UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22649

iShares U.S. ETF Trust

(Exact name of Registrant as specified in charter)

c/o: State Street Bank and Trust Company

1 Iron Street, Boston, MA 02210

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 670-2000

Date of fiscal year end: July 31, 2016

Date of reporting period: July 31, 2016

| Item 1. | Reports to Stockholders. |

Copies of the annual reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 are attached.

JULY 31, 2016

| | | | |

2016 ANNUAL REPORT | | | |  |

iShares U.S. ETF Trust

| Ø | | iShares Enhanced International Large-Cap ETF | IEIL | NYSE Arca |

| Ø | | iShares Enhanced International Small-Cap ETF | IEIS | NYSE Arca |

| Ø | | iShares Enhanced U.S. Large-Cap ETF | IELG | NYSE Arca |

| Ø | | iShares Enhanced U.S. Small-Cap ETF | IESM | NYSE Arca |

Table of Contents

Management’s Discussion of Fund Performance

iSHARES® U.S. ETF TRUST

GLOBAL EQUITY MARKET OVERVIEW

Global equity markets declined modestly for the 12 months ended July 31, 2016 (the “reporting period”). The MSCI ACWI, a broad global equity index that includes both developed and emerging markets, returned -0.44% for the reporting period.

The modest overall decline in global stock markets masked significant volatility during the reporting period. Stocks fell during the first half of the reporting period amid lower energy prices and weaker global economic growth, including slowdowns in stronger developed economies such as the U.S. and U.K. In response, many of the world’s central banks took more aggressive actions to stimulate economic activity, including expanded quantitative easing measures and negative interest rates.

In the U.S., the Federal Reserve Bank (the “Fed”) postponed plans to raise its short-term interest rate target until December 2015, when it ended a seven-year period of near-zero interest rates by increasing the federal funds target rate from a range of 0%-0.25% to a range of 0.25%-0.50%. It was the Fed’s first interest rate hike since June 2006.

Central bank stimulus activity and a recovery in energy prices helped global equity markets reverse course after bottoming in mid-February 2016. The global equity market rally in the latter half of the reporting period was also driven by signs of stabilization in China, which had experienced a marked economic slowdown that put downward pressure on its currency. Late in the reporting period, market volatility increased following the “Brexit” referendum in the U.K., where an affirmative vote to leave the European Union led to a sharp decline in the British pound (which fell by 18% against the U.S. dollar for the reporting period) and increased expectations of an interest rate cut from the Bank of England.

Among developed markets, the U.S. was one of the few markets to advance, returning approximately 4% for the reporting period. Although employment growth remained robust, other segments of the U.S. economy struggled, leading to three consecutive quarters of growth below a 1.5% annual rate. As a result, the Fed — which was expected to raise short-term interest rates further in 2016 — held rates steady through the first seven months of the year. Stable Fed monetary policy provided a favorable backdrop for U.S. equity market performance.

Equity markets in the Asia/Pacific region were mixed. Australia and New Zealand posted positive returns for the reporting period, benefiting from improving economic growth. However, other markets in the region, including Japan and Singapore, fell during the reporting period. In particular, the Japanese equity market declined by nearly 20%, but a strong rally in the Japanese yen (which appreciated by 17% against the U.S. dollar) helped offset the overall market decline.

European stock markets declined by approximately 10% for the reporting period. Markets in Italy and Spain, which were adversely affected by political instability and struggling banking sectors, declined the most, while Belgium and Denmark performed best. In the U.K., the equity market advanced by about 4%, but the sharp decline in the British pound led to negative returns in U.S. dollar terms.

Emerging markets stocks declined by approximately 1% for the reporting period in U.S. dollar terms. Latin American equity markets generated the best returns, led by rebounding markets in Peru and Brazil. Stock markets in Eastern Europe fell the most, primarily because of sharp declines in Greece, Poland, and the Czech Republic.

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 5 | |

Management’s Discussion of Fund Performance

iSHARES® ENHANCED INTERNATIONAL LARGE-CAP ETF

Performance as of July 31, 2016

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since Inception | | | | | | 1 Year | | | Since Inception | |

Fund NAV | | | (6.35)% | | | | (1.81)% | | | | | | | | (6.35)% | | | | (4.34)% | |

Fund Market | | | (6.82)% | | | | (2.00)% | | | | | | | | (6.82)% | | | | (4.79)% | |

MSCI World ex USA Index | | | (6.88)% | | | | (2.80)% | | | | | | | | (6.88)% | | | | (6.68)% | |

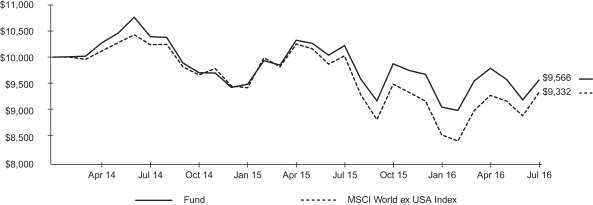

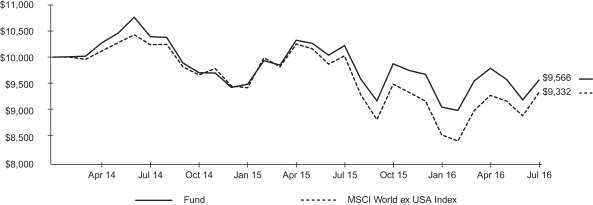

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 2/25/14. The first day of secondary market trading was 2/27/14.

The MSCI World ex USA Index is an unmanaged broad-based index that measures the performance of the large- and mid-capitalization sectors of developed equity markets, excluding the United States.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 14 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholder Expenses | |

| Actual | | | Hypothetical 5% Return | | | | |

Beginning

Account Value

(2/1/16) | | | Ending

Account Value

(7/31/16) | | | Expenses Paid

During Period a | | | Beginning

Account Value

(2/1/16) | | | Ending

Account Value

(7/31/16) | | | Expenses Paid

During Period a | | | Annualized

Expense Ratio | |

| $ | 1,000.00 | | | $ | 1,056.50 | | | $ | 1.79 | | | $ | 1,000.00 | | | $ | 1,023.10 | | | $ | 1.76 | | | | 0.35% | |

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (182 days) and divided by the number of days in the year (366 days). See “Shareholder Expenses” on page 14 for more information. | |

| | |

| 6 | | 2016 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® ENHANCED INTERNATIONAL LARGE-CAP ETF

The iShares Enhanced International Large-Cap ETF (the “Fund”) seeks long-term capital appreciation by investing, under normal circumstances, at least 80% of its net assets in equity securities of international large-capitalization issuers. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index. For the 12-month reporting period ended July 31, 2016, the total return for the Fund was -6.35%, net of fees.

The Fund declined for the reporting period and performed in line with the -6.88% return of the MSCI World ex USA Index. The Fund combines the investment characteristics, or factors, of quality, value, and size exposures based on BlackRock insights. Quality is defined as a company that exhibits positive fundamentals, including high cash earnings, low earnings variability, and low debt-to-equity ratio, while value refers to companies with lower relative valuations based on measures such as price-to-earnings and price-to-book ratios. Size refers to relative market capitalization, and the Fund attempts to invest in stocks with lower relative market capitalizations.

The Fund was positioned to have less volatility than the broader market, and this positioning added value during the reporting period as the broad international equity markets experienced periods of significant volatility, particularly over the latter half of the reporting period. For example, international equity markets declined significantly in early 2016 amid lower energy prices and slowing global growth. International stocks subsequently rebounded somewhat before falling substantially again in late June following the U.K.’s referendum to leave the European Union.

The Fund’s exposure to stocks with smaller relative market capitalizations also added value, while exposure to value-oriented stocks detracted from performance.

As of the end of the reporting period, the Fund’s largest sector overweights relative to the MSCI World ex USA Index were telecommunication services and financials, while the largest underweights were consumer discretionary and healthcare.

Special Note: On June 23, 2016, the Board unanimously voted to close and liquidate the Fund. After the close of business on August 23, 2016, subject to applicable law, the Fund no longer accepted creation orders. Trading in the Fund was halted prior to market open on August 24, 2016. Proceeds of the liquidation were sent to shareholders on August 30, 2016.

ALLOCATION BY SECTOR

As of 7/31/16

| | |

| Sector | | Percentage of

Total Investments* |

| | | | |

Financials | | | 28.92 | % |

Industrials | | | 16.73 | |

Telecommunication Services | | | 10.42 | |

Consumer Staples | | | 10.18 | |

Health Care | | | 7.29 | |

Materials | | | 6.75 | |

Energy | | | 5.89 | |

Utilities | | | 5.07 | |

Consumer Discretionary | | | 4.88 | |

Information Technology | | | 3.87 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

TEN LARGEST COUNTRIES

As of 7/31/16

| | |

| Country | | Percentage of

Total Investments* |

| | | | |

Japan | | | 26.15 | % |

Switzerland | | | 13.14 | |

United Kingdom | | | 12.21 | |

Canada | | | 9.29 | |

Denmark | | | 5.90 | |

Netherlands | | | 5.53 | |

Belgium | | | 5.30 | |

France | | | 4.29 | |

Australia | | | 4.02 | |

Germany | | | 3.30 | |

| | | | |

TOTAL | | | 89.13 | % |

| | | | |

| | * | Excludes money market funds. |

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 7 | |

Management’s Discussion of Fund Performance

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

Performance as of July 31, 2016

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since Inception | | | | | | 1 Year | | | Since Inception | |

Fund NAV | | | 6.62% | | | | 1.55% | | | | | | | | 6.62% | | | | 3.80% | |

Fund Market | | | 5.99% | | | | 1.40% | | | | | | | | 5.99% | | | | 3.43% | |

MSCI World ex USA Small Cap Index | | | 2.55% | | | | 0.69% | | | | | | | | 2.55% | | | | 1.68% | |

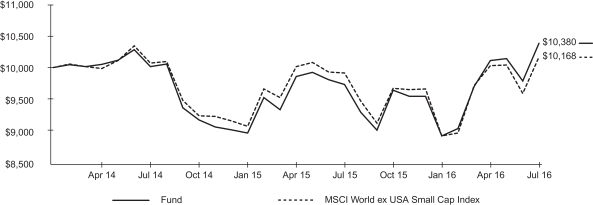

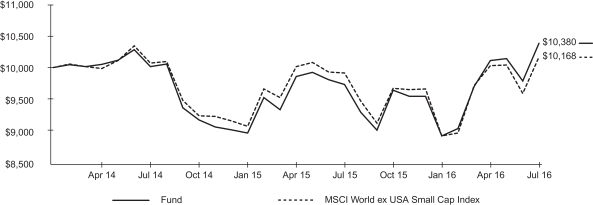

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 2/25/14. The first day of secondary market trading was 2/27/14.

