united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22554

Vertical Capital Income Fund

(Exact name of registrant as specified in charter)

80 Arkay Drive, Hauppauge, NY 11788

(Address of principal executive offices) (Zip code)

Gemini Fund Services, LLC

17645 Wright Street, Omaha, Nebraska, 68130

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2616

Date of fiscal year end: 9/30

Date of reporting period:9/30/19

Item 1. Reports to Stockholders.

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Vertical Capital Income Fund | |

| | | |

| | | |

| | | |

| | VCIF | |

| | Cusip: 92535C104 | |

| | | |

| | | |

| | Annual Report | |

| | September 30, 2019 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Investor Information: 1-866-277-VCIF | |

| | | |

| | | |

| | | |

| | This report and the financial statements contained herein are submitted for the general information of shareholders. Nothing contained herein is to be considered an offer of sale or solicitation of an offer to buy shares of the Vertical Capital Income Fund. | |

| | | |

| | Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website https://www.vertical-incomefund.com/, and you will be notified by mail each time a report is posted and provided with a website link to access the report. | |

| | | |

| | If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically or to continue receiving paper copies of shareholder reports, which are available free of charge, by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

November 27, 2019

Dear Shareholder,

We have mixed feelings as we report to you the results of another year for the Vertical Capital Income Fund (the “Fund”). While we are pleased with our investment performance and your decision to seek liquidity through a listing, we are displeased that the Fund had to bear significant non-recurring costs in dealing with a proxy challenge, resulting in lower earnings and distributions than otherwise would have occurred.

As a result of the Trustees’ desire to provide additional liquidity for the Fund’s shareholders, the Trustees undertook an analysis of strategic options to determine the best path forward for the Fund’s investors. In the end, the decision was made that a listing on the New York Stock Exchange (“NYSE”) would benefit shareholders the most. To list and cease operations as an “interval” fund that provides liquidity through quarterly repurchase offers; the Fund needed shareholder approval, which was obtained through a proxy vote in March 2019. The Fund then applied for listing with the NYSE and, after receiving approval, began trading on May 29, 2019.

Soon thereafter as a result of a technical change of control of the parent ownership of the Fund’s advisor, which did not in any way effect the daily management of the Fund or the economic terms of the advisory agreement; the Fund was required to again obtain shareholder approval through another proxy solicitation for the renewal of the Fund’s advisory agreement. Shortly after mailing the proxy statements, the Fund was notified by an activist investor that it was seeking to contest the proxy and press management to undertake a plan of liquidation. The activist took this position despite the fact that the Fund’s shareholders had just a few months earlier voted in support of a listing on the NYSE in lieu of pursuing other strategic alternatives, including liquidation.

In October 2019 the Fund accepted the certified final report of the independent inspector of election that determined the renewal of the advisory agreement had been approved. The cost to the Fund of dealing with this matter through September 30, 2019 was approximately $684,000, representing approximately $0.066 per share of distributions lost to you, our shareholders. The negative impact on the Fund’s share price cannot be measured.

Update on Financial Performance

The Fund made distributions from operations aggregating approximately $0.34 per share for the fiscal year ended September 30, 2019. In addition, the Fund made a special distribution of approximately $0.20 per share in December 2018 as a result of net capital gains realized on loan sales and loan payoffs for the taxable year 2018. The Fund expects to make another similar special distribution currently estimated at approximately $0.20 per share in December 2019. The annualized dividend yield, excluding net capital gain distributions, for the period October 2018 through May 2019, prior to the Fund’s listing, was approximately 4.13%. The annualized dividend yield thereafter was approximately 1.96%, primarily reflecting the negative impact of the cost of dealing with the activist investor and the contested proxy.

Based on NAV, for the fiscal year ended September 30, 2019, the Fund produced a total return (load waived) of 8.80% (including the $0.20 per share special dividend paid in December 2018) compared to one of its key benchmarks, the Barclays Capital Mortgage Backed Securities Index, which reported a total return of 7.80%. Including the maximum load, the Fund’s total return was 2.51%. Since inception through the end of our fiscal year 2019, the Fund has produced an annualized total return of 7.97%. The SEC Yield as of September 30, 2019, including the expense cap subsidized by the Advisor, totaled 0.40%.

Since the Fund listed on the NYSE mid-year without the benefit of an initial offering price, any performance measurement from the date of listing through September 30, 2019, when the Fund’s closing price was $10.68 per

share, would be difficult to give a traditional meaning. However, there are several conclusions from this period that are worth noting. First, notwithstanding the Fund’s eight-year track record, the Fund listed on the NYSE with little visibility among trading market participants. Second, although the Fund’s quarterly redemption queue was a consideration in the decision to list the Fund, there was a lack of specificity concerning the intentions of individual shareholders. Notwithstanding, management expected that there might be more downward pressure on the shares than upward interest immediately after listing due to some shareholders seeking immediate liquidity. Third, management knew that it would take some time for many shareholders to register their shares with the DTC, thereby delaying their ability to trade, should they want to. Fourth, the uncertainty caused by the actions of the activist may have weakened market interest in the shares. And fifth, we know the dividend yield would have been higher without the negative impact of the non-recurring costs noted above. Next year we will be reporting investment performance based on over a year of market share price, in addition to performance based on NAV.

We believe the downward pressure created by legacy shareholders seeking liquidity, combined with the activist-related disruptions, have not given the Fund a runway to demonstrate its full return profile and value proposition in an undisputed manner. Looking forward, we are hopeful and continue to believe in both the Fund’s fundamental investment strategy and in management’s ability to generate competitive risk-adjusted returns. The listing has stabilized the Fund’s asset base and eliminated the quarterly redemption overhang. Those factors should enhance our ability to more fully execute the Fund’s investment strategy by making long-term decisions that are in the best interest of shareholders. The Fund’s earnings should additionally benefit from the accretive deployment of capital previously held in reserve for contingencies, in addition to the judicious use of the Fund’s line of credit.

Update on Economic Outlook and Fund Strategy

During the past year, the U.S. economy again grew; however, at a slower pace than last year. Real GDP is expected to average 2.0% for the 12 months ended September 30, 2019 compared to approximately 2.8% for the twelve months ended September 30, 2018. The first half of the calendar year was fueled by consumer spending and business investment, both of which slowed in the third quarter of 2019. Expectations are for more cooling in the coming quarters. Current forecasts suggest GDP should be in the 1.1% range for calendar 2020 and 1.4% for 2021. The unemployment rate has trended down slightly from 3.8% at the beginning of the fiscal year, based on a tight job market; but it is now expected to increase back to around 4.1% in 2020 and 2021.

For some time, the Federal Reserve’s focus has been on containing inflation, yet, in a defensive move in July 2019, the Fed lowered its short-term benchmark rate for the first time since 2008, dropping rates by 0.50% to their second quarter 2018 level. Last year, forecasters predicted a Fed Funds rate of 3.25% by the end of 2019 and 3.5% by the end of 2020. Now predictions are that the Fed will likely continue to lower rates again in 2020.

One reason for the Fed’s defensive positioning is that there is much uncertainty concerning the broader global economy, once again underscored by the ups and downs of the escalating U.S. -China trade war, as well as the continuing saga of Brexit. Many investors have moved into safer investments, including sovereign debt, pushing down long-term interest rates. At September 30, 2019, mid-term US Treasury rates were lower than short-term rates, resulting in a partially inverted yield curve, seen by many as a sign of a coming recession. A year ago, the 10-year U.S. Treasury rate was approximately 3.0%, and long-term rates were expected to rise by 25 bps before the end of 2018 and by another 50 bps by mid-2019. Instead rates have fallen over that period, with the 10-year Treasury at 1.68% on September 30, 2019.

Economic growth helps support jobs and wage growth, and along with population growth and household formation, are important factors in creating demand for housing. Slightly less than two-thirds of all U. S. households own a home. Home ownership generates demand for purchase mortgage originations and for refinancing of existing mortgages. Mortgage volume is also highly influenced by home prices, the inventory of homes for sale, particularly newly constructed housing, and by the cost of mortgage financing.

Total mortgage originations for calendar year 2019 are expected to be $1.89 trillion, an increase over last year’s projection, due primarily to a 38% increase in projected refinancing volume of $633 billion, as a result of lower interest rates. Volume for 2020 is projected to be around $1.7 trillion, of which 25% is estimated to be refinancing.

The Fund primarily invests in first mortgage, residential whole loans traded in the secondary market at a discount to their unpaid principal balances. The secondary whole loan market is part of the larger almost $11 trillion residential mortgage market which boasts a deep roster of institutional participants. As such, we are comfortable that we will continue to see one-off and portfolio acquisition opportunities, as well as disposition opportunities when it makes sense for the Fund to sell.

Update on the Portfolio and Liquidity

At September 30, 2019 the Fund owned 764 individual loans with an average unpaid principal balance of approximately $169,000 and an average collateral value of approximately $236,000, or 71%. By comparison the median prices of existing and new homes in the U.S. are approximately $280,000 and $318,000, respectively, with average down payments upon purchase of 13% and 6%, respectively. We continue to be pleased with the fundamental character of the portfolio and each of its key metrics, including acquisition cost, current loan-to-collateral value, nominal and effective interest rates, borrower FICO scores and delinquency rates, among others.

We employ a conservative approach to managing the Fund’s financial position, focusing primarily on the generation of current income while maintaining a positive net working capital position and low, if any, leverage. In addition to scheduled monthly amortization payments, the Fund typically receives unscheduled receipts of loan payoffs as a result of home sales or refinancing. Coupled with the proceeds from sale of loans, the Fund is able to self-generate cash available for investment. In addition, the Fund has a $35 million bank line of credit for general working capital purposes, including investment. The Fund had $2.5 million outstanding on the line of credit at year-end.

We again appreciate your support during the past year and look forward to working on your behalf in 2020.

Regards,

Robert J. Chapman

Chairman of the Board of Trustees and Co-Portfolio Manager

David Aisner

Co-Portfolio Manager

Past performance is neither indicative nor a guarantee of future results.The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. The investment return and principal value of an investment will fluctuate so that investor’s shares, when sold, may be worth more or less than their original cost. Results shown reflect the Fund’s expense waiver, without which the results could have been lower. For more recent price information please go to vertical-incomefund.com.

This material contains forward-looking statements relating to the business and financial outlook of Vertical Capital Income Fund that are based on our current expectations, estimates, forecasts and projections and are not guarantees of future performance. There is no assurance that the Fund will achieve its investment objective. Actual results may differ materially from those expressed in these forward-looking statements, and you should not place undue reliance on any such statements. A number of important factors could cause actual results to differ materially from the forward-looking statements contained in this material.

