UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-35477

Regional Management Corp.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 57-0847115 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

509 West Butler Road Greenville, South Carolina | | 29607 |

| (Address of principal executive offices) | | (Zip Code) |

(864) 422-8011

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, $0.10 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x |

| | | |

| Non-accelerated filer | | ¨ (do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

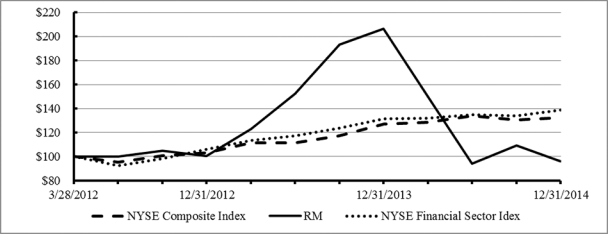

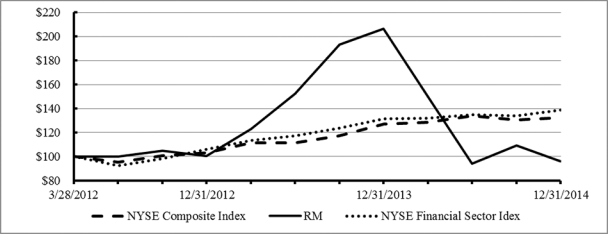

As of June 30, 2014 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the common stock held by non-affiliates of the registrant was $181,021,880 based upon the closing sale price as reported on the New York Stock Exchange. See Part II, Item 5 of this Annual Report on Form 10-K for additional information.

As of March 9, 2015, there were 12,853,743 shares of the registrant’s common stock outstanding.

Documents Incorporated by Reference

Certain information required by Part III of this Annual Report on Form 10-K is incorporated herein by reference to the Proxy Statement for the registrant’s 2015 Annual Meeting of Stockholders, which is expected to be filed pursuant to Regulation 14A within 120 days after the end of the registrant’s fiscal year ended December 31, 2014.

REGIONAL MANAGEMENT CORP.

ANNUAL REPORT ON FORM 10-K

Fiscal Year Ended December 31, 2014

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, certain statements and disclosures contained in Item 1, “Business,” Item 1A, “Risk Factors,” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These forward-looking statements include, but are not limited to, statements about our strategies, future operations, future financial position, future revenues, projected costs, expectations regarding demand and acceptance for our financial products, growth opportunities and trends in the market in which we operate, prospects, plans and objectives of management, representations, and contentions, and are not historical facts. Forward-looking statements typically are identified by the use of terms such as “may,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” and similar words, although some forward-looking statements are expressed differently. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Forward-looking statements included herein represent management’s current judgment and expectations, but our actual results, events, and performance could differ materially from the plans, intentions, and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including without limitation, the risks set forth in Item 1A, “Risk Factors” in this Annual Report on Form 10-K. We do not intend to update any of these forward-looking statements or publicly announce the results of any revisions to these forward-looking statements, other than as is required under the federal securities laws.

The following discussion should be read in conjunction with, and is qualified in its entirety by reference to, our audited consolidated financial statements, including the notes thereto.

PART I

Overview

Regional Management Corp. (together with its subsidiaries, “Regional,” the “Company,” “we,” “us,” and “our”) was incorporated in South Carolina on March 25, 1987, and converted into a Delaware corporation on August 23, 2011. We are a diversified specialty consumer finance company providing a broad array of loan products primarily to customers with limited access to consumer credit from banks, thrifts, credit card companies, and other traditional lenders. We began operations in 1987 with four branches in South Carolina and have expanded our branch network to 300 locations with approximately 345,500 active accounts primarily across Alabama, Georgia, New Mexico, North Carolina, Oklahoma, South Carolina, Tennessee, and Texas as of December 31, 2014. Most of our loan products are secured and each is structured on a fixed rate, fixed term basis with fully amortizing equal monthly installment payments, repayable at any time without penalty. Our loans are sourced through our multiple channel platform, including in our branches, through direct mail campaigns, independent and franchise automobile dealerships, online credit application networks, retailers, and our consumer website. We operate an integrated branch model in which nearly all loans, regardless of origination channel, are serviced and collected through our branch network, providing us with frequent in-person contact with our customers, which we believe improves our credit performance and customer loyalty. Our goal is to consistently and soundly grow our finance receivables and manage our portfolio risk while providing our customers with attractive and easy-to-understand loan products that serve their varied financial needs.

Our diversified product offerings include:

| | • | | Small Loans– We offer standardized small installment loans ranging from $500 to $2,500, with terms of up to 36 months, which are typically secured by non-essential household goods. We originate these |

1

| | loans through our branches, via our consumer website, by customer referrals, and through direct mail campaigns, including by mailing convenience checks to pre-screened individuals who are able to enter into a loan by depositing these checks. As of December 31, 2014, we had approximately 289,700 small loans outstanding representing $319.5 million in finance receivables or an average of approximately $1,100 per loan. In 2014, 2013, and 2012, interest and fee income from small loans contributed $134.7 million, $98.0 million, and $65.9 million, respectively, to our total revenue. |

| | • | | Large Loans– We offer large installment loans through our branches ranging from $2,501 to $20,000, with terms of between 18 and 60 months. Our large loans are secured by either a vehicle, which may be an automobile, motorcycle, boat, or all-terrain vehicle, and/or non-essential household goods. As of December 31, 2014, we had approximately 12,600 large loans outstanding representing $46.1 million in finance receivables or an average of approximately $3,700 per loan. In 2014, 2013, and 2012, interest and fee income from large loans contributed $11.5 million, $12.5 million, and $16.3 million, respectively, to our total revenue. |

| | • | | Automobile Loans– We offer automobile loans of up to $27,500, generally with terms of between 36 and 72 months, which are secured by the purchased vehicle. Our automobile loans are offered through a network of dealers in our geographic footprint. Our automobile loans include both direct loans, which are sourced through a dealership and closed at one of our branches, and indirect loans, which are originated and closed at a dealership in our network without the need for the customer to visit one of our branches. As of December 31, 2014, we had approximately 17,300 automobile loans outstanding representing $154.4 million in finance receivables or an average of approximately $8,900 per loan. In 2014, 2013, and 2012, interest and fee income from automobile loans contributed $33.4 million, $36.2 million, and $32.7 million, respectively, to our total revenue. |

| | • | | Retail Loans– We offer indirect retail loans of up to $7,500, with terms of between 6 and 48 months, which are secured by the purchased item. These loans are offered through a network of retailers within and, to a limited extent, outside of our geographic footprint. As of December 31, 2014, we had approximately 25,900 retail loans outstanding representing $26.1 million in finance receivables or an average of approximately $1,000 per loan. In 2014, 2013, and 2012, interest and fee income from retail loans contributed $5.2 million, $5.6 million, and $4.2 million, respectively, to our total revenue. |

| | • | | Optional Insurance Products– We offer our customers optional payment protection insurance relating to many of our loan products. In 2014, insurance income, net, was $10.7 million, or 5.2% of our total revenue. |

We report operating segments in accordance with generally accepted accounting principles in the United States of America (“GAAP”). We have one reportable segment, which is the consumer finance segment. Our other revenue generating activities, including insurance operations, are performed in the existing branch network in conjunction with or as a complement to the lending operations. For financial information regarding the results of our only reportable segment, the consumer finance segment, for each of the last three fiscal years, refer to Item 6, “Selected Financial Data” and Item 8, “Financial Statements and Supplementary Data” of this Annual Report on Form 10-K.