The MSCI World ex USA Small Cap Index is an unmanaged broad-based index that measures the performance of the small-capitalization sector of developed equity markets, excluding the United States.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 14 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholder Expenses | |

| Actual | | | Hypothetical 5% Return | | | | |

Beginning

Account Value

(2/1/16) | | | Ending

Account Value

(7/31/16) | | | Expenses Paid

During Period a | | | Beginning

Account Value

(2/1/16) | | | Ending

Account Value

(7/31/16) | | | Expenses Paid

During Period a | | | Annualized

Expense Ratio | |

| $ | 1,000.00 | | | $ | 1,162.40 | | | $ | 2.63 | | | $ | 1,000.00 | | | $ | 1,022.40 | | | $ | 2.46 | | | | 0.49% | |

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (182 days) and divided by the number of days in the year (366 days). See “Shareholder Expenses” on page 14 for more information. | |

| | |

| 8 | | 2016 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

The iShares Enhanced International Small-Cap ETF (the “Fund”) seeks long-term capital appreciation by investing, under normal circumstances, at least 80% of its net assets in equity securities of international small-capitalization issuers. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index. For the 12-month reporting period ended July 31, 2016, the total return for the Fund was 6.62%, net of fees.

The Fund posted a positive return for the reporting period and outperformed the 2.55% return of the MSCI World ex USA Small Cap Index. The Fund combines the investment characteristics, or factors, of quality, value, and size exposures based on BlackRock insights. Quality is defined as a company that exhibits positive fundamentals, including high cash earnings, low earnings variability, and low debt-to-equity ratio, while value refers to companies with lower relative valuations based on measures such as price-to-earnings and price-to-book ratios. Size refers to relative market capitalization, and the Fund attempts to invest in stocks with lower relative market capitalizations.

The Fund was positioned to have less volatility than the broader market, and this positioning added value during the reporting period as the broad international equity markets experienced periods of significant volatility, particularly over the latter half of the reporting period. For example, international equity markets declined significantly in early 2016 amid lower energy prices and slowing global growth. International stocks subsequently rebounded somewhat before falling substantially again in late June following the U.K.’s referendum to leave the European Union.

The Fund’s exposure to value detracted from performance during the reporting period as value-oriented international stocks underperformed. The Fund’s exposure to stocks with smaller relative market capitalizations had little impact on overall performance.

As of the end of the reporting period, the Fund’s largest sector overweights relative to the MSCI World ex USA Small Cap Index were consumer discretionary and information technology, while the largest underweights were financials and industrials.

Special Note: On June 23, 2016, the Board unanimously voted to close and liquidate the Fund. After the close of business on August 23, 2016, subject to applicable law, the Fund no longer accepted creation orders. Trading in the Fund was halted prior to market open on August 24, 2016. Proceeds of the liquidation were sent to shareholders on August 30, 2016.

ALLOCATION BY SECTOR

As of 7/31/16

| | |

| Sector | | Percentage of

Total Investments* |

| | | | |

Consumer Discretionary | | | 18.80 | % |

Industrials | | | 16.65 | |

Financials | | | 16.49 | |

Information Technology | | | 12.82 | |

Materials | | | 11.78 | |

Consumer Staples | | | 7.83 | |

Energy | | | 6.42 | |

Health Care | | | 5.77 | |

Telecommunication Services | | | 2.40 | |

Utilities | | | 1.04 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

TEN LARGEST COUNTRIES As of 7/31/16

| | |

| Country | | Percentage of

Total Investments* |

| | | | |

Japan | | | 33.65 | % |

United Kingdom | | | 10.71 | |

Australia | | | 7.82 | |

Canada | | | 6.52 | |

Denmark | | | 6.18 | |

Finland | | | 4.60 | |

Germany | | | 4.11 | |

Belgium | | | 3.99 | |

New Zealand | | | 3.90 | |

France | | | 3.23 | |

| | | | |

TOTAL | | | 84.71 | % |

| | | | |

| | * | Excludes money market funds. |

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 9 | |

Management’s Discussion of Fund Performance

iSHARES® ENHANCED U.S. LARGE-CAP ETF

Performance as of July 31, 2016

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since Inception | | | | | | 1 Year | | | Since Inception | |

Fund NAV | | | 5.57% | | | | 12.26% | | | | | | | | 5.57% | | | | 46.36% | |

Fund Market | | | 5.57% | | | | 12.28% | | | | | | | | 5.57% | | | | 46.44% | |

Russell 1000 Index | | | 4.84% | | | | 12.50% | | | | | | | | 4.84% | | | | 47.33% | |

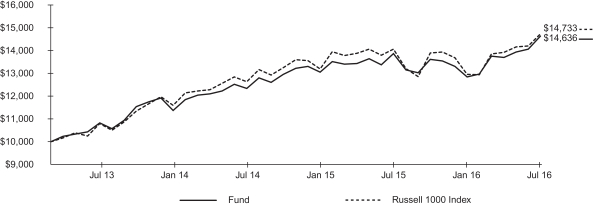

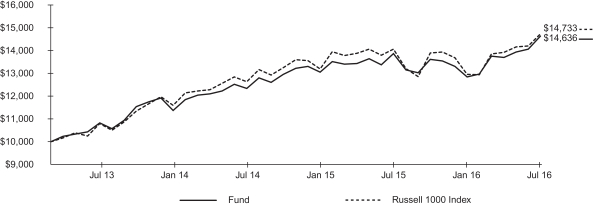

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 4/16/13. The first day of secondary market trading was 4/18/13.

The Russell 1000® Index is an unmanaged broad-based index that measures the performance of the large- and mid-capitalization sectors of the U.S. equity market.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 14 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholder Expenses | |

| Actual | | | Hypothetical 5% Return | | | | |

Beginning

Account Value

(2/1/16) | | | Ending

Account Value

(7/31/16) | | | Expenses Paid

During Period a | | | Beginning

Account Value

(2/1/16) | | | Ending

Account Value

(7/31/16) | | | Expenses Paid

During Period a | | | Annualized

Expense Ratio | |

| $ | 1,000.00 | | | $ | 1,139.80 | | | $ | 0.96 | | | $ | 1,000.00 | | | $ | 1,024.00 | | | $ | 0.91 | | | | 0.18% | |

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (182 days) and divided by the number of days in the year (366 days). See “Shareholder Expenses” on page 14 for more information. | |

| | |

| 10 | | 2016 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® ENHANCED U.S. LARGE-CAP ETF

The iShares Enhanced U.S. Large-Cap ETF (the “Fund”) seeks long-term capital appreciation by investing, under normal circumstances, at least 80% of its net assets in equity securities of U.S. large-capitalization issuers. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index. For the 12-month reporting period ended July 31, 2016, the total return for the Fund was 5.57%, net of fees.

The Fund posted a positive return for the reporting period and outperformed the 4.84% return of the Russell 1000® Index. The Fund combines the investment characteristics, or factors, of quality, value, and size exposures based on BlackRock insights. Quality is defined as a company that exhibits positive fundamentals, including high cash earnings, low earnings variability, and low debt-to-equity ratio, while value refers to companies with lower relative valuations based on measures such as price-to-earnings and price-to-book ratios. Size refers to relative market capitalization, and the Fund attempts to invest in stocks with lower relative market capitalizations.

The Fund was positioned to have less volatility than the broader market, and this positioning added value during the reporting period as the broad U.S. equity market experienced periods of significant volatility, particularly over the latter half of the reporting period. For example, the domestic equity market declined significantly in early 2016 amid lower energy prices and slowing global growth. Stocks subsequently rebounded until late June, when concerns over the U.K.’s referendum to leave the European Union contributed to another sharp decline.

The Fund’s exposure to stocks with smaller relative market capitalizations also added value, while exposure to value-oriented stocks detracted from performance.

As of the end of the reporting period, the Fund’s largest sector overweights relative to the Russell 1000® Index were information technology and utilities, while the largest underweights were consumer staples and materials.

Special Note: On June 23, 2016, the Board unanimously voted to close and liquidate the Fund. After the close of business on August 23, 2016, subject to applicable law, the Fund no longer accepted creation orders. Trading in the Fund was halted prior to market open on August 24, 2016. Proceeds of the liquidation were sent to shareholders on August 30, 2016.

ALLOCATION BY SECTOR

As of 7/31/16

| | |

| Sector | | Percentage of

Total Investments* |

| | | | |

Information Technology | | | 31.21 | % |

Financials | | | 18.54 | |

Consumer Discretionary | | | 13.30 | |

Health Care | | | 12.65 | |

Utilities | | | 7.13 | |

Consumer Staples | | | 5.60 | |

Industrials | | | 5.09 | |

Energy | | | 4.32 | |

Telecommunication Services | | | 2.16 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

TEN LARGEST FUND HOLDINGS

As of 7/31/16

| | |

| Security | | Percentage of

Total Investments* |

| | | | |

VMware Inc. Class A | | | 2.46 | % |

Johnson & Johnson | | | 2.43 | |

CR Bard Inc. | | | 2.26 | |

Amazon.com Inc. | | | 2.16 | |

AT&T Inc. | | | 2.15 | |

Reinsurance Group of America Inc. | | | 2.15 | |

Intuit Inc. | | | 2.15 | |

Aflac Inc. | | | 2.12 | |

TJX Companies Inc. (The) | | | 2.12 | |

Intel Corp. | | | 2.10 | |

| | | | |

TOTAL | | | 22.10 | % |

| | | | |

| | * | Excludes money market funds. |

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 11 | |

Management’s Discussion of Fund Performance

iSHARES® ENHANCED U.S. SMALL-CAP ETF

Performance as of July 31, 2016

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since Inception | | | | | | 1 Year | | | Since Inception | |

Fund NAV | | | 4.77% | | | | 10.78% | | | | | | | | 4.77% | | | | 40.11% | |

Fund Market | | | 4.71% | | | | 10.76% | | | | | | | | 4.71% | | | | 40.03% | |

Russell 2000 Index | | | 0.00% | | | | 10.34% | | | | | | | | 0.00% | | | | 38.21% | |

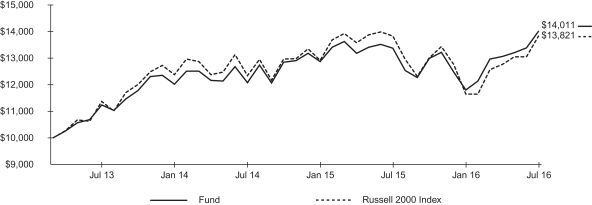

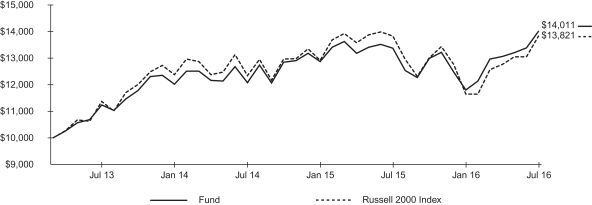

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 4/16/13. The first day of secondary market trading was 4/18/13.

