UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22538

Advisers Investment Trust

(Exact name of registrant as specified in charter)

50 S. LaSalle Street

Chicago, Illinois 60603

(Address of principal executive offices) (Zip code)

The Northern Trust Company

50 S. LaSalle Street

Chicago, Illinois 60603

(Name and address of agent for service)

Registrant’s telephone number, including area code: 866-638-5859

Date of fiscal year end: September 30

Date of reporting period: September 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The following are copies of reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

| | | | | | | | |

| |  | | |

| | | |

| | | | | | |

| | | |

| | | | | | |

| | | | INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND | | |

| | | |

| | | | | | |

| | | | ANNUAL REPORT September 30, 2022 | | |

| | | |

| | | | | | |

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for the distribution to prospective investors unless preceded or accompanied by an effective prospectus.

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

TABLE OF CONTENTS

September 30, 2022

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

SHAREHOLDER LETTER

September 30, 2022

Dear Shareholder:

We are pleased to present to shareholders the September 30, 2022 Annual Report for the Independent Franchise Partners US Equity Fund (the “Fund”), a series of the Advisers Investment Trust. This report contains the results of Fund operations for the year ended September 30, 2022.

We appreciate the trust and confidence you have placed in us by choosing the Fund and its Investment Adviser, Independent Franchise Partners, LLP, and we look forward to continuing to serve your investing needs.

Sincerely,

| | | | |

| | | |  |

| | |

| Barbara J. Nelligan | | | | Sandeep Ghela |

| President | | | | Chief Operating Officer |

| Advisers Investment Trust | | | | Independent Franchise Partners, LLP |

1

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

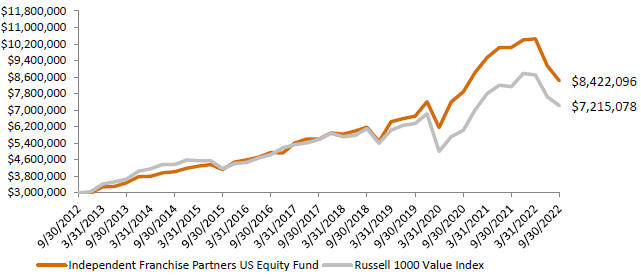

Independent Franchise Partners US Equity Fund

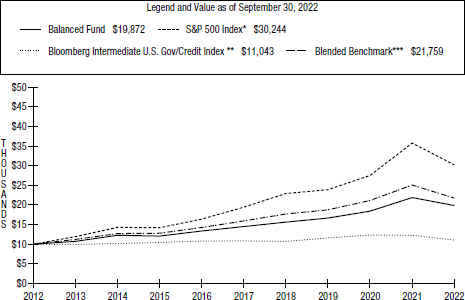

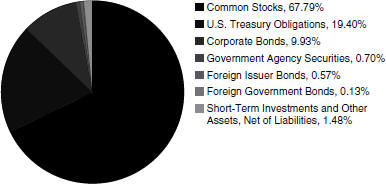

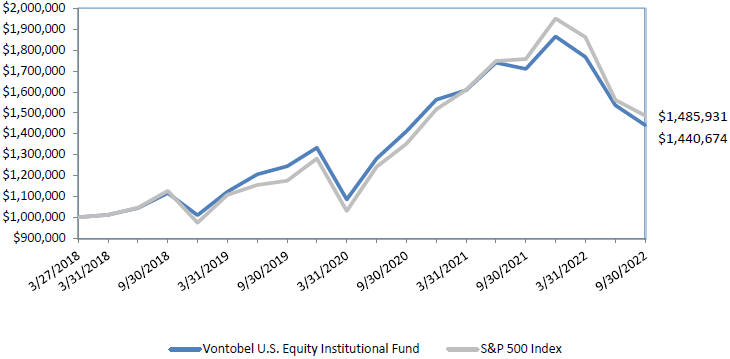

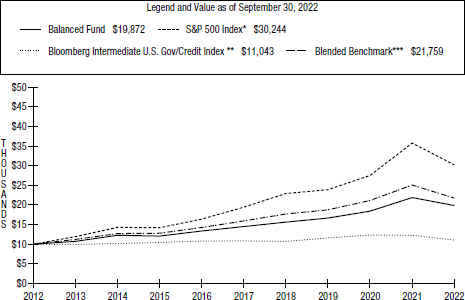

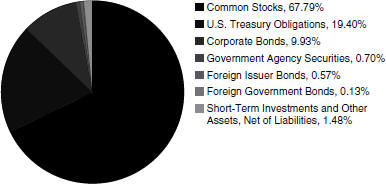

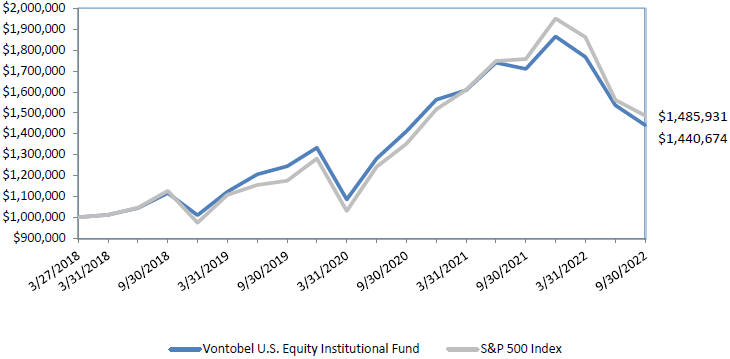

Value of a hypothetical $3,000,000 investment in the Fund from September 30, 2012 to September 30, 2022

Average Annual Total Returns as of September 30, 2022

| | | | | | | | | | |

| | | Independent Franchise Partners US Equity Fund (without redemption fee) | | Independent Franchise Partners US Equity Fund (with redemption fee) | | Russell 1000 Value Index | | S&P 500 Index | | |

Q4 2021 | | 3.56% | | 3.32% | | 7.77% | | 11.03% |

Q1 2022 | | 0.51% | | 0.26% | | -0.74% | | -4.60% |

Q2 2022 | | -12.53% | | -12.75% | | -12.21% | | -16.10% |

Q3 2022 | | -7.66% | | -7.89% | | -5.62% | | -4.88% |

Year to Date | | -18.82% | | -19.02% | | -17.75% | | -23.87% |

1 Year | | -15.93% | | -16.12% | | -11.36% | | -15.47% |

3 Years (Annualized) | | 7.95% | | 7.88% | | 4.36% | | 8.16% |

5 Years (Annualized) | | 8.57% | | 8.53% | | 5.29% | | 9.24% |

10 Years (Annualized) | | 10.90% | | 10.89% | | 9.17% | | 11.70% |

Since Inception (Annualized) | | 11.40% | | 11.39% | | 10.17% | | 12.53% |

The Fund’s performance reflects the reinvestment of dividends as well as the impact of transaction costs (including the Fund’s 0.25% redemption fee unless noted otherwise) and the deduction of fees and expenses. The Fund’s Total Annual Operating Expense, per the most recent Prospectus, is 0.68%.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 855-233-0437 or 312-557-7902.

Data as at September 30, 2022. The Inception date of the Fund is December 20, 2011. Performance is shown net of fees and periods greater than one year are annualized. The performance does not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

The Fund’s primary benchmark for performance comparison purposes is the Russell 1000 Value Index. The Russell 1000 Value Index measures the return of the large-cap value segment of the US equity universe. It includes those Russell 1000

2

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

companies with lower price-to-book ratios and lower expected growth values. The Russell 1000 Value Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment of the US economy. The Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics. Benchmark returns are calculated with dividends reinvested gross of withholding tax. The index reflects the returns of approximately 1000 holdings. The secondary benchmark is the S&P 500 Index. The S&P 500 Index is a capitalisation-weighted index of 500 US stocks. The benchmark is designed to measure the return of the broad domestic US economy through changes in the aggregate market value of 500 stocks representing all major industries. Sources of foreign exchange rates may be different between composites and the benchmark. Benchmark returns are calculated with dividends reinvested gross of withholding tax. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index. Please refer to the Fund’s Prospectus for further information.

Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and / or Russell ratings or underlying data and no party may rely on any Russell Indexes and / or Russell ratings and / or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. Please refer to the Fund’s Prospectus for further information.

Capacity Status

Client assets in the US Franchise strategy are $3.3bn at September 30, 2022. We have capacity available in the strategy for existing or new clients.

Portfolio Commentary

In the year to September 30, 2022, the Fund declined 15.93% (assuming no redemption fee), falling more than the Russell 1000 Value Index which fell 11.36%, and broadly in line with the S&P 500 Index, which declined 15.47%. It is unusual for the US Franchise strategy to decline more than broader equity markets, but not unprecedented. We are confident that the Fund retains the right balance of quality and value to seek to help compound clients’ capital over the longer term.

The Fund benefitted from exposure to certain stocks that possess durable intangible assets, notably Bristol Myers Squibb in the health care sector, Corteva in the materials sector, World Wrestling Entertainment (WWE) in the communication services sector, CME Group in the financials sector, and Ritchie Bros. Auctioneers in the industrials sector.

The Fund’s weaker return relative to the Russell 1000 Value Index for the period was mainly driven by its lack of exposure to the energy sector. Weaker returns from some of the Fund’s real estate and consumer discretionary stocks – particularly Zillow, Booking Holdings and eBay – also detracted from relative returns.

Energy was the strongest sector in the Russell 1000 Value Index, returning 46%. The Fund had no exposure to the energy sector. Companies in this sector tend to be highly capital intensive and operate in an environment in which it is hard to exercise pricing power. Further, they tend to be highly cyclical. These attributes do not fit our long-term, buy and hold investment approach.

We encourage clients to assess returns over longer intervals, like a full market cycle, in line with our investment horizon. We caution that Franchise returns will likely continue to lag if markets are led by sectors where we do not find Franchise opportunities. As always, we continue to design Franchise portfolios with the dual goals of earning an attractive long-term rate of return while insulating clients from the worst of equity market drawdowns.

Investment Returns and Contribution to Fund Return – 1 Year ending September 30, 2022

| | | | | | | | | | | | | | | | | | | | | | |

| US Equity Fund – Stock Returns (%) | | | US Equity Fund – Contribution to Fund Return (bps) | |

| Top | | | Bottom | | | Top | | | Bottom | |

Corteva | | | +38% | | | Zillow | | | -57% | | | Bristol Myers Squibb | | | +101 | | | Zillow | | | -258 | |

WWE | | | +26% | | | eBay | | | -46% | | | Corteva | | | +99 | | | News Corp | | | -198 | |

Bristol Myers Squibb | | | +23% | | | IAA | | | -42% | | | WWE | | | +56 | | | Booking Holdings | | | -153 | |

CME Group | | | +22% | | | News Corp | | | -35% | | | CME Group | | | +39 | | | eBay | | | -150 | |

Altria | | | +13% | | | Booking Holdings | | | -31% | | | Ritchie Bros. Auctioneers | | | +24 | | | IAA | | | -138 | |

3

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

Stock returns reflect total returns and are presented in US Dollars for the period the stock was held during the year ending September 30, 2022. Contribution to Fund return reflects contribution to gross return and is presented in US Dollars for the period the stocks were held during the year to September 30, 2022. Source: FactSet, Independent Franchise Partners, LLP. For complete attribution and methodology, please contact clientservice@franchisepartners.com.

Significant Contributors to the Fund’s Return

Among the top contributors to the Fund’s return were Bristol Myers Squibb, Corteva and WWE.

Bristol’s full year and first quarter results were broadly in line with market expectations. The company also received approval for its new immuno-oncology drug, Opdualag, to treat melanoma, as well as approval for Camzyos, an important first-in-class medicine to treat symptomatic obstructive hypertrophic cardiomyopathy. Camzyos is forecast by Bristol to achieve over $4bn in peak sales. These approvals were followed by a number of positive data releases in June.

Bristol faces sizable and well-understood patent headwinds. However, we continue to think it is one of the better-invested pharmaceutical companies and that the continued progression of its pipeline of new drugs leaves it well placed to offset these patent expirations. Bristol’s shares trade on an 8.5% estimated free cash flow yield, adjusting for the upcoming patent expiry of its largest drug, Revlimid.

Corteva released better-than-expected results for the third and fourth quarters of 2021, and for the first quarter of 2022. Strong revenue and earnings growth was supported by a combination of strong pricing, contributions from newly launched products from its Crop Protection Pipeline, and increased penetration of its Enlist seed traits platform.

We continue to believe that Corteva has the opportunity to significantly improve its margins over the long term, primarily through the development and commercialisation of its in-house seed traits pipeline. This should help to materially reduce its trait licensing payments to Bayer and provide the company with the opportunity to create a high margin revenue stream from its own traits. Corteva’s shares trade on a 5.3% estimated free cash flow yield.

WWE reported strong 2021 full year and second quarter 2022 results, and increased 2022 annual guidance by approx. 3% despite the challenging macro-economic environment. This highlights the robustness of the contracted media rights driven business model. The company also announced a number of international agreements. The global market for live sports rights remains robust and appears likely to be bolstered by the entry of streaming companies like Netflix into the advertising market. This is important as WWE is set to renew its critical U.S. Raw and Smackdown rights next year.

Founder, Chairman and CEO Vince McMahon retired in July following a board investigation into executive misconduct. His daughter Stephanie McMahon is now Chairwoman as well as co-CEO alongside Nick Khan. Paul Levesque has also returned to the company as Chief Content Officer. The initial audience response to his creative direction is promising with a 15% increase in Monday Night Raw viewership and a double-digit increase in social media engagement. We engaged with the company during the misconduct investigation and have met with the new management team. We were encouraged by the swift handling of the investigation and are pleased with the management appointments. WWE’s shares trade on an estimated 4.5% free cash flow yield. We think this is an attractive valuation given the potential for improved compounding from the company’s upcoming media rights negotiations.

Notable Detractors from the Fund’s Return

Among the largest detractors from the Fund’s return were Zillow, News Corp and Booking.

Zillow’s share price weakness since we initiated the position in November 2021 has been driven by market concerns that the sharp rise in U.S. mortgage rates will weigh on U.S. housing transactions and prices. While near-term cyclical pressures are acute, we continue to believe Zillow has a substantial opportunity to monetise its dominant position in U.S. property search. The company is investing in new product roll outs and improvements across home viewing, mortgage, and seller services to unlock this opportunity.

Zillow’s shares trade on an 8.5% estimated free cash flow yield. While attractive on a standalone basis, we think this valuation meaningfully understates the long-term free cash flow potential for the business. Rightmove and

4

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

REA Group, which have similar leading portal market shares in the U.K. and Australia respectively, boast earnings before interest and taxes (EBIT) margins of around 75% and 60%, more than double Zillow’s. We think this highlights the potential opportunity for Zillow. The company also has a much stronger balance sheet now that it has almost completely unwound its home buying operations. We also expect the board to continue to buy back shares given the share price weakness.

News Corp released quarterly results in May that were in line with consensus estimates. However, it appears the market was disappointed that the results did not significantly exceed expectations, as they had in recent quarters. Underlying revenues increased 6%, with continued strong growth in both Dow Jones and Digital Real Estate. Underlying earnings before interest, taxes, depreciation and amortization (EBITDA) grew 25%, as increased digitization continues to improve profitability.

We expect increased digitization to lead to stickier and higher margin revenues across its business units. We think the quality of the company is significantly underappreciated by the market and that there remains substantial potential on a sum-of-the-parts basis as management continues to simplify its corporate and operational structure. News’ shares trade on an estimated free cash flow yield of 10.0%.

