Exhibit 99.9

Management's Discussion and Analysis

Three months ended March 31, 2019

| | 1 |

FORWARD LOOKING STATEMENTS

Certain statements in this Management's Discussion & Analysis ("MD&A"), and in particular the "Business Highlights and Growth Initiatives" section and "Outlook" subsection, contain forward-looking information (collectively referred to herein as the "Forward-Looking Statements") within the meaning of applicable securities laws. The use of any of the words "expect", "anticipate", "continue", "estimate", "may", "will", "project", "should", "believe", "plans", "intends" and similar expressions are intended to identify Forward-Looking Statements. In particular, but without limiting the forgoing, this MD&A contains Forward-Looking Statements pertaining to: (i) expectations regarding deployment of capital called into our lending LPs in 2019; (ii) expectation that Lending net capital calls will occur over the mid-to-long term life of our funds; (iii) expectation that the strong finish to the price of gold last year will carry forward to 2019; (iv) expectations regarding our legacy balance sheet loans; (v) anticipation that earnings from the managed equities business will be relatively flat to slightly positive year-over-year; (vi) expectation of a challenging equity origination and placement fee environment, similar to what was experienced in 2018; (vii) expectation that we will see a material decrease in corporate expenses in 2019 and the primary reasons causing such decrease as described under the heading “Outlook - Corporate”; and (viii) the declaration, payment and designation of dividends.

Although the Company believes that the Forward-Looking Statements are reasonable, they are not guarantees of future results, performance or achievements. A number of factors or assumptions have been used to develop the Forward-Looking Statements, including: (i) the impact of increasing competition in each business in which the Company operates will not be material; (ii) quality management will be available; (iii) the effects of regulation and tax laws of governmental agencies will be consistent with the current environment; and (iv) those assumptions disclosed herein under the heading "Significant Accounting Judgments, Estimates and Changes in Accounting Policies". Actual results, performance or achievements could vary materially from those expressed or implied by the Forward-Looking Statements should assumptions underlying the Forward-Looking Statements prove incorrect or should one or more risks or other factors materialize, including: (i) difficult market conditions; (ii) poor investment performance; (iii) failure to continue to retain and attract quality staff; (iv) employee errors or misconduct resulting in regulatory sanctions or reputational harm; (v) performance fee fluctuations; (vi) a business segment or another counterparty failing to pay its financial obligation; (vii) failure of the Company to meet its demand for cash or fund obligations as they come due; (viii) changes in the investment management industry; (ix) failure to implement effective information security policies, procedures and capabilities; (x) lack of investment opportunities; (xi) risks related to regulatory compliance; (xii) failure to manage risks appropriately; (xiii) failure to deal appropriately with conflicts of interest; (xiv) competitive pressures; (xv) corporate growth which may be difficult to sustain and may place significant demands on existing administrative, operational and financial resources; (xvi) failure to comply with privacy laws; (xvii) failure to successfully implement succession planning; (xviii) foreign exchange risk relating to the relative value of the U.S. dollar; (xix) litigation risk; (xx) failure to develop effective business resiliency plans; (xxi) failure to obtain or maintain sufficient insurance coverage on favourable economic terms; (xxii) historical financial information being not necessarily indicative of future performance; (xxiii) the market price of common shares of the Company may fluctuate widely and rapidly; (xxiv) risks relating to the Company’s investment products; (xxv) risks relating to the Company's proprietary investments; (xxvi) risks relating to the Company's lending business; (xxvii) risks relating to the Company’s merchant bank and advisory business; (xxviii) those risks described under the heading "Risk Factors" in the Company’s annual information form dated February 27, 2019; and (xxix) those risks described under the headings "Managing Risk: Financial" and "Managing Risk: Non-Financial" in this MD&A. In addition, the payment of dividends is not guaranteed and the amount and timing of any dividends payable by the Company will be at the discretion of the Board of Directors of the Company and will be established on the basis of the Company’s earnings, the satisfaction of solvency tests imposed by applicable corporate law for the declaration and payment of dividends, and other relevant factors. The Forward-Looking Statements speak only as of the date hereof, unless otherwise specifically noted, and the Company does not assume any obligation to publicly update any Forward-Looking Statements, whether as a result of new information, future events or otherwise, except as may be expressly required by applicable Canadian securities laws.

MANAGEMENT'S DISCUSSION AND ANALYSIS

This MD&A of financial condition and results of operations, dated May 9, 2019, presents an analysis of the consolidated financial condition of the Company and its subsidiaries as at March 31, 2019, compared with December 31, 2018, and the consolidated results of operations for the three months ended March 31, 2019, compared with the three months ended March 31, 2018. The Board of Directors approved this MD&A on May 9, 2019. All note references in this MD&A are to the notes to the Company's March 31, 2019 unaudited interim condensed consolidated financial statements ("interim financial statements"), unless otherwise noted. The Company was incorporated under the Business Corporations Act (Ontario) on February 13, 2008.

PRESENTATION OF FINANCIAL INFORMATION

The interim financial statements, including the required comparative information, have been prepared in accordance with International Financial Reporting Standards ("IFRS"), as issued by the International Accounting Standards Board ("IASB"). Financial results, including related historical comparatives contained in this MD&A, unless otherwise specified herein, are based on the interim financial statements. The Canadian dollar is the Company's functional and reporting currency for purposes of preparing the interim financial statements given that the Company conducts most of its operations in that currency. Accordingly, all dollar references in this MD&A are in Canadian dollars, unless otherwise specified. The use of the term "prior period" refers to the three months ended March 31, 2018.

| | 2 |

KEY PERFORMANCE INDICATORS (NON-IFRS FINANCIAL MEASURES)

The Company measures the success of its business using a number of key performance indicators that are not measurements in accordance with IFRS and should not be considered as an alternative to net income (loss) or any other measure of performance under IFRS. Non-IFRS financial measures do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. Our key performance indicators include:

Assets Under Management

Assets Under Management ("AUM") refers to the total net assets managed by the Company through its various investment product offerings, managed accounts and managed companies.

Net Sales

Fund sales (net of redemptions) are a key performance indicator as new assets being managed will lead to higher management fees and can potentially lead to increased carried interest and performance fee generation given that AUM is also the basis upon which carried interest and performance fees are calculated.

Capital calls and distributions

Capital calls into our lending LPs is a key source of AUM creation, and ultimately, earnings for the Company. Once committed capital is called into our lending LPs, it is included within the AUM of the Company as it will now earn a management fee (note that it is possible for some forms of committed capital to earn a commitment fee, in which case, it will also be included in AUM at that time). Conversely, once loans in our lending LPs are repaid, capital may be returned to investors in the form of a distribution, thereby reducing our AUM.