The Russell 2000® Index is an unmanaged broad-based index that measures the performance of the small-capitalization sector of the U.S. equity market.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 14 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholder Expenses | |

| Actual | | | Hypothetical 5% Return | | | | |

Beginning

Account Value

(2/1/16) | | | Ending

Account Value

(7/31/16) | | | Expenses Paid

During Period a | | | Beginning

Account Value

(2/1/16) | | | Ending

Account Value

(7/31/16) | | | Expenses Paid

During Period a | | | Annualized

Expense Ratio | |

| $ | 1,000.00 | | | $ | 1,187.80 | | | $ | 1.90 | | | $ | 1,000.00 | | | $ | 1,023.10 | | | $ | 1.76 | | | | 0.35% | |

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (182 days) and divided by the number of days in the year (366 days). See “Shareholder Expenses” on page 14 for more information. | |

| | |

| 12 | | 2016 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® ENHANCED U.S. SMALL-CAP ETF

The iShares Enhanced U.S. Small-Cap ETF (the “Fund”) seeks long-term capital appreciation by investing, under normal circumstances, at least 80% of its net assets in equity securities of U.S. small-capitalization issuers. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index. For the 12-month reporting period ended July 31, 2016, the total return for the Fund was 4.77%, net of fees.

The Fund posted a positive return for the reporting period and outperformed the 0.00% return of the Russell 2000® Index. The Fund combines the investment characteristics, or factors, of quality, value, and size exposures based on BlackRock insights. Quality is defined as a company that exhibits positive fundamentals, including high cash earnings, low earnings variability, and low debt-to-equity ratio, while value refers to companies with lower relative valuations based on measures such as price-to-earnings and price-to-book ratios. Size refers to relative market capitalization, and the Fund attempts to invest in stocks with lower relative market capitalizations.

The Fund was positioned to have less volatility than the broader market, and this positioning added value during the reporting period as the broad U.S. equity market experienced periods of significant volatility, particularly over the latter half of the reporting period. For example, the domestic equity market declined significantly in early 2016 amid lower energy prices and slowing global growth. Stocks subsequently rebounded until late June, when concerns over the U.K.’s referendum to leave the European Union contributed to another sharp decline.

The Fund’s exposure to stocks with smaller relative market capitalizations detracted from performance, as did exposure to value-oriented stocks.

As of the end of the reporting period, the Fund’s largest sector overweights relative to the Russell 2000® Index were information technology and consumer staples, while the largest underweights were healthcare and materials.

Special Note: On June 23, 2016, the Board unanimously voted to close and liquidate the Fund. After the close of business on August 23, 2016, subject to applicable law, the Fund no longer accepted creation orders. Trading in the Fund was halted prior to market open on August 24, 2016. Proceeds of the liquidation were sent to shareholders on August 30, 2016.

ALLOCATION BY SECTOR

As of 7/31/16

| | |

| Sector | | Percentage of

Total Investments* |

| | | | |

Information Technology | | | 26.80 | % |

Financials | | | 22.75 | |

Consumer Discretionary | | | 14.88 | |

Industrials | | | 9.20 | |

Health Care | | | 7.58 | |

Utilities | | | 6.30 | |

Energy | | | 4.29 | |

Consumer Staples | | | 4.11 | |

Materials | | | 3.63 | |

Telecommunication Services | | | 0.46 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

TEN LARGEST FUND HOLDINGS

As of 7/31/16

| | |

| Security | | Percentage of

Total Investments* |

| | | | |

Cirrus Logic Inc. | | | 2.61 | % |

Advanced Energy Industries Inc. | | | 2.60 | |

ManTech International Corp./VA Class A | | | 2.49 | |

LogMeIn Inc. | | | 2.32 | |

Children’s Place Inc. (The) | | | 2.19 | |

Cash America International Inc. | | | 2.13 | |

Hyatt Hotels Corp. Class A | | | 2.00 | |

American National Insurance Co. | | | 2.00 | |

Select Income REIT | | | 1.98 | |

MFA Financial Inc. | | | 1.84 | |

| | | | |

TOTAL | | | 22.16 | % |

| | | | |

| | * | Excludes money market funds. |

| | | | |

MANAGEMENT’S DISCUSSIONSOF FUND PERFORMANCE | | | 13 | |

About Fund Performance

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.ishares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Certain funds may have a NAV which is determined prior to the opening of regular trading on its listed exchange and their market returns are calculated using the midpoint of the bid/ask spread as of the opening of regular trading on the exchange. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

Shareholder Expenses

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares and (2) ongoing costs, including management fees and other fund expenses. The expense example, which is based on an investment of $1,000 invested on February 1, 2016 and held through July 31, 2016, is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

Actual Expenses — The table provides information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. To estimate the expenses that you paid on your account over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number corresponding to your Fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes — The table also provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | |

| 14 | | 2016 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments

iSHARES® ENHANCED INTERNATIONAL LARGE-CAP ETF

July 31, 2016

| | | | | | | | |

| Security | | Shares | | | Value | |

COMMON STOCKS — 97.96% | |

| | |

AUSTRALIA — 3.94% | | | | | | | | |

Aristocrat Leisure Ltd. | | | 8,085 | | | $ | 97,952 | |

ASX Ltd. | | | 20,429 | | | | 771,694 | |

Brambles Ltd. | | | 7,425 | | | | 75,903 | |

Caltex Australia Ltd. | | | 2,850 | | | | 71,829 | |

CIMIC Group Ltd. | | | 1,290 | | | | 28,669 | |

Dexus Property Group | | | 11,597 | | | | 86,116 | |

GPT Group (The) | | | 5,805 | | | | 24,752 | |

Qantas Airways Ltd. | | | 65,774 | | | | 157,973 | |

| | | | | | | | |

| | | | | | | 1,314,888 | |

AUSTRIA — 0.58% | | | | | | | | |

OMV AG | | | 7,260 | | | | 192,936 | |

| | | | | | | | |

| | | | | | | 192,936 | |

BELGIUM — 5.19% | | | | | | | | |

Ageas | | | 2,970 | | | | 99,951 | |

bpost SA | | | 5,460 | | | | 143,025 | |

Colruyt SA | | | 1,125 | | | | 62,763 | |

Proximus SADP | | | 10,793 | | | | 336,914 | |

Solvay SA | | | 6,850 | | | | 710,926 | |

Telenet Group Holding NVa | | | 2,565 | | | | 121,688 | |

UCB SA | | | 270 | | | | 21,126 | |

Umicore SA | | | 4,095 | | | | 236,930 | |

| | | | | | | | |

| | | | | | | 1,733,323 | |

CANADA — 9.11% | | | | | | | | |

Agnico Eagle Mines Ltd. | | | 2,235 | | | | 130,221 | |

Alimentation Couche-Tard Inc. Class B | | | 1,050 | | | | 47,530 | |

Bank of Montreal | | | 5,739 | | | | 368,356 | |

Bank of Nova Scotia (The) | | | 1,860 | | | | 94,580 | |

BCE Inc. | | | 495 | | | | 23,736 | |

Canadian Imperial Bank of Commerce/Canada | | | 8,084 | | | | 614,894 | |

Constellation Software Inc./Canada | | | 1,827 | | | | 744,656 | |

Empire Co. Ltd. Class A | | | 5,175 | | | | 82,543 | |

Franco-Nevada Corp. | | | 615 | | | | 47,477 | |

George Weston Ltd. | | | 150 | | | | 13,338 | |

Husky Energy Inc. | | | 4,254 | | | | 50,106 | |

Intact Financial Corp. | | | 165 | | | | 11,842 | |

National Bank of Canada | | | 11,203 | | | | 384,100 | |

Open Text Corp. | | | 615 | | | | 37,521 | |

Rogers Communications Inc. Class B | | | 2,025 | | | | 89,553 | |

SNC-Lavalin Group Inc. | | | 4,691 | | | | 202,346 | |

Thomson Reuters Corp. | | | 2,310 | | | | 97,445 | |

| | | | | | | | |

| | | | | | | 3,040,244 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

DENMARK — 5.79% | | | | | | | | |

AP Moeller – Maersk A/S Class A | | | 305 | | | $ | 398,706 | |

AP Moeller – Maersk A/S Class B | | | 548 | | | | 743,964 | |

Coloplast A/S Class B | | | 5,480 | | | | 430,066 | |

Danske Bank A/S | | | 2,450 | | | | 66,596 | |

Jyske Bank A/S Registered | | | 1,225 | | | | 50,960 | |

TDC A/S | | | 38,394 | | | | 202,145 | |

Vestas Wind Systems A/S | | | 548 | | | | 38,261 | |

| | | | | | | | |

| | | | | | | 1,930,698 | |

FINLAND — 2.35% | | | | | | | | |

Neste OYJ | | | 1,440 | | | | 54,540 | |

Nokian Renkaat OYJ | | | 2,355 | | | | 87,510 | |

Stora Enso OYJ Class R | | | 33,779 | | | | 306,720 | |

UPM-Kymmene OYJ | | | 16,289 | | | | 335,706 | |

| | | | | | | | |

| | | | | | | 784,476 | |

FRANCE — 4.21% | | | | | | | | |

Electricite de France SA | | | 1,470 | | | | 19,241 | |

Eutelsat Communications SA | | | 915 | | | | 18,193 | |

Lagardere SCA | | | 2,025 | | | | 51,732 | |

Peugeot SAa | | | 34,510 | | | | 521,362 | |

SCOR SE | | | 1,110 | | | | 32,440 | |

SES SA | | | 7,080 | | | | 155,138 | |

SFR Group SA | | | 390 | | | | 9,215 | |

Total SA | | | 12,209 | | | | 583,790 | |

Veolia Environnement SA | | | 630 | | | | 13,991 | |

| | | | | | | | |

| | | | | | | 1,405,102 | |

GERMANY — 3.12% | | | | | | | | |

CTS Eventim AG & Co. KGaA | | | 555 | | | | 19,320 | |

Deutsche Lufthansa AG Registered | | | 39,694 | | | | 471,843 | |

MAN SE | | | 345 | | | | 36,180 | |

Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen Registered | | | 1,221 | | | | 203,715 | |

