PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MAY 2, 2014

STARBOARD VALUE LP

May 2, 2014

Dear Fellow Shareholders:

Starboard Value LP and the other participants in this solicitation (collectively, “Starboard,” “our,” or “we”) are the beneficial owners of an aggregate of 7,254,818 shares of common stock, no par value per share (the “Common Stock”), of Darden Restaurants, Inc. (“Darden” or the “Company”), representing approximately 5.5% of the Company’s outstanding shares, making us one of the Company’s largest shareholders.

Since December 19, 2013, Starboard, at least one other shareholder, and several research analysts have expressed serious concerns with the Company’s proposed separation of Red Lobster, whether through a spin-off or sale (the “Red Lobster Separation”). Starboard does not believe that the Red Lobster Separation, as currently contemplated by the Company, is in the best interests of the Company’s shareholders. Unfortunately, to-date, despite the serious concerns voiced by its shareholders regarding the Red Lobster Separation, the Company appears unwavering in its commitment to the proposed separation. Further, based upon the Company’s filing of a Form 10 registration statement in furtherance of a spin-off, the Company appears intent on expeditiously pursuing this separation.

For this reason, we undertook a solicitation seeking the support of the holders of at least 50% of the Company’s outstanding shares entitled to vote to call a special meeting of shareholders (the “Special Meeting”) in order to provide shareholders with a platform for potentially influencing management and the Board with regard to this material transaction. On April 22, 2014, we delivered written requests from the holders of more than 55% of the Company’s outstanding common stock to call the Special Meeting. Several days later, we supplemented our delivered written requests to Darden such that we have delivered written requests from holders representing an aggregate of approximately 57% of the shares outstanding based on preliminary voting results from IVS Associates, Inc. This strong show of support indicates that shareholders demand the calling of the Special Meeting in order to vote on the following proposal:

to approve a non-binding resolution urging the Board of Directors of the Company (the “Board”) not to approve any agreement or proposed transaction involving a separation or spin-off of the Company’s Red Lobster business prior to the 2014 Annual Meeting of Shareholders (the “2014 Annual Meeting”) unless such agreement or transaction would require shareholder approval.

We do not believe management or the current Board have earned the right to make this critical decision on their own. Darden’s long-term performance under the leadership of this management team and Board has been unacceptable. As detailed in our investor presentation dated March 31, 2014 and available at http://tinyurl.com/March31-Investor-Presentation, both Darden’s operating performance and its stock price performance have significantly trailed peers over an extended period of time. Despite Darden’s significant scale advantage, Darden’s same-store-sales (“SSS”) and EBITDA margins are well below peers. In addition, Darden’s returns on capital have deteriorated significantly, with returns on capital falling from a high of approximately 19% in 2007 to approximately 9% in 2013. As a result, over the past five years Darden’s stock price has underperformed its closest peers by approximately 300%:

| | Share Price Performance (1) |

| | |

| | 1 Year | | 3 Year | | 5 Year |

| | | | | | |

| S&P 500 Index | 20% | | 52% | | 171% |

| RUSSELL 3000 Restaurants Industry | 18% | | 68% | | 212% |

Proxy Group (2) | 29% | | 93% | | 412% |

Closest Direct Peers (3) | 34% | | 80% | | 400% |

| | | | | | |

| Darden Restaurants, Inc. | 5% | | 18% | | 104% |

| | | | | | |

| Underperformance vs. S&P 500 | (15%) | | (34%) | | (66%) |

| Underperformance vs. RUSSELL 3000 | (13%) | | (50%) | | (108%) |

| Underperformance vs. Proxy Group | (24%) | | (75%) | | (308%) |

| Underperformance vs. Closest Direct Peers | (29%) | | (62%) | | (296%) |

| | | | | | |

| Source: CapitalIQ | | | | | |

| Note: For each time period, excludes companies not publicly traded throughout that entire period |

| 1. Performance as of 3/14/14, adjusted for dividends |

| 2. Proxy Group consists of companies used in the Company's proxy to set executive compensation |

| 3. Includes EAT, BLMN, DIN, BWLD, TXRH, RT, RRGB, BBRG, CAKE, and DFRG |

Given what we believe to be management and the Board’s track record of poor performance and poor decision-making, together with our concerns regarding the Red Lobster Separation, we believe it is critical for shareholders to have the right to review and approve any transaction involving Red Lobster that takes place prior to the 2014 Annual Meeting, at which time shareholders will have an opportunity to elect directors whom they believe best represent their interests. Accordingly, Starboard has taken the necessary steps to call this Special Meeting to provide shareholders with a forum to opine on the Red Lobster Separation. At the Special Meeting, we aim to prove once and for all that shareholders are in favor of stopping the Board from proceeding with the Red Lobster Separation prior to the 2014 Annual Meeting, unless it has received shareholder approval.

Separate and apart from the Special Meeting, Starboard has expressed its desire to engage with the Company regarding Board composition and believes that substantial change in Board composition may be required. Starboard intends to closely monitor all developments at the Company over the coming months, and is prepared, if necessary, to put forth a majority slate of directors for election at the 2014 Annual Meeting to ensure that shareholders of Darden have a Board that is both well equipped to oversee the Company and open to listening to shareholders on critical matters such as the future of Red Lobster.

While we understand that the approval of the non-binding resolution by shareholders at the Special Meeting would not prohibit the Board from proceeding with the Red Lobster Separation, we do not believe that the Board would sanction proceeding with the Red Lobster Separation in direct opposition to a clear shareholder directive. We believe that moving forward with the Red Lobster Separation despite a clear expression of concern by the Company’s shareholders would be an egregious violation of proper corporate governance. The Company has publicly stated that “if a special meeting is called and Starboard’s proposed resolution is presented to shareholders, serious consideration will be given to the results of the meeting and any other shareholder feedback received by the Company.” We believe that if the non-binding resolution is approved, meaning that more shareholders vote in favor of the resolution than against it, the Company must recognize the will of the shareholders and refrain from proceeding with the Red Lobster Separation prior to the 2014 Annual Meeting, unless it has received shareholder approval.

Starboard is therefore seeking your support at the Special Meeting, scheduled to be held on ____________ __, 2014 at _______ _.m., ___________, at_________________, for the purpose of approving a non-binding resolution urging the Company’s Board of Directors not to approve any agreement or proposed transaction involving a separation or spin-off of the Company’s Red Lobster business prior to the 2014 Annual Meeting unless such agreement or transaction would require shareholder approval.

Starboard urges you to carefully consider the information contained in the attached Proxy Statement and then support its efforts by signing, dating and returning the enclosed WHITE proxy card today. The attached Proxy Statement and the enclosed WHITE proxy card are first being furnished to the shareholders on or about May [__], 2014.

If you have already voted against the proposal described in this Proxy Statement, you have every right to change your vote by signing, dating and returning a later dated proxy.

If you have any questions or require any assistance with your vote, please contact Okapi Partners, LLC, which is assisting us, at their address and toll-free numbers listed on the following page.

| | Thank you for your support, |

| | |

| | /s/ Jeffrey C. Smith |

| | |

| | Jeffrey C. Smith |

| | Starboard Value LP |

If you have any questions, require assistance in voting your WHITE proxy card,

or need additional copies of Starboard’s proxy materials, please call

Okapi Partners LLC at the phone numbers listed below.

OKAPI PARTNERS LLC 437 Madison Avenue, 28th Floor New York, N.Y. 10022 (212) 297-0720 Shareholders Call Toll-Free at: (877) 285-5990 E-mail: info@okapipartners.com |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MAY 2, 2014

SPECIAL MEETING OF SHAREHOLDERS

OF

DARDEN RESTAURANTS, INC.

