0001516212ssga:C000164160Member2020-05-310001516212ssga:SPDRETFsIndexMSCIACWIIMIIndex12129BroadBasedIndexMember2019-05-310001516212ssga:SPDRETFsIndexDBIQOptimumYieldDiversifiedCommodityIndexExcessReturn12126AdditionalIndexMember2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22542

SSGA ACTIVE TRUST

(Exact name of registrant as specified in charter)

One Iron Street, Boston, Massachusetts 02210

(Address of principal executive offices) (zip code)

Sean O’Malley, Esq.

Senior Vice President and General Counsel

c/o SSGA Funds Management, Inc.

One Iron Street

Boston, Massachusetts 02210

(Name and address of agent for service)

Copy to:

W. John McGuire, Esq.

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue, NW

Washington, DC 20004

Registrant’s telephone number, including area code: (617) 664-1465

Date of fiscal year end: June 30

Date of reporting period: June 30, 2024

Item 1. Report to Shareholders.

(a) The Reports to Shareholders are attached herewith.

SPDR Blackstone High Income ETF

Principal Listing Exchange: Cboe BZX Exchange, Inc.

Annual Shareholder Report

June 30, 2024

This annual shareholder report contains important information about the SPDR Blackstone High Income ETF (the "Fund") for the year ended June 30, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

What were the Fund costs for the last year?

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR Blackstone High Income ETF | $72 | 0.68% |

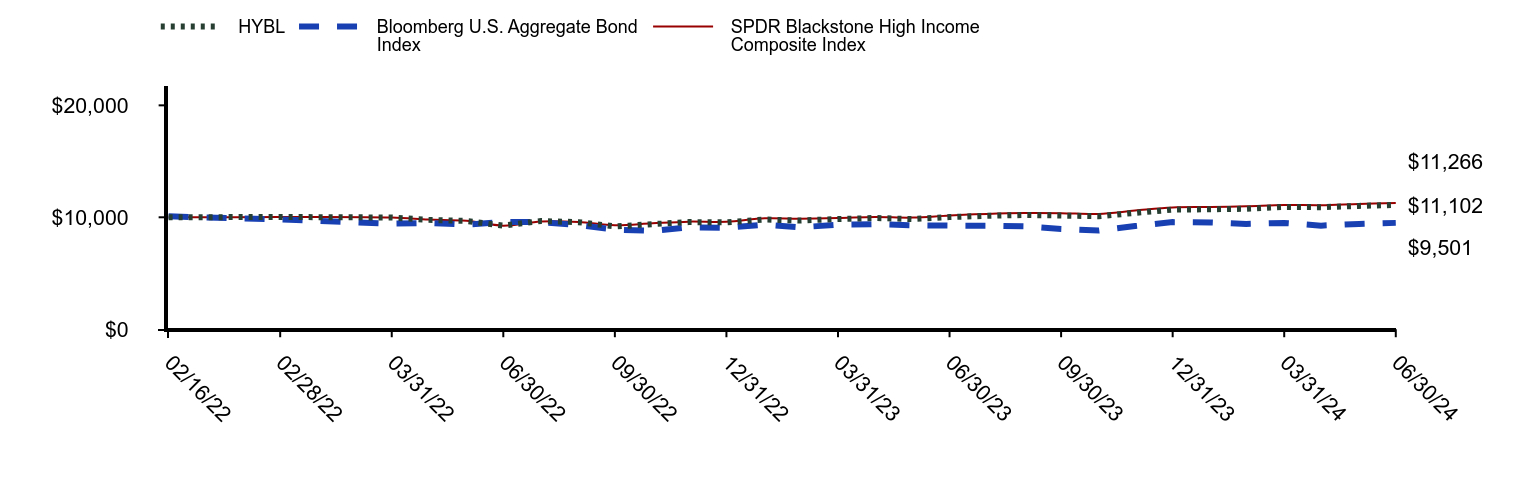

How did the Fund perform last year and what affected its performance?

The Fund's allocation to shorter duration assets coupled with the contribution from its credit risk exposure were contributors to the Fund's outperformance vs. the Primary Index during the reporting period. The Fund's asset allocation, especially its allocation to CLOs, was the largest contributor to the Fund's outperformance relative to the Secondary Index during the reporting period. This was augmented by the Fund’s credit selection within loans. On an issuer level, the top contributors to the Fund’s total return during the reporting period were Point Au Roche Park CLO, SPDR Blackstone Senior Loan ETF, and Asurion. The top detractors from the Fund’s total return during the reporting period were iHeartCommunications, Hughes Satellite Systems, and Realogy Group / Realogy Co-Issuer.

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| HYBL | Bloomberg U.S. Aggregate Bond Index | SPDR Blackstone High Income Composite Index |

|---|

| 02/16/22 | $10,000 | $10,085 | $10,000 |

| 02/28/22 | $10,028 | $9,804 | $10,017 |

| 03/31/22 | $9,982 | $9,432 | $9,974 |

| 04/30/22 | $9,769 | $9,493 | $9,802 |

| 05/31/22 | $9,674 | $9,344 | $9,689 |

| 06/30/22 | $9,259 | $9,572 | $9,254 |

| 07/31/22 | $9,665 | $9,573 | $9,632 |

| 08/31/22 | $9,563 | $9,302 | $9,589 |

| 09/30/22 | $9,185 | $8,901 | $9,288 |

| 10/31/22 | $9,388 | $8,785 | $9,466 |

| 11/30/22 | $9,570 | $9,108 | $9,611 |

| 12/31/22 | $9,551 | $9,067 | $9,595 |

| 01/31/23 | $9,803 | $9,346 | $9,910 |

| 02/28/23 | $9,709 | $9,105 | $9,875 |

| 03/31/23 | $9,846 | $9,336 | $9,928 |

| 04/30/23 | $9,935 | $9,392 | $10,026 |

| 05/31/23 | $9,844 | $9,290 | $9,972 |

| 06/30/23 | $10,022 | $9,257 | $10,166 |

| 07/31/23 | $10,128 | $9,251 | $10,304 |

| 08/31/23 | $10,209 | $9,191 | $10,380 |

| 09/30/23 | $10,159 | $8,958 | $10,369 |

| 10/31/23 | $10,091 | $8,817 | $10,303 |

| 11/30/23 | $10,398 | $9,216 | $10,601 |

| 12/31/23 | $10,682 | $9,569 | $10,884 |

| 01/31/24 | $10,716 | $9,542 | $10,922 |

| 02/29/24 | $10,764 | $9,407 | $10,987 |

| 03/31/24 | $10,926 | $9,494 | $11,100 |

| 04/30/24 | $10,905 | $9,255 | $11,078 |

| 05/31/24 | $11,017 | $9,411 | $11,192 |

| 06/30/24 | $11,102 | $9,501 | $11,266 |

Average Annual Total Returns (%)

| Name | 1 Year | Since Inception 2/16/22 |

|---|

| HYBL | 10.95% | 4.43% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | (2.14%) |

| SPDR Blackstone High Income Composite Index | 10.82% | 5.16% |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

| Statistic | Value |

|---|

| Total Net Assets | $149,593,840 |

| # of Portfolio Holdings | 530 |

| Portfolio Turnover Rate | 137% |

| Total Advisory Fees Paid | $911,236 |

What did the Fund invest in?

| Maturity Duration | % Value of Total Net Assets |

| 0 to 1 Year | 3.9% |

| 1 to 2 Years | 0.2% |

| 2 to 3 Years | 2.8% |

| 3 to 5 Years | 43.0% |

| 5 to 10 Years | 45.2% |

| 10 to 20 Years | 5.1% |

| 20 to 30 Years | 0.2% |

| Holdings | % Value of Total Net Assets |

| SPDR Blackstone Senior Loan ETF | 3.5% |

| Point Au Roche Park CLO Ltd., 11.69%, due 07/20/34 | 1.0% |

| Allison Transmission, Inc., 3.75%, due 01/30/31 | 0.6% |

| DaVita, Inc., 4.63%, due 06/01/30 | 0.6% |

| Ally Financial, Inc., 6.70%, due 02/14/33 | 0.6% |

| Xerox Holdings Corp., 5.50%, due 08/15/28 | 0.5% |

| Fertitta Entertainment LLC, 9.08%, due 01/27/29 | 0.5% |

| ARES LXVIII CLO Ltd., 13.87%, due 04/25/35 | 0.5% |

| Garda World Security Corp., 9.59%, due 02/01/29 | 0.5% |

| Sunoco LP/Sunoco Finance Corp., 4.50%, due 05/15/29 | 0.5% |

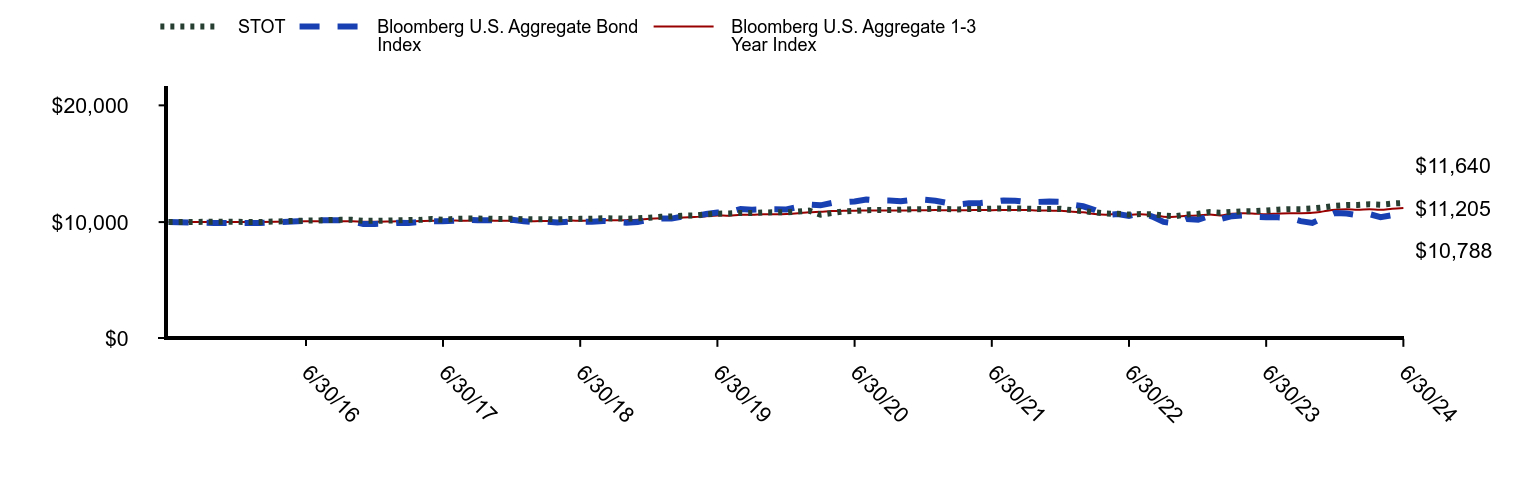

SPDR Blackstone Senior Loan ETF

Principal Listing Exchange: NYSEArca

Annual Shareholder Report

June 30, 2024

This annual shareholder report contains important information about the SPDR Blackstone Senior Loan ETF (the "Fund") for the year ended June 30, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

What were the Fund costs for the last year?

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR Blackstone Senior Loan ETF | $73 | 0.70% |

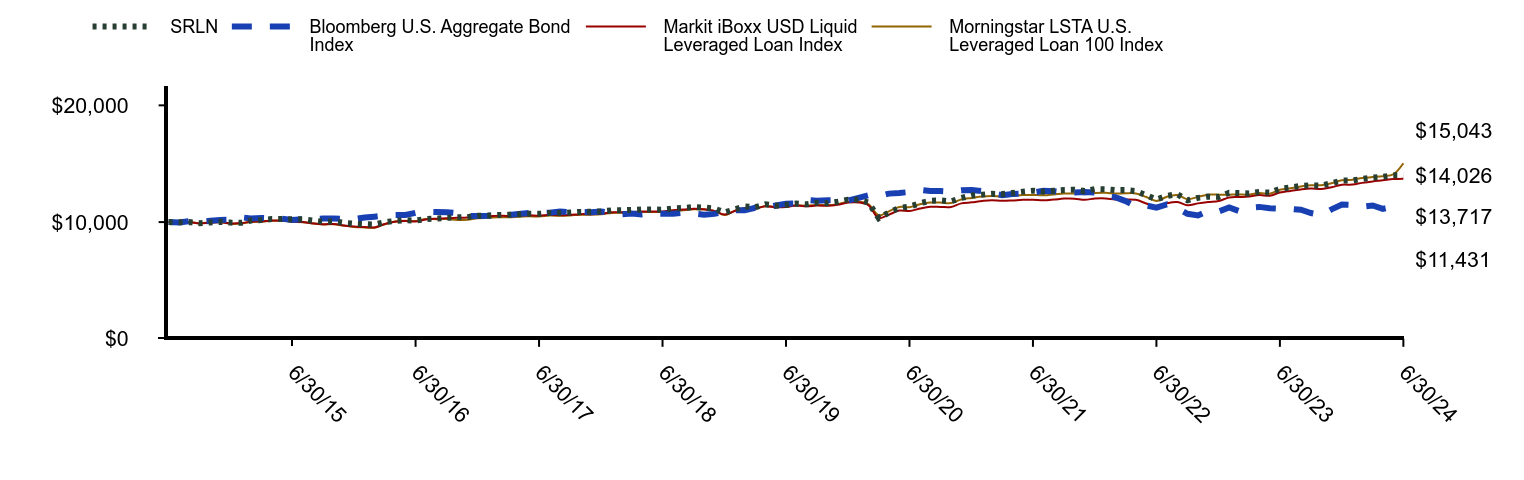

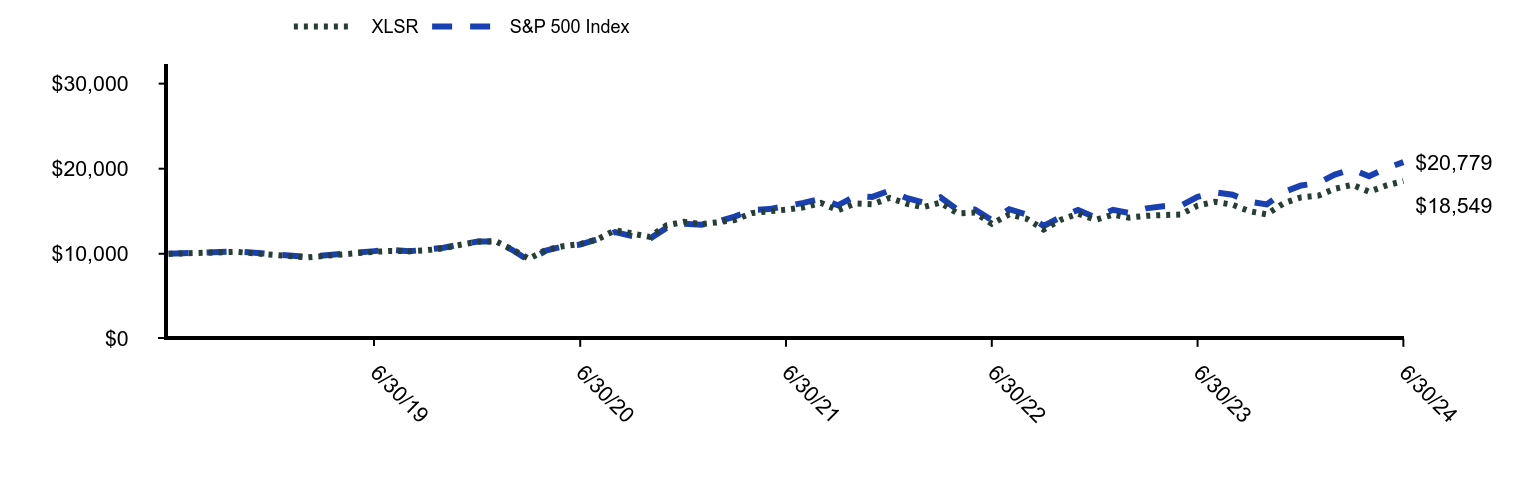

How did the Fund perform last year and what affected its performance?

