UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23146

Natixis ETF Trust

(Exact name of Registrant as specified in charter)

| | |

| 888 Boylston Street, Suite 800 Boston, Massachusetts | | 02199-8197 |

| (Address of principal executive offices) | | (Zip code) |

Russell L. Kane, Esq.

Natixis Distribution, L.P.

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2822

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Annual Report

December 31, 2020

Natixis Loomis Sayles Short Duration Income ETF

Natixis U.S. Equity Opportunities ETF

Natixis Vaughan Nelson Mid Cap ETF

Natixis Vaughan Nelson Select ETF

Table of Contents

NATIXIS LOOMIS SAYLES SHORT DURATION INCOME ETF

| | |

| |

| Managers | | NYSE Arca: LSST |

| |

| Daniel Conklin, CFA® | | |

| |

| Christopher T. Harms | | |

| |

| Clifton V. Rowe, CFA® | | |

| |

| Loomis, Sayles & Company, L.P. | | |

Investment Goal

The Fund’s investment objective is current income consistent with preservation of capital.

Market Conditions

The financial markets experienced significant volatility in 2020, as investors grappled with the persistent uncertainty surrounding Covid-19. The bulk of the market disruptions occurred in February and March, when world governments first aimed to contain the virus by locking down broad swaths of their economies. Higher-risk assets were hit hard in the ensuing selloff, while demand for “safe-haven” investments surged. The US Federal Reserve (Fed) sought to counter the extraordinary developments by cutting short-term interest rates to zero, reestablishing traditional quantitative easing through asset purchases in the Treasury and mortgage-backed securities markets, and establishing lending facilities which either have only been used during the global financial crisis or were created for the first time in Fed history, such as the Corporate Credit facility. Aided by the $2.2 trillion stimulus package passed by the US Congress in late March, the Fed’s response fueled an impressive recovery in higher-risk assets from early spring onward. After pausing in the lead-up to the US elections, the rally gained steam in November thanks to the long-awaited headline that coronavirus vaccines would soon become available to the public. The markets took this as an indication that economic conditions could gradually return to normal in 2021, boosting sentiment into year-end.

US Treasurys were the primary beneficiaries of the first-quarter “flight to quality” and the Fed’s subsequent commitment to maintain its low-rate monetary policy indefinitely. Twelve-month returns were progressively higher along the yield curve, with 30-year issues generating the largest gain.

Although investment-grade corporate bonds suffered a sharp downturn in the February-March selloff, the category finished as the top performing major segment of the fixed-income market for the full, 12-month period. Corporates benefited from the gradual improvement in the credit outlook throughout the course of the year, together with rising demand for high-quality alternatives to low-yielding government debt.

Securitized assets — including mortgage-backed securities (MBS), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS) — posted positive total returns but failed to keep pace with the broader U.S. bond market. CMBS was the strongest performer in this segment despite concerns about the outlook for commercial real estate in the wake of the pandemic.

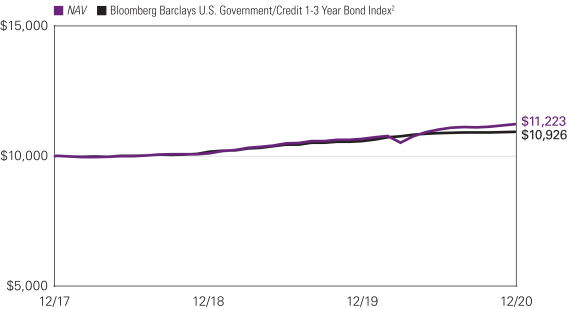

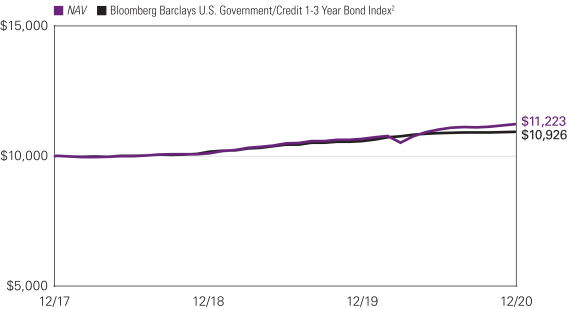

Performance Results

For the 12 months ended December 31, 2020, the Natixis Loomis Sayles Short Duration Income ETF returned 5.27%. The Fund outperformed its benchmark, the Bloomberg Barclays U.S. Government/Credit 1-3 Year Bond Index, which returned 3.33%.

Explanation of Fund Performance

Security selection was the largest positive contributor to the Fund’s performance during the period. By asset class, both investment grade and non-investment grade corporate bond security selection drove positive relative performance. Allocation decisions were also additive to performance as the Fund used risk assets such as corporate bonds and securitized assets to generate above-benchmark returns. By industry, security selection was most beneficial within technology, consumer non-cyclical and energy names.

