UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22545

DREXEL HAMILTON MUTUAL FUNDS

(exact name of registrant as specified in charter)

45 Rockefeller Plaza, Suite 2000, New York, New York 10111

(Address of principal executive offices) (Zip code)

Andrew Bang

45 Rockefeller Plaza, Suite 2000

New York, New York 10111

(Name and address of agent for service)

Registrant’s telephone number, including area code: (855) 298.4236

Date of fiscal year end: September 30

Date of reporting period: December 21, 2011 – September 30, 2012

| Item 1. | Reports to Stockholders. |

| | |

Drexel Hamilton Mutual Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

November 2012

Dear Shareholders,

With pleasure and excitement, we publish the inaugural annual report of the Drexel Hamilton Mutual Funds covering their inception on December 21, 2011 through our fiscal year ended September 30, 2012.

For the fiscal year ending September 30, 2012, the Net Asset Value (“NAV”) of the Drexel Hamilton Centre American Fund (DHAMX) increased 17.90% since inception and 16.16% year to date and the NAV of the Drexel Hamilton Centre Global Fund (DHGLX) increased 14.30% since inception and 13.06% year to date. Additional performance and fund information is available in the following Manager Commentary sections.

Of particular note and distinction is that our Drexel Hamilton Centre American Equity Fund was recognized as a WSJ’s Category King.

As of this letter, the Drexel Hamilton Multi-Asset Real Return Fund received SEC effectiveness and was launched on October 9, 2012 with backing of initial investors. The Multi-Asset Real Return Fund complements our equity funds and seeks total return that exceeds U.S. inflation over a full inflation cycle (typically 5 years) by using flexible tactical allocation strategy diversified across various asset classes to include equity, fixed income, commodities and cash. While navigating changing market conditions, the Fund will endeavor to dynamically shift allocation mix to maximize risk-adjusted returns and to preserve invested capital. Drexel Hamilton Investment Partners LLC serves as the Multi-Asset Real Return Fund adviser.

In an effort to focus the business on our core products, the Board of Trustees of the Drexel Hamilton Mutual Funds approved the liquidation and closure of the Drexel Hamilton 8IP Asia Pacific Equity Fund (DHAPX) and the Drexel Hamilton FOUR European Equity Fund (DHEUX) with effect on September 13, 2012. Based on investor feedback and business development efforts, it was determined that these funds were unlikely to attract sufficient new investment in the near future. We have reluctantly taken the decision to close the Funds as they would not be economically viable on an ongoing basis with disproportionately high fixed costs of operating such Funds borne by investors. The Drexel Hamilton Mutual Funds are committed to continued long-term management and growth of our core offerings of mutual funds: the Drexel Hamilton Centre American Equity, the Drexel Hamilton Centre Global Equity and the new Drexel Hamilton Multi-Asset Real Return Funds.

| | — | | Drexel Hamilton Centre American Equity Fund (DHAMX) |

| | — | | Drexel Hamilton Centre Global Equity Fund (DHGLX) |

| | — | | Drexel Hamilton Multi-Asset Real Return Fund (DHMUX) |

On September 17, 2012, the Board of Trustees of Drexel Hamilton Mutual Funds unanimously approved an agreement among the Trust, on behalf of Drexel Hamilton Centre American Equity Fund, to acquire Ameristock Mutual Fund, Inc. (“Ameristock Fund”). The proposed reorganization would involve (1) the Ameristock Fund transferring all of its assets to the Drexel Hamilton Centre American Equity Fund and assuming all of the Ameristock Fund’s liabilities; (2) the Ameristock Fund distributing pro rata to its shareholders shares of the Drexel Hamilton Centre American Equity Fund in exchange for such shareholders’ Ameristock Fund shares and in connection with the complete liquidation of the Ameristock Fund; and (3) the dissolution and termination of the Ameristock Fund. The Plan was unanimously approved by the Ameristock Fund Board on September 19, 2012 and will be submitted to the Ameristock Fund shareholders for approval at a Special Meeting of Shareholders expected to be held on or about December 12, 2012. The proposed reorganization is subject to various conditions to its consummation, including (among others) the approval of the Ameristock Fund shareholders. If the Plan is approved at the special meeting, it is currently anticipated that the reorganization would be consummated as of the close of business on or about December 28, 2012. We expect the completion of this transaction will enhance Drexel Hamilton Centre American Equity Fund’s overall capability by acquiring additional securities consistent with investment objective and having additional assets in the portfolio should create a larger, more viable fund with the potential for greater efficiencies and investment opportunities and other long-term benefits.

During this challenging and uncertain market, political and economic environment, Drexel Hamilton Mutual Funds’ equity strategies will continue to focus on fundamentals and stock selection skills within disciplined and research intensive processes. The Fund Managers have laid the building blocks in keeping with the investment objectives of seeking

long-term growth of capital and will build on the strong foundations laid during this initial year. The Multi-Asset Real Return Fund will look to actively allocate between asset classes using a fundamentally-driven disciplined model framework. Consistent, steady, proven and differentiated investment processes based on fundamentals across our funds will allow for insight and investment with conviction.

Drexel Hamilton Investment Partners LLC, the Adviser, offers funds management to clients, intermediaries, advisers and distributors as a leading Service Disabled Veteran Owned Small Business (“SDVOSB”) investment manager. We continue to see many state and municipal pension plans as well as other investors seeking to lead in implementing mandates and preference for SDVOSBs, a key focus of our expected growth as institutional investors may benefit or receive business credit for engaging DHIP as an investment manager per federal mandates and state/local regulations.

| | |

Annual Report | September 30, 2012 | | 1 |

| | |

Drexel Hamilton Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

As an Investment Manager with expertise in asset allocation and manager selection, Drexel Hamilton Investment Partners LLC’s business model is committed to:

| | — | | provide access to specialist single manager equity fund strategies that we believe demonstrate a competitive advantage in their region/style as well as a distinctive multi-asset capability; |

| | — | | aim to deliver results for our clients using a selection of highly talented investment fund managers, in-house and external sub-advisers; |

| | — | | dedication to risk management and the highest institutional standards; |

| | — | | offer funds with competitive fees, liquidity and transparency; and |

| | — | | working in partnership with our clients in the education and adherence regarding federal, state and local laws mandating use of Disabled Veteran Owned firms. |

In our inaugural year of the Funds’ operation, many significant milestones have been achieved and our Drexel Hamilton Centre American Equity Fund has received accolades. We believe that the Funds are off to strong start and look forward to continuing the goal of providing differentiation, value and performance for many years to come.

Sincerely yours,

Andrew Bang

President

Liquidity: The fund can be bought or sold on a daily basis.

Transparency: The fund posts its holdings 30 days after fiscal quarter end.

Andrew Bang is a registered representative of ALPS Distributors, Inc.

The statements and opinions expressed are those of the Adviser and are as of the date of this report.

| | |

Drexel Hamilton Centre American Equity Fund | | Manager Commentary |

| | September 30, 2012 (Unaudited) |

Performance:

Since inception (December 21, 2011) to September 30, 2012, the Drexel Hamilton Centre American Equity Fund returned 17.90% and outperformed its benchmark, the S&P 500 Index, which returned 17.81%.

From inception to September 30, 2012, sectors such as Telecom, Technology and Financials were market leaders whilst sectors such as Utilities, Energy, and Industrials lagged. Stocks that were strong performers within the Fund over this period included Apple (Technology), Huntsman (Materials), and Amazon.com (Consumer Discretionary); stocks that were laggards included Coach (Consumer Discretionary), McDonald’s (Consumer Discretionary), and Caterpillar (Industrials), all of which remain in the Fund.

Our principal overweight sectors over the period were Technology and Industrials driven by bottom-up stock level opportunities. We have, however, materially increased our positions within the Health Care and Staples sectors recently after harvesting gains in the Materials and Industrials sectors. In Health Care, we continue to add opportunistically to our existing core holdings such as Johnson & Johnson, Merck and Abbott Labs, as well as new positions in medical device manufacturer Zimmer and biotechnology concern Amgen. On the margin, our stock sales since the early part of the year are in more cyclical stocks, namely Alcoa, Dell, KLA-Tencor and Parker Hannifin due to recent loss of positive profit margin and return on capital momentum.

We maintain our general underweight of the large “too big to fail” financial stocks as regulatory scrutiny and increased capital requirements continue to depress returns on equity and intrinsic values. Our stock selection success in names such as Zions Bancorp and Capital One, part of our stock focus on the regional banking group, offset partially for the sector underweight versus the Index.

Economic and Market Review:

Over the period since inception through September 2012, U.S. stocks generated double digit returns as measured by the S&P 500 Index. The U.S. stock market rebounded from the low in the summer and fall of 2011 then fell sharply in May and June of 2012 due to the re-emergence of sovereign default worries and their impact on global economic growth. Since the summer months however, the U.S. stock market witnessed a reversal due to confidence in a positive impact from quantitative easing actions by the Federal Reserve and ECB. Despite the recent rally ignited by the Federal Reserve, what is unique and troubling about this economic and stock market cycle is that the U.S. appears to be on its way to joining Europe in economic slowdown despite monetary policy at its most accommodative posture. Normally, it’s the Federal Reserve and restrictive monetary policy via higher interest rates that slow the economy down. Given the uniqueness and the deterioration in profit margins generally across the S&P 500, we continue to move the Fund towards less cyclical and mega-capitalization type stocks and view large U.S. multinationals as one of the best opportunities amongst investment choices.

