UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22538

Advisers Investment Trust

(Exact name of registrant as specified in charter)

50 S. LaSalle Street

Chicago, Illinois 60603

(Address of principal executive offices) (Zip code)

The Northern Trust Company

50 S. LaSalle Street

Chicago, Illinois 60603

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 557-4100

Date of fiscal year end: September 30

Date of reporting period: September 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

(a) The following are copies of reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

| | | | | | | | |

| |  | |  | | |

| | | |

| | | | | | |

| | | |

| | | | | | |

| | | | INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND | | |

| | | |

| | | | | | |

| | | | ANNUAL REPORT September 30, 2020 | | |

| | | |

| | | | | | |

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for the distribution to prospective investors unless preceded or accompanied by an effective prospectus.

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

TABLE OF CONTENTS

September 30, 2020

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

SHAREHOLDER LETTER

September 30, 2020

Dear Shareholder:

We are pleased to present to shareholders the September 30, 2020 Annual Report for the Independent Franchise Partners US Equity Fund (the “Fund”), a series of the Advisers Investment Trust. This report contains the results of Fund operations for the year ended September 30, 2020.

We appreciate the trust and confidence you have placed in us by choosing the Fund and its Investment Adviser, Independent Franchise Partners, LLP, and we look forward to continuing to serve your investing needs.

Sincerely,

| | | | | | |

| | | |  | | |

| | | |

| Barbara J. Nelligan | | | | Sandeep Ghela | | |

| President | | | | Chief Operating Officer | | |

| Advisers Investment Trust | | | | Independent Franchise Partners, LLP | | |

1

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2020 (Unaudited)

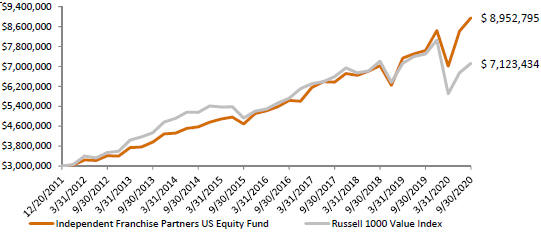

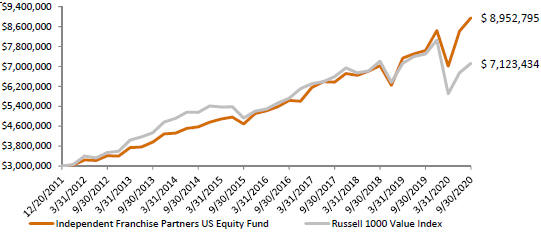

Independent Franchise Partners US Equity Fund

Value of a hypothetical $3,000,000 investment in the Fund from inception on December 20, 2011 to September 30, 2020

Average Annual Total Returns as of September 30, 2020

| | | | | | | | | | | | | | | | | | | | |

| | | Independent Franchise Partners US Equity Fund (without redemption fee) | | Independent Franchise Partners US Equity Fund (with redemption fee) | | Russell 1000 Value Index | | S&P 500 Index |

Q4 2019 | | | | 10.47 | % | | | | 10.22 | % | | | | 7.41 | % | | | | 9.07 | % |

Q1 2020 | | | | -16.94 | % | | | | -17.14 | % | | | | -26.73 | % | | | | -19.60 | % |

Q2 2020 | | | | 20.13 | % | | | | 19.83 | % | | | | 14.29 | % | | | | 20.54 | % |

Q3 2020 | | | | 6.59 | % | | | | 6.33 | % | | | | 5.59 | % | | | | 8.93 | % |

Year to Date | | | | 6.36 | % | | | | 6.10 | % | | | | -11.58 | % | | | | 5.57 | % |

1 Year | | | | 17.50 | % | | | | 17.24 | % | | | | -5.02 | % | | | | 15.15 | % |

3 Years (Annualized) | | | | 12.11 | % | | | | 12.03 | % | | | | 2.63 | % | | | | 12.28 | % |

5 Years (Annualized) | | | | 13.87 | % | | | | 13.83 | % | | | | 7.66 | % | | | | 14.15 | % |

Since Inception (Annualized) | | | | 13.29 | % | | | | 13.29 | % | | | | 10.35 | % | | | | 14.36 | % |

The Fund’s performance reflects the reinvestment of dividends as well as the impact of transaction costs (including the Fund’s 0.25% redemption fee unless noted otherwise) and the deduction of fees and expenses. The Fund’s Total Annual Operating Expense, per the Prospectus dated January 28, 2020, was 0.76%. Effective October 1, 2020, the Fund’s Total Annual Operating Expense is 0.72%.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 855-233-0437 or 312-557-7902.

Data as at September 30, 2020. The Inception date of the Fund is December 20, 2011. Performance is shown net of fees and periods greater than one year are annualized. The performance does not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

2

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2020 (Unaudited)

The Fund’s primary benchmark for performance comparison purposes is the Russell 1000 Value Index. The secondary benchmark is the S&P 500 Index. Benchmark returns reflect dividends reinvested gross of any withholding taxes. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index. Please refer to the Fund’s Prospectus for further information.

Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and / or Russell ratings or underlying data and no party may rely on any Russell Indexes and / or Russell ratings and / or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. Please refer to the Fund’s Prospectus for further information.

Capacity Status

Client assets in the US Franchise strategy are $3.8bn at September 30, 2020. Mindful of the $5bn capacity limit for US Franchise we set in 2009, we have some capacity available in the strategy for existing or new clients.

Portfolio Commentary

For the fiscal year ended September 30, 2020, the Fund delivered a return of 17.50% (assuming no redemption fee). This is an attractive absolute return and compares favorably against the Russell 1000 Value Index and S&P 500 Index, which fell 5.02% and rose 15.15% respectively. Although the Fund has generated strong returns over the period, if markets continue to rise appreciably from these levels, we would not expect the Fund to keep pace.

The Fund benefitted from exposure to certain stocks that possess durable intangible assets, notably Apple and Microsoft in the information technology sector, Nintendo and Electronic Arts in the communication services sector, and S&P Global in the financials sector.

The Fund’s lack of exposure to energy, real estate and the broader financials sector, the weakest sectors in the review period, benefitted relative returns. The energy, real estate and financials sectors fell 45%, 18% and 17% respectively compared to the 5% decline for the Russell 1000 Value Index. Companies in the energy and real estate sectors tend to be highly capital intensive and operate in an environment in which it is hard to exercise pricing power. Further, they tend to be highly cyclical. While financials tend to be highly leveraged and experience commoditization of their product offering. These attributes do not fit our long-term, buy and hold investment approach.

Consumer staples was the weakest sector for the Fund. As noted in previous reports, we have historically found many franchise companies within the consumer staples sector. Weak returns from some consumer staples companies, particularly Molson Coors, detracted from the Fund’s relative return.

Companies, such as Booking Holdings and Fox, whose revenues are particularly exposed to the impact of COVID-19, also detracted from the Fund’s returns during the review period.

We consistently encourage clients to assess returns over longer intervals, like a full market cycle, in line with our investment horizon. We caution that Franchise returns will likely lag if markets are led by sectors where we do not find Franchise opportunities. As always, we continue to design Franchise portfolios with the goal of protecting capital better than the broader market should there be a major fall. Experience has taught us that this is a key ingredient in compounding wealth over the long term.