RWE AGa | | | 2,490 | | | | 44,287 | |

Telefonica Deutschland Holding AG | | | 60,195 | | | | 245,693 | |

United Internet AG Registeredb | | | 420 | | | | 18,570 | |

| | | | | | | | |

| | | | | | | 1,039,608 | |

HONG KONG — 0.43% | | | | | | | | |

CK Hutchison Holdings Ltd. | | | 7,500 | | | | 87,758 | |

PCCW Ltd. | | | 33,000 | | | | 24,027 | |

Yue Yuen Industrial Holdings Ltd. | | | 7,500 | | | | 30,445 | |

| | | | | | | | |

| | | | | | | 142,230 | |

ISRAEL — 2.16% | | | | | | | | |

Bank Hapoalim BM | | | 36,976 | | | | 188,984 | |

| | | | |

SCHEDULESOF INVESTMENTS | | | 15 | |

Schedule of Investments (Continued)

iSHARES® ENHANCED INTERNATIONAL LARGE-CAP ETF

July 31, 2016

| | | | | | | | |

| Security | | Shares | | | Value | |

Bank Leumi le-Israel BMa | | | 29,806 | | | $ | 107,528 | |

Bezeq The Israeli Telecommunication Corp. Ltd. | | | 198,657 | | | | 396,282 | |

Teva Pharmaceutical Industries Ltd. | | | 495 | | | | 26,663 | |

| | | | | | | | |

| | | | | | | 719,457 | |

ITALY — 0.28% | | | | | | | | |

EXOR SpA | | | 1,455 | | | | 56,670 | |

Mediaset SpA | | | 11,790 | | | | 35,703 | |

| | | | | | | | |

| | | | | | | 92,373 | |

JAPAN — 25.65% | | | | | | | | |

Aisin Seiki Co. Ltd. | | | 1,500 | | | | 69,449 | |

Aozora Bank Ltd. | | | 60,000 | | | | 221,886 | |

Canon Inc. | | | 4,500 | | | | 128,873 | |

Chubu Electric Power Co. Inc. | | | 3,000 | | | | 44,187 | |

Daiichi Sankyo Co. Ltd. | | | 10,500 | | | | 252,139 | |

Eisai Co. Ltd. | | | 6,000 | | | | 353,847 | |

ITOCHU Corp. | | | 6,000 | | | | 68,644 | |

Japan Airlines Co. Ltd. | | | 19,500 | | | | 608,109 | |

Japan Exchange Group Inc. | | | 1,500 | | | | 21,515 | |

JX Holdings Inc. | | | 147,000 | | | | 556,387 | |

Kansai Electric Power Co. Inc. (The)a | | | 7,500 | | | | 69,991 | |

Kawasaki Heavy Industries Ltd. | | | 138,000 | | | | 413,387 | |

KDDI Corp. | | | 12,000 | | | | 368,249 | |

Kuraray Co. Ltd. | | | 1,500 | | | | 19,144 | |

Lawson Inc. | | | 1,500 | | | | 115,773 | |

Marubeni Corp. | | | 45,000 | | | | 211,289 | |

Mitsubishi UFJ Financial Group Inc. | | | 40,500 | | | | 206,284 | |

Mitsui & Co. Ltd. | | | 21,000 | | | | 247,631 | |

Mizuho Financial Group Inc. | | | 436,500 | | | | 711,706 | |

Nexon Co. Ltd. | | | 3,000 | | | | 45,080 | |

Nippon Telegraph & Telephone Corp. | | | 15,000 | | | | 714,397 | |

Nippon Yusen KK | | | 48,000 | | | | 86,179 | |

Oracle Corp. Japan | | | 3,000 | | | | 183,246 | |

Park24 Co. Ltd. | | | 1,500 | | | | 51,081 | |

Resona Holdings Inc. | | | 121,500 | | | | 491,999 | |

Shinsei Bank Ltd. | | | 48,000 | | | | 73,064 | |

Sompo Japan Nipponkoa Holdings Inc. | | | 1,500 | | | | 49,237 | |

Sumitomo Chemical Co. Ltd. | | | 18,000 | | | | 80,792 | |

Sumitomo Corp. | | | 6,000 | | | | 63,463 | |

Sumitomo Mitsui Financial Group Inc. | | | 16,500 | | | | 532,585 | |

Sumitomo Rubber Industries Ltd. | | | 4,500 | | | | 64,283 | |

Suntory Beverage & Food Ltd. | | | 3,000 | | | | 130,995 | |

Takeda Pharmaceutical Co. Ltd. | | | 1,500 | | | | 67,151 | |

Tohoku Electric Power Co. Inc. | | | 6,000 | | | | 77,397 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

Tokyo Electric Power Co. Holdings Inc.a | | | 133,500 | | | $ | 526,262 | |

Tokyo Gas Co. Ltd. | | | 60,000 | | | | 257,013 | |

West Japan Railway Co. | | | 6,000 | | | | 374,982 | |

| | | | | | | | |

| | | | | | | 8,557,696 | |

NETHERLANDS — 5.43% | | | | | | | | |

Aegon NV | | | 46,395 | | | | 189,159 | |

AerCap Holdings NVa | | | 1,305 | | | | 47,646 | |

Altice NV Class Aa | | | 540 | | | | 8,016 | |

Altice NV Class Ba | | | 435 | | | | 6,433 | |

Boskalis Westminster | | | 4,635 | | | | 170,317 | |

Koninklijke Ahold Delhaize NV | | | 46,621 | | | | 1,113,581 | |

NN Group NV | | | 10,224 | | | | 275,821 | |

| | | | | | | | |

| | | | | | | 1,810,973 | |

NORWAY — 0.10% | | | | | | | | |

Orkla ASA | | | 3,541 | | | | 32,917 | |

| | | | | | | | |

| | | | | | | 32,917 | |

SINGAPORE — 1.71% | | | | | | | | |

ComfortDelGro Corp. Ltd. | | | 19,500 | | | | 40,943 | |

Singapore Airlines Ltd. | | | 27,000 | | | | 220,728 | |

Singapore Exchange Ltd. | | | 11,500 | | | | 64,474 | |

StarHub Ltd. | | | 84,000 | | | | 245,164 | |

| | | | | | | | |

| | | | | | | 571,309 | |

SPAIN — 0.17% | | | | | | | | |

Endesa SA | | | 525 | | | | 11,034 | |

Mediaset Espana Comunicacion SA | | | 4,110 | | | | 47,247 | |

| | | | | | | | |

| | | | | | | 58,281 | |

SWEDEN — 2.88% | | | | | | | | |

Boliden AB | | | 15,436 | | | | 340,434 | |

ICA Gruppen AB | | | 13,944 | | | | 467,828 | |

Nordea Bank AB | | | 16,151 | | | | 144,317 | |

Skandinaviska Enskilda Banken AB Class A | | | 1,035 | | | | 9,103 | |

| | | | | | | | |

| | | | | | | 961,682 | |

SWITZERLAND — 12.89% | | | | | | | | |

Aryzta AG | | | 6,220 | | | | 234,589 | |

Baloise Holding AG Registered | | | 2,542 | | | | 287,223 | |

Banque Cantonale Vaudoise Registered | | | 90 | | | | 61,089 | |

Barry Callebaut AG Registered | | | 198 | | | | 259,780 | |

Credit Suisse Group AG Registered | | | 33,145 | | | | 382,396 | |

Helvetia Holding AG Registered | | | 150 | | | | 75,586 | |

Lonza Group AG Registered | | | 1 | | | | 189 | |

Novartis AG Registered | | | 4,110 | | | | 341,490 | |

| | |

| 16 | | 2016 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® ENHANCED INTERNATIONAL LARGE-CAP ETF

July 31, 2016

| | | | | | | | |

| Security | | Shares | | | Value | |

PSP Swiss Property AG Registered | | | 315 | | | $ | 31,860 | |

Swiss Life Holding AG Registered | | | 2,588 | | | | 593,142 | |

Swiss Prime Site AG Registered | | | 416 | | | | 38,331 | |

Swiss Re AG | | | 7,459 | | | | 627,854 | |

Swisscom AG Registered | | | 1,340 | | | | 661,508 | |

Zurich Insurance Group AG | | | 2,923 | | | | 704,399 | |

| | | | | | | | |

| | | | | | | 4,299,436 | |

UNITED KINGDOM — 11.97% | | | | | | | | |

3i Group PLC | | | 35,868 | | | | 293,828 | |

Ashtead Group PLC | | | 4,365 | | | | 69,313 | |

AstraZeneca PLC | | | 10,912 | | | | 731,348 | |

BP PLC | | | 49,905 | | | | 282,826 | |

BT Group PLC | | | 16,995 | | | | 93,269 | |

Centrica PLC | | | 186,098 | | | | 595,716 | |

GlaxoSmithKline PLC | | | 7,260 | | | | 162,708 | |

Imperial Brands PLC | | | 4,995 | | | | 264,180 | |

Investec PLC | | | 3,525 | | | | 21,037 | |

J Sainsbury PLC | | | 169,186 | | | | 503,841 | |

Just Eat PLCa | | | 4,065 | | | | 28,983 | |

Marks & Spencer Group PLC | | | 12,765 | | | | 54,115 | |

Micro Focus International PLC | | | 1,410 | | | | 36,243 | |

Old Mutual PLC | | | 21,510 | | | | 60,145 | |

Rentokil Initial PLC | | | 124,691 | | | | 355,937 | |

Rightmove PLC | | | 825 | | | | 44,373 | |

Royal Dutch Shell PLC Class A | | | 5,265 | | | | 135,892 | |

Royal Mail PLC | | | 8,640 | | | | 58,447 | |

RSA Insurance Group PLC | | | 19,665 | | | | 129,946 | |

Sky PLC | | | 5,835 | | | | 71,312 | |

| | | | | | | | |

| | | | | | | 3,993,459 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost: $37,921,225) | | | | | | | 32,681,088 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

