SOLICITATION STATEMENT

TO REQUEST A SPECIAL MEETING OF SHAREHOLDERS

BY

STARBOARD VALUE LP |

IMPORTANT

STARBOARD VALUE LP IS ONE OF THE LARGEST SHAREHOLDERS OF DARDEN RESTAURANTS, INC. (“DARDEN” OR THE “COMPANY”). WE BELIEVE SHAREHOLDERS DESERVE TO HAVE A FORUM FOR EXPRESSING THEIR VIEWS ON THE COMPANY’S PROPOSED SEPARATION OF RED LOBSTER. WE ARE THEREFORE SEEKING YOUR SUPPORT TO CALL A SPECIAL MEETING OF THE COMPANY’S SHAREHOLDERS TO DISCUSS THIS EXTREMELY IMPORTANT ISSUE. WE ARE CONCERNED THAT THE PROPOSED RED LOBSTER SEPARATION MAY DESTROY SUBSTANTIAL SHAREHOLDER VALUE AND, WITHOUT A MEETING, SUCH SEPARATION MAY BE COMPLETED WITHOUT SHAREHOLDER SUPPORT. IT IS IMPORTANT TO NOTE THAT WHILE THE RESOLUTION FOR WHICH WE WOULD SEEK SHAREHOLDER APPROVAL AT THE SPECIAL MEETING, IF IT IS CALLED, IS NON-BINDING IN NATURE, WE NEVERTHELESS BELIEVE THE SPECIAL MEETING IS CRITICAL FOR PROVIDING AN OPPORTUNITY FOR SHAREHOLDERS TO VOICE THEIR CONCERNS ON THE PROPOSED RED LOBSTER SEPARATION BEFORE IT IS TOO LATE.

AT THIS TIME, WE ARE ONLY SOLICITING YOUR WRITTEN REQUEST TO CALL A SPECIAL MEETING OF SHAREHOLDERS. AS DESCRIBED MORE FULLY BELOW, IN ORDER TO CALL A SPECIAL MEETING, WE ARE REQUIRED TO DELIVER WRITTEN REQUESTS FROM THE HOLDERS OF AT LEAST FIFTY PERCENT (50%) OF THE COMPANY’S OUTSTANDING SHARES, INCLUDING OUR OWN. ONCE THE SPECIAL MEETING HAS BEEN CALLED, WE WILL THEN SEND YOU PROXY MATERIALS URGING YOU TO VOTE IN FAVOR OF THE PROPOSAL DESCRIBED BELOW.

PLEASE JOIN US IN REQUESTING THAT DARDEN CALL A SPECIAL MEETING AND SHOW ITS BOARD OF DIRECTORS (THE “BOARD”) THAT SHAREHOLDERS WANT TO HAVE THEIR VOICES HEARD BEFORE A RED LOBSTER SEPARATION TRANSACTION IS COMPLETED.

Why You Were Sent This Solicitation Statement

Starboard Value LP (“Starboard”) and the other participants in this solicitation (collectively, “Starboard,” “our,” or “we”) are the beneficial owners of an aggregate of 7,253,073 shares of common stock, no par value per share (the “Common Stock”), of Darden Restaurants, Inc. (“Darden” or the “Company”), representing approximately 5.5% of the Company’s outstanding shares and making us one of the Company’s largest shareholders since the filing of our initial Schedule 13D with the SEC on December 23, 2013.

On December 19, 2013, the Company announced a proposed separation of the Company’s Red Lobster business through an expected spin-off. The Company stated in its December 19, 2013 press release that the contemplated Red Lobster separation will not require shareholder approval and that it expects to close the separation transaction in early fiscal 2015, which begins May 26, 2014. It therefore appears that the Company intends to complete the Red Lobster separation several months before the Company’s 2014 Annual Meeting of Shareholders (the “2014 Annual Meeting”), which is not expected to be held until September. We are seeking to call the special meeting to give shareholders a platform for potentially influencing management and the Board with regard to this material transaction. It is important to note that the resolution for which we would seek shareholder approval at the special meeting, if it is called, is non-binding in nature and that neither the calling of the special meeting, itself, nor the approval of the non-binding proposal by shareholders at the special meeting would prohibit the Company from proceeding to complete the proposed Red Lobster separation. Nevertheless, we believe the special meeting is critical for providing an opportunity for shareholders to express their views on the proposed Red Lobster separation before it is too late.

Since December 19, 2013, both Starboard and at least one other shareholder have expressed serious concerns with the Company’s proposed separation of Red Lobster, whether through a spin-out or sale. Starboard does not believe that a Red Lobster separation, as currently contemplated, is in the best interests of the Company’s shareholders. Specifically, Starboard is primarily concerned that if the Company completes a spin-off or sale of Red Lobster without first fully and objectively evaluating all opportunities for the Company’s owned real estate, then substantial shareholder value could be destroyed.

Starboard believes that the Company should undertake a comprehensive review of all available operational, financial, and strategic alternatives to create value for shareholders before hastening to complete a Red Lobster separation that may destroy substantial value. Such a comprehensive review should include, among other things, an evaluation of all options for the Company’s real estate holdings, including a tax-efficient sale or REIT spin-off of the Company’s owned properties. Only then does Starboard believe that the Company can properly assess the value of the Red Lobster business, both with and without the real estate assets included, in order to ensure that the price received in any sale transaction, after taxes and transaction costs, fully and fairly reflects the value of both the Red Lobster operating business and the real estate business, to the extent included as part of any such transaction.

Unfortunately, to date, despite the serious concerns voiced by its shareholders regarding the proposed Red Lobster separation, the Company appears unwavering in its commitment to the proposed separation. Further, the Company appears intent on expeditiously pursuing this separation.

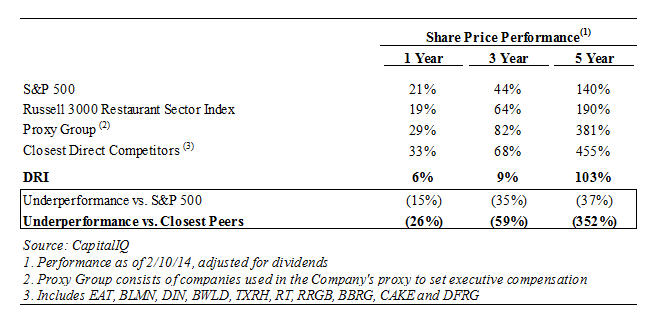

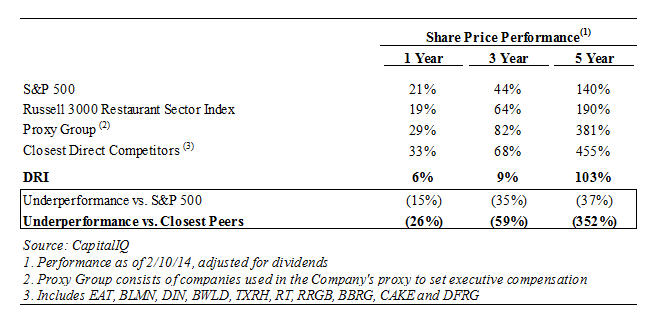

Darden’s long-term performance under the leadership of this management team and Board has been unacceptable. As just one example, Selling, General, and Administrative (“SG&A”) expenses now stand at approximately 10% of sales, or 60 basis points worse than in fiscal year 2012, prior to the acquisition of Yard House, and the highest percentage since at least fiscal year 2001. In that time, Darden has acquired four new concepts – LongHorn Steakhouse, Capital Grille, Eddie V’s and Yard House – and has more than doubled revenue, but has failed to realize any of the expected cost synergies or to see any SG&A leverage. As a result, Darden’s consolidated margins, when adjusted for the Company’s substantial real estate ownership, are now well below peers despite having among the highest average unit volumes and the greatest scale in the casual dining space. Even more concerning, Darden’s stock price performance has been unacceptable, with Darden underperforming its peer group by more than 300% over the last five years, as evidenced by the chart below.