Investment Returns and Contribution to Fund Return – 1 Year ending September 30, 2020

| | | | | | | | | | | | | | | | | | | | | | |

| US Equity Fund – Stock Returns (%) | | | | | US Equity Fund – Contribution to Fund Return (bps) | |

| Top | | | | | Bottom | | | | | Top | | | | | Bottom | | | |

Apple | | | +110% | | | Molson Coors | | | -31% | | | Apple | | | +432 | | | Molson Coors | | | -122 | |

Autodesk | | | +81% | | | IBM | | | -19% | | | Nintendo | | | +285 | | | IBM | | | -89 | |

Facebook | | | +67% | | | WWE | | | -16% | | | Microsoft | | | +285 | | | Booking | | | -77 | |

Microsoft | | | +55% | | | Booking | | | -13% | | | S&P Global | | | +202 | | | Fox | | | -69 | |

Nintendo | | | +53% | | | Chipotle Mexican Grill | | | -12% | | | Electronic Arts | | | +161 | | | Chipotle Mexican Grill | | | -50 | |

Stock returns reflect total returns and are presented in US Dollars for the period the stock was held during the year ending September 30, 2020. Contribution to Fund return reflects contribution to gross return and is presented in US Dollars for the period the stocks were held during the year to September 30, 2020. Source: FactSet, Independent Franchise Partners, LLP. For complete attribution and methodology, please contact clientservice@franchisepartners.com.

3

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2020 (Unaudited)

Significant Contributors to the Fund’s Return

Among the top contributors to the Fund’s return were Apple, Nintendo and Microsoft.

Apple’s revenues have continued their strong growth, particularly in its high margin Services division which has shown double digit growth over the past few quarters. The company also reported 550 million paid Services subscribers for the first time. This is a useful indication of the strength of customer loyalty to the Apple ecosystem. Anticipation continues to build about the next generation iPhone and the potential opportunities that 5G will offer. We reduced the position during the review period given the substantial increase in Apple’s share price and the commensurate reduction in its free cash flow yield.

Sales of Nintendo’s Switch console appear to be well ahead of company guidance. Furthermore, its latest Animal Crossing game was released to wide acclaim and continues to be a top selling software game. Media reports suggest that the next generation Switch console will be released in 2021 and that it will feature enhanced graphics and streaming capabilities. A successful launch should extend the Switch platform’s lifecycle. We continue to believe that Nintendo can benefit from the shift towards mobile gaming and further monetize its intellectual property. Nintendo’s shares trade on an estimated 5.8% free cash flow yield, after adjusting for its considerable net cash position.

Microsoft continues to grow revenues, led by its Office365 and Azure cloud platform businesses. As these high-margin businesses grow, they are improving Microsoft’s total gross and operating margins. We are mindful that the valuation is at the lower end of the portfolio, but continue to balance this against the company’s strong execution and potential for growth in its cloud services.

Notable Detractors from the Fund’s Return

Among the detractors from the Fund’s return were Molson Coors, Booking Holdings and Fox.

Molson Coors continues to wrestle with weaker demand. The company has meaningful exposure to on-trade beer consumption in the US, and the decline in demand from this channel has not been offset by off-trade growth. This has been a disappointing investment and, as described in detail in the final sales section below, we completed the final sale of Molson Coors in June.

Demand for Booking’s services has been significantly affected by COVID-19, with travel and hotel occupancy very low in many of its key markets. The travel industry will return, and we think that Booking will emerge from the pandemic-related disruption in a stronger position relative to its competitors and its hotel supplier base. Booking’s hotel suppliers should be more reliant on its leisure customers to improve occupancy, while the company’s strong balance sheet and margin structure leave it better placed to maintain investment than its competitors. The company’s shares trade on a 4.3% estimated free cash flow yield, after adjusting for the cash on its balance sheet.

Fox is exposed to advertising weakness due to COVID-19, with advertising accounting for 44% of Fox’s revenues in the last financial year. However, several factors give us comfort that Fox should be able to withstand an advertising downturn. First, the majority of its revenue comes from high-margin affiliate fee contracts. At its third quarter results announced in May, affiliate fee revenues improved 10%, reflecting the brand strength and pricing power of its channel portfolio. Second, the company has robust operating margins which should enable it to absorb the expected decline in advertising revenue. Third, it has a strong liquidity profile. As such we retain our long-term investment thesis and quality assessment of the Fox franchise. The company’s shares trade on an 11.9% estimated free cash flow yield, after adjusting for the cash on its balance sheet.

Significant Portfolio Changes During the Year

Portfolio activity has once again been higher than usual, primarily due to the increased dispersion of valuations across the universe of Franchise stocks. During the year, we initiated positions in Alphabet, Aon, Autodesk, Corteva, Facebook, IAA, IBM, ServiceMaster and World Wrestling Entertainment (“WWE”). We sold the positions in Chipotle Mexican Grill, Facebook, Imperial Brands, Molson Coors and Tiffany.

Initial Purchases

We initiated a position in Alphabet in March. Alphabet comprises two businesses: Google and OtherBets. Google contains the company’s core products and platforms such as Android, Chrome, Gmail, Google Cloud, Google Maps, Search, and YouTube. This is the jewel of the franchise that offers the potential for high free cash flow compounding. It benefits from a combination of powerful intangible assets: network effects, proprietary data, switching costs, and brands. OtherBets is a collection of earlier stage technologies – like autonomous vehicles, drone technology and life sciences – that are further afield from the core Google. This part of the business offers long-term optionality but is not core to our investment thesis.

Search and video advertising are core to the Google business. Once the COVID-19 disruption passes, we think Google can grow revenues in this category at a double-digit rate over the next few years. We expect search activity to continue to shift from desktop to mobile, which is under-monetized and offers attractive pricing potential. In addition, Google should be able to capture more of the value stream in popular search categories, like shopping and travel, and increase the monetization of video content on YouTube. Longer-term, Google should be able to increase its Search value proposition even further by combining its machine learning intelligence with other services such as Maps, Assistant and Gmail.

4

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2020 (Unaudited)

The main risks to the investment thesis are the long-term relevance of search, and increased regulation. It is well known that regulators are investigating Alphabet’s monopoly position in search and whether it uses this to benefit other parts of its Google business. This could lead to fines, as seen in Europe, or, in a worst-case scenario, a break-up of Google. We think the arrival of the COVID-19 virus alters government and agency priorities and this likely becomes a medium- to long-term risk rather than a short-term concern. The impact of COVID-19 does, however, introduce a risk of disruption to near-term advertising revenues.

We initiated a smaller than average position in Alphabet at a 4.8% estimated free cash flow yield, adjusting for the company’s net cash position and early-stage business costs.

We initiated a position in Aon in July. Aon is a leading global provider of insurance and reinsurance broking services, as well as retirement and health solutions. Aon’s key intangible asset has historically been its customer relationships but its single corporate brand and heavy investment in data capabilities are increasingly important additional sources of competitive advantage.

Aon’s insurance and reinsurance broking business accounts for around 70% of operating profit. The company is the joint number one insurance broker globally and boasts annual retention rates in this business of more than 90%. Property and Casualty (“P&C”) insurance and reinsurance broking are particularly attractive categories. P&C insurance is a mandatory purchase with good revenue visibility, wide margins and low capital intensity. This makes it an attractive and sticky business.

The opportunity to purchase the shares came from the company’s decision to acquire the number three insurance broker, Willis Tower Watson (“WTW”), in March. The market appears overly concerned that a complex integration and extended deal review process could weaken Aon’s operating performance. We recognize these concerns but take a more positive long-term view of the combined business.

Our research suggests that Aon should be able to successfully execute the acquisition and integration of WTW once it receives anti-trust approval. Over the past few years, it has succeeded in accelerating organic growth while undertaking an ambitious restructuring program to unify its brands and operating businesses. Increased scale should also strengthen Aon’s data advantages and accelerate its long-term transition from insurance broker to the preeminent global supplier of insurance risk data and analytics. We think this transition should result in a more profitable and valuable business.

We initiated the position at an estimated 5.3% free cash flow yield, adjusting for the cash on its balance sheet, a valuation which does not factor in any potential upside from the WTW transaction.

We began building a position in Autodesk in March. The company provides the dominant software tool used by architects and engineers to design buildings. It also has an attractive challenger position in manufacturing design software. Its intangible assets are a combination of high switching costs and network effects. Architects and engineers train for several years on Autodesk tools, often at university. This creates meaningful barriers to switching to other software tools. In addition, the company’s dominance means that its software has become the de facto standard to share and collaborate on architectural and engineering drawings.

