UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-2474 |

|---|

| |

Midas Dollar Reserves, Inc.

(Exact name of registrant as specified in charter)

11 Hanover Square, New York, NY 10005

(Address of principal executive offices) (Zipcode)

Thomas B. Winmill, President

11 Hanover Square

New York, NY 10005

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-212-480-6432

Date of fiscal year end: 12/31

Date of reporting period: 1/1/08 - 06/30/08

Form N-CSRS is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSRS in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSRS and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSRS unless the Form displays a current valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under clearance requirements of 44 U.S.C. sec. 3507.

Item 1. Report to Stockholders

Seeks primarily capital appreciation and protection against inflation and secondarily current income through investments in precious metals and natural resources companies.

Invests aggressively for capital appreciation in any security in any sector.

A money market fund investing in securities issued by the U.S. Government, its agencies and instrumentalities. Free, unlimited, check writing with only a $250 minimum per check.

To Our Shareholders

The newspapers these days seem to be full of gloom. Oil prices are continuing to rise and housing markets are continuing to fall. The economy seems to be heading into a recession. U.S. consumer confidence is at a 16 year low. How should investors best cope with this unpleasant situation?

A Path Ahead

At Midas, how we deal with trying financial news and inevitable market volatility reflects three key principles: First, we seek to invest in quality; second, we offer three separate investment options to provide overall portfolio diversity; and third, we invest for the long term. What does this do for us and our investors? More than a financial strategy, it helps sustain the critical emotional stamina we all need to take advantage of market lows in pursuing our long term investing goals.

Fortunately, the Midas Funds have a flexible investing approach, an important advantage when seeking to formulate a superior strategy to navigate the volatility of the global financial markets. In addition, no matter what part of the economic cycle investors may find themselves, the Midas Funds remain focused on quality companies with unique combinations of strength in operations, finances, and products. With our disciplined and flexible analytical process, we continue to seek attractive investments that offer the potential for rewarding returns across varied economic cycles.

I invite you to read the following commentaries for each of the Midas Funds to see for yourself the gratifying results of the Midas quality approach to long term investing.

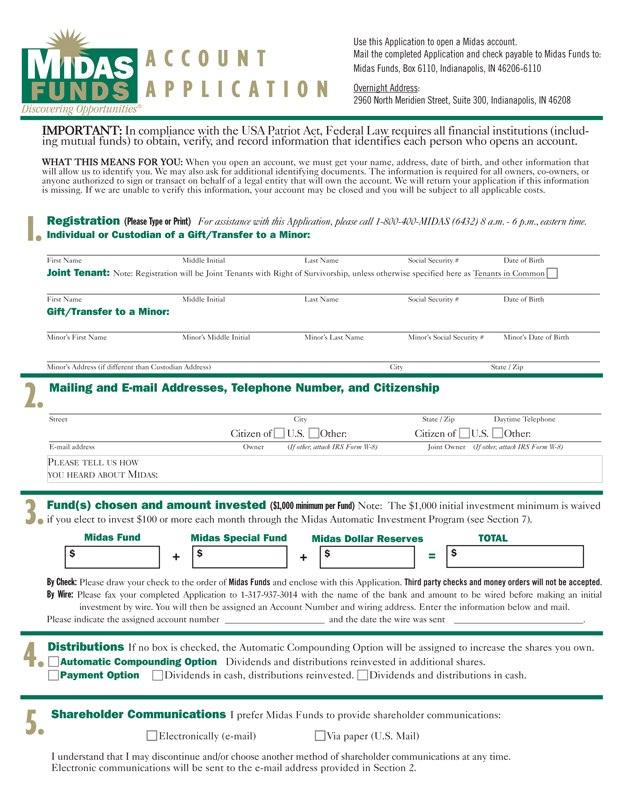

Discovering Opportunities for Your Personal Investment Planning

We believe personal investment planning can be successful by following three easy steps. First, commit to a long term investing approach. Second, follow a regular investment plan as described below. Third, manage your investment risk by diversifying among the three Midas Funds: Midas Special Fund for a longer term, stock market oriented objective; Midas Dollar Reserves money market fund for income, short term liquidity, and check writing; and Midas Fund for precious metals capital appreciation and as a hedge against inflation. As you invest in the Midas Funds for the future, we will remain committed to seeking to achieve the investment objectives of the Funds within the investment policies of each.

Investing Now . . . For Your Future

Midas offers an excellent service to make regular investing secure and convenient to help you reach your future financial goals. With regular automatic investing, you decide now to invest through the free Midas Bank Transfer Plan, and at the same time each month in the future for as long as you like, a fixed amount of money will be transferred from your bank account for investment in your Midas Funds account. You should then periodically review your overall portfolio. For retirement investing goals, consider the tax-advantaged Midas Traditional, Roth, SEP, or SIMPLE IRA, as well as the Midas Education Savings Account and 403(b)(7) Account. Forms for all of these plans may be found at www.midasfunds.com.

Investing the same amount regularly, known as “dollar cost averaging,” can reduce the anxiety of investing in a rising or falling market or buying all your shares at market highs. Although this strategy cannot assure a profit or protect against loss in a declining market, it can result in a lower average cost for your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels when undertaking such a strategy.

If you have any questions, we will be happy to assist you without any obligation on your part. We look forward to hearing from you. Please call us at 1-800-400-MIDAS (6432), or visit www.MidasFunds.com.

|

| Sincerely, |

|

|

| Thomas B. Winmill |

| President |

1

Midas Fund

C O M M E N T A R Y

We are very pleased to welcome new shareholders attracted to Midas Fund by its track record of past performance, its policy of investing in securities of companies principally involved in mining, processing, distributing or otherwise dealing in gold, silver, platinum, or other natural resources, and its no-charge shareholder services. Midas Fund’s net asset value declined in the first half of 2008, a disappointing result after achieving a total return of 31.70% in 2007, 44.02% in 2006, and 39.72% in 2005.

Market Review, Strategies, and Outlook

To calm panicky markets and tightening credit conditions, on April 30, 2008, the Federal Reserve cut the key federal funds rate — the rate banks charge each other for overnight loans — by a quarter percentage point to 2%, its seventh consecutive rate cut since September 2007. With these easier credit conditions, however, we expect inflation in the U.S. to continue to increase. We note that the U.S. Department of Labor reported that in the 12 months ended June 2008, the Producer Price Index of finished goods rose 9.2%, intermediate goods rose 14.5%, and crude goods jumped 45.5%. A recent Conference Board survey suggested that 12 month inflation expectations rose to 7.7%, the most since at least 1987. Sadly, U.S. consumer confidence recently hit a 16 year low.

| | |

TOP 10 HOLDINGS

AS OF JUNE 30, 2008 |

| |

| 1 | | Golden Cycle Gold Corp. |

| 2 | | Impala Platinum Holdings Ltd. |

| 3 | | Teck Cominco Ltd. |

| 4 | | Kinross Gold Corp. |

| 5 | | Freeport McMoRan Copper & Gold, Inc. |

| 6 | | Lihir Gold Limited |

| 7 | | Anglo Platinum Ltd. |

| 8 | | First Quantum Minerals Ltd. |

| 9 | | Yamana Gold, Inc. |

| 10 | | Agnico-Eagle Mines Ltd. |

With inflation, the U.S. dollar has shown weakness versus other currencies. Slowing industrial growth is evident as businesses and consumers seek to deal with mounting debts and higher oil prices. A likely result may be an economic environment with a “stagflationary” feel.

“...two companies in the Fund’s portfolio saw their share prices appreciate upon agreeing to be acquired., and we anticipate more consolidation in the sector.”

Given this market environment, and using its core strategy of “quality, with growth,” Midas Fund broadened its focus to invest in a number of quality growth companies judged more likely to achieve production objectives and deliver on promises of future profitability. The Fund sought to limit its holdings of smaller companies to those deemed attractive enough to receive a high bid in an acquisition. In fact, during the first six months of the year two companies in the Fund’s portfolio saw their share prices appreciate upon agreeing to be acquired at a premium, and we anticipate more consolidation in the mining sector in the months ahead.

Adjusting leverage and re-weighting the portfolio to companies with financial strength, strong management, and robust project development plans, the Fund sought investments in companies involved in both precious and base metals, as well as energy. Major gold and platinum mining companies contributed most to returns in the first half while smaller operations and companies subject to the swiftly changing and adverse policies of third world governments underperformed. Midas Fund is leveraged for a resurgence in precious metals prices, and the portfolio is currently emphasizing gold, platinum, and copper from operations in politically safer jurisdictions.

Since the beginning of 2008, gold prices have oscillated between $846 and $1,011, averaging about $910 and ending the first half at $919. We anticipate seasonal and investment demand potentially driving the gold price over $1,000. Potential catalysts for gold include adverse geopolitical developments and interest rate cuts by the central banks of the United States or Europe. By seeking quality investments with growth potential, we seek to address the risks inherent in the sector yet position Midas Fund to benefit from these emerging trends.