_________________________

PROXY STATEMENT

OF

STARBOARD VALUE LP

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Starboard Value LP and the other participants in this solicitation (collectively, “Starboard,” “our,” or “we”) are the beneficial owners of an aggregate of 7,254,818 shares of common stock, no par value per share (the “Common Stock”), of Darden Restaurants, Inc. (“Darden” or the “Company”), representing approximately 5.5% of the Company’s outstanding shares, making us one of the Company’s largest shareholders. Starboard does not believe the Company’s proposed separation of Red Lobster (the “Red Lobster Separation”) is in the best interests of Darden’s shareholders as it is irreversible and could lead to substantial destruction of shareholder value. Starboard is seriously concerned that management appears to be targeting completion of the Red Lobster Separation prior to the 2014 Annual Meeting of Shareholders (the “2014 Annual Meeting”), when all of Darden’s directors are up for election. We are therefore seeking your support at the special meeting of shareholders (the “Special Meeting”) called by the Company at Starboard’s request, scheduled to be held on ____________ __, 2014 at _______ _.m., ___________, at_________________, for the following purpose:

| | To approve a non-binding resolution urging the Company’s Board of Directors not to approve any agreement or proposed transaction involving a separation or spin-off of the Company’s Red Lobster business prior to the 2014 Annual Meeting unless such agreement or transaction would require shareholder approval (the “Shareholders’ Say on Red Lobster Proposal”). |

Starboard strongly opposes the Red Lobster Separation because it believes it is the wrong spin-off, at the wrong time, for the wrong reasons and that this decision is a reactive attempt by management and the Board, in the face of shareholder pressure, to conveniently cast off the weight of the struggling Red Lobster business, rather than address the Company’s serious operational issues head-on. If shareholders support the Shareholders’ Say on Red Lobster Proposal, even if non-binding, we hope that the Board would not proceed with the Red Lobster Separation prior to the 2014 Annual Meeting without shareholder approval. You should refer to the information set forth under the heading “REASONS TO VOTE FOR THE SHAREHOLDERS’ SAY ON RED LOBSTER PROPOSAL” for a more detailed explanation of Starboard’s rationale for opposing the Red Lobster Separation.

The participants in this solicitation are Starboard Value LP, Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”), Starboard Value and Opportunity S LLC (“Starboard S LLC”), Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard Leaders Delta LLC (“Delta LLC”), Starboard Leaders Fund LP (“Leaders Fund”), Starboard Value LP, Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal Co LP (“Principal Co”), Starboard Principal Co GP LLC (“Principal GP”), Starboard Value A LP (“Starboard A LP”), Starboard Value A GP LLC (“Starboard A GP”), Starboard Value R LP (“Starboard R LP”), Starboard Value R GP LLC (“Starboard R GP”), Jeffrey C. Smith, Mark R. Mitchell, Peter A. Feld, Bradley D. Blum, Charles M. Sonsteby, Robert Mock and Craig S. Miller. For additional information concerning the participants in this proxy solicitation, please refer to the information set forth under the heading “Other Participant Information.” This Proxy Statement and the WHITE proxy card are first being furnished to Darden’s shareholders on or about [___________].

The Company has set the record date for determining shareholders entitled to notice of and to vote at the Special Meeting as [_____________], 2014 (the “Record Date”). The mailing address of the principal executive offices of the Company is 1000 Darden Center Drive, Orlando, Florida 32837. Shareholders of record at the close of business on the Record Date will be entitled to vote at the Special Meeting. According to the Company, as of the Record Date, there were [___________] shares of common stock, no par value per share (the “Shares”), outstanding and entitled to vote at the Special Meeting. As of [_____], the approximate date on which Starboard expects to mail this Proxy Statement to shareholders, Starboard beneficially owned an aggregate of [7,254,818] Shares, which represents approximately [5.5]% of the Shares outstanding. We intend to vote such Shares FOR the Shareholders’ Say on Red Lobster Proposal described in this Proxy Statement.

THIS SOLICITATION IS BEING MADE BY STARBOARD AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE SPECIAL MEETING OTHER THAN AS DESCRIBED HEREIN. SHOULD OTHER MATTERS, WHICH WE ARE NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE SPECIAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED WHITE PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

WE URGE YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE SHAREHOLDERS’ SAY ON RED LOBSTER PROPOSAL.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY THE COMPANY’S MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE FOR THE SHAREHOLDERS’ SAY ON RED LOBSTER PROPOSAL BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE SPECIAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE SPECIAL MEETING TO STARBOARD, C/O OKAPI PARTNERS LLC, WHICH IS ASSISTING IN THIS SOLICITATION, OR TO THE SECRETARY OF THE COMPANY, OR BY VOTING IN PERSON AT THE SPECIAL MEETING.

IMPORTANT

Your vote is important, no matter how many Shares you own. We urge you to sign, date, and return the enclosed WHITE proxy card today to vote FOR the Shareholders’ Say on Red Lobster Proposal.

| | · | If your Shares are registered in your own name, please sign and date the enclosed WHITE proxy card and return it today to Starboard, c/o Okapi Partners LLC, in the enclosed envelope. |

| | · | If your Shares are held in a brokerage account or bank, you are considered the beneficial owner of the Shares, and these proxy materials, together with a WHITE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your Shares on your behalf without your instructions. |

| | · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or through the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

If you have any questions regarding your proxy,

or need assistance in voting your Shares, please call:

OKAPI PARTNERS LLC 437 Madison Avenue, 28th Floor New York, N.Y. 10022 (212) 297-0720 Shareholders Call Toll-Free at: (877) 285-5990 E-mail: info@okapipartners.com |

BACKGROUND OF THE SOLICITATION

The following is a chronology of events leading up to the proxy solicitation related to the Special Meeting:

| | · | On December 19, 2013, Darden issued a press release announcing, among other things, that the Board had approved a proposed separation of the Company’s Red Lobster business through a spin-off or sale transaction. In the press release, the Company stated that it expects the form of such separation for Red Lobster to be a spin-off. |

| | · | On December 23, 2013, Starboard filed a Schedule 13D with the SEC (the “Schedule 13D”) disclosing a 5.6% interest in Darden. In the Schedule 13D, Starboard stated that it invested in the Company based on Starboard’s belief that Darden is deeply undervalued and represents an attractive investment opportunity and that opportunities exist within the control of management and the Board to take actions that would create significant value for the benefit of all shareholders. Starboard further stated that it had conducted extensive research on Darden and had reviewed the proposed separation of Red Lobster as well as the second quarter financial results and believed that the plan outlined by management falls significantly short of the actions required to maximize shareholder value and that it is disappointed with the continued poor financial performance of the Company. Starboard also expressed its belief in the Schedule 13D that there is a significant opportunity to dramatically improve Darden’s operating performance, as well as opportunities to realize substantial value from the Company’s real estate holdings and to explore other strategic options available to Darden to maximize shareholder value, including alternative business sale or separation transactions. |

| | · | On January 8, 2013, representatives of Starboard had a discussion with certain members of management to gain a better understanding of Darden as well as the proposed separation of Red Lobster. |

| | · | Over the following week, representatives of Starboard worked with Matthew Stroud, Darden’s Vice President of Investor Relations, to schedule a meeting with management at the Company’s headquarters in Orlando, FL. The meeting was scheduled for January 29, 2014. |

| | · | On January 21, 2014, Starboard delivered a letter to the Company’s Chairman and CEO, Clarence Otis, and the Board expressing its serious concerns with the proposed separation of Red Lobster. |

| | · | On January 29, 2014, representatives of Starboard met with certain members of management at the Company’s headquarters in Orlando, FL to discuss the proposed separation of Red Lobster and the operations of the Company. |

| | · | On February 10, 2014, Starboard delivered a letter to the Company’s Chairman and CEO, Clarence Otis, and the Board reiterating its belief that the Company’s current plan to spin-out or sell Red Lobster is not in the best interests of shareholders. |

| | · | On February 24, 2014, Starboard delivered an open letter to Darden’s shareholders informing them that it has filed a preliminary solicitation statement seeking to call a special meeting of Darden’s shareholders to provide shareholders with a democratic forum for expressing their views on the proposed separation of Red Lobster. |

| | · | On March 3, 2014, the Company issued a press release announcing the Company’s conference call to investors and the investor presentation titled “Strategic Action Plan to Enhance Shareholder Value — Spring 2014” prepared by the Company for use during the conference call, which states, among other things, that Darden remains on track to execute its previously announced plan to separate the Red Lobster business through either a spin-off or a sale of the Red Lobster business and that the sale process is well underway. |