PREFERRED STOCKS — 0.12% | |

| | |

GERMANY — 0.12% | | | | | | | | |

Bayerische Motoren Werke AG | | | 540 | | | $ | 39,130 | |

| | | | | | | | |

| | | | | | | 39,130 | |

| | | | | | | | |

TOTAL PREFERRED STOCKS

(Cost: $51,508) | | | | | | | 39,130 | |

|

SHORT-TERM INVESTMENTS — 0.04% | |

| | |

MONEY MARKET FUNDS — 0.04% | | | | | | | | |

BlackRock Cash Funds: Treasury,

SL Agency Shares | | | | | | | | |

0.28%c,d | | | 14,393 | | | | 14,393 | |

| | | | | | | | |

| | | | | | | 14,393 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost: $14,393) | | | | 14,393 | |

| | | | | | | | |

TOTAL INVESTMENTS

IN SECURITIES — 98.12%

(Cost: $37,987,126)e | | | | 32,734,611 | |

Other Assets, Less Liabilities — 1.88% | | | | 627,047 | |

| | | | | | | | |

NET ASSETS — 100.00% | | | $ | 33,361,658 | |

| | | | | | | | |

| a | Non-income earning security. |

| b | This security may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the Securities Act of 1933. |

| c | Affiliated money market fund. |

| d | The rate quoted is the annualized seven-day yield of the fund at period end. |

| e | The cost of investments for federal income tax purposes was $38,129,377. Net unrealized depreciation was $5,394,766, of which $1,498,475 represented gross unrealized appreciation on securities and $6,893,241 represented gross unrealized depreciation on securities. |

Schedule 1 — Fair Value Measurements

Various inputs are used in determining the fair value of financial instruments. For description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, see Note 1.

The following table summarizes the value of the Fund’s investments according to the fair value hierarchy as of July 31, 2016. The breakdown of the Fund’s investments into major categories is disclosed in the schedule of investments above.

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments: | | | | | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | | | | | |

Common stocks | | $ | 32,681,088 | | | $ | — | | | $ | — | | | $ | 32,681,088 | |

Preferred stocks | | | 39,130 | | | | — | | | | — | | | | 39,130 | |

Money market funds | | | 14,393 | | | | — | | | | — | | | | 14,393 | |

| | | | | | | | | | | | | | | | |

Total | | $ | 32,734,611 | | | $ | — | | | $ | — | | | $ | 32,734,611 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

See notes to financial statements.

| | | | |

SCHEDULESOF INVESTMENTS | | | 17 | |

Schedule of Investments

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

July 31, 2016

| | | | | | | | |

| Security | | Shares | | | Value | |

COMMON STOCKS — 98.05% | | | | | | | | |

| | |

AUSTRALIA — 7.76% | | | | | | | | |

Cabcharge Australia Ltd. | | | 9,504 | | | $ | 28,605 | |

Downer EDI Ltd. | | | 8,288 | | | | 26,268 | |

Estia Health Ltd. | | | 29,114 | | | | 113,517 | |

Evolution Mining Ltd. | | | 245,784 | | | | 526,799 | |

FlexiGroup Ltd./Australia | | | 40,352 | | | | 61,339 | |

Independence Group NL | | | 9,192 | | | | 28,085 | |

McMillan Shakespeare Ltd. | | | 9,460 | | | | 101,380 | |

Metals X Ltd. | | | 10,192 | | | | 12,665 | |

Mineral Resources Ltd. | | | 1,866 | | | | 13,927 | |

MYOB Group Ltd. | | | 3,848 | | | | 11,026 | |

Northern Star Resources Ltd. | | | 122,624 | | | | 491,166 | |

OZ Minerals Ltd. | | | 3,720 | | | | 18,067 | |

Pact Group Holdings Ltd. | | | 2,792 | | | | 12,075 | |

Sandfire Resources NL | | | 14,145 | | | | 61,603 | |

St. Barbara Ltd.a | | | 4,240 | | | | 9,700 | |

| | | | | | | | |

| | | | | | | 1,516,222 | |

AUSTRIA — 0.38% | | | | | | | | |

Austria Technologie & Systemtechnik AG | | | 2,312 | | | | 27,418 | |

EVN AG | | | 2,160 | | | | 25,241 | |

S IMMO AG | | | 1,257 | | | | 12,159 | |

UNIQA Insurance Group AG | | | 1,544 | | | | 9,565 | |

| | | | | | | | |

| | | | | | | 74,383 | |

BELGIUM — 3.96% | | | | | | | | |

AGFA-Gevaert NVa | | | 40,750 | | | | 147,278 | |

Cie. d’Entreprises CFE | | | 840 | | | | 77,401 | |

Euronav NV | | | 3,072 | | | | 26,452 | |

Gimv NV | | | 384 | | | | 20,861 | |

Intervest Offices & Warehouses NV | | | 416 | | | | 11,837 | |

Nyrstar NVa | | | 8,523 | | | | 77,714 | |

Orange Belgium SAa | | | 17,012 | | | | 412,433 | |

| | | | | | | | |

| | | | | | | 773,976 | |

CANADA — 6.47% | | | | | | | | |

Amaya Inc.a | | | 8,470 | | | | 131,267 | |

Artis REIT | | | 1,648 | | | | 17,250 | |

Cogeco Communications Inc. | | | 2,866 | | | | 141,229 | |

Dominion Diamond Corp. | | | 8,728 | | | | 80,249 | |

Granite REIT | | | 354 | | | | 11,032 | |

Intertain Group Ltd. (The)a | | | 1,472 | | | | 11,683 | |

Laurentian Bank of Canada | | | 5,506 | | | | 204,398 | |

Mainstreet Equity Corp.a | | | 872 | | | | 22,903 | |

Milestone Apartments REIT | | | 4,880 | | | | 78,324 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

Morguard REIT | | | 1,498 | | | $ | 18,035 | |

NorthWest Healthcare Properties REIT | | | 2,144 | | | | 16,786 | |

Spin Master Corp.a,b | | | 576 | | | | 11,838 | |

TMX Group Ltd. | | | 9,429 | | | | 421,180 | |

Transcontinental Inc. Class A | | | 1,712 | | | | 24,694 | |

Valener Inc. | | | 1,056 | | | | 18,269 | |

Wajax Corp. | | | 1,249 | | | | 13,514 | |

Yellow Pages Ltd./Canadaa | | | 2,832 | | | | 40,980 | |

| | | | | | | | |

| | | | | | | 1,263,631 | |

DENMARK — 6.13% | | | | | | | | |

Bavarian Nordic A/Sa | | | 2,524 | | | | 96,195 | |

Dfds A/S | | | 10,202 | | | | 466,429 | |

IC Group A/S | | | 328 | | | | 8,260 | |

NKT Holding A/S | | | 248 | | | | 12,800 | |

Per Aarsleff Holding A/S | | | 512 | | | | 12,008 | |

Rockwool International A/S Class B | | | 2,560 | | | | 484,947 | |

Schouw & Co. | | | 1,669 | | | | 96,856 | |

TORM PLCa | | | 2,068 | | | | 19,898 | |

| | | | | | | | |

| | | | | | | 1,197,393 | |

FINLAND — 4.57% | | | | | | | | |

Atria OYJ | | | 1,096 | | | | 10,969 | |

Cramo OYJ | | | 4,344 | | | | 102,546 | |

HKScan OYJ Class A | | | 5,851 | | | | 20,741 | |

PKC Group OYJ | | | 824 | | | | 15,250 | |

Ramirent OYJ | | | 6,201 | | | | 52,562 | |

Sanoma OYJ | | | 34,042 | | | | 273,134 | |

Sponda OYJ | | | 55,082 | | | | 252,541 | |

Tieto OYJ | | | 4,210 | | | | 121,180 | |

YIT OYJ | | | 6,424 | | | | 43,640 | |

| | | | | | | | |

| | | | | | | 892,563 | |

FRANCE — 3.21% | | | | | | | | |

Adociaa | | | 96 | | | | 5,579 | |

Assystem | | | 640 | | | | 17,599 | |

Cegedim SAa | | | 464 | | | | 13,563 | |

Cegid Group SA | | | 784 | | | | 53,698 | |

Cellectis SAa | | | 1,656 | | | | 43,333 | |

Cie. des Alpes | | | 1,257 | | | | 24,950 | |

Ubisoft Entertainment SAa | | | 11,386 | | | | 467,598 | |

| | | | | | | | |

| | | | | | | 626,320 | |

GERMANY — 4.08% | | | | | | | | |

ADLER Real Estate AGa | | | 952 | | | | 14,287 | |

Bauer AG | | | 1,072 | | | | 14,805 | |

Borussia Dortmund GmbH & Co. KGaA | | | 17,450 | | | | 77,020 | |

CENTROTEC Sustainable AG | | | 1,640 | | | | 25,858 | |

| | |

| 18 | | 2016 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

July 31, 2016

| | | | | | | | |

| Security | | Shares | | | Value | |

CTS Eventim AG & Co. KGaA | | | 1,552 | | | $ | 54,027 | |

Deutsche Beteiligungs AG | | | 1,136 | | | | 35,976 | |

DIC Asset AG | | | 1,065 | | | | 10,378 | |

Draegerwerk AG & Co. KGaA | | | 184 | | | | 10,498 | |

MLP AG | | | 8,320 | | | | 32,191 | |

PATRIZIA Immobilien AGa | | | 6,615 | | | | 167,029 | |

RHOEN-KLINIKUM AG | | | 11,792 | | | | 347,462 | |

Sixt Leasing AG | | | 336 | | | | 7,176 | |

| | | | | | | | |

| | | | | | | 796,707 | |

HONG KONG — 0.18% | | | | | | | | |

SmarTone Telecommunications Holdings Ltd. | | | 20,162 | | | | 35,907 | |

| | | | | | | | |

| | | | | | | 35,907 | |

ISRAEL — 3.18% | |

Delek Automotive Systems Ltd. | | | 10,484 | | | | 92,973 | |

Harel Insurance Investments & Financial Services Ltd. | | | 2,408 | | | | 8,864 | |