The effects of positioning along the yield curve (which depicts the relationship among bond yields across the maturity spectrum) detracted, as did the Fund’s stance with respect to duration (and corresponding interest rate sensitivity). An underweight allocation to government-related sectors detracted slightly from relative return. Finally, an allocation to sovereign bonds marginally detracted from relative performance.

Outlook

We believe the Federal Reserve will remain accommodative for the foreseeable future, keeping the fed funds rate unchanged at the zero lower bound and anchoring the front end of the Treasury yield curve through 2021 (and likely through 2023). Current Fed balance sheet policy with respect to quantitative easing should remain in place through most of 2021, with some possible tapering of

1 |

asset purchases anticipated by around the fourth quarter. We do not expect the economy to return to full strength until the later part of 2021 as fiscal and monetary policy remain supportive and vaccine distribution progresses toward herd immunity.

We believe the credit cycle1 is migrating from the credit repair phase into the recovery phase, with a generally healthy consumer, strength in housing and improving economic growth. Credit sector valuations look less attractive as they return to levels observed at the end of 2019. However, favorable technical factors could support modest spread compression given a positive economic and fiscal outlook in our view.

We continue to favor spread sectors, such as corporate bonds and securitized assets. However, we have reduced the portfolio’s overall risk level to the lower end of our range, a similar posture to the beginning of 2020.

Reduction in corporate bond risk has been the biggest driver in the decline of overall portfolio risk. While corporate fundamentals are improving, we believe valuations are not compelling and favor a low use of our risk budget for the asset class. We remain overweight both agency and non-agency commercial mortgage-backed securities, particularly senior parts of the capital stack. Within mortgage-backed securities, we remain focused on securities with limited prepayment risk. We believe the high-quality asset-backed securities sector remains attractive relative to government bonds, and favor auto loans and credit card receivables within the sector.

We continue to follow our process in building diversified exposures by asset class, industry and issuer.

| 1. | A credit cycle is a cyclical pattern that follows credit availability and corporate health. |

Hypothetical Growth of $10,000 Investment3

December 27, 2017 (inception) through December 31, 2020

See notes to chart on page 3.

| 2

NATIXIS LOOMIS SAYLES SHORT DURATION INCOME ETF

Average Annual Total Returns – December 31, 20203

| | | | | | | | | | | | | | | | |

| | | | |

| | | 1 Year | | | Life of Fund

(Inception 12/27/17) | | | Expense Ratios4 | |

| | Gross | | | Net | |

| NAV1 | | | 5.27 | % | | | 3.91 | % | | | 0.95 | % | | | 0.38 | % |

| Market1 | | | 5.55 | | | | 3.99 | | | | | | | | | |

| | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | |

| Bloomberg Barclays U.S. Government/Credit 1-3 Year Bond Index2 | | | 3.33 | | | | 2.97 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem or sell their shares.

| 1 | The NAV return is based on the NAV of the Fund, and the market return is based on the market price per share of the Fund, which is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade on the secondary market until December 28, 2017, NAV is used as a proxy for the market price prior to that date. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively. |

| 2 | The Bloomberg Barclays U.S. Government/Credit 1-3 Year Bond Index is an unmanaged index which is a component of the U.S. Government/Credit Bond Index, which includes Treasury and agency securities (U.S. Government Bond Index) and publicly issued US corporate and foreign debentures and secured notes (U.S. Credit Bond Index). The bonds in the index are investment grade with a maturity between one and three years. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/23. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

3 |

NATIXIS U.S. EQUITY OPPORTUNITIES ETF

| | |

| |

| Managers | | NYSE Arca: EQOP |

| |

| William C. Nygren, CFA® | | |

| |

| Kevin G. Grant, CFA® | | |

| |

| M. Colin Hudson, CFA® | | |

| |

| Michael J. Mangan, CFA®, CPA | | |

| |

| Michael A. Nicolas, CFA® | | |

| |

| Harris Associates L.P. | | |

| |

| | |

| |

| Aziz V. Hamzaogullari, CFA® | | |

| |

| Loomis, Sayles & Company, L.P. | | |

Investment Goal

The Fund seeks long-term growth of capital.

Market Conditions

As the U.S. economy ended the third quarter, economic activity had picked up during the summer as more states allowed stores and restaurants to re-open. Covid-19 case and death rates were fairly stable throughout the country. However, as the weather grew colder across much of the United States, both case and death rates began to rise again. Holiday travel over Thanksgiving created a new wave of cases into December and the New Year.

During the fourth quarter, the economy expanded by 4 percent, slightly under the 4.2 percent expected by Bloomberg consensus data. For the full year, economic output declined by 3.5 percent, the first decline since 2009 and the largest drop in gross domestic product since 1946. Bright spots in the economy include the housing market and corporate investment.