| | · | On March 10, 2014, the Company issued a press release announcing that it has filed a Form 10 Registration Statement with the SEC in connection with the separation of Red Lobster. |

| | · | On March 20, 2014, Starboard filed a Definitive Solicitation Statement on Form DEFC 14A with the SEC in connection with its solicitation of written requests from Darden’s shareholders to call the Special Meeting. |

| | · | Also, on March 20, 2014, Starboard issued an open letter to Darden shareholders detailing, among other things, the reasons shareholders should support Starboard’s request that Darden call the Special Meeting and urging shareholders to join Starboard’s efforts by submitting their written request cards. |

| | · | On March 31, 2014, Starboard filed an investor presentation (the “Investor Presentation”) outlining in detail, among other things, its serious concerns with the Red Lobster Separation and why it believes the Special Meeting is critical to provide shareholders with a forum to express their views and influence the future of Red Lobster before it is too late. Starboard also filed a detailed presentation entitled A Primer on Darden’s Real Estate (the “Real Estate Primer”) outlining, among other things, the substantial value intrinsic to Darden’s real estate and a number of highly attractive alternatives for Darden’s real estate assets. |

| | · | On April 1, 2014, Starboard issued a press release disclosing the Investor Presentation and the Real Estate Primer. |

| | · | On April 1, 2014, the Company filed a Revocation Solicitation Statement on Form DEFC 14A with the SEC in response to Starboard’s Solicitation Statement in connection with Starboard’s request that Darden call the Special Meeting. |

| | · | On April 11, 2014, Starboard issued a press release disclosing that Glass Lewis & Co., LLC (“Glass Lewis”), a leading independent proxy voting advisory firm, had recommended that Darden shareholders consent on Starboard's WHITE request card to support Starboard's solicitation to call the Special Meeting. |

| | · | Also, on April 11, 2014, Starboard issued a press release disclosing that Institutional Shareholder Services (“ISS”), a leading independent proxy voting advisory firm, had also recommended that Darden shareholders consent on Starboard's WHITE request card to support Starboard's solicitation to call the Special Meeting. |

| | · | On April 11, 2014, Darden issued a statement disclosing its disagreement with Glass Lewis’ and ISS’ recommendations to Darden shareholders and advised Darden shareholders not to consent on Starboard’s WHITE request card with respect to Starboard’s solicitation to call the Special Meeting. |

| | · | Also on April 11, 2014, Darden issued a statement disclosing that Egan-Jones Proxy Services had recommended that Darden shareholders revoke on Darden’s BLUE revocation card and reject Starboard’s efforts to solicit written requests to call the Special Meeting. |

| | · | On April 14, 2014, Starboard issued a press release and statement to Darden shareholders expressing its gratification with both Glass Lewis’ and ISS’ recommendations that Darden shareholders support Starboard’s efforts to call the Special Meeting by consenting on Starboard’s white request card. |

| | · | On April 22, 2014, Starboard delivered a cover letter to the Corporate Secretary together with written requests from the holders of 73,233,321 shares of Common Stock, representing approximately 55.5% of the outstanding shares of Common Stock as of the March 20, 2014 record date for the Special Meeting solicitation. |

| | · | On April 25, 2014, Starboard delivered a supplemental cover letter to the Corporate Secretary together with written requests from the holders of an additional 2,210,867 shares of Common Stock, meaning Starboard had delivered written requests representing an aggregate of 75,444,188 shares of Common Stock, representing approximately 57.2% of the outstanding shares of Common Stock as of the March 20, 2014 record date for the Special Meeting solicitation. |

| | · | On April 29, 2014, representatives of Starboard met with certain members of management at the Barclays Retail and Consumer Discretionary Conference in New York, NY to discuss the operations of the Company as it relates to the Company’s announced objectives for Olive Garden and Red Lobster. |

| | · | On May 2, 2014, IVS Associates, Inc. released preliminary voting results disclosing that Starboard had delivered written requests representing an aggregate of 74,638,027 shares of Common Stock, representing approximately 56.6% of the outstanding shares of Common Stock as of the March 20, 2014 record date for the Special Meeting solicitation. |

THE SHAREHOLDERS’ SAY ON RED LOBSTER PROPOSAL

Starboard is seeking the support of Darden shareholders to vote in favor of its non-binding Shareholders’ Say on Red Lobster Proposal, which urges the Board not to approve any agreement or proposed transaction involving a separation or spin-off of the Company’s Red Lobster business prior to the 2014 Annual Meeting unless such agreement or transaction would require shareholder approval.

Although the Shareholders’ Say on Red Lobster Proposal is non-binding and would not prevent the Company from proceeding with the proposed separation, we nevertheless believe your approval is critical so shareholders can clearly voice their concerns on the Red Lobster Separation before it is too late and substantial shareholder value is potentially destroyed. We do not believe that the Board would sanction what we would view as an egregious violation of good corporate governance, like proceeding with the Red Lobster Separation in direct opposition to a clear shareholder directive, especially just months before a potential Board election contest. Shareholders can provide such a clear directive by passing the Shareholders’ Say on Red Lobster Proposal, which, assuming a quorum is present, will be achieved if more shareholders vote in favor of the proposal at the Special Meeting than against it.

For the reasons discussed below, we support the Shareholders’ Say on Red Lobster Proposal, and are therefore soliciting your proxy to vote FOR this proposal.

REASONS TO VOTE FOR THE SHAREHOLDERS’ SAY ON RED LOBSTER PROPOSAL

We believe the Red Lobster Separation is the wrong spin-off, at the wrong time, for the wrong reasons. We believe that Darden’s decision to separate Red Lobster at this time is a mistake that would be irreversible and could lead to substantial destruction of shareholder value. We are extremely gratified that ISS and Glass Lewis, the two most highly-respected independent proxy advisory firms, have each recognized the importance for shareholders to have the opportunity to be formally heard on the Red Lobster Separation as evidenced by their recommendation to Darden shareholders to support Starboard's efforts to call this Special Meeting.

Importantly, both ISS and Glass Lewis also recognized in their respective reports that the Red Lobster Separation, as currently conceived, threatens to irreversibly destroy shareholder value. Glass Lewis stated:

“[W]e believe Starboard has put forth a compelling case that management and the board have failed to enhance shareholder value to the extent of the Company's closest peers and that executives and directors are currently pursuing an initiative -- the separation of the Red Lobster business -- which in its current form threatens to destroy shareholder value.”

Meanwhile, ISS noted that based on Starboard’s analysis:

“[T]here appears credible reason to believe that significant value might be at risk in a sale or spin transaction, relative to other strategic alternatives, and that shareholders might reasonably want a check point at which they could ratify or reject this irreversible strategic decision.”

Since Darden’s December 19th announcement of its plan to separate Red Lobster, Starboard, as well as at least one other significant shareholder and leading sell-side analysts, have all publicly expressed serious concerns with the proposed separation. Despite these serious concerns, management and the Board have steadfastly reiterated their commitment to completing the Red Lobster Separation as expeditiously as possible, as evidenced by public statements and the Company’s filing of its Form 10 registration statement for the Red Lobster Separation on March 10, 2014.

We further note that management's recent shareholder-unfriendly Bylaw amendments and poor track record when it comes to shareholder and analyst engagement, as more fully discussed below, cause us to doubt whether the Company is truly concerned with the views of its shareholders regarding the Red Lobster Separation and whether the Board has the best interests of shareholders in mind. Both ISS and Glass Lewis appear to agree. As Glass Lewis stated:

“Darden’s portrayal of itself as a company that is strongly committed to shareholder engagement, that welcomes shareholder input and that values the views of shareholders rings somewhat hollow, to our ears, considering the Company's corporate governance policies and its track record of dealing with investors and analysts who have been critical of the Company.”

ISS expressed similar doubts regarding Darden’s private engagement with shareholders, noting,

“[T]he private engagement process Darden advocates…inherently lacks transparency, results in answers whose credibility relies on the credibility of the very board whose judgment is being challenged, and may never reach a moment of denouement.”