Net Fees

Management fees, carried interest and performance fees, net of trailer and sub-advisor fees, carried interest and performance fee payouts, is a key revenue indicator as it represents the net revenue contribution after directly associated costs that we generate from our AUM.

Net Commissions

Commissions, net of commission expenses, arise from the transaction based service offerings of our brokerage segment.

| | 3 |

EBITDA, Adjusted EBITDA and Adjusted base EBITDA

EBITDA in its most basic form is defined as earnings before interest expense, income taxes, depreciation and amortization. EBITDA is a measure commonly used in the investment industry by management, investors and investment analysts in understanding and comparing results by factoring out the impact of different financing methods, capital structures, amortization techniques and income tax rates between companies in the same industry. While other companies, investors or investment analysts may not utilize the same method of calculating EBITDA (or adjustments thereto), the Company believes its adjusted base EBITDA metric, in particular, results in a better comparison of the Company's underlying operations against its peers.

Neither EBITDA, adjusted EBITDA or adjusted base EBITDA have standardized meaning under IFRS. Consequently, they should not be considered in isolation, nor should they be used in substitute for measures of performance prepared in accordance with IFRS.

The following table outlines how our EBITDA measures are determined:

| | | 3 months ended | |

| (in thousands $) | | Mar. 31, 2019 | | | Mar. 31, 2018 | |

| Net income (loss) for the periods | | | 3,784 | | | | 13,657 | |

| Adjustments: | | | | | | | | |

| Interest expense | | | 324 | | | | 66 | |

| Provision (recovery) for income taxes | | | 877 | | | | (2,772 | ) |

| Depreciation and amortization | | | 1,101 | | | | 688 | |

| EBITDA | | | 6,086 | | | | 11,639 | |

| | | | | | | | | |

| Other adjustments: | | | | | | | | |

| (Gains) losses on proprietary investments | | | (73 | ) | | | 1,879 | |

| (Gains) losses on foreign exchange | | | 1,025 | | | | (857 | ) |

| Non-cash stock-based compensation | | | 1,658 | | | | 1,418 | |

| Net proceeds from Sale Transaction | | | — | | | | (4,200 | ) |

| Unamortized placement fees (1) | | | — | | | | (268 | ) |

| Other expenses(2) | | | 488 | | | | 974 | |

| Adjusted EBITDA | | | 9,184 | | | | 10,585 | |

| | | | | | | | | |

| Other adjustments: | | | | | | | | |

| Carried interest and performance fees | | | — | | | | (1,117 | ) |

| Carried interest and performance fee related expenses | | | — | | | | 559 | |

| Adjusted base EBITDA | | | 9,184 | | | | 10,027 | |

(1) The March 31, 2018 comparative figure contained a placement fee amortization adjustment to ensure the 2018 results were comparable to 2017 in light of the 2018 adoption of IFRS 15.

(2) See Other Expenses in Note 6 of the interim financial statements. In addition to the items outlined in Note 6, Other expenses also includes severance and new hire accruals of $0.1 million for the 3 months ended (3 months ended March 31, 2018 - $0.1 million).

| | 4 |

BUSINESS OVERVIEW

Our reportable operating segments are as follows:

Exchange Listed Products

| • | The Company's closed-end physical trusts and exchange traded funds ("ETFs"). |

Lending

| • | The Company's lending activities primarily occur through limited partnership vehicles ("lending LPs"). |

Managed Equities

| • | The Company's alternative investment strategies (open-end, closed-end, fixed-term LPs, etc.) managed in-house and on a sub-advised basis. Prior to Q1 2019, the Company's fixed-term LP vehicles formed part of the "Global segment" (which historically housed all of our U.S. business activities). Effective Q1 2019, Global no longer satisfied the qualitative tests of IFRS 8 as the geographic location of the U.S businesses is no longer a relevant consideration by management in the allocation of resources and assessment of product and service performance. Consequently, Global has been deconstructed and its fixed-term LP assets and earnings reallocated to the managed equities segment given that it is now at the managed equities level that the allocation of resources and assessment of product and service performance occurs by management. |

Brokerage

| • | Formerly "Merchant Banking & Advisory Services", this segment has been renamed to reflect the inclusion of our U.S. broker-dealer alongside our Canada based broker-dealer as the Company's "brokerage segment". Prior to Q1 2019 , the Company's U.S. broker-dealer formed part of the "Global segment" (which historically housed all of our U.S. business activities). Effective Q1 2019, Global no longer satisfied the qualitative tests of IFRS 8 as the geographic location of the U.S. businesses is no longer a relevant consideration by management in the allocation of resources and assessment of product and service performance. Consequently, Global has been deconstructed and its U.S. broker-dealer assets and earnings reallocated to the brokerage segment given that it is now at the brokerage level (independent of geography) that the allocation of resources and assessment of product and service performance occurs by management. |

Corporate

| • | Provides the Company's various operating segments with capital, balance sheet management and other shared services. |

All Other Segments

| • | Contains all non-reportable segments as per IFRS 8. See note 11 of the interim financial statements for further details. |

For a detailed account of the underlying principal subsidiaries within our reportable business segments, refer to the Company's Annual Information Form and Note 2 of the annual financial statements.

| | 5 |

BUSINESS HIGHLIGHTS AND GROWTH INITIATIVES

Investment Performance

Market value depreciation was $133 million during the quarter. A weaker US dollar and slightly lower silver prices in our exchange listed products segment more than offset market value appreciation experienced in our managed equities and other AUM in the quarter.