Autodesk is approaching the final stage of a transition from a license to a subscription software model, which should lead to meaningful margin improvements in the next few years. There is also significant penetration and upsell opportunity through AI-led design and automation of construction workflow. Finally, we see an additional growth opportunity in market share gains in manufacturing software. We think the company is well-invested and well-run, and capital allocation has been impressive.

Autodesk’s end markets are cyclical and economic disruption due to COVID-19 may modestly curb revenue growth in the near term. Most of the company’s revenue comes from subscriptions, which should limit that impact. In the long term, the emergence of AI-enabled design tools could disrupt Autodesk’s dominance. However, this risk is mitigated by the company’s high levels of R&D investment and early investment in AI-enabled tools. There was a short window of opportunity to begin purchasing the shares during the market nadir in mid-March at an estimated 5.5% free cash flow yield.

We began building a position in Corteva, a global seed and agrochemical company, in October and completed the purchase in November. Corteva was spun out of DowDuPont in June 2019 and the company operates across two segments, Seed and Crop Protection Chemicals (CPC). It is the number one global producer of corn and soybean seeds, and the number four company in CPC. The key intangible asset in Seed is a patented, difficult-to-replicate library of high-quality seed germplasm and genetic traits. In CPC, patents are again the key intangible asset. We believe Corteva has a promising pipeline of new products that should help improve its competitive position over the medium term.

5

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2020 (Unaudited)

The company has the opportunity to deliver low double-digit free cash flow compounding in the medium term through a combination of modest revenue growth and significant margin improvement. We believe there are still meaningful synergies to be harvested from the merged Dow and DuPont cost base. In addition, Corteva’s roll-out of new traits should reduce its reliance on in-licensing seed traits and lower costs further.

The main risks are Corteva’s exposure to the agricultural cycle and the launches of its new products. We purchased the company’s shares at an estimated 5.8% free cash flow yield after factoring in some margin improvement. We think this valuation is attractive and helps compensate for these risks.

We initiated a position in Facebook, the leading global social media platform, in March. The company’s core intangible assets are the Facebook, Instagram, Messenger and WhatsApp brands, its extensive direct networks, proprietary and highly personalized advertising user data, and broad patent portfolios.

Once we pass through the economic disruption created by COVID-19, Facebook has the potential to deliver attractive long-term revenue growth and operating margin expansion. Revenue growth is supported by continued user growth, greater monetization of the Messenger, WhatsApp and Instagram platforms, and increasing international advertising yields. For example, total users across the platforms grew 11% year-on-year last quarter to 2.26bn daily users, and the Messenger, WhatsApp and Instagram platforms are all still under monetized.

There is also a long-term opportunity to improve operating margins. Operating margins have declined considerably over the past two years – from around 50% in 2017 to a little over 30% in 2019 – as the company has invested heavily in platform security and content moderation. These margins should begin to improve once the company’s investment phase moderates and the global economy normalizes.

The key risks to the investment thesis are a deep recession and increased regulation. Advertising comprises 98% of Facebook’s revenues and is skewed to small-to-medium sized businesses. Should COVID-19 result in a deep economic malaise, near-term advertising revenues will be depressed. However, Facebook’s advertising proposition benefits from the immediacy, measurability and flexibility it offers its customers and should emerge even stronger from the downturn. Regulation also presents a risk. However, it is possible this will be deprioritized by governments and agencies given the political focus on the coronavirus outbreak.

We initiated a small position in Facebook at an estimated 5.4% free cash flow yield. However, we subsequently sold the position in July. This is an unusually short holding period for a Franchise investment. We continue to view Facebook as a high-quality company with the potential to deliver attractive long-term revenue growth and operating margin expansion. However, given the rapid share price appreciation since we initiated the position, the valuation no longer provided adequate compensation for the risks the company faces.

We began building a position in IAA in late September 2019. The company provides an auction platform for US insurance companies to sell cars damaged in accidents. The US auto salvage auction industry benefits from a strong network effect and a supportive duopoly market structure: IAA and its main competitor, Copart, each have 40-45% market share. IAA has two key competitive advantages. First, it owns a network of nearly 200 salvage yards across the US. Each yard is around 50 acres and, because of strict planning permission and local opposition, it can take several years to find and obtain approval for new yards. This creates a high barrier for new entrants. Insurers prefer to deal with companies that operate nationwide and we estimate it would take around a decade for a competitor to replicate a national network of salvage yards. Second, the customer base purchasing salvage autos is highly fragmented which makes it hard for any single insurer to disintermediate the auction platforms.

The number of cars sent to salvage in the US has been increasing at high single-digit rates, driven by an increase in hard-to-repair electronic parts, an aging auto fleet and increased miles driven. In addition, the buyer base from outside of the US has expanded significantly, boosting salvage car prices and making it incrementally more compelling to sell a car at salvage than to repair a damaged car.

IAA was spun out of an automotive conglomerate in June 2019 and our research suggests that it has an opportunity to improve its operations as an independent company. Its EBITDA margin, while attractive at around 29%, is considerably lower than Copart’s despite a broadly similar business model. We think there is an opportunity for significant improvement in its margins and return on capital employed over the medium term.

The main risk to the investment thesis is the potential for the loss of a large auto insurer to Copart. The auto insurers on the supply-side of the network are relatively concentrated and there have been a few switches to Copart over the past 15 years.

6

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2020 (Unaudited)

Geico is IAA’s largest insurance relationship. We estimate it supplies around 15-20% of IAA volumes and has been a customer since 2003. Leading up to our initial purchase, there had been rumours that Geico was exploring the use of Copart in certain geographies. Indeed, it was this speculation that gave us the opportunity to initiate a position in IAA at an attractive valuation. We initiated the purchase of IAA at an estimated 5.0% free cash flow yield after factoring in some margin improvement.

In February, we initiated a position in IBM, a leading technology infrastructure, application software and consulting company. The company’s key intangible asset is the high switching costs arising from the mission-critical software it provides to its customers.

We have followed IBM for close to a decade but historically felt that its valuation did not compensate us sufficiently for the risks associated with the stagnant state of its business. However, we view the company’s 2019 acquisition of Red Hat as transformational. Red Hat is the dominant provider of enterprise Linux and has a leading share in the provision of container platforms, which we believe to be the future of software application development.

The combination of Red Hat’s early lead in containers with IBM’s salesforce and customer relationships has the potential to accelerate IBM’s revenue growth and foster low-single-digit free cash flow compounding. When combined with the ongoing turnaround in IBM’s Global Business Services division and the positive impact of IBM’s senior management changes, we see the potential for further free cash flow compounding and a re-rating of the company’s stock price.

There are two main risks to the thesis. The first is that IBM fails to properly integrate Red Hat, particularly because of Red Hat’s unique culture. Our research into the calibre of the new management team at IBM gives us confidence that they should be able to execute sufficiently well to minimize this risk.

The second risk is that the hyper-scale cloud players – Amazon, Microsoft and Google – provide their own container management platforms and that clients prefer them. We expect Red Hat to co-exist alongside these larger cloud providers’ offerings; some customers prefer to have a single container platform and toolkit across all public cloud players, rather than training their developers on multiple hyperscale container platforms.

At the time of purchase, IBM’s shares traded on a 7.1% estimated free cash flow yield, after adjusting for its operational debt and pension. We think this valuation helps to compensate for the risks, particularly given the opportunity for revenue growth to accelerate.

We initiated a position in ServiceMaster in February. The company provides pest control, cleaning and restoration services. The company’s key asset is the Terminix pest control business, which accounts for 80% of the company’s profits and is the second largest pest control company in the U.S. Its intangible assets are a combination of brand power and a network of branches that enables it to serve national commercial accounts across the U.S.