While approving the Shareholders’ Say on Red Lobster Proposal will not prohibit the Board from proceeding with the Red Lobster Separation, we believe it would be incumbent upon the Board not to proceed with the Red Lobster Separation without shareholder approval.

WE HAVE SERIOUS CONCERNS WITH THE PROPOSED RED LOBSTER SEPARATION

While we believe that Darden’s eight restaurant concepts do not all belong together over the long-term, we feel strongly that management’s plan to spin out Red Lobster is the wrong spin-off, at the wrong time, for the wrong reasons. Glass Lewis expressed similar concerns regarding the Board’s inadequate justification for pursuing the Red Lobster Separation rather than a more rational plan for separating similar brands together:

"Thus, if the Company has deemed a separation of its brands as the best strategic course, then wequestion why the board and management would not pursue a seemingly logical plan of groupingrelatively similar brands together. In light of these questions and concerns, as voiced byshareholders and the investor community to the board and management, we believe the board has, up to this point, provided an inadequate justification to shareholders for opting instead to pursue a plan which many view as suboptimal."

Although management released an investor presentation on March 3, 2014 (the “Darden Investor Presentation”) discussing some of the reasons that the Company chose to separate Red Lobster and other alternatives that management considered, we believe, as discussed in detail in Section III of our investor presentation dated March 31, 2014 (available at http://tinyurl.com/March31-Investor-Presentation) that the Darden Investor Presentation (i) is missing numerous critical details necessary to facilitate a constructive dialogue with shareholders regarding the Red Lobster Separation and possible alternatives, (ii) does not provide sufficient proof that the Red Lobster Separation will create value for shareholders or is better for shareholders than other alternatives, and (iii) contains numerous incomplete and highly misleading statements.

We Believe the Red Lobster Separation May Damage the Long-Term Value of Shareholders’ Investment in Darden

We have serious concerns about the Red Lobster Separation and believe it could be both sub-optimal and value destructive. We believe that in the case of a Red Lobster spin-off, although management will no longer have the burden of turning around Red Lobster, Darden’s shareholders will still own Red Lobster’s poor results in the form of shares in the newly spun-off company. In the case of a sale, particularly if Red Lobster’s real estate is included, the proceeds that shareholders receive, net of taxes and transaction costs, may be substantially less than the value that could be realized following a more objective review of alternatives. The Red Lobster Separation, as conceived by management:

| | (i) | Would, in the case of a spin-off, create a new public company with a single poorly-performing restaurant concept that we would expect to trade at a steep discount to Darden and other peers; |

| | (ii) | May impair Darden’s ability to realize full value for its substantial real estate holdings; and |

| | (iii) | Fails, we believe, to address the key factors driving Darden’s continued underperformance, including a bloated cost structure, a lack of focus on restaurant operations, and an inefficient asset base and capital structure. |

New Red Lobster Is Likely to Trade at a Substantial Discount Post-Separation

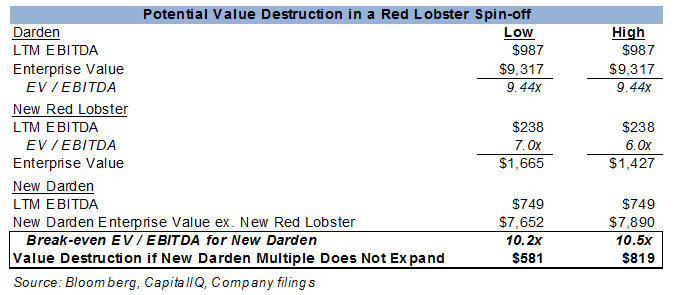

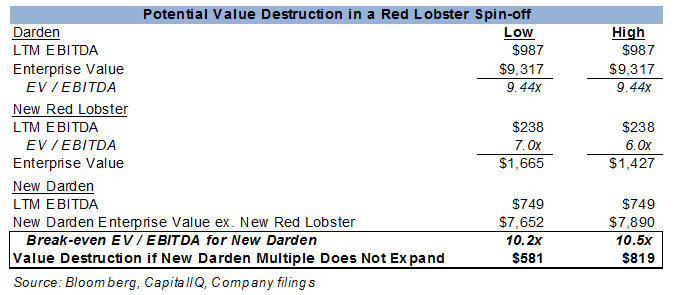

Darden currently trades at approximately 9.5x LTM EBITDA. We believe that Red Lobster, as a standalone public company (“New Red Lobster”), given its lack of unit growth, declining same-store-sales, and commodity price headwinds, is likely to trade at a substantial discount to casual dining peers. Should New Red Lobster trade substantially below Darden’s current multiple, Darden post-separation (“New Darden”) would need to trade at a substantially higher multiple than where it currently trades just to get the combined stock prices back to Darden’s current price. For example, if New Red Lobster traded at 6.5x EBITDA, New Darden would need to trade at approximately 10.4x EBITDA just for shareholders to break even.1

We seriously question why management appears to be in such a rush to separate Red Lobster. From a performance standpoint, Red Lobster’s same-store-sales are the worst they’ve ever been, and margins have been pressured by a spike in shrimp prices caused by a blight affecting shrimp populations in Asia. Rather than developing a credible plan to turn around the business, Darden appears to be more interested in jettisoning Red Lobster as soon as possible. We believe, and sell-side analysts appear to agree, that a standalone Red Lobster would have trouble attracting an investor base.

1 Estimated as of March 31, 2014.

“We find it difficult to believe many long only investors would have any interest in a standalone RL and believe it would likely trade at the lowest EBITDA multiple within the restaurant universe (less than 7x).” – UBS, March 3, 2014

“Our assumption is that RL will assume half of the debt for DRI, which is roughly $1.25B. Applying a 6x EV/EBITDA multiple would give us an EV slightly less than $2B, which is $5 per share for RL.” – Buckingham, March 21, 2014

We Believe the Red Lobster Separation Could Impair Darden’s Ability to Realize the Full Value of Darden’s Real Estate

We believe that Darden’s real estate is highly valuable, and that the Red Lobster Separation, as conceived by management, could permanently impair that value. Our extensive research has indicated that: (1) Darden’s real estate is worth approximately $4 billion, and possibly far more; (2) separating the real estate could create an additional $1-2 billion of shareholder value; (3) a real estate separation can be structured with minimal debt breakage costs and we believe management’s comments regarding debt breakage costs are highly misleading; (4) in a real estate separation, Darden shareholders can maintain their current dividend on a combined basis, while the combined companies will have lower payout ratios; and (5) both Darden as an operating company and a Darden REIT can maintain investment grade ratings, if desired. To supplement our own research, we have retained Green Street Advisors (“Green Street”), the leading independent research firm specializing in real estate and REITs.2

The Red Lobster Separation Does Not Address the Key Issues Facing Red Lobster or Darden

We believe a spin-off of Red Lobster into a new public company would hinder, rather than enhance, Red Lobster’s ability to execute on the operational and brand-related transformation it desperately needs. Despite our repeated inquiries, we believe management has failed to specify a single turnaround initiative Red Lobster plans to implement as a standalone public company that could not be implemented with Red Lobster inside of Darden. It appears management’s “turnaround plan” for Red Lobster essentially boils down to slightly altering Red Lobster’s marketing focus. We believe this is something that could be done with Red Lobster inside of Darden, and should have been done years ago. Moreover, Darden has chosen the same management team to lead New Red Lobster that we believe has been mismanaging Red Lobster for most of the last decade.