Securities may be subject to prepayment risk because borrowers are typically able to prepay principal. The Fund will not invest in real estate directly, but, because the Fund will invest the majority of its assets in securities secured by real estate, its portfolio will be significantly impacted by the performance of the real estate market and may experience more volatility and be exposed to greater risk than a more diversified portfolio.

| Vertical Capital Income Fund |

| PORTFOLIO REVIEW (Unaudited) |

| September 30, 2019 |

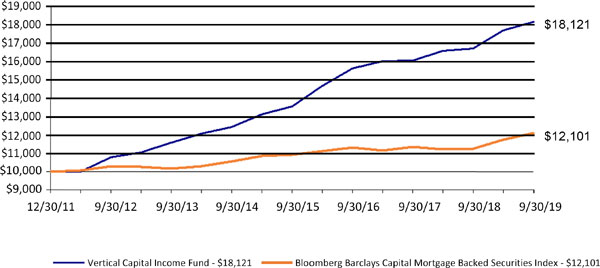

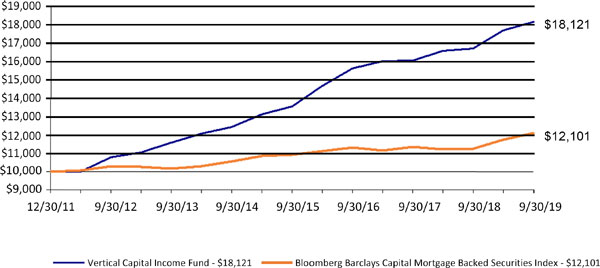

PERFORMANCE OF A $10,000 INVESTMENT

(Based upon Net Asset Value)

| The Fund’s performance figures for the period ended September 30, 2019, compared to its |

| benchmark: |

| | | | | | |

| | | One Year | Three Years | Five Years | Since Inception* |

| Vertical Capital Income Fund-NAV | 8.62% | 5.15% | 7.86% | 7.97% |

| Vertical Capital Income Fund-Market Price ** | -8.73% | -1.04% | 4.08% | 5.52% |

| Bloomberg Barclays Capital Mortgage Backed Securities Index | 7.80% | 2.32% | 2.80% | 2.49% |

| * | The Fund commenced operations on December 30, 2011. The performance of the Fund is based on average annual returns. |

| ** | The calculation is comparing the Market Price to the NAV until the initial Market Price on May 30, 2019. |

The Bloomberg Barclays Capital Mortgage Backed Securities Index is an unmanaged index composed of securities backed by mortgage pools of Ginnie Mae, Freddie Mac and Fannie Mae. Investors cannot invest directly in an index or benchmark.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the dviser not waived its fees and reimbursed a portion of the Fund’s expenses. For performance information current to the most recent month-end, please call 1-866-277-VCIF.

| PORTFOLIO COMPOSITION*** |

| |

| Mortgage Notes | | | 99.7 | % |

| Other Investments | | | 0.3 | % |

| | | | 100.0 | % |

*** Based on Investments at Value as of September 30, 2019.

| Vertical Capital Income Fund |

| PORTFOLIO OF INVESTMENTS |

| September 30, 2019 |

| Principal | | | | | Loan Type | | Interest Rate | | | Maturity | | Fair Value | |

| | | | | MORTGAGE NOTES - 97.9% | | | | | | | | | | | | |

| $ | 113,914 | | | Loan ID 200003 | | Fixed | | | 7.250 | % | | 9/1/2035 | | $ | 101,667 | |

| | 230,985 | | | Loan ID 200004 | | Fixed | | | 7.990 | % | | 10/1/2036 | | | 242,535 | |

| | 48,672 | | | Loan ID 200012 | | ARM | | | 9.800 | % | | 7/1/2037 | | | 49,751 | |

| | 35,524 | | | Loan ID 200016 | | ARM | | | 10.375 | % | | 1/1/2031 | | | 37,300 | |

| | 47,445 | | | Loan ID 200018 | | Fixed | | | 7.000 | % | | 1/1/2033 | | | 49,817 | |

| | 97,739 | | | Loan ID 200023 | | Fixed | | | 5.875 | % | | 12/1/2050 | | | 91,671 | |

| | 205,980 | | | Loan ID 200026 | | Interest Only | | | 4.750 | % | | 1/1/2050 | | | 215,490 | |

| | 228,102 | | | Loan ID 200028 | | Fixed | | | 4.875 | % | | 6/1/2050 | | | 239,350 | |

| | 201,942 | | | Loan ID 200029 | | Fixed | | | 6.310 | % | | 7/1/2037 | | | 206,832 | |

| | 320,872 | | | Loan ID 200032 | | Fixed | | | 3.130 | % | | 1/1/2051 | | | 305,960 | |

| | 539,346 | | | Loan ID 200035 | | Fixed | | | 4.625 | % | | 11/1/2050 | | | 562,536 | |

| | 152,438 | | | Loan ID 200037 | | Fixed | | | 7.800 | % | | 5/1/2035 | | | 160,059 | |

| | 111,310 | | | Loan ID 200041 | | Fixed | | | 4.875 | % | | 8/1/2039 | | | 116,876 | |

| | 38,931 | | | Loan ID 200042 | | Fixed | | | 7.000 | % | | 12/1/2037 | | | 40,878 | |

| | 48,550 | | | Loan ID 200043 | | Fixed | | | 6.125 | % | | 7/1/2039 | | | 50,977 | |

| | 49,544 | | | Loan ID 200048 | | Fixed | | | 5.500 | % | | 8/1/2039 | | | 52,021 | |

| | 147,496 | | | Loan ID 200052 | | Fixed | | | 5.125 | % | | 5/1/2040 | | | 154,871 | |

| | 52,265 | | | Loan ID 200054 | | Fixed | | | 8.250 | % | | 3/1/2039 | | | 54,878 | |

| | 78,999 | | | Loan ID 200055 | | Fixed | | | 10.000 | % | | 1/5/2036 | | | 82,949 | |

| | 119,239 | | | Loan ID 200057 | | ARM | | | 4.875 | % | | 10/1/2036 | | | 125,098 | |

| | 31,155 | | | Loan ID 200060 | | Fixed | | | 5.750 | % | | 8/1/2039 | | | 32,712 | |

| | 24,326 | | | Loan ID 200065 | | ARM | | | 9.000 | % | | 1/1/2037 | | | 25,542 | |

| | 190,183 | | | Loan ID 200075 | | Fixed | | | 4.250 | % | | 2/1/2042 | | | 198,041 | |

| | 157,496 | | | Loan ID 200076 | | Fixed | | | 4.250 | % | | 12/1/2041 | | | 163,635 | |

| | 24,410 | | | Loan ID 200078 | | Fixed | | | 7.000 | % | | 8/1/2036 | | | 25,630 | |

| | 133,362 | | | Loan ID 200079 | | Fixed | | | 5.000 | % | | 2/1/2059 | | | 121,565 | |

| | 64,737 | | | Loan ID 200082 | | Fixed | | | 8.250 | % | | 4/1/2040 | | | 58,581 | |

| | 176,046 | | | Loan ID 200084 | | Fixed | | | 7.000 | % | | 3/1/2039 | | | 153,185 | |

| | 190,887 | | | Loan ID 200086 | | Fixed | | | 4.250 | % | | 11/1/2050 | | | 158,601 | |

| | 218,064 | | | Loan ID 200087 | | Fixed | | | 6.000 | % | | 3/1/2051 | | | 205,750 | |

| | 116,692 | | | Loan ID 200088 | | Fixed | | | 7.000 | % | | 6/1/2039 | | | 101,446 | |

| | 256,323 | | | Loan ID 200089 | | Fixed | | | 3.875 | % | | 3/1/2052 | | | 216,544 | |

| | 271,213 | | | Loan ID 200090 | | Fixed | | | 4.500 | % | | 11/1/2036 | | | 76,650 | |

| | 124,386 | | | Loan ID 200093 | | Fixed | | | 5.000 | % | | 2/1/2038 | | | 130,605 | |

| | 70,632 | | | Loan ID 200102 | | Fixed | | | 8.250 | % | | 3/1/2040 | | | 71,100 | |

| | 107,513 | | | Loan ID 200110 | | Fixed | | | 8.250 | % | | 8/1/2039 | | | 112,888 | |

| | 69,180 | | | Loan ID 200128 | | Fixed | | | 4.710 | % | | 7/1/2037 | | | 52,463 | |

| | 444,762 | | | Loan ID 200129 | | Fixed | | | 4.625 | % | | 3/1/2052 | | | 395,053 | |

| | 26,581 | | | Loan ID 200131 | | Fixed | | | 3.875 | % | | 11/1/2027 | | | 27,318 | |

| | 116,004 | | | Loan ID 200135 | | Fixed | | | 4.375 | % | | 12/1/2042 | | | 121,131 | |

| | 119,217 | | | Loan ID 200137 | | Fixed | | | 4.500 | % | | 9/1/2042 | | | 124,930 | |

| | 75,522 | | | Loan ID 200141 | | Fixed | | | 4.250 | % | | 2/1/2042 | | | 77,601 | |

| | 119,559 | | | Loan ID 200143 | | Fixed | | | 3.000 | % | | 2/1/2037 | | | 117,905 | |

| | 379,287 | | | Loan ID 200145 | | Fixed | | | 4.625 | % | | 8/1/2051 | | | 342,876 | |

| | 95,445 | | | Loan ID 200152 | | ARM | | | 5.000 | % | | 9/1/2037 | | | 100,148 | |

| | 145,783 | | | Loan ID 200158 | | Fixed | | | 3.625 | % | | 12/1/2042 | | | 148,397 | |

| | 117,799 | | | Loan ID 200160 | | Fixed | | | 3.250 | % | | 2/1/2043 | | | 117,538 | |

| | 207,682 | | | Loan ID 200162 | | Fixed | | | 3.875 | % | | 7/1/2042 | | | 213,506 | |

| | 185,486 | | | Loan ID 200165 | | Fixed | | | 4.375 | % | | 12/1/2041 | | | 193,908 | |

| | 102,800 | | | Loan ID 200168 | | Fixed | | | 3.750 | % | | 10/1/2042 | | | 104,883 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Vertical Capital Income Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Principal | | | | | Loan Type | | Interest Rate | | | Maturity | | Fair Value | |

| | | | | MORTGAGE NOTES (Continued) - 97.9% | | | | | | | | | |

| $ | 21,407 | | | Loan ID 200169 | | Fixed | | | 6.923 | % | | 9/1/2034 | | $ | 22,478 | |

| | 131,226 | | | Loan ID 200172 | | Fixed | | | 7.250 | % | | 2/1/2037 | | | 137,787 | |

| | 85,476 | | | Loan ID 200174 | | Fixed | | | 7.340 | % | | 4/1/2037 | | | 89,750 | |

| | 49,275 | | | Loan ID 200175 | | Fixed | | | 9.600 | % | | 5/1/2037 | | | 51,738 | |

| | 27,585 | | | Loan ID 200177 | | Fixed | | | 8.000 | % | | 1/11/2022 | | | 28,964 | |

| | 107,212 | | | Loan ID 200181 | | Fixed | | | 7.500 | % | | 6/1/2041 | | | 112,573 | |

| | 69,592 | | | Loan ID 200184 | | Fixed | | | 4.375 | % | | 12/1/2042 | | | 72,570 | |

| | 26,753 | | | Loan ID 200185 | | Fixed | | | 5.375 | % | | 6/1/2042 | | | 28,091 | |

| | 50,874 | | | Loan ID 200186 | | Fixed | | | 5.125 | % | | 8/1/2042 | | | 53,417 | |

| | 312,976 | | | Loan ID 200190 | | Fixed | | | 3.625 | % | | 11/1/2042 | | | 318,666 | |

| | 154,855 | | | Loan ID 200194 | | Fixed | | | 4.750 | % | | 9/1/2041 | | | 162,598 | |

| | 246,182 | | | Loan ID 200195 | | Fixed | | | 3.875 | % | | 3/1/2042 | | | 253,021 | |

| | 95,006 | | | Loan ID 200196 | | Fixed | | | 4.500 | % | | 1/1/2043 | | | 99,585 | |

| | 37,270 | | | Loan ID 200197 | | Fixed | | | 4.750 | % | | 11/1/2042 | | | 39,133 | |

| | 38,962 | | | Loan ID 200198 | | Fixed | | | 5.250 | % | | 10/1/2042 | | | 40,911 | |

| | 268,090 | | | Loan ID 200199 | | Fixed | | | 4.000 | % | | 9/1/2042 | | | 276,490 | |

| | 230,587 | | | Loan ID 200200 | | Fixed | | | 3.875 | % | | 9/1/2042 | | | 234,156 | |

| | 43,130 | | | Loan ID 200201 | | Fixed | | | 5.125 | % | | 8/1/2041 | | | 45,287 | |

| | 21,507 | | | Loan ID 200206 | | Fixed | | | 3.990 | % | | 12/1/2042 | | | 22,140 | |

| | 44,387 | | | Loan ID 200208 | | Fixed | | | 4.250 | % | | 1/1/2043 | | | 46,157 | |

| | 184,501 | | | Loan ID 200209 | | Fixed | | | 3.875 | % | | 8/1/2042 | | | 189,692 | |

| | 51,560 | | | Loan ID 200214 | | Fixed | | | 5.750 | % | | 7/1/2039 | | | 54,138 | |

| | 108,010 | | | Loan ID 200216 | | Fixed | | | 5.750 | % | | 9/1/2039 | | | 113,411 | |

| | 136,414 | | | Loan ID 200217 | | Fixed | | | 5.250 | % | | 7/1/2040 | | | 143,235 | |

| | 69,881 | | | Loan ID 200218 | | Fixed | | | 4.250 | % | | 12/1/2041 | | | 72,767 | |

| | 188,832 | | | Loan ID 200219 | | Fixed | | | 4.250 | % | | 4/1/2043 | | | 196,445 | |

| | 179,062 | | | Loan ID 200224 | | Fixed | | | 4.000 | % | | 7/1/2043 | | | 184,994 | |

| | 77,110 | | | Loan ID 200226 | | Fixed | | | 5.250 | % | | 7/1/2041 | | | 80,966 | |

