January 21, 2014

Darden Restaurants, Inc.

1000 Darden Center Drive

Orlando, FL 32837

Attn: Clarence Otis, Chairman and Chief Executive Officer

cc: Board of Directors

Dear Clarence,

Thank you for taking the time to speak with us on January 8th. Our discussion with you, Brad Richmond, Bill White, and Matthew Stroud was helpful in gaining a better understanding of Darden Restaurants, Inc. (“Darden”, or the “Company”), as well as the recently announced plan to separate Red Lobster through a spin-off or sale transaction. As you know, Starboard Value LP, together with its affiliates (“Starboard”), currently owns approximately 5.5% of the outstanding common stock of Darden, making us one of the Company’s largest shareholders. We look forward to meeting with you later this month in Orlando to continue our dialogue and discuss our views on the Company in more detail. In the meantime, given the critical and time-sensitive nature of the Company’s recently-announced plan to separate Red Lobster, we feel it is important to comment publicly at this time, so that management, shareholders, and the board of directors (the “Board”) can fully understand the matters at hand before the Company goes too far down the road toward pursuing a strategy that may not be in the best long-term interests of shareholders.

As we have discussed with you, we believe that the current market price of Darden significantly understates the value of Darden’s businesses and real estate assets. We believe this is due primarily to the Company’s extended record of disappointing operating performance, poor capital allocation, and missed expectations. Most notably, when adjusted for Darden’s extensive real estate ownership, the Company’s operating margins are well below peers.

We plan to address these issues and others in greater detail at a later date. However, the purpose of this letter is primarily to share our thoughts on the proposed separation of Red Lobster announced by Darden in conjunction with its second quarter earnings announcement on December 19, 2013.

While we are pleased that you recognize that Red Lobster could perform better with increased management focus, we do not believe the currently proposed plan to spin-off or sell Red Lobster, by itself, is in the best interest of shareholders. We believe the Company should more fully evaluate all available operational, financial, and strategic alternatives for Darden in order to create and execute on a comprehensive plan to address all aspects of the business and to ensure the best possible outcome for all shareholders. This evaluation should include consultation with the Company’s financial advisors and discussions with shareholders such as Starboard.

In writing this letter, our hope is to convince management and the Board to delay the proposed separation of Red Lobster to allow for more time to evaluate all available opportunities, so that a more beneficial, all-encompassing solution can be proffered.

We Believe a Separation of Red Lobster as Currently Conceived Could Destroy Substantial Value

As one of the largest shareholders of Darden, we have serious concerns about the Company’s proposed plan to separate Red Lobster. We believe this view is shared broadly by other shareholders, as evidenced by the substantial sell-off in the stock immediately following the announcement of the proposed separation. The proposed separation is highly concerning for the following reasons:

| (i) | It would create a new public company with a single poorly performing restaurant concept that we would expect to trade at a steep discount to Darden and other peers; |

| (ii) | As currently contemplated, it may impair Darden’s ability to realize full value for its substantial real estate holdings; and |

| (iii) | It fails to address the key factors driving Darden’s continued underperformance, including a bloated cost structure, a lack of focus on restaurant operations, and an inefficient asset base and capital structure. |

We believe the proposed Red Lobster separation is not just a sub-optimal outcome, but one that may ultimately prove to be value destructive – potentially even worse for shareholders than the status quo. It appears to us that the proposed plan is a hurried, reactive attempt, in the face of shareholder pressure, to do the bare minimum to appease shareholders and distract from the Company’s underlying problems, rather than the result of an informed and comprehensive review of all available opportunities to create shareholder value.

We Question the Operational and Strategic Rationale for a Separation of Red Lobster

It is difficult to understand the rationale for the proposed Red Lobster separation from a shareholder’s perspective. From management’s perspective, we can certainly see the appeal – Red Lobster is currently facing several challenges, including declining same-store-sales and severe shrimp price inflation, driven by a blight that is currently affecting Asian shrimp supplies. Red Lobster has therefore been the main culprit behind recent earnings misses and guidance revisions. Without Red Lobster, you may reason, it will be easier to hit earnings forecasts and management may be subject to less criticism for poor performance. However, it does not change the fact that, following a spin-out of Red Lobster, existing shareholders of Darden will continue to be adversely affected by the same issues that plague Red Lobster today. We agree that Red Lobster is in need of substantial operational improvements and could perform better with increased management focus. However, it is not clear why a new, stand-alone public Company is the optimal structure for Red Lobster to begin this intensive turnaround.