Ituran Location and Control Ltd. | | | 648 | | | | 15,526 | |

Migdal Insurance & Financial Holding Ltd.a | | | 21,464 | | | | 13,150 | |

Oil Refineries Ltd.a | | | 497,008 | | | | 178,649 | |

Tower Semiconductor Ltd.a | | | 23,058 | | | | 311,501 | |

| | | | | | | | |

| | | | | | | 620,663 | |

ITALY — 0.08% | | | | | | | | |

Juventus Football Club SpAa | | | 46,808 | | | | 15,258 | |

| | | | | | | | |

| | | | | | | 15,258 | |

JAPAN — 33.39% | | | | | | | | |

Achilles Corp. | | | 8,000 | | | | 11,007 | |

Aderans Co. Ltd. | | | 2,400 | | | | 10,983 | |

Aichi Corp. | | | 5,600 | | | | 44,971 | |

Arcland Sakamoto Co. Ltd. | | | 3,200 | | | | 35,814 | |

Asahi Diamond Industrial Co. Ltd. | | | 1,600 | | | | 12,443 | |

Asahi Holdings Inc. | | | 3,200 | | | | 54,861 | |

Ashikaga Holdings Co. Ltd. | | | 4,800 | | | | 16,158 | |

Avex Group Holdings Inc. | | | 1,600 | | | | 18,937 | |

Cawachi Ltd. | | | 2,400 | | | | 56,203 | |

CKD Corp. | | | 2,400 | | | | 22,645 | |

Comforia Residential REIT Inc. | | | 56 | | | | 133,436 | |

Cosmo Energy Holdings Co. Ltd. | | | 9,600 | | | | 106,786 | |

Create Restaurants Holdings Inc. | | | 2,400 | | | | 24,847 | |

DCM Holdings Co. Ltd. | | | 1,600 | | | | 13,739 | |

Dip Corp. | | | 8,000 | | | | 242,767 | |

Doshisha Co. Ltd. | | | 800 | | | | 16,838 | |

Dydo Drinco Inc. | | | 1,600 | | | | 83,368 | |

Enplas Corp. | | | 1,600 | | | | 45,244 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

Foster Electric Co. Ltd. | | | 6,400 | | | $ | 125,146 | |

France Bed Holdings Co. Ltd. | | | 3,200 | | | | 28,789 | |

Fuji Soft Inc. | | | 1,600 | | | | 40,061 | |

Fujibo Holdings Inc. | | | 16,000 | | | | 47,617 | |

G-Tekt Corp. | | | 4,400 | | | | 67,834 | |

Geo Holdings Corp. | | | 24,000 | | | | 348,929 | |

Godo Steel Ltd. | | | 8,000 | | | | 13,504 | |

Heiwa Corp. | | | 1,600 | | | | 33,004 | |

Heiwado Co. Ltd. | | | 1,600 | | | | 31,130 | |

Hitachi Maxell Ltd. | | | 12,400 | | | | 209,318 | |

Hokkaido Electric Power Co. Inc. | | | 2,400 | | | | 19,109 | |

Hokuetsu Bank Ltd. (The) | | | 8,000 | | | | 16,783 | |

Hokuetsu Kishu Paper Co. Ltd. | | | 8,000 | | | | 56,828 | |

Hokuto Corp. | | | 1,600 | | | | 29,803 | |

Idemitsu Kosan Co. Ltd. | | | 22,581 | | | | 441,991 | |

IwaiCosmo Holdings Inc. | | | 3,200 | | | | 28,352 | |

J-Oil Mills Inc. | | | 16,000 | | | | 54,174 | |

Japan Petroleum Exploration Co. Ltd. | | | 1,600 | | | | 33,472 | |

Japan Rental Housing Investments Inc. | | | 16 | | | | 13,692 | |

Juki Corp. | | | 1,600 | | | | 13,942 | |

Kamei Corp. | | | 4,800 | | | | 39,389 | |

Kanamoto Co. Ltd. | | | 2,400 | | | | 50,372 | |

Kanematsu Corp. | | | 16,000 | | | | 26,384 | |

Kasai Kogyo Co. Ltd. | | | 800 | | | | 8,048 | |

Kenedix Residential Investment Corp. | | | 25 | | | | 67,986 | |

Kenedix Retail REIT Corp. | | | 16 | | | | 43,729 | |

KEY Coffee Inc. | | | 800 | | | | 15,378 | |

Kinugawa Rubber Industrial Co. Ltd. | | | 16,000 | | | | 121,462 | |

Kohnan Shoji Co. Ltd. | | | 20,800 | | | | 428,847 | |

Kura Corp. | | | 800 | | | | 42,387 | |

Life Corp. | | | 800 | | | | 23,613 | |

Maruha Nichiro Corp. | | | 17,800 | | | | 452,620 | |

MCUBS MidCity Investment Corp. | | | 8 | | | | 29,117 | |

Megachips Corp. | | | 6,400 | | | | 78,248 | |

Mimasu Semiconductor Industry Co. Ltd. | | | 1,600 | | | | 16,564 | |

Ministop Co. Ltd. | | | 1,600 | | | | 26,868 | |

Mitsubishi Steel Manufacturing Co. Ltd. | | | 16,000 | | | | 26,853 | |

Mixi Inc. | | | 10,484 | | | | 377,479 | |

Morinaga Milk Industry Co. Ltd. | | | 16,000 | | | | 118,964 | |

Murata Manufacturing Co. Ltd. | | | 302 | | | | 37,792 | |

Musashi Seimitsu Industry Co. Ltd. | | | 1,600 | | | | 33,160 | |

NEC Capital Solutions Ltd. | | | 800 | | | | 11,920 | |

Nichiha Corp. | | | 1,600 | | | | 31,271 | |

Nikkon Holdings Co. Ltd. | | | 1,600 | | | | 32,255 | |

| | | | |

SCHEDULESOF INVESTMENTS | | | 19 | |

Schedule of Investments (Continued)

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

July 31, 2016

| | | | | | | | |

| Security | | Shares | | | Value | |

Nippon Coke & Engineering Co. Ltd. | | | 32,000 | | | $ | 20,920 | |

Nippon Koei Co. Ltd. | | | 8,000 | | | | 25,604 | |

Nippon Signal Co. Ltd. | | | 1,600 | | | | 15,394 | |

Nishimatsuya Chain Co. Ltd. | | | 6,400 | | | | 91,612 | |

Nissha Printing Co. Ltd. | | | 1,600 | | | | 31,911 | |

Nisshin OilliO Group Ltd. (The) | | | 16,000 | | | | 75,718 | |

Nisshin Steel Co. Ltd. | | | 1,600 | | | | 20,015 | |

Okinawa Electric Power Co. Inc. (The) | | | 3,600 | | | | 72,502 | |

Pacific Industrial Co. Ltd. | | | 4,800 | | | | 54,611 | |

Park24 Co. Ltd. | | | 806 | | | | 27,447 | |

Pioneer Corp.a | | | 4,000 | | | | 7,377 | |

Press Kogyo Co. Ltd. | | | 16,800 | | | | 62,620 | |

Prima Meat Packers Ltd. | | | 16,000 | | | | 51,051 | |

Riso Kagaku Corp. | | | 1,600 | | | | 23,262 | |

Round One Corp. | | | 2,400 | | | | 16,299 | |

Saizeriya Co. Ltd. | | | 2,400 | | | | 53,510 | |

Sanyo Shokai Ltd. | | | 16,000 | | | | 29,819 | |

Senshu Ikeda Holdings Inc. | | | 18,400 | | | | 80,613 | |

Shinko Electric Industries Co. Ltd. | | | 16,800 | | | | 93,438 | |

Showa Corp. | | | 1,600 | | | | 9,367 | |

Tachi-S Co. Ltd. | | | 1,600 | | | | 27,789 | |

Taiho Kogyo Co. Ltd. | | | 2,400 | | | | 25,924 | |

Taikisha Ltd. | | | 1,600 | | | | 43,495 | |

Takata Corp.a | | | 5,600 | | | | 22,840 | |

Tamron Co. Ltd. | | | 1,600 | | | | 23,402 | |

Tatsuta Electric Wire and Cable Co. Ltd. | | | 3,200 | | | | 10,460 | |

TOKAI Holdings Corp. | | | 6,400 | | | | 41,903 | |

Tokyo Seimitsu Co. Ltd. | | | 800 | | | | 19,055 | |

Tokyo TY Financial Group Inc. | | | 1,800 | | | | 47,632 | |

Topy Industries Ltd. | | | 16,000 | | | | 35,908 | |

Toridoll.corp. | | | 1,600 | | | | 46,914 | |

Towa Bank Ltd. (The) | | | 80,000 | | | | 71,035 | |

TPR Co. Ltd. | | | 1,600 | | | | 34,440 | |

Tsukuba Bank Ltd. | | | 5,600 | | | | 17,540 | |

UKC Holdings Corp. | | | 4,800 | | | | 76,343 | |

Unipres Corp. | | | 7,600 | | | | 125,400 | |

United Super Markets Holdings Inc. | | | 3,200 | | | | 30,943 | |

Warabeya Nichiyo Co. Ltd. | | | 2,400 | | | | 50,630 | |

Yahagi Construction Co. Ltd. | | | 1,600 | | | | 14,550 | |

Yellow Hat Ltd. | | | 1,600 | | | | 36,844 | |

Yorozu Corp. | | | 7,200 | | | | 113,320 | |

| | | | | | | | |

| | | | | | | 6,524,688 | |

NETHERLANDS — 1.02% | |

COSMO Pharmaceuticals NVa | | | 742 | | | | 119,847 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