| | 47,911 | | | Loan ID 200228 | | Fixed | | | 4.625 | % | | 8/1/2042 | | | 50,306 | |

| | 137,494 | | | Loan ID 200230 | | Fixed | | | 3.500 | % | | 2/1/2043 | | | 139,147 | |

| | 64,472 | | | Loan ID 200232 | | Fixed | | | 3.875 | % | | 8/1/2042 | | | 66,291 | |

| | 111,522 | | | Loan ID 200243 | | Fixed | | | 3.750 | % | | 4/1/2043 | | | 113,867 | |

| | 25,326 | | | Loan ID 200244 | | Fixed | | | 5.000 | % | | 5/1/2042 | | | 26,592 | |

| | 189,957 | | | Loan ID 200245 | | Fixed | | | 3.875 | % | | 3/1/2043 | | | 195,259 | |

| | 85,753 | | | Loan ID 200286 | | Fixed | | | 4.500 | % | | 7/1/2043 | | | 89,918 | |

| | 95,002 | | | Loan ID 200287 | | Fixed | | | 4.375 | % | | 7/1/2043 | | | 99,127 | |

| | 318,366 | | | Loan ID 200288 | | Fixed | | | 4.375 | % | | 11/1/2041 | | | 333,233 | |

| | 272,956 | | | Loan ID 200290 | | Fixed | | | 4.250 | % | | 4/1/2043 | | | 284,012 | |

| | 193,191 | | | Loan ID 200296 | | Fixed | | | 3.250 | % | | 2/1/2043 | | | 192,804 | |

| | 182,693 | | | Loan ID 200299 | | Fixed | | | 3.625 | % | | 10/1/2042 | | | 185,872 | |

| | 114,507 | | | Loan ID 200300 | | Fixed | | | 8.400 | % | | 10/20/2037 | | | 120,232 | |

| | 104,049 | | | Loan ID 200302 | | Fixed | | | 9.875 | % | | 10/1/2035 | | | 109,251 | |

| | 128,112 | | | Loan ID 200304 | | Fixed | | | 7.250 | % | | 10/1/2033 | | | 134,518 | |

| | 40,250 | | | Loan ID 200307 | | Fixed | | | 6.500 | % | | 7/1/2031 | | | 42,262 | |

| | 36,028 | | | Loan ID 200313 | | Fixed | | | 8.500 | % | | 3/1/2028 | | | 37,829 | |

| | 282,814 | | | Loan ID 200315 | | ARM | | | 5.750 | % | | 6/1/2037 | | | 281,634 | |

| | 65,951 | | | Loan ID 200317 | | Fixed | | | 7.000 | % | | 9/1/2032 | | | 69,249 | |

| | 72,482 | | | Loan ID 200326 | | Fixed | | | 8.375 | % | | 10/1/2036 | | | 76,106 | |

| | 137,943 | | | Loan ID 200327 | | Fixed | | | 6.790 | % | | 10/26/2036 | | | 144,840 | |

| | 238,894 | | | Loan ID 200330 | | Fixed | | | 7.000 | % | | 8/1/2037 | | | 197,634 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Vertical Capital Income Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Principal | | | | | Loan Type | | Interest Rate | | | Maturity | | Fair Value | |

| | | | | MORTGAGE NOTES (Continued) - 97.9% | | | | | | | | | |

| $ | 94,532 | | | Loan ID 200332 | | Fixed | | | 5.775 | % | | 10/1/2037 | | $ | 99,259 | |

| | 86,905 | | | Loan ID 200334 | | Fixed | | | 7.000 | % | | 1/1/2033 | | | 91,250 | |

| | 259,133 | | | Loan ID 200335 | | Fixed | | | 4.000 | % | | 11/1/2052 | | | 212,081 | |

| | 41,236 | | | Loan ID 200337 | | Fixed | | | 7.000 | % | | 10/1/2034 | | | 37,407 | |

| | 47,067 | | | Loan ID 200338 | | ARM | | | 10.500 | % | | 8/1/2029 | | | 42,631 | |

| | 137,012 | | | Loan ID 200339 | | Fixed | | | 2.000 | % | | 10/1/2033 | | | 128,190 | |

| | 29,475 | | | Loan ID 200340 | | Fixed | | | 7.000 | % | | 3/1/2030 | | | 30,949 | |

| | 57,639 | | | Loan ID 200348 | | Fixed | | | 6.500 | % | | 7/1/2038 | | | 60,521 | |

| | 229,534 | | | Loan ID 200349 | | Fixed | | | 7.000 | % | | 1/1/2037 | | | 167,401 | |

| | 69,431 | | | Loan ID 200352 | | Fixed | | | 7.000 | % | | 8/1/2030 | | | 69,431 | |

| | 92,403 | | | Loan ID 200358 | | Fixed | | | 5.000 | % | | 4/1/2025 | | | 96,575 | |

| | 64,913 | | | Loan ID 200361 | | Fixed | | | 7.500 | % | | 1/1/2034 | | | 68,159 | |

| | 63,046 | | | Loan ID 200366 | | Fixed | | | 6.250 | % | | 1/1/2033 | | | 63,046 | |

| | 162,099 | | | Loan ID 200368 | | Fixed | | | 4.500 | % | | 4/1/2036 | | | 169,927 | |

| | 69,085 | | | Loan ID 200374 | | ARM | | | 8.500 | % | | 5/1/2034 | | | 69,085 | |

| | 177,473 | | | Loan ID 200380 | | Fixed | | | 4.220 | % | | 4/1/2049 | | | 169,280 | |

| | 374,314 | | | Loan ID 200383 | | Fixed | | | 5.030 | % | | 12/1/2046 | | | 393,029 | |

| | 282,586 | | | Loan ID 200384 | | Fixed | | | 5.000 | % | | 11/1/2047 | | | 266,972 | |

| | 137,967 | | | Loan ID 200385 | | Fixed | | | 8.250 | % | | 1/1/2040 | | | 144,865 | |

| | 116,927 | | | Loan ID 200389 | | Fixed | | | 4.820 | % | | 9/1/2047 | | | 74,754 | |

| | 192,188 | | | Loan ID 200390 | | Fixed | | | 4.780 | % | | 4/16/2047 | | | 172,140 | |

| | 153,280 | | | Loan ID 200391 | | Fixed | | | 4.000 | % | | 1/13/2035 | | | 157,036 | |

| | 62,569 | | | Loan ID 200392 | | Fixed | | | 10.000 | % | | 6/5/2034 | | | 65,697 | |

| | 76,691 | | | Loan ID 200395 | | Fixed | | | 4.860 | % | | 4/1/2047 | | | 51,697 | |

| | 68,945 | | | Loan ID 200396 | | Fixed | | | 10.000 | % | | 2/1/2036 | | | 72,392 | |

| | 83,052 | | | Loan ID 200397 | | ARM | | | 5.375 | % | | 9/1/2037 | | | 87,204 | |

| | 68,234 | | | Loan ID 200399 | | Fixed | | | 4.980 | % | | 6/1/2037 | | | 67,030 | |

| | 45,055 | | | Loan ID 200403 | | Fixed | | | 8.300 | % | | 10/15/2032 | | | 47,308 | |

| | 53,238 | | | Loan ID 200404 | | Fixed | | | 8.100 | % | | 5/1/2037 | | | 55,900 | |

| | 89,819 | | | Loan ID 200405 | | Fixed | | | 4.870 | % | | 12/1/2035 | | | 78,592 | |

| | 113,130 | | | Loan ID 200406 | | Fixed | | | 4.875 | % | | 10/1/2051 | | | 118,787 | |

| | 223,327 | | | Loan ID 200407 | | Fixed | | | 6.500 | % | | 4/1/2042 | | | 234,493 | |

| | 335,524 | | | Loan ID 200409 | | Fixed | | | 6.000 | % | | 2/1/2049 | | | 269,888 | |

| | 99,880 | | | Loan ID 200411 | | Fixed | | | 8.275 | % | | 6/1/2037 | | | 104,874 | |

| | 176,611 | | | Loan ID 200416 | | Fixed | | | 4.670 | % | | 8/1/2053 | | | 168,534 | |

| | 65,156 | | | Loan ID 200417 | | Fixed | | | 7.000 | % | | 5/1/2035 | | | 68,413 | |

| | 143,615 | | | Loan ID 200419 | | Fixed | | | 4.000 | % | | 12/19/2035 | | | 144,642 | |

| | 152,595 | | | Loan ID 200420 | | Fixed | | | 4.225 | % | | 4/10/2038 | | | 145,360 | |

| | 71,818 | | | Loan ID 200421 | | Fixed | | | 7.710 | % | | 8/1/2037 | | | 75,409 | |

| | 131,293 | | | Loan ID 200422 | | Fixed | | | 3.830 | % | | 8/1/2053 | | | 111,462 | |

| | 121,878 | | | Loan ID 200423 | | Fixed | | | 4.500 | % | | 6/1/2043 | | | 127,652 | |

| | 210,988 | | | Loan ID 200430 | | Fixed | | | 3.625 | % | | 7/1/2043 | | | 214,466 | |

| | 174,506 | | | Loan ID 200431 | | Fixed | | | 4.625 | % | | 7/1/2043 | | | 183,232 | |

| | 277,622 | | | Loan ID 200432 | | Fixed | | | 4.875 | % | | 5/1/2043 | | | 291,503 | |

| | 121,539 | | | Loan ID 200433 | | Fixed | | | 4.250 | % | | 8/1/2043 | | | 126,470 | |

| | 193,360 | | | Loan ID 200435 | | Fixed | | | 4.625 | % | | 11/1/2052 | | | 200,691 | |

| | 41,360 | | | Loan ID 200439 | | Fixed | | | 5.000 | % | | 8/1/2041 | | | 43,428 | |

| | 141,502 | | | Loan ID 200445 | | Fixed | | | 5.250 | % | | 2/1/2039 | | | 148,577 | |

| | 38,814 | | | Loan ID 200447 | | Fixed | | | 5.875 | % | | 11/4/2034 | | | 40,754 | |

| | 75,466 | | | Loan ID 200448 | | Fixed | | | 5.750 | % | | 5/1/2042 | | | 70,385 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Vertical Capital Income Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Principal | | | | | Loan Type | | Interest Rate | | | Maturity | | Fair Value | |

| | | | | MORTGAGE NOTES (Continued) - 97.9% | | | | | | | | | |

| $ | 132,636 | | | Loan ID 200449 | | Fixed | | | 5.000 | % | | 2/1/2042 | | $ | 139,267 | |

| | 336,977 | | | Loan ID 200451 | | Fixed | | | 6.250 | % | | 7/1/2038 | | | 353,825 | |

| | 8,129 | | | Loan ID 200453 | | ARM | | | 6.000 | % | | 3/1/2026 | | | 8,535 | |

| | 180,520 | | | Loan ID 200460 | | Fixed | | | 7.000 | % | | 7/1/2041 | | | 189,546 | |

| | 369,334 | | | Loan ID 200462 | | Fixed | | | 6.000 | % | | 7/1/2045 | | | 348,485 | |

| | 230,334 | | | Loan ID 200465 | | Fixed | | | 6.500 | % | | 7/1/2037 | | | 233,691 | |

| | 101,915 | | | Loan ID 200468 | | Fixed | | | 5.625 | % | | 12/1/2044 | | | 40,211 | |

| | 120,786 | | | Loan ID 200469 | | Fixed | | | 6.500 | % | | 7/1/2037 | | | 115,912 | |

| | 272,266 | | | Loan ID 200473 | | Fixed | | | 4.000 | % | | 12/1/2042 | | | 232,151 | |

| | 235,843 | | | Loan ID 200474 | | Fixed | | | 5.750 | % | | 11/1/2050 | | | 247,635 | |

| | 162,798 | | | Loan ID 200475 | | Fixed | | | 5.450 | % | | 7/1/2049 | | | 170,938 | |

| | 185,956 | | | Loan ID 200476 | | Fixed | | | 6.000 | % | | 9/1/2050 | | | 195,254 | |

| | 146,544 | | | Loan ID 200477 | | Fixed | | | 4.125 | % | | 12/1/2028 | | | 151,504 | |

| | 90,609 | | | Loan ID 200482 | | Fixed | | | 4.375 | % | | 11/1/2028 | | | 94,672 | |

