UnitedHealth Group, Inc. | | | 100 | | | $ | 53,557 | |

| Waters Corp. (a) | | | 20 | | | | 4,771 | |

| Zoetis, Inc. | | | 57 | | | | 8,949 | |

| Total Health Care | | | | | | | 299,823 | |

| | | | | | | | | |

| Industrials — 10.2% | | | | | | | | |

| 3M Co. | | | 67 | | | | 6,094 | |

| ABB Ltd. | | | 158 | | | | 5,285 | |

| Automatic Data Processing, Inc. | | | 34 | | | | 7,419 | |

| BAE Systems PLC | | | 222 | | | | 2,974 | |

| Brambles Ltd. | | | 512 | | | | 4,250 | |

| C.H. Robinson Worldwide, Inc. | | | 22 | | | | 1,800 | |

| Canadian National Railway | | | 22 | | | | 2,325 | |

| Carrier Global Corp. | | | 144 | | | | 6,863 | |

| Caterpillar, Inc. | | | 29 | | | | 6,555 | |

| Cie de Saint-Gobain | | | 117 | | | | 6,357 | |

| Cintas Corp. | | | 8 | | | | 4,057 | |

| Copart, Inc. (a) | | | 80 | | | | 3,482 | |

| Daikin Industries Ltd. | | | 100 | | | | 14,282 | |

| Deere & Co. | | | 32 | | | | 11,692 | |

| DHL Group | | | 133 | | | | 5,168 | |

| Equifax, Inc. | | | 21 | | | | 3,561 | |

| Experian PLC | | | 176 | | | | 5,320 | |

| Hitachi Ltd. | | | 200 | | | | 12,515 | |

| Itochu Corp. | | | 100 | | | | 3,548 | |

| Kingspan Group PLC | | | 76 | | | | 5,100 | |

| Komatsu Ltd. | | | 200 | | | | 4,573 | |

| Kuehne + Nagel International | | | 14 | | | | 3,761 | |

| Legrand | | | 96 | | | | 8,268 | |

| Marubeni Corp. | | | 300 | | | | 4,314 | |

| Mitsubishi Corp. | | | 200 | | | | 9,185 | |

| MTU Aero Engines | | | 12 | | | | 2,245 | |

| Nibe Industrier (a) | | | 816 | | | | 4,687 | |

| NIDEC Corp. | | | 100 | | | | 3,580 | |

| Recruit Holdings | | | 200 | | | | 5,722 | |

| Relx PLC | | | 276 | | | | 9,605 | |

| Rentokil Initial PLC | | | 842 | | | | 4,259 | |

| Schneider Electric | | | 135 | | | | 20,688 | |

| Siemens | | | 86 | | | | 11,359 | |

| Siemens Energy AG (a) | | | 283 | | | | 2,504 | |

| Sumitomo Corp. | | | 300 | | | | 5,821 | |

See Notes to the Financial Statements

V-SHARES MSCI WORLD ESG MATERIALITY AND CARBON TRANSITION ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Industrials — 10.2% (Continued) | | | | | | |

| Transurban Group | | | 1,127 | | | $ | 8,434 | |

| Veralto Corp. (a) | | | 25 | | | | 1,725 | |

| Vestas Wind Systems AS (a) | | | 264 | | | | 5,692 | |

| Vinci | | | 74 | | | | 8,172 | |

| Volvo AB | | | 282 | | | | 5,576 | |

| Wartsila | | | 310 | | | | 3,683 | |

| Wolters Kluwer | | | 56 | | | | 7,168 | |

| Total Industrials | | | | | | | 259,668 | |

| | | | | | | | | |

| Information Technology — 25.5% (b) | | | | | | | | |

| Adobe, Inc. (a) | | | 36 | | | | 19,154 | |

| Applied Materials, Inc. | | | 76 | | | | 10,059 | |

| ASML Holding | | | 34 | | | | 20,316 | |

| Autodesk, Inc. (a) | | | 27 | | | | 5,336 | |

| Dassault Systemes SE | | | 183 | | | | 7,508 | |

| First Solar, Inc. (a) | | | 8 | | | | 1,140 | |

| Infineon Technologies AG | | | 160 | | | | 4,647 | |

| Intel Corp. | | | 648 | | | | 23,652 | |

| International Business Machines Corp. | | | 136 | | | | 19,671 | |

| Intuit, Inc. | | | 22 | | | | 10,889 | |

| Lam Research Corp. | | | 14 | | | | 8,235 | |

| Microsoft Corp. | | | 812 | | | | 274,545 | |

| NEC Corp. | | | 100 | | | | 4,758 | |

| NVIDIA Corp. | | | 380 | | | | 154,964 | |

| NXP Semiconductors | | | 30 | | | | 5,173 | |

| Sage Group PLC | | | 803 | | | | 9,457 | |

| salesforce.com, Inc. (a) | | | 152 | | | | 30,526 | |

| SAP | | | 165 | | | | 22,104 | |

| Texas Instruments, Inc. | | | 55 | | | | 7,811 | |

| VMware, Inc. (a) | | | 33 | | | | 4,806 | |

| Workday, Inc. (a) | | | 28 | | | | 5,928 | |

| Total Information Technology | | | | | | | 650,679 | |

| | | | | | | | | |

| Materials — 3.4% | | | | | | | | |

| Amcor PLC | | | 522 | | | | 4,641 | |

| Avery Dennison Corp. | | | 46 | | | | 8,007 | |

| Ball Corp. | | | 104 | | | | 5,008 | |

| Croda International | | | 73 | | | | 3,878 | |

| Givaudan | | | 1 | | | | 3,319 | |

| Linde PLC | | | 46 | | | | 17,579 | |

| Martin Marietta Materials, Inc. | | | 7 | | | | 2,863 | |

| Novozymes | | | 132 | | | | 5,918 | |

See Notes to the Financial Statements

V-SHARES MSCI WORLD ESG MATERIALITY AND CARBON TRANSITION ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| Materials — 3.4% (Continued) | | | | | | |