Our Industry

We operate in the consumer finance industry serving the large population of non-prime and underbanked consumers who have limited access to credit from banks, thrifts, credit card companies, and other traditional lenders. According to the Federal Deposit Insurance Corporation (“FDIC”), there were approximately 51 million adults living in underbanked households in the United States in 2013, up from 43 million in 2009. While the number of non-prime consumers in the United States has grown, the supply of consumer credit to this demographic has contracted. Following deregulation of the U.S. banking industry in the 1980s, many banks and finance companies that traditionally provided small denomination consumer credit refocused their businesses on larger loans with lower comparative origination costs and lower charge-off rates. Tightened credit requirements imposed by banks, thrifts, credit card companies, and other traditional lenders that began during the recession in

2

2008 and 2009 have further reduced the supply of consumer credit for the growing number of non-prime and underbanked individuals. We believe the large number of potential customers in our target market, combined with the decline in available consumer credit, provides an attractive market opportunity for our diversified product offerings—installment lending, automobile lending, and retail lending.

Installment Lending. Installment lending to underbanked and other non-prime consumers is one of the most highly fragmented sectors of the consumer finance industry. Providers of installment loans, such as Regional, generally offer loans with longer terms and lower interest rates than other alternatives available to underbanked consumers, such as title, payday, and pawn lenders.

Automobile Lending. Automobile finance comprises one of the largest consumer finance markets in the United States. The automobile loan sector is generally segmented by the credit characteristics of the borrower. Automobile loans are typically initiated or arranged through automobile dealers nationwide who rely on financing to drive their automobile sales.

Retail Lending. The retail industry represents a large consumer market in which retailers often do not provide their own financing, but instead partner with large banks and credit card companies that generally limit their lending activities to prime borrowers. As a result, non-prime customers often do not qualify for financing from these traditional lenders. Continued consumer demand from non-prime consumers presents a growth opportunity for retail loans.

Our Business Model and Operations

Integrated Branch Model.Our branch network, with 300 locations across eight states as of December 31, 2014, serves as the foundation of our multiple channel platform and the primary point of contact with our approximately 345,500 active accounts. By integrating underwriting, servicing, and collections at the branch level, our employees are able to maintain a relationship with our customers throughout the life of a loan. For loans originated at a branch, underwriting decisions are typically made by our local branch manager. Our branch managers combine our company-wide underwriting standards and flexibility within our guidelines to consider each customer’s unique circumstances. This tailored branch-level underwriting approach allows us to both reject certain marginal loans that would otherwise be approved solely based on a credit report or automated loan approval system, as well as to selectively extend loans to customers with prior credit challenges who might otherwise be denied credit. In addition, nearly all loans, regardless of origination channel, are serviced and collected through our branches, which allows us to maintain frequent, in-person contact with our customers. We believe this frequent-contact, relationship-driven lending model provides greater insight into potential payment difficulties and allows us to more effectively pursue payment solutions, which improves our overall credit performance. It also provides us with frequent opportunities to assess the borrowing needs of our customers and to offer new loan products as their credit profiles evolve.

Multiple Channel Platform. We offer a diversified range of loan products through our multiple channel platform, which enables us to efficiently reach existing and new customers throughout our markets. We began building our strategically located branch network over 25 years ago and have expanded to 300 branches as of December 31, 2014. Our automobile loans are offered through a network of dealers in our geographic footprint. We offer direct automobile loans, which are sourced through a dealership and closed at one of our branches, and indirect automobile loans, which are closed at the dealership without the need for the customer to visit a branch. In addition, we have relationships with retailers that offer our retail loans in their stores at the point of sale. Our direct mail campaigns include pre-screened convenience check mailings and mailings of preapproved offers, prequalified offers, and invitations to apply, which enable us to market our products to hundreds of thousands of customers on a cost-effective basis. Finally, we have developed our consumer website to promote our products and facilitate loan applications. We believe that our multiple channel platform provides us with a competitive advantage by giving us broad access to our existing customers and multiple avenues for attracting new customers.

3

Attractive Products for Customers with Limited Access to Credit. Our flexible loan products, ranging from $500 to $27,500 with terms of up to 72 months, are competitively priced, easy to understand, and incorporate features designed to meet the varied financial needs and credit profiles of a broad array of consumers. This product diversity distinguishes us from monoline competitors and provides us with the ability to offer our customers new loan products as their credit profiles evolve, building customer loyalty.

We believe that the rates on our products are significantly more attractive than many other credit options available to our customers, such as payday, pawn, or title loans. We also differentiate ourselves from such alternative financial service providers by reporting our customers’ payment performance to credit bureaus. This practice provides our customers with the opportunity to improve their credit score by establishing a responsible payment history with us and ultimately to gain access to a wider range of credit options, including our own. We believe this opportunity for our customers to improve their credit history, combined with our diversity of products and competitive pricing and terms, distinguishes us in the consumer finance market and provides us with a competitive advantage.

Demonstrated Organic Growth. We have grown our finance receivables by 120% from $247.7 million at December 31, 2010 to $546.2 million at December 31, 2014. Our growth has come from both expanding our branch network and developing new channels and products. From 2010 to 2014, we grew our year-end branch count from 134 branches to 300 branches, a compound annual growth rate (“CAGR”) of 22.3%. We opened or acquired 36 net new branches in 2014, and we have also grown our existing branch revenues. Historically, our branches have rapidly increased their outstanding finance receivables during the early years of operations and generally have quickly achieved profitability.

We have also grown by adding new channels and products, which are serviced at the local branch level. We introduced direct automobile purchase loans in 1998, and in late 2010, we expanded our product offerings to include indirect automobile purchase loans. Indirect automobile purchase loans allow customers to obtain a loan at a dealership without visiting one of our branches. Net loan originations from our convenience check program have grown from $34.3 million in 2010 to $134.5 million in 2014, a CAGR of 40.8%, as we have increased the volume of our convenience check marketing campaigns. We also introduced a consumer website enabling customers to complete a loan application online. Since the launch of our website in late 2008, we have received more than 117,000 web applications resulting in $26.0 million of gross finance receivables.

Established Portfolio Performance. Despite the challenges posed by the sharp economic downturn beginning in 2008, our annual net charge-off rates between 2008 and 2013 remained consistent, ranging from 6.3% to 8.6% of our average finance receivables. In 2014, due to branch staffing issues in the first half of the year and convenience check credit quality deterioration in our mail campaigns between April and September, we experienced an uncharacteristically high annual net charge-off rate of 11.1% of our average finance receivables. In 2015, we seek to return to and improve upon our historical portfolio performance. In late 2014 and early 2015, we hired a Chief Risk Officer and other personnel focused on credit risk management, established a Credit Committee to oversee direct mail campaign underwriting and origination processes, implemented additional policies and internal control procedures related to the audit of direct mail campaign files, and improved upon early-stage delinquency reporting and communication. Through these initiatives and others, we plan to carefully manage our credit exposure in 2015 and beyond as we grow our business, develop new products, and enter new markets.