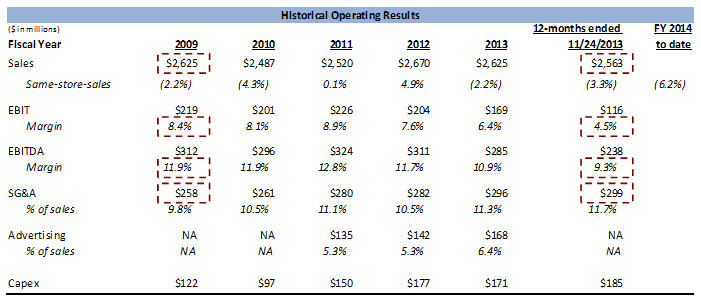

Further, we believe management has failed to address the additional challenges that Red Lobster will face in trying to transform its brand and operations while simultaneously dealing with the added cost and complexity of being a new publicly traded company. The Form 10 for the spin-off indicates that Red Lobster’s SG&A currently stands at approximately 13% of sales3 while the median SG&A ratio among Darden’s direct competitors is approximately 6.5%.4 Management has given shareholders no explanation for how the Red Lobster Separation will help to improve upon this unacceptable ratio. Moreover, in addition to all of the initiatives required to turn around the brand and reduce costs, New Red Lobster management will need to spend a substantial portion of their time engaging with investors and building corporate infrastructure, including new accounting, HR, supply-chain, real estate, and IT organizations. We seriously question how Darden can credibly argue that the optimal time to do all of this is while same-store-sales are down, commodity prices are up, and the brand is in desperate need of a turnaround. In fact, Red Lobster’s same-store-sales trends and margins are the worst in years. As evidenced by the chart below, over the past 5 years, Red Lobster’s EBITDA margins have declined from 11.9% to 9.3% due to same-store-sale declines and significant increases in operating expenses.

2 It cannot be guaranteed that the analysis performed by Green Street is, or would be, consistent with analyses performed by other financial advisors. Accordingly, different analyses may yield different results.

We therefore seriously question the timing of the Red Lobster Separation. After decades of running the brand, the Company is now attempting to rush through a separation during its worst period of performance. We believe this underperformance will create difficulties for New Red Lobster management, who will need to turn around the brand while also adjusting to new public company responsibilities, such as meeting with research analysts and shareholders, while decisions and results are magnified in the public spotlight. Glass Lewis expressed similar concerns regarding the Board’s failure to justify how the Red Lobster Separation will resolve the Company’s operational issues or lead to shareholder value creation:

"In our view, the board has also fallen short of justifying that it should be given completedeference with respect to strategic matters or how a spin-off of Red Lobster into a separatecompany is likely to resolve the operational issues that the brand and Darden face, or how thespin-off would lead to the creation of shareholder value."

To be clear, we are not saying that the Company should never separate Red Lobster, or any other concept, but rather that now is not the right time. We believe that Red Lobster does not need to be a standalone company to begin its long-overdue operational transformation. Before rushing to separate Red Lobster, we believe a more comprehensive Company-wide plan must be crafted that includes a strategy to realize maximum value for the Company’s owned real estate, a portfolio approach to determining the right mix of concepts to own or separate, and a detailed operational turnaround plan for Darden that includes substantial cost savings and a comprehensive strategy to fix the struggling Red Lobster and Olive Garden concepts. To-date, what we have seen from Darden are what we believe to be weak arguments for separating Red Lobster, no operational plan to address the serious issues at Red Lobster, only a high-level generic plan to address the issues at Olive Garden, and limited cost savings that do not come close to addressing the magnitude of the bloated cost structure at Darden.

Wall Street research analysts appear to agree and have voiced their concern and skepticism regarding the Red Lobster Separation:

“Moving forward with Red Lobster sale or spin. Unless the separation helps drive a significant improvement in operating results, we don't envision this being very accretive to valuation. Mgmt has previously stated standalone RL will do mid-to high single-digit EBIT growth, a target that appears aggressive.” - Oppenheimer, March 3, 2014

“We find it odd management believes value can be created by separating the business into two mature companies…We think one of the most interesting statements in the Darden release was the following one: ‘A spin-off will also allow us to target our efforts and investments on value creation opportunities that may be material to a stand-alone Red Lobster but not to Darden overall.’ Management did not elaborate on this value-creation opportunity during the conference call, but we believe monetizing the real estate Red Lobster owns may be impactful for shareholders.” - KeyBanc, December 20, 2013

“On the day Darden’s strategic plan was announced, the stock closed down 4% to $51. This didn’t exactly strike us as a vote of confidence in management’s plan to create value. Two days later, Starboard Value announced a 5.5% position in the company and the stock rallied 6%. For the most part, the stock has traded sideways since then, until rallying 3% on the news that Starboard retained former Olive Garden president Brad Blum to serve as an advisor in its battle against Darden. The takeaway from stock action and, in our opinion, sentiment since 12/20/13 is the stock rallies when there is movement toward replacing management and sells off when management publicly digs their heels in.” - Hedgeye Risk Management, February 24, 2014

Perhaps even more telling is the fact that according to a recent poll conducted by Hedgeye Risk Management, 84% of respondents said that they did not believe that management’s plan to spin-off Red Lobster would create value. In a separate survey, sell-side research firm Bernstein Research found that, “nearly all survey respondents (78%) evinced dissatisfaction with management; most (69%) would support an activist slate of BOD nominees including 80% of current shareholders.” We seriously question why the Company would continue to proceed with the Red Lobster Separation despite this broad-based concern about the lack of value such a transaction would create and management’s inability to put forth a compelling argument.

WE DO NOT BELIEVE MANAGEMENT AND THE BOARD SHOULD BE TRUSTED TO MAKE THIS CRITICAL AND IRREVERSIBLE DECISION ON THEIR OWN

Given what we believe to be their track record of poor decision making and execution, we do not think management and the Board should be trusted to make this significant decision without shareholder involvement. Past decisions have resulted in terrible operating and financial performance. As shown in the table below, Darden’s stock has drastically underperformed its peers over almost any time period.

| | Share Price Performance (1) |

| | |

| | 1 Year | | 3 Year | | 5 Year |

| | | | | | |

| S&P 500 Index | 20% | | 52% | | 171% |

| RUSSELL 3000 Restaurants Industry | 18% | | 68% | | 212% |

Proxy Group (2) | 29% | | 93% | | 412% |

Closest Direct Peers (3) | 34% | | 80% | | 400% |

| | | | | | |

| Darden Restaurants, Inc. | 5% | | 18% | | 104% |

| | | | | | |

| Underperformance vs. S&P 500 | (15%) | | (34%) | | (66%) |

| Underperformance vs. RUSSELL 3000 | (13%) | | (50%) | | (108%) |

| Underperformance vs. Proxy Group | (24%) | | (75%) | | (308%) |

| Underperformance vs. Closest Direct Peers | (29%) | | (62%) | | (296%) |

| | | | | | |

| Source: CapitalIQ | | | | | |

| Note: For each time period, excludes companies not publicly traded throughout that entire period |

| 1. Performance as of 3/14/14, adjusted for dividends |

| 2. Proxy Group consists of companies used in the Company's proxy to set executive compensation |

| 3. Includes EAT, BLMN, DIN, BWLD, TXRH, RT, RRGB, BBRG, CAKE, and DFRG |

ISS agreed, noting that “[o]ver the 3-year and 5-year periods leading up to this consent solicitation, the company’s TSR has significantly underperformed the S&P 500 and peers.”

We believe this unacceptable stock performance is the result of both poor operating performance and poor decision making around strategy and capital allocation. For example, since Mr. Otis became CEO in 2004, Darden has spent $6.1 billion – or $46.50 per current Darden share – on capital expenditures and acquisitions to fund revenue and EPS growth. Moreover, Darden also has a history of acquiring restaurant concepts at inflated prices and disposing of underperforming concepts at rock bottom prices. This includes acquiring Yard House for more than 20x EBITDA despite decelerating growth prospects, and selling Smokey Bones for just $80 million in 2007 after investing more than $400 million in capital since 2002, when Mr. Otis was named President of Smokey Bones.5

Both ISS and Glass Lewis also discussed the prolonged and troubling underperformance of the Company under current management and the Board as an important factor that calls into question the Company’s judgment in pursuing the Red Lobster Separation. Specifically, Glass Lewis stated:

5 Yard House transaction multiples based on the latest twelve month historical period, per CapitalIQ. Note that for Yard House, this is for calendar year 2011. At the time of the announcement, management claimed that the “pro forma” 2013 acquisition multiple, including tax benefits, would be approximately 12.5x, but it is not clear that Yard House ever achieved the results assumed in this projection. Smokey Bones figures per Company filings. Disclosed amount invested per store of $3.49m, $3.45m, and $3.66m for 2004, 2005, and 2006, respectively. Assumed $3.0m invested per store for stores opened from 2002-2003.