We think ServiceMaster can sustainably improve its free cash flow compounding, which should lead to a re-rating of its shares. The company is in the midst of a turnaround, having previously been mismanaged and underinvested. The turnaround began in 2017. Since then, management and the board have overhauled its senior executive team, spun-off its warranty business (now trading as Frontdoor), separated the residential and commercial pest control businesses, and changed the compensation structure to encourage a greater focus on service levels and greater equity ownership.

In January of this year, the company announced plans to become a pure play pest control company by selling its cleaning and restoration services business. It completed the sale in September. We think all these actions should help the company improve organic revenue growth, margins and the balance sheet.

There are three main risks to the investment thesis. The first is the impact of COVID-19. However, pest control tends to be a non-discretionary expenditure, and the category held up relatively well in the 2008/ 2009 Global Financial crisis. The second is that the turnaround stalls or falters and the company is unable to sell its cleaning and restoration services business. The third is that elevated termite litigation claims in Mobile, Alabama, end up being higher than expected or spread to other regions. We have factored these claims into our forecasts.

It was the market’s reaction to the third risk that gave us the opportunity to purchase the shares at a 6.0% estimated free cash flow yield. We began with a relatively small position size to reflect the risks posed by the ongoing termite claims, and the company’s ability to sell the cleaning and restoration services business given the impact of COVID-19 on the economy and credit conditions.

We initiated a position in WWE, the leading global wrestling entertainment company, in January. WWE is a well-invested business with unique, fully integrated media content production and distribution assets: the WWE brand, its cast and characters, and its distribution rights.

7

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2020 (Unaudited)

We think WWE has attractive long-term growth prospects based on a combination of its expanding global presence, its brand-enhancing investments, and the increasing value of its TV rights. For example, in 2018 WWE returned to U.S. broadcast TV for the first time in a decade with a 360% increase in the value of its TV rights. There is an opportunity to increase future U.S. TV rights renewal rates given the good value they offer relative to other top tier sports rights.

Internationally, WWE is broadcast in 25 languages in 180 countries. By creating resonant, localized content, the company should be able to continue to increase the value of its international media rights. If successful, WWE should be able to increase revenue and operating margins. Encouragingly, WWE announced a five-year extension of its broadcast rights in India, a top 5 market, with Sony Pictures Network at the end of March.

The opportunity to purchase the shares came with the departure of the company’s two co-presidents at the end of January. The departures raised market concerns about the company’s capital allocation priorities. WWE’s share price fell 22% on the day of the announcement to a level approximately 50% below its April 2019 peak. We assessed this to be an overreaction that created an opportunity to invest in a unique business with a strong net cash balance sheet and highly visible revenues at an attractive valuation. We purchased the shares at a 5.1% estimated free cash flow yield.

After our purchase in January, COVID-19 has clearly affected the company, disrupting its live events. The company is continuing to deliver its key Raw, Smackdown and NXT programs to its broadcast partners, however, the lack of ringside fans appears to have curbed WWE’s television appeal. We do not expect this to have a long-term impact on the company or our investment thesis. Financially, WWE has a strong balance sheet that is net cash.

Final Sales

We completed the final sale of Chipotle Mexican Grill in November. We established the position in November 2017. The company has performed well, recovering not only from the food safety scares of 2015 but also making several operational improvements that have helped same-store-sales and restaurant-level-margins return to close to their pre-2015 levels. We continue to see opportunity for further sales, profit and cash flow growth. However, given the strong share price appreciation, Chipotle’s shares traded below our valuation hurdle and so we sold the position.

As discussed in the section on initial purchases, we sold the position in Facebook in July. Given the rapid share price appreciation since we initiated the position in March, the valuation no longer provided adequate compensation for the risks the company faces.

We sold the position in Imperial Brands in May. It has been a disappointing and costly investment since we established the position in March 2017. Imperial remains highly free cash generative and offers a well-covered dividend yield of 9.4%. However, the company’s ability to compound free cash flow has become increasingly constrained due to the strategic and execution challenges in its next generation product (“NGP”) portfolio, as well as the geographic mix of its core tobacco business.

New CEO Stefan Bomhard joined the company at the start of July. We think he can further rationalize NGP investment, simplify the company’s overly complex geographic footprint, and rebuild investor confidence through improved transparency. Imperial Brands’ shares trade on an estimated 11.0% free cash flow yield, after adjusting for the debt on its balance sheet.

Despite the attractive valuation, we decided there are better risk/reward options available for the US Franchise portfolio, particularly given the limited capacity to hold non-US listed businesses. Non-US securities effectively have to cross a higher hurdle to be included in the Fund.

We completed the final sale of Molson Coors in June. The company’s shares held up better than we felt was warranted during the initial phase of the market downturn in late February and early March, particularly given the company’s exposure to the lockdown in the US. Having completed a substantial portion of the disposal early on, we were price sensitive sellers and tried to take advantage of the stock’s comparatively high volatility to complete the rest of the sale in mid-June.

We initiated the position in April 2017. Margins at the company have expanded in line with our original thesis. However, Molson Coors has faced two unexpected headwinds. First, US beer category volume growth in the past three years has deteriorated relative to long-term historic category volume trends, despite the generally healthier economy over most of that period. Second, innovation in the company’s premium beer portfolio has lagged and its premium beers have failed to grow ahead of its mainstream and economy beer segments. As a result, profits stagnated instead of growing in the low-single-digits as we had originally anticipated.

Looking back, we made a number of mistakes. We over-emphasized margin expansion in our thesis and under-estimated the burden of the moderately stretched balance sheet. We also assumed that family ownership would drive alignment and lead to improved execution. This has not happened and there are a handful of lessons here to help shape how we balance these sorts of risks with valuation in the future.

8

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2020 (Unaudited)

We sold the position in Tiffany in March. We established the position in February 2019, following the market correction in the fourth quarter of 2018. Tiffany’s unique position in the luxury jewelry market was underscored by LVMH’s $135 per share bid for the company in November 2019. With that agreed bid acting as a floor to the share price, the shares held up relatively well in the first quarter of 2020. Given the limited upside potential, we sold the position and used the proceeds to fund the initial purchases outlined above.

We remain completely dedicated to investing our clients’ portfolios in keeping with the rigors of the Franchise quality and value criteria. As ever, we measure our success through long-term investment results and enduring client relationships. We thank you for your support and look forward to serving you in the coming years.

Hassan Elmasry, CFA

Lead Portfolio Manager of the Fund and Partner of Independent Franchise Partners, LLP

Michael Allison, CFA

Portfolio Manager of the Fund and Partner of Independent Franchise Partners, LLP

Richard Crosthwaite

Portfolio Manager of the Fund and Partner of Independent Franchise Partners, LLP

Sandeep Ghela

Chief Operating Officer and Partner of Independent Franchise Partners, LLP

Karim Ladha, CFA

Portfolio Manager of the Fund and Partner of Independent Franchise Partners, LLP

Jayson Vowles, CFA

Portfolio Manager of the Fund and Partner of Independent Franchise Partners, LLP

Principal Investment Risks: Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security. All investments carry a certain amount of risk, and the Fund cannot guarantee that it will achieve its investment objective. The value of the Fund’s investments will fluctuate with market conditions, and the value of your investment in the Fund also will vary. You could lose money on your investment in the Fund, or the Fund could perform worse than other investments. Investments in the Fund are not deposits of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The main risks of investing in the Fund are set out in the Fund’s Prospectus, which can be obtained at www.franchisepartners.com/funds or by calling 855-233-0437 or 312-557-7902.

The comments and free cash flow yield estimates reflect the views of Independent Franchise Partners, LLP at the time of writing, unless otherwise indicated, and are subject to change without notice to the recipients of this document. Free cash flow yield estimates are based on the firm’s proprietary research and methodology.