We generally do not make loans to customers with limited stability as represented by length of time at their current employer and at their current residence, although we consider numerous other factors in evaluating a potential customer’s creditworthiness, such as unencumbered income, debt-to-income ratios, and a credit report detailing the applicant’s credit history. Our underwriting standards focus on our customers’ ability to affordably make loan payments out of their discretionary income, with the value of pledged collateral serving as a credit enhancement rather than the primary underwriting criterion. Portfolio performance is improved by our regular in-person contact with customers at our branches, which helps us to anticipate repayment problems before they

4

occur and allows us to work with customers to develop solutions prior to default, using repossession only as a last option. In addition, our centralized management information system enables regular monitoring of branch portfolio metrics. Our state operations vice presidents and district supervisors monitor loan underwriting, delinquencies, and charge-offs of each branch in their respective regions. In addition, the compensation received by our branch managers and assistant managers has a significant performance component and is closely tied to credit quality, among other defined performance targets. We believe our frequent-contact, relationship-driven lending model, combined with regular monitoring and alignment of employee incentives, improves our overall credit performance.

Experienced Management Team.Our executive and senior operations management teams consist of individuals highly experienced in installment lending and other consumer finance services. In 2014, we appointed a new Chief Executive Officer and a new President and Chief Operating Officer with more than 30 years and 25 years, respectively, of consumer finance experience. Also in 2015, we appointed a Chief Risk Officer with nearly 20 years of financial and consumer lending experience, including significant expertise in credit risk management. As of December 31, 2014, our state operations vice presidents averaged more than 24 years of industry experience and more than 10 years of service at Regional, while our district supervisors averaged 25 years of industry experience and more than four years of service with Regional. Our executive and senior operations management team members intend to leverage their experience and expertise in consumer lending to grow our business, deliver high-quality service to our customers, and carefully manage our credit risk.

Our Strategies

Grow Our Branch Network. We intend to continue growing the revenue and profitability of our branch network by increasing volume at our existing branches, opening new branches within our existing geographic footprint, and expanding our operations into new states. Establishing local contact with our customers through the expansion of our branch network is key to our frequent-contact, relationship-driven lending model and is embodied in our marketing tagline: “Your Hometown Credit Source.”

| | • | | Existing Branches– We intend to continue increasing same-store revenues by further building relationships in the communities in which we operate and capitalizing on opportunities to offer our customers new loan products as their credit profiles evolve. From 2010 to 2014, we opened or acquired 183 new branches, and we expect revenues at these branches will grow faster than our overall same-store revenue growth rate as they mature. |

| | • | | New Branches– We believe there is sufficient demand for consumer finance services to continue our pattern of new branch openings and branch acquisitions in the states where we currently operate, allowing us to capitalize on our existing infrastructure and experience in these markets. We also analyze detailed demographic and market data to identify favorable locations for new branches. Opening new branches allows us to generate both direct lending at the branches, as well as to create new origination opportunities by establishing relationships with automobile dealerships and retailers in the community. |

| | • | | New States– We intend to explore opportunities for growth in several states outside of our existing geographic footprint that enjoy favorable operating environments, such as Kentucky, Louisiana, Mississippi, Missouri, and Virginia. We do not expect to expand into states with unfavorable operating environments even if those states are demographically attractive for our business. In 2011, we opened our first branch in Oklahoma; in 2012, we opened our first branch in New Mexico; and in 2013, we opened our first branch in Georgia. |

We also believe that the highly fragmented nature of the consumer finance industry and the evolving competitive, regulatory, and economic environment provide attractive opportunities for growth through branch acquisitions.

5

Expand and Capitalize on Our Diverse Channels and Products. We intend to continue to expand and capitalize on our multiple channel platform and broad array of offerings as follows:

| | • | | Direct Mail Programs– We plan to continue to improve our screening criteria and tracking for direct mail campaigns, which we believe will enable us to improve response rates and credit performance. Since 2007, we have more than tripled the annual number of convenience checks that we have mailed, and we have diversified our direct mail campaign efforts. In 2014, we mailed over 3.1 million convenience checks, 2.0 million prequalified loan offers, and 1.7 million invitations to apply. We intend to continue increasing the size of our direct mail campaigns to grow our loan portfolio. This effort will add new customers, increase volume at our branches, and create opportunities to offer new loan products to our existing customers. In addition, we mail convenience checks in new markets as soon as new branches are open, which we believe helps our new branches more quickly develop a customer base and build finance receivables. |

| | • | | Automobile Loans– We source our automobile loans through a network of dealers in our geographic footprint. We have hired dedicated marketing personnel to develop relationships with these dealers and to expand our automobile financing network. We will also seek to capture a larger percentage of the financing activity of dealers in our existing network by continuing to improve our relationships with dealers, maintaining the competitiveness of the products we offer, and reducing our response time to loan applications. |

| | • | | Retail Loans– Our retail loans are offered through a network of retailers. We intend to continue to grow our network of retailers by having our dedicated marketing personnel continue to solicit new retailers, obtain referrals through relationships with our existing retail partners, and to a lesser extent, reach retailers through trade shows and industry associations. |

| | • | | Online Sourcing– To serve customers who want to reach us over the Internet, we developed a new channel in late 2008 by making an online loan application available on our consumer website. We intend to continue to develop and expand our online marketing efforts and increase traffic to our consumer website through the use of tools such as search engine optimization and paid online advertising. |

We believe the expansion of our channels and products, supported by the growth of our branch network, will provide us with opportunities to reach new customers as well as to offer new loan products to our existing customers as their credit profiles evolve. We plan to continue to develop and introduce new products that are responsive to the needs of our customers in the future.

Focus on Sound Underwriting and Credit Control. In response to the credit quality deterioration in our convenience check mail campaigns in 2014, we have renewed our focus on sound underwriting and credit control. In late 2014 and early 2015, we hired a Chief Risk Officer and other personnel focused on credit risk management, established a Credit Committee to oversee direct mail campaign underwriting and origination processes, implemented additional policies and internal control procedures related to the audit of direct mail campaigns, and improved upon early-stage delinquency reporting and communication. We expect that, once fully implemented, these and other efforts will improve our delinquency and charge-off experience in 2015 and beyond.

Our philosophy is to emphasize sound underwriting standards focused on a customer’s prior credit payment history and ability to affordably make loan payments, to work with customers experiencing payment difficulties, and to use repossession only as a last option. For example, we permit customers to defer payments or refinance delinquent loans under limited circumstances, although we generally do not offer customers experiencing payment difficulties the opportunity to modify their loans to reduce the amount of principal that they owe. A deferral extends the due date of the loan by one month and allows the customer to maintain his or her credit rating in good standing. In addition to deferrals, we also allow customers to refinance loans. We limit the refinancing of delinquent loans to those customers who otherwise satisfy our credit standards (other than with respect to the delinquency). We believe that refinancing delinquent loans for certain deserving customers who

6

have made periodic payments allows us to help customers resolve temporary financial setbacks and repair or sustain their credit. During 2014, we refinanced only $6.6 million of loans that were 60 days or more contractually past due, representing approximately 0.7% of our total loan volume for fiscal 2014. As of December 31, 2014, the outstanding gross balance of such refinancings was only $3.7 million, or less than 0.6% of gross finance receivables as of such date.

In accordance with this philosophy, we intend to continue to refine our underwriting standards to assess an individual’s creditworthiness and ability to repay a loan. In recent years, we have implemented several new programs to continue to improve our underwriting standards and loan collection rates, including those initiatives described above. Our management information system enables us to regularly review loan volumes, collections, and delinquencies. We believe this central oversight, combined with our branch-level servicing and collections, improves credit performance. We plan to continue to develop strategies and custom credit models utilizing our historical loan performance data and credit bureau attributes to further improve our underwriting standards and loan collection rates as we expand.