The Fund’s performance, which was in line with the Primary Index during the reporting period, was positively impacted by its underweight exposure to BB rated assets, while its allocation to high yield bonds detracted from performance relative to the Primary Index. The Fund’s credit selection within its loan allocation was the primary driver of underperformance during the reporting period relative to the Secondary Index. This headwind was partially offset by the positive impact of an underweight allocation to Telecommunication Services during the reporting period. On an issuer level, the top contributors to the Fund’s total return during the reporting period were Asurion, Cloud Software Group, and Neptune Bidco US. The top detractors from the Fund’s total return during the reporting period were Ivanti Software, Numericable US, and Newfold Digital Holdings Group.

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| SRLN | Bloomberg U.S. Aggregate Bond Index | Markit iBoxx USD Liquid Leveraged Loan Index | Morningstar LSTA U.S. Leveraged Loan 100 Index |

|---|

| 6/30/14 | $10,000 | $10,000 | $10,000 | $10,000 |

| 7/31/14 | $9,979 | $9,975 | $9,961 | $9,975 |

| 8/31/14 | $9,998 | $10,085 | $9,992 | $9,998 |

| 9/30/14 | $9,911 | $10,017 | $9,878 | $9,902 |

| 10/31/14 | $9,975 | $10,115 | $9,944 | $9,962 |

| 11/30/14 | $10,019 | $10,187 | $9,990 | $9,998 |

| 12/31/14 | $9,957 | $10,196 | $9,881 | $9,855 |

| 1/31/15 | $9,937 | $10,410 | $9,918 | $9,875 |

| 2/28/15 | $10,133 | $10,312 | $10,038 | $10,018 |

| 3/31/15 | $10,171 | $10,360 | $10,055 | $10,037 |

| 4/30/15 | $10,256 | $10,323 | $10,140 | $10,110 |

| 5/31/15 | $10,258 | $10,298 | $10,130 | $10,116 |

| 6/30/15 | $10,239 | $10,186 | $10,055 | $10,028 |

| 7/31/15 | $10,238 | $10,257 | $10,003 | $9,993 |

| 8/31/15 | $10,121 | $10,242 | $9,884 | $9,900 |

| 9/30/15 | $10,044 | $10,311 | $9,815 | $9,804 |

| 10/31/15 | $10,061 | $10,313 | $9,841 | $9,805 |

| 11/30/15 | $9,938 | $10,286 | $9,714 | $9,703 |

| 12/31/15 | $9,853 | $10,252 | $9,615 | $9,584 |

| 1/31/16 | $9,819 | $10,393 | $9,577 | $9,543 |

| 2/29/16 | $9,799 | $10,467 | $9,537 | $9,522 |

| 3/31/16 | $9,994 | $10,564 | $9,841 | $9,822 |

| 4/30/16 | $10,097 | $10,604 | $10,036 | $10,052 |

| 5/31/16 | $10,167 | $10,607 | $10,083 | $10,114 |

| 6/30/16 | $10,133 | $10,798 | $10,045 | $10,098 |

| 7/31/16 | $10,260 | $10,866 | $10,221 | $10,264 |

| 8/31/16 | $10,307 | $10,854 | $10,290 | $10,253 |

| 9/30/16 | $10,367 | $10,847 | $10,337 | $10,259 |

| 10/31/16 | $10,411 | $10,765 | $10,362 | $10,181 |

| 11/30/16 | $10,427 | $10,510 | $10,391 | $10,199 |

| 12/31/16 | $10,547 | $10,524 | $10,499 | $10,331 |

| 1/31/17 | $10,556 | $10,546 | $10,482 | $10,366 |

| 2/28/17 | $10,606 | $10,616 | $10,553 | $10,418 |

| 3/31/17 | $10,626 | $10,611 | $10,514 | $10,412 |

| 4/30/17 | $10,665 | $10,693 | $10,555 | $10,454 |

| 5/31/17 | $10,708 | $10,775 | $10,595 | $10,500 |

| 6/30/17 | $10,708 | $10,764 | $10,552 | $10,477 |

| 7/31/17 | $10,779 | $10,810 | $10,632 | $10,558 |

| 8/31/17 | $10,772 | $10,908 | $10,580 | $10,536 |

| 9/30/17 | $10,816 | $10,855 | $10,615 | $10,570 |

| 10/31/17 | $10,875 | $10,862 | $10,681 | $10,630 |

| 11/30/17 | $10,877 | $10,848 | $10,677 | $10,637 |

| 12/31/17 | $10,910 | $10,898 | $10,709 | $10,671 |

| 1/31/18 | $11,011 | $10,772 | $10,846 | $10,785 |

| 2/28/18 | $11,007 | $10,670 | $10,844 | $10,792 |

| 3/31/18 | $11,041 | $10,738 | $10,866 | $10,821 |

| 4/30/18 | $11,080 | $10,659 | $10,913 | $10,864 |

| 5/31/18 | $11,078 | $10,734 | $10,911 | $10,865 |

| 6/30/18 | $11,060 | $10,722 | $10,912 | $10,866 |

| 7/31/18 | $11,160 | $10,724 | $11,022 | $10,962 |

| 8/31/18 | $11,213 | $10,793 | $11,070 | $11,017 |

| 9/30/18 | $11,282 | $10,724 | $11,151 | $11,091 |

| 10/31/18 | $11,243 | $10,639 | $11,103 | $11,072 |

| 11/30/18 | $11,157 | $10,702 | $10,961 | $10,950 |

| 12/31/18 | $10,833 | $10,899 | $10,641 | $10,605 |

| 1/31/19 | $11,104 | $11,015 | $10,972 | $10,982 |

| 2/28/19 | $11,346 | $11,008 | $11,187 | $11,202 |

| 3/31/19 | $11,272 | $11,220 | $11,153 | $11,148 |

| 4/30/19 | $11,518 | $11,223 | $11,365 | $11,381 |

| 5/31/19 | $11,405 | $11,422 | $11,265 | $11,305 |

| 6/30/19 | $11,471 | $11,565 | $11,293 | $11,325 |

| 7/31/19 | $11,582 | $11,591 | $11,416 | $11,443 |

| 8/31/19 | $11,522 | $11,891 | $11,351 | $11,396 |

| 9/30/19 | $11,661 | $11,828 | $11,422 | $11,476 |

| 10/31/19 | $11,612 | $11,863 | $11,391 | $11,453 |

| 11/30/19 | $11,739 | $11,857 | $11,478 | $11,539 |

| 12/31/19 | $11,921 | $11,849 | $11,669 | $11,734 |

| 1/31/20 | $11,905 | $12,077 | $11,684 | $11,760 |

| 2/29/20 | $11,685 | $12,294 | $11,460 | $11,532 |

| 3/31/20 | $10,331 | $12,222 | $10,349 | $10,575 |

| 4/30/20 | $10,815 | $12,439 | $10,642 | $10,921 |

| 5/31/20 | $11,218 | $12,497 | $10,985 | $11,295 |

| 6/30/20 | $11,329 | $12,576 | $10,945 | $11,273 |

| 7/31/20 | $11,614 | $12,764 | $11,162 | $11,520 |

| 8/31/20 | $11,827 | $12,661 | $11,316 | $11,671 |

| 9/30/20 | $11,851 | $12,654 | $11,299 | $11,672 |

| 10/31/20 | $11,783 | $12,597 | $11,289 | $11,627 |

| 11/30/20 | $12,062 | $12,721 | $11,602 | $11,940 |

| 12/31/20 | $12,287 | $12,739 | $11,694 | $12,067 |

| 1/31/21 | $12,353 | $12,647 | $11,813 | $12,186 |

| 2/28/21 | $12,420 | $12,465 | $11,877 | $12,226 |

| 3/31/21 | $12,408 | $12,309 | $11,821 | $12,191 |

| 4/30/21 | $12,496 | $12,406 | $11,852 | $12,245 |

| 5/31/21 | $12,610 | $12,447 | $11,909 | $12,314 |

| 6/30/21 | $12,689 | $12,534 | $11,914 | $12,329 |

| 7/31/21 | $12,609 | $12,674 | $11,862 | $12,298 |

| 8/31/21 | $12,693 | $12,650 | $11,926 | $12,371 |

| 9/30/21 | $12,756 | $12,541 | $12,012 | $12,449 |

| 10/31/21 | $12,772 | $12,537 | $12,008 | $12,449 |

| 11/30/21 | $12,655 | $12,574 | $11,915 | $12,391 |

| 12/31/21 | $12,833 | $12,542 | $12,017 | $12,494 |

| 1/31/22 | $12,814 | $12,272 | $12,025 | $12,511 |

| 2/28/22 | $12,735 | $12,135 | $11,937 | $12,443 |

| 3/31/22 | $12,744 | $11,798 | $11,937 | $12,471 |

| 4/30/22 | $12,660 | $11,350 | $11,905 | $12,455 |

| 5/31/22 | $12,298 | $11,423 | $11,596 | $12,144 |

| 6/30/22 | $11,937 | $11,244 | $11,285 | $11,809 |

| 7/31/22 | $12,245 | $11,519 | $11,606 | $12,171 |

| 8/31/22 | $12,388 | $11,193 | $11,727 | $12,313 |

| 9/30/22 | $11,874 | $10,710 | $11,440 | $11,961 |

| 10/31/22 | $12,075 | $10,571 | $11,604 | $12,158 |

| 11/30/22 | $12,186 | $10,960 | $11,719 | $12,348 |

| 12/31/22 | $12,156 | $10,910 | $11,803 | $12,348 |

| 1/31/23 | $12,510 | $11,246 | $12,113 | $12,348 |

| 2/28/23 | $12,491 | $10,955 | $12,148 | $12,363 |

| 3/31/23 | $12,459 | $11,234 | $12,192 | $12,352 |

| 4/30/23 | $12,571 | $11,302 | $12,323 | $12,494 |

| 5/31/23 | $12,524 | $11,179 | $12,256 | $12,436 |

| 6/30/23 | $12,848 | $11,139 | $12,529 | $12,765 |

| 7/31/23 | $12,962 | $11,131 | $12,672 | $12,901 |

| 8/31/23 | $13,103 | $11,060 | $12,796 | $13,054 |

| 9/30/23 | $13,146 | $10,779 | $12,873 | $13,159 |

| 10/31/23 | $13,133 | $10,609 | $12,844 | $13,158 |

| 11/30/23 | $13,323 | $11,089 | $12,984 | $13,322 |

| 12/31/23 | $13,561 | $11,514 | $13,197 | $13,584 |

| 1/31/24 | $13,570 | $11,482 | $13,214 | $13,628 |

| 2/29/24 | $13,700 | $11,320 | $13,360 | $13,780 |

| 3/31/24 | $13,823 | $11,424 | $13,485 | $13,854 |

| 4/30/24 | $13,875 | $11,136 | $13,579 | $13,933 |

| 5/31/24 | $14,018 | $11,324 | $13,686 | $14,089 |

| 6/30/24 | $14,026 | $11,431 | $13,717 | $15,043 |

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | 10 Years |

|---|

| SRLN | 9.45% | 4.12% | 3.46% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | (0.23%) | 1.35% |

| Markit iBoxx USD Liquid Leveraged Loan Index | 9.45% | 3.96% | 3.21% |

| Morningstar LSTA U.S. Leveraged Loan 100 Index | 10.78% | 5.24% | 4.17% |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

| Statistic | Value |

|---|

| Total Net Assets | $6,276,214,724 |

| # of Portfolio Holdings | 533 |

| Portfolio Turnover Rate | 176% |

| Total Advisory Fees Paid | $35,911,436 |

What did the Fund invest in?

| Industry | % Value of Total Net Assets |

| Software | 18.8% |

| Insurance | 7.8% |

| Retail | 7.0% |

| Commercial Services | 6.0% |

| Entertainment | 4.0% |

| Health Care Providers & Services | 3.8% |

| Diversified Financial Services | 3.5% |

| Health Care Equipment & Supplies | 3.1% |

| Commercial Services & Supplies | 3.1% |

| Internet & Telecom | 2.6% |

| Holdings | % Value of Total Net Assets |

| Cloud Software Group, Inc., 9.33% | 1.8% |

| McAfee LLC, 8.58%, due 03/01/29 | 1.5% |

| Sedgwick Claims Management Services, Inc., 9.09%, due 02/24/28 | 1.4% |

| AthenaHealth Group, Inc., 8.59%, due 02/15/29 | 1.4% |

| Neptune Bidco U.S., Inc., 10.41%, due 04/11/29 | 1.4% |

| Allied Universal Holdco LLC, 9.19%, due 05/12/28 | 1.4% |

| Peraton Corp., 9.19%, due 02/01/28 | 1.4% |

| Polaris Newco LLC, 9.59%, due 06/02/28 | 1.3% |

| RealPage, Inc., 8.46%, due 04/24/28 | 1.2% |

| Gainwell Acquisition Corp., 9.43%, due 10/01/27 | 1.2% |

SPDR DoubleLine Emerging Markets Fixed Income ETF

Principal Listing Exchange: Cboe BZX Exchange, Inc.

Annual Shareholder Report

June 30, 2024

This annual shareholder report contains important information about the SPDR DoubleLine Emerging Markets Fixed Income ETF (the "Fund") for the year ended June 30, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

What were the Fund costs for the last year?

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR DoubleLine Emerging Markets Fixed Income ETF | $68 | 0.65% |

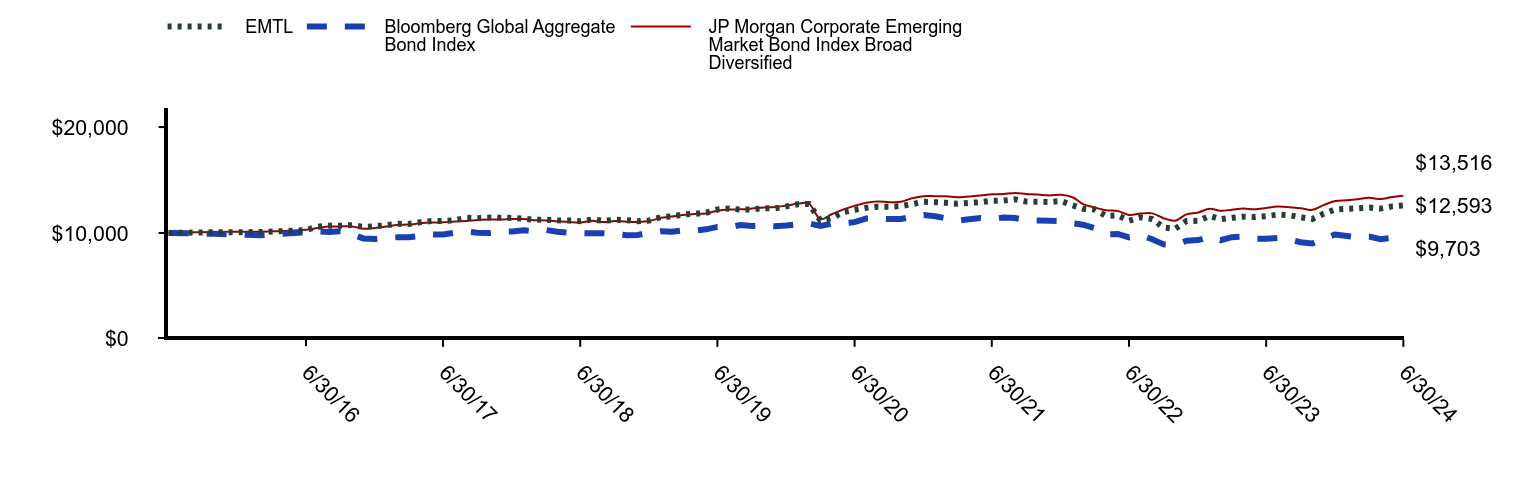

How did the Fund perform last year and what affected its performance?