2

Midas Special Fund

C O M M E N T A R Y

It is a pleasure to submit the 2008 Semi-Annual Report for Midas Special Fund, and to welcome our new shareholders who find the Fund’s aggressive and flexible investment approach attractive. The Fund invests aggressively for capital appreciation, using a flexible strategy in the selection of securities, and is not limited by an issuer’s location, size, or market capitalization. To achieve its objective, Midas Special Fund may use a seasonal investing strategy to gain exposure to the securities markets during periods anticipated to be favorable based on patterns of investor behavior related to accounting periods, tax events, holidays, and other factors. During periods anticipated to be less favorable, and from time to time, the Fund may take a defensive position.

The Fund may invest in equity and fixed income securities of both new and seasoned U.S. and foreign issuers with no minimum rating, including securities convertible into common stock, debt securities, and other instruments. The Fund also may employ aggressive and speculative investment techniques, such as using futures or options, selling securities short and borrowing money for investment purposes, a practice known as “leveraging,” and may invest defensively in short term, liquid, high grade securities.

Markets Conditions and Investment Strategies

The first half of 2008 has seen the United States and a number of other developed countries under increasing monetary and fiscal pressure. Weakening industrial growth, falling housing markets, and tight credit conditions are besetting the prospects for businesses and consumers alike. Inflation remains a leading problem. Consumer price inflation in the developed world has risen to a seven year high, largely from higher oil and food prices, according to the Organization for Economic Cooperation and Development. In view of these changes in market conditions, the Fund reduced its emphasis on financial and technology companies and increased its weighting of consumer products and credit processing companies. By the end of the first half of 2008, Midas Special Fund’s holdings included the stocks of some of the largest and best known U.S. companies in consumer products, insurance, resource development, and finance.

“Midas Special Fund will pursue its capital appreciation objective aggressively as market conditions evolve, seeking to discover long term opportunities for attractive investment.”

Going forward, we note that based on a survey of the National Association of Credit Management, credit conditions in both the service and manufacturing sectors have been deteriorating, with the latter indicating contraction for only the second time since 2002. Reflecting the malaise in manufacturing, the U.S. auto industry reported disappointing sales in June, with General Motors sales down 18%, Ford Motor down 28%, and Chrysler down 36%. Some cause for optimism exists, however, as the general U.S. manufacturing sector expanded in June for the first time in five months, according to the Institute for Supply Management’s index of business activity. For these and other reasons, Midas Special Fund’s emphasis on financial strength and quality should appeal to investors concerned with future unexpected shocks to the marketplace.

Objective: Capital Appreciation

Midas Special Fund will pursue its capital appreciation objective aggressively as financial market conditions evolve, seeking to discover long term opportunities for attractive investment—whether due to a changing outlook for the prospects of a particular company or an industry sector generally. Since these strategies may reflect longer term wealth building goals, we believe the Fund can be especially appropriate for tax advantaged retirement accounts. For long term investing goals, consider the tax-advantaged Midas Traditional, Roth, SEP, or SIMPLE IRA, as well as the Midas Education Savings Account and 403(b)(7) Account. Forms for all of these plans may be found at www.MidasFunds.com.

| | |

TOP 10 HOLDINGS

AS OF JUNE 30, 2008 |

| |

| 1 | | Berkshire Hathaway Inc., Class B |

| 2 | | MasterCard, Inc. |

| 3 | | Google Inc. - Class A |

| 4 | | ConocoPhillips |

| 5 | | Canadian Natural Resources Ltd. |

| 6 | | Leucadia National Corporation |

| 7 | | Johnson & Johnson |

| 8 | | Costco Wholesale Corp. |

| 9 | | The Goldman Sachs Group, Inc. |

| 10 | | JPMorgan Chase & Co. |

3

Midas Dollar Reserves

COMMENTARY

We are very pleased to submit this Semi-Annual Report for the first half of 2008, and to welcome our new shareholders who have made their initial investment in the Fund since our last Report. In conditions of economic uncertainty such as these, the Fund’s objective of seeking maximum current income consistent with preservation of capital and maintenance of liquidity has great appeal to safety conscious investors. Midas Dollar Reserves invests exclusively in obligations of the U.S. Government, its agencies and instrumentalities.

The Fund’s all-weather income and safety conscious approach, plus free check writing have made it an attractive vehicle for a program of steady monthly or quarterly investing. To make regular investing in the Fund as easy, safe, convenient and affordable as possible, we offer the Midas Bank Transfer Plan. For information on this free service simply give us a toll free call. We look forward to helping you get started.

Investment Strategy, Review, and Outlook

On April 30, the Federal Reserve Open Market Committee cut the key federal funds rate by a quarter percentage point to 2%, its lowest level since 2004. This cut was the seventh consecutive rate cut by the Committee since September 2007, when the funds rate had stood at 5.25%.

TOP 10 HOLDINGS

AS OF JUNE 30, 2008

| | |

| 1 | | Freddie Mac, due 08/04/08 |

| 2 | | Federal Home Loan Bank, due 08/15/08 |

| 3 | | Freddie Mac, due 07/14/08 |

| 4 | | Fannie Mae, due 08/12/08 |

| 5 | | Fannie Mae, due 08/25/08 |

| 6 | | Federal Home Loan Bank, due 08/01/08 |

| 7 | | Freddie Mac, due 07/28/08 |

| 8 | | Federal Home Loan Bank, due 07/07/08 |

| 9 | | Federal Home Loan Bank, due 07/11/08 |

| 10 | | Fannie Mae, due 08/12/08 |

By easing credit conditions, the Committee appeared to be reacting to the potential for recession and a growing crisis in the financial sector. In view of these conditions, the strategy of Midas Dollar Reserves was to continue seeking the benefit of relative safety through investment in money market obligations of the U.S. Government, its agencies and instrumentalities, and maintaining an average maturity in the first half of the year of approximately 35 days.

“In addition to providing easy access to your account, the Fund’s free checking enables you to continue receiving dividends until your check is presented for payment.”

In its statement on June 25, the Committee noted that overall economic activity continues to expand, partly reflecting some firming in household spending, although labor markets have softened further and financial markets remain under considerable stress. We agree with its view that tight credit conditions, the ongoing housing contraction, and the rise in energy prices are likely to weigh on economic growth in the second half of 2008. We also agree with the Committee that the substantial easing of monetary policy to date, combined with ongoing measures to foster market liquidity, should help to promote moderate growth over time.

Check Writing Privilege for Easy Access

Many shareholders have established free, unlimited check writing privileges with Midas Dollar Reserves. In addition to providing easy access to your account, the Fund’s free checking enables you to continue receiving dividends until your check is presented for payment. The minimum amount each check may be for is only $250 and there is no maximum to the number of checks you may write. Checkbooks are free and there is no per check or any other charge to your account for this attractive service.

Contact Us for Information and Services

If you have any questions or would like further information on the Midas Funds Family, or our Traditional or Roth IRAs, as well as our Education Savings Accounts, we would be very pleased to hear from you and provide this information to you or a friend or relative. Just call 1- 800-400-MIDAS (6432) and a Shareholder Services Representative will be happy to help, as always, without obligation on your part.

4

Midas Fund, Inc.

Schedule of Portfolio Investments - June 30, 2008 (Unaudited)