The proposed plan also does little to address the equally important tasks of turning around Olive Garden and reducing the Company’s bloated cost structure. Although Olive Garden’s same-store-sales have not been as weak as Red Lobster’s in recent quarters, Olive Garden is a key driver of Darden’s value and is also in need of substantial operational improvements. As an example, we estimate that Olive Garden has had same-restaurant traffic declines in 16 of the past 20 quarters. Olive Garden has been able to largely offset these declines through price increases. However, this is merely a short-term fix, and driving improvements in traffic will be paramount to the long-term growth and success of the Olive Garden concept. The Company has also done a poor job at managing expenses, and reductions throughout the entire organization are needed. Selling, General, and Administrative (“SG&A”) expenses now stand at approximately 10% of sales, or 60 basis points worse than in fiscal year 2012, prior to the acquisition of Yard House, and is the highest percentage that it has been since at least fiscal year 2001. In that time, Darden has acquired four new concepts – LongHorn Steakhouse, Capital Grille, Eddie V’s and Yard House – and has more than doubled revenue, but has failed to realize any of the expected cost synergies or to see any SG&A leverage.

While offloading Red Lobster in order to provide increased focus on execution may have some benefits, the proposed separation, as currently contemplated, is a mistake. Following a comprehensive evaluation, it is quite possible that the optimal solution arrived at will include some form of spin-off or sale transaction. However, it is far more likely that the optimal solution will involve separating multiple concepts together in a way that makes strategic sense, rather than simply isolating the most challenged business and spinning it out by itself.

A Red Lobster Separation Could Materially Impair Darden’s Substantial Real Estate Value

Our extensive research indicates that (i) Darden’s real estate is extremely valuable, (ii) such value is not currently recognized in the share price, (iii) there is little strategic value to owning the real estate, and (iv) the current corporate structure is not tax efficient. Points (ii) and (iii), in particular, are evidenced by the fact that most of Darden’s best-performing peers, including those that trade at higher multiples than Darden, own comparatively little real estate and have moved increasingly to divest what real estate they do own.

There are multiple potential solutions and strong transaction precedents where similarly situated companies have been able to realize substantial value for shareholders by separating their real estate holdings from their operating assets in a tax-efficient manner. We have had discussions regarding several realistic scenarios for a potential separation with real estate advisors, tax-experts, and interested buyers, and we do not believe there are any substantial impediments to completing a real estate transaction that creates significant value for shareholders. We plan to address this in detail at the appropriate time, but for now the key points for management and the Board to recognize are that substantial long-term value may be created by separating Darden’s real estate and that the proposed Red Lobster separation may meaningfully impair that value.

Unfortunately, despite repeated inquiries from both shareholders and sell-side analysts, management has refused to provide any detailed analysis supporting its decision not to monetize Darden’s real estate. It is our understanding that, when questioned regarding a real estate separation, management has repeatedly responded with specious arguments, including bloated estimates for debt refinancing costs, based on unrealistic scenarios for pro forma capitalization, and valuation multiples or cap rates that are inconsistent with recently completed comparable transactions.

Separating Red Lobster before Consummating a Real Estate Transaction Would Destroy Value

First, as discussed above, a stand-alone Red Lobster would likely trade at a substantial discount to casual dining peers or to where Darden currently trades. This discounted multiple would be applied to consolidated earnings and cash flow, even though a material portion of Red Lobster’s earnings and cash flow will be directly attributable to rental income, which should be quite stable, even if Red Lobster continues to struggle. Given the positive characteristics of rental income together with the tax efficiency available through a Real Estate Investment Trust (“REIT”) structure, REITs typically trade at substantial premiums to casual dining companies. Therefore, allowing the real estate to reside with the Red Lobster operating company is highly inefficient from both a valuation and tax standpoint.

Second, by spinning out Red Lobster before separating the real estate, this value may be permanently impaired. It is important to understand that when valuing real estate, in addition to factors like location, lease agreements, and alternative uses, the credit-worthiness of the tenant is an important consideration. By spinning out Red Lobster alone, the real estate within Red Lobster would be less valuable than it is today because the credit-worthiness of Red Lobster on a stand-alone basis would be far worse than that of either Darden, as it is currently comprised, or even a new company composed of a subset of Darden’s current concepts. We have engaged in discussions with Wall Street REIT analysts, whose expertise lies in valuing REITs, as well as potential buyers of Darden’s real estate, and both strongly corroborate this view.