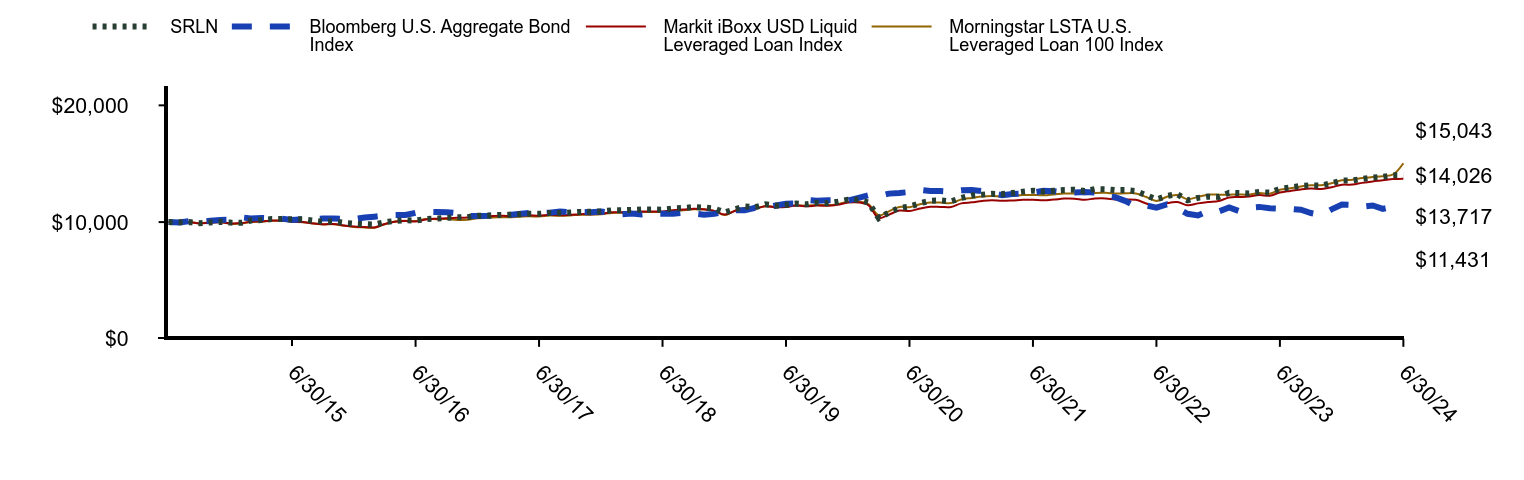

Over the reporting period, Emerging Markets sovereigns and corporates generated strong returns driven by credit spread tightening despite the continued rise in U.S. Treasury yields. The primary driver of the Fund’s relative underperformance was asset allocation. The Fund maintained an underweight to high yield credits relative to the Index which detracted from performance.

Over the 12-month period, high yield credits significantly outperformed their investment grade counterparts due to material spread compression within frontier market economies. The Fund’s allocation to sovereigns and quasi-sovereign debt also detracted from performance as their longer duration profile was keenly impacted by the rise in rates. In terms of regional allocation, the Fund lacked exposure to Europe, the best performing region within the Index, detracting from relative performance. In contrast, the Fund benefited from its underweight to the Middle East and Asia which were the weakest regions within the Index. The Fund ended the period with a slightly shorter duration than the Index and did not invest in derivatives during the reporting period.

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| EMTL | Bloomberg Global Aggregate Bond Index | JP Morgan Corporate Emerging Market Bond Index Broad Diversified |

|---|

| 3/31/16 | $10,000 | $10,000 | $10,000 |

| 4/30/16 | $10,064 | $9,921 | $10,097 |

| 5/31/16 | $10,082 | $9,788 | $10,118 |

| 6/30/16 | $10,267 | $10,074 | $10,299 |

| 7/31/16 | $10,586 | $10,150 | $10,462 |

| 8/31/16 | $10,681 | $10,100 | $10,600 |

| 9/30/16 | $10,691 | $10,156 | $10,616 |

| 10/31/16 | $10,739 | $9,874 | $10,615 |

| 11/30/16 | $10,575 | $9,482 | $10,395 |

| 12/31/16 | $10,631 | $9,438 | $10,476 |

| 1/31/17 | $10,742 | $9,545 | $10,606 |

| 2/28/17 | $10,864 | $9,590 | $10,754 |

| 3/31/17 | $10,845 | $9,604 | $10,788 |

| 4/30/17 | $11,005 | $9,713 | $10,909 |

| 5/31/17 | $11,132 | $9,863 | $10,979 |

| 6/30/17 | $11,131 | $9,854 | $11,001 |

| 7/31/17 | $11,204 | $10,020 | $11,088 |

| 8/31/17 | $11,429 | $10,119 | $11,126 |

| 9/30/17 | $11,400 | $10,028 | $11,233 |

| 10/31/17 | $11,452 | $9,990 | $11,271 |

| 11/30/17 | $11,425 | $10,101 | $11,275 |

| 12/31/17 | $11,423 | $10,136 | $11,311 |

| 1/31/18 | $11,361 | $10,257 | $11,319 |

| 2/28/18 | $11,238 | $10,166 | $11,204 |

| 3/31/18 | $11,259 | $10,274 | $11,183 |

| 4/30/18 | $11,191 | $10,110 | $11,109 |

| 5/31/18 | $11,167 | $10,033 | $11,032 |

| 6/30/18 | $11,108 | $9,988 | $10,985 |

| 7/31/18 | $11,268 | $9,972 | $11,144 |

| 8/31/18 | $11,143 | $9,982 | $11,024 |

| 9/30/18 | $11,242 | $9,896 | $11,129 |

| 10/31/18 | $11,209 | $9,786 | $11,062 |

| 11/30/18 | $11,104 | $9,816 | $11,045 |

| 12/31/18 | $11,175 | $10,015 | $11,124 |

| 1/31/19 | $11,493 | $10,167 | $11,426 |

| 2/28/19 | $11,557 | $10,109 | $11,549 |

| 3/31/19 | $11,741 | $10,235 | $11,697 |

| 4/30/19 | $11,804 | $10,205 | $11,788 |

| 5/31/19 | $11,908 | $10,343 | $11,846 |

| 6/30/19 | $12,212 | $10,572 | $12,106 |

| 7/31/19 | $12,311 | $10,543 | $12,215 |

| 8/31/19 | $12,202 | $10,757 | $12,230 |

| 9/30/19 | $12,225 | $10,648 | $12,307 |

| 10/31/19 | $12,337 | $10,719 | $12,412 |

| 11/30/19 | $12,312 | $10,637 | $12,459 |

| 12/31/19 | $12,508 | $10,700 | $12,580 |

| 1/31/20 | $12,717 | $10,836 | $12,773 |

| 2/29/20 | $12,726 | $10,909 | $12,772 |

| 3/31/20 | $11,174 | $10,665 | $11,300 |

| 4/30/20 | $11,408 | $10,874 | $11,763 |

| 5/31/20 | $11,964 | $10,922 | $12,223 |

| 6/30/20 | $12,186 | $11,019 | $12,560 |

| 7/31/20 | $12,372 | $11,370 | $12,851 |

| 8/31/20 | $12,484 | $11,353 | $12,967 |

| 9/30/20 | $12,479 | $11,312 | $12,905 |

| 10/31/20 | $12,530 | $11,323 | $12,938 |

| 11/30/20 | $12,725 | $11,529 | $13,282 |

| 12/31/20 | $12,944 | $11,683 | $13,477 |

| 1/31/21 | $12,909 | $11,581 | $13,468 |

| 2/28/21 | $12,843 | $11,381 | $13,455 |

| 3/31/21 | $12,762 | $11,162 | $13,369 |

| 4/30/21 | $12,839 | $11,303 | $13,449 |

| 5/31/21 | $12,898 | $11,409 | $13,536 |

| 6/30/21 | $13,046 | $11,309 | $13,649 |

| 7/31/21 | $13,057 | $11,459 | $13,679 |

| 8/31/21 | $13,170 | $11,412 | $13,775 |

| 9/30/21 | $12,960 | $11,209 | $13,683 |

| 10/31/21 | $12,950 | $11,182 | $13,620 |

| 11/30/21 | $12,919 | $11,149 | $13,545 |

| 12/31/21 | $13,013 | $11,134 | $13,600 |

| 1/31/22 | $12,612 | $10,905 | $13,372 |

| 2/28/22 | $12,282 | $10,776 | $12,725 |

| 3/31/22 | $12,220 | $10,448 | $12,400 |

| 4/30/22 | $11,617 | $9,875 | $12,145 |

| 5/31/22 | $11,657 | $9,902 | $12,073 |

| 6/30/22 | $11,154 | $9,584 | $11,704 |

| 7/31/22 | $11,470 | $9,788 | $11,827 |

| 8/31/22 | $11,311 | $9,402 | $11,848 |

| 9/30/22 | $10,514 | $8,919 | $11,395 |

| 10/31/22 | $10,398 | $8,858 | $11,161 |

| 11/30/22 | $11,123 | $9,274 | $11,751 |

| 12/31/22 | $11,151 | $9,325 | $11,932 |

| 1/31/23 | $11,620 | $9,631 | $12,295 |

| 2/28/23 | $11,296 | $9,310 | $12,098 |

| 3/31/23 | $11,433 | $9,605 | $12,199 |

| 4/30/23 | $11,538 | $9,647 | $12,306 |

| 5/31/23 | $11,502 | $9,459 | $12,235 |

| 6/30/23 | $11,587 | $9,458 | $12,367 |

| 7/31/23 | $11,739 | $9,523 | $12,488 |

| 8/31/23 | $11,668 | $9,393 | $12,432 |

| 9/30/23 | $11,489 | $9,119 | $12,335 |

| 10/31/23 | $11,312 | $9,010 | $12,185 |

| 11/30/23 | $11,810 | $9,464 | $12,628 |

| 12/31/23 | $12,221 | $9,857 | $13,016 |

| 1/31/24 | $12,287 | $9,721 | $13,092 |

| 2/29/24 | $12,322 | $9,599 | $13,186 |

| 3/31/24 | $12,401 | $9,652 | $13,318 |

| 4/30/24 | $12,302 | $9,408 | $13,200 |

| 5/31/24 | $12,511 | $9,532 | $13,392 |

| 6/30/24 | $12,593 | $9,703 | $13,516 |

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | Since Inception 4/13/16 |

|---|

| EMTL | 8.87% | 0.63% | 2.82% |

| Bloomberg Global Aggregate Bond Index | 0.93% | (2.02%) | (0.37%) |

| JP Morgan Corporate Emerging Market Bond Index Broad Diversified | 9.30% | 2.23% | 3.74% |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

| Statistic | Value |

|---|

| Total Net Assets | $87,506,798 |

| # of Portfolio Holdings | 125 |

| Portfolio Turnover Rate | 56% |

| Total Advisory Fees Paid | $526,833 |

What did the Fund invest in?

| Maturity Duration | % Value of Total Net Assets |

| 0 to 1 Year | 12.0% |

| 1 to 2 Years | 2.1% |

| 2 to 3 Years | 7.0% |

| 3 to 5 Years | 15.9% |

| 5 to 10 Years | 41.5% |

| 10 to 20 Years | 15.2% |

| 20 to 30 Years | 4.2% |

| Greater than 30 Years | 1.2% |

| Holdings | % Value of Total Net Assets |

| Guara Norte SARL, 5.20%, due 06/15/34 | 2.4% |

| Oversea-Chinese Banking Corp. Ltd., 1.83%, due 09/10/30 | 2.3% |

| Minejesa Capital BV, 5.63%, due 08/10/37 | 2.3% |

| Bharti Airtel Ltd., 4.38%, due 06/10/25 | 2.3% |

| JBS USA Holding Lux SARL/ JBS USA Food Co./ JBS Lux Co. SARL, 5.13%, due 02/01/28 | 2.3% |

| DBS Group Holdings Ltd., 1.82%, due 03/10/31 | 2.2% |

| Pertamina Persero PT, 1.40%, due 02/09/26 | 2.1% |

| Banco Internacional del Peru SAA Interbank, 4.00%, due 07/08/30 | 2.1% |

| Cometa Energia SA de CV, 6.38%, due 04/24/35 | 2.0% |

| BBVA Bancomer SA, 5.88%, due 09/13/34 | 2.0% |

SPDR DoubleLine Short Duration Total Return Tactical ETF

Principal Listing Exchange: Cboe BZX Exchange, Inc.

Annual Shareholder Report

June 30, 2024

This annual shareholder report contains important information about the SPDR DoubleLine Short Duration Total Return Tactical ETF (the "Fund") for the year ended June 30, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

What were the Fund costs for the last year?

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR DoubleLine Short Duration Total Return Tactical ETF | $46 | 0.45% |

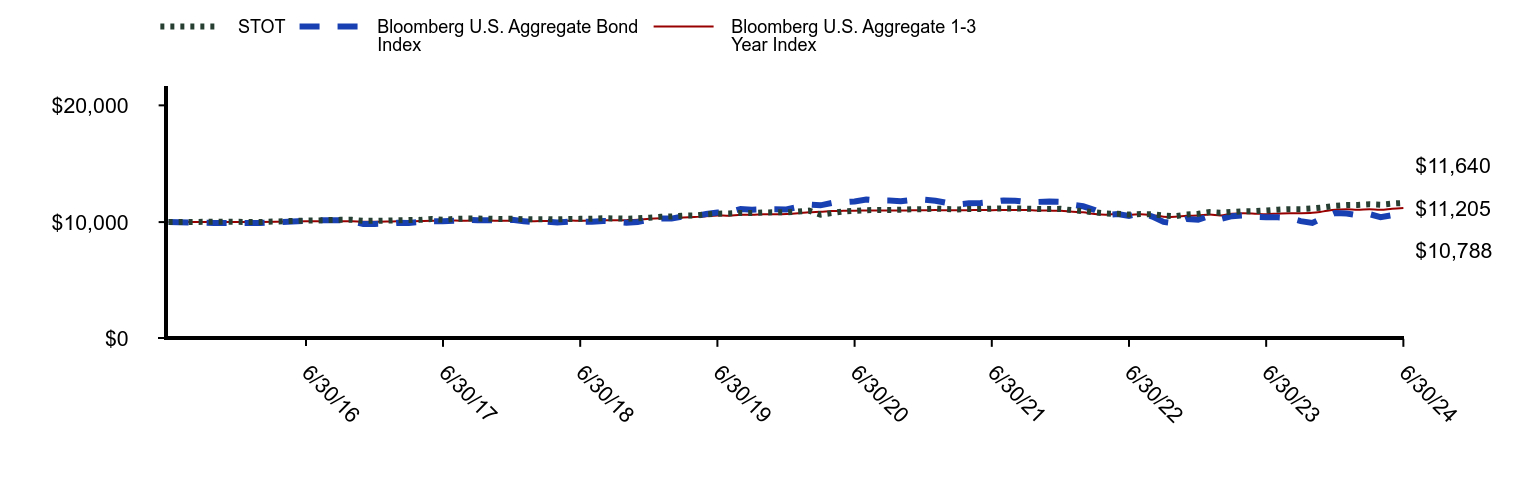

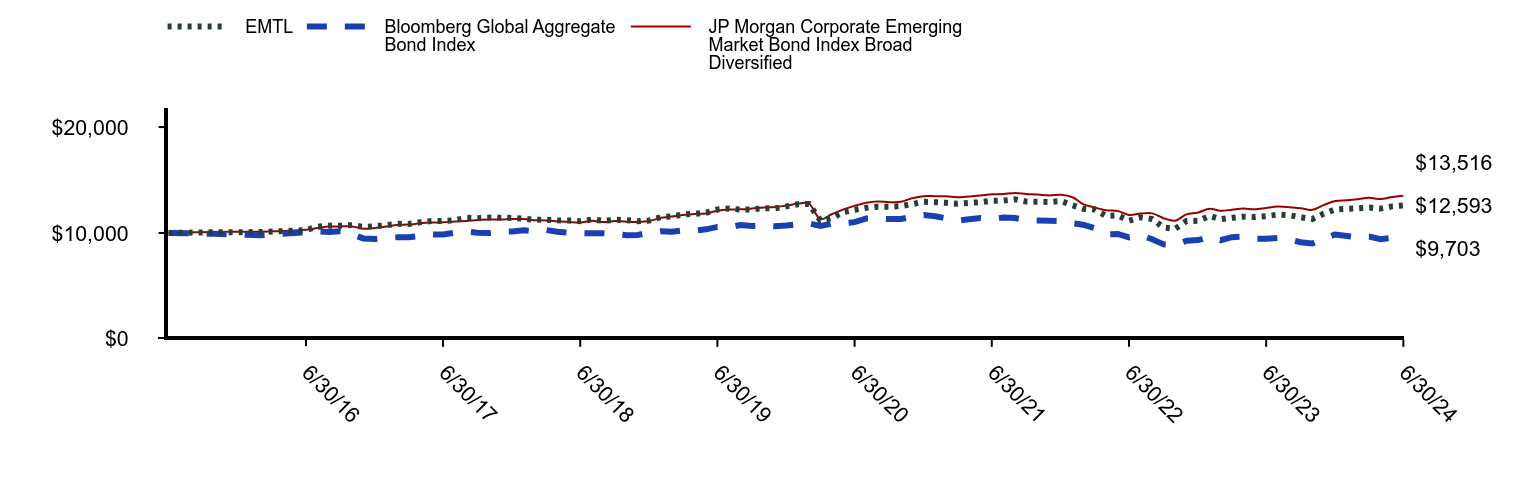

How did the Fund perform last year and what affected its performance?