Separate and apart from the attempt to call the special meeting, Starboard has expressed its desire to engage with the Company regarding Board composition and believes that immediate changes in Board composition are required at the Company. Starboard intends to closely monitor all developments at the Company over the coming months, and may seek to elect an alternative slate of director candidates at the Company’s 2014 Annual Meeting.

Given what we believe to be management and the Board's track record of poor performance and poor decision-making, together with our concerns regarding the proposed Red Lobster separation, we believe it is critical for shareholders in this case to have the right to review and approve any transaction involving Red Lobster that takes place prior to the 2014 Annual Meeting, at which time shareholders will have an opportunity to elect directors whom they believe represent their best interests. While we understand that neither (i) the calling of the special meeting nor (ii) the approval of the non-binding resolution by shareholders at the special meeting would prohibit the Board from proceeding with the Red Lobster separation, we nevertheless believe shareholders deserve to have their voices heard on this very important issue.

Darden typically holds its annual meeting of shareholders in September. Since the Company currently intends to complete the Red Lobster separation prior to holding the 2014 Annual Meeting, at which time the Company’s directors will be up for election, shareholders will not have an opportunity to have their voices heard on the Red Lobster separation, as a referendum or otherwise. Starboard strongly believes it is imperative for the Board to have a clear picture of the lack of support among its shareholder base for this potentially destructive separation of Red Lobster and that shareholders deserve to have a forum for expressing their views on the proposed separation. If a majority of the Company’s unaffiliated shareholders are indeed against the proposed Red Lobster separation, we believe it would be incumbent upon the Board to immediately delay any pending separation transaction involving Red Lobster and conduct a full evaluation of all value-creation opportunities for the Company and its businesses.

Accordingly, we are hereby asking you to help us request that the management of Darden call a special meeting of shareholders of the Company for the following purposes:

| | (i) | to approve a non-binding resolution urging the Board not to approve any agreement or proposed transaction involving a separation or spin-off of the Company’s Red Lobster business prior to the 2014 Annual Meeting unless such agreement or transaction would require shareholder approval; and |

| | (ii) | to transact such other business as may properly come before the special meeting (items (i) and (ii) above are collectively referred to as the “Proposals”). |

This Solicitation Statement and the accompanying WHITE request card are being furnished to holders of the Common Stock.

At this time, Starboard is only soliciting your written request to call the special meeting. Starboard is not currently seeking your proxy, consent, authorization or agent designation for approval of the Proposals or any other actions. In the event the special meeting is called, Starboard will send you proxy materials relating to the Proposals to be voted upon at the special meeting.

Section 607.0702 of the Florida Business Corporations Act (the “FBCA”) provides that a special meeting of shareholders shall be called upon delivery to the corporation’s secretary of one or more written demands for the meeting, describing the purpose or purposes for which it is to be held, by the holders of not less than ten percent (10%) of all the votes entitled to be cast on any issue proposed to be considered at the proposed special meeting, unless a greater percentage not to exceed fifty percent (50%) is required by such corporation’s articles of incorporation. Article XI of Darden’s Articles of Incorporation, as amended (the “Charter”), provides that a special meeting of the Company’s shareholders shall be called by the holders of not less than fifty percent (50%) of all the votes entitled to be cast on any issue proposed to be considered at the special meeting, if such holders sign, date and deliver to the Company’s secretary, one or more written requests for the special meeting describing the purpose(s) for which it is to be held.

As of the close of business on March 10, 2014, Starboard collectively beneficially owned, and had the right to vote, 7,253,073 shares of the Common Stock, representing approximately 5.5% of the outstanding Common Stock of the Company.

Pursuant to Section 607.0707 of the FBCA, the record date for determining the shareholders entitled to demand a special meeting shall be the first date on which a signed written request is delivered to the Company. Starboard anticipates delivering a signed written request to the Company’s principal place of business on [_______], 2014 (the “Record Date”). In order for our request to call a special meeting to be effective, the Company must receive properly completed and unrevoked written requests signed by a sufficient number of shareholders within seventy (70) days of the Record Date. Consequently, it is anticipated that by [_______], 2014, Starboard will need to deliver properly completed and unrevoked written requests to call the special meeting from holders of at least fifty percent (50%) of the shares of Common Stock outstanding as of the close of business on the Record Date. Nevertheless, we intend to set [_______], 2014 as the goal for submission of such written requests.

This Solicitation Statement and the accompanying WHITE request card are first being mailed to shareholders on or about [_________], 2014. Requests to call a special meeting should be delivered as promptly as possible, by mail (using the enclosed envelope), to Starboard’s solicitation agent, Okapi Partners LLC, as set forth below.

AT THIS TIME, STARBOARD IS ONLY SEEKING YOUR WRITTEN REQUEST TO CALL THE SPECIAL MEETING. IN THE EVENT THE SPECIAL MEETING IS CALLED, YOU WILL THEN BE ASKED TO VOTE ON THE PROPOSALS.

THIS SOLICITATION IS BEING MADE BY STARBOARD AND NOT ON BEHALF OF THE COMPANY’S BOARD. AT THIS TIME, STARBOARD IS NOT CURRENTLY SEEKING YOUR PROXY, CONSENT, AUTHORIZATION OR AGENT DESIGNATION FOR APPROVAL OF THE PROPOSALS. STARBOARD IS ONLY SOLICITING YOUR WRITTEN REQUEST TO CALL THE SPECIAL MEETING. AFTER THE SPECIAL MEETING HAS BEEN CALLED, STARBOARD WILL SEND YOU PROXY MATERIALS URGING YOU TO VOTE IN FAVOR OF THE PROPOSALS. YOUR WRITTEN REQUEST IS IMPORTANT, NO MATTER HOW MANY OR HOW FEW SHARES YOU OWN. STARBOARD URGES YOU TO SIGN, DATE AND RETURN THE ENCLOSED WHITE REQUEST CARD TO CALL A SPECIAL MEETING AS PROMPTLY AS POSSIBLE.

WE URGE YOU NOT TO SIGN ANY REVOCATION OF CONSENT CARD THAT MAY BE SENT TO YOU BY THE COMPANY. IF YOU HAVE DONE SO, YOU MAY REVOKE THAT REVOCATION OF CONSENT BY DELIVERING A LATER DATED WHITE REQUEST CARD TO STARBOARD, IN CARE OF OKAPI PARTNERS LLC, WHICH IS ASSISTING US IN THIS SOLICITATION, AT THEIR ADDRESS LISTED ON THE FOLLOWING PAGE, OR TO THE PRINCIPAL EXECUTIVE OFFICES OF THE COMPANY.

IMPORTANT

IF YOUR SHARES OF COMMON STOCK ARE REGISTERED IN YOUR OWN NAME, PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE REQUEST CARD TO OKAPI PARTNERS LLC IN THE POSTAGE-PAID ENVELOPE PROVIDED.