Hence, it appears that management’s proposed plan is sub-optimal and may actually destroy shareholder value by impairing the value of the Red Lobster real estate.

When considering all of the issues highlighted in the preceding paragraphs, it is difficult to understand the rationale for the proposed Red Lobster separation from a shareholder perspective. We do not believe that there is any single-point solution, such as a spin-off of Red Lobster, for solving the Company’s underlying issues. Instead, Darden needs a comprehensive plan that includes value creation initiatives for all aspects of the business. The current plan proposed by management is wholly inadequate, merely offloads management’s headache to shareholders, and does little to address the long-term underperformance of the Company.

We Urge the Board to Delay the Red Lobster Separation and Immediately Conduct a Comprehensive Evaluation of All Alternatives to Maximize Shareholder Value

We implore management and the Board to delay the impending separation of Red Lobster to allow time for a broader exploration of available alternatives, as well as to provide sufficient time for communications with shareholders, including Starboard, who have specific views on the best way for Darden to achieve the optimal result.

We believe a full exploration of available alternatives must include:

| (i) | A substantial Company-wide (not just Red Lobster-specific) operational improvement plan designed to reduce costs meaningfully and put restaurant performance on par with Darden’s better-performing peers; |

| (ii) | An evaluation of all options for the Company’s real estate holdings, including a tax-efficient sale or REIT spin-off of the owned properties; |

| (iii) | An evaluation of the most logical and efficient combination of restaurant concepts to be spun out or otherwise separated from Darden. As an example, the creation of a mainstream casual dining company including Red Lobster, Olive Garden, and LongHorn, and a high-end growth restaurant company including the five niche brands that currently operate as part of SRG; and |

| (iv) | An evaluation of other value creation initiatives, such as franchising certain concepts to take advantage of international growth opportunities, as well as domestic opportunities in certain markets, and re-franchising certain existing stores in markets where Darden has operational deficiencies, in order to improve both restaurant operating performance and returns on capital. |

This evaluation of alternatives should include an in-depth review of management performance and skill set requirements to ensure the best possible execution of the new plan. We believe that if the Company fully explores all alternatives and executes on the best available plan, the Company will create significant value for shareholders from the current undervalued market price.

Based on our research and discussions with you to date, we do not believe that these initiatives have been fully and objectively explored. Further, given the negative reaction to the announcement of the proposed Red Lobster separation, shareholders are also clearly dissatisfied with the current proposal. In light of the foregoing concerns, as well as those raised by other large shareholders, we urge you not to continue down the current, potentially value destructive path. Instead, we believe it is incumbent upon management and the Board to commit to a full exploration of all alternatives, including those discussed in this letter, with an open mind. We believe that a failure to do so may violate the Board’s fiduciary duties.

We thank you in advance for considering our views and look forward to meeting with you at Darden’s corporate headquarters later this month. We take our investment in the Company, and the Board’s stewardship of shareholders’ capital, very seriously. We look forward to maintaining an open dialogue and working with you to ensure that value is created for all shareholders.

| Best Regards, |

| |

| /s/ Jeffrey C. Smith |

| |

| Jeffrey C. Smith |

| Managing Member |

| Starboard Value LP |

February 10, 2014

Darden Restaurants, Inc.

1000 Darden Center Drive

Orlando, FL 32837

Attn: Clarence Otis, Chairman and Chief Executive Officer

cc: Board of Directors

Dear Clarence,

We appreciate the time that you and your team spent with us in Orlando on January 29th. Starboard Value LP, together with its affiliates (“Starboard”), currently owns approximately 5.5% of the outstanding common stock of Darden Restaurants, Inc. (“Darden”, or the “Company”), making us one of the Company’s largest shareholders. As we previously indicated, we have conducted extensive research on the Company and the casual dining industry, and we believe substantial opportunities exist to create value for all shareholders within the control of management and the board of directors of the Company (the “Board”). Although we appreciate your efforts during our meeting to address our concerns regarding the current plan to spin-out or sell Red Lobster, we continue to believe the plan is not in the best interests of shareholders and could potentially destroy substantial value.