The primary driver of outperformance was asset allocation as the portfolio maintained a higher credit allocation than the Index, with roughly sixty-six percent weighting to credit risk sectors compared to approximately thirty percent in the Index. This contributed positively to performance as credit spreads tightened materially during the period. The Fund maintained a slightly shorter duration position than the Index.

The Fund’s best performing sector was emerging market bonds as these credits significantly outperformed their investment grade counterparts because of material credit spread tightening within frontier market economies. Shorter-duration structured credit sectors such as collateralized loan obligations (CLOs), commercial MBS, and asset backed securities also delivered strong performance as these assets are less rate sensitive but still provide high levels of monthly income.

Every sector within the portfolio generated a positive return. The top positive contributor to the Fund’s performance during the period was U.S. Treasurys. Agency MBS contributed the least to performance during the period, though the sector still generated a positive return.

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| STOT | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Aggregate 1-3 Year Index |

|---|

| 3/31/16 | $10,000 | $10,000 | $10,000 |

| 4/30/16 | $10,026 | $9,921 | $10,010 |

| 5/31/16 | $10,012 | $9,924 | $10,004 |

| 6/30/16 | $10,131 | $10,103 | $10,064 |

| 7/31/16 | $10,140 | $10,166 | $10,066 |

| 8/31/16 | $10,173 | $10,155 | $10,056 |

| 9/30/16 | $10,190 | $10,149 | $10,068 |

| 10/31/16 | $10,194 | $10,072 | $10,065 |

| 11/30/16 | $10,101 | $9,833 | $10,025 |

| 12/31/16 | $10,110 | $9,847 | $10,031 |

| 1/31/17 | $10,126 | $9,867 | $10,050 |

| 2/28/17 | $10,158 | $9,933 | $10,066 |

| 3/31/17 | $10,176 | $9,928 | $10,072 |

| 4/30/17 | $10,190 | $10,004 | $10,090 |

| 5/31/17 | $10,273 | $10,081 | $10,107 |

| 6/30/17 | $10,191 | $10,071 | $10,103 |

| 7/31/17 | $10,272 | $10,114 | $10,129 |

| 8/31/17 | $10,307 | $10,205 | $10,117 |

| 9/30/17 | $10,304 | $10,156 | $10,138 |

| 10/31/17 | $10,283 | $10,163 | $10,136 |

| 11/30/17 | $10,271 | $10,149 | $10,114 |

| 12/31/17 | $10,283 | $10,196 | $10,117 |

| 1/31/18 | $10,236 | $10,079 | $10,090 |

| 2/28/18 | $10,234 | $9,983 | $10,081 |

| 3/31/18 | $10,247 | $10,047 | $10,097 |

| 4/30/18 | $10,230 | $9,973 | $10,087 |

| 5/31/18 | $10,273 | $10,043 | $10,125 |

| 6/30/18 | $10,276 | $10,031 | $10,123 |

| 7/31/18 | $10,290 | $10,034 | $10,129 |

| 8/31/18 | $10,327 | $10,098 | $10,165 |

| 9/30/18 | $10,311 | $10,033 | $10,158 |

| 10/31/18 | $10,290 | $9,954 | $10,168 |

| 11/30/18 | $10,319 | $10,013 | $10,198 |

| 12/31/18 | $10,380 | $10,197 | $10,277 |

| 1/31/19 | $10,449 | $10,306 | $10,319 |

| 2/28/19 | $10,482 | $10,300 | $10,335 |

| 3/31/19 | $10,554 | $10,497 | $10,403 |

| 4/30/19 | $10,567 | $10,500 | $10,426 |

| 5/31/19 | $10,658 | $10,687 | $10,499 |

| 6/30/19 | $10,718 | $10,821 | $10,557 |

| 7/31/19 | $10,737 | $10,845 | $10,553 |

| 8/31/19 | $10,781 | $11,126 | $10,636 |

| 9/30/19 | $10,788 | $11,066 | $10,631 |

| 10/31/19 | $10,824 | $11,100 | $10,667 |

| 11/30/19 | $10,838 | $11,094 | $10,668 |

| 12/31/19 | $10,832 | $11,086 | $10,692 |

| 1/31/20 | $10,903 | $11,300 | $10,752 |

| 2/29/20 | $10,983 | $11,503 | $10,840 |

| 3/31/20 | $10,644 | $11,435 | $10,884 |

| 4/30/20 | $10,771 | $11,639 | $10,943 |

| 5/31/20 | $10,905 | $11,693 | $10,964 |

| 6/30/20 | $10,956 | $11,766 | $10,979 |

| 7/31/20 | $11,020 | $11,942 | $10,996 |

| 8/31/20 | $11,041 | $11,846 | $10,997 |

| 9/30/20 | $11,038 | $11,839 | $10,997 |

| 10/31/20 | $11,060 | $11,786 | $10,996 |

| 11/30/20 | $11,099 | $11,902 | $11,007 |

| 12/31/20 | $11,113 | $11,918 | $11,021 |

| 1/31/21 | $11,155 | $11,833 | $11,026 |

| 2/28/21 | $11,115 | $11,662 | $11,019 |

| 3/31/21 | $11,089 | $11,516 | $11,013 |

| 4/30/21 | $11,116 | $11,607 | $11,022 |

| 5/31/21 | $11,129 | $11,645 | $11,035 |

| 6/30/21 | $11,152 | $11,727 | $11,019 |

| 7/31/21 | $11,178 | $11,858 | $11,038 |

| 8/31/21 | $11,168 | $11,836 | $11,038 |

| 9/30/21 | $11,146 | $11,733 | $11,029 |

| 10/31/21 | $11,114 | $11,730 | $10,993 |

| 11/30/21 | $11,115 | $11,765 | $10,984 |

| 12/31/21 | $11,132 | $11,735 | $10,967 |

| 1/31/22 | $11,014 | $11,482 | $10,889 |

| 2/28/22 | $10,939 | $11,354 | $10,840 |

| 3/31/22 | $10,835 | $11,038 | $10,692 |

| 4/30/22 | $10,737 | $10,619 | $10,633 |

| 5/31/22 | $10,706 | $10,688 | $10,698 |

| 6/30/22 | $10,644 | $10,520 | $10,624 |

| 7/31/22 | $10,687 | $10,777 | $10,681 |

| 8/31/22 | $10,674 | $10,473 | $10,595 |

| 9/30/22 | $10,565 | $10,020 | $10,465 |

| 10/31/22 | $10,511 | $9,890 | $10,451 |

| 11/30/22 | $10,646 | $10,254 | $10,538 |

| 12/31/22 | $10,711 | $10,208 | $10,559 |

| 1/31/23 | $10,857 | $10,522 | $10,645 |

| 2/28/23 | $10,799 | $10,250 | $10,565 |

| 3/31/23 | $10,870 | $10,510 | $10,718 |

| 4/30/23 | $10,927 | $10,574 | $10,755 |

| 5/31/23 | $10,937 | $10,459 | $10,723 |

| 6/30/23 | $10,988 | $10,422 | $10,680 |

| 7/31/23 | $11,058 | $10,414 | $10,725 |

| 8/31/23 | $11,106 | $10,348 | $10,765 |

| 9/30/23 | $11,106 | $10,085 | $10,758 |

| 10/31/23 | $11,167 | $9,926 | $10,793 |

| 11/30/23 | $11,259 | $10,375 | $10,918 |

| 12/31/23 | $11,395 | $10,772 | $11,050 |

| 1/31/24 | $11,454 | $10,743 | $11,093 |

| 2/29/24 | $11,466 | $10,591 | $11,055 |

| 3/31/24 | $11,525 | $10,689 | $11,100 |

| 4/30/24 | $11,494 | $10,419 | $11,062 |

| 5/31/24 | $11,584 | $10,595 | $11,143 |

| 6/30/24 | $11,640 | $10,788 | $11,205 |

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | Since Inception 4/13/16 |

|---|

| STOT | 6.14% | 1.74% | 1.88% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | (0.23%) | 0.93% |

| Bloomberg U.S. Aggregate 1-3 Year Index | 4.92% | 1.20% | 1.40% |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

| Statistic | Value |

|---|

| Total Net Assets | $147,821,835 |

| # of Portfolio Holdings | 334 |

| Portfolio Turnover Rate | 117% |

| Total Advisory Fees Paid | $669,708 |

What did the Fund invest in?

| Maturity Duration | % Value of Total Net Assets |

| 0 to 1 Year | 4.2% |

| 1 to 2 Years | 12.2% |

| 2 to 3 Years | 22.3% |

| 3 to 5 Years | 5.6% |

| 5 to 10 Years | 16.0% |

| 10 to 20 Years | 26.9% |

| 20 to 30 Years | 6.8% |

| Greater than 30 Years | 5.3% |

| Holdings | % Value of Total Net Assets |

| U.S. Treasury Notes, 0.63%, due 07/31/26 | 11.8% |

| U.S. Treasury Notes, 0.38%, due 01/31/26 | 7.5% |

| U.S. Treasury Notes, 0.63%, due 03/31/27 | 4.1% |

| Citigroup Mortgage Loan Trust, Inc., 2A1A, 5.15%, due 07/25/37 | 1.6% |

| Regatta XXIII Funding Ltd., A1, 6.74%, due 01/20/35 | 1.5% |

| Luminent Mortgage Trust, 1A1, 5.78%, due 11/25/36 | 1.5% |

| Marble Point CLO XXI Ltd., A1, 6.82%, due 10/17/34 | 1.4% |

| Federal Home Loan Mortgage Corp. STACR REMICS Trust, M1, 6.59%, due 03/25/44 | 1.1% |

| Anchorage Capital CLO 19 Ltd., A, 6.80%, due 10/15/34 | 1.0% |

| CQS U.S. CLO Ltd., A, 6.81%, due 01/20/35 | 1.0% |

SPDR DoubleLine Total Return Tactical ETF

Principal Listing Exchange: NYSEArca

Annual Shareholder Report

June 30, 2024

This annual shareholder report contains important information about the SPDR DoubleLine Total Return Tactical ETF (the "Fund") for the year ended June 30, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR DoubleLine Total Return Tactical ETF | $56 | 0.55% |

How did the Fund perform last year and what affected its performance?

The primary drivers of Fund performance were asset allocation and duration positioning. The Fund maintained a roughly forty-five percent weighting to credit risk sectors compared to approximately thirty percent in the Index, which contributed positively to outperformance as credit spreads tightened materially over the period. In terms of duration positioning, the Fund maintained a slightly shorter duration than the Index, which bolstered relative performance as U.S. Treasury yields rose significantly during the period.

The best performance generally came from the shorter duration credit sectors. The top performing sector was collateralized loan obligations (CLOs) as these assets benefit from considerable monthly income and credit spread tightening. U.S. Treasurys were the lowest performing sector as rates rose across the curve during the period.

Every credit sector in the portfolio generated a positive return. The greatest contribution to the Fund’s performance during the period was Agency MBS U.S. Treasury's was the only sector to detract from performance during the period.

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

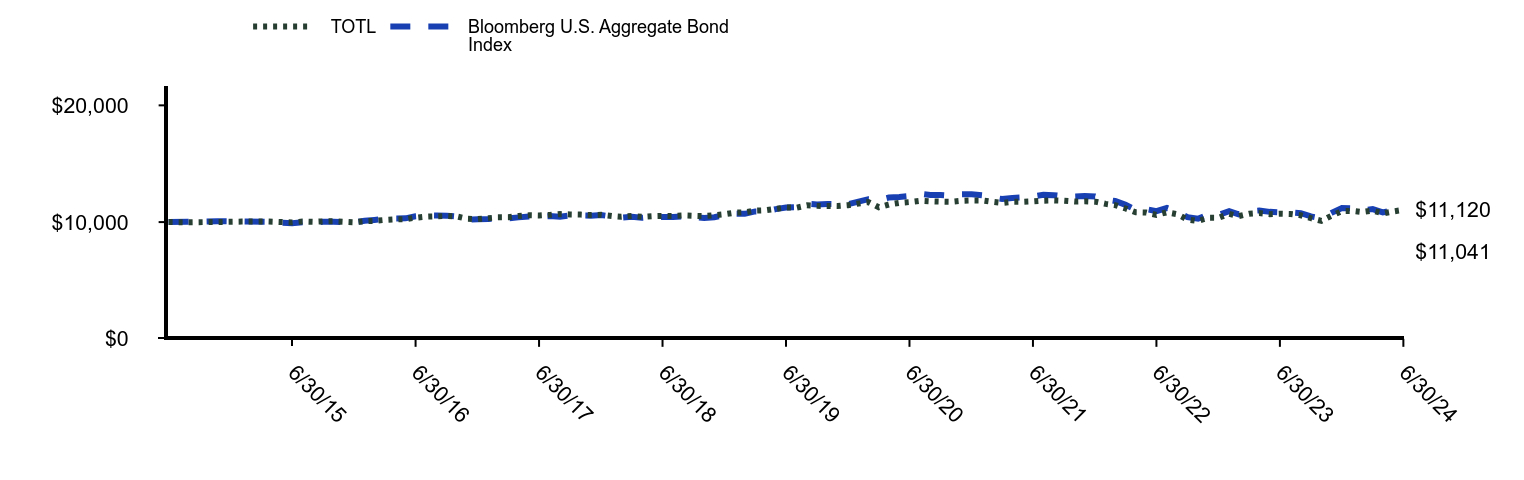

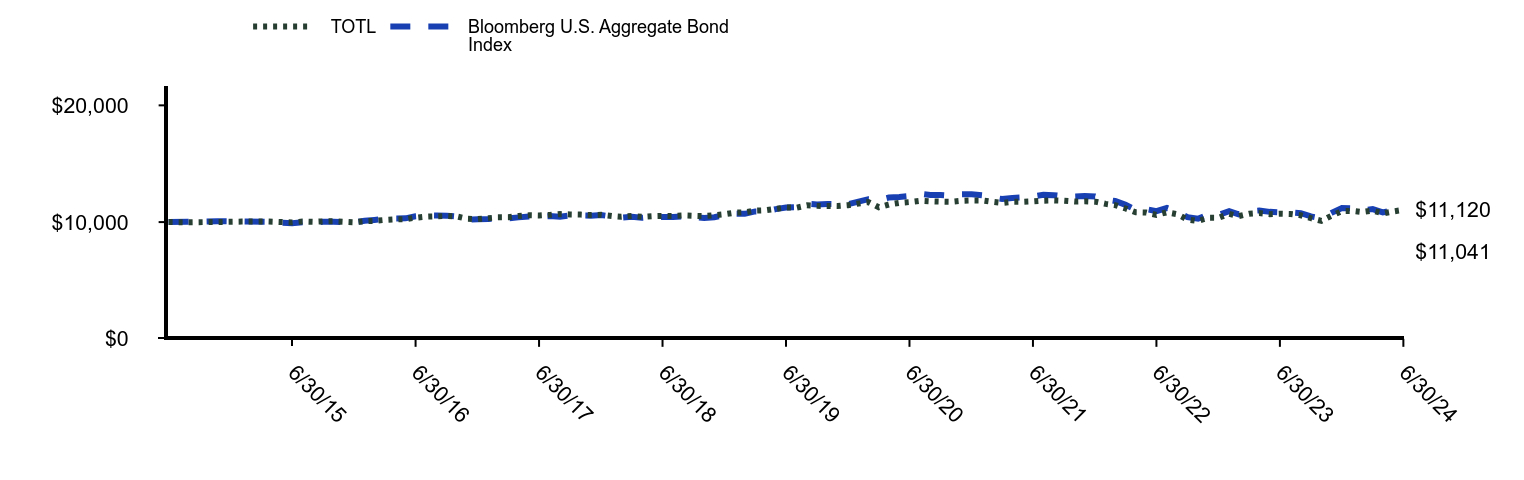

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| TOTL | Bloomberg U.S. Aggregate Bond Index |