Despite the continuing bleak employment figures in the U.S. since the onset of recession in late 2007, economic expansion as measured by the ISM Index, a national purchasing manager survey, has experienced one of the longest post WWII periods of economic growth, 34 months. This said, three out of the past five recent sub-50 Index readings since June indicate economic contraction and portend a possible recession on the horizon. Looking back, stock markets rallying to new highs in January 2007 based upon confidence of a “goldilocks” economy, a term describing conditions that are neither too hot nor too cold, taking hold in the U.S. despite the ISM Index piercing the below 50 threshold was a warning shot about the imminent recession to follow. This was after being in expansion above 50, a level that indicates economic growth, from July 2003. At other times when the ISM Index fell below 50 after expansion such as August 2000, June 1998, May 1989 and August 1979, foretold of further economic contraction, consistent in most cases with outright recessions that followed. Today, aside from the broad ISM index moving average decelerating, employment, supplier deliveries, production, new orders and inventories all decreased as well. Even the bright spot in the economy, manufacturing activity, is decelerating because it is no longer being driven by businesses rebuilding their inventories and even capital expansion plans remain tentative as election year uncertainty contributes to delays in decision making for large projects. We’re likely to see growth rates to continue dropping off until corporations as well as consumers regain confidence and start spending again. Perhaps the one bright spot is that because many employers already cut their workforces so deeply during the last recession, they simply can’t cut any more.

The major difference between prior points when the U.S. economy began periods of economic contraction and today is that, outside of instigating a high inflation policy through further quantitative easing, the Federal Reserve seems impotent in trying to combat the current contraction and massaging the business cycle; U.S. rates are already at record lows across the yield spectrum and, in fact, higher rates may be the necessary tonic to bring long-term recovery hopes but we see no chance in that happening. Housing construction, notably absent during the current economic expansion, seems stable but not yet at a point of re-accelerating despite the record low mortgage rates. On the positive, many of the excesses typically seen at the start of recessions, excessive reinvestment rates, booming mergers and acquisitions activity, etc. are not evident.

| | |

Annual Report | September 30, 2012 | | 3 |

| | |

Drexel Hamilton Centre American Equity Fund | | Manager Commentary |

| | September 30, 2012 (Unaudited) |

Portfolio Structure:

Our focus in the Fund remains on companies ‘wisely contracting’, remaining disciplined in their capital expenditures and headcount growth and staying ahead of their peers by doing so. Continued profit margin expansion and more rapid asset turns will allow these companies to maintain the positive momentum in their returns on capital and, as we believe, related stock returns. Bar-belled against these types of companies, we are focused on those ‘wealth creators’ that have business models that are able to continue to power through the macro environment by expanding market share and their global sales presence, many of which can be classified as ‘Nifty-Fifty’ type stocks concentrated in the Technology, Industrial and Consumer sectors.

Outlook:

We believe the best strategy to employ in the current environment is one comprised mainly of leading mega-capitalization blue chips with those attributes that render them undervalued based upon their current multiples. These companies, whose fundamentals will stand out increasingly as the business cycle matures and will distinguish themselves from the broad market through organic growth from innovation and pricing power. U.S. companies such as Apple, Caterpillar, and Google typify these attributes. Combined with this portfolio component in a barbell approach, there remain selective companies in the U.S. that continue to harvest growth in earnings and took the initiative during the most recent recession to enhance operations by streamlining labor forces and optimizing assets. U.S. companies such as Textron, Harley-Davidson, and St. Jude Medical typify these attributes.

When the U.S. stock market’s main driver for performance is multiple expansion, rather than earnings growth, it accrues mainly to blue-chip growth stocks historically. Many Large and Mega-Cap stocks represent the best investment area of the U.S. stock market due to their potential for valuation re-ratings versus peers even as the broad stock market rating stays steady. We recommend a barbell approach within portfolios that concentrates on those companies whose growth or valuation profiles will distinguish them from the broad market. Specifically, the rating of U.S. shares is still inexpensive relative to the past twenty years with the price to earnings ratio (P/E) of the S&P 500 Index now at around 14 times forward earnings and even lower for the largest 100 stocks within the S&P 500. This said, our thesis for the U.S. market is that a further re-rating of shares will be very selective and concentrated on those blue-chip shares that have dominant market shares, are globally positioned to benefit from emerging markets growth, leaders in innovation, or those companies that are driving margin expansion despite rising headwinds from higher energy and other input costs.

While there are no easy answers in this macro environment and the U.S. presidential election holds some hope for a turnaround in business, consumer and investor confidence, the recent economic figures portend the formal declaration of a recession in the U.S. before year-end as a possibility. The good news is that investors aren’t buying shares of the ISM index or frankly even the U.S. economy when they invest in the U.S. stock market; they’re buying leading dynamic businesses that allocate capital where it will generate the best operating returns around the globe as well as be proactive in reducing costs in anticipation of reduced demand. For now, a defensive sector bias seems warranted with emphasis on leading blue-chips in the Health Care and Staples sectors as well as certain industries within Technology. We see genuine value in many large-capitalisation stocks in these areas and anticipate investors to further embrace them as the U.S. economy lurches toward slowdown regardless of the Federal Reserve’s accommodations.

As always, our process in managing the Fund is to focus bottom-up on each individual company’s growth outlook, not just on earnings but understanding the capital allocation decisions being made today and how they will lead to future earnings growth. In other words, we expect companies to invest in productive assets of the business, organically and through opportunistic purchases, which, in turn provides the foundation for future revenue and profits growth that will create shareholder value. Alternatively, if companies cannot invest in productive assets due to a cyclical downturn or existing excess capacity, we expect these companies to “wisely contract” through the restructuring of their assets and other resources to regain their footing for future shareholder value creation. Our top-down views on interest rates, etc. are important as many of those are inputs into our company models and, at the end of the day, are reconciled to the bottom-up information we gather and process from company performance. The end result is our attempt to find the best 45-70 stocks within the S&P and weight those securities in a manner that delivers a Fund with risk adjusted returns. We see profits moving higher and stock prices have ample room to reflect this growth in profits as well as re-rate positively to reflect this and diminished risk aversion. From a bottom-up perspective, we see continuing profit and return on capital momentum and, most importantly, tremendous upside versus downside asymmetry in price targets in the Fund’s stock positions.

| | |

Drexel Hamilton Centre American Equity Fund | | Manager Commentary |

| | September 30, 2012 (Unaudited) |

Bar-belled: A strategy that balances aggressive stocks on one side with defensive stocks on the other.

Blue chip: A nationally recognized well-established and financially sound company. Blue chips generally sell high-quality, widely accepted products and services. Blue chip companies are known to weather downturns and operate profitably in the face of adverse economic conditions, which help to contribute to their long record of stable and reliable growth.

ECB: The central bank responsible for the monetary system of the European Union (EU) and the euro currency. The bank was formed in Germany in June 1998 and works with the other national banks of each of the EU members to formulate the monetary policy that helps maintain price stability in the European Union.

Nifty-fifty: The 50 Stocks that were most favored by institutional investors in the 1960s and 1970s. Companies in this group were usually characterized by consistent earnings growth and high P/E ratios.

Price to earnings ratio: A valuation ratio of a company’s current share price compared to its per-share earnings.

Quantitative easing: A government monetary policy occasionally used to increase the money supply by buying government securities of other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital, in an effort to promote increased lending and liquidity.

Sub-50 Index Readings: When a major economic indicator, such as PMI (Purchasing Manager Index), drops below the level 50 or “sub” 50 it can be interpreted as a down of contraction in the economy/industry.