| PPG Industries, Inc. | | | 42 | | | $ | 5,156 | |

| Sherwin-Williams | | | 36 | | | | 8,575 | |

| Shin-Etsu Chemical Ltd. | | | 200 | | | | 5,900 | |

| Symrise | | | 48 | | | | 4,881 | |

| UPM-Kymmene | | | 146 | | | | 4,903 | |

| Wheaton Precious Metals Corp. | | | 173 | | | | 7,299 | |

| Total Materials | | | | | | | 87,927 | |

| | | | | | | | | |

| Real Estate — 2.4% | | | | | | | | |

| American Tower Corp. | | | 44 | | | | 7,840 | |

| CapitaLand Integrated Commercial Trust | | | 5,000 | | | | 6,423 | |

| Crown Castle International Corp. | | | 48 | | | | 4,463 | |

| Digital Realty Trust, Inc. | | | 79 | | | | 9,824 | |

| Equinix, Inc. | | | 18 | | | | 13,134 | |

| Prologis, Inc. | | | 73 | | | | 7,355 | |

| SBA Communications Corp. | | | 18 | | | | 3,755 | |

| Stockland | | | 1,909 | | | | 4,279 | |

| Ventas, Inc. | | | 130 | | | | 5,520 | |

| Total Real Estate | | | | | | | 62,593 | |

| | | | | | | | | |

| Utilities — 2.4% | | | | | | | | |

| Edison International | | | 157 | | | | 9,900 | |

| Enel | | | 1,288 | | | | 8,152 | |

| Iberdrola | | | 383 | | | | 4,251 | |

| NextEra Energy, Inc. | | | 172 | | | | 10,028 | |

| Northland Power, Inc. | | | 275 | | | | 3,861 | |

| Orsted | | | 75 | | | | 3,609 | |

| Redeia Corp. | | | 796 | | | | 12,372 | |

| Terna – Rete Elettrica Nazionale | | | 1,213 | | | | 9,265 | |

| Total Utilities | | | | | | | 61,438 | |

| Total Common Stocks | | | | | | | | |

| (Cost $2,520,012) | | | | | | | 2,516,132 | |

See Notes to the Financial Statements

V-SHARES MSCI WORLD ESG MATERIALITY AND CARBON TRANSITION ETF

Schedule of Investments – Continued

October 31, 2023

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENTS — 1.0% | | | | | | |

| | | | | | | |

| Money Market Funds — 1.0% | | | | | | |

| First American Government Obligations Fund – Class X, 5.28% (c) | | | 24,626 | | | $ | 24,626 | |

| Total Money Market Funds | | | | | | | 24,626 | |

| Total Short-Term Investments | | | | | | | | |

| (Cost $24,626) | | | | | | | 24,626 | |

| Total Investments — 99.9% | | | | | | | | |

| (Cost $2,544,638) | | | | | | | 2,540,758 | |

| Other Assets in Excess of Liabilities — 0.1% | | | | | | | 2,808 | |

| Total Net Assets — 100.0% | | | | | | $ | 2,543,566 | |

Percentages are stated as a percent of net assets.

PLC – Public Limited Company

| (a) | Non-income producing security. |

| (b) | As of October 31, 2023, the Fund had a significant portion of its assets invested in this sector and therefore is subject to additional risks. See Note 8 in Notes to Financial Statements. |

| (c) | The rate shown represents the 7-day effective yield as of October 31, 2023. |

See Notes to the Financial Statements

V-SHARES MSCI WORLD ESG MATERIALITY AND CARBON TRANSITION ETF

Schedule of Investments – Continued

October 31, 2023

At October 31, 2023, the country diversification for the Fund was as follows:

| | | % of |

| Country | | Net Assets |

| United States | | | 59.94 | % | |

| United Kingdom | | | 6.79 | % | |

| Japan | | | 6.78 | % | |

| France | | | 4.79 | % | |

| Germany | | | 3.61 | % | |

| Canada | | | 3.31 | % | |

| Australia | | | 2.27 | % | |

| Denmark | | | 2.14 | % | |

| Switzerland | | | 2.05 | % | |

| Netherlands | | | 1.96 | % | |

| Spain | | | 1.55 | % | |

| Italy | | | 1.05 | % | |

| Hong Kong | | | 0.97 | % | |

| Ireland | | | 0.82 | % | |

| Finland | | | 0.53 | % | |

| Sweden | | | 0.48 | % | |

| Belgium | | | 0.35 | % | |

| Norway | | | 0.27 | % | |

| Singapore | | | 0.25 | % | |

| New Zealand | | | 0.09 | % | |

| Total | | | 100.00 | % | |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.