Annual Report

December 31, 2023

| Kensington Active Advantage Fund |

Class A Shares (KADAX)

Class C Shares (KADCX)

Institutional Class Shares (KADIX)

| Kensington Managed Income Fund |

Class A Shares (KAMAX)

Class C Shares (KAMCX)

Institutional Class Shares (KAMIX)

| Kensington Dynamic Growth Fund |

Class A Shares (KAGAX)

Class C Shares (KAGCX)

Institutional Class Shares (KAGIX)

Institutional Class Shares (DFNDX)

1-855-375-3060

www.kensingtonassetmanagement.com

Distributed by Quasar Distributors, LLC

KENSINGTON FUNDS

January 2024

Reflection on 2023

The year 2023 was marked by significant geopolitical upheaval, including persistent armed conflicts, notably a de facto proxy war between Russia and Western nations, escalating tensions and trade protectionism between the U.S. and China, and instability in the Middle East impacting crucial global shipping routes. Such events traditionally have limited direct impacts on the private sector; in fact, historically, conflict has often coincided with economic gain. However, the global unrest post-pandemic raises concerns that the current situation may diverge from historical trends. On the domestic front, demographic shifts, particularly the rise in influence of younger generations like Millennials, Gen X, and Gen Z, are reshaping priorities and potentially altering market dynamics.

The stock market concluded 2023 on a strong note. The S&P 500 reported gains of 4.54% for the month, 11.69% for the quarter, and 26.29% annually. The Nasdaq 100 demonstrated remarkable growth, especially in technology-focused mega-caps, known as the “Magnificent Seven,” which surged by 111% due to their significant potential in leveraging advancements in artificial intelligence. However, this performance was not uniformly seen across the board, with the remaining companies in the index showing more modest gains. International markets also witnessed substantial growth, adding to the global positive sentiment in equity sectors.

The fixed income sector saw a resurgence at the year’s end, overturning losses from earlier in the year. This resurgence was fueled by favorable conditions such as successful Treasury auctions, encouraging inflation data, and a general economic slowdown, which led investors to believe that the prolonged bearish trend in bonds was concluding. Various bond indices, including government and corporate bonds, reported positive returns, reflecting renewed investor confidence in the fixed income market.

Market Outlook: The decline in key inflation indicators, such as the PCE Deflator and Core PCE inflation rate, has instilled optimism in the market. The expectation of continued downward pressure on inflation, particularly from housing costs, suggests that the current downward inflation trend is likely to persist. However, the bond market faces challenges ahead, including managing the U.S. fiscal deficit and refinancing a significant volume of corporate bonds. The national deficit, now nearing $34 trillion, poses a significant challenge, with projections showing a potential rise to over 120% of GDP, as per Fitch Ratings Service. The market is anticipating a potential shift in Federal Reserve policies in the first half of 2024, signaling the end of the tightening phase initiated in early 2022. The Federal Reserve will need to carefully manage market expectations, considering the substantial easing of financial conditions since early 2023.

Past performance is no guarantee of future results.

Investors may not invest in an index directly; unlike the Funds’ returns, an index does not reflect any fees or expenses.

Opinions expressed are those of the Investment Manager, are subject to change, are not guaranteed, and should not be considered investment advice.

Investing in a mutual fund involves risk, including loss of principal. There is no guarantee that a Fund will meet its investment objectives. Risks specific to each Fund are detailed in the prospectus and include Management Risk, Market Risk, Underlying Funds Risk, Non- Diversification Risk, Turnover Risk, U.S. Government Securities Risk, and Models and Data Risk. Additional risks that may apply include High- Yield Bond Risk, Fixed-Income Securities Risk, Equity Securities Risk, Foreign Investment Risk, Loans

KENSINGTON FUNDS

Risk, Small and Mid-Capitalization Companies Risk, LIBOR Risk, and Limited History of Operations Risk. For details regarding each risk, please see the Fund’s prospectus.

The S&P 500 Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends.

The NASDAQ 100 Index is a modified capitalization-weighted index which is comprised of 102 equity securities issued by 101 of the largest non-financial companies listed on the NASDAQ stock exchange.

The Magnificent Seven stocks are a group of high-performing and influential companies in the U.S. stock market: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

Personal consumption expenditures (PCE), also known as consumer spending, is a measure of the spending on goods and services by people of the United States.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security.

This report must be preceded or accompanied by a current prospectus.

Kensington Asset Management, LLC is the adviser to the Funds, distributed by Quasar Distributors, LLC. Member FINRA/SIPC. Kensington Asset Management, LLC is not affiliated with Quasar.

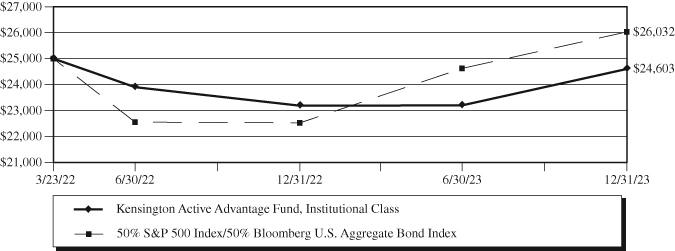

KENSINGTON ACTIVE ADVANTAGE FUND

Value of $25,000 Investment (Unaudited)

The chart assumes an initial investment of $25,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-375-3060. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return as of December 31, 2023

| | | Since |

| | 1 Year | Inception(1) |

| Class A | 5.92% | -1.14% |

Class A with load(2) | 0.88% | -3.82% |

| Class C | 5.02% | -1.89% |

Class C with load(3) | 4.02% | -1.89% |

| Institutional Class | 6.12% | -0.90% |

50% S&P 500 Index/50% Bloomberg U.S. Aggregate Bond Index(4) | 15.58% | 2.31% |

| (1) | March 23, 2022. |

| (2) | Performance data shown with load reflects the Class A maximum sales charge of 4.75%. |

| (3) | Performance data shown with load reflects the Class C 1.00% contingent deferred sales charge on shares redeemed prior to the first 12 months after purchase. |

| (4) | The Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. The Bloomberg U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities. Investors cannot invest directly in an index. |

The following is expense information for the Kensington Active Advantage Fund as disclosed in the Fund’s most recent prospectus dated April 30, 2023:

| Class A Gross Expense Ratio – 3.96% | Net Expense Ratio – 1.67% |

| Class C Gross Expense Ratio – 4.71% | Net Expense Ratio – 2.42% |

| Institutional Class Gross Expense Ratio – 3.71% | Net Expense Ratio – 1.42% |

KENSINGTON ACTIVE ADVANTAGE FUND

Kensington Asset Management, LLC (the “Adviser”) has contractually agreed to waive its management fee and pay Fund expenses to ensure that Total Annual Fund Operating Expenses (excluding Acquired Fund Fees and Expenses (“AFFE”), leverage/borrowing interest, interest expense, dividends paid on short sales, taxes, brokerage commissions, extraordinary expenses, and distribution (12b-1) fees and expenses) do not exceed 1.35% of the average net assets of the applicable share class. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and the expense limit in effect at the time of recoupment. The Operating Expense Limitation Agreement is indefinite in term and cannot be terminated through at least June 30, 2024. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser.

The actual net expense ratio applicable to investors, as disclosed in the Financial Highlights for the period ended December 31, 2023, was 1.61%, 2.36% and 1.36% for the Class A, Class C and Institutional Class, respectively.

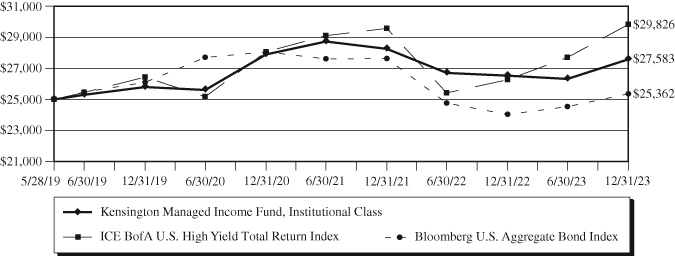

KENSINGTON MANAGED INCOME FUND

Value of $25,000 Investment (Unaudited)

The chart assumes an initial investment of $25,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-375-3060. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return as of December 31, 2023

| | | | Since |

| | 1 Year | 3 Year | Inception(1) |

| Class A | 3.67% | -0.62% | 1.91% |

Class A with load(2) | -1.24% | -2.22% | 0.83% |

| Class C | 2.92% | -1.33% | 0.87% |

Class C with load(3) | 1.92% | -1.33% | 0.87% |

| Institutional Class | 3.97% | -0.38% | 2.16% |

ICE BofA U.S. High Yield Total Return Index(4) | 13.46% | 2.00% | 3.89% |

Bloomberg U.S. Aggregate Bond Index(5) | 5.53% | -3.31% | 0.31% |

| (1) | May 28, 2019 for the Class A and Institutional Class and August 27, 2019 for the Class C. Performance shown for the Class C prior to the inception of the Class C is based on the performance of the Institutional Class shares, adjusted for the lower expenses applicable to Class C shares. |

| (2) | Performance data shown with load reflects the Class A maximum sales charge of 4.75%. |

| (3) | Performance data shown with load reflects the Class C 1.00% contingent deferred sales charge on shares redeemed prior to the first 12 months after purchase. |

| (4) | ICE BofA U.S. High Yield Total Return Index measures the performance of below investment grade U.S.-denominated corporate bonds publicly issued in the U.S. market. The index is unmanaged; includes net reinvested dividends; does not reflect fees or expenses; and is not available for direct investment. Investors cannot invest directly in an index. |

| (5) | The Bloomberg U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities. Investors cannot invest directly in an index. |

KENSINGTON MANAGED INCOME FUND

The following is expense information for the Kensington Managed Income Fund as disclosed in the Fund’s most recent prospectus dated April 30, 2023:

| Class A Gross Expense Ratio – 1.70% | Net Expense Ratio – 1.67% |

| Class C Gross Expense Ratio – 2.45% | Net Expense Ratio – 2.42% |

| Institutional Class Gross Expense Ratio – 1.45% | Net Expense Ratio – 1.42% |

Kensington Asset Management, LLC (the “Adviser”) has contractually agreed to waive its management fee and pay Fund expenses to ensure that Total Annual Fund Operating Expenses (excluding AFFE, leverage/borrowing interest, interest expense, dividends paid on short sales, taxes, brokerage commissions, extraordinary expenses, and distribution (12b-1) fees and expenses) do not exceed 1.35% of the average net assets of the applicable share class. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and the expense limit in effect at the time of recoupment. The Operating Expense Limitation Agreement is indefinite in term and cannot be terminated through at least June 30, 2024. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser.