IF YOUR SHARES OF COMMON STOCK ARE HELD IN THE NAME OF A BROKERAGE FIRM, BANK, BANK NOMINEE OR OTHER INSTITUTION, ONLY IT CAN SIGN A WRITTEN REQUEST WITH RESPECT TO YOUR SHARES AND ONLY UPON RECEIPT OF SPECIFIC INSTRUCTIONS FROM YOU. ACCORDINGLY, YOU SHOULD CONTACT THE PERSON RESPONSIBLE FOR YOUR ACCOUNT AND GIVE INSTRUCTIONS FOR A WRITTEN REQUEST TO BE SIGNED REPRESENTING YOUR SHARES OF COMMON STOCK. STARBOARD URGES YOU TO CONFIRM IN WRITING YOUR INSTRUCTIONS TO THE PERSON RESPONSIBLE FOR YOUR ACCOUNT AND TO PROVIDE A COPY OF SUCH INSTRUCTIONS TO STARBOARD IN CARE OF OKAPI PARTNERS LLC TO THE ADDRESS BELOW, SO THAT STARBOARD WILL BE AWARE OF ALL INSTRUCTIONS GIVEN AND CAN ATTEMPT TO ENSURE THAT SUCH INSTRUCTIONS ARE FOLLOWED.

IF YOU HAVE ANY QUESTIONS ABOUT EXECUTING OR DELIVERING YOUR WHITE REQUEST CARD OR REQUIRE ASSISTANCE, PLEASE CONTACT:

OKAPI PARTNERS LLC 437 Madison Avenue, 28th Floor New York, N.Y. 10022 (212) 297-0720 Stockholders Call Toll-Free at: (877) 285-5990 E-mail: info@okapipartners.com |

WHILE NEITHER CALLING THE SPECIAL MEETING NOR THE APPROVAL BY SHAREHOLDERS OF THE NON-BINDING RESOLUTION AT THE SPECIAL MEETING WOULD PROHIBIT THE COMPANY FROM PROCEEDING WITH THE RED LOBSTER SEPARATION, WE BELIEVE SHAREHOLDERS SHOULD HAVE A FORUM FOR EXPRESSING THEIR VIEWS ON THIS EXTREMELY IMPORTANT ISSUE. STARBOARD IS THEREFORE SEEKING YOUR SUPPORT TO CALL A SPECIAL MEETING TO DISCUSS THE PROPSOED RED LOBSTER SEPARATION BEFORE IT IS FORCED THROUGH WITHOUT SHAREHOLDER SUPPORT. ONLY AFTER THE SPECIAL MEETING IS CALLED, WILL SHAREHOLDERS BE ASKED TO VOTE ON THE NON-BINDING PROPOSAL. IF SHAREHOLDERS APPROVE THE NON-BINDING RESOLUTION AT THE SPECIAL MEETING, WE BELIEVE IT WOULD SEND A STRONG MESSAGE TO THE BOARD AND WE WOULD HOPE THE COMPANY WOULD DELAY ANY PENDING SEPARATION TRANSACTION INVOLVING RED LOBSTER AND CONDUCT A FULL EVALUATION OF ALL VALUE-CREATION OPPORTUNITIES FOR THE COMPANY AND ITS BUSINESSES. SHOULD THE BOARD REFUSE TO IMPLEMENT THE NON-BIDING RESOLUTION IF APPROVED BY SHAREHOLDERS AT THE SPECIAL MEETING, WE ARE PREPARED TO TAKE ALL STEPS NECESSARY TO HOLD THE BOARD ACCOUNTABLE FOR ITS ACTIONS, INCLUDING NOMINATING A MAJORITY SLATE OF DIRECTOR CANDIDATES AND SEEKING THE SUPPORT OF OUR FELLOW SHAREHOLDERS TO REPLACE A MAJORITY OF THE BOARD AT THE 2014 ANNUAL MEETING.

WE HOPE THIS WILL PROVE UNNECESSARY. WE REMAIN HOPEFUL THAT THE BOARD WILL TAKE A STEP BACK, LISTEN TO THE SHAREHOLDERS, AND ULTIMATELY DO WHAT IS RIGHT.

We are seeking your support to request that the Company call a special meeting of shareholders, in accordance with the applicable provisions of the Charter, Bylaws and FBCA. If we are successful in our solicitation of written requests, and the special meeting of shareholders is called and held, Starboard expects to present, at the special meeting, a proposal to approve a non-binding resolution urging the Board not to approve any agreement or proposed transaction involving a separation or spin-off of the Company’s Red Lobster business prior to the 2014 Annual Meeting unless such agreement or transaction would require shareholder approval.

PAST CONTACTS

The following is a chronology of events leading up to the current solicitation:

| | · | On December 19, 2013, Darden issued a press release announcing, among other things, that the Board has approved a proposed separation of the Company’s Red Lobster business through a spin-off or sale transaction. In the press release, the Company stated that it expects the form of such separation for Red Lobster to be a spin-off. |

| | · | On December 23, 2013, Starboard filed a Schedule 13D with the SEC (the “Schedule 13D”) disclosing a 5.6% interest in Darden. In the Schedule 13D, Starboard stated that it invested in the Company based on Starboard’s belief that Darden is deeply undervalued and represents an attractive investment opportunity and that opportunities exist within the control of management and the Board to take actions that would create significant value for the benefit of all shareholders. Starboard further stated that it had conducted extensive research on Darden and had reviewed the proposed separation of Red Lobster as well as the second quarter financial results and believed that the plan outlined by management falls significantly short of the actions required to maximize shareholder value and that it is disappointed with the continued poor financial performance of the Company. Starboard also expressed its belief in the Schedule 13D that there is a significant opportunity to dramatically improve Darden’s operating performance, as well as opportunities to realize substantial value from the Company’s real estate holdings and to explore other strategic options available to Darden to maximize shareholder value, including alternative business sale or separation transactions. |

| | · | On January 8, 2013, representatives of Starboard had a discussion with certain members of management to gain a better understanding of Darden as well as the proposed separation of Red Lobster . |

| | · | Over the following week, representatives of Starboard worked with Matthew Stroud, Darden’s Vice President of Investor Relations, to schedule a meeting with management at the Company’s headquarters in Orlando, FL. The meeting was scheduled for January 29, 2014. |

| | · | On January 21, 2014, Starboard delivered a letter to the Company’s Chairman and CEO, Clarence Otis, and the Board expressing its serious concerns with the proposed separation of Red Lobster . |

| | · | On January 29, 2014, representatives of Starboard met with certain members of management at the Company’s headquarters in Orlando, FL to discuss the proposed separation of Red Lobster and the operations of the Company. |

| | · | On February 10, 2014, Starboard delivered a letter to the Company’s Chairman and CEO, Clarence Otis, and the Board reiterating its belief that the Company’s current plan to spin-out or sell Red Lobster is not in the best interests of shareholders. |

| | · | On February 24, 2014, Starboard delivered an open letter to Darden’s shareholders informing them that it has filed a preliminary solicitation statement seeking to call a special meeting of Darden’s shareholders to provide shareholders with a democratic forum for expressing their views on the proposed separation of Red Lobster. |

| | · | On March 3, 2014, the Company issued a press release announcing the Company’s conference call to investors and the investor presentation titled “Strategic Action Plan to Enhance Shareholder Value — Spring 2014” prepared by the Company for use during the conference call, which states, among other things, that Darden remains on track to execute its previously announced plan to separate the Red Lobster business through either a spin-off or a sale of the Red Lobster business and that the sale process is well underway. |

THE SPECIAL MEETING

Shareholders deserve a forum to discuss the potentially value destructive separation of Red Lobster. At this time, Starboard is only soliciting your request to call the special meeting to discuss the proposed separation. Starboard is not currently seeking your proxy, consent, authorization or agent designation for approval of the Proposals or any other actions. In the event the special meeting is called, Starboard will send you proxy materials relating to the Proposals to be voted upon at the special meeting. While we understand that the Proposals, if approved, will not prohibit the Company from proceeding with the separation of Red Lobster, we believe shareholders deserve to have their voices heard on this very important issue and that it is imperative for the Board to have a clear picture of the level of support among its shareholder base for the proposed separation of Red Lobster.