Booking’s shares declined in November due to concerns that the Omicron COVID-19 variant would impede the recovery in leisure travel. Further share price weakness followed management guidance that 2022 EBITDA margins will be lower than anticipated due to increased marketing investment. We think it makes sense to increase investment as travel re-opening accelerates and it is an opportunity to meaningfully grow market share from a position of commercial and financial strength. Nonetheless, we shall monitor the company’s market share progress in the context of this additional investment.

Booking’s shares again declined in June, driven by the sharp fall in consumer confidence indicators, and compounded by flight disruption at a number of major European airports. These are cyclical rather than structural factors and we continue to think Booking is a well-invested company with attractive medium-term growth prospects. Third-party data suggests Booking is increasing market share across most of its major markets. We think this market share growth should be further supported by rising travel costs, with price comparison websites such as Booking.com likely to benefit from increased consumer sensitivity to price. The company’s shares trade on a 9.2% estimated free cash flow yield, which we think helps compensate for these cyclical risks.

Significant Portfolio Changes During the Year

During the year, we initiated positions in Richemont, Salesforce, TransUnion and Zillow. We sold the positions in Alcon, Altria, Apple, CME Group and Terminix.

Initial Purchases

We initiated a position in Richemont in September. Richemont is a leading luxury goods company and the global market leader in the branded jewelry category. The company’s two key brands, Cartier and Van Cleef & Arpels, have deep-rooted provenance and are well managed. They account for 96% of operating profit. Revenues have grown at around 9% per annum over the last decade.

Branded jewelry benefits from high barriers to entry and durable pricing power. We believe the category is well placed to continue to benefit from secular growth trends including increasing upper middle-class prosperity in emerging markets, an increase in direct purchases by female customers due to an ever-greater number of women in the workplace, and a growing shift from unbranded to branded jewelry.

The primary risk to the investment thesis is the potential for a deterioration in the brand strength of Cartier or Van Cleef & Arpels. The company also faces the risk of short-term cyclicality in its end markets, especially given its large presence in China.

We took the opportunity to initiate the position following a near 40% drop in the share price since early December 2021. This was primarily driven by ongoing lockdowns in China, one of the company’s key end markets, and increasing concerns over consumer sentiment driven by the war in Ukraine. We purchased the shares at a 6.9% estimated free cash flow yield. We think this valuation helps to compensate for any short-term cyclical risks, particularly given the strength and durability of Richemont’s jewelry brands.

5

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

We completed the initial purchase of Salesforce in March. Salesforce is the leading cloud software vendor in the fast-growing Client Relationship Management (CRM) category. It has a dominant position in public cloud sales automation and customer service software, and leading positions in the more fragmented categories for public cloud marketing and ecommerce software. The company has a track record of solid innovation and customer success, underpinned by an excellent strategic vision and clear focus on the long-term category opportunity.

The key intangible asset is the switching costs customers face if they want to migrate to a competing product. This has led to customer retention in excess of 90%. Customer switching costs increase as more data is stored within Salesforce’s applications, and as customers use more of Salesforce’s suite of CRM products.

The key risk to our thesis is the potential for poor strategy execution over the next few years. This could lead to a material slowdown in growth. Some market participants also have concerns about the company’s capital allocation strategy.

Salesforce has an ambitious FY2024 revenue target, which implies strong double digit revenue growth in the next few years. However, we think this is an achievable medium-term target given the company’s track record, the market share opportunity, and underlying category growth.

Salesforce has spent heavily on mergers and acquisitions in the last decade, especially given its limited historic free cash flow generation. All five of its large deals have been strategically sound and delivered strong financial outcomes. ExactTarget, Demandware and Mulesoft have all increased customer switching costs and provided the foundational pillars for important parts of its CRM horizontal suite, like marketing and ecommerce. Revenue growth and operating margins have also accelerated after each acquisition. We think Salesforce’s acquisition of Slack in 2021 also makes good sense: Slack’s tools increase customer workforce productivity and engagement when bundled with Salesforce’s CRM suite and its revenue growth should accelerate due to Salesforce’s strong customer relationships.

The opportunity to initiate the position followed the sharp share price fall in late 2021 and early 2022. This was caused in part by the indiscriminate underperformance of many of the faster growing application software stocks, and in part by market concerns about the Slack acquisition. We purchased the shares at a 5.3% estimated free cash flow yield, based on what we believe are reasonable margin assumptions.

We began building a position in TransUnion, the U.S. credit bureau, in February and completed the purchase in March. We know the U.S. credit bureaus well and have previously held TransUnion in the Fund. In our view, the company is well-diversified and well-invested, with strong positions in a number of fast-growing U.S. categories and international markets. The company has a good track record of innovation and capital allocation.

TransUnion’s core intangible asset is a combination of contributory and proprietary consumer credit data that allows it to deliver differentiated products to its business customers.

The company’s operating profit is diversified across four key areas: traditional business-to-business U.S. consumer credit products sold to financial services customers; products in faster-growing U.S. categories that leverage proprietary data to prevent fraud, improve insurance underwriting, or optimize enterprise marketing budgets; market-leading credit bureaus in India, the U.K. and Colombia; and credit information sold to U.S. consumers directly under the TransUnion brand or indirectly through partners. Underlying revenue and EBITDA compounding has been in the high-single-digits and low-double-digits respectively.

In December 2021, the company completed the acquisition of Neustar, the identity resolution company, which now accounts for around 15-20% of group EBITDA. Neustar brings close to real-time identity data as well as additional analytical and data science capabilities. Management is targeting low-double-digit revenue growth at Neustar and for margins to double to around 40% by 2026.

TransUnion’s shares had declined 27% since the announcement of the Neustar deal in mid-September 2021. The market appeared to have concerns about execution risks around both the Neustar acquisition and the subsequent Argus acquisition from Verisk. However, TransUnion has a track record of purchasing high-quality assets at reasonable prices and of integrating them well. We took advantage of the fall in the share price to purchase the position at a 5.0% estimated free cash flow yield.

6

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

We initiated a position in Zillow in November. Zillow.com is the leading U.S. property website as measured by search activity and revenues, with an estimated 80% share of U.S. property portal searches. The key intangible assets are Zillow’s brand, proprietary data, and agent switching costs.

We believe Zillow has the potential for strong long-term free cash flow compounding. We think low to mid-teens revenue growth should be sustainable over the medium term if the company is able to improve its market share. There is also a significant long-term margin opportunity. Zillow’s 2021 EBIT margin is less than half that of the equivalent leading UK and Australian property portals.

The main risk to Zillow’s revenue growth is a weaker housing market. A prolonged slowdown would weigh on Zillow’s revenues and profitability. As mentioned in the discussion on largest detractors, since we initiated the position, Zillow’s share price has been weak in part due to rising U.S. mortgage rates and its potential impact on housing transactions. While we recognise the likely short-term impact, we think that it will be more than offset by the structural trend of digitization in the U.S. property market over the longer term.

The opportunity to purchase the shares came when Zillow surprised the market and announced it was exiting its home buying operation. The home buying business was an untested and capital-intensive business model that produced uncertain and risky cashflows. We were not fans of that part of the business and were pleased by the move. At the time we initiated the position, the shares had fallen almost 70% from their February 2021 peak and offered a 5.1% estimated free cash flow yield.

Final Sales

We completed the final sale of Alcon in May, having acquired the position in April 2019 following its spin-off from Novartis. Our initial investment thesis focused on the opportunity to improve margins and innovation. We think this has largely been achieved. Organic revenue growth has improved from the low single digits to mid-to-high single digits. Margins have also improved materially and are expected to increase by nearly 900 basis points (bps) within the next few years relative to 2019 margins. We felt Alcon’s strong market share, attractive growth rates and improved profitability were fully reflected in the estimated 3.3% free cash flow yield. Consistent with our valuation discipline, we sold the position.

