For the year ended August 31, 2010, certain dividends paid by the Funds may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The percentage of dividends declared from ordinary income designated as qualified income was follows:

In an effort to decrease costs, the Funds intend to reduce the number of duplicate prospectuses, Annual and Semi-Annual Reports, proxy statements and other similar documents you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders we reasonably believe are from the same family or household. Householding begins once you have signed your account application. After such time, if you would like to discontinue householding for your accounts, please call toll-free at (800) 851-0511 to request individual copies of these documents. Once the Funds receive notice to stop householding, we will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

Investment Advisory and Subadvisory Agreements Approvals

Provided below is a summary of certain of the factors the Board considered at its August 18, 2010 Board meeting in renewing, as applicable: (1) the Advisory Agreement between Rafferty Asset Management (“Rafferty”) and the Direxion Funds (the “Trust”), on behalf of the HCM Freedom Fund, Spectrum Equity Opportunity Fund, Spectrum Global Perspective Fund and Spectrum Select Alternative Fund, each a series of the Trust; (2) the Subadvisory Agreement between Rafferty and Horizon Capital Management, Inc. (“Horizon”) on behalf of the HCM Freedom Fund; and (3) the Subadvisory Agreement between Rafferty and Hundredfold Advisors, LLC (“Hundredfold”) on behalf of the Spectrum Equity Opportunity Fund, Spectrum Global Perspective Fund and Spectrum Select Alternative Fund. Each Fund listed above is referred to herein as each “Fund” and collectively, the “Funds.”

The Board did not identify any particular information that was most relevant to its consideration to approve each Advisory or Subadvisory Agreement (each an “Agreement” and collectively, the “Agreements”) and each Trustee may have afforded different weight to the various factors. In determining whether to approve the continuance of the Agreements, the Board considered the best interests of each Fund separately. In addition, the Board noted that the Trustees have considered various reports and information provided throughout the year at their regular Board meetings and otherwise. While the Agreements for all of the Funds were considered at the same Board meeting, the Board considered each Fund’s investment advisory and subadvisory relationship separately. In each instance, the Board considered, among other things, the following factors: (1) the nature and quality of the services provided; (2) the investment performance of the Fund to the extent applicable; (3) the cost to Rafferty or a subadviser for providing services and the profitability of the advisory business to Rafferty or a subadviser, if such information was provided; (4) the extent to which economies of scale have been taken into account in setting fee schedules; (5) whether fee levels reflect these economies of scale, if any, for the benefit of Fund shareholders; (6) comparisons of services and fees with contracts entered into by Rafferty and, in certain cases, a subadviser with other clients (such as pension funds and other institutional investors), if any; and (7) other benefits derived or anticipated to be derived by Rafferty or a subadviser from its relationship with the Funds.

Nature, Extent and Quality of Services Provided. The Board reviewed the nature, extent and quality of the services provided or to be provided under the Advisory Agreements by Rafferty. The Board noted that Rafferty has provided services to the Trusts since their inception and has developed an expertise in managing the Funds. The Board also noted that Rafferty trades efficiently with low commission schedules, which helps improve performance results. The Board considered Rafferty’s representation that it has the financial resources and appropriate staffing to manage the Funds and meet its expense reimbursement obligations, if any. The Board also considered that Rafferty utilizes the services of an independent compliance consulting firm and that reports from the chief compliance officer are provided to the Board at its regularly scheduled quarterly Board meetings. The Board considered that Rafferty oversees all aspects of the operation of the Funds, including oversight of the Funds’ service providers and subadvisers. Regarding the Subadvisory Agreements with Horizon and Hundredfold, the Board noted that each subadviser utilizes those Funds it subadvises as the primary investments for its separate account clients. Based on these and other considerations, the Board determined that, in the exercise of its business judgment, the nature, extent and quality of the services provided by Rafferty to the Funds under the Agreements and each subadviser under the applicable Subadvisory Agreement were fair and reasonable.

Performance of the Funds. The Board evaluated the performance of each Fund relative to: (1) its benchmark index for monthly and annual periods ended July 31, 2010, where applicable; and (2) the average performance of the relevant Lipper fund universe for monthly and annual periods ended June 30, 2010. Although the Board received monthly performance reports for its consideration, the Board generally assigned more weight to the longer-term performance of the Funds. In this regard, the Board for all Funds noted the challenging nature of the markets for the calendar years 2008 and 2009.

With respect to the HCM Freedom Fund, the Board considered management’s description of the performance of the Lipper universe of flexible portfolio funds. The Board also considered that: (1) as of July 31, 2010, the Fund outperformed its benchmark index for the three-month, year-to-date, three- and five-year periods, and underperformed for the one-, six-, nine-month and one-year periods; and (2) as of June 30, 2010, the Fund outperformed the average of the relevant Lipper fund universe for all periods presented. The Board noted that the Fund’s six-month and three-year performance records were ranked first in its Lipper fund universe.