9

ADVISERS INVESTMENT TRUST

IFP US EQUITY FUND

SCHEDULE OF INVESTMENTS

September 30, 2020

| | | | | | | | | | | | | | |

| |

| | | | |

| | | Percentage of Net Assets | | | | | Shares | | | Value | |

| |

COMMON STOCKS | | | 98.3% | | | | | | | | | | | |

Biotechnology | | | 4.1% | | | | | | | | | | | |

Corteva Inc. | | | | | | | | | 2,356,119 | | | $ | 67,879,788 | |

| | | | | | | | | | | | | | |

Commercial Services | | | 2.1% | | | | | | | | | | | |

ServiceMaster Global Holdings Inc.(a) | | | | | | | | | 898,608 | | | | 35,836,487 | |

| | | | | | | | | | | | | | |

Computers & Peripherals | | | 7.7% | | | | | | | | | | | |

Apple Inc. | | | | | | | | | 529,334 | | | | 61,302,171 | |

International Business Machines Corp. | | | | | | | | | 550,094 | | | | 66,929,937 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 128,232,108 | |

| | | | | | | | | | | | | | |

Diversified Financials | | | 6.2% | | | | | | | | | | | |

S&P Global Inc. | | | | | | | | | 152,952 | | | | 55,154,491 | |

Western Union Co. | | | | | | | | | 2,284,138 | | | | 48,949,078 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 104,103,569 | |

| | | | | | | | | | | | | | |

Diversified Support Services | | | 2.0% | | | | | | | | | | | |

IAA Inc.(a) | | | | | | | | | 650,130 | | | | 33,852,269 | |

| | | | | | | | | | | | | | |

Health Care Equipment & Supplies | | | 2.3% | | | | | | | | | | | |

Alcon Inc.(a) | | | | | | | | | 688,792 | | | | 39,111,689 | |

| | | | | | | | | | | | | | |

Information Services | | | 0.8% | | | | | | | | | | | |

Equifax Inc. | | | | | | | | | 85,640 | | | | 13,436,916 | |

| | | | | | | | | | | | | | |

Insurance | | | 4.1% | | | | | | | | | | | |

Aon PLC - Class A | | | | | | | | | 332,496 | | | | 68,593,925 | |

| | | | | | | | | | | | | | |

Internet Software & Services | | | 9.8% | | | | | | | | | | | |

Alphabet Inc. - Class A(a) | | | | | | | | | 25,606 | | | | 37,528,154 | |

Booking Holdings Inc.(a) | | | | | | | | | 42,421 | | | | 72,568,756 | |

eBay Inc. | | | | | | | | | 1,032,808 | | | | 53,809,297 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 163,906,207 | |

| | | | | | | | | | | | | | |

IT Services | | | 3.7% | | | | | | | | | | | |

Accenture PLC - Class A | | | | | | | | | 271,368 | | | | 61,326,454 | |

| | | | | | | | | | | | | | |

Media | | | 11.6% | | | | | | | | | | | |

Fox Corp. - Class A | | | | | | | | | 2,725,370 | | | | 75,847,047 | |

News Corp. - Class A | | | | | | | | | 4,106,804 | | | | 57,577,392 | |

News Corp. - Class B | | | | | | | | | 1,566,403 | | | | 21,898,314 | |

World Wrestling Entertainment Inc. - Class A | | | | | | | | | 982,350 | | | | 39,755,705 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 195,078,458 | |

| | | | | | | | | | | | | | |

Pharmaceuticals | | | 11.5% | | | | | | | | | | | |

Bristol-Myers Squibb Co. | | | | | | | | | 1,070,421 | | | | 64,535,682 | |

Johnson & Johnson | | | | | | | | | 504,944 | | | | 75,176,063 | |

Novartis AG - REG | | | | | | | | | 612,436 | | | | 53,134,749 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 192,846,494 | |

| | | | | | | | | | | | | | |

Software | | | 13.5% | | | | | | | | | | | |

Autodesk Inc.(a) | | | | | | | | | 64,579 | | | | 14,918,395 | |

Electronic Arts Inc.(a) | | | | | | | | | 428,838 | | | | 55,924,763 | |

Microsoft Corp. | | | | | | | | | 343,981 | | | | 72,349,524 | |

Oracle Corp. | | | | | | | | | 1,398,361 | | | | 83,482,152 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 226,674,834 | |

| | | | | | | | | | | | | | |

See Notes to Financial Statements.

10

ADVISERS INVESTMENT TRUST

IFP US EQUITY FUND

SCHEDULE OF INVESTMENTS

September 30, 2020

| | | | | | | | | | | | | | |

| |

| | | | |

| | | Percentage of Net Assets | | | | | Shares | | | Value | |

| |

Tobacco | | | 12.7% | | | | | | | | | | | |

Altria Group Inc. | | | | | | | | | 1,409,133 | | | $ | 54,448,899 | |

British American Tobacco PLC | | | | | | | | | 1,860,469 | | | | 66,678,228 | |

Philip Morris International Inc. | | | | | | | | | 1,230,516 | | | | 92,276,395 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 213,403,522 | |

| | | | | | | | | | | | | | |

Toys/Games/Hobbies | | | 6.2% | | | | | | | | | | | |

Nintendo Co. Ltd. | | | | | | | | | 184,917 | | | | 104,604,828 | |

| | | | | | | | | | | | | | |

TOTAL COMMON STOCKS (Cost $1,330,527,643) | | | | | | | | | | | | | 1,648,887,548 | |

| | | | | | | | | | | | | | |

TOTAL INVESTMENTS

(Cost $1,330,527,643) | | | 98.3% | | | | | | | | | | 1,648,887,548 | |

NET OTHER ASSETS (LIABILITIES) | | | 1.7% | | | | | | | | | | 29,037,450 | |

| | | | | | | | | | | | | | |

NET ASSETS | | | 100.0% | | | | | | | | | $ | 1,677,924,998 | |

| | | | | | | | | | | | | | |

(a)Non-income producing security.

Abbreviations:

REG – Registered

At September 30, 2020, the Fund’s investments were concentrated in the following countries:

| | | | |

| Country Allocation (Unaudited) | | Percentage of Net Assets | |

| |

United States | | | 82.6% | |

Japan | | | 6.2 | |

Switzerland | | | 5.5 | |

United Kingdom | | | 4.0 | |

| |

Total | | | 98.3% | |

| |

See Notes to Financial Statements.

11

ADVISERS INVESTMENT TRUST

STATEMENT OF ASSETS & LIABILITIES

September 30, 2020

| | | | |

| | | Independent Franchise Partners US Equity Fund | |

| |

Assets: | | | | |

Investments, at value (Cost: $1,330,527,643) | | $ | 1,648,887,548 | |

Cash | | | 33,598,032 | |

Foreign currency (Cost: $1,692) | | | 1,645 | |

Receivable for dividends | | | 4,105,018 | |

Reclaims receivable | | | 2,764,662 | |

Receivable for investments sold | | | 2,324,050 | |

Prepaid expenses | | | 6,573 | |

| | | | |

Total Assets | | | 1,691,687,528 | |

Liabilities: | | | | |

Securities purchased payable | | | 12,063,971 | |

Capital shares redeemed payable | | | 200,000 | |

Investment advisory fees payable | | | 956,693 | |

Accounting and Administration fees payable | | | 469,753 | |

Regulatory and Compliance fees payable | | | 13,814 | |

Risk Officer fees payable | | | 8,000 | |

Accrued expenses and other payables | | | 50,299 | |

| | | | |

Total Liabilities | | | 13,762,530 | |

| | | | |

Net Assets | | $ | 1,677,924,998 | |

| | | | |

Net assets | | $ | 1,677,924,998 | |

Shares of common stock outstanding | | | 85,071,919 | |

| | | | |

Net asset value per share | | $ | 19.72 | |

| | | | |

Net Assets: | | | | |

Paid in capital | | $ | 1,199,432,998 | |

Distributable earnings (loss) | | | 478,492,000 | |

| | | | |

Net Assets | | $ | 1,677,924,998 | |

| | | | |

See Notes to Financial Statements.

