UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22649

iShares U.S. ETF Trust

(Exact name of Registrant as specified in charter)

|

| c/o: State Street Bank and Trust Company |

| 1 Iron Street, Boston, MA 02210 |

| (Address of principal executive offices) (Zip code) |

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 670-2000

Date of fiscal year end: October 31, 2015

Date of reporting period: October 31, 2015

| Item 1. | Reports to Stockholders. |

Copies of the annual reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 are attached.

OCTOBER 31, 2015

| | | | |

2015 ANNUAL REPORT | | | |  |

iShares U.S. ETF Trust

| Ø | | iShares Short Maturity Bond ETF | NEAR | BATS |

| Ø | | iShares Short Maturity Municipal Bond ETF | MEAR | BATS |

| Ø | | iShares Ultra Short-Term Bond ETF | ICSH | BATS |

Table of Contents

Management’s Discussion of Fund Performance

iSHARES® U.S. ETF TRUST

U.S. BOND MARKET OVERVIEW

U.S. bonds returned approximately 2% for the 12 months ended October 31, 2015 (the “reporting period”). The modest bond market returns reflected an inconsistent but moderate overall level of U.S. economic growth and low inflation. After generating its fastest quarterly growth rate in 11 years in the third quarter of 2014, the U.S. economy slowed over the next two quarters, weighed down by a stronger U.S. dollar (which made U.S. goods more expensive overseas) and severe winter weather in many regions of the country. The economy rebounded in the second and third quarters of 2015, led by strong employment growth — sending the unemployment rate to its lowest level since April 2008 — and robust vehicle sales.

Inflation stayed low throughout the reporting period, with the consumer price index increasing 0.2% for the reporting period. Falling energy prices, including a decline of more than 40% in the price of oil, contributed to the muted inflation rate.

At the beginning of the reporting period, the U.S. Federal Reserve Bank (the “Fed”) ended a two-year quantitative easing program and signaled its intent to raise its short-term interest rate target sometime in 2015. However, the mixed economic data, lack of inflationary pressure, and slowing growth elsewhere in the world (particularly in China and other emerging economies) convinced the Fed to hold short-term interest rates steady throughout the reporting period.

Nonetheless, short-term bond yields generally rose during the reporting period in anticipation of a potential Fed interest rate increase. In contrast, intermediate- and long-term bond yields declined modestly for the reporting period, reflecting the benign inflationary environment and investor demand for U.S. bonds.

A number of other factors buffeted the fixed-income market during the reporting period. Geopolitical conflicts, most notably in Ukraine and across the Middle East, continued to have an effect on financial markets. Greece and Puerto Rico wrestled with potential defaults on their government debt. The U.S. dollar strengthened against most major currencies during the reporting period, which made U.S. investments more attractive to international investors but created headwinds for the domestic economy.

Investor concerns brought on by many of these factors, as well as uncertainty surrounding the strength of the U.S. economy and Fed interest rate policy, led to a flight to quality during the reporting period. As a result, higher-quality bonds outperformed riskier assets for the reporting period.

Mortgage-backed securities were the leading performers for the reporting period. Both residential and commercial mortgage-backed securities benefited from investor demand for high credit quality and relatively high yields. U.S. Treasury bonds were also among the better performers in the fixed-income market. In addition to the flight to quality, Treasury securities benefited from their interest-rate sensitivity as declining yields across most maturity sectors of the Treasury market led to rising bond prices. The primary exception was Treasury inflation-protected securities, which posted negative returns for the reporting period, reflecting a lack of investor demand for inflation protection.

Corporate bonds underperformed the broader bond market for the reporting period. Corporate bonds tend to have greater credit risk than other sectors of the bond market, and the broad flight to quality led to reduced demand for corporate securities. In particular, high-yield corporate bonds were among the only sectors of the bond market to decline for the reporting period.

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 5 | |

Management’s Discussion of Fund Performance

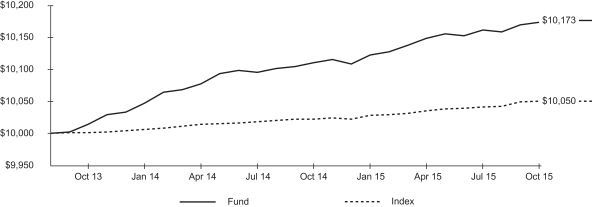

iSHARES® SHORT MATURITY BOND ETF

Performance as of October 31, 2015

| | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since Inception | | | | | 1 Year | | | Since Inception | |

Fund NAV | | | 0.62% | | | | 0.82% | | | | | | 0.62% | | | | 1.73% | |

Fund Market | | | 0.50% | | | | 0.82% | | | | | | 0.50% | | | | 1.73% | |

Barclays Short-Term Government/Corporate Index | | | 0.28% | | | | 0.24% | | | | | | 0.28% | | | | 0.50% | |

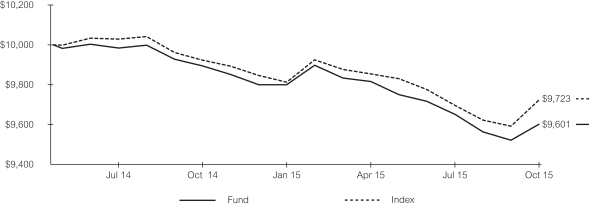

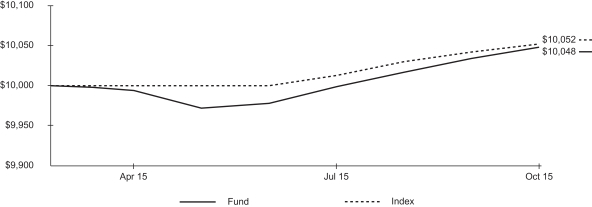

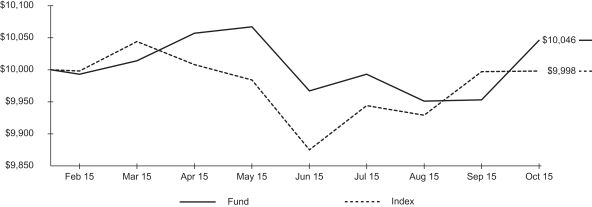

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 9/25/13. The first day of secondary market trading was 9/26/13.

The Barclays Short-Term Government/Corporate Index is an unmanaged index that measures the performance of government and corporate securities with less than 1 year remaining to maturity.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 12 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholder Expenses | |

| Actual | | | Hypothetical 5% Return | | | | |

Beginning

Account Value

(5/1/15) | | | Ending

Account Value

(10/31/15) | | | Expenses Paid

During Period a | | | Beginning

Account Value

(5/1/15) | | | Ending

Account Value

(10/31/15) | | | Expenses Paid

During Period a | | | Annualized

Expense Ratio | |

| $ | 1,000.00 | | | $ | 1,002.50 | | | $ | 1.26 | | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 1.28 | | | | 0.25% | |

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (365 days). See “Shareholder Expenses” on page 12 for more information. | |

| | |

| 6 | | 2015 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® SHORT MATURITY BOND ETF

The iShares Short Maturity Bond ETF (the “Fund”) seeks to maximize current income by investing, under normal circumstances, at least 80% of its net assets in a portfolio of U.S. dollar-denominated investment-grade fixed income securities and maintain a weighted average maturity that is less than three years. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index. For the 12-month reporting period ended October 31, 2015, the total return for the Fund was 0.62%, net of fees.

Short-term investment-grade bonds produced modestly positive returns for the reporting period, benefiting from a combination of high credit quality and attractive yields in a period of market uncertainty and low prevailing interest rates. However, interest rate volatility increased during the last half of the reporting period, driven by headlines around a potential Greek exit from the euro, a Chinese stock market correction, declining commodity prices, and the potential for a short-term interest rate increase by the Fed. At the same time, the corporate bond market experienced record levels of new issuance driven by heavy merger activity, share buybacks, and dividend payments. As a result, corporate bonds generally underperformed U.S. Treasury securities.

Against this backdrop, a decision to underweight Treasury securities in favor of higher-yielding bond sectors detracted marginally from Fund performance relative to the Barclays Short-Term Government/Corporate Index. However, many short-term corporate securities performed well during the reporting period, making the Fund’s allocation to investment-grade financial and industrial bonds key contributors. Another active decision that contributed to relative results was an overweight to securitized bonds, such as asset-backed and commercial mortgage-backed securities, which benefited from strong investor demand for yield.

During the reporting period, the Fund’s allocation to short-term floating-rate securities increased, which lowered the Fund’s duration (a measure of interest rate sensitivity) in anticipation of a possible interest rate hike from the Fed. As a result, the Fund ended the reporting period with a duration of 0.40 years, the lowest level since the Fund’s inception in September 2013.

ALLOCATION BY INVESTMENT TYPE

As of 10/31/15

| | |

| Investment Type | | Percentage of

Total Investments1 |

| | | | |

Corporate Bonds & Notes | | | 55.47 | % |

Asset-Backed Securities | | | 28.07 | |

Mortgage-Backed Securities | | | 10.41 | |

Foreign Government Obligations | | | 1.05 | |

Municipal Debt Obligations | | | 0.17 | |

Repurchase Agreements | | | 4.83 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

| | |

ALLOCATION BY CREDIT QUALITY

As of 10/31/15 |

| Moody’s Credit Rating2 | | Percentage of

Total Investments1 |

| | | | |

Aaa | | | 27.75 | % |

Aa | | | 4.26 | |

A | | | 18.63 | |

Baa | | | 30.01 | |

Ba | | | 1.58 | |

Not Rated | | | 17.77 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

| 1 | Excludes money market funds. |

| 2 | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 7 | |

Management’s Discussion of Fund Performance

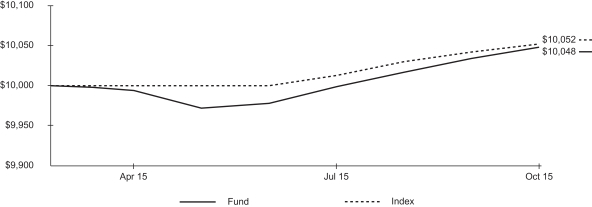

iSHARES® SHORT MATURITY MUNICIPAL BOND ETF

Performance as of October 31, 2015

| | | | |

| | | Cumulative Total Returns | |

| | | Since Inception | |

Fund NAV | | | 0.48% | |

Fund Market | | | 0.54% | |

Barclays Municipal Bond: 1 Year (1-2) Index | | | 0.52% | |

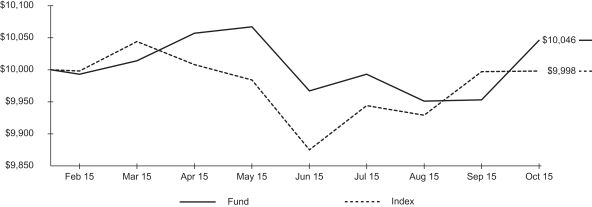

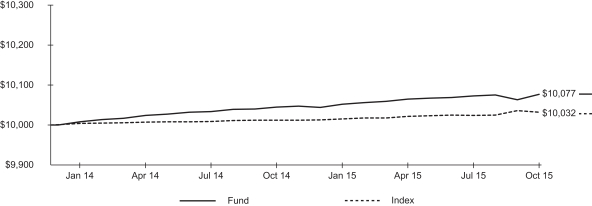

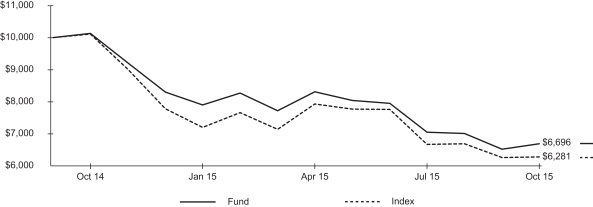

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 3/3/15. The first day of secondary market trading was 3/5/15.