With respect to the Spectrum Equity Opportunity Fund, the Board considered management’s description of the performance of the Lipper universe of specialty diversified equity funds. The Board also considered that: (1) as of July 31, 2010, the Fund

DIREXION ANNUAL REPORT 35

outperformed its benchmark index for the three-month, year-to date and three year-periods, and underperformed for all other periods presented; and (2) as of June 30, 2010, the Fund outperformed the average of the relevant Lipper fund universe for all periods presented with the exception of the six-month and one-year periods, during which it underperformed.

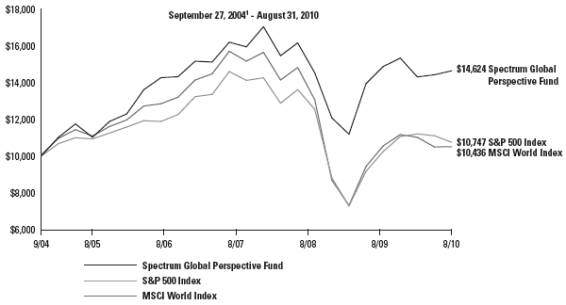

With respect to the Spectrum Global Perspective Fund, the Board considered management’s description of the performance of the Lipper universe of global flexible funds. The Board also considered that: (1) as of July 31, 2010, the Fund outperformed its benchmark index for the three-month, three- and five-year periods, and underperformed for all other periods presented; and (2) as of June 30, 2010, the Fund outperformed the average of the relevant Lipper fund universe for the three-month period, and underperformed for the six-month, one- and three-year periods. The Board noted Hundredfold’s representation that the Fund in part underperformed due to its reduced market exposure during periods of market volatility.

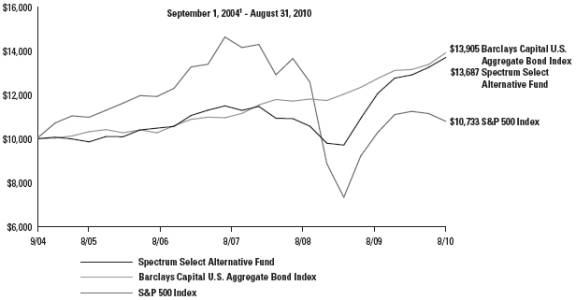

With respect to the Spectrum Select Alternative Fund, the Board considered management’s description of the performance of the Lipper universe of high current yield funds. The Board also considered that: (1) as of July 31, 2010, the Fund outperformed its benchmark index for the one-, six- and nine-month, and one- and five-year periods, and underperformed for the three-month, year-to-date and three-year periods; and (2) as of June 30, 2010, the Fund underperformed the average of the relevant Lipper fund universe for all periods presented. The Board noted Hundredfold’s representation that, within the last 12-month period, the Fund took defensive positions, including large positions in cash, that detracted from its investment performance.

Costs of Services Provided to the Funds and Profits Realized. The Board considered the overall fees paid to Rafferty on an annual basis since each Fund’s commencement of operations, including any fee waivers and recoupment of fees previously waived. The Board considered the overall profitability of Rafferty’s investment business and its representation that it does not allocate internal costs and assess profitability with respect to its services to individual Funds. Based on these considerations, the Board determined that, in the exercise of its business judgment, the costs of the services provided and the profits realized under the Advisory Agreement were fair and reasonable.

In considering the fees paid by Rafferty to the subadvisers of the Funds, the Board considered Rafferty’s representation that the fees and expenses generally are higher than industry averages. However, Rafferty explained that, in certain cases, the Funds help to lower the overall fees paid by the clients of the subadvisers. The Board considered the representation that the current expense ratio of each Fund is lower compared to the total cost of investing when the Funds were part of the subadvisers’ wrap account advisory programs. The Board noted the subadvisers’ representations that the Funds pay the lowest fee rate that a subadvisor charges for comparable client accounts. With respect to each Fund, the Board considered each subadviser’s profits or losses for its services, to the extent such information was provided. In this regard, the Board noted Hundredfold’s representation that it donated to charity all of the profits it earned with respect to the services it provided to the Spectrum Funds and Horizon’s pre-tax profits with respect to the services it provided to the HCM Freedom Fund. Based on these considerations, the Board determined that, in the exercise of its business judgment, the costs of the services provided and the profits realized under the Agreements were fair and reasonable.

Economies of Scale. The Board considered Rafferty’s representation that it believes that asset levels at this time are not sufficient to achieve economies of scale or warrant a reduction in fee rates or the addition of breakpoints. Rafferty noted that it was continuing to work on its sales and marketing efforts to raise additional assets. Based on these and other considerations, the Board determined that, in the exercise of its business judgment, the reduction in fee rates or additions of breakpoints were not necessary at this time.