Our Products

Small Loans.We originate small loans ranging from $500 to $2,500 through our branches, which we refer to as our branch small loans, and through our convenience check program, which we refer to as our convenience checks. Our small loans are standardized by amount, rate, and maturity to reduce documentation and related processing costs and to comply with federal and state lending laws. They are payable in fixed rate, fully amortizing equal monthly installments with terms of up to 36 months, and are repayable at any time without penalty. In 2014, the average originated net loan size and term for our small installment loans were $1,143 and 14 months, respectively. The weighted-average yield we earned on our portfolio of small loans was 46.7% in 2014. The interest rates, fees and other charges, maximum principal amounts, and maturities for our small loans vary from state to state, depending upon relevant laws and regulations.

Branch Small Loans. Our branch small loans are made to customers who visit one of our branches and complete a standardized credit application. Customers may also complete and submit a loan application by phone or on our consumer website before closing the loan in one of our branches. We carefully evaluate each potential customer’s creditworthiness by examining the individual’s unencumbered income, length of current employment, duration of residence, and a credit report detailing the applicant’s credit history. Our branch small loan approval process is based on the customer’s creditworthiness rather than the value of collateral pledged. Loan amounts are established based on underwriting standards designed to allow customers to affordably make their loan payments out of their discretionary income. We require our customers to submit a list of non-essential household goods and pledge these goods as collateral. We do not perfect our security interests by filing UCC financing statements with respect to these goods and instead typically collect a non-file insurance fee and obtain non-file insurance.

Each of our branches is equipped to perform immediate background, employment, and credit checks, and approve loan applications promptly while the customer waits. Our employees verify the applicant’s employment and credit histories through telephone checks with employers, other employment references, supporting documentation, such as paychecks and earnings summaries, and a variety of third-party credit reporting agencies.

Convenience Checks. Our convenience check loans are originated through direct mail campaigns to pre-screened individuals. These campaigns are often timed to coincide with seasonal demand for loans to finance vacations, back-to-school needs, and holiday spending. We also launch convenience check campaigns in conjunction with opening new branches to help build an initial customer base. Customers can cash or deposit convenience checks at their convenience, thereby agreeing to the terms of the loan as prominently set forth on the check and accompanying disclosures. Each individual we solicit for a convenience check loan has been pre-screened through a major credit bureau or data aggregator against our underwriting criteria. In addition to screening each potential convenience check recipient’s credit score and bankruptcy history, we also use a

7

proprietary model that assesses approximately 25 to 30 different attributes of potential recipients. When a customer enters into a loan by cashing or depositing the convenience check, our personnel gather additional contact and other information on the borrower to assist us in servicing the loan and offering other products to meet the customer’s financing needs.

The following table sets forth the composition of our finance receivables for small loans by state at December 31st of each year from 2010 through 2014:

| | | | | | | | | | | | | | | | | | | | |

| | | At December 31, | |

| | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

South Carolina | | | 43 | % | | | 40 | % | | | 31 | % | | | 26 | % | | | 25 | % |

Texas | | | 29 | % | | | 29 | % | �� | | 31 | % | | | 29 | % | | | 29 | % |

North Carolina | | | 20 | % | | | 21 | % | | | 21 | % | | | 16 | % | | | 15 | % |

Alabama | | | 3 | % | | | 4 | % | | | 9 | % | | | 14 | % | | | 13 | % |

Tennessee | | | 5 | % | | | 6 | % | | | 7 | % | | | 8 | % | | | 8 | % |

Oklahoma | | | — | | | | — | | | | 1 | % | | | 5 | % | | | 7 | % |

New Mexico | | | — | | | | — | | | | — | | | | 2 | % | | | 3 | % |

Georgia | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 100 | % | | | 100 | % | | | 100 | % | | | 100 | % | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | |

The following table sets forth the total number of small loans, finance receivables, and average per loan for our small loans by state at December 31, 2014:

| | | | | | | | | | | | |

| | | Total

Number

of Loans | | | Finance

Receivables | | | Average

Per Loan | |

| | | | | | (In thousands) | | | | |

South Carolina | | | 70,734 | | | $ | 78,553 | | | $ | 1,111 | |

Texas | | | 90,351 | | | | 90,716 | | | | 1,004 | |

North Carolina | | | 36,337 | | | | 48,225 | | | | 1,327 | |

Alabama | | | 40,399 | | | | 42,583 | | | | 1,054 | |

Tennessee | | | 22,584 | | | | 24,374 | | | | 1,079 | |

Oklahoma | | | 18,829 | | | | 23,778 | | | | 1,263 | |

New Mexico | | | 8,161 | | | | 9,858 | | | | 1,208 | |

Georgia | | | 2,257 | | | | 1,446 | | | | 641 | |

| | | | | | | | | | | | |

Total | | | 289,652 | | | $ | 319,533 | | | $ | 1,103 | |

| | | | | | | | | | | | |

Large Loans. We also offer large loans through our branches in amounts ranging from $2,501 to $20,000. Our large loans are payable in fixed rate, fully amortizing equal monthly installments with terms of 18 to 60 months, and are repayable at any time without penalty. We require our large loans to be secured by a vehicle, which may be an automobile, motorcycle, boat, or all-terrain vehicle, or non-essential household goods. In 2014, our average originated net loan size and term for large loans were $3,915 and 29 months, respectively. The weighted-average yield we earned on our portfolio of large loans was 26.9% for 2014.

A potential customer applies for a large loan by visiting one of our branches, where he or she is interviewed by one of our employees who evaluates the customer’s creditworthiness, including a review of a credit bureau report, before extending a loan. As with our branch small loans, large loans are made based on the customer’s gross income, debt-to-income ratios, length of current employment, duration of residence, and prior credit experience and credit report history. Loan amounts are established based on underwriting standards designed to allow customers to affordably make their loan payments out of their discretionary income. Our branches perform the same immediate verifications that we perform for branch small loans in order to approve large loan applications promptly.

8

Our branch employees will perform an in-person appraisal of any vehicle collateral pledged for a large loan using our multipoint checklist and will use one or more third-party valuation sources, such as the National Automobile Dealers Association Appraisal Guides, to determine an estimate of the collateral’s value. Regardless of the value of the vehicle or other collateral, we will not lend in excess of our assessment of the borrower’s ability to repay.

We perfect all first-lien security interests in each pledged vehicle by retaining the title to the collateral in our files until the loan is fully repaid. In certain states, we offer large loans secured by second-lien security interests on vehicles, in which case we instead seek to perfect our security interest by recording our lien on the title. We work with customers experiencing payment difficulties to help them find a solution and view repossession only as a last option. In the event we do elect to repossess a vehicle, we use third-party vendors in the vast majority of circumstances. We then sell our repossessed vehicle inventory through public sales conducted by independent automobile auction organizations or, to a lesser extent, private sales after the required post-repossession waiting period. Any excess proceeds from the sale of the collateral are returned to the customer.