The statements and opinions expressed are those of the Sub-Adviser and are of the date of this report.

| | |

Annual Report | September 30, 2012 | | 5 |

| | |

Drexel Hamilton Centre American Equity Fund | | Manager Commentary |

| | September 30, 2012 (Unaudited) |

| | | | | | | | | | | | | | | | | | | | |

SECTOR WEIGHTINGS | | GROWTH OF HYPOTHETICAL $10,000 INVESTMENT AS OF SEPTEMBER 30, 2012 | | |

As a percentage of Net Assets | |

| | |

Information Technology | | | 28.28 | % | | | | | |

Health Care | | | 16.50 | % | | | | | |

Consumer Staples | | | 13.04 | % | | | | |

Industrials | | | 11.17 | % | | | | |

Consumer Discretionary | | | 10.63 | % | | | | |

Energy | | | 8.12 | % | | | | |

Financials | | | 7.16 | % | | | | |

Materials | | | 2.63 | % | | | | |

Telecommunication Services | | | 0.99 | % | | | | |

Utilities | | | 0.74 | % | | | | |

Cash & Equivalents | | | 0.74 | % | | | | |

Total | | | 100.00 | % | | | | |

These allocations may not reflect the current or future positions of the portfolio. | | | | | |

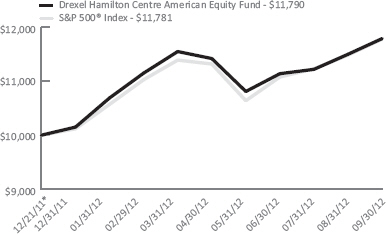

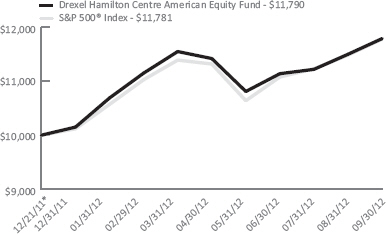

| | | | | | This graph assumes an initial investment of $10,000 at December 21, 2011, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund versus the S&P 500® Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only. | | |

| | | | | | | | | | CUMULATIVE TOTAL RETURNS – FOR THE PERIOD ENDED SEPTEMBER 30, 2012 | | |

| | | | | | | | | | | | 1

Month | | 3

Month | | YTD | | Since

Inception* | | |

| | | | | | | | | | Drexel Hamilton Centre American Equity Fund | | 2.52% | | 5.83% | | 16.16% | | 17.90% | | |

| | | | | | | | | | S&P 500® Index | | 2.58% | | 6.35% | | 16.44% | | 17.81% | | |

| | | | | |

| | | | | | | | | | The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data please call

855-298-4236 or visit www.dhipfunds.com. | | |

| | | | | | | | | | The total annual operating expense ratio (after expense reimbursements) as stated in the fee table of the most recent prospectus, dated November 16, 2011, was 1.25%. | | |

| | | | | | | | | | The Adviser has entered into a written expense limitation agreement through November 17, 2012 under which it has agreed to limit the total expenses of the Fund (excluding interest, taxes, litigation, brokerage, extraordinary expenses, and any transactions costs associated with short sales which may include but are not limited to brokerage commissions and dividends that are paid to persons from whom the Fund borrows securities) to an annual rate of 1.25% of the average net assets of the Fund. Without this waiver the total annual fund operating expenses of the fund would be 2.19%. | | |

| | | | | | | | | | The S&P 500® Index is a commonly recognized, market-capitalization weighted index of 500 widely held securities, designed to measure broad U.S. equity performance. You cannot invest directly in an index. | | |

| | | | | | | | | | * The Fund’s inception date was December 21, 2011. | | |

| | | | | | | | | | | | | | | | | | | | |

| | |

| Drexel Hamilton Centre Global Equity Fund | | Manager Commentary |

| | September 30, 2012 (Unaudited) |

Performance:

Since inception (December 21, 2011) to September 30, 2012, the Drexel Hamilton Centre Global Equity Fund returned 14.30% and marginally underperformed its benchmark, the MSCI All Country (ACWI) Index, which returned 15.03%.

Global equities started the current year with a bull-run gaining more than 12% from January to March. In the following period from April to June, worries of global economic slowdown and European sovereign debt crisis led to a market

sell-off dragging down the global equity market average by more than 13% to touch new lows in June, as measured by MSCI ACWI. However, by mid-September, anticipating easing monetary policies from the European Central Bank (ECB) and the U.S. Federal Reserve (Fed), the global equity markets, as measured by MSCI ACWI, made a new high for the year in September.

From inception to September 30, 2012, good stock selection in Asia Pacific, U.S., Western Europe and Latin America contributed positively to the Fund’s performance. The Fund’s performance also benefited from its overweight posture in Asia and Europe. On the other hand, regional underweight posture in South America and overweight posture in Eastern Europe detracted from the Fund’s performance. During this period, North America outperformed the global equity market average (MSCI ACWI), whereas, Europe and Asia Pacific underperformed. Within Europe, Belgium, Denmark and Germany were among the best performing markets globally whilst Greece, Spain and Italy were some of the worst performing. In Asia Pacific, Philippines, Thailand, India and Singapore outperformed while China and Japan underperformed. Emerging markets as a group underperformed the MSCI ACWI but with mixed results. Egypt, Turkey and Philippines outperformed materially both their emerging market peers and the global average whereas Argentina, Brazil, Indonesia and China underperformed.

Among the Fund’s holdings, SABESP in Brazil; Inditex in Spain; Tencent and Hengan International in China; Advanced Info Service in Thailand; Anheuser-Busch in Belgium; Syngenta in Switzerland; Telstra in Australia and Fast Retailing in Japan were large contributors to Fund’s positive Fund’s performance. On the negative side, Banco do Brasil and Vale in Brazil; Li & Fung in Hong Kong; Canon in Japan; Generali and Enel in Italy and Belle International in China detracted from Fund’s performance.

Economic and Market Outlook:

Looking ahead, we are cautiously optimistic. As always, the Fund focuses on large market capitalization blue chips in the developed markets and emerging blue chips in the developing countries. The Fund’s holdings continue to emphasize on high quality large market capitalization stocks with impressive track records of creating shareholder value in good times and bad.

In the near-term, results of the general election in the U.S. and once-in-a-decade leadership transition in China will have a bearing on market movement. Following this the global investors will be closely scrutinizing how the leaders in the U.S., China and Europe will be dealing with the European sovereign debt crisis, the economic slowdown in China and the fiscal cliff in the U.S.

We expect that after the transition of leadership in early November in China, there will be more policy adjustments by the new Chinese leaders to safeguard the Chinese economy from slowing export demand globally and to restructure the economy so that in the long run the economic growth is less dependent on exports. This, however, will likely to be a slow and gradual process.

Finally, we think that the markets have already discounted many of the uncertainties and risks facing the global equity investors. Moreover, we see numerous investment opportunities for long-term global equity investors among the many attractively valued blue-chip large market capitalization multi-national companies all over the world. We believe that

long-term global equity investors will be rewarded by focusing their investments, as we do in the Fund, in high quality blue chip stocks that have impressive track records of creating shareholder value, growing dividends in challenging operating environments, maintaining strong balance sheets, and are well positioned competitively in their respective industries.

Portfolio Structure & Strategy:

The Drexel Hamilton Centre Global Equity Fund offers a unique investment vehicle for investors by focusing on large capitalization blue chips in the developed world and emerging blue chips in the developing countries. The Fund’s investment process combines bottom-up stock selection with structured portfolio construction and risk management that’s cognizant of secular growth forces.

Our approach in managing the Fund is to focus bottom-up on each individual company’s growth outlook, not just on earnings but understanding the capital allocation decisions being made today and how they will lead to future earnings growth. Our top-down views on macro outlooks of various markets, regions and global sectors etc. are important as many of those are inputs into our company models and at the end of the day, are reconciled to the bottom-up information we gather and process from company performance and operating results.

| | |

Annual Report | September 30, 2012 | | 7 |

| | |

| Drexel Hamilton Centre Global Equity Fund | | Manager Commentary |

| | September 30, 2012 (Unaudited) |

Our unique and disciplined economic-value-added based investment process and unique dynamic GDP-adjusted focused portfolio construction process insure that the Fund is unencumbered by traditional market capitalization weighted benchmarks and goes where the bottom-up stock opportunities are globally. Consequently, the Fund is well positioned to benefit and profit from the positive demographics and long-term economic growth in many developing economies as well as attractive investment opportunities in developed countries across the globe.

We remain cautiously optimistic for the global equity markets over the long-run. Currently, the Fund maintains its above benchmark dividend yield, its overweight postures in Technology, Telecommunication Services, Consume Discretionary and Consumer Staples; and underweight postures in Industrials, Financials and Materials. The Fund has close to neutral postures in Healthcare, Energy and Utilities.

Going forward, the Fund will continue to be anchored with shareholder value creators who 1) have long track records of growing their cash earnings and dividends in both good times and bad, 2) are in excellent competitive positions locally or globally in their respective industries and markets, and 3) are likely to be the main beneficiaries of good fundamental long-term economic growth and demographics in various parts of the world, such as Apple, AmBev, Inditex and China Mobile.

Blue chip: A nationally recognized well-established and financially sound company. Blue chips generally sell high-quality, widely accepted products and services. Blue chip companies are known to weather downturns and operate profitably in the face of adverse economic conditions, which help to contribute to their long record of stable and reliable growth.

GDP: The monetary value of all finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

Sovereign debt: Bonds issued by a national government in a foreign currency, in order to finance the issuing country’s growth. Sovereign debt is generally a riskier investment when it comes from a developing country and a safer investment when it comes from a developed country The stability of the issuing government is an important factor to consider, when assessing the risk of investing in sovereign debt, and sovereign credit ratings help investors weigh this risk.

