market highs and lows and the overall direction of market trends. As a result, the Subadviser may reposition the Fund’s portfolio in response to market movements in an attempt to participate in a developing trend. The Subadviser also may attempt to anticipate market moves and initiate appropriate action in advance of actual market trends in order to minimize the loss of capital appreciation that would occur with a “buy and hold” investment strategy. The Subadviser will likely engage in frequent trading of the Fund’s securities in an attempt to position its portfolio in line with the Subadviser’s expectations for market trends. In addition, the Subadviser will employ leveraged investment techniques that allow the Fund to gain greater exposure to target securities.

An investment in the Fund entails risks. The Fund could lose money, or its performance could trail that of other investment alternatives. The Advisers cannot guarantee that the Fund will achieve its objective. In addition, the Fund presents some risks not traditionally associated with most mutual funds. It is important that investors closely review and understand these risks before making an investment in the Fund. Turbulence in financial markets and reduced liquidity in equity, credit and fixed income markets could negatively affect many issuers worldwide, including the Fund. There is the risk that you could lose all or a portion of your money on your investment in the Fund.

The Fund uses investment techniques that may be considered aggressive. Risks associated with the use of swap agreements and futures contracts include potentially dramatic price changes (losses) in the value of the instruments and imperfect correlations between the price of the contract and the underlying security or index. These instruments may increase the volatility of the Fund and may involve a small investment of cash relative to the magnitude of the risk assumed.

The Fund could lose money if the issuer of a debt security is unable to meet its financial obligations or goes bankrupt. The Fund could also lose money if the issuer of a debt security in which it has a short position is upgraded or generally improves its standing. Changes in an issuer’s financial strength or in an issuer’s or debt security’s credit rating also may affect a security’s value and thus have an impact on Fund performance. Credit risk usually applies to most debt securities, but generally is not a factor for U.S. government obligations.

The Fund may invest in financial instruments involving counterparties for the purpose of attempting to gain exposure to a particular group of securities or asset class without actually purchasing those securities or investments, or to hedge a position. The Fund may enter into swap agreements with a limited number of counterparties, which may increase the Fund’s exposure to counterparty credit risk. Swap agreements also may be considered to be illiquid.

Investments in derivatives are subject to market risks that may cause their prices to fluctuate over time and increase the Fund’s volatility. As a result, the Fund may incur larger losses or smaller gains than otherwise would be the case if the Fund invested directly in the underlying securities.

Investments in emerging markets instruments involve greater risks than investing in foreign instruments in general. Risks of investing in emerging market countries include political or social upheaval, nationalization of businesses, restrictions on foreign ownership and prohibitions on the repatriation of assets and risks from an economy’s dependence on revenues from particular commodities or industries. In addition, currency transfer restrictions, limited potential buyers for such instruments, delays and disruption in settlement procedures and illiquidity or low volumes of transactions may make exits difficult or impossible at times.

Investments in publicly issued equity securities in general are subject to market risks that may cause their prices to fluctuate over time and in turn cause the Fund’s NAV to fluctuate.

Investments in foreign securities involve greater risks than investing in domestic securities. As a result, the Fund’s returns and net asset values may be affected to a large degree by fluctuations in currency exchange rates,

political, diplomatic or economic conditions and regulatory requirements in other countries. The Fund also may invest in depositary receipts, including ADRs, which are traded on exchanges and provide an alternative to investing directly in foreign securities. Investments in ADRs are subject to many of the risks associated with investing directly in foreign securities.

High Portfolio Turnover Risk |

The Fund may experience high portfolio turnover, which would involve correspondingly greater expenses to the Fund, as well as potentially adverse tax consequences, to the Fund’s shareholders from distributions of increased net short-term capital gains and may adversely affect the Fund’s performance.

High-Yield Securities Risk |

The Fund will invest a significant portion or all of its assets in securities rated below investment grade or “junk bonds.” Junk bonds may be sensitive to economic changes, political changes, or adverse developments specific to a company. These securities generally involve greater risk of default or price changes than other types of fixed-income securities and the Fund’s performance may vary significantly as a result. Therefore, an investment in the Fund is subject to a higher risk of loss than an investment in a fund that may not invest in lower-rated securities.

The Fund may hold cash positions when the market is not producing returns greater than the short-term cash investments in which the Fund may invest. There is a risk that the sections of the market in which the Fund invests will begin to rise or fall rapidly and the Fund will not be able to sell stocks quickly enough to avoid losses, or reinvest its cash positions into areas of the advancing market quickly enough to capture the initial returns of changing market conditions.

Debt securities have varying levels of sensitivity to changes in interest rates. The longer the maturity of a security, the greater the impact a change in interest rates could have on the security’s price.

The Fund may employ leveraged investment techniques, including the use of financial instruments to produce leverage results as well as borrowing money for investment purposes. Use of leverage can magnify the effects of changes in the value of the Fund and makes it more volatile. The leveraged investment techniques that the Fund employs could cause investors in the Fund to lose more money in adverse environments.

A non-diversified fund invests a high percentage of its assets in a limited number of securities, exposing the Fund to fluctuations in net asset value and total return.

Other Investment Companies and ETFs Risk |

Investments in the securities of other investment companies may involve duplication of advisory fees and certain other expenses. Fund shareholders indirectly bear the Fund’s proportionate share of the fees and expenses paid by shareholders of the other investment company or ETF, in addition to the fees and expenses Fund shareholders directly bear in connection with the Fund’s own operations. If the investment company or ETF fails to achieve its investment objective, the value of the Fund’s investment will decline, adversely affecting the Fund’s performance. In addition, ETF shares potentially may trade at a discount or a premium and are subject to brokerage and other trading costs, which could result in greater expenses to a Fund. Finally, because the value of ETF shares depends on the demand in the market, the Adviser may not be able to liquidate a Fund’s holdings in an ETF’s shares at the most optimal time, adversely affecting the Fund’s performance.

Short positions are designed to profit from a decline in the price of particular securities, baskets of securities or indices. The Fund will lose value if and when the instrument’s price rises — a result that is the opposite from traditional mutual funds.

Small and Mid-Capitalization Companies Risk |

Investing in the securities of small-capitalization and mid-capitalization companies involves greater risks and the possibility of greater price volatility than investing in larger capitalization and more-established companies. Investments in mid-cap companies involve less risk than investing in small-cap companies. Smaller companies may have limited operating history, product lines, and financial resources, and the securities of these companies may lack

8 THE DIREXION FUNDS PROSPECTUS

sufficient market liquidity. Mid-cap companies often have narrower markets and more limited managerial and financial resources than larger, more established companies.

Subadviser’s Investment Strategy Risk |

The Subadviser has limited previous experience advising investment companies. The principal risk of investing in the Fund is that the Subadviser’s investment strategy will not be successful. While the Subadviser seeks to take advantage of investment opportunities for the Fund that will maximize its investment returns, there is no guarantee that such opportunities will ultimately benefit the Fund. The Subadviser will aggressively change the Fund’s portfolio in response to market conditions that are unpredictable and may expose the Fund to greater market risk than other mutual funds. There is no assurance that the Subadviser’s investment strategy will enable the Fund to achieve its investment objective.