The following table sets forth the composition of our finance receivables for large loans by state at December 31st of each year from 2010 through 2014:

| | | | | | | | | | | | | | | | | | | | |

| | | At December 31, | |

| | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

South Carolina | | | 57 | % | | | 49 | % | | | 30 | % | | | 28 | % | | | 25 | % |

Texas | | | 9 | % | | | 9 | % | | | 6 | % | | | 4 | % | | | 10 | % |

North Carolina | | | 26 | % | | | 27 | % | | | 22 | % | | | 28 | % | | | 27 | % |

Alabama | | | 4 | % | | | 7 | % | | | 35 | % | | | 30 | % | | | 26 | % |

Tennessee | | | 4 | % | | | 8 | % | | | 7 | % | | | 9 | % | | | 8 | % |

Oklahoma | | | — | | | | — | | | | — | | | | 1 | % | | | 2 | % |

New Mexico | | | — | | | | — | | | | — | | | | — | | | | 2 | % |

Georgia | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 100 | % | | | 100 | % | | | 100 | % | | | 100 | % | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | |

The following table sets forth the total number of large loans, finance receivables, and average per loan for our large loans by state at December 31, 2014:

| | | | | | | | | | | | |

| | | Total

Number

of Loans | | | Finance

Receivables | | | Average

Per Loan | |

| | | | | | (In thousands) | | | | |

South Carolina | | | 2,757 | | | $ | 11,731 | | | $ | 4,255 | |

Texas | | | 1,425 | | | | 4,402 | | | | 3,089 | |

North Carolina | | | 4,118 | | | | 12,237 | | | | 2,972 | |

Alabama | | | 2,975 | | | | 12,088 | | | | 4,063 | |

Tennessee | | | 882 | | | | 3,783 | | | | 4,289 | |

Oklahoma | | | 266 | | | | 1,102 | | | | 4,143 | |

New Mexico | | | 197 | | | | 804 | | | | 4,081 | |

Georgia | | | — | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | | 12,620 | | | $ | 46,147 | | | $ | 3,657 | |

| | | | | | | | | | | | |

Automobile Loans. Our automobile loans are offered through a network of dealers in our geographic footprint. These loans are offered in amounts up to $27,500 and are secured by the purchased vehicle. They are payable in fixed rate, fully amortizing equal monthly installments with terms generally of 36 to 72 months, and are repayable at any time without penalty. In 2014, our average originated net loan size and term for automobile loans were $11,567 and 53 months, respectively. The weighted-average yield we earned on our portfolio of automobile loans was 19.7% for 2014.

9

Direct Automobile Loans. We have business relationships with dealerships throughout our geographic footprint that offer our loans to their customers in need of financing. These dealers will contact one of our local branches to initiate a loan application when they have identified a customer who meets our written underwriting standards. Applications for direct automobile loans may also be received through one of the online credit application networks in which we participate, such as DealerTrack and RouteOne. We will review the application and requested loan terms and propose modifications, if necessary, before providing initial approval and inviting the dealer and the customer to come to a local branch to close the loan. Our branch employees interview the customer to verify information in the dealer’s credit application, obtain a credit bureau report on the customer, and inspect the vehicle to confirm that the customer’s order accurately describes the vehicle before closing the loan. Our branch employees will perform the same in-person appraisal of the pledged vehicle that they would perform for a vehicle securing a large loan.

Indirect Automobile Loans. Since late 2010, we have also offered indirect automobile loans, which allow customers and dealers to complete a loan at the dealership without the need to visit one of our branches. We typically offer indirect loans through larger franchise and independent dealers within our geographic footprint. These larger dealers collect credit applications from their customers and either forward the applications to us specifically or, more commonly, submit the applications to numerous potential lenders through online credit application networks, such as DealerTrack and RouteOne. After receiving an indirect automobile loan application, it is processed by our centralized underwriting department or, to a lesser extent, our branches and supervisors. Once the loan is approved, the dealer closes the loan on a standardized retail installment sales contract at the point of sale. Subsequently, we purchase the loan and then service and collect on it locally through our nearest branch.

Automobile loans are made to individuals based on the customer’s gross income, debt-to-income ratios, length of current employment, duration of residence, prior credit experience and credit report history, and the loan-to-value ratio. Loan amounts are established based on underwriting standards designed to allow customers to affordably make their loan payments out of their discretionary income. We perfect our collateral by recording our lien and retaining the vehicle’s title. Our underwriting standards, however, are primarily based on the creditworthiness of the borrower, and we view repossession only as a last option.

The following table sets forth the composition of our finance receivables for automobile loans by state at December 31st of each year from 2010 through 2014:

| | | | | | | | | | | | | | | | | | | | |

| | | At December 31, | |

| | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

South Carolina | | | 64 | % | | | 55 | % | | | 48 | % | | | 42 | % | | | 42 | % |

Texas | | | 5 | % | | | 13 | % | | | 19 | % | | | 22 | % | | | 23 | % |

North Carolina | | | 27 | % | | | 26 | % | | | 26 | % | | | 26 | % | | | 24 | % |

Alabama | | | 1 | % | | | 2 | % | | | 4 | % | | | 5 | % | | | 5 | % |

Tennessee | | | 3 | % | | | 4 | % | | | 3 | % | | | 3 | % | | | 2 | % |

Oklahoma | | | — | | | | — | | | | — | | | | 1 | % | | | 2 | % |

New Mexico | | | — | | | | — | | | | — | | | | — | | | | — | |

Georgia | | | — | | | | — | | | | — | | | | 1 | % | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 100 | % | | | 100 | % | | | 100 | % | | | 100 | % | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | |

10

The following table sets forth the total number of automobile loans, finance receivables, and average per loan for our automobile loans by state at December 31, 2014:

| | | | | | | | | | | | |

| | | Total

Number

of Loans | | | Finance

Receivables | | | Average

Per Loan | |

| | | | | | (In thousands) | | | | |

South Carolina | | | 7,933 | | | $ | 63,874 | | | $ | 8,052 | |

Texas | | | 3,167 | | | | 35,627 | | | | 11,249 | |

North Carolina | | | 4,324 | | | | 37,552 | | | | 8,685 | |

Alabama | | | 856 | | | | 7,886 | | | | 9,213 | |

Tennessee | | | 457 | | | | 3,533 | | | | 7,731 | |

Oklahoma | | | 316 | | | | 2,598 | | | | 8,222 | |

New Mexico | | | 13 | | | | 111 | | | | 8,538 | |

Georgia | | | 277 | | | | 3,201 | | | | 11,556 | |

| | | | | | | | | | | | |

Total | | | 17,343 | | | $ | 154,382 | | | $ | 8,902 | |

| | | | | | | | | | | | |

Retail Loans.We began offering loans to finance the purchase of furniture, appliances, and other retail products in late 2009. Our retail loans are indirect installment loans structured as retail installment sales contracts that are offered in amounts of up to $7,500. They are payable in fixed rate, fully amortizing equal monthly installments with terms of between six and 48 months, and are repayable at any time without penalty. In 2014, our average originated net loan size and term for retail loans were $1,398 and 21 months, respectively. The weighted-average yield we earned on our portfolio of retail loans was 18.3% for 2014.

Our retail loans provide financing to customers who may not qualify for prime financing from traditional lenders. As compared to other sources of non-prime financing, our retail loans often offer more attractive interest rates and terms to customers. Our retail loans are indirect loans made through a retailer at the point of sale without the need for the customer to visit one of our branches, similar to our indirect automobile loans. We partner with retailers who offer our retail loans directly to their customers. In recent years, in an effort to expand our relationship with existing retailer partners, we began offering retail loans in states outside of our eight-state brick-and-mortar footprint that are serviced centrally from our headquarters in Greenville, South Carolina. By providing a source of non-prime financing, we are often able to help our retail partners complete sales to customers who otherwise may not have been able to finance their purchase.