Product and Business Line Expansion

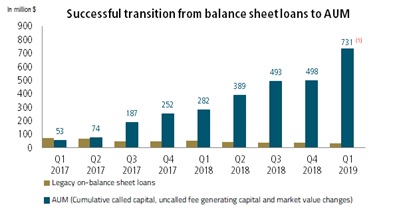

| • | AUM in our lending LPs stood at $731 million (US$547 million) as of March 31, 2019. The $233 million (US$182 million) increase in the quarter was primarily due to additional new AUM arising from fee earning committed capital in a new lending LP and new capital calls into existing LPs. |

| • | On January 11, 2019, the Company launched a new Korean co-managed private equity fund with KB Securities (KB Solar fund), raising $75 million in commitment fee earning AUM in the process. |

| • | On February 6, 2019, the Company announced a joint venture with Tocqueville Asset Management to co-manage a new gold equities investment strategy (Sprott Hathaway Special Situations Fund), raising $27 million in initial AUM in the process. |

Outlook

Exchange Listed Products

| • | We continue to expect the strong finish to the price of gold last year to carry forward to 2019, however, the benefit of higher gold prices will be somewhat offset by starting 2019 with a lower AUM base given our 2018 redemption experience which continued in the first quarter of 2019. |

Lending

| • | We continue to expect a relatively steady deployment of called capital (AUM growth) into our lending LPs in 2019, ranging from US$200 million - US$400 million by end of this year. Over that same time period, we expect our legacy balance sheet loans to continue running off at about the same pace it has historically. However, to the extent that loan repayments outpace capital deployments, declines in 2019 interest income could outpace increases in 2019 management fees from our lending LPs. There is also the risk of capital distributions outpacing capital calls in the near term, however, we do expect net capital calls to occur over the mid-to-long term life of our funds. We anticipate the balance sheet run-off to reach a conclusion by end of 2019. |

Managed Equities

| • | We continue to anticipate earnings from this business to be relatively flat to slightly positive year-over-year. |

Brokerage

| • | We continue to expect a challenging equity origination and placement fee environment, similar to what was experienced in 2018. |

Corporate

| • | We continue to expect to see a material decrease in corporate expenses in 2019, primarily due to: (1) lower LTIP amortization as the graded vesting schedule of the 2017 grants reach the low points of the amortization schedule; and (2) slightly flat to lower SG&A as we continue our cost containment efforts. |

| | 6 |

SUMMARY FINANCIAL INFORMATION

| (In thousands $) | | Q1

2019 | | | Q4

2018 | | | Q3

2018 | | | Q2

2018 | | | Q1

2018 | | | Q4

2017 | | | Q3

2017 | | | Q2

2017 | |

| SUMMARY INCOME STATEMENT | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

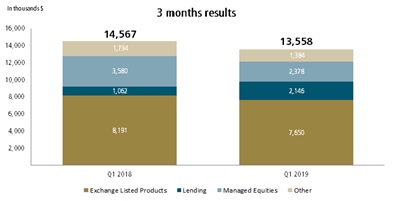

| Management fees | | | 13,558 | | | | 13,182 | | | | 13,722 | | | | 14,559 | | | | 14,056 | | | | 10,247 | | | | 13,597 | | | | 20,460 | |

| Carried interest and performance fees | | | — | | | | — | | | | — | | | | 685 | | | | 1,117 | | | | 3,584 | | | | 835 | | | | 126 | |

| less: Trailer and sub-advisor fees | | | — | | | | 38 | | | | 45 | | | | 49 | | | | 47 | | | | 225 | | | | 1,043 | | | | 3,886 | |

| less: Carried interest and performance fee payouts | | | — | | | | — | | | | — | | | | 356 | | | | 559 | | | | 2,267 | | | | — | | | | 12 | |

| Net Fees | | | 13,558 | | | | 13,144 | | | | 13,677 | | | | 14,839 | | | | 14,567 | | | | 11,339 | | | | 13,389 | | | | 16,688 | |

| Commissions | | | 4,409 | | | | 6,414 | | | | 4,573 | | | | 7,516 | | | | 8,857 | | | | 7,366 | | | | 4,746 | | | | 8,878 | |

| less: Commission expense | | | 1,844 | | | | 2,704 | | | | 2,447 | | | | 2,701 | | | | 3,667 | | | | 2,855 | | | | 1,553 | | | | 3,364 | |

| Net Commissions | | | 2,565 | | | | 3,710 | | | | 2,126 | | | | 4,815 | | | | 5,190 | | | | 4,511 | | | | 3,193 | | | | 5,514 | |

| Interest income | | | 3,918 | | | | 4,244 | | | | 4,824 | | | | 3,293 | | | | 3,066 | | | | 3,588 | | | | 2,789 | | | | 3,387 | |

| Gains (losses) on proprietary investments | | | 73 | | | | 3,912 | | | | (4,765 | ) | | | (3,050 | ) | | | (1,879 | ) | | | (63 | ) | | | (3,770 | ) | | | 613 | |

| Gains (losses) on long-term investments | | | (67 | ) | | | 3,007 | | | | (151 | ) | | | (72 | ) | | | 56 | | | | 3,639 | | | | — | | | | — | |

| Other income (loss) | | | (644 | ) | | | 2,453 | | | | (275 | ) | | | 3,683 | | | | 6,242 | | | | 1,144 | | | | 31,487 | | | | (2,648 | ) |

| Total Net Revenues | | | 19,403 | | | | 30,470 | | | | 15,436 | | | | 23,508 | | | | 27,242 | | | | 24,158 | | | | 47,088 | | | | 23,554 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

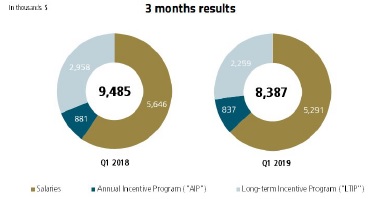

| Compensation (1) | | | 8,387 | | | | 11,163 | | | | 8,167 | | | | 10,634 | | | | 9,485 | | | | 10,631 | | | | 5,655 | | | | 11,784 | |

| Compensation - severance and new hire accruals | | | 146 | | | | 38 | | | | 359 | | | | — | | | | 149 | | | | 2,193 | | | | 62 | | | | 196 | |

| Placement and referral fees | | | 78 | | | | 368 | | | | 223 | | | | 148 | | | | 204 | | | | 833 | | | | 782 | | | | 4,628 | |

| Selling, general and administrative | | | 4,069 | | | | 4,171 | | | | 3,404 | | | | 4,905 | | | | 4,586 | | | | 5,739 | | | | 5,084 | | | | 6,112 | |

| Interest Expense | | | 324 | | | | 312 | | | | 26 | | | | 15 | | | | 66 | | | | 22 | | | | 124 | | | | 51 | |

| Amortization and impairment charges (2) | | | 1,101 | | | | 598 | | | | 457 | | | | 456 | | | | 688 | | | | 1,386 | | | | 1,473 | | | | 1,778 | |

| Other expenses | | | 637 | | | | 606 | | | | 790 | | | | 802 | | | | 1,179 | | | | 2,069 | | | | 703 | | | | 289 | |