Delta Lloyd NV | | | 22,448 | | | $ | 80,203 | |

| | | | | | | | |

| | | | | | | 200,050 | |

NEW ZEALAND — 3.87% | | | | | | | | |

Air New Zealand Ltd. | | | 21,376 | | | | 34,070 | |

Fletcher Building Ltd. | | | 71,550 | | | | 500,022 | |

Ryman Healthcare Ltd. | | | 32,323 | | | | 222,157 | |

| | | | | | | | |

| | | | | | | 756,249 | |

NORWAY — 2.18% | | | | | | | | |

BW LPG Ltd.b | | | 1,272 | | | | 4,532 | |

REC Silicon ASAa | | | 267,856 | | | | 50,691 | |

TGS Nopec Geophysical Co. ASA | | | 22,335 | | | | 371,503 | |

| | | | | | | | |

| | | | | | | 426,726 | |

SINGAPORE — 1.75% | | | | | | | | |

AIMS AMP Capital Industrial REIT | | | 39,200 | | | | 42,904 | |

Cambridge Industrial Trust | | | 116,800 | | | | 47,830 | |

Chip Eng Seng Corp. Ltd. | | | 32,000 | | | | 15,010 | |

Ezion Holdings Ltd.a | | | 20,000 | | | | 4,467 | |

Far East Hospitality Trust | | | 40,000 | | | | 19,060 | |

First REIT | | | 24,000 | | | | 23,230 | |

k1 Ventures Ltd. | | | 14,640 | | | | 9,592 | |

Noble Group Ltd.a | | | 821,796 | | | | 99,122 | |

Perennial Real Estate Holdings Ltd. | | | 18,400 | | | | 11,919 | |

Yangzijiang Shipbuilding Holdings Ltd. | | | 7,200 | | | | 4,664 | |

Yanlord Land Group Ltd. | | | 72,000 | | | | 63,256 | |

| | | | | | | | |

| | | | | | | 341,054 | |

SPAIN — 0.14% | | | | | | | | |

Abengoa SA Class Ba | | | 43,864 | | | | 10,889 | |

Tubacex SA | | | 6,608 | | | | 17,402 | |

| | | | | | | | |

| | | | | | | 28,291 | |

SWEDEN — 1.97% | | | | | | | | |

Bure Equity AB | | | 4,114 | | | | 42,305 | |

Haldex AB | | | 1,936 | | | | 23,878 | |

Hemfosa Fastigheter AB | | | 1,694 | | | | 18,214 | |

Industrial & Financial Systems Class B | | | 742 | | | | 31,607 | |

Industrivarden AB Class C | | | 2,887 | | | | 48,718 | |

Modern Times Group MTG AB Class B | | | 1,282 | | | | 33,517 | |

NetEnt AB | | | 1,104 | | | | 9,373 | |

Nolato AB Class B | | | 2,819 | | | | 76,145 | |

Peab AB | | | 3,870 | | | | 31,202 | |

Sweco AB Class B | | | 1,815 | | | | 33,393 | |

Tethys Oil AB | | | 5,638 | | | | 37,164 | |

| | | | | | | | |

| | | | | | | 385,516 | |

SWITZERLAND — 3.10% | | | | | | | | |

Autoneum Holding AG | | | 734 | | | | 207,338 | |

| | |

| 20 | | 2016 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

July 31, 2016

| | | | | | | | |

| Security | | Shares | | | Value | |

BKW AG | | | 1,432 | | | $ | 65,936 | |

Emmi AG | | | 136 | | | | 87,951 | |

Intershop Holdings AG | | | 112 | | | | 55,047 | |

Mobilezone Holding AG | | | 5,050 | | | | 65,055 | |

St Galler Kantonalbank AG Registered | | | 128 | | | | 52,745 | |

Swissquote Group Holding SA Registered | | | 480 | | | | 11,920 | |

Vetropack Holding AG Bearer | | | 16 | | | | 25,247 | |

Zehnder Group AGa | | | 864 | | | | 33,525 | |

| | | | | | | | |

| | | | | | | 604,764 | |

UNITED KINGDOM — 10.63% | | | | | | | | |

Beazley PLC | | | 18,064 | | | | 95,047 | |

Berendsen PLC | | | 6,936 | | | | 117,598 | |

BGEO Group PLC | | | 560 | | | | 20,305 | |

Big Yellow Group PLC | | | 2,192 | | | | 20,663 | |

Cape PLC | | | 7,224 | | | | 17,840 | |

Carillion PLC | | | 3,280 | | | | 11,614 | |

Centamin PLC | | | 92,384 | | | | 203,490 | |

Chesnara PLC | | | 3,424 | | | | 14,218 | |

Dairy Crest Group PLC | | | 9,440 | | | | 75,577 | |

Dart Group PLC | | | 22,724 | | | | 146,328 | |

Debenhams PLC | | | 240,616 | | | | 179,061 | |

Devro PLC | | | 3,896 | | | | 14,665 | |

Entertainment One Ltd. | | | 19,644 | | | | 51,458 | |

Fenner PLC | | | 4,584 | | | | 9,799 | |

FirstGroup PLCa | | | 23,232 | | | | 30,938 | |

Go-Ahead Group PLC | | | 5,606 | | | | 136,060 | |

Greencore Group PLC | | | 4,872 | | | | 21,191 | |

Greggs PLC | | | 5,688 | | | | 78,087 | |

GVC Holdings PLC | | | 1,827 | | | | 15,306 | |

Halfords Group PLC | | | 2,656 | | | | 12,430 | |

Intermediate Capital Group PLC | | | 2,548 | | | | 19,384 | |

Kcom Group PLC | | | 12,088 | | | | 17,654 | |

Laird PLC | | | 3,696 | | | | 14,393 | |

Lancashire Holdings Ltd. | | | 24,856 | | | | 198,833 | |

LondonMetric Property PLC | | | 12,568 | | | | 26,999 | |

Mitie Group PLC | | | 27,560 | | | | 91,003 | |

Moneysupermarket.com Group PLC | | | 6,776 | | | | 26,855 | |

Morgan Advanced Materials PLC | | | 3,616 | | | | 13,155 | |

Northgate PLC | | | 41,243 | | | | 209,177 | |

Paragon Group of Companies PLC (The) | | | 5,624 | | | | 20,362 | |

Paysafe Group PLCa | | | 10,352 | | | | 53,053 | |

QinetiQ Group PLC | | | 8,176 | | | | 24,392 | |

Restaurant Group PLC (The) | | | 1,888 | | | | 8,879 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

Savills PLC | | | 1,000 | | | $ | 9,281 | |

Shanks Group PLC | | | 15,064 | | | | 21,101 | |

Speedy Hire PLC | | | 19,048 | | | | 8,725 | |

Trinity Mirror PLC | | | 12,200 | | | | 12,148 | |

TT electronics PLC | | | 9,400 | | | | 16,817 | |

Vesuvius PLC | | | 2,768 | | | | 13,524 | |

| | | | | | | | |

| | | | | | | 2,077,410 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost: $17,176,899) | | | | | | | 19,157,771 | |

|

PREFERRED STOCKS — 1.19% | |

| | |

ITALY — 1.19% | | | | | | | | |

Intesa Sanpaolo SpA | | | 111,592 | | | | 232,605 | |

| | | | | | | | |

| | | | | | | 232,605 | |

| | | | | | | | |

TOTAL PREFERRED STOCKS

(Cost: $350,024) | | | | | | | 232,605 | |

|

SHORT-TERM INVESTMENTS — 0.11% | |

| | |

MONEY MARKET FUNDS — 0.11% | | | | | | | | |

BlackRock Cash Funds: Treasury,

SL Agency Shares | | | | | | | | |

0.28%c,d | | | 21,793 | | | | 21,793 | |

| | | | | | | | |

| | | | | | | 21,793 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost: $21,793) | | | | 21,793 | |

| | | | | | | | |

TOTAL INVESTMENTS

IN SECURITIES — 99.35%

(Cost: $17,548,716)e | | | | 19,412,169 | |

Other Assets, Less Liabilities — 0.65% | | | | 126,164 | |

| | | | | | | | |

NET ASSETS — 100.00% | | | | | | $ | 19,538,333 | |

| | | | | | | | |

| a | Non-income earning security. |

| b | This security may be resold to qualified institutional buyers under Rule 144A of the Securities Act of 1933. |

| c | Affiliated money market fund. |

| d | The rate quoted is the annualized seven-day yield of the fund at period end. |

| e | The cost of investments for federal income tax purposes was $17,722,610. Net unrealized appreciation was $1,689,559, of which $3,449,467 represented gross unrealized appreciation on securities and $1,759,908 represented gross unrealized depreciation on securities. |

| | | | |

SCHEDULESOF INVESTMENTS | | | 21 | |

Schedule of Investments (Continued)

iSHARES® ENHANCED INTERNATIONAL SMALL-CAP ETF

July 31, 2016

Schedule 1 — Fair Value Measurements

Various inputs are used in determining the fair value of financial instruments. For description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, see Note 1.

The following table summarizes the value of the Fund’s investments according to the fair value hierarchy as of July 31, 2016. The breakdown of the Fund’s investments into major categories is disclosed in the schedule of investments above.