The actual net expense ratio applicable to investors, as disclosed in the Financial Highlights for the period ended December 31, 2023, was 1.60%, 2.35% and 1.35% for the Class A, Class C and Institutional Class, respectively.

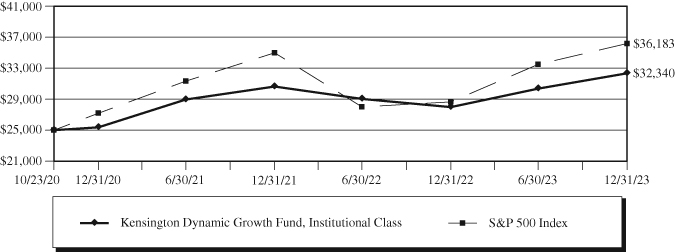

KENSINGTON DYNAMIC GROWTH FUND

Value of $25,000 Investment (Unaudited)

The chart assumes an initial investment of $25,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-375-3060. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return as of December 31, 2023

| |

|

| Since |

| | 1 Year | 3 Year | Inception(1) |

| Class A | 15.29% | 8.14% | 8.09% |

Class A with load(2) | 9.78% | 6.41% | 6.45% |

| Class C | 14.49% | 7.34% | 7.35% |

Class C with load(3) | 13.49% | 7.34% | 7.35% |

| Institutional Class | 15.59% | 8.43% | 8.41% |

S&P 500 Index(4) | 26.29% | 10.00% | 12.29% |

| (1) | October 23, 2020. |

| (2) | Performance data shown with load reflects the Class A maximum sales charge of 4.75%. |

| (3) | Performance data shown with load reflects the Class C 1.00% contingent deferred sales charge on shares redeemed prior to the first 12 months after purchase. |

| (4) | The S&P 500 Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index. |

The following is expense information for the Kensington Dynamic Growth Fund as disclosed in the Fund’s most recent prospectus dated April 30, 2023:

| Class A Gross Expense Ratio – 1.68% | Net Expense Ratio – 1.67% |

| Class C Gross Expense Ratio – 2.43% | Net Expense Ratio – 2.42% |

| Institutional Class Gross Expense Ratio – 1.43% | Net Expense Ratio – 1.42% |

KENSINGTON DYNAMIC GROWTH FUND

Kensington Asset Management, LLC (the “Adviser”) has contractually agreed to waive its management fee and pay Fund expenses to ensure that Total Annual Fund Operating Expenses (excluding AFFE, leverage/borrowing interest, interest expense, dividends paid on short sales, taxes, brokerage commissions, extraordinary expenses, and distribution (12b-1) fees and expenses) do not exceed 1.38% of the average net assets of the applicable share class. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and the expense limit in effect at the time of recoupment. The Operating Expense Limitation Agreement is indefinite in term and cannot be terminated through at least June 30, 2024. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser.

The actual net expense ratio applicable to investors, as disclosed in the Financial Highlights for the period ended December 31, 2023, was 1.63%, 2.38% and 1.38% for the Class A, Class C and Institutional Class, respectively.

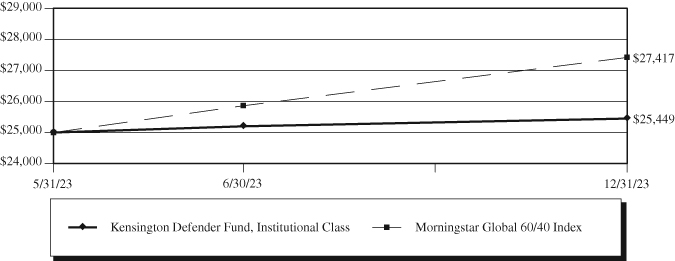

KENSINGTON DEFENDER FUND

Value of $25,000 Investment (Unaudited)

The chart assumes an initial investment of $25,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-375-3060. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Rates of Return as of December 31, 2023

| | Since |

| | Inception(1) |

| Institutional Class | 1.80% |

Morningstar Global 60/40 Index(2) | 9.67% |

| (1) | May 31, 2023. |

| (2) | The Morningstar Global 60/40 Index is a blended benchmark of 60% Morningstar Global Markets Net Return USD / 40% Morningstar Global Core Bond Gross Return USD, rebalanced to target weights of 60% equity and 40% fixed income on monthly basis. This Index does not incorporate Environmental, Social, or Governance (ESG) criteria. Investors cannot invest directly in an index. |

The following is expense information for the Kensington Defender Fund as disclosed in the Fund’s most recent prospectus dated May 30, 2023:

| Institutional Class Gross Expense Ratio – 2.48% | Net Expense Ratio – 1.72% |

Kensington Asset Management, LLC (the “Adviser”) has contractually agreed to waive its management fee and pay Fund expenses to ensure that Total Annual Fund Operating Expenses (excluding AFFE, leverage/borrowing interest, interest expense, dividends paid on short sales, taxes, brokerage commissions, extraordinary expenses, and distribution (12b-1) fees and expenses) do not exceed 1.49% of the average net assets of the Fund. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieved without

KENSINGTON DEFENDER FUND

exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and the expense limit in effect at the time of recoupment. The Operating Expense Limitation Agreement is indefinite in term and cannot be terminated through at least May 30, 2024. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser.

The actual net expense ratio applicable to shareholders, as disclosed in the Financial Highlights for the period ended December 31, 2023, was 1.49%.

KENSINGTON FUNDS

Expense Examples (Unaudited)

December 31, 2023

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2023 – December 31, 2023).

ACTUAL EXPENSES

For each class, the first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Kensington Active Advantage Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (7/1/23) | (12/31/23) | (7/1/23 to 12/31/23) |

Institutional Class | | | |

Actual(2)(3) | $1,000.00 | $1,060.60 | $ 7.06 |

Hypothetical (5% return before expenses)(4) | $1,000.00 | $1,018.35 | $ 6.92 |

| | | | |

A Class | | | |

Actual(2)(3) | $1,000.00 | $1,059.30 | $ 8.36 |

Hypothetical (5% return before expenses)(4) | $1,000.00 | $1,017.09 | $ 8.19 |

| | | | |

C Class | | | |

Actual(2)(3) | $1,000.00 | $1,054.60 | $12.22 |

Hypothetical (5% return before expenses)(4) | $1,000.00 | $1,013.31 | $11.98 |

| (1) | Expenses are equal to the fund’s annualized expense ratio for the most recent six-month period of 1.36%, 1.61% and 2.36% for the Institutional Class, A Class and C Class, respectively, multiplied by the average account value over the period, multiplied 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended December 31, 2023, of 6.06%, 5.93% and 5.46% for the Institutional Class, A Class, and C Class, respectively. |

| (3) | Excluding interest expense, the actual expenses would be $7.01, $8.30 and $12.17 for the Institutional Class, A Class and C Class, respectively. |

| (4) | Excluding interest expense, the hypothetical expenses would be $6.87, $8.13 and $11.93 for the Institutional Class, A Class and C Class, respectively. |

KENSINGTON FUNDS

Expense Examples (Unaudited) – Continued

December 31, 2023

Kensington Managed Income Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (7/1/23) | (12/31/23) | (7/1/23 to 12/31/23) |

Institutional Class | | | |

Actual(2) | $1,000.00 | $1,048.00 | $ 6.97 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,018.40 | $ 6.87 |

| | | | |

A Class | | | |

Actual(2) | $1,000.00 | $1,046.70 | $ 8.25 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,017.14 | $ 8.13 |

| | | | |

C Class | | | |

Actual(2) | $1,000.00 | $1,042.90 | $12.10 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,013.36 | $11.93 |

| (1) | Expenses are equal to the fund’s annualized expense ratio for the most recent six-month period of 1.35%, 1.60% and 2.35% for the Institutional Class, A Class and C Class, respectively, multiplied by the average account value over the period, multiplied 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended December 31, 2023, of 4.80%, 4.67% and 4.29% for the Institutional Class, A Class, and C Class, respectively. |

Kensington Dynamic Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (7/1/23) | (12/31/23) | (7/1/23 to 12/31/23) |

