UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22649

iShares U.S. ETF Trust

(Exact name of Registrant as specified in charter)

c/o: State Street Bank and Trust Company

1 Iron Street, Boston, MA 02210

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-670-2000

Date of fiscal year end: July 31, 2014

Date of reporting period: July 31, 2014

Item 1. Reports to Stockholders.

JULY 31, 2014

| | | | |

2014 ANNUAL REPORT | | | |  |

iShares U.S. ETF Trust

| Ø | | iShares Enhanced International Large-Cap ETF | IEIL | NYSE Arca |

| Ø | | iShares Enhanced International Small-Cap ETF | IEIS | NYSE Arca |

| Ø | | iShares Enhanced U.S. Large-Cap ETF | IELG | NYSE Arca |

| Ø | | iShares Enhanced U.S. Small-Cap ETF | IESM | NYSE Arca |

Table of Contents

Management’s Discussion of Fund Performance

iSHARES® U.S. ETF TRUST

GLOBAL MARKET OVERVIEW

Global stocks gained approximately 16% for the 12-month period ended July 31, 2014 (the “reporting period”). The global equity markets generally benefited from significant liquidity as many central banks around the world maintained or expanded their accommodative monetary policies in an effort to stimulate economic activity. These efforts began to have a positive impact during the reporting period as improving economic conditions in many regions of the world provided a favorable backdrop for global stock market performance.

Although global stocks advanced steadily throughout the reporting period, they experienced some volatility along the way. The global equity markets began the reporting period on a down note, declining in the first two months amid unrest in the Middle East and signs of weaker economic growth worldwide. Global stocks rebounded throughout the fourth quarter of 2013 and into the new year, when a spate of weaker economic data led to a sharp correction in global stocks during the last half of January 2014. However, the disappointing economic news was attributed largely to severe winter weather in the Northern Hemisphere, and the global equity markets recovered to post solid gains over the last half of the reporting period.

Equity market performance was similar across most regions of the world. In the U.S., stocks advanced by about 17% for the reporting period. The U.S. economy grew at an uneven but moderate rate, led by improving job growth (the unemployment rate fell to as low as 6.1%, its lowest level since September 2008, before finishing the reporting period at 6.2%) and a continued recovery in the housing market. The U.S. Federal Reserve Bank (the “Fed”) expressed its confidence in the economy’s resilience by tapering its quantitative easing activity beginning in January 2014. The Fed reduced its government bond purchases from $85 billion per month in 2013 to $35 billion per month as of the end of the reporting period.

European stocks generated returns of approximately 16% for the reporting period. Although economic growth remained subdued across the Continent, the weakest European economies showed meaningful signs of stabilization during the reporting period. In particular, many southern European countries reported consecutive quarters of positive growth after several years of recession. Nonetheless, concerns about the possibility of deflation led the European Central Bank to lower short-term interest rates late in the reporting period. From a country perspective, the best-performing markets in Europe included Finland, Denmark, and Spain.

Stocks in the Asia/Pacific region returned approximately 13% for the reporting period. Economic growth in the region diverged as emerging markets generally slowed while more developed economies showed signs of improvement. Japan’s stock market lagged amid concerns about the negative impact of a new consumption tax on the Japanese economy. Stock markets in New Zealand and Australia were among the best performers during the reporting period.

Emerging markets stocks gained about 15% for the reporting period, but experienced significantly greater volatility than stocks in developed markets. Concerns about slowing economic growth in many bellwether emerging economies, including China and Brazil, led to a sharp decline in emerging markets stocks between November 2013 and January 2014. However, stronger demand for exports in developed countries, along with stimulus efforts from central banks, helped fuel a recovery in emerging markets stocks over the last half of the reporting period.

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 5 | |

Management’s Discussion of Fund Performance

iSHARES® ENHANCED INTERNATIONAL LARGE-CAP ETF

Performance as of July 31, 2014

| | | | |

| | | Cumulative Total Returns | |

| | | Since Inception | |

Fund NAV | | | 3.80% | |

Fund Market | | | 3.67% | |

MSCI World ex USA Index | | | 2.30% | |

The inception date of the Fund was 2/25/14. The first day of secondary market trading was 2/27/14.

The MSCI World ex USA Index is an unmanaged broad-based index that measures the performance of the large- and mid-capitalization sectors of developed equity markets, excluding the United States.

For the fiscal period ended 7/31/14, the Fund did not have six months of performance and therefore line graphs are not presented.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 14 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholder Expenses | |

| Actual | | | Hypothetical 5% Return | | | | |

Beginning

Account Value

(2/25/14) a | | | Ending

Account Value

(7/31/14) | | | Expenses Paid

During Period b | | | Beginning

Account Value

(2/1/14) | | | Ending

Account Value

(7/31/14) | | | Expenses Paid

During Period b | | | Annualized

Expense Ratio | |

| $ | 1,000.00 | | | $ | 1,038.00 | | | $ | 1.52 | | | $ | 1,000.00 | | | $ | 1,023.10 | | | $ | 1.76 | | | | 0.35% | |

| a | The beginning of the period (commencement of operations) is February 25, 2014. | |

| b | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (156 days for actual and 181 days for hypothetical expenses) and divided by the number of days in the year (365 days). See “Shareholder Expenses” on page 14 for more information. | |

The iShares Enhanced International Large-Cap ETF (the “Fund”) seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its net assets in equity securities of international large-capitalization issuers. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index. For the period from February 25, 2014 (inception date of the Fund) through July 31, 2014 (the “reporting period”), the total return for the Fund was 3.80%, net of fees.

The Fund delivered a positive return for the reporting period and outpaced the MSCI World ex USA Index, which returned 2.30%. The Fund combines the investment characteristics, or factors, of quality, value, and size exposures based on BlackRock insights. Quality is defined as a company that exhibits positive fundamentals, including high cash earnings, low earnings variability and low debt-to-equity ratio, while value refers to companies with lower relative valuations based on measures such as price-to-earnings and price-to-book ratios. Size refers to relative market capitalization and the Fund attempts to invest in stocks with lower relative market capitalizations. Each of the investment characteristics contributed positively to results during the reporting period, with value and quality stocks performing strongly.

| | |

| 6 | | 2014 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® ENHANCED INTERNATIONAL LARGE-CAP ETF

Higher quality stocks, as defined above, performed well relative to lower quality stocks during the reporting period. In addition, the Fund’s exposure to value also contributed to results during the period as the MSCI World ex USA Value Index returned 3.11%, compared with the 1.34% return of the MSCI World ex USA Growth Index. In addition, the Fund was positioned to have less volatility than the broad international indexes, and this lower risk profile had a positive impact on results. During the reporting period large company stocks produced stronger returns than small company stocks within the MSCI World ex USA Index universe, benefiting Fund performance.

PORTFOLIO ALLOCATION

As of 7/31/14

| | |

| Sector | | Percentage of

Total Investments* |

| | | | |

Financials | | | 22.79 | % |

Energy | | | 15.48 | |

Industrials | | | 12.12 | |

Telecommunication Services | | | 9.83 | |

Health Care | | | 8.66 | |

Materials | | | 7.64 | |

Consumer Staples | | | 7.63 | |

Consumer Discretionary | | | 7.04 | |

Utilities | | | 5.56 | |

Information Technology | | | 3.25 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

TEN LARGEST COUNTRY ALLOCATIONS

As of 7/31/14

| | |

| Country | | Percentage of

Total Investments* |

| | | | |

Japan | | | 17.10 | % |

Canada | | | 14.91 | |

United Kingdom | | | 14.44 | |

Switzerland | | | 12.71 | |

Germany | | | 9.27 | |

Denmark | | | 6.11 | |

France | | | 5.24 | |

Norway | | | 4.46 | |

Finland | | | 4.03 | |

Sweden | | | 3.51 | |

| | | | |

TOTAL | | | 91.78 | % |

| | | | |

| | * | Excludes money market funds. |

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 7 | |

Management’s Discussion of Fund Performance

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

Performance as of July 31, 2014

| | | | |

| | | Cumulative Total Returns | |

| | | Since Inception | |

Fund NAV | | | 0.18% | |

Fund Market | | | 0.14% | |

MSCI World ex USA Small Cap Index | | | 0.72% | |

The inception date of the Fund was 2/25/14. The first day of secondary market trading was 2/27/14.

The MSCI World ex USA Small Cap Index is an unmanaged broad-based index that measures the performance of the small-capitalization sector of developed equity markets, excluding the United States.

For the fiscal period ended 7/31/14, the Fund did not have six months of performance and therefore line graphs are not presented.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 14 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholder Expenses | |

| Actual | | | Hypothetical 5% Return | | | | |

Beginning

Account Value

(2/25/14) a | | | Ending

Account Value

(7/31/14) | | | Expenses Paid

During Period b | | | Beginning

Account Value

(2/1/14) | | | Ending

Account Value

(7/31/14) | | | Expenses Paid

During Period b | | | Annualized

Expense Ratio | |

| $ | 1,000.00 | | | $ | 1,001.80 | | | $ | 2.10 | | | $ | 1,000.00 | | | $ | 1,022.40 | | | $ | 2.46 | | | | 0.49% | |

| a | The beginning of the period (commencement of operations) is February 25, 2014. | |

| b | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (156 days for actual and 181 days for hypothetical expenses) and divided by the number of days in the year (365 days). See “Shareholder Expenses” on page 14 for more information. | |

The iShares Enhanced International Small-Cap ETF (the “Fund”) seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its net assets in equity securities of international small-capitalization issuers. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index. For the period from February 25, 2014 (inception date of the Fund) through July 31, 2014 (the “reporting period”), the total return for the Fund was 0.18%, net of fees.

The Fund delivered a fractionally positive return for the reporting period and trailed the MSCI World ex USA Small Cap Index, which returned 0.72%. The Fund combines the investment characteristics, or factors, of quality, value, and size exposures based on BlackRock insights. Quality is defined as a company that exhibits positive fundamentals, including high cash earnings, low earnings variability and low debt-to-equity ratio, while value refers to companies with lower relative valuations based on measures such as price-to-earnings and price-to-book ratios. Size refers to relative market capitalization and the Fund attempts to invest in stocks with lower relative market capitalizations.

| | |

| 8 | | 2014 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

Quality and value were positive contributors to Fund results during the reporting period, while exposure to smaller stocks hurt results as large company stocks produced stronger returns than small company stocks in the MSCI World ex USA Index universe. For the reporting period, the MSCI World ex USA Small Cap Value Index returned 1.47%, compared with the MSCI World ex USA Growth Index, which delivered a 0.03% return for the period. The Fund had a lower risk profile than the broad international indexes, which also contributed positively during the reporting period.