| | | | | |

| Common Stocks (107.25%) | | |

Shares | | | | Value |

Major Precious Metals Producers (26.37%) | | | |

| 50,000 | | Anglo Platinum Ltd. | | $ | 8,348,024 |

| 150,000 | | Barrick Gold Corp. (a) | | | 6,825,000 |

| 82,000 | | Compania De Minas Buenaventura (a)(b) | | | 5,360,340 |

| 490,000 | | Gold Fields Ltd. (b) | | | 6,198,500 |

| 250,000 | | Impala Platinum Holdings Ltd. (c) | | | 9,868,169 |

| 400,000 | | Kinross Gold Corp. (a) | | | 9,444,000 |

| 465,000 | | Yamana Gold, Inc. (a) | | | 7,691,100 |

| | | | | |

| | | | | 53,735,133 |

Intermediate Precious Metals Producers (20.10%) | | | |

| 100,000 | | Agnico-Eagle Mines Ltd. (a) | | | 7,437,000 |

| 680,000 | | Centerra Gold Inc. (c) | | | 3,200,276 |

| 800,000 | | Eldorado Gold Corp. (c) | | | 6,920,000 |

| 171,178 | | Hochschild Mining PLC | | | 1,332,804 |

| 2,723,333 | | Lihir Gold Limited (c) | | | 8,635,691 |

| 150,000 | | Randgold Resources Limited (a)(b) | | | 6,927,000 |

| 1,100,000 | | Silvercorp Metals, Inc. (c) | | | 6,505,345 |

| | | | | |

| | | | | 40,958,116 |

Junior Precious Metals Producers (13.13%) | | | |

| 450,000 | | First Majestic Silver Corp. (c) | | | 2,044,648 |

| 1,964,500 | | Golden Cycle Gold Corp. (c)(d) | | | 20,784,410 |

| 407,675 | | Jaguar Mining, Inc. (c) | | | 3,925,910 |

| | | | | |

| | | | | 26,754,968 |

Exploration and Project Development Companies (18.66%) | | | |

| 1,400,000 | | Andean Resources Ltd. (c) | | | 2,042,184 |

| 1,000,000 | | Aurelian Resources, Inc. (c) | | | 5,588,409 |

| 500,000 | | Comaplex Minerals Corp. (c) | | | 2,698,108 |

| 1,125,000 | | Etruscan Resources Inc. (c) | | | 1,901,612 |

| 7,000,000 | | Farallon Resources Ltd. (c) | | | 5,346,935 |

| 1,000,000 | | Great Basin Gold Ltd. (e) | | | 3,400,000 |

| 180,000 | | Guyana Goldfields (a)(c) | | | 759,314 |

| 37,699 | | Ivanhoe Nickel & Platinum Ltd. (c)(f) | | | — |

| 400,000 | | Minefinders Corporation Ltd. (c) | | | 4,160,000 |

| 600,000 | | Northern Dynasty Minerals Ltd. (a)(c) | | | 4,818,000 |

| 364,500 | | Olympus Pacific Minerals, Inc. (c) | | | 88,017 |

| 186,100 | | Pelangio Mines Inc. (c) | | | 999,357 |

| 2,700,000 | | Ridge Mining PLC (c) | | | 6,232,836 |

| | | | | |

| | | | | 38,034,772 |

| | | | | | |

Shares | | | | Value | |

Other Natural Resources Companies (28.99%) | | | | |

| 154,700 | | Anglo American PLC (a)(b) | | $ | 5,484,115 | |

| 500,000 | | Anvil Mining Ltd. (c) | | | 4,726,000 | |

| 2,000 | | Areva | | | 2,341,264 | |

| 894,000 | | Brilliant Mining Corp. (c) | | | 634,418 | |

| 173,500 | | Endeavour Mining Capital Corp. | | | 1,270,554 | |

| 115,000 | | First Quantum Minerals Ltd. (a) | | | 7,971,565 | |

| 75,000 | | Freeport McMoRan Copper & Gold, Inc. | | | 8,789,250 | |

| 100,000 | | Harry Winston Diamond Corp. (a) | | | 2,879,000 | |

| 63,000 | | Inmet Mining Corp. (a) | | | 4,198,137 | |

| 48,000 | | Mechel OAO (a)(b) | | | 2,377,920 | |

| 608,200 | | Mercator Minerals Ltd. (c) | | | 7,286,291 | |

| 46,700 | | OM Group Inc. (a)(c) | | | 1,531,293 | |

| 200,000 | | Teck Cominco Ltd. (a) | | | 9,590,000 | |

| | | | | | |

| | | | | 59,079,807 | |

| | | | | | |

Total common stocks (cost: $194,776,786) | | | 218,562,796 | |

| |

Warrants (0.72%) (c) | | | | |

| 562,500 | | Etruscan Resources Inc., expiring 11/2/10 | | | 192,656 | |

| 225,000 | | First Majestic Silver Corp., expiring 3/25/10 | | | 38,808 | |

| 300,000 | | Great Basin Gold Ltd., expiring 4/19/09 | | | 187,500 | |

| 100,000 | | IAMGOLD Corp., expiring 8/12/08 | | | 4,189 | |

| 100,000 | | Kinross Gold Corp., expiring 9/7/2011 | | | 413,956 | |

| 275,000 | | Silver Eagle Mines, Inc. expiring 10/31/08 (f) | | | — | |

| 84,375 | | Yamana Gold Inc., expiring 11/20/08 | | | 637,428 | |

| | | | | | |

Total warrants (cost: $129,310) | | | 1,474,537 | |

| |

Bullion Ounces (0%)* | | | | |

| 10 | | Gold (c) (cost: $9,643) | | | 9,263 | |

| |

Investment of Security Lending Collateral (0%)* | | | | |

| | |

| 4,900 | | State Street Navigator Securities Lending Prime Portfolio (cost: $4,900) | | | 4,900 | |

| | | | | | |

Total investments (cost: $194,920,639) (107.97%) | | | 220,051,496 | |

Liabilities in excess of other assets (-7.97%) | | | (16,246,027 | ) |

| | | | | | |

Net assets (100.00%) | | $ | 203,805,469 | |

| | | | | | |

| (a) | Fully or partially pledged as collateral on bank credit facility. |

| (b) | American Depositary Receipt. |

| (e) | All or a portion of this security was on loan. The total value of the securities on loan, as of June 30, 2008, was $4,760. |

| (f) | Illiquid and/or restricted security that has been fair valued. |

| * | Rounds to less than .01% |

| | | | |

| | 5 | | See notes to financial statements. |

Midas Special Fund, Inc.

Schedule of Portfolio Investments - June 30, 2008 (Unaudited)

| | | | | | |

| Common Stocks (115.76%) | | | |

Shares | | | | Value | |

Crude Petroluem & Natural Gas (6.50%) | | | | |

| 10,000 | | Canadian Natural Resources Ltd. | | $ | 1,002,500 | |

Electric Services (0.10%) | | | | |

| 720 | | Brookfield Infrastructure Partners LP (a)(b) | | | 14,112 | |

Electronic Computers (2.71%) | | | | |

| 2,500 | | Apple Inc. (c) | | | 418,600 | |

Fire, Marine & Casualty Insurance (37.62%) | | | | |

| 1,050 | | Berkshire Hathaway, Inc. Class B (b)(c) | | | 4,212,600 | |

| 20,000 | | Leucadia National Corporation (b)(c) | | | 938,800 | |

| 14,000 | | Loews Corp. (a)(b) | | | 656,600 | |

| | | | | | |

| | | | | 5,808,000 | |

Holding Companies (3.79%) | | | | |

| 18,000 | | Brookfield Asset Management Inc. | | | 585,720 | |

Metal Ores (3.94%) | | | | |

| 25,000 | | Franco-Nevada Corp. (c) | | | 608,614 | |

Miscellaneous Food Stores (2.35%) | | | | |

| 23,000 | | Starbucks Corp. (c) | | | 362,020 | |

National Commercial Banks (4.31%) | | | | |

| 19,400 | | JP Morgan Chase & Co. (b) | | | 665,614 | |

Operative Builders (2.14%) | | | | |

| 25,000 | | Hovnanian Enterprises, Inc. (a)(b)(c) | | | 137,000 | |

| 20,000 | | Pulte Homes, Inc. (a)(b) | | | 192,600 | |

| | | | | | |

| | | | | 329,600 | |

Petroleum Refining (6.60%) | | | | |

| 10,800 | | ConocoPhillips (b) | | | 1,019,412 | |

Pharmaceutical Preparations (4.59%) | | | | |

| 11,000 | | Johnson & Johnson (b) | | | 707,740 | |

Retail - Lumber & Other Building Materials Dealers (2.55%) | | | | |

| 19,000 | | Lowe’s Companies, Inc. (a)(b) | | | 394,250 | |

Security Brokers, Dealers & Flotation Companies (4.42%) | | | | |

| 3,900 | | The Goldman Sachs Group, Inc. | | | 682,110 | |

Services - Business Services (19.83%) | | | | |

| 10,000 | | MasterCard, Inc. (b) | | | 2,655,200 | |

| 5,000 | | Visa Inc. (a)(b)(c) | | | 406,550 | |

| | | | | | |

| | | | | 3,061,750 | |

Services - Computer Programming, Data Processing, Etc. | | | | |

| 2,000 | | Google Inc. - Class A (b)(c) | | | 1,052,840 | |

Soap, Detergents, Cleaning Preparations, Perfumes, Cosmetics (2.95%) | | | | |

| 7,500 | | Procter & Gamble Company | | | 456,075 | |

Variety Stores (4.54%) | | | | |

| 10,000 | | Costco Wholesale Corp. (a)(b) | | | 701,400 | |

| | | | | | |

Total common stocks (cost: $12,993,554) | | | 17,870,357 | |

Investment of Security Lending Collateral (16.40%) | | | | |

| |

Shares/Principal Amount | | Value | |

| 1,395,867 | | State Street Navigator Securities Lending Prime Portfolio | | | 1,395,867 | |

| 507,160 | | Investments in U.S. Treasury and U.S. Government Agency securities with coupons ranging from 2.0% to 7.5% and maturity dates ranging from Aug. 1, 2008 to Feb. 15, 2031 | | | 534,352 | |

| 601,521 | | Letters of Credit, Banco Santander Central Hispana and BNP Paribas | | | 601,521 | |

| | | | | | |

Total investment in security lending collateral (cost: $2,531,740) | | | 2,531,740 | |

| | | | | | |

Total investments (cost: $15,525,294)(132.16%) | | | 20,402,097 | |

Liabilities in excess of cash and other assets (-32.16%) | | | (4,964,533 | ) |

| | | | | | |

Net assets (100.00%) | | $ | 15,437,564 | |

| | | | | | |

| (a) | All or a portion of this security was on loan. The total value of the securities on loan, as of June 30, 2008, was $2,422,782. |

| (b) | Fully or partially pledged as collateral on bank credit facility. |

| | | | |

| See notes to financial statements. | | 6 | | |

Midas Dollar Reserves, Inc.