Our retail partners typically submit applications to us online while the customer waits. If a customer is not accepted by a retailer’s prime financing provider, we will evaluate the customer’s credit based on the same application data, without the need for the customer to complete an additional application. Underwriting for our retail loans is conducted through RMC Retail, a centralized underwriting team.

We individually evaluate the creditworthiness of potential retail loan customers using the same information and resources used for our other loan products, including a credit bureau report, before providing a credit decision to the retailer within ten minutes. If we approve the loan, the retailer completes our standardized retail installment sales contract, which includes a security interest in the purchased item. Loan amounts are established based on underwriting standards designed to allow customers to affordably make their loan payments out of their discretionary income. The servicing of nearly all such loans are performed within our branches, with only out-of-footprint retail loans being serviced centrally from our headquarters in Greenville, South Carolina. We work with customers experiencing payment difficulties to help them find a solution and view repossession of the collateral only as a last option.

11

The following table sets forth the composition of our finance receivables for retail loans by state at December 31st of each year from 2010 through 2014:

| | | | | | | | | | | | | | | | | | | | |

| | | At December 31, | |

| | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

South Carolina | | | 15 | % | | | 10 | % | | | 8 | % | | | 6 | % | | | 6 | % |

Texas | | | 29 | % | | | 59 | % | | | 63 | % | | | 61 | % | | | 62 | % |

North Carolina | | | 56 | % | | | 25 | % | | | 15 | % | | | 15 | % | | | 14 | % |

Alabama | | | — | | | | 3 | % | | | 5 | % | | | 5 | % | | | 3 | % |

Tennessee | | | — | | | | 1 | % | | | 4 | % | | | 4 | % | | | 2 | % |

Oklahoma | | | — | | | | — | | | | — | | | | 3 | % | | | 7 | % |

New Mexico | | | — | | | | — | | | | — | | | | 1 | % | | | 1 | % |

Georgia | | | — | | | | — | | | | — | | | | — | | | | — | |

Other | | | — | | | | 2 | % | | | 5 | % | | | 5 | % | | | 5 | % |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 100 | % | | | 100 | % | | | 100 | % | | | 100 | % | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | |

The following table sets forth the total number of retail loans, the finance receivables, and average per loan for our retail loans by state at December 31, 2014:

| | | | | | | | | | | | |

| | | Total

Number

of Loans | | | Finance

Receivables | | | Average

Per Loan | |

| | | | | | (In thousands) | | | | |

South Carolina | | | 1,143 | | | $ | 1,271 | | | $ | 1,112 | |

Texas | | | 16,255 | | | | 16,288 | | | | 1,002 | |

North Carolina | | | 3,535 | | | | 3,560 | | | | 1,007 | |

Alabama | | | 928 | | | | 870 | | | | 938 | |

Tennessee | | | 688 | | | | 530 | | | | 770 | |

Oklahoma | | | 1,628 | | | | 1,897 | | | | 1,165 | |

New Mexico | | | 333 | | | | 329 | | | | 988 | |

Georgia | | | — | | | | — | | | | — | |

Other States | | | 1,360 | | | | 1,385 | | | | 1,018 | |

| | | | | | | | | | | | |

Total | | | 25,870 | | | $ | 26,130 | | | $ | 1,010 | |

| | | | | | | | | | | | |

Optional Credit Insurance Products.We offer our customers a number of different optional insurance products in connection with our loans. The insurance products we offer customers are voluntary and not a condition of the loan. Our insurance products, including the types of products offered and their terms and conditions, vary from state to state in compliance with applicable laws and regulations. Premiums and other charges for credit insurance and similar payment protection products are set at authorized statutory rates and are stated separately in our disclosure to customers, as required by the federal Truth in Lending Act and by various applicable state laws. We do not sell insurance to non-borrowers. In 2014, insurance income, net, was $10.7 million, or 5.2% of our total revenue.

We market and sell insurance policies as an agent for an unaffiliated third-party insurance company. The policies are then ceded to our wholly-owned reinsurance subsidiary, RMC Reinsurance, Ltd., which then bears the full risk of the policy. For the sale of insurance policies, we, as agent, write policies only within the limitations established by our agency contracts with the unaffiliated third-party insurance company.

Credit Life Insurance, Credit Accident and Health Insurance, and Involuntary Unemployment Insurance. We market and sell optional credit life insurance, credit accident and health insurance, and involuntary unemployment insurance in connection with our loans in selected markets. Credit life insurance provides for the payment in full of the borrower’s credit obligation to the lender in the event of the borrower’s

12

death. Credit accident and health insurance, which is only offered in conjunction with credit life insurance, provides for the repayment of loan installments to the lender that come due during an insured’s period of income interruption resulting from disability from illness or injury. Involuntary unemployment insurance provides for repayment of loan installments in the event the borrower is no longer employed as the result of a layoff or reduction in workforce. All customers purchasing these types of insurance from us sign a statement affirming that they understand that their purchase of insurance is not a condition of our granting the loan. In addition, customers may cancel purchased insurance within 30 days of the date of purchase and receive a full refund of the insurance premium. Customers are paid a partial refund in the event of an early payoff or loan refinancing.

Collateral Protection Collision Insurance. Before we originate an automobile loan, we require the borrower to provide proof of acceptable liability and collision insurance on the vehicle securing the loan. While we do not offer automobile insurance to our customers, we will obtain collateral protection collision insurance (“CPI”) on behalf of customers who permit their other insurance coverage to lapse. If we obtain CPI for a vehicle, the customer has the opportunity to provide proof of insurance to cancel the CPI and receive a refund of all unearned premiums.

Property Insurance. We also require that our customers provide proof of acceptable insurance for any personal property securing a loan. Customers can provide proof of such insurance purchased from a third party (such as homeowners or renters insurance) or can purchase the property insurance that we offer.

Our Branches

Our branches are generally conveniently located in visible, high traffic locations, such as shopping centers. We do not need to keep large amounts of cash at our branches because we disburse loan proceeds over $200 by check, rather than by cash payment. As a result, our branches have an open, welcoming, and hospitable layout.

The following table sets forth the number of branches as of the dates indicated:

| | | | | | | | | | | | | | | | | | | | |

| | | At December 31, | |

| | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

South Carolina | | | 61 | | | | 69 | | | | 69 | | | | 70 | | | | 70 | |

Texas | | | 35 | | | | 44 | | | | 56 | | | | 67 | | | | 83 | |

North Carolina | | | 19 | | | | 24 | | | | 26 | | | | 29 | | | | 34 | |

Alabama | | | 9 | | | | 14 | | | | 42 | | | | 49 | | | | 49 | |

Tennessee | | | 10 | | | | 18 | | | | 20 | | | | 21 | | | | 21 | |

Oklahoma | | | — | | | | 1 | | | | 6 | | | | 21 | | | | 27 | |

New Mexico | | | — | | | | — | | | | 2 | | | | 4 | | | | 13 | |

Georgia | | | — | | | | — | | | | — | | | | 3 | | | | 3 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 134 | | | | 170 | | | | 221 | | | | 264 | | | | 300 | |

| | | | | | | | | | | | | | | | | | | | |

During the period presented in the table above, we grew by 166 net branches. In 2014, we opened or acquired 36 new branches. In evaluating whether to locate a branch in a particular community, we examine several factors, including the demographic profile of the community, demonstrated demand for consumer finance, the regulatory and political climate, and the availability of suitable employees to staff, manage, and supervise the new branch. We also look for a concentration of automobile dealers and retailers to build our sales finance business.