The Barclays Municipal Bond: 1 Year (1-2) Index is an unmanaged index comprised of national municipal bond issues having a maturity of at least one year and less than two years.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 12 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholder Expenses | |

| Actual | | | Hypothetical 5% Return | | | | |

Beginning

Account Value

(5/1/15) | | | Ending

Account Value

(10/31/15) | | | Expenses Paid

During Period a | | | Beginning

Account Value

(5/1/15) | | | Ending

Account Value

(10/31/15) | | | Expenses Paid

During Period a | | | Annualized

Expense Ratio | |

| $ | 1,000.00 | | | $ | 1,005.40 | | | $ | 1.26 | | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 1.28 | | | | 0.25% | |

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (365 days). See “Shareholder Expenses” on page 12 for more information. |

| | |

| 8 | | 2015 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® SHORT MATURITY MUNICIPAL BOND ETF

The iShares Short Maturity Municipal Bond ETF (the “Fund”) seeks to maximize tax-free current income by investing, under normal circumstances, at least 80% of its net assets in municipal securities such that the interest on each bond is exempt from U.S. federal income taxes and the federal alternative minimum tax. The Fund will also seek to maintain a weighted average maturity that is less than three years. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index. For the period from March 3, 2015 (inception date of the Fund) through October 31, 2015 (the “reporting period”), the total return for the Fund was 0.48%, net of fees.

Short-term municipal bonds generated positive returns for the reporting period. Looking at the broad economic and interest rate backdrop, bonds generally rallied as a lack of inflation, a sharp decline in commodity prices, and disappointing growth in China helped support bond prices and lower yields. However, shorter-term securities were influenced more by expectations that the Fed would raise its short-term interest rate target at some point in 2015.

In the municipal bond market, favorable supply and demand trends contributed to a positive backdrop for performance. With investors concerned about the possibility that the Fed would raise short-term interest rates, the market saw significant demand for short-term bonds as investors maintained a defensive posture. In particular, municipal notes and bonds with remaining maturities of 13 months or less were in high demand as lower levels of supply remained a dominant theme.

The Fund performed well during the reporting period on both an absolute basis and relative (before fees) to the Barclays Municipal Bond: 1 Year (1-2) Index. Outperformance was derived mainly from security selection decisions among tax-backed local bonds, with an emphasis on newly issued securities. Additionally, security selection in the education sector, as well as municipal securities backed by corporate obligors, aided Fund performance. At the other end of the spectrum, an underweight position in the transportation sector detracted from performance relative to the Barclays Municipal Bond: 1 Year (1-2) Index, as did limited exposure to pre-refunded bonds.

ALLOCATION BY CREDIT QUALITY As of 10/31/15

| | |

| S&P Credit Rating1 | | Percentage of

Total Investments2 |

| | | | |

AA | | | 16.22 | % |

A | | | 47.92 | |

BBB | | | 4.32 | |

Not Rated | | | 31.54 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

TEN LARGEST STATES As of 10/31/15

| | |

| State | | Percentage of Total Investments2 |

| | | | |

New Jersey | | | 26.69 | % |

Ohio | | | 9.96 | |

California | | | 7.86 | |

Michigan | | | 7.82 | |

Illinois | | | 7.66 | |

Florida | | | 5.57 | |

Rhode Island | | | 5.22 | |

Georgia | | | 5.03 | |

Indiana | | | 4.63 | |

Utah | | | 4.32 | |

| | | | |

TOTAL | | | 84.76 | % |

| | | | |

| 1 | Credit quality ratings shown reflect the ratings assigned by Standard & Poor’s Ratings Service (“S&P”), a widely used independent, nationally recognized statistical rating organization. S&P credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of BBB or higher. Below investment grade ratings are credit ratings of BB or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 2 | Excludes money market funds. |

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 9 | |

Management’s Discussion of Fund Performance

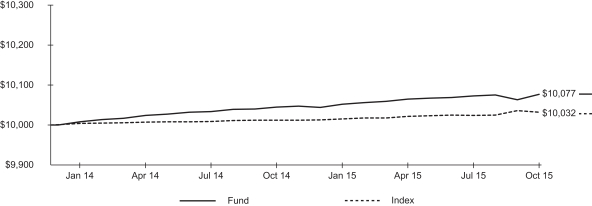

iSHARES® ULTRA SHORT-TERM BOND ETF

Performance as of October 31, 2015

| | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since Inception | | | | | 1 Year | | | Since Inception | |

Fund NAV | | | 0.32% | | | | 0.41% | | | | | | 0.32% | | | | 0.77% | |

Fund Market | | | 0.38% | | | | 0.41% | | | | | | 0.38% | | | | 0.77% | |

Bank of America Merrill Lynch 6-Month US Treasury Bill Index | | | 0.20% | | | | 0.17% | | | | | | 0.20% | | | | 0.32% | |

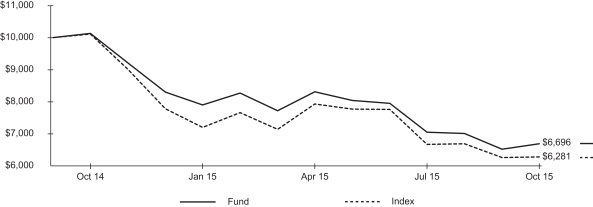

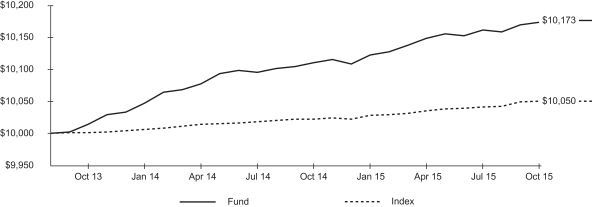

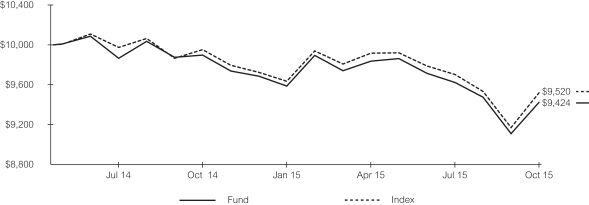

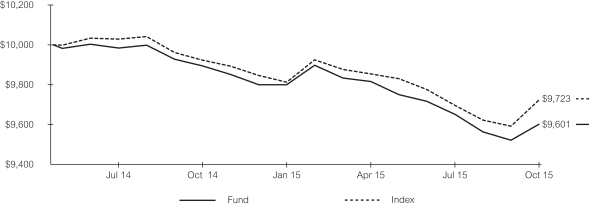

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 12/11/13. The first day of secondary market trading was 12/13/13.

The Bank of America Merrill Lynch 6-month US Treasury Bill Index is an unmanaged index that measures the performance of government securities with less than 6 months remaining to maturity.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 12 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholder Expenses | |

| Actual | | | Hypothetical 5% Return | | | | |

Beginning

Account Value

(5/1/15) | | | Ending

Account Value

(10/31/15) | | | Expenses Paid

During Period a | | | Beginning

Account Value

(5/1/15) | | | Ending

Account Value

(10/31/15) | | | Expenses Paid

During Period a | | | Annualized

Expense Ratio | |

| $ | 1,000.00 | | | $ | 1,001.20 | | | $ | 0.91 | | | $ | 1,000.00 | | | $ | 1,024.30 | | | $ | 0.92 | | | | 0.18% | |

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (365 days). See “Shareholder Expenses” on page 12 for more information. |

| | |

| 10 | | 2015 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® ULTRA SHORT-TERM BOND ETF

The iShares Ultra Short-Term Bond ETF (the “Fund”) (formerly the iShares Liquidity Income ETF) seeks to provide current income consistent with preservation of capital by investing, under normal circumstances, at least 80% of its net assets in a portfolio of U.S. dollar-denominated investment-grade fixed- and floating-rate debt securities and maintain a dollar-weighted average maturity that is less than 180 days. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index. For the 12-month reporting period ended October 31, 2015, the total return for the Fund was 0.32%, net of fees.

Short-term investment-grade bonds produced modestly positive returns for the reporting period as the Fed kept short-term interest rates unchanged. However, yields were somewhat volatile among one- to two-year securities as investors aimed to anticipate an expected interest rate increase from the Fed. Additional sources of rate volatility included a potential Greek exit from the euro, a Chinese stock market correction, and declining commodity prices.

At the same time, the corporate bond market experienced record levels of new issuance driven by heavy merger activity, share buybacks, and dividend payments. As a result, corporate bonds generally underperformed U.S. Treasury securities. Nevertheless, many short-term corporate securities performed well during the reporting period, benefiting from a combination of attractive yields, investment-grade credit quality, and short remaining maturities.

The Fund performed well on both an absolute basis and relative to the Bank of America Merrill Lynch 6-Month US Treasury Bill Index during the reporting period. Sector allocation and security selection decisions contributed the most to Fund performance. From a sector allocation standpoint, the Fund’s allocation to high-quality corporate securities, particularly those issued by the financials sector, were key contributors to performance. In general, the Fund was focused primarily on corporate securities in the financials and industrials sectors, as Fund managers believed that these bonds provided more attractive risk-adjusted return potential relative to other short-term fixed-income sectors due to strong demand from investors seeking yield.