Performance

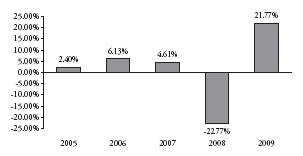

The following performance information provides some indication of the risks of investing in the Fund by demonstrating how its returns have varied over time. The bar chart shows changes in the Fund’s performance from calendar year to calendar year. The table shows how the Fund’s average annual returns for the one-year, five-year and since inception periods compare with those of a broad-based market index for the same periods. The Fund’s past performance, before and after taxes, is not necessarily an indication of how it will perform in the future. Updated performance is available on the Fund’s website at www.direxionfunds.com or by calling the Fund toll-free at (800) 851-0511.

Total Return for the Calendar Year Ended December 31*

* | Year-to-date total return as of September 30, 2010 for the Fund was 1.72%. |

During the period of time shown in the bar chart, the Fund’s highest calendar quarter return was 17.57% for the quarter ended June 30, 2009 and its lowest calendar quarter return was –7.79% for the quarter ended March 31, 2009.

Average Annual Total Returns (for the periods ended December 31, 2009)

| | 1 Year | | 5 Years | | Since

Inception

(9/27/2004) | |

Spectrum Global Perspective Fund | | | | | | | |

Return Before Taxes | | 22.09 | % | 5.79 | % | 8.42 | % |

Return After Taxes on Distributions | | 22.09 | % | 2.94 | % | 5.54 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 14.36 | % | 3.41 | % | 5.69 | % |

MSCI World Index | | 26.98 | % | –0.01 | % | 2.32 | % |

S&P 500® Index | | 26.46 | % | 0.42 | % | 2.30 | % |

After-tax returns are calculated using the historically highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or IRA.

Management

Investment Adviser. Rafferty Asset Management, LLC is the Fund’s investment adviser.

Investment Subadviser. Hundredfold Advisors LLC is the Fund’s investment subadviser.

Portfolio Manager. Ralph J. Doudera, the founder, CEO and investment manager for Hundredfold, has managed the Fund since its inception in September of 2004, under Rafferty’s supervision.

Purchase and Sale of Fund Shares

You may purchase or redeem Fund shares on any business day by written request via mail (Direxion Funds —Spectrum Global Perspective Fund, P.O. Box 701, Milwaukee, Wisconsin 53201-0701), by wire transfer, by telephone at (800) 851-0511, or through a financial intermediary. Purchases and redemptions by telephone are only permitted if you previously established these options on

THE DIREXION FUNDS PROSPECTUS 9

your account. IRA accounts are not eligible for telephone redemption privileges. The Fund accepts investment in the following minimum amounts:

| | Minimum

Initial Investment | | Subsequent

Investment | |

Regular Accounts | | $ | 25,000 | | $ | 1,000 | |

Retirement Accounts | | $ | 25,000 | | $ | 0 | |

Tax Information

The Fund’s distributions to you are taxable, and will be taxed as ordinary income or net capital gain, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an IRA. Distributions on investments made through tax-deferred vehicles, such as 401(k) plans or IRA, may be taxed later upon withdrawal of assets from those plans or accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank or financial advisor), the Fund and/or the Adviser may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

10 THE DIREXION FUNDS PROSPECTUS

Spectrum Equity Opportunity Fund

Investment Objective

The Fund seeks a high total rate of return (income from short-term trading plus capital appreciation) on an annual basis.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

Management Fees | | | | 1.00 | % |

Distribution and/or Service (12b-1) Fees | | | | 1.00 | % |

Other Expenses of the Fund | | | | 0.55 | % |

Operating Services Fee | | 0.55 | % | | |

Acquired Fund Fees and Expenses | | | | 0.23 | % |

Total Annual Fund Operating Expenses(1) | | | | 2.78 | % |

(1) | Total Annual Fund Operating Expenses for the Fund do not correlate to the “Ratios to Average Net Assets: Net Expenses” provided in the Financial Highlights section of the statutory prospectus, which reflects the operating expenses of the Fund and does not include acquired fund fees and expenses. |

Example. This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Investor Class | | $ | 281 | | $ | 862 | | $ | 1,469 | | $ | 3,109 | |

| | | | | | | | | | | | | |

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 1,447% of the average value of its portfolio. The Fund has a very high portfolio turnover due to its aggressive management strategy.

Principal Investment Strategy

Under normal market conditions, the Fund will invest at least 80% of its net assets (plus any borrowing for investment purposes) in equity securities or derivatives of such securities. The Fund invests in equity securities of any market capitalization, investment style, market sector or industry. The Fund also may seek exposure to issuers of foreign securities. Although the Fund may invest directly in equity securities, it may also invest in such securities indirectly through securities that invest in or are a derivative of equity securities, primarily including futures contracts, swap agreements, exchange-traded funds (‘‘ETFs”) and other investment companies. The Fund is a “non-diversified” fund, meaning that a relatively high percentage of its assets may be invested in a limited number of issuers of securities.

Hundredfold Advisors LLC (“Hundredfold” or the “Subadviser”) actively manages the Fund’s portfolio by attempting to anticipate, and respond to, trends in equity securities. The Subadviser will employ an investment strategy that alternates between positions designed to profit from market trends, such as entering into “long” and “short” positions of equity securities, and investing in cash or cash equivalents as a temporary defensive measure. The Subadviser seeks to take “long” positions in or purchase equity securities prior to or at the outset of upward trends for such securities and seeks to take “short” positions in or sell equity securities prior to or early in downward trends in the value of such securities. When the Subadviser believes it appropriate, the Subadviser will employ leveraged investment techniques that allow the Equity Fund to gain greater exposure to its target investments. The Fund employs an aggressive management strategy that typically results in high portfolio turnover.

The Subadviser will consider elements of market trends and momentum, including price actions, advance-decline lines, market highs and lows and the overall direction of market trends. The Subadviser’s strategy does not involve fundamental research and analysis of individual equity securities. The Subadviser will analyze the overall investment opportunities and risks among categories or sectors of equity securities or investment vehicles that

THE DIREXION FUNDS PROSPECTUS 11

represent pools of equity securities, such as major market indices and ETFs. As a result, the Subadviser may reposition the Fund’s portfolio in response to market movements in an attempt to participate in a developing trend and may attempt to anticipate market moves and initiate appropriate action in advance of actual market trends. The Subadviser will likely engage in frequent trading of the Fund’s securities in an attempt to position its portfolio in line with the Subadviser’s expectations for market trends.

Principal Investment Risks

An investment in the Fund entails risks. The Fund could lose money, or its performance could trail that of other investment alternatives. The Advisers cannot guarantee that the Fund will achieve its objective. In addition, the Fund presents some risks not traditionally associated with most mutual funds. It is important that investors closely review and understand these risks before making an investment in the Fund. Turbulence in financial markets and reduced liquidity in equity, credit and fixed income markets could negatively affect many issuers worldwide, including the Fund. There is the risk that you could lose all or a portion of your money on your investment in the Fund.

Aggressive Investment Techniques Risk |

The Fund uses investment techniques that may be considered aggressive. Risks associated with the use of swap agreements and futures contracts include potentially dramatic price changes (losses) in the value of the instruments and imperfect correlations between the price of the contract and the underlying security or index. These instruments may increase the volatility of the Fund and may involve a small investment of cash relative to the magnitude of the risk assumed.

The Fund may invest in financial instruments involving counterparties for the purpose of attempting to gain exposure to a particular group of securities or asset class without actually purchasing those securities or investments, or to hedge a position. The Fund may enter into swap agreements with a limited number of counterparties, which may increase the Fund’s exposure to counterparty credit risk. Swap agreements also may be considered to be illiquid.