We completed the final sale of Altria in February. We have become increasingly concerned about Altria’s lack of a strong next generation product (“NGP”) portfolio. Philip Morris International and British American Tobacco are both further along in the development and execution of their NGP strategies than Altria. Following the approximate 20% increase in Altria’s share price from the end of November 2021 to February 2022 and the commensurate reduction in the free cash flow yield, we felt that the valuation no longer compensated us for the risks associated with the company’s traditional cigarette business. We sold the position at an 8.5% estimated free cash flow yield.

We sold the position in Apple in November. The company has improved the durability of its revenue, profit and cashflow, largely thanks to better client retention because of the ecosystem between its integrated hardware, software, and service offerings. The company has also grown services including AppStore, subscriptions and advertising. Finally, the company has managed its capital extremely well, returning most of its substantial free cash flow to shareholders.

We initiated the position in 2012 at an estimated free cash flow yield of nearly 13%, including its cash on the balance sheet. Despite the significant free cash flow growth, the share price increase over the last decade has resulted in the estimated free cash flow yield declining to 2.7%. This valuation no longer provides adequate compensation for risks such as moderating smartphone adoption and the possibility of business disruption from alternative/virtual reality forms of hardware.

We sold the position in CME Group in February, having initiated the position in October 2020. We established the position at an estimated 4.7% free cash flow yield, which we felt was an attractive valuation for a high-quality company. Since then, the combination of an increase in volatility, which is positive for CME’s trading and hedging volumes, and changes in the level and shape of the U.S. yield curve, have helped to deliver strong operational performance and share price appreciation. This is a relatively short holding period for a Franchise investment but,

7

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

given the commensurate decline in the estimated free cash flow yield to 2.9%, we felt that the valuation no longer provided adequate compensation for the risks the company faces and exited the position.

We completed the final sale of Terminix, previously named ServiceMaster, in July. Our initial investment thesis focused on the company improving operating performance in its key pest control business. This would lead to increased margins and free cash flow compounding. There were initial positive signs that the turnaround was working. During 2020, the company divested its non-core assets, leaving it as a pure-play pest control company. Management’s focus then turned to improving operating performance. We were encouraged by the steps being taken and the investments being made in areas such as its Customer Experience Platform and digital marketing.

However, in December 2021, Terminix and Rentokil announced they had entered into an agreement for Rentokil to acquire Terminix for cash and stock. From the outset, we did not think the value or the structure of the proposed offer was attractive. We thought it significantly undervalued Terminix as a pure play, strategically important pest control company. Despite our engagements to improve the terms of the deal with the management teams of both Terminix and Rentokil, as well as other shareholders, the acquisition looks set to proceed as originally proposed. We therefore took the opportunity to sell the position at a 4.8% estimated free cash flow yield ahead of the transaction closing later this year.

We remain completely dedicated to investing our clients’ portfolios in keeping with the rigors of the Franchise quality and value criteria. As ever, we measure our success through long-term investment results and enduring client relationships. We thank you for your support and look forward to serving you in the coming years.

Jayson Vowles, CFA

Co-Lead Portfolio Manager of the Fund and Partner of Independent Franchise Partners, LLP

Michael Allison, CFA

Co-Lead Portfolio Manager of the Fund and Partner of Independent Franchise Partners, LLP

Hassan Elmasry

Managing Partner of Independent Franchise Partners, LLP

Richard Crosthwaite

Portfolio Manager of the Fund and Partner of Independent Franchise Partners, LLP

Sandeep Ghela

Chief Operating Officer and Partner of Independent Franchise Partners, LLP

Karim Ladha, CFA

Portfolio Manager of the Fund and Partner of Independent Franchise Partners, LLP

Principal Investment Risks: Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security. All investments carry a certain amount of risk, and the Fund cannot guarantee that it will achieve its investment objective. The value of the Fund’s investments will fluctuate with market conditions, and the value of your investment in the Fund also will vary. You could lose money on your investment in the Fund, or the Fund could perform worse than other investments. Investments in the Fund are not deposits of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The main risks of investing in the Fund are set out in the Fund’s Prospectus, which can be obtained at www.franchisepartners.com/funds or by calling 855-233-0437 or 312-557-7902.

8

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

The comments and free cash flow yield estimates reflect the views of Independent Franchise Partners, LLP at the time of writing, unless otherwise indicated, and are subject to change without notice to the recipients of this document. Free cash flow yield estimates are based on the firm’s proprietary research and methodology.

•Free cash flow yield: A valuation ratio that measures the operating cash flow after capital expenditure and expenses, relative to the company’s market capitalization.

•EBIT: A measure of a company’s operating profit.

•EBITDA: A measure of a company’s operating profit excluding costs from depreciation and amortization.

9

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

SCHEDULE OF INVESTMENTS

September 30, 2022

| | | | | | | | | | | | | | |

| | | Percentage of Net Assets | | | | | Shares | | | Value | |

| |

COMMON STOCKS | | | 99.2% | | | | | | | | | | | |

Biotechnology | | | 3.6% | | | | | | | | | | | |

Corteva Inc. | | | | | | | | | 930,355 | | | $ | 53,169,788 | |

| | | | | | | | | | | | | | |

Commercial Services | | | 7.1% | | | | | | | | | | | |

Ritchie Bros. Auctioneers Inc. | | | | | | | | | 969,348 | | | | 60,564,863 | |

TransUnion | | | | | | | | | 775,573 | | | | 46,138,838 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 106,703,701 | |

| | | | | | | | | | | | | | |

Diversified Financials | | | 8.0% | | | | | | | | | | | |

Intercontinental Exchange Inc. | | | | | | | | | 564,223 | | | | 50,977,548 | |

S&P Global Inc. | | | | | | | | | 137,915 | | | | 42,112,345 | |

Western Union Co. | | | | | | | | | 1,960,940 | | | | 26,472,690 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 119,562,583 | |

| | | | | | | | | | | | | | |

Diversified Support Services | | | 3.0% | | | | | | | | | | | |

IAA Inc.(a) | | | | | | | | | 1,415,147 | | | | 45,072,432 | |

| | | | | | | | | | | | | | |

Insurance | | | 4.3% | | | | | | | | | | | |

Aon PLC - Class A | | | | | | | | | 237,594 | | | | 63,644,305 | |

| | | | | | | | | | | | | | |

Internet Software & Services | | | 13.9% | | | | | | | | | | | |

Alphabet, Inc. - Class A(a) | | | | | | | | | 485,980 | | | | 46,483,987 | |

Booking Holdings Inc.(a) | | | | | | | | | 36,563 | | | | 60,080,688 | |

eBay Inc. | | | | | | | | | 1,135,900 | | | | 41,812,479 | |

Zillow Group Inc. - Class A(a) | | | | | | | | | 254,522 | | | | 7,286,965 | |

Zillow Group Inc. - Class C(a) | | | | | | | | | 1,816,923 | | | | 51,982,167 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 207,646,286 | |

| | | | | | | | | | | | | | |

IT Services | | | 0.5% | | | | | | | | | | | |

Accenture PLC - Class A | | | | | | | | | 27,537 | | | | 7,085,270 | |

| | | | | | | | | | | | | | |

Media | | | 13.0% | | | | | | | | | | | |

Fox Corp. - Class A | | | | | | | | | 2,148,345 | | | | 65,911,224 | |

News Corp. - Class A | | | | | | | | | 3,289,031 | | | | 49,697,258 | |

News Corp. - Class B | | | | | | | | | 1,481,302 | | | | 22,841,677 | |

World Wrestling Entertainment Inc. - Class A | | | | | | | | | 786,380 | | | | 55,180,285 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 193,630,444 | |

| | | | | | | | | | | | | | |

Pharmaceuticals | | | 14.2% | | | | | | | | | | | |

Bristol-Myers Squibb Co. | | | | | | | | | 1,395,883 | | | | 99,233,323 | |

Johnson & Johnson | | | | | | | | | 274,374 | | | | 44,821,737 | |

Novartis AG - REG | | | | | | | | | 886,407 | | | | 67,852,762 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 211,907,822 | |

| | | | | | | | | | | | | | |

Software | | | 15.0% | | | | | | | | | | | |

Electronic Arts Inc. | | | | | | | | | 523,082 | | | | 60,525,818 | |

Microsoft Corp. | | | | | | | | | 183,477 | | | | 42,731,794 | |

Oracle Corp. | | | | | | | | | 1,042,518 | | | | 63,666,574 | |

Salesforce Inc.(a) | | | | | | | | | 390,642 | | | | 56,189,945 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 223,114,131 | |

| | | | | | | | | | | | | | |

Textiles, Apparel & Luxury Goods | | | 3.5% | | | | | | | | | | | |

Cie Financiere Richemont S.A. - Class A - REG | | | | | | | | | 547,324 | | | | 52,297,260 | |

| | | | | | | | | | | | | | |

See Notes to Financial Statements.