Institutional Class | | | |

Actual(2) | $1,000.00 | $1,065.10 | $ 7.18 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,018.25 | $ 7.02 |

| | | | |

A Class | | | |

Actual(2) | $1,000.00 | $1,063.00 | $ 8.48 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,016.99 | $ 8.29 |

| | | | |

C Class | | | |

Actual(2) | $1,000.00 | $1,059.10 | $12.35 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,013.21 | $12.08 |

| (1) | Expenses are equal to the fund’s annualized expense ratio for the most recent six-month period of 1.38%, 1.63% and 2.38% for the Institutional Class, A Class and C Class, respectively, multiplied by the average account value over the period, multiplied 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended December 31, 2023, of 6.51%, 6.30% and 5.91% for the Institutional Class, A Class, and C Class, respectively. |

Kensington Defender Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (7/1/23) | (12/31/23) | (7/1/23 to 12/31/23) |

Institutional Class | | | |

Actual(2) | $1,000.00 | $1,009.90 | $ 7.55 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,017.69 | $ 7.58 |

| (1) | Expenses are equal to the fund’s annualized expense ratio for the most recent six-month period of 1.49%, multiplied by the average account value over the period, multiplied 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended December 31, 2023, of 0.99%. |

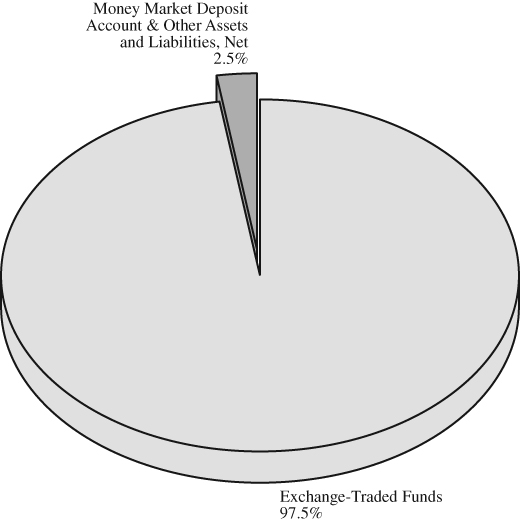

KENSINGTON ACTIVE ADVANTAGE FUND

Allocation of Portfolio(1) (% of Net Assets) (Unaudited)

December 31, 2023

Top Holdings(1) (Unaudited)

as of December 31, 2023

(% of Net Assets)

| | iShares Broad USD High Yield Corporate Bond ETF | | | 32.9 | % |

| | Vanguard S&P 500 ETF | | | 25.2 | % |

| | iShares Core U.S. Aggregate Bond ETF | | | 17.7 | % |

| | Invesco QQQ Trust Series 1 | | | 15.5 | % |

| | Vanguard Total Stock Market ETF | | | 6.2 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

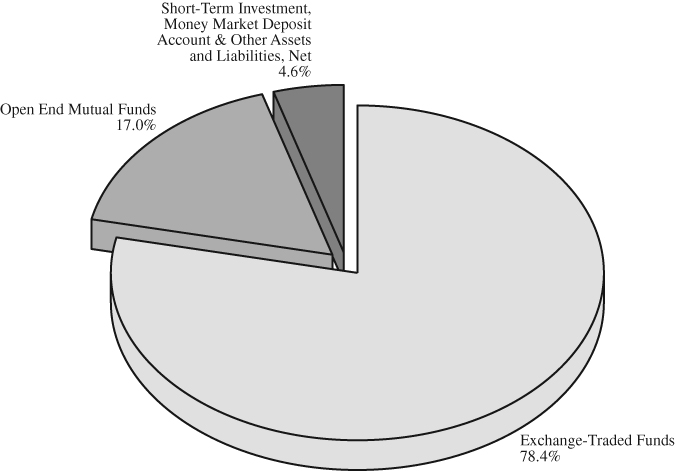

KENSINGTON MANAGED INCOME FUND

Allocation of Portfolio(1) (% of Net Assets) (Unaudited)

December 31, 2023

Top Ten Holdings(1)(2) (Unaudited)

as of December 31, 2023

(% of Net Assets)

| | iShares Broad USD High Yield Corporate Bond ETF | | | 22.4 | % |

| | SPDR Bloomberg High Yield Bond ETF | | | 19.2 | % |

| | Fidelity Capital & Income Fund | | | 10.3 | % |

| | VanEck Fallen Angel High Yield Bond ETF | | | 6.5 | % |

| | SPDR Portfolio High Yield Bond ETF | | | 6.4 | % |

| | SPDR Bloomberg Short Term High Yield Bond ETF | | | 6.3 | % |

| | Invesco Senior Loan ETF | | | 5.0 | % |

| | SPDR Blackstone Senior Loan ETF | | | 4.9 | % |

| | Xtrackers USD High Yield Corporate Bond ETF | | | 4.5 | % |

| | Pioneer Strategic Income Fund – Class K | | | 3.7 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Excludes short-term investments. |

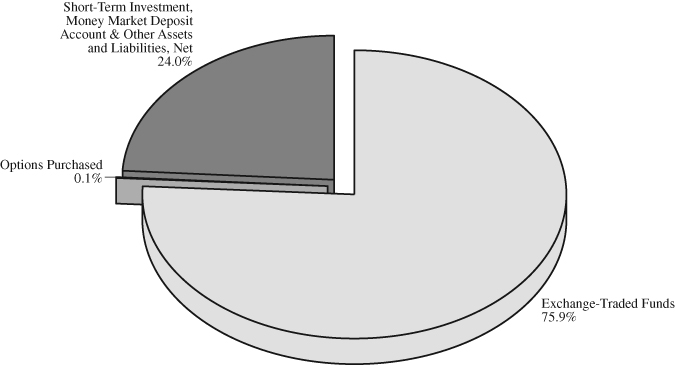

KENSINGTON DYNAMIC GROWTH FUND

Allocation of Portfolio(1) (% of Net Assets) (Unaudited)

December 31, 2023

Top Holdings(1)(2) (Unaudited)

as of December 31, 2023

(% of Net Assets)

| | Invesco QQQ Trust Series 1 | | | 33.7 | % |

| | Vanguard S&P 500 ETF | | | 33.1 | % |

| | Vanguard Growth ETF | | | 9.6 | % |

| | Vanguard Mega Cap Growth ETF | | | 9.6 | % |

| | Vanguard Total Stock Market ETF | | | 9.5 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Excludes short-term investments. |

KENSINGTON DEFENDER FUND

Allocation of Portfolio(1) (% of Net Assets) (Unaudited)

December 31, 2023

Top Holdings(1) (Unaudited)

as of December 31, 2023

(% of Net Assets)

| | iShares Short Treasury Bond ETF | | | 23.5 | % |

| | Invesco QQQ Trust Series 1 | | | 8.9 | % |

| | Vanguard FTSE Europe ETF | | | 8.8 | % |

| | SPDR Portfolio S&P 500 ETF | | | 8.8 | % |

| | iShares iBoxx High Yield Corporate Bond ETF | | | 8.7 | % |

| | Franklin FTSE Japan ETF | | | 8.7 | % |

| | abrdn Physical Gold Shares ETF | | | 8.5 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

KENSINGTON ACTIVE ADVANTAGE FUND

Schedule of Investments

December 31, 2023

Description | | Shares | | | Value | |

| EXCHANGE-TRADED FUNDS – 97.5% | | | | | | |

Invesco QQQ Trust Series 1 | | | 4,030 | | | $ | 1,650,366 | |

iShares Broad USD High Yield Corporate Bond ETF (a) | | | 96,700 | | | | 3,515,045 | |

iShares Core U.S. Aggregate Bond ETF | | | 19,100 | | | | 1,895,675 | |

Vanguard S&P 500 ETF (a) | | | 6,170 | | | | 2,695,056 | |

Vanguard Total Stock Market ETF | | | 2,770 | | | | 657,099 | |

| TOTAL EXCHANGE-TRADED FUNDS | | | | | | | | |

| (Cost $9,734,029) | | | | | | | 10,413,241 | |

| TOTAL INVESTMENTS – 97.5% | | | | | | | | |

| (Cost $9,734,029) | | | | | | | 10,413,241 | |

Money Market Deposit Account – 2.7% (b) | | | | | | | 289,887 | |

Liabilities in Excess of Other Assets – (0.2)% | | | | | | | (18,647 | ) |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 10,684,481 | |

Percentages are stated as a percent of net assets.

| (a) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (b) | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and is subject to change daily. The rate shown as of December 31, 2023, was 5.27%. |

See Notes to the Financial Statements

KENSINGTON MANAGED INCOME FUND

Schedule of Investments

December 31, 2023

Description | | Shares | | | Value | |

| EXCHANGE-TRADED FUNDS – 78.4% | | | | | | |

FlexShares High Yield Value-Scored Bond Index Fund | | | 635,400 | | | $ | 25,968,798 | |

Invesco Senior Loan ETF | | | 1,903,300 | | | | 40,311,894 | |

iShares Broad USD High Yield Corporate Bond ETF | | | 5,012,800 | | | | 182,215,280 | |

SPDR Blackstone Senior Loan ETF | | | 960,400 | | | | 40,269,572 | |

SPDR Bloomberg High Yield Bond ETF | | | 1,651,300 | | | | 156,427,649 | |

SPDR Bloomberg Short Term High Yield Bond ETF | | | 2,048,700 | | | | 51,504,318 | |