As you know, we issued a letter on January 21st, 2014 expressing our serious concerns with the proposed separation of Red Lobster and urging the Board to undertake a comprehensive review of all available operational, financial, and strategic alternatives to create value for shareholders. A copy of that letter is available at http://tinyurl.com/Starboard-Letter-to-Darden. We were surprised and terribly disappointed with the Company’s hurried response, just a few hours after the release of our letter, reaffirming the Company’s intention to move forward with its existing plan, including the separation of Red Lobster. This hasty response, lacking any substance, demonstrates the Board is intent on ignoring the serious concerns voiced by significant shareholders regarding the proposed Red Lobster separation and is unwavering in its commitment to consummate the proposed separation despite the potential destruction of shareholder value.

Over the past two weeks, we have had a chance to speak with a number of Darden shareholders. These shareholders have expressed similar concerns regarding the current plan and their desire for the Company to undertake a more fulsome review of all available opportunities to create value for shareholders. Additionally, these shareholders are all acutely aware that completing a spin-off or sale of Red Lobster without fully and objectively evaluating opportunities for the Company’s owned real estate could result in substantial shareholder value destruction.

It appears that the Company currently intends to complete the Red Lobster separation prior to holding the Company’s 2014 Annual Meeting of Shareholders (the “2014 Annual Meeting”), when all of the Company’s directors will be up for election. Should the Board force through this ill-conceived and potentially value destructive plan while continuing to ignore the input of its major shareholders, it would clearly demonstrate that this Board does not regard acting in the best interests of shareholders as its primary directive. We are currently evaluating all options in furtherance of providing a means for shareholders to have their voices heard on the proposed Red Lobster separation prior to its completion. We are also prepared to take all steps necessary to hold the Board accountable for its actions, including nominating a majority slate of director candidates and seeking the support of our fellow shareholders to replace a majority of the Board at the 2014 Annual Meeting.

We hope this will prove unnecessary. We ask that you and the Board take a step back, listen to your shareholders, and do what is right.

We continue to conduct our own analysis of Darden and look forward to publicly sharing the results of our independent review. This analysis will include a detailed discussion of the key value creation opportunities that we have identified through our in-depth research and our discussions with other large shareholders of Darden, including:

| 1. | A substantial Company-wide (not just Red Lobster-specific) operational improvement plan, including meaningful cost reductions and other changes that will put restaurant performance on par with Darden’s better-performing peers; |

| 2. | An evaluation of all options for the Company’s real estate holdings, including a tax-efficient sale or REIT spin-off of the owned properties; |

| 3. | An evaluation of the most logical and efficient combination of restaurant concepts to be spun out or otherwise separated from Darden. As an example, the creation of a mainstream casual dining company including Red Lobster, Olive Garden, and LongHorn, and a high-end growth restaurant company including the five niche brands that currently operate as part of the Specialty Restaurant Group; and |

| 4. | An evaluation of other value creation initiatives, such as franchising certain concepts to take advantage of international growth opportunities, as well as domestic opportunities in certain markets, and re-franchising certain existing stores in markets where Darden has operational deficiencies, in order to improve both restaurant operating performance and returns on capital. |

As part of this broad assessment of value creation opportunities, we would also like to engage with you regarding the composition of the Board. It is our belief that, given the dismal historical performance of Darden under the guidance of the existing Board, and the required actions needed to return the Company to profitable growth, immediate changes in Board composition are absolutely required.

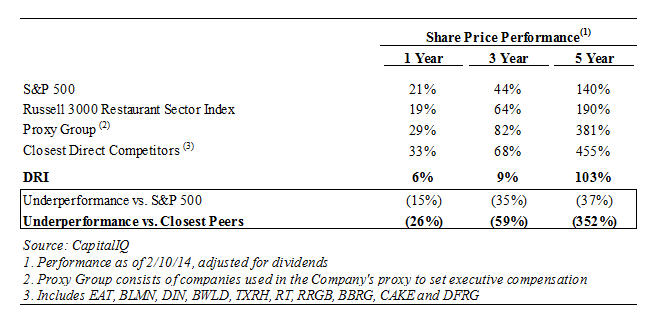

Darden’s stock price performance has been abysmal over almost any time period. Most notably, the Company has underperformed its closest direct competitors by a shocking 350% over the past five years.