| | 85,117 | | | Loan ID 200483 | | Fixed | | | 4.375 | % | | 11/1/2028 | | | 88,934 | |

| | 70,444 | | | Loan ID 200485 | | Fixed | | | 4.125 | % | | 2/1/2043 | | | 73,003 | |

| | 231,319 | | | Loan ID 200486 | | Fixed | | | 3.500 | % | | 1/1/2043 | | | 233,782 | |

| | 107,250 | | | Loan ID 200489 | | Fixed | | | 4.000 | % | | 3/1/2043 | | | 110,621 | |

| | 53,805 | | | Loan ID 200490 | | Fixed | | | 4.000 | % | | 11/1/2028 | | | 55,515 | |

| | 190,859 | | | Loan ID 200491 | | Fixed | | | 5.500 | % | | 10/1/2039 | | | 190,859 | |

| | 113,851 | | | Loan ID 200492 | | Fixed | | | 4.000 | % | | 1/1/2043 | | | 117,466 | |

| | 262,267 | | | Loan ID 200494 | | Fixed | | | 4.625 | % | | 10/1/2043 | | | 275,381 | |

| | 188,559 | | | Loan ID 200496 | | Fixed | | | 3.875 | % | | 2/1/2043 | | | 193,695 | |

| | 300,106 | | | Loan ID 200497 | | Fixed | | | 3.250 | % | | 4/1/2043 | | | 299,292 | |

| | 255,265 | | | Loan ID 200499 | | Fixed | | | 4.250 | % | | 1/1/2043 | | | 265,181 | |

| | 197,936 | | | Loan ID 200500 | | Fixed | | | 5.875 | % | | 2/1/2037 | | | 207,833 | |

| | 350,083 | | | Loan ID 200504 | | Fixed | | | 3.375 | % | | 3/1/2043 | | | 351,277 | |

| | 65,509 | | | Loan ID 200507 | | Fixed | | | 4.500 | % | | 9/1/2042 | | | 68,784 | |

| | 312,638 | | | Loan ID 200514 | | Fixed | | | 3.000 | % | | 4/1/2047 | | | 308,357 | |

| | 93,251 | | | Loan ID 200515 | | Fixed | | | 8.250 | % | | 2/1/2039 | | | 97,914 | |

| | 96,698 | | | Loan ID 200517 | | Fixed | | | 8.000 | % | | 5/1/2039 | | | 101,515 | |

| | 193,800 | | | Loan ID 200518 | | Fixed | | | 3.000 | % | | 12/1/2050 | | | 191,158 | |

| | 298,784 | | | Loan ID 200519 | | Fixed | | | 3.000 | % | | 11/1/2049 | | | 295,007 | |

| | 264,279 | | | Loan ID 200525 | | Fixed | | | 3.250 | % | | 12/1/2042 | | | 215,050 | |

| | 105,365 | | | Loan ID 200527 | | Fixed | | | 4.500 | % | | 12/1/2043 | | | 110,529 | |

| | 373,716 | | | Loan ID 200529 | | Fixed | | | 4.625 | % | | 2/1/2044 | | | 392,402 | |

| | 165,015 | | | Loan ID 200531 | | Fixed | | | 4.625 | % | | 11/1/2043 | | | 173,266 | |

| | 102,347 | | | Loan ID 200532 | | Fixed | | | 3.250 | % | | 7/1/2043 | | | 102,093 | |

| | 87,834 | | | Loan ID 200537 | | Fixed | | | 4.500 | % | | 3/1/2042 | | | 92,226 | |

| | 78,783 | | | Loan ID 200540 | | Fixed | | | 3.875 | % | | 2/1/2043 | | | 80,977 | |

| | 45,657 | | | Loan ID 200545 | | Fixed | | | 4.375 | % | | 2/1/2029 | | | 47,639 | |

| | 115,980 | | | Loan ID 200546 | | Fixed | | | 5.375 | % | | 12/1/2043 | | | 121,779 | |

| | 157,509 | | | Loan ID 200548 | | Fixed | | | 5.250 | % | | 2/1/2044 | | | 165,384 | |

| | 128,573 | | | Loan ID 200564 | | Fixed | | | 4.875 | % | | 5/1/2039 | | | 128,573 | |

| | 123,332 | | | Loan ID 200567 | | Fixed | | | 3.375 | % | | 5/1/2043 | | | 123,847 | |

| | 127,601 | | | Loan ID 200571 | | Fixed | | | 4.500 | % | | 7/1/2043 | | | 133,695 | |

| | 89,177 | | | Loan ID 200573 | | Fixed | | | 3.750 | % | | 9/1/2042 | | | 91,089 | |

| | 123,656 | | | Loan ID 200574 | | Fixed | | | 4.875 | % | | 1/1/2044 | | | 129,839 | |

| | 172,505 | | | Loan ID 200578 | | Fixed | | | 4.750 | % | | 8/1/2040 | | | 181,130 | |

| | 45,180 | | | Loan ID 200579 | | Fixed | | | 4.875 | % | | 5/1/2042 | | | 47,439 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Vertical Capital Income Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Principal | | | | | Loan Type | | Interest Rate | | | Maturity | | Fair Value | |

| | | | | MORTGAGE NOTES (Continued) - 97.9% | | | | | | | | | |

| $ | 161,382 | | | Loan ID 200580 | | Fixed | | | 4.125 | % | | 11/1/2041 | | $ | 167,395 | |

| | 36,382 | | | Loan ID 200581 | | Fixed | | | 4.750 | % | | 9/1/2042 | | | 38,119 | |

| | 349,881 | | | Loan ID 200582 | | Fixed | | | 4.000 | % | | 11/1/2042 | | | 357,156 | |

| | 55,439 | | | Loan ID 200583 | | Fixed | | | 3.625 | % | | 9/1/2027 | | | 56,400 | |

| | 305,600 | | | Loan ID 200586 | | Fixed | | | 3.500 | % | | 1/1/2043 | | | 309,064 | |

| | 235,025 | | | Loan ID 200588 | | Fixed | | | 3.750 | % | | 5/1/2042 | | | 240,511 | |

| | 62,550 | | | Loan ID 200593 | | Fixed | | | 3.875 | % | | 6/1/2042 | | | 64,258 | |

| | 214,049 | | | Loan ID 200594 | | Fixed | | | 4.250 | % | | 4/1/2043 | | | 222,927 | |

| | 36,256 | | | Loan ID 200597 | | Fixed | | | 5.625 | % | | 2/1/2044 | | | 38,069 | |

| | 175,672 | | | Loan ID 200600 | | Fixed | | | 4.625 | % | | 4/1/2044 | | | 184,456 | |

| | 172,698 | | | Loan ID 200602 | | Fixed | | | 3.750 | % | | 3/1/2043 | | | 176,663 | |

| | 21,388 | | | Loan ID 200603 | | Fixed | | | 4.125 | % | | 6/1/2043 | | | 22,114 | |

| | 68,562 | | | Loan ID 200604 | | Fixed | | | 3.500 | % | | 1/1/2043 | | | 69,339 | |

| | 140,005 | | | Loan ID 200605 | | Fixed | | | 4.875 | % | | 12/1/2043 | | | 147,005 | |

| | 126,118 | | | Loan ID 200608 | | Fixed | | | 4.125 | % | | 11/1/2043 | | | 130,792 | |

| | 118,152 | | | Loan ID 200612 | | Fixed | | | 4.500 | % | | 2/1/2043 | | | 123,994 | |

| | 191,047 | | | Loan ID 200613 | | Fixed | | | 3.369 | % | | 1/1/2043 | | | 192,015 | |

| | 96,073 | | | Loan ID 200615 | | Fixed | | | 4.250 | % | | 8/1/2043 | | | 99,948 | |

| | 322,296 | | | Loan ID 200616 | | Fixed | | | 4.875 | % | | 2/1/2044 | | | 338,411 | |

| | 214,669 | | | Loan ID 200620 | | Fixed | | | 4.250 | % | | 10/1/2043 | | | 223,321 | |

| | 123,506 | | | Loan ID 200621 | | Fixed | | | 3.625 | % | | 1/1/2043 | | | 125,316 | |

| | 68,000 | | | Loan ID 200623 | | Fixed | | | 4.375 | % | | 12/1/2042 | | | 70,990 | |

| | 123,779 | | | Loan ID 200627 | | Fixed | | | 4.250 | % | | 10/1/2043 | | | 128,808 | |

| | 157,163 | | | Loan ID 200630 | | Fixed | | | 5.250 | % | | 9/1/2043 | | | 165,021 | |

| | 327,381 | | | Loan ID 200632 | | Fixed | | | 5.250 | % | | 5/1/2044 | | | 343,750 | |

| | 213,829 | | | Loan ID 200633 | | Fixed | | | 5.125 | % | | 5/1/2044 | | | 224,521 | |

| | 217,774 | | | Loan ID 200634 | | Fixed | | | 4.375 | % | | 1/1/2044 | | | 227,468 | |

| | 138,105 | | | Loan ID 200642 | | Fixed | | | 5.000 | % | | 3/1/2044 | | | 135,225 | |

| | 111,844 | | | Loan ID 200645 | | Fixed | | | 5.000 | % | | 4/1/2044 | | | 117,436 | |

| | 134,080 | | | Loan ID 200649 | | Fixed | | | 4.375 | % | | 3/1/2044 | | | 139,960 | |

| | 122,949 | | | Loan ID 200650 | | Fixed | | | 4.875 | % | | 5/1/2044 | | | 129,097 | |

| | 221,185 | | | Loan ID 200651 | | Fixed | | | 3.625 | % | | 7/1/2043 | | | 224,802 | |

| | 130,905 | | | Loan ID 200655 | | Fixed | | | 3.375 | % | | 5/1/2043 | | | 131,440 | |

| | 143,031 | | | Loan ID 200656 | | Fixed | | | 6.875 | % | | 7/1/2037 | | | 76,028 | |

| | 140,821 | | | Loan ID 200657 | | Fixed | | | 4.875 | % | | 8/1/2051 | | | 147,862 | |

| | 169,405 | | | Loan ID 200660 | | Fixed | | | 5.875 | % | | 3/1/2038 | | | 177,876 | |

| | 199,623 | | | Loan ID 200662 | | Fixed | | | 5.000 | % | | 3/1/2044 | | | 209,604 | |

| | 65,370 | | | Loan ID 200663 | | Fixed | | | 4.750 | % | | 5/1/2044 | | | 68,638 | |

| | 282,433 | | | Loan ID 200668 | | Fixed | | | 3.625 | % | | 4/1/2043 | | | 287,561 | |

| | 147,705 | | | Loan ID 200669 | | Fixed | | | 5.250 | % | | 4/1/2044 | | | 155,090 | |

| | 51,839 | | | Loan ID 200670 | | Fixed | | | 4.375 | % | | 2/1/2029 | | | 54,085 | |

| | 224,312 | | | Loan ID 200671 | | Fixed | | | 4.625 | % | | 8/1/2043 | | | 235,528 | |

| | 147,014 | | | Loan ID 200672 | | Fixed | | | 3.750 | % | | 7/1/2043 | | | 150,188 | |

| | 293,332 | | | Loan ID 200674 | | Fixed | | | 4.500 | % | | 5/1/2044 | | | 307,420 | |

| | 96,716 | | | Loan ID 200677 | | Fixed | | | 3.625 | % | | 5/1/2028 | | | 98,372 | |

| | 437,932 | | | Loan ID 200678 | | Fixed | | | 4.375 | % | | 2/1/2044 | | | 457,045 | |

| | 241,923 | | | Loan ID 200679 | | Fixed | | | 5.000 | % | | 4/1/2044 | | | 214,966 | |

| | 180,114 | | | Loan ID 200682 | | Fixed | | | 4.875 | % | | 5/1/2044 | | | 175,197 | |

| | 119,953 | | | Loan ID 200684 | | Fixed | | | 4.875 | % | | 4/1/2044 | | | 125,951 | |

| | 217,779 | | | Loan ID 200685 | | Fixed | | | 4.875 | % | | 5/1/2044 | | | 228,668 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Vertical Capital Income Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Principal | | | | | Loan Type | | Interest Rate | | | Maturity | | Fair Value | |

| | | | | MORTGAGE NOTES (Continued) - 97.9% | | | | | | | | | |

| $ | 212,030 | | | Loan ID 200690 | | Fixed | | | 4.250 | % | | 4/1/2044 | | $ | 220,821 | |