Other Benefits. The Board considered Rafferty’s representation that its relationship with the Funds has permitted Rafferty to attract business to its non-mutual fund account. The Board also considered that Rafferty’s overall business with brokerage firms helps to lower commission rates and provide better execution for Fund portfolio transactions. The subadvisers represented that they realized no benefits other than their direct compensation. Based on these and other considerations, the Board determined that, in the exercise of its business judgment, the benefits were fair and reasonable.

Conclusion. Based on, but not limited to, the above considerations and determinations, the Board determined that the Agreements for the Funds were fair and reasonable in light of the services to be performed, fees, expenses and such other matters as the Board considered relevant in the exercise of its business judgment. On this basis, the Board unanimously voted in favor of the continuance of the Agreements.

36 DIREXION ANNUAL REPORT

Direxion Funds

TRUSTEES AND OFFICERS

The business affairs of each Fund are managed by or under the direction of the Board of Trustees. Information pertaining to the Trustees and Officers of the Funds is set forth below. The SAI includes additional information about the Funds’ Trustee and Officers and is available without charge, upon request by calling 1-800-851-0511.

Interested Trustees | | | | | | | | | | |

Name, Address and Age | | Position(s) Held with Fund | | Term of Office and Length of Time Served | | Principal Occupation(s) During Past Five Years | | # of Portfolios

in Direxion Complex Overseen by Trustee(2) | | Other Trusteeships/ Directorships Held by Trustee |

Lawrence C. Rafferty(1) Age: 68 | | Chairman of the Board of Trustees | | Lifetime of Trust until removal or resignation; Since 1997 | | Chairman and Chief Executive Officer of Rafferty, 1997-present; Chief Executive Officer of Rafferty Companies, LLC, 1996-present; Chief Executive Officer of Rafferty Capital Markets, Inc., 1995-present. | | 135 | | Board of Trustees, Fairfield University; Board of Directors, St. Vincent’s Services; Executive Committee, Metropolitan Golf Association |

| | | | | | | | | | |

Non-Interested Trustees | | | | | | | | | | |

Name, Address and Age | | Position(s) Held with Fund | | Term of Office and Length of Time Served | | Principal Occupation(s) During Past Five Years | | # of Portfolios

in Direxion Complex Overseen by Trustee(2) | | Other Trusteeships/ Directorships Held by Trustee |

Daniel J. Byrne

Age: 66 | | Trustee | | Lifetime of Trust until removal or resignation; Since 1997 | | President and Chief Executive Officer of Byrne Securities Inc., 1992-present. | | 135 | | Trustee, The Opening Word Program, Wyandanch, New York |

| | | | | | | | | | |

Gerald E. Shanley III

Age: 66 | | Trustee | | Lifetime of Trust until removal or resignation; Since 1997 | | Business Consultant, 1985-present; C.P.A. 1979-present. | | 135 | | Trustee of Trust Under Will of Charles S. Payson |

| | | | | | | | | | |

John Weisser

Age: 68 | | Trustee | | Lifetime of Trust until removal or resignation; Since 2007 | | Retired, Since 1995; Salomon Brothers, Inc, 1971-1995, most recently as Managing Director. | | 135 | | Director, MainStay VP Fund Series; Director ICAP Funds, Inc; Director, The MainStay Funds; Director, Eclipse Funds, Inc. |

DIREXION ANNUAL REPORT 37

Direxion Funds

TRUSTEES AND OFFICERS

Officers

Name, Address and Age | | Position(s) Held with Fund | | Term of Office and Length of Time Served | | Principal Occupation(s) During Past Five Years | | # of Portfolios in Direxion Complex Overseen by Trustee(2) | | Other Trusteeships/ Directorships Held by Trustee |

Daniel D. O’Neill

Age: 42 | | President; Chief Operating Officer and Chief Investment Officer | | One Year; Since 1999 One Year; Since 2006 | | Managing Director of Rafferty, 1999-present. | | N/A | | N/A |

| | | | | | | | | | |

William Franca

Age: 53 | | Executive Vice President – Head of Distribution | | One Year; Since 2006 | | Senior Vice President – National Sales, Massachusetts Financial Services/SunLife Financial Distributors, 2002-2004; Executive Vice President, Distribution, SunLife, 2001-2002. | | N/A | | N/A |

| | | | | | | | | | |

Christopher Lewis

Age: 39 | | Chief Compliance Officer | | One Year; Since 2009 | | Director, Alaric Compliance Services, LLC, 2009 – present; Partner, Thacher Proffitt & Wood LLP, 2004-2008; Partner, Simmons & Simmons, 2002-2004. | | N/A | | N/A |