SPDR Portfolio High Yield Bond ETF | | | 2,224,800 | | | | 52,015,824 | |

VanEck Fallen Angel High Yield Bond ETF | | | 1,828,500 | | | | 52,624,230 | |

Xtrackers USD High Yield Corporate Bond ETF | | | 1,028,200 | | | | 36,552,510 | |

| TOTAL EXCHANGE-TRADED FUNDS | | | | | | | | |

| (Cost $615,095,335) | | | | | | | 637,890,075 | |

| | | | | | | | | |

| OPEN-END FUNDS – 17.0% | | | | | | | | |

Fidelity Advisor High Income Advantage Fund – Class Z | | | 999,001 | | | | 10,489,510 | |

Fidelity Capital & Income Fund | | | 8,686,211 | | | | 83,821,933 | |

Manning & Napier High Yield Bond Series – Class Z | | | 1,788,079 | | | | 13,839,735 | |

Pioneer Strategic Income Fund – Class K (a) | | | 3,151,261 | | | | 29,905,462 | |

| TOTAL OPEN-END FUNDS | | | | | | | | |

| (Cost $133,484,125) | | | | | | | 138,056,640 | |

| | | | | | | | | |

| | | Par | | | | | |

| SHORT-TERM INVESTMENTS – 3.1% | | | | | | | | |

| | | | | | | | | |

| U.S. Treasury Bills – 3.1% | | | | | | | | |

4.69%, 01/18/2024 (b) | | | 25,000,000 | | | | 24,941,374 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $24,937,313) | | | | | | | 24,941,374 | |

| TOTAL INVESTMENTS – 98.5% | | | | | | | | |

| (Cost $773,516,773) | | | | | | | 800,888,089 | |

Money Market Deposit Account – 1.1% (c) | | | | | | | 9,178,517 | |

Other Assets in Excess of Liabilities – 0.4% | | | | | | | 3,208,887 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 813,275,493 | |

Percentages are stated as a percent of net assets.

| (a) | Represents an affiliated company as defined by the Investment Company Act of 1940. See Note 8 in Notes to Financial Statements. |

| (b) | The rate shown is the effective yield as of December 31, 2023. |

| (c) | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and is subject to change daily. The rate shown as of December 31, 2023, was 5.27%. |

See Notes to the Financial Statements

KENSINGTON DYNAMIC GROWTH FUND

Schedule of Investments

December 31, 2023

Description | | Shares | | | Value | |

| EXCHANGE-TRADED FUNDS – 95.5% | | | | | | |

Invesco QQQ Trust Series 1 (a) | | | 986,000 | | | $ | 403,786,720 | |

Vanguard Growth ETF | | | 370,300 | | | | 115,118,864 | |

Vanguard Mega Cap Growth ETF | | | 441,700 | | | | 114,625,567 | |

Vanguard S&P 500 ETF (a) | | | 906,000 | | | | 395,740,800 | |

Vanguard Total Stock Market ETF | | | 479,900 | | | | 113,841,878 | |

| TOTAL EXCHANGE-TRADED FUNDS | | | | | | | | |

| (Cost $1,036,735,409) | | | | | | | 1,143,113,829 | |

| | | | | | | | | |

| | | Par | | | | | |

| SHORT-TERM INVESTMENTS – 0.2% | | | | | | | | |

| | | | | | | | | |

| U.S. Treasury Bills – 0.2% | | | | | | | | |

4.94%, 01/30/2024 (b)(c) | | | 1,526,000 | | | | 1,519,723 | |

5.07%, 03/28/2024 (b)(c) | | | 1,027,000 | | | | 1,014,263 | |

| | | | | | | | 2,533,986 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $2,533,484) | | | | | | | 2,533,986 | |

| TOTAL INVESTMENTS – 95.7% | | | | | | | | |

| (Cost $1,039,268,893) | | | | | | | 1,145,647,815 | |

Money Market Deposit Account – 3.9% (d) | | | | | | | 46,345,307 | |

Other Assets in Excess of Liabilities – 0.4% | | | | | | | 4,966,068 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 1,196,959,190 | |

Percentages are stated as a percent of net assets.

| (a) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (b) | The rate shown is the effective yield as of December 31, 2023. |

| (c) | All or a portion of this security is designated as collateral for futures contracts. As of December 31, 2023, the fair value of the collateral was $2,533,986. |

| (d) | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and is subject to change daily. The rate shown as of December 31, 2023, was 5.27%. |

See Notes to the Financial Statements

KENSINGTON DYNAMIC GROWTH FUND

Schedule of Open Futures Contracts

December 31, 2023

| | | | | | | | | | Value/Unrealized | |

| | | Contracts | | Expiration | | | | | Appreciation | |

Description | | Purchased | | Date | | Notional | | | (Depreciation) | |

E-mini S&P 500 Index | | | 115 | | March 15, 2024 | | $ | 27,715,000 | | | $ | 783,405 | |

| Total Unrealized Appreciation (Depreciation) | | | | | | | | | | | $ | 783,405 | |

See Notes to the Financial Statements

KENSINGTON DEFENDER FUND

Schedule of Investments

December 31, 2023

Description | | | | | Shares | | | Value | |

| EXCHANGE-TRADED FUNDS – 75.9% | | | | | | | | | |

abrdn Physical Gold Shares ETF (a) | | | | | | 193,458 | | | $ | 3,818,861 | |

Franklin FTSE Japan ETF | | | | | | 138,093 | | | | 3,865,223 | |

Invesco QQQ Trust Series 1 | | | | | | 9,745 | | | | 3,990,772 | |

iShares iBoxx High Yield Corporate Bond ETF | | | | | | 50,123 | | | | 3,879,019 | |

iShares Short Treasury Bond ETF (b) | | | | | | 95,297 | | | | 10,495,059 | |

SPDR Portfolio S&P 500 ETF | | | | | | 70,450 | | | | 3,938,155 | |

Vanguard FTSE Europe ETF | | | | | | 61,255 | | | | 3,949,722 | |

| TOTAL EXCHANGE-TRADED FUNDS | | | | | | | | | | | |

| (Cost $32,946,061) | | | | | | | | | | 33,936,811 | |

| | | | | | | | | | | | |

| | | Notional | | | Contracts | | | | | |

| OPTIONS PURCHASED – 0.1% | | | | | | | | | | | |

| | | | | | | | | | | | |

| Put Options – 0.1% (c) | | | | | | | | | | | |

CBOE S&P 500 Index (d) | | | | | | | | | | | |

Expires January 12, 2024 at $4,610.00 | | | 10,970,609 | | | | 23 | | | | 10,396 | |

Expires January 16, 2024 at $4,610.00 | | | 10,493,626 | | | | 22 | | | | 11,550 | |

Expires January 17, 2024 at $4,610.00 | | | 10,970,609 | | | | 23 | | | | 13,938 | |

Expires January 19, 2024 at $4,610.00 | | | 10,493,626 | | | | 22 | | | | 18,744 | |

| Total Put Options | | | | | | | | | | | 54,628 | |

| TOTAL OPTIONS | | | | | | | | | | | | |

| (Cost $51,479) | | | | | | | | | | | 54,628 | |

| TOTAL INVESTMENTS – 76.0% | | | | | | | | | | | | |

| (Cost $32,997,540) | | | | | | | | | | | 33,991,439 | |

Money Market Deposit Account – 20.8% (e) | | | | | | | | | | | 9,309,638 | |

Other Assets in Excess of Liabilities – 3.2% | | | | | | | | | | | 1,429,805 | |

| TOTAL NET ASSETS – 100.0% | | | | | | | | | | $ | 44,730,882 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | All or a portion of this security is designated as collateral for options contracts. As of December 31, 2023, the fair value of collateral was $2,202,600. |

| (c) | Exchange-traded. |

| (d) | Held in connection with written option contracts. See Schedule of Written Options for further information. |

| (e) | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and is subject to change daily. The rate shown as of December 31, 2023, was 5.27%. |

See Notes to the Financial Statements

KENSINGTON DEFENDER FUND

Schedule of Written Options

December 31, 2023

| | | Notional | | | Contracts | | | Value | |

| | | | | | | | | | |

| OPTIONS WRITTEN – (0.5)% (a) | | | | | | | | | |

| | | | | | | | | | |

| Put Options – (0.5)% | | | | | | | | | |

CBOE S&P 500 Index (b) | | | | | | | | | |

Expires January 12, 2024 at $4,750.00 | | $ | (10,970,609 | ) | | | (23 | ) | | $ | (58,880 | ) |

Expires January 16, 2024 at $4,750.00 | | | (10,493,626 | ) | | | (22 | ) | | | (62,216 | ) |

Expires January 17, 2024 at $4,750.00 | | | (10,970,609 | ) | | | (23 | ) | | | (64,538 | ) |

Expires January 19, 2024 at $4,750.00 | | | (10,493,626 | ) | | | (22 | ) | | | (72,160 | ) |

| Total Put Options | | | | | | | | | | | (257,794 | ) |

| Total Options Written | | | | | | | | | | | | |

| (Premiums received $244,212) | | | | | | | | | | $ | (257,794 | ) |

| (a) | Exchange-traded. |

| (b) | Held in connection with purchased option contracts. See Schedule of Investments for further information. |