PORTFOLIO ALLOCATION

As of 7/31/14

| | |

| Sector | | Percentage of

Total Investments* |

| | | | |

Financials | | | 20.75 | % |

Consumer Discretionary | | | 18.29 | |

Industrials | | | 17.40 | |

Information Technology | | | 13.55 | |

Consumer Staples | | | 9.82 | |

Energy | | | 8.76 | |

Materials | | | 4.82 | |

Health Care | | | 3.31 | |

Telecommunication Services | | | 2.52 | |

Utilities | | | 0.78 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

TEN LARGEST COUNTRY ALLOCATIONS

As of 7/31/14

| | |

| Country | | Percentage of

Total Investments* |

| | | | |

Japan | | | 27.00 | % |

United Kingdom | | | 16.49 | |

Switzerland | | | 8.53 | |

Canada | | | 7.22 | |

Denmark | | | 6.65 | |

Australia | | | 6.60 | |

Germany | | | 4.35 | |

Norway | | | 4.00 | |

Belgium | | | 4.00 | |

Sweden | | | 3.88 | |

| | | | |

TOTAL | | | 88.72 | % |

| | | | |

| | * | Excludes money market funds. |

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 9 | |

Management’s Discussion of Fund Performance

iSHARES® ENHANCED U.S. LARGE-CAP ETF

Performance as of July 31, 2014

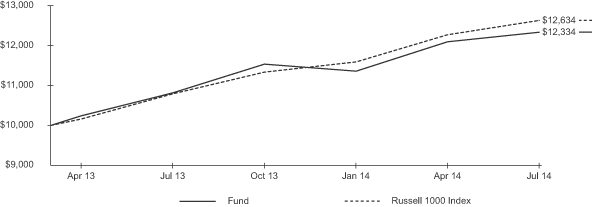

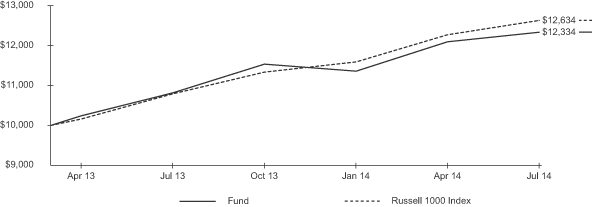

| | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since Inception | | | | | 1 Year | | | Since Inception | |

Fund NAV | | | 14.00% | | | | 17.61% | | | | | | 14.00% | | | | 23.34% | |

Fund Market | | | 14.03% | | | | 17.70% | | | | | | 14.03% | | | | 23.46% | |

Russell 1000 Index | | | 17.06% | | | | 19.89% | | | | | | 17.06% | | | | 26.34% | |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 4/16/13. The first day of secondary market trading was 4/18/13.

The Russell 1000® Index is an unmanaged broad-based index that measures the performance of the large- and mid-capitalization sectors of the U.S. equity market.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 14 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholder Expenses | |

| Actual | | | Hypothetical 5% Return | | | | |

Beginning

Account Value

(2/1/14) | | | Ending

Account Value

(7/31/14) | | | Expenses Paid

During Period a | | | Beginning

Account Value

(2/1/14) | | | Ending

Account Value

(7/31/14) | | | Expenses Paid

During Period a | | | Annualized

Expense Ratio | |

| $ | 1,000.00 | | | $ | 1,085.30 | | | $ | 0.93 | | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 0.90 | | | | 0.18% | |

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). See “Shareholder Expenses” on page 14 for more information. | |

| | |

| 10 | | 2014 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® ENHANCED U.S. LARGE-CAP ETF

The iShares Enhanced U.S. Large-Cap ETF (the “Fund”) seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its net assets in equity securities of U.S. large-capitalization issuers. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index. For the 12-month reporting period ended July 31, 2014, the total return for the Fund was 14.00%, net of fees.

The Fund delivered a strong return for the reporting period but trailed the broad Russell 1000 Index, which returned 17.06%. The Fund combines the investment characteristics, or factors, of quality, value, and size exposures based on BlackRock insights. Quality is defined as a company that exhibits positive fundamentals, including high cash earnings, low earnings variability and low debt-to-equity ratio, while value refers to companies with lower relative valuations based on measures such as price-to-earnings and price-to-book ratios. Size refers to relative market capitalization and the Fund attempts to have a lower relative market capitalization than a broad market capitalization weighted index such as the Russell 1000 Index.

The Fund’s position in quality stocks contributed positively to performance during the reporting period. The Fund’s exposure to value detracted from performance during the reporting period as the Russell 1000 Value Index returned 15.47%, trailing the 18.69% return of the Russell 1000 Growth Index.

The Fund’s exposure to size also limited performance during the reporting period, as smaller stocks trailed the performance of larger stocks. As an example, the Russell Midcap Index returned 16.36%, and the Russell 2000 Index, a measure of small-capitalization stock performance, returned 8.56% versus the Russell 1000 Index return of 17.06%.

The Fund was also positioned to have less volatility than the broad U.S. equity indexes, and this positioning had a negative impact on results. The MSCI USA Minimum Volatility Index returned 11.43% for the reporting period, trailing the broader U.S. equity indexes.

PORTFOLIO ALLOCATION

As of 7/31/14

| | | | |

| Sector | | Percentage of

Total Investments* | |

Information Technology | | | 16.75 | % |

Financials | | | 15.53 | |

Health Care | | | 13.87 | |

Energy | | | 13.81 | |

Consumer Discretionary | | | 11.00 | |

Consumer Staples | | | 10.53 | |

Utilities | | | 8.54 | |

Industrials | | | 7.94 | |

Telecommunication Services | | | 1.99 | |

Materials | | | 0.04 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

TEN LARGEST FUND HOLDINGS

As of 7/31/14

| | | | |

| Security | | Percentage of

Total Investments* | |

Intel Corp. | | | 2.69 | % |

Western Digital Corp. | | | 2.43 | |

General Dynamics Corp. | | | 2.42 | |

Microsoft Corp. | | | 2.40 | |

O’Reilly Automotive Inc. | | | 2.32 | |

Archer-Daniels-Midland Co. | | | 2.29 | |

WellPoint Inc. | | | 2.27 | |

Reinsurance Group of America Inc. | | | 2.25 | |

EOG Resources Inc. | | | 2.16 | |

eBay Inc. | | | 2.14 | |

| | | | |

TOTAL | | | 23.37 | % |

| | | | |

| | * | Excludes money market funds. |

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 11 | |

Management’s Discussion of Fund Performance

iSHARES® ENHANCED U.S. SMALL-CAP ETF

Performance as of July 31, 2014

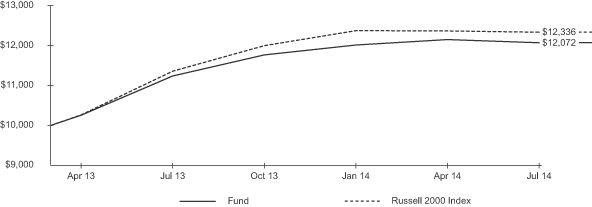

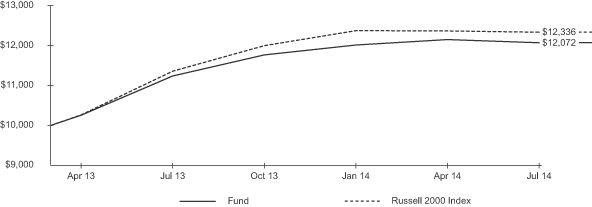

| | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since Inception | | | | | 1 Year | | | Since Inception | |

Fund NAV | | | 7.43% | | | | 15.68% | | | | | | 7.43% | | | | 20.72% | |

Fund Market | | | 7.28% | | | | 15.71% | | | | | | 7.28% | | | | 20.76% | |

Russell 2000 Index | | | 8.56% | | | | 17.69% | | | | | | 8.56% | | | | 23.36% | |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 4/16/13. The first day of secondary market trading was 4/18/13.

The Russell 2000® Index is an unmanaged broad-based index that measures the performance of the small-capitalization sector of the U.S. equity market.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 14 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholder Expenses | |

| Actual | | | Hypothetical 5% Return | | | | |

Beginning

Account Value

(2/1/14) | | | Ending

Account Value

(7/31/14) | | | Expenses Paid

During Period a | | | Beginning

Account Value

(2/1/14) | | | Ending

Account Value

(7/31/14) | | | Expenses Paid

During Period a | | | Annualized

Expense Ratio | |

| $ | 1,000.00 | | | $ | 1,004.40 | | | $ | 1.74 | | | $ | 1,000.00 | | | $ | 1,023.10 | | | $ | 1.76 | | | | 0.35% | |

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). See “Shareholder Expenses” on page 14 for more information. | |

| | |

| 12 | | 2014 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® ENHANCED U.S. SMALL-CAP ETF

The iShares Enhanced U.S. Small-Cap ETF (the “Fund”) seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its net assets in equity securities of U.S. small-capitalization issuers. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index. For the 12-month reporting period ended July 31, 2014, the total return for the Fund was 7.43%, net of fees.

The Fund delivered a solid return for the reporting period but trailed the small-capitalization Russell 2000 Index, which returned 8.56%. The Fund combines the investment characteristics, or factors, of quality, value, and size exposures based on BlackRock insights. Quality is defined as a company that exhibits positive fundamentals, including high cash earnings, low earnings variability and low debt-to-equity ratio, while value refers to companies with lower relative valuations based on measures such as price-to-earnings and price-to-book ratios. Size refers to relative market capitalization and the Fund attempts to invest in stocks with lower relative market capitalizations.

The Fund’s exposure to quality had little effect on performance during the reporting period as small capitalization quality stocks performed in-line with the Russell 2000 index, while the Fund’s exposure to size added value during the reporting period.

The Fund’s exposure to value detracted modestly from performance during the reporting period as growth stocks performed relatively better, as shown by the Russell 2000 Value Index which returned 8.18%, trailing the 8.93% return of the Russell 2000 Growth Index.

The Fund was also positioned to have less volatility than the broad U.S. equity indexes, and this positioning had a negative impact on results. The Russell 2000 Defensive Index, which focuses on stocks with lower price and earnings volatility, returned 7.60% for the reporting period, underperforming the broad Russell 2000 Index.