| Total Expenses | | | 14,742 | | | | 17,256 | | | | 13,426 | | | | 16,960 | | | | 16,357 | | | | 22,873 | | | | 13,883 | | | | 24,838 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income (Loss) | | | 3,784 | | | | 9,831 | | | | 1,975 | | | | 5,916 | | | | 13,657 | | | | 2,519 | | | | 29,804 | | | | (3,606 | ) |

| Net Income (Loss) per share | | | 0.02 | | | | 0.04 | | | | 0.01 | | | | 0.02 | | | | 0.06 | | | | 0.01 | | | | 0.12 | | | | (0.01 | ) |

| Adjusted base EBITDA | | | 9,184 | | | | 10,092 | | | | 9,707 | | | | 10,686 | | | | 10,027 | | | | 7,524 | | | | 8,007 | | | | 8,751 | |

| Adjusted base EBITDA per share | | | 0.04 | | | | 0.04 | | | | 0.04 | | | | 0.04 | | | | 0.04 | | | | 0.03 | | | | 0.03 | | | | 0.04 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SUMMARY BALANCE SHEET | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Assets | | | 444,325 | | | | 428,215 | | | | 401,366 | | | | 403,985 | | | | 407,177 | | | | 409,849 | | | | 408,093 | | | | 387,636 | |

| Total Liabilities | | | 72,172 | | | | 55,094 | | | | 36,486 | | | | 36,372 | | | | 42,417 | | | | 65,985 | | | | 61,707 | | | | 62,925 | |

| Cash | | | 48,193 | | | | 47,252 | | | | 41,452 | | | | 37,974 | | | | 52,097 | | | | 156,120 | | | | 152,952 | | | | 96,572 | |

| less: syndicate cash holdings | | | (12,218 | ) | | | (10,421 | ) | | | (967 | ) | | | (796 | ) | | | (932 | ) | | | (776 | ) | | | (649 | ) | | | (477 | ) |

| Net cash | | | 35,975 | | | | 36,831 | | | | 40,485 | | | | 37,178 | | | | 51,165 | | | | 155,344 | | | | 152,303 | | | | 96,095 | |

| Proprietary and long-term investments | | | 134,681 | | | | 129,271 | | | | 115,744 | | | | 120,853 | | | | 96,352 | | | | 114,327 | | | | 134,306 | | | | 137,505 | |

| less: obligations related to securities sold short | | | — | | | | (255 | ) | | | — | | | | (2,927 | ) | | | (8,543 | ) | | | (24,993 | ) | | | (25,988 | ) | | | (26,577 | ) |

| Net investments | | | 134,681 | | | | 129,016 | | | | 115,744 | | | | 117,926 | | | | 87,809 | | | | 89,334 | | | | 108,318 | | | | 110,928 | |

| Loans receivable | | | 32,360 | | | | 36,021 | | | | 36,532 | | | | 40,208 | | | | 50,467 | | | | 48,673 | | | | 46,215 | | | | 67,804 | |

| Investable Capital | | | 203,016 | | | | 201,868 | | | | 192,761 | | | | 195,312 | | | | 189,441 | | | | 293,351 | | | | 306,836 | | | | 274,827 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Enterprise AUM | | | 10,569,449 | | | | 10,578,426 | | | | 10,066,112 | | | | 11,126,042 | | | | 11,591,213 | | | | 7,323,382 | | | | 7,191,512 | | | | 9,306,457 | |

(1) Compensation includes stock-based compensation, but excludes commission expense, carried interest and performance fee payouts, which are reported net of commission revenue, carried interest and performance fees, respectively.

(2) Starting Q1, 2019, in order to comply with the new IFRS 16 accounting standard, certain lease assets have now been capitalized and depreciated over their expected lease term. See Note 2, Changes in Accounting Policies of the interim financial statements.

| | 7 |

SUMMARY MANAGEMENT FEE BREAKDOWN

Below is a detailed list of management fee rates on our fund products as at March 31, 2019 (in millions $):

| FUND | | AUM | | | BLENDED NET

MANAGEMENT

FEE RATE | | | CARRIED INTEREST AND PERFORMANCE

FEE CRITERIA |

| Exchange Listed Products | | | | | | | | | | |

| Sprott Physical Gold and Silver Trust | | | 3,466 | | | | 0.40 | % | | N/A (1) |

| Sprott Physical Gold Trust | | | 2,745 | | | | 0.35 | % | | N/A (1) |

| Sprott Physical Silver Trust | | | 1,131 | | | | 0.45 | % | | N/A (1) |

| Sprott Gold Miner's ETF | | | 197 | | | | 0.57 | % | | N/A (1) |

| Sprott Physical Platinum & Palladium Trust | | | 139 | | | | 0.50 | % | | N/A (1) |

| Sprott Jr. Gold Miner's ETF | | | 72 | | | | 0.57 | % | | N/A (1) |

| | | | | | | | | | | |

| Total | | | 7,750 | | | | 0.40 | % | | |

| | | | | | | | | | | |

| Lending | | | | | | | | | | |

| Sprott Private Resource Lending LPs | | | 731 | | | | 1.11 | % | | 15-70% of net profits over guaranteed return |

| | | | | | | | | | | |

| Managed Equities: In-house | | | | | | | | | | |

| Sprott U.S. Value Strategies | | | 305 | | | | 0.98 | % | | 15% of all net profits in excess of the HWM |

| Fixed Term Limited Partnerships | | | 241 | | | | 1.70 | % | | 15-30% over guaranteed return |

| Separately Managed Accounts (2) | | | 48 | | | | 1.00 | % | | N/A |

| Total | | | 594 | | | | 1.27 | % | | |

| | | | | | | | | | | |

| Managed Equities: Sub-advised | | | | | | | | | | |

| Bullion Funds (3) | | | 319 | | | | 0.51 | % | | 5% excess over applicable benchmark indices |

| Corporate Class Funds (3) | | | 130 | | | | 0.75 | % | | 5% excess over applicable benchmark indices |

| Flow-through LPs (3) | | | 74 | | | | 0.70 | % | | 10% of all net profits in excess of the HWM |

| | | | | | | | | | | |

| Total | | | 523 | | | | 0.60 | % | | |

| | | | | | | | | | | |

| Other | | | | | | | | | | |

| Managed Companies (4) | | | 686 | | | | 0.50 | % | | N/A |

| Separately Managed Accounts (5) | | | 285 | | | | 0.61 | % | | 20% of net profits over guaranteed return |

| | | | | | | | | | | |

| Total | | | 971 | | | | 0.53 | % | | |

| | | | | | | | | | | |

| Total AUM | | | 10,569 | | | | 0.52 | % | | |

| | | | | | | | | | | |

(1) Exchange listed products do not attract performance fees, however the management fees they generate are closely correlated to precious metals prices.