Starboard is soliciting written requests to have the Company call a special meeting of shareholders pursuant to the Charter and FBCA. Starboard is furnishing this Solicitation Statement and the WHITE request card to enable you and the Company’s other shareholders to support us in requesting the special meeting be called and held. For the special meeting to be properly requested in accordance with the Charter and FBCA, written requests in favor of calling the special meeting must be executed by the holders of not less than fifty percent (50%) of all votes entitled to be cast on any issue contemplated to be considered at the proposed special meeting.

According to the Company’s Quarterly Report on Form 10-Q for the quarterly period ended November 24, 2013, as of December 13, 2013 there were 131,264,373 shares of Common Stock outstanding. Based on such number, and the fact that Starboard already owns in the aggregate 7,253,073 shares of Common Stock, additional written requests to call a special meeting from holders of an aggregate of at least [58,379,687] shares of Common Stock will be required to request the Company to call the special meeting. Please complete, sign and return the enclosed WHITE request card as promptly as possible. The failure to sign and return the WHITE request card will have the same effect as opposing the calling of the special meeting.

In order for our request to call a special meeting to be effective, the Company must receive properly completed and unrevoked written requests signed by a sufficient number of shareholders within seventy (70) days of the Record Date. Consequently, it is anticipated that by [_______], 2014, Starboard will need to deliver properly completed and unrevoked written requests to call the special meeting from holders of at least fifty percent (50%) of the shares of Common Stock outstanding as of the close of business on the Record Date. Nevertheless, we intend to set [_______], 2014 as the goal for submission of such written requests.

If Starboard is successful in its solicitation of written requests, the Company will be required under the Charter and FBCA to call and hold the special meeting. Upon receipt of the requisite number of written requests from shareholders in favor of calling the special meeting, Starboard anticipates delivering such written requests to the Company promptly, together with written notice of the business proposed to be brought before the special meeting pursuant to Article XI of the Charter, Section 8 of the Bylaws and Section 607.0702 of the FBCA.

Section 6 of the Bylaws requires the Company to mail or otherwise deliver notice of the special meeting, stating the time and place of the meeting and the general nature of the business to be considered, to shareholders entitled to vote at the meeting at least ten (10) days before the date of the special meeting.

After the special meeting is called, Starboard intends to solicit proxies from shareholders in support of the Proposals by sending you a notice of the special meeting, a proxy statement and a proxy card for use in connection with the special meeting. At the special meeting, shareholders will be asked to vote “FOR” the Proposals.

Starboard expects to request, in any future proxy solicitation relating to the special meeting, authority to (i) initiate and vote for proposals to recess or adjourn the special meeting for any reason and (ii) oppose and vote against any proposal to recess or adjourn the special meeting. Starboard does not currently anticipate additional proposals on any substantive matters. Nevertheless, Starboard reserves the right to either modify the Proposals or cause additional proposals to be identified in the notice of, and in, the proxy materials for the special meeting. Starboard is not aware of any other proposals to be brought before the special meeting. However, should other proposals be brought before the special meeting, Starboard will vote its proxies on such matters in its discretion.

WRITTEN REQUEST PROCEDURES

Starboard is only soliciting your written requests to call the special meeting to discuss this extremely important matter. In the event the special meeting is called, Starboard will send you proxy materials relating to the Proposals to be voted upon at the special meeting.

Pursuant to this Solicitation Statement, Starboard is soliciting written requests from holders of outstanding shares of Common Stock to call the special meeting. By executing a request, a shareholder is requesting the Company to call the special meeting and designating specified persons as the shareholder’s agents and is authorizing the designated agents to (i) request that the Company call the special meeting and hold the special meeting as soon as possible, and (ii) exercise all rights of the holders of shares of Common Stock incidental to calling the special meeting and causing the purposes of the authority expressly granted pursuant to the written requests to the designated agents to be carried into effect, including to apply, if need be, to an appropriate court to order that the special meeting be held. Please note that written requests to call the special meeting do not grant the designated agent(s) the power to vote your shares of Common Stock at the special meeting and do not commit you to cast any vote in favor or against any proposal to be brought before the special meeting. To vote on the matters to be brought before the special meeting, you must vote by proxy or in person at the special meeting.

You may revoke your written request to have the Company call a special meeting at any time before the delivery of requests from holders of shares of Common Stock representing in the aggregate, including shares held in the aggregate by Starboard, the requisite fifty percent (50%) threshold by delivering a written revocation to Starboard in care of Okapi Partners LLC at the address set forth on page 5 of this Solicitation Statement. Such a revocation must clearly state that your written request to call a special meeting is no longer effective. Any revocation of a written request to call a special meeting will not affect any action taken by the designated agent(s) pursuant to the written request prior to such revocation. Although such revocation is also effective if delivered to the Secretary of the Company or to such other recipient as the Company may designate as its agent, Starboard requests that either the original or photostatic copies of all revocations be mailed or faxed to Starboard, care of Okapi Partners LLC, so that Starboard will be aware of all revocations and can more accurately determine if and when enough requests have been received from shareholders to call a special meeting. While we urge you not to sign any revocation of a request card that may be sent to you by the Company, if you have done so or do so, you may revoke that revocation of your written request by delivering a later dated WHITE request card to Starboard, in care of Okapi Partners LLC, at its address listed herein, or to the principal executive offices of the Company. If so properly delivered, a later dated WHITE request card will constitute an effective revocation of any earlier-dated written revocation.

Upon receipt of the requisite number of written requests from shareholders in favor of calling a special meeting, Starboard anticipates delivering such written requests to the Company promptly. Only after the special meeting is called, will shareholders be asked to vote on the Proposals.

If your shares of Common Stock are held in the name of a brokerage firm, bank nominee or other institution, only it can sign a written request or revoke any request previously given with respect to your shares and only upon receipt of your specific instructions. Accordingly, please contact the person responsible for your account and give instructions for a WHITE request card representing your shares to be signed. Starboard urges you to confirm in writing your instructions to the person responsible for your account and to provide a copy of such instructions to Starboard, care of Okapi Partners LLC, at the address set forth on page 5 of this Solicitation Statement so that Starboard will be aware of all instructions given and can attempt to ensure that such instructions are followed.

SOLICITATION OF REQUESTS; EXPENSES

The entire expense of preparing and mailing this Solicitation Statement and any other soliciting material and the total expenditures relating to the solicitation of requests to call the special meeting will be borne by Starboard. In addition to the use of the mails, requests may be solicited by Starboard by facsimile, telephone, telegraph, Internet, in person and by advertisements. Banks, brokerage houses, and other custodians, nominees and fiduciaries will be requested to forward solicitation material to the beneficial owners of the Common Stock that such institutions hold, and Starboard will reimburse such institutions for their reasonable out-of-pocket expenses in so doing.

Starboard has retained Okapi Partners LLC, a proxy solicitation firm, to assist in the solicitation of requests and the proxy solicitation in connection with the special meeting for a fee not to exceed $[________] plus reimbursement of reasonable out-of-pocket expenses. Okapi Partners LLC will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. That firm will utilize approximately [___] persons in its solicitation efforts.

Starboard estimates that its total expenditures relating to the solicitation of requests to call a special meeting and the solicitation of proxies for approval of the Proposals at the special meeting will be approximately $[_________]. Total cash expenditures to date relating to these solicitations have been approximately $[_________].

If Starboard is successful in its solicitation of requests to call a special meeting and in its solicitation of proxies approving the Proposals at the special meeting, it intends to seek reimbursement from the Company for the actual expenses incurred in connection with this solicitation and the solicitation of proxies approving the Proposals at the special meeting. Following the special meeting, Starboard will request that the Board approve a reimbursement of such expenses. Starboard does not currently intend to submit such matter to a vote of the Company’s shareholders.