10

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

SCHEDULE OF INVESTMENTS

September 30, 2022

| | | | | | | | | | | | | | |

| | | Percentage of Net Assets | | | | | Shares | | | Value | |

| |

Tobacco | | | 9.3% | | | | | | | | | | | |

British American Tobacco PLC | | | | | | | | | 1,592,376 | | | $ | 57,366,123 | |

Philip Morris International Inc. | | | | | | | | | 978,922 | | | | 81,260,315 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 138,626,438 | |

| | | | | | | | | | | | | | |

Toys/Games/Hobbies | | | 3.8% | | | | | | | | | | | |

Nintendo Co. Ltd. | | | | | | | | | 1,387,170 | | | | 56,107,878 | |

| | | | | | | | | | | | | | |

TOTAL COMMON STOCKS (Cost $1,391,442,838) | | | | | | | | | | | | | 1,478,568,338 | |

| | | | | | | | | | | | | | |

TOTAL INVESTMENTS

(Cost $1,391,442,838) | | | 99.2% | | | | | | | | | | 1,478,568,338 | |

NET OTHER ASSETS (LIABILITIES) | | | 0.8% | | | | | | | | | | 11,650,421 | |

| | | | | | | | | | | | | | |

NET ASSETS | | | 100.0% | | | | | | | | | $ | 1,490,218,759 | |

| | | | | | | | | | | | | | |

(a)Non-income producing security.

Abbreviations:

REG – Registered

At September 30, 2022, the Fund’s investments were concentrated in the following countries:

| | | | |

| Country Allocation (Unaudited) | | Percentage

of Net Assets | |

| |

United States | | | 79.5% | |

Switzerland | | | 8.0 | |

Canada(b) | | | 4.1 | |

United Kingdom | | | 3.8 | |

Japan | | | 3.8 | |

| |

Total | | | 99.2% | |

| |

| |

(b)Ritchie Bros. Auctioneers Inc. is incorporated in Canada; however, its primary listing is on the New York Stock Exchange (NYSE) in the United States. We therefore define Ritchie Bros. Auctioneers Inc. as a United States equity security, consistent with the terms set out in the prospectus.

See Notes to Financial Statements.

11

ADVISERS INVESTMENT TRUST

STATEMENT OF ASSETS & LIABILITIES

September 30, 2022

| | | | |

| | | Independent

Franchise Partners

US Equity Fund | |

Assets: | | | | |

Investments, at value (Cost: $1,391,442,838) | | $ | 1,478,568,338 | |

Cash | | | 6,605,871 | |

Receivable for dividends | | | 3,240,301 | |

Reclaims receivable | | | 2,357,859 | |

Receivable for investments sold | | | 1,484,067 | |

Prepaid expenses | | | 10,474 | |

| | | | |

Total Assets | | | 1,492,266,910 | |

| | | | |

Liabilities: | | | | |

Capital shares redeemed payable | | | 240,000 | |

Investment advisory fees payable | | | 791,063 | |

Accounting and Administration fees payable | | | 931,705 | |

Regulatory and Compliance fees payable | | | 27,661 | |

Accrued expenses and other payables | | | 57,722 | |

| | | | |

Total Liabilities | | | 2,048,151 | |

| | | | |

Net Assets | | $ | 1,490,218,759 | |

| | | | |

Net Assets | | $ | 1,490,218,759 | |

Shares of common stock outstanding | | | 85,318,132 | |

| | | | |

Net asset value per share | | $ | 17.47 | |

| | | | |

Net Assets: | | | | |

Paid in capital | | $ | 1,189,107,743 | |

Distributable earnings (loss) | | | 301,111,016 | |

| | | | |

Net Assets | | $ | 1,490,218,759 | |

| | | | |

See Notes to Financial Statements.

12

ADVISERS INVESTMENT TRUST

STATEMENT OF OPERATIONS

For the year ended September 30, 2022

| | | | |

| | | Independent

Franchise Partners

US Equity Fund | |

Investment Income: | | | | |

Dividend income (Net of foreign withholding tax of $882,747) | | $ | 32,245,598 | |

Operating expenses: | | | | |

Investment advisory | | | 11,116,463 | |

Accounting and Administration | | | 1,039,984 | |

Regulatory and Compliance | | | 171,323 | |

Trustees | | | 76,742 | |

Legal | | | 53,710 | |

Risk Officer | | | 27,229 | |

Other | | | 118,314 | |

| | | | |

Total expenses | | | 12,603,765 | |

| | | | |

Net investment income | | | 19,641,833 | |

| | | | |

Realized and Unrealized Gains (Losses) from Investment Activities: | | | | |

Net realized gains from investment transactions | | | 212,508,780 | |

Net realized losses from foreign currency transactions | | | (78,155 | ) |

Change in unrealized appreciation (depreciation) on investments | | | (511,811,790 | ) |

Change in unrealized appreciation (depreciation) on foreign currency | | | (206,389 | ) |

| | | | |

Net realized and unrealized losses from investment activities | | | (299,587,554 | ) |

| | | | |

Change in Net Assets Resulting from Operations | | $ | (279,945,721 | ) |

| | | | |

See Notes to Financial Statements.

13

ADVISERS INVESTMENT TRUST

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended September 30, 2022 and 2021

| | | | | | | | |

| | | Independent Franchise Partners

US Equity Fund | |

| | |

| | | 2022 | | | 2021 | |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 19,641,833 | | | $ | 27,599,242 | |

Net realized gains (losses) from investment and foreign currency transactions | | | 212,430,625 | | | | 145,447,061 | |

Change in unrealized appreciation (depreciation) on investments and foreign currency | | | (512,018,179 | ) | | | 280,478,053 | |

| | | | | | | | |

Change in net assets resulting from operations | | | (279,945,721 | ) | | | 453,524,356 | |

| | | | | | | | |

Dividends paid to shareholders: | | | | | | | | |

From distributable earnings | | | (137,522,026 | ) | | | (212,970,649 | ) |

| | | | | | | | |

Total dividends paid to shareholders | | | (137,522,026 | ) | | | (212,970,649 | ) |

| | | | | | | | |

Capital Transactions: | | | | | | | | |

Proceeds from sale of shares | | | 63,964,242 | | | | 87,844,606 | |

Value of shares issued to shareholders in reinvestment of dividends | | | 131,436,175 | | | | 203,820,740 | |

Value of shares redeemed | | | (315,038,992 | ) | | | (182,818,970 | ) |

| | | | | | | | |

Change in net assets from capital transactions | | | (119,638,575 | ) | | | 108,846,376 | |

| | | | | | | | |

Change in net assets | | | (537,106,322 | ) | | | 349,400,083 | |

Net assets: | | | | | | | | |

Beginning of year | | | 2,027,325,081 | | | | 1,677,924,998 | |

| | | | | | | | |

End of year | | $ | 1,490,218,759 | | | $ | 2,027,325,081 | |

| | | | | | | | |

Share Transactions: | | | | | | | | |

Sold | | | 3,008,252 | | | | 4,116,944 | |

Reinvested | | | 6,238,072 | | | | 10,566,135 | |

Redeemed | | | (15,006,072 | ) | | | (8,677,118 | ) |

| | | | | | | | |

Change | | | (5,759,748 | ) | | | 6,005,961 | |

| | | | | | | | |

See Notes to Financial Statements.