(2) Institutional managed accounts.

(3) Management fee rate represents the net amount received by the Company as sub-advisor for these products.

(4) Includes Sprott Resource Holdings Inc. and Sprott Korea Corp.

(5) Includes our private equity strategy in Sprott Asia and high net worth discretionary managed accounts in the U.S.

| | 8 |

RESULTS OF OPERATIONS

AUM SUMMARY

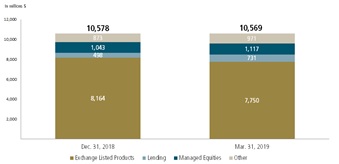

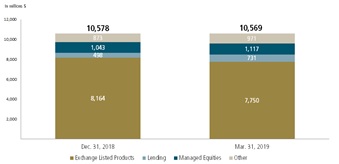

| AUM was $10.6 billion as at March 31, 2019, down slightly from December 31, 2018. We benefited from $264 million of additional AUM arising from a combination of new commitment fee earning assets and new capital calls in our lending LPs. We also benefited from $118 million in new AUM from fund launches in our managed equities segment and our Korea based business (included in the "other" section below). However, these net sales items were more than offset by physical trust redemptions, a weaker US dollar and lower silver prices in our exchange listed products segment. |  |

| In millions $ | | AUM

Dec. 31, 2018 | | | Net Sales

& Capital Calls | | | Market

Value Change | | | Distributions, Acquisitions

& Divestitures | | | AUM

Mar. 31, 2019 | |

| Exchange Listed Products | | | | | | | | | | | | | | | | | | | | |

| - Physical Trusts | | | 7,927 | | | | (260 | ) | | | (186 | ) | | | — | | | | 7,481 | |

| - ETFs | | | 237 | | | | 17 | | | | 15 | | | | — | | | | 269 | |

| | | | 8,164 | | | | (243 | ) | | | (171 | ) | | | — | | | | 7,750 | |

| | | | | | | | | | | | | | | | | | | | | |

| Lending | | | 498 | | | | 264 | | | | (16 | ) | | | (15 | )(1) | | | 731 | |

| | | | | | | | | | | | | | | | | | | | | |

| Managed Equities | | | | | | | | | | | | | | | | | | | | |

| - In-house | | | 295 | | | | 27 | | | | 31 | | | | — | | | | 353 | |

| - Sub-advised | | | 505 | | | | 19 | | | | (1 | ) | | | — | | | | 523 | |

| - Fixed Term LPs | | | 243 | | | | — | | | | (2 | ) | | | — | | | | 241 | |

| | | | 1,043 | | | | 46 | | | | 28 | | | | — | | | | 1,117 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other | | | 873 | | | | 72 | | | | 26 | | | | — | | | | 971 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total | | | 10,578 | | | | 139 | | | | (133 | ) | | | (15 | ) | | | 10,569 | |

(1) Distributions of principal receipts to clients of our lending LPs.

| | 9 |

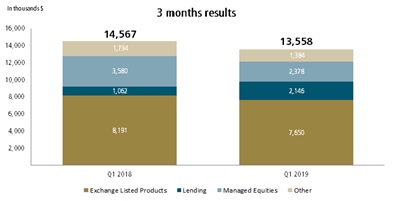

KEY REVENUE LINES

Net Fees in the quarter were $13.6 million, down $1.0 million (7%) from the prior period. Excluding net performance fees generated in the prior period ($0.6 million), the decrease on a three months ended basis was 3% and was due to lower average AUM in our exchange listed products and managed equities segments. This decline more than offset the increased fee generation from our lending LPs as we continue to grow our lending AUM.

Interest Income in the quarter was $3.9 million, up $0.9 million (28%) from the prior period. The increase on a three months ended basis was primarily due to increased income from co-investments made in our lending LPs.

(1) $1,137 million (US$851 million) of committed capital remains uncalled, of which $240 million (US$180 million) earns a commitment fee (AUM), and $897 million (US$671 million) does not (future AUM).

Net Commissions in the quarter were $2.6 million, down $2.6 million (51%) from the prior period. The decline was due to weak equity origination and placement activities in our brokerage segment.

| | 10 |

KEY EXPENSE LINES

Compensation, excluding commissions, carried interest and performance fee payouts, which are presented net of their related revenues in this MD&A, and severance and new hire accruals which are non-recurring, was $8.4 million, down $1.1 million (12%) from the prior period.The decrease was primarily due to lower equity amortization as well as lower salaries on lower head count.

SG&A was $4.1 million in the quarter, down $0.5 million (11%) from the prior period. This was largely due to adoption of IFRS 16 and our on-going cost containment program.

ADDITIONAL REVENUE AND EXPENSE HIGHLIGHTS

Proprietary investments gains during the quarter were due to market value movements of certain resource equity holdings.

Loss on long-term investments was due to market value depreciation of certain long-term investments.

Other income was lower in the quarter. The decrease was primarily due to net sales proceeds received on last year's Sale Transaction and from FX losses on U.S dollar dominated cash, receivables and loans.

Placement and referral fees were lower in the quarter due to less usage of placement agents in our lending business.

Interest expense was higher in the quarter due to the draw down of our loan facility (see Note 12 of the interim financial statements) and interest accruals on leases from the adoption of IFRS 16.

Amortization of intangibles was lower due to finite life fund management contracts related to fixed term LPs in our managed equities segment being fully amortized by the end of the first quarter of the prior period.

Amortization of property and equipment was higher during the quarter due to increased depreciation expense related to leases that were capitalized on the adoption of IFRS 16.

Other expenses were lower in the quarter due to lower non-recurring professional fees and costs related to our energy assets.

| 11 |

Adjusted Base EBITDA

Adjusted base EBITDA in the quarter was $9.2 million, down $0.8 million (8%) from the prior period. The decrease was primarily due to lower net commissions on lower equity origination and placement activities in our brokerage segment and lower fee income earned in our exchange listed products and managed equities segments. These decreases more than offset higher management fees, commitment fees and co-investment income in our lending segment, lower LTIP amortization and lower SG&A.

Balance Sheet

Investable Capital was $203 million, up $1 million (1%) from December 31, 2018.

Total Assets were $444 million, up $16 million (4%) from December 31, 2018. The increase was primarily due to increased long term investments made in the quarter, as well as the capitalization of leases on adoption of IFRS 16.