| | 231,348 | | | Loan ID 200692 | | Fixed | | | 4.625 | % | | 7/1/2044 | | | 242,916 | |

| | 101,032 | | | Loan ID 200694 | | Fixed | | | 4.500 | % | | 9/1/2043 | | | 105,854 | |

| | 45,281 | | | Loan ID 200696 | | Fixed | | | 3.750 | % | | 10/1/2042 | | | 46,345 | |

| | 85,942 | | | Loan ID 200700 | | Fixed | | | 4.250 | % | | 2/1/2044 | | | 89,359 | |

| | 160,533 | | | Loan ID 200701 | | Fixed | | | 4.750 | % | | 6/1/2044 | | | 151,368 | |

| | 91,372 | | | Loan ID 200704 | | Fixed | | | 4.375 | % | | 3/1/2043 | | | 95,239 | |

| | 125,354 | | | Loan ID 200708 | | Fixed | | | 4.875 | % | | 2/1/2044 | | | 131,621 | |

| | 48,205 | | | Loan ID 200709 | | Fixed | | | 4.375 | % | | 4/1/2043 | | | 50,330 | |

| | 109,216 | | | Loan ID 200710 | | Fixed | | | 4.500 | % | | 7/1/2044 | | | 114,427 | |

| | 578,596 | | | Loan ID 200714 | | Fixed | | | 4.175 | % | | 11/1/2036 | | | 541,171 | |

| | 199,946 | | | Loan ID 200716 | | ARM | | | 5.483 | % | | 8/1/2037 | | | 178,192 | |

| | 134,173 | | | Loan ID 200720 | | ARM | | | 5.500 | % | | 4/1/2042 | | | 123,371 | |

| | 145,779 | | | Loan ID 200726 | | Fixed | | | 4.375 | % | | 9/1/2037 | | | 106,955 | |

| | 154,135 | | | Loan ID 200727 | | Fixed | | | 3.500 | % | | 7/1/2037 | | | 155,809 | |

| | 442,662 | | | Loan ID 200730 | | ARM | | | 4.750 | % | | 9/1/2036 | | | 346,672 | |

| | 188,584 | | | Loan ID 200732 | | Fixed | | | 4.125 | % | | 9/1/2027 | | | 195,048 | |

| | 216,820 | | | Loan ID 200733 | | Fixed | | | 3.750 | % | | 12/1/2042 | | | 221,811 | |

| | 223,242 | | | Loan ID 200734 | | ARM | | | 3.375 | % | | 4/1/2044 | | | 225,003 | |

| | 95,940 | | | Loan ID 200735 | | Fixed | | | 4.500 | % | | 6/1/2044 | | | 100,619 | |

| | 137,384 | | | Loan ID 200736 | | Fixed | | | 4.750 | % | | 5/1/2044 | | | 133,127 | |

| | 166,875 | | | Loan ID 200742 | | Fixed | | | 4.250 | % | | 4/1/2043 | | | 173,327 | |

| | 180,472 | | | Loan ID 200744 | | Fixed | | | 3.625 | % | | 6/1/2043 | | | 183,492 | |

| | 427,773 | | | Loan ID 200748 | | Fixed | | | 4.750 | % | | 12/1/2043 | | | 449,162 | |

| | 146,053 | | | Loan ID 200749 | | Fixed | | | 4.750 | % | | 9/1/2043 | | | 153,355 | |

| | 56,977 | | | Loan ID 200753 | | Fixed | | | 5.250 | % | | 5/1/2044 | | | 59,826 | |

| | 52,238 | | | Loan ID 200755 | | Fixed | | | 4.250 | % | | 6/1/2043 | | | 54,367 | |

| | 180,316 | | | Loan ID 200756 | | Fixed | | | 4.875 | % | | 11/1/2043 | | | 168,792 | |

| | 118,185 | | | Loan ID 200759 | | Fixed | | | 3.750 | % | | 6/1/2043 | | | 120,974 | |

| | 161,766 | | | Loan ID 200760 | | Fixed | | | 3.750 | % | | 6/1/2043 | | | 165,449 | |

| | 281,903 | | | Loan ID 200762 | | Fixed | | | 3.875 | % | | 5/1/2042 | | | 289,839 | |

| | 144,625 | | | Loan ID 200763 | | Fixed | | | 4.250 | % | | 11/1/2043 | | | 150,298 | |

| | 194,154 | | | Loan ID 200765 | | Fixed | | | 4.875 | % | | 11/1/2043 | | | 203,862 | |

| | 461,839 | | | Loan ID 200766 | | Fixed | | | 3.625 | % | | 12/1/2042 | | | 470,163 | |

| | 169,106 | | | Loan ID 200771 | | Fixed | | | 4.500 | % | | 4/1/2043 | | | 169,106 | |

| | 231,487 | | | Loan ID 200772 | | Fixed | | | 3.750 | % | | 3/1/2043 | | | 236,913 | |

| | 192,428 | | | Loan ID 200774 | | Fixed | | | 3.875 | % | | 7/1/2043 | | | 197,783 | |

| | 42,158 | | | Loan ID 200775 | | Fixed | | | 4.250 | % | | 4/1/2043 | | | 43,826 | |

| | 76,969 | | | Loan ID 200776 | | Fixed | | | 4.250 | % | | 3/1/2044 | | | 80,000 | |

| | 51,079 | | | Loan ID 200777 | | Fixed | | | 4.750 | % | | 6/1/2044 | | | 53,149 | |

| | 159,760 | | | Loan ID 200781 | | Fixed | | | 4.625 | % | | 9/1/2044 | | | 167,459 | |

| | 133,876 | | | Loan ID 200783 | | Fixed | | | 4.750 | % | | 9/1/2044 | | | 140,569 | |

| | 106,560 | | | Loan ID 200785 | | Fixed | | | 4.500 | % | | 8/1/2044 | | | 111,759 | |

| | 215,834 | | | Loan ID 200786 | | Fixed | | | 4.625 | % | | 7/1/2044 | | | 226,626 | |

| | 41,189 | | | Loan ID 200787 | | Fixed | | | 4.750 | % | | 9/1/2044 | | | 43,248 | |

| | 122,881 | | | Loan ID 200789 | | Fixed | | | 3.750 | % | | 9/1/2044 | | | 125,649 | |

| | 143,796 | | | Loan ID 200790 | | Fixed | | | 4.250 | % | | 8/1/2044 | | | 149,774 | |

| | 193,966 | | | Loan ID 200791 | | Fixed | | | 4.875 | % | | 6/1/2044 | | | 203,664 | |

| | 87,386 | | | Loan ID 200795 | | Fixed | | | 6.750 | % | | 8/1/2036 | | | 91,756 | |

| | 69,677 | | | Loan ID 200796 | | Fixed | | | 5.170 | % | | 12/1/2053 | | | 30,876 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Vertical Capital Income Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Principal | | | | | Loan Type | | Interest Rate | | | Maturity | | Fair Value | |

| | | | | MORTGAGE NOTES (Continued) - 97.9% | | | | | | | | | |

| $ | 57,432 | | | Loan ID 200799 | | Fixed | | | 4.000 | % | | 2/5/2053 | | $ | 55,941 | |

| | 62,779 | | | Loan ID 200800 | | Fixed | | | 4.000 | % | | 1/1/2053 | | | 59,430 | |

| | 150,062 | | | Loan ID 200805 | | Fixed | | | 4.625 | % | | 7/1/2050 | | | 120,988 | |

| | 155,659 | | | Loan ID 200806 | | Fixed | | | 5.000 | % | | 8/1/2049 | | | 127,102 | |

| | 55,752 | | | Loan ID 200808 | | Fixed | | | 4.250 | % | | 11/1/2050 | | | 28,857 | |

| | 114,217 | | | Loan ID 200809 | | Fixed | | | 5.000 | % | | 4/1/2050 | | | 71,574 | |

| | 230,114 | | | Loan ID 200814 | | Fixed | | | 8.250 | % | | 7/1/2039 | | | 241,620 | |

| | 275,963 | | | Loan ID 200817 | | Fixed | | | 5.000 | % | | 1/1/2050 | | | 204,705 | |

| | 198,435 | | | Loan ID 200821 | | Fixed | | | 4.250 | % | | 8/1/2044 | | | 206,582 | |

| | 77,113 | | | Loan ID 200823 | | Fixed | | | 4.250 | % | | 9/1/2044 | | | 80,298 | |

| | 210,675 | | | Loan ID 200824 | | Fixed | | | 4.250 | % | | 8/1/2044 | | | 216,564 | |

| | 100,409 | | | Loan ID 200826 | | Fixed | | | 4.375 | % | | 9/1/2044 | | | 104,609 | |

| | 195,079 | | | Loan ID 200829 | | Fixed | | | 4.375 | % | | 7/1/2043 | | | 203,650 | |

| | 191,330 | | | Loan ID 200830 | | ARM | | | 2.875 | % | | 7/1/2044 | | | 191,825 | |

| | 58,034 | | | Loan ID 200831 | | Fixed | | | 4.250 | % | | 10/1/2044 | | | 60,261 | |

| | 322,777 | | | Loan ID 200832 | | Fixed | | | 4.250 | % | | 10/1/2044 | | | 335,615 | |

| | 151,930 | | | Loan ID 200834 | | Fixed | | | 4.125 | % | | 7/1/2043 | | | 157,392 | |

| | 312,092 | | | Loan ID 200835 | | Fixed | | | 5.000 | % | | 8/1/2043 | | | 327,697 | |

| | 220,536 | | | Loan ID 200839 | | Fixed | | | 5.000 | % | | 5/1/2044 | | | 231,563 | |

| | 283,409 | | | Loan ID 200844 | | Fixed | | | 4.500 | % | | 7/1/2043 | | | 297,202 | |

| | 192,422 | | | Loan ID 200846 | | Fixed | | | 4.375 | % | | 11/1/2043 | | | 201,169 | |

| | 173,707 | | | Loan ID 200847 | | Fixed | | | 4.750 | % | | 10/1/2044 | | | 182,392 | |

| | 102,933 | | | Loan ID 200853 | | Fixed | | | 5.000 | % | | 4/1/2037 | | | 108,079 | |

| | 182,431 | | | Loan ID 200856 | | Fixed | | | 6.500 | % | | 6/1/2042 | | | 118,475 | |

| | 255,078 | | | Loan ID 200858 | | Fixed | | | 4.000 | % | | 1/1/2053 | | | 225,666 | |

| | 160,334 | | | Loan ID 200860 | | Fixed | | | 3.875 | % | | 3/1/2052 | | | 117,396 | |

| | 409,019 | | | Loan ID 200861 | | Fixed | | | 3.000 | % | | 6/1/2054 | | | 292,207 | |

| | 239,962 | | | Loan ID 200863 | | Fixed | | | 3.380 | % | | 7/1/2052 | | | 240,043 | |

| | 254,469 | | | Loan ID 200866 | | Fixed | | | 3.400 | % | | 5/1/2053 | | | 256,059 | |

| | 108,640 | | | Loan ID 200867 | | Fixed | | | 4.370 | % | | 9/1/2053 | | | 98,497 | |

| | 193,227 | | | Loan ID 200873 | | Fixed | | | 4.525 | % | | 11/1/2053 | | | 85,827 | |

| | 180,155 | | | Loan ID 200880 | | Fixed | | | 4.250 | % | | 6/1/2043 | | | 187,390 | |

| | 67,156 | | | Loan ID 200883 | | Fixed | | | 3.375 | % | | 5/1/2028 | | | 67,402 | |

| | 83,691 | | | Loan ID 200886 | | Fixed | | | 4.250 | % | | 10/1/2044 | | | 87,065 | |

| | 240,663 | | | Loan ID 200887 | | Fixed | | | 4.750 | % | | 9/1/2044 | | | 252,697 | |

| | 195,874 | | | Loan ID 200891 | | Fixed | | | 4.250 | % | | 10/1/2044 | | | 203,514 | |

| | 239,165 | | | Loan ID 200892 | | Fixed | | | 3.750 | % | | 9/1/2043 | | | 244,399 | |

| | 212,043 | | | Loan ID 200895 | | Fixed | | | 3.875 | % | | 11/1/2043 | | | 218,070 | |

| | 184,131 | | | Loan ID 200897 | | Fixed | | | 4.750 | % | | 10/1/2044 | | | 193,337 | |

| | 326,401 | | | Loan ID 200900 | | Fixed | | | 4.375 | % | | 9/1/2044 | | | 341,417 | |