Investments in derivatives are subject to market risks that may cause their prices to fluctuate over time and increase the Fund’s volatility. As a result, the Fund may incur larger losses or smaller gains than otherwise would be the case if the Fund invested directly in the underlying securities.

Investments in publicly issued equity securities in general are subject to market risks that may cause their prices to fluctuate over time and in turn cause the Fund’s NAV to fluctuate.

Investments in foreign securities involve greater risks than investing in domestic securities. As a result, the Fund’s returns and net asset values may be affected to a large degree by fluctuations in currency exchange rates, political, diplomatic or economic conditions and regulatory requirements in other countries. The Fund also may invest in depositary receipts, including ADRs, which are traded on exchanges and provide an alternative to investing directly in foreign securities. Investments in ADRs are subject to many of the risks associated with investing directly in foreign securities.

High Portfolio Turnover Risk |

The Fund may experience high portfolio turnover, which would involve correspondingly greater expenses to the Fund, as well as potentially adverse tax consequences, to the Fund’s shareholders from distributions of increased net short-term capital gains and may adversely affect the Fund’s performance.

The Fund may hold cash positions when the market is not producing returns greater than the short-term cash investments in which the Fund may invest. There is a risk that the sections of the market in which the Fund invests will begin to rise or fall rapidly and the Fund will not be able to sell stocks quickly enough to avoid losses, or reinvest its cash positions into areas of the advancing market quickly enough to capture the initial returns of changing market conditions.

The Fund may employ leveraged investment techniques, including the use of financial instruments to produce

12 THE DIREXION FUNDS PROSPECTUS

leverage results as well as borrowing money for investment purposes. Use of leverage can magnify the effects of changes in the value of the Fund and makes it more volatile. The leveraged investment techniques that the Fund employs could cause investors in the Fund to lose more money in adverse environments.

A non-diversified fund invests a high percentage of its assets in a limited number of securities, exposing the Fund to fluctuations in net asset value and total return.

Other Investment Companies and ETFs Risk |

Investments in the securities of other investment companies may involve duplication of advisory fees and certain other expenses. Fund shareholders indirectly bear the Fund’s proportionate share of the fees and expenses paid by shareholders of the other investment company or ETF, in addition to the fees and expenses Fund shareholders directly bear in connection with the Fund’s own operations. If the investment company or ETF fails to achieve its investment objective, the value of the Fund’s investment will decline, adversely affecting the Fund’s performance. In addition, ETF shares potentially may trade at a discount or a premium and are subject to brokerage and other trading costs, which could result in greater expenses to a Fund. Finally, because the value of ETF shares depends on the demand in the market, the Adviser may not be able to liquidate a Fund’s holdings in an ETF’s shares at the most optimal time, adversely affecting the Fund’s performance.

Short positions are designed to profit from a decline in the price of particular securities, baskets of securities or indices. The Fund will lose value if and when the instrument’s price rises — a result that is the opposite from traditional mutual funds.

Small- and Mid-Capitalization Companies Risk |

Investing in the securities of small-capitalization and mid-capitalization companies involves greater risks and the possibility of greater price volatility than investing in larger capitalization and more-established companies. Investments in mid-cap companies involve less risk than investing in small-cap companies. Smaller companies may have limited operating history, product lines, and financial resources, and the securities of these companies may lack sufficient market liquidity. Mid-cap companies often have narrower markets and more limited managerial and financial resources than larger, more established companies.

Subadviser’s Investment Strategy Risk |

The Subadviser has limited previous experience advising investment companies. The principal risk of investing in the Fund is that the Subadviser’s investment strategy will not be successful. While the Subadviser seeks to take advantage of investment opportunities for the Fund that will maximize its investment returns, there is no guarantee that such opportunities will ultimately benefit the Fund. The Subadviser will aggressively change the Fund’s portfolio in response to market conditions that are unpredictable and may expose the Fund to greater market risk than other mutual funds. There is no assurance that the Subadviser’s investment strategy will enable the Fund to achieve its investment objective.

Performance

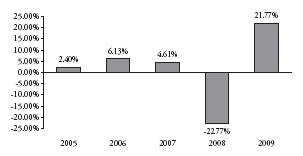

The following performance information provides some indication of the risks of investing in the Fund by demonstrating how its returns have varied over time. The bar chart shows changes in the Fund’s performance from calendar year to calendar year. The table shows how the Fund’s average annual returns for the one year, five year and since inception periods compare with those of a broad-based market index for the same periods. The Fund’s past performance, before and after taxes, is not necessarily an indication of how it will perform in the future. Updated performance is available on the Fund’s website at www.direxionfunds.com or by calling the Fund toll-free at (800) 851-0511.

Total Return for the Calendar Year Ended December 31*

* | Year-to-date total return as of September 30, 2010 for the Fund was 2.13%. |

THE DIREXION FUNDS PROSPECTUS 13

During the period of time shown in the bar chart, the Fund’s highest calendar quarter return was 15.12% for the quarter ended September 30, 2008 and its lowest calendar quarter return was –10.07% for the quarter ended March 31, 2008.

Average Annual Total Returns (for the periods ended December 31, 2009)

| | | | | | Since | |

| | | | | | Inception | |

| | 1 Year | | 5 Years | | (10/11/2004) | |

Spectrum Equity Opportunity Fund | | | | | | | |

Return Before Taxes | | 21.77 | % | 1.35 | % | 3.06 | % |

Return After Taxes on Distributions | | 21.68 | % | –0.10 | % | 1.65 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 14.27 | % | 0.37 | % | 1.86 | % |

S&P 500® Index | | 26.46 | % | 0.42 | % | 1.93 | % |

After-tax returns are calculated using the historically highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or IRA.

Management

Investment Adviser. Rafferty Asset Management, LLC is the Fund’s investment adviser.

Investment Subadviser. Hundredfold Advisors LLC is the Fund’s investment subadviser.

Portfolio Manager. Ralph J. Doudera, the founder, CEO and investment manager for Hundredfold, has managed the Fund since its inception in October of 2004, under Rafferty’s supervision.

Purchase and Sale of Fund Shares

You may purchase or redeem Fund shares on any business day by written request via mail (Direxion Funds —Spectrum Equity Opportunity Fund, P.O. Box 701, Milwaukee, Wisconsin 53201-0701), by wire transfer, by telephone at (800) 851-0511, or through a financial intermediary. Purchases and redemptions by telephone are only permitted if you previously established these options on your account. IRA accounts are not eligible for telephone redemption privileges. The Fund accepts investment in the following minimum amounts:

| | | Minimum | | | Subsequent | |

| | | Initial Investment | | | Investment | |

Regular Accounts | | $ | 25,000 | | $ | 1,000 | |

Retirement Accounts | | $ | 25,000 | | $ | 0 | |

Tax Information

The Fund’s distributions to you are taxable, and will be taxed as ordinary income or net capital gain, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an IRA. Distributions on investments made through tax-deferred vehicles, such as 401(k) plans or IRAs, may be taxed later upon withdrawal of assets from those plans or accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank or financial advisor), the Fund and/or the Adviser may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

14 THE DIREXION FUNDS PROSPECTUS

ADDITIONAL DETAILS ABOUT THE FUNDS

This Prospectus relates to the Service Class shares of the Spectrum Select Alternative Fund (the “Select Alternative Fund”), Spectrum Global Perspective Fund (the “Global Fund”) and Spectrum Equity Opportunity Fund (the “Equity Fund”) (each a “Fund” and collectively “the Funds”). Rafferty serves as the Funds’ investment adviser and Hundredfold Advisors LLC serves as the Funds’ subadviser.