Total Liabilities were $72 million, up $17 million (31%) from December 31, 2018. The increase was primarily due to the draw down of $23.8 million on our loan facility to help fund current and anticipated co-investments in our lending LPs over the next 12-18 months. The increase is also due to the recording of a lease liability on adoption of IFRS 16. These increases were partially offset by the payment of prior year's accrued liabilities in the quarter.

Total Shareholder's Equity was $372 million, down $1 million from December 31, 2018.

| 12 |

REPORTABLE OPERATING SEGMENTS

Exchange Listed Products

| | | 3 months ended | |

| (In thousands $) | | Mar. 31, 2019 | | | Mar. 31, 2018 | |

| SUMMARY INCOME STATEMENT | | | | | | | | |

| Management fees | | | 7,650 | | | | 8,191 | |

| Other income (loss) | | | (357 | ) | | | (264 | ) |

| Total Revenues | | | 7,293 | | | | 7,927 | |

| | | | | | | | | |

| Compensation | | | 1,051 | | | | 1,324 | |

| Selling, general and administrative | | | 900 | | | | 835 | |

| Interest expense | | | 274 | | | | — | |

| Amortization and impairment charges | | | 317 | | | | 314 | |

| Total Expenses | | | 2,542 | | | | 2,473 | |

| | | | | | | | | |

| Net Income before income taxes | | | 4,751 | | | | 5,454 | |

| Adjusted base EBITDA | | | 5,699 | | | | 6,032 | |

| Total AUM | | | 7,750,030 | | | | 9,014,378 | |

3 months ended

Adjusted base EBITDA in the quarter was $5.7 million, down $0.3 million (6%) from the prior period. The decrease was primarily due to lower management fees given redemption experience in our physical trusts. This was only partially offset by lower LTIP amortization.

Non-EBITDA highlights:

| • | Other loss during the quarter was mainly driven by FX movements on U.S dollar dominated cash and receivables. |

| 13 |

Lending

| | | 3 months ended | |

| (In thousands $) | | Mar. 31, 2019 | | | Mar. 31, 2018 | |

| SUMMARY INCOME STATEMENT | | | | | | | | |

| Management fees | | | 2,146 | | | | 1,062 | |

| Interest income (1) | | | 3,310 | | | | 2,775 | |

| Gains (losses) on proprietary investments | | | (1,421 | ) | | | 1,171 | |

| Gains on long-term investments | | | (11 | ) | | | 14 | |

| Other income (loss) | | | (642 | ) | | | 1,783 | |

| Total Revenues | | | 3,382 | | | | 6,805 | |

| | | | | | | | | |

| Compensation | | | 1,360 | | | | 1,099 | |

| Placement and referral fees | | | 8 | | | | 31 | |

| Selling, general and administrative | | | 119 | | | | 468 | |

| Amortization and impairment charges | | | 36 | | | | 2 | |

| Total Expenses | | | 1,523 | | | | 1,600 | |

| | | | | | | | | |

| Net Income before income taxes | | | 1,859 | | | | 5,205 | |

| Adjusted base EBITDA | | | 4,042 | | | | 2,757 | |

| Total AUM (2) | | | 731,237 | | | | 282,421 | |

(1) Includes: (1) interest income from on-balance sheet loans; and (2) co-investment income from lending LP units held as part of our long-term investments portfolio.

(2) $1,137 million (US$851 million) of committed capital remains uncalled, of which $240 million (US$180 million) earns a commitment fee (AUM), and $897 million (US$671 million) does not (future AUM).

3 months ended

Adjusted base EBITDA in the quarter was $4.0 million, up $1.3 million (47%) from the prior period. The increase was primarily due to higher management fees (including commitment fees) and co-investment income on increased capital calls and new commitment fee earning AUM.

Non-EBITDA highlights:

| • | Losses on proprietary investments were due to market value depreciation on equity kickers received on certain loan arrangements. |

| • | Other loss was mainly driven by FX movements on U.S dollar dominated cash, receivables and loans. |

| 14 |

Managed Equities*

| | | 3 months ended | |

| (In thousands $) | | Mar. 31, 2019 | | | Mar. 31, 2018 | |

| SUMMARY INCOME STATEMENT | | | | | | | | |

| Management fees | | | 2,419 | | | | 3,172 | |

| Carried interest and performance fees | | | — | | | | 1,061 | |

| less: Trailer and sub-advisor fees | | | 41 | | | | 94 | |

| less: Carried interest and performance fee payouts | | | — | | | | 559 | |

| Net Fees | | | 2,378 | | | | 3,580 | |

| Gains (losses) on proprietary investments | | | 545 | | | | 9 | |

| Gains (losses) on long-term investments | | | 59 | | | | (27 | ) |

| Other income (loss) | | | 211 | | | | (467 | ) |

| Total Net Revenues | | | 3,193 | | | | 3,095 | |

| | | | | | | | | |

| Compensation | | | 2,184 | | | | 1,505 | |

| Selling, general and administrative | | | 569 | | | | 344 | |

| Amortization and impairment charges | | | 73 | | | | 331 | |

| Total Expenses | | | 2,826 | | | | 2,180 | |

| | | | | | | | | |

| Net Income before income taxes | | | 367 | | | | 915 | |

| Adjusted base EBITDA | | | 915 | | | | 1,314 | |

| Total AUM | | | 1,117,211 | | | | 1,366,661 | |

*See "Managed Equities" in the business overview section on page 7 of this MD&A.

3 months ended

Adjusted base EBITDA in the quarter was $0.9 million, down $0.4 million (30%) from the prior period. The decrease was primarily due to lower market valuation in our fixed-term LPs which led to lower management fee income.

Non-EBITDA highlights:

| • | Compensation increased due to non-recurring stock based compensation expense on a new hire. |

| 15 |

Brokerage*

| | | 3 months ended | |

| (In thousands $) | | Mar. 31, 2019 | | | Mar. 31, 2018 | |

| SUMMARY INCOME STATEMENT | | | | | | | | |

| Commissions | | | 4,306 | | | | 8,263 | |

| less: Commission Expense | | | 1,864 | | | | 3,701 | |

| Net Commissions | | | 2,442 | | | | 4,562 | |

| Management fees | | | 372 | | | | 475 | |

| Interest income | | | 608 | | | | 291 | |

| Gains (losses) on proprietary investments | | | 297 | | | | (649 | ) |

| Other income (loss) | | | 65 | | | | 4,261 | |

| Total Net Revenues | | | 3,784 | | | | 8,940 | |

| | | | | | | | | |

| Compensation (1) | | | 2,408 | | | | 2,839 | |

| Placement and referral fees | | | 59 | | | | 142 | |

| Selling, general and administrative | | | 1,485 | | | | 1,323 | |

| Interest expense | | | 21 | | | | — | |

| Amortization and impairment charges | | | 186 | | | | 13 | |

| Other expenses | | | — | | | | 72 | |

| Total Expenses | | | 4,159 | | | | 4,389 | |

| Net Income (Loss) before income taxes | | | (375 | ) | | | 4,551 | |

| Adjusted base EBITDA | | | 3 | | | | 2,127 | |

*See "Brokerage" in the business overview section on page 7 of this MD&A.