CERTAIN INFORMATION REGARDING THE PARTICIPANTS

The participants in this solicitation are Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”), Starboard Value and Opportunity S LLC (“Starboard S LLC”), Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard Leaders Delta LLC (“Delta LLC”), Starboard Leaders Fund LP (“Leaders Fund”), Starboard Value LP, Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal Co LP (“Principal Co”), Starboard Principal Co GP LLC (“Principal GP”), Starboard Value A LP (“Starboard A LP”), Starboard Value A GP LLC (“Starboard A GP”), Starboard Value R LP (“Starboard R LP”), Starboard Value R GP LLC (“Starboard R GP”), Jeffrey C. Smith, Mark R. Mitchell, Peter A. Feld, Bradley D. Blum, Charles M. Sonsteby and Robert Mock.

The principal business of Starboard V&O Fund, a Cayman Islands exempted company, is serving as a private investment fund. Starboard V&O Fund has been formed for the purpose of making equity investments and, on occasion, taking an active role in the management of portfolio companies in order to enhance shareholder value. Each of Starboard S LLC, a Delaware limited liability company, Starboard C LP, a Delaware limited partnership, and Delta LLC, a Delaware limited liability company, has been formed for the purpose of investing in securities and engaging in all related activities and transactions. The principal business of Leaders Fund, a Delaware limited partnership, is serving as a private investment partnership. Starboard Value LP, a Delaware limited partnership, provides investment advisory and management services and acts as the investment manager of Starboard V&O Fund, Starboard C LP, Delta LLC, Leaders Fund and of certain managed accounts (the “Starboard Value LP Accounts”) and as the manager of Starboard S LLC. The principal business of Starboard Value GP, a Delaware limited liability company, is providing a full range of investment advisory, pension advisory and management services and serving as the general partner of Starboard Value LP. The principal business of Principal Co, a Delaware limited partnership, is providing investment advisory and management services. Principal Co is a member of Starboard Value GP. Principal GP, a Delaware limited liability company, serves as the general partner of Principal Co. Starboard A LP, a Delaware limited partnership, serves as the general partner of Leaders Fund and the managing member of Delta LLC. Starboard A GP, a Delaware limited liability company, serves as the general partner of Starboard A LP. Starboard R LP, a Delaware limited partnership, serves as the general partner of Starboard C LP. Starboard R GP, a Delaware limited liability company, serves as the general partner of Starboard R LP. Messrs. Smith, Mitchell and Feld serve as members of Principal GP and the members of each of the Management Committee of Starboard Value GP and the Management Committee of Principal GP. The principal occupation of Mr. Blum is serving as a restaurateur and the owner of BLUM Enterprises, LLC, a progressive restaurant company focused on creating and operating new restaurant brands. Among other restaurant industry roles, Mr. Blum formerly served as President of Olive Garden and as CEO of Burger King. The principal occupation of Mr. Sonsteby is serving as the Chief Financial Officer and Chief Administrative Officer of each of The Michaels Companies, Inc. and Michaels Stores, Inc. Mr. Sonsteby formerly served as Chief Financial Officer and Executive Vice President of Brinker International, Inc. The principal occupation of Mr. Mock is serving as a restaurant consultant. Among other restaurant industry roles, Mr. Mock formerly served as Executive Vice President Operations of Olive Garden and Chief Operating Officer of Romano’s Macaroni Grill. Messrs. Smith, Mitchell, Feld, Blum, Sonsteby and Mock are citizens of the United States.

The address of the principal office of each of Starboard S LLC, Starboard C LP, Delta LLC, Leaders Fund, Starboard Value LP, Starboard Value GP, Principal Co, Principal GP, Starboard A LP, Starboard A GP, Starboard R LP, Starboard R GP and Messrs. Smith, Mitchell and Feld is 830 Third Avenue, 3rd Floor, New York, New York 10022. The address of the principal office of Starboard V&O Fund is 89 Nexus Way, Camana Bay, PO Box 31106, Grand Cayman KY1-1205, Cayman Islands. The principal business address of Mr. Blum is c/o BLUM Enterprises, LLC, 126 Park Avenue South, Suite A, Winter Park, Florida 32789. The principal business address of Mr. Sonsteby is c/o Michaels Stores, Inc., 8000 Bent Branch Drive, Irving Texas 75063. The principal business address of Mr. Mock is 606 Crestwood Lane, Holmes Beach, Florida 34217.

As of the date hereof, Starboard V&O Fund directly owns 1,161,790 shares of Common Stock. As of the date hereof, Starboard S LLC directly owns 281,286 shares of Common Stock. As of the date hereof, Starboard C LP directly owns 172,625 shares of Common Stock. Starboard R LP, as the general partner of Starboard C LP, may be deemed the beneficial owner of the 172,625 shares owned by Starboard C LP. Starboard R GP, as the general partner of Starboard R LP, may be deemed the beneficial owner of the 172,625 shares owned by Starboard C LP. As of the date hereof, Delta LLC directly owns 1,272,025 shares of Common Stock. Leaders Fund, as a member of Delta LLC, may be deemed the beneficial owner of the 1,272,025 shares owned by Delta LLC. Starboard A LP, as the general partner of Leaders Fund and the managing member of Delta LLC, may be deemed the beneficial owner of the 1,272,025 shares owned by Delta LLC. Starboard A GP, as the general partner of Starboard A LP, may be deemed the beneficial owner of the 1,272,025 shares owned by Delta LLC. As of the date hereof, Starboard Value LP beneficially owns 7,250,000 shares of Common Stock, consisting of shares of Common Stock owned directly by Starboard V&O Fund, Starboard S LLC, Starboard C LP and Delta LLC, and 4,362,274 shares of Common Stock held in the Starboard Value LP Accounts. Each of Starboard Value GP, as the general partner of Starboard Value LP, Principal Co, as a member of Starboard Value GP, Principal GP, as the general partner of Principal Co, and Messrs. Smith, Feld and Mitchell, each as a member of Principal GP and as a member of the Management Committee of Starboard Value GP and the Management Committee of Principal GP, may be deemed to be the beneficial owner of the aggregate of 7,250,000 shares of Common Stock owned directly by Starboard V&O Fund, Starboard S LLC, Starboard C LP, Delta LLC and held in the Starboard Value LP Accounts. As of the date hereof, Mr. Blum directly owns 1,000 shares of Common Stock. As of the date hereof, Mr. Sonsteby directly owns 1,500 shares of Common Stock. As of the date hereof, Mr. Mock directly owns 573 shares of Common Stock.

Each participant in this solicitation, as a member of a “group” with the other participants for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), may be deemed to beneficially own the 7,253,073 shares of Common Stock owned in the aggregate by all of the participants in this solicitation. Each participant in this solicitation specifically disclaims beneficial ownership of the shares of Common Stock he or it does not directly own. For information regarding purchases and sales of securities of the Company during the past two years by the participants in this solicitation, see Schedule I.

The shares of Common Stock purchased by each of Starboard V&O Fund, Starboard S LLC, Starboard C LP, Delta LLC and through the Starboard Value LP Accounts were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business). The shares of Common Stock purchased by each of Messrs. Blum, Sonsteby and Mock were purchased in the open market with personal funds.