14

ADVISERS INVESTMENT TRUST

FINANCIAL HIGHLIGHTS

For the years indicated

| | | | | | | | | | | | | | | | | | | | |

| | | Independent Franchise Partners

US Equity Fund | |

| | | Year Ended September 30, 2022 | | | Year Ended September 30, 2021 | | | Year Ended September 30, 2020 | | | Year Ended September 30, 2019 | | | Year Ended September 30, 2018 | |

| |

Net asset value, beginning of year | | $ | 22.26 | | | $ | 19.72 | | | $ | 18.67 | | | $ | 18.55 | | | $ | 17.66 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.23 | | | | 0.31 | | | | 0.37 | | | | 0.30 | | | | 0.28 | |

Net realized and unrealized gains (losses) from investments | | | (3.52 | ) | | | 4.70 | | | | 2.72 | | | | 1.06 | | | | 1.51 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (3.29 | ) | | | 5.01 | | | | 3.09 | | | | 1.36 | | | | 1.79 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions paid: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.26 | ) | | | (0.30 | ) | | | (0.37 | ) | | | (0.31 | ) | | | (0.24 | ) |

From net realized gains on investments | | | (1.24 | ) | | | (2.17 | ) | | | (1.68 | ) | | | (0.93 | ) | | | (0.66 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions paid | | | (1.50 | ) | | | (2.47 | ) | | | (2.05 | ) | | | (1.24 | ) | | | (0.90 | ) |

| | | | | | | | | | | | | | | | | | | | |

Increase from redemption fees | | | — | (a) | | | — | (a) | | | 0.01 | | | | — | (a) | | | — | (a) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value | | | (4.79 | ) | | | 2.54 | | | | 1.05 | | | | 0.12 | | | | 0.89 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 17.47 | | | $ | 22.26 | | | $ | 19.72 | | | $ | 18.67 | | | $ | 18.55 | |

| | | | | | | | | | | | | | | | | | | | |

Total return(b) | | | (15.93 | %) | | | 27.34 | % | | | 17.50 | %(c) | | | 8.67 | % | | | 10.34 | % |

Ratios/Supplemental data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 1,490,219 | | | $ | 2,027,325 | | | $ | 1,677,925 | | | $ | 2,128,522 | | | $ | 2,125,045 | |

Ratio of net expenses to average net assets | | | 0.68 | % | | | 0.72 | % | | | 0.76 | % | | | 0.76 | % | | | 0.76 | % |

Ratio of net investment income to average net assets | | | 1.06 | % | | | 1.42 | % | | | 1.49 | % | | | 1.62 | % | | | 1.54 | % |

Ratio of gross expenses to average net assets | | | 0.68 | % | | | 0.72 | % | | | 0.76 | % | | | 0.76 | %(d) | | | 0.76 | %(d) |

Portfolio turnover rate(e) | | | 25.80 | % | | | 23.67 | % | | | 43.46 | % | | | 37.99 | % | | | 38.63 | % |

|

| |

| (a) | Redemption fees were less than $0.005 per share. |

| (b) | Total return excludes redemption fees. |

| (c) | During the period, the Adviser reimbursed the Fund for a loss realized in connection with a trade error. Such payment represented 0.02% to the Fund’s total return. |

| (d) | During the years shown, certain fees were reduced. If such fee reductions had not occurred, the ratio would have been as indicated. |

| (e) | Portfolio turnover rate includes applicable corporate action activity and securities trading as a result of investor subscription and redemption activity. |

See Notes to Financial Statements.

15

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2022

Advisers Investment Trust (the “Trust”) is a Delaware statutory trust operating under a Fourth Amended and Restated Agreement and Declaration of Trust (the “Trust Agreement”) dated March 10, 2022. The Trust was formerly an Ohio business trust, which commenced operations on December 20, 2011. On March 31, 2017, the Trust was converted to a Delaware statutory trust. As an open-end registered investment company, as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) 2013-08, the Trust follows accounting and reporting guidance under FASB Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The Trust Agreement permits the Board of Trustees (the “Trustees” or “Board”) to authorize and issue an unlimited number of shares of beneficial interest, at no par value, in separate series of the Trust. The Independent Franchise Partners US Equity Fund (the “IFP US Equity Fund” or “Fund”) is a series of the Trust. These financial statements and notes only relate to the IFP US Equity Fund.

The Fund is a non-diversified fund, meaning it may invest in a smaller number of companies than a diversified fund, and seeks to achieve an attractive long-term rate of return.

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust and Fund. In addition, in the normal course of business, the Trust enters into contracts with its vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund.

| A. | Significant accounting policies are as follows: |

INVESTMENT VALUATION

Investments are recorded at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques employed by the Fund, as described below, maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. These inputs are summarized in the following three broad levels:

Level 1 — quoted prices in active markets for identical assets

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, certain short-term debt securities may be valued using amortized cost. Generally, amortized cost approximates the current value of a security, but since this valuation is not obtained from a quoted price in an active market, such securities would be reflected as Level 2 in the fair value hierarchy.

Security prices are generally provided by an approved independent third party pricing service as of the close of the New York Stock Exchange, normally at 4:00 p.m. Eastern Time, each business day on which the share price of the Fund is calculated. Equity securities listed or traded on a primary exchange are valued at the closing price, if available, or the last sales price on the primary exchange. If no sale occurred on the valuation date, the securities will be valued at the latest quotations as of the close of the primary exchange. Investments in other open-end registered investment companies are valued at their respective net asset value as reported by such companies. In these types of situations, valuations are typically categorized as Level 1 in the fair value hierarchy.

Debt and other fixed income securities, if any, are generally valued at an evaluated price provided by an approved independent pricing source. To value debt securities, pricing services may use various pricing techniques, which take into account appropriate factors such as market activity, yield, quality, coupon rate, maturity, type of issue, trading characteristics, call features, credit ratings and other data, as well as broker quotes. Short-term debt securities of sufficient credit quality that mature within sixty days may be valued at amortized cost, which approximates fair value. In each of these situations, valuations are typically categorized as Level 2 in the fair value hierarchy.

16

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2022

Prior to September 8, 2022, when the price of a security was not readily available or deemed unreliable (e.g., an approved pricing service does not provide a price, a furnished price is in error, certain stale prices, or an event occurs that materially affects the furnished price), the Fund’s Fair Value Committee would in good faith establish a fair value for that security in accordance with procedures established by and under the general supervision of the Trustees. Since September 8, 2022, the Trustees designated Independent Franchise Partners, LLP, as investment adviser to the Fund, as the Fund’s Valuation Designee with responsibility for establishing fair value when the price of a security is not readily available or deemed unreliable. In addition, fair value pricing may be used if events materially affecting the value of foreign securities occur between the time when the exchange on which they are traded closes and the time when the Fund’s net asset value is calculated. The Fund identifies possible fluctuations in international securities by monitoring the increase or decrease in the value of a designated benchmark index. In the event of an increase or decrease greater than predetermined levels, the Fund may use a systematic valuation model provided by an approved independent third party pricing service to fair value its international equity securities.

In the fair value situations noted above, while the Trust’s valuation policy is intended to result in a calculation of the Fund’s net asset value that fairly reflects security values as of the time of pricing, the Trust cannot ensure that fair values determined pursuant to these guidelines would accurately reflect the price that the Fund could obtain for a security if it were to dispose of that security as of the time of pricing (for instance, in a forced or distressed sale). The prices used by the Fund may differ from the value that would be realized if the securities were sold, and these differences could be material to the financial statements. Depending on the source and relative significance of the valuation inputs in these instances, the instruments may be classified as Level 2 or Level 3 in the fair value hierarchy.