(1) Compensation is presented excluding commission expense, which is reported net of commission revenue.

3 months ended

Adjusted base EBITDA in the quarter was nominal, down $2.1 million from the prior period. The decrease was primarily due to lower net commissions on weak equity origination and placement activity.

Non-EBITDA highlights:

| • | Gains on proprietary investments were the result of market value appreciation on equity kickers earned on private placements. |

| • | Other income in the prior period was primarily related to net sales proceeds received on last year's Sale Transaction. See Note 6 of the interim financial statements. |

| 16 |

Corporate

This segment is primarily a cost centre that provides capital, balance sheet management and shared services to the Company's subsidiaries.

| | | 3 months ended | |

| (In thousands $) | | Mar. 31, 2019 | | | Mar. 31, 2018 | |

| SUMMARY INCOME STATEMENT | | | | | | | | |

| Gains (losses) on proprietary investments | | | (155 | ) | | | (782 | ) |

| Gains (losses) on long-term investments | | | (115 | ) | | | 69 | |

| Other income (loss) | | | 118 | | | | 553 | |

| Total Revenues | | | (152 | ) | | | (160 | ) |

| | | | | | | | | |

| Compensation | | | 886 | | | | 1,752 | |

| Selling, general and administrative | | | 803 | | | | 1,114 | |

| Interest expense | | | 29 | | | | 66 | |

| Amortization and impairment charges | | | 483 | | | | 20 | |

| Other expenses | | | 334 | | | | 722 | |

| Total Expenses | | | 2,535 | | | | 3,674 | |

| | | | | | | | | |

| Net Income (Loss) before income taxes | | | (2,687 | ) | | | (3,834 | ) |

| Adjusted base EBITDA | | | (1,691 | ) | | | (2,428 | ) |

3 months ended

| • | Proprietary investments losses during the quarter were due to market value depreciation of certain resource equity holdings. |

| • | Long-term investment losses were due to market value depreciation of our long-term investments. |

| • | Lower compensation expense was largely a result of lower LTIP amortization. |

| • | Lower SG&A was largely due to our on-going cost containment program. |

| 17 |

Dividends

The following dividends were declared by the Company during the 3 months ended March 31, 2019:

| Record date | | Payment Date | | Cash dividend per share ($) | | | Total dividend amount (in thousands $) | |

| March 08, 2019 - Regular Dividend Q4 - 2018 | | March 25, 2019 | | | 0.03 | | | | 7,602 | |

| Dividends (1) | | | | | | | | | 7,602 | |

(1) Subsequent to quarter-end, on May 9, 2019, a regular dividend of $0.03 per common share was declared for the quarter ended March 31, 2019. This dividend is payable on June 5, 2019 to shareholders of record at the close of business on May 21, 2019.

Capital Stock

Including the 9.1 million unvested common shares currently held in the EPSP Trust (December 31, 2018 - 9.9 million), total capital stock issued and outstanding was 253.5 million (December 31, 2018 - 253.0 million).

Earnings per share for the current and prior periods have been calculated using the weighted average number of shares outstanding during the respective periods. Basic earnings per share was $0.02 for the three months ended compared to $0.06 in the prior period. Diluted earnings per share was $0.01 for the three months ended compared to $0.05 in the prior period. Diluted earnings per share reflects the dilutive effect of in-the-money stock options, unvested shares held in the EPSP Trust and outstanding restricted stock units.

A total of 3.3 million stock options are outstanding pursuant to our stock option plan, of which 2.6 million are exercisable.

| 18 |

Liquidity and Capital Resources

As at March 31, 2019, the Company had $23.8 million (December 31, 2018 - $Nil) outstanding on its credit facility, $5 million of which is due within 12 months and $18.8 million is due after 12 months (December 31, 2018 - $Nil and $Nil respectively).

The Company has a 5 year, $90 million credit facility with a major Canadian schedule I chartered bank. The facility consists of a $25 million term loan and a $65 million revolving line of credit. Amounts may be borrowed under the facility through prime rate loans or bankers’ acceptances. Amounts may also be borrowed in U.S. dollars through base rate loans. During the quarter, the Company drew $23.8 million on the term loan portion of the credit facility to avoid its expiry and to partially fund near-term anticipated growth in the business, in particular, the anticipated pace of capital calls over the next 12-18 months in its lending LPs. Key terms under the credit facility are noted below:

Structure

| ◦ | 5-year, $65 million revolver with "bullet maturity" December 31, 2022 |

| ◦ | 5-year, $25 million term loan with 5% of principal amortizing quarterly |

Interest Rate

| ◦ | Banker Acceptance Rate + 170 bps |

Covenant Terms

| ◦ | AUM more than 70% of AUM at origination date (compliant at March 31, 2019) |

| ◦ | Debt to EBITDA less than 3.25:1 for first 18 months, after which, debt to EBITDA less than 2.50:1 |

(compliant at March 31, 2019)

| ◦ | EBITDA to interest expense more than 2.50:1 (compliant at March 31, 2019) |

Commitments

Besides the Company's long-term lease agreements, there may be commitments to provide loans or make co-investments in lending LPs arising from our Lending segment or commitments to make investments in the net investments portfolio of the Company. As at March 31, 2019, the Company had $5.7 million in co-investment commitments from the Lending segment (December 31, 2018 - $38.7 million).

| 19 |

Significant Accounting Judgments, Estimates and Changes in Accounting Policies

The interim financial statements have been prepared in accordance with IFRS standards in effect as at March 31, 2019, specifically, IAS 34 Interim Financial Reporting.

Compliance with IFRS requires the Company to exercise judgment, make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may vary. Except as otherwise noted, significant accounting judgments and estimates are described in Note 2 of the December 31, 2018 annual audited financial statements and have been applied consistently to the interim financial statements as at and for the three ended March 31, 2019.