| | 622,954 | | | Loan ID 200902 | | Fixed | | | 4.250 | % | | 9/1/2044 | | | 648,679 | |

| | 384,917 | | | Loan ID 200905 | | Fixed | | | 5.375 | % | | 9/1/2044 | | | 404,163 | |

| | 281,298 | | | Loan ID 200906 | | Fixed | | | 4.875 | % | | 2/1/2035 | | | 295,362 | |

| | 359,834 | | | Loan ID 200907 | | ARM | | | 5.533 | % | | 8/1/2047 | | | 367,007 | |

| | 101,307 | | | Loan ID 200908 | | Fixed | | | 4.000 | % | | 6/1/2049 | | | 104,112 | |

| | 111,502 | | | Loan ID 200909 | | Fixed | | | 4.870 | % | | 3/1/2046 | | | 90,259 | |

| | 194,513 | | | Loan ID 200910 | | Fixed | | | 5.300 | % | | 4/1/2053 | | | 175,625 | |

| | 685,906 | | | Loan ID 200912 | | Fixed | | | 4.500 | % | | 3/1/2037 | | | 719,865 | |

| | 56,834 | | | Loan ID 200913 | | Fixed | | | 4.250 | % | | 5/1/2047 | | | 53,271 | |

| | 142,484 | | | Loan ID 200914 | | Fixed | | | 2.875 | % | | 12/1/2047 | | | 139,933 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Vertical Capital Income Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Principal | | | | | Loan Type | | Interest Rate | | | Maturity | | Fair Value | |

| | | | | MORTGAGE NOTES (Continued) - 97.9% | | | | | | | | | |

| $ | 87,034 | | | Loan ID 200916 | | Fixed | | | 4.000 | % | | 10/1/2037 | | $ | 86,991 | |

| | 154,459 | | | Loan ID 200917 | | Fixed | | | 4.875 | % | | 1/1/2051 | | | 162,181 | |

| | 89,963 | | | Loan ID 200921 | | ARM | | | 5.625 | % | | 7/1/2051 | | | 94,461 | |

| | 408,770 | | | Loan ID 200922 | | Fixed | | | 3.340 | % | | 9/1/2053 | | | 421,241 | |

| | 496,397 | | | Loan ID 200924 | | Fixed | | | 5.500 | % | | 9/1/2051 | | | 521,217 | |

| | 299,238 | | | Loan ID 200927 | | Fixed | | | 3.000 | % | | 8/1/2038 | | | 295,675 | |

| | 113,189 | | | Loan ID 200928 | | Fixed | | | 4.800 | % | | 12/1/2036 | | | 118,848 | |

| | 153,879 | | | Loan ID 200929 | | Fixed | | | 4.625 | % | | 1/1/2043 | | | 161,573 | |

| | 380,116 | | | Loan ID 200931 | | Fixed | | | 4.250 | % | | 12/1/2052 | | | 354,051 | |

| | 287,473 | | | Loan ID 200933 | | Fixed | | | 4.250 | % | | 3/1/2043 | | | 299,162 | |

| | 108,423 | | | Loan ID 200934 | | Fixed | | | 3.810 | % | | 1/1/2043 | | | 111,085 | |

| | 168,785 | | | Loan ID 200935 | | Fixed | | | 3.875 | % | | 4/1/2043 | | | 173,560 | |

| | 184,159 | | | Loan ID 200936 | | Fixed | | | 4.000 | % | | 5/1/2042 | | | 190,021 | |

| | 187,718 | | | Loan ID 200940 | | Fixed | | | 3.250 | % | | 2/1/2043 | | | 187,207 | |

| | 108,413 | | | Loan ID 200941 | | Fixed | | | 3.780 | % | | 1/1/2043 | | | 110,963 | |

| | 265,182 | | | Loan ID 200942 | | Fixed | | | 4.000 | % | | 4/1/2043 | | | 273,744 | |

| | 99,524 | | | Loan ID 200944 | | Fixed | | | 4.500 | % | | 2/1/2044 | | | 104,050 | |

| | 274,059 | | | Loan ID 200947 | | Fixed | | | 4.000 | % | | 2/1/2043 | | | 282,755 | |

| | 123,757 | | | Loan ID 200948 | | Fixed | | | 4.625 | % | | 12/1/2042 | | | 129,945 | |

| | 267,415 | | | Loan ID 200949 | | Fixed | | | 3.875 | % | | 4/1/2043 | | | 275,017 | |

| | 172,716 | | | Loan ID 200952 | | Fixed | | | 3.875 | % | | 1/1/2043 | | | 177,540 | |

| | 111,163 | | | Loan ID 200953 | | Fixed | | | 3.750 | % | | 12/1/2042 | | | 113,622 | |

| | 358,997 | | | Loan ID 200954 | | Fixed | | | 3.625 | % | | 1/1/2043 | | | 365,202 | |

| | 308,900 | | | Loan ID 200955 | | Fixed | | | 3.250 | % | | 5/1/2043 | | | 308,398 | |

| | 255,894 | | | Loan ID 200956 | | Fixed | | | 5.000 | % | | 8/1/2051 | | | 268,689 | |

| | 397,359 | | | Loan ID 200959 | | Fixed | | | 4.000 | % | | 11/1/2042 | | | 410,272 | |

| | 341,959 | | | Loan ID 200960 | | Fixed | | | 3.500 | % | | 1/1/2043 | | | 345,594 | |

| | 195,557 | | | Loan ID 200962 | | Fixed | | | 4.250 | % | | 10/1/2044 | | | 203,539 | |

| | 113,084 | | | Loan ID 200963 | | Fixed | | | 4.750 | % | | 9/1/2044 | | | 118,739 | |

| | 336,085 | | | Loan ID 200964 | | Fixed | | | 3.750 | % | | 7/1/2043 | | | 343,834 | |

| | 140,109 | | | Loan ID 200966 | | Fixed | | | 4.875 | % | | 7/1/2044 | | | 147,114 | |

| | 90,360 | | | Loan ID 200968 | | Fixed | | | 4.250 | % | | 11/1/2044 | | | 94,878 | |

| | 347,462 | | | Loan ID 200969 | | Fixed | | | 4.875 | % | | 8/1/2043 | | | 364,835 | |

| | 147,641 | | | Loan ID 200974 | | Fixed | | | 4.250 | % | | 10/1/2044 | | | 153,630 | |

| | 338,243 | | | Loan ID 200977 | | Fixed | | | 4.875 | % | | 9/1/2044 | | | 355,155 | |

| | 192,856 | | | Loan ID 200983 | | Fixed | | | 4.375 | % | | 8/1/2044 | | | 201,392 | |

| | 109,789 | | | Loan ID 200987 | | Fixed | | | 4.625 | % | | 10/1/2044 | | | 115,278 | |

| | 176,860 | | | Loan ID 200989 | | Fixed | | | 3.750 | % | | 6/1/2029 | | | 180,427 | |

| | 160,633 | | | Loan ID 200993 | | Fixed | | | 2.004 | % | | 7/15/2049 | | | 147,007 | |

| | 53,550 | | | Loan ID 200996 | | Fixed | | | 2.500 | % | | 8/1/2048 | | | 43,514 | |

| | 353,896 | | | Loan ID 200998 | | Fixed | | | 3.875 | % | | 12/1/2050 | | | 357,869 | |

| | 123,790 | | | Loan ID 201005 | | Fixed | | | 4.750 | % | | 7/1/2041 | | | 129,980 | |

| | 41,144 | | | Loan ID 201006 | | Fixed | | | 6.875 | % | | 3/1/2038 | | | 43,202 | |

| | 83,521 | | | Loan ID 201007 | | Fixed | | | 7.125 | % | | 4/1/2037 | | | 87,697 | |

| | 76,458 | | | Loan ID 201010 | | Fixed | | | 5.500 | % | | 4/1/2039 | | | 80,281 | |

| | 44,382 | | | Loan ID 201012 | | Fixed | | | 7.500 | % | | 12/1/2038 | | | 46,601 | |

| | 53,942 | | | Loan ID 201013 | | Fixed | | | 7.500 | % | | 12/1/2038 | | | 47,637 | |

| | 100,623 | | | Loan ID 201016 | | Fixed | | | 6.500 | % | | 2/1/2036 | | | 105,654 | |

| | 74,250 | | | Loan ID 201022 | | ARM | | | 4.875 | % | | 5/1/2037 | | | 62,370 | |

| | 133,990 | | | Loan ID 201023 | | Fixed | | | 6.450 | % | | 2/1/2036 | | | 128,256 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Vertical Capital Income Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Principal | | | | | Loan Type | | Interest Rate | | | Maturity | | Fair Value | |

| | | | | MORTGAGE NOTES (Continued) - 97.9% | | | | | | | | | |

| $ | 103,452 | | | Loan ID 201027 | | ARM | | | 9.538 | % | | 3/1/2037 | | $ | 108,624 | |

| | 98,998 | | | Loan ID 201030 | | Fixed | | | 5.000 | % | | 7/1/2042 | | | 103,947 | |

| | 136,098 | | | Loan ID 201032 | | Fixed | | | 4.500 | % | | 11/1/2044 | | | 141,996 | |

| | 274,326 | | | Loan ID 201033 | | Fixed | | | 4.125 | % | | 12/1/2044 | | | 284,588 | |

| | 86,180 | | | Loan ID 201036 | | Fixed | | | 4.375 | % | | 12/1/2044 | | | 89,931 | |

| | 66,545 | | | Loan ID 201037 | | Fixed | | | 8.250 | % | | 7/1/2039 | | | 69,872 | |

| | 88,399 | | | Loan ID 201041 | | Fixed | | | 3.750 | % | | 11/1/2052 | | | 82,317 | |

| | 109,531 | | | Loan ID 201043 | | Fixed | | | 4.000 | % | | 4/1/2039 | | | 106,449 | |

| | 170,440 | | | Loan ID 201044 | | Fixed | | | 4.870 | % | | 3/29/2037 | | | 178,962 | |

| | 103,031 | | | Loan ID 201045 | | Fixed | | | 3.375 | % | | 7/1/2037 | | | 91,233 | |

| | 276,448 | | | Loan ID 201046 | | Fixed | | | 3.000 | % | | 10/1/2058 | | | 192,810 | |

| | 106,098 | | | Loan ID 201047 | | Fixed | | | 3.625 | % | | 4/1/2053 | | | 102,683 | |

| | 63,645 | | | Loan ID 201053 | | Fixed | | | 3.860 | % | | 7/1/2053 | | | 65,258 | |

| | 203,307 | | | Loan ID 201054 | | Fixed | | | 2.400 | % | | 5/17/2050 | | | 186,777 | |

| | 569,061 | | | Loan ID 201056 | | Fixed | | | 3.000 | % | | 7/1/2054 | | | 508,357 | |

| | 159,963 | | | Loan ID 201057 | | Fixed | | | 3.000 | % | | 1/1/2050 | | | 140,124 | |

| | 122,592 | | | Loan ID 201058 | | Fixed | | | 4.250 | % | | 8/1/2037 | | | 127,444 | |

| | 103,127 | | | Loan ID 201060 | | ARM | | | 5.000 | % | | 7/1/2035 | | | 92,496 | |

| | 84,762 | | | Loan ID 201061 | | Fixed | | | 5.000 | % | | 2/1/2050 | | | 73,592 | |

| | 113,920 | | | Loan ID 201062 | | Fixed | | | 3.100 | % | | 4/1/2047 | | | 112,987 | |

| | 119,913 | | | Loan ID 201063 | | Fixed | | | 4.000 | % | | 9/1/2047 | | | 111,045 | |

| | 222,465 | | | Loan ID 201066 | | Fixed | | | 4.250 | % | | 12/1/2046 | | | 231,135 | |

| | 418,561 | | | Loan ID 201067 | | Fixed | | | 4.750 | % | | 1/1/2044 | | | 439,489 | |

| | 65,651 | | | Loan ID 201069 | | Fixed | | | 4.625 | % | | 12/1/2044 | | | 68,933 | |

| | 91,601 | | | Loan ID 201072 | | Fixed | | | 3.500 | % | | 3/1/2028 | | | 92,701 | |

| | 91,784 | | | Loan ID 201075 | | Fixed | | | 4.375 | % | | 10/1/2044 | | | 95,816 | |