On February 19, 2014, Starboard Value LP entered into an advisor agreement (the “Advisor Agreement”) with Mr. Blum in view of Mr. Blum’s unique skill set, broad restaurant industry experience and extensive restaurant industry knowledge. Pursuant to the Advisor Agreement and in consideration for the performance of certain consulting and advisory services by Mr. Blum, Starboard Value LP agreed to pay Mr. Blum an upfront fee equal to $50,000 in cash. Mr. Blum agreed to use the after-tax proceeds from such compensation, or an equivalent amount of other funds, to acquire securities of the Company, no later than ten (10) business days after receipt of such compensation, except in certain limited circumstances.

On February 24, 2014, Starboard V&O Fund, Starboard S LLC, Starboard C LP, Delta LLC, Leaders Fund, Starboard Value LP, Starboard Value GP, Principal Co, Principal GP, Starboard A LP, Starboard A GP, Starboard R LP, Starboard R GP and Messrs. Smith, Mitchell, Feld and Blum entered into a Joint Filing and Solicitation Agreement in which, among other things, (a) they agreed to solicit proxies or written consents to (i) request that Darden call a special meeting of shareholders to approve the Proposals and (ii) approve the Proposals at any special meeting called for such purpose, and (b) Starboard V&O Fund, Starboard S LLC, Starboard C LP and Delta LLC agreed to bear all expenses incurred in connection with the activities of the joint filing participants, subject to certain limitations (the “Joint Filing and Solicitation Agreement”).

On February 28, 2014, Starboard Value LP entered into an advisor agreement (the “Advisor Agreement”) with Mr. Sonsteby in view of Mr. Sonsteby’s unique skill set, broad restaurant industry experience and extensive restaurant industry knowledge. Pursuant to the Advisor Agreement and in consideration for the performance of certain consulting and advisory services by Mr. Sonsteby, Starboard Value LP agreed to pay Mr. Sonsteby an upfront fee equal to $50,000 in cash. Mr. Sonsteby agreed to use the after-tax proceeds from such compensation, or an equivalent amount of other funds, to acquire securities of the Company, no later than ten (10) business days after receipt of such compensation, except in certain limited circumstances.

On March 4, 2014, Mr. Sonsteby entered into a Joinder Agreement to the Joint Filing Solicitation Agreement, pursuant to which he agreed to be bound by the terms and conditions set forth therein, including, among other things, the joint filing on behalf of each of the participants of statements on Schedule 13D, and any amendments thereto, with respect to the securities of the Company.

On March 9, 2014, Starboard Value LP entered into an advisor agreement (the “Advisor Agreement”) with Mr. Mock in view of Mr. Mock’s unique skill set, broad restaurant industry experience and extensive restaurant industry knowledge. Pursuant to the Advisor Agreement and in consideration for the performance of certain consulting and advisory services by Mr. Mock, Starboard Value LP agreed to pay Mr. Mock an upfront fee equal to $50,000 in cash. Mr. Mock agreed to use the after-tax proceeds from such compensation, or an equivalent amount of other funds, to acquire securities of the Company, no later than ten (10) business days after receipt of such compensation, except in certain limited circumstances.

On March 10, 2014, Mr. Mock entered into a Joinder Agreement to the Joint Filing Solicitation Agreement, pursuant to which he agreed to be bound by the terms and conditions set forth therein, including, among other things, the joint filing on behalf of each of the participants of statements on Schedule 13D, and any amendments thereto, with respect to the securities of the Company.

Except as set forth in this Solicitation Statement (including the Schedules hereto), (i) during the past 10 years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the special meeting; (xii) no participant in this solicitation holds any positions or offices with the Company; (xiii) no participant in this solicitation has a family relationship with any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer; and (xiv) no corporations or organizations, with which any participant in this solicitation has been employed in the past five years, is a parent, subsidiary or other affiliate of the Company. There are no material proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

OTHER MATTERS

The principal executive offices of the Company are located at 1000 Darden Center Drive, Orlando, Florida 32837. Except as otherwise noted herein, the information concerning the Company has been taken from or is based upon documents and records on file with the SEC and other publicly available information. Although Starboard does not have any knowledge that would indicate that any statement contained herein based upon such documents and records is untrue, it does not take any responsibility for the accuracy or completeness of the information contained in such documents and records, or for any failure by the Company to disclose events that may affect the significance or accuracy of such information. For information regarding the security ownership of certain beneficial owners and management of the Company, see Schedule II.

SHAREHOLDER PROPOSALS

According to the Company’s proxy statement for its 2013 Annual Meeting of Shareholders (the “2013 Annual Meeting”), any shareholder wishing to submit a proposal to be included in the Company’s proxy statement for its 2014 Annual Meeting, must deliver such proposal(s) to Darden’s principal office on or before April 8, 2014. Shareholder proposals should be mailed to the Corporate Secretary, Darden Restaurants, Inc., 1000 Darden Center Drive, Orlando, Florida 32837.

In addition, according to the Company’s proxy statement for its 2013 Annual Meeting, under the Bylaws, any shareholder wishing to nominate a director or bring other business before the shareholders at the Company’s 2014 Annual Meeting, must notify the Company’s Corporate Secretary in writing on or before May 21, 2014 and include in such notice the specific information required under the Bylaws.

The information set forth above regarding the procedures for submitting shareholder proposals for consideration at the 2014 Annual Meeting is based on information contained in the Company’s proxy statement for its 2013 Annual Meeting. The incorporation of this information in this Solicitation Statement should not be construed as an admission by Starboard that such procedures are legal, valid or binding.

YOUR SUPPORT IS IMPORTANT

NO MATTER HOW MANY OR HOW FEW SHARES YOU OWN WE ARE SEEKING YOUR SUPPORT. PLEASE SIGN, DATE AND MAIL IN THE ENCLOSED POSTAGE-PAID ENVELOPE THE ENCLOSED WHITE REQUEST CARD AS SOON AS POSSIBLE.

IF YOUR SHARES OF COMMON STOCK ARE HELD IN THE NAME OF A BROKERAGE FIRM, BANK, BANK NOMINEE OR OTHER INSTITUTION, ONLY IT CAN SIGN A WRITTEN REQUEST WITH RESPECT TO YOUR COMMON STOCK. ACCORDINGLY, PLEASE CONTACT THE PERSON RESPONSIBLE FOR YOUR ACCOUNT AND GIVE INSTRUCTIONS FOR A WRITTEN REQUEST TO BE SIGNED REPRESENTING YOUR SHARES OF COMMON STOCK.

WHOM YOU CAN CALL IF YOU HAVE QUESTIONS

If you have any questions or require any assistance, please contact Okapi Partners LLC, Starboard’s solicitation agent, at the following address and telephone numbers:

OKAPI PARTNERS LLC 437 Madison Avenue, 28th Floor New York, N.Y. 10022 (212) 297-0720 Stockholders Call Toll-Free at: (877) 285-5990 E-mail: info@okapipartners.com |

IT IS IMPORTANT THAT YOU SIGN AND DATE YOUR WHITE REQUEST CARD AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE TO AVOID UNNECESSARY EXPENSE AND DELAY. NO POSTAGE IS NECESSARY.