PORTFOLIO ALLOCATION

As of 7/31/14

| | | | |

| Sector | | Percentage of

Total Investments* | |

Financials | | | 27.89 | % |

Consumer Discretionary | | | 18.21 | |

Information Technology | | | 16.58 | |

Industrials | | | 9.83 | |

Consumer Staples | | | 6.67 | |

Utilities | | | 6.53 | |

Health Care | | | 6.52 | |

Energy | | | 5.21 | |

Telecommunication Services | | | 1.29 | |

Materials | | | 1.27 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

TEN LARGEST FUND HOLDINGS

As of 7/31/14

| | | | |

| Security | | Percentage of

Total Investments* | |

Cash America International Inc. | | | 2.42 | % |

Symetra Financial Corp. | | | 2.41 | |

Cirrus Logic Inc. | | | 2.27 | |

Unit Corp. | | | 2.16 | |

Children’s Place Inc. (The) | | | 2.11 | |

Fresh Market Inc. (The) | | | 1.97 | |

Buffalo Wild Wings Inc. | | | 1.94 | |

Bob Evans Farms Inc. | | | 1.93 | |

RPX Corp. | | | 1.93 | |

Manning & Napier Inc. | | | 1.88 | |

| | | | |

TOTAL | | | 21.02 | % |

| | | | |

| | * | Excludes money market funds. |

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 13 | |

About Fund Performance

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.iShares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment management fees. Without such waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not have traded in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary trading, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

Shareholder Expenses

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares and (2) ongoing costs, including management fees and other fund expenses. The expense example, which is based on an investment of $1,000 invested on February 1, 2014 (or commencement of operations, as applicable) and held through July 31, 2014, is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

Actual Expenses — The table provides information about actual account values and actual expenses. To estimate the expenses that you paid on your account over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number for your Fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes — The table also provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | |

| 14 | | 2014 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments

iSHARES® ENHANCED INTERNATIONAL LARGE-CAP ETF

July 31, 2014

| | | | | | | | |

| Security | | Shares | | | Value | |

COMMON STOCKS — 99.50% | |

| |

AUSTRALIA — 2.32% | | | | | |

ASX Ltd. | | | 6,288 | | | $ | 211,565 | |

Brambles Ltd. | | | 5,940 | | | | 52,076 | |

CFS Retail Property Trust Group | | | 9,312 | | | | 18,787 | |

Dexus Property Group | | | 55,632 | | | | 61,548 | |

GPT Group (The) | | | 4,644 | | | | 17,572 | |

Scentre Groupa | | | 8,394 | | | | 26,533 | |

Telstra Corp. Ltd. | | | 27,108 | | | | 138,361 | |

Woodside Petroleum Ltd. | | | 4,632 | | | | 183,107 | |

| | | | | | | | |

| | | | | | | 709,549 | |

AUSTRIA — 0.42% | | | | | |

OMV AG | | | 3,228 | | | | 129,831 | |

| | | | | | | | |

| | | | | | | 129,831 | |

BELGIUM — 2.08% | | | | | |

Ageas | | | 564 | | | | 20,266 | |

Belgacom SA | | | 2,976 | | | | 97,238 | |

Colruyt SA | | | 900 | | | | 43,640 | |

Delhaize Brothers and Co. “The Lion” (Delhaize Group) SA | | | 2,796 | | | | 182,619 | |

Solvay SA | | | 156 | | | | 25,225 | |

Telenet Group Holding NVa | | | 2,052 | | | | 109,795 | |

Umicore SA | | | 3,276 | | | | 158,237 | |

| | | | | | | | |

| | | | | | | 637,020 | |

CANADA — 14.86% | | | | | |

Agnico-Eagle Mines Ltd. | | | 684 | | | | 25,471 | |

Agrium Inc. | | | 1,236 | | | | 112,854 | |

Alimentation Couche-Tard Inc. Class B | | | 720 | | | | 19,735 | |

Bank of Montreal | | | 5,328 | | | | 397,746 | |

Bank of Nova Scotia | | | 2,124 | | | | 144,396 | |

Baytex Energy Corp. | | | 3,624 | | | | 155,593 | |

Canadian Imperial Bank of Commerce | | | 5,964 | | | | 554,463 | |

Canadian Natural Resources Ltd. | | | 11,916 | | | | 520,248 | |

Constellation Software Inc. | | | 1,740 | | | | 413,962 | |

Crescent Point Energy Corp. | | | 16,692 | | | | 682,154 | |

Empire Co. Ltd. Class A | | | 1,248 | | | | 88,397 | |

Husky Energy Inc. | | | 2,100 | | | | 63,985 | |

Intact Financial Corp. | | | 300 | | | | 20,040 | |

Magna International Inc. Class A | | | 1,452 | | | | 156,170 | |

Methanex Corp. | | | 732 | | | | 47,713 | |

Metro Inc. Class A | | | 504 | | | | 32,912 | |

National Bank of Canada | | | 8,640 | | | | 387,298 | |

Open Text Corp. | | | 492 | | | | 27,405 | |

Pacific Rubiales Energy Corp. | | | 5,448 | | | | 104,341 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

Peyto Exploration & Development Corp. | | | 840 | | | $ | 28,279 | |

Rogers Communications Inc. Class B | | | 2,076 | | | | 81,198 | |

Shaw Communications Inc. Class B | | | 2,112 | | | | 51,837 | |

Suncor Energy Inc. | | | 8,688 | | | | 357,288 | |

Thomson Reuters Corp. | | | 1,848 | | | | 69,921 | |

| | | | | | | | |

| | | | | | | 4,543,406 | |

DENMARK — 6.09% | | | | | |

A.P. Moeller-Maersk A/S Class B | | | 228 | | | | 531,555 | |

Carlsberg A/S Class B | | | 1,332 | | | | 127,898 | |

Danske Bank A/S | | | 11,400 | | | | 330,023 | |

GN Store Nord A/S | | | 23,184 | | | | 592,520 | |

Jyske Bank A/S Registereda | | | 984 | | | | 55,824 | |

TDC A/S | | | 18,012 | | | | 182,163 | |

Vestas Wind Systems A/Sa | | | 912 | | | | 41,231 | |

| | | | | | | | |

| | | | | | | 1,861,214 | |

FINLAND — 4.01% | | | | | |

Elisa OYJ | | | 2,076 | | | | 59,526 | |

Neste Oil OYJb | | | 8,844 | | | | 163,299 | |

Nokian Renkaat OYJ | | | 12,624 | | | | 438,657 | |

UPM-Kymmene OYJ | | | 34,620 | | | | 566,050 | |

| | | | | | | | |

| | | | | | | 1,227,532 | |

FRANCE — 5.22% | | | | | |

ALSTOMa | | | 2,952 | | | | 106,209 | |

Casino Guichard-Perrachon SA | | | 372 | | | | 44,876 | |

Danone SA | | | 636 | | | | 46,029 | |

Eutelsat Communications SA | | | 732 | | | | 25,259 | |

Iliad SA | | | 108 | | | | 29,768 | |

Orange | | | 7,260 | | | | 114,138 | |

Renault SA | | | 1,128 | | | | 94,133 | |

SCOR SE | | | 888 | | | | 28,545 | |

SES SA Class A FDR | | | 12,312 | | | | 452,196 | |

STMicroelectronics NV | | | 3,528 | | | | 29,385 | |

Total SA | | | 9,708 | | | | 624,656 | |

| | | | | | | | |

| | | | | | | 1,595,194 | |

GERMANY — 9.10% | | | | | |

Deutsche Lufthansa AG Registered | | | 23,820 | | | | 423,090 | |

Deutsche Telekom AG Registered | | | 13,608 | | | | 220,402 | |

E.ON SE | | | 4,608 | | | | 87,119 | |

Hannover Rueck SE Registered | | | 2,604 | | | | 222,498 | |

KION Group AG | | | 540 | | | | 21,061 | |

Merck KGaA | | | 3,288 | | | | 292,029 | |

Muenchener Rueckversicherungs-Gesellschaft AG Registered | | | 1,764 | | | | 374,805 | |

| | | | |

SCHEDULESOF INVESTMENTS | | | 15 | |

Schedule of Investments (Continued)

iSHARES® ENHANCED INTERNATIONAL LARGE-CAP ETF

July 31, 2014

| | | | | | | | |

| Security | | Shares | | | Value | |

ProSiebenSat.1 Media AG Registered | | | 3,936 | | | $ | 165,706 | |

RWE AG | | | 7,764 | | | | 312,218 | |

Telefonica Deutschland Holding AGc | | | 42,096 | | | | 330,850 | |

ThyssenKrupp AGa | | | 5,580 | | | | 158,019 | |

Volkswagen AG | | | 180 | | | | 41,677 | |

Wirecard AG | | | 3,552 | | | | 132,240 | |

| | | | | | | | |

| | | | | | | 2,781,714 | |

ISRAEL — 0.21% | | | | | |

Bezeq The Israel Telecommunication

Corp. Ltd. | | | 34,380 | | | | 64,193 | |

| | | | | | | | |

| | | | | | | 64,193 | |

JAPAN — 17.04% | | | | | |

AEON Co. Ltd. | | | 6,000 | | | | 67,856 | |

Aisin Seiki Co. Ltd. | | | 1,200 | | | | 47,143 | |

Aozora Bank Ltd. | | | 36,000 | | | | 123,227 | |

Asahi Group Holdings Ltd. | | | 1,200 | | | | 36,583 | |

Canon Inc. | | | 3,600 | | | | 118,746 | |

Chubu Electric Power Co. Inc.a | | | 2,400 | | | | 28,169 | |

Daihatsu Motor Co. Ltd. | | | 2,400 | | | | 43,013 | |

GungHo Online Entertainment Inc.b | | | 18,000 | | | | 102,572 | |

Hoya Corp. | | | 1,200 | | | | 39,337 | |

ITOCHU Corp. | | | 4,800 | | | | 61,963 | |

Japan Airlines Co. Ltd. | | | 9,600 | | | | 534,915 | |

JFE Holdings Inc. | | | 2,400 | | | | 51,041 | |

JX Holdings Inc. | | | 18,000 | | | | 93,558 | |

Kuraray Co. Ltd. | | | 2,400 | | | | 31,857 | |

Marubeni Corp. | | | 36,000 | | | | 256,010 | |

Mitsubishi Corp. | | | 2,400 | | | | 51,018 | |

Mitsubishi UFJ Financial Group Inc. | | | 28,800 | | | | 172,405 | |

Mitsui & Co. Ltd. | | | 16,800 | | | | 272,172 | |

Mizuho Financial Group Inc. | | | 174,000 | | | | 340,944 | |

Nexon Co. Ltd. | | | 4,800 | | | | 46,677 | |

Nippon Telegraph and Telephone Corp. | | | 4,800 | | | | 320,202 | |

NTT DOCOMO Inc. | | | 36,000 | | | | 638,537 | |

Rakuten Inc. | | | 3,600 | | | | 47,925 | |

Resona Holdings Inc. | | | 51,600 | | | | 290,327 | |

Sekisui House Ltd. | | | 2,400 | | | | 31,799 | |

Sharp Corp.a | | | 36,000 | | | | 114,125 | |

Showa Shell Sekiyu K.K. | | | 8,400 | | | | 95,489 | |

Sumitomo Corp. | | | 14,400 | | | | 191,911 | |

Sumitomo Mitsui Financial Group Inc. | | | 7,200 | | | | 298,264 | |

Sumitomo Rubber Industries Inc. | | | 1,200 | | | | 17,574 | |

Suntory Beverage & Food Ltd. | | | 1,200 | | | | 45,276 | |

Tokyo Electric Power Co. Inc.a | | | 24,000 | | | | 94,520 | |

Tokyo Electron Ltd. | | | 1,200 | | | | 78,650 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