13

The following table sets forth the average finance receivables per branch based on maturity, excluding acquired branches:

| | | | | | | | | | | | |

Age of Branch (As of December 31, 2014) | | Average Finance

Receivables Per

Branch as of

December 31, 2014 | | | Percentage Increase

From Prior Age

Category | | | Number of

Branches | |

| | | (In thousands) | | | | | | | |

Branches open less than one year | | $ | 925 | | | | — | | | | 36 | |

Branches open one to three years | | $ | 1,458 | | | | 57.6 | % | | | 95 | |

Branches open three to five years | | $ | 1,903 | | | | 30.5 | % | | | 52 | |

Branches open five years or more | | $ | 2,284 | | | | 20.0 | % | | | 117 | |

The average contribution to operating income from our branches has historically increased as our branches mature. The following table sets forth the average operating income contribution per branch for the twelve months ended December 31, 2014, based on maturity of the branch, excluding acquired branches.

| | | | | | | | | | | | |

Age of Branch (As of December 31, 2014) | | Average Branch

Operating Income

Contribution | | | Percentage Increase

From Prior Age

Category | | | Number of

Branches | |

| | | (In thousands) | | | | | | | |

Branches open less than one year | | $ | 78 | | | | — | | | | 36 | |

Branches open one to three years | | $ | 167 | | | | 114.1 | % | | | 95 | |

Branches open three to five years | | $ | 262 | | | | 56.9 | % | | | 52 | |

Branches open five years or more | | $ | 455 | | | | 73.7 | % | | | 117 | |

We calculate the average branch contribution as total revenues generated by the branch less the expenses directly attributable to the branch, including the provision for losses and operating expenses such as personnel, lease, and interest expenses. General corporate overhead, including management salaries, are not attributable to any individual branch. Accordingly, the sum of branch contributions from all of our branches is greater than our income before taxes.

Payment and Loan Collections

We have implemented company-wide payment and loan collection policies and practices, which are designed to maintain consistent portfolio performance and to facilitate regulatory compliance. Our district supervisors and state vice presidents oversee the training of each branch employee in these policies and practices, which include standard procedures for communicating with customers in person, over the telephone, and by mail. Our corporate procedures require the maintenance of a log of collection activity for each account. Our state vice presidents, district supervisors, and internal audit teams regularly review these records to ensure compliance with our company procedures, which are designed to comply with applicable regulatory requirements.

Our corporate policies also include encouraging customers to visit our branches to make payments. Encouraging payment at the branch allows us to maintain regular contact with our customers and further develop our overall relationship with them. We believe that the development and continual reinforcement of personal relationships with customers improves our ability to monitor their creditworthiness, reduces credit risk, and generates opportunities to offer them new loan products as their credit profiles evolve. To reduce late payment risk, branch employees encourage customers to inform us in advance of expected payment problems.

Branch employees also promptly contact customers following the first missed payment and thereafter remain in close contact with such customers, including through phone calls and letters. Our branch employees also contact a delinquent customer at his or her home and contact other references listed on the customer’s loan application. We use third-party skip tracing services to locate delinquent customers in the event that our branch employees are unable to do so. In certain cases, we seek a legal judgment against delinquent customers.

We obtain security interests for most of our loans, and we perfect the security interests in vehicles securing large loans and automobile loans. Our district supervisors and internal audit teams regularly review collateral

14

documentation to confirm compliance with our guidelines. We perfect all first-lien security interests in each pledged vehicle by retaining the title to the collateral in our files until the loan is fully repaid. In certain states, we offer large loans secured by second-lien security interests on vehicles, in which case we instead seek to perfect our security interest by recording our lien on the title. We only initiate repossession efforts when an account is seriously delinquent, we have exhausted other means of collection, and in the opinion of management, the customer is unlikely to make further payments. Since 2010, we have sold substantially all repossessed vehicles through public sales conducted by independent automobile auction organizations, after the required post-repossession waiting period. Losses on the sale of repossessed collateral are charged to the allowance for credit losses.

In certain cases, we permit our existing customers to refinance their loans. Our refinancings of existing loans are divided into three categories: refinancings of loans in an amount greater than the original loan amount, renewals of existing loans at or below the original loan amount, and renewals of existing loans that are 60 or more days contractually past due, which represented 21.1%, 35.8%, and 0.7%, respectively, of our loan originations in 2014. Any refinancing of a loan in an amount greater than the original amount generally requires an underwriting review to determine a customer’s qualification for the increased loan amount. Furthermore, we obtain a new credit report and may complete a new application on renewals of existing loans if they have not completed one within the prior two years. We allow customers to refinance delinquent loans on a limited basis if those customers otherwise satisfy our credit standards (other than with respect to the delinquency). We believe that refinancing delinquent loans for certain deserving customers who have made periodic payments allows us to help customers resolve temporary financial setbacks and repair or sustain their credit. During 2014, we refinanced only $6.6 million of loans that were 60 or more days contractually past due, and as of December 31, 2014, the outstanding balance of such refinancings was only $3.7 million, or less than 0.6% of gross finance receivables as of such date.

Accounts are charged off at 180 days contractually delinquent. We continue to attempt to collect on charged-off loans centrally, and historically, we have not sold any of our charged-off accounts to third-party debt purchasers, nor have we placed any debt with third-party collection agencies. We updated our charge-off policy during the fourth quarter of 2014, and we will continue to review our practices relating to our handling of charged-off accounts.

Information Technology

Since 1999, we have used a data processing software package developed and owned by ParaData Financial Systems and have invested in customizing the ParaData software to improve the management of our specific processes and product types. The ParaData software is also used by many of our competitors. With this software package, we are able to fully automate all of our loan account processing and servicing. The system provides thorough management information and control capabilities, including monitoring of all loans made, collections, delinquencies, and other functions. While we believe that the ParaData loan management system is adequate for our current business needs, we determined in 2013 to transition to a competing loan management and data processing software platform offered by DHI Computing Service, Inc. d/b/a GOLDPoint Systems. We anticipate that the transition to the GOLDPoint Systems platform will be complete in 2015. With the GOLDPoint Systems platform, we expect enhanced functionality and efficiency in the processing and servicing of our diverse product portfolio and growing loan account base.

Competition

The consumer finance industry is highly fragmented, with numerous competitors. The competition we face for each of our loan products is distinct.

Small and Large Loans.The installment loan industry is highly fragmented in the eight states in which we operate. Our largest installment loan competitors in most of the markets in which we operate are World Acceptance Corp., Security Finance Corporation, OneMain Financial, and Springleaf Financial Services, each of

15

which has greater than 800 branch locations. We also compete with a handful of private competitors, such as Lendmark Financial Services and Mariner Finance, with between 100 and 250 branches in certain of the states in which we operate. We believe that the majority of our competitors are independent operators with generally less than 100 branches. We believe that competition between installment consumer loan companies occurs primarily on the basis of price, breadth of loan product offerings, flexibility of loan terms offered, and the quality of customer service provided. While underbanked customers may also use alternative financial services providers, such as title lenders, payday lenders, and pawn shops, their products offer different terms and typically carry substantially higher interest rates and fees than our installment loans. Accordingly, we believe alternative financial services providers are not an attractive alternative for customers who meet our underwriting standards, which are generally stricter than the underwriting standards of alternative financial services providers. Our small and large loans also compete with online or peer-to-peer lenders and issuers of non-prime credit cards.