In Q1, 2019 the Company adopted IFRS 16 Leases (“IFRS 16”) and IFRIC 23 Uncertainty over Income Tax Treatments ("IFRIC 23"). As a result, the Company changed its accounting policies. As permitted by the transition provision of IFRS 16, the Company elected not to restate comparative period results. Accordingly, all comparative period information is presented in accordance with previous accounting policies. The adoption of IFRIC 23 did not have a material impact on the Company's financial statements.

Managing Risk: Financial

Market risk

The Company separates market risk into three categories: price risk, interest rate risk and foreign currency risk.

Price risk

Price risk arises from the possibility that changes in the price of the Company's on and off-balance sheet assets and liabilities will result in changes in carrying value or recoverable amounts. The Company's revenues are also exposed to price risk since management fees, carried interests and performance fees are correlated with AUM, which fluctuates with changes in the market values of the assets in the funds and managed accounts managed by the Company.

Interest rate risk

Interest rate risk arises from the possibility that changes in interest rates will adversely affect the value of, or cash flows from, financial instrument assets. The Company’s earnings, particularly through its Lending segment, are exposed to volatility as a result of sudden changes in interest rates. Management takes into account a number of factors and is committed to several processes to ensure that this risk is appropriately managed.

Foreign currency risk

Foreign currency risk arises from foreign exchange rate movements that could negatively impact either the carrying value of financial assets and liabilities or the related cash flows when translating those balances into Canadian dollars. The Company's primary foreign currency is the United States Dollar ("USD"). The Company may employ certain hedging strategies to mitigate foreign currency risk.

Credit risk

Credit risk is the risk that a borrower will not honor its commitments and a loss to the Company may result. Credit risk generally arises in the Company's on balance sheet loans, co-investments in lending LPs and its net investments portfolio.

Loans receivable

The Company incurs credit risk primarily in the on-balance sheet loans of Sprott Resource Lending Corporation ("SRLC") and through co-investments made in the lending LPs managed by SRLC. In addition to the relative default probability of SRLC borrowers (both directly via on balance sheet loans and indirectly via borrowers of the lending LPs we co-invest with), credit risk is also dependent on loss given default, which can increase credit risk if the values of the underlying assets securing the Company's loans and co-investments decline to levels approaching or below the loan amounts. A decrease in commodity prices may delay the development of the underlying security or business plans of the borrower and could adversely affect the value of the Company's security against a loan. Additionally, the value of the Company's underlying security in a loan can be negatively affected if the actual amount or quality of the commodity proves to be less than originally estimated, or the ability to extract the commodity proves to be more difficult or more costly than originally estimated. During the loan origination process, management takes into account a number of factors and is committed to several processes to ensure that this risk is appropriately managed.

| 20 |

Collectability of loans

Besides the above noted measures we take to manage credit risk, the Company will report on credit risk in the notes to the annual financial statements and records expected credit loss provisions to ensure the loans are recorded at their estimated recoverable amount (i.e. net of impairment risk we believe to exist as at the balance sheet date and in accordance with IFRS). Actual losses incurred in the loan portfolio could differ materially from our provisions. Management takes into account a number of factors and is committed to several processes to ensure that this risk is appropriately managed.

Net investments

The Company incurs credit risk when entering into, settling and financing transactions with counterparties. Management takes into account a number of factors and is committed to several processes to ensure that this risk is appropriately managed.

Other

The majority of accounts receivable relate to management fees, carried interest and performance fees receivable from the funds, managed accounts and managed companies managed by the Company. These receivables are short-term in nature and any credit risk associated with them is managed by dealing with counterparties that the Company believes to be creditworthy and by actively monitoring credit exposure and the financial health of the counterparties.

Liquidity risk

Liquidity risk is the risk that the Company cannot meet a demand for cash or fund its obligations as they come due. The Company's exposure to liquidity risk is minimal as it maintains sufficient levels of liquid assets to meet its obligations as they come due. Additionally, the Company has access to a $90 million committed line of credit with a major Canadian schedule I chartered bank. As part of its cash management program, the Company primarily invests in short-term debt securities issued by the Government of Canada with maturities of less than three months.

The Company's exposure to liquidity risk as it relates to loans receivable arises from fluctuations in cash flows from making loan advances and receiving loan repayments (both directly via on balance sheet loans and indirectly via borrowers of the lending LPs we co-invest with). The Company manages its loan commitment liquidity risk through the ongoing monitoring of scheduled loan fundings and repayments ("match funding") and through its broader treasury risk management program and enterprise capital budgeting.

Financial liabilities, including accounts payable and accrued liabilities and compensation and employee bonuses payable, are short-term in nature and are generally due within a year.

The Company's management team is responsible for reviewing resources to ensure funds are readily available to meet its financial obligations (e.g. dividend payments) as they come due, as well as ensuring adequate funds exist to support business strategies and operations growth. The Company manages liquidity risk by monitoring cash balances on a daily basis and through its broader treasury risk management program. To meet any liquidity shortfalls, actions taken by the Company could include: syndicating a portion of its loans; slowing its lending activities; cutting its dividend; drawing on the line of credit; liquidating net investments; and/or issuing common shares.

Concentration risk

A significant portion of the Company's AUM as well as its net investments and loans are focused on the natural resource sector, and in particular, precious metals related investments and transactions. In addition, from time-to-time, certain net investment and loan positions may be concentrated to a material degree in a single position or group of positions. Management takes into account a number of factors and is committed to several processes to ensure that this risk is appropriately managed.

| 21 |

Disclosure Controls and Procedures ("DC&P") and Internal Control over Financial Reporting ("ICFR")

Management is responsible for the design and operational effectiveness of DC&P and ICFR in order to provide reasonable assurance regarding the disclosure of material information relating to the Company. This includes information required to be disclosed in the Company's annual filings, interim filings and other reports filed under securities legislation, as well as the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS.

Consistent with National Instrument 52-109, the Company's CEO and CFO evaluate quarterly the DC&P and ICFR. As of March 31, 2019, the Company's CEO and CFO concluded that the Company's DC&P and ICFR were properly designed and were operating effectively. In addition, there were no material changes to ICFR during the quarter.

Managing Risk: Non-financial

For details around other risks managed by the Company (e.g. confidentiality of information, conflicts of interest, etc.) refer to the Company's annual report as well as the Annual Information Form available on SEDAR at www.sedar.com.

Additional information relating to the Company, including the Company's Annual Information Form is available on SEDAR at www.sedar.com

| 22 |