Schedule of Portfolio Investments - June 30, 2008 (Unaudited)

| | | | | | | | | | |

| | U.S. Government Agencies (100.23%) | | | | | | | |

Principal

Amount | | | | Yield* | | | Value** | |

| | Federal Home Loan Bank (41.97%) | | | | | | | |

| $ | 740,000 | | Federal Home Loan Bank, due 07/07/08 | | 2.100 | % | | $ | 739,741 | |

| | 625,000 | | Federal Home Loan Bank, due 07/11/08 | | 2.080 | % | | | 624,638 | |

| | 250,000 | | Federal Home Loan Bank, due 07/21/08 | | 2.100 | % | | | 249,703 | |

| | 160,000 | | Federal Home Loan Bank, due 07/21/08 | | 2.200 | % | | | 159,810 | |

| | 300,000 | | Federal Home Loan Bank, due 07/23/08 | | 2.100 | % | | | 299,632 | |

| | 200,000 | | Federal Home Loan Bank, due 07/23/08 | | 2.005 | % | | | 199,755 | |

| | 340,000 | | Federal Home Loan Bank, due 07/30/08 | | 2.040 | % | | | 339,441 | |

| | 970,000 | | Federal Home Loan Bank, due 08/01/08 | | 2.015 | % | | | 968,317 | |

| | 1,200,000 | | Federal Home Loan Bank, due 08/15/08 | | 2.210 | % | | | 1,196,685 | |

| | 485,000 | | Federal Home Loan Bank, due 09/05/08 | | 2.370 | % | | | 482,893 | |

| | | | | | | | | | |

| | | | | | | | | 5,260,615 | |

| | Federal National Mortgage Association (25.67%) | | | | | | | |

| | 600,000 | | Federal National Mortgage Association, due 07/01/08 | | 2.060 | % | | | 600,000 | |

| | 75,000 | | Federal National Mortgage Association, due 07/23/08 | | 2.090 | % | | | 74,904 | |

| | 1,100,000 | | Federal National Mortgage Association, due 08/12/08 | | 2.200 | % | | | 1,097,177 | |

| | 1,050,000 | | Federal National Mortgage Association, due 08/25/08 | | 2.250 | % | | | 1,046,391 | |

| | 400,000 | | Federal National Mortgage Association, due 09/09/08 | | 2.360 | % | | | 398,164 | |

| | | | | | | | | | |

| | | | | | | | | 3,216,636 | |

| | Freddie Mac Discount Notes (32.59%) | | | | | | | |

| $ | 1,150,000 | | Freddie Mac Discount Note, due 07/14/08 | | 2.050 | % | | | 1,149,149 | |

| | 400,000 | | Freddie Mac Discount Note, due 07/21/08 | | 1.980 | % | | | 399,560 | |

| | 790,000 | | Freddie Mac Discount Note, due 07/28/08 | | 2.050 | % | | | 788,786 | |

| | 1,750,000 | | Freddie Mac Discount Note, due 08/04/08 | | 2.040 | % | | | 1,746,628 | |

| | | | | | | | | | |

| | | | | | | | | 4,084,123 | |

| | | | | | | | | | |

| | Total investments (cost: $12,561,374) (100.23%) | | | | | | 12,561,374 | |

| | Liabilities in excess of other assets (-0.23%) | | | | | | (29,090 | ) |

| | | | | | | | | | |

| | Net assets (100.00%) | | | | | $ | 12,532,284 | |

| | | | | | | | | | |

| * | Represents discount rate at date of purchase for discount securities, or coupon for coupon-bearing securities. |

| ** | Cost of investments for financial reporting and for Federal income tax purposes is the same as value. |

| | | | |

| | 7 | | See notes to financial statements. |

Statements of Assets and Liabilities

| | | | | | | | | | | | |

June 30, 2008 (Unaudited) | | Midas Fund | | | Midas Special

Fund | | | Midas Dollar

Reserves | |

Assets | | | | | | | | | | | | |

Investments at cost | | | | | | | | | | | | |

Non-affiliated | | $ | 191,860,606 | | | $ | 15,525,294 | | | $ | 12,561,374 | |

Affiliated | | | 3,060,033 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total investments at cost | | $ | 194,920,639 | | | $ | 15,525,294 | | | $ | 12,561,374 | |

| | | | | | | | | | | | |

Investments at value | | | | | | | | | | | | |

Non-affiliated | | $ | 199,262,326 | | | $ | 17,979,315 | | | $ | 12,561,374 | |

Affiliated | | | 20,784,410 | | | | — | | | | — | |

Securities loaned | | | 4,760 | | | | 2,422,782 | | | | — | |

| | | | | | | | | | | | |

Total investments at value | | | 220,051,496 | | | | 20,402,097 | | | | 12,561,374 | |

| | | | | | | | | | | | |

Cash | | | 316 | | | | — | | | | 3,606 | |

Receivables: | | | | | | | | | | | | |

Investments sold | | | 9,665,863 | | | | — | | | | — | |

Dividends and interest | | | 164,503 | | | | 17,415 | | | | — | |

Fund shares sold | | | 145,167 | | | | — | | | | — | |

Other assets | | | 36,601 | | | | 7,821 | | | | 7,087 | |

| | | | | | | | | | | | |

Total assets | | | 230,063,946 | | | | 20,427,333 | | | | 12,572,067 | |

| | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | |

Bank line of credit | | | 15,574,366 | | | | 2,363,353 | | | | — | |

Payables: | | | | | | | | | | | | |

Investments purchased | | | 9,867,047 | | | | — | | | | — | |

Accrued expenses | | | 334,654 | | | | 70,883 | | | | 38,819 | |

Fund shares redeemed | | | 251,117 | | | | — | | | | — | |

Management fees | | | 160,962 | | | | 9,597 | | | | — | |

Distribution fees | | | 42,122 | | | | 12,483 | | | | — | |

Administrative services | | | 23,309 | | | | 1,713 | | | | 964 | |

Collateral on securities loaned, at value | | | 4,900 | | | | 2,531,740 | | | | — | |

| | | | | | | | | | | | |

| | | 26,258,477 | | | | 4,989,769 | | | | 39,783 | |

| | | | | | | | | | | | |

Net assets | | $ | 203,805,469 | | | $ | 15,437,564 | | | $ | 12,532,284 | |

| | | | | | | | | | | | |

Shares outstanding, $0.01 par value | | | 39,322,985 | | | | 885,549 | | | | 12,532,891 | |

Net asset value, offering, and redemption price per share | | $ | 5.18 | | | $ | 17.43 | | | $ | 1.00 | |

Net assets consist of: | | | | | | | | | | | | |

Paid in capital | | $ | 252,842,756 | | | $ | 16,948,411 | | | $ | 12,533,683 | |

Accumulated undistributed net investment income (loss) | | | (5,092,317 | ) | | | (206,839 | ) | | | 252 | |

Accumulated net realized loss on investments | | | (69,076,013 | ) | | | (6,180,810 | ) | | | (1,651 | ) |

Net unrealized appreciation on investments and foreign currencies | | | 25,131,043 | | | | 4,876,802 | | | | — | |

| | | | | | | | | | | | |

| | $ | 203,805,469 | | | $ | 15,437,564 | | | $ | 12,532,284 | |

| | | | | | | | | | | | |

| | | | |

| See notes to financial statements. | | 8 | | |

Statements of Operations

| | | | | | | | | | | | |

For the Six Months Ended June 30, 2008 (Unaudited) | | Midas Fund | | | Midas Special

Fund | | | Midas Dollar

Reserves | |

Investment income | | | | | | | | | | | | |

Dividends - non-affiliates | | $ | 1,046,170 | | | $ | 98,696 | | | $ | — | |

Dividends - affiliates | | | 6,191 | | | | 7 | | | | — | |

Other | | | 4,521 | | | | — | | | | — | |

Securities lending income | | | 19 | | | | 150 | | | | — | |

Foreign tax withholding | | | (24,471 | ) | | | (675 | ) | | | — | |

Interest | | | — | | | | — | | | | 181,432 | |

| | | | | | | | | | | | |

Total investment income | | | 1,032,430 | | | | 98,178 | | | | 181,432 | |

| | | | | | | | | | | | |

Expenses | | | | | | | | | | | | |

Investment management | | | 1,200,798 | | | | 76,753 | | | | 32,388 | |

Interest and fees on bank credit facility | | | 440,815 | | | | 51,564 | | | | 101 | |