The statements and opinions expressed are those of the Sub-Adviser and are as of the date of this report.

| | |

| Drexel Hamilton Centre Global Equity Fund | | Manager Commentary |

| | September 30, 2012 (Unaudited) |

| | | | |

SECTOR WEIGHTINGS | | | | |

As a percentage of Net Assets | |

| |

Financials | | | 16.91 | % |

Information Technology | | | 16.16 | % |

Consumer Discretionary | | | 12.14 | % |

Consumer Staples | | | 12.04 | % |

Energy | | | 11.07 | % |

Health Care | | | 9.90 | % |

Telecommunication Services | | | 7.23 | % |

Materials | | | 6.21 | % |

Industrials | | | 4.00 | % |

Utilities | | | 3.14 | % |

Cash and Cash Equivalents | | | 1.20 | % |

Total | | | 100.00 | % |

| |

COUNTRY WEIGHTINGS | | | | |

As a percentage of Net Assets | |

| |

United States | | | 26.61 | % |

China | | | 12.22 | % |

Germany | | | 8.01 | % |

Brazil | | | 7.25 | % |

Japan | | | 4.86 | % |

Switzerland | | | 4.59 | % |

France | | | 4.49 | % |

Italy | | | 3.50 | % |

Australia | | | 3.32 | % |

Great Britain | | | 3.19 | % |

Spain | | | 3.16 | % |

Russia | | | 2.74 | % |

Netherlands | | | 1.93 | % |

Taiwan | | | 1.75 | % |

Denmark | | | 1.64 | % |

Hong Kong | | | 1.57 | % |

Korea | | | 1.31 | % |

Mexico | | | 1.25 | % |

Thailand | | | 1.09 | % |

Belgium | | | 0.98 | % |

India | | | 0.95 | % |

Norway | | | 0.93 | % |

Singapore | | | 0.76 | % |

Israel | | | 0.70 | % |

Cash & Equivalents | | | 1.20 | % |

Total | | | 100.00 | % |

|

| These sector and country allocations may not reflect the current or future positions of the portfolio. | |

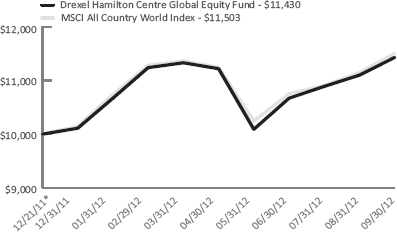

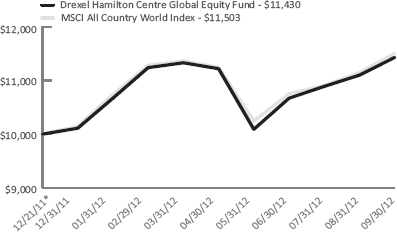

GROWTH OF HYPOTHETICAL $10,000 INVESTMENT AS OF SEPTEMBER 30, 2012

This graph assumes an initial investment of $10,000 at December 21, 2011, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund versus the MSCI All Country World Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

CUMULATIVE TOTAL RETURNS – FOR THE PERIOD ENDED SEPTEMBER 30, 2012

| | | | | | | | |

| | | 1 Month | | 3 Month | | YTD | | Since

Inception* |

Drexel Hamilton Centre Global Equity Fund | | 2.97% | | 7.12% | | 13.06% | | 14.30% |

MSCI All Country World Index | | 3.19% | | 6.97% | | 13.39% | | 15.03% |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data please call 855-298-4236 or visit www.dhipfunds.com.

The total annual operating expense ratio (after expense reimbursements) as stated in the fee table of the most recent prospectus, dated November 16, 2011, was 1.25%.

The Adviser has entered into a written expense limitation agreement through November 17, 2012 under which it has agreed to limit the total expenses of the Fund (excluding interest, taxes, litigation, brokerage, extraordinary expenses, and any transactions costs associated with short sales which may include but are not limited to brokerage commissions and dividends that are paid to persons from whom the Fund borrows securities) to an annual rate of 1.25% of the average net assets of the Fund. Without this waiver the total annual fund operating expenses of the fund would be 2.68%.

Investing in the securities of foreign companies generally involves greater risk than investing in larger, more established domestic companies. Therefore, investments in the Fund may involve a greater degree of risk than investments in other mutual funds that invest in larger, more established domestic companies.

The MSCI (Morgan Stanley Capital International) All Country World Index is an unmanaged, free float-adjusted market capitalization weighted index composed of stocks of companies located in countries throughout the world. It is designed to measure equity market performance in global developed and emerging markets. The index includes reinvestment of dividends, net of foreign withholding taxes. You cannot invest directly in an index.

* The Fund’s inception date was December 21, 2011.

| | |

Annual Report | September 30, 2012 | | 9 |

| | |

| Drexel Hamilton Funds | | Disclosure of Fund Expenses |

| | September 30, 2012 (Unaudited) |

As a shareholder of a series of Drexel Hamilton Mutual Funds (each series, a “Fund” and together, the “Funds”), you will incur two types of costs: (1) transaction costs, including applicable redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on April 1, 2012 and held until September 30, 2012.

Actual Expenses. The first line of each table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as redemption fees or exchange fees. Therefore, the second line of each table below is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line for each Fund within the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| | | | | | | | |

| | | BEGINNING ACCOUNT VALUE 04/01/12 | | ENDING ACCOUNT VALUE 09/30/12 | | EXPENSE RATIO(a) | | EXPENSES PAID DURING PERIOD 04/01/12-09/30/12 |

Drexel Hamilton Centre American Equity Fund |

Actual | | $ 1,000.00 | | $ 1,020.80 | | 1.25% | | $ 6.32 |

Hypothetical (5% return before expenses)(b) | | $ 1,000.00 | | $ 1,018.75 | | 1.25% | | $ 6.31 |

|

Drexel Hamilton Centre Global Equity Fund |

Actual | | $ 1,000.00 | | $ 1,008.80 | | 1.25% | | $ 6.28 |

Hypothetical (5% return before expenses)(b) | | $ 1,000.00 | | $ 1,018.75 | | 1.25% | | $ 6.31 |

| (a) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Portfolios’ annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), then divided by 366. |

| | |

Drexel Hamilton Centre American Equity Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | | | |

| | | Shares | | | Value | |

COMMON STOCKS (99.26%) | | | | | | | | |

Consumer Discretionary (10.63%) | | | | | | | | |

Advertising (1.74%) | | | | | | | | |

Interpublic Group of Cos., Inc. | | | 15,860 | | | $ | 176,363 | |

Omnicom Group, Inc. | | | 4,770 | | | | 245,941 | |

| | | | | | | | |

| | | | | | | 422,304 | |

| | | | | | | | |

Apparel (0.95%) | | | | | | | | |

Coach, Inc. | | | 4,120 | | | | 230,802 | |

| | | | | | | | |

| | |

Internet (1.67%) | | | | | | | | |

Amazon.com, Inc.(a) | | | 1,590 | | | | 404,369 | |

| | | | | | | | |

| | |

Leisure Time (0.84%) | | | | | | | | |

Harley-Davidson, Inc. | | | 4,810 | | | | 203,800 | |

| | | | | | | | |

| | |

Lodging (1.60%) | | | | | | | | |

Marriott International, Inc., Class A | | | 4,810 | | | | 188,071 | |

MGM Resorts International(a) | | | 18,520 | | | | 199,090 | |

| | | | | | | | |

| | | | | | | 387,161 | |

| | | | | | | | |

Retail (3.83%) | | | | | | | | |

Macy’s, Inc. | | | 4,980 | | | | 187,348 | |

McDonald’s Corp. | | | 3,770 | | | | 345,897 | |

Starbucks Corp. | | | 7,770 | | | | 394,328 | |

| | | | | | | | |

| | | | | | | 927,573 | |

| | | | | | | | |

Total Consumer Discretionary | | | | | | | 2,576,009 | |

| | | | | | | | |

| | |

Consumer Staples (13.04%) | | | | | | | | |

Agriculture (3.23%) | | | | | | | | |

Philip Morris International, Inc. | | | 6,280 | | | | 564,823 | |

Reynolds American, Inc. | | | 5,010 | | | | 217,134 | |

| | | | | | | | |

| | | | | | | 781,957 | |

| | | | | | | | |

Beverages (4.29%) | | | | | | | | |

Coca-Cola Co. | | | 15,310 | | | | 580,708 | |

PepsiCo, Inc. | | | 6,480 | | | | 458,590 | |

| | | | | | | | |

| | | | | | | 1,039,298 | |

| | | | | | | | |

Cosmetics & Personal Care (4.21%) | | | | | |

Colgate-Palmolive Co. | | | 4,590 | | | | 492,140 | |

Procter & Gamble Co. | | | 7,610 | | | | 527,829 | |

| | | | | | | | |

| | | | | | | 1,019,969 | |

| | | | | | | | |

Retail (1.31%) | | | | | | | | |

Wal-Mart Stores, Inc. | | | 4,300 | | | | 317,340 | |

| | | | | | | | |

| | |

Total Consumer Staples | | | | | | | 3,158,564 | |

| | | | | | | | |

| | |

Energy (8.12%) | | | | | | | | |

Oil & Gas (8.12%) | | | | | | | | |

Chevron Corp. | | | 3,680 | | | | 428,941 | |

Exxon Mobil Corp. | | | 10,170 | | | | 930,047 | |

Occidental Petroleum Corp. | | | 2,370 | | | | 203,962 | |

Schlumberger, Ltd. | | | 5,570 | | | | 402,878 | |

| | | | | | | | |

| | | | | | | 1,965,828 | |

| | | | | | | | |

Total Energy | | | | | | | 1,965,828 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

