As filed with the Securities and Exchange Commission on June 24, 2022

Registration No. 333-220368

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 4

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ADIAL PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 8071 | | 82-3074668 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

1180 Seminole Trail, Suite 495

Charlottesville, Virginia 22901

(434) 422-9800

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

William B. Stilley, III

President and Chief Executive Officer

Adial Pharmaceuticals, Inc.

1180 Seminole Trail, Suite 495

Charlottesville, Virginia 22901

(434) 422-9800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Leslie Marlow, Esq.

Hank Gracin, Esq.

Patrick J. Egan, Esq.

Blank Rome LLP

1271 Avenue of the Americas

New York, NY 10020

Telephone: (212) 885-5000

Facsimile: (212) 885-5001

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | Emerging Growth Company ☒ |

If an emerging growth company, indicate by checkmark if the registrant has not elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Post-Effective Amendment No. 4 (this “Amendment”) to the Registration Statement on Form S-1, as amended by Amendment No. 1, Amendment No. 2 and Amendment No. 3 thereto (Commission File No. 333-220368) (the “Original Registration Statement”), of Adial Pharmaceuticals, Inc. (the “Company”) is being filed pursuant to the undertakings in the Original Registration Statement to update and supplement the information contained in the Original Registration Statement, which was originally declared effective by the Securities and Exchange Commission on July 26, 2018.

The Original Registration Statement, as amended by this Amendment, pertains solely to the registration of an aggregate of 1,575,112 shares of common stock, par value $0.001 per share, consisting of: 1,516,552 shares of common stock, par value $0.001 per share, underlying warrants (the “Investor Warrants”) previously issued by the Company to investors in its initial public offering and warrants to purchase 58,560 shares of common stock previously issued to the underwriters (the “Underwriters Warrants” and together with the Investor Warrants, the “Warrant”). The shares of Common Stock issuable upon exercise of the Warrants (the “Warrant Shares”) were initially registered on the Original Registration Statement.

For the convenience of the reader, this Amendment sets forth the Original Registration Statement in its entirety, as amended by this Amendment. This Amendment is being filed to incorporate certain information from the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 filed with the SEC on March 28, 2022 and the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 filed with the SEC on May 16, 2022.

No additional securities are being registered under this Amendment. All applicable registration fees were paid at the time of the filing of the Original Registration Statement. Accordingly, the Company hereby amends the Original Registration Statement, as amended and supplemented through the date hereof, by filing this Amendment.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

| PROSPECTUS | SUBJECT TO COMPLETION, DATED JUNE 24, 2022 |

1,575,112 Shares of Common Stock Underlying Previously Issued Warrants

This prospectus relates to the offer and sale by Adial Pharmaceuticals, Inc., a Delaware corporation of up to 1,575,112 shares of common stock underlying warrants previously issued by us that are issuable at a price of $6.25 per share from time to time upon exercise of outstanding warrants issued to investors and the underwriters in our initial public offering, the issuance of which were previously registered on a Registration Statement on Form S-1 (File No. 333-220368).

We are not selling any shares of our common stock in this offering and, as a result, we will not receive any proceeds from the sale of the common stock covered by this prospectus. All of the net proceeds from the sale of our common stock will go to the warrant holders. Upon exercise of the warrants, however, we will receive proceeds from the exercise of such warrants if exercised for cash and not on a cashless basis. Any proceeds received from the exercise of such warrants will be used for general working capital and other corporate purposes.

Our common stock and the warrants issued in the initial public offering are listed on the Nasdaq Capital Market under the symbols “ADIL” and “ADILW.” On June 21, 2022, the last reported sale price of our common stock on the Nasdaq Capital Market was $1.28 per share. The last reported sale price of our warrants issued in the initial public offering on June 21, 2022 was $0.37 per warrant. We urge prospective purchasers of our common stock to obtain current information about the market prices of our common stock and our warrants issued in connection with our initial public offering in July 2018.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and, as such, elect to comply with certain reduced public company reporting requirements for future filings.

Investing in our securities involves significant risks, including those set forth in the “Risk Factors” section of this prospectus beginning on page 9.

See the “Plan of Distribution” section of this prospectus beginning on page 128 for more information on this offering.

No underwriter or person has been engaged to facilitate the sale of Shares in this offering. All costs associated with the registration were borne by us.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022

Table of Contents

You should rely only on the information contained in this prospectus and any free writing prospectus that we have authorized for use in connection with this offering. We have not authorized anyone to provide you with information that is different. We are offering to sell, and seeking offers to buy, the securities covered hereby only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities covered hereby. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find Additional Information” in the prospectus. In addition, this prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information.”

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside must inform themselves about, and observe any restrictions relating to, the offering of securities and the distribution of this prospectus outside the United States.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We believe that the data obtained from these industry publications and third-party research, surveys and studies are reliable. The Company is ultimately responsible for all disclosure included in this prospectus.

PROSPECTUS SUMMARY

The items in the following summary are described in more detail elsewhere in this prospectus and in the documents incorporated by reference herein. This summary highlights selected information contained elsewhere in this prospectus. This summary is not intended to be complete and does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire prospectus carefully, especially the “Risk Factors” section of this prospectus and other documents or information included or incorporated by reference in this prospectus before making an investment decision.

Overview

We are a clinical-stage biopharmaceutical company focused on the development of therapeutics for the treatment or prevention of addiction and related disorders. Our lead investigational new drug product, AD04, is being developed as a therapeutic agent for the treatment of alcohol use disorder (“AUD”). In January 2021, we expanded our portfolio in the field of addiction with the acquisition of Purnovate, LLC via a merger into our wholly owned subsidiary, Purnovate, Inc., (“Purnovate”) and we continue to explore opportunities to expand our portfolio in the field of addiction and related disorders such as pain reduction, both through internal development and through acquisitions. Our vision is to create the world’s leading addiction focused pharmaceutical company. Additionally, we are using Purnovate’s adenosine drug discovery and development platform to invent and develop novel chemical entities as drug candidates for large unmet medical needs with the intention of spinning off or licensing drug candidates and development programs not related to the field of addiction (see Purnovate and the Adenosine Platform below).

Alcohol Use Disorder and AD04

AUD is characterized by an urge to consume alcohol and an inability to control the levels of consumption. We have completed the clinical phase of the landmark ONWARD™ pivotal Phase 3 clinical trial using AD04 for the potential treatment of AUD in subjects with certain target genotypes. As of this filing, all 302 patients included in the trial had completed dosing and follow up visits and the final monitoring and close-out activities are underway (a total of 303 patients were recruited and then randomized in the trial, however, one subject never initiated treatment and has been excluded from enrollment numbers and will not be included in the full analysis data set or efficacy analysis for the trial). ONWARD trial data is expected to be unblinded and analyzed in the second quarter of 2022. We believe our approach is unique in that it targets the serotonin system and individualizes the treatment of AUD, through the use of genetic screening (i.e., a companion diagnostic genetic biomarker). We have created an investigational companion diagnostic biomarker test for the genetic screening of patients with certain biomarkers that, as reported in the American Journal of Psychiatry (Johnson, et. al. 2011 & 2013), we believe will benefit from treatment with AD04. Our strategy is to integrate the pre-treatment genetic screening into AD04’s label to create a patient-specific treatment in one integrated therapeutic offering. Our goal is to develop a genetically targeted, effective and safe product candidate to treat AUD by reducing or eliminating the patients’ consumption of alcohol.

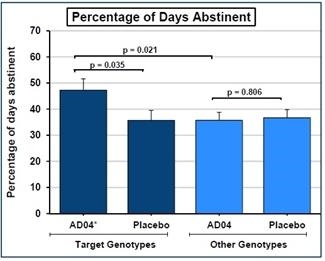

We have a worldwide, exclusive license from the University of Virginia Patent Foundation (d.b.a the Licensing & Venture Group) (“UVA LVG”), which is the licensing arm of the University of Virginia, to commercialize our investigational drug candidate, AD04, subject to Food and Drug Administration (“FDA”) approval of the product, based upon three separate patent application families, with patents issued in over 40 jurisdictions, including three issued patents in the U.S. Our investigational agent has been used in several investigator-sponsored trials and we possess or have rights to use toxicology, pharmacokinetic and other preclinical and clinical data that supports our landmark ONWARD pivotal Phase 3 clinical trial. Our therapeutic agent was the product candidate used in a University of Virginia investigator sponsored Phase 2b clinical trial of 283 patients. In this Phase 2b clinical trial, ultra-low dose ondansetron, the active pharmaceutical agent in AD04, showed a statistically significant difference between ondansetron and placebo for both the primary endpoint and secondary endpoint, which were reduction in severity of drinking measured in drinks per drinking day (1.71 drinks/drinking day; p=0.0042), and reduction in frequency of drinking measured in days of abstinence/no drinking (11.56%; p=0.0352), respectively. Additionally, and importantly, the Phase 2b results showed a significant decrease in the percentage of heavy drinking days (11.08%; p=0.0445) with a “heavy drinking day” defined as a day with four (4) or more alcoholic drinks for women or five (5) or more alcoholic drinks for men consumed in the same day.

The active pharmaceutical agent in AD04, our lead investigational new drug product, is ondansetron, which is also the active ingredient in Zofran®, which was granted FDA approval in 1991 for nausea and vomiting post-operatively and after chemotherapy or radiation treatment and is now commercially available in generic form. In studies of Zofran®, conducted as part of its FDA review process, ondansetron was given acutely at dosages up to almost 100 times the dosage expected to be formulated in AD04 with the highest doses of Zofran® given intravenously (“i.v.”), which results in approximately 160% of the exposure level as oral dosing. Even at high doses given i.v. the studies found that ondansetron is well-tolerated and results in few adverse side effects at the currently marketed doses, which reach more than 80 times the AD04 dose and are given i.v. The formulation dosage of ondansetron used in our drug candidate (and expected to be used by us in our Phase 3 clinical trials) has the potential advantage that it contains a much lower concentration of ondansetron than the generic formulation/dosage that has been used in prior clinical trials, is dosed orally, and is available with use of a companion diagnostic genetic biomarker. Our development plan for AD04 is designed to demonstrate both the efficacy of AD04 in the genetically targeted population and the safety of ondansetron when administered chronically at the AD04 dosage. However, to the best of our knowledge, no comprehensive clinical study has been performed to date that has evaluated the safety profile of ondansetron at any dosage for long-term use as anticipated in our ongoing and planned clinical trials.

According to the National Institute of Alcohol Abuse and Alcoholism (the “NIAAA”) and the Journal of the American Medical Association (“JAMA”), in the United States alone, approximately 35 million people each year have AUD (such number is based upon the 2012 data provided in Grant et. al. the JAMA 2015 publication and has been adjusted to reflect a compound annual growth rate of 1.13%, which is the growth rate reported by U.S. Census Bureau for the general adult population from 2012-2017), resulting in significant health, social and financial costs with excessive alcohol use being the third leading cause of preventable death and is responsible for 31% of driving fatalities in the United States (NIAAA Alcohol Facts & Statistics). AUD contributes to over 200 different diseases and 10% of children live with a person that has an alcohol problem. According to the American Society of Clinical Oncologists, 5-6% of new cancers and cancer deaths globally are directly attributable to alcohol. And, The Lancet published that alcohol is the leading cause of death in people ages 15-49 globally. The Centers for Disease Control (the “CDC”) has reported that AUD costs the U.S. economy about $250 billion annually, with heavy drinking accounting for greater than 75% of the social and health related costs. Despite this, according to the article in the JAMA 2015 publication, only 7.7% of patients (i.e., approximately 2.7 million people) with AUD are estimated to have been treated in any way and only 3.6% by a physician (i.e., approximately 1.3 million people). In addition, according to the JAMA 2017 publication, the problem in the United States appears to be growing with almost a 50% increase in AUD prevalence between 2002 and 2013.

AUD is characterized by an urge to consume alcohol and an inability to control the levels of consumption. Until the publication of the fifth revision of the Diagnostic and Statistical Manual of Mental Disorders in 2013 (the “DSM-5”), AUD was broken into “alcohol dependence” and “alcohol abuse”. More broadly, overdrinking due to the inability to moderate drinking is called alcohol addiction and is often called “alcoholism”, sometimes pejoratively.

Since ondansetron is already manufactured for generic sale, the active ingredient for AD04 is readily available from several manufacturers, and we have contracted with a U.S. manufacturer to acquire ondansetron at a cost expected to be under $0.01 per dose. Clinical trial material (“CTM”) has already been manufactured for the ONWARD Phase 3 trial. The CTM has demonstrated good stability after four years with the stability studies to date.

We have also developed the manufacturing process at a third-party vendor to produce tablets at what we expect will serve for commercial scale production (i.e., greater than 1 million tablets per batch), also at a cost expected to be less than $0.01 per dose. A proprietary packaging process has been developed, which appears to extend the stability of the drug product. Packaging costs are expected to be less than $0.05 per dose. We do not have a written commitment for supply of either the tablets or the packaging and believe that alternative suppliers are available to whom we can transfer the processes that have been developed.

Methods for the companion diagnostic genetic test have been developed as a blood test, and we established the test with a third-party vendor capable of supporting the ONWARD Phase 3 clinical trial. Additionally, we have built validation and possible approval of the companion diagnostic into the Phase 3 program, including that we plan to store blood samples for all patients in the event additional genetic testing is required by regulatory authorities.

Purnovate and the Adenosine Platform

Overview –Unlocking the Promise of Adenosine

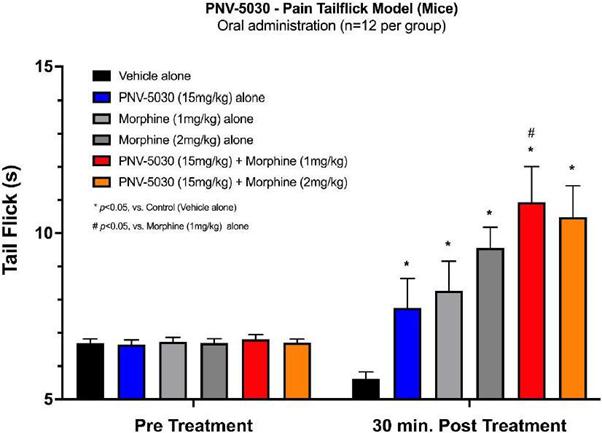

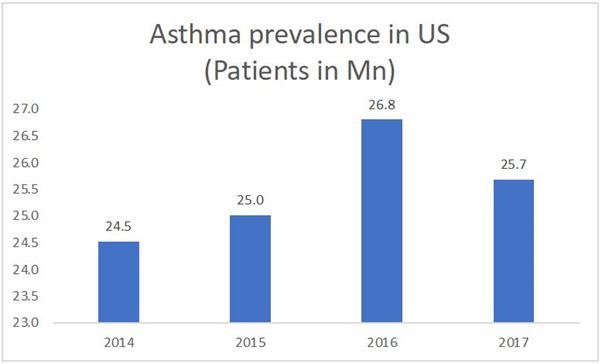

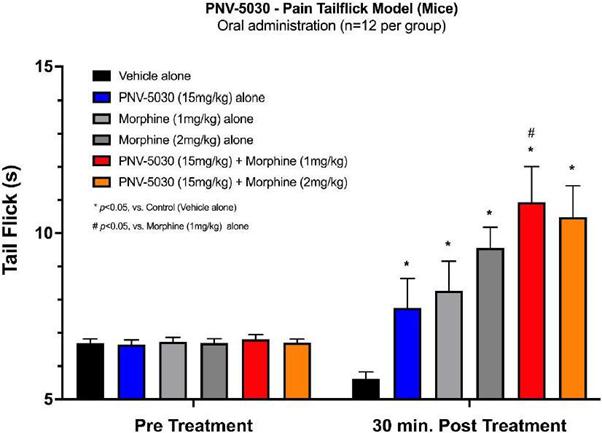

Purnovate, Inc. (“Purnovate”) is a development-stage biopharmaceutical company focused on the development of therapeutic agents that selectively activate or block one or more of the adenosine receptors (i.e., selective agonists and antagonists). We believe we have developed novel chemistries that change the physical properties relative to historical adenosine analogs (i.e., molecules related to the adenosine neurotransmitter) to allow us to create novel and patentable new chemical entities (“NCE’s”) (i.e., novel molecules/drug candidates) that are selective and potent against the targeted receptors while also having the physical properties to allow significant tissue penetration – our Adenosine Platform. This is expected to allow us to unlock the previously elusive promise of adenosine compounds and target large unmet medical needs. Initial targets include, without limitation, pain, cancer, asthma, diabetes, and inflammatory diseases and disorders such as wound/burn healing, inflammatory bowel disorder, and infectious diseases where cytokine storms play a significant role (i.e., COVID, MRSA, sepsis). All of Purnovate’s compounds are currently pre-clinical; we expect our first clinical trial using a drug candidate developed using the Purnovate adenosine platform to commence in the fourth quarter of 2022.

Summary Risk Factors

Our business faces significant risks and uncertainties of which investors should be aware before making a decision to invest in our common stock. If any of the following risks are realized, our business, financial condition and results of operations could be materially and adversely affected. The following is a summary of the more significant risks relating to our Company. A more detailed description of our risk factors set forth under the caption “Risk Factors” beginning on page 9.

Risks Relating to Our Company

| | ● | We have a limited operating history with which to compare, have incurred significant losses since our inception, and expect to incur substantial and increasing losses for the foreseeable future. |

| | ● | We currently have no product revenues and may not generate revenue at any time in the near future, if at all. |

| | ● | We will need to secure additional financing, which may not be available to us on favorable terms, if at all. |

| | ● | We have identified weaknesses in our internal controls. |

| | ● | We rely on a license to use various technologies that are material to our business. |

| | ● | Our business is dependent upon the success of our lead product candidate, AD04, which requires significant additional clinical testing before we can seek regulatory approval and potentially launch commercial sales. |

| | ● | The active ingredient of our product candidate, ondansetron, is currently available in generic form. |

| | ● | Coronavirus or other global health crises could adversely impact our business, including our clinical trials. |

| | | |

| | ● | Business disruptions could seriously harm our future revenue and financial conditions. |

| | ● | For ondansetron, under short-term use, there are currently no long-term use clinical safety data available. |

| | ● | All of our current data for our lead product candidate do not necessarily provide sufficient evidence that our products are viable as potential pharmaceutical products. |

| | ● | The FDA and/or EMA may not accept our planned Phase 3 endpoints for final approval of AD04. |

| | ● | AD04 is dependent on a successful development, approval, and commercialization of a genetic test. |

| | ● | We have limited experience as a company conducting clinical trials. |

| | ● | Our success will be depending upon adoption of our products by physicians. |

Risks Relating to Purnovate

| | ● | The combined company may not experience the anticipated strategic benefits of the acquisition and we may be unable to successfully integrate the Purnovate businesses. |

| | ● | Purnovate has a limited operating history upon which to evaluate its ability to commercialize its products. |

| | ● | The product candidates of Purnovate are in the early stages of development and there is uncertainty as to whether Purnovate’s technology will result in any successful drug candidates. |

Risks Relating to Our Business and Industry

| | ● | We must obtain and maintain regulatory approvals in every jurisdiction in which we intend to sell our product candidate and the regulatory approval in one jurisdiction does not guarantee the approval in another jurisdiction. |

| | ● | Clinical trials are very expensive, time-consuming and difficult to design. |

| | ● | AD04 and any future product candidates may cause undesirable side effects. |

| | ● | We may incur substantial liabilities and may be required to limit commercialization of our products in response to product liability lawsuits. |

| | ● | There is uncertainty as to market acceptance of our technology and product candidates. |

| | ● | We will continue to be subject to ongoing and extensive regulatory requirements even after regulatory approval, and compliance with such regulatory requirements cannot be assured. |

| | ● | Our employees, independent contractors, consultants, commercial partners and vendors may engage in misconduct or other improper activities. |

| | ● | We have no experience selling, marketing or distributing products and have no internal capability to do so. |

| | ● | We may not be successful in establishing and maintaining strategic partnerships. |

| | ● | Our internal computer systems, or those used by our CROs or other contractors or consultants, may fail or suffer security breaches and we may face particular data protection, data security and privacy risks. |

| | ● | We have limited protection for our intellectual property. Our licensed patents and proprietary rights may not prohibit potential competitors from commercializing products. |

| | ● | We may be involved in lawsuits to protect or enforce the patents of our licensors, or if independent contractors have wrongfully used or disclosed confidential information of third parties, which could be expensive, time-consuming and unsuccessful. |

| | ● | Obtaining and maintaining patent protection depends on compliance with requirements imposed by governmental patent agencies and the Courts. |

| | ● | Our ability to generate product revenues will be diminished if our products sell for inadequate prices or patients are unable to obtain adequate levels of reimbursement. |

| | ● | We rely on key executive officers and scientific, regulatory and medical advisors. |

| | ● | Certain of our officers may have a conflict of interest. |

| | ● | We may acquire other businesses or form joint ventures or make investments in other companies or technologies that could harm our operating results, dilute our stockholders’ ownership, increase our debt or cause us to incur significant expense. |

| | ● | Declining general economic or business conditions may have a negative impact on our business. |

| | ● | Changes in general economic conditions may adversely impact our business and operating results. |

| | ● | Health care policy changes, including legislation reforming the U.S. health care system and other legislative initiatives, may have a material adverse effect on our financial condition, results of operations and cash flows. |

Risks Related to Our Securities and Investing in Our Securities

| | ● | Certain of our shareholders have sufficient voting power to make corporate governance decisions that could have a significant influence on us and the other stockholders. |

| | ● | Future sales of securities could result in additional dilution. |

| | ● | Issuance of additional securities available could adversely affect the rights of the holders of our common stock. |

| | ● | If we issue preferred stock with superior rights than our common stock, it could result in a decrease in the value of our common stock and delay or prevent a change in control of us. |

| | ● | We have never paid dividends and have no plans to pay dividends in the foreseeable future. |

| | ● | Our failure to meet the continued listing requirements of The Nasdaq Capital Market could result in a de-listing of our common stock. |

| | ● | We are an “emerging growth company,” and we cannot be certain if the reduced SEC reporting requirements applicable to emerging growth companies will make our common stock less attractive to investors. |

| | ● | As a result of being a public company, we are subject to additional reporting and corporate governance requirements that will require additional management time, resources and expense. |

| | ● | Our common stock has often been thinly traded, so you may be unable to sell at or near ask prices or at all. |

| | ● | Our stock price has fluctuated in the past, has recently been volatile and may be volatile in the future. |

| | ● | Our need for future financing may result in the issuance of additional securities which will cause investors to experience dilution. |

| | ● | Fluctuations in the international currency markets may significantly impact the cost of our planned trial. |

| | ● | The application of the “penny stock” rules to our common stock could limit the trading and liquidity. |

| | ● | Provisions in our corporate charter documents and under Delaware law could make an acquisition of our company more difficult and may prevent attempts by our stockholders to replace or remove our current management. |

| | ● | Our Certificate of Incorporation and our bylaws provide that the Court of Chancery of the State of Delaware will be the exclusive forum for certain types of state actions. |

| | ● | If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline. |

| | ● | The warrants that we have issued are speculative in nature and holders of the warrants will have no rights as a common stockholder except as otherwise provided in the warrants until they acquire our common stock. |

| | ● | There is no established market for the warrants. |

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and therefore we intend to take advantage of certain exemptions from various public company reporting requirements, including not being required to have our internal controls over financial reporting audited by our independent registered public accounting firm pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments. We may take advantage of these exemptions until we are no longer an “emerging growth company.” In addition, the JOBS Act provides that an “emerging growth company” can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to use the extended transition period for complying with new or revised accounting standards under the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates. We will remain an “emerging growth company” until the earlier of (1) the last day of the fiscal year: (a) following the fifth anniversary of the completion of our initial public offering; (b) in which we have total annual gross revenue of at least $1.07 billion; or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeded $700.0 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. References herein to “emerging growth company” have the meaning associated with that term in the JOBS Act.

Corporate Information

ADial Pharmaceuticals, L.L.C. was formed as a Virginia limited liability company in November 2010. ADial Pharmaceuticals, L.L.C. converted from a Virginia limited liability company into a Virginia corporation on October 3, 2017, and then reincorporated in Delaware on October 11, 2017 by merging the Virginia corporation with and into Adial Pharmaceuticals, Inc., a Delaware corporation that was incorporated on October 5, 2017 as a wholly owned subsidiary of the Virginia corporation. We refer to this as the corporate conversion/reincorporation. In connection with the corporate conversion/reincorporation, each unit of ADial Pharmaceuticals, L.L.C. was converted into shares of common stock of the Virginia corporation and then into shares of common stock of Adial Pharmaceuticals, Inc., the members of ADial Pharmaceuticals, L.L.C. became stockholders of Adial Pharmaceuticals, Inc. and Adial Pharmaceuticals, Inc. succeeded to the business of ADial Pharmaceuticals, L.L.C.

Purnovate, LLC, our wholly owned subsidiary, was formed as a Virginia limited liability company in April 2019. Purnovate, LLC converted from a Virginia limited liability company into a Virginia corporation on January 18, 2021, and reincorporated in Delaware on January 26, 2021 by merging the Virginia corporation with and into Purnovate, Inc., a Delaware corporation that was incorporated on January 20, 2021 and as a wholly owned subsidiary of Adial Pharmaceuticals, Inc. (“Adial”).

Our principal executive offices are located at 1180 Seminole Trail, Suite 495, Charlottesville VA 22901, and our telephone number is (434) 422-9800. Our website address is www.adialpharma.com. Information contained in our website does not form part of prospectus and is intended for informational purposes only. The Securities and Exchange Commission (“SEC”) maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that website is www.sec.gov.

This prospectus contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

THE OFFERING

| Common Stock Offered by us | | Up to 1,575,112 shares of common stock issuable upon exercise of the outstanding warrants issued in our IPO. Each warrant is exercisable at any time for the purchase of one share of our common stock at an exercise price of $6.25 per share. The warrants expire on July 31, 2023. |

| | | |

| Common Stock Outstanding prior to this offering | | 25,653,962(1) |

| | | |

| Common Stock Outstanding after this offering | | 27,229,074 (assuming full exercise of the warrants issued in our initial public offering) |

| | | |

| Use of Proceeds | | We will receive approximately $9,844,450 of proceeds if all the currently outstanding warrants issued in the IPO are exercised for cash. We currently intend to use these proceeds for general corporate purposes. See “Use of Proceeds.” |

| | | |

| NASDAQ Capital Markets Symbols | | Our common stock and the warrants issued in the IPO are listed on the Nasdaq Capital Market under the symbols “ADIL” and “ADILW,” respectively. |

| | | |

Risk Factors | | Investment in our securities involves a high degree of risk and could result in a loss of your entire investment. See “Risk Factors” beginning on page 9 to read about factors you should consider before buying our shares of common stock. |

| (1) | The number of shares of our common stock that will be outstanding immediately after this offering is based on 25,653,962 shares of common stock outstanding as of June 21, 2022. |

Unless specifically stated otherwise, the information in this prospectus:

| | ● | excludes an additional 12,168,159 shares of our common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $4.03 per share; |

| | ● | excludes an additional 4,146,977 shares of our common stock issuable upon outstanding options to purchase shares of common stock with a weighted average exercise price of $2.56 per share; and |

| | | |

| | ● | excludes an additional 2,277,716 shares of our common stock reserved for future issuance under the 2017 equity incentive plan. |

OUR INITIAL PUBLIC OFFERING

On July 31, 2018, we closed our IPO whereby we sold 1,464,000 units, each unit consisting of one share of common stock and one warrant to purchase one share of common stock, at a public offering price of $5.00 per unit, before underwriting discounts and expenses. In addition, the underwriters partially exercised their over-allotment option to purchase up to 219,600 warrants granted in connection with the offering by purchasing an additional 170,652 warrants at the offering price of $0.01 per warrant, for proceeds of $1,707. The aggregate net proceeds received by us from the offering were $6.3 million, net of offering expenses not recognized in previous periods. Approximately $633,000 of these proceeds were used for cash repayment of debts. We also issued to the underwriters in the IPO warrants to purchase 58,560 shares of common stock at a purchase price of $6.25 per share.