Events in the financial sector have resulted, and may result, in an unusually high degree of volatility in the financial markets. Both domestic and foreign equity markets could experience increased volatility and turmoil, and it is uncertain whether or for how long these conditions could continue. The U.S. Government had taken a number of unprecedented actions designed to support certain financial institutions and segments of the financial markets that experienced extreme volatility, and in some cases a lack of liquidity. Reduced liquidity in equity, credit and fixed-income markets adversely affect many issuers worldwide. These events and possible continued market turbulence may have an adverse effect on the Funds.

Rafferty has entered into an Operating Services Agreement with each of the Funds. Under this Operating Services Agreement, Rafferty, in exchange for an Operating Services Fee paid to Rafferty by each Fund, has contractually agreed to pay all expenses of the Funds other than the following: management fees, distribution and/or service fees, shareholder servicing fees, acquired fund fees and expenses, taxes, leverage interest, dividends or interest on short positions, other interest expenses, brokerage commissions, expenses incurred in connection with any merger or reorganization and extraordinary expenses such as litigation or other expenses outside the typical day-to-day operations of the Funds. This Operating Services Agreement may be terminated at anytime by the Board of Trustees.

Each Fund’s investment objective is not a fundamental policy and may be changed by the Trust’s Board of Trustees without shareholder approval.

Spectrum Select Alternative Fund

Portfolio Investment Strategy. The Subadviser actively manages the Select Alternative Fund’s portfolio to invest in any combination of equity and fixed-income securities based on market conditions and trends and the Subadviser’s expectations and assessment of risks. (The term “Alternative” in the Fund’s name simply refers to the fact that the Subadviser may choose from among many investment alternatives.) Within these securities, the Subadviser employs an investment strategy that alternates between positions designed to profit from market trends, such as entering into “long” and “short” positions, directly or indirectly through ETFs, other investment companies and, as discussed later in this section, derivatives of equity and fixed-income securities, and investing in cash or cash equivalents as a temporary defensive measure. The Subadviser seeks to take “long” positions in or purchase securities prior to or at the outset of upward trends for such securities and seeks to take “short” positions in or sell securities prior to or early in downward trends in the value of such securities. There is no limit on the amount of the Select Alternative Fund’s assets that may be invested in the derivative instruments later discussed or used to cover short positions.

The Subadviser’s decisions are based on a variety of trading models and an analysis of the overall investment opportunities and risks among categories or sectors of equity and fixed-income securities or investment vehicles that represent pools of such securities, including major market indices, investment companies and ETFs. The Subadviser’s strategy does not involve fundamental research and analysis of individual securities. The Subadviser considers elements of market trends and momentum, including price actions, advance-decline lines, market highs and lows and the overall direction of market trends. The Subadviser may reposition the Select Alternative Fund’s portfolio in response to market movements in an attempt to participate in a developing trend and may attempt to anticipate market moves and initiate appropriate action in advance of actual market trends.

The Subadviser will likely engage in frequent trading of the Select Alternative Fund’s securities in an attempt to position its portfolio in line with the Subadviser’s expectations for market trends. In addition, the Subadviser will employ leveraged investment techniques that allow the Select Alternative Fund to increase its exposure to the market during times when the Subadviser anticipates a strong market trend. The Subadviser also may employ hedging strategies designed to reduce volatility and risk.

THE DIREXION FUNDS PROSPECTUS 15

Although the Select Alternative Fund may invest directly in equity and fixed-income securities, it will primarily invest in such securities indirectly through securities that invest in or are a derivative of such securities, primarily including futures contracts, swap agreements, ETFs and other investment companies. The Select Alternative Fund also may invest in options contracts, options on futures contracts and financial instruments in baskets of equity or fixed income securities.

The Select Alternative Fund’s direct investments may include the following equity and fixed-income securities in any combination that the Subadviser believes appropriate:

| • | High-yield bonds (“Junk Bonds”); |

| • | U.S. Treasury bonds and notes; |

| • | U.S. government-sponsored enterprises; |

| • | U.S. dollar-denominated corporate obligations; |

| • | Mortgage and asset-backed securities; |

| • | Corporate bonds and notes and asset-backed securities; |

| • | Commercial paper and other money market instruments; |

| • | Fixed-income securities issued by foreign governments and companies that are denominated in U.S. dollars or foreign currencies, some of which may be issued by governments in emerging market countries; |

The Select Alternative Fund invests in fixed-income securities without any restriction on maturity or creditworthiness, which could range from government securities to Junk Bonds, which are debt securities rated below investment grade. With respect to the Select Alternative Fund’s investments in fixed-income securities, the Subadviser will lengthen and shorten the average dollar weighted maturity of the portfolio and make shifts in quality and sector distribution, according to the Subadviser’s expectations for the future course of interest rates and the then-prevailing price and yield levels in the fixed-income market. The Select Alternative Fund invests in equity securities without consideration to any specific sector or market capitalization range.

Consistent with its investment strategy for temporary defensive purposes, up to 100% of the Select Alternative Fund’s assets may be invested in cash or cash equivalents. To earn income on available cash, a large portion or all of the assets of the Select Alternative Fund may be invested in high quality, U.S. dollar-denominated short-term obligations issued or guaranteed by the U.S. government, its agencies or instrumentalities and repurchase agreements that are fully collateralized by such obligations. As a result of investing in cash and cash equivalents, the Select Alternative Fund may not achieve its investment objective.

The Select Alternative Fund is a “non-diversified” fund, meaning that a relatively high percentage of its assets may be invested in a limited number of issuers of securities.

Spectrum Global Perspective Fund

Portfolio Investment Strategy. The Subadviser actively manages the Global Fund’s portfolio by attempting to anticipate, and respond to, trends in markets in various countries and regions around the world, including emerging markets. The Subadviser employs an investment strategy that alternates between positions designed to profit from market trends, such as entering into “long” and “short” positions in domestic and international securities, and investing in cash or cash equivalents as a temporary defensive measure. The Subadviser seeks to take “long” positions in domestic or international securities prior to or at the outset of upward trends for such securities and seeks to take “short” positions in or sell such securities prior to or early in downward trends in the value of such securities.

The Subadviser considers elements of market trends and momentum, including price actions, advance-decline lines, market highs and lows and the overall direction of market trends. As a result, the Subadviser may reposition the Global Fund’s portfolio in response to market movements in an attempt to participate in a developing trend. The Subadviser also may attempt to anticipate market moves and initiate appropriate action in advance of actual market trends in order to minimize the loss of capital appreciation that would occur with a “buy and hold” investment strategy. The Subadviser will likely engage in frequent trading of the Global Fund’s securities in an attempt to position its portfolio in line with the Subadviser’s expectations for market trends. In addition, the Subadviser employs leveraged investment techniques that allow the Global Fund to gain greater exposure to target securities.

16 THE DIREXION FUNDS PROSPECTUS

The Subadviser analyzes the overall investment opportunities and risks among issuers in various countries, regions and market sectors of foreign securities or investment vehicles that represent pools of foreign securities, such as major market indices and ETFs. The Subadviser’s strategy does not involve fundamental research and analysis of individual equity securities.