12

ADVISERS INVESTMENT TRUST

STATEMENT OF OPERATIONS

For the year ended September 30, 2020

| | | | |

| | | Independent Franchise Partners US Equity Fund | |

| |

Investment Income: | | | | |

Dividend income (Net of foreign withholding tax of $559,373) | | $ | 36,094,896 | |

Operating expenses: | | | | |

Investment advisory | | | 10,906,679 | |

Accounting and Administration | | | 933,508 | |

Regulatory and Compliance | | | 164,844 | |

Risk Officer | | | 28,546 | |

Trustees | | | 52,830 | |

Other | | | 143,887 | |

| | | | |

Total expenses | | | 12,230,294 | |

| | | | |

Net investment income | | | 23,864,602 | |

| | | | |

Realized and Unrealized Gains (Losses) from Investment Activities: | | | | |

Net realized gains from investment transactions | | | 349,104,887 | |

Net increase from payments by affiliates | | | 271,684 | |

Net realized gains from foreign currency transactions | | | 37,029 | |

Change in unrealized appreciation (depreciation) on investments | | | (116,273,609 | ) |

Change in unrealized appreciation (depreciation) on foreign currency | | | 189,122 | |

| | | | |

Net realized and unrealized gains from investment activities | | | 233,329,113 | |

| | | | |

Change in Net Assets Resulting from Operations | | $ | 257,193,715 | |

| | | | |

|

| |

See Notes to Financial Statements.

13

ADVISERS INVESTMENT TRUST

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended September 30, 2020 and 2019

| | | | | | | | |

| | | Independent Franchise Partners

US Equity Fund | |

| | | 2020 | | | 2019 | |

| |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 23,864,602 | | | $ | 33,123,824 | |

Net realized gains (losses) from investment and foreign currency transactions | | | 349,413,600 | | | | 111,691,667 | |

Change in unrealized appreciation (depreciation) on investments and foreign currency | | | (116,084,487 | ) | | | 25,037,278 | |

| | | | | | | | |

Change in net assets resulting from operations | | | 257,193,715 | | | | 169,852,769 | |

| | | | | | | | |

Dividends paid to shareholders: | | | | | | | | |

From distributable earnings | | | (165,226,614 | ) | | | (135,851,949 | ) |

| | | | | | | | |

Total dividends paid to shareholders | | | (165,226,614 | ) | | | (135,851,949 | ) |

| | | | | | | | |

Capital Transactions: | | | | | | | | |

Proceeds from sale of shares | | | 84,665,411 | | | | 106,291,312 | |

Value of shares issued to shareholders in reinvestment of dividends | | | 158,832,872 | | | | 130,469,928 | |

Value of shares redeemed | | | (786,062,798 | ) | | | (267,284,191 | ) |

| | | | | | | | |

Change in net assets from capital transactions | | | (542,564,515 | ) | | | (30,522,951 | ) |

| | | | | | | | |

Change in net assets | | | (450,597,414 | ) | | | 3,477,869 | |

Net assets: | | | | | | | | |

Beginning of year | | | 2,128,522,412 | | | | 2,125,044,543 | |

| | | | | | | | |

End of year | | $ | 1,677,924,998 | | | $ | 2,128,522,412 | |

| | | | | | | | |

Share Transactions: | | | | | | | | |

Sold | | | 4,371,881 | | | | 5,806,665 | |

Reinvested | | | 8,693,644 | | | | 8,384,957 | |

Redeemed | | | (42,009,553 | ) | | | (14,716,739 | ) |

| | | | | | | | |

Change | | | (28,944,028 | ) | | | (525,117 | ) |

| | | | | | | | |

|

| |

See Notes to Financial Statements.

14

ADVISERS INVESTMENT TRUST

FINANCIAL HIGHLIGHTS

For the years indicated

| | | | | | | | | | | | | | | | | | | | |

| | | Independent Franchise Partners

US Equity Fund | |

| | | Year Ended September 30, 2020 | | | Year Ended September 30, 2019 | | | Year Ended September 30, 2018 | | | Year Ended September 30, 2017 | | | Year Ended September 30, 2016 | |

| |

Net asset value, beginning of year | | $ | 18.67 | | | $ | 18.55 | | | $ | 17.66 | | | $ | 16.21 | | | $ | 14.57 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.37 | | | | 0.30 | | | | 0.28 | | | | 0.23 | | | | 0.22 | |

Net realized and unrealized gains from investments | | | 2.72 | | | | 1.06 | | | | 1.51 | | | | 1.80 | | | | 2.59 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 3.09 | | | | 1.36 | | | | 1.79 | | | | 2.03 | | | | 2.81 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions paid: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.37 | ) | | | (0.31 | ) | | | (0.24 | ) | | | (0.22 | ) | | | (0.24 | ) |

From net realized gains on investments | | | (1.68 | ) | | | (0.93 | ) | | | (0.66 | ) | | | (0.36 | ) | | | (0.93 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions paid | | | (2.05 | ) | | | (1.24 | ) | | | (0.90 | ) | | | (0.58 | ) | | | (1.17 | ) |

| | | | | | | | | | | | | | | | | | | | |

Increase from redemption fees | | | 0.01 | | | | — | (a) | | | — | (a) | | | — | (a) | | | — | (a) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value | | | 1.05 | | | | 0.12 | | | | 0.89 | | | | 1.45 | | | | 1.64 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 19.72 | | | $ | 18.67 | | | $ | 18.55 | | | $ | 17.66 | | | $ | 16.21 | |

| | | | | | | | | | | | | | | | | | | | |

Total return(b) | | | 17.50 | %(c) | | | 8.67 | % | | | 10.34 | % | | | 12.99 | % | | | 20.23 | % |

Ratios/Supplemental data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 1,677,925 | | | $ | 2,128,522 | | | $ | 2,125,045 | | | $ | 1,929,030 | | | $ | 1,558,064 | |

Ratio of net expenses to average net assets | | | 0.76 | % | | | 0.76 | % | | | 0.76 | % | | | 0.77 | % | | | 0.79 | % |

Ratio of net investment income to average net assets | | | 1.49 | % | | | 1.62 | % | | | 1.54 | % | | | 1.42 | % | | | 1.64 | % |

Ratio of gross expenses to average net assets | | | 0.76 | % | | | 0.76 | %(d) | | | 0.76 | %(d) | | | 0.77 | % | | | 0.79 | % |

Portfolio turnover rate(e) | | | 43.46 | % | | | 37.99 | % | | | 38.63 | % | | | 30.72 | % | | | 19.29 | % |

| |

| (a) | Redemption fees were less than $0.005 per share. |

| (b) | Total return excludes redemption fees. |

| (c) | During the period, the Adviser reimbursed the fund for a loss realized in connection with a trade error. Such payment represented 0.02% to the Fund’s total return. |

| (d) | During the years shown, certain fees were reduced. If such fee reductions had not occurred, the ratio would have been as indicated. |

| (e) | Portfolio turnover rate includes applicable corporate action activity and securities trading as a result of investor subscription and redemption activity. |

See Notes to Financial Statements.

15

ADVISERS INVESTMENT TRUST

IFP US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2020

Advisers Investment Trust (the “Trust”) is a Delaware statutory trust operating under a Second Amended and Restated Agreement and Declaration of Trust (the “Trust Agreement”) dated June 21, 2018. The Trust was formerly an Ohio business trust, which commenced operations on December 20, 2011. On March 31, 2017, the Trust was converted to a Delaware statutory trust. As an open-end registered investment company, as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) 2013-08, the Trust follows accounting and reporting guidance under FASB Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The Trust Agreement permits the Board of Trustees (the “Trustees” or “Board”) to authorize and issue an unlimited number of shares of beneficial interest, at no par value, in separate series of the Trust. The Independent Franchise Partners US Equity Fund (the “IFP US Equity Fund” or “Fund”) is a series of the Trust. These financial statements and notes only relate to the IFP US Equity Fund.