|---|

| 1/31/15 | $10,000 | $10,000 |

| 2/28/15 | $9,986 | $10,033 |

| 3/31/15 | $10,012 | $10,080 |

| 4/30/15 | $10,041 | $10,043 |

| 5/31/15 | $10,048 | $10,019 |

| 6/30/15 | $9,974 | $9,910 |

| 7/31/15 | $10,047 | $9,979 |

| 8/31/15 | $10,019 | $9,965 |

| 9/30/15 | $10,062 | $10,032 |

| 10/31/15 | $10,071 | $10,034 |

| 11/30/15 | $10,027 | $10,007 |

| 12/31/15 | $9,987 | $9,975 |

| 1/31/16 | $10,078 | $10,112 |

| 2/29/16 | $10,108 | $10,184 |

| 3/31/16 | $10,187 | $10,277 |

| 4/30/16 | $10,230 | $10,316 |

| 5/31/16 | $10,254 | $10,319 |

| 6/30/16 | $10,379 | $10,505 |

| 7/31/16 | $10,465 | $10,571 |

| 8/31/16 | $10,496 | $10,560 |

| 9/30/16 | $10,523 | $10,553 |

| 10/31/16 | $10,479 | $10,473 |

| 11/30/16 | $10,285 | $10,225 |

| 12/31/16 | $10,255 | $10,239 |

| 1/31/17 | $10,334 | $10,260 |

| 2/28/17 | $10,407 | $10,328 |

| 3/31/17 | $10,413 | $10,323 |

| 4/30/17 | $10,522 | $10,403 |

| 5/31/17 | $10,581 | $10,483 |

| 6/30/17 | $10,566 | $10,472 |

| 7/31/17 | $10,618 | $10,517 |

| 8/31/17 | $10,687 | $10,467 |

| 9/30/17 | $10,657 | $10,561 |

| 10/31/17 | $10,641 | $10,567 |

| 11/30/17 | $10,602 | $10,554 |

| 12/31/17 | $10,621 | $10,602 |

| 1/31/18 | $10,518 | $10,480 |

| 2/28/18 | $10,460 | $10,381 |

| 3/31/18 | $10,532 | $10,447 |

| 4/30/18 | $10,456 | $10,370 |

| 5/31/18 | $10,512 | $10,444 |

| 6/30/18 | $10,532 | $10,431 |

| 7/31/18 | $10,524 | $10,433 |

| 8/31/18 | $10,570 | $10,501 |

| 9/30/18 | $10,539 | $10,433 |

| 10/31/18 | $10,511 | $10,351 |

| 11/30/18 | $10,583 | $10,412 |

| 12/31/18 | $10,674 | $10,604 |

| 1/31/19 | $10,812 | $10,716 |

| 2/28/19 | $10,835 | $10,710 |

| 3/31/19 | $10,979 | $10,916 |

| 4/30/19 | $11,008 | $10,918 |

| 5/31/19 | $11,132 | $11,112 |

| 6/30/19 | $11,261 | $11,252 |

| 7/31/19 | $11,235 | $11,277 |

| 8/31/19 | $11,433 | $11,569 |

| 9/30/19 | $11,390 | $11,507 |

| 10/31/19 | $11,387 | $11,542 |

| 11/30/19 | $11,374 | $11,536 |

| 12/31/19 | $11,444 | $11,528 |

| 1/31/20 | $11,597 | $11,750 |

| 2/29/20 | $11,715 | $11,961 |

| 3/31/20 | $11,274 | $11,891 |

| 4/30/20 | $11,508 | $12,102 |

| 5/31/20 | $11,648 | $12,159 |

| 6/30/20 | $11,715 | $12,235 |

| 7/31/20 | $11,824 | $12,418 |

| 8/31/20 | $11,776 | $12,318 |

| 9/30/20 | $11,753 | $12,311 |

| 10/31/20 | $11,742 | $12,256 |

| 11/30/20 | $11,828 | $12,376 |

| 12/31/20 | $11,855 | $12,393 |

| 1/31/21 | $11,852 | $12,304 |

| 2/28/21 | $11,743 | $12,127 |

| 3/31/21 | $11,645 | $11,975 |

| 4/30/21 | $11,734 | $12,070 |

| 5/31/21 | $11,734 | $12,109 |

| 6/30/21 | $11,772 | $12,194 |

| 7/31/21 | $11,836 | $12,331 |

| 8/31/21 | $11,856 | $12,307 |

| 9/30/21 | $11,823 | $12,201 |

| 10/31/21 | $11,759 | $12,197 |

| 11/30/21 | $11,783 | $12,233 |

| 12/31/21 | $11,750 | $12,202 |

| 1/31/22 | $11,559 | $11,939 |

| 2/28/22 | $11,453 | $11,806 |

| 3/31/22 | $11,167 | $11,478 |

| 4/30/22 | $10,835 | $11,043 |

| 5/31/22 | $10,818 | $11,114 |

| 6/30/22 | $10,618 | $10,939 |

| 7/31/22 | $10,837 | $11,207 |

| 8/31/22 | $10,665 | $10,890 |

| 9/30/22 | $10,223 | $10,419 |

| 10/31/22 | $10,091 | $10,285 |

| 11/30/22 | $10,372 | $10,663 |

| 12/31/22 | $10,372 | $10,615 |

| 1/31/23 | $10,710 | $10,941 |

| 2/28/23 | $10,513 | $10,658 |

| 3/31/23 | $10,714 | $10,929 |

| 4/30/23 | $10,772 | $10,995 |

| 5/31/23 | $10,681 | $10,876 |

| 6/30/23 | $10,712 | $10,837 |

| 7/31/23 | $10,689 | $10,829 |

| 8/31/23 | $10,584 | $10,760 |

| 9/30/23 | $10,332 | $10,487 |

| 10/31/23 | $10,110 | $10,321 |

| 11/30/23 | $10,538 | $10,789 |

| 12/31/23 | $10,954 | $11,202 |

| 1/31/24 | $10,961 | $11,171 |

| 2/29/24 | $10,866 | $11,013 |

| 3/31/24 | $10,987 | $11,115 |

| 4/30/24 | $10,743 | $10,834 |

| 5/31/24 | $10,915 | $11,017 |

| 6/30/24 | $11,041 | $11,120 |

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | Since Inception 2/23/15 |

|---|

| TOTL | 3.27% | (0.34%) | 1.06% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | (0.23%) | 1.14% |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

| Statistic | Value |

|---|

| Total Net Assets | $2,918,069,885 |

| # of Portfolio Holdings | 1,370 |

| Portfolio Turnover Rate | 120% |

| Total Advisory Fees Paid | $16,685,752 |

What did the Fund invest in?

| Maturity Duration | % Value of Total Net Assets |

| 0 to 1 Year | 2.4% |

| 1 to 2 Years | 5.1% |

| 2 to 3 Years | 4.5% |

| 3 to 5 Years | 10.5% |

| 5 to 10 Years | 21.2% |

| 10 to 20 Years | 20.3% |

| 20 to 30 Years | 27.7% |

| Greater than 30 Years | 7.4% |

| Holdings | % Value of Total Net Assets |

| U.S. Treasury Notes, 0.75%, due 01/31/28 | 6.1% |

| U.S. Treasury Notes, 0.88%, due 09/30/26 | 3.0% |

| U.S. Treasury Notes, 0.63%, due 08/15/30 | 3.0% |

| U.S. Treasury Notes, 0.75%, due 05/31/26 | 2.1% |

| U.S. Treasury Notes, 0.88%, due 11/15/30 | 2.0% |

| U.S. Treasury Notes, 0.38%, due 11/30/25 | 1.9% |

| U.S. Treasury Notes, 0.38%, due 04/30/25 | 1.7% |

| Federal National Mortgage Association REMICS, VZ, 3.00%, due 01/25/43 | 1.0% |

| Federal Home Loan Mortgage Corp. REMICS, ZX, 4.00%, due 07/15/44 | 0.8% |

| Progress Residential Trust, B, 3.50%, due 06/17/41 | 0.8% |

Effective on April 1, 2024, changes were made to the Fund’s principal investment strategy to reflect the Fund’s ability to invest in futures contracts and to clarify the types of TBA Transactions the Fund engages in.

SPDR Loomis Sayles Opportunistic Bond ETF

Principal Listing Exchange: Cboe BZX Exchange, Inc.

Annual Shareholder Report

June 30, 2024

This annual shareholder report contains important information about the SPDR Loomis Sayles Opportunistic Bond ETF (the "Fund") for the year ended June 30, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

What were the Fund costs for the last year?

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR Loomis Sayles Opportunistic Bond ETF | $54 | 0.52% |

How did the Fund perform last year and what affected its performance?

U.S. investment grade bond spreads tightened over the period. The sector was broadly aided by conservative issuer financial policies, solid appetite for risk, and an overall strong consumer. Within the portfolio, investment grade corporates contributed to absolute performance with financial, particularly banking, names being mostly responsible.

U.S. high yield corporate bond spreads tightened over the period, largely remaining range-bound as of late. Within the portfolio, our allocation to the sector positively contributed to absolute performance. Consumer cyclical, energy, and technology names were mostly responsible for the positive impact.

For the bank loan market, continued appetite for risk was supportive and the sector showed strong overall performance. The sector also benefitted as stubborn inflation caused policy rates to remain higher for longer than the market initially expected. For the portfolio, our allocation to bank loans aided absolute performance, with individual technology, consumer, and financial issues adding in particular.

The use of derivatives instruments within the fund had a modest negative impact over the period. The majority of this effect is attributed to long exposure in interest rate futures.

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

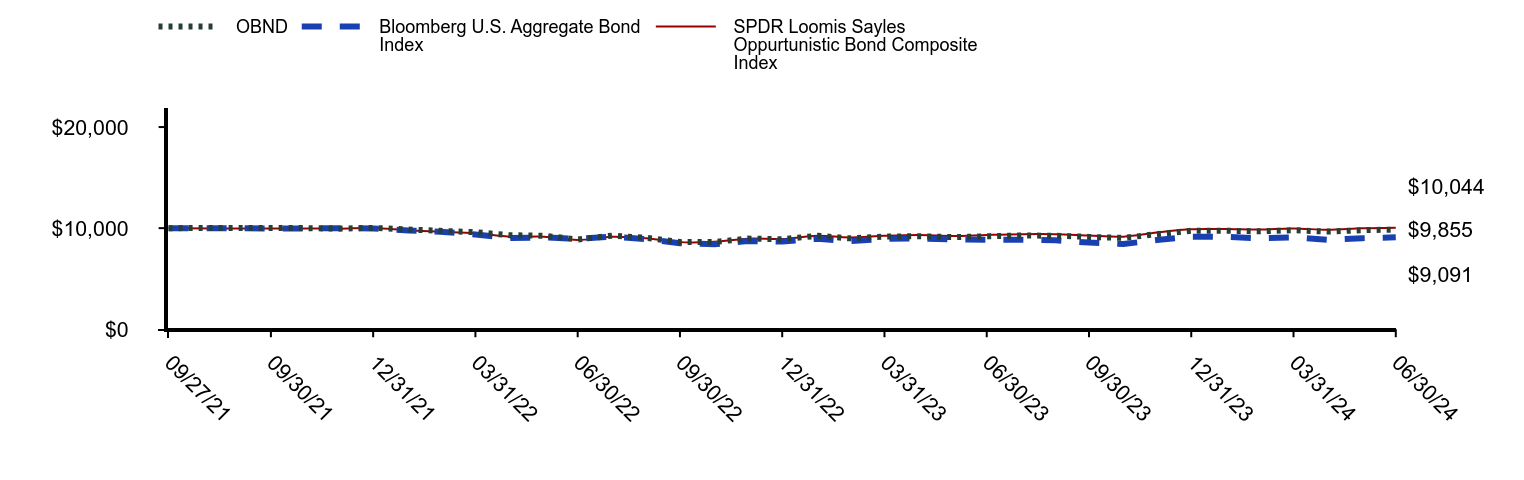

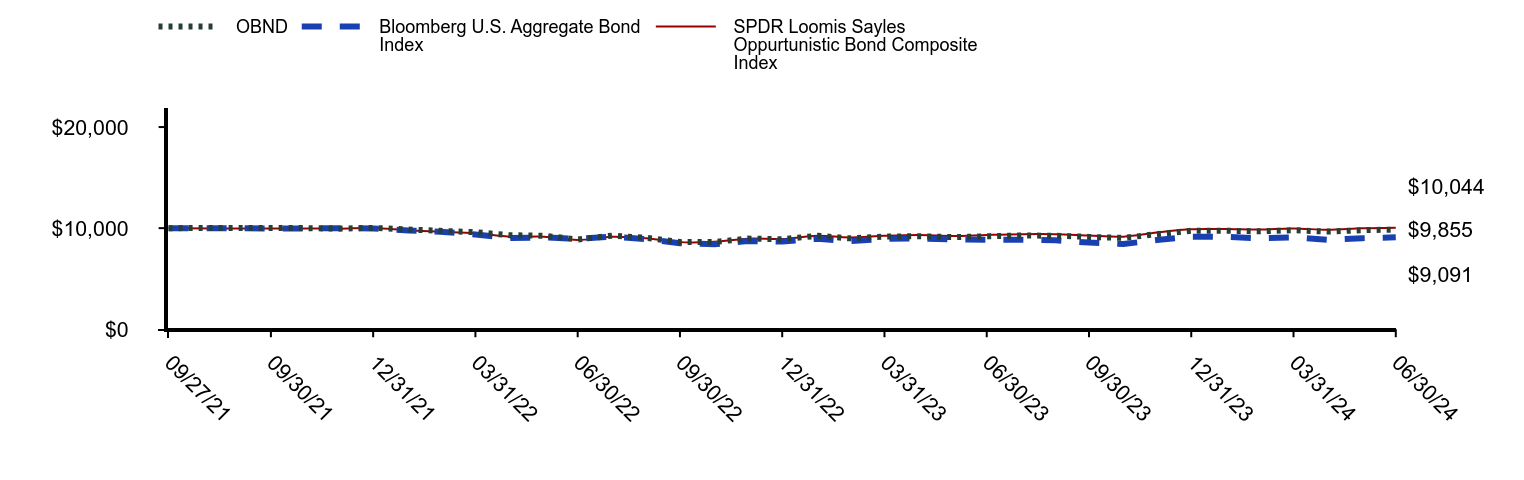

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| OBND | Bloomberg U.S. Aggregate Bond Index | SPDR Loomis Sayles Oppurtunistic Bond Composite Index |

|---|

| 09/27/21 | $10,000 | $10,000 | $10,000 |

| 09/30/21 | $10,018 | $9,973 | $9,961 |

| 10/31/21 | $10,005 | $9,970 | $9,976 |

| 11/30/21 | $9,948 | $10,000 | $9,952 |

| 12/31/21 | $10,027 | $9,974 | $10,011 |

| 01/31/22 | $9,864 | $9,759 | $9,781 |

| 02/28/22 | $9,735 | $9,650 | $9,645 |

| 03/31/22 | $9,601 | $9,382 | $9,497 |

| 04/30/22 | $9,308 | $9,026 | $9,159 |

| 05/31/22 | $9,247 | $9,084 | $9,157 |

| 06/30/22 | $8,881 | $8,942 | $8,826 |

| 07/31/22 | $9,258 | $9,160 | $9,149 |

| 08/31/22 | $9,034 | $8,902 | $8,989 |

| 09/30/22 | $8,631 | $8,517 | $8,617 |

| 10/31/22 | $8,634 | $8,407 | $8,652 |

| 11/30/22 | $8,967 | $8,716 | $8,954 |

| 12/31/22 | $8,903 | $8,677 | $8,930 |

| 01/31/23 | $9,243 | $8,943 | $9,247 |

| 02/28/23 | $8,994 | $8,712 | $9,079 |

| 03/31/23 | $9,165 | $8,934 | $9,237 |

| 04/30/23 | $9,203 | $8,988 | $9,315 |

| 05/31/23 | $9,117 | $8,890 | $9,223 |

| 06/30/23 | $9,195 | $8,858 | $9,327 |

| 07/31/23 | $9,272 | $8,852 | $9,403 |

| 08/31/23 | $9,251 | $8,795 | $9,398 |

| 09/30/23 | $9,134 | $8,572 | $9,266 |

| 10/31/23 | $9,036 | $8,437 | $9,159 |

| 11/30/23 | $9,405 | $8,819 | $9,566 |

| 12/31/23 | $9,746 | $9,156 | $9,895 |

| 01/31/24 | $9,748 | $9,131 | $9,906 |

| 02/29/24 | $9,687 | $9,002 | $9,855 |

| 03/31/24 | $9,794 | $9,085 | $9,970 |

| 04/30/24 | $9,661 | $8,856 | $9,836 |

| 05/31/24 | $9,797 | $9,006 | $9,979 |

| 06/30/24 | $9,855 | $9,091 | $10,044 |

Average Annual Total Returns (%)

| Name | 1 Year | Since Inception 9/27/21 |

|---|

| OBND | 7.06% | (0.58%) |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | (3.40%) |

| SPDR Loomis Sayles Oppurtunistic Bond Composite Index | 7.72% | 0.16% |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

| Statistic | Value |

|---|

| Total Net Assets | $37,253,353 |

| # of Portfolio Holdings | 474 |

| Portfolio Turnover Rate | 77% |

| Total Advisory Fees Paid | $182,659 |

What did the Fund invest in?