We recognize that the changes necessary to improve upon this performance are substantial, but we ask that you and the Board approach our engagement with an open mind. Our goal is to work with you to take the actions required to set the Company back on the right track towards profitable growth and shareholder value creation. We are, after all, one of the Company’s largest shareholders, and our sole motivation is to ensure the best outcome for all shareholders.

Thank you for your time and attention. We will make ourselves available at your convenience to discuss these and other topics.

| Best Regards, |

| |

| /s/ Jeffrey C. Smith |

| |

| Jeffrey C. Smith |

| Managing Member |

| Starboard Value LP |

AN IMPORTANT MESSAGE TO THE SHAREHOLDERS OF DARDEN RESTAURANTS, INC.

February 24, 2014

Dear Fellow Shareholders:

Starboard Value LP, together with its affiliates (“Starboard”), currently owns approximately 5.5% of the outstanding common stock of Darden Restaurants, Inc. (“Darden” or the “Company”), making us one of the Company’s largest shareholders. As discussed in our two public letters to the Company (available at http://tinyurl.com/Starboard-Letter-to-Darden and http://tinyurl.com/Starboard-Letter-to-Darden-II), we have conducted extensive research on the Company and the casual dining industry, and we believe substantial opportunities exist to create value for all shareholders within the control of management and the board of directors of the Company (the “Board”).

Unfortunately, instead of addressing the serious concerns and value creation opportunities outlined publicly by us and another large shareholder, the Company announced a poorly-conceived plan to separate Red Lobster (the “Red Lobster Separation”). We believe the Red Lobster Separation would not only be suboptimal, but may ultimately prove to be value destructive – potentially even worse for shareholders than the status quo. It appears that the proposed plan is a hurried, reactive attempt, in the face of shareholder pressure, to conveniently cast off the weight of the struggling Red Lobster business, rather than address the Company’s serious operational issues head-on through increased management focus. What seems clear is that the Red Lobster Separation is not the result of an informed evaluation of all available opportunities to create shareholder value.

Starboard believes that the Company should undertake a comprehensive review of all available operational, financial, and strategic alternatives to create value for shareholders before hastening to complete a Red Lobster Separation that may destroy substantial value. Starboard is concerned that if the Company completes a spin-off or sale of Red Lobster without first fully and objectively evaluating all opportunities for the Company’s owned real estate, then substantial shareholder value could be destroyed.

Potentially even more concerning, management appears to be rushing the implementation of the Red Lobster Separation before shareholders would have the opportunity to express their views on this issue or elect Board members to better represent shareholder interests. As currently conceived, the Red Lobster Separation would be completed prior to the Company’s 2014 Annual Meeting of Shareholders (the “2014 Annual Meeting”) and without requiring a shareholder vote. We believe that shareholders deserve the right to voice their displeasure with this suboptimal and potentially value-destroying plan. This issue is far too important for the future value of Darden to be rushed through without shareholder support.

SHAREHOLDERS DESERVE AN OPPORTUNITY TO HAVE THEIR VOICES HEARD BEFORE DARDEN COMPLETES ANY SEPARATION OR SPIN-OFF OF THE RED LOBSTER BUSINESS

Unfortunately, to date, the Company has largely ignored the serious concerns voiced by us and other shareholders, and the Board appears unwavering in its commitment to the Red Lobster Separation. The Company also appears intent on expeditiously completing the Red Lobster Separation prior to the 2014 Annual Meeting, which is not expected to be held until mid-September. If management and the Board are left unchecked, shareholders will not have an opportunity to have their voices heard on the Red Lobster Separation, as a referendum or otherwise.

We cannot allow this to happen. The future value of Darden will be materially impacted by this important decision, and shareholders deserve the right to seek to stop a potential mistake before it happens. For these reasons, we filed this morning a Preliminary Solicitation Statement with the Securities and Exchange Commission (“SEC”) to solicit your support to help us request that Darden call a special meeting of shareholders of the Company (the “Special Meeting”). Under Florida law and the Company’s Bylaws, the holders of 50% of the Company’s outstanding shares have the right to demand that the Company call a Special Meeting. We believe that calling the Special Meeting is the best means available for providing a democratic forum for all shareholders to express their views on the Company’s proposed separation of Red Lobster before it is too late.