| | STARBOARD VALUE LP |

| | |

| | [_____________], 2014 |

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

Shares of Common Stock Purchased/(Sold) | Date of Purchase / Sale |

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

| 56,300 | 10/01/2013 |

| 42,225 | 10/02/2013 |

| 14,075 | 10/03/2013 |

| 112,600 | 10/09/2013 |

| 84,450 | 10/10/2013 |

| 84,450 | 10/11/2013 |

| 28,150 | 10/15/2013 |

| (56,300) | 10/17/2013 |

| (28,150) | 10/25/2013 |

| (42,225) | 10/28/2013 |

| 126,675 | 10/29/2013 |

| 42,225 | 10/30/2013 |

| 28,150 | 10/31/2013 |

| 28,250 | 11/01/2013 |

| 13,683 | 12/11/2013 |

| 6,754 | 12/12/2013 |

| 62,886 | 12/19/2013 |

| 44,100 | 12/19/2013 |

| 28,848 | 12/19/2013 |

| 380,764 | 12/19/2013 |

| 25,200 | 12/19/2013 |

| 50,776 | 12/20/2013 |

| 27,904 | 12/20/2013 |

STARBOARD VALUE AND OPPORTUNITY S LLC

| 13,800 | 10/01/2013 |

| 10,350 | 10/02/2013 |

| 3,450 | 10/03/2013 |

| 27,600 | 10/09/2013 |

| 20,700 | 10/10/2013 |

| 20,700 | 10/11/2013 |

| 6,900 | 10/15/2013 |

| (13,800) | 10/17/2013 |

| (6,900) | 10/25/2013 |

| (10,350) | 10/28/2013 |

| 31,050 | 10/29/2013 |

| 10,350 | 10/30/2013 |

| 6,900 | 10/31/2013 |

| 6,800 | 11/01/2013 |

| 2,582 | 12/11/2013 |

| 1,269 | 12/12/2013 |

| 15,191 | 12/19/2013 |

| 10,653 | 12/19/2013 |

| 6,969 | 12/19/2013 |

| 91,978 | 12/19/2013 |

| 6,087 | 12/19/2013 |

| 12,266 | 12/20/2013 |

| 6,741 | 12/20/2013 |

STARBOARD VALUE AND OPPORTUNITY C LP

| 8,300 | 10/01/2013 |

| 6,225 | 10/02/2013 |

| 2,075 | 10/03/2013 |

| 16,600 | 10/09/2013 |

| 12,450 | 10/10/2013 |

| 12,450 | 10/11/2013 |

| 4,150 | 10/15/2013 |

| (8,300) | 10/17/2013 |

| (4,150) | 10/25/2013 |

| (6,225) | 10/28/2013 |

| 18,675 | 10/29/2013 |

| 6,225 | 10/30/2013 |

| 4,150 | 10/31/2013 |

| 4,150 | 11/01/2013 |

| 2,191 | 12/11/2013 |

| 1,083 | 12/12/2013 |

| 9,383 | 12/19/2013 |

| 6,580 | 12/19/2013 |

| 4,304 | 12/19/2013 |

| 56,810 | 12/19/2013 |

| 3,760 | 12/19/2013 |

| 7,576 | 12/20/2013 |

| 4,163 | 12/20/2013 |

STARBOARD LEADERS DELTA LLC

| 121,481 | 12/19/2013 |

| 85,189 | 12/19/2013 |

| 55,725 | 12/19/2013 |

| 735,543 | 12/19/2013 |

| 48,680 | 12/19/2013 |

| 145,466 | 12/20/2013 |

| 79,941 | 12/20/2013 |

STARBOARD VALUE LP

(Through the Starboard Value LP Accounts)

| 21,600 | 10/01/2013 |

| 16,200 | 10/02/2013 |

| 5,400 | 10/03/2013 |

| 43,200 | 10/09/2013 |

| 32,400 | 10/10/2013 |

| 32,400 | 10/11/2013 |

| 10,800 | 10/15/2013 |

| (21,600) | 10/17/2013 |

| (10,800) | 10/25/2013 |

| (16,200) | 10/28/2013 |

| 48,600 | 10/29/2013 |

| 16,200 | 10/30/2013 |

| 10,800 | 10/31/2013 |

| 10,800 | 11/01/2013 |

| 200,000 | 11/19/2013 |

| 300,000 | 11/20/2013 |

| 22,680 | 11/21/2013 |

| 8,000 | 11/22/2013 |

| 269,320 | 11/26/2013 |

| 125,000 | 11/27/2013 |

| 15,000 | 12/03/2013 |

| 131,544 | 12/11/2013 |

| 65,894 | 12/12/2013 |

| 290,160 | 12/19/2013 |

| 203,478 | 12/19/2013 |

| 133,104 | 12/19/2013 |

| 1,756,854 | 12/19/2013 |

| 116,273 | 12/19/2013 |

| 338,916 | 12/20/2013 |

| 186,251 | 12/20/2013 |

BRADLEY D. BLUM

CHARLES M. SONSTEBY

| 500 | 02/14/2014 |

| 1,000 | 03/04/2014 |

ROBERT MOCK

| (2,008.267) | 04/18/2012 |

| (54.44) | 09/24/2012 |

SCHEDULE II

The following tables are reprinted from the Company’s definitive proxy statement filed with the Securities and Exchange Commission on August 6, 2013.

STOCK OWNERSHIP OF MANAGEMENT

This table shows the beneficial ownership of our common shares, and information concerning restricted stock units, phantom stock units and PSUs, as of May 26, 2013, by our directors, director nominees, executive officers named in the Summary Compensation Table and all of our directors and executive officers as a group. Under applicable SEC rules, the definition of beneficial ownership for purposes of this table includes shares over which a person has sole or shared voting power, or sole or shared power to invest or dispose of the shares, whether or not a person has any economic interest in the shares, and also includes shares for which the person has the right to acquire beneficial ownership within 60 days of May 26, 2013. Except as otherwise indicated, a person has sole voting and investment power with respect to the common shares beneficially owned by that person.

| | Amount and Nature of Beneficial Ownership of Common Shares(1) | | | Phantom Stock Units and Performance Stock Units(2) | | | Common Shares Beneficially Owned as Percent of Common Shares Outstanding(3) | |

| Michael W. Barnes | | | 2,323 | | | | — | | | | * | |

| Leonard L. Berry | | | 41,960 | | | | — | | | | * | |

| Christopher J. Fraleigh | | | 24,567 | | | | — | | | | * | |

| Victoria D. Harker | | | 9,211 | | | | — | | | | * | |

| David H. Hughes | | | 94,519 | (4) | | | — | | | | * | |

| Charles A. Ledsinger, Jr. | | | 72,640 | | | | 4,475 | | | | * | |

| Eugene Lee | | | 222,730 | | | | 31,370 | | | | * | |

| William M. Lewis, Jr. | | | 113,253 | | | | — | | | | * | |

| Senator Connie Mack, III (5) | | | 36,019 | | | | — | | | | * | |

| Andrew H. Madsen | | | 799,106 | (4) | | | 65,200 | | | | * | |

| Clarence Otis, Jr. | | | 1,296,339 | (4) | | | 176,497 | | | | * | |

| David T. Pickens | | | 390,098 | | | | 33,378 | | | | * | |

| C. Bradford Richmond | | | 229,969 | | | | 35,176 | | | | * | |

| Michael D. Rose | | | 161,786 | (4) | | | — | | | | * | |

| Maria A. Sastre | | | 48,586 | | | | — | | | | * | |

| William S. Simon | | | 2,323 | | | | — | | | | * | |

All directors and executive officers as a group (23 persons) | | | 4,446,820 | | | | 468,247 | | | | 3.32 | % |

* Less than one percent.

| (1) | Includes common shares subject to options exercisable within 60 days of May 26, 2013, as follows: Dr. Berry, 12,000 shares; Mr. Hughes, 17,254 shares; Mr. Ledsinger, 46,165 shares; Mr. Lee, 164,842 shares; Mr. Lewis, 39,338 shares; Senator Mack, 12,000 shares; Mr. Madsen, 672,065 shares; Mr. Otis, 977,684 shares; Mr. Pickens, 326,984 shares; Mr. Richmond, 199,721 shares; Mr. Rose, 60,825 shares; Ms. Sastre, 18,274 shares; and all directors and executive officers as a group, 3,330,136 shares. |

Includes common shares held by the trustee of the Darden Savings Plan in the Employee Stock Ownership Plan for the accounts of our executive officers, with respect to which the officers have sole voting power and sole investment power, as follows: Mr. Pickens, 724 shares and all directors and executive officers as a group, 1,493 shares.