The following is a summary of the valuation inputs used as of September 30, 2022 in valuing the Fund’s investments based upon the three fair value levels defined above:

| | | | | | | | | | | | | | | | | | | | | | |

| Fund | | Level 1 - Quoted Prices | | | | | Level 2 - Other Significant Observable Inputs | | | | | Level 3 - Significant Unobservable Inputs | | | | | Total | |

| |

Independent Franchise Partners US Equity Fund | | | | | | | | | | | | | | | | | | | | | | |

Common Stocks* | | $ | 1,478,568,338 | | | | | $ | — | | | | | $ | — | | | | | $ | 1,478,568,338 | |

| | | | |

Total Investments | | $ | 1,478,568,338 | | | | | $ | — | | | | | $ | — | | | | | $ | 1,478,568,338 | |

| | | | |

| * | See additional categories in the Schedule of Investments. |

As of September 30, 2022, there were no Level 2 or Level 3 securities held by the Fund. There were no transfers to or from Level 3 during the year ended September 30, 2022.

CURRENCY TRANSACTIONS

The Fund may engage in spot currency transactions for the purpose of foreign security settlement and operational processes. Changes in foreign currency exchange rates will affect the value of the Fund’s securities and the price of the Fund’s shares. Generally, when the value of the U.S. dollar rises in value relative to a foreign currency, an investment in that country loses value because that currency is worth fewer U.S. dollars. Devaluation of a currency by a country’s government or banking authority also may have a significant impact on the value of any investments denominated in that currency. Currency markets generally are not as regulated as securities markets.

INVESTMENT TRANSACTIONS AND INCOME

Investment transactions are accounted for no later than one business day after trade date. At financial reporting period ends, investments are reported as of the trade date. The Fund determines the gain or loss realized from investment transactions by using an identified cost basis method. Dividend income is recognized on the ex-dividend date. Dividends from foreign securities are recorded on the ex-dividend date, or as soon as the information is available.

17

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2022

EXPENSE ALLOCATIONS

Expenses directly attributable to a fund in the Trust are charged to that fund, while expenses that are attributable to more than one fund in the Trust are allocated among the applicable funds on a pro-rata basis to each adviser’s series of funds based on relative net assets or another reasonable basis.

DIVIDENDS AND DISTRIBUTIONS

The Fund intends to distribute substantially all of its net investment income as dividends to shareholders on an annual basis. The Fund intends to distribute its net realized long-term capital gains and its net realized short-term capital gains at least once a year.

Distributions from net investment income and from net realized capital gain are determined in accordance with Federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America (“GAAP”). These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (e.g. treatment of certain dividend distributions, gains/losses, return of capital, redemption in-kind, etc.), such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. Distributions to shareholders that exceed net investment income and net realized capital gains for tax purposes are reported as return of capital.

REDEMPTION FEES

The Fund will charge a redemption fee of up to 0.25% of the total redemption amount if you sell your shares, regardless of the length of time you have held your shares and subject to certain exceptions and limitations described in the prospectus. The redemption fee is paid directly to the Fund and is intended to encourage long-term investment in the Fund, to facilitate portfolio management and to avoid (or compensate the Fund for the impact of) transaction and other Fund expenses incurred as a result of shareholder redemptions. Redemption fees charged for the years ended September 30, 2022 and September 30, 2021 were $450,889 and $247,154, respectively, and are reflected within the value of shares redeemed on the Statements of Changes in Net Assets.

FEDERAL INCOME TAX INFORMATION

No provision is made for Federal income taxes as the Fund intends to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and distribute substantially all of its net investment income and net realized capital gain in accordance with the Code.

As of September 30, 2022, the Fund did not have material uncertain tax positions that would require financial statement recognition or disclosure based on an evaluation of all open tax years for all major tax jurisdictions. The Fund’s Federal tax returns for the tax years ended September 30, 2019, 2020, 2021 and 2022 remain subject to examination by the Internal Revenue Service. Interest or penalties incurred, if any, on future unknown, uncertain tax positions taken by the Fund will be recorded as interest expense on the Statement of Operations.

Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

USE OF ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

18

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2022

| B. | Fees and Transactions with Affiliates and Other Parties |

The Trust, on behalf of the Fund, has entered into an Investment Advisory Agreement (the “Agreement”) with Independent Franchise Partners, LLP (the “Adviser”) to provide investment management services to the Fund. Total fees incurred pursuant to the Agreement are reflected as “Investment advisory” fees on the Statement of Operations. Under the terms of the Agreement, and for the year ended September 30, 2022, the Fund paid the Adviser a monthly fee based on the Fund’s daily net assets at the following annualized rates:

| | | | | | |

Adviser’s Assets Under Management(1) | | Scale Discount for

Assets in each Range(1) | | Annualized Rate(1) | | Effective Overall Annual

Fee(1) |

|

First $1 billion | | — | | 0.80% | | 0.80% |

$1 - 2 billion | | 0.10% | | 0.70% | | at $2 billion 0.75% |

$2 - 3 billion | | 0.20% | | 0.60% | | at $3 billion 0.70% |

$3 - 4 billion | | 0.30% | | 0.50% | | at $4 billion 0.65% |

$4 - 5 billion | | 0.40% | | 0.40% | | at $5 billion 0.60% |

Above $5 billion | | — | | — | | 0.60% |

| (1) | The Adviser’s total assets under management at the end of each calendar quarter are used to calculate the effective annual fee to be applied during the next calendar quarter. During the year ended September 30, 2022, the effective annualized rate was 0.60% given the Adviser’s total assets under management were in excess of $5 billion during the year. |

Foreside Financial Services, LLC (the “Distributor”) provides distribution services to the Fund pursuant to a distribution agreement with the Trust, on behalf of the Fund. Under its agreement with the Trust, the Distributor acts as an agent of the Trust in connection with the offering of the shares of the Fund on a continuous basis. The Adviser, at its own expense, pays the Distributor an annual $5,000 fee for these services and reimbursement for certain expenses incurred on behalf of the Fund.

The Northern Trust Company (“Northern Trust”) serves as the administrator, transfer agent, custodian and fund accounting agent for the Fund pursuant to written agreements between the Trust, on behalf of the Fund, and Northern Trust. The Fund has agreed to pay Northern Trust certain annual and transaction-based fees, a tiered basis-point fee based on the Fund’s daily net assets, subject to a minimum annual fee of $175,000 relating to these services, and reimburse for certain expenses incurred on behalf of the Fund as well as other charges for additional service activities. Total fees paid to Northern Trust pursuant to these agreements are reflected as “Accounting and Administration” fees on the Statement of Operations.

Foreside Fund Officer Services, LLC (“Foreside”) provides compliance and financial control services for the Fund pursuant to a written agreement with the Trust, on behalf of the Fund, including providing certain officers to the Fund. The Fund pays Foreside an annual base fee, a basis-point fee based on the Fund’s daily net assets and reimburses for certain expenses incurred on behalf of the Fund. Total fees paid to Foreside pursuant to these agreements are reflected as “Regulatory and Compliance” fees on the Statement of Operations.

Carne Global Financial Services (US) LLC (“Carne”) provides risk management and oversight services for the Fund pursuant to a written agreement between the Trust, on behalf of the Fund, and Carne, including providing the Risk Officer to the Fund to administer the Fund’s risk program and oversee the analysis of investment performance and performance of service providers. The Fund has agreed to pay Carne an annual fee of $30,000 for these services, and reimburse for certain expenses incurred on behalf of the Fund. Total fees paid to Carne pursuant to this agreement are reflected as “Risk Officer” fees on the Statement of Operations.

The officers of the Trust are affiliated with Foreside, Northern Trust, Carne or the Distributor and receive no compensation directly from the Fund for serving in their respective roles. The Trust paid each Trustee who is not an “interested person,” as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”) (each, an “Independent Trustee” and, collectively, the “Independent Trustees”) compensation for their services based on an annual retainer of $125,000 and reimbursement for certain expenses. If there are more than six meetings in a year, additional meeting fees may apply. For the year ended September 30, 2022, the aggregate Trustee compensation paid by the Trust was $472,750. The amount of total Trustee compensation and reimbursement of out-of-pocket expenses allocated from the Trust to the Fund is reflected as “Trustees” expenses on the Statement of Operations.