As a first step, we will be soliciting your written request to call the Special Meeting. Your support to call the Special Meeting will simply allow shareholders the opportunity and right to voice their opinions. By supporting the call of the Special Meeting, you are not committing to vote either in favor or against the Red Lobster Separation. Instead, you are affirming that you would be in favor of calling a Special Meeting to discuss this extremely important decision affecting the future value of your company and your investment. Assuming we are successful in getting the Special Meeting called, we will then be requesting your support for the following proposal at the Special Meeting:

to approve a non-binding resolution urging the board of directors of the Company (the “Board”) not to approve any agreement or proposed transaction involving a separation or spin-off of the Company’s Red Lobster business prior to the 2014 Annual Meeting unless such agreement or transaction would require shareholder approval.

If, as we believe, the vast majority of the Company’s shareholders are against the proposed Red Lobster Separation and ultimately approve our non-binding proposal at the Special Meeting, we believe it would be incumbent upon the Board to immediately delay any separation transaction and conduct a full and objective evaluation of all value creation opportunities.

THE SPECIAL MEETING IS AN OPPORTUNITY FOR SHAREHOLDERS TO SEND A CLEAR MESSAGE TO THE BOARD THAT WE ARE DISSATISFIED WITH THE PROPOSED RED LOBSTER SEPARATION AS CURRENTLY CONCEIVED

Our SEC filing earlier today represents the first step towards allowing all shareholders to have their voices heard on the proposed Red Lobster Separation before it is too late. Your support in calling the Special Meeting will send a strong message that shareholders want the Board to slow down and review all strategic alternatives to maximize value before rushing to complete the Red Lobster Separation. If our non-binding proposal is ultimately approved at the Special Meeting, the message would even be that much louder and clearer and should compel the Board not to continue down its current, potentially value destructive path. Should the Board nevertheless continue to disregard the serious concerns of its shareholders, we are prepared to take all steps necessary to hold the Board accountable for its actions, including nominating a majority slate of director candidates and seeking the support of our fellow shareholders to replace a majority of the Board at the 2014 Annual Meeting.

As we discussed in our two public letters to the Company, Darden’s long-term performance under the leadership of this management team and Board have been unacceptable. As just one example, Selling, General, and Administrative (“SG&A”) expenses now stand at approximately 10% of sales, or 60 basis points worse than in fiscal year 2012, prior to the acquisition of Yard House, and the highest percentage since at least fiscal year 2001. In that time, Darden has acquired four new concepts – LongHorn Steakhouse, Capital Grille, Eddie V’s, and Yard House – and has more than doubled revenue, but has failed to realize any of the expected cost synergies or to see any SG&A leverage. As a result, Darden’s consolidated margins, when adjusted for the Company’s substantial real estate ownership, are now well below peers despite having among the highest average unit volumes and the greatest scale in the casual dining space. Even more concerning, Darden’s stock price performance has been unacceptable, with Darden underperforming its peer group by more than 300% over the last five years.1

Given management and the Board's track record of poor performance and poor decision-making, together with our belief that the proposed Red Lobster Separation is deeply flawed, we believe it is critical for shareholders in this case to have the right to review and approve any transaction involving Red Lobster that takes place prior to the 2014 Annual Meeting, at which time shareholders will have an opportunity to elect directors whom they believe represent their best interests.

WE ARE CONDUCTING AN INDEPENDENT, DETAILED ANALYSIS OF THE VALUE CREATION OPPORTUNITIES AT DARDEN

We continue to conduct our own independent analysis of Darden's operations. We plan to publicly comment in more detail in advance of the Special Meeting. Our analysis will include a detailed discussion of each of the value creation opportunities that we outlined in our public letters to the Company. In particular, we will highlight numerous operating improvements that we believe are necessary to turn around Darden’s key restaurant concepts.

To that end, we have begun recruiting highly qualified restaurant operators to advise us as we refine our operating plan for Darden. We believe the perspective of leading restaurant operating executives will be invaluable to shareholders, particularly in light of the notable lack of meaningful restaurant operating experience among Darden’s Board and senior management.

1 For full stock price performance details, see our letter dated February 10, 2014 and available at http://tinyurl.com/Starboard-Letter-to-Darden-II

Prior to any Special Meeting, we will also comment in detail on the value of Darden’s real estate and outline several ways in which Darden can realize that value in a tax-efficient manner. However, the Board needs to understand that shareholders are keenly aware that this value could be meaningfully impaired if Darden completes the Red Lobster Separation prior to a real estate transaction.