| | 128,907 | | | Loan ID 201077 | | Fixed | | | 3.625 | % | | 7/1/2044 | | | 131,252 | |

| | 219,892 | | | Loan ID 201084 | | Fixed | | | 5.000 | % | | 8/1/2038 | | | 219,892 | |

| | 141,488 | | | Loan ID 201086 | | Fixed | | | 4.625 | % | | 11/1/2044 | | | 148,562 | |

| | 151,838 | | | Loan ID 201091 | | Fixed | | | 4.125 | % | | 1/1/2045 | | | 156,826 | |

| | 242,235 | | | Loan ID 201092 | | Fixed | | | 5.250 | % | | 4/1/2046 | | | 242,235 | |

| | 132,227 | | | Loan ID 201093 | | Fixed | | | 4.125 | % | | 9/1/2043 | | | 109,528 | |

| | 139,674 | | | Loan ID 201094 | | Fixed | | | 4.550 | % | | 3/1/2044 | | | 146,213 | |

| | 335,801 | | | Loan ID 201101 | | Fixed | | | 4.625 | % | | 3/1/2045 | | | 352,591 | |

| | 145,355 | | | Loan ID 201103 | | ARM | | | 2.875 | % | | 5/1/2044 | | | 147,331 | |

| | 153,529 | | | Loan ID 201104 | | Fixed | | | 4.375 | % | | 4/1/2045 | | | 160,092 | |

| | 73,409 | | | Loan ID 201107 | | Fixed | | | 5.150 | % | | 2/1/2036 | | | 77,080 | |

| | 150,051 | | | Loan ID 201108 | | Fixed | | | 4.750 | % | | 2/1/2054 | | | 84,713 | |

| | 495,399 | | | Loan ID 201110 | | ARM | | | 5.875 | % | | 4/1/2037 | | | 412,743 | |

| | 157,614 | | | Loan ID 201111 | | Fixed | | | 4.875 | % | | 4/1/2050 | | | 111,159 | |

| | 229,916 | | | Loan ID 201112 | | Fixed | | | 4.750 | % | | 8/1/2037 | | | 241,412 | |

| | 76,931 | | | Loan ID 201113 | | Fixed | | | 5.750 | % | | 12/1/2052 | | | 80,778 | |

| | 116,556 | | | Loan ID 201114 | | Fixed | | | 8.087 | % | | 5/1/2054 | | | 122,384 | |

| | 492,488 | | | Loan ID 201115 | | Fixed | | | 4.000 | % | | 2/1/2051 | | | 502,254 | |

| | 84,746 | | | Loan ID 201121 | | Fixed | | | 4.125 | % | | 10/1/2037 | | | 82,756 | |

| | 82,947 | | | Loan ID 201122 | | Fixed | | | 4.750 | % | | 11/1/2048 | | | 80,848 | |

| | 230,971 | | | Loan ID 201124 | | Fixed | | | 4.750 | % | | 4/1/2040 | | | 242,520 | |

| | 76,898 | | | Loan ID 201127 | | ARM | | | 4.875 | % | | 4/1/2037 | | | 73,523 | |

| | 112,876 | | | Loan ID 201130 | | Fixed | | | 4.850 | % | | 12/1/2037 | | | 118,520 | |

| | 115,353 | | | Loan ID 201131 | | Fixed | | | 8.250 | % | | 5/1/2053 | | | 121,120 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Vertical Capital Income Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Principal | | | | | Loan Type | | Interest Rate | | | Maturity | | Fair Value | |

| | | | | MORTGAGE NOTES (Continued) - 97.9% | | | | | | | | | |

| $ | 165,629 | | | Loan ID 201132 | | Fixed | | | 4.250 | % | | 7/1/2037 | | $ | 146,104 | |

| | 191,819 | | | Loan ID 201134 | | Fixed | | | 3.000 | % | | 10/1/2053 | | | 169,735 | |

| | 51,744 | | | Loan ID 201138 | | Fixed | | | 4.250 | % | | 3/1/2034 | | | 53,631 | |

| | 157,161 | | | Loan ID 201139 | | Fixed | | | 3.000 | % | | 11/1/2053 | | | 130,299 | |

| | 145,612 | | | Loan ID 201140 | | Fixed | | | 4.870 | % | | 1/1/2038 | | | 152,893 | |

| | 83,536 | | | Loan ID 201143 | | Fixed | | | 3.500 | % | | 11/1/2037 | | | 74,688 | |

| | 127,799 | | | Loan ID 201146 | | Fixed | | | 4.875 | % | | 8/1/2054 | | | 122,899 | |

| | 106,336 | | | Loan ID 201147 | | Fixed | | | 4.125 | % | | 11/1/2051 | | | 100,781 | |

| | 91,108 | | | Loan ID 201148 | | Fixed | | | 3.950 | % | | 10/1/2042 | | | 93,521 | |

| | 312,518 | | | Loan ID 201149 | | Fixed | | | 5.000 | % | | 5/1/2058 | | | 150,247 | |

| | 91,184 | | | Loan ID 201155 | | Fixed | | | 3.000 | % | | 11/1/2053 | | | 59,293 | |

| | 62,299 | | | Loan ID 201156 | | Fixed | | | 5.000 | % | | 4/1/2050 | | | 51,229 | |

| | 282,046 | | | Loan ID 201157 | | Fixed | | | 4.000 | % | | 3/1/2055 | | | 290,489 | |

| | 197,861 | | | Loan ID 201160 | | Fixed | | | 4.920 | % | | 10/1/2049 | | | 148,734 | |

| | 371,696 | | | Loan ID 201163 | | Fixed | | | 4.750 | % | | 12/1/2049 | | | 259,396 | |

| | 160,795 | | | Loan ID 201164 | | Fixed | | | 4.250 | % | | 11/1/2051 | | | 166,707 | |

| | 105,392 | | | Loan ID 201165 | | Fixed | | | 4.750 | % | | 1/1/2044 | | | 110,662 | |

| | 420,282 | | | Loan ID 201168 | | Fixed | | | 3.875 | % | | 4/1/2052 | | | 388,914 | |

| | 101,150 | | | Loan ID 201169 | | Fixed | | | 5.934 | % | | 9/1/2037 | | | 63,485 | |

| | 61,068 | | | Loan ID 201170 | | Fixed | | | 4.375 | % | | 7/1/2037 | | | 63,789 | |

| | 104,763 | | | Loan ID 201173 | | Fixed | | | 4.280 | % | | 11/1/2047 | | | 60,738 | |

| | 140,880 | | | Loan ID 201174 | | Fixed | | | 4.750 | % | | 1/1/2053 | | | 147,924 | |

| | 130,908 | | | Loan ID 201176 | | Fixed | | | 4.250 | % | | 8/1/2053 | | | 135,777 | |

| | 294,528 | | | Loan ID 201179 | | Fixed | | | 4.750 | % | | 5/1/2051 | | | 244,756 | |

| | 279,446 | | | Loan ID 201181 | | Fixed | | | 4.500 | % | | 4/1/2034 | | | 292,088 | |

| | 129,036 | | | Loan ID 201183 | | Fixed | | | 3.500 | % | | 10/1/2052 | | | 118,609 | |

| | 60,986 | | | Loan ID 201184 | | Fixed | | | 4.000 | % | | 6/1/2049 | | | 62,697 | |

| | 250,595 | | | Loan ID 201185 | | Fixed | | | 6.760 | % | | 10/1/2053 | | | 216,309 | |

| | 78,278 | | | Loan ID 201187 | | Fixed | | | 4.000 | % | | 11/1/2048 | | | 43,908 | |

| | 602,585 | | | Loan ID 201196 | | Fixed | | | 4.000 | % | | 11/1/2036 | | | 541,078 | |

| | 180,558 | | | Loan ID 201197 | | Fixed | | | 6.500 | % | | 4/1/2049 | | | 189,586 | |

| | 322,303 | | | Loan ID 201199 | | Fixed | | | 5.125 | % | | 11/1/2046 | | | 300,664 | |

| | 431,536 | | | Loan ID 201204 | | Fixed | | | 3.750 | % | | 4/1/2045 | | | 440,776 | |

| | 142,028 | | | Loan ID 201205 | | Fixed | | | 4.625 | % | | 1/1/2045 | | | 149,130 | |

| | 124,644 | | | Loan ID 201206 | | Fixed | | | 3.990 | % | | 4/1/2045 | | | 128,513 | |

| | 407,482 | | | Loan ID 201207 | | Fixed | | | 4.625 | % | | 8/1/2051 | | | 422,548 | |

| | 110,708 | | | Loan ID 201208 | | Fixed | | | 4.625 | % | | 4/1/2045 | | | 115,984 | |

| | 172,082 | | | Loan ID 201209 | | Fixed | | | 4.250 | % | | 4/1/2045 | | | 170,911 | |

| | 122,849 | | | Loan ID 201211 | | Fixed | | | 4.125 | % | | 7/1/2044 | | | 106,344 | |

| | 359,698 | | | Loan ID 201212 | | Fixed | | | 4.625 | % | | 10/1/2058 | | | 322,709 | |

| | 190,193 | | | Loan ID 201213 | | Fixed | | | 4.875 | % | | 8/1/2044 | | | 199,049 | |

| | 517,849 | | | Loan ID 201214 | | ARM | | | 3.875 | % | | 9/1/2043 | | | 405,836 | |

| | 120,564 | | | Loan ID 201218 | | Fixed | | | 4.125 | % | | 1/1/2045 | | | 123,062 | |

| | 61,155 | | | Loan ID 201221 | | Fixed | | | 3.250 | % | | 5/1/2043 | | | 64,212 | |

| | 46,444 | | | Loan ID 201222 | | Fixed | | | 5.125 | % | | 1/1/2045 | | | 48,766 | |

| | 188,136 | | | Loan ID 201223 | | Fixed | | | 3.875 | % | | 4/1/2030 | | | 195,861 | |

| | 55,805 | | | Loan ID 201226 | | Fixed | | | 5.000 | % | | 3/1/2045 | | | 58,595 | |

| | 52,207 | | | Loan ID 201229 | | Fixed | | | 3.250 | % | | 7/1/2024 | | | 52,567 | |

| | 248,228 | | | Loan ID 201233 | | Fixed | | | 4.500 | % | | 12/1/2044 | | | 216,620 | |

| | 224,568 | | | Loan ID 201237 | | Fixed | | | 3.750 | % | | 5/1/2045 | | | 229,719 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Vertical Capital Income Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Principal | | | | | Loan Type | | Interest Rate | | | Maturity | | Fair Value | |

| | | | | MORTGAGE NOTES (Continued) - 97.9% | | | | | | | | | |

| $ | 152,865 | | | Loan ID 201240 | | Fixed | | | 4.250 | % | | 10/1/2045 | | $ | 102,861 | |

| | 285,600 | | | Loan ID 201241 | | Fixed | | | 4.375 | % | | 7/1/2045 | | | 298,616 | |

| | 217,885 | | | Loan ID 201242 | | Fixed | | | 4.625 | % | | 11/1/2044 | | | 228,248 | |

| | 105,961 | | | Loan ID 201243 | | Fixed | | | 4.625 | % | | 11/1/2045 | | | 111,068 | |

| | 384,958 | | | Loan ID 201244 | | Fixed | | | 4.500 | % | | 6/1/2045 | | | 402,732 | |

| | 109,620 | | | Loan ID 201245 | | Fixed | | | 4.750 | % | | 8/1/2044 | | | 115,101 | |

| | 96,973 | | | Loan ID 201248 | | Fixed | | | 4.875 | % | | 7/1/2044 | | | 101,822 | |

| | 466,697 | | | Loan ID 201249 | | Fixed | | | 4.625 | % | | 3/1/2059 | | | 472,474 | |

| | 154,364 | | | Loan ID 201254 | | ARM | | | 9.000 | % | | 9/1/2034 | | | 154,364 | |

| | 230,339 | | | Loan ID 201255 | | ARM | | | 9.125 | % | | 6/1/2035 | | | 241,855 | |

| | 17,427 | | | Loan ID 201256 | | ARM | | | 10.500 | % | | 10/1/2021 | | | 18,169 | |

| | 230,490 | | | Loan ID 201257 | | Fixed | | | 4.500 | % | | 5/1/2044 | | | 240,579 | |

| | 87,481 | | | Loan ID 201258 | | Fixed | | | 4.500 | % | | 6/1/2045 | | | 81,512 | |