19

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2022

The Adviser has contractually agreed to waive fees and/or reimburse expenses to the extent necessary to limit the Fund’s total annual fund operating expenses (exclusive of brokerage costs, interest, taxes, dividends on short positions, litigation and indemnification expenses, fees and expenses associated with investments in underlying investment companies and extraordinary expenses) to 0.85% of the average daily net assets of the Fund until January 28, 2023. For the year ended September 30, 2022, there were no expenses reduced by the Adviser. Any fees waived or expenses reimbursed during a fiscal year are not subject to repayment from the Fund to the Adviser in subsequent fiscal years.

| C. | Investment Transactions |

For the year ended September 30, 2022, the aggregate costs of purchases and proceeds from sales of securities (excluding short-term investments) for the Fund were as follows:

| | | | | | | | |

| Fund | | Cost of Purchases | | | Proceeds from sales | |

| |

Independent Franchise Partners US Equity Fund | | | $ 465,749,044 | | | | $ 687,148,535 | |

As of September 30, 2022, the cost, gross unrealized appreciation and gross unrealized depreciation on investments, for Federal income tax purposes, were as follows:

| | | | | | | | | | | | | | | | |

Fund | | Cost | | | Gross Unrealized Appreciation | | | Gross Unrealized (Depreciation) | | | Net Unrealized Appreciation (Depreciation) | |

| |

Independent Franchise Partners US Equity Fund | | | $ 1,405,438,757 | | | | $ 235,174,054 | | | | $ (162,044,473) | | | | $ 73,129,581 | |

The tax character of distributions paid to shareholders during the latest tax years ended September 30, 2022 and September 30, 2021 for the Fund was as follows:

| | | | | | | | | | | | | | | | | | | | |

Independent Franchise Partners US Equity

Fund | | Ordinary Income | | | Net Long

Term Gains | | | Total Taxable

Distributions | | | Tax Return

of Capital | | | Total Distributions

Paid | |

| |

2022 | | | $ 38,179,775 | | | | $ 99,342,251 | | | | $ 137,522,026 | | | $ | — | | | | $ 137,522,026 | |

2021 | | | $ 43,931,463 | | | | $ 169,039,186 | | | | $ 212,970,649 | | | $ | — | | | | $ 212,970,649 | |

As of the latest tax year ended September 30, 2022, the components of accumulated earnings on a tax basis were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fund | | Undistributed

Ordinary Income | | | Undistributed Long

Term Capital

Gains | | | Accumulated

Earnings | | | Distributions

Payable | | | Accumulated

Capital and

Other Losses | | | Unrealized

Appreciation | | | Total

Accumulated

Earnings | |

| |

Independent Franchise Partners US Equity Fund | | | $23,670,068 | | | | $204,471,984 | | | | $228,142,052 | | | | $ — | | | | $ — | | | | $72,968,964 | | | | $301,111,016 | |

At September 30, 2022, the latest tax year end, the Fund had no capital loss carry-forwards available to offset future net capital gains.

Certain shareholders in the Fund received securities rather than cash for their redemption amounts in accordance with the provisions of the Fund. These shareholders received securities with a fair value equal to the value of the number of shares they owned at the current net asset value at the redemption date.

In-kind withdrawals of $1,258,761 are reflected within the “Value of shares redeemed” on the Statements of Changes in Net Assets, and net gains of $466,945 on the securities distributed to shareholders are reflected within the “Net realized gains from investment transactions” on the Statement of Operations.

20

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2022

| F. | Concentration of Ownership Risk |

A significant portion of the Fund’s shares may be held in a limited number of shareholder accounts. To the extent that a shareholder or group of shareholders redeem a significant portion of the shares issued by the Fund, this could have a disruptive impact on the efficient implementation of the Fund’s investment strategy.

The Fund is subject to market risk, which is the risk related to investments in securities in general and the daily fluctuations in the securities markets. The Fund’s investment return per share will change daily based on many factors, including fluctuation in interest rates, the quality of the instruments in the Fund’s investment portfolio, national and international economic conditions and general market conditions. The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in the Fund’s portfolio may be impacted by inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics (including COVID-19), epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. These events can have a significant impact on the Fund’s operations and performance.

21

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Advisers Investment Trust and Shareholders of Independent Franchise Partners US Equity Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Independent Franchise Partners US Equity Fund (one of the funds constituting Advisers Investment Trust, referred to hereafter as the “Fund”) as of September 30, 2022, the related statement of operations for the year ended September 30, 2022, the statement of changes in net assets for each of the two years in the period ended September 30, 2022, including the related notes, and the financial highlights for each of the five years in the period ended September 30, 2022 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2022, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended September 30, 2022 and the financial highlights for each of the five years in the period ended September 30, 2022 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of September 30, 2022 by correspondence with the custodian and brokers. We believe that our audit provides a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Chicago, IL

November 23, 2022

We have served as the auditor of one or more investment companies in Advisers Investment Trust since 2011.

PricewaterhouseCoopers LLP, One North Wacker, Chicago, IL 60606

T: (312) 298 2000, www.pwc.com/us

22

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

ADDITIONAL INFORMATION

September 30, 2022 (Unaudited)

| A. | Other Federal Tax Information |

Under the Jobs and Growth Tax Relief Reconciliation Act of 2003 (the “Act”), the following percentages of ordinary dividends paid during the fiscal year ended September 30, 2022 are designated as Qualified Dividend Income (“QDI”), as defined in the Act, subject to reduced tax rates in 2022:

| | | | |

| Fund | | QDI Percentage | |

| |

IFP US Equity Fund | | | 100.00 | % |

A percentage of the dividends distributed during the fiscal year for the Fund qualifies for the Dividends-Received Deduction (“DRD”) for corporate shareholders:

| | | | |

Fund | | Corporate

DRD Percentage | |

| |

IFP US Equity Fund | | | 68.02 | % |

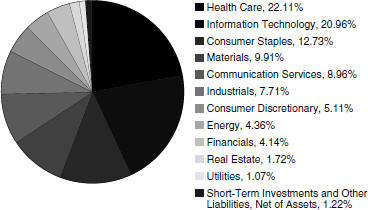

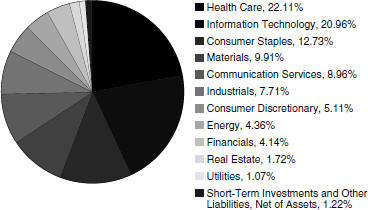

| B. | Summary of Fund Holdings as of September 30, 2022 |

| | | | |

| Market Exposure | |

| |

| Equity Securities | | % of Net Assets | |

| |

Software | | | 15.0% | |

Pharmaceuticals | | | 14.2 | |

Internet Software & Services | | | 13.9 | |

Media | | | 13.0 | |

Tobacco | | | 9.3 | |

Diversified Financials | | | 8.0 | |

Commercial Services | | | 7.1 | |

Insurance | | | 4.3 | |

Toys/Games/Hobbies | | | 3.8 | |

Biotechnology | | | 3.6 | |

Textiles, Apparel & Luxury Goods | | | 3.5 | |

Diversified Support Services | | | 3.0 | |

IT Services | | | 0.5 | |

| |

Total | | | 99.2% | |

| |

|

| 5 Largest Security Positions | |

| |

| Issuer | | % of Net Assets | |

| |

Bristol-Myers Squibb Co. | | | 6.7% | |

Philip Morris International Inc. | | | 5.4 | |

Novartis AG - REG | | | 4.5 | |

Fox Corp. - Class A | | | 4.4 | |

Oracle Corp. | | | 4.3 | |

| |

Total | | | 25.3% | |

| |

As a Fund shareholder, you may incur two types of costs: (1) transaction costs, including redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Please note that the expenses

23

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

ADDITIONAL INFORMATION

September 30, 2022 (Unaudited)