Financials (7.16%) | | | | | | | | |

Banks (7.16%) | | | | | | | | |

BB&T Corp. | | | 6,360 | | | $ | 210,898 | |

Capital One Financial Corp. | | | 3,160 | | | | 180,152 | |

Citigroup, Inc. | | | 5,310 | | | | 173,743 | |

Fifth Third Bancorp | | | 11,710 | | | | 181,622 | |

Goldman Sachs Group, Inc. | | | 1,800 | | | | 204,624 | |

SunTrust Banks, Inc. | | | 7,540 | | | | 213,156 | |

US Bancorp | | | 5,360 | | | | 183,848 | |

Wells Fargo & Co. | | | 5,260 | | | | 181,628 | |

Zions Bancorporation | | | 9,860 | | | | 203,658 | |

| | | | | | | 1,733,329 | |

| | | | | | | | |

Total Financials | | | | | | | 1,733,329 | |

| | | | | | | | |

| | |

Health Care (16.50%) | | | | | | | | |

Biotechnology (1.91%) | | | | | | | | |

Amgen, Inc. | | | 5,480 | | | | 462,074 | |

| | | | | | | | |

| | |

Healthcare-Products (5.23%) | | | | | | | | |

Boston Scientific Corp.(a) | | | 31,750 | | | | 182,245 | |

Medtronic, Inc. | | | 6,770 | | | | 291,922 | |

St Jude Medical, Inc. | | | 5,820 | | | | 245,197 | |

Stryker Corp. | | | 5,750 | | | | 320,045 | |

Zimmer Holdings, Inc. | | | 3,360 | | | | 227,203 | |

| | | | | | | | |

| | | | | | | 1,266,612 | |

Healthcare-Services (0.92%) | | | | | | | | |

UnitedHealth Group, Inc. | | | 4,010 | | | | 222,194 | |

| | | | | | | | |

| | |

Pharmaceuticals (8.44%) | | | | | | | | |

Abbott Laboratories | | | 9,580 | | | | 656,805 | |

Johnson & Johnson | | | 12,490 | | | | 860,686 | |

Merck & Co., Inc. | | | 11,710 | | | | 528,121 | |

| | | | | | | | |

| | | | | | | 2,045,612 | |

| | | | | | | | |

Total Health Care | | | | | | | 3,996,492 | |

| | | | | | | | |

| | |

Industrials (11.17%) | | | | | | | | |

Aerospace/Defense (0.88%) | | | | | | | | |

United Technologies Corp. | | | 2,740 | | | | 214,515 | |

| | | | | | | | |

| |

Airlines (1.69%) | | | | | |

Delta Air Lines, Inc.(a) | | | 23,270 | | | | 213,153 | |

United Continental Holdings, Inc.(a) | | | 10,020 | | | | 195,390 | |

| | | | | | | | |

| | | | | | | 408,543 | |

| | | | | | | | |

| | |

Auto Manufacturers (0.80%) | | | | | | | | |

PACCAR, Inc. | | | 4,820 | | | | 192,921 | |

| | | | | | | | |

| | |

Commercial Services (0.90%) | | | | | | | | |

Robert Half International, Inc. | | | 8,210 | | | | 218,632 | |

| | |

Electronics (1.25%) | | | | | | | | |

Honeywell International, Inc. | | | 5,090 | | | | 304,127 | |

| | | | | | | | |

| | |

Machinery, Construction &

Mining (1.27%) | | | | | | | | |

Caterpillar, Inc. | | | 3,570 | | | | 307,163 | |

| | | | | | | | |

| | |

Annual Report | September 30, 2012 | | 11 |

| | |

Drexel Hamilton Centre American Equity Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | | | |

| | | Shares | | | Value | |

Industrials (continued) | | | | | | | | |

Miscellaneous Manufacturing (1.53%) | | | | | | | | |

General Electric Co. | | | 8,460 | | | $ | 192,126 | |

Textron, Inc. | | | 6,810 | | | | 178,218 | |

| | | | | | | | |

| | | | | | | 370,344 | |

| | | | | | | | |

Textiles (0.79%) | | | | | | | | |

Cintas Corp. | | | 4,610 | | | | 191,084 | |

| | | | | | | | |

| | |

Transportation (2.06%) | | | | | | | | |

Union Pacific Corp. | | | 1,910 | | | | 226,717 | |

United Parcel Service, Inc., Class B | | | 3,810 | | | | 272,682 | |

| | | | | | | | |

| | | | | | | 499,399 | |

| | | | | | | | |

Total Industrials | | | | | | | 2,706,728 | |

| | | | | | | | |

| | |

Information Technology (28.28%) | | | | | | | | |

Commercial Services (1.17%) | | | | | | | | |

Total System Services, Inc. | | | 11,970 | | | | 283,689 | |

| | | | | | | | |

| | |

Computers (12.49%) | | | | | | | | |

Apple, Inc. | | | 3,180 | | | | 2,121,887 | |

International Business Machines Corp. | | | 4,350 | | | | 902,407 | |

| | | | | | | | |

| | | | | | | 3,024,294 | |

| | | | | | | | |

Diversified Financial Services (1.26%) | | | | | | | | |

Visa, Inc. | | | 2,280 | | | | 306,158 | |

| | | | | | | | |

| | |

Internet (4.83%) eBay, Inc.(a) | | | 8,710 | | | | 421,651 | |

Google, Inc., Class A(a) | | | 990 | | | | 746,955 | |

| | | | | | | | |

| | | | | | | 1,168,606 | |

| | | | | | | | |

Semiconductors (2.62%) | | | | | | | | |

Intel Corp. | | | 8,730 | | | | 197,997 | |

QUALCOMM, Inc. | | | 6,990 | | | | 436,805 | |

| | | | | | | | |

| | | | | | | 634,802 | |

| | | | | | | | |

Software (5.16%) | | | | | | | | |

Intuit, Inc. | | | 5,950 | | | | 350,336 | |

Microsoft Corp. | | | 15,880 | | | | 472,907 | |

Oracle Corp. | | | 13,560 | | | | 427,004 | |

| | | | | | | | |

| | | | | | | 1,250,247 | |

| | | | | | | | |

Telecommunications (0.75%) | | | | | | | | |

Cisco Systems, Inc. | | | 9,480 | | | | 180,973 | |

| | | | | | | | |

| |

Total Information Technology | | | | 6,848,769 | |

| | | | | | | | |

| | |

Materials (2.63%) | | | | | | | | |

Chemicals (2.63%) | | | | | | | | |

Huntsman Corp. | | | 11,320 | | | | 169,007 | |

Monsanto Co. | | | 5,140 | | | | 467,843 | |

| | | | | | | | |

| | | | | | | 636,850 | |

| | | | | | | | |

Total Materials | | | | | | | 636,850 | |

| | | | | | | | |

| | | | | | | | | | | | |

| | | | Shares | | | Value | |

Telecommunication Services (0.99%) | | | | | | | | | |

Telecommunications (0.99%) | | | | | | | | | |

Verizon Communications, Inc. | | | | 5,260 | | | $ | 239,698 | |

| | | | | | | | | |

| | |

Total Telecommunication Services | | | | | | | | 239,698 | |

| | | | | | | | | | | | |

| | |

Utilities (0.74%) | | | | | | | | | |

Electric (0.74%) | | | | | | | | | |

Calpine Corp.(a) | | | | 10,330 | | | | 178,709 | |

| | | | | | | | | | | | |

| | |

Total Utilities | | | | | | | | 178,709 | |

| | | | | | | | | | | | |

| | | | | | | | | |

TOTAL COMMON STOCKS (Cost $21,076,609) | | | | | | | | 24,040,976 | |

| | | |

| | | 7-Day Yield | | | Shares | | | Value | |

SHORT TERM INVESTMENTS (0.82%) | |

Money Market Fund (0.82%) | | | | | |

Dreyfus Treasury Prime Cash Management, Institutional Class | | | 0.00004 | % | | | 197,924 | | | | 197,924 | |

| | | | | | | | | | | | |

| | | | | |

TOTAL SHORT TERM INVESTMENTS (Cost $197,924) | | | | 197,924 | |

| |

TOTAL INVESTMENTS (Cost $21,274,533) (100.08%) | | | $ | 24,238,900 | |

| |

Liabilities in Excess of Other Assets (- 0.08%) | | | | (18,500 | ) |

NET ASSETS (100.00%) | | | | | | | $ | 24,220,400 | |

| | |

| (a) | Non-income producing security. |

Common Abbreviations:

Ltd. - Limited.