| | 166,026 | | | Loan ID 201260 | | Fixed | | | 4.750 | % | | 9/1/2045 | | | 174,327 | |

| | 48,362 | | | Loan ID 201263 | | Fixed | | | 4.750 | % | | 10/1/2045 | | | 46,560 | |

| | 345,509 | | | Loan ID 201265 | | Fixed | | | 4.750 | % | | 6/1/2045 | | | 362,784 | |

| | 140,802 | | | Loan ID 201266 | | Fixed | | | 4.500 | % | | 2/1/2046 | | | 146,755 | |

| | 146,120 | | | Loan ID 201270 | | Fixed | | | 4.125 | % | | 2/1/2045 | | | 151,105 | |

| | 245,406 | | | Loan ID 201271 | | Fixed | | | 4.500 | % | | 6/1/2045 | | | 226,493 | |

| | 134,965 | | | Loan ID 201272 | | Fixed | | | 4.750 | % | | 11/1/2044 | | | 141,713 | |

| | 232,822 | | | Loan ID 201273 | | Fixed | | | 4.500 | % | | 12/1/2045 | | | 242,969 | |

| | 209,621 | | | Loan ID 201274 | | Fixed | | | 4.125 | % | | 10/1/2045 | | | 216,462 | |

| | 185,295 | | | Loan ID 201278 | | Fixed | | | 3.750 | % | | 12/1/2045 | | | 186,059 | |

| | 358,293 | | | Loan ID 201280 | | Fixed | | | 4.500 | % | | 4/1/2046 | | | 373,292 | |

| | 147,969 | | | Loan ID 201281 | | Fixed | | | 4.875 | % | | 7/1/2044 | | | 155,367 | |

| | 125,603 | | | Loan ID 201282 | | Fixed | | | 5.250 | % | | 1/1/2046 | | | 131,884 | |

| | 107,100 | | | Loan ID 201283 | | Fixed | | | 4.250 | % | | 11/1/2045 | | | 110,648 | |

| | 115,267 | | | Loan ID 201284 | | Fixed | | | 3.625 | % | | 2/1/2029 | | | 118,917 | |

| | 28,433 | | | Loan ID 201285 | | Fixed | | | 4.625 | % | | 11/1/2028 | | | 29,748 | |

| | 106,505 | | | Loan ID 201286 | | Fixed | | | 4.375 | % | | 12/1/2045 | | | 111,016 | |

| | 82,184 | | | Loan ID 201289 | | Fixed | | | 4.000 | % | | 3/1/2045 | | | 84,451 | |

| | 240,124 | | | Loan ID 201290 | | Fixed | | | 4.750 | % | | 7/1/2045 | | | 252,130 | |

| | 294,901 | | | Loan ID 201291 | | Fixed | | | 5.000 | % | | 8/1/2045 | | | 309,646 | |

| | 119,918 | | | Loan ID 201294 | | Fixed | | | 4.625 | % | | 2/1/2046 | | | 125,464 | |

| | 738,930 | | | Loan ID 201296 | | Fixed | | | 4.250 | % | | 2/1/2046 | | | 764,674 | |

| | 329,254 | | | Loan ID 201297 | | Fixed | | | 4.875 | % | | 8/1/2045 | | | 345,716 | |

| | 70,604 | | | Loan ID 201301 | | Fixed | | | 4.550 | % | | 10/1/2044 | | | 73,850 | |

| | 131,131 | | | Loan ID 201302 | | Fixed | | | 4.250 | % | | 5/1/2045 | | | 136,074 | |

| | 218,588 | | | Loan ID 201304 | | Fixed | | | 4.125 | % | | 2/1/2046 | | | 225,988 | |

| | 143,680 | | | Loan ID 201305 | | Fixed | | | 4.625 | % | | 8/1/2044 | | | 150,864 | |

| | 112,680 | | | Loan ID 201306 | | Fixed | | | 3.875 | % | | 9/1/2045 | | | 116,631 | |

| | 170,077 | | | Loan ID 201307 | | Fixed | | | 4.250 | % | | 10/1/2048 | | | 176,298 | |

| | 60,319 | | | Loan ID 201308 | | Fixed | | | 4.625 | % | | 11/1/2045 | | | 63,037 | |

| | 157,132 | | | Loan ID 201309 | | Fixed | | | 4.000 | % | | 9/1/2045 | | | 159,820 | |

| | 312,730 | | | Loan ID 201313 | | Fixed | | | 4.625 | % | | 1/1/2046 | | | 326,922 | |

| | 109,342 | | | Loan ID 201315 | | Fixed | | | 4.375 | % | | 9/1/2045 | | | 113,650 | |

| | 157,308 | | | Loan ID 201316 | | Fixed | | | 4.500 | % | | 2/1/2046 | | | 136,911 | |

| | 166,910 | | | Loan ID 201319 | | Fixed | | | 4.375 | % | | 10/1/2045 | | | 171,722 | |

| | 132,156 | | | Loan ID 201324 | | Fixed | | | 5.250 | % | | 4/1/2046 | | | 138,764 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Vertical Capital Income Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Principal | | | | | Loan Type | | Interest Rate | | | Maturity | | Fair Value | |

| | | | | MORTGAGE NOTES (Continued) - 97.9% | | | | | | | | | |

| $ | 171,231 | | | Loan ID 201326 | | Fixed | | | 4.625 | % | | 3/1/2046 | | $ | 178,901 | |

| | 185,035 | | | Loan ID 201328 | | Fixed | | | 4.250 | % | | 11/1/2045 | | | 109,734 | |

| | 262,652 | | | Loan ID 201330 | | Fixed | | | 4.375 | % | | 6/1/2046 | | | 273,312 | |

| | 337,205 | | | Loan ID 201333 | | Fixed | | | 3.875 | % | | 1/1/2046 | | | 344,894 | |

| | 187,350 | | | Loan ID 201335 | | Fixed | | | 4.750 | % | | 1/1/2046 | | | 196,236 | |

| | 185,395 | | | Loan ID 201336 | | Fixed | | | 4.750 | % | | 1/1/2046 | | | 163,408 | |

| | 404,572 | | | Loan ID 201339 | | Fixed | | | 4.625 | % | | 7/1/2045 | | | 388,358 | |

| | 140,766 | | | Loan ID 201342 | | Fixed | | | 4.750 | % | | 7/1/2045 | | | 147,805 | |

| | 83,430 | | | Loan ID 201343 | | Fixed | | | 4.250 | % | | 11/1/2045 | | | 86,505 | |

| | 71,294 | | | Loan ID 201344 | | Fixed | | | 5.000 | % | | 7/1/2044 | | | 74,859 | |

| | 132,027 | | | Loan ID 201345 | | Fixed | | | 4.125 | % | | 5/1/2045 | | | 134,414 | |

| | 462,232 | | | Loan ID 201347 | | Fixed | | | 5.750 | % | | 5/1/2046 | | | 485,344 | |

| | 234,756 | | | Loan ID 201350 | | Fixed | | | 4.000 | % | | 6/1/2045 | | | 137,960 | |

| | 68,705 | | | Loan ID 201352 | | Fixed | | | 4.875 | % | | 3/1/2045 | | | 72,140 | |

| | 489,851 | | | Loan ID 201354 | | Fixed | | | 3.375 | % | | 7/1/2046 | | | 510,506 | |

| | 131,448 | | | Loan ID 201355 | | Fixed | | | 5.250 | % | | 12/1/2045 | | | 138,020 | |

| | 101,421 | | | Loan ID 201356 | | Fixed | | | 4.625 | % | | 10/1/2045 | | | 106,142 | |

| | 146,788 | | | Loan ID 201358 | | Fixed | | | 4.875 | % | | 7/1/2045 | | | 139,799 | |

| | 141,220 | | | Loan ID 201361 | | Fixed | | | 5.250 | % | | 7/1/2044 | | | 148,281 | |

| | 109,406 | | | Loan ID 201364 | | Fixed | | | 3.875 | % | | 4/1/2046 | | | 110,416 | |

| | 331,210 | | | Loan ID 201365 | | Fixed | | | 4.250 | % | | 10/1/2045 | | | 342,739 | |

| | 46,879 | | | Loan ID 201368 | | Fixed | | | 5.125 | % | | 2/1/2045 | | | 49,223 | |

| | 177,978 | | | Loan ID 201370 | | Fixed | | | 4.250 | % | | 7/1/2046 | | | 167,629 | |

| | 98,142 | | | Loan ID 201371 | | Fixed | | | 4.125 | % | | 4/1/2046 | | | 100,961 | |

| | 254,200 | | | Loan ID 201372 | | Fixed | | | 4.625 | % | | 8/1/2046 | | | 254,200 | |

| | 153,691 | | | Loan ID 201373 | | Fixed | | | 5.125 | % | | 4/1/2046 | | | 161,376 | |

| | 140,859 | | | Loan ID 201375 | | Fixed | | | 4.500 | % | | 6/1/2045 | | | 147,262 | |

| | 281,603 | | | Loan ID 201377 | | Fixed | | | 3.875 | % | | 5/1/2046 | | | 295,684 | |

| | 66,543 | | | Loan ID 201379 | | Fixed | | | 5.000 | % | | 10/1/2045 | | | 69,871 | |

| | 307,642 | | | Loan ID 201381 | | Fixed | | | 4.875 | % | | 7/1/2045 | | | 323,024 | |

| | 131,711 | | | Loan ID 201383 | | Fixed | | | 4.125 | % | | 12/1/2045 | | | 138,297 | |

| | 77,000 | | | Loan ID 201384 | | Fixed | | | 4.375 | % | | 10/1/2045 | | | 80,850 | |

| | 136,250 | | | Loan ID 201385 | | Fixed | | | 4.625 | % | | 12/1/2045 | | | 143,063 | |

| | 68,947 | | | Loan ID 201386 | | Fixed | | | 5.250 | % | | 5/1/2046 | | | 72,394 | |

| | 231,040 | | | Loan ID 201390 | | Fixed | | | 5.125 | % | | 9/1/2045 | | | 242,592 | |

| | 388,127 | | | Loan ID 201391 | | Fixed | | | 5.125 | % | | 10/1/2045 | | | 407,534 | |

| | 164,753 | | | Loan ID 201392 | | Fixed | | | 3.750 | % | | 2/1/2046 | | | 150,303 | |

| | 422,702 | | | Loan ID 201393 | | Fixed | | | 3.750 | % | | 4/1/2056 | | | 443,837 | |

| | 76,149 | | | Loan ID 201394 | | Fixed | | | 6.700 | % | | 6/1/2034 | | | 79,956 | |

| | 83,763 | | | Loan ID 201395 | | Fixed | | | 6.300 | % | | 7/1/2044 | | | 79,622 | |

| | 259,826 | | | Loan ID 201397 | | Fixed | | | 4.125 | % | | 1/1/2046 | | | 268,265 | |

| | 80,167 | | | Loan ID 201399 | | Fixed | | | 5.000 | % | | 11/1/2045 | | | 84,176 | |

| | 84,063 | | | Loan ID 201400 | | Fixed | | | 4.750 | % | | 7/1/2044 | | | 88,266 | |

| | 88,874 | | | Loan ID 201401 | | Fixed | | | 4.750 | % | | 10/1/2044 | | | 93,318 | |

| | 92,055 | | | Loan ID 201403 | | Fixed | | | 4.750 | % | | 8/1/2044 | | | 80,618 | |

| | 132,282 | | | Loan ID 201404 | | Fixed | | | 4.750 | % | | 10/1/2044 | | | 116,157 | |

| | 70,314 | | | Loan ID 201405 | | Fixed | | | 5.250 | % | | 8/1/2044 | | | 73,829 | |

| | 53,635 | | | Loan ID 201406 | | Fixed | | | 4.250 | % | | 6/1/2046 | | | 55,308 | |

| | 237,105 | | | Loan ID 201407 | | Fixed | | | 4.875 | % | | 1/1/2046 | | | 248,960 | |

| | 161,750 | | | Loan ID 201408 | | Fixed | | | 4.125 | % | | 1/1/2046 | | | 167,353 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Vertical Capital Income Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Principal | | | | | Loan Type | | Interest Rate | | | Maturity | | Fair Value | |

| | | | | MORTGAGE NOTES (Continued) - 97.9% | | | | | | | | | |

| $ | 160,209 | | | Loan ID 201411 | | Fixed | | | 4.750 | % | | 12/1/2045 | | $ | 168,219 | |