ALLOCATION BY INVESTMENT TYPE

As of 10/31/15

| | |

| Investment Type | | Percentage of

Total Investments1 |

| | | | |

Corporate Bonds & Notes | | | 72.58 | % |

Repurchase Agreements | | | 9.63 | |

Commercial Paper | | | 9.14 | |

Certificates Of Deposit | | | 8.02 | |

Asset-backed Securities | | | 0.63 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

ALLOCATION BY CREDIT QUALITY

As of 10/31/15

| | |

| Moody’s Credit Rating2 | | Percentage of

Total Investments1 |

| | | | |

Aaa | | | 0.63 | % |

Aa | | | 23.65 | |

A | | | 44.48 | |

Baa | | | 19.61 | |

P-1 | | | 2.01 | |

Not Rated | | | 9.62 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

| 1 | Excludes money market funds. |

| 2 | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 11 | |

About Fund Performance

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.ishares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Certain funds may have a NAV which is determined prior to the opening of regular trading on its listed exchange and their market returns are calculated using the midpoint of the bid/ask spread as of the opening of regular trading on the exchange. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

Shareholder Expenses

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares and (2) ongoing costs, including management fees and other fund expenses. The expense example, which is based on an investment of $1,000 invested on May 1, 2015 and held through October 31, 2015, is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

Actual Expenses — The table provides information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. To estimate the expenses that you paid on your account over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number corresponding to your Fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes — The table also provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | |

| 12 | | 2015 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments

iSHARES® SHORT MATURITY BOND ETF

October 31, 2015

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

ASSET-BACKED SECURITIES — 26.55% | |

ABCLO Ltd. | | | | | | | | |

Series 2007-1A, Class A1B | | | | | | | | |

0.67%, 04/15/21a,b | | $ | 110 | | | $ | 110,030 | |

ACAS CLO Ltd. | | | | | | | | |

Series 2007-1A, Class A1S | | | | | | | | |

0.53%, 04/20/21a,b | | | 164 | | | | 163,269 | |

Series 2012-1AR, Class A1R | | | | | | | | |

1.57%, 09/20/23a,b | | | 7,990 | | | | 7,960,280 | |

Ally Auto Receivables Trust | | | | | | | | |

Series 2014-1, Class A3 | | | | | | | | |

0.97%, 10/15/18 (Call 11/15/17) | | | 9,000 | | | | 8,990,887 | |

American Credit Acceptance Receivables Trust | | | | | | | | |

Series 2014-4, Class A | | | | | | | | |

1.33%, 07/10/18 (Call 08/10/17)a | | | 276 | | | | 275,198 | |

American Express Credit Account Master Trust | | | | | | | | |

Series 2013-1, Class A | | | | | | | | |

0.62%, 02/16/21b | | | 5,000 | | | | 5,000,163 | |

American Express Credit Account Secured Note | | | | | | | | |

Series 2012-4, Class A | | | | | | | | |

0.44%, 05/15/20b | | | 14,500 | | | | 14,448,145 | |

American Homes 4 Rent | | | | | | | | |

Series 2014-SFR1, Class A | | | | | | | | |

1.25%, 06/17/31a,b | | | 449 | | | | 439,270 | |

AmeriCredit Automobile Receivables Trust | | | | | | | | |

Series 2012-3, Class D | | | | | | | | |

3.03%, 07/09/18 (Call 10/08/16) | | | 1,700 | | | | 1,725,761 | |

Series 2013-1, Class D | | | | | | | | |

2.09%, 02/08/19 (Call 04/08/17) | | | 2,500 | | | | 2,509,099 | |

Apidos CDO V | | | | | | | | |

0.55%, 04/15/21a,b | | | 1,085 | | | | 1,072,471 | |

ARI Fleet Lease Trust | | | | | | | | |

Series 2012-B, Class A | | | | | | | | |

0.50%, 01/15/21 (Call 03/15/16)a,b | | | 1,296 | | | | 1,292,708 | |

Series 2014-A, Class A2 | | | | | | | | |

0.81%, 11/15/22 (Call 06/15/17)a | | | 580 | | | | 579,725 | |

Avalon IV Capital Ltd. | | | | | | | | |

Series 2012-1AR, Class AR | | | | | | | | |

1.46%, 04/17/23a,b | | | 1,253 | | | | 1,249,914 | |

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

BA Credit Card Trust | | | | | | | | |

Series 2014-A3, Class A | | | | | | | | |

0.49%, 01/15/20b | | $ | 2,000 | | | $ | 1,995,658 | |

BlueMountain CLO Ltd. | | | | | | | | |

Series 2012-1A, Class A | | | | | | | | |

1.61%, 07/20/23a,b | | | 15,000 | | | | 14,921,355 | |

Cabela’s Credit Card Master Note Trust | | | | | | | | |

Series 2014-2, Class A | | | | | | | | |

0.65%, 07/15/22b | | | 3,500 | | | | 3,463,748 | |

Capital One Multi-Asset Execution Trust | | | | | | | | |

Series 2007-A1, Class A1 | | | | | | | | |

0.25%, 11/15/19b | | | 10,250 | | | | 10,215,149 | |

Series 2007-A5, Class A5 | | | | | | | | |

0.24%, 07/15/20b | | | 6,860 | | | | 6,805,115 | |

CarMax Auto Owner Trust | | | | | | | | |

Series 2015-4, Class A2B | | | | | | | | |

0.80%, 04/15/19 | | | 10,000 | | | | 9,947,108 | |

Chase Issuance Trust | | | | | | | | |

Series 2007-A5, Class A5 | | | | | | | | |

0.24%, 03/15/19b | | | 5,120 | | | | 5,101,824 | |

Series 2012-A02, Class A2 | | | | | | | | |

0.47%, 05/15/19b | | | 9,480 | | | | 9,471,009 | |

Series 2012-A10, Class A10 | | | | | | | | |

0.46%, 12/16/19b | | | 3,994 | | | | 3,980,301 | |

Series 2013-A9, Class A | | | | | | | | |

0.62%, 11/16/20b | | | 2,000 | | | | 1,997,817 | |

Chesapeake Funding LLC | | | | | | | | |

Series 2012-1A, Class B | | | | | | | | |

1.79%, 11/07/23a,b | | | 1,635 | | | | 1,636,438 | |

Chrysler Capital Auto Receivables Trust | | | | | | | | |

Series 2013-BA, Class A4 | | | | | | | | |

1.27%, 03/15/19 (Call 09/15/17)a | | | 1,460 | | | | 1,460,199 | |

Series 2014-BA, Class A3 | | | | | | | | |

1.27%, 05/15/19 (Call 05/15/18)a | | | 9,300 | | | | 9,302,958 | |

CIFC Funding Ltd. | | | | | | | | |

Series 2012-2A, Class A1R | | | | | | | | |

1.68%, 12/05/24a,b | | | 1,500 | | | | 1,490,833 | |

Citibank Credit Card Issuance Trust | | | | | | | | |

Series 2013-A4, Class A4 | | | | | | | | |

0.62%, 07/24/20b | | | 2,000 | | | | 1,997,654 | |

| | | | |

SCHEDULESOF INVESTMENTS | | | 13 | |

Schedule of Investments (Continued)

iSHARES® SHORT MATURITY BOND ETF

October 31, 2015

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

CNH Wholesale Master Note Trust | | | | | | | | |

Series 2013-2A, Class B | | | | | | | | |

1.10%, 08/15/19a,b | | $ | 300 | | | $ | 299,773 | |

COA Caerus CLO Ltd. | | | | | | | | |

Series 2007-6A, Class A1 | | | | | | | | |

0.96%, 12/13/19 (Call 01/11/16)a,b | | | 1,158 | | | | 1,150,112 | |

Cornerstone CLO Ltd. | | | | | | | | |

Series 2007-1A, Class A1S | | | | | | | | |

0.54%, 07/15/21 (Call 01/15/16)a,b | | | 178 | | | | 175,622 | |

Credit Acceptance Auto Loan Trust | | | | | | | | |

2.00%, 07/15/22a | | | 2,315 | | | | 2,306,147 | |

Series 2013-2A, Class A | | | | | | | | |

1.50%, 04/15/21a | | | 1,000 | | | | 999,063 | |

Discover Card Execution Note Trust | | | | | | | | |

Series 2013-A6, Class A6 | | | | | | | | |

0.65%, 04/15/21b | | | 3,370 | | | | 3,365,024 | |

Series 2015-A1, Class A1 | | | | | | | | |

0.55%, 08/17/20b | | | 11,100 | | | | 11,064,079 | |

Discover Card Master Trust | | | | | | | | |

Series 2012-A4, Class A | | | | | | | | |

0.56%, 11/15/19b | | | 10,470 | | | | 10,465,437 | |

Drive Auto Receivables Trust | | | | | | | | |

Series 2015-BA, Class A2B | | | | | | | | |

0.80%, 12/15/17a,b | | | 3,340 | | | | 3,336,811 | |

Series 2015-DA, Class A2B | | | | | | | | |

1.07%, 06/15/18a,b | | | 8,000 | | | | 8,000,471 | |

Dryden XXII Senior Loan Fund | | | | | | | | |

Series 2011-22A, Class A1R | | | | | | | | |

1.49%, 01/15/22a,b | | | 1,353 | | | | 1,349,551 | |

Dryden XXV Senior Loan Fund | | | | | | | | |

Series 2012-25A, Class A | | | | | | | | |

1.70%, 01/15/25a,b | | | 9,000 | | | | 8,944,105 | |

DT Auto Owner Trust | | | | | | | | |

Series 2014-1A, Class B | | | | | | | | |

1.43%, 03/15/18 (Call 07/15/17)a | | | 760 | | | | 759,558 | |

Flatiron CLO Ltd. | | | | | | | | |

Series 2011-1A, Class A | | | | | | | | |

1.87%, 01/15/23a,b | | | 10,000 | | | | 10,008,737 | |

Ford Credit Auto Owner Trust | | | | | | | | |

Series 2012-B, Class D | | | | | | | | |

2.93%, 10/15/18 (Call 08/15/16) | | | 1,790 | | | | 1,815,306 | |

Series 2014-B, Class A3 | | | | | | | | |

0.90%, 10/15/18 (Call 02/15/18) | | | 6,943 | | | | 6,942,401 | |

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

Ford Credit Floorplan Master Owner Trust A | | | | | | | | |

Series 2012-2, Class D | | | | | | | | |

3.50%, 01/15/19 | | $ | 1,885 | | | $ | 1,926,250 | |

Series 2013-1, Class A1 | | | | | | | | |

0.85%, 01/15/18 | | | 3,970 | | | | 3,971,577 | |

Series 2013-5, Class A1 | | | | | | | | |

1.50%, 09/15/18 | | | 11,785 | | | | 11,833,248 | |

Series 2014-1, Class A1 | | | | | | | | |

1.20%, 02/15/19 | | | 17,375 | | | | 17,365,074 | |

Series 2014-1, Class A2 | | | | | | | | |

0.60%, 02/15/19b | | | 6,110 | | | | 6,103,290 | |

Series 2014-4, Class A2 | | | | | | | | |

0.55%, 08/15/19b | | | 3,000 | | | | 2,989,160 | |

Series 2015-1, Class A2 | | | | | | | | |

0.60%, 01/15/20b | | | 5,940 | | | | 5,903,805 | |

Fraser Sullivan CLO VII Ltd. | | | | | | | | |

Series 2012-7A, Class A1R | | | | | | | | |

1.36%, 04/20/23 (Call 01/20/16)a,b | | | 4,838 | | | | 4,817,986 | |

GoldenTree Loan Opportunities VII Ltd. | | | | | |

Series 2013-7A, Class A | | | | | | | | |

1.47%, 04/25/25a,b | | | 10,000 | | | | 9,783,000 | |

Honda Auto Receivables Owner Trust | | | | | | | | |

Series 2014-2, Class A3 | | | | | | | | |

0.77%, 03/19/18 (Call 07/18/17) | | | 5,700 | | | | 5,692,601 | |

Hyundai Auto Receivables Trust | | | | | | | | |

Series 2015-C, Class A2B | | | | | | | | |

0.57%, 11/15/18b | | | 16,000 | | | | 15,997,949 | |

ING IM CLO Ltd. | | | | | | | | |

Series 2012-1RA, Class A1R | | | | | | | | |

1.54%, 03/14/22a,b | | | 4,170 | | | | 4,157,625 | |

Invitation Homes Trust | | | | | | | | |

Series 2013-SFR1, Class A | | | | | | | | |

1.40%, 12/17/30a,b | | | 1,966 | | | | 1,935,643 | |

Series 2014-SFR3, Class A | | | | | | | | |

1.40%, 12/17/31 | | | 3,000 | | | | 2,941,593 | |

Series 2015-SFR3, Class A | | | | | | | | |

1.50%, 08/17/32a,b | | | 7,355 | | | | 7,207,585 | |

John Deere Capital Corp. | | | | | | | | |

Series 2015-B, Class A2 | | | | | | | | |

0.98%, 06/15/18 | | | 15,000 | | | | 14,990,158 | |

Katonah Ltd.