The Fund is a non-diversified fund, meaning it may invest in a smaller number of companies than a diversified fund, and seeks to achieve an attractive long-term rate of return.

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust and Fund. In addition, in the normal course of business, the Trust enters into contracts with its vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund.

| A. | Significant accounting policies are as follows: |

INVESTMENT VALUATION

Investments are recorded at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques employed by the Fund, as described below, maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. These inputs are summarized in the following three broad levels:

| • | | Level 1 — quoted prices in active markets for identical assets |

| • | | Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, certain short-term debt securities may be valued using amortized cost. Generally, amortized cost approximates the current value of a security, but since this valuation is not obtained from a quoted price in an active market, such securities would be reflected as Level 2 in the fair value hierarchy.

Security prices are generally provided by an independent third party pricing service approved by the Trustees as of the close of the New York Stock Exchange, normally at 4:00 p.m. Eastern Time, each business day on which the share price of the Fund is calculated. Equity securities listed or traded on a primary exchange are valued at the closing price, if available, or the last sales price on the primary exchange. If no sale occurred on the valuation date, the securities will be valued at the latest quotations as of the close of the primary exchange. Investments in other open-end registered investment companies are valued at their respective net asset value as reported by such companies. In these types of situations, valuations are typically categorized as Level 1 in the fair value hierarchy.

Debt and other fixed income securities, if any, are generally valued at an evaluated price provided by an independent pricing source approved by the Trustees. To value debt securities, pricing services may use various pricing techniques, which take into account appropriate factors such as market activity, yield, quality, coupon rate, maturity, type of issue, trading characteristics, call features, credit

16

ADVISERS INVESTMENT TRUST

IFP US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2020

ratings and other data, as well as broker quotes. Short-term debt securities of sufficient credit quality that mature within sixty days may be valued at amortized cost, which approximates fair value. In each of these situations, valuations are typically categorized as Level 2 in the fair value hierarchy.

When the price of a security is not readily available or deemed unreliable (e.g., an approved pricing service does not provide a price, a furnished price is in error, certain stale prices, or an event occurs that materially affects the furnished price), the Fund’s Fair Value Committee may in good faith establish a fair value for that security in accordance with procedures established by and under the general supervision of the Trustees. In addition, fair value pricing may be used if events materially affecting the value of foreign securities occur between the time when the exchange on which they are traded closes and the time when the Fund’s net asset value is calculated. The Fund identifies possible fluctuations in international securities by monitoring the increase or decrease in the value of a designated benchmark index. In the event of an increase or decrease greater than predetermined levels, the Fund may use a systematic valuation model provided by an independent third party pricing service to fair value its international equity securities.

In the fair value situations noted above, while the Trust’s valuation policy is intended to result in a calculation of the Fund’s net asset value that fairly reflects security values as of the time of pricing, the Trust cannot ensure that fair values determined pursuant to these guidelines would accurately reflect the price that the Fund could obtain for a security if it were to dispose of that security as of the time of pricing (for instance, in a forced or distressed sale). The prices used by the Fund may differ from the value that would be realized if the securities were sold, and these differences could be material to the financial statements. Depending on the source and relative significance of the valuation inputs in these instances, the instruments may be classified as Level 2 or Level 3 in the fair value hierarchy.

The following is a summary of the valuation inputs used as of September 30, 2020 in valuing the Fund’s investments based upon the three fair value levels defined above:

| | | | | | | | | | | | | | | | |

| Fund | | Level 1 – Quoted Prices | | | Level 2 – Other Significant Observable Inputs | | | Level 3 – Significant Unobservable Inputs | | | Total | |

| |

IFP US Equity Fund | | | | | | | | | | | | | | | | |

Common Stocks(1) | | $ | 1,648,887,548 | | | $ | — | | | $ | — | | | $ | 1,648,887,548 | |

| | | | |

Total Investments | | $ | 1,648,887,548 | | | $ | — | | | $ | — | | | $ | 1,648,887,548 | |

| | | | |

| (1) | See investment industries in the Schedule of Investments. |

As of September 30, 2020, there were no Level 2 or Level 3 securities held by the Fund. There were no transfers to or from Level 3 during the year ended September 30, 2020.

CURRENCY TRANSACTIONS

The Fund may engage in spot currency transactions for the purpose of foreign security settlement and operational processes. Changes in foreign currency exchange rates will affect the value of the Fund’s securities and the price of the Fund’s shares. Generally, when the value of the U.S. dollar rises in value relative to a foreign currency, an investment in that country loses value because that currency is worth fewer U.S. dollars. Devaluation of a currency by a country’s government or banking authority also may have a significant impact on the value of any investments denominated in that currency. Currency markets generally are not as regulated as securities markets.

INVESTMENT TRANSACTIONS AND INCOME

Investment transactions are accounted for no later than one business day after trade date. At financial reporting period ends, investments are reported as of the trade date. The Fund determines the gain or loss realized from investment transactions by using an identified cost basis method. Dividend income is recognized on the ex-dividend date. Dividends from foreign securities are recorded on the ex-dividend date, or as soon as the information is available.

17

ADVISERS INVESTMENT TRUST

IFP US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2020

EXPENSE ALLOCATIONS

Expenses directly attributable to a fund in the Trust are charged to that fund, while expenses that are attributable to more than one fund in the Trust are allocated among the applicable funds on a pro-rata basis to each adviser’s series of funds based on relative net assets or another reasonable basis.

DIVIDENDS AND DISTRIBUTIONS

The Fund intends to distribute substantially all of its net investment income as dividends to shareholders on an annual basis. The Fund intends to distribute its net realized long-term capital gains and its net realized short-term capital gains at least once a year.

Distributions from net investment income and from net realized capital gain are determined in accordance with Federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America (“GAAP”). These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (e.g. treatment of certain dividend distributions, gains/losses, return of capital etc.), such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. Distributions to shareholders that exceed net investment income and net realized capital gains for tax purposes are reported as return of capital.

REDEMPTION FEES

The Fund will charge a redemption fee of up to 0.25% of the total redemption amount if you sell your shares, regardless of the length of time you have held your shares and subject to certain exceptions and limitations described in the prospectus. The redemption fee is paid directly to the Fund and is intended to encourage long-term investment in the Fund, to facilitate portfolio management and to avoid (or compensate the Fund for the impact of) transaction and other Fund expenses incurred as a result of shareholder redemptions. Redemption fees charged for the years ended September 30, 2020 and 2019 were $860,901 and $564,454, respectively, and are reflected within the value of shares redeemed on the Statements of Changes in Net Assets.

FEDERAL INCOME TAX INFORMATION

No provision is made for Federal income taxes as the Fund intends to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and distribute substantially all of its net investment income and net realized capital gain in accordance with the Code.

As of September 30, 2020, the Fund did not have material uncertain tax positions that would require financial statement recognition or disclosure based on an evaluation of all open tax years for all major tax jurisdictions. The Fund’s Federal tax returns for the tax years ended September 30, 2017, 2018, 2019 and 2020 remain subject to examination by the Internal Revenue Service. Interest or penalties incurred, if any, on future unknown, uncertain tax positions taken by the Fund will be recorded as interest expense on the Statement of Operations.

Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

USE OF ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

18

ADVISERS INVESTMENT TRUST

IFP US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2020

| B. | Fees and Transactions with Affiliates and Other Parties |

The Trust, on behalf of the Fund, has entered into an Investment Advisory Agreement (the “Agreement”) with Independent Franchise Partners, LLP (the “Adviser” or “IFP”) to provide investment management services to the Fund. Total fees incurred pursuant to the Agreement are reflected as “Investment advisory” fees on the Statement of Operations. Under the terms of the Agreement, the Fund pays the Adviser a monthly fee based on the Fund’s daily net assets at the following annualized rates:

| | | | | | |

Adviser’s Assets Under Management(1) | | Scale Discount for Assets in each Range(1) | | Annualized Rate(1) | | Effective Overall Annual Fee(1) |

|

First $1 billion | | — | | 0.88% | | 0.88% |

$1 - 2 billion | | 0.10% | | 0.78% | | at $2 billion 0.83% |

$2 - 3 billion | | 0.20% | | 0.68% | | at $3 billion 0.78% |

$3 - 4 billion | | 0.30% | | 0.58% | | at $4 billion 0.73% |

$4 - 5 billion | | 0.40% | | 0.48% | | at $5 billion 0.68% |

Above $5 billion | | — | | — | | 0.68% |

| (1) | The Adviser’s total assets under management at the end of each calendar quarter are used to calculate the effective annual fee to be applied during the next calendar quarter. During the year ended September 30, 2020, the effective annualized rate was 0.68% given the Adviser’s total assets under management were in excess of $5 billion during the year. Effective October 1, 2020 the Adviser reduced its management fee annual rate by 0.04% for each asset tier. |

Foreside Financial Services, LLC (the “Distributor”) provides distribution services to the Fund pursuant to a distribution agreement with the Trust, on behalf of the Fund. Under its agreement with the Trust, the Distributor acts as an agent of the Trust in connection with the offering of the shares of the Fund on a continuous basis. The Adviser, at its own expense, pays the Distributor an annual $5,000 fee for these services and reimbursement for certain expenses incurred on behalf of the Fund.

The Northern Trust Company (“Northern Trust”) serves as the administrator, transfer agent, custodian and fund accounting agent for the Fund pursuant to written agreements between the Trust, on behalf of the Fund, and Northern Trust. The Fund has agreed to pay Northern Trust certain annual and transaction-based fees, a tiered basis-point fee based on the Fund’s daily net assets, subject to a minimum annual fee of $175,000 relating to these services, and reimburse for certain expenses incurred on behalf of the Fund as well as other charges for additional service activities. Total fees paid to Northern Trust pursuant to these agreements are reflected as “Accounting and Administration” fees on the Statement of Operations.

Foreside Fund Officer Services, LLC (“Foreside”) provides compliance and financial control services for the Fund pursuant to a written agreement with the Trust, on behalf of the Fund, including providing certain officers to the Fund. The Fund pays Foreside an annual base fee, a basis-point fee based on the Fund’s daily net assets and reimburses for certain expenses incurred on behalf of the Fund. Total fees paid to Foreside pursuant to these agreements are reflected as “Regulatory and Compliance” fees on the Statement of Operations.

Carne Global Financial Services (US) LLC (“Carne”) provides Risk Management and Oversight Services for the Fund pursuant to a written agreement between the Trust, on behalf of the Fund, and Carne, including providing the Risk Officer to the Fund to administer the Fund risk program and oversee the analysis of investment performance and performance of service providers. The Fund has agreed to pay Carne an annual fee of $30,000 for these services, and reimburse for certain expenses incurred on behalf of the Fund. Total fees paid to Carne pursuant to this agreement are reflected as “Risk Officer” fees on the Statement of Operations.

Certain officers and Trustees of the Trust are affiliated with Foreside, Northern Trust, Carne or the Distributor and receive no compensation directly from the Fund for serving in their respective roles. Through March 31, 2020, the Trust paid each Independent Trustee compensation for their services based on an annual retainer of $120,000 and reimbursement for certain expenses. Effective April 1, 2020, the Trust pays an annual retainer of $125,000 and reimbursement for certain expenses. If there are more than six meetings in a year, additional meeting fees may apply. For the year ended September 30, 2020, the aggregate Trustee compensation paid by the Trust was $367,500. The amount of total Trustee compensation and reimbursement of out-of-pocket expenses allocated from the Trust to the Fund is reflected as “Trustees” expenses on the Statement of Operations.

19

ADVISERS INVESTMENT TRUST

IFP US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2020

The Adviser has contractually agreed to waive fees or reimburse expenses to the extent necessary to limit total annual fund operating expenses (exclusive of brokerage costs, interest, taxes, dividends on short positions, litigation and indemnification expenses, expenses associated with investments in underlying investment companies and extraordinary expenses) to 0.85% of the average daily net assets of the Fund until January 28, 2021. For the year ended September 30, 2020, there were no expenses reduced by the Adviser. Any fees waived or expenses reimbursed during a fiscal year are not subject to repayment from the Fund to the Adviser in subsequent fiscal years.

During the year, the Adviser made a payment of $271,684 to the Fund as disclosed on the Statement of Operations to reimburse for a loss realized in connection with a trade error. Such payment represented 0.02% to the Fund’s total return.

| C. | Investment Transactions |

For the year ended September 30, 2020, the aggregate costs of purchases and proceeds from sales of securities (excluding short-term investments) for the Fund were as follows:

| | | | | | | | |

| Fund | | Cost of Purchases | | | Proceeds from sales | |

| |

IFP US Equity Fund | | $ | 684,947,254 | | | $ | 711,100,070 | |

As of September 30, 2020, the cost, gross unrealized appreciation and gross unrealized depreciation on investments, for Federal income tax purposes, were as follows:

| | | | | | | | | | | | | | | | |

| Fund | | Tax Cost | | | Tax Unrealized Appreciation | | | Tax Unrealized (Depreciation) | | | Net Unrealized Appreciation (Depreciation) | |

| |

IFP US Equity Fund | | $ | 1,340,777,759 | | | $ | 402,831,200 | | | $ | (94,721,411 | ) | | $ | 308,109,789 | |

The tax character of distributions paid to shareholders during the latest tax years ended September 30, 2020 and September 30, 2019 for the Fund was as follows:

| | | | | | | | | | | | | | | | | | | | |

| IFP US Equity Fund | | Ordinary Income | | | Net Long Term Gains | | | Total Taxable Distributions | | | Tax Return of Capital | | | Total Distributions Paid | |

| |

2020 | | $ | 36,780,971 | | | $ | 128,445,643 | | | $ | 165,226,614 | | | $ | — | | | $ | 165,226,614 | |

2019 | | | 51,861,949 | | | | 83,990,000 | | | | 135,851,949 | | | | — | | | | 135,851,949 | |

As of the latest tax year ended September 30, 2020, the components of accumulated earnings on a tax basis were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fund | | Undistributed Ordinary Income | | | Undistributed Long Term Capital Gains | | | Accumulated Earnings | | | Distributions Payable | | | Accumulated Capital and Other Losses | | | Unrealized Appreciation | | | Total Accumulated Earnings | |

| |

IFP US Equity Fund | | | $36,085,921 | | | | $134,151,187 | | | | $170,237,108 | | | | $ — | | | | $ — | | | | $308,254,892 | | | | $478,492,000 | |

At September 30 2020, the latest tax year end, the Fund had no capital loss carry-forwards available to offset future net capital gains.

Certain shareholders in the Fund received securities rather than cash for their redemption amounts in accordance with the provisions of the Fund. These shareholders received securities with a fair value equal to the value of the number of shares they owned at the current net asset value at the redemption date.

20

ADVISERS INVESTMENT TRUST

IFP US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2020

In-kind withdrawals of $611,922,128 are reflected within the “Value of shares redeemed” on the Statement of Changes in Net Assets, and net gains of $183,574,687 on the securities distributed to shareholders are reflected within the “Net realized gains from investment transactions” on the Statement of Operations.

| F. | Concentration of Ownership Risk |

A significant portion of the Fund’s shares may be held in a limited number of shareholder accounts. To the extent that a shareholder or group of shareholders redeem a significant portion of the shares issued by the Fund, this could have a disruptive impact on the efficient implementation of the Fund’s investment strategy.