Tokyo Gas Co. Ltd. | | | 36,000 | | | $ | 207,455 | |

West Japan Railway Co. | | | 4,800 | | | | 219,287 | |

| | | | | | | | |

| | | | | | | 5,210,547 | |

NETHERLANDS — 1.60% | | | | | |

AEGON NV | | | 37,116 | | | | 302,337 | |

Corio NV | | | 418 | | | | 22,218 | |

Delta Lloyd NV | | | 1,656 | | | | 38,255 | |

Heineken Holding NV | | | 732 | | | | 46,659 | |

Koninklijke Ahold NV | | | 2,603 | | | | 45,468 | |

TNT Express NV | | | 4,368 | | | | 35,242 | |

| | | | | | | | |

| | | | | | | 490,179 | |

NEW ZEALAND — 0.19% | | | | | |

Telecom Corp. of New Zealand Ltd. | | | 23,712 | | | | 57,157 | |

| | | | | | | | |

| | | | | | | 57,157 | |

NORWAY — 4.44% | | | | | |

Orkla ASA | | | 44,256 | | | | 402,292 | |

Statoil ASA | | | 18,000 | | | | 514,731 | |

Yara International ASA | | | 9,660 | | | | 441,890 | |

| | | | | | | | |

| | | | | | | 1,358,913 | |

PORTUGAL — 0.21% | | | | | |

Energias de Portugal SA | | | 13,704 | | | | 64,231 | |

| | | | | | | | |

| | | | | | | 64,231 | |

SINGAPORE — 0.18% | | | | | |

Noble Group Ltd. | | | 48,000 | | | | 54,622 | |

| | | | | | | | |

| | | | | | | 54,622 | |

SPAIN — 0.98% | | | | | |

Acerinox SA | | | 3,948 | | | | 65,661 | |

Gas Natural SDG SA | | | 864 | | | | 26,537 | |

Repsol SA | | | 8,280 | | | | 206,284 | |

| | | | | | | | |

| | | | | | | 298,482 | |

SWEDEN — 3.50% | | | | | |

Boliden AB | | | 22,800 | | | | 370,758 | |

Electrolux AB Class B | | | 3,036 | | | | 75,571 | |

Hakon Invest AB | | | 19,344 | | | | 602,509 | |

Nordea Bank AB | | | 1,536 | | | | 20,640 | |

| | | | | | | | |

| | | | | | | 1,069,478 | |

SWITZERLAND — 12.66% | | | | | |

Actelion Ltd. Registereda | | | 5,208 | | | | 629,451 | |

Baloise Holding AG Registered | | | 1,356 | | | | 163,740 | |

Banque Cantonale Vaudoise Registered | | | 72 | | | | 38,403 | |

Clariant AG Registereda | | | 11,424 | | | | 213,329 | |

Credit Suisse Group AG Registereda | | | 8,280 | | | | 225,280 | |

Helvetia Holding AG Registered | | | 120 | | | | 58,595 | |

| | |

| 16 | | 2014 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® ENHANCED INTERNATIONAL LARGE-CAP ETF

July 31, 2014

| | | | | | | | |

| Security | | Shares | | | Value | |

Holcim Ltd. Registereda | | | 468 | | | $ | 37,520 | |

PSP Swiss Property AG Registereda | | | 252 | | | | 22,323 | |

Swiss Life Holding AG Registereda | | | 1,848 | | | | 428,619 | |

Swiss Prime Site AG Registereda | | | 384 | | | | 30,490 | |

Swiss Re AGa | | | 6,876 | | | | 585,666 | |

Swisscom AG Registered | | | 1,032 | | | | 573,144 | |

Transocean Ltd.a | | | 7,248 | | | | 292,614 | |

Zurich Insurance Group AGa | | | 1,968 | | | | 572,891 | |

| | | | | | | | |

| | | | | | | 3,872,065 | |

UNITED KINGDOM — 14.39% | | | | | |

3i Group PLC | | | 15,372 | | | | 97,971 | |

Amlin PLC | | | 4,632 | | | | 35,676 | |

AstraZeneca PLC | | | 5,916 | | | | 433,928 | |

BP PLC | | | 39,924 | | | | 326,234 | |

British Sky Broadcasting Group PLC | | | 3,108 | | | | 46,123 | |

BT Group PLC | | | 13,596 | | | | 89,177 | |

Centrica PLC | | | 108,648 | | | | 566,800 | |

Imperial Tobacco Group PLC | | | 3,996 | | | | 173,451 | |

Investec PLC | | | 2,820 | | | | 24,495 | |

J Sainsbury PLC | | | 26,424 | | | | 139,590 | |

Marks & Spencer Group PLC | | | 10,212 | | | | 74,170 | |

Old Mutual PLC | | | 17,208 | | | | 56,884 | |

Rentokil Initial PLC | | | 82,608 | | | | 165,269 | |

Rolls-Royce Holdings PLCa | | | 36,132 | | | | 634,417 | |

Royal Dutch Shell PLC Class A | | | 4,212 | | | | 173,582 | |

RSA Insurance Group PLC | | | 15,732 | | | | 121,832 | |

Shire PLC | | | 8,376 | | | | 691,646 | |

SSE PLC | | | 12,432 | | | | 305,809 | |

Stagecoach Group PLC | | | 6,552 | | | | 39,347 | |

Vedanta Resources PLC | | | 1,272 | | | | 22,570 | |

Wm Morrison Supermarkets PLC | | | 63,024 | | | | 179,396 | |

| | | | | | | | |

| | | | | | | 4,398,367 | |

| | | | | | | | |

TOTAL COMMON STOCKS | | | | | |

(Cost: $29,815,414) | | | | 30,423,694 | |

|

PREFERRED STOCKS — 0.13% | |

| |

GERMANY — 0.13% | | | | | |

Bayerische Motoren Werke AG | | | 432 | | | | 41,051 | |

| | | | | | | | |

| | | | 41,051 | |

| | | | | | | | |

TOTAL PREFERRED STOCKS | | | | | |

(Cost: $41,198) | | | | 41,051 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

SHORT-TERM INVESTMENTS — 0.90% | |

| |

MONEY MARKET FUNDS — 0.90% | | | | | |

BlackRock Cash Funds: Institutional,

SL Agency Shares | | | | | |

0.14%d,e,f | | | 243,137 | | | $ | 243,137 | |

BlackRock Cash Funds: Prime,

SL Agency Shares | | | | | |

0.12%d,e,f | | | 15,166 | | | | 15,166 | |

BlackRock Cash Funds: Treasury,

SL Agency Shares | | | | | |

0.00%d,e | | | 15,227 | | | | 15,227 | |

| | | | | | | | |

| | | | 273,530 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS | | | | | |

(Cost: $273,530) | | | | 273,530 | |

| | | | | | | | |

TOTAL INVESTMENTS

IN SECURITIES — 100.53% | | | | | |

(Cost: $30,130,142) | | | | | | | 30,738,275 | |

Other Assets, Less Liabilities — (0.53)% | | | | (162,780 | ) |

| | | | | | | | |

NET ASSETS — 100.00% | | | $ | 30,575,495 | |

| | | | | | | | |

FDR — Fiduciary Depositary Receipts

| a | Non-income earning security. |

| b | All or a portion of this security represents a security on loan. See Note 1. |

| c | This security may be resold to qualified institutional buyers under Rule 144A of the Securities Act of 1933. |

| d | Affiliated issuer. See Note 2. |

| e | The rate quoted is the annualized seven-day yield of the fund at period end. |

| f | All or a portion of this security represents an investment of securities lending collateral. See Note 1. |

See notes to financial statements.