“[T]he Company has clearly underperformed its peers by a significant margin, in our opinion and makes a strong case for investors to question the board's and management's strategic judgment regarding a Red Lobster separation."

ISS expressed similar concerns, noting:

“This consent solicitation is not itself a referendum on the board’s stewardship of shareholdervalue. That record of stewardship, however, is part of the larger context shareholders shouldconsider, since it may suggest whether they should have more or less confidence in the board’sassessment of the competing strategic visions which engendered this consent solicitation.”

Given management and the Board’s poor track record, as well as the lack of any credible proof that the Red Lobster Separation will create value for shareholders, as evidenced by our critical dissection of Darden’s Investor Presentation and Glass Lewis and ISS’ similarly expressed concerns, it is highly disturbing to see the Board attempt to force through this highly questionable and irreversible plan without a shareholder vote and prior to the 2014 Annual Meeting.

Darden Has Shown a Disregard for Shareholder Concerns and a Propensity to Silence Critics

Management's recent shareholder-unfriendly Bylaw changes and poor track record when it comes to shareholder and analyst engagement cause us to doubt whether the Company is acting in the best interests of shareholders with regard to the Red Lobster Separation. Glass Lewis stated in its report that:

“Darden's portrayal of itself as a company that is strongly committed to shareholder engagement, that welcomes shareholder input and that values the views of shareholders rings somewhat hollow, to our ears, considering the Company's corporate governance policies and its track record of dealing with investors and analysts who have been critical of the Company.”

ISS expressed similar doubts regarding Darden's private engagement with shareholders, noting:

“[T]he private engagement process Darden advocates…inherently lacks transparency, results in answers whose credibility relies on the credibility of the very board whose judgment is being challenged, and may never reach a moment of denouement.”

Darden maintains numerous shareholder-unfriendly corporate governance provisions, as evidenced by ISS’ governance Quickscore of 10, indicating the highest possible governance risk. Darden’s extremely restrictive Bylaws prohibit, for example, shareholders ability to act by written consent and fill Board vacancies, and permit shareholders to remove directors only for cause and then only by the vote of 66 2/3% of the votes entitled to be cast in the election of directors generally. In addition, Darden requires at least 50% of the voting power for shareholders to call a special meeting, the highest threshold permitted under Florida law (default Florida provision requires only 10%). The Company also has a shareholder rights plan in place with an “acquiring person” threshold of 15% of the outstanding common stock of Darden.

In our view, Darden’s recent Bylaw amendments underscore the Company’s disregard for shareholder interests and call into question the Board’s motives. The amendments effectively give the Board discretion to unilaterally delay the annual meeting of shareholders, which is typically held in September, beyond October and provide for more stringent nomination notice and business proposal requirements. In addition, the amended Bylaws set Orange County, FL as the exclusive forum for shareholders to bring derivative suits and other claims and remove the ability of shareholders to fill existing vacancies at the next annual or special meeting. It appears that the Board has taken steps to further entrench itself. ISS expressed similar concerns regarding Darden’s problematic governance issues, including the recent Bylaw changes:

“On March 19, 2014 the company announced several changes to its bylaws which would‘update the bylaws to address current market practices.’ However, some of the bylaw changesappear to go beyond modernization, and—in the context of an extant challenge fromshareholders—call into question the board’s motivation….the nature of these particular changes, coupled with the last-minute cancelation of its formerly annual 2-day analyst conference in March, may suggest cause for concern to shareholders. At the very least, one has to wonder whythe board chose this particular time to ‘modernize’ the bylaws by granting itself powers to obstruct, or otherwise raising defenses against, shareholders who might wish to use the annual meeting to hold directors accountable. This is a particularly resonant question when the board is also arguing that a special meeting to request shareholders be allowed to ratify or reject a major strategic transaction is an ‘unsatisfactory’ approach.”

We also have serious concerns with Darden’s long history of silencing critics and trying to avoid an active dialogue on the key issues facing the Company. A recent CNBC article titled Darden Uses Lobster Claws On Critical Analysts chronicles tactics used by Darden to put a muzzle on analysts who provide critical analysis. The article discusses how analysts from leading sell-side research firms have had access limited to varying degrees following their publication of analysis that did not reflect positively on management, and notes that this practice has been going on for more than a decade and continues to this day. Further, the New York Post recently published an article titled Darden Accused of Icing out Critics of Red Lobster Spinoff, which states:

“[S]ome investors are protesting that Darden’s idea of ‘direct engagement’ amounts to returning the phone calls of analysts and investors who agree with its strategy while ignoring calls from dissenters. ‘They’ve got a history of only engaging with investors and analysts who are supportive of their views,’ said one Darden shareholder, who declined to give his name for fear of retribution from the company. ‘If the board is so convinced [a Red Lobster spinoff] is such a great idea, then put it to a vote.’”

Similarly, we believe Darden has avoided addressing shareholder concerns to-date regarding the Red Lobster Separation. In fact, Darden canceled its analyst and investor meeting, scheduled for March 28th, only to hold a private lunch for sell-side research analysts. The announcement that Darden would cancel the analyst day did not come until after management’s March 3rd conference call to discuss the Red Lobster Separation, in which management took questions from just four out of thirty publishing equity research analysts and declined to provide details on several important questions. In addition, on March 21st management shortened the Q3 2014 earnings call to 45 minutes and shut out critical analysts from asking questions. We are troubled by the management and the Board’s continued attempts to avoid open discussion on the most important and difficult issues facing the Company.

We Strongly Believe Shareholders Should Support the Shareholders’ Say on Red Lobster Proposal

Given the recent shareholder-unfriendly Bylaw amendments and Darden’s propensity to silence critics, coupled with management and the Board’s poor track record, we question the Company’s intentions with respect to the Red Lobster Separation. We further question their judgment in pursuing such a transaction despite such widespread concern. We firmly believe that your support of the Shareholders’ Say on Red Lobster Proposal is critical since the Red Lobster Separation is irreversible and may destroy substantial shareholder value, and, if left unchecked, Darden intends to complete the Red Lobster Separation prior to the 2014 Annual Meeting, when all of Darden’s directors are up for election. Although the Shareholders’ Say on Red Lobster Proposal is non-binding, we nevertheless believe your approval is critical for providing an opportunity for shareholders to voice their concerns on the Red Lobster Separation and if approved, are hopeful that Darden would not proceed with the transaction prior to the 2014 Annual Meeting without shareholder approval.

For the reasons written above, we strongly recommend that you vote “FOR” this proposal.

YOU ARE URGED TO VOTE “FOR” THIS PROPOSAL ON THE ENCLOSED WHITE PROXY CARD

VOTING AND PROXY PROCEDURES

Only shareholders of record on the Record Date will be entitled to notice of and to vote at the Special Meeting. Each Share is entitled to one vote. Shareholders who sell Shares before the Record Date (or acquire them without voting rights after the Record Date) may not vote such Shares. Shareholders of record on the Record Date will retain their voting rights in connection with the Special Meeting even if they sell their Shares after the Record Date. Based on publicly available information, we believe that the only outstanding class of securities of the Company entitled to vote at the Special Meeting is the Shares.

Shares represented by properly executed WHITE proxy cards will be voted at the Special Meeting as marked and, in the absence of specific instructions, will be voted FOR the Shareholders’ Say on Red Lobster Proposal and in the discretion of the persons named as proxies on all other matters as may properly come before the Special Meeting.

QUORUM; DISCRETIONARY VOTING

In order to constitute a quorum with respect to each matter to be presented at the Special Meeting, a majority of the outstanding Shares as of the Record Date must be present at the Special Meeting either in person or by proxy. If you vote, your Shares will be part of the quorum. Abstentions and broker non-votes will count as Shares that are present for the purpose of establishing a quorum, but will not be counted as votes cast either in favor of or against the Shareholders’ Say on Red Lobster Proposal. A “broker non-vote” is a proxy submitted by a bank, broker or other custodian that does not indicate a vote for the proposal because the broker does not have or does not exercise discretionary voting authority on certain types of proposals and has not received instructions from its client as to how to vote.