Series 2007-10A, Class A2B | | | | | | | | |

0.57%, 04/17/20a,b | | | 621 | | | | 620,345 | |

| | |

| 14 | | 2015 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® SHORT MATURITY BOND ETF

October 31, 2015

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

LCM X LP

Series 10AR, Class AR | | | | | | | | |

1.58%, 04/15/22a,b | | $ | 1,767 | | | $ | 1,762,630 | |

LCM XII LP

Series 12A, Class AR | | | | | | | | |

1.55%, 10/19/22a,b | | | 5,000 | | | | 4,977,488 | |

Mercedes Benz Auto Receivables Trust

Series 2015-1, Class A2A | | | | | | | | |

0.82%, 06/15/18 | | | 2,000 | | | | 1,997,447 | |

Navient Private Education Loan Trust | | | | | | | | |

Series 2014-AA, Class A1 | | | | | | | | |

0.68%, 05/16/22a,b | | | 438 | | | | 437,423 | |

Series 2014-CT, Class A | | | | | | | | |

0.90%, 09/16/24a,b | | | 4,636 | | | | 4,584,340 | |

Navient Student Loan Trust

Series 2015-2, Class A2 | | | | | | | | |

0.62%, 08/27/29b | | | 4,465 | | | | 4,398,990 | |

Nissan Master Owner Trust Receivables

Series 2013-A, Class A | | | | | | | | |

0.50%, 02/15/18b | | | 10,000 | | | | 9,996,129 | |

OneMain Financial Issuance Trust

Series 2014-2A, Class A | | | | | | | | |

2.47%, 09/18/24a | | | 3,510 | | | | 3,513,292 | |

Palmer Square CLO Ltd.

Series 2014-1A, Class A1 | | | | | | | | |

1.59%, 10/17/22 (Call 01/17/16)a,b | | | 2,486 | | | | 2,481,381 | |

PFS Financing Corp. | | | | | | | | |

Series 2014-AA, Class A | | | | | | | | |

0.80%, 02/15/19a,b | | | 1,000 | | | | 995,238 | |

Series 2014-AA, Class B | | | | | | | | |

1.15%, 02/15/19a,b | | | 1,100 | | | | 1,095,952 | |

Series 2014-BA, Class A | | | | | | | | |

0.80%, 10/15/19a,b | | | 1,915 | | | | 1,893,045 | |

Regatta Funding Ltd.

Series 2007-1A, Class A1L | | | | | | | | |

0.59%, 06/15/20 (Call 12/15/15)a,b | | | 199 | | | | 197,891 | |

Santander Drive Auto Receivables Trust | | | | | | | | |

Series 2012-1, Class D | | | | | | | | |

4.56%, 11/15/17 (Call 06/15/16) | | | 6,480 | | | | 6,578,874 | |

Series 2012-2, Class D | | | | | | | | |

3.87%, 02/15/18 (Call 08/15/16) | | | 2,000 | | | | 2,032,003 | |

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

Series 2012-2A, Class E | | | | | | | | |

5.95%, 04/15/19 (Call 08/15/16)a | | $ | 3,695 | | | $ | 3,809,569 | |

Series 2012-AA, Class C | | | | | | | | |

1.78%, 11/15/18 (Call 03/15/17)a | | | 1,545 | | | | 1,548,606 | |

Series 2012-AA, Class D | | | | | | | | |

2.46%, 12/17/18 (Call 03/15/17)a | | | 2,500 | | | | 2,523,573 | |

Series 2013-1, Class C | | | | | | | | |

1.76%, 01/15/19 | | | 2,250 | | | | 2,256,404 | |

Series 2013-2, Class B | | | | | | | | |

1.33%, 03/15/18 (Call 07/15/17) | | | 1,749 | | | | 1,750,100 | |

Series 2013-5, Class B | | | | | | | | |

1.55%, 10/15/18 (Call 10/15/17) | | | 775 | | | | 775,910 | |

Series 2014-1, Class D | | | | | | | | |

2.91%, 04/15/20 (Call 09/15/17) | | | 2,345 | | | | 2,362,009 | |

Series 2014-3, Class B | | | | | | | | |

1.45%, 05/15/19 (Call 11/15/17) | | | 785 | | | | 785,132 | |

Series 2014-S1, Class R | | | | | | | | |

1.42%, 08/16/18a | | | 102 | | | | 102,441 | |

Silver Bay Realty Trust

Series 2014-1, Class A | | | | | | | | |

1.20%, 09/17/31 | | | 993 | | | | 968,085 | |

SLM Private Credit Student Loan Trust | | | | | | | | |

Series 2004-A, Class A2 | | | | | | | | |

0.54%, 03/16/20b | | | 113 | | | | 113,416 | |

Series 2004-B, Class A2 | | | | | | | | |

0.54%, 06/15/21b | | | 1,690 | | | | 1,681,833 | |

Series 2005-A, Class A3 | | | | | | | | |

0.54%, 06/15/23b | | | 2,514 | | | | 2,417,175 | |

Series 2006-A, Class A4 | | | | | | | | |

0.53%, 12/15/23b | | | 814 | | | | 801,884 | |

SLM Private Education Loan Trust | | | | | | | | |

Series 2011-C, Class A1 | | | | | | | | |

1.60%, 12/15/23a,b | | | 2,234 | | | | 2,235,055 | |

Series 2011-C, Class A2A | | | | | | | | |

3.45%, 10/17/44a,b | | | 2,000 | | | | 2,118,799 | |

Series 2012-A, Class A1 | | | | | | | | |

1.60%, 08/15/25a,b | | | 575 | | | | 576,238 | |

Series 2012-B, Class A1 | | | | | | | | |

1.30%, 12/15/21a,b | | | 20 | | | | 19,811 | |

Series 2012-B, Class A2 | | | | | | | | |

3.48%, 10/15/30a | | | 1,250 | | | | 1,279,667 | |

Series 2012-C, Class A1 | | | | | | | | |

1.30%, 08/15/23a,b | | | 952 | | | | 951,845 | |

| | | | |

SCHEDULESOF INVESTMENTS | | | 15 | |

Schedule of Investments (Continued)

iSHARES® SHORT MATURITY BOND ETF

October 31, 2015

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

Series 2012-E, Class A1 | | | | | | | | |

0.95%, 10/16/23a,b | | $ | 759 | | | $ | 758,361 | |

Series 2012-E, Class A2B | | | | | | | | |

1.95%, 06/15/45a,b | | | 5,250 | | | | 5,354,479 | |

Series 2013-A, Class A1 | | | | | | | | |

0.80%, 08/15/22a,b | | | 2,176 | | | | 2,169,304 | |

Series 2013-A, Class A2B | | | | | | | | |

1.25%, 05/17/27a,b | | | 265 | | | | 263,123 | |

Series 2013-B, Class A1 | | | | | | | | |

0.85%, 07/15/22a,b | | | 1,234 | | | | 1,231,710 | |

Series 2013-C, Class A1 | | | | | | | | |

1.05%, 02/15/22a,b | | | 1,092 | | | | 1,091,755 | |

Series 2013-C, Class A2B | | | | | | | | |

1.60%, 10/15/31a,b | | | 1,750 | | | | 1,760,889 | |

Series 2014-A, Class A1 | | | | | | | | |

0.80%, 07/15/22a,b | | | 7,531 | | | | 7,503,422 | |

Series 2015-B, Class A1 | | | | | | | | |

0.90%, 02/15/23a,b | | | 3,432 | | | | 3,426,284 | |

SLM Student Loan Trust | | | | | | | | |

Series 2006-4, Class A5 | | | | | | | | |

0.42%, 10/27/25b | | | 1,614 | | | | 1,599,223 | |

Series 2011-2, Class A1 | | | | | | | | |

0.80%, 11/25/27b | | | 1,184 | | | | 1,169,328 | |

SMB Private Education Loan Trust | | | | | | | | |

Series 2014-A, Class A1 | | | | | | | | |

0.70%, 09/15/21a,b | | | 1,873 | | | | 1,867,100 | |

Series 2015-A, Class A1 | | | | | | | | |

0.80%, 07/17/23a,b | | | 4,754 | | | | 4,721,556 | |

Series 2015-C, Class A1 | | | | | | | | |

1.09%, 07/15/22 | | | 7,500 | | | | 7,495,350 | |

SoFi Professional Loan Program LLC | | | | | | | | |

1.40%, 03/25/33a,b | | | 2,300 | | | | 2,284,414 | |

Series 2014-A, Class A1 | | | | | | | | |

1.80%, 06/25/25a,b | | | 1,307 | | | | 1,311,296 | |

Series 2014-B, Class A1 | | | | | | | | |

1.45%, 08/25/32a,b | | | 794 | | | | 790,017 | |

SWAY Residential Trust

Series 2014-1, Class A | | | | | | | | |

1.50%, 01/17/32a,b | | | 6,503 | | | | 6,371,571 | |

Synchrony Credit Card Master Note Trust

Series 2012-3, Class A | | | | | | | | |

0.65%, 03/15/20b | | | 9,295 | | | | 9,281,091 | |

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

Voya CLO Ltd.