| | | | |

SCHEDULESOF INVESTMENTS | | | 17 | |

Schedule of Investments

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

July 31, 2014

| | | | | | | | |

| Security | | Shares | | | Value | |

COMMON STOCKS — 99.40% | | | | | | | | |

| | |

AUSTRALIA — 6.56% | | | | | | | | |

Acrux Ltd. | | | 4,720 | | | $ | 8,052 | |

Arrium Ltd. | | | 40,964 | | | | 31,419 | |

Atlas Iron Ltd. | | | 17,516 | | | | 10,422 | |

Ausdrill Ltd. | | | 15,256 | | | | 15,460 | |

BC Iron Ltd. | | | 12,320 | | | | 38,714 | |

BWP Trust | | | 7,872 | | | | 18,736 | |

Cabcharge Australia Ltd. | | | 4,752 | | | | 20,411 | |

Charter Hall Group | | | 2,844 | | | | 11,475 | |

Credit Corp. Group Ltd. | | | 3,048 | | | | 25,022 | |

CSR Ltd. | | | 3,628 | | | | 12,750 | |

David Jones Ltd. | | | 5,850 | | | | 21,701 | |

Evolution Mining Ltd. | | | 12,984 | | | | 9,416 | |

Goodman Fielder Ltd. | | | 30,272 | | | | 18,012 | |

Hills Ltd. | | | 20,628 | | | | 35,000 | |

iiNET Ltd. | | | 2,484 | | | | 17,621 | |

Investa Office Fund | | | 4,904 | | | | 16,276 | |

Iress Ltd. | | | 1,160 | | | | 9,447 | |

M2 Group Ltd. | | | 6,492 | | | | 36,696 | |

MACA Ltd. | | | 26,252 | | | | 50,033 | |

McMillan Shakespeare Ltd. | | | 2,148 | | | | 18,971 | |

Medusa Mining Ltd.a | | | 8,228 | | | | 12,737 | |

Mount Gibson Iron Ltd. | | | 10,828 | | | | 7,399 | |

Myer Holdings Ltd. | | | 16,344 | | | | 34,645 | |

NRW Holdings Ltd. | | | 15,720 | | | | 15,784 | |

OZ Minerals Ltd. | | | 2,844 | | | | 12,295 | |

RCR Tomlinson Ltd. | | | 3,724 | | | | 10,179 | |

Reject Shop Ltd. (The)b | | | 1,040 | | | | 9,340 | |

Resolute Mining Ltd.a | | | 22,100 | | | | 12,328 | |

Roc Oil Co. Ltd.a | | | 51,472 | | | | 29,669 | |

SMS Management & Technology Ltd. | | | 2,620 | | | | 10,011 | |

Sundance Energy Australia Ltd.a | | | 32,592 | | | | 41,512 | |

Tassal Group Ltd. | | | 3,076 | | | | 11,468 | |

Thorn Group Ltd. | | | 2,380 | | | | 5,045 | |

Tiger Resources Ltd.a | | | 32,668 | | | | 9,871 | |

| | | | | | | | |

| | | | | | | 647,917 | |

AUSTRIA — 0.28% | | | | | | | | |

Austria Technologie & Systemtechnik AG | | | 1,480 | | | | 17,101 | |

S IMMO AG | | | 1,360 | | | | 10,827 | |

| | | | | | | | |

| | | | | | | 27,928 | |

BELGIUM — 3.97% | | | | | | | | |

Ablynx NVa | | | 816 | | | | 9,608 | |

Agfa-Gevaert NVa | | | 10,500 | | | | 31,343 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

Arseus NV | | | 1,016 | | | $ | 54,750 | |

Barco NV | | | 188 | | | | 13,835 | |

Bekaert NV | | | 304 | | | | 11,363 | |

Compagnie d’Entreprises CFE SA | | | 560 | | | | 55,012 | |

Econocom Group SA | | | 880 | | | | 8,013 | |

Elia System Operator SA | | | 296 | | | | 14,396 | |

Galapagos NVa,b | | | 1,104 | | | | 21,611 | |

GIMV NV | | | 156 | | | | 7,637 | |

Intervest Offices & Warehouses NV | | | 208 | | | | 6,152 | |

Mobistar SAa | | | 7,432 | | | | 147,917 | |

Tessenderlo Chemie NVa | | | 368 | | | | 10,653 | |

| | | | | | | | |

| | | | | | | 392,290 | |

CANADA — 7.18% | | | | | | | | |

AG Growth International Inc. | | | 264 | | | | 11,827 | |

Alaris Royalty Corp. | | | 480 | | | | 13,928 | |

Alliance Grain Traders Inc. | | | 568 | | | | 10,910 | |

Allied Properties Real Estate Investment Trust | | | 392 | | | | 12,588 | |

Artis Real Estate Investment Trust | | | 824 | | | | 11,770 | |

Black Diamond Group Ltd. | | | 368 | | | | 9,908 | |

BRP Inc.a | | | 2,564 | | | | 61,306 | |

Calloway Real Estate Investment Trust | | | 1,208 | | | | 29,128 | |

Canadian Apartment Properties Real Estate Investment Trust | | | 1,168 | | | | 24,676 | |

Capstone Infrastructure Corp. | | | 2,940 | | | | 11,991 | |

Cineplex Inc. | | | 184 | | | | 6,588 | |

Cogeco Cable Inc. | | | 1,528 | | | | 85,085 | |

DirectCash Payments Inc. | | | 648 | | | | 8,672 | |

Granite Real Estate Investment Trust | | | 864 | | | | 32,150 | |

Laurentian Bank of Canada | | | 3,980 | | | | 188,462 | |

Mainstreet Equity Corp.a | | | 292 | | | | 10,890 | |

Manitoba Telecom Services Inc. | | | 236 | | | | 6,803 | |

Norbord Inc. | | | 624 | | | | 13,006 | |

NorthWest Healthcare Properties Real Estate Investment Trust | | | 1,072 | | | | 9,739 | |

Premium Brands Holdings Corp. | | | 872 | | | | 17,878 | |

ShawCor Ltd. | | | 1,804 | | | | 91,455 | |

Total Energy Services Inc. | | | 536 | | | | 10,709 | |

Transcontinental Inc. Class A | | | 856 | | | | 10,937 | |

TransForce Inc. | | | 504 | | | | 12,764 | |

Yellow Media Ltd.a | | | 368 | | | | 5,993 | |

| | | | | | | | |

| | | | | | | 709,163 | |

DENMARK — 6.61% | | | | | | | | |

Alm. Brand A/Sa | | | 2,780 | | | | 14,270 | |

Auriga Industries A/S Class Ba | | | 752 | | | | 40,490 | |

| | |

| 18 | | 2014 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

July 31, 2014

| | | | | | | | |

| Security | | Shares | | | Value | |

DFDS A/S | | | 812 | | | $ | 65,216 | |

IC Companys A/S | | | 768 | | | | 24,535 | |

Matas A/S | | | 3,220 | | | | 81,774 | |

Royal Unibrew A/Sa | | | 512 | | | | 74,983 | |

Schouw & Co. A/S | | | 2,112 | | | | 97,795 | |

Sydbank A/Sa | | | 7,364 | | | | 201,685 | |

Topdanmark A/Sa | | | 1,688 | | | | 52,138 | |

| | | | | | | | |

| | | | | | | 652,886 | |

FINLAND — 1.61% | | | | | | | | |

Citycon OYJ | | | 1,860 | | | | 6,844 | |

HKScan OYJ Class A | | | 3,728 | | | | 18,755 | |

PKC Group OYJ | | | 328 | | | | 9,084 | |

Sanoma OYJ | | | 4,144 | | | | 32,520 | |

Tieto OYJ | | | 3,440 | | | | 91,594 | |

| | | | | | | | |

| | | | | | | 158,797 | |

FRANCE — 3.16% | | | | | | | | |

Assystem | | | 328 | | | | 9,414 | |

Belvedere SAa | | | 2,212 | | | | 24,950 | |

Cegedim SAa | | | 272 | | | | 9,524 | |

Cegid Group | | | 264 | | | | 10,646 | |

Compagnie des Alpesa | | | 604 | | | | 12,850 | |

Euro Disney SCA Registereda | | | 928 | | | | 4,607 | |

Groupe Steria SCA | | | 1,080 | | | | 29,985 | |

Interparfums SA | | | 1,132 | | | | 36,730 | |

Jacquet Metal Service SA | | | 472 | | | | 9,757 | |

Montupet | | | 176 | | | | 10,950 | |

MPI | | | 9,568 | | | | 54,152 | |

Seche Environnement SA | | | 192 | | | | 5,970 | |

Soitec SAa,b | | | 4,312 | | | | 13,097 | |

Solocal Groupa | | | 6,168 | | | | 5,034 | |

Tessi SA | | | 40 | | | | 5,325 | |

Ubisoft Entertainment SAa | | | 4,128 | | | | 69,179 | |

| | | | | | | | |

| | | | | | | 312,170 | |

GERMANY — 4.32% | | | | | | | | |

Alstria Office REIT AG | | | 4,088 | | | | 54,085 | |

Amadeus Fire AG | | | 112 | | | | 7,999 | |

Balda AG | | | 3,816 | | | | 14,868 | |

Bauer AGa | | | 536 | | | | 11,658 | |

CANCOM SE | | | 216 | | | | 10,088 | |

CENTROTEC Sustainable AG | | | 616 | | | | 13,196 | |

CropEnergies AG | | | 1,344 | | | | 7,912 | |

Deutsche Beteiligungs AG | | | 572 | | | | 16,799 | |

DIC Asset AG | | | 1,408 | | | | 13,348 | |

Draegerwerk AG & Co. KGaA | | | 128 | | | | 10,154 | |

Gerresheimer AG | | | 1,096 | | | | 75,815 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

Gesco AG | | | 120 | | | $ | 11,742 | |

Indus Holding AG | | | 440 | | | | 23,166 | |

Init Innovation in Traffic Systems AG | | | 296 | | | | 7,654 | |

OHB AG | | | 588 | | | | 16,915 | |

Pfeiffer Vacuum Technology AG | | | 312 | | | | 31,017 | |

TAG Immobilien AG | | | 6,196 | | | | 75,607 | |

VTG AG | | | 596 | | | | 12,269 | |

Wacker Neuson SE | | | 584 | | | | 12,834 | |

| | | | | | | | |

| | | | | | | 427,126 | |

HONG KONG — 0.20% | | | | | | | | |

SmarTone Telecommunications Holding Ltd. | | | 8,000 | | | | 11,623 | |

United Photovoltaics Group Ltd.a,b | | | 64,000 | | | | 8,589 | |

| | | | | | | | |

| | | | | | | 20,212 | |

ISRAEL — 0.11% | | | | | | | | |

Ituran Location and Control Ltd. | | | 456 | | | | 10,667 | |

| | | | | | | | |

| | | | | | | 10,667 | |

ITALY — 0.31% | | | | | | | | |

Banca IFIS SpA | | | 560 | | | | 10,303 | |

Banca Profilo SpA | | | 21,308 | | | | 10,323 | |

Juventus Football Club SpAa | | | 32,132 | | | | 9,759 | |

| | | | | | | | |

| | | | | | | 30,385 | |

JAPAN — 26.84% | | | | | | | | |

Accordia Golf Co. Ltd. | | | 800 | | | | 10,059 | |

Achilles Corp. | | | 8,000 | | | | 11,358 | |

Aderans Co. Ltd. | | | 800 | | | | 11,848 | |

Aeon Fantasy Co. Ltd.b | | | 2,000 | | | | 27,189 | |

Aichi Corp. | | | 2,400 | | | | 11,179 | |

AIFUL Corp.a | | | 3,200 | | | | 17,457 | |

Alpen Co. Ltd. | | | 800 | | | | 13,420 | |

Aoki Holdings Inc. | | | 800 | | | | 10,557 | |

Arc Land Sakamoto Co. Ltd. | | | 800 | | | | 17,784 | |

Asahi Co. Ltd. | | | 800 | | | | 10,798 | |

Asahi Diamond Industrial Co. Ltd. | | | 800 | | | | 11,770 | |

Avex Group Holdings Inc. | | | 800 | | | | 13,832 | |

Axell Corp. | | | 800 | | | | 12,657 | |

Capcom Co. Ltd. | | | 1,600 | | | | 29,422 | |

Cawachi Ltd. | | | 800 | | | | 14,524 | |

CKD Corp. | | | 800 | | | | 7,250 | |

Coca-Cola West Co. Ltd. | | | 800 | | | | 13,396 | |

cocokara fine Inc. | | | 800 | | | | 22,039 | |

Comforia Residential REIT Inc. | | | 32 | | | | 58,688 | |

Cosmo Oil Co. Ltd. | | | 8,000 | | | | 16,181 | |

Dai-ichi Seiko Co. Ltd. | | | 800 | | | | 13,599 | |

Daikoku Denki Co. Ltd. | | | 1,200 | | | | 20,783 | |

| | | | |

SCHEDULESOF INVESTMENTS | | | 19 | |

Schedule of Investments (Continued)