| | |

Drexel Hamilton Centre Global Equity Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | | | |

| | | Shares | | | Value | |

COMMON STOCKS (95.90%) | | | | | | | | |

ASIA (27.83%) | | | | | | | | |

Australia (3.32%) | | | | | | | | |

Financials (1.01%) | | | | | | | | |

Commonwealth Bank of Australia | | | 2,090 | | | | $ 120,907 | |

| | |

Materials (0.90%) | | | | | | | | |

BHP Billiton, Ltd. | | | 3,157 | | | | 108,198 | |

| | | | | | | | |

| | |

Telecommunication

Services (1.41%) | | | | | | | | |

Telstra Corp., Ltd. | | | 41,540 | | | | 168,911 | |

| | | | | | | | |

| | |

Total Australia | | | | | | | 398,016 | |

| | | | | | | | |

| | |

China (12.22%) | | | | | | | | |

Consumer Staples (1.70%) | | | | | | | | |

Want Want China Holdings, Ltd. | | | 160,000 | | | | 204,074 | |

| | | | | | | | |

| | |

Energy (2.99%) | | | | | | | | |

China Petroleum & Chemical Corp., Class H | | | 112,500 | | | | 105,042 | |

CNOOC, Ltd. | | | 64,000 | | | | 131,235 | |

PetroChina Co., Ltd., Class H | | | 93,200 | | | | 122,118 | |

| | | | | | | 358,395 | |

| | | | | | | | |

Financials (5.30%) | | | | | | | | |

Bank of China, Ltd., Class H | | | 350,300 | | | | 133,270 | |

China Construction Bank Corp., Class H | | | 221,500 | | | | 153,684 | |

China Life Insurance Co., Ltd., Class H | | | 41,000 | | | | 118,441 | |

Industrial & Commercial Bank of China, Class H | | | 222,900 | | | | 131,658 | |

Ping An Insurance Group Co., Class H | | | 13,000 | | | | 98,246 | |

| | | | | | | 635,299 | |

| | | | | | | | |

Information Technology (0.57%) | | | | | | | | |

Tencent Holdings, Ltd. | | | 2,000 | | | | 68,145 | |

| | |

Telecommunication

Services (1.66%) | | | | | | | | |

China Mobile, Ltd. | | | 17,900 | | | | 198,413 | |

| | | | | | | | |

| | |

Total China | | | | | | | 1,464,326 | |

| | | | | | | | |

| | |

Hong Kong (1.57%) | | | | | | | | |

Consumer Discretionary (1.57%) | | | | | | | | |

Li & Fung, Ltd. | | | 54,000 | | | | 83,709 | |

Sands China, Ltd. | | | 27,800 | | | | 103,792 | |

| | | | | | | | |

| | | | | | | 187,501 | |

| | | | | | | | |

Total Hong Kong | | | | | | | 187,501 | |

| | | | | | | | |

| | |

India (0.95%) | | | | | | | | |

Information Technology (0.95%) | | | | | |

Infosys, Ltd., Sponsored ADR | | | 2,350 | | | | 114,069 | |

| | |

Total India | | | | | | | 114,069 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

Japan (4.86%) | | | | | | | | |

Consumer Discretionary (3.96%) | | | | | | | | |

Fast Retailing Co., Ltd. | | | 1,030 | | | $ | 239,550 | |

Honda Motor Co., Ltd. | | | 3,300 | | | | 101,359 | |

Toyota Motor Corp. | | | 3,450 | | | | 134,393 | |

| | | | | | | 475,302 | |

| | | | | | | | |

Financials (0.90%) | | | | | | | | |

Mitsubishi UFJ Financial Group, Inc. | | | 22,900 | | | | 107,399 | |

| | |

Total Japan | | | | | | | 582,701 | |

| | | | | | | | |

| | |

Korea (1.31%) | | | | | | | | |

Information Technology (1.31%) | | | | | | | | |

Samsung Electronics Co., Ltd. | | | 130 | | | | 157,437 | |

| | |

Total Korea | | | | | | | 157,437 | |

| | | | | | | | |

| | |

Singapore (0.76%) | | | | | | | | |

Financials (0.76%) | | | | | | | | |

DBS Group Holdings, Ltd. | | | 7,800 | | | | 91,462 | |

| | |

Total Singapore | | | | | | | 91,462 | |

| | | | | | | | |

| | |

Taiwan (1.75%) | | | | | | | | |

Information Technology (1.75%) | | | | | | | | |

Delta Electronics, Inc. | | | 24,000 | | | | 92,926 | |

Taiwan Semiconductor

Manufacturing Co., Ltd. | | | 38,100 | | | | 116,717 | |

| | | | | | | | |

| | | | | | | 209,643 | |

| | | | | | | | |

Total Taiwan | | | | | | | 209,643 | |

| | | | | | | | |

| | |

Thailand (1.09%) | | | | | | | | |

Financials (1.09%) | | | | | | | | |

Kasikornbank Pcl | | | 22,100 | | | | 131,035 | |

| | | | | | | | |

| | |

Total Thailand | | | | | | | 131,035 | |

| | | | | | | | |

| | |

TOTAL ASIA (Cost $3,089,112) | | | | | | | 3,336,190 | |

| | |

EUROPE (35.86%) | | | | | | | | |

Belgium (0.98%) | | | | | | | | |

Consumer Staples (0.98%) | | | | | | | | |

Anheuser-Busch InBev NV | | | 1,378 | | | | 117,174 | |

| | | | | | | | |

| | |

Total Belgium | | | | | | | 117,174 | |

| | |

Denmark (1.64%) | | | | | | | | |

Health Care (1.64%) | | | | | | | | |

Coloplast A/S, Class B | | | 500 | | | | 104,111 | |

Novo Nordisk A/S, Class B | | | 582 | | | | 91,942 | |

| | | | | | | 196,053 | |

Total Denmark | | | | | | | 196,053 | |

| | | | | | | | |

| | |

Annual Report | September 30, 2012 | | 13 |

| | |

| Drexel Hamilton Centre Global Equity Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | | | |

| | | Shares | | | Value | |

France (4.49%) | | | | | | | | |

Energy (1.21%) | | | | | | | | |

Total SA | | | 2,917 | | | $ | 144,692 | |

| | | | | | | | |

| | |

Health Care (2.13%) | | | | | | | | |

Cie Generale d’Optique Essilor International SA | | | 1,350 | | | | 126,416 | |

Sanofi | | | 1,513 | | | | 129,003 | |

| | | | | | | | |

| | | | | | | 255,419 | |

| | | | | | | | |

| | |

Information Technology (1.15%) | | | | | | | | |

Dassault Systemes SA | | | 1,310 | | | | 137,636 | |

| | | | | | | | |

| | |

Total France | | | | | | | 537,747 | |

| | | | | | | | |

| | |

Germany (8.01%) | | | | | | | | |

Consumer Discretionary (1.61%) | | | | | | | | |

Adidas AG | | | 1,300 | | | | 106,649 | |

Daimler AG | | | 1,774 | | | | 85,864 | |

| | | | | | | | |

| | | | | | | 192,513 | |

| | | | | | | | |

| | |

Financials (0.88%) | | | | | | | | |

Allianz SE | | | 883 | | | | 105,062 | |

| | | | | | | | |

| | |

Health Care (1.01%) | | | | | | | | |

Bayer AG | | | 1,415 | | | | 121,520 | |

| | | | | | | | |

| | |

Industrials (1.11%) | | | | | | | | |

Siemens AG | | | 1,336 | | | | 133,243 | |

| | | | | | | | |

| | |

Information Technology (1.08%) | | | | | | | | |

SAP AG | | | 1,832 | | | | 129,741 | |

| | | | | | | | |

| | |

Materials (1.31%) | | | | | | | | |

BASF SE | | | 1,860 | | | | 156,916 | |

| | | | | | | | |

| | |

Telecommunication Services (0.54%) | | | | | | | | |

Deutsche Telekom AG | | | 5,300 | | | | 65,213 | |

| | | | | | | | |

| | |

Utilities (0.47%) | | | | | | | | |

E.ON AG | | | 2,367 | | | | 56,165 | |

| | | | | | | | |

| | |

Total Germany | | | | | | | 960,373 | |

| | | | | | | | |

| | |

Great Britain (3.19%) | | | | | | | | |

Consumer Staples (1.88%) | | | | | | | | |

Diageo Plc | | | 8,040 | | | | 225,840 | |

| | | | | | | | |

| | |

Financials (0.80%) | | | | | | | | |

HSBC Holdings Plc | | | 10,388 | | | | 96,169 | |

| | | | | | | | |

| | |

Telecommunication Services (0.51%) | | | | | | | | |

Vodafone Group Plc | | | 21,500 | | | | 61,017 | |

| | | | | | | | |

| | |

Total Great Britain | | | | | | | 383,026 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