| Maturity Duration | % Value of Total Net Assets |

| 0 to 1 Year | 9.8% |

| 1 to 2 Years | 6.2% |

| 2 to 3 Years | 5.0% |

| 3 to 5 Years | 31.5% |

| 5 to 10 Years | 40.4% |

| 10 to 20 Years | 6.0% |

| 20 to 30 Years | 1.7% |

| Greater than 30 Years | 0.8% |

| Holdings | % Value of Total Net Assets |

| SPDR Blackstone Senior Loan ETF | 4.6% |

| UniCredit SpA, 7.30%, due 04/02/34 | 1.1% |

| OneMain Direct Auto Receivables Trust, A, 0.87%, due 07/14/28 | 0.9% |

| EW Scripps Co., 8.02%, due 05/01/26 | 0.8% |

| Bank of America Corp., 6.68%, due 04/02/26 | 0.8% |

| CHG Healthcare Services, Inc., 8.69%, due 09/29/28 | 0.8% |

| GTCR W Merger Sub LLC, due 01/31/31 | 0.7% |

| GTCR W Merger Sub LLC, 8.33%, due 01/31/31 | 0.7% |

| CBAM Ltd., B2R, 7.69%, due 01/15/31 | 0.7% |

| Post CLO Ltd., B1, 7.82%, due 04/20/36 | 0.7% |

SPDR Nuveen Municipal Bond ESG ETF

Principal Listing Exchange: Cboe BZX Exchange, Inc.

Annual Shareholder Report

June 30, 2024

This annual shareholder report contains important information about the SPDR Nuveen Municipal Bond ESG ETF (the "Fund") for the year ended June 30, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR Nuveen Municipal Bond ESG ETF | $44 | 0.43% |

How did the Fund perform last year and what affected its performance?

The reporting period was a period of shifting markets, as interest rates expectations moved drastically during the period. Initially, we saw a large sell off, before a significant rally at the end of 2023. 2024 saw a slight sell off in the first half. Despite this, performance held in due to higher income. Spreads tightened in 2024, providing better performance for high yield municipals. The yield curve became barbelled, with yields on the short and long ends providing more yield than the belly of the curve.

Despite the fund’s longer duration positioning, resulting curve exposure aided performance as an underweight in bonds with durations between 2 and 8 years aided performance, as did an overweight in greater than 8 years. Rating allocation was the largest driver of performance, as an overweight in unrated bonds, bonds rated BB and BBB as well as underweights in bonds rated AAA and AA aided performance.

Selection was also a strong positive contributor to returns. Top contributors include Wisconsin Acts Retirement Community & Black Belt Gas. Top detractors include Dallas General Obligation & California State Various Purpose bonds – all of which were sold before the rally that occurred in the late fall of 2023.

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

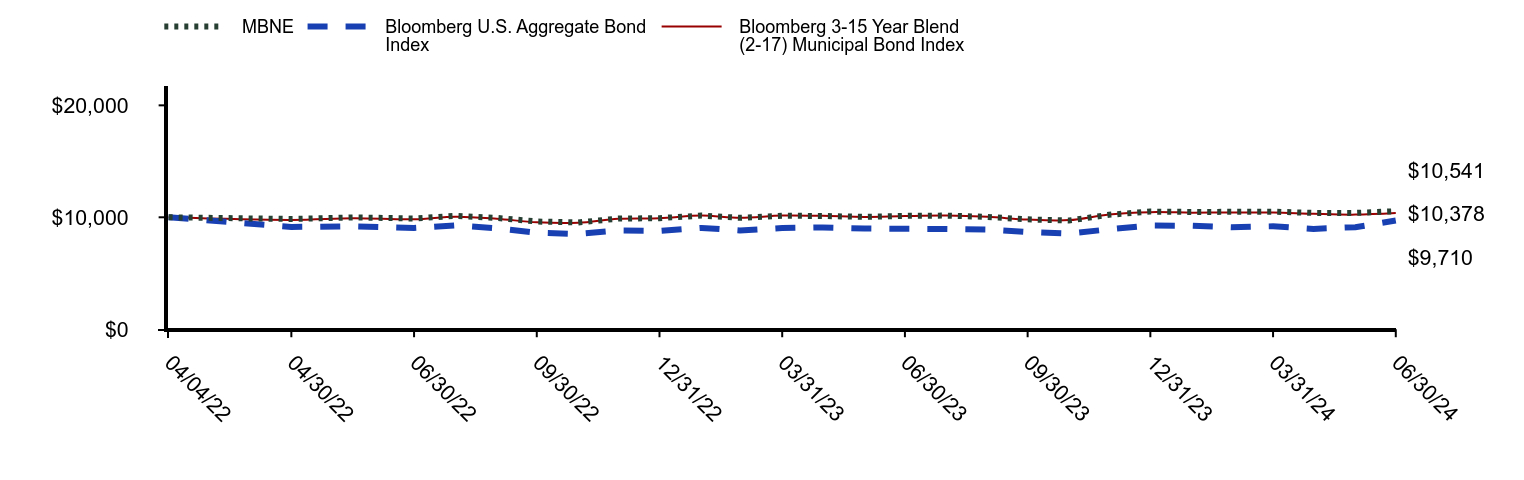

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| MBNE | Bloomberg U.S. Aggregate Bond Index | Bloomberg 3-15 Year Blend (2-17) Municipal Bond Index |

|---|

| 04/04/22 | $10,000 | $10,000 | $10,000 |

| 04/30/22 | $9,850 | $9,137 | $9,768 |

| 05/31/22 | $9,991 | $9,196 | $9,912 |

| 06/30/22 | $9,893 | $9,052 | $9,820 |

| 07/31/22 | $10,130 | $9,273 | $10,057 |

| 08/31/22 | $9,942 | $9,011 | $9,873 |

| 09/30/22 | $9,624 | $8,621 | $9,552 |

| 10/31/22 | $9,535 | $8,510 | $9,510 |

| 11/30/22 | $9,882 | $8,823 | $9,868 |

| 12/31/22 | $9,924 | $8,783 | $9,920 |

| 01/31/23 | $10,154 | $9,053 | $10,158 |

| 02/28/23 | $9,951 | $8,819 | $9,956 |

| 03/31/23 | $10,134 | $9,043 | $10,158 |

| 04/30/23 | $10,121 | $9,098 | $10,130 |

| 05/31/23 | $10,034 | $8,999 | $10,033 |

| 06/30/23 | $10,126 | $8,967 | $10,111 |

| 07/31/23 | $10,152 | $8,961 | $10,153 |

| 08/31/23 | $10,034 | $8,903 | $10,039 |

| 09/30/23 | $9,815 | $8,677 | $9,795 |

| 10/31/23 | $9,709 | $8,540 | $9,747 |

| 11/30/23 | $10,223 | $8,927 | $10,252 |

| 12/31/23 | $10,509 | $9,269 | $10,460 |

| 01/31/24 | $10,480 | $9,243 | $10,416 |

| 02/29/24 | $10,485 | $9,113 | $10,425 |

| 03/31/24 | $10,505 | $9,197 | $10,425 |

| 04/30/24 | $10,391 | $8,964 | $10,308 |

| 05/31/24 | $10,393 | $9,116 | $10,239 |

| 06/30/24 | $10,541 | $9,710 | $10,378 |

Average Annual Total Returns (%)

| Name | 1 Year | Since Inception 4/4/22 |

|---|

| MBNE | 4.18% | 2.38% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | (1.31%) |

| Bloomberg 3-15 Year Blend (2-17) Municipal Bond Index | 2.64% | 1.67% |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

| Statistic | Value |

|---|

| Total Net Assets | $40,124,549 |

| # of Portfolio Holdings | 100 |

| Portfolio Turnover Rate | 33% |

| Total Advisory Fees Paid | $165,396 |

What did the Fund invest in?

| State | % Value of Total Net Assets |

| New York | 9.2% |

| Texas | 8.4% |

| Florida | 7.9% |

| Wisconsin | 6.7% |

| Washington | 6.5% |

| Pennsylvania | 6.2% |

| Connecticut | 6.1% |

| California | 4.9% |

| Illinois | 4.9% |

| Oregon | 4.1% |

| Holdings | % Value of Total Net Assets |

| Idaho Housing & Finance Association Revenue, ID, 4.00%, due 08/15/48 | 2.4% |

| New York City Transitional Finance Authority Future Tax Secured Revenue, NY, 5.00%, due 11/01/26 | 2.3% |

| Pennsylvania Turnpike Commission Revenue, PA, 6.00%, due 12/01/30 | 2.2% |

| City of Dallas, General Obligation, TX, 3.13%, due 02/15/35 | 2.2% |

| South Carolina Jobs-Economic Development Authority Revenue, SC, 5.00%, due 11/01/39 | 2.1% |

| Medford Hospital Facilities Authority Revenue, OR, 5.00%, due 08/15/37 | 2.0% |

| Wisconsin Health & Educational Facilities Authority Revenue, WI, 4.00%, due 04/01/39 | 1.9% |

| Pennsylvania Economic Development Financing Authority Revenue, PA, 4.60%, due 10/01/46 | 1.9% |

| Michigan State Housing Development Authority Revenue, MI, 4.70%, due 12/01/43 | 1.9% |

| Port of Seattle Revenue, WA, 5.00%, due 04/01/35 | 1.9% |

Effective on July 31, 2024, changes will be made to the Fund’s principal investment strategy from Rules-based to Full fundamental active with no constraints to securities in the benchmark.

SPDR Nuveen Municipal Bond ETF

Principal Listing Exchange: Cboe BZX Exchange, Inc.

Annual Shareholder Report

June 30, 2024

This annual shareholder report contains important information about the SPDR Nuveen Municipal Bond ETF (the "Fund") for the year ended June 30, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR Nuveen Municipal Bond ETF | $41 | 0.40% |

How did the Fund perform last year and what affected its performance?

The reporting period was a period of shifting markets, as interest rates expectations moved drastically during the period. Initially, we saw a large sell off, before a significant rally at the end of 2023. 2024 saw a slight sell off in the first half. Despite this municipal performance held in due to higher income. Spreads tightened in 2024, providing better performance for high yield municipals. The yield curve became barbelled, with yields on the short and long ends providing more yield than the belly of the curve.

Despite the fund’s longer duration positioning, resulting curve exposure aided performance as an underweight in bonds with durations between 2 and 8 years aided performance, as did an overweight in greater than 8 years. Rating allocation was the largest driver of performance, as an overweight in unrated bonds, bonds rated double-B and triple-B as well as underweights in bonds rated triple-A and double-A aided performance.

Selection was also a strong positive contributor to returns. Top contributors include New Hope Sanctuary LTC, Florida Brightline and Duluth St Lukes Hospital. Largest detractors include Idaho Housing and San Francisco Wastewater bonds – both of which were sold before the rally in the late fall.

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

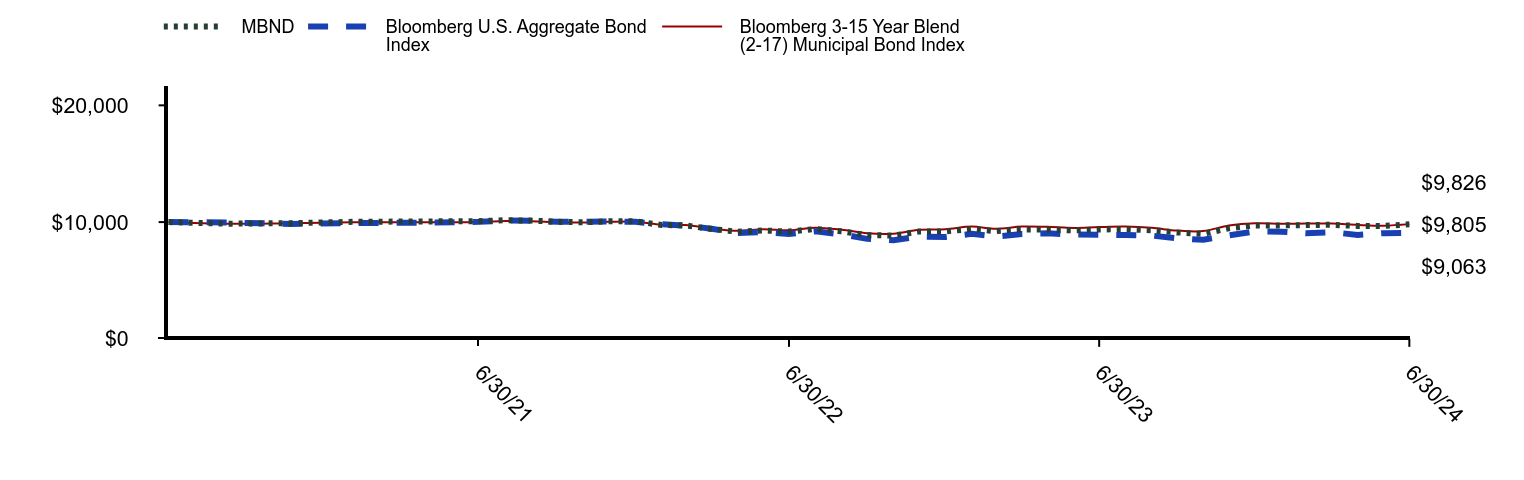

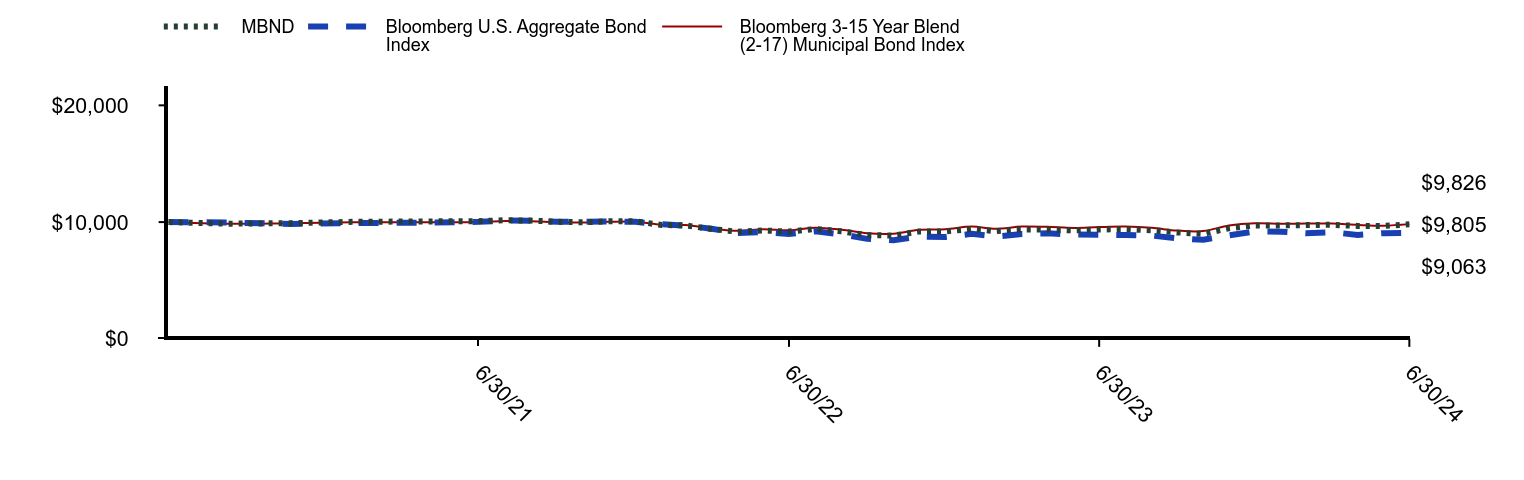

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| MBND | Bloomberg U.S. Aggregate Bond Index | Bloomberg 3-15 Year Blend (2-17) Municipal Bond Index |