YOU DO NOT NEED TO DO ANYTHING AT THIS TIME

WE WILL BE SENDING YOU A DEFINITIVE SOLICITATION STATEMENT AND A WHITE SPECIAL MEETING REQUEST CARD IN THE NEXT FEW WEEKS

We believe that shareholders have a right to be heard. As one of Darden’s largest shareholders, our interests are directly aligned with those of all shareholders. Over the coming weeks, we will communicate additional details regarding how you can support us in calling the Special Meeting.

For now, it is important to know that we are not seeking your written request to call the Special Meeting at this time. In the next few weeks, we hope to file our Definitive Solicitation Statement with the SEC, at which time we will be sending you a copy of the Definitive Solicitation Statement together with a WHITE Special Meeting Request card.

We thank you in advance for your support.

| Best Regards, |

| |

| /s/ Jeffrey C. Smith |

| |

| Jeffrey C. Smith |

| Managing Member |

| Starboard Value LP |

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Starboard Value LP, together with the other participants named herein (“Starboard”), has made a preliminary filing with the Securities and Exchange Commission (“SEC”) of a solicitation statement and an accompanying WHITE request card to be used to solicit requests that Darden Restaurants, Inc. (the “Company”) call a special meeting of shareholders to approve a non-binding resolution urging the Board of Directors of the Company not to approve any agreement or proposed transaction involving a separation or spin-off of the Company’s Red Lobster business prior to the 2014 Annual Meeting of Shareholders unless such agreement or transaction would require shareholder approval.

STARBOARD ADVISES ALL SHAREHOLDERS OF THE COMPANY TO READ THE SOLICITATION STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THE SOLICITATION WILL PROVIDE COPIES OF THESE MATERIALS WITHOUT CHARGE UPON REQUEST.

The participants in this solicitation are Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”), Starboard Value and Opportunity S LLC (“Starboard S LLC”), Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard Leaders Delta LLC (“Delta LLC”), Starboard Leaders Fund LP (“Leaders Fund”), Starboard Value LP, Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal Co LP (“Principal Co”), Starboard Principal Co GP LLC (“Principal GP”), Starboard Value A LP (“Starboard A LP”), Starboard Value A GP LLC (“Starboard A GP”), Starboard Value R LP (“Starboard R LP”), Starboard Value R GP LLC (“Starboard R GP”), Jeffrey C. Smith, Mark R. Mitchell, Peter A. Feld and Bradley D. Blum.

As of the date hereof, Starboard V&O Fund directly owns 1,161,790 shares of common stock, no par value of the Company (the “Common Stock”). As of the date hereof, Starboard S LLC directly owns 281,286 shares of Common Stock. As of the date hereof, Starboard C LP directly owns 172,625 shares of Common Stock. Starboard R LP, as the general partner of Starboard C LP, may be deemed the beneficial owner of the 172,625 shares owned by Starboard C LP. Starboard R GP, as the general partner of Starboard R LP, may be deemed the beneficial owner of the 172,625 shares owned by Starboard C LP. As of the date hereof, Delta LLC directly owns 1,272,025 shares of Common Stock. Leaders Fund, as a member of Delta LLC, may be deemed the beneficial owner of the 1,272,025 shares owned by Delta LLC. Starboard A LP, as the general partner of Leaders Fund and the managing member of Delta LLC, may be deemed the beneficial owner of the 1,272,025 shares owned by Delta LLC. Starboard A GP, as the general partner of Starboard A LP, may be deemed the beneficial owner of the 1,272,025 shares owned by Delta LLC. As of the date hereof, Starboard Value LP beneficially owns 7,250,000 shares of Common Stock, consisting of shares of Common Stock owned directly by Starboard V&O Fund, Starboard S LLC, Starboard C LP and Delta LLC, and 4,362,274 shares of Common Stock held in the Starboard Value LP Accounts. Each of Starboard Value GP, as the general partner of Starboard Value LP, Principal Co, as a member of Starboard Value GP, Principal GP, as the general partner of Principal Co, and Messrs. Smith, Feld and Mitchell, each as a member of Principal GP and as a member of the Management Committee of Starboard Value GP and the Management Committee of Principal GP, may be deemed to be the beneficial owner of the aggregate of 7,250,000 shares of Common Stock owned directly by Starboard V&O Fund, Starboard S LLC, Starboard C LP, Delta LLC and held in the Starboard Value LP Accounts. As of the date hereof, Mr. Blum does not own shares of Common Stock of the Company.