Series 2013-1A, Class A1 | | | | | | | | |

1.46%, 04/15/24a,b | | $ | 1,900 | | | $ | 1,869,354 | |

Wheels SPV 2 LLC

Series 2014-1A, Class A2 | | | | | | | | |

0.84%, 03/20/23a | | | 383 | | | | 382,230 | |

World Financial Network Credit Card Master Trust

Series 2015-A, Class A | | | | | | | | |

0.68%, 02/15/22b | | | 15,405 | | | | 15,349,611 | |

| | | | | | | | |

TOTAL ASSET-BACKED SECURITIES | | | | | |

(Cost: $474,547,663) | | | | 472,894,315 | |

|

COLLATERALIZED MORTGAGE

OBLIGATIONS — 9.84% | |

MORTGAGE-BACKED SECURITIES — 9.84% | |

BAMLL Commercial Mortgage Securities Trust | | | | | | | | |

Series 2013-DSNY, Class A | | | | | | | | |

1.25%, 09/15/26a,b | | | 525 | | | | 523,688 | |

Series 2014-FL1, Class A | | | | | | | | |

1.60%, 12/15/31a,b | | | 2,670 | | | | 2,669,122 | |

Banc of America Commercial Mortgage Trust | | | | | | | | |

Series 2006-2, Class A4 | | | | | | | | |

5.76%, 05/10/45b | | | 1,430 | | | | 1,441,916 | |

Series 2007-4, Class A1A | | | | | | | | |

5.77%, 02/10/51b | | | 1,888 | | | | 1,990,875 | |

Series 2007-5, Class A4 | | | | | | | | |

5.49%, 02/10/51 | | | 2,946 | | | | 3,073,951 | |

Banc of America Merrill Lynch Commercial Mortgage Inc.

Series 2005-6, Class B | | | | | | | | |

5.15%, 09/10/47b | | | 1,580 | | | | 1,579,124 | |

Bear Stearns Commercial Mortgage Securities Trust | | | | | | | | |

Series 2006-PW12, Class A4 | | | | | | | | |

5.71%, 09/11/38b | | | 1,144 | | | | 1,156,392 | |

Series 2006-PW14, Class A1A | | | | | | | | |

5.19%, 12/11/38 | | | 191 | | | | 197,012 | |

Series 2006-T22, Class AJ | | | | | | | | |

5.62%, 04/12/38b | | | 4,055 | | | | 4,113,189 | |

| | |

| 16 | | 2015 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® SHORT MATURITY BOND ETF

October 31, 2015

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

Series 2007-PW15, Class A1A | | | | | | | | |

5.32%, 02/11/44 | | $ | 218 | | | $ | 226,508 | |

Series 2007-PW15, Class A4 | | | | | | | | |

5.33%, 02/11/44 | | | 794 | | | | 822,726 | |

Series 2007-PW17, Class A4 | | | | | | | | |

5.69%, 06/11/50b | | | 7,768 | | | | 8,166,768 | |

Series 2007-PW18, Class A4 | | | | | | | | |

5.70%, 06/11/50 | | | 1,300 | | | | 1,367,142 | |

Brunel Residential Mortgage Securitisation PLC

Series 2007-1A, Class A4C | | | | | | | | |

0.52%, 01/13/39 (Call 01/13/16)a,b | | | 1,166 | | | | 1,148,378 | |

Carefree Portfolio Trust

Series 2014-CARE, Class A | | | | | | | | |

1.52%, 11/15/19a,b | | | 4,500 | | | | 4,492,962 | |

CDGJ Commercial Mortgage Trust

Series 2014-BXCH, Class A | | | | | | | | |

1.60%, 12/15/27a,b | | | 7,350 | | | | 7,313,180 | |

Citigroup Commercial Mortgage Trust | | | | | | | | |

Series 2006-C5, Class A4 | | | | | | | | |

5.43%, 10/15/49 | | | 1,987 | | | | 2,036,024 | |

Series 2014-388G, Class A | | | | | | | | |

0.95%, 06/15/33a,b | | | 2,125 | | | | 2,108,974 | |

COMM Mortgage Trust | | | | | | | | |

Series 2006-C7, Class A4 | | | | | | | | |

5.76%, 06/10/46b | | | 1,231 | | | | 1,243,009 | |

Series 2006-C8, Class AM | | | | | | | | |

5.35%, 12/10/46 | | | 5,000 | | | | 5,156,466 | |

Series 2014-FL5, Class A | | | | | | | | |

1.57%, 10/15/31a,b | | | 1,375 | | | | 1,369,840 | |

Series 2014-PAT, Class A | | | | | | | | |

1.00%, 08/13/27a,b | | | 1,420 | | | | 1,409,321 | |

Credit Suisse Commercial Mortgage Trust | | | | | | | | |

Series 2006-C1, Class AJ | | | | | | | | |

5.47%, 02/15/39b | | | 791 | | | | 794,529 | |

Series 2006-C3, Class AM | | | | | | | | |

5.82%, 06/15/38b | | | 2,500 | | | | 2,552,182 | |

Series 2006-C5, Class A3 | | | | | | | | |

5.31%, 12/15/39 | | | 475 | | | | 483,580 | |

DBRR Trust | | | | | | | | |

Series 2013-EZ2, Class A | | | | | | | | |

0.85%, 02/25/45a,b | | | 4 | | | | 3,771 | |

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

Series 2013-EZ3, Class A | | | | | | | | |

1.64%, 12/18/49a,b | | $ | 917 | | | $ | 917,324 | |

FCT Marsollier Mortgages

Series 2009-1, Class A | | | | | | | | |

0.46%, 09/27/50b,c | | | 202 | | | | 223,497 | |

GMAC Commercial Mortgage Securities Inc. Trust

Series 2006-C1, Class A1A | | | | | | | | |

5.23%, 11/10/45b | | | 1,272 | | | | 1,272,016 | |

Granite Master Issuer PLC | | | | | | | | |

Series 2005-1, Class A4 | | | | | | | | |

0.39%, 12/20/54b | | | 244 | | | | 242,874 | |

Series 2006-1A, Class A5 | | | | | | | | |

0.33%, 12/20/54a,b | | | 3,676 | | | | 3,656,283 | |

Series 2006-2, Class A4 | | | | | | | | |

0.27%, 12/20/54b | | | 1,211 | | | | 1,204,827 | |

Series 2006-3, Class A3 | | | | | | | | |

0.27%, 12/20/54b | | | 1,027 | | | | 1,021,676 | |

Series 2006-3, Class A4 | | | | | | | | |

0.27%, 12/20/54b | | | 1,829 | | | | 1,819,403 | |

Series 2007-1, Class 2A1 | | | | | | | | |

0.33%, 12/20/54b | | | 1,525 | | | | 1,516,992 | |

Series 2007-2, Class 2A1 | | | | | | | | |

0.28%, 12/17/54b | | | 332 | | | | 330,262 | |

Series 2007-2, Class 3A1 | | | | | | | | |

0.38%, 12/17/54b | | | 451 | | | | 448,507 | |

Series 2007-2, Class 4A1 | | | | | | | | |

0.29%, 12/17/54b | | | 84 | | | | 83,454 | |

Granite Mortgages PLC

Series 2004-1, Class 2A1 | | | | | | | | |

0.67%, 03/20/44b | | | 740 | | | | 733,668 | |

GS Mortgage Securities Trust

Series 2006-GG8, Class AM | | | | | | | | |

5.59%, 11/10/39 (Call 10/06/16) | | | 1,000 | | | | 1,029,860 | |

Hilton USA Trust

Series 2013-HLT, Class EFX | | | | | | | | |

2.66%, 11/05/30 | | | 12,667 | | | | 12,680,627 | |

JPMorgan Chase Commercial Mortgage Securities Trust

| | | | | | | | |

Series 2006-CB14, Class AM | | | | | | | | |

5.49%, 12/12/44b | | | 1,000 | | | | 1,002,783 | |

Series 2006-LDP7, Class A4 | | | | | | | | |

5.91%, 04/15/45b | | | 2,990 | | | | 3,025,345 | |

| | | | |

SCHEDULESOF INVESTMENTS | | | 17 | |

Schedule of Investments (Continued)