|---|

| 1/31/21 | $10,000 | $10,000 | $10,000 |

| 2/28/21 | $9,863 | $9,965 | $9,860 |

| 3/31/21 | $9,910 | $9,841 | $9,910 |

| 4/30/21 | $10,019 | $9,918 | $9,977 |

| 5/31/21 | $10,056 | $9,951 | $9,991 |

| 6/30/21 | $10,076 | $10,021 | $10,005 |

| 7/31/21 | $10,161 | $10,133 | $10,085 |

| 8/31/21 | $10,129 | $10,113 | $10,063 |

| 9/30/21 | $10,024 | $10,026 | $9,996 |

| 10/31/21 | $9,988 | $10,023 | $9,964 |

| 11/30/21 | $10,066 | $10,053 | $10,022 |

| 12/31/21 | $10,069 | $10,027 | $10,038 |

| 1/31/22 | $9,757 | $9,811 | $9,774 |

| 2/28/22 | $9,714 | $9,702 | $9,742 |

| 3/31/22 | $9,412 | $9,432 | $9,464 |

| 4/30/22 | $9,179 | $9,074 | $9,249 |

| 5/31/22 | $9,279 | $9,133 | $9,385 |

| 6/30/22 | $9,185 | $8,989 | $9,298 |

| 7/31/22 | $9,407 | $9,209 | $9,522 |

| 8/31/22 | $9,213 | $8,949 | $9,348 |

| 9/30/22 | $8,884 | $8,562 | $9,044 |

| 10/31/22 | $8,847 | $8,451 | $9,004 |

| 11/30/22 | $9,189 | $8,762 | $9,343 |

| 12/31/22 | $9,202 | $8,722 | $9,392 |

| 1/31/23 | $9,412 | $8,991 | $9,618 |

| 2/28/23 | $9,232 | $8,758 | $9,426 |

| 3/31/23 | $9,378 | $8,981 | $9,618 |

| 4/30/23 | $9,368 | $9,035 | $9,591 |

| 5/31/23 | $9,290 | $8,937 | $9,499 |

| 6/30/23 | $9,368 | $8,905 | $9,574 |

| 7/31/23 | $9,391 | $8,899 | $9,613 |

| 8/31/23 | $9,301 | $8,842 | $9,505 |

| 9/30/23 | $9,113 | $8,617 | $9,274 |

| 10/31/23 | $8,996 | $8,481 | $9,229 |

| 11/30/23 | $9,475 | $8,865 | $9,707 |

| 12/31/23 | $9,718 | $9,205 | $9,903 |

| 1/31/24 | $9,715 | $9,179 | $9,862 |

| 2/29/24 | $9,746 | $9,050 | $9,871 |

| 3/31/24 | $9,767 | $9,133 | $9,871 |

| 4/30/24 | $9,669 | $8,903 | $9,760 |

| 5/31/24 | $9,669 | $9,054 | $9,694 |

| 6/30/24 | $9,805 | $9,063 | $9,826 |

Average Annual Total Returns (%)

| Name | 1 Year | Since Inception 2/3/21 |

|---|

| MBND | 4.59% | (0.58%) |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | (2.85%) |

| Bloomberg 3-15 Year Blend (2-17) Municipal Bond Index | 2.64% | (0.52%) |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

| Statistic | Value |

|---|

| Total Net Assets | $49,406,398 |

| # of Portfolio Holdings | 113 |

| Portfolio Turnover Rate | 34% |

| Total Advisory Fees Paid | $186,192 |

What did the Fund invest in?

| State | % Value of Total Net Assets |

| California | 7.7% |

| Illinois | 7.2% |

| Texas | 6.7% |

| Oregon | 5.5% |

| Michigan | 5.4% |

| New York | 4.9% |

| Florida | 4.8% |

| Pennsylvania | 4.5% |

| New Jersey | 3.5% |

| Louisiana | 3.5% |

| Holdings | % Value of Total Net Assets |

| Southfield Public Schools, 5.00%, due 05/01/46 | 2.2% |

| New Jersey Economic Development Authority, 5.00%, due 06/15/31 | 2.2% |

| City of New York, 4.00%, due 08/01/37 | 2.1% |

| Port of Portland Airport Revenue, 4.65%, due 07/01/26 | 2.0% |

| New Mexico Hospital Equipment Loan Council, 4.00%, due 08/01/39 | 2.0% |

| Medford Hospital Facilities Authority, 5.00%, due 08/15/32 | 2.0% |

| Park Hill School District of Platte County, 3.00%, due 03/01/32 | 1.9% |

| State of Hawaii, 5.00%, due 10/01/27 | 1.9% |

| Louisiana Stadium & Exposition District, 5.00%, due 07/01/39 | 1.8% |

| South Carolina Jobs-Economic Development Authority, 5.00%, due 11/01/39 | 1.7% |

Effective on July 31, 2024, changes will be made to the Fund’s principal investment strategy from Rules-based to Full- fundamental active with no constraints to securities in the benchmark.

SPDR SSGA Fixed Income Sector Rotation ETF

Principal Listing Exchange: NYSEArca

Annual Shareholder Report

June 30, 2024

This annual shareholder report contains important information about the SPDR SSGA Fixed Income Sector Rotation ETF (the "Fund") for the year ended June 30, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

What were the Fund costs for the last year?

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR SSGA Fixed Income Sector Rotation ETF | $36 | 0.36% |

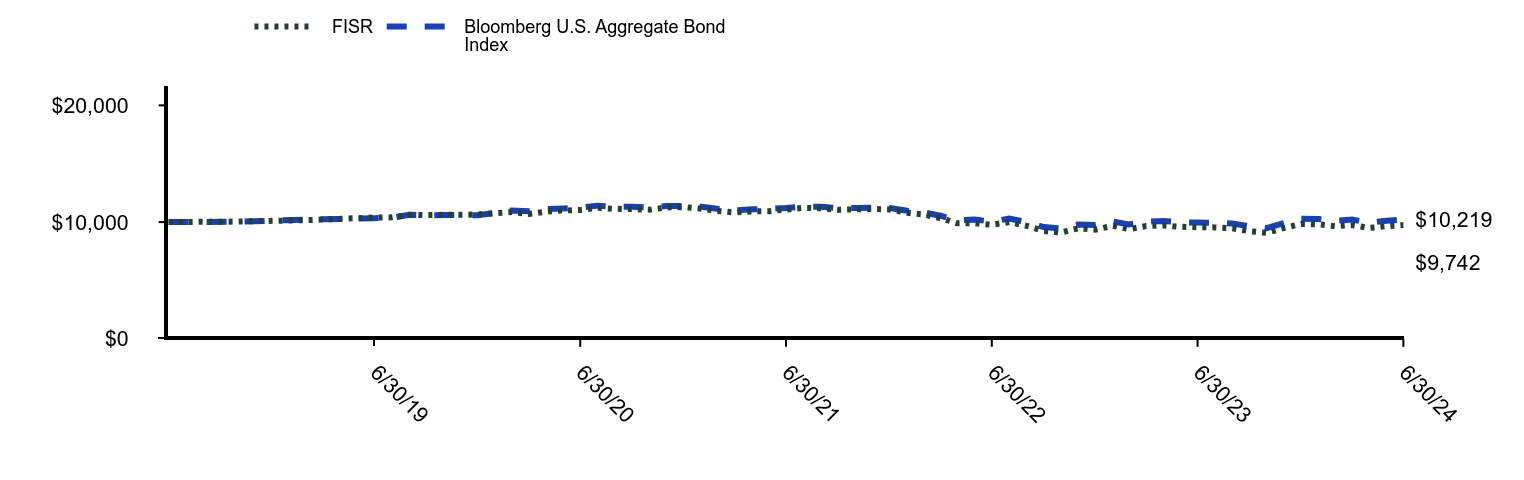

How did the Fund perform last year and what affected its performance?

The 12-month period ended June 30, 2024 was characterized by central banks’ restrictive monetary policies to return price stability in the world economies. Although the market continued to battle with sticky and inconsistent progress against inflation and an interest rate scare in the fall which was exacerbated by elevated levels of Treasury issuance, the U.S. Federal Reserve discussed the possibility of rate cuts in late 2024 during its Federal Open Market Committee meeting in March, and the European Central Bank has already reversed the restrictive policy leading to a rate cut in June. Among the developed markets’ central banks, the Bank of Japan’s decision to raise the short-term policy rate from -0.1% to between 0% and 0.1% in March was the exception, but its elevated spread relative to the U.S. Treasury yield continued to put pressure on the Japanese Yen and detracted the Fund’s performance with its allocation to international sovereign bond. However, the Fund’s high-yield bond position benefited from an easing financial condition coupled with a robust lender’s participation in the credit market and issuing companies’ sustainable cashflow to repay interests.

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

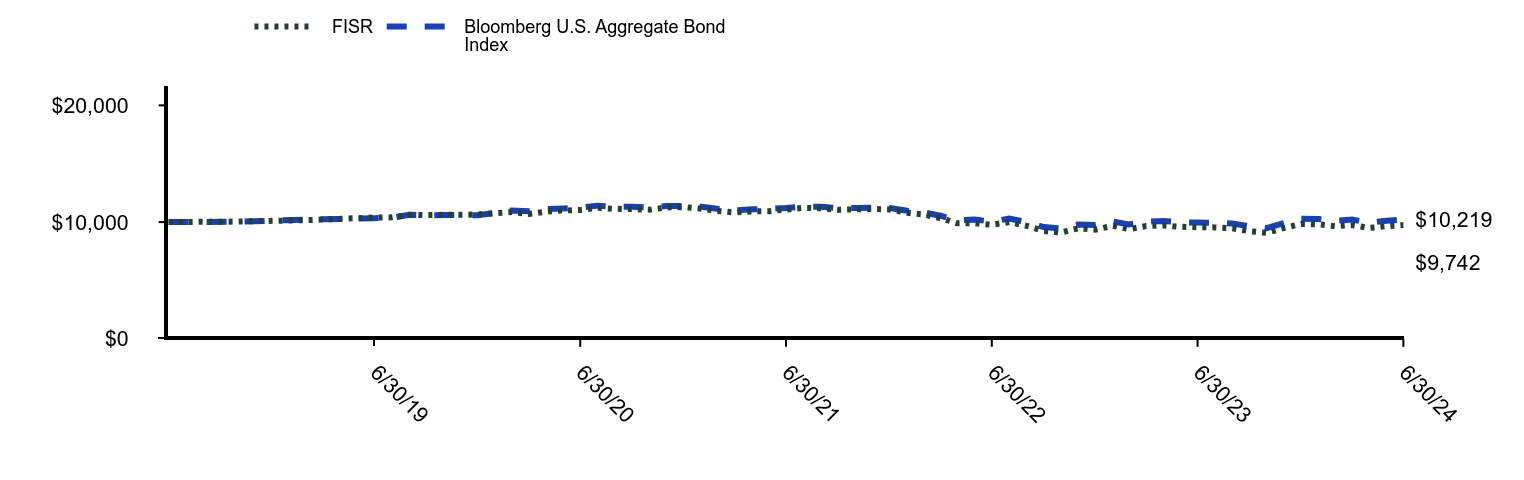

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| FISR | Bloomberg U.S. Aggregate Bond Index |

|---|

| 3/31/19 | $10,000 | $10,000 |

| 4/30/19 | $10,045 | $10,032 |

| 5/31/19 | $10,166 | $10,209 |

| 6/30/19 | $10,393 | $10,338 |

| 7/31/19 | $10,405 | $10,361 |

| 8/31/19 | $10,618 | $10,629 |

| 9/30/19 | $10,601 | $10,572 |

| 10/31/19 | $10,622 | $10,604 |

| 11/30/19 | $10,620 | $10,599 |

| 12/31/19 | $10,656 | $10,592 |

| 1/31/20 | $10,762 | $10,795 |

| 2/29/20 | $10,859 | $10,990 |

| 3/31/20 | $10,691 | $10,925 |

| 4/30/20 | $10,897 | $11,119 |

| 5/31/20 | $10,989 | $11,171 |

| 6/30/20 | $11,042 | $11,241 |

| 7/31/20 | $11,221 | $11,409 |

| 8/31/20 | $11,137 | $11,317 |

| 9/30/20 | $11,111 | $11,311 |

| 10/31/20 | $11,063 | $11,260 |

| 11/30/20 | $11,254 | $11,371 |

| 12/31/20 | $11,279 | $11,387 |

| 1/31/21 | $11,145 | $11,305 |

| 2/28/21 | $10,959 | $11,142 |

| 3/31/21 | $10,824 | $11,003 |

| 4/30/21 | $10,914 | $11,090 |

| 5/31/21 | $10,937 | $11,126 |

| 6/30/21 | $11,076 | $11,204 |

| 7/31/21 | $11,220 | $11,329 |

| 8/31/21 | $11,181 | $11,308 |

| 9/30/21 | $11,058 | $11,210 |

| 10/31/21 | $11,098 | $11,207 |

| 11/30/21 | $11,123 | $11,240 |

| 12/31/21 | $11,085 | $11,211 |

| 1/31/22 | $10,795 | $10,969 |

| 2/28/22 | $10,661 | $10,847 |

| 3/31/22 | $10,346 | $10,546 |

| 4/30/22 | $9,894 | $10,146 |

| 5/31/22 | $9,898 | $10,211 |

| 6/30/22 | $9,777 | $10,051 |

| 7/31/22 | $9,995 | $10,296 |

| 8/31/22 | $9,678 | $10,005 |

| 9/30/22 | $9,233 | $9,573 |

| 10/31/22 | $9,112 | $9,449 |

| 11/30/22 | $9,459 | $9,797 |

| 12/31/22 | $9,347 | $9,752 |

| 1/31/23 | $9,690 | $10,052 |

| 2/28/23 | $9,398 | $9,793 |

| 3/31/23 | $9,664 | $10,041 |

| 4/30/23 | $9,715 | $10,102 |

| 5/31/23 | $9,598 | $9,992 |

| 6/30/23 | $9,562 | $9,957 |

| 7/31/23 | $9,547 | $9,950 |

| 8/31/23 | $9,472 | $9,886 |

| 9/30/23 | $9,217 | $9,635 |

| 10/31/23 | $9,081 | $9,483 |

| 11/30/23 | $9,483 | $9,912 |

| 12/31/23 | $9,838 | $10,292 |

| 1/31/24 | $9,815 | $10,263 |

| 2/29/24 | $9,656 | $10,118 |

| 3/31/24 | $9,737 | $10,212 |

| 4/30/24 | $9,496 | $9,954 |

| 5/31/24 | $9,652 | $10,123 |

| 6/30/24 | $9,742 | $10,219 |

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | Since Inception 4/2/19 |

|---|

| FISR | 1.87% | (1.26%) | (0.49%) |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | (0.23%) | 0.41% |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

| Statistic | Value |

|---|

| Total Net Assets | $237,952,463 |

| # of Portfolio Holdings | 9 |

| Portfolio Turnover Rate | 100% |

| Total Advisory Fees Paid | $702,489 |

What did the Fund invest in?

| Asset | % Value of Total Net Assets |

| Mutual Funds and Exchange Traded Products | 100.0% |

| Short-Term Investments | 9.1% |

| Holdings | % Value of Total Net Assets |

| SPDR Portfolio Intermediate Term Treasury ETF | 36.9% |

| SPDR Portfolio Mortgage-Backed Bond ETF | 33.0% |

| SPDR Portfolio Long Term Treasury ETF | 15.0% |

| SPDR Bloomberg High Yield Bond ETF | 9.4% |

| SPDR Portfolio Long Term Corporate Bond ETF | 4.9% |

| SPDR Portfolio Intermediate Term Corporate Bond ETF | 0.7% |

| SPDR Bloomberg 1-3 Month T-Bills ETF | 0.2% |

SPDR SSGA Global Allocation ETF

Principal Listing Exchange: NYSEArca

Annual Shareholder Report

June 30, 2024

This annual shareholder report contains important information about the SPDR SSGA Global Allocation ETF (the "Fund") for the year ended June 30, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

What were the Fund costs for the last year?