Israel (0.70%) | | | | | | | | |

Health Care (0.70%) | | | | | | | | |

Teva Pharmaceutical Industries, Ltd., Sponsored ADR | | | 2,040 | | | $ | 84,476 | |

| | | | | | | | |

| | |

Total Israel | | | | | | | 84,476 | |

| | | | | | | | |

| | |

Italy (3.50%) | | | | | | | | |

Energy (1.33%) | | | | | | | | |

Eni SpA | | | 7,299 | | | | 159,640 | |

| | | | | | | | |

| | |

Financials (1.15%) | | | | | | | | |

Assicurazioni Generali SpA | | | 6,800 | | | | 97,782 | |

Intesa Sanpaolo SpA | | | 26,400 | | | | 40,134 | |

| | | | | | | | |

| | | | | | | 137,916 | |

| | | | | | | | |

| | |

Utilities (1.02%) | | | | | | | | |

Enel SpA | | | 34,520 | | | | 122,079 | |

| | | | | | | | |

| | |

Total Italy | | | | | | | 419,635 | |

| | | | | | | | |

| | |

Netherlands (1.93%) | | | | | | | | |

Consumer Staples (0.81%) | | | | | | | | |

Unilever NV | | | 2,744 | | | | 97,076 | |

| | | | | | | | |

| | |

Information Technology (1.12%) | | | | | | | | |

ASML Holding NV | | | 2,510 | | | | 134,147 | |

| | | | | | | | |

| | |

Total Netherlands | | | | | | | 231,223 | |

| | | | | | | | |

| | |

Norway (0.93%) | | | | | | | | |

Energy (0.93%) | | | | | | | | |

Statoil ASA | | | 4,330 | | | | 111,785 | |

| | | | | | | | |

| | |

Total Norway | | | | | | | 111,785 | |

| | | | | | | | |

| | |

Russia (2.74%) | | | | | | | | |

Energy (2.01%) | | | | | | | | |

Gazprom OAO, Sponsored ADR | | | 11,515 | | | | 115,496 | |

Lukoil OAO, Sponsored ADR | | | 2,034 | | | | 125,294 | |

| | | | | | | | |

| | | | | | | 240,790 | |

| | | | | | | | |

| | |

Financials (0.73%) | | | | | | | | |

Sberbank of Russia, Sponsored ADR | | | 7,567 | | | | 87,554 | |

| | | | | | | | |

| | |

Total Russia | | | | | | | 328,344 | |

| | | | | | | | |

| | |

Spain (3.16%) | | | | | | | | |

Consumer Discretionary (0.88%) | | | | | | | | |

Inditex SA | | | 850 | | | | 105,548 | |

| | | | | | | | |

| | |

Financials (1.39%) | | | | | | | | |

Banco Bilbao Vizcaya Argentaria SA | | | 6,730 | | | | 52,868 | |

Banco Santander SA(a) | | | 15,199 | | | | 113,185 | |

| | | | | | | | |

| | | | | | | 166,053 | |

| | | | | | | | |

| | |

| Drexel Hamilton Centre Global Equity Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | | | |

| | | Shares | | | Value | |

Spain (continued) | | | | | | | | |

Telecommunication Services (0.89%) | | | | | | | | |

Telefonica SA | | | 8,030 | | | $ | 107,059 | |

| | | | | | | | |

| | |

Total Spain | | | | | | | 378,660 | |

| | | | | | | | |

| | |

Switzerland (4.59%) | | | | | | | | |

Consumer Discretionary (0.75%) | | | | | | | | |

Cie Financiere Richemont SA, Class A | | | 1,500 | | | | 89,952 | |

| | | | | | | | |

| | |

Consumer Staples (0.53%) | | | | | | | | |

Nestle SA | | | 1,000 | | | | 63,051 | |

| | | | | | | | |

| | |

Health Care (1.91%) | | | | | | | | |

Novartis AG | | | 1,910 | | | | 116,875 | |

Roche Holding AG | | | 600 | | | | 112,089 | |

| | | | | | | | |

| | | | | | | 228,964 | |

| | | | | | | | |

| | |

Materials (1.40%) | | | | | | | | |

Syngenta AG | | | 450 | | | | 168,182 | |

| | | | | | | | |

| | |

Total Switzerland | | | | | | | 550,149 | |

| | | | | | | | |

| | |

TOTAL EUROPE (Cost $3,963,702) | | | | | | | 4,298,645 | |

| | |

NORTH AMERICA (27.86%) | | | | | | | | |

Mexico (1.25%) | | | | | | | | |

Telecommunication Services (1.25%) | | | | | | | | |

America Movil, Series L | | | 117,900 | | | | 150,217 | |

| | | | | | | | |

| | |

Total Mexico | | | | | | | 150,217 | |

| | | | | | | | |

| | |

United States (26.61%) | | | | | | | | |

Consumer Discretionary (3.37%) | | | | | | | | |

Home Depot, Inc. | | | 3,400 | | | | 205,258 | |

Walt Disney Co. | | | 3,800 | | | | 198,664 | |

| | | | | | | | |

| | | | | | | 403,922 | |

| | | | | | | | |

| | |

Consumer Staples (4.44%) | | | | | | | | |

Coca-Cola Co. | | | 2,790 | | | | 105,825 | |

Philip Morris International, Inc. | | | 1,400 | | | | 125,916 | |

Procter & Gamble Co. | | | 1,360 | | | | 94,329 | |

Whole Foods Market, Inc. | | | 2,120 | | | | 206,488 | |

| | | | | | | | |

| | | | | | | 532,558 | |

| | | | | | | | |

| | |

Energy (2.14%) | | | | | | | | |

Chevron Corp. | | | 950 | | | | 110,732 | |

Exxon Mobil Corp. | | | 1,600 | | | | 146,320 | |

| | | | | | | | |

| | | | | | | 257,052 | |

| | | | | | | | |

| | |

Financials (2.05%) | | | | | | | | |

JPMorgan Chase & Co. | | | 3,010 | | | | 121,845 | |

Wells Fargo & Co. | | | 3,580 | | | | 123,617 | |

| | | | | | | | |

| | | | | | | 245,462 | |

| | | | | | | | |

| | |

Health Care (2.51%) | | | | | | | | |

Johnson & Johnson | | | 1,900 | | | | 130,929 | |

Merck & Co., Inc. | | | 1,290 | | | | 58,179 | |

Pfizer, Inc. | | | 4,500 | | | | 111,825 | |

| | | | | | | | |

| | | | | | | 300,933 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

United States (continued) | | | | | | | | |

Industrials (1.00%) | | | | | | | | |

General Electric Co. | | | 5,280 | | | $ | 119,909 | |

| | | | | | | | |

| | |

Information Technology (8.23%) | | | | | | | | |

Apple, Inc. | | | 360 | | | | 240,214 | |

Cisco Systems, Inc. | | | 7,200 | | | | 137,448 | |

Google, Inc., Class A(a) | | | 180 | | | | 135,810 | |

Intel Corp. | | | 3,700 | | | | 83,916 | |

International Business Machines Corp. | | | 430 | | | | 89,204 | |

Microsoft Corp. | | | 3,810 | | | | 113,462 | |

Oracle Corp. | | | 2,360 | | | | 74,316 | |

QUALCOMM, Inc. | | | 1,800 | | | | 112,482 | |

| | | | | | | | |

| | | | | | | 986,852 | |

| | | | | | | | |

| | |

Materials (1.90%) | | | | | | | | |

Monsanto Co. | | | 2,500 | | | | 227,550 | |

| | | | | | | | |

| | |

Telecommunication Services (0.97%) | | | | | | | | |

AT&T, Inc. | | | 3,080 | | | | 116,116 | |

| | | | | | | | |

| | |

Total United States | | | | | | | 3,190,354 | |

| | | | | | | | |

| | |

TOTAL NORTH AMERICA (Cost $2,935,829) | | | | | | | 3,340,571 | |

| | |

SOUTH AMERICA (4.35%) | | | | | | | | |

Brazil (4.35%) | | | | | | | | |

Consumer Staples (0.81%) | | | | | | | | |

Natura Cosmeticos SA | | | 3,600 | | | | 97,492 | |

| | | | | | | | |

| | |

Industrials (1.89%) | | | | | | | | |

CCR SA | | | 25,500 | | | | 226,918 | |

| | | | | | | | |

| | |

Utilities (1.65%) | | | | | | | | |

Cia de Saneamento Basico do Estado de Sao Paulo | | | 4,850 | | | | 197,349 | |

| | | | | | | | |

| | |

Total Brazil | | | | | | | 521,759 | |

| | | | | | | | |

| | |

TOTAL SOUTH AMERICA (Cost $445,520) | | | | | | | 521,759 | |

| | | | | | | | |

TOTAL COMMON STOCKS (Cost $10,434,163) | | | | | | | 11,497,165 | |

| | |

PREFERRED STOCKS (2.90%) | | | | | | | | |

SOUTH AMERICA (2.90%) | | | | | | | | |

Brazil (2.90%) | | | | | | | | |

Consumer Staples (0.89%) | | | | | | | | |

Cia de Bebidas das Americas | | | 2,800 | | | | 106,696 | |

| | | | | | | | |

| | |

Energy (0.46%) | | | | | | | | |

Petroleo Brasileiro SA | | | 5,000 | | | | 55,124 | |

| | | | | | | | |

| | |

Financials (0.85%) | | | | | | | | |

Banco Bradesco SA | | | 3,000 | | | | 48,080 | |

| | |

Annual Report | September 30, 2012 | | 15 |

| | |

| Drexel Hamilton Centre Global Equity Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