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments: | | | | | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | | | | | |

Common stocks | | $ | 19,157,771 | | | $ | — | | | $ | — | | | $ | 19,157,771 | |

Preferred stocks | | | 232,605 | | | | — | | | | — | | | | 232,605 | |

Money market funds | | | 21,793 | | | | — | | | | — | | | | 21,793 | |

| | | | | | | | | | | | | | | | |

Total | | $ | 19,412,169 | | | $ | — | | | $ | — | | | $ | 19,412,169 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

See notes to financial statements.

| | |

| 22 | | 2016 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments

iSHARES® ENHANCED U.S. LARGE-CAP ETF

July 31, 2016

| | | | | | | | |

| Security | | Shares | | | Value | |

COMMON STOCKS — 97.83% | |

| | |

AEROSPACE & DEFENSE — 2.01% | | | | | | | | |

General Dynamics Corp. | | | 6,133 | | | $ | 900,876 | |

L-3 Communications Holdings Inc. | | | 2,932 | | | | 444,579 | |

| | | | | | | | |

| | | | | | | 1,345,455 | |

AIR FREIGHT & LOGISTICS — 1.50% | | | | | | | | |

FedEx Corp. | | | 6,210 | | | | 1,005,399 | |

| | | | | | | | |

| | | | | | | 1,005,399 | |

AIRLINES — 0.34% | | | | | | | | |

Allegiant Travel Co. | | | 1,724 | | | | 223,723 | |

| | | | | | | | |

| | | | | | | 223,723 | |

BANKS — 1.81% | | | | | | | | |

Commerce Bancshares Inc./MO | | | 7,268 | | | | 343,704 | |

JPMorgan Chase & Co. | | | 13,510 | | | | 864,234 | |

| | | | | | | | |

| | | | | | | 1,207,938 | |

BEVERAGES — 0.20% | | | | | | | | |

Molson Coors Brewing Co. | | | 588 | | | | 60,070 | |

PepsiCo Inc. | | | 669 | | | | 72,868 | |

| | | | | | | | |

| | | | | | | 132,938 | |

COMMUNICATIONS EQUIPMENT — 2.84% | | | | | |

Cisco Systems Inc. | | | 43,548 | | | | 1,329,521 | |

F5 Networks Inc.a | | | 4,622 | | | | 570,447 | |

| | | | | | | | |

| | | | | | | 1,899,968 | |

CONSTRUCTION & ENGINEERING — 0.79% | |

Jacobs Engineering Group Inc.a | | | 1,560 | | | | 83,491 | |

Quanta Services Inc.a | | | 17,492 | | | | 447,795 | |

| | | | | | | | |

| | | | | | | 531,286 | |

DIVERSIFIED FINANCIAL SERVICES — 2.31% | |

Berkshire Hathaway Inc. Class Ba | | | 767 | �� | | | 110,655 | |

CBOE Holdings Inc. | | | 14,371 | | | | 988,725 | |

CME Group Inc. | | | 2,245 | | | | 229,529 | |

FactSet Research Systems Inc. | | | 265 | | | | 45,569 | |

Nasdaq Inc. | | | 2,405 | | | | 170,178 | |

| | | | | | | | |

| | | | | | | 1,544,656 | |

DIVERSIFIED TELECOMMUNICATION SERVICES — 2.11% | |

AT&T Inc. | | | 32,559 | | | | 1,409,479 | |

| | | | | | | | |

| | | | | | | 1,409,479 | |

ELECTRIC UTILITIES — 2.00% | |

Alliant Energy Corp. | | | 6,162 | | | | 248,020 | |

Great Plains Energy Inc. | | | 2,847 | | | | 84,784 | |

PG&E Corp. | | | 13,763 | | | | 880,006 | |

Xcel Energy Inc. | | | 2,816 | | | | 123,848 | |

| | | | | | | | |

| | | | | | | 1,336,658 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

ELECTRICAL EQUIPMENT — 0.06% | | | | | | | | |

Regal Beloit Corp. | | | 650 | | | $ | 39,656 | |

| | | | | | | | |

| | | | | | | 39,656 | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS — 4.46% | |

Arrow Electronics Inc.a | | | 1,051 | | | | 69,881 | |

Avnet Inc. | | | 1,879 | | | | 77,227 | |

Corning Inc. | | | 60,589 | | | | 1,346,288 | |

Ingram Micro Inc. Class A | | | 37,544 | | | | 1,285,506 | |

Jabil Circuit Inc. | | | 10,082 | | | | 205,169 | |

| | | | | | | | |

| | | | | | | 2,984,071 | |

ENERGY EQUIPMENT & SERVICES — 3.61% | |

Helmerich & Payne Inc. | | | 6,377 | | | | 395,182 | |

National Oilwell Varco Inc. | | | 22,434 | | | | 725,740 | |

Schlumberger Ltd. | | | 16,088 | | | | 1,295,406 | |

| | | | | | | | |

| | | | | | | 2,416,328 | |

FOOD & STAPLES RETAILING — 2.21% | |

CVS Health Corp. | | | 1,521 | | | | 141,027 | |

Wal-Mart Stores Inc. | | | 18,358 | | | | 1,339,583 | |

| | | | | | | | |

| | | | | | | 1,480,610 | |

FOOD PRODUCTS — 2.22% | | | | | | | | |

Archer-Daniels-Midland Co. | | | 24,762 | | | | 1,116,271 | |

Hormel Foods Corp. | | | 3,454 | | | | 129,007 | |

JM Smucker Co. (The) | | | 713 | | | | 109,916 | |

Tyson Foods Inc. Class A | | | 1,751 | | | | 128,874 | |

| | | | | | | | |

| | | | | | | 1,484,068 | |

GAS UTILITIES — 0.58% | | | | | | | | |

Atmos Energy Corp. | | | 4,527 | | | | 361,210 | |

Piedmont Natural Gas Co. Inc. | | | 494 | | | | 29,541 | |

| | | | | | | | |

| | | | | | | 390,751 | |

HEALTH CARE EQUIPMENT & SUPPLIES — 3.39% | |

Abbott Laboratories | | | 3,823 | | | | 171,079 | |

Becton Dickinson and Co. | | | 1,411 | | | | 248,336 | |

CR Bard Inc. | | | 6,595 | | | | 1,475,500 | |

Medtronic PLC | | | 4,219 | | | | 369,711 | |

| | | | | | | | |

| | | | | | | 2,264,626 | |

HEALTH CARE PROVIDERS & SERVICES — 3.98% | |

Aetna Inc. | | | 1,048 | | | | 120,740 | |

AmerisourceBergen Corp. | | | 10,931 | | | | 931,212 | |

Anthem Inc. | | | 9,418 | | | | 1,236,960 | |

Cardinal Health Inc. | | | 977 | | | | 81,677 | |

Cigna Corp. | | | 269 | | | | 34,691 | |

UnitedHealth Group Inc. | | | 1,781 | | | | 255,039 | |

| | | | | | | | |

| | | | | | | 2,660,319 | |

| | | | |

SCHEDULESOF INVESTMENTS | | | 23 | |

Schedule of Investments (Continued)

iSHARES® ENHANCED U.S. LARGE-CAP ETF

July 31, 2016

| | | | | | | | |

| Security | | Shares | | | Value | |

HOTELS, RESTAURANTS & LEISURE — 1.62% | |

Carnival Corp. | | | 19,433 | | | $ | 907,910 | |

Panera Bread Co. Class Aa | | | 807 | | | | 176,991 | |

| | | | | | | | |

| | | | | | | 1,084,901 | |

HOUSEHOLD PRODUCTS — 0.85% | |

Procter & Gamble Co. (The) | | | 6,645 | | | | 568,746 | |

| | | | | | | | |

| | | | | | | 568,746 | |

INSURANCE — 14.02% | | | | | | | | |

Aflac Inc. | | | 19,188 | | | | 1,386,909 | |

Allied World Assurance Co. Holdings AG | | | 20,292 | | | | 831,769 | |

American Financial Group Inc./OH | | | 3,058 | | | | 223,540 | |

Axis Capital Holdings Ltd. | | | 16,712 | | | | 928,853 | |

Chubb Ltd. | | | 10,183 | | | | 1,275,522 | |

Lincoln National Corp. | | | 4,690 | | | | 204,812 | |

Loews Corp. | | | 31,064 | | | | 1,283,875 | |

MetLife Inc. | | | 7,547 | | | | 322,559 | |

Principal Financial Group Inc. | | | 4,644 | | | | 216,550 | |

Prudential Financial Inc. | | | 6,774 | | | | 510,014 | |

Reinsurance Group of America Inc. | | | 14,191 | | | | 1,408,457 | |

Torchmark Corp. | | | 6,061 | | | | 374,994 | |

Travelers Companies Inc. (The) | | | 2,550 | | | | 296,361 | |

Validus Holdings Ltd. | | | 2,218 | | | | 109,636 | |

| | | | | | | | |

| | | | | | | 9,373,851 | |

INTERNET & CATALOG RETAIL — 2.12% | |

Amazon.com Inc.a | | | 1,866 | | | | 1,415,939 | |

| | | | | | | | |

| | | | | | | 1,415,939 | |

INTERNET SOFTWARE & SERVICES — 3.33% | |

Akamai Technologies Inc.a | | | 1,326 | | | | 67,003 | |

Alphabet Inc. Class Aa | | | 955 | | | | 755,730 | |

Alphabet Inc. Class Ca | | | 995 | | | | 764,946 | |

eBay Inc.a | | | 20,589 | | | | 641,553 | |

| | | | | | | | |

| | | | | | | 2,229,232 | |

IT SERVICES — 5.54% | | | | | | | | |

Amdocs Ltd. | | | 13,319 | | | | 777,297 | |

Automatic Data Processing Inc. | | | 1,774 | | | | 157,797 | |

Jack Henry & Associates Inc. | | | 315 | | | | 28,114 | |

PayPal Holdings Inc.a | | | 19,198 | | | | 714,933 | |

Teradata Corp.a | | | 47,131 | | | | 1,337,578 | |

Total System Services Inc. | | | 11,115 | | | | 565,976 | |

Xerox Corp. | | | 12,224 | | | | 125,907 | |

| | | | | | | | |

| | | | | | | 3,707,602 | |

MACHINERY — 0.28% | | | | | | | | |

AGCO Corp. | | | 3,881 | | | | 186,909 | |

| | | | | | | | |

| | | | | | | 186,909 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

MULTI-UTILITIES — 4.39% | | | | | | | | |

Consolidated Edison Inc. | | | 14,669 | | | $ | 1,174,693 | |

DTE Energy Co. | | | 13,221 | | | | 1,289,312 | |

Public Service Enterprise Group Inc. | | | 10,266 | | | | 472,339 | |

| | | | | | | | |

| | | | | | | 2,936,344 | |

MULTILINE RETAIL — 2.32% | | | | | | | | |

Nordstrom Inc. | | | 23,724 | | | | 1,049,312 | |

Target Corp. | | | 6,699 | | | | 504,636 | |

| | | | | | | | |

| | | | | | | 1,553,948 | |

OIL, GAS & CONSUMABLE FUELS — 0.62% | |

California Resources Corp. | | | 17 | | | | 175 | |

Chevron Corp. | | | 3,655 | | | | 374,564 | |

Occidental Petroleum Corp. | | | 504 | | | | 37,664 | |

| | | | | | | | |

| | | | | | | 412,403 | |

PHARMACEUTICALS — 5.02% | | | | | | | | |

Eli Lilly & Co. | | | 2,760 | | | | 228,776 | |

Johnson & Johnson | | | 12,720 | | | | 1,592,926 | |