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR SSGA Global Allocation ETF | $16 | 0.15% |

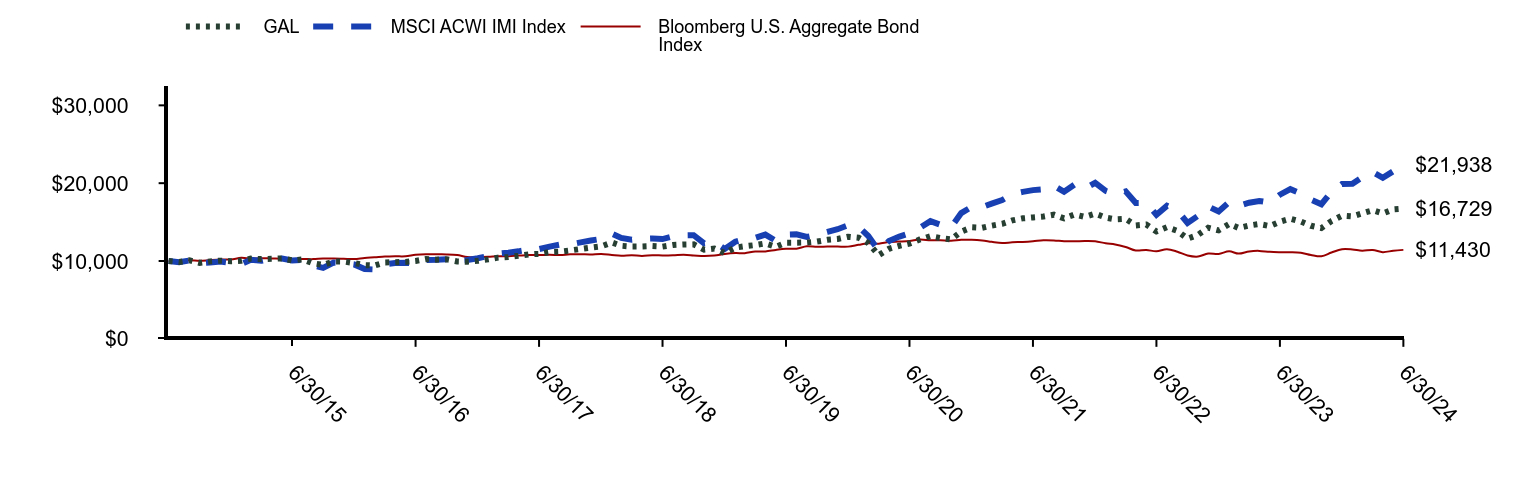

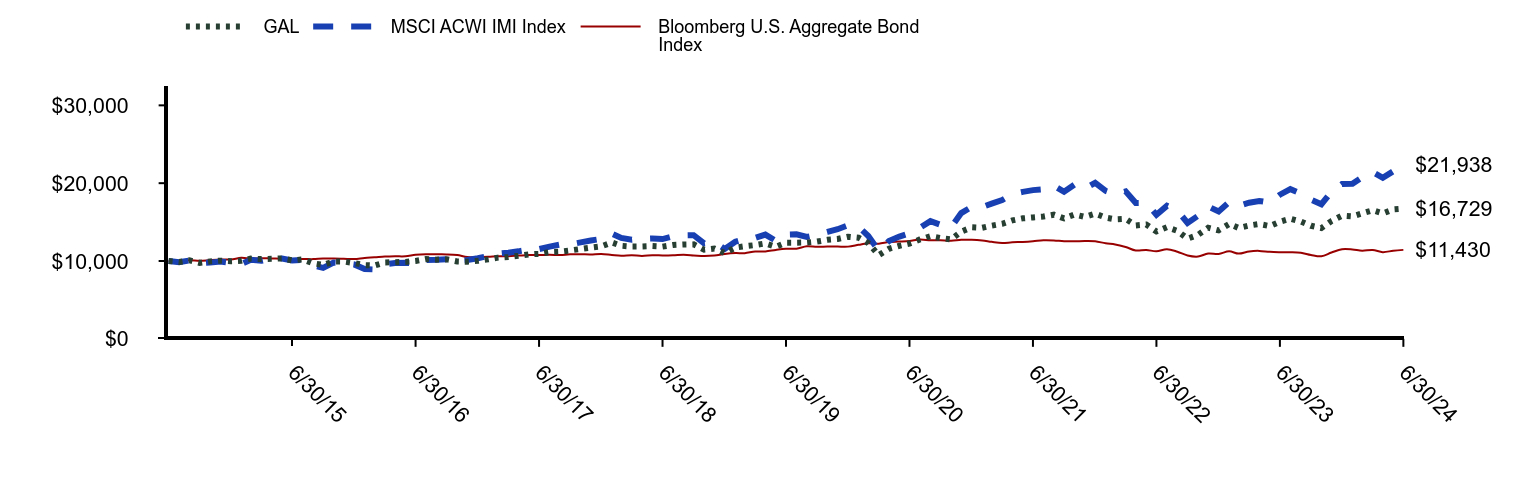

How did the Fund perform last year and what affected its performance?

The 12-month period ended June 30, 2024 was characterized by positive returns for most asset classes and a strong equity market rally. In that environment, the multi-asset exposure of the Fund led to underperformance when measured against an all-equity benchmark such as the MSCI ACWI IMI Index. Although markets continued to battle with sticky and inconsistent progress against inflation and an interest rate scare in the fall, a broad easing of financial conditions contributed to a favorable environment for risk-taking in the Fund. As a result, overweight allocations were held in equities to varying degrees which contributed favorably to performance. The Fund’s investment in gold was another positive contributor during the reporting period. Strong technical indicators supported holding gold which performed well. An aspect of the Fund’s strategy which detracted was investments across U.S. equity sectors. The negative impact from performance here came from both sector selection, including an allocation to the energy sector, as well as from tracking error of certain sector ETFs.

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| GAL | MSCI ACWI IMI Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 6/30/14 | $10,000 | $10,000 | $10,000 |

| 7/31/14 | $9,876 | $9,846 | $9,975 |

| 8/31/14 | $10,082 | $10,074 | $10,085 |

| 9/30/14 | $9,756 | $9,717 | $10,017 |

| 10/31/14 | $9,952 | $9,794 | $10,115 |

| 11/30/14 | $10,043 | $9,939 | $10,187 |

| 12/31/14 | $9,966 | $9,775 | $10,196 |

| 1/31/15 | $10,023 | $9,623 | $10,410 |

| 2/28/15 | $10,311 | $10,161 | $10,312 |

| 3/31/15 | $10,251 | $10,027 | $10,360 |

| 4/30/15 | $10,283 | $10,302 | $10,323 |

| 5/31/15 | $10,329 | $10,309 | $10,298 |

| 6/30/15 | $10,075 | $10,081 | $10,186 |

| 7/31/15 | $10,211 | $10,139 | $10,257 |

| 8/31/15 | $9,713 | $9,459 | $10,242 |

| 9/30/15 | $9,491 | $9,114 | $10,311 |

| 10/31/15 | $9,937 | $9,803 | $10,313 |

| 11/30/15 | $9,934 | $9,743 | $10,286 |

| 12/31/15 | $9,738 | $9,561 | $10,252 |

| 1/31/16 | $9,471 | $8,962 | $10,393 |

| 2/29/16 | $9,411 | $8,915 | $10,467 |

| 3/31/16 | $9,815 | $9,590 | $10,563 |

| 4/30/16 | $9,848 | $9,741 | $10,603 |

| 5/31/16 | $9,881 | $9,761 | $10,607 |

| 6/30/16 | $10,005 | $9,690 | $10,797 |

| 7/31/16 | $10,251 | $10,122 | $10,866 |

| 8/31/16 | $10,167 | $10,156 | $10,854 |

| 9/30/16 | $10,210 | $10,230 | $10,847 |

| 10/31/16 | $9,951 | $10,032 | $10,765 |

| 11/30/16 | $9,909 | $10,141 | $10,509 |

| 12/31/16 | $10,027 | $10,359 | $10,524 |

| 1/31/17 | $10,210 | $10,640 | $10,545 |

| 2/28/17 | $10,431 | $10,933 | $10,616 |

| 3/31/17 | $10,521 | $11,062 | $10,611 |

| 4/30/17 | $10,671 | $11,241 | $10,692 |

| 5/31/17 | $10,852 | $11,465 | $10,775 |

| 6/30/17 | $10,918 | $11,533 | $10,764 |

| 7/31/17 | $11,148 | $11,849 | $10,810 |

| 8/31/17 | $11,199 | $12,103 | $10,758 |

| 9/30/17 | $11,361 | $12,145 | $10,855 |

| 10/31/17 | $11,540 | $12,390 | $10,862 |

| 11/30/17 | $11,720 | $12,633 | $10,847 |

| 12/31/17 | $11,887 | $12,839 | $10,897 |

| 1/31/18 | $12,383 | $13,531 | $10,772 |

| 2/28/18 | $11,957 | $12,967 | $10,670 |

| 3/31/18 | $11,856 | $12,724 | $10,738 |

| 4/30/18 | $11,864 | $12,843 | $10,659 |

| 5/31/18 | $11,914 | $12,893 | $10,734 |

| 6/30/18 | $11,850 | $12,815 | $10,721 |

| 7/31/18 | $12,054 | $13,170 | $10,724 |

| 8/31/18 | $12,120 | $13,291 | $10,793 |

| 9/30/18 | $12,139 | $13,313 | $10,723 |

| 10/31/18 | $11,451 | $12,271 | $10,639 |

| 11/30/18 | $11,601 | $12,445 | $10,702 |

| 12/31/18 | $11,021 | $11,544 | $10,899 |

| 1/31/19 | $11,721 | $12,483 | $11,014 |

| 2/28/19 | $11,895 | $12,831 | $11,008 |

| 3/31/19 | $12,045 | $12,963 | $11,219 |

| 4/30/19 | $12,255 | $13,392 | $11,222 |

| 5/31/19 | $11,821 | $12,590 | $11,422 |

| 6/30/19 | $12,353 | $13,400 | $11,564 |

| 7/31/19 | $12,357 | $13,440 | $11,589 |

| 8/31/19 | $12,375 | $13,101 | $11,890 |

| 9/30/19 | $12,495 | $13,376 | $11,826 |

| 10/31/19 | $12,719 | $13,744 | $11,862 |

| 11/30/19 | $12,829 | $14,087 | $11,856 |

| 12/31/19 | $13,126 | $14,586 | $11,848 |

| 1/31/20 | $12,994 | $14,393 | $12,076 |

| 2/29/20 | $12,290 | $13,215 | $12,293 |

| 3/31/20 | $10,752 | $11,313 | $12,221 |

| 4/30/20 | $11,564 | $12,559 | $12,438 |

| 5/31/20 | $11,956 | $13,137 | $12,496 |

| 6/30/20 | $12,245 | $13,557 | $12,575 |

| 7/31/20 | $12,769 | $14,261 | $12,762 |

| 8/31/20 | $13,190 | $15,125 | $12,659 |

| 9/30/20 | $12,943 | $14,656 | $12,652 |

| 10/31/20 | $12,774 | $14,339 | $12,596 |

| 11/30/20 | $13,776 | $16,154 | $12,720 |

| 12/31/20 | $14,333 | $16,957 | $12,737 |

| 1/31/21 | $14,269 | $16,927 | $12,646 |

| 2/28/21 | $14,541 | $17,377 | $12,463 |

| 3/31/21 | $14,779 | $17,828 | $12,308 |

| 4/30/21 | $15,218 | $18,601 | $12,405 |

| 5/31/21 | $15,482 | $18,879 | $12,445 |

| 6/30/21 | $15,599 | $19,107 | $12,533 |

| 7/31/21 | $15,711 | $19,203 | $12,673 |

| 8/31/21 | $15,948 | $19,679 | $12,649 |

| 9/30/21 | $15,477 | $18,894 | $12,539 |

| 10/31/21 | $15,982 | $19,813 | $12,536 |

| 11/30/21 | $15,669 | $19,281 | $12,573 |

| 12/31/21 | $16,088 | $20,047 | $12,541 |

| 1/31/22 | $15,577 | $19,007 | $12,271 |

| 2/28/22 | $15,348 | $18,572 | $12,134 |

| 3/31/22 | $15,407 | $18,951 | $11,797 |

| 4/30/22 | $14,571 | $17,446 | $11,349 |

| 5/31/22 | $14,692 | $17,456 | $11,422 |

| 6/30/22 | $13,793 | $15,950 | $11,243 |

| 7/31/22 | $14,340 | $17,089 | $11,518 |

| 8/31/22 | $13,868 | $16,483 | $11,192 |

| 9/30/22 | $12,871 | $14,892 | $10,709 |

| 10/31/22 | $13,359 | $15,808 | $10,570 |

| 11/30/22 | $14,278 | $17,011 | $10,959 |

| 12/31/22 | $13,934 | $16,357 | $10,909 |

| 1/31/23 | $14,751 | $17,562 | $11,245 |

| 2/28/23 | $14,244 | $17,074 | $10,954 |

| 3/31/23 | $14,563 | $17,494 | $11,232 |

| 4/30/23 | $14,752 | $17,717 | $11,300 |

| 5/31/23 | $14,485 | $17,503 | $11,177 |

| 6/30/23 | $15,049 | $18,524 | $11,137 |

| 7/31/23 | $15,442 | $19,232 | $11,130 |

| 8/31/23 | $15,073 | $18,680 | $11,059 |

| 9/30/23 | $14,529 | $17,894 | $10,778 |

| 10/31/23 | $14,230 | $17,298 | $10,607 |

| 11/30/23 | $15,143 | $18,897 | $11,088 |

| 12/31/23 | $15,821 | $19,888 | $11,512 |

| 1/31/24 | $15,725 | $19,933 | $11,481 |

| 2/29/24 | $16,118 | $20,767 | $11,318 |

| 3/31/24 | $16,523 | $21,424 | $11,423 |

| 4/30/24 | $16,110 | $20,698 | $11,134 |

| 5/31/24 | $16,630 | $21,538 | $11,323 |

| 6/30/24 | $16,729 | $21,938 | $11,430 |

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | 10 Years |

|---|

| GAL | 11.15% | 6.25% | 5.28% |

| MSCI ACWI IMI Index | 18.40% | 10.36% | 8.17% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | (0.23%) | 1.35% |