See Notes to the Financial Statements

KENSINGTON FUNDS

Statement of Assets and Liabilities

December 31, 2023

| | | Kensington | | | Kensington | | | Kensington | | | Kensington | |

| | | Active Advantage | | | Managed Income | | | Dynamic Growth | | | Defender | |

| | | Fund | | | Fund | | | Fund | | | Fund | |

| ASSETS: | | | | | | | | | | | | |

| Unaffiliated investments, at fair value | | | | | | | | | | | | |

| (cost $9,734,029, $743,516,773, | | | | | | | | | | | | |

| $1,039,268,893 and | | | | | | | | | | | | |

| $32,997,540, respectively) | | $ | 10,413,241 | | | $ | 770,982,627 | | | $ | 1,145,647,815 | | | $ | 33,991,439 | |

| Affiliated investments (cost $0, | | | | | | | | | | | | | | | | |

| $30,000,000, $0 and $0, respectively) | | | — | | | | 29,905,462 | | | | — | | | | — | |

| Cash & Cash Equivalents | | | 289,887 | | | | 9,185,841 | | | | 46,345,307 | | | | 9,309,638 | |

| Cash held as collateral for options | | | — | | | | — | | | | — | | | | 571,478 | |

| Deposits at the broker for | | | | | | | | | | | | | | | | |

| futures contracts | | | — | | | | — | | | | 2,295,675 | | | | — | |

| Dividends & interest receivable | | | 1,863 | | | | 594,454 | | | | 410,926 | | | | 47,280 | |

| Receivable for investment securities sold | | | — | | | | — | | | | — | | | | 244,212 | |

| Receivable for capital shares sold | | | — | | | | 5,095,838 | | | | 4,643,357 | | | | 945,549 | |

| Receivable for investment adviser | | | | | | | | | | | | | | | | |

| expense reimbursement | | | 8,937 | | | | — | | | | — | | | | — | |

| Prepaid expenses and other assets | | | 8,342 | | | | 37,046 | | | | 49,511 | | | | 23,247 | |

| Total assets | | | 10,722,270 | | | | 815,801,268 | | | | 1,199,392,591 | | | | 45,132,843 | |

| | | | | | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | | | | | |

| Written option contracts, at value | | | | | | | | | | | | | | | | |

| (premiums received $0, $0, $0 | | | | | | | | | | | | | | | | |

| and $244,212, respectively) | | | — | | | | — | | | | — | | | | 257,794 | |

| Payable for investment | | | | | | | | | | | | | | | | |

| securities purchased | | | — | | | | — | | | | — | | | | 51,479 | |

| Payable for capital shares redeemed | | | — | | | | 1,493,868 | | | | 980,309 | | | | 7,434 | |

| Payable to investment adviser, net | | | — | | | | 837,778 | | | | 1,253,833 | | | | 33,694 | |

| Payable for fund administration | | | | | | | | | | | | | | | | |

| & accounting fees | | | 2,163 | | | | 36,592 | | | | 58,093 | | | | 3,716 | |

| Payable for compliance fees | | | 1,585 | | | | 1,586 | | | | 1,585 | | | | 1,588 | |

| Payable for custody fees | | | 1,366 | | | | 24,860 | | | | 26,864 | | | | 1,229 | |

| Payable for audit & tax fees | | | 18,751 | | | | 18,750 | | | | 18,750 | | | | 24,500 | |

| Payable for transfer agent fees & expenses | | | 5,987 | | | | 54,601 | | | | 57,802 | | | | 5,015 | |

| Payable for legal fees | | | 5,432 | | | | 5,433 | | | | 5,432 | | | | 7,845 | |

| Accrued expenses | | | 1,115 | | | | 27,028 | | | | 6,580 | | | | 7,667 | |

| Accrued distribution fees | | | 1,390 | | | | 25,279 | | | | 24,153 | | | | — | |

| Total liabilities | | | 37,789 | | | | 2,525,775 | | | | 2,433,401 | | | | 401,961 | |

| Net Assets | | $ | 10,684,481 | | | $ | 813,275,493 | | | $ | 1,196,959,190 | | | $ | 44,730,882 | |

| | | | | | | | | | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | | | | | | | | | |

| Capital stock | | $ | 11,525,525 | | | $ | 894,032,350 | | | $ | 1,137,177,887 | | | $ | 43,341,230 | |

| Total accumulated gain (loss) | | | (841,044 | ) | | | (80,756,857 | ) | | | 59,781,303 | | | | 1,389,652 | |

| Net Assets | | $ | 10,684,481 | | | $ | 813,275,493 | | | $ | 1,196,959,190 | | | $ | 44,730,882 | |

See Notes to the Financial Statements

KENSINGTON FUNDS

Statement of Assets and Liabilities – Continued

December 31, 2023

| | | Kensington | | | Kensington | | | Kensington | | | Kensington | |

| | | Active Advantage | | | Managed Income | | | Dynamic Growth | | | Defender | |

| | | Fund | | | Fund | | | Fund | | | Fund | |

| Institutional Class | | | | | | | | | | | | |

Net assets | | $ | 9,703,074 | | | $ | 775,311,673 | | | $ | 1,143,770,152 | | | $ | 44,730,882 | |

Shares issued and outstanding(1) | | | 1,013,559 | | | | 78,840,646 | | | | 98,050,644 | | | | 4,441,361 | |

Net asset value, redemption price | | | | | | | | | | | | | | | | |

and minimum offering price per share | | $ | 9.57 | | | $ | 9.83 | | | $ | 11.67 | | | $ | 10.07 | |

| | | | | | | | | | | | | | | | | |

| A Class | | | | | | | | | | | | | | | | |

Net Assets | | $ | 483,881 | | | $ | 28,049,870 | | | $ | 36,707,530 | | | $ | — | |

Shares issued and outstanding(1) | | | 50,622 | | | | 2,858,193 | | | | 3,169,383 | | | | — | |

Net asset value, redemption price | | | | | | | | | | | | | | | | |

and minimum offering price per share | | $ | 9.56 | | | $ | 9.81 | | | $ | 11.58 | | | $ | — | |

Maximum offering price per share(2) | | $ | 10.04 | | | $ | 10.30 | | | $ | 12.16 | | | $ | — | |

| | | | | | | | | | | | | | | | | |

| C Class | | | | | | | | | | | | | | | | |

Net Assets | | $ | 497,526 | | | $ | 9,913,950 | | | $ | 16,481,508 | | | $ | — | |

Shares issued and outstanding(1) | | | 52,377 | | | | 1,020,145 | | | | 1,448,744 | | | | — | |

Net asset value, redemption price | | | | | | | | | | | | | | | | |

and minimum offering price per share | | $ | 9.50 | | | $ | 9.72 | | | $ | 11.38 | | | $ | — | |

| (1) | Unlimited shares authorized. |

| (2) | The offering price is calculated by dividing the net asset value by 1 minus the maximum sales charge of 4.75%. |

See Notes to the Financial Statements

KENSINGTON FUNDS

Statements of Operations

For the Year or Period Ended December 31, 2023

| | | Kensington | | | Kensington | | | Kensington | | | Kensington | |

| | | Active Advantage | | | Managed Income | | | Dynamic Growth | | | Defender | |

| | | Fund | | | Fund | | | Fund | | | Fund(1) | |

| INVESTMENT INCOME: | | | | | | | | | | | | |

Dividend income from unaffiliated investments | | $ | 201,475 | | | $ | 28,675,309 | | | $ | 8,923,818 | | | $ | 343,717 | |

Dividend income from affiliated investments | | | — | | | | 7,324 | | | | — | | | | — | |

Interest income | | | 320,691 | | | | 21,087,279 | | | | 21,228,770 | | | | 230,868 | |

Total investment income | | | 522,166 | | | | 49,769,912 | | | | 30,152,588 | | | | 574,585 | |

| | | | | | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | | | | | |

Advisory fees (See Note 5) | | | 187,751 | | | | 11,473,466 | | | | 13,113,598 | | | | 136,405 | |

Registration fees | | | 57,297 | | | | 102,210 | | | | 156,989 | | | | 12,963 | |

Transfer agent fees & expenses (See Note 5) | | | 40,989 | | | | 381,928 | | | | 372,163 | | | | 16,603 | |

Legal fees | | | 22,884 | | | | 21,035 | | | | 19,824 | | | | 8,002 | |

Trustee fees | | | 20,906 | | | | 17,466 | | | | 17,996 | | | | 14,502 | |

Audit & tax fees | | | 18,759 | | | | 18,749 | | | | 18,749 | | | | 25,876 | |

Fund administration & accounting | | | | | | | | | | | | | | | | |

fees (See Note 5) | | | 16,427 | | | | 378,556 | | | | 431,507 | | | | 14,351 | |

Compliance fees (See Note 5) | | | 9,152 | | | | 9,042 | | | | 9,159 | | | | 5,546 | |

Other fees | | | 7,100 | | | | 13,951 | | | | 14,072 | | | | 3,156 | |

Custody fees (See Note 5) | | | 5,727 | | | | 95,911 | | | | 107,173 | | | | 3,421 | |

Postage and printing fees | | | 3,000 | | | | 87,580 | | | | 69,999 | | | | 1,000 | |

Insurance fees | | | 1,996 | | | | 7,588 | | | | 6,886 | | | | — | |

Distribution fees (See Note 7): | | | | | | | | | | | | | | | | |

A Class | | | 975 | | | | 107,092 | | | | 81,860 | | | | — | |

C Class | | | 3,511 | | | | 125,636 | | | | 203,202 | | | | — | |

Total expenses before interest expense | | | | | | | | | | | | | | | | |

and recoupment/reimbursement | | | 396,474 | | | | 12,840,210 | | | | 14,623,177 | | | | 241,825 | |