Transfer agent | | | 311,720 | | | | 31,304 | | | | 17,788 | |

Distribution | | | 302,941 | | | | 80,614 | | | | 16,194 | |

Legal | | | 169,350 | | | | 5,440 | | | | 3,118 | |

Administrative services | | | 80,340 | | | | 4,495 | | | | 2,725 | |

Registration | | | 59,057 | | | | 15,672 | | | | 15,705 | |

Bookkeeping and pricing | | | 56,652 | | | | 12,110 | | | | 13,250 | |

Printing and postage | | | 54,093 | | | | 4,440 | | | | 1,149 | |

Custodian | | | 46,916 | | | | 2,107 | | | | 2,441 | |

Directors | | | 18,202 | | | | 4,898 | | | | 1,820 | |

Insurance | | | 16,640 | | | | 1,560 | | | | 1,638 | |

Auditing | | | 15,244 | | | | 12,459 | | | | 10,456 | |

Other | | | 10,229 | | | | 1,374 | | | | 1,330 | |

| | | | | | | | | | | | |

Total expenses | | | 2,782,997 | | | | 304,790 | | | | 120,103 | |

Expense reductions | | | (658 | ) | | | (39 | ) | | | (304 | ) |

Waived investment management and distribution fees | | | — | | | | — | | | | (48,582 | ) |

| | | | | | | | | | | | |

Net expenses | | | 2,782,339 | | | | 304,751 | | | | 71,217 | |

| | | | | | | | | | | | |

Net investment income (loss) | | | (1,749,909 | ) | | | (206,573 | ) | | | 110,215 | |

| | | | | | | | | | | | |

Realized and Unrealized Gain (Loss) on Investments | | | | | | | | | | | | |

Net realized gain (loss) | | | | | | | | | | | | |

Investments | | | 10,504,256 | | | | (299,864 | ) | | | (1,433 | ) |

Short sales | | | (220,523 | ) | | | — | | | | — | |

Foreign currencies | | | 162,154 | | | | (444 | ) | | | — | |

Unrealized depreciation on | | | | | | | | | | | | |

Investments | | | (24,310,976 | ) | | | (1,001,399 | ) | | | — | |

Translation of assets and liabilities in foreign currencies | | | (3,358,835 | ) | | | (10,473 | ) | | | — | |

| | | | | | | | | | | | |

Net realized and unrealized gain (loss) on investments | | | (17,223,924 | ) | | | (1,312,180 | ) | | | (1,433 | ) |

| | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | $ | (18,973,833 | ) | | $ | (1,518,753 | ) | | $ | 108,782 | |

| | | | | | | | | | | | |

| | | | |

| | 9 | | See notes to financial statements. |

Statements of Changes in Net Assets

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Midas Fund | | | Midas Special Fund | | | Midas Dollar Reserves | |

| | | Six Months

Ended

6/30/08

(Unaudited) | | | For the Year

Ended

12/31/07 | | | Six Months

Ended

6/30/08

(Unaudited) | | | For the Year

Ended

12/31/07 | | | Six Months

Ended

6/30/08

(Unaudited) | | | For the Year

Ended

12/31/07 | |

Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | (1,749,909 | ) | | $ | (3,048,302 | ) | | $ | (206,573 | ) | | $ | (473,358 | ) | | $ | 110,215 | | | $ | 536,079 | |

Net realized gain (loss) from sale of investments, short sales, and foreign currencies | | | 10,445,887 | | | | 40,287,946 | | | | (300,308 | ) | | | 2,749,314 | | | | (1,433 | ) | | | 327 | |

Net unrealized appreciation (depreciation) of investments and foreign currency translations | | | (27,669,811 | ) | | | 8,271,826 | | | | (1,011,872 | ) | | | (131,364 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (18,973,833 | ) | | | 45,511,470 | | | | (1,518,753 | ) | | | 2,144,592 | | | | 108,782 | | | | 536,406 | |

| | | | | | |

Distributions to shareholders | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from ordinary income | | | (715,888 | ) | | | (428,183 | ) | | | — | | | | — | | | | (110,215 | ) | | | (536,129 | ) |

| | | | | | |

Capital share transactions | | | | | | | | | | | | | | | | | | | | | | | | |

Change in net assets resulting from capital share transactions (a) | | | (27,954,113 | ) | | | 67,447,306 | | | | (377,766 | ) | | | (1,961,394 | ) | | | (1,982,516 | ) | | | (11,927 | ) |

Redemption fees | | | 55,218 | | | | 137,633 | | | | 257 | | | | 1,767 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Increase (decrease) in net assets resulting from capital share transactions | | | (27,898,895 | ) | | | 67,584,939 | | | | (377,509 | ) | | | (1,959,627 | ) | | | (1,982,516 | ) | | | (11,927 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total change in net assets | | | (47,588,616 | ) | | | 112,668,226 | | | | (1,896,262 | ) | | | 184,965 | | | | (1,983,949 | ) | | | (11,650 | ) |

| | | | | | |

Net assets | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of period | | | 251,394,085 | | | | 138,725,859 | | | | 17,333,826 | | | | 17,148,861 | | | | 14,516,233 | | | | 14,527,883 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

End of period (b) | | $ | 203,805,469 | | | $ | 251,394,085 | | | $ | 15,437,564 | | | $ | 17,333,826 | | | $ | 12,532,284 | | | $ | 14,516,233 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(a) Capital share transactions were as follows: | | | | | | | | | | | | | | | | | | | | | | | | |

Value | | | | | | | | | | | | | | | | | | | | | | | | |

Shares sold | | $ | 69,752,931 | | | $ | 184,044,970 | | | $ | 282,121 | | | $ | 821,189 | | | $ | 26,819,851 | | | $ | 23,573,730 | |

Shares issued and reinvestment of distributions | | | 649,779 | | | | 385,333 | | | | — | | | | — | | | | 107,774 | | | | 527,201 | |

Shares redeemed | | | (98,356,823 | ) | | | (116,982,997 | ) | | | (659,887 | ) | | | (2,782,583 | ) | | | (28,910,141 | ) | | | (24,112,858 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) | | $ | (27,954,113 | ) | | $ | 67,447,306 | | | $ | (377,766 | ) | | $ | (1,961,394 | ) | | $ | (1,982,516 | ) | | $ | (11,927 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Number | | | | | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 12,454,948 | | | | 36,048,415 | | | | 15,900 | | | | 48,234 | | | | 26,819,851 | | | | 23,573,730 | |

Shares issued and reinvestment of distributions | | | 119,445 | | | | 67,359 | | | | — | | | | — | | | | 107,774 | | | | 527,201 | |

Shares redeemed | | | (17,822,814 | ) | | | (23,895,005 | ) | | | (36,541 | ) | | | (166,363 | ) | | | (28,910,490 | ) | | | (24,112,858 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) | | | (5,248,421 | ) | | | 12,220,769 | | | | (20,641 | ) | | | (118,129 | ) | | | (1,982,865 | ) | | | (11,927 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

(b) End of period net assets include undistributed net investment income (loss) | | $ | (5,092,317 | ) | | $ | (2,626,520 | ) | | $ | (206,839 | ) | | $ | (266 | ) | | $ | 252 | | | $ | 252 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| See notes to financial statements. | | 10 | | |

Statements of Cash Flows

| | | | | | | | | | | | |

For the Six Months Ended June 30, 2008 (Unaudited) | | Midas Fund | | | Midas Special

Fund | | | Midas Dollar

Reserves | |

Cash flows from operating activities | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | $ | (18,973,833 | ) | | $ | (1,518,753 | ) | | $ | 108,782 | |

Adjustments to reconcile change in net assets resulting from operations to net cash provided by (used in) operating activities: | | | | | | | | | | | | |

Proceeds from sales of long term investments | | | 176,694,078 | | | | 2,668,079 | | | | — | |

Purchase of long term investments | | | (164,971,337 | ) | | | (1,773,397 | ) | | | — | |

Unrealized depreciation of investments and foreign currencies | | | 27,669,811 | | | | 1,011,873 | | | | — | |

Net realized (gain) loss on sales of investments, short sales, and foreign currencies | | | (10,445,887 | ) | | | 300,308 | | | | 1,433 | |

Increase (decrease) in payable for investments purchased | | | 9,867,047 | | | | (1,060,421 | ) | | | — | |

Increase in receivable for investments sold | | | (9,643,751 | ) | | | — | | | | — | |

Buy to cover investments held short | | | (8,705,107 | ) | | | — | | | | — | |

Proceeds from short sale of investments | | | 8,484,584 | | | | — | | | | — | |

Net sales (purchases) of short term investments | | | 2,250,670 | | | | (444 | ) | | | 1,586,025 | |

Decrease in other assets and liabilities | | | (79,599 | ) | | | (11,249 | ) | | | (3,256 | ) |

| | | | | | | | | | | | |

Net cash provided by (used in) operating activities | | | 12,146,676 | | | | (384,004 | ) | | | 1,692,984 | |

| | | | | | | | | | | | |

Cash flows from financing activities | | | | | | | | | | | | |

Net shares redeemed | | | (27,654,933 | ) | | | (378,166 | ) | | | (2,090,290 | ) |