iSHARES® SHORT MATURITY BOND ETF

October 31, 2015

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

Series 2006-LDP9, Class A3 | | | | | | | | |

5.34%, 05/15/47 | | $ | 2,386 | | | $ | 2,455,926 | |

Series 2007-CB18, Class A1A | | | | | | | | |

5.43%, 06/12/47b | | | 245 | | | | 254,171 | |

Series 2007-CB18, Class A4 | | | | | | | | |

5.44%, 06/12/47 | | | 1,878 | | | | 1,920,482 | |

Series 2007-CB20, Class A4 | | | | | | | | |

5.79%, 02/12/51b | | | 1,700 | | | | 1,797,413 | |

Series 2007-LDPX, Class A3 | | | | | | | | |

5.42%, 01/15/49 | | | 12,528 | | | | 12,947,068 | |

Series 2013-WT, Class A | | | | | | | | |

2.80%, 02/16/25a | | | 3,999 | | | | 4,062,748 | |

Series 2014-FL6, Class A | | | | | | | | |

1.60%, 11/15/31a,b | | | 2,295 | | | | 2,285,597 | |

Series 2015-CSMO, Class A | | | | | | | | |

1.45%, 01/15/32a,b | | | 4,000 | | | | 3,977,421 | |

LB Commercial Mortgage Trust

Series 2007-C3, Class A1A | | | | | | | | |

5.85%, 07/15/44b | | | 3,745 | | | | 3,963,135 | |

LB-UBS Commercial Mortgage Trust | | | | | | | | |

Series 2006-C3, Class A1A | | | | | | | | |

5.64%, 03/15/39b | | | 1,216 | | | | 1,222,861 | |

Series 2006-C4, Class AM | | | | | | | | |

5.84%, 06/15/38b | | | 1,250 | | | | 1,281,100 | |

Series 2006-C7, Class A3 | | | | | | | | |

5.35%, 11/15/38 | | | 525 | | | | 538,450 | |

Series 2007-C2, Class A1A | | | | | | | | |

5.39%, 02/15/40 | | | 2,494 | | | | 2,611,124 | |

Series 2007-C2, Class A3 | | | | | | | | |

5.43%, 02/15/40 | | | 1,965 | | | | 2,036,034 | |

Merrill Lynch Mortgage Trust

Series 2006-C2, Class AM | | | | | | | | |

5.78%, 08/12/43b | | | 4,400 | | | | 4,509,629 | |

ML-CFC Commercial Mortgage Trust | | | | | | | | |

Series 2006-1, Class AM | | | | | | | | |

5.51%, 02/12/39b | | | 6,043 | | | | 6,091,412 | |

Series 2006-3, Class A4 | | | | | | | | |

5.41%, 07/12/46b | | | 2,522 | | | | 2,572,372 | |

Series 2006-4, Class AM | | | | | | | | |

5.20%, 12/12/49 | | | 2,050 | | | | 2,119,718 | |

Series 2007-9, Class A4 | | | | | | | | |

5.70%, 09/12/49 | | | 1,421 | | | | 1,486,011 | |

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

Morgan Stanley Capital I Trust | | | | | | | | |

Series 2006-HQ9, Class A4FL | | | | | | | | |

0.34%, 07/12/44b | | $ | 2,957 | | | $ | 2,947,981 | |

Series 2006-IQ12, Class A1A | | | | | | | | |

5.32%, 12/15/43 | | | 376 | | | | 388,233 | |

Series 2006-T23, Class A4 | | | | | | | | |

5.84%, 08/12/41b | | | 2,606 | | | | 2,650,084 | |

Series 2007-HQ11, Class A4FL | | | | | | | | |

0.33%, 02/12/44b | | | 3,960 | | | | 3,929,580 | |

Series 2007-IQ13, Class A1A | | | | | | | | |

5.31%, 03/15/44 | | | 5,315 | | | | 5,502,905 | |

Series 2007-IQ15, Class A4 | | | | | | | | |

5.92%, 06/11/49b | | | 1,457 | | | | 1,528,028 | |

Series 2007-T25, Class A3 | | | | | | | | |

5.51%, 11/12/49b | | | 482 | | | | 496,480 | |

Series 2007-T27, Class A4 | | | | | | | | |

5.65%, 06/11/42b | | | 2,615 | | | | 2,760,459 | |

PUMA Global Trust No. 5

Series G5, Class A1 | | | | | | | | |

0.47%, 02/21/38a,b | | | 467 | | | | 466,126 | |

Wachovia Bank Commercial Mortgage Trust | | | | | | | | |

Series 2006-C24, Class A3 | | | | | | | | |

5.56%, 03/15/45b | | | 102 | | | | 102,481 | |

Series 2006-C29, Class A1A | | | | | | | | |

5.30%, 11/15/48 | | | 215 | | | | 221,851 | |

Series 2007-C32, Class AMFL | | | | | | | | |

0.42%, 06/15/49a,b | | | 8,000 | | | | 7,572,413 | |

| | | | | | | | |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS | | | | | | | | |

(Cost: $176,680,717) | | | | | | | 175,349,320 | |

|

CORPORATE BONDS & NOTES — 52.45% | |

ADVERTISING — 0.15% | | | | | | | | |

Omnicom Group Inc. | | | | | | | | |

5.90%, 04/15/16 | | | 2,649 | | | | 2,705,686 | |

| | | | | | | | |

| | | | | | | 2,705,686 | |

AEROSPACE & DEFENSE — 0.15% | |

Exelis Inc. | | | | | | | | |

4.25%, 10/01/16 | | | 2,260 | | | | 2,315,377 | |

L-3 Communications Corp. | |

3.95%, 11/15/16 | | | 403 | | | | 411,171 | |

| | |

| 18 | | 2015 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® SHORT MATURITY BOND ETF

October 31, 2015

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

AGRICULTURE — 1.47% | | | | | | | | |

BAT International Finance PLC | | | | | | | | |

0.85%, 06/15/18a,b | | $ | 2,000 | | | $ | 1,998,340 | |

Philip Morris International Inc. | | | | | | | | |

2.50%, 05/16/16d | | | 10,000 | | | | 10,103,450 | |

Reynolds American Inc. | | | | | | | | |

3.50%, 08/04/16a,d | | | 13,800 | | | | 14,016,260 | |

| | | | | | | | |

| | | | | | | 26,118,050 | |

AIRLINES — 0.62% | | | | | | | | |

Continental Airlines Inc. 2009-1 Pass Through Trust | | | | | | | | |

9.00%, 01/08/18 | | | 2,684 | | | | 2,806,980 | |

Delta Air Lines 2010-2 Pass Through Trust Class B | | | | | | | | |

6.75%, 05/23/17 | | | 5,000 | | | | 5,012,500 | |

Delta Air Lines Inc. 2010-1 Pass Through Trust Series 101B | | | | | | | | |

6.38%, 07/02/17a | | | 1,500 | | | | 1,511,250 | |

UAL 2009-1 Pass Through Trust | | | | | | | | |

10.40%, 05/01/18d | | | 125 | | | | 132,930 | |

UAL 2009-2 Pass Through Trust Class A | | | | | | | | |

9.75%, 07/15/18 | | | 1,518 | | | | 1,620,810 | |

| | | | | | | | |

| | | | | | | 11,084,470 | |

AUTO MANUFACTURERS — 1.02% | | | | | | | | |

Daimler Finance North America LLC | | | | | | | | |

0.64%, 08/01/17a,b | | | 1,700 | | | | 1,684,784 | |

1.01%, 08/03/17a,b | | | 6,450 | | | | 6,422,188 | |

2.63%, 09/15/16a | | | 2,250 | | | | 2,275,184 | |

3.00%, 03/28/16a | | | 2,750 | | | | 2,773,471 | |

Ford Motor Credit Co. LLC | | | | | | | | |

0.96%, 03/27/17b | | | 1,600 | | | | 1,588,069 | |

Nissan Motor Acceptance Corp. | | | | | | | | |

0.88%, 03/03/17a,b,d | | | 250 | | | | 249,572 | |

1.00%, 03/15/16a | | | 2,400 | | | | 2,403,595 | |

1.03%, 09/26/16a,b | | | 750 | | | | 750,494 | |

| | | | | | | | |

| | | | | | | 18,147,357 | |

AUTO PARTS & EQUIPMENT — 0.03% | | | | | |

Johnson Controls Inc. | | | | | | | | |

5.50%, 01/15/16d | | | 500 | | | | 504,248 | |

| | | | | | | | |

| | | | | | | 504,248 | |

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

BANKS — 20.70% | | | | | | | | |

Abbey National Treasury Services PLC/United Kingdom | | | | | | | | |

4.00%, 04/27/16 | | $ | 6,000 | | | $ | 6,096,060 | |

ABN AMRO Bank NV | | | | | | | | |

1.12%, 10/28/16a,b | | | 635 | | | | 636,829 | |

1.38%, 01/22/16a | | | 250 | | | | 250,198 | |

Bank of America Corp. | | | | | | | | |

0.94%, 08/25/17b | | | 1,250 | | | | 1,247,241 | |

1.14%, 03/22/16b,d | | | 2,750 | | | | 2,754,661 | |

1.35%, 11/21/16 | | | 1,300 | | | | 1,301,138 | |

1.39%, 03/22/18b | | | 6,750 | | | | 6,790,770 | |

3.63%, 03/17/16d | | | 5,250 | | | | 5,307,293 | |

5.63%, 10/14/16 | | | 910 | | | | 949,212 | |

Series 1 | | | | | | | | |

3.75%, 07/12/16 | | | 11,000 | | | | 11,211,838 | |

Bank of Montreal | | | | | | | | |

0.93%, 07/31/18b | | | 6,450 | | | | 6,439,557 | |

Banque Federative du Credit Mutuel SA | | | | | | | | |

1.17%, 01/20/17a,b | | | 1,000 | | | | 1,004,747 | |

Barclays Bank PLC | | | | | | | | |

0.90%, 02/17/17b | | | 3,150 | | | | 3,148,671 | |

BB&T Corp. | | | | | | | | |

1.20%, 06/15/18 (Call 05/15/18)b | | | 15,275 | | | | 15,360,616 | |

3.95%, 04/29/16 | | | 1,000 | | | | 1,015,865 | |

BNP Paribas SA | | | | | | | | |

0.93%, 12/12/16b | | | 750 | | | | 751,175 | |

3.60%, 02/23/16 | | | 3,500 | | | | 3,530,520 | |

BPCE SA | | | | | | | | |

0.96%, 06/17/17b | | | 700 | | | | 699,469 | |

1.16%, 02/10/17b,d | | | 1,900 | | | | 1,905,694 | |

Capital One Financial Corp. | | | | | | | | |

1.00%, 11/06/15 | | | 2,220 | | | | 2,220,029 | |

3.15%, 07/15/16 | | | 26,150 | | | | 26,522,271 | |

Capital One N.A./Mclean VA | | | | | | | | |

0.98%, 02/05/18 (Call 01/05/18)b | | | 500 | | | | 497,780 | |

Citigroup Inc. | | | | | | | | |

0.87%, 03/10/17b | | | 1,750 | | | | 1,745,629 | |

1.28%, 07/25/16b | | | 975 | | | | 977,384 | |

1.30%, 04/01/16 | | | 3,500 | | | | 3,501,844 | |

Credit Suisse/New York NY | | | | | | | | |

1.00%, 04/27/18b | | | 5,035 | | | | 5,012,307 | |

| | | | |

SCHEDULESOF INVESTMENTS | | | 19 | |

Schedule of Investments (Continued)