Brazil (continued) | | | | | | | | | | | | |

Itau Unibanco Holding SA | | | | | | | 3,510 | | | $ | 53,154 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 101,234 | |

| | | | | | | | | | | | |

| | | |

Materials (0.70%) | | | | | | | | | | | | |

Vale SA | | | | | | | 4,840 | | | | 84,111 | |

| | | | | | | | | | | | |

| | | |

Total Brazil | | | | | | | | | | | 347,165 | |

| | | | | | | | | | | | |

| | |

TOTAL SOUTH AMERICA (Cost $368,943) | | | | | | | | 347,165 | |

| | | | | | | | | | | | |

TOTAL PREFERRED STOCKS (Cost $368,943) | | | | | | | | 347,165 | |

| | | |

| | | 7-Day Yield | | | Shares | | | Value | |

SHORT TERM INVESTMENTS (0.87%) | |

Money Market Fund (0.87%) | | | | | |

Dreyfus Treasury Prime Cash Management, Institutional Class | | | 0.00004% | | | | 104,944 | | | | 104,944 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

TOTAL SHORT TERM INVESTMENTS (Cost $104,944) | | | | 104,944 | |

| |

TOTAL INVESTMENTS (Cost $10,908,050) (99.67%) | | | $ | 11,949,274 | |

| |

Other Assets In Excess Of Liabilities (0.33%) | | | | 39,016 | |

NET ASSETS (100.00%) | | | | | | | | | | $ | 11,988,290 | |

| |

| (a) | Non-income producing security. |

Common Abbreviations:

| ADR - | American Depository Receipt. |

| AG - | Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders. |

| ASA - | Allmennaksjeselskap is the Norwegian term for public limited company. |

| A/S - | Aktieselskab is the Danish term for Joint Stock Company. |

| NV - | Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

| OAO - | Otkrytoe Aktsionernoe Obschestvo (a Russian open joint stock corporation) |

| Pcl | - Public Company Limited. |

| Plc - | Public Limited Company. |

| SA - | Generally designates corporations in various countries, mostly those employing the civil law. |

| SE - | SE Regulation. A European Company which can operate on a Europe-wide basis and be governed by Community law directly applicable in all Member States. |

| SpA - | Societa Per Azioni is an Italian shared company. |

| UFJ - | United Financial of Japan. |

See Notes to Financial Statements.

| | |

| Drexel Hamilton Mutual Funds | | Statements of Assets and Liabilities |

| | September 30, 2012 |

| | | | | | | | |

| | | Drexel Hamilton Centre

American Equity Fund | | | Drexel Hamilton Centre Global Equity Fund | |

| | | | |

ASSETS: | | | | | | | | |

| | |

Investments, at value | | $ | 24,238,900 | | | $ | 11,949,274 | |

Foreign currency, at value (Cost $– and $8,131, respectively) | | | – | | | | 8,156 | |

Dividends | | | 35,707 | | | | 32,484 | |

Receivable due from investment advisor | | | 48,601 | | | | 65,908 | |

Deferred offering cost | | | 2,054 | | | | 1,243 | |

| | | | | | | | |

Total Assets | | | 24,325,262 | | | | 12,057,065 | |

| | | | | | | | |

| | |

LIABILITIES: | | | | | | | | |

| | |

Payable to administrator | | | 27,870 | | | | 16,493 | |

Payable to transfer agency | | | 4,237 | | | | 4,209 | |

Payable to custodian | | | 1,667 | | | | 6,527 | |

Payable for printing | | | 2,558 | | | | 1,257 | |

Payable for legal and audit fees | | | 54,885 | | | | 33,468 | |

Payable to trustees | | | 4,948 | | | | 2,438 | |

Payable to chief compliance officer | | | 6,187 | | | | 3,049 | |

Other payables | | | 2,510 | | | | 1,334 | |

| | | | | | | | |

Total Liabilities | | | 104,862 | | | | 68,775 | |

| | | | | | | | |

NET ASSETS | | $ | 24,220,400 | | | $ | 11,988,290 | |

| | | | | | | | |

| | |

NET ASSETS CONSIST OF: | | | | | | | | |

| | |

Paid-in capital | | $ | 20,542,095 | | | $ | 10,487,858 | |

Accumulated net investment income | | | 131,605 | | | | 171,696 | |

Accumulated net realized gain on investments and foreign currency transactions | | | 582,333 | | | | 287,498 | |

Net unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | 2,964,367 | | | | 1,041,238 | |

| | | | | | | | |

NET ASSETS | | $ | 24,220,400 | | | $ | 11,988,290 | |

| | | | | | | | |

INVESTMENTS, AT COST | | $ | 21,274,533 | | | $ | 10,908,050 | |

| | |

PRICING OF SHARES | | | | | | | | |

Net Assets | | $ | 24,220,400 | | | $ | 11,988,290 | |

Shares outstanding | | | 2,054,881 | | | | 1,048,994 | |

Net Asset Value, offering and redemption price per share | | | $11.79 | | | | $11.43 | |

See Notes to Financial Statements.

| | |

Annual Report | September 30, 2012 | | 17 |

| | |

| Drexel Hamilton Mutual Funds | | Statements of Operations |

| For the Period December 21, 2011 (Inception) to September 30, 2012 |

| | | | | | | | |

| | | Drexel Hamilton Centre

American Equity Fund | | | Drexel Hamilton Centre

Global Equity Fund | |

| | | | |

INVESTMENT INCOME: | | | | | | | | |

Dividends | | $ | 343,221 | | | $ | 316,273 | |

Foreign taxes withheld | | | – | | | | (24,988 | ) |

| | | | | | | | |

Total Investment Income | | | 343,221 | | | | 291,285 | |

| | | | | | | | |

| | |

EXPENSES: | | | | | | | | |

Investment advisory fees | | | 132,915 | | | | 88,020 | |

Administration fees | | | 110,565 | | | | 61,966 | |

Transfer agent fees | | | 18,562 | | | | 18,515 | |

Custodian fees | | | 4,167 | | | | 18,752 | |

Legal fees | | | 49,845 | | | | 24,473 | |

Audit fees | | | 18,169 | | | | 15,400 | |

Trustees’ fees and expenses | | | 11,395 | | | | 5,643 | |

Chief compliance officer fees | | | 28,328 | | | | 14,058 | |

Offering costs | | | 25,381 | | | | 14,928 | |

Miscellaneous expenses | | | 11,300 | | | | 5,992 | |

| | | | | | | | |

Total expenses before waivers | | | 410,627 | | | | 267,747 | |

Fees waived/reimbursed by investment advisor (Note 5) | | | (189,101 | ) | | | (157,721 | ) |

Net Expenses | | | 221,526 | | | | 110,026 | |

| | | | | | | | |

Net Investment Income | | | 121,695 | | | | 181,259 | |

| | | | | | | | |

| | |

Net realized gain on investments | | | 582,333 | | | | 287,517 | |

Net realized loss on foreign currencies | | | – | | | | (14,391 | ) |

Net change in unrealized appreciation on investments | | | 2,964,367 | | | | 1,041,224 | |

Net change in unrealized appreciation on translation of assets and liabilities denominated in foreign currency transactions | | | – | | | | 14 | |

| | | | | | | | |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCIES | | | 3,546,700 | | | | 1,314,364 | |

| | | | | | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 3,668,395 | | | $ | 1,495,623 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| Drexel Hamilton Mutual Funds | | Statements of Changes in Net Assets |

| | |

| | | | | | | | |

| | | Drexel Hamilton Centre

American Equity Fund | | | Drexel Hamilton Centre

Global Equity Fund | |

| | | | |

| | | For the Period

December 21, 2011

(Inception) to

September 30, 2012 | | | For the Period

December 21, 2011

(Inception) to

September 30, 2012 | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 121,695 | | | $ | 181,259 | |

Net realized gain on investments | | | 582,333 | | | | 287,517 | |

Net realized loss on foreign currency transactions | | | – | | | | (14,391) | |

Net change in unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | 2,964,367 | | | | 1,041,238 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 3,668,395 | | | | 1,495,623 | |

| | | | | | | | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Proceeds from sale of shares | | | 20,527,005 | | | | 10,467,667 | |

| | | | | | | | |

Net increase from capital share transactions | | | 20,527,005 | | | | 10,467,667 | |

| | | | | | | | |

| | |

Net increase in net assets | | | 24,195,400 | | | | 11,963,290 | |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of period | | | 25,000 | | | | 25,000 | |

| | | | | | | | |

End of period* | | $ | 24,220,400 | | | $ | 11,988,290 | |

| | | | | | | | |

*Including accumulated net investment income of: | | $ | 131,605 | | | $ | 171,696 | |

| | |

OTHER INFORMATION: | | | | | | | | |

Share Transactions: | | | | | | | | |

Beginning shares | | | 2,500 | | | | 2,500 | |

Shares sold | | | 2,052,381 | | | | 1,046,494 | |

| | | | | | | | |

Ending Shares | | | 2,054,881 | | | | 1,048,994 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

Annual Report | September 30, 2012 | | 19 |

| | |

Drexel Hamilton Centre American Equity Fund | | Financial Highlights |

| | For a share outstanding throughout the period presented. |

| | | | | | |

| | | | | For the Period

December 21, 2011

(inception) to

September 30, 2012 | |

| | |

NET ASSET VALUE, BEGINNING OF PERIOD | | $ | | | 10.00 | |

INCOME FROM INVESTMENT OPERATIONS: | | | | | | |

Net investment income(a) | | | | | 0.07 | |

Net realized and unrealized gain on investments | | | | | 1.72 | |

Total income from investment operations | | | | | 1.79 | |

| | |