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

July 31, 2014

| | | | | | | | |

| Security | | Shares | | | Value | |

Daikyo Inc. | | | 20,000 | | | $ | 42,593 | |

Denki Kagaku Kogyo K.K. | | | 8,000 | | | | 30,184 | |

Doshisha Co. Ltd. | | | 800 | | | | 14,843 | |

Duskin Co. Ltd. | | | 800 | | | | 14,719 | |

Dydo Drinco Inc. | | | 800 | | | | 35,513 | |

EDION Corp. | | | 1,600 | | | | 10,673 | |

Endo Lighting Corp. | | | 800 | | | | 11,024 | |

Financial Products Group Co. Ltd. | | | 1,200 | | | | 11,179 | |

Foster Electric Co. Ltd. | | | 3,200 | | | | 42,476 | |

France Bed Holdings Co. Ltd. | | | 8,000 | | | | 14,703 | |

Fuji Oil Co. Ltd.b | | | 3,200 | | | | 11,047 | |

Fuji Oil Co. Ltd. New | | | 800 | | | | 12,813 | |

Fuji Soft Inc. | | | 800 | | | | 17,908 | |

Fujibo Holdings Inc. | | | 8,000 | | | | 22,249 | |

GCA Savvian Group Corp. | | | 2,000 | | | | 16,726 | |

Geo Holdings Corp. | | | 8,400 | | | | 71,637 | |

Godo Steel Ltd. | | | 8,000 | | | | 13,303 | |

Hakuto Co. Ltd. | | | 800 | | | | 8,285 | |

Heiwa Corp. | | | 800 | | | | 18,997 | |

Heiwado Co. Ltd. | | | 800 | | | | 13,210 | |

Hitachi Koki Co. Ltd. | | | 1,600 | | | | 13,614 | |

Hokuetsu Bank Ltd. (The) | | | 4,000 | | | | 8,207 | |

Hokuetsu Kishu Paper Co. Ltd. | | | 4,000 | | | | 17,776 | |

Hokuto Corp. | | | 800 | | | | 15,263 | |

Honeys Co. Ltd. | | | 880 | | | | 9,054 | |

Hoosiers Holdings Co. Ltd. | | | 1,600 | | | | 7,577 | |

Hosiden Corp. | | | 2,400 | | | | 14,540 | |

Ines Corp. | | | 3,200 | | | | 25,361 | |

IT Holdings Corp. | | | 800 | | | | 14,797 | |

IwaiCosmo Holdings Inc. | | | 800 | | | | 8,176 | |

J-Oil Mills Inc. | | | 4,000 | | | | 12,797 | |

Japan Hotel REIT Investment Corp. | | | 24 | | | | 13,303 | |

Japan Petroleum Exploration Co. Ltd. | | | 800 | | | | 30,495 | |

Japan Rental Housing Investments Inc. | | | 16 | | | | 11,778 | |

Juki Corp.a | | | 8,000 | | | | 18,671 | |

JVC Kenwood Corp.a | | | 4,800 | | | | 11,016 | |

Kamei Corp. | | | 800 | | | | 6,052 | |

Kanematsu Corp. | | | 8,000 | | | | 14,470 | |

Kasumi Co. Ltd. | | | 1,600 | | | | 12,494 | |

Keiyo Co. Ltd. | | | 2,400 | | | | 11,506 | |

Kenedix Residential Investment Corp. | | | 16 | | | | 37,341 | |

KEY Coffee Inc. | | | 800 | | | | 12,766 | |

Kinugawa Rubber Industrial Co. Ltd. | | | 8,000 | | | | 43,176 | |

Koei Tecmo Holdings Co. Ltd. | | | 800 | | | | 11,809 | |

Kohnan Shoji Co. Ltd. | | | 14,800 | | | | 153,275 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