Borrowing on bank line of credit | | | 15,574,366 | | | | 762,170 | | | | — | |

Cash distributions paid | | | (66,109 | ) | | | — | | | | (2,441 | ) |

| | | | | | | | | | | | |

Net cash (used in) provided by financing activities | | | (12,146,676 | ) | | | 384,004 | | | | (2,092,731 | ) |

| | | | | | | | | | | | |

Net change in cash | | | — | | | | — | | | | (399,747 | ) |

| | | |

Cash | | | | | | | | | | | | |

Beginning of period | | | 316 | | | | — | | | | 403,353 | |

| | | | | | | | | | | | |

End of period | | $ | 316 | | | $ | — | | | $ | 3,606 | |

| | | | | | | | | | | | |

Supplemental disclosure of cash flow information: | | | | | | | | | | | | |

Cash paid for interest | | $ | 502,376 | | | $ | 50,976 | | | $ | 101 | |

| | | |

Non-cash financing activities not included herein consisted of reinvestment of distributions | | $ | 649,779 | | | $ | — | | | $ | 107,774 | |

| | | | |

| | 11 | | See notes to financial statements. |

Notes to Financial Statements

(UNAUDITED)

June 30, 2008

1 Organization and Significant Accounting Policies

The Midas Funds are all Maryland corporations registered under the Investment Company Act of 1940, as amended (the “Act”), as open end management investment companies. Midas Fund’s investment objectives are primarily capital appreciation and protection against inflation and, secondarily, current income through investments in precious metals and natural resource companies. Midas Special Fund’s investment objective is capital appreciation which it seeks by investing aggressively in any security in any sector. Midas Dollar Reserves is a money market fund investing in securities issued by the U.S. Government, its agencies and instrumentalities.

Midas Fund and Midas Dollar Reserves each has authorized capital of one billion shares of common stock, par value $0.01 per share. Midas Special Fund has authorized capital of 500 million shares of common stock, par value $0.01. The Funds each offer only one class of shares. Each Fund’s shareholders are entitled to one vote for each whole share owned and a fractional vote for each fraction of a share owned. Voting rights are not cumulative. All shares of a Fund are fully paid and non-assessable and have no preemptive or conversion rights.

Midas Fund and Midas Special Fund impose a short term trading redemption fee on any Fund shares that are redeemed or exchanged within 30 days following their purchase date. The redemption fee is 1% of the amount redeemed. Such fees are retained by the Funds for the benefit of the remaining shareholders and are accounted for as an addition to paid in capital.

The following is a summary of significant accounting policies consistently followed by each Fund in the preparation of its financial statements.

Security Valuation - With respect to security valuation, except for Midas Dollar Reserves, securities traded on a U.S. national securities exchange (“USNSE”) are valued at the last reported sale price on the day the valuations are made. Securities traded primarily on the Nasdaq Stock Market (“Nasdaq”) are normally valued by the Funds at the Nasdaq Official Closing Price (“NOCP”) provided by Nasdaq each business day. The NOCP is the most recently reported price as of 4:00:02 p.m., eastern time, unless that price is outside the range of the “inside” bid and asked prices (i.e., the bid and asked prices that dealers quote to each other when trading for their own accounts); in that case, Nasdaq will adjust the price to equal the inside bid or asked price, whichever is closer. Because of delays in reporting trades, the NOCP may not be based on the price of the last trade to occur before the market closes. Securities that are not traded on a particular day, and securities traded in foreign and over-the-counter markets that are not also traded on a USNSE or Nasdaq, are valued at the mean between the last bid and asked prices. Gold bullion is valued at 4:00 p.m., eastern time, at the mean between the last bid and asked quotations of the Bloomberg Composite (NY) Gold Spot Price. Debt obligations with remaining maturities of 60 days or less are valued at cost adjusted for amortization of premiums and accretion of discounts. Open end investment companies are valued at their net asset value. Foreign securities markets may be open on days when the U.S. markets are closed. For this reason, the value of any foreign securities owned by the Fund could change on a day when stockholders cannot buy or sell shares of the Fund. Securities for which market quotations are not readily available or reliable and other assets may be valued as determined in good faith under the direction of and pursuant to procedures established by the Fund’s Board of Directors. Due to the inherent uncertainty of valuation, these values may differ from the values that would have been used had a readily available market for the securities existed. These differences in valuation could be material. A security’s valuation may differ depending on the method used for determining value. The use of fair value pricing by the Fund may cause the net asset value of its shares to differ from the net asset value that would be calculated using market prices.

Midas Dollar Reserves values its portfolio securities using the amortized cost method of valuation, under which the market value is approximated by amortizing the difference between acquisition cost and value at maturity of an instrument on a straight-line basis over its remaining life.

The Funds adopted Financial Accounting Standards Board (“FASB”) Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“FAS 157”), on January 1, 2008. FAS 157 defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. FAS 157 establishes a framework for measuring fair value and a three level hierarchy for fair value measurements based on the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing

12

Notes to Financial Statements

(UNAUDITED)

the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Funds. Unobservable inputs reflect a Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. A Fund’s investment in its entirety is assigned a level based upon the inputs which are significant to the overall valuation. The hierarchy of inputs is summarized below.

| | • | | Level 1 - quoted prices in active markets for identical investments. |

| | • | | Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.). |

| | • | | Level 3 - significant unobservable inputs (including a Fund’s own assumptions in determining fair value of investments). |

The inputs or methodology used for valuing investments are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of June 30, 2008 in valuing the Funds’ investments:

| | | | | | | | | | | | | | |

| | | | | Valuation Inputs | | |

Fund | | Investment | | Level 1 | | Level 2 | | Level 3 | | Total |

Midas Fund | | Securities and gold bullion | | $ | 220,051,496 | | $ | — | | $ | — | | $ | 220,051,496 |

Midas Special Fund | | Securities | | $ | 20,402,097 | | $ | — | | $ | — | | $ | 20,402,097 |

Midas Dollar Reserves | | Securities | | $ | — | | $ | 12,561,374 | | $ | — | | $ | 12,561,374 |

Foreign Currency Translation - Securities denominated in foreign currencies are translated into U.S. dollars at prevailing exchange rates. Realized gain or loss on the sale of investments denominated in foreign currencies is reported separately from gain or loss attributable to the change in foreign exchange rates for those investments.

Foreign Currency Contracts - Forward contracts are marked to market and the change in market value is recorded by the Fund as an unrealized gain or loss. When a contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. The Fund could be exposed to risk if the counterparties are unable to meet the terms of the contracts or if the value of the currency changes unfavorably.

Futures Contracts - Midas Fund and Midas Special Fund may engage in transactions in futures contracts. Upon entering into a futures contract, the Fund provides the broker/dealer an amount of cash or securities at least equal to a certain percentage of the contract amount. This is known as “initial margin.” Subsequent payments (“variation margin”) are credited to or debited from the Fund each day, depending on the daily fluctuation of the value of the contract. The daily change in the contract is included in unrealized appreciation or depreciation on investments and futures contracts. The Fund recognizes a realized gain or loss when the contract is closed. Futures transactions sometimes may reduce returns or increase volatility. In addition, futures can be illiquid and highly sensitive to changes in their underlying security, interest rate or index, and as a result can be highly volatile. A small investment in futures could have a large impact on a Fund’s performance.

Short Sales - Midas Fund and Midas Special Fund each may sell a security it does not own in anticipation of a decline in the market value of the security. When a Fund sells a security short, it must borrow the security sold short and deliver it to the broker/dealer through which it made the short sale. The Fund is liable for any dividends or interest paid on securities sold short. A gain, limited to the price at which the Fund sold the security short, or a loss, unlimited in size, will be recognized upon the termination of a short sale.

Investment in Affiliated Money Market Fund - Midas Fund and Midas Special Fund invest daily available cash balances in Midas Dollar Reserves. As a shareholder, each investing Fund is subject to its proportional share of Midas Dollar Reserves expenses, including the management and distribution fees, respectively, of Midas Management Corporation (the “Investment Manager”) and Investor Service Center, Inc. (the “Distributor”). With respect to Midas Dollar Reserves, the Investment Manager and Distributor have contractually agreed to waive their fees from April 29, 2008 to April 29, 2009. The Investment Manager and the Distributor may voluntarily waive fees after April 29, 2009 but are not contractually obligated to do so. Should the Distributor discontinue waiving its Midas Dollar Reserves distribution fee, the Investment Manager will waive a sufficient amount of its investing Fund management fee to offset the cost of such distribution fee.

13

Notes to Financial Statements

(UNAUDITED)

Security Transactions - Security transactions are accounted for on the trade date (the date the order to buy or sell is executed). Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income - Interest income is recorded on the accrual basis. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividend income is recorded on the ex-dividend date or in the case of certain foreign securities, as soon as the Fund is notified. Withholding taxes on foreign dividends have been provided for in accordance with a Fund’s understanding of the applicable country’s tax rules and rates.