There are no “routine” matters for purposes of the Special Meeting. Brokers cannot vote on their customers’ behalf on “non-routine” proposals. If you hold your Shares in street name and do not provide voting instructions to your bank, broker, or other custodian, your Shares will not be voted on the Shareholders’ Say on Red Lobster Proposal, which your broker does not have discretionary authority to vote on. A broker non-vote on the Shareholders’ Say on Red Lobster Proposal presented at the Special Meeting will have no effect on the outcome of the Shareholders’ Say on Red Lobster Proposal.

VOTE REQUIRED

Shareholders’ Say on Red Lobster Proposal. Although the vote is non-binding, assuming that a quorum is present, the advisory vote on the Shareholders’ Say on Red Lobster Proposal will be approved if the holders of a majority of the shares having voting power present in person or represented by proxy at the Special Meeting vote in favor of approval of the resolution. Abstentions and broker non-votes will count as Shares that are present for the purpose of establishing a quorum, but will not be counted as votes cast either in favor of or against the Shareholders’ Say on Red Lobster Proposal.

REVOCATION OF PROXIES

Shareholders of the Company may revoke their proxies at any time prior to exercise by attending the Special Meeting and voting in person (although attendance at the Special Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to Starboard in care of Okapi Partners LLC at the address set forth on the back cover of this Proxy Statement or to Darden at 1000 Darden Center Drive, Orlando, Florida 32837, Attention: Corporate Secretary, or any other address provided by Darden. Although a revocation is effective if delivered to Darden, Starboard requests that either the original or photostatic copies of all revocations be mailed to Starboard in care of Okapi Partners LLC at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding Shares. Additionally, Okapi Partners LLC may use this information to contact shareholders who have revoked their proxies in order to solicit later dated proxies for the approval of the Shareholders’ Say on Red Lobster Proposal.

IF YOU WISH TO VOTE FOR THE SHAREHOLDERS’ SAY ON RED LOBSTER PROPOSAL, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED WHITE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by Starboard. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements.

Starboard has entered into an agreement with Okapi Partners LLC (“Okapi Partners”) for solicitation and advisory services in connection with this solicitation, for which Okapi Partners will receive a fee not to exceed $[_______], together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Okapi Partners will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Okapi Partners has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the Shares they hold of record. Okapi Partners will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that Okapi Partners will employ approximately [___] persons to solicit Darden for the Special Meeting.

The entire expense of soliciting proxies is being borne by Starboard. Costs of this solicitation of proxies are currently estimated to be approximately $[_______]. Starboard estimates that through the date hereof, its expenses in connection with this solicitation are approximately $[_______]. Starboard intends to seek reimbursement from the Company of all expenses it incurs in connection with the solicitation of proxies. Starboard does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

OTHER PARTICIPANT INFORMATION

The participants in this solicitation are Starboard V&O Fund, Starboard S LLC, Starboard C LP, Delta LLC, Leaders Fund, Starboard Value LP, Starboard Value GP, Principal Co, Principal GP, Starboard A LP, Starboard A GP, Starboard R LP, Starboard R GP, Jeffrey C. Smith, Mark R. Mitchell, Peter A. Feld, Bradley D. Blum, Charles M. Sonsteby, Robert Mock and Craig S. Miller.

The principal business of Starboard V&O Fund, a Cayman Islands exempted company, is serving as a private investment fund. Starboard V&O Fund has been formed for the purpose of making equity investments and, on occasion, taking an active role in the management of portfolio companies in order to enhance shareholder value. Each of Starboard S LLC, a Delaware limited liability company, Starboard C LP, a Delaware limited partnership, and Delta LLC, a Delaware limited liability company, has been formed for the purpose of investing in securities and engaging in all related activities and transactions. The principal business of Leaders Fund, a Delaware limited partnership, is serving as a private investment partnership. Starboard Value LP, a Delaware limited partnership, provides investment advisory and management services and acts as the investment manager of Starboard V&O Fund, Starboard C LP, Delta LLC, Leaders Fund and of certain managed accounts (the “Starboard Value LP Accounts”) and as the manager of Starboard S LLC. The principal business of Starboard Value GP, a Delaware limited liability company, is providing a full range of investment advisory, pension advisory and management services and serving as the general partner of Starboard Value LP. The principal business of Principal Co, a Delaware limited partnership, is providing investment advisory and management services. Principal Co is a member of Starboard Value GP. Principal GP, a Delaware limited liability company, serves as the general partner of Principal Co. Starboard A LP, a Delaware limited partnership, serves as the general partner of Leaders Fund and the managing member of Delta LLC. Starboard A GP, a Delaware limited liability company, serves as the general partner of Starboard A LP. Starboard R LP, a Delaware limited partnership, serves as the general partner of Starboard C LP. Starboard R GP, a Delaware limited liability company, serves as the general partner of Starboard R LP. Messrs. Smith, Mitchell and Feld serve as members of Principal GP and the members of each of the Management Committee of Starboard Value GP and the Management Committee of Principal GP. The principal occupation of Mr. Blum is serving as a restaurateur and the owner of BLUM Enterprises, LLC, a progressive restaurant company focused on creating and operating new restaurant brands. Among other restaurant industry roles, Mr. Blum formerly served as President of Olive Garden and as CEO of Burger King. The principal occupation of Mr. Sonsteby is serving as the Chief Financial Officer and Chief Administrative Officer of each of The Michaels Companies, Inc. and Michaels Stores, Inc. Mr. Sonsteby formerly served as Chief Financial Officer and Executive Vice President of Brinker International, Inc. The principal occupation of Mr. Mock is serving as a restaurant consultant. Among other restaurant industry roles, Mr. Mock formerly served as Executive Vice President Operations of Olive Garden and Chief Operating Officer of Romano’s Macaroni Grill. The principal occupation of Mr. Miller is serving as Chairman and Vice President of Miller Partners Restaurant Solutions Inc. and Managing Member of Miller Sinton Capital Partners LLC. Among other restaurant industry roles, Mr. Miller formerly served as President, Chief Executive Officer and Chairman of Ruth’s Chris Steak House Inc., Executive Vice President, Chief Operating Officer, President and Chief Executive Officer of Uno Restaurant Corporation and various positions at General Mills Restaurants. Messrs. Smith, Mitchell, Feld, Blum, Sonsteby, Mock and Miller are citizens of the United States.

The address of the principal office of each of Starboard S LLC, Starboard C LP, Delta LLC, Leaders Fund, Starboard Value LP, Starboard Value GP, Principal Co, Principal GP, Starboard A LP, Starboard A GP, Starboard R LP, Starboard R GP and Messrs. Smith, Mitchell and Feld is 830 Third Avenue, 3rd Floor, New York, New York 10022. The address of the principal office of Starboard V&O Fund is 89 Nexus Way, Camana Bay, PO Box 31106, Grand Cayman KY1-1205, Cayman Islands. The principal business address of Mr. Blum is c/o BLUM Enterprises, LLC, 126 Park Avenue South, Suite A, Winter Park, Florida 32789. The principal business address of Mr. Sonsteby is c/o Michaels Stores, Inc., 8000 Bent Branch Drive, Irving Texas 75063. The principal business address of Mr. Mock is 606 Crestwood Lane, Holmes Beach, Florida 34217. The principal business address of Mr. Miller is 2305 Edgewater Dr. #1212, Orlando, Florida 32804.