iSHARES® SHORT MATURITY BOND ETF

October 31, 2015

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

1.01%, 01/29/18b,d | | $ | 1,250 | | | $ | 1,248,115 | |

Deutsche Bank AG/London | | | | | | | | |

0.80%, 05/30/17b | | | 1,000 | | | | 995,098 | |

0.99%, 02/13/18b | | | 3,000 | | | | 2,985,156 | |

3.25%, 01/11/16 | | | 5,959 | | | | 5,989,307 | |

Fifth Third Bancorp | �� | | | | | | | |

0.77%, 12/20/16b | | | 750 | | | | 745,963 | |

3.63%, 01/25/16 | | | 5,000 | | | | 5,033,355 | |

Fifth Third Bank/Cincinnati OH | | | | | | | | |

1.15%, 11/18/16 (Call 10/18/16) | | | 3,500 | | | | 3,506,065 | |

Goldman Sachs Group Inc. (The) | | | | | | | | |

0.77%, 03/22/16b | | | 4,665 | | | | 4,665,079 | |

0.96%, 06/04/17b,d | | | 5,000 | | | | 4,993,125 | |

1.52%, 04/30/18b | | | 2,000 | | | | 2,018,374 | |

1.60%, 11/23/15 | | | 1,700 | | | | 1,701,165 | |

3.63%, 02/07/16d | | | 8,500 | | | | 8,565,849 | |

5.35%, 01/15/16 | | | 3,400 | | | | 3,433,177 | |

5.63%, 01/15/17 | | | 2,000 | | | | 2,095,738 | |

5.75%, 10/01/16 | | | 4,000 | | | | 4,173,404 | |

HSBC Bank PLC | | | | | | | | |

0.96%, 05/15/18a,b | | | 5,000 | | | | 4,988,690 | |

HSBC USA Inc. | | | | | | | | |

0.78%, 03/03/17b | | | 3,000 | | | | 2,993,880 | |

1.08%, 08/07/18b | | | 3,250 | | | | 3,244,709 | |

Huntington National Bank (The) | | | | | | | | |

0.74%, 04/24/17 (Call 03/25/17)b | | | 1,405 | | | | 1,396,212 | |

ING Bank NV | | | | | | | | |

0.89%, 03/16/18a,b | | | 4,250 | | | | 4,234,823 | |

1.28%, 03/07/16a,b | | | 800 | | | | 801,465 | |

2.50%, 01/14/16a | | | 11,020 | | | | 11,063,419 | |

4.00%, 03/15/16a | | | 1,250 | | | | 1,265,775 | |

Intesa Sanpaolo SpA | | | | | | | | |

3.13%, 01/15/16 | | | 8,253 | | | | 8,288,158 | |

Intesa Sanpaolo SpA/New York NY | | | | | | | | |

1.70%, 04/11/16b | | | 1,500 | | | | 1,501,743 | |

JPMorgan Chase & Co. | | | | | | | | |

0.84%, 02/15/17b | | | 4,952 | | | | 4,949,940 | |

0.87%, 04/25/18b | | | 3,000 | | | | 2,985,435 | |

0.95%, 02/26/16b | | | 1,575 | | | | 1,576,430 | |

3.15%, 07/05/16 | | | 15,960 | | | | 16,164,033 | |

3.45%, 03/01/16 | | | 3,800 | | | | 3,835,515 | |

KeyBank N.A./Cleveland OH | | | | | | | | |

1.10%, 11/25/16 (Call 10/25/16) | | | 7,250 | | | | 7,259,128 | |

5.45%, 03/03/16 | | | 5,000 | | | | 5,073,435 | |

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

Morgan Stanley | | | | | | | | |

1.06%, 01/05/18b | | $ | 1,600 | | | $ | 1,600,206 | |

1.58%, 02/25/16b | | | 1,750 | | | | 1,754,645 | |

1.60%, 04/25/18b | | | 6,282 | | | | 6,365,613 | |

1.75%, 02/25/16d | | | 4,000 | | | | 4,014,208 | |

3.80%, 04/29/16 | | | 4,960 | | | | 5,035,293 | |

5.45%, 01/09/17 | | | 5,000 | | | | 5,237,470 | |

MUFG Union Bank N.A. | | | | | | | | |

1.08%, 09/26/16b,d | | | 1,000 | | | | 1,001,756 | |

National Bank of Canada | | | | | | | | |

2.20%, 10/19/16a | | | 10,500 | | | | 10,627,774 | |

Nordea Bank AB | | | | | | | | |

1.17%, 09/17/18a,b | | | 10,000 | | | | 10,045,210 | |

Nordea Eiendomskreditt AS | | | | | | | | |

2.13%, 09/22/17a | | | 1,000 | | | | 1,010,621 | |

Royal Bank of Canada | | | | | | | | |

0.86%, 07/30/18b | | | 6,000 | | | | 5,993,028 | |

1.13%, 07/22/16 | | | 9,000 | | | | 9,017,766 | |

Royal Bank of Scotland Group PLC | | | | | | | | |

1.27%, 03/31/17b | | | 1,150 | | | | 1,149,501 | |

SpareBank 1 Boligkreditt AS | | | | | | | | |

2.63%, 05/27/16a | | | 1,250 | | | | 1,262,711 | |

Standard Chartered PLC | | | | | | | | |

3.20%, 05/12/16a | | | 4,171 | | | | 4,219,067 | |

Sumitomo Mitsui Trust Bank Ltd. | | | | | | | | |

1.11%, 09/16/16a,b | | | 500 | | | | 501,334 | |

Swedbank Hypotek AB | | | | | | | | |

2.13%, 08/31/16a | | | 11,000 | | | | 11,106,249 | |

Toronto-Dominion Bank (The) | | | | | | | | |

0.86%, 07/23/18b | | | 7,000 | | | | 6,991,901 | |

1.63%, 09/14/16a | | | 12,000 | | | | 12,086,820 | |

UBS AG/Stamford CT | | | | | | | | |

1.03%, 03/26/18b | | | 6,450 | | | | 6,441,841 | |

Wachovia Corp. | | | | | | | | |

0.69%, 10/15/16b | | | 3,250 | | | | 3,243,715 | |

5.63%, 10/15/16 | | | 3,000 | | | | 3,134,145 | |

Wells Fargo & Co. | | | | | | | | |

0.95%, 04/23/18b | | | 4,000 | | | | 4,017,172 | |

2.63%, 12/15/16 | | | 8,000 | | | | 8,149,752 | |

| | | | | | | | |

| | | | | | | 368,658,356 | |

BEVERAGES — 0.48% | | | | | | | | |

PepsiCo Inc. | | | | | | | | |

0.67%, 10/13/17b | | | 8,500 | | | | 8,506,417 | |

| | | | | | | | |

| | | | | | | 8,506,417 | |

| | |

| 20 | | 2015 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® SHORT MATURITY BOND ETF

October 31, 2015

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

BIOTECHNOLOGY — 0.44% | | | | | | | | |

Amgen Inc. | | | | | | | | |

2.30%, 06/15/16 | | $ | 7,750 | | | $ | 7,820,936 | |

| | | | | | | | |

| | | | | | | 7,820,936 | |

CHEMICALS — 0.27% | | | | | | | | |

Eastman Chemical Co. | | | | | | | | |

3.00%, 12/15/15d | | | 4,800 | | | | 4,812,648 | |

| | | | | | | | |

| | | | | | | 4,812,648 | |

COMMERCIAL SERVICES — 0.12% | | | | | | | | |

ERAC USA Finance LLC | | | | | | | | |

1.40%, 04/15/16a | | | 1,660 | | | | 1,661,826 | |

5.90%, 11/15/15a | | | 400 | | | | 400,637 | |

| | | | | | | | |

| | | | | | | 2,062,463 | |

COMPUTERS — 0.92% | | | | | | | | |

Hewlett Packard Enterprise Co. | | | | | | | | |

2.25%, 10/05/18a,b | | | 16,340 | | | | 16,385,817 | |

| | | | | | | | |

| | | | | | | 16,385,817 | |

DIVERSIFIED FINANCIAL SERVICES — 5.10% | | | | | |

Air Lease Corp. | | | | | | | | |

4.50%, 01/15/16d | | | 6,595 | | | | 6,628,832 | |

American Express Credit Corp. | | | | | | | | |

1.30%, 07/29/16d | | | 12,000 | | | | 12,049,440 | |

Caisse Centrale Desjardins | | | | | | | | |

0.69%, 09/12/17a,b | | | 3,800 | | | | 3,780,726 | |

Credit Suisse USA Inc. | | | | | | | | |

5.85%, 08/16/16d | | | 5,000 | | | | 5,193,750 | |

Ford Motor Credit Co. LLC | | | | | | | | |

0.90%, 12/06/17b | | | 1,000 | | | | 987,028 | |

1.56%, 05/09/16b | | | 1,500 | | | | 1,504,212 | |

1.70%, 05/09/16 | | | 750 | | | | 751,721 | |

2.50%, 01/15/16d | | | 3,500 | | | | 3,511,197 | |

3.98%, 06/15/16 | | | 15,570 | | | | 15,810,214 | |

4.21%, 04/15/16d | | | 8,750 | | | | 8,868,213 | |

8.00%, 12/15/16 | | | 2,000 | | | | 2,139,650 | |

General Electric Capital Corp. | | | | | | | | |

2.95%, 05/09/16 | | | 5,000 | | | | 5,061,595 | |

General Motors Financial Co. Inc. | | | | | | | | |

2.75%, 05/15/16d | | | 20,328 | | | | 20,461,067 | |

HSBC Finance Corp. | | | | | | | | |

0.75%, 06/01/16b | | | 4,025 | | | | 4,017,956 | |

| | | | | | | | |

| | | | | | | 90,765,601 | |

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

ELECTRIC — 1.41% | | | | | | | | |

Duke Energy Corp. | | | | | | | | |

2.15%, 11/15/16 | | $ | 715 | | | $ | 722,337 | |

Duke Energy Florida LLC | | | | | | | | |

0.65%, 11/15/15 | | | 370 | | | | 370,004 | |

Duke Energy Indiana Inc. | | | | | | | | |

6.05%, 06/15/16 | | | 7,300 | | | | 7,535,330 | |

Jersey Central Power & Light Co. | | | | | | | | |

5.63%, 05/01/16 | | | 7,339 | | | | 7,474,008 | |

LG&E and KU Energy LLC | | | | | | | | |

2.13%, 11/15/15 | | | 1,233 | | | | 1,233,410 | |

Nevada Power Co. Series M | | | | | | | | |

5.95%, 03/15/16 | | | 1,091 | | | | 1,111,932 | |

Ohio Power Co. | | | | | | | | |

6.00%, 06/01/16 | | | 835 | | | | 858,844 | |

Progress Energy Inc. | | | | | | | | |

5.63%, 01/15/16 | | | 3,725 | | | | 3,758,994 | |

Southern Co. (The) | | | | | | | | |

1.95%, 09/01/16 | | | 2,105 | | | | 2,120,276 | |

| | | | | | | | |

| | | | | | | 25,185,135 | |

ELECTRONICS — 0.57% | | | | | | | | |

Thermo Fisher Scientific Inc. | | | | | | | | |

2.25%, 08/15/16 | | | 5,250 | | | | 5,290,940 | |

3.20%, 03/01/16 | | | 4,864 | | | | 4,899,390 | |

| | | | | | | | |

| | | | | | | 10,190,330 | |

FOOD — 0.23% | | | | | | | | |

Mondelez International Inc. | | | | | | | | |

4.13%, 02/09/16 | | | 4,000 | | | | 4,034,372 | |

| | | | | | | | |

| | | | | | | 4,034,372 | |

HEALTH CARE — PRODUCTS — 0.60% | | | | | |

Life Technologies Corp. | | | | | | | | |

3.50%, 01/15/16 | | | 7,310 | | | | 7,347,880 | |

Medtronic Inc. | | | | | | | | |

2.63%, 03/15/16 | | | 1,158 | | | | 1,166,540 | |

Zimmer Biomet Holdings Inc. | | | | | | | | |

1.45%, 04/01/17 | | | 2,250 | | | | 2,244,920 | |

| | | | | | | | |

| | | | | | | 10,759,340 | |

HEALTH CARE — SERVICES — 1.57% | | | | | |

UnitedHealth Group Inc. | | | | | | | | |

0.77%, 01/17/17b | | | 12,000 | | | | 12,013,356 | |

Ventas Realty LP | | | | | | | | |

1.55%, 09/26/16 | | | 15,900 | | | | 15,968,863 | |

| | | | | | | | |

| | | | | | | 27,982,219 | |

| | | | |

SCHEDULESOF INVESTMENTS | | | 21 | |

Schedule of Investments (Continued)