Includes restricted stock awarded under our Management and Professional Incentive Plan (“MIP”) as of May 26, 2013, with respect to which the officers have sole voting power but no investment power, as follows: Mr. Madsen, 15,460 shares; Mr. Otis, 18,660 shares; Mr. Pickens, 7,249 shares; Mr. Richmond, 2,234 shares; and all directors and executive officers as a group, 55,483 shares.

Includes phantom stock units allocated to the Darden stock fund under our Director Compensation Program for the accounts of the following non-employee directors, which are settled in stock, with respect to which the individuals have no voting or investment power, as follows: Mr. Fraleigh, 4,452 units; Mr. Hughes, 5,113 units; Mr. Ledsinger, 24,970 units; Mr. Lewis, 23,092 units; Senator Mack, 849 units; Mr. Rose, 36,447 units; Ms. Sastre 9,810 units; and all directors and executive officers as a group, 104,733 units.

Includes restricted stock units awarded under the Director Compensation Program, which are settled in stock, with respect to which the individuals have no voting or investment power, as follows: Mr. Hughes, 5,565 units; Mr. Rose, 22,413 units; Ms. Sastre, 3,727 units; and all directors and executive officers as a group, 31,705 units.

| (2) | Includes phantom stock units allocated to the Darden stock fund under our non-qualified deferred compensation plan, the FlexComp Plan, which are settled in cash, with respect to which the individuals have no voting or investment power, as follows: Mr. Madsen, 87 units; Mr. Otis, 46,103 units; Mr. Pickens, 7 units; Mr. Ledsinger, 4,475 units; Mr. Richmond, 4,440 units; and all directors and executive officers as a group, 55,112 units. |

Includes PSUs awarded under our MIP as of May 26, 2013, with respect to which officers have no voting or investment power, as follows: Mr. Lee, 31,370 units; Mr. Madsen, 65,113 units; Mr. Otis, 130,394 units; Mr. Pickens, 33,371 units; Mr. Richmond, 30,736 units; and all directors and executive officers as a group, 413,135 units.

| (3) | For any individual or group, the percentages are calculated by dividing (a) the number of shares beneficially owned by that individual or group, which includes shares underlying options exercisable within 60 days, and the phantom stock units and restricted stock units settled in stock described in footnote 1 above, by (b) the sum of (i) the number of shares outstanding on May 26, 2013, plus (ii) the number of shares underlying options exercisable within 60 days and phantom stock units and restricted stock units described in footnote 1 above held by just that individual or group. This calculation does not include phantom stock units settled in cash or PSUs described in footnote 2 above. |

| (4) | Includes shares held in a trust for the following: Mr. Hughes, 7,500 shares; Mr. Madsen, 110,100 shares; Mr. Otis, 95,000 shares and Mr. Rose, 38,034 shares. |

| (5) | Popularly known as Connie Mack, III, Senator Mack files Section 16 reports (Forms 3, 4 and 5) under his legal name of Cornelius McGillicuddy, III. |

STOCK OWNERSHIP OF PRINCIPAL SHAREHOLDERS

This table shows all shareholders that we know to beneficially own more than five percent of our outstanding common shares as of May 26, 2013. As indicated in the footnotes, we have based this information on reports filed by these shareholders with us and with the SEC.

Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership(1) | | |

Capital Research Global Investors 333 South Hope Street Los Angeles, CA 90071 | | 14,341,000(3) | | 11.01 |

BlackRock, Inc. 40 East 52nd Street New York, NY 10022 | | 9,216,038(4) | | 7.07 |

The Vanguard Group, Inc. 100 Vanguard Blvd. Malvern, PA 19355 | | 7,564,877(5) | | 5.81 |

| (1) | “Beneficial ownership” is defined under the SEC rules to mean more than ownership in the usual sense. Under applicable rules, you beneficially own our common shares not only if you hold them directly but also if you indirectly (such as through a relationship, a position as a director or trustee, or a contract or understanding) have or share the power to vote, sell or acquire them within 60 days. |

| (2) | The figure reported is a percentage of the total of 130,291,985 common shares outstanding on May 26, 2013, excluding treasury shares. |

| (3) | Based on a Schedule 13G filed February 13, 2013, as of December 31, 2012, Capital Research Global Investors beneficially owned an aggregate of 14,341,000 shares, and had sole power to vote and dispose of all those shares. |

| (4) | Based on a Schedule 13G filed February 8, 2013, as of December 31, 2012, BlackRock, Inc. beneficially owned an aggregate of 9,216,038 shares, and had sole power to vote and dispose of all those shares. |

| (5) | Based on a Schedule 13G filed February 11, 2013, as of December 31, 2012, The Vanguard Group, Inc. beneficially owned an aggregate of 7,564,877 shares, and had sole power to vote 223,896 shares, sole dispositive power over 7,350,081 shares, and shared dispositive power over 241,796 shares. |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 11, 2014

WRITTEN REQUEST

OF SHAREHOLDERS OF DARDEN RESTAURANTS, INC.

SOLICITED BY STARBOARD VALUE LP

TO CALL A SPECIAL MEETING OF SHAREHOLDERS OF

DARDEN RESTAURANTS, INC.

THIS SOLICITATION IS NOT BEING MADE ON BEHALF OF DARDEN RESTAURANTS, INC.

Each of the undersigned hereby constitutes and appoints [______], with full power of substitution, the agent of the undersigned (said agent, together with each substitute appointed, if any, collectively, the “Designated Agents”) in respect of all shares of common stock, no par value per share (the “Common Stock”), of Darden Restaurants, Inc. (the “Company”) owned by each of the undersigned to do any or all of the following, to which each of the undersigned hereby consents:

1. The demand of the call of a special meeting of shareholders of the Company pursuant to Section 607.0702 of the Florida Business Corporations Act and Article XI of the Company’s Articles of Incorporation, as amended, for the following purposes: (i) to approve a non-binding resolution urging the Board of Directors of the Company not to approve any agreement or proposed transaction involving a separation or spin-off of the Company’s Red Lobster business prior to the Company’s 2014 Annual Meeting of Shareholders unless such agreement or transaction would require shareholder approval, and (ii) to transact such other business as may properly come before the special meeting.

2. The exercise of any and all rights of each of the undersigned incidental to calling the special meeting and causing the purposes of the authority expressly granted herein to the Designated Agents to be carried into effect; provided, however, that nothing contained in this instrument shall be construed to grant the Designated Agents the right, power or authority to vote any shares of Common Stock owned by the undersigned at the special meeting or at any other shareholders meeting.

The undersigned hereby authorizes and designates the Designated Agents to collect and deliver this request to the Company, and to deliver any other information required in connection therewith.

This request supersedes, and the undersigned hereby revokes, any earlier dated revocation which the undersigned may have submitted to Starboard, the Company or any designee of either.

Print Name:______________________________________________________________

Signature:_______________________________________________________________

Signature (if held jointly):____________________________________________________

Title (only if shares are held by an entity):_______________________________________

Dated:__________________________________________________________________

Please sign exactly as your shares are registered. When shares are held by joint tenants, both should sign. When signing as an attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporation name by a duly authorized officer. If a partnership, please sign in partnership name by authorized person. This demand will represent all shares held in all capacities.

PLEASE COMPLETE, SIGN, DATE AND MAIL

IN THE ENCLOSED POSTAGE-PAID ENVELOPE AS PROMPTLY AS POSSIBLE