Kura Corp. | | | 400 | | | $ | 10,701 | |

Maruha Nichiro Corp. | | | 800 | | | | 12,696 | |

Megachips Corp. | | | 3,200 | | | | 45,152 | |

Mimasu Semiconductor Industry Co. Ltd. | | | 800 | | | | 7,204 | |

Ministop Co. Ltd. | | | 800 | | | | 12,719 | |

Mitsubishi Steel Manufacturing Co. Ltd. | | | 8,000 | | | | 17,815 | |

Mitsui Matsushima Co. Ltd. | | | 8,000 | | | | 10,658 | |

Mitsui Mining & Smelting Co. Ltd. | | | 8,000 | | | | 24,039 | |

Monex Group Inc. | | | 2,400 | | | | 7,842 | |

Morinaga & Co. Ltd. | | | 8,000 | | | | 17,037 | |

Morinaga Milk Industry Co. Ltd. | | | 8,000 | | | | 28,940 | |

Musashi Seimitsu Industry Co. Ltd. | | | 800 | | | | 19,822 | |

NEC Capital Solutions Ltd. | | | 400 | | | | 8,390 | |

Net One Systems Co. Ltd. | | | 1,600 | | | | 10,627 | |

Nichi-Iko Pharmaceutical Co. Ltd. | | | 800 | | | | 11,708 | |

Nichii Gakkan Co. | | | 800 | | | | 6,854 | |

Nippon Chemi-Con Corp.a | | | 8,000 | | | | 21,082 | |

Nippon Coke & Engineering Co. Ltd. | | | 12,800 | | | | 14,563 | |

Nippon Denko Co. Ltd. | | | 4,000 | | | | 12,797 | |

Nippon Konpo Unyu Soko Co. Ltd. | | | 800 | | | | 13,871 | |

Nippon Signal Co. Ltd. (The) | | | 800 | | | | 7,569 | |

Nipro Corp. | | | 800 | | | | 6,908 | |

Nissha Printing Co. Ltd. | | | 800 | | | | 11,755 | |

Nisshin OilliO Group Ltd. (The) | | | 8,000 | | | | 27,073 | |

Odelic Co. Ltd.b | | | 1,200 | | | | 33,829 | |

Oki Electric Industry Co. Ltd. | | | 16,000 | | | | 35,941 | |

Okinawa Electric Power Co. Inc. (The) | | | 800 | | | | 25,828 | |

Pacific Industrial Co. Ltd. | | | 1,600 | | | | 11,918 | |

Press Kogyo Co. Ltd. | | | 4,000 | | | | 15,442 | |

Prima Meat Packers Ltd. | | | 8,000 | | | | 20,927 | |

Riso Kagaku Corp. | | | 800 | | | | 23,611 | |

Ryoyo Electro Corp. | | | 800 | | | | 8,962 | |

Saizeriya Co. Ltd. | | | 1,600 | | | | 21,596 | |

Sanshin Electronics Co. Ltd. | | | 1,600 | | | | 13,038 | |

Sanyo Shokai Ltd. | | | 8,000 | | | | 18,437 | |

Sapporo Holdings Ltd. | | | 8,000 | | | | 34,774 | |

Senshu Ikeda Holdings Inc. | | | 6,400 | | | | 32,798 | |

Shima Seiki Manufacturing Ltd. | | | 800 | | | | 15,481 | |

Shimachu Co. Ltd. | | | 800 | | | | 18,671 | |

Shinko Electric Industries Co. Ltd. | | | 8,000 | | | | 72,038 | |

Showa Corp. | | | 800 | | | | 9,001 | |

SKY Perfect JSAT Holdings Inc. | | | 1,600 | | | | 9,600 | |

Sodick Co. Ltd. | | | 2,400 | | | | 16,827 | |

| | |

| 20 | | 2014 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

July 31, 2014

| | | | | | | | |

| Security | | Shares | | | Value | |

Stella Chemifa Corp. | | | 1,200 | | | $ | 16,349 | |

Systena Corp. | | | 800 | | | | 6,052 | |

Tachi-S Co. Ltd. | | | 800 | | | | 13,575 | |

Taiho Kogyo Co. Ltd. | | | 800 | | | | 8,853 | |

Taikisha Ltd. | | | 800 | | | | 18,694 | |

Tama Home Co. Ltd.b | | | 4,000 | | | | 26,061 | |

Tamron Co. Ltd. | | | 800 | | | | 18,002 | |

Tatsuta Electric Wire and Cable Co. Ltd. | | | 1,600 | | | | 9,366 | |

TOKAI Holdings Corp. | | | 3,200 | | | | 13,599 | |

Tokai Rika Co. Ltd. | | | 800 | | | | 16,866 | |

TOKO Inc. | | | 8,000 | | | | 22,794 | |

Tokyo Seimitsu Co. Ltd. | | | 800 | | | | 14,314 | |

Tokyo Tomin Bank Ltd. (The) | | | 800 | | | | 9,553 | |

Tomy Co. Ltd. | | | 2,400 | | | | 12,533 | |

TOPY Industries Ltd. | | | 8,000 | | | | 16,726 | |

Toridoll Corp. | | | 800 | | | | 6,721 | |

Towa Bank Ltd. (The) | | | 44,000 | | | | 43,643 | |

Toyo Tire & Rubber Co. Ltd. | | | 4,000 | | | | 73,516 | |

TPR Co. Ltd. | | | 800 | | | | 18,966 | |

UKC Holdings Corp. | | | 1,200 | | | | 18,892 | |

Unipres Corp. | | | 800 | | | | 17,473 | |

ValueCommerce Co. Ltd. | | | 800 | | | | 6,667 | |

Warabeya Nichiyo Co. Ltd. | | | 800 | | | | 16,103 | |

Watami Co. Ltd. | | | 800 | | | | 10,852 | |

Yachiyo Bank Ltd. (The) | | | 800 | | | | 25,672 | |

Yahagi Construction Co. Ltd. | | | 800 | | | | 6,161 | |

Yellow Hat Ltd. | | | 800 | | | | 17,667 | |

Yokohama Reito Co. Ltd. | | | 1,600 | | | | 13,567 | |

| | | | | | | | |

| | | | | | | 2,650,964 | |

NETHERLANDS — 1.16% | | | | | | | | |

Amsterdam Commodities NV | | | 584 | | | | 13,284 | |

BE Semiconductor Industries NV | | | 1,352 | | | | 22,558 | |

Corbion NV | | | 368 | | | | 7,014 | |

Eurocommercial Properties NV | | | 904 | | | | 45,152 | |

Kendrion NV | | | 152 | | | | 4,739 | |

Koninklijke Wessanen NV | | | 3,724 | | | | 21,675 | |

| | | | | | | | |

| | | | | | | 114,422 | |

NORWAY — 3.97% | | | | | | | | |

Atea ASA | | | 2,412 | | | | 28,436 | |

Bakkafrost P/F | | | 680 | | | | 13,280 | |

BW Offshore Ltd. | | | 20,032 | | | | 26,558 | |

Deep Sea Supply PLCa | | | 5,220 | | | | 8,098 | |

Dolphin Group ASAa | | | 56,616 | | | | 50,251 | |

Electromagnetic GeoServices ASa | | | 22,024 | | | | 19,583 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

Fred Olsen Energy ASA | | | 6,340 | | | $ | 143,852 | |

Kvaerner ASA | | | 16,872 | | | | 29,468 | |

Norwegian Air Shuttle ASa,b | | | 1,140 | | | | 34,573 | |

Polarcus Ltd.a | | | 64,348 | | | | 33,512 | |

Songa Offshore SEa | | | 11,516 | | | | 4,681 | |

| | | | | | | | |

| | | | | | | 392,292 | |

PORTUGAL — 0.18% | | | | | | | | |

BANIF – Banco Internacional do Funchal SAa | | | 1,075,916 | | | | 12,956 | |

Mota-Engil SGPS SA | | | 729 | | | | 4,557 | |

| | | | | | | | |

| | | | | | | 17,513 | |

SINGAPORE — 3.70% | | | | | | | | |

AIMS AMP Capital Industrial REIT | | | 24,000 | | | | 28,753 | |

Blumont Group Ltd.a | | | 216,000 | | | | 8,482 | |

Cambridge Industrial Trust | | | 96,000 | | | | 55,006 | |

Charisma Energy Services Ltd.a | | | 256,000 | | | | 10,258 | |

Chip Eng Seng Corp. Ltd. | | | 20,000 | | | | 13,303 | |

CSE Global Ltd. | | | 136,000 | | | | 79,016 | |

Far East Hospitality Trust | | | 16,000 | | | | 11,219 | |

First REIT | | | 12,000 | | | | 11,732 | |

Frasers Centrepoint Trust | | | 16,000 | | | | 24,875 | |

Ho Bee Land Ltd. | | | 8,000 | | | | 14,425 | |

Hong Fok Corp. Ltd. | | | 8,000 | | | | 6,828 | |

k1 Ventures Ltd. | | | 56,000 | | | | 9,200 | |

Perennial China Retail Trust | | | 24,000 | | | | 10,482 | |

Rotary Engineering Ltd. | | | 76,000 | | | | 45,374 | |

Swiber Holdings Ltd.b | | | 56,000 | | | | 23,560 | |

Wing Tai Holdings Ltd. | | | 8,000 | | | | 12,662 | |

| | | | | | | | |

| | | | | | | 365,175 | |

SPAIN — 0.51% | | | | | | | | |

Duro Felguera SA | | | 4,072 | | | | 25,498 | |

Viscofan SA | | | 456 | | | | 25,559 | |

| | | | | | | | |

| | | | | | | 51,057 | |

SWEDEN — 3.86% | | | | | | | | |

Bure Equity AB | | | 2,040 | | | | 8,803 | |

Fastighets AB Balder Class Ba | | | 684 | | | | 8,691 | |

Gunnebo AB | | | 4,416 | | | | 26,154 | |

Haldex AB | | | 960 | | | | 12,650 | |

HIQ International AB | | | 1,632 | | | | 8,767 | |

Industrial & Financial Systems Class B | | | 368 | | | | 12,043 | |

Klovern AB | | | 6,532 | | | | 32,537 | |

Kungsleden AB | | | 9,548 | | | | 67,055 | |

Loomis AB Class B | | | 568 | | | | 16,902 | |

Nolato AB | | | 424 | | | | 10,376 | |

| | | | |

SCHEDULESOF INVESTMENTS | | | 21 | |

Schedule of Investments (Continued)

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

July 31, 2014

| | | | | | | | |

| Security | | Shares | | | Value | |

Oriflame Cosmetics SA SDRb | | | 4,516 | | | $ | 97,828 | |

Peab AB | | | 3,252 | | | | 22,942 | |

Tethys Oil ABa | | | 2,460 | | | | 27,250 | |

Wihlborgs Fastigheter AB | | | 1,560 | | | | 29,027 | |

| | | | | | | | |

| | | | | | | 381,025 | |

SWITZERLAND — 8.48% | | | | | | | | |

Autoneum Holding AG | | | 412 | | | | 70,683 | |

BKW AG | | | 688 | | | | 24,401 | |

Bossard Holding AG | | | 96 | | | | 11,202 | |

EFG International AG | | | 952 | | | | 11,359 | |

Emmi AG | | | 104 | | | | 35,885 | |

Forbo Holding AG Registered | | | 132 | | | | 128,981 | |

GAM Holding AG | | | 3,372 | | | | 61,188 | |

Gategroup Holding AG | | | 312 | | | | 7,909 | |

Implenia AG Registered | | | 668 | | | | 39,339 | |

Intershop Holdings AG Bearer | | | 60 | | | | 23,293 | |

Komax Holding AG Registered | | | 380 | | | | 58,507 | |

Kudelski SA Bearer | | | 2,092 | | | | 35,660 | |

LEM Holding SA Registered | | | 8 | | | | 6,713 | |

Leonteq AG | | | 72 | | | | 14,403 | |

Micronas Semiconductor Holding AG Registered | | | 1,420 | | | | 11,650 | |

Mobilezone Holding AG Bearera | | | 5,836 | | | | 65,144 | |

Rieter Holding AG Registered | | | 104 | | | | 24,156 | |

Schweizerische National-Versicherungs-Gesellschaft AG Registered | | | 536 | | | | 47,717 | |

Siegfried Holding AG Registered | | | 184 | | | | 32,134 | |

St Galler Kantonalbank AG Registered | | | 64 | | | | 24,353 | |

Swisslog Holding AG Registereda | | | 17,088 | | | | 21,235 | |

Swissquote Group Holding SA Registered | | | 240 | | | | 7,918 | |

Temenos Group AG Registered | | | 780 | | | | 27,964 | |

U-Blox AG | | | 168 | | | | 21,838 | |

Vetropack Holding AG Bearer | | | 4 | | | | 6,972 | |

Vontobel Holding AG Registered | | | 468 | | | | 16,779 | |

| | | | | | | | |

| | | | | | | 837,383 | |

UNITED KINGDOM — 16.39% | | | | | | | | |

African Minerals Ltd.a,b | | | 14,556 | | | | 17,141 | |

Awilco Drilling PLC | | | 216 | | | | 5,367 | |

Bank of Georgia Holdings PLC | | | 280 | | | | 11,511 | |

Beazley PLC | | | 9,032 | | | | 37,268 | |

Berendsen PLC | | | 3,468 | | | | 61,302 | |

Big Yellow Group PLC | | | 1,096 | | | | 9,280 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