Expenses - Estimated expenses are accrued daily. Expenses directly attributable to a Fund are charged to that Fund. Expenses borne by the complex of related investment companies, which includes open end and closed end investment companies for which the Investment Manager and its affiliates serve as investment manager, that are not directly attributed to the Fund are allocated among the Fund and the other investment companies in the complex on the basis of relative net assets, except where a more appropriate allocation of expenses to each investment company in the complex can otherwise be made fairly.

Expense Reduction Arrangement - Through arrangements with the Funds’ custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce custody and transfer agency expenses, by $346 and $655, respectively, during the six months ended June 30, 2008.

Distributions - Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Income Taxes - No provision has been made for U.S. income taxes because each Fund intends to qualify as a regulated investment company under the Internal Revenue Code and to distribute to shareholders substantially all taxable income and net realized gains. Foreign securities held by a Fund may be subject to foreign taxation. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests.

The Funds have reviewed their tax positions taken on federal, state, and local income tax returns for all open tax years (tax years ended December 31, 2004-2007) and have concluded that no provisions for income taxes are required in the Funds’ financial statements.

Use of Estimates - In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Indemnifications - The Funds indemnify officers and directors for certain liabilities that might arise from their performance of their duties for the Funds. Additionally, in the normal course of business the Funds enter into contracts that contain a variety of representations and warranties and which may provide general indemnifications. The Funds’ maximum exposure under these arrangements is unknown, as it involves future claims that may be made against the Funds under circumstances that have not occurred.

2 Fees and Transactions with Related Parties

Under the investment management agreement of Midas Fund, the Investment Manager receives a management fee, payable monthly, based on the average daily net assets of the Fund at the annual rate of 1% on the first $200

14

Notes to Financial Statements

(UNAUDITED)

million, .95% from $200 million to $400 million, .90% from $400 million to $600 million, .85% from $600 million to $800 million, .80% from $800 million to $1 billion, and .75% over $1 billion. Under the investment management agreement of Midas Special Fund, the Investment Manager receives a management fee, payable monthly, based on the average daily net assets of the Fund at the annual rate of 1% on the first $10 million, 7/8 of 1% from $10 million to $30 million, 3/4 of 1% from $30 million to $150 million, 5/8 of 1% from $150 million to $500 million, and 1/2 of 1% over $500 million. Under the investment management agreement of Midas Dollar Reserves, the Investment Manager receives a management fee, payable monthly, based on the average daily net assets of the Fund, at the annual rate of .50 of 1% of the first $250 million, .45 of 1% from $250 million to $500 million, and .40 of 1% over $500 million.

Each Fund has adopted a plan of distribution pursuant to Rule 12b-1 under the Act. Under each plan, each Fund pays the Distributor, an affiliate of the Investment Manager, a fee of .25% (Midas Fund and Midas Dollar Reserves) or 1.00% (Midas Special Fund) for distribution and shareholder services. The shareholder service fee is intended to cover personal services provided to the shareholders of the Funds and the maintenance of shareholder accounts. The distribution fee is to cover all other activities and expenses primarily intended to result in the sale of the Funds’ shares. In addition, Midas Fund, Midas Special Fund, and Midas Dollar Reserves each reimbursed the Distributor $82,339, $636, and $2, respectively, for payments made to certain brokers for record keeping services for the six months ended June 30, 2008.

For Midas Dollar Reserves, the Investment Manager and the Distributor have contractually agreed to waive its management fee and distribution fee, respectively, for the period from April 29, 2008 to April 29, 2009. The Investment Manager and the Distributor voluntarily waived its management fee and distribution fee, respectively, for the period January 1, 2008 through April 28, 2008. For the six months ended June 30, 2008, the total fees waived through contractual and voluntary arrangements by the Investment Manager and the Distributor were $32,388 and $16,194, respectively.

Certain officers and directors of the Funds are officers and directors of the Investment Manager and the Distributor.

Pursuant to the investment management agreements, the Funds reimburse the Investment Manager for providing certain administrative services at cost comprised of compliance and accounting services. For the six months ended June 30, 2008, the Funds incurred administrative services expenses as follows:

| | | | | | | | | |

| | | Midas Fund | | Midas Special Fund | | Midas Dollar Reserves |

Compliance services | | $ | 42,355 | | $ | 2,445 | | $ | 1,585 |

Accounting services | | | 37,985 | | | 2,050 | | | 1,140 |

| | | | | | | | | |

Total administrative services | | $ | 80,340 | | $ | 4,495 | | $ | 2,725 |

| | | | | | | | | |

3 Distributions to Shareholders and Distributable Earnings

The tax character of distributions paid by the Funds for the six months ended June 30, 2008 and year ended December 31, 2007 are summarized as follows:

| | | | | | | | | | | | |

| | | Midas Fund | | Midas Dollar Reserves |

| | | Six Months Ended

June 30, 2008 | | Year Ended

December 30, 2007 | | Six Months Ended

June 30, 2008 | | Year Ended

December 30, 2007 |

Distributions paid from ordinary income | | $ | 715,888 | | $ | 428,183 | | $ | 110,215 | | $ | 536,129 |

There were no distributions paid by Midas Special Fund during the six months ended June 30, 2008 and year ended December 31, 2007.

15

Notes to Financial Statements

(UNAUDITED)

At December 31, 2007, the components of distributable earnings on a tax basis were as follows:

| | | | | | | | | | | | |

| | | Midas Fund | | | Midas Special

Fund | | | Midas Dollar

Reserves | |

Accumulated undistributed net investment income | | $ | 714,438 | | | $ | — | | | $ | 252 | |

Accumulated net realized loss on investments | | | (79,364,655 | ) | | | (5,480,327 | ) | | | (218 | ) |

Capital loss carryover limitation | | | (157,245 | ) | | | (131,565 | ) | | | — | |

Post-October losses | | | — | | | | (268,876 | ) | | | — | |

Unrealized appreciation | | | 49,459,896 | | | | 5,888,674 | | | | — | |

| | | | | | | | | | | | |

| | $ | (29,347,566 | ) | | $ | 7,906 | | | $ | 34 | |

| | | | | | | | | | | | |

Federal income tax regulations permit post-October net capital losses to be deferred and recognized on the tax return of the next succeeding taxable year. The differences between book-basis and tax-basis unrealized appreciation is attributable primarily to the Passive Foreign Investment Company (“PFIC”) mark to market adjustments and deficiency dividends. Accounting principles generally accepted in the United States of America require certain components of net assets to be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended December 31, 2007, permanent differences between book and tax accounting have been reclassified to paid-in capital as follows:

| | | | | | | | |

| | | Midas Fund | | | Midas Special

Fund | |

Increase (decrease) in: | | | | | | | | |

Accumulated undistributed net investment loss | | $ | 2,354,496 | | | $ | 473,092 | |

Accumulated net realized loss on investments | | $ | 38,451,233 | | | $ | 266 | |

Paid-in capital | | $ | (40,805,729 | ) | | $ | (473,358 | ) |

At December 31, 2007, Midas Fund had net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes of $79,364,655, of which $72,484,629, $6,800,444, and $79,582 expire in 2008, 2009, and 2010, respectively. A capital loss carryover of $157,245 related to the acquisition of Midas Investors Ltd. in November 2001 is remaining to be recognized over 2008.

At December 31, 2007, Midas Special Fund had net capital loss carryovers that may be used to offset future realized gains for federal income tax purposes of $5,480,327, of which $3,316,069, $1,823,745, and $340,513 expire in 2009, 2011, and 2014, respectively. A capital loss carryover of $131,565 related to the acquisition of the Midas U.S. and Overseas Fund Ltd. in November 2001 is remaining to be recognized over 2008.

At December 31, 2007, Midas Dollar Reserves had net capital loss carryovers that may be used to offset future realized gains for federal income tax purposes of $218 which expire in 2014.

4 Securities Transactions

At June 30, 2008, aggregate cost and unrealized appreciation of securities for federal income tax purposes were as follows:

| | | | | | | | | | | | | |

| | | Federal Income

Tax Cost | | Gross

Unrealized

Appreciation | | Gross

Unrealized

Depreciation | | | Net

Unrealized

Appreciation |

Midas Fund | | $ | 195,306,150 | | $ | 48,327,638 | | $ | (23,582,292 | ) | | $ | 24,745,346 |

Midas Special Fund | | $ | 15,525,294 | | $ | 6,002,240 | | $ | (1,125,437 | ) | | $ | 4,876,803 |

The cost of investments is the same for financial reporting and federal income tax purposes for Midas Dollar Reserves.