Although the Global Fund may invest in domestic equity and debt securities, it primarily invests in international equity and debt securities, including Junk Bonds. In addition, the Global Fund may invest in foreign currencies. The Global Fund generally invests in such international equity and debt securities and foreign currencies indirectly through securities that invest in or are a derivative of international equity securities, primarily including futures contracts, swap agreements, ETFs and other investment companies. The Global Fund also may invest in options contracts, options on future contracts and financial instruments consisting of interest in baskets of international equity securities

The Global Fund may also invest directly in foreign currencies and individual foreign securities or indirectly through ADRs. The Global Fund primarily invests in developed and emerging countries in Europe, the Far East, the Middle East, Africa, Australia and Latin America. In addition, the Global Fund may invest in international equity securities representing any market capitalization, investment style, market sector or industry.

The Global Fund is not meant to provide diversified exposure to international securities. The Global Fund is a “non-diversified” fund, meaning that a relatively high percentage of its assets may be invested in a limited number of issuers of securities.

Consistent with its investment strategy, up to 100% of the Global Fund’s assets may be invested in cash or cash equivalents. To earn income on available cash, a large portion or all of the assets of the Global Fund may be invested in high quality, U.S. dollar-denominated short-term obligations issued or guaranteed by the U.S. government, its agencies or instrumentalities and repurchase agreements that are fully collateralized by such obligations. As a result of investing in cash and cash equivalents, the Global Fund may not achieve its investment objective.

Spectrum Equity Opportunity Fund

Portfolio Investment Strategy. The Subadviser actively manages the Equity Fund’s portfolio by attempting to anticipate, and respond to, trends in equity securities. The Subadviser will employ an investment strategy that alternates between positions designed to profit from market trends, such as entering into “long” and “short” positions of equity securities, and investing in cash or cash equivalents as a temporary defensive measure. The Subadviser seeks to take “long” positions in or purchase equity securities prior to or at the outset of upward trends for such securities and seeks to take “short” positions in or sell equity securities prior to or early in downward trends in the value of such securities. When the Subadviser believes it appropriate, the Subadviser will employ leveraged investment techniques that allow the Equity Fund to gain greater exposure to its target investments.

The Subadviser will consider elements of market trends and momentum, including price actions, advance-decline lines, market highs and lows and the overall direction of market trends. The Subadviser’s strategy does not involve fundamental research and analysis of individual equity securities. The Subadviser will analyze the overall investment opportunities and risks among categories or sectors of equity securities or investment vehicles that represent pools of equity securities, such as major market indices and ETFs. As a result, the Subadviser may reposition the Equity Fund’s portfolio in response to market movements in an attempt to participate in a developing trend and may attempt to anticipate market moves and initiate appropriate action in advance of actual market trends. The Subadviser will likely engage in frequent trading of the Equity Fund’s securities in an attempt to position its portfolio in line with the Subadviser’s expectations for market trends.

Under normal market conditions, the Equity Fund will invest at least 80% of its net assets (plus any borrowing for investment purposes) in equity securities or derivatives of such securities. At times, for temporary defensive purposes, up to 100% of the Equity Fund’s portfolio may be invested in cash or cash equivalents. Although the Equity Fund may invest directly in equity securities, it may also invest in such securities indirectly through securities that invest in or are a derivative of equity securities, primarily including futures contracts, swap agreements, ETFs and other investment companies. Equity securities include common stocks,

THE DIREXION FUNDS PROSPECTUS 17

ADRs, preferred stock, convertible stock, warrants, and rights. The Equity Fund also may invest in options contracts, options on futures contracts, and financial instruments consisting of interests in baskets of equity securities.

The Equity Fund invests in equity securities of any market capitalization, investment style, market sector or industry. The Equity Fund also may seek exposure to issuers of foreign securities.

The Equity Fund is a “non-diversified” fund, meaning that a relatively high percentage of its assets may be invested in a limited number of issuers of securities.

Consistent with its investment strategy for temporary defensive purposes, up to 100% of the Equity Fund’s assets may be invested in cash or cash equivalents. To earn income on available cash, a large portion or all of the assets of the Equity Fund may be invested in high quality, U.S. dollar-denominated short-term obligations issued or guaranteed by the U.S. government, its agencies or instrumentalities and repurchase agreements that are fully collateralized by such obligations. As a result of investing in cash and cash equivalents, the Equity Fund may not achieve its investment objective.

18 THE DIREXION FUNDS PROSPECTUS

PRINCIPAL RISK FACTORS

An investment in any of the Funds entails risk. The Funds could lose money, or their performance could trail that of other investment alternatives. Neither Hundredfold nor Rafferty can guarantee that the Funds will achieve their objectives. In addition, the Funds present some risks not traditionally associated with most mutual funds. It is important that investors closely review and understand these risks before making an investment in the Funds. Turbulence in financial markets and reduced liquidity in equity, credit and fixed income markets could negatively affect many issuers worldwide, including the Funds. The table below provides the principal risks of investing in the Funds. Following the table, each risk is explained.

| | Spectrum Select | | Spectrum Global | | Spectrum Equity |

| | Alternative Fund | | Perspective Fund | | Opportunity Fund |

Aggressive Investment Techniques Risk | | X | | X | | X |

Asset-Backed Securities Risk | | X | | | | |

Counterparty Risk | | X | | X | | X |

Credit Risk | | X | | X | | |

Depositary Risk | | | | X | | X |

Derivatives Risk | | X | | X | | X |

Emerging Markets Risk | | | | X | | |

Equity Securities Risk | | X | | X | | X |

Foreign Securities Risk | | | | X | | X |

High Portfolio Turnover Risk | | X | | X | | X |

High Yield Securities Risk | | X | | X | | |

Holding Cash Risk | | X | | X | | X |

Interest Rate Risk | | X | | | | |

Leverage Risk | | X | | X | | X |

Non-Diversification Risk | | X | | X | | X |

Other Investment Companies and ETFs Risk | | X | | X | | X |

Prepayment Risk | | X | | | | |

Shorting Securities Risk | | X | | X | | X |

Small and Mid-Capitalization Companies Risk | | X | | X | | X |

Subadviser’s Investment Strategy Risk | | X | | X | | X |

THE DIREXION FUNDS PROSPECTUS 19

Aggressive Investment Techniques Risk |

The Funds use investment techniques that may be considered aggressive, including investments in derivatives. Risks associated with derivative instruments such as futures contracts, swap agreements and options on securities, securities indices and futures contracts include potentially dramatic price changes (losses) in the value of the instruments and imperfect correlations between the price of the contract and the underlying security or index. These instruments may increase the volatility of a Fund and may involve a small investment of cash relative to the magnitude of the risk assumed.

Asset-Backed Securities Risk |

Payment of interest and repayment of principal may be impacted by the cash flows generated by the assets backing these securities. The value of the Select Alternative Fund’s asset-backed securities also may be affected by changes in interest rates, the availability of information concerning the interests in and structure of the pools of purchase contracts, financing leases or sales agreements that are represented by these securities, the creditworthiness of the servicing agent for the pool, the originator of the loans or receivables, or the entities that provide any supporting letters of credit, surety bonds, or other credit enhancements.

The Funds may invest in financial instruments involving counterparties for the purpose of attempting to gain exposure to a particular group of securities or asset class without actually purchasing those securities or investments, or to hedge a position. Such financial instruments include, but are not limited to, total return, index, interest rate, and credit default swap agreements, and structured notes. The Funds will use short-term counterparty agreements to exchange the returns (or differentials in rates of return) earned or realized in particular predetermined investments or instruments. The Funds will not enter into any agreement involving a counterparty unless the Adviser believes that the other party to the transaction is creditworthy. The use of swap agreements and structured notes involves risks that are different from those associated with ordinary portfolio securities transactions. For example, the Funds bear the risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap agreement counterparty. In addition, the Funds may enter into swap agreements with a limited number of counterparties, and certain of the Funds may invest in commodity-linked structured notes issued by a limited number of issuers that will act as counterparties, which may increase the Fund’s exposure to counterparty credit risk. Swap agreements also may be considered to be illiquid.