| | | | | | | | | | |

Patrick J. Rudnick

615 East

Michigan Street

Milwaukee, WI 53202

Age: 37 | | Principal Financial Officer and Treasurer(3) | | One Year; Since 2010 | | Vice President, U.S. Bancorp Fund Services LLC, since 2006; Manager, PricewaterhouseCoopers LLP, 1999-2006. | | N/A | | N/A |

| | | | | | | | | | |

Eric W. Falkeis

615 East

Michigan Street

Milwaukee, WI 53202

Age: 37 | | Secretary | | One Year; Since 2004 | | Senior Vice President, U.S. Bancorp Fund Services, LLC, since September 2007; Chief Financial Officer, U.S. Bancorp Fund Services, LLC, since April 2006; Vice President, U.S. Bancorp Fund Services LLC, 1997-present; formerly, Chief Financial Officer, Quasar Distributors, LLC, 2000-2003. | | N/A | | N/A |

(1) | Mr. Rafferty is affiliated with Rafferty. Mr. Rafferty is the Chairman and Chief Executive Officer of Rafferty and owns a beneficial interest in Rafferty. |

(2) | The Direxion Complex consists of the Direxion Funds which currently offers for sale to the public 32 portfolios, the Direxion Insurance Trust which currently offers for sale 1 portfolio and the Direxion ETF Trust which currently offers for sale to the public 34 of the 102 funds currently registered with the SEC. |

(3) | Mr. Rudnick replaced Guy F Talarico as Principal Financial Officer and Treasurer effective June 1, 2010.

The address for all trustees and officers except Patrick J. Rudnick and Eric W. Falkeis is 33 Whitehall St., New York, NY 10004. |

38 DIREXION ANNUAL REPORT

THIS PAGE INTENTIONALLY LEFT BLANK

39

THIS PAGE INTENTIONALLY LEFT BLANK

40

PRIVACY NOTICE

At the Direxion Funds, we are committed to protecting your privacy. To open and service your Direxion accounts, we collect and maintain certain nonpublic personal information about you, such as your address, phone number, social security number, purchases, sales, account balances, bank account information and other personal financial information. We collect this information from the following sources:

• | Account applications or other forms on which you provide information, |

• | Mail, e-mail, the telephone and our website, and |

• | Your transactions and account inquiries with us. |

We safeguard the personal information that you have entrusted to us in the following ways:

• | As a general policy, only those employees who maintain your account and respond to your requests for additional services have access to your account information. |

• | We maintain physical, electronic, and procedural safeguards to insure the security of your personal information and to prevent unauthorized access to your information. |

We do not disclose any nonpublic personal information about you or our former shareholders to anyone, except as permitted or required by law. In the course of conducting business and maintaining your account we may share shareholder information, as allowed by law, with our affiliated companies and with other service providers, including financial intermediaries, custodians, transfer agents and marketing consultants. Those companies are contractually bound to use that information only for the services for which we hired them. They are not permitted to use or share our shareholders’ nonpublic personal information for any other purpose. There also may be times when we provide information to federal, state or local authorities as required by law.

In the event that you hold fund shares of Direxion through a financial intermediary, including, but not limited to, a broker-dealer, bank, or trust company, the privacy policy of your financial intermediary would govern how your nonpublic personal information would be shared with nonaffiliated third parties.

For questions about our policy, please contact us at (800) 851-0511.

ANNUAL REPORT

Adviser

Rafferty Asset Management, LLC

33 Whitehall St. 10th Floor

New York, NY 10004

Sub-Advisor

Spectrum Funds Sub-Advisor

Hundredfold Advisors, LLC

2940 N. Lynnhaven Road

Virginia Beach, VA 23452

Administrator, Transfer Agent, Dividend Paying

Agent & Shareholding Servicing Agent

U.S. Bancorp Fund Services, LLC

P.O. Box 1993

Milwaukee, WI 53201-1993

Custodian

U.S. Bank, N.A.

1555 RiverCenter Dr., Suite 302

Milwaukee, WI 53212

Independent Registered Public Accounting Firm

Ernst & Young LLP

5 Times Square

New York, NY 10036

Distributor

Rafferty Capital Markets, LLC

59 Hilton Avenue

Garden City, NY 11530

The Fund’s Proxy Voting Policies are available without charge by calling 1-800-851-0511, or by accessing the SEC’s website, at www.sec.gov.

The actual voting records relating to portfolio securities during the most recent period ended June 30 (starting with the year ended June 30, 2005) is available without charge by calling 1-800-851-0511 or by accessing the SEC’s website at www.sec.gov.

The Funds file its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Form N-Q is available without charge, upon request, by calling 1-800-851-0511, or by accessing the SEC’s website, at www.sec.gov. The Funds’ Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information or the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by a current prospectus.