Interest expense (See Note 9) | | | 631 | | | | 7,663 | | | | — | | | | — | |

Total expenses before | | | | | | | | | | | | | | | | |

recoupment/reimbursement | | | 397,105 | | | | 12,847,873 | | | | 14,623,177 | | | | 241,825 | |

Fee recoupment | | | — | | | | — | | | | 139,052 | | | | 4,332 | |

Less: expense reimbursement by | | | | | | | | | | | | | | | | |

investment adviser | | | (189,217 | ) | | | (214,930 | ) | | | (1,621 | ) | | | (83,562 | ) |

Net expenses | | | 207,888 | | | | 12,632,943 | | | | 14,760,608 | | | | 162,595 | |

| NET INVESTMENT INCOME | | | 314,278 | | | | 37,136,969 | | | | 15,391,980 | | | | 411,990 | |

See Notes to the Financial Statements

KENSINGTON FUNDS

Statements of Operations – Continued

For the Year or Period Ended December 31, 2023

| | | Kensington | | | Kensington | | | Kensington | | | Kensington | |

| | | Active Advantage | | | Managed Income | | | Dynamic Growth | | | Defender | |

| | | Fund | | | Fund | | | Fund | | | Fund(1) | |

| REALIZED AND UNREALIZED | | | | | | | | | | | | |

| GAIN (LOSS) ON INVESTMENTS | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | |

| Unaffiliated investments | | $ | (465,701 | ) | | $ | (34,121,691 | ) | | $ | 33,001,060 | | | $ | (164,771 | ) |

| Futures | | | — | | | | — | | | | (862,828 | ) | | | — | |

| Purchased options | | | — | | | | — | | | | — | | | | (749,674 | ) |

| Written options | | | — | | | | — | | | | — | | | | 1,320,385 | |

Net change in unrealized appreciation/ | | | | | | | | | | | | | | | | |

depreciation of: | | | | | | | | | | | | | | | | |

| Unaffiliated investments | | | 679,212 | | | | 27,465,854 | | | | 106,378,922 | | | | 990,750 | |

| Affiliated investments | | | — | | | | (94,538 | ) | | | — | | | | — | |

| Futures | | | — | | | | — | | | | 783,405 | | | | — | |

| Purchased options | | | — | | | | — | | | | — | | | | 3,149 | |

| Written options | | | — | | | | — | | | | — | | | | (13,582 | ) |

Net realized and unrealized | | | | | | | | | | | | | | | | |

gain (loss) on investments | | | 213,511 | | | | (6,750,375 | ) | | | 139,300,559 | | | | 1,386,257 | |

| NET INCREASE IN NET ASSETS | | | | | | | | | | | | | | | | |

| RESULTING FROM OPERATIONS | | $ | 527,789 | | | $ | 30,386,594 | | | $ | 154,692,539 | | | $ | 1,798,247 | |

| (1) | For the period May 31, 2023 (inception date of the Fund) through December 31, 2023. |

See Notes to the Financial Statements

KENSINGTON FUNDS

Statements of Changes in Net Assets

| | | Kensington | | | Kensington | |

| | | Active Advantage Fund | | | Managed Income Fund | |

| | | | | | Since Inception(1) | | | | | | | |

| | | Year Ended | | | through | | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| OPERATIONS: | | | | | | | | | | | | |

Net investment income | | $ | 314,278 | | | $ | 98,125 | | | $ | 37,136,969 | | | $ | 7,091,585 | |

Net realized loss on unaffiliated investments | | | (465,701 | ) | | | (1,056,889 | ) | | | (34,121,691 | ) | | | (74,457,529 | ) |

Net realized loss on affiliated investments | | | — | | | | — | | | | — | | | | (4,013,651 | ) |

Capital gain distributions from | | | | | | | | | | | | | | | | |

underlying investment companies | | | — | | | | — | | | | — | | | | 5,559,843 | |

Net change in unrealized appreciation/ | | | | | | | | | | | | | | | | |

depreciation of unaffiliated investments | | | 679,212 | | | | — | | | | 27,465,854 | | | | 5,100,259 | |

Net change in unrealized appreciation/ | | | | | | | | | | | | | | | | |

depreciation of affiliated investments | | | — | | | | — | | | | (94,538 | ) | | | — | |

Net increase (decrease) in net assets | | | | | | | | | | | | | | | | |

resulting from operations | | | 527,789 | | | | (958,764 | ) | | | 30,386,594 | | | | (60,719,493 | ) |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

Institutional Class: | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 7,512,421 | | | | 24,327,003 | | | | 480,317,985 | | | | 688,576,129 | |

| Proceeds from reinvestment of distributions | | | 238,794 | | | | 93,718 | | | | 30,146,665 | | | | 5,875,858 | |

| Payments for shares redeemed | | | (19,530,437 | ) | | | (2,051,041 | ) | | | (625,699,214 | ) | | | (459,176,586 | ) |

Increase (decrease) in net assets from | | | | | | | | | | | | | | | | |

Institutional Class transactions | | | (11,779,222 | ) | | | 22,369,680 | | | | (115,234,564 | ) | | | 235,275,401 | |

A Class: | | | | | | | | | | | | | | | | |

Proceeds from shares sold(2) | | | 565,531 | | | | 1,095 | | | | 4,936,056 | | | | 58,427,602 | |

| Proceeds from reinvestment of distributions | | | 5,482 | | | | — | | | | 1,287,014 | | | | 381,465 | |

| Payments for shares redeemed | | | (109,545 | ) | | | — | | | | (49,349,815 | ) | | | (42,545,640 | ) |

Increase (decrease) in net assets from | | | | | | | | | | | | | | | | |

A Class transactions | | | 461,468 | | | | 1,095 | | | | (43,126,745 | ) | | | 16,263,427 | |

C Class: | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 440,000 | | | | 31,000 | | | | 1,799,934 | | | | 5,827,693 | |

| Proceeds from reinvestment of distributions | | | 6,006 | | | | 16 | | | | 339,261 | | | | 50,730 | |

Payments for shares redeemed(2) | | | (4,518 | ) | | | — | | | | (7,359,207 | ) | | | (6,142,117 | ) |

Increase (decrease) in net assets from | | | | | | | | | | | | | | | | |

C Class transactions | | | 441,488 | | | | 31,016 | | | | (5,220,012 | ) | | | (263,694 | ) |

Net increase (decrease) in net assets resulting | | | | | | | | | | | | | | | | |

from capital share transactions | | | (10,876,266 | ) | | | 22,401,791 | | | | (163,581,321 | ) | | | 251,275,134 | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | |

From distributable earnings | | | | | | | | | | | | | | | | |

| Institutional Class | | | (297,068 | ) | | | (97,873 | ) | | | (34,578,148 | ) | | | (6,656,393 | ) |

| A Class | | | (9,025 | ) | | | (3 | ) | | | (1,344,199 | ) | | | (391,530 | ) |

| C Class | | | (6,051 | ) | | | (49 | ) | | | (363,215 | ) | | | (53,306 | ) |

Total distributions to shareholders | | | (312,144 | ) | | | (97,925 | ) | | | (36,285,562 | ) | | | (7,101,229 | ) |

| TOTAL INCREASE (DECREASE) | | | | | | | | | | | | | | | | |

| IN NET ASSETS | | | (10,660,621 | ) | | | 21,345,102 | | | | (169,480,289 | ) | | | 183,454,412 | |

See Notes to the Financial Statements

KENSINGTON FUNDS

Statements of Changes in Net Assets – Continued

| | | Kensington | | | Kensington | |

| | | Active Advantage Fund | | | Managed Income Fund | |

| | | | | | Since | | | | | | | |

| | | | | | Inception(1) | | | | | | | |

| | | Year Ended | | | through | | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| NET ASSETS: | | | | | | | | | | | | |

Beginning of period | | $ | 21,345,102 | | | $ | — | | | $ | 982,755,782 | | | $ | 799,301,370 | |

End of period | | $ | 10,684,481 | | | $ | 21,345,102 | | | $ | 813,275,493 | | | $ | 982,755,782 | |

| TRANSACTIONS IN SHARES: | | | | | | | | | | | | | | | | |

Institutional Class: | | | | | | | | | | | | | | | | |

| Shares sold | | | 818,138 | | | | 2,517,646 | | | | 49,336,333 | | | | 67,300,002 | |

| Shares issued to holders in | | | | | | | | | | | | | | | | |

| reinvestment of dividends | | | 25,949 | | | | 10,139 | | | | 3,119,313 | | | | 595,084 | |

| Shares redeemed | | | (2,139,157 | ) | | | (219,156 | ) | | | (64,433,309 | ) | | | (45,271,897 | ) |

Increase (decrease) in | | | | | | | | | | | | | | | | |

Institutional Class shares outstanding | | | (1,295,070 | ) | | | 2,308,629 | | | | (11,977,663 | ) | | | 22,623,189 | |

A Class: | | | | | | | | | | | | | | | | |

Shares sold(2) | | | 62,144 | | | | 110 | | | | 507,937 | | | | 5,642,866 | |

| Shares issued to holders in | | | | | | | | | | | | | | | | |

| reinvestment of dividends | | | 593 | | | | — | | | | 133,304 | | | | 38,767 | |

| Shares redeemed | | | (12,225 | ) | | | — | | | | (5,069,594 | ) | | | (4,184,070 | ) |

Increase (decrease) in | | | | | | | | | | | | | | | | |

A Class shares outstanding | | | 50,512 | | | | 110 | | | | (4,428,353 | ) | | | 1,497,563 | |