A Fund could lose money if the issuer of a debt security is unable to meet its financial obligations or goes bankrupt. A Fund could also lose money if the issuer of a debt security in which it has a short position is upgraded or generally improves its standing. Changes in an issuer’s financial strength or in an issuer’s or debt security’s credit rating also may affect a security’s value and thus have an impact on Fund performance. Credit risk usually applies to most debt securities, but generally is not a factor for U.S. government obligations.

To the extent the Fund invests in stocks of foreign corporations, the Fund’s investment in such stocks may also be in the form of depositary receipts or other securities convertible into securities of foreign issuers, including American Depositary Receipts (“ADRs”). While the use of ADRs, which are traded on exchanges and represent an ownership in a foreign security, provide an alternative to directly purchasing the underlying foreign securities in their respective national markets and currencies, investments in ADRs continue to be subject to many of the risks associated with investing directly in foreign securities.

The Funds may invest long or short in derivatives, such as futures and swaps. Derivatives are instruments that derive their value from an underlying investment or group of investments. Investments in derivatives are subject to market risks that may cause their prices to fluctuate over time. Investments in derivatives may not correlate with the price movements of underlying securities or indices. As a result, the use of derivatives may expose the Funds to risks that they would not be subject to if they invested directly in the securities underlying those derivatives. There may not be a liquid market for a Fund to sell derivative instruments, which could result in difficulty closing the position, and certain derivative instruments can magnify the extent of

20 THE DIREXION FUNDS PROSPECTUS

losses incurred due to changes in market value of the securities to which they relate. Accordingly, the use of derivatives may result in large losses or smaller gains than otherwise would be the case. In addition, some derivative instruments are subject to counterparty risk.

Investments in emerging markets instruments involve all of the risks of investing in foreign instruments; however these risks are generally heightened because emerging markets are in the initial stages of industrialization and have lower per capita income. Emerging markets are generally more volatile than the markets of developed countries with more mature economies. Emerging markets often provide significantly higher or lower rates of return than developed markets and carry significantly more risks to investors.

A Fund may invest in publicly issued equity securities, including common stocks. Investments in common stocks are subject to market risks that may cause their prices to fluctuate over time. Fluctuations in the value of common stocks in which a Fund invests will cause the net asset value (“NAV”) of the Fund to fluctuate.

Investments in foreign securities involve greater risks than investing in domestic securities. As a result, a Fund’s returns and NAVs may be affected to a large degree by fluctuations in currency exchange rates, political, diplomatic or economic conditions and regulatory requirements in other countries. The laws and accounting, auditing, and financial reporting standards in foreign countries typically are not as strict as they are in the U.S., and there may be less public information available about foreign companies.

High Portfolio Turnover Risk |

A Fund’s aggressive investment strategy has resulted in significant portfolio turnover far in excess of a typical mutual fund. High portfolio turnover involves correspondingly greater expenses to a Fund, including brokerage commissions or dealer mark-ups and other transaction costs on the sale of securities and reinvestments in other securities. Such sales also may result in adverse tax consequences to the Fund’s shareholders from distributions to them of net gains realized on the sales. The trading costs and tax effects associated with portfolio turnover may adversely affect a Fund’s performance. See the Financial Highlights for the Funds’ portfolio turnover rates.

High-Yield Securities Risk |

A Fund may invest in high-yield securities. Investments in securities rated below investment grade or “junk bonds” generally involve significantly greater risks of loss of your money than an investment in investment grade bonds. Compared with issuers of investment grade bonds, junk bonds are more likely to encounter financial difficulties and to be materially affected by these difficulties. Rising interest rates may compound these difficulties and reduce an issuer’s ability to repay principal and interest obligations. Issuers of lower-rated securities also have a greater risk of default or bankruptcy. Additionally, due to the greater number of considerations involved in the selection of the fund’s securities, the achievement of the fund’s objective depends more on the skills of the portfolio manager than investing only in higher rated securities. Therefore, your investment may experience greater volatility in price and yield. High-yield securities may be less liquid than higher quality investments. A security whose credit rating has been lowered may be particularly difficult to sell.

One of the Fund’s strategies is to hold cash positions when the market is not producing returns greater than the short-term cash investments in which the Fund may invest. This usually occurs when broad markets are declining rapidly. The purpose of this strategy is to protect principal in falling markets. There is a risk that the sections of the market in which the Fund invests will begin to rise or fall rapidly and that the Fund will not be able to sell stocks quickly enough to avoid losses, or to reinvest its cash positions into areas of the

THE DIREXION FUNDS PROSPECTUS 21

advancing market quickly enough to capture the initial returns of changing market conditions.

Debt securities have varying levels of sensitivity to changes in interest rates. In general, the price of a debt security will fall when interest rates rise and will rise when interest rates fall. Securities with longer maturities and mortgage securities can be more sensitive to interest rate changes. In other words, the longer the maturity of a security, the greater the impact a change in interest rates could have on the security’s price. In addition, short-term and long-term interest rates do not necessarily move in the same amount or the same direction. Short-term securities tend to react to changes in short-term interest rates, and long-term securities tend to react to changes in long-term interest rates.

Each Fund may employ leveraged investment techniques, including the use of financial instruments to produce leverage results as well as borrowing money for investment purposes. Use of leverage can magnify the effects of changes in the value of the Funds and makes them more volatile. The leveraged investment techniques that the Funds employ could cause investors in the Funds to lose more money in adverse environments.

Each Fund is non-diversified, which means that it may invest a high percentage of its assets in a limited number of securities. Since the Funds are non-diversified, their NAVs and total returns may fluctuate more or fall further in times of weaker markets than a diversified mutual fund.

Other Investment Companies and ETFs Risk |

Investments in the securities of other investment companies and ETFs, may involve duplication of advisory fees and certain other expenses. Fund shareholders indirectly bear the Fund’s proportionate share of the fees and expenses paid by shareholders of the other investment company or ETF, in addition to the fees and expenses Fund shareholders directly bear in connection with the Fund’s own operations. If the investment company or ETF fails to achieve its investment objective, the value of the Fund’s investment will decline, adversely affecting the Fund’s performance. In addition, ETF shares potentially may trade at a discount or a premium and are subject to brokerage and other trading costs, which could result in greater expenses to a Fund. Finally, because the value of ETF shares depends on the demand in the market, the Adviser may not be able to liquidate a Fund’s holdings in an ETF’s shares at the most optimal time, adversely affecting the Fund’s performance.

Many types of debt securities, including mortgage securities, are subject to prepayment risk. Prepayment occurs when the issuer of a security can repay principal prior to the security’s maturity. Securities subject to prepayment can offer less potential for gains during a declining interest rate environment and similar or greater potential for loss in a rising interest rate environment. In addition, the potential impact of prepayment features on the price of a debt security can be difficult to predict and result in greater volatility.