As of the date hereof, Starboard V&O Fund directly owns 1,161,790 shares of Common Stock. As of the date hereof, Starboard S LLC directly owns 281,286 shares of Common Stock. As of the date hereof, Starboard C LP directly owns 172,625 shares of Common Stock. Starboard R LP, as the general partner of Starboard C LP, may be deemed the beneficial owner of the 172,625 shares owned by Starboard C LP. Starboard R GP, as the general partner of Starboard R LP, may be deemed the beneficial owner of the 172,625 shares owned by Starboard C LP. As of the date hereof, Delta LLC directly owns 1,272,025 shares of Common Stock. Leaders Fund, as a member of Delta LLC, may be deemed the beneficial owner of the 1,272,025 shares owned by Delta LLC. Starboard A LP, as the general partner of Leaders Fund and the managing member of Delta LLC, may be deemed the beneficial owner of the 1,272,025 shares owned by Delta LLC. Starboard A GP, as the general partner of Starboard A LP, may be deemed the beneficial owner of the 1,272,025 shares owned by Delta LLC. As of the date hereof, Starboard Value LP beneficially owns 7,250,000 shares of Common Stock, consisting of shares of Common Stock owned directly by Starboard V&O Fund, Starboard S LLC, Starboard C LP and Delta LLC, and 4,362,274 shares of Common Stock held in the Starboard Value LP Accounts. Each of Starboard Value GP, as the general partner of Starboard Value LP, Principal Co, as a member of Starboard Value GP, Principal GP, as the general partner of Principal Co, and Messrs. Smith, Feld and Mitchell, each as a member of Principal GP and as a member of the Management Committee of Starboard Value GP and the Management Committee of Principal GP, may be deemed to be the beneficial owner of the aggregate of 7,250,000 shares of Common Stock owned directly by Starboard V&O Fund, Starboard S LLC, Starboard C LP, Delta LLC and held in the Starboard Value LP Accounts. As of the date hereof, Mr. Blum directly owns 1,000 shares of Common Stock. As of the date hereof, Mr. Sonsteby directly owns 1,500 shares of Common Stock. As of the date hereof, Mr. Mock directly owns 1,318 shares of Common Stock. As of the date hereof, Mr. Miller directly owns 1,000 shares of Common Stock.

Each participant in this solicitation, as a member of a “group” with the other participants for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), may be deemed to beneficially own the 7,254,818 shares of Common Stock owned in the aggregate by all of the participants in this solicitation. Each participant in this solicitation specifically disclaims beneficial ownership of the shares of Common Stock he or it does not directly own. For information regarding purchases and sales of securities of the Company during the past two years by the participants in this solicitation, see Schedule I.

The shares of Common Stock purchased by each of Starboard V&O Fund, Starboard S LLC, Starboard C LP, Delta LLC and through the Starboard Value LP Accounts were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business). The shares of Common Stock purchased by each of Messrs. Blum, Sonsteby, Mock and Miller were purchased in the open market with personal funds.

On February 19, 2014, Starboard Value LP entered into an advisor agreement (the “Advisor Agreement”) with Mr. Blum in view of Mr. Blum’s unique skill set, broad restaurant industry experience and extensive restaurant industry knowledge. Pursuant to the Advisor Agreement and in consideration for the performance of certain consulting and advisory services by Mr. Blum, Starboard Value LP agreed to pay Mr. Blum an upfront fee equal to $50,000 in cash. Mr. Blum agreed to use the after-tax proceeds from such compensation, or an equivalent amount of other funds, to acquire securities of the Company, no later than ten (10) business days after receipt of such compensation, except in certain limited circumstances.

On February 24, 2014, Starboard V&O Fund, Starboard S LLC, Starboard C LP, Delta LLC, Leaders Fund, Starboard Value LP, Starboard Value GP, Principal Co, Principal GP, Starboard A LP, Starboard A GP, Starboard R LP, Starboard R GP and Messrs. Smith, Mitchell, Feld and Blum entered into a Joint Filing and Solicitation Agreement in which, among other things, (a) they agreed to solicit proxies or written consents to (i) request that Darden call a special meeting of shareholders to approve the Proposals and (ii) approve the Proposals at any special meeting called for such purpose, and (b) Starboard V&O Fund, Starboard S LLC, Starboard C LP and Delta LLC agreed to bear all expenses incurred in connection with the activities of the joint filing participants, subject to certain limitations (the “Joint Filing and Solicitation Agreement”).

On February 28, 2014, Starboard Value LP entered into an advisor agreement (the “Advisor Agreement”) with Mr. Sonsteby in view of Mr. Sonsteby’s unique skill set, broad restaurant industry experience and extensive restaurant industry knowledge. Pursuant to the Advisor Agreement and in consideration for the performance of certain consulting and advisory services by Mr. Sonsteby, Starboard Value LP agreed to pay Mr. Sonsteby an upfront fee equal to $50,000 in cash. Mr. Sonsteby agreed to use the after-tax proceeds from such compensation, or an equivalent amount of other funds, to acquire securities of the Company, no later than ten (10) business days after receipt of such compensation, except in certain limited circumstances.

On March 4, 2014, Mr. Sonsteby entered into a Joinder Agreement to the Joint Filing Solicitation Agreement, pursuant to which he agreed to be bound by the terms and conditions set forth therein, including, among other things, the joint filing on behalf of each of the participants of statements on Schedule 13D, and any amendments thereto, with respect to the securities of the Company.

On March 9, 2014, Starboard Value LP entered into an advisor agreement (the “Advisor Agreement”) with Mr. Mock in view of Mr. Mock’s unique skill set, broad restaurant industry experience and extensive restaurant industry knowledge. Pursuant to the Advisor Agreement and in consideration for the performance of certain consulting and advisory services by Mr. Mock, Starboard Value LP agreed to pay Mr. Mock an upfront fee equal to $50,000 in cash. Mr. Mock agreed to use the after-tax proceeds from such compensation, or an equivalent amount of other funds, to acquire securities of the Company, no later than ten (10) business days after receipt of such compensation, except in certain limited circumstances.

On March 10, 2014, Mr. Mock entered into a Joinder Agreement to the Joint Filing Solicitation Agreement, pursuant to which he agreed to be bound by the terms and conditions set forth therein, including, among other things, the joint filing on behalf of each of the participants of statements on Schedule 13D, and any amendments thereto, with respect to the securities of the Company.

On March 13, 2014, Starboard Value LP entered into an advisor agreement (the “Advisor Agreement”) with Mr. Miller in view of Mr. Miller’s unique skill set, broad restaurant industry experience and extensive restaurant industry knowledge. Pursuant to the Advisor Agreement and in consideration for the performance of certain consulting and advisory services by Mr. Miller, Starboard Value LP agreed to pay Mr. Miller an upfront fee equal to $50,000 in cash. Mr. Miller agreed to use the after-tax proceeds from such compensation, or an equivalent amount of other funds, to acquire securities of the Company, no later than ten (10) business days after receipt of such compensation, except in certain limited circumstances.

On March 14, 2014, Mr. Miller entered into a Joinder Agreement to the Joint Filing Solicitation Agreement, pursuant to which he agreed to be bound by the terms and conditions set forth therein, including, among other things, the joint filing on behalf of each of the participants of statements on Schedule 13D, and any amendments thereto, with respect to the securities of the Company.

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the special meeting; (xii) no participant in this solicitation holds any positions or offices with the Company; (xiii) no participant in this solicitation has a family relationship with any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer; and (xiv) no corporations or organizations, with which any participant in this solicitation has been employed in the past five years, is a parent, subsidiary or other affiliate of the Company. There are no material proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

There are no material proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

OTHER MATTERS AND ADDITIONAL INFORMATION

Starboard is unaware of any other matters to be considered at the Special Meeting. However, should other matters, which Starboard is not aware of a reasonable time before this solicitation, be brought before the Special Meeting, the persons named as proxies on the enclosed WHITE proxy card will vote on such matters in their discretion.

SHAREHOLDER PROPOSALS

According to the Company’s proxy statement for the Special Meeting, any shareholder wishing to submit a proposal to be included in the Company’s proxy statement for the 2014 Annual Meeting pursuant to Rule 14a-8, must deliver such proposal(s) to Darden’s principal office on or before [_____]. Shareholder proposals should be mailed to the Corporate Secretary, Darden Restaurants, Inc., 1000 Darden Center Drive, Orlando, Florida 32837.