Cape PLC | | | 3,612 | | | $ | 17,319 | |

Carillion PLC | | | 1,640 | | | | 9,256 | |

Centamin PLCa | | | 46,192 | | | | 56,267 | |

Chesnara PLC | | | 1,712 | | | | 8,960 | |

COLT Group SAa | | | 6,788 | | | | 16,617 | |

CSR PLC | | | 872 | | | | 7,781 | |

Dairy Crest Group PLC | | | 4,720 | | | | 33,445 | |

Dart Group PLC | | | 10,448 | | | | 36,866 | |

De La Rue PLC | | | 1,216 | | | | 14,987 | |

Debenhams PLC | | | 119,308 | | | | 133,043 | |

Devro PLC | | | 1,948 | | | | 8,386 | |

EnQuest PLCa | | | 43,892 | | | | 100,261 | |

Fenner PLC | | | 1,432 | | | | 8,244 | |

FirstGroup PLCa | | | 11,616 | | | | 24,808 | |

Globo PLCa,b | | | 38,752 | | | | 31,568 | |

Go-Ahead Group PLC (The) | | | 288 | | | | 10,721 | |

Greencore Group PLC | | | 2,436 | | | | 10,870 | |

Greggs PLC | | | 2,844 | | | | 25,136 | |

Halfords Group PLC | | | 1,328 | | | | 10,762 | |

Hargreaves Services PLC | | | 3,752 | | | | 50,391 | |

Imagination Technologies Group PLCa,b | | | 3,252 | | | | 9,778 | |

Innovation Group PLC | | | 41,680 | | | | 21,814 | |

Intermediate Capital Group PLC | | | 1,488 | | | | 10,122 | |

Interserve PLC | | | 1,056 | | | | 11,348 | |

IQE PLCa | | | 74,508 | | | | 23,900 | |

Kcom Group PLC | | | 6,044 | | | | 10,255 | |

Laird PLC | | | 1,848 | | | | 9,020 | |

Lancashire Holdings Ltd. | | | 12,328 | | | | 127,482 | |

LondonMetric Property PLC | | | 6,284 | | | | 14,959 | |

Mitie Group PLC | | | 13,780 | | | | 70,958 | |

Moneysupermarket.com Group PLC | | | 3,388 | | | | 10,622 | |

Morgan Advanced Materials PLC | | | 1,808 | | | | 9,585 | |

Northgate PLC | | | 20,548 | | | | 171,027 | |

Optimal Payments PLCa | | | 6,756 | | | | 51,670 | |

Pace PLC | | | 13,348 | | | | 72,091 | |

Paragon Group of Companies PLC (The) | | | 2,812 | | | | 16,365 | |

Premier Farnell PLC | | | 4,576 | | | | 13,968 | |

QinetiQ Group PLC | | | 4,088 | | | | 14,273 | |

Restaurant Group PLC (The) | | | 944 | | | | 9,817 | |

Salamander Energy PLCa | | | 8,512 | | | | 16,203 | |

Shanks Group PLC | | | 7,532 | | | | 13,702 | |

SOCO International PLC | | | 1,792 | | | | 13,009 | |

Speedy Hire PLC | | | 9,524 | | | | 8,482 | |

Spirent Communications PLC | | | 5,756 | | | | 10,000 | |

| | |

| 22 | | 2014 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

July 31, 2014

| | | | | | | | |

| Security | | Shares | | | Value | |

Stobart Group Ltd. | | | 4,176 | | | $ | 8,883 | |

Synergy Health PLC | | | 1,384 | | | | 31,801 | |

Tipp24 SE | | | 136 | | | | 6,605 | |

Trinity Mirror PLCa | | | 6,100 | | | | 20,391 | |

TT electronics PLC | | | 9,080 | | | | 28,360 | |

Vesuvius PLC | | | 1,384 | | | | 10,872 | |

Xchanging PLC | | | 4,696 | | | | 13,974 | |

| | | | | | | | |

| | | | | | | 1,618,893 | |

| | | | | | | | |

TOTAL COMMON STOCKS | | | | | |

(Cost: $9,855,354) | | | | 9,818,265 | |

| | |

RIGHTS — 0.01% | | | | | | | | |

| | |

SWITZERLAND — 0.01% | | | | | | | | |

Leonteq AGa | | | 72 | | | | 618 | |

| | | | | | | | |

| | | | | | | 618 | |

| | | | | | | | |

TOTAL RIGHTS | | | | | |

(Cost: $0) | | | | 618 | |

|

SHORT-TERM INVESTMENTS — 3.33% | |

| | |

MONEY MARKET FUNDS — 3.33% | | | | | | | | |

BlackRock Cash Funds: Institutional,

SL Agency Shares | | | | | | | | |

0.14%c,d,e | | | 278,051 | | | | 278,051 | |

BlackRock Cash Funds: Prime,

SL Agency Shares | | | | | | | | |

0.12%c,d,e | | | 17,343 | | | | 17,343 | |

BlackRock Cash Funds: Treasury,

SL Agency Shares | | | | | | | | |

0.00%c,d | | | 34,303 | | | | 34,303 | |

| | | | | | | | |

| | | | | | | 329,697 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS | | | | | |

(Cost: $329,697) | | | | 329,697 | |

| | | | | | | | |

TOTAL INVESTMENTS

IN SECURITIES — 102.74% | | | | | |

(Cost: $10,185,051) | | | | | | | 10,148,580 | |

Other Assets, Less Liabilities — (2.74)% | | | | (270,865 | ) |

| | | | | | | | |

NET ASSETS — 100.00% | | | $ | 9,877,715 | |

| | | | | | | | |

SDR — Swedish Depositary Receipts

| a | Non-income earning security. |

| b | All or a portion of this security represents a security on loan. See Note 1. |

| c | Affiliated issuer. See Note 2. |

| d | The rate quoted is the annualized seven-day yield of the fund at period end. |

| e | All or a portion of this security represents an investment of securities lending collateral. See Note 1. |

See notes to financial statements.

| | | | |

SCHEDULESOF INVESTMENTS | | | 23 | |

Schedule of Investments

iSHARES® ENHANCED U.S. LARGE-CAP ETF

July 31, 2014

| | | | | | | | |

| Security | | Shares | | | Value | |

COMMON STOCKS — 99.73% | | | | | |

| |

AEROSPACE & DEFENSE — 2.67% | | | | | |

General Dynamics Corp. | | | 11,791 | | | $ | 1,376,835 | |

L-3 Communications Holdings Inc. | | | 1,406 | | | | 147,574 | |

| | | | | | | | |

| | | | | | | 1,524,409 | |

AIR FREIGHT & LOGISTICS — 3.63% | | | | | |

FedEx Corp. | | | 6,795 | | | | 998,050 | |

United Parcel Service Inc. Class B | | | 11,050 | | | | 1,072,844 | |

| | | | | | | | |

| | | | | | | 2,070,894 | |

AIRLINES — 1.37% | | | | | | | | |

Allegiant Travel Co. | | | 6,614 | | | | 778,865 | |

| | | | | | | | |

| | | | | | | 778,865 | |

BEVERAGES — 0.32% | | | | | | | | |

Molson Coors Brewing Co. Class B NVS | | | 573 | | | | 38,695 | |

PepsiCo Inc. | | | 1,641 | | | | 144,572 | |

| | | | | | | | |

| | | | | | | 183,267 | |

CHEMICALS — 0.04% | | | | | | | | |

Sigma-Aldrich Corp. | | | 198 | | | | 19,883 | |

| | | | | | | | |

| | | | | | | 19,883 | |

COMMERCIAL BANKS — 0.48% | | | | | | | | |

BOK Financial Corp. | | | 494 | | | | 32,723 | |

Cullen/Frost Bankers Inc. | | | 1,824 | | | | 142,217 | |

First Citizens BancShares Inc. Class A | | | 266 | | | | 59,145 | |

Prosperity Bancshares Inc. | | | 186 | | | | 10,812 | |

Trustmark Corp. | | | 1,322 | | | | 30,446 | |

| | | | | | | | |

| | | | | | | 275,343 | |

COMMERCIAL SERVICES & SUPPLIES — 0.06% | |

Brady Corp. Class A | | | 865 | | | | 22,620 | |

UniFirst Corp. | | | 115 | | | | 11,179 | |

| | | | | | | | |

| | | | | | | 33,799 | |

COMMUNICATIONS EQUIPMENT — 0.02% | | | | | |

Brocade Communications Systems Inc. | | | 1,406 | | | | 12,949 | |

| | | | | | | | |

| | | | | | | 12,949 | |

COMPUTERS & PERIPHERALS — 3.05% | | | | | |

EMC Corp. | | | 12,084 | | | | 354,061 | |

Western Digital Corp. | | | 13,872 | | | | 1,384,842 | |

| | | | | | | | |

| | | | | | | 1,738,903 | |

CONSUMER FINANCE — 1.65% | | | | | | | | |

Cash America International Inc. | | | 21,166 | | | | 939,559 | |

| | | | | | | | |

| | | | | | | 939,559 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

DIVERSIFIED FINANCIAL SERVICES — 0.37% | | | | | |

CBOE Holdings Inc. | | | 4,329 | | | $ | 209,827 | |

| | | | | | | | |

| | | | | | | 209,827 | |

DIVERSIFIED TELECOMMUNICATION SERVICES — 1.98% | |

AT&T Inc. | | | 31,724 | | | | 1,129,057 | |

| | | | | | | | |

| | | | | | | 1,129,057 | |

ELECTRIC UTILITIES — 2.03% | | | | | | | | |

ALLETE Inc. | | | 648 | | | | 30,404 | |

Duke Energy Corp. | | | 2,195 | | | | 158,325 | |

Great Plains Energy Inc. | | | 2,774 | | | | 68,767 | |

IDACORP Inc. | | | 498 | | | | 26,668 | |

Northeast Utilities | | | 995 | | | | 43,681 | |

Pinnacle West Capital Corp. | | | 14,830 | | | | 793,257 | |

Portland General Electric Co. | | | 1,091 | | | | 34,836 | |

| | | | | | | | |

| | | | | | | 1,155,938 | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS — 0.50% | |

AVX Corp. | | | 4,712 | | | | 64,083 | |

Dolby Laboratories Inc. Class Aa | | | 1,710 | | | | 76,334 | |

Tech Data Corp.a | | | 2,310 | | | | 145,045 | |

| | | | | | | | |

| | | | | | | 285,462 | |

ENERGY EQUIPMENT & SERVICES — 1.42% | | | | | |

Patterson-UTI Energy Inc. | | | 7,410 | | | | 254,533 | |

RPC Inc. | | | 7,182 | | | | 161,595 | |

Unit Corp.a | | | 6,234 | | | | 394,924 | |

| | | | | | | | |

| | | | | | | 811,052 | |

FOOD & STAPLES RETAILING — 2.31% | | | | | |

Costco Wholesale Corp. | | | 680 | | | | 79,927 | |

CVS Caremark Corp. | | | 1,482 | | | | 113,166 | |

Fresh Market Inc. (The)a,b | | | 490 | | | | 14,666 | |

Wal-Mart Stores Inc. | | | 15,083 | | | | 1,109,807 | |

| | | | | | | | |

| | | | | | | 1,317,566 | |

FOOD PRODUCTS — 5.83% | | | | | | | | |

Archer-Daniels-Midland Co. | | | 28,116 | | | | 1,304,582 | |

Bunge Ltd. | | | 7,553 | | | | 595,479 | |

Fresh Del Monte Produce Inc.b | | | 3,078 | | | | 92,155 | |

Hershey Co. (The) | | | 10,138 | | | | 893,665 | |

Hormel Foods Corp. | | | 2,474 | | | | 111,973 | |

Ingredion Inc. | | | 306 | | | | 22,531 | |

J.M. Smucker Co. (The) | | | 2,681 | | | | 267,135 | |

Lancaster Colony Corp. | | | 430 | | | | 37,560 | |

| | | | | | | | |

| | | | | | | 3,325,080 | |

| | |

| 24 | | 2014 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® ENHANCED U.S. LARGE-CAP ETF

July 31, 2014

| | | | | | | | |

| Security | | Shares | | | Value | |

GAS UTILITIES — 0.50% | | | | | | | | |

AGL Resources Inc. | | | 721 | | | $ | 37,233 | |

Atmos Energy Corp. | | | 4,057 | | | | 196,034 | |

New Jersey Resources Corp. | | | 748 | | | | 38,208 | |

Piedmont Natural Gas Co. | | | 315 | | | | 10,927 | |

| | | | | | | | |

| | | | | | | 282,402 | |

HEALTH CARE EQUIPMENT & SUPPLIES — 5.13% | |

Abbott Laboratories | | | 25,650 | | | | 1,080,378 | |

Becton, Dickinson and Co. | | | 2,597 | | | | 301,875 | |

C.R. Bard Inc. | | | 5,569 | | | | 831,062 | |