A Fund may, from time to time, establish short positions designed to profit from the decline in the price of particular securities, baskets of securities or indices. In general, when a Fund shorts securities, it borrows the securities from a broker and sells the borrowed securities. The Fund is obligated to deliver to the broker securities that are identical to the securities sold short and will be subject to the risk of loss, which may be significant, in the event that the market value of the securities sold short plus related transaction costs exceeds the proceeds to the Fund from the short sale. A short sale involves the theoretically unlimited risk of an increase in the market price of the security, basket of securities or index sold short which, except in the case of a short sale “against the box,” would result in a theoretically unlimited loss. As a consequence, the Fund will lose value if and when the prices of particular securities, baskets of securities or indexes rises — a result that is the opposite from traditional equity mutual funds. The holder of a short position is responsible for paying the dividends and interest accruing on the short position. Because dividends and interest accruing on a short position is an expense to a Fund, the performance of a Fund may be adversely impacted by the cost of maintaining its short positions.

Small and Mid-Capitalization Companies Risk |

Investing in the securities of small-capitalization and mid-capitalization companies involves greater risks and the possibility of greater price volatility than investing in larger capitalization and more-established companies.

22 THE DIREXION FUNDS PROSPECTUS

Investments in mid-cap companies involve less risk than investing in small-cap companies. Smaller companies may have limited operating history, product lines, and financial resources, and the securities of these companies may lack sufficient market liquidity. Mid-cap companies often have narrower markets and more limited managerial and financial resources than larger, more established companies.

Subadviser’s Investment Strategy Risk |

The Subadviser has limited previous experience advising investment companies. The principal risk of investing in a Fund is that Hundredfold’s investment strategy will not be successful. While the Subadviser seeks to take advantage of investment opportunities for a Fund that will maximize its investment returns, there is no guarantee that such opportunities will ultimately benefit a Fund. The Subadviser will aggressively change a Fund’s portfolio in response to market conditions that are unpredictable and may expose the Fund to greater market risk than other mutual funds. There is no assurance that the Subadviser’s investment strategy will enable a Fund to achieve its investment objective.

THE DIREXION FUNDS PROSPECTUS 23

ABOUT YOUR INVESTMENT

Share Prices of the Funds |

A fund’s share price is known as its NAV. The Funds’ Service Class share prices are calculated as of the close of regular trading, usually 4:00 p.m. Eastern time, each day the New York Stock Exchange (“NYSE”) is open for business (“Business Day”). The value of a Fund’s assets that trade in markets outside the United States or in currencies other than the U.S. Dollar may fluctuate on days that foreign markets are open but the Funds are not open for business.

All shareholder transaction orders received in good form by the Funds’ transfer agent or an authorized financial intermediary by the close of regular trading (generally 4:00 p.m. Eastern time) will be processed at that day’s NAV. Transaction orders received after 4:00 p.m. Eastern time will receive the next Business Day’s NAV.

Share price is calculated by dividing a class’ net assets by its shares outstanding. The Funds use the following methods to price securities held in their portfolios:

| • | Equity securities, over-the-counter securities, swap agreements, closed-end investment companies, options, futures and options on futures are valued at their last sales price, or if not available, the average of the last bid and ask prices; |

| • | Securities primarily traded in the NASDAQ Global Market® are valued using the NASDAQ® Official Closing Price; |

| • | Short-term debt securities with maturities of 60 days or less are valued using the “amortized” cost method; |

| • | Other debt securities are valued by using the closing bid and asked prices provided by the Funds’ pricing service or, if such prices are unavailable, by a pricing matrix method; and |

| • | Securities and other assets for which market quotations are unavailable or unreliable are valued at fair value estimates by the Adviser under the oversight of the Board of Trustees. |

Fair Value Pricing. Portfolio securities and other assets are valued chiefly by market prices from the primary market in which they are traded. Securities are priced at a fair value as determined by the Adviser, under the oversight of the Board of Trustees, when reliable market quotations are not readily available, the Funds’ pricing service does not provide a valuation for such securities, the Funds’ pricing service provides a valuation that in the judgment of the Adviser does not represent fair value, the Adviser believes that the market price is stale, or an event that affects the value of an instrument (a “Significant Event”) has occurred since the closing prices were established, but before the time as of which the Funds calculate their NAVs. Examples of Significant Events may include: (1) events that relate to a single issuer or to an entire market sector; (2) significant fluctuations in domestic or foreign markets; or (3) occurrences not tied directly to the securities markets, such as natural disasters, armed conflicts, or significant government actions. If such Significant Events occur, the Funds may value the instruments at fair value, taking into account such events when it calculates each Fund’s NAV. Fair value determinations are made in good faith in accordance with procedures adopted by the Board of Trustees. In addition, the Funds may also fair value an instrument if trading in a particular instrument is halted and does not resume prior to the closing of the exchange or other market.

Attempts to determine the fair value of securities introduce an element of subjectivity to the pricing of securities. As a result, the price of a security determined through fair valuation techniques may differ from the price quoted or published by other sources and may not accurately reflect the market value of the security when trading resumes. If a reliable market quotation becomes available for a security formerly valued through fair valuation techniques, Rafferty compares the market quotation to the fair value price to evaluate the effectiveness of the Funds’ fair valuation procedures. If any significant discrepancies are found, Rafferty may adjust the Funds’ fair valuation procedures.

The Funds have adopted a Service Class distribution plan under Rule 12b-1 pursuant to which each Fund pays for distribution and services provided to Fund shareholders. Because these fees are paid out of the Service Class assets on an ongoing basis, over time these fees will increase the cost of your investment and may cost you more than paying other types of sales charges.

Pursuant to the plan, each Fund may pay an annual Rule 12b-1 Fee of up to 1.00% of the Fund’s average daily net assets. The Direxion Board of Trustees has authorized each Fund to pay Rule 12b-1 fees equal to 1.00% of the average daily net assets of the Service Class. Under an agreement with the Funds, your Financial Advisor,

24 THE DIREXION FUNDS PROSPECTUS

including Spectrum Financial, Inc., may receive these fees from the Funds. In exchange, your Financial Advisor or Spectrum Financial, Inc. may provide a number of services, such as:

| • | Placing your orders and issuing confirmations; |

| • | Providing investment advice, research and other advisory services; |

| • | Handling correspondence for individual accounts; |

| • | Acting as the sole shareholder of record for individual shareholders; |

| • | Issuing shareholder statements and reports; |

| • | Executing daily investment “sweep” functions; |

| • | Recommending the allocation of client account assets: |

| • | Performing annual reviews of shareholder investments; |

| • | Providing each shareholder with updates on his or her holdings and on current market conditions; |

| • | Effecting all purchase, redemption and exchange transactions in accordance with shareholder instructions; |

| • | Responding to shareholder inquiries; |

| • | Assisting shareholders in utilizing the Funds’ website; |

| • | Assisting with implementing changes in beneficial owners of accounts; |

| • | Assisting with other changes in account information; and |

| • | Responding to questions regarding Fund documents, including tax forms. |

For more information on these and other services, you should speak directly to your Financial Advisor. Your Financial Advisor may charge additional account fees for services beyond those specified above.

How to Invest in Service Class Shares of the Funds |

You may invest in the Service Class of the Funds through traditional investment accounts, IRAs (including Roth IRAs), self-directed retirement plans or company sponsored retirement plans or other products available from your Financial Advisor. Applications and descriptions of any service fees for retirement or other accounts are available from your Financial Advisor. In addition, the Funds may allow for purchases through an Automatic Investment Plan.

Shares of the Funds have not been registered for sale outside of the United States. The Funds generally do not sell shares to investors residing outside of the United States, even if they are United States citizens or lawful permanent residents, except to investors with United States military APO or FPO addresses.