As of the date of this prospectus, we had outstanding warrants to purchase an aggregate of 1,575,112 shares of our common stock, which warrants were issued in the IPO, calculated as follows: (i) 1,516,552 shares of our common stock issuable upon exercise of warrants issued to investors and (ii) 58,560 shares of our common stock issuable upon exercise of warrants issued to the representative of the underwriters.

RISK FACTORS

Investors should carefully consider the risks described below before deciding whether to invest in our securities. If any of the following risks actually occurs, our business, financial condition or results of operations could be adversely affected. In such case, the trading price of our common stock could decline and you could lose all or part of your investment. Our actual results could differ materially from those anticipated in the forward-looking statements made throughout this prospectus as a result of different factors, including the risks we face described below.

Risks Relating to our Company

We have incurred net losses every year and quarter since our inception and anticipate that we will continue to incur net losses in the future.

We are a clinical stage biotechnology pharmaceutical company that is focused on the discovery and development of medications for the treatment of addictions and related disorders of AUD in patients with certain targeted genotypes. We have a limited operating history. Investment in biopharmaceutical product development is highly speculative because it entails substantial upfront capital expenditures and significant risk that any potential product candidate will fail to demonstrate adequate effect or an acceptable safety profile, gain regulatory approval and become commercially viable. We have no products approved for commercial sale and have not generated any revenue from product sales to date, and we continue to incur significant research and development and other expenses related to our ongoing operations. To date, we have not generated positive cash flow from operations, revenues, or profitable operations, nor do we expect to in the foreseeable future. As of March 31, 2022, we had an accumulated deficit of approximately $53.9 million.

Even if we succeed in commercializing our product candidate or any future product candidates, we expect that the commercialization of our product will not begin until 2025 or later, we will continue to incur substantial research and development and other expenditures to develop and market additional product candidates and will continue to incur substantial losses and negative operating cash flow. We may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our business. The size of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenue. Our prior losses and expected future losses have had and will continue to have an adverse effect on our shareholders’ equity and working capital.

We currently have no product revenues and may not generate revenue at any time in the near future, if at all. Currently, we have no products approved for commercial sale.

We currently have no products for sale and we cannot guarantee that we will ever have any drug products approved for sale. We and our product candidate are subject to extensive regulation by the FDA, and comparable regulatory authorities in other countries governing, among other things, research, testing, clinical trials, manufacturing, labeling, promotion, marketing, adverse event reporting and recordkeeping of our product candidates. Until, and unless, we receive approval from the FDA or other regulatory authorities for our product candidates, we cannot commercialize product candidates and will not have product revenues. Even if we successfully develop products, achieve regulatory approval, and then commercialize our products, we may be unable to generate revenue for many years, if at all. We do not anticipate that we will generate revenue for at least several years, if at all. If we are unable to generate revenue, we will not become profitable, and we may be unable to continue our operations. For the foreseeable future, we will have to fund all of our operations from equity and debt offerings, cash on hand and grants. In addition, changes may occur that would consume our available capital at a faster pace than expected, including changes in and progress of our development activities, acquisitions of additional candidates and changes in regulation. Moreover, preclinical and clinical testing may not start or be completed as we forecast and may not achieve the desired results. Therefore, we expect to seek additional sources of funding, such as additional financing, grant funding or partner or collaborator funding, which additional sources of funding may not be available on favorable terms, if at all.

We have had limited operations to date and there can be no assurance that we will be able to execute on our business strategy.

We are a clinical stage company and have had limited operations to date. We have yet to demonstrate our ability to overcome the risks frequently encountered in our industry and are still subject to many of the risks common to such enterprises, including our ability to implement our business plan, market acceptance of our proposed business and lead product, under-capitalization, cash shortages, limitations with respect to personnel, financing and other resources, competition from better funded and experienced companies, and uncertainty of our ability to generate revenues. In fact, though individual team members have experience running clinical trials, as a company we have yet to prove that we can successfully run a clinical trial. There is no assurance that our activities will be successful or will result in any revenues or profit, and the likelihood of our success must be considered in light of the stage of our development. In addition, no assurance can be given that we will be able to consummate our business strategy and plans, or that financial, technological, market, or other limitations may force us to modify, alter, significantly delay, or significantly impede the implementation of such plans. We have insufficient results for investors to use to identify historical trends. Investors should consider our prospects in light of the risk, expenses and difficulties we will encounter as an early stage company. Our revenue and income potential is unproven and our business model is continually evolving. We are subject to the risks inherent to the operation of a new business enterprise, and cannot assure you that we will be able to successfully address these risks.

We will need to secure additional financing in order to support our operations and fund our current and future clinical trials. We can provide no assurances that any additional sources of financing will be available to us on favorable terms, if at all. Our forecast of the period of time through which our current financial resources will be adequate to support our operations and the costs to support our general and administrative, selling and marketing and research and development activities are forward-looking statements and involve risks and uncertainties.

If we do not succeed in raising additional funds on acceptable terms, we may be unable to complete planned product development activities or obtain approval of our product candidate from the FDA and other regulatory authorities. We do not have any committed sources of capital other than our equity line with Keystone Capital for which there can be no assurance that we will meet the use requirements. Moreover, if our trial activities are significantly delayed due to the coronavirus pandemic or the unrest in Eastern Europe, our project cost, including for planned Purnovate research and development and operating overhead costs may significantly increase. In such case, we would need to obtain additional funding, either through other grants or through potentially dilutive means. In any case, we will need to raise additional capital to complete our development program and to meet our long-term business objectives.

While cash and cash equivalents at the date of this prospectus are not expected to be sufficient to fund our operations for the next twelve months, given current expectations, we will require additional financing as we continue to execute our business strategy. We will require additional funds in order for additional Phase 3 trials of AD04, as well as any additional clinical trials or other development of any products we may acquire or license, including those acquired from Purnovate. Our liquidity may be negatively impacted as a result of a research and development cost increases in addition to general economic and industry factors. We anticipate that, to the extent that we require additional liquidity, it will be funded through the incurrence of other indebtedness, additional equity financings or a combination of these potential sources of liquidity. In addition, we may raise additional funds to finance future cash needs through grant funding and/or corporate collaboration and licensing arrangements. If we raise additional funds by issuing equity securities or convertible debt, including pursuant to our Equity Purchase Agreement with Keystone Capital, our stockholders will experience dilution. Debt financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish valuable rights to our products, future revenue streams or product candidates or to grant licenses on terms that may not be favorable to us. The covenants under future credit facilities may limit our ability to obtain additional debt financing. We cannot be certain that additional funding will be available on acceptable terms, or at all. Any failure to raise capital in the future could have a negative impact on our financial condition and our ability to pursue our business strategies.

Additional financing, which is not in place at this time, may be from the sale of equity or convertible or other debt securities in a public or private offering, from a credit facility or strategic partnership coupled with an investment in us or a combination of both. Our ability to raise capital through the sale of equity may be limited by the various rules of the Securities and Exchange Commission (the “SEC”) and The Nasdaq Capital Market (the “Nasdaq”), which place limits on the number of shares of stock that may be sold. Equity issuances would have a dilutive effect on our stockholders. We may be unable to raise sufficient additional financing on terms that are acceptable to us, if at all. Our failure to raise additional capital and in sufficient amounts may significantly impact our ability to expand our business. For further discussion of our liquidity requirements as they relate to our long-term plans, see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

We have identified weaknesses in our internal controls, and we cannot provide assurances that these weaknesses will be effectively remediated or that additional material weaknesses will not occur in the future.

As a public company, we are subject to the reporting requirements of the Exchange Act, and the Sarbanes-Oxley Act. We expect that the requirements of these rules and regulations will continue to increase our legal, accounting and financial compliance costs, make some activities more difficult, time consuming and costly, and place significant strain on our personnel, systems and resources.

The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures, and internal controls over financial reporting.

We do not yet have effective disclosure controls and procedures, or internal controls over all aspects of our financial reporting. We are continuing to develop and refine our internal controls over financial reporting. Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule 13a-15(f) under the Exchange Act. We will be required to expend time and resources to further improve our internal controls over financial reporting, including by expanding our staff. However, we cannot assure you that our internal control over financial reporting, as modified, will enable us to identify or avoid material weaknesses in the future.

We have identified material weaknesses in our internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our financial statements will not be prevented or detected on a timely basis. The material weaknesses identified to date include (i) policies and procedures which are not yet adequately documented, (ii) approval processes and review processes and documentation for such reviews, (iii) GAAP experience regarding complex transactions and reporting, and (iv) optimal segregation of duties and levels of oversight. As such, our internal controls over financial reporting were not designed or operating effectively.

We will be required to expend time and resources to further improve our internal controls over financial reporting, including by expanding our staff. However, we cannot assure you that our internal control over financial reporting, as modified, will enable us to identify or avoid material weaknesses in the future.

Our current controls and any new controls that we develop may become inadequate because of changes in conditions in our business, including increased complexity resulting from our international expansion. Further, weaknesses in our disclosure controls or our internal control over financial reporting may be discovered in the future. Any failure to develop or maintain effective controls, or any difficulties encountered in their implementation or improvement, could harm our operating results or cause us to fail to meet our reporting obligations and may result in a restatement of our financial statements for prior periods. Any failure to implement and maintain effective internal control over financial reporting could also adversely affect the results of management reports and independent registered public accounting firm audits of our internal control over financial reporting that we will eventually be required to include in our periodic reports that will be filed with the SEC. Ineffective disclosure controls and procedures, and internal control over financial reporting could also cause investors to lose confidence in our reported financial and other information, which would likely have a negative effect on the market price of our common stock.

Our independent registered public accounting firm is not required to audit the effectiveness of our internal control over financial reporting until after we are no longer an “emerging growth company” as defined in the JOBS Act and meet other requirements. At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our internal control over financial reporting is documented, designed or operating. Any failure to maintain effective disclosure controls and internal control over financial reporting could have a material and adverse effect on our business and operating results, and cause a decline in the market price of our common stock.

We rely on a license to use various technologies that are material to our business and if the agreement were to be terminated or if other rights that may be necessary or we deem advisable for commercializing our intended products cannot be obtained, it would halt our ability to market our products and technology, as well as have an immediate material adverse effect on our business, operating results and financial condition.

Our prospects are significantly dependent upon the UVA LVG License. The UVA LVG License grants us exclusive, worldwide rights to certain existing patents and related intellectual property that covers AD04, our lead and currently only product candidate. If we breach the terms of the UVA LVG License, including any failure to make minimum royalty payments required thereunder or failure to reach certain developmental milestones and completion of deadlines, including, submitting an NDA by December 31, 2024 and commencing commercialization of an FDA approved product by December 31, 2025, or other factors, including but not limited to, the failure to comply with material terms of the Agreement, the licensor has the right to terminate the license. If we were to lose or otherwise be unable to maintain this license on acceptable terms, or find that it is necessary or appropriate to secure new licenses from other third parties, we would not be able to market our products and technology, which would likely require us to cease our current operations which would have an immediate material adverse effect on our business, operating results and financial condition.

Our business is dependent upon the success of our lead product candidate, AD04, which requires significant additional clinical testing before we can seek regulatory approval and potentially launch commercial sales.

Our business and future success depends upon our ability to obtain regulatory approval of and then successfully commercialize our lead investigational product candidate, AD04 and other product candidates. AD04 is in clinical stage development. To date, our main focus and the investment of a significant portion of our efforts and financial resources has been in the development of our lead and only investigational product candidate, AD04, for which we are currently conducting the ONWARD Phase 3 clinical trial with approximately 302 patients in Scandinavia and Central and Eastern Europe, which targets the reduction of risk drinking (heavy drinking of alcohol) in subjects that possess selected genetics of the serotonin transporter and/or 5-HT3 receptor gene. We expect that at least one additional Phase 3 clinical trial will be required for approval, as well as, one or more supportive clinical studies. Even though we are pursuing a registration pathway based on specific FDA input and guidance and the EMA precedents and guidance, there are many uncertainties known and unknown that may affect the outcome of the trial. These include adequate patient enrollment, adequate supply of our product candidate, potential changes in the regulatory landscape, and the results of the trial being successful.

All of our future product candidates, as well as AD04, will require additional clinical and non-clinical development, regulatory review and approval in multiple jurisdictions, substantial investment, access to sufficient commercial manufacturing capacity and significant marketing efforts before we can generate any revenue from product sales. We expect AD04 will need at least two Phase 3 trials (including the ONWARD Phase 3 trial are conducting in Scandinavia and Central and Eastern Europe) and one or more supportive clinical studies to gain approval in either the U.S. or Europe for AUD and additional development activity, including, without limitation, clinical trials, in order to seek approval for the use of AD04 to treat any other indications (e.g., such as opioid use disorder, gambling addiction, smoking cessation, and other drug addictions). In addition, because AD04 is our most advanced product candidate and there is limited history information on long-term effects of our proposed dosage, there is always a chance of developmental delays or regulatory issues or other problems arising, with our development plans and depending on their magnitude, our business could be significantly harmed. In any case, the costs associated with completion of our ONWARD Phase 3 trial, a second, confirmatory trial, commercialization of AD04, and the costs of developing AD04 for use in other indications are significant, and will require obtaining funding, possibly through equity sales, before AD04 generates revenue.

Our future success depends heavily on our ability to successfully manufacture, develop, obtain regulatory approval, and commercialize AD04, which may never occur. We currently generate no revenues from our product candidate, and we may never be able to develop or commercialize a marketable drug.

The active ingredient of our product candidate, ondansetron, is currently available in generic form.

Ondansetron, the active pharmaceutical ingredient (“API”) of our current drug treatment, was granted FDA approval as Zofran® in January 1991 and is approved in many foreign markets. Ondansetron is commercially available in generic form, but not available: (i) at the formulation/dosage levels expected to be marketed by us, or (ii) with a requirement to use a diagnostic biomarker, as we expect to be the case with AD04. Although ondansetron has been approved to treat nausea and emesis it has not been approved to treat AUD and it has not been approved for daily long-term use as planned by us. Clinical testing to date of ondansetron at the higher doses used to treat nausea/emesis have not shown effectiveness in treating AUD or any other addictive disorder; however, if a third party conducted a Phase 3 clinical program and showed success treating AUD at those doses, we could not prevent such third party from marketing ondansetron for AUD at those doses.

Results from clinical studies suggest that high intravenous doses of ondansetron may affect the electrical activity of the heart. In a Drug Safety Communication dated June 29, 2012, the FDA stated that: “A 32 mg single intravenous dose of ondansetron (Zofran, ondansetron hydrochloride, and generics) may affect the electrical activity of the heart (QT interval prolongation), which could pre-dispose patients to develop an abnormal and potentially fatal heart rhythm known as Torsades de Pointes.” In addition: “No single intravenous dose should exceed 16 mg.” There are also several recent lawsuits claiming that Zofran® used for the unapproved use of morning sickness causes birth defects. Although we do not believe that our dosage will cause such adverse event there can be no assurance that the negative side effects of the generic drug that have been found in higher dosages will not occur in our dosage or otherwise deter potential users of our product candidate and adversely impact sales of our product candidate. If we were to be required to have such a warning on our drug label, patients may be deterred from using our product candidates.

In addition, we also face the risk, that doctors will prescribe off label, the generic form of ondansetron to treat AUD despite the different dosage of ondansetron in the generic form from that in AD04, the lack of demonstrated clinical efficacy against AUD at the currently available doses (i.e., the Zofran ® and approved generics), and the potential safety concerns if the currently available/higher doses are taken chronically as would be needed for AUD or other addictions. Physicians, or their patients, could divide the lowest dose existing oral tablet into more than ten parts to approximate the necessary AD04 dosage.

Although we believe that any attempt by competitors to reformulate and market ondansetron at our intended dosage levels, while technically feasible, infringes on our intellectual property rights, and should, accordingly, be actionable, we cannot give assurances that we would be successful in defending our rights or that we will have access to sufficient funds necessary to successfully prosecute any such violations of, or infringements on, our intellectual property rights. Additionally, we cannot ensure investors that other companies will not discover and seek to commercialize low doses of ondansetron, not currently available, for other indications.

Coronavirus could adversely impact our business, including our clinical trials.

In December 2019, a novel strain of coronavirus, COVID-19, was reported to have surfaced in Wuhan, China. Since then, the COVID-19 coronavirus has spread to multiple countries, including countries in Europe which we have planned or active clinical trial sites. As the COVID-19 coronavirus continues to spread around the globe, we will likely experience disruptions that could severely impact our business and clinical trials, including:

| | ● | delays or difficulties in enrolling patients in our clinical trials; |

| | ● | delays or difficulties in clinical site initiation, including difficulties in recruiting clinical site investigators and clinical site staff; |

| | ● | diversion of healthcare resources away from the conduct of clinical trials, including the diversion of hospitals serving as our clinical trial sites and hospital staff supporting the conduct of our clinical trials; |

| | ● | interruption of key clinical trial activities, such as clinical trial site monitoring, due to limitations on travel imposed or recommended by federal or state governments, employers and others; |

| | ● | limitations in employee resources that would otherwise be focused on the conduct of our clinical trials, including because of sickness of employees or their families or the desire of employees to avoid contact with large groups of people; |

| | ● | delays in receiving approval from local regulatory authorities to initiate our planned clinical trials; |

| | ● | delays in clinical sites receiving the supplies and materials needed to conduct our clinical trials; |

| | ● | interruption in global shipping that may affect the transport of clinical trial materials, such as investigational drug product used in our clinical trials; |

| | ● | changes in local regulations as part of a response to the COVID-19 coronavirus outbreak which may require us to change the ways in which our clinical trials are conducted, which may result in unexpected costs, or to discontinue the clinical trials altogether; |

| | ● | delays in necessary interactions with local regulators, ethics committees and other important agencies and contractors due to limitations in employee resources or forced furlough of government employees; |

| | ● | delay in the timing of interactions with the FDA due to absenteeism by federal employees or by the diversion of their efforts and attention to approval of other therapeutics or other activities related to COVID-19; and |

| | ● | refusal of the FDA to accept data from clinical trials in affected geographies outside the United States. |

In addition, the outbreak of the coronavirus (“COVID-19”) could continue to disrupt our operations due to absenteeism by infected or ill members of management or other employees, or absenteeism by members of management and other employees who elect not to come to work due to the illness affecting others in our office or laboratory facilities, or due to quarantines. COVID-19 illness could also impact members of our Board of Directors resulting in absenteeism from meetings of the directors or committees of directors, and making it more difficult to convene the quorums of the full Board of Directors or its committees needed to conduct meetings for the management of our affairs.

The global outbreak of the COVID-19 coronavirus continues to rapidly evolve. The extent to which the COVID-19 coronavirus may impact our business and clinical trials will depend on future developments, which are highly uncertain and cannot be predicted with confidence, such as the ultimate geographic spread and possible resurgences of the disease, the duration of the outbreak, travel restrictions and social distancing in the United States and other countries, business closures or business disruptions and the effectiveness of actions taken in the United States and other countries to contain and treat the disease.

Business disruptions could seriously harm our future revenue and financial condition and increase costs and expenses.

Our operations and those of our third-party suppliers and collaborators could be subject to earthquakes, power shortages, telecommunications failures, water shortages, floods, hurricanes or other extreme weather conditions, medical epidemics, labor disputes, war or other business interruptions. Any interruption could seriously harm our ability to timely proceed with any clinical programs or to supply product candidates for use in our clinical programs or during commercialization. For example, the current COVID-19 pandemic has, at points, caused an interruption in our clinical trial activities. Additionally, supply chains disruptions impact and may continue to impact our research activities. Moreover, at the end of 2021 and into 2022, tensions between the United States and Russia escalated when Russia amassed large numbers of military ground forces and support personnel on the Ukraine-Russia border and, in February 2022, Russia invaded Ukraine. In response, North Atlantic Treaty Organization, or NATO, has deployed additional military forces to Eastern Europe and the Biden administration announced certain sanctions against Russia. The invasion of Ukraine and the retaliatory measures that have been taken, or could be taken in the future, by the United States, NATO, and other countries have created global security concerns that could result in a regional conflict and otherwise have a lasting impact on regional and global economies, any or all of which could disrupt our supply chain, and may adversely impact the cost and conduct of our international clinical trials of our product candidates. For example, currently we have plans to conduct clinical trials in Eastern European countries, and may be prevented from doing so. This could negatively impact the anticipated timing and completion of our clinical trials and/or analyses of clinical results.