Automobile Loans. In the automobile loan industry, we compete with numerous financial service companies, including non-prime auto lenders, dealers that provide financing, captive finance companies owned by automobile manufacturers, banks, and credit unions. Competition among automobile lenders is fierce and is largely on the basis of interest rates charged, the quality of credit accepted, the flexibility of loan terms offered, the speed of approval, and the quality of customer service provided. Much of the automobile loan marketplace has evolved to processing loan applications generated at dealers through online credit application networks such as DealerTrack or RouteOne where prompt service and response times to dealers and their customers are essential to compete in this market.

Retail Loans. In recent years, the retail loan industry has seen an increasing number of lenders dedicated to serving non-prime retail loans enter the market. We also face competition from rent-to-own financing providers and credit card companies. Our retail loans are typically made at competitive rates, and competition is largely on the same basis as automobile loans. Point-of-sale financing decisions must be made rapidly while the customer is on the sales floor. We endeavor to provide responses to customers in less than ten minutes, and we staff RMC Retail, our centralized retail loan underwriting team, with multiple shifts seven days per week during peak retail shopping hours to ensure rapid response times.

Seasonality

Our loan volume and corresponding finance receivables balances follow seasonal trends. Demand for our loans is typically highest during the third and fourth quarters, largely due to customers borrowing money for back-to-school and holiday spending. With the exception of automobile loans, loan demand has generally been the lowest during the first quarter, largely due to the timing of income tax refunds. During the remainder of the year, we typically experience loan growth from general operations. In addition, we typically generate higher loan volumes in the second half of the year from our direct mail campaigns, which are timed to coincide with seasonal consumer demand. Consequently, we experience significant seasonal fluctuations in our operating results and cash needs.

Employees

As of December 31, 2014, we had 1,443 employees, none of whom were represented by labor unions. We consider our relations with our personnel to be good. We experience a high level of turnover among our entry-level employees, which we believe is typical of the consumer finance industry.

Staff and Training. Local branches are generally staffed with three to four employees. The branch manager oversees operations of the branch and is responsible for approving loan applications. Each branch has one or two assistant managers who contact delinquent customers, review loan applications, and prepare operational reports. Generally, each branch also has a customer service representative who takes loan applications, processes loan applications, processes payments, and assists in the preparation of operational reports, collection efforts, and marketing activities. Larger volume branches may employ additional assistant managers and customer service representatives. New employees train on an operating manual that outlines our operating policies and procedures

16

during the first year of employment. In addition, each employee is required to complete a curriculum of compliance training modules within the first 180 days of employment. Beginning in July 2015, employees are also required to re-certify on certain compliance modules each year. Our training of assistant managers focuses on developing the skills necessary to allow for the future promotion of the assistant managers to branch managers.

Monitoring and Supervision.We have oversight structures and procedures in place to ensure compliance with our operational standards and policies and the applicable regulatory requirements in each state. All of our loans, other than indirect automobile and retail loans, are prepared using our loan management software, which is programmed to compute fees, interest rates, and other loan terms in compliance with our underwriting standards and applicable regulations. We work with our regulatory counsel to develop standardized forms and agreements for each state, ensuring consistency and compliance.

Our loan operations are organized by geography. As of March 2015, we have two state vice presidents to oversee Texas; one state vice president to oversee North Carolina and Tennessee; one state vice president to oversee South Carolina and Georgia; one state vice president to oversee New Mexico and Oklahoma; and one state vice president to oversee Alabama. Several levels of management monitor and supervise the operations of each of our branches. Branch managers are directly responsible for the performance of their respective branches. District supervisors are responsible for the performance of between 8 and 13 branches in their districts, communicating with the branch managers of each of their branches at least weekly, and visiting each branch at least monthly. Our state vice presidents monitor the performance of all of the branches in their respective states, primarily through communications with district supervisors. These state vice presidents communicate with the district supervisors of each of their districts at least weekly and visit each of their branches at least annually, or more often as necessary. Our information technology platform enables us to monitor our portfolio regularly, which we believe improves our credit performance.

The majority of our branches undergo an internal audit every year, and every branch undergoes an internal audit at least every two years. These audits include a review of compliance with state and federal laws and regulations, as well as a review of operations. The review of operations includes a review of adherence to policies and procedures concerning cash management, loan approval processes, and all other policies and procedures concerning branch operations, such as collection procedures. Branches are rated at four different levels, and the timing of audits is impacted by the rating received. Other factors impacting the timing of branch audits include, but are not limited to, the date the branch opened, the timing of new managers commencing employment at the branch, and the results of branch examinations conducted by state regulators. Our branch employees’ compensation is directly impacted by the internal audit rating assigned to the branch.

We have a “scorecard” program to systematically monitor a range of operating metrics at each branch. Our scorecard system currently tracks different dimensions of operations, including the performance and compliance of each branch on a series of credit metrics. Senior management receives daily delinquency, loan volume, charge-off, and other statistical reports consolidated by state and has access to these daily reports for each branch. On at least a quarterly basis, district supervisors audit the operations of each branch in their geographic area and submit standardized reports detailing their findings to senior management. State vice presidents meet with the executive management team once per quarter to review branch scorecard results as well as to discuss other operational and financial performance results against our targets and historical standards. Remedial plans are put in place to correct any underperformance.

Government Regulation

Consumer finance companies are subject to extensive regulation, supervision, and licensing under various state and federal statutes, ordinances, and regulations. Many of these regulations impose detailed constraints on the terms of our loans and the retail installment sales contracts that we purchase, lending forms, and operations. The software that we use to originate loans is designed to ensure compliance with all applicable lending regulations.

17

State Lending Regulation. In general, state statutes establish maximum loan amounts and interest rates and the types and maximum amounts of fees and insurance premiums that may be charged for both direct and indirect lending. Specific allowable charges vary by state. For example, statutes in Texas allow for indexing the maximum small loan amounts to the Consumer Price Index and set maximum rates for automobile loans based on the age of the vehicle. Except in the states of North Carolina and New Mexico, our direct loan products are pre-computed loans in which the finance charge is determined at the time of the loan origination and is a combination of origination or acquisition fees, account maintenance fees, monthly account handling fees, and other charges permitted by the relevant state laws. Direct loans in North Carolina and New Mexico are structured as simple interest loans as prescribed by state law.

In addition, state laws regulate the keeping of books and records and other aspects of the operation of consumer finance companies, and state and federal laws regulate account collection practices. Generally, state regulations also establish minimum capital requirements for each local branch. State agency approval is required to open new branches, and each of our branches is separately licensed under the laws of the state in which the branch is located. Licenses granted by the regulatory agencies in these states are subject to renewal every year and may be revoked for failure to comply with applicable state and federal laws and regulations. In the states in which we currently operate, licenses may be revoked only after an administrative hearing. We believe we are in compliance with state law and regulations applicable to our lending operations in each state.