Minimum Investment. The minimum initial and subsequent investments set forth below may be invested in as many of the Funds as you wish. However, you must invest at least $1,000 in any one of the Funds. For example, if you decide to invest $25,000 in all three of the Funds, you may allocate your minimum initial investment as $15,000, $9,000 and $1,000.

| | Minimum | | | |

| | Initial | | Subsequent | |

| | Investment | | Investment | |

Regular Accounts | | $ | 25,000 | | $ | 1,000 | |

Retirement Accounts | | $ | 25,000 | | $ | 0 | |

Rafferty may waive these minimum requirements at its discretion. Contact your Financial Advisor for further information.

Good Form. Good form means that your purchase (whether direct or through a financial intermediary) is complete and contains all necessary information; has all supporting documentation (such as trust documents, beneficiary designations, proper signature guarantees, IRA rollover forms, etc.); and is accompanied by sufficient purchase proceeds. For a purchase request to be in good form, it must include (1) the name of the Fund; (2) the dollar amount of shares to be purchased; and (3) your purchase application or investment stub. An Account Application that is sent to the Funds’ transfer agent does not constitute a purchase order until the transfer agent processes the Account Application and receives correct payment by check or wire transfer.

Purchasing Shares Through Your Financial Advisor. You may purchase shares of the Funds through your Financial Advisor, who can help you complete the necessary paperwork, mail your Account Application to the Direxion Funds and place your order to purchase shares of the Funds.

Your Financial Advisor is responsible for placing orders promptly with the Funds and forwarding payment promptly, as well as ensuring that you receive copies of the Funds’ Prospectus. Financial Advisors may charge fees for the services they provide to you in connection with

THE DIREXION FUNDS PROSPECTUS 25

processing your transaction order or maintaining your account with them. Each Financial Advisor also may have its own rules about share transactions, limits on the number of share transactions you are permitted to make in a given time period, and may have earlier cut-off times for processing your transaction. For more information about your Financial Advisor’s rules and procedures, you should contact your Financial Advisor directly.

Purchasing Shares Through The Funds’ Transfer Agent.

You may also purchase shares through the Funds’ transfer agent by using the following instructions:

By Mail:

| • | Complete and sign your Account Application. |

| • | Indicate the Fund and the amount you wish to invest. |

| • | Mail your check (payable to “Direxion Funds”) along with the completed Account Application to: |

| | Regular Mail | | Express/Overnight Mail |

| | Direxion Funds - Service Class | | Direxion Funds - Service Class |

| | c/o U.S. Bancorp | | c/o U.S. Bancorp Fund |

| | Fund Services, LLC | | Services, LLC Mutual Fund |

| | P.O. Box 701 Milwaukee, | | Services - 3rd Floor 615 East |

| | Wisconsin 53201-0701 | | Michigan Street Milwaukee, |

| | | | Wisconsin 53202 |

The Funds do not consider the U.S. Postal Service or other independent delivery services to be their agents. Therefore, deposit in the mail or with such services, or receipt at U.S. Bancorp Fund Services, LLC post office box, of purchase applications or redemption requests does not constitute receipt by the transfer agent of the Fund.

| • | The Funds will not accept payment in cash or money orders. The Funds also do not accept cashier’s checks in amounts of less than $10,000. In addition, to prevent check fraud, the Funds do not accept third party checks, U.S. Treasury checks, credit card checks, traveler’s checks, or starter checks for the purchase of shares. The Funds are unable to accept post-dated checks, post-dated on-line bill pay checks or any conditional order or payment. |

| • | All purchases must be made in U.S. dollars through a U.S. bank. |

| • | If your check does not clear, you will be charged a $25.00 fee. In addition, you may be responsible for losses sustained by a Fund for any returned payment. |

| • | You will receive written confirmation by mail, but we do not issue share certificates. |

| • | The Funds’ transfer agent will verify certain information from investors as part of the Funds’ anti-money laundering program. |

The USA PATRIOT Act of 2001 requires financial institutions, including the Funds, to adopt certain policies and programs to prevent money laundering activities, including procedures to verify the identity of customers opening new accounts. When completing a new Account Application, you will be required to supply your full name, date of birth, social security number and permanent street address to assist in verifying your identity. Mailing addresses containing only a P.O. Box will not be accepted. Until such verification is made, the Funds may temporarily limit additional share purchases. In addition, the Funds may limit additional share purchases or close an account if they are unable to verify a shareholder’s identity. As required by law, the Funds may employ various procedures, such as comparing the information to fraud databases or requesting additional information or documentation from you, to ensure that the information supplied by you is correct.

If the Funds do not have a reasonable belief in the identity of a shareholder, the account will be rejected or the shareholder will not be allowed to perform a transaction on the account until such information is received. The Funds may also reserve the right to close the account within five business days if clarifying information and/or documentation is not received.

By Bank Wire Transfer:

Initial Investment — By Wire

| • | If you are making an initial investment in the Funds, before you wire funds, please contact the Funds’ transfer agent by phone to make arrangements with a telephone service representative to submit your completed Account Application via mail, overnight delivery, or facsimile. Upon receipt of your Account Application, your account will be established and a service representative will contact you within 24 hours to provide an account number and wiring instructions. You may then contact your bank to initiate the wire using the instructions you were given. |

26 THE DIREXION FUNDS PROSPECTUS

For Subsequent Investments — By Wire. Before sending your wire, please contact the Funds’ transfer agent to advise them of your intent to wire funds. This will ensure prompt and accurate credit upon receipt of your wire.

| U.S. Bank, N.A.

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

ABA number 075000022

For credit to U.S. Bancorp Fund Services, LLC

Account Number 112-952-137

For further credit to the Direxion Funds

(Your name)

(Your account number)

(Name of Fund(s) to purchase) — Service Class |

| • | Your bank may charge a fee for such services. |

| • | Wired funds must be received prior to 4:00 p.m., Eastern time to be eligible for same day pricing. Neither the Funds nor U.S. Bank, N.A., the Funds’ custodian, is responsible for the consequences of delays from the banking or Federal Reserve wire system or from incomplete wiring instructions. |

By Telephone:

| • | Investors may purchase additional shares of the Funds by calling the Funds at (800) 851-0511. If you elected this option on your Account Application and your account has been open for at least 15 days, telephone orders will be accepted via electronic funds transfer from your bank account through the Automated Clearing House (“ACH”) network. You must have banking information established on your account prior to making a purchase. Each telephone purchase order must be a minimum of $1,000. Your shares will be purchased at the NAV calculated on the day your order is placed, provided that your order is received prior to 4:00 p.m., Eastern time. |

Automatic Investment Plan:

For your convenience, the Funds offer an Automatic Investment Plan (“AIP”). Under the AIP, after you make your initial minimum investment of $25,000, you authorize the Funds to withdraw the amount you wish to invest from your personal bank account on a monthly basis. The AIP requires a minimum monthly investment of $1,000. If you wish to participate in the AIP, please complete the “Automatic Investment Plan” section on the Account Application or call the Funds at (800) 851-0511. In order to participate in the AIP, your bank or financial institution must be a member of the Automated Clearing House (“ACH”) network. The Funds may terminate or modify this privilege at any time. You may change your investment amount or terminate your participation in the AIP at any time by notifying the Funds’ transfer agent by telephone or in writing, five days prior to the effective date of the next transaction. A fee, currently $25, will be imposed if your AIP transaction is returned.

How to Exchange Shares of the Funds |