C Class: | | | | | | | | | | | | | | | | |

| Shares sold | | | 49,019 | | | | 3,200 | | | | 186,635 | | | | 571,436 | |

| Shares issued to holders in | | | | | | | | | | | | | | | | |

| reinvestment of dividends | | | 653 | | | | 2 | | | | 35,527 | | | | 5,203 | |

Shares redeemed(2) | | | (497 | ) | | | — | | | | (766,165 | ) | | | (603,051 | ) |

Increase (decrease) in | | | | | | | | | | | | | | | | |

| C Class shares outstanding | | | 49,175 | | | | 3,202 | | | | (544,003 | ) | | | (26,412 | ) |

| Net increase (decrease) in | | | | | | | | | | | | | | | | |

| shares outstanding | | | (1,195,383 | ) | | | 2,311,941 | | | | (16,950,019 | ) | | | 24,094,340 | |

| (1) | March 23, 2022. |

| (2) | Includes exchanges between share classes of the fund. |

See Notes to the Financial Statements

KENSINGTON FUNDS

Statements of Changes in Net Assets – Continued

| | | Kensington | | | Kensington | |

| | | Dynamic Growth Fund | | | Defender Fund | |

| | | | | | | | | Since | |

| | | | | | | | | Inception(1) | |

| | | Year Ended | | | Year Ended | | | through | |

| | | December 31, | | | December 31, | | | December 31, | |

| | | 2023 | | | 2022 | | | 2023 | |

| OPERATIONS: | | | | | | | | | |

Net investment income (loss) | | $ | 15,391,980 | | | $ | (354,251 | ) | | $ | 411,990 | |

Net realized gain (loss) on: | | | | | | | | | | | | |

| Unaffiliated investments | | | 33,001,060 | | | | (82,593,602 | ) | | | (164,771 | ) |

| Futures | | | (862,828 | ) | | | — | | | | — | |

| Purchased options | | | — | | | | — | | | | (749,674 | ) |

| Written options | | | — | | | | — | | | | 1,320,385 | |

Net change in unrealized appreciation/depreciation of: | | | | | | | | | | | | |

| Unaffiliated investments | | | 106,378,922 | | | | 4,544,612 | | | | 990,750 | |

| Futures | | | 783,405 | | | | — | | | | — | |

| Purchased options | | | — | | | | — | | | | 3,149 | |

| Written options | | | — | | | | — | | | | (13,582 | ) |

Net increase (decrease) in net assets | | | | | | | | | | | | |

resulting from operations | | | 154,692,539 | | | | (78,403,241 | ) | | | 1,798,247 | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | |

Institutional Class: | | | | | | | | | | | | |

| Proceeds from shares sold | | | 580,911,068 | | | | 974,697,042 | | | | 45,838,218 | |

| Proceeds from reinvestment of distributions | | | 10,910,308 | | | | 8,152,939 | | | | 400,252 | |

| Payments for shares redeemed | | | (469,235,558 | ) | | | (354,416,549 | ) | | | (2,897,240 | ) |

| Proceeds from redemption fees | | | 816 | | | | — | | | | — | |

Increase in net assets from Institutional Class transactions | | | 122,586,634 | | | | 628,433,432 | | | | 43,341,230 | |

A Class: | | | | | | | | | | | | |

Proceeds from shares sold(2) | | | 17,148,333 | | | | 23,975,548 | | | | — | |

| Proceeds from reinvestment of distributions | | | 318,470 | | | | 269,781 | | | | — | |

| Payments for shares redeemed | | | (13,804,921 | ) | | | (12,834,776 | ) | | | — | |

| Proceeds from redemption fees | | | 27 | | | | — | | | | — | |

Increase in net assets from A Class transactions | | | 3,661,909 | | | | 11,410,553 | | | | — | |

C Class: | | | | | | | | | | | | |

| Proceeds from shares sold | | | 3,377,086 | | | | 14,587,548 | | | | — | |

| Proceeds from reinvestment of distributions | | | 98,726 | | | | 166,475 | | | | — | |

Payments for shares redeemed(2) | | | (10,428,301 | ) | | | (2,797,240 | ) | | | — | |

| Proceeds from redemption fees | | | 17 | | | | — | | | | — | |

Increase (decrease) in net assets from C Class transactions | | | (6,952,472 | ) | | | 11,956,783 | | | | — | |

Net increase in net assets resulting from | | | | | | | | | | | | |

capital share transactions | | | 119,296,071 | | | | 651,800,768 | | | | 43,341,230 | |

See Notes to the Financial Statements

KENSINGTON FUNDS

Statements of Changes in Net Assets – Continued

| | | Kensington | | | Kensington | |

| | | Dynamic Growth Fund | | | Defender Fund | |

| | | | | | | | | Since | |

| | | | | | | | | Inception(1) | |

| | | Year Ended | | | Year Ended | | | through | |

| | | December 31, | | | December 31, | | | December 31, | |

| | | 2023 | | | 2022 | | | 2023 | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | |

From distributable earnings | | | | | | | | | |

| Institutional Class | | $ | (11,860,387 | ) | | $ | — | | | $ | (408,595 | ) |

| A Class | | | (331,155 | ) | | | — | | | | — | |

| C Class | | | (126,092 | ) | | | — | | | | — | |

From net realized gains | | | | | | | | | | | | |

| Institutional Class | | | — | | | | (8,635,460 | ) | | | — | |

| A Class | | | — | | | | (279,507 | ) | | | — | |

| C Class | | | — | | | | (209,684 | ) | | | — | |

Total distributions to shareholders | | | (12,317,634 | ) | | | (9,124,651 | ) | | | (408,595 | ) |

| TOTAL INCREASE IN NET ASSETS | | | 261,670,976 | | | | 564,272,876 | | | | 44,730,882 | |

| NET ASSETS: | | | | | | | | | | | | |

Beginning of period | | | 935,288,214 | | | | 371,015,338 | | | | — | |

End of period | | $ | 1,196,959,190 | | | $ | 935,288,214 | | | $ | 44,730,882 | |

| TRANSACTIONS IN SHARES: | | | | | | | | | | | | |

Institutional Class: | | | | | | | | | | | | |

| Shares sold | | | 53,966,547 | | | | 88,890,176 | | | | 4,697,550 | |

| Shares issued to holders in reinvestment of dividends | | | 1,032,580 | | | | 797,744 | | | | 39,766 | |

| Shares redeemed | | | (43,628,308 | ) | | | (33,035,251 | ) | | | (295,955 | ) |

Increase in Institutional Class shares outstanding | | | 11,370,819 | | | | 56,652,669 | | | | 4,441,361 | |

A Class: | | | | | | | | | | | | |

Shares sold(2) | | | 1,608,115 | | | | 2,175,317 | | | | — | |

| Shares issued to holders in reinvestment of dividends | | | 30,347 | | | | 26,579 | | | | — | |

| Shares redeemed | | | (1,284,214 | ) | | | (1,200,173 | ) | | | — | |

Increase in A Class shares outstanding | | | 354,248 | | | | 1,001,723 | | | | — | |

C Class: | | | | | | | | | | | | |

| Shares sold | | | 326,458 | | | | 1,335,947 | | | | — | |

| Shares issued to holders in reinvestment of dividends | | | 9,619 | | | | 16,648 | | | | — | |

Shares redeemed(2) | | | (988,449 | ) | | | (260,725 | ) | | | — | |

Increase (decrease) in C Class shares outstanding | | | (652,372 | ) | | | 1,091,870 | | | | — | |

| Net increase in shares outstanding | | | 11,072,695 | | | | 58,746,262 | | | | 4,441,361 | |

| (1) | May 31, 2023. |

| (2) | Includes exchanges between share classes of the fund. |

See Notes to the Financial Statements

KENSINGTON ACTIVE ADVANTAGE FUND

Financial Highlights

Institutional Class

| | | Year | | | Since Inception(1) | |

| | | Ended | | | through | |

| | | December 31, | | | December 31, | |

| | | 2023 | | | 2022 | |

PER COMMON SHARE DATA(2): | | | | | | |

Net asset value, beginning of period | | $ | 9.23 | | | $ | 10.00 | |

| | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | |

Net investment income(3) | | | 0.22 | | | | 0.04 | |

| Net realized and unrealized income (loss) on investments | | | 0.33 | | | | (0.77 | ) |

Total from investment operations | | | 0.55 | | | | (0.73 | ) |

| | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | |

| Net investment income | | | (0.21 | ) | | | (0.04 | ) |

| Net realized gains | | | — | | | | — | |

Total distributions | | | (0.21 | ) | | | (0.04 | ) |

| | | | | | | | | |

Net asset value, end of period | | $ | 9.57 | | | $ | 9.23 | |

| | | | | | | | | |

TOTAL RETURN(4) | | | 6.12 | % | | | -7.26 | % |

| | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | |

Net assets, end of period (in 000’s) | | $ | 9,703 | | | $ | 21,315 | |

Ratio of expenses to average net assets(5)(6): | | | | | | | | |

| Before expense waiver | | | 2.60 | % | | | 3.64 | % |

| After expense waiver | | | 1.36 | % | | | 1.35 | % |

Ratio of expenses excluding interest expense to average net assets(5)(6): | | | | | | | | |

| Before expense waiver | | | 2.59 | % | | | 3.64 | % |

| After expense waiver | | | 1.35 | % | | | 1.35 | % |

Ratio of net investment gain to average net assets(6) | | | 2.12 | % | | | 1.46 | % |