iSHARES® SHORT MATURITY BOND ETF

October 31, 2015

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

HOLDING COMPANIES — DIVERSIFIED — 0.11% | |

MUFG Americas Holdings Corp. | | | | | | | | |

0.88%, 02/09/18 (Call 01/09/18)b | | $ | 2,000 | | | $ | 2,002,214 | |

| | | | | | | | |

| | | | | | | 2,002,214 | |

INSURANCE — 3.85% | | | | | | | | |

Allied World Assurance Co. Holdings Ltd. | | | | | | | | |

7.50%, 08/01/16 | | | 4,000 | | | | 4,181,644 | |

American International Group Inc. | | | | | | | | |

5.60%, 10/18/16 | | | 5,140 | | | | 5,363,179 | |

Aon Corp. | | | | | | | | |

3.13%, 05/27/16 | | | 15,830 | | | | 16,026,941 | |

Liberty Mutual Group Inc. | | | | | | | | |

6.70%, 08/15/16a | | | 13,445 | | | | 14,018,779 | |

MetLife Inc. | | | | | | | | |

6.75%, 06/01/16 | | | 12,451 | | | | 12,886,760 | |

Pricoa Global Funding I | | | | | | | | |

1.15%, 11/25/16a | | | 6,180 | | | | 6,186,495 | |

Prudential Financial Inc. | | | | | | | | |

3.00%, 05/12/16 | | | 9,715 | | | | 9,824,877 | |

| | | | | | | | |

| | | | | | | 68,488,675 | |

LEISURE TIME — 0.71% | | | | | | | | |

Carnival Corp. | | | | | | | | |

1.20%, 02/05/16 | | | 12,650 | | | | 12,664,105 | |

| | | | | | | | |

| | | | | | | 12,664,105 | |

LODGING — 0.05% | | | | | | | | |

Marriott International Inc./MD | | | | | | | | |

6.20%, 06/15/16 | | | 945 | | | | 974,274 | |

| | |

MANUFACTURING — 0.21% | | | | | | | | |

Pentair Finance SA | | | | | | | | |

1.35%, 12/01/15 | | | 3,800 | | | | 3,800,315 | |

| | | | | | | | |

| | | | | | | 3,800,315 | |

MEDIA — 1.18% | | | | | | | | |

Comcast Corp. | | | | | | | | |

4.95%, 06/15/16 | | | 7,722 | | | | 7,925,668 | |

Cox Communications Inc. | | | | | | | | |

5.88%, 12/01/16a | | | 1,850 | | | | 1,934,210 | |

DIRECTV Holdings LLC/DIRECTV Financing Co. Inc. | | | | | | | | |

2.40%, 03/15/17d | | | 11,000 | | | | 11,143,704 | |

| | | | | | | | |

| | | | | | | 21,003,582 | |

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

OIL & GAS — 0.14% | | | | | | | | |

Anadarko Petroleum Corp. | | | | | | | | |

5.95%, 09/15/16 | | $ | 1,300 | | | $ | 1,347,823 | |

Marathon Oil Corp. | | | | | | | | |

0.90%, 11/01/15 | | | 1,200 | | | | 1,200,000 | |

| | | | | | | | |

| | | | | | | 2,547,823 | |

PHARMACEUTICALS — 3.00% | | | | | | | | |

AbbVie Inc. | | | | | | | | |

1.20%, 11/06/15 | | | 8,350 | | | | 8,350,334 | |

Actavis Funding SCS | | | | | | | | |

1.20%, 09/01/16b | | | 4,000 | | | | 3,995,264 | |

1.42%, 03/12/18b,d | | | 2,000 | | | | 1,988,326 | |

Allergan Inc./U.S. | | | | | | | | |

5.75%, 04/01/16d | | | 9,630 | | | | 9,814,193 | |

Express Scripts Holding Co. | | | | | | | | |

3.13%, 05/15/16 | | | 7,750 | | | | 7,840,660 | |

McKesson Corp. | | | | | | | | |

0.95%, 12/04/15 | | | 600 | | | | 599,946 | |

Mylan Inc. | | | | | | | | |

1.80%, 06/24/16 | | | 13,300 | | | | 13,291,222 | |

Perrigo Co. PLC | | | | | | | | |

1.30%, 11/08/16 | | | 1,220 | | | | 1,206,751 | |

Zoetis Inc. | | | | | | | | |

1.15%, 02/01/16 | | | 6,400 | | | | 6,401,875 | |

| | | | | | | | |

| | | | | | | 53,488,571 | |

PIPELINES — 0.25% | | | | | | | | |

Kinder Morgan Finance Co. LLC | | | | | | | | |

5.70%, 01/05/16d | | | 4,500 | | | | 4,533,610 | |

| | | | | | | | |

| | | | | | | 4,533,610 | |

REAL ESTATE INVESTMENT TRUSTS — 1.45% | |

DDR Corp. | | | | | | | | |

9.63%, 03/15/16d | | | 1,500 | | | | 1,544,929 | |

ERP Operating LP | | | | | | | | |

5.13%, 03/15/16d | | | 3,400 | | | | 3,453,479 | |

5.38%, 08/01/16 | | | 11,759 | | | | 12,124,023 | |

HCP Inc. | | | | | | | | |

3.75%, 02/01/16d | | | 6,129 | | | | 6,165,535 | |

Welltower Inc. | | | | | | | | |

6.20%, 06/01/16 | | | 2,500 | | | | 2,566,595 | |

| | | | | | | | |

| | | | | | | 25,854,561 | |

RETAIL — 1.27% | | | | | | | | |

AutoZone Inc. | | | | | | | | |

5.50%, 11/15/15 | | | 500 | | | | 500,752 | |

6.95%, 06/15/16 | | | 4,000 | | | | 4,142,948 | |

| | |

| 22 | | 2015 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® SHORT MATURITY BOND ETF

October 31, 2015

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

CVS Health Corp. | | | | | | | | |

6.13%, 08/15/16 | | $ | 17,013 | | | $ | 17,688,944 | |

Macy’s Retail Holdings Inc. | | | | | | | | |

5.90%, 12/01/16 | | | 230 | | | | 241,768 | |

| | | | | | | | |

| | | | | | | 22,574,412 | |

SAVINGS & LOANS — 0.19% | | | | | | | | |

Santander Holdings USA Inc. | | | | | | | | |

4.63%, 04/19/16 | | | 3,319 | | | | 3,374,059 | |

| | | | | | | | |

| | | | | | | 3,374,059 | |

TELECOMMUNICATIONS — 2.32% | | | | | | | | |

AT&T Inc. | | | | | | | | |

2.40%, 08/15/16 | | | 6,000 | | | | 6,068,226 | |

2.95%, 05/15/16d | | | 6,250 | | | | 6,314,137 | |

Orange SA | | | | | | | | |

2.75%, 09/14/16 | | | 2,000 | | | | 2,030,342 | |

Verizon Communications Inc. | | | | | | | | |

0.73%, 06/09/17b | | | 3,500 | | | | 3,489,668 | |

1.87%, 09/15/16b | | | 3,250 | | | | 3,280,374 | |

2.00%, 11/01/16 | | | 6,850 | | | | 6,914,445 | |

2.09%, 09/14/18b | | | 4,500 | | | | 4,622,796 | |

2.50%, 09/15/16 | | | 8,000 | | | | 8,109,360 | |

Vodafone Group PLC | | | | | | | | |

0.72%, 02/19/16b,d | | | 500 | | | | 499,768 | |

| | | | | | | | |

| | | | | | | 41,329,116 | |

TRANSPORTATION — 0.20% | | | | | | | | |

Kansas City Southern de Mexico SA de CV | | | | | | | | |

1.02%, 10/28/16b | | | 1,000 | | | | 990,557 | |

Ryder System Inc. | | | | | | | | |

3.60%, 03/01/16 | | | 784 | | | | 790,037 | |

Union Pacific Corp. | | | | | | | | |

7.00%, 02/01/16 | | | 1,700 | | | | 1,726,352 | |

| | | | | | | | |

| | | | | | | 3,506,946 | |

TRUCKING & LEASING — 1.67% | | | | | | | | |

GATX Corp. | | | | | | | | |

3.50%, 07/15/16 | | | 8,007 | | | | 8,115,439 | |

Penske Truck Leasing Co. LP/PTL Finance Corp. | | | | | | | | |

2.50%, 03/15/16a | | | 21,578 | | | | 21,685,739 | |

| | | | | | | | |

| | | | | | | 29,801,178 | |

| | | | | | | | |

TOTAL CORPORATE BONDS & NOTES | | | | | |

(Cost: $935,061,871) | | | | 934,393,434 | |

| | | | | | | | |

| | | | | | | | |

Security | |

Principal

(000s) | | | Value | |

FOREIGN GOVERNMENT OBLIGATIONSe — 0.99% | |

ITALY — 0.06% | | | | | | | | |

Italy Government International Bond | | | | | | | | |

5.25%, 09/20/16 | | $ | 1,000 | | | $ | 1,034,882 | |

JAPAN — 0.93% | | | | | | | | |

Japan Treasury Discount Bill | | | | | | | | |

0.00%, 12/21/15 | | | 2,000,000 | | | | 16,573,524 | |

| | | | | | | | |

TOTAL FOREIGN GOVERNMENT OBLIGATIONS | |

(Cost: $17,631,159) | | | | 17,608,406 | |

|

MUNICIPAL DEBT OBLIGATIONS — 0.18% | |

NEW JERSEY — 0.18% | | | | | | | | |

New Jersey Economic Development Authority RB

Series Q

| | | | | | | | |

1.10%, 06/15/16d | | | 3,180 | | | | 3,177,901 | |

| | | | | | | | |

TOTAL MUNICIPAL DEBT OBLIGATIONS | |

(Cost: $3,176,586) | | | | 3,177,901 | |

| |

REPURCHASE AGREEMENTS — 4.55% | | | | | |

Barclays Capital Inc., 0.70%, 11/02/15b (Purchased on 10/30/15 to be repurchased at $21,001,225 collateralized by various non-agency asset-backed and mortgage-backed securities, 0.34% to 7.52%, due 2/25/21 to 8/25/47, par and fair value of $35,409,694 and $23,995,842, respectively)f | | | 21,000 | | | | 21,000,000 | |

Merrill Lynch, 0.85%, 11/02/15b (Purchased on 10/30/15 to be repurchased at $15,001,063, collateralized by a non-agency mortgage backed security, 0.00%, due 03/25/58, par and fair value of $17,789,063 and $17,250,001, respectively)f | | | 15,000 | | | | 15,000,000 | |

Mizuho Securities USA Inc., 1.42%, 11/02/15b (Purchased on 10/30/15 to be repurchased at $45,005,332, collateralized by a U.S. government debt obligation, 3.13%, due 05/15/21, par and fair value of $42,109,500 and $45,900,042, respectively)f | | | 45,000 | | | | 45,000,000 | |

| | | | | | | | |

TOTAL REPURCHASE AGREEMENTS | | | | | |

(Cost: $81,000,000) | | | | 81,000,000 | |

| | | | |

SCHEDULESOF INVESTMENTS | | | 23 | |

Schedule of Investments (Continued)

iSHARES® SHORT MATURITY BOND ETF

October 31, 2015

| | | | | | | | |

| Security | | Shares

(000s) | | | Value | |

MONEY MARKET FUNDS — 7.99% | | | | | |

BlackRock Cash Funds: Institutional, SL Agency Shares | | | | | | | | |

0.19%g,h,i | | | 47,721 | | | | 47,721,212 | |

BlackRock Cash Funds: Prime,

SL Agency Shares | |

0.19%g,h,i | | | 94,640 | | | | 94,640,405 | |

| | | | | | | | |