While there exists a large body of evidence supporting the safety of our primary API, ondansetron, under short-term use, there are currently no long-term use clinical safety data available.

We intend to market our products, particularly AD04, for long-term use by patients seeking to reduce their number of days of heavy drinking, and we assume future sales volumes reflecting such extended use.

Studies of Zofran® conducted as part of its FDA and other regulatory agencies review process found that the drug is well-tolerated and results in few adverse side effects at dosages almost 100 times the dosage expected to be formulated in AD04. However, to the best of our knowledge, no comprehensive clinical study has been performed to date that has evaluated the safety profile of ondansetron for long-term use. We expect the FDA will require us to provide safety data in at least 100 patients for 12 months and can offer no assurances that safety results of these long term use studies will lead to any subsequent approval for long-term use. There can be no assurance that long-term usage of ondansetron, at dosages anticipated by us, will be safe. Though the FDA has stated it will not require additional non-clinical testing nor will it require a QT interval prolongation clinical study, such statements by the FDA are not legally binding on the agency.

All of our current data for our lead product candidate are the result of Phase 2 clinical trials conducted by third parties and do not necessarily provide sufficient evidence that our products are viable as potential pharmaceutical products.

Through our proprietary access to relevant laboratory and clinical trial results of the University of Virginia’s research program, and through our reliance on publicly available third-party research, we possess toxicology, pharmacokinetic, and other preclinical data and clinical data on AD04. As of now, AD04 has completed only Phase 2 clinical trials and we are now conducting its first Phase 3 trial. There is no guarantee that Phase 2 results can or will be replicated by pivotal Phase 3 studies.

To date, long-term safety and efficacy have not yet been demonstrated in clinical trials for our investigational product candidate. Favorable results in early studies or trials may not be repeated in later studies or trials. Even if our clinical trials are initiated and completed as planned, we cannot be certain that the results will support our product candidate claims. Success in preclinical testing and early clinical trials does not ensure that later clinical trials will be successful. We cannot be sure that the results of later clinical trials would replicate the results of prior clinical trials and preclinical testing, nor that they would satisfy the requirements of the FDA or other regulatory agencies. Clinical trials may fail to demonstrate that our product candidate is safe for humans and effective for indicated uses. Preclinical and clinical results are frequently susceptible to varying interpretations that may delay, limit or prevent regulatory approvals or commercialization. Any delay in, or termination of, our clinical trials would delay our obtaining FDA or EMA approval for the affected product candidate and, ultimately, our ability to commercialize that product candidate.

Previous clinical trials using ondansetron have had different trial designs, doses, parameters and endpoints than the current ONWARD Phase 3 clinical trial that is expected to serve as a basis for approval of AD04. Though various doses of ondansetron have been tested as treatments for alcohol addiction (Johnson, BA et al., 2011; Johnson, BA et al., 2000; Kranzler et al, 2003; Sellers, EM et al., 1994), the 283-patient Phase 2b clinical trial on which we are largely basing our clinical expectations only tested one dosing regimen, which was weight-based (Johnson, BA et al., 2011). We plan to use a fixed dose in future clinical trials that we believe provides good coverage given the dose ranges tested clinically; however, it is possible that the dose selected will not be the optimal dose and so drug effects may be limited or not be demonstrated sufficiently in clinical testing. Additionally, only one genotype in the genetic panel that will be used to define patients that are genotype positive for treatment with AD04 was used in primary analyses of the Phase 2b trial and three of the genotypes were added to the panel after a retrospective exploratory analysis of the Phase 2b data. The genotype in the panel related to the 5-HTT, that was included in the primary analysis (Johnson, BA et al., 2011) appears to make up about half of the patients that are genotype positive. The three genotypes related to modulation of the 5-HT3 receptor were selected based on a retrospective analysis that was constrained to 18 single-nucleotide polymorphism (“SNPs”) identified for analysis (Johnson, BA et al., 2013). Therefore, confidence in the effects of the 5-HT3 genetics is less than that for the 5-HTT genetics, and this could negatively impact the treatment effect of AD04 in Phase 3 trials for a segment of the patients identified as genotype positive, which could dilute the overall demonstrated effect of AD04 in the trial.

The endpoints for the Phase 2b clinical trial of AD04 were reduction in the severity of drinking, measured as drinks per day of drinking alcohol and reduction frequency of drinking, measured by days of total abstinence from alcohol. These are surrogate endpoints for the endpoints expected to be required for approval, which, for Europe, are expected to be reduction of heavy drinking days (defined herein), measured in percentage of heavy drinking days per month, and total average alcohol consumed per month, and, for the United States, is expected to be the percentage of patients that have no heavy drinking days in the final 2 months of a six month treatment regimen of AD04. Though the Phase 2b trial showed a statistically significant effect against both pre-specified endpoints and when analyzed for reducing heavy drinking days, all when compared against the placebo group, it is possible that AD04 could affect the endpoints of the Phase 2b trial while not demonstrating a strong enough effect to gain approval.

The Phase 2b clinical trial was 12 weeks in duration, including a one week placebo run-in period, and the Phase 3 trials expected to be required for approval will be 24 weeks. Though the effect of AD04 against AUD in the Phase 2b trial appeared to begin in the first month of the trial and appeared durable throughout the trial, we cannot be sure the effect will extend for the duration of the Phase 3 trials.

The FDA and/or EMA may not accept our planned Phase 3 endpoints for final approval of AD04 and may determine additional clinical trials are required for approval of AD04.

The FDA has indicated to us that a comparison of the percent of patients with no heavy drinking days in the last two months of a six month clinical trial between the drug and placebo groups will be a satisfactory endpoint for determination of a successful Phase 3 trial of AD04 and has published the draft guidance Alcoholism: Developing Drugs for Treatment Guidance for Industry dated February 2015 indicating this endpoint for the development of drugs for AUD. Similarly, the EMA has in the past accepted the co-primary endpoints of reduction from baseline in days of heavy drinking and reduction total grams of alcohol consumed per month and has published the Guideline on the development of medicinal products for the treatment of alcohol dependence on February 18, 2010 stating these endpoints as approvable endpoints for alcohol addiction treatment. Despite these indications, neither the FDA nor the EMA is bound to accept the stated endpoint if a new drug application for AD04 is submitted and their definitions of a heavy drinking day may change. We, however, can offer no assurance that the FDA or EMA will approve our primary endpoints, that we can achieve success at the any endpoints they do approve, or that these potential benefits will subsequently be realized.