Portfolio turnover rate(4) | | | 944 | % | | | 1,515 | % |

| (1) | March 23, 2022. |

| (2) | For an Institutional Class Share outstanding for the entire period. |

| (3) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (4) | Not annualized for periods less than one year. |

| (5) | Does not include expenses of investment companies in which the Fund invests. |

| (6) | Annualized for periods less than one year. |

See Notes to the Financial Statements

KENSINGTON ACTIVE ADVANTAGE FUND

Financial Highlights – Continued

A Class

| | | Year | | | Since Inception(1) | |

| | | Ended | | | through | |

| | | December 31, | | | December 31, | |

| | | 2023 | | | 2022 | |

PER COMMON SHARE DATA(2): | | | | | | |

Net asset value, beginning of period | | $ | 9.22 | | | $ | 10.00 | |

| | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | |

Net investment income(3) | | | 0.10 | | | | 0.09 | |

| Net realized and unrealized loss on investments | | | 0.44 | | | | (0.84 | ) |

Total from investment operations | | | 0.54 | | | | (0.75 | ) |

| | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | |

| Net investment income | | | (0.20 | ) | | | (0.03 | ) |

| Net realized gains | | | — | | | | — | |

Total distributions | | | (0.20 | ) | | | (0.03 | ) |

| | | | | | | | | |

Net asset value, end of period | | $ | 9.56 | | | $ | 9.22 | |

| | | | | | | | | |

TOTAL RETURN(4)(5) | | | 5.92 | % | | | -7.49 | % |

| | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | |

Net assets, end of period (in 000’s) | | $ | 484 | | | $ | 1 | |

Ratio of expenses to average net assets(6)(7): | | | | | | | | |

| Before expense waiver | | | 3.24 | % | | | 255.94 | % |

| After expense waiver | | | 1.61 | % | | | 1.60 | % |

Ratio of expenses excluding interest expense to average net assets(6)(7): | | | | | | | | |

| Before expense waiver | | | 3.23 | % | | | 255.94 | % |

| After expense waiver | | | 1.60 | % | | | 1.60 | % |

Ratio of net investment income to average net assets(7) | | | 1.86 | % | | | 1.20 | % |

Portfolio turnover rate(6) | | | 944 | % | | | 1,515 | % |

| (1) | March 23, 2022. |

| (2) | For an A Class Share outstanding for the entire period. |

| (3) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (4) | Total return does not reflect sales charges. |

| (5) | Not annualized for periods less than one year. |

| (6) | Does not include expenses of investment companies in which the Fund invests. |

| (7) | Annualized for periods less than one year. |

See Notes to the Financial Statements

KENSINGTON ACTIVE ADVANTAGE FUND

Financial Highlights – Continued

C Class

| | | Year | | | Since Inception(1) | |

| | | Ended | | | through | |

| | | December 31, | | | December 31, | |

| | | 2023 | | | 2022 | |

PER COMMON SHARE DATA(2): | | | | | | |

Net asset value, beginning of period | | $ | 9.19 | | | $ | 10.00 | |

| | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | |

Net investment income(3) | | | 0.11 | | | | 0.02 | |

| Net realized and unrealized gain (loss) on investments | | | 0.35 | | | | (0.81 | ) |

Total from investment operations | | | 0.46 | | | | (0.79 | ) |

| | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | |

| Net investment income | | | (0.15 | ) | | | (0.02 | ) |

| Net realized gains | | | — | | | | — | |

Total distributions | | | (0.15 | ) | | | (0.02 | ) |

| | | | | | | | | |

Net asset value, end of period | | $ | 9.50 | | | $ | 9.19 | |

| | | | | | | | | |

TOTAL RETURN(4)(5) | | | 5.02 | % | | | -7.95 | % |

| | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | |

Net assets, end of period (in 000’s) | | $ | 498 | | | $ | 29 | |

Ratio of expenses to average net assets(6)(7): | | | | | | | | |

| Before expense waiver | | | 4.03 | % | | | 23.83 | % |

| After expense waiver | | | 2.36 | % | | | 2.35 | % |

Ratio of expenses excluding interest expense to average net assets(6)(7): | | | | | | | | |

| Before expense waiver | | | 4.02 | % | | | 23.83 | % |

| After expense waiver | | | 2.35 | % | | | 2.35 | % |

Ratio of net investment income to average net assets(7) | | | 1.11 | % | | | 0.46 | % |

Portfolio turnover rate(5) | | | 944 | % | | | 1,515 | % |

| (1) | March 23, 2022. |

| (2) | For a C Class Share outstanding for the entire period. |

| (3) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (4) | Total return does not reflect sales charges. |

| (5) | Not annualized for periods less than one year. |

| (6) | Does not include expenses of investment companies in which the Fund invests. |

| (7) | Annualized for periods less than one year. |

See Notes to the Financial Statements

KENSINGTON MANAGED INCOME FUND

Financial Highlights

Institutional Class

| | | Year | | | Year | | | Year | | | Year | | | Since Inception(1) | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | through | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

PER COMMON SHARE DATA(2): | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 9.86 | | | $ | 10.58 | | | $ | 10.80 | | | $ | 10.21 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Net investment income(3) | | | 0.42 | | | | 0.07 | | | | 0.28 | (4) | | | 0.32 | (4) | | | 0.17 | (4) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (0.04 | ) | | | (0.72 | ) | | | (0.13 | ) | | | 0.51 | | | | 0.15 | |

Total from investment operations | | | 0.38 | | | | (0.65 | ) | | | 0.15 | | | | 0.83 | | | | 0.32 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.41 | ) | | | (0.07 | ) | | | (0.27 | ) | | | (0.21 | ) | | | (0.11 | ) |

| Net realized gains | | | — | | | | — | | | | (0.10 | ) | | | (0.02 | ) | | | — | |

| Return of capital | | | — | | | | — | | | | — | | | | (0.01 | ) | | | — | |

Total distributions | | | (0.41 | ) | | | (0.07 | ) | | | (0.37 | ) | | | (0.24 | ) | | | (0.11 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 9.83 | | | $ | 9.86 | | | $ | 10.58 | | | $ | 10.80 | | | $ | 10.21 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN(5) | | | 3.97 | % | | | -6.11 | % | | | 1.29 | % | | | 8.13 | % | | | 3.20 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in 000’s) | | $ | 775,312 | | | $ | 895,811 | | | $ | 721,445 | | | $ | 296,660 | | | $ | 54,723 | |

Ratio of expenses to | | | | | | | | | | | | | | | | | | | | |

average net assets(6)(7)(8): | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver/recoupment | | | 1.37 | % | | | 1.38 | % | | | 1.41 | % | | | 1.59 | % | | | 2.20 | % |

| After expense waiver/recoupment | | | 1.35 | % | | | 1.36 | % | | | 1.41 | % | | | 1.61 | % | | | 1.99 | % |

Ratio of expenses excluding interest | | | | | | | | | | | | | | | | | | | | |

expense to average net assets(6)(7)(8): | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver/recoupment | | | 1.37 | % | | | 1.38 | % | | | 1.41 | % | | | 1.59 | % | | | 2.20 | % |

| After expense waiver/recoupment | | | 1.35 | % | | | 1.36 | % | | | 1.41 | % | | | 1.61 | % | | | 1.99 | % |

Ratio of net investment income to | | | | | | | | | | | | | | | | | | | | |

average net assets(7) | | | 4.07 | % | | | 0.79 | % | | | 2.54 | % | | | 3.06 | % | | | 2.83 | % |

Portfolio turnover rate(5) | | | 600 | % | | | 1,244 | % | | | 220 | % | | | 233 | % | | | 61 | % |

| (1) | May 28, 2019. |

| (2) | For an Institutional Class Share outstanding for the entire period. |

| (3) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (4) | Per share amounts calculated using average shares method. |

| (5) | Not annualized for periods less than one year. |

| (6) | Does not include expenses of investment companies in which the Fund invests. |

| (7) | Annualized for periods less than one year. |

| (8) | On June 24, 2022, the Adviser lowered the limit of annual operating expenses from 1.45% to 1.35%. |

See Notes to the Financial Statements

KENSINGTON MANAGED INCOME FUND

Financial Highlights – Continued

A Class

| | | Year | | | Year | | | Year | | | Year | | | Since Inception(1) | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | through | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

PER COMMON SHARE DATA(2): | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 9.84 | | | $ | 10.56 | | | $ | 10.78 | | | $ | 10.20 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Net investment income(3) | | | 0.49 | | | | 0.05 | | | | 0.25 | (4) | | | 0.31 | (4) | | | 0.15 | (4) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (0.14 | ) | | | (0.72 | ) | | | (0.13 | ) | | | 0.49 | | | | 0.15 | |

Total from investment operations | | | 0.35 | | | | (0.67 | ) | | | 0.12 | | | | 0.80 | | | | 0.30 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.38 | ) | | | (0.05 | ) | | | (0.24 | ) | | | (0.19 | ) | | | (0.10 | ) |

| Net realized gains | | | — | | | | — | | | | (0.10 | ) | | | (0.02 | ) | | | — | |

| Return of capital | | | — | | | | — | | | | — | | | | (0.01 | ) | | | — | |

| Total distributions | | | (0.38 | ) | | | (0.05 | ) | | | (0.34 | ) | | | (0.22 | ) | | | (0.10 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 9.81 | | | $ | 9.84 | | | $ | 10.56 | | | $ | 10.78 | | | $ | 10.20 | |