16

Notes to Financial Statements

(UNAUDITED)

Purchases and sales of securities, excluding short sale transactions and short term investments, for the six months ended June 30, 2008 were as follows:

| | | | | | |

| | | Midas Fund | | Midas Special Fund |

Purchase of investment securities | | $ | 164,971,337 | | $ | 1,773,397 |

Proceeds from the sale of investment securities | | $ | 176,694,078 | | $ | 2,668,079 |

5 Illiquid and Restricted Securities

Midas Fund owns securities which have a limited trading market and/or certain restrictions on trading and, therefore, may be illiquid and/or restricted. Such securities have been valued at fair value in accordance with the procedures described in Note 1. Due to the inherent uncertainty of valuation, these values may differ from the values that would have been used had a readily available market for the securities existed. These differences in valuation could be material. Illiquid and/or restricted securities owned at June 30, 2008, were as follows:

| | | | | | | | | | |

Security | | Acquisition

Date | | Cost | | | Value | |

Silver Eagle Mines, Inc., warrants expiring 10/31/08 | | 4/30/07 | | $ | — | | | $ | — | |

Ivanhoe Nickel & Platinum Ltd., common stock | | 9/8/98 | | | — | | | | — | |

| | | | | | | | | | |

| | | | $ | — | | | $ | — | |

| | | | | | | | | | |

Percent of net assets | | | | | 0.0 | % | | | 0.0 | % |

| | | | | | | | | | |

6 Affiliated Issuers

As defined under the Act, the Fund’s affiliates include, among others, companies in which the Funds have (a) direct or indirect ownership, control, or voting power over 5% or more of the outstanding voting shares of such company or (b) controls, is controlled by, or is under common control with such other company or person. Transactions with affiliates for the six months ended June 30, 2008 were as follows:

| | | | | | | | | | | | | | | | | | |

| Midas Fund |

| | | | | | | |

Name of Issuer | | Number of

Shares Held

December 31,

2007 | | Gross

Additions | | Gross

Reductions | | | Number of

Shares Held

June 30,

2008 | | Value

June 30, 2008 | | Dividend

Income | | Realized

Gains/(Losses) |

Golden Cycle Gold Corp. | | 1,964,500 | | — | | — | | | 1,964,500 | | $ | 20,784,410 | | $ | — | | $ | — |

Midas Dollar Reserves, Inc. | | 2,088,515 | | 15,103,872 | | (17,192,387 | ) | | — | | | — | | | 6,191 | | | — |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | $ | 20,784,410 | | $ | 6,191 | | $ | — |

|

| Midas Special Fund |

Name of Issuer | | Number of

Shares Held

December 31,

2007 | | Gross

Additions | | Gross

Reductions | | | Number of

Shares Held

June 30,

2008 | | Value

June 30, 2008 | | Dividend

Income | | Realized

Gains/(Losses) |

Midas Dollar Reserves, Inc. | | — | | 53,682 | | (53,682 | ) | | — | | $ | — | | $ | 7 | | $ | — |

7 Bank Credit Facilities

The Funds (except Midas Dollar Reserves), Global Income Fund, Inc., and Foxby Corp. (the “Borrowers”) have entered into a committed secured line of credit facility with State Street Bank and Trust Company (“SSB”), the Funds’ custodian. Global Income Fund, Inc. and Foxby Corp. are closed end investment companies advised by CEF Advisers, Inc., an affiliate of the Investment Manager. The aggregate amount of the credit facility is $25,000,000. The

17

Notes to Financial Statements

(UNAUDITED)

borrowing of each Borrower is collateralized by the underlying investments of such Borrower. SSB will make revolving loans to a Borrower not to exceed in the aggregate outstanding at any time with respect to any one Borrower the least of $25,000,000, the maximum amount permitted pursuant to each Borrower’s investment policies, or as permitted under the Act. The commitment fee on this facility is 0.10% per annum on the unused portion of the commitment, based on a 360 day year. All loans under this facility will be available at the Borrower’s option of (i) overnight Federal funds or (ii) LIBOR (30, 60, 90 days), each as in effect from time to time, plus 0.75% per annum, calculated on the basis of actual days elapsed for a 360-day year.

The Funds have also entered into an uncommitted secured redemption facility with SSB with an aggregate amount available of $25,000,000. The borrowing of each Borrower is collateralized by the underlying investments of such Borrower. This facility carries no legal obligation on the part of SSB to lend any amount of money to the Funds at any time and the Borrower does not pay a commitment fee under this facility. SSB may make revolving loans to a Borrower not to exceed in the aggregate outstanding at any time with respect to any one Borrower the least of $25,000,000, the maximum amount permitted pursuant to the Borrower’s investment policies, or as permitted under the Act. All loans under this facility will be available at the overnight Federal Funds rate in effect from time to time plus a spread to be determined at the time of borrowing, calculated on the basis of actual days elapsed for a 360 day year.

The outstanding loan balance and the market value of eligible collateral investments at June 30, 2008, and the weighted average interest rate and average daily amount outstanding under the committed and uncommitted facilities for the six months ended June 30, 2008 were as follows:

| | | | | | | | | | | | |

| | | Midas Fund | | | Midas Special

Fund | | | Midas Dollar

Reserves | |

Outstanding balance | | $ | 15,574,366 | | | $ | 2,363,353 | | | $ | — | |

Value of eligible collateral | | $ | 85,654,475 | | | $ | 13,622,346 | | | $ | — | |

Average daily amount outstanding | | $ | 26,289,885 | | | $ | 2,897,379 | | | $ | 3,362 | |

Weighted average interest rate | | | 3.47 | % | | | 3.48 | % | | | 3.60 | % |

8 Securities Lending

Effective June 23, 2008, the Funds may lend their securities through an agreement with SSB. In accordance with the Funds’ security lending procedures, the loans are collateralized at all times with cash or securities or both with a value at least equal to the securities on loan. The value of the loaned securities is determined at the close of business of the Funds, in accordance with the Funds’ valuation policies or, if applicable, by the valuation procedures established by the Funds’ Boards of Directors, and any additional required collateral is delivered to the Funds on the next business day. As with other extensions of credit, the Funds bear the risk of delay on recovery or loss of rights in the collateral should the borrower of the securities fail financially.

The Funds invest the cash collateral received in connection with securities lending transactions in the State Street Navigator Securities Lending Prime Portfolio (the “Navigator Portfolio”). The Navigator Portfolio is a private, registered money market fund and is managed by State Street Global Advisors. The Navigator Portfolio has been established primarily for the investment of cash collateral on behalf of funds participating in SSB’s securities lending program and complies with the requirements of Rule 2a-7 of the Act. The Funds bear the risk of incurring a loss from the investment of cash collateral due to either credit or market factors. Both the Funds and SSB receive compensation relating to the lending of the Funds’ securities. The amounts earned by the Funds for the period ended June 30, 2008, are reported on the Statements of Operations. Midas Fund received cash collateral which was subsequently invested in the Navigator Portfolio. Midas Special Fund received both cash and non-cash collateral. The cash collateral was subsequently invested in the Navigator Portfolio and the non-cash collateral consisted of 2 bank letters of credit and 19 issues of U.S. Treasury and Government Agency securities.

At June 30, 2008, the value of securities loaned and the value of the related collateral received were as follows:

| | | | | | | | | |

| | | Midas Fund | | Midas Special Fund | | Midas Dollar Reserves |

Value of securities loaned | | $ | 4,760 | | $ | 2,422,782 | | $ | — |

Value of related collateral | | $ | 4,900 | | $ | 2,531,740 | | $ | — |

18

Notes to Financial Statements

(UNAUDITED)

9 Off-Balance Sheet Risks

Option contracts written and securities sold short result in off-balance sheet risk as the Funds’ ultimate obligation to satisfy the terms of the contract or the sale of securities sold short may exceed the amount recognized in the Statement of Assets and Liabilities.

10 Recently Issued Accounting Standards

In March 2008, the FASB issued Statement on Financial Accounting Standards No. 161 (“FAS 161”), “Disclosures about Derivative Instruments and Hedging Activities – an amendment of FASB Statement No.133,” which requires enhanced disclosures about an entity’s derivative and hedging activities. Entities are required to provide enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for under Statement 133 and its related interpretations, and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial performance, and cash flows. FAS 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. The Funds do not expect FAS 161 to have a material impact on its financial statements.

Financial Highlights - Midas Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended

June 30 2008

(Unaudited) | | | Years Ended December 31, | |

| | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Per Share Data (for a share outstanding throughout each period) | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 5.64 | | | $ | 4.29 | | | $ | 2.99 | | | $ | 2.14 | | | $ | 2.20 | | | $ | 1.53 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.04 | ) | | | (0.08 | ) | | | (0.08 | ) | | | (0.05 | ) | | | (0.05 | ) | | | (0.02 | ) |

Net realized and unrealized gain (loss) on investments | | | (0.40 | ) | | | 1.44 | | | | 1.39 | | | | 0.90 | | | | (0.01 | ) | | | 0.69 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.44 | ) | | | 1.36 | | | | 1.31 | | | | 0.85 | | | | (0.06 | ) | | | 0.67 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Paid-in capital from redemption fees | | | — | * | | | — | * | | | 0.01 | | | | — | * | | | — | * | | | — | * |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.02 | ) | | | (0.01 | ) | | | (0.02 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |