PRELIMINARY COPY SUBJECT TO COMPLETION

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

August [__], 2014

It is Time for the Current Board to be Held Accountable for Years of Poor Performance, Egregious Corporate Governance, and Substantial Shareholder Value Destruction

Our Interests Are Directly Aligned with ALL Darden Shareholders

With Your Support, We Believe a Change in Leadership Can Improve Value at Darden

Vote the WHITE Proxy Card Today to Support the Most Qualified Slate of Directors to Oversee Darden

Dear Fellow Darden Shareholders:

Starboard Value and Opportunity Master Fund Ltd and the other participants in this solicitation (collectively, “Starboard” or “we”) beneficially own a total of 11,652,386 shares, or approximately 8.8%, of the outstanding common stock, no par value per share (the “Common Stock”), of Darden Restaurants, Inc., a Florida corporation (“Darden” or the “Company”), making us one of the Company’s largest shareholders.

“You just have to have good people if you are going to have a good operation, without them you are lost.”

- Bill Darden (Founder of Darden Restaurants)

As founder Bill Darden noted, running a successful restaurant company starts with the people. Darden is a great company that is blessed with some of the most highly visible casual dining concepts around the globe and an incredibly strong employee base of approximately 150,000 restaurant and field-level employees. Unfortunately, Darden has lost its way in recent years due to poor leadership at the top. For too long, Darden shareholders have suffered mightily under senior management and a board of directors (the “Board) that has seemed to blatantly disregard the best interests of shareholders. We believe the current management and Board are preventing Darden from regaining its position as the world’s premier full-service restaurant company and creating value for shareholders.

The upcoming 2014 Annual Meeting of Shareholders of Darden (the “Annual Meeting”) marks an exciting and critical opportunity for shareholders at Darden to elect a new Board that is both tremendously qualified and excited to significantly improve the operating performance, oversight, and value of the Company for the benefit of all shareholders. Even before the recent debacle involving the sale of Red Lobster, the current Board had presided over an extended period of poor stock price performance, poor operating performance, poor corporate governance, and substantial destruction of shareholder value. During the five years prior to our filing of proxy materials for the solicitation of written requests to try to stop the Company from separating its Red Lobster business (the “Red Lobster Separation”), Darden underperformed its closest direct competitors and its proxy peer group by approximately 300%. We did everything within our power to prevent, or to at least get Darden to reconsider, the disposal of Red Lobster. Shareholders overwhelmingly supported our efforts, with more than 80% of the shares realistically available to vote delivering written requests asking the Company to hold a special meeting of shareholders (the “Special Meeting”) to discuss the Red Lobster Separation. Unfortunately, the Board unilaterally ignored a clear shareholder directive calling for the Special Meeting to be held as a forum for shareholder input on the Red Lobster Separation, and sold Red Lobster (the “Red Lobster Sale”) at what we believe to be a fire sale price. Even worse, the Board determined to rush the Red Lobster Sale by entering into a definitive agreement before holding the shareholder-requested Special Meeting and without subjecting the transaction to a shareholder vote. In the two months following the Red Lobster debacle, Darden’s stock price has declined by approximately 11% while the overall market has appreciated and comparable restaurant companies have performed well. Darden has performed poorly for a long time, but to make matters worse, since the Red Lobster Sale, which we and shareholders strongly urged management and the Board not to proceed with, Darden has further underperformed peers by 15%. This 15% decline represents $1 billion in Darden’s market value relative to peers since the Red Lobster Sale.1 For far too long shareholders have suffered under management and the Board’s poor strategy, poor execution, and poor performance. Clearly, it is time for a change.

1 Calculated as the decline in Darden’s market cap compared to its Proxy Group. While other general factors could impact stock price performance, we believe this underperformance is directly attributable to the Red Lobster Sale and the market’s lack of confidence in Darden’s current leadership.

We have gone to great lengths to carefully select a group of twelve world-class director nominees with diverse skill sets and perspectives directly relevant to Darden’s business and current challenges, including experienced restaurant operators, and experts in real estate, finance, turnarounds, supply chain, effective public company governance, and executive compensation. Notably, among our slate of director nominees are several world-class executives with direct experience successfully leading Olive Garden or overseeing similar turnarounds at competing casual dining companies such as Brinker International.

Our slate of director nominees is prepared to seamlessly begin executing on a comprehensive turnaround plan for Darden that will seek to put operations on par with well-performing competitors and create substantial value for shareholders. We have been working diligently with our group of advisors and one of the leading operationally-focused consulting firms to finalize this comprehensive turnaround plan to create substantial value at Darden. Importantly, our comprehensive plan will also include a 100-day plan outlining the operational actions our nominees would pursue, if elected, during the first 100 days following the Annual Meeting. We look forward to publicly releasing our comprehensive turnaround plan during the first week of September. This time frame should allow ample opportunity for shareholders to fully review and appreciate the details of our comprehensive plan prior to the September 30, 2014 Annual Meeting date.

Darden recently announced that Chairman and CEO Clarence Otis will be stepping down upon the earlier of the appointment of his successor or December 31, 2014. We believe Mr. Otis leaving represents just one step in the transformation that is urgently needed at Darden, and that the Company still requires a major overhaul at the Board level. The Company has indicated that it expects “an expeditious search process” for the next CEO. We hope that the Board does not rush to appoint a successor during the pendency of this election contest. We believe that this all-important decision should be left to the new Board that is elected at the Annual Meeting. Our nominees, if elected, are committed to undertaking a robust process to vet both internal and external talent in order to find a truly great, transformational, operationally-focused restaurant leader. If Mr. Otis steps down prior to the appointment of his successor and before the end of the calendar year, we believe that certain of our director nominees, as well as certain senior officers of the Company, could step in as CEO on an interim basis, however, we have not made any specific determinations at this time.

It is not every day that shareholders are asked to replace an existing board of directors. But it is not every day that a board of directors so blatantly and defiantly ignores a clear shareholder directive involving the delivery of written requests from a substantial majority of its shareholders for a special meeting to discuss an important transaction. It is also not every day that a board of directors unilaterally chooses to enter into a value-destructive transaction, yet does not believe that it did anything wrong.

The egregious corporate governance practices, violations of shareholder trust, and dramatic underperformance at Darden are unlike any we have ever seen at other public companies. We often work with boards and management teams who understand that shareholders are the true owners of the Company, who place a priority on the creation of shareholder value, and who work diligently to deliver this value. The unashamed and stubborn manner in which this Board so wrongly ignored the will of its shareholders further demonstrated to us that this Board will not take the views of its shareholders seriously. It is time for this Board to be held accountable for its actions, and for a new board of directors to be put in place with a commitment to substantially improve Darden for the benefit of all shareholders.

We hope that you share our excitement about the prospect of a bright, new future for Darden under the direction of a newly constituted and extraordinarily capable board of directors. We believe that shareholders have suffered long enough at Darden. Fortunately, shareholders finally have the opportunity to choose a much better alternative at the Annual Meeting. By voting the enclosed WHITE proxy card, you will be helping to elect a highly-qualified slate of restaurant industry veterans, real estate experts, and corporate governance stewards who are fully committed to take Darden in a new and dramatically improved direction.

The Company has nominated candidates for only nine of the twelve Board seats that are up for election at the Annual Meeting. We question the decision by the current Board to leave three seats to be automatically filled by our director nominees. We do not believe that such token Board change is sufficient given the depth of the value destruction and the poor corporate governance that we believe this Board has overseen. The Company may try to argue that we are seeking a level of Board representation that is disproportionate to our 8.8% ownership interest in the Company. It is important to understand, however, that this election is not about Starboard versus the current Board. This election is about what is best for the Company and its shareholders. We strongly believe that anything short of a majority change in the Board at the Annual Meeting will be wholly insufficient to drive the level of change that we believe is required to improve value and performance at Darden. We have nominated only two Starboard representatives on our twelve-person slate. We have otherwise gone to great lengths to identify ten unaffiliated director candidates who are independent-thinking business leaders with highly relevant experience and credentials. Therefore, while the election of a majority of our director candidates may be sufficient to ensure that the changes we are seeking are implemented at Darden following the Annual Meeting, we have nevertheless nominated a full slate because we believe that each of the director nominees that we have identified is more qualified than the Company’s nominees and that each will bring specific skills and experiences that are directly relevant to different aspects of Darden’s business and current challenges. We believe shareholders deserve to have the best possible Board, one through twelve. It is important to note that since the Company has left three open seats to be automatically filled by our director nominees, any shareholder who wishes to specifically select any of our director nominees to fill one or more of these seats can only do so by voting on our WHITE proxy card.

Each of our director nominees is committed to the implementation of our comprehensive turnaround plan for Darden. Therefore, in the event that our director nominees comprise a majority of the Board following the Annual Meeting, we expect that the Board will implement our comprehensive turnaround plan for Darden. While we have confidence that our director nominees’ plans for Darden will put the Company on the right path towards substantial shareholder value creation, there can be no assurance that the implementation of our comprehensive turnaround plan will ultimately enhance shareholder value. In the event that our director nominees comprise less than a majority of the Board following the Annual Meeting, there can be no assurance that any actions or changes proposed by our director nominees, including the implementation of our turnaround plan, will be adopted or supported by the Board.

If all of our nominees are elected, our nominees are willing to add back to the Board up to two incumbent directors. In this event, our nominees would endeavor to meet with certain of the incumbent directors following the Annual Meeting to determine which ones have the skill sets, experience and perspectives that will best complement the new Board members. Although we are considering all incumbent directors of the Company, other than those not running for re-election, we have not determined the specific incumbent directors that our nominees would consider adding back to the Board at this time. Any decision would depend upon not only the credentials of such incumbent directors, but also upon any such incumbent director’s willingness to serve on the Board together with our nominees. In the event that the Board is expanded following the Annual Meeting, we would expect that Board compensation would be reduced so that the aggregate Board compensation is no more than it is today.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating, and returning the enclosed WHITE proxy card today. The attached Proxy Statement and the enclosed WHITE proxy card are first being furnished to the shareholders on or about _________ __, 2014.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating, and returning a later dated proxy or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at its address and toll-free numbers listed below.

| Thank you for your support. |

| |

| |

| /s/ Jeffrey C. Smith |

| |

| Jeffrey C. Smith |

| Starboard Value and Opportunity Master Fund Ltd |

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of Starboard’s proxy materials, please contact Okapi Partners at the phone numbers or email listed below.

OKAPI PARTNERS LLC 437 Madison Avenue, 28th Floor New York, N.Y. 10022 (212) 297-0720 Shareholders Call Toll-Free at: (877) 285-5990 E-mail: info@okapipartners.com |

PRELIMINARY COPY SUBJECT TO COMPLETION

2014 ANNUAL MEETING OF SHAREHOLDERS

OF

DARDEN RESTAURANTS, INC.

_________________________

PROXY STATEMENT

OF

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Starboard Value LP (“Starboard Value LP”), Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”), Starboard Value and Opportunity S LLC (“Starboard S LLC”), Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard Leaders Delta LLC (“Starboard Delta LLC”), Starboard Leaders Fund LP (“Starboard Leaders Fund”), Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal Co LP (“Principal Co”), Starboard Principal Co GP LLC (“Principal GP”), Starboard Value R LP (“Starboard R LP”), Starboard Value R GP LLC (“Starboard R GP”), Starboard Value A LP (“Starboard A LP”), Starboard Value A GP LLC (“Starboard A GP”), Jeffrey C. Smith, Mark R. Mitchell, and Peter A. Feld (collectively, “Starboard” or “we”) are significant shareholders of Darden Restaurants, Inc., a Florida corporation (“Darden” or the “Company”), who, together with the other participants in this solicitation, beneficially own in the aggregate approximately 8.8% of the outstanding shares of common stock, no par value per share (the “Common Stock”), of the Company.

We are seeking to elect a full slate of nominees to the Company’s Board of Directors (the “Board”) because we believe that wholesale change in the boardroom is required to reverse the many years of poor stock price performance, poor operating performance, and poor corporate governance at Darden and to ensure that the interests of the shareholders, the true owners of Darden, are appropriately represented in the boardroom. We have nominated a slate of highly qualified and capable candidates with relevant backgrounds and industry experience. If elected, our nominees will bring fresh perspectives, talented leadership, and responsible oversight in implementing a much-needed turnaround at Darden. We are seeking your support at the Company’s 2014 Annual Meeting of Shareholders, scheduled to be held at ______________, on Tuesday, September 30, 2014, at _________ a.m., Eastern Daylight Time (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

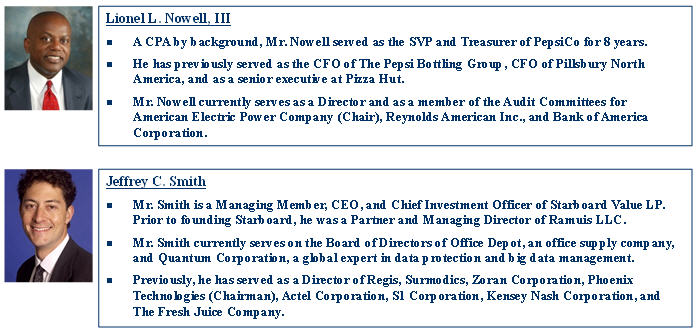

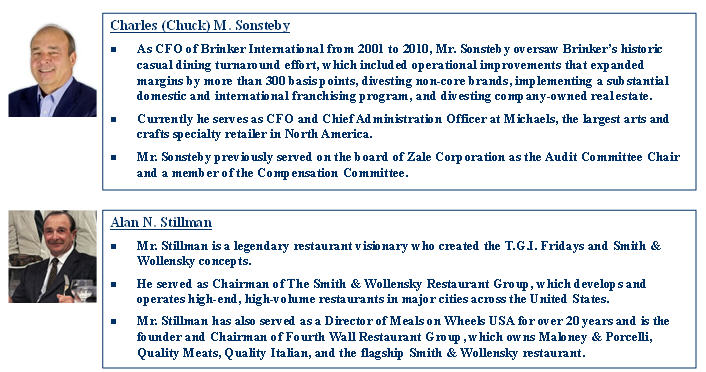

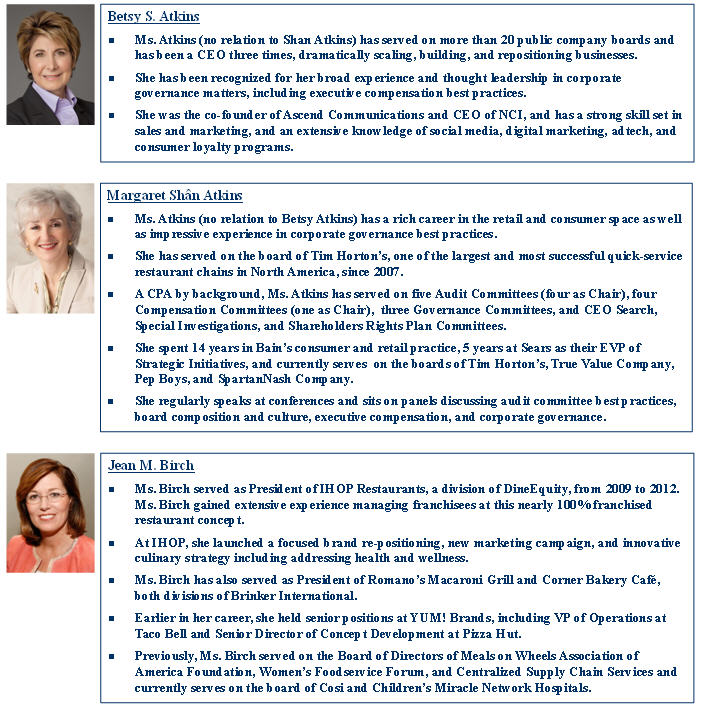

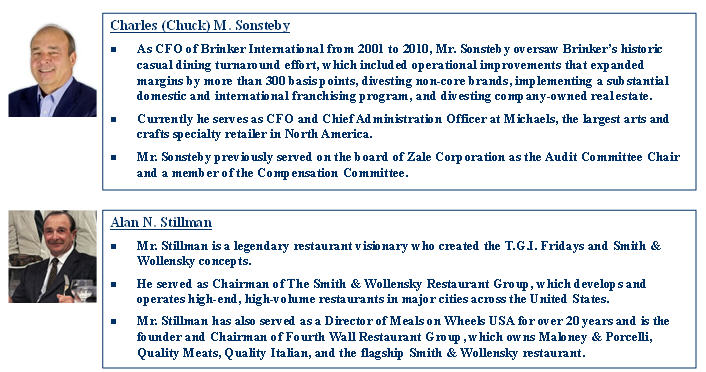

| | 1. | To elect Starboard’s director nominees, Betsy S. Atkins, Margaret Shân Atkins, Jean M. Birch, Bradley D. Blum, Peter A. Feld, James P. Fogarty, Cynthia T. Jamison, William H. Lenehan, Lionel L. Nowell, III, Jeffrey C. Smith, Charles M. Sonsteby, and Alan N. Stillman (each a “Nominee” and, collectively, the “Nominees”) to hold office until the 2015 Annual Meeting of Shareholders (the “2015 Annual Meeting”) and until their respective successors have been duly elected and qualified; |

| | 2. | To obtain advisory approval of the Company's executive compensation (the “Say-on-Pay Proposal”); |

| | 3. | To ratify the appointment of KPMG LLP as the independent registered public accounting firm of the Company for the fiscal year ending May 31, 2015; |

| | 4. | To vote on a management proposal to amend the Company’s Bylaws, as amended (the “Bylaws”) to provide for proxy access; |

| | 5. | To vote on a shareholder proposal regarding political contributions (the “Political Contribution Proposal”), if properly presented at the Annual Meeting; |

| | 6. | To vote on a shareholder proposal regarding lobbying disclosures (the “Lobbying Disclosure Proposal”), if properly presented at the Annual Meeting; and |

| | 7. | To transact such other business, if any, as may properly come before the Annual Meeting and any adjournment thereof. |

This Proxy Statement is soliciting proxies to elect only our Nominees. Accordingly, the enclosed WHITE proxy card may only be voted for our Nominees and does not confer voting power with respect to any of the Company’s director nominees. See “Voting and Proxy Procedures” on page [__] for additional information. You can only vote for the Company’s director nominees by signing and returning a proxy card provided by the Company. Shareholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications, and other information concerning the Company’s nominees. By nominating only nine director candidates for the twelve seats available at the Annual Meeting, the Company has left three open seats to be automatically filled by our Nominees. Any shareholder who wishes to specifically select any of our Nominees to fill the three open seats can only do so by voting on our WHITE proxy card.

As of the date hereof, the members of Starboard, its advisors and the Nominees collectively beneficially own 11,652,386 shares of Common Stock (the “Starboard Group Shares”), or approximately 8.8% of the outstanding Common Stock. While we currently intend to vote all of the Starboard Group Shares in favor of the election of the Nominees, we reserve the right to vote some or all of the Starboard Group Shares for some or all of the Company’s director nominees, up to and including the date of the Annual Meeting, as we see fit, in order to achieve a Board composition that we believe is in the best interest of all shareholders. Consequently, shareholders may not know which of the Company’s director nominees that Starboard votes some or all of the Starboard Group Shares for, if Starboard does in fact vote for some or all of the Company’s director nominees. We would only intend to vote some or all of the Starboard Group Shares for some or all of the Company’s director nominees in the event it were to become apparent to us, based on the projected voting results at such time, that less than all of the Nominees would be elected at the Annual Meeting and that by voting the Starboard Group Shares we could help elect the Company nominees that we believe are the most qualified to serve as directors and thus help achieve a Board composition that we believe is in the best interest of all stockholders. If we decide to vote some or all of the Starboard Group Shares for some or all of the Company’s director nominees prior to the date of the Annual Meeting, we will file a statement on Schedule 14A on the same day such determination is made in order to notify shareholders accordingly. Shareholders should understand, however, that all shares of Common Stock represented by the enclosed WHITE proxy card will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted in accordance with Starboard’s recommendations specified herein and in accordance with the discretion of the persons named on the WHITE proxy card with respect to any other matters that may be voted upon at the Annual Meeting.

The Company has set the close of business on August 11, 2014 as the record date for determining shareholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 1000 Darden Center Drive, Orlando, Florida 32837. Shareholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were ______ shares of Common Stock outstanding.

THIS SOLICITATION IS BEING MADE BY STARBOARD AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH STARBOARD IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED WHITE PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

STARBOARD URGES YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING, AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our WHITE proxy card are available at

______________________

______________________________

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you own. Starboard urges you to sign, date, and return the enclosed WHITE proxy card today to vote FOR the election of the Nominees and in accordance with Starboard’s recommendations on the other proposals on the agenda for the Annual Meeting.

| | · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed WHITE proxy card and return it to Starboard, c/o Okapi Partners LLC (“Okapi Partners”) in the enclosed postage-paid envelope today. |

| | · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a WHITE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| | · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our twelve (12) Nominees only on our WHITE proxy card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

OKAPI PARTNERS LLC 437 Madison Avenue, 28th Floor New York, N.Y. 10022 (212) 297-0720 Shareholders Call Toll-Free at: (877) 285-5990 E-mail: info@okapipartners.com |

Background to the Solicitation

The following is a chronology of material events leading up to this proxy solicitation:

| | · | On December 19, 2013, Darden issued a press release announcing, among other things, that the Board had approved a proposed separation of the Company’s Red Lobster business through a spin-off or sale transaction (the “Red Lobster Separation”). |

| | · | On December 23, 2013, Starboard filed a Schedule 13D with the SEC (the “Schedule 13D”) disclosing a 5.6% interest in Darden. In the Schedule 13D, Starboard stated, among other things, that it invested in the Company based on Starboard’s belief that Darden is deeply undervalued and represents an attractive investment opportunity and that opportunities exist within the control of management and the Board to take actions that would create significant value for the benefit of all shareholders. Starboard further stated that it had conducted extensive research on Darden and had reviewed the proposed separation of Red Lobster and believed that the plan outlined by management fell significantly short of the actions required to maximize shareholder value. Starboard also expressed its belief in the Schedule 13D that there is a significant opportunity to dramatically improve Darden’s operating performance, as well as opportunities to realize substantial value from the Company’s real estate holdings and to explore other strategic options available to Darden to maximize shareholder value. |

| | · | On January 8, 2013, representatives of Starboard had a discussion with certain members of management to gain a better understanding of Darden as well as the proposed separation of Red Lobster. |

| | · | Over the following week, representatives of Starboard worked with Matthew Stroud, Darden’s Vice President of Investor Relations, to schedule a meeting with management at the Company’s headquarters in Orlando, FL. The meeting was scheduled for January 29, 2014. |

| | · | On January 21, 2014, Starboard delivered a letter to the Company’s Chairman and Chief Executive Officer (“CEO”), Clarence Otis, and the Board expressing its serious concerns with the Red Lobster Separation. |

| | · | On January 29, 2014, representatives of Starboard met with certain members of management at the Company’s headquarters in Orlando, FL to discuss the proposed separation of Red Lobster and the operations of the Company. |

| | · | On February 10, 2014, Starboard delivered a letter to the Company’s Chairman and CEO, Clarence Otis, and the Board reiterating its belief that the Company’s current plan to spin-out or sell Red Lobster is not in the best interests of shareholders. |

| | · | On February 24, 2014, Starboard delivered an open letter to Darden’s shareholders informing them that it filed a preliminary solicitation statement seeking to call a special meeting of Darden’s shareholders (the “Special Meeting”) to provide shareholders with a democratic forum for expressing their views on the Red Lobster Separation. |

| | · | On March 3, 2014, the Company issued a press release announcing the Company’s conference call to investors and an investor presentation prepared by the Company for use during the conference call, which stated, among other things, that Darden remains on track to execute its previously announced plan to separate the Red Lobster business through either a spin-off or a sale of the Red Lobster business and that the sale process is well underway. |

| | · | On March 10, 2014, the Company issued a press release announcing that it filed a Form 10 Registration Statement with the SEC in connection with the proposed separation of Red Lobster. |

| | · | On March 20, 2014, Starboard filed a definitive solicitation statement with the SEC in connection with its solicitation of written requests from Darden’s shareholders to call the Special Meeting. |

| | · | Also, on March 20, 2014, Starboard issued an open letter to Darden shareholders detailing, among other things, the reasons shareholders should support Starboard’s request that Darden call the Special Meeting and urging shareholders to join Starboard’s efforts by submitting their written request cards. |

| | · | On March 31, 2014, Starboard filed an investor presentation (the “Investor Presentation”) outlining in detail, among other things, its serious concerns with the proposed separation of Red Lobster and why it believes the Special Meeting is critical to provide shareholders with a forum to express their views and influence the future of Red Lobster before it is too late. Starboard also filed a detailed presentation entitled A Primer on Darden’s Real Estate (the “Real Estate Primer”) outlining, among other things, the substantial value intrinsic to Darden’s real estate and a number of highly attractive alternatives for Darden’s real estate assets. |

| | · | On April 1, 2014, Starboard issued a press release disclosing the Investor Presentation and the Real Estate Primer. |

| | · | Also, on April 1, 2014, the Company filed a revocation solicitation statement with the SEC in response to Starboard’s solicitation statement in connection with Starboard’s request that Darden call the Special Meeting. |

| | · | On April 10, 2014, representatives of Starboard met with representatives of Darden’s Board, including Darden’s lead independent director, to discuss the Red Lobster Separation and to request that Darden put any plans to separate Red Lobster on hold to allow time to conduct a new and objective review of more shareholder-friendly alternatives, or at the very least to subject any final Red Lobster transaction to a shareholder vote. |

| | · | On April 11, 2014, Starboard issued a press release disclosing that Glass Lewis & Co., LLC (“Glass Lewis”), a leading independent proxy voting advisory firm, had recommended that Darden shareholders consent on Starboard's WHITE request card to support Starboard's solicitation to call the Special Meeting. |

| | · | Also, on April 11, 2014, Starboard issued a press release disclosing that Institutional Shareholder Services (“ISS”), a leading independent proxy voting advisory firm, had also recommended that Darden shareholders consent on Starboard's WHITE request card to support Starboard's solicitation to call the Special Meeting. |

| | · | Also, on April 11, 2014, Darden issued a statement disclosing its disagreement with Glass Lewis’ and ISS’ recommendations to Darden shareholders and advised Darden shareholders not to consent on Starboard’s WHITE request card with respect to Starboard’s solicitation to call the Special Meeting. |

| | · | Also, on April 11, 2014, Darden issued a statement disclosing that Egan-Jones Proxy Services had recommended that Darden shareholders revoke on Darden’s blue revocation card and reject Starboard’s efforts to solicit written requests to call the Special Meeting. |

| | · | On April 14, 2014, Starboard issued a press release and statement to Darden shareholders expressing its gratification with both Glass Lewis’ and ISS’ recommendations that Darden shareholders support Starboard’s efforts to call the Special Meeting by consenting on Starboard’s white request card. |

| | · | On April 22, 2014, Starboard delivered a cover letter to Darden’s Secretary together with written requests from the holders of 73,233,321 shares of Common Stock, representing approximately 55.5% of the outstanding shares of Common Stock as of the March 20, 2014 record date for the Special Meeting solicitation. |

| | · | On April 25, 2014, Starboard delivered a supplemental cover letter to Darden’s Secretary together with written requests from the holders of an additional 2,210,867 shares of Common Stock, meaning Starboard had delivered written requests representing an aggregate of 75,444,188 shares of Common Stock, representing approximately 57.2% of the outstanding shares of Common Stock as of the March 20, 2014 record date for the Special Meeting solicitation. As Starboard explained in several subsequent letters, the holders of approximately 57% of shares outstanding that delivered written requests represent approximately 80% of the shares realistically available to vote on such a matter. |

| | · | On April 29, 2014, representatives of Starboard met with certain members of management at the Barclays Retail and Consumer Discretionary Conference in New York, NY to discuss the operations of the Company as it relates to the Company’s announced objectives for Olive Garden and Red Lobster. |

| | · | On May 2, 2014, IVS Associates, Inc. (“IVS”) released preliminary voting results disclosing that Starboard had delivered written requests representing an aggregate of 74,638,027 shares of Common Stock, representing approximately 56.6% of the outstanding shares of Common Stock as of the March 20, 2014 record date for the Special Meeting solicitation. |

| | · | Also, on May 2, 2014, Starboard filed a preliminary proxy statement with the SEC in connection with its solicitation of votes from Darden shareholders for the Special Meeting to approve a non-binding proposal regarding the Red Lobster Separation. |

| | · | Also, on May 2, 2014, Starboard delivered a letter to the Board urging the Company to hold the Special Meeting immediately and without unnecessary delay in light of Starboard’s delivery of written requests to the Company from the holders of approximately 57% of Darden’s outstanding shares of Common Stock, well in excess of the 50% required to call the Special Meeting, which was certified by IVS in its preliminary voting report. |

| | · | Also, on May 2, 2014, Starboard issued a press release regarding the May 2nd letter to the Board and IVS’ preliminary voting report confirming that Starboard delivered valid written requests to call the Special Meeting as well as Starboard’s filing of preliminary proxy materials for the upcoming Special Meeting. |

| | · | On May 6, 2014, Darden issued a press release confirming receipt of IVS’ certification regarding Starboard’s solicitation to call the Special Meeting. In the press release, Darden stated that it will announce details regarding the Special Meeting as it deems appropriate. |

| | · | On May 7, 2014, Starboard delivered a letter to the Board following the final certification by IVS of valid written requests delivered by Starboard to call the Special Meeting from the holders of approximately 57% of the Company’s outstanding shares. In the letter, Starboard called on the Board to stop wasting time and to take this extraordinary shareholder action seriously by immediately providing notice of the Special Meeting without further undue delay. |

| | · | Also on May 7, 2014, Starboard issued a press release regarding its delivery of the May 7th letter to the Board and IVS’ certified, final voting report confirming that Darden shareholders validly requested the calling of the Special Meeting. |

| | · | On May 14, 2014, Starboard delivered a letter to the Board following statements made by Matthew Stroud, Darden's VP, Investor Relations, to a group of shareholders that the Company is on a timetable to complete a sale or spin-off of Red Lobster in June or July. In the letter, Starboard noted that Mr. Stroud also informed such shareholders that the Company believes it can delay calling the Special Meeting as far as 60 days from the date of certification of the written requests, and that it is not required to hold the Special Meeting thereafter for an additional 60 days, which Starboard noted is inconsistent with Florida law, which clearly provides that the initial 60 days to call the Special Meeting starts when the written requests are delivered, not certified. Starboard further stated in the letter that it is disturbed that Darden seems more intent on discussing how it can delay the Special Meeting rather than taking the steps required to hold the Special Meeting and that if the Company intends to announce a Red Lobster transaction prior to the Special Meeting, that the Board should make such transaction subject to shareholder approval. |

| | · | Also on May 14, 2014, Starboard issued a press release regarding the May 14th letter to the Board. In the press release, Starboard highlighted its concerns, among others, with the Company’s statement that the timetable to complete a Red Lobster sale or spin-off is June or July, which Starboard viewed as a transparent strategy to disenfranchise shareholders by delaying the Special Meeting as long as possible and forcing through a Red Lobster sale or spin-off prior to allowing shareholders to voice their opinions. |

| | · | On May 16, 2014, Darden announced that it had entered into a definitive agreement to sell its Red Lobster business and real estate assets for approximately $1.6 billion in net proceeds (the “Red Lobster Sale”) to Golden Gate Capital (“Golden Gate”). Darden also released a related investor presentation on May 16, 2014 regarding the Red Lobster Sale, but did not schedule a conference call with investors and analysts to answer questions regarding the transaction. |

| | · | On May 22, 2014, Starboard delivered a letter to Darden’s Secretary (the “Nomination Letter”) nominating Betsy S. Atkins, Margaret Shân Atkins, Jean M. Birch, Bradley D. Blum, Peter A. Feld, James P. Fogarty, Cynthia T. Jamison, William H. Lenehan, Lionel L. Nowell, III, Jeffrey C. Smith, Charles M. Sonsteby, and Alan N. Stillman, for election to the Board at the Annual Meeting. In the Nomination Letter, Starboard stated that it believes that the terms of twelve (12) directors currently serving on the Board expire at the Annual Meeting. Depending on certain factors, including the total number of directors up for election at the Annual Meeting and the Company’s financial and operational performance, Starboard reserved the right to either withdraw certain or all of its Nominees or to nominate additional nominees for election to the Board at the Annual Meeting. |

| | · | Also on May 22, 2014, Starboard delivered an open letter to shareholders of Darden expressing, among other things, why substantial change to the Board is required at this time. In the letter, Starboard expressed its dismay that the Board has essentially “given away” Red Lobster in what Starboard believes was a value-destructive transaction without shareholder approval, and condemned the Board for ignoring Starboard’s Special Meeting request, violating a clear shareholder directive calling for a forum for shareholder input on the Red Lobster Separation, and disenfranchising shareholders. Starboard further stated that while it has been clear for some time that some level of change would be required at Darden to increase and protect value for shareholders as a result of years of poor performance and poor governance, the apparent self-serving and value destructive sale of Red Lobster has made it clear that the Board must be reconstituted at this time. In addition, Starboard identified significant opportunities to unlock substantial value at Darden in the letter. Starboard also issued a press release on May 22, 2014 disclosing its nomination of a slate of twelve (12) highly qualified director candidates for election to the Board at the Annual Meeting and its delivery of the May 22nd letter to Darden shareholders. |

| | · | On May 30, 2014, Darden filed a preliminary proxy statement with the SEC for the Special Meeting. |

| | · | On June 2, 2014, Starboard issued a press release announcing its delivery of a private letter to the Board withdrawing its Special Meeting request delivered to Darden’s Secretary on April 22, 2014 and condemning the Board for rendering the Special Meeting moot by entering into a binding contract to sell Red Lobster that does not require shareholder approval. Starboard questioned how the Board, after committing to address the Special Meeting request “as appropriate” could deem the appropriate time to hold the meeting to be after the Board had signed a binding contract irrevocably committing the Board to ignore the results of the Special Meeting. |

| | · | On June 5, 2014, Starboard delivered to Darden at its principal place of business a letter, under oath, demanding inspection of certain of the Company's books and records pursuant to Section 607.1602 of the Florida Business Corporations Act (the “June 5 Demand”). Starboard’s purposes for the June 5 Demand are: (1) to investigate potential mismanagement, wrongdoing and/or waste of corporate assets in connection with the sale of Red Lobster; and (2) to evaluate proceeding with a proxy contest and preparing proxy materials in support of its nominees for election to the Board. The June 5 Demand included a series of requests for certain books and records relating directly to Starboard’s two stated purposes for investigating potential mismanagement and evaluating a potential proxy contest. |

| | · | On June 12, 2014, Darden’s counsel sent Starboard’s counsel a letter contesting the propriety of Starboard’s stated purposes for seeking books and records and asserting that Starboard’s requests were neither directly connected to its stated purposes nor described with reasonable particularity. |

| | · | On June 19, 2014, Starboard’s counsel sent a letter responding to Darden’s counsel (the “June 19 Demand”), reaffirming the propriety of Starboard’s stated purposes and the June 5 Demand’s satisfaction of all of the other requirements of Section 607.1602. In the June 19 Demand, Starboard also voluntarily narrowed its specific books and records requests in an effort to reach a resolution. |

| | · | After delivery of the June 19 Demand, counsel to Darden and Starboard commenced negotiations regarding the scope of the categories of documents to be produced by Darden and the restrictions to be applied to Starboard’s use of such documents. Although Darden and Starboard were able to reach a preliminary agreement over the scope of some of the production, Darden was not willing to accept reasonable terms regarding confidentiality restrictions. Specifically, Darden proposed that Starboard must not only keep the books and records themselves confidential and not disclose them, but also insisted that Starboard could not express any “opinions, conclusions, views, or perspectives” derived from the produced books and records. Thus, Darden attempted to condition any production of books and records on Starboard’s agreement not to express any view or opinion informed by or derived in any way from any produced books and records. Starboard’s counsel informed Starboard that such an unreasonable condition could put Starboard in the position of being unable to satisfy its disclosure obligations under the federal securities laws. |

| | · | On July 1, 2014, representatives of Starboard met with Darden’s lead independent director to discuss the value destruction that Starboard believes has resulted from the Red Lobster Sale and the remaining opportunities to create value at Darden. |

| | · | On July 7, 2014, representatives of Starboard met with the Company’s President and Chief Operating Officer in Winter Park, Florida for lunch at the newly remodeled Olive Garden restaurant. |

| | · | On July 15, 2014, Starboard issued a press release announcing that it had delivered a letter to the Board. In the letter, Starboard highlighted the need for a new direction and new leadership at the Company. Starboard condemned the Board for the recent value destruction at Darden that Starboard believes resulted from the sale of Red Lobster. Starboard stated in the letter its belief that the sale of Red Lobster is the latest in a string of bad decisions by management and the Board that Starboard believes have led to the Company’s massive stock price underperformance relative to its peers over the past five years. Starboard concluded the letter by urging the Board to allow Starboard’s highly qualified slate of restaurant industry veterans, real estate experts, and corporate governance stewards to begin to take Darden in a new and dramatically improved direction without unnecessary delay. |

| | · | On July 23, 2014, Starboard Value LP and its affiliates filed a Complaint in the Circuit Court for the Ninth Judicial Circuit in and for Orange County, Florida against the Company seeking an order directing Darden to permit Starboard to inspect and make copies of the documents sought in the June 19 Demand pursuant to Section 607.1604 of the Florida Business Corporations Act. Despite Starboard’s efforts to negotiate confidentiality terms in good faith, the Company refused to provide any of the requested books and records, and Starboard filed the Complaint seeking to enforce its inspection rights under Florida law. Starboard also filed an accompanying Motion Seeking An Expedited Order Permitting Inspection and Copying of Corporate Books and Records. |

| | · | On July 24, 2014, the Board approved a resolution approving and nominating Starboard’s director nominees for election to the Board for the limited purposes of the definitions of “Change in Control,” “Change of Control” and/or “Continuing Directors” under the Company's outstanding debt agreements, including the Company's revolving credit facility, term loan agreement and notes, as applicable. |

| | · | On July 28, 2014, Starboard filed its preliminary proxy statement on Form PREC14A in connection with the Annual Meeting. |

| | · | On July 28, 2014, the Company announced that Clarence Otis, Jr. will be stepping down as Chairman of the Board and CEO of the Company. Mr. Otis agreed to continue serving as CEO of the Company until the earlier of the appointment of his successor or December 31, 2014. Mr. Otis will remain a director of the Company, but will not stand for reelection at the Annual Meeting. In connection with Mr. Otis’ resignation, the Company also announced that the Board appointed Charles A. Ledsinger, Jr., as Independent Non-Executive Chairman of the Board and that Darden has amended its corporate governance policies to provide for the separation of the Chairman and CEO roles. In addition, the Company announced that David Hughes, a current member of the Board, informed the Board that he will not stand for re-election at the Annual Meeting but will continue to serve as a director of the Company until the Annual Meeting. The Company also announced that it expects to nominate a slate of nine directors for the available twelve seats at the Annual Meeting. |

| | · | On July 29, 2014, Starboard issued a statement and press release in response to Darden’s announcement that Mr. Otis will be stepping down as Chairman and CEO of the Company and that the Company is running a reduced slate of nine (9) director nominees for twelve (12) seats at the Annual Meeting. In the press release, Starboard expressed its belief, among other things, that Mr. Otis leaving represents just one step in the transformation that is urgently needed at Darden, and that the Company still requires a major overhaul at the Board level. |

| | · | On July 31, 2014, the Company erroneously filed its preliminary proxy statement on form DEF 14A in connection with the Annual Meeting. |

| | · | On August 4, 2014, the Company issued a press release entitled “Darden Files Presentation Regarding Red Lobster Divestiture and Issues Open Letter to Shareholders” and an investor presentation entitled “Update on Successful Red Lobster Sale Process.” |

| | · | Also, on August 4, 2014, the Company filed its preliminary proxy statement on form PREC 14A in connection with the Annual Meeting. |

| | · | Also, on August 4, 2014, the Company filed its opposition to Starboard’s Motion Seeking An Expedited Order Permitting Inspection and Copying of Corporate Books and Records. Among other things, the Company’s opposition reiterated its earlier position that Starboard’s purposes in demanding inspection of the Company’s books and records are not proper. |

| | · | On August 5, 2014, Starboard issued a statement and press release responding to what it believes to be the Company’s latest misleading statements. In the press release, Starboard, among other things, affirmed its commitment to sustaining and enhancing the Company’s $2.20 annual dividend and investment-grade rating, which Darden had erroneously claimed Starboard would not support. |

| | · | On August 7, 2014, Starboard filed its Reply in Further Support of its Motion Seeking An Expedited Order Permitting Inspection and Copying of Corporate Books and Records. The Motion is now fully submitted and the Court will hear argument on the Motion on August 14, 2014. |

| | · | On August 14, 2014, the Circuit Court for the Ninth Judicial Circuit in and for Orange County, Florida granted Starboard's Motion Seeking An Expedited Order Permitting Inspection and Copying of Corporate Books and Records directing Darden to provide Starboard with books and records relating to, among other things, the Red Lobster Sale, Darden's March 2014 Bylaw amendments, and Darden's failure to hold the Special Meeting prior to agreeing to sell Red Lobster. |

| | · | Also, on August 14, 2014, Starboard filed amendment no. 1 to its preliminary proxy statement on Form PRRN14A. |

| | · | On August 18, 2014, Darden filed amendment no. 1 to its preliminary proxy statement on Form PRER14A. |

REASONS FOR THE SOLICITATION

WE BELIEVE THE CURRENT BOARD HAS DISRESPECTED THE BEST INTERESTS OF SHAREHOLDERS – IT IS TIME FOR SUBSTANTIAL CHANGE AT DARDEN

For far too long, the current Board has presided over an extended period of poor stock price performance, poor operating performance, and poor corporate governance. Further, the current Board also lacks meaningful restaurant operating experience.

While it has been clear for some time that some level of change would be required at Darden to increase and protect value for shareholders, the egregious corporate governance practices and recent value destruction that we believe resulted from the Red Lobster Sale, which the Board forced through in direct conflict with the principle of corporate democracy, made it absolutely clear to us that the majority of Darden’s current directors must be replaced at the Annual Meeting. We believe shareholders deserve a board of directors who collectively possess the objectivity, perspective, and qualifications to make decisions that are in the best interests of shareholders, and whom they can trust to lead a turnaround at Darden. With the right leadership in place, we believe Darden will once again be able to create substantial value for shareholders.

We have nominated a slate of twelve (12) highly qualified director candidates for election to the Board at the Annual Meeting. Our Nominees were carefully selected and possess diverse skill sets in areas directly relevant to Darden’s business, its current challenges, and its opportunities. Our Nominees collectively bring decades of restaurant experience, a proven ability to execute, financial acumen, and an unequivocal commitment to respect and represent the best interests of all shareholders. We believe that our Nominees, if elected, are fully capable of bringing about the much-needed change that is required at Darden.

WE BELIEVE IT IS TIME FOR THE BOARD TO BE HELD ACCOUNTABLE FOR YEARS OF POOR PERFORMANCE, EGREGIOUS CORPORATE GOVERNANCE, AND SUBSTANTIAL SHAREHOLDER VALUE DESTRUCTION

Darden’s Stock Price and Operating Performance Have Significantly Underperformed Peers

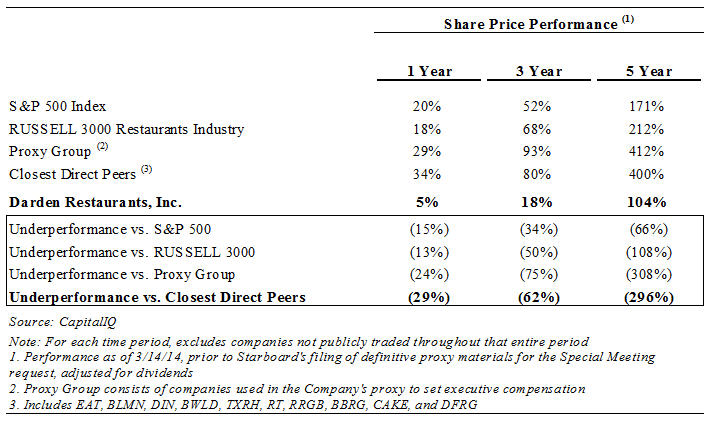

Darden’s stock has significantly underperformed peers over an extended period of time. As displayed in the chart below, in the five years prior to our filing of proxy materials for the solicitation of written requests, Darden has underperformed its closest direct competitors and its proxy peer group by approximately 300%.

As we detailed in our investor presentation dated March 31, 2014 (available at http://tinyurl.com/March31-Investor-Presentation) (the “Investor Presentation”), Darden’s top- and bottom-line performance has significantly trailed peers. Same-store-sales for each of Darden’s largest concepts, Olive Garden and Red Lobster, have declined significantly, and management’s strategy of increasing price to offset traffic declines has only exacerbated the problem.

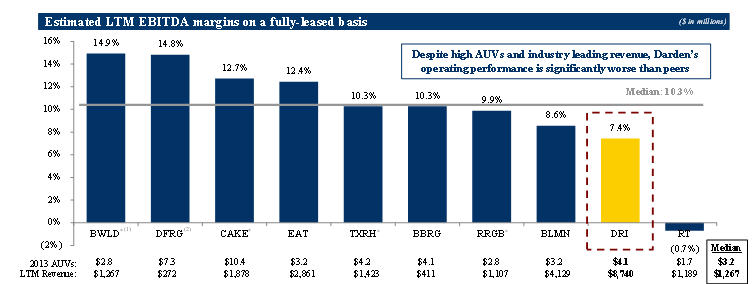

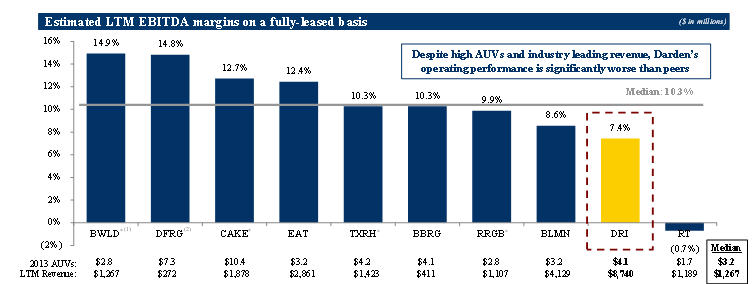

Further, despite Darden’s inherent advantages of industry-leading average unit volumes (AUV) and scale, Darden’s margins are well below peers, as demonstrated in the chart below.

| |  | |

| | Source: Company filings, Capital IQ, company presentations and Green Street Advisors. Note: Assumes $27.10/rent per square foot for owned properties and $10.65/rent per square foot for ground leased properties. If adjusted for franchised stores, assuming a 40% margin on franchised revenue, the median EBITDA margin equals 10.3% and the average equals 9.9% *Denotes at leased 20% franchised properties. (1) BWLD leases the land and building for all sites or utilizes ground leases, but does not specify the number of ground leases, no adjustment has been made. (2) Assumes $65.00/rent per sq. for single owned property.

| |

We believe the Company’s recent operating results demonstrate that management and the Board are not executing and lack the skill and understanding to improve the operating performance at Darden. However, we also believe this underperformance is addressable and highlights an important opportunity for value creation at Darden, as we believe a more capable team will be able to close the gap between Darden and peers, positioning Darden as the industry leader in performance, not just in size.

WE BELIEVE THE RED LOBSTER SALE REPRESENTS A SUBSTANTIAL DESTRUCTION OF SHAREHOLDER VALUE

The Board Stubbornly Proceeded with the Red Lobster Sale in One of the Most Egregious Violations of Shareholder Trust we Have Ever Seen

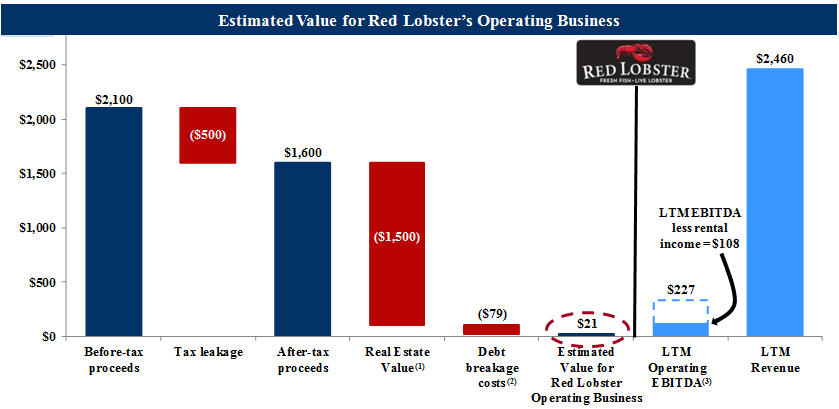

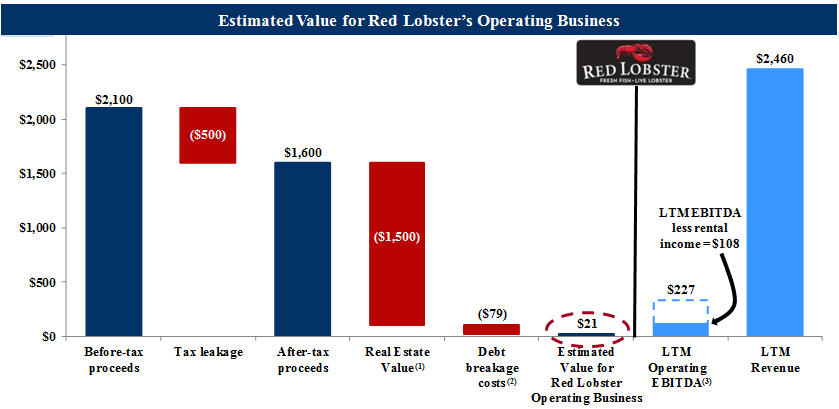

On May 16, 2014, Darden announced the Red Lobster Sale, in which Darden’s Red Lobster operating business and real estate assets would be sold to Golden Gate for gross proceeds of approximately $2.1 billion and net proceeds of $1.6 billion, after taxes. Golden Gate concurrently signed an agreement to sell Red Lobster’s real estate to American Realty Capital Properties, Inc. for $1.5 billion. As we have previously demonstrated, we believe that Darden could have realized this $1.5 billion in real estate value on a tax-free basis, which implies that the net proceeds to Darden represent just $100 million in value for Red Lobster’s operating business, or less than 1x EBITDA, before debt breakage and transaction costs. We believe that the transaction both destroyed substantial shareholder value and contradicted a clear directive from shareholders calling for the Special Meeting to be held as a forum for shareholder input on the Red Lobster Separation through a vote on a non-binding resolution urging the Board not to approve any agreement or transaction involving Red Lobster prior to the Annual Meeting unless such agreement or transaction would require shareholder approval. In the two months following this announcement, Darden’s stock price declined by approximately 11% and underperformed peers by 15%.

| |  | |

| | Source: Capital IQ. As of July 27, 2014, adjusted for dividends. Proxy Group consists of companies used in the Company’s proxy statement to set executive compensation. Closest Direct Peers includes EAT, BLMN, DIN, BWLD, TXRH, RT, RRGB, BBRG, CAKE, and DFRG. | |

We believe that this relative performance represents a destruction of over $1 billion in total shareholder value,2 and was just the latest in a string of awful decision-making under the leadership of the current management team and Board.

We believe this destruction of value was entirely avoidable. We asked the Board to pause and reconsider its plan. A substantial majority of shareholders joined us in asking the Board to pause and reconsider its plan. In fact, the 57% of outstanding shares that delivered written requests to hold the Special Meeting represented approximately 80% of the shares realistically available to vote on such a matter, an overwhelming show of concern about management’s proposed plan to sell Red Lobster. The Board chose to ignore all of us and, instead, decided unilaterally to sell Red Lobster at, what we believe was, a fire sale price. All the Board needed to do to avoid this outcome was to simply listen to its shareholders and either pause the process to sell Red Lobster or agree to make any final transaction subject to a shareholder vote. Instead, the Board chose to stubbornly ignore shareholders and, as predicted, the Board’s decision resulted in what we believe to be a destruction of substantial value. As ISS explained:

In April, Starboard delivered written consents from a majority of outstanding shares supporting its request for a special meeting. Several weeks later, however, the board – acting within its purview but with clear disregard for the strong mandate shareholders had already provided through the written consent process – announced it had agreed to sell Red Lobster to Golden Gate Capital for $2.1 billion in cash. The transaction would not be subject to a shareholder vote.

In one of the most effectively-titled research notes in the history of sell-side research, the equity analyst at Janney Montgomery Scott deftly captured in 6 words the reaction of many observers: "Who Knew Lobsters Had Middle Fingers?"3

As discussed above, we believe the Red Lobster Sale generated virtually no value to Darden shareholders for the operating business of Red Lobster. Even after adding in rent expense, and despite a temporary trough due largely to substantial one-time costs, including inflated shrimp prices, Red Lobster is an iconic brand with $2.5 billion in sales and $108 million in EBITDA. In fact, now that Darden has disclosed the debt breakage costs and transaction fees associated with the deal, it appears that the actual net proceeds for the operating business approximate zero.

2Calculated as the decline in Darden’s market cap compared to its Proxy Group. While other general factors could impact stock price performance, we believe this underperformance is directly attributable to the Red Lobster Sale and the market’s lack of confidence in Darden’s current leadership.

3Institution Shareholder Services 2014 Mid-Year Activism Review, July 8, 2014.

| |  | |

| | Source: Company filings. (1) As demonstrated in our real estate primer, A Primer on Darden’s Real Estate released on 3/31/2014, we believe this value could be realized on an after-tax basis through a variety of options. (2) Assumes debt breakage costs of $0.39 per share, per management’s statement on its Q4 2014 earnings call, and 35% tax rate. (3) Pro-forma operating EBITDA assumes Red Lobster LTM EBITDA of $227 million less assumed rental income of $119 million. | |

Since, as shown above, we believe Darden received essentially no value for the Red Lobster operating business, it should not be surprising that Darden’s stock has lost substantial value relative to peers since the announcement of the Red Lobster Sale. This result should have been easy for the Board to foresee, given the valuation that we previously released for Red Lobster’s operating business and real estate assets in our March 31, 2014 Investor Presentation. We outlined why Red Lobster’s operating business and real estate assets were worth at least $2.4 billion to shareholders (on an after-tax basis), even before taking into account the substantial opportunity for improvement in Red Lobster’s earnings.4 Therefore, by choosing to sell Red Lobster for net proceeds of just $1.6 billion (before transaction costs and debt breakage), it should have been clear to the Board that a minimum of $800 million in shareholder value would be destroyed. Moreover, given the opportunities that we believe were readily available for improvement in Red Lobster’s earnings, the value destruction relative to the true value of Red Lobster inside of Darden was likely well over $1 billion – approximately in line with the $1 billion in market value that Darden’s stock has lost relative to peers. It is highly concerning that the Board made this decision when it should have known full-well the value that would be destroyed. As we explain below, we believe this decision was driven at least in part by recent changes in how management is compensated that would have made it difficult for management to achieve their bonus targets without divesting Red Lobster on an accelerated timeline.

4Please see slide 14 of our Investor Presentation dated March 31, 2014 (available at http://tinyurl.com/March31 Investor-Presentation), in which we lay out the value of Red Lobster’s operating business and real estate of approximately $850 million and $1.5 billion, respectively, or $2.4 billion in total. As we demonstrated in detail in our accompanying real estate presentation (the “Real Estate Presentation”) (available at http://tinyurl.com/Primer-On-Darden-Real-Estate), we believe Darden could have realized the value of the real estate tax-free through a number of alternatives. The minimum value of the operating business could also have been realized through a tax-free spin-off, or, as we recommended, simply keeping the operating businesses inside of Darden. The valuations referenced in the Real Estate Presentation are estimates and, therefore, there can be no assurance that such estimates are reflective of actual realizable value. While there could be additional information regarding Darden’s real estate assets that could alter the valuations referenced in the Real Estate Presentation, Starboard strongly believes that the assumptions used in such valuations are conservative, and that the incorporation of any such additional data would likely to lead to a higher valuation range.

This marks a truly disastrous end to Darden’s ownership of its first iconic brand. Darden’s ownership of Red Lobster deserved a better ending and, more importantly, we, as shareholders, deserved far better performance from our Board.

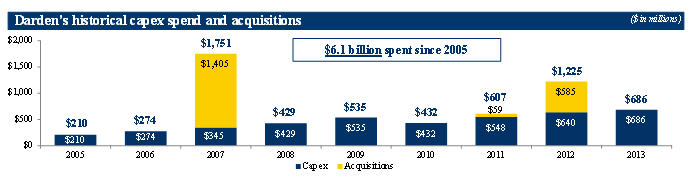

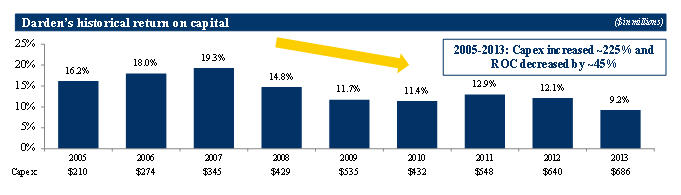

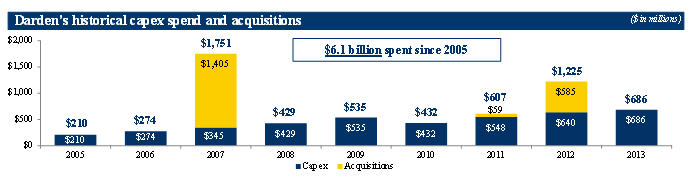

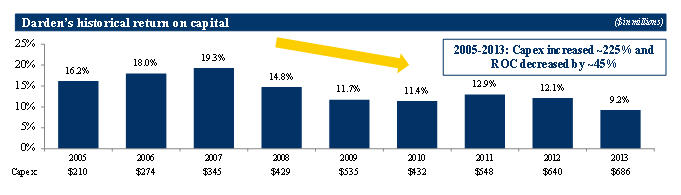

Darden’s Record of Capital Allocation is Unacceptable

We believe Darden’s record of capital allocation under the current Board is one of unchecked spending for top-line growth combined with abandonment of valuable assets that management does not have the skill to turn around. On the one hand, Darden has a history of acquiring brands at inflated prices, including RARE Hospitality, which was acquired for more than 11x EBITDA at the peak of the market in 2007, and Yard House, which was acquired for more than 20x EBITDA despite decelerating growth prospects.5 On the other hand, Darden appears to have a predisposition to dispose of troubled concepts at rock bottom prices, such as Smokey Bones, which was sold for just $80 million6 after Darden invested more than $400 million7 in new stores since Mr. Otis was named President. Now, unfortunately, Darden has done the same thing with Red Lobster, disposing of it in a transaction that we believe generated essentially no net proceeds to Darden shareholders for Red Lobster’s operating business.

In addition, the Company persisted with excessive capital spending on new units at both Red Lobster and Olive Garden long after it became clear that same-store-sales were decelerating and investors and sell-side analysts started asking management to slow new unit growth. In total, since Clarence Otis was named CEO in 2004, Darden has spent approximately $6.1 billion – or $46.50 per Darden share, [more than] the entire market capitalization of Darden – on capital expenditures and acquisitions.

5Transaction multiples based on the latest twelve month historical period, per CapitalIQ. Note that for Yard House, this is for calendar year 2011. At the time of the announcement, management claimed that the “pro forma” 2013 acquisition multiple, including tax benefits, would be approximately 12.5x, but it is not clear that Yard House ever achieved the results assumed in this projection.

6Sold to Sun Capital Partners on December 4, 2007 for $80 million, per Orlando Sentinel.

7Company filings. Disclosed amount invested per store of $3.49m, $3.45m, and $3.66m for 2004, 2005, and 2006, respectively. Assumed $3.0m invested per store for stores opened from 2002-2003.

As we discussed in our Investor Presentation dated March 31, 2014 (available at http://tinyurl.com/March31 Investor-Presentation), we believe this poor capital allocation was the direct result of poor corporate governance at the Board level, including shareholder-unfriendly compensation practices that incentivized management to pursue growth at the expense of return on capital and shareholder value.

In its 2013 Proxy Report, Glass Lewis notes:

“The Company has been deficient in linking executive pay to corporate performance…[and] Shareholders should be concerned with this disconnect…Overall, the Company paid more than its peers, but performed moderately worse than its peers.”

Darden’s Performance under the Current Board Has Been Abysmal

When compared to peers on almost any metric – stock price performance, operating performance, or return on capital – Darden’s results have been abysmal. Despite this terrible track record, management has been paid at the top of its peer group, demonstrating extremely poor pay-for-performance. It is also quite possible that compensation played a large role in the motivation for the sale of Red Lobster. It is worth noting that around the same time as the Company’s announcement of its plan to separate Red Lobster, the Company announced a shift in compensation practices from a compensation plan based on total revenue growth and total EPS growth to one based on same-store-sales and free cash flow. We believe Red Lobster’s declining same-store-sales would have significantly hurt management’s ability to reach its compensation targets under this new plan.

SUBSTANTIAL OPPORTUNITIES EXIST AT DARDEN TO CREATE VALUE FOR SHAREHOLDERS

We Believe the Current Board Has Proven Time and Again That It Cannot Be Trusted to Act in the Best Interests of Shareholders

There is a Better Way

We Have Nominated a Slate of Highly Qualified Directors Who We Believe Can Absolutely Be Trusted to Represent Shareholders’ Best Interests

We believe the Red Lobster Sale was unquestionably a bad deal for shareholders; however, the value inherent in Red Lobster was just one element of the tremendous opportunity we see at Darden. We believe a unique opportunity still exists to unlock substantial value at Darden. We have been working diligently with our Nominees, our group of advisors, and one of the leading operationally-focused consulting firms to finalize a comprehensive turnaround plan to create substantial value at Darden. Our Nominees, if elected, are prepared to seamlessly begin executing on this comprehensive turnaround plan for Darden that will seek to put operations on par with well-performing competitors and create substantial value for shareholders. Importantly, our comprehensive plan will also include a 100-day plan outlining the operational actions our Nominees would pursue, if elected, during the first 100 days following the Annual Meeting.

We look forward to publicly releasing our comprehensive turnaround plan during the first week of September. This time frame should allow ample opportunity for shareholders to fully review and appreciate the details of our comprehensive plan in advance of the September 30, 2014 Annual Meeting date.

It Is Time for New Leadership at Darden

Darden recently announced that Chairman and CEO Clarence Otis will be stepping down upon the earlier of the appointment of his successor or December 31, 2014. The Company has indicated that it expects “an expeditious search process” for the next CEO. We hope that the Board does not rush to appoint a successor during the pendency of this election contest. We believe that this all-important decision should be left to the new Board that is elected at the Annual Meeting. Our Nominees, if elected, are committed to undertaking a robust process to vet both internal and external talent in order to find a truly great, transformational, operationally-focused restaurant leader. If Mr. Otis steps down prior to the appointment of his successor and before the end of the calendar year, we believe that certain of our director Nominees, as well as certain senior officers of the Company, could step in as CEO on an interim basis, however, we have not made any specific determinations at this time.

Mr. Otis leaving represents just one step in the transformation that is urgently needed at Darden, and that the Company still requires a major overhaul at the Board level. We believe the current Board lacks the objectivity and perspective needed to make decisions that are in the best interests of Darden shareholders. We also believe the current Board lacks meaningful restaurant operating experience. We have therefore carefully selected twelve (12) highly qualified director candidates with a unique set of complementary skills and perspectives directly relevant to Darden's business and current challenges, including experienced restaurant operators with expertise in Darden's major business lines, and experts in real estate, finance, turnarounds, supply chain, and, critically, effective public company governance and compensation programs. Importantly, these directors will commit to fairly and objectively representing the best interests of all shareholders.

Included among our group of directors and advisors are several executives with direct experience leading Darden’s most important concepts and overseeing similar turnarounds at competing casual dining companies. For example, one of our Nominees, Bradley D. Blum, along with our advisor Robert Mock, previously turned around Darden’s Olive Garden concept at a time when many questioned the brand’s relevance and future. The last time Olive Garden struggled, they transformed Olive Garden from a challenged chain with substantially negative same-store-sales into a highly profitable, industry-leading concept that experienced 29 (twenty-nine) consecutive quarters of same-store-sales increases. Under their watch Average Unit Volume (AUV) grew from approximately $2.5 million to $4 million.

Separately, while at Brinker International, Inc., one of our other Nominees, Charles M. Sonsteby, oversaw a company with many of the same challenges that Darden faces today, and was instrumental in implementing a plan that included (i) the successful turnaround of its restaurant operations, leading to both improved sales and a more than 300 basis point increase in margins, (ii) divesting non-core brands, (iii) a significantly expanded franchising program both domestically and internationally, and (iv) the monetization of company-owned real estate for the benefit of shareholders.

We believe experiences such as these, along with those of our other Nominees and advisors, will be invaluable to the new Darden board.

We are highly confident that the team of professionals we have proposed for election to the Board at the Annual Meeting will provide the much needed change required to substantially improve Darden’s operations, strategy, and value.

WE BELIEVE THE BOARD HAS A LONG HISTORY OF DISREGARDING SHAREHOLDERS’ CONCERNS AND BEST INTERESTS WHILE MAINTAINING POOR CORPORATE GOVERNANCE PRACTICES

For Years, Darden Has Maintained Shareholder-Unfriendly Corporate Governance Provisions

We believe management's recent shareholder-unfriendly Bylaw changes and poor track record when it comes to shareholder and analyst engagement call into question whether the current Board has been fulfilling its most basic fiduciary duties to shareholders.

For years, Darden has maintained numerous shareholder-unfriendly corporate governance provisions, as evidenced by Institutional Shareholder Services’ (“ISS”), a leading independent proxy voting advisory firm, giving Darden a governance Quickscore of 10, indicating the highest possible governance risk. Further, Glass Lewis & Co., LLC (“Glass Lewis”), another leading independent proxy voting advisory firm, highlighted Darden’s troubling governance in its recent report in connection with our Special Meeting campaign:

“Darden's portrayal of itself as a company that is strongly committed to shareholder engagement, that welcomes shareholder input and that values the views of shareholders rings somewhat hollow, to our ears, considering the Company's corporate governance policies and its track record of dealing with investors and analysts who have been critical of the Company.”

Amazingly, ISS gave Darden this rating and Glass Lewis levied this criticism of Darden’s governance even before the Company ignored the shareholder-requested Special Meeting and nevertheless proceeded with the Red Lobster Sale, which we believe resulted in the destruction of substantial shareholder value.

We believe Darden’s recent Bylaw amendments and the Board’s decision to sell Red Lobster before holding the Special Meeting underscore the Company’s disregard for shareholder interests and call into question the Board’s motives. Perhaps the Board foreshadowed the extreme angst of shareholders upon the Red Lobster Sale announcement when it amended the Bylaws to provide for more stringent nomination notice and business proposal requirements. In addition, the amended Bylaws remove the ability of shareholders to fill existing vacancies at the next annual or special meeting. It appears quite clear to us that the Board has taken steps to further entrench itself. ISS expressed similar concerns regarding Darden’s problematic governance issues, including the recent Bylaw changes:

“On March 19, 2014 the company announced several changes to its bylaws which would ‘update the bylaws to address current market practices.’ However, some of the bylaw changes appear to go beyond modernization, and—in the context of an extant challenge from shareholders—call into question the board’s motivation….the nature of these particular changes, coupled with the last-minute cancelation of its formerly annual 2-day analyst conference in March, may suggest cause for concern to shareholders. At the very least, one has to wonder why the board chose this particular time to ‘modernize’ the bylaws by granting itself powers to obstruct, or otherwise raising defenses against, shareholders who might wish to use the annual meeting to hold directors accountable. This is a particularly resonant question when the board is also arguing that a special meeting to request shareholders be allowed to ratify or reject a major strategic transaction is an ‘unsatisfactory’ approach.”

Shareholders Deserve a Board That Will Address and Respect Shareholder Concerns

We also have serious concerns with Darden’s long history of silencing critics and trying to avoid an active dialogue on the key issues facing the Company. A recent CNBC article titled Darden Uses Lobster Claws On Critical Analysts chronicles tactics used by Darden to put a muzzle on analysts who provide critical analysis. The article discusses how analysts from leading sell-side research firms have had access limited to varying degrees following their publication of analysis that did not reflect positively on management, and notes that this practice has been going on for more than a decade and continues to this day. Further, the New York Post recently published an article titled Darden Accused of Icing out Critics of Red Lobster Spinoff, which states:

“[S]ome investors are protesting that Darden’s idea of ‘direct engagement’ amounts to returning the phone calls of analysts and investors who agree with its strategy while ignoring calls from dissenters. ‘They’ve got a history of only engaging with investors and analysts who are supportive of their views,’ said one Darden shareholder, who declined to give his name for fear of retribution from the company. ‘If the board is so convinced [a Red Lobster spinoff] is such a great idea, then put it to a vote.’”

We are Concerned with the Board’s Lack of Sufficient Stock Ownership

Collectively, the members of the Board, other than Mr. Otis who is not standing for re-election, beneficially own less than 1% of the outstanding shares of Common Stock, the vast majority of which has been granted to the Board members as part of their director compensation. In contrast, Starboard itself beneficially owns an aggregate of 11,635,000 shares of Common Stock, or approximately 8.8% of the outstanding shares of Common Stock, and the shareholders that delivered written requests to hold the Special Meeting own 57% of the Common Stock.

We believe the Board’s collective lack of a substantial vested interest in shares of Darden may compromise the Board’s ability to properly evaluate and address the opportunities to enhance shareholder value at Darden with the best interests of shareholders in mind.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of twelve (12) directors, each with terms expiring at the Annual Meeting. According to the Company’s proxy statement, Senator Mack and Messrs. Hughes and Otis, three of the Company’s current directors, will not stand for reelection at the Annual Meeting, however, the size of the Board shall remain at twelve (12) directors.

Accordingly, we are seeking your support at the Annual Meeting to elect our twelve (12) Nominees, Betsy S. Atkins, Margaret Shân Atkins, Jean M. Birch, Bradley D. Blum, Peter A. Feld, James P. Fogarty, Cynthia T. Jamison, William H. Lenehan, Lionel L. Nowell, III, Jeffrey C. Smith, Charles M. Sonsteby, and Alan N. Stillman.