Unemployment also declined during the fourth quarter, falling from 7.8 percent in the last month of the third quarter, September, to 6.7 percent in December. New jobless claims continued to fall, although they remained significantly above the pre-pandemic peak.

Despite the recovery, Moody’s Analytics estimated that the economy had only recovered about 75 percent of the strength it had demonstrated pre-pandemic by the end of the year. In December, the U.S. Food and Drug Administration approved two vaccines for distribution. Just before the end of the year, Congress and the Trump Administration agreed to a $900 billion stimulus to continue the economic recovery.

The S&P 500 ended the year with a 16.26 percent gain in price (excluding reinvested dividends); the Dow Jones Industrial Average1 rose by 7.25 percent and the Nasdaq Composite Index2 by 43.64 percent. The yield on the benchmark U.S. 10-Year Treasury bond ended the year at 0.93 percent.

As 2020 drew to a close, the country waited to welcome the Biden administration in 2021 and looked forward to the widespread deployment of two Covid-19 vaccines, which many hoped would lead to a return to normalcy after a year in which anything was normal.

Performance Results

The Natixis U.S. Equity Opportunities ETF was launched on September 16, 2020. For the period ending December 31, 2020, the Fund returned 14.78% at net asset value. The Fund outperformed its primary benchmark, the S&P 500® Index, which returned 11.45%. The Fund also outperformed its secondary benchmark, the Russell 1000® Index3, which returned 13.12%.

Explanation of Fund Performance

Each of the portfolio’s segments uses a distinct investment style, providing shareholders with exposure to a variety of different stocks:

| | • | | The Harris Associates L.P. Large Cap Value segment invests primarily in the common stocks of larger-capitalization companies that Harris Associates believes are trading at a substantial discount to the company’s “true business value.” |

| | • | | The Loomis, Sayles & Company, L.P. All Cap Growth segment invests primarily in equity securities and may invest in companies of any size. The segment employs a growth style of equity management that emphasizes companies with sustainable competitive advantages, long-term structural growth drivers, attractive cash flow returns on invested capital, and management teams focused on creating long-term value for shareholders. The segment aims to invest in companies when they trade at a significant discount to the estimate of intrinsic value. |

| 1. | The Dow Jones Industrial Average (DJIA) is a popular stock market index that tracks 30 U.S. blue-chip stocks. |

| 2. | The Nasdaq Composite Index is a broad-based market index that includes over 3,000 of the equities listed on the Nasdaq stock exchange. |

| 3. | The Russell 1000 Index, a subset of the Russell 3000 Index, represents the 1000 top companies by market capitalization in the United States. |

| 4

NATIXIS U.S. EQUITY OPPORTUNITIES ETF

Harris Associates Large Cap Value Segment

As value investors with an emphasis on individual stock selection, our sector weights are a byproduct of our bottom-up process. On an absolute-return basis, the industrials sector gained the most value, while holdings in the materials sector delivered the smallest positive collective return.

The largest contributors to fund performance for the reporting period were Charles Schwab and Citigroup. Third-quarter revenue and earnings per share from Charles Schwab were slightly better than market expectations. Although year-over-year net revenue and net profit fell, we found the results were good considering the challenging operating environment. Ongoing low interest rates continued to pressure net interest income and pushed down the net interest margin by more than 100 basis points. However, we were pleased that net new asset (NNA) growth, a metric that we see as the core business driver for the long term, remained strong. NNA finished the third quarter at $52 billion and totaled roughly $250 billion for the trailing 12-month period, which reflected a 6.5% advance from the same period last year. Third-quarter total client assets increased by 17% from a year earlier to $4.40 trillion from a combination of net inflows and rising markets. In addition, the acquisition of TD Ameritrade closed in mid-October, which management cited brings total client assets to $6 trillion and brokerage accounts to 28 million. Citigroup’s third-quarter results were acceptable to us and certain metrics, including non-interest income, investment bank revenues and earnings per share, surpassed market expectations. At a financial services conference held in December, Citigroup’s CFO Mark Mason stated full-year 2020 revenue would likely be unchanged from the 2019 level of roughly $74 billion, while expenses would increase about 2% from last year, which appears reasonable considering the current macroeconomic environment. In addition, Citigroup passed the latest stress test the Federal Reserve conducted on financial firms as its common equity Tier 1 ratio of 11.8% exceeds the minimum requirement of 9.6%. Also in December, we had an opportunity to meet with new CEO Jane Fraser and found her to be a thoughtful, well-balanced and sensible executive. Fraser is in the process of performing a detailed strategy review with the goal of improving Citigroup’s growth profile, assessing the impact of technology change on banking and identifying opportunities to commoditize certain businesses, while creating revenue-boosting opportunities in others.

Loomis, Sayles and Company All Cap Growth Segment

We are an active manager with a long-term, private equity approach to investing. Through our proprietary bottom-up research framework, we look to invest in those few high-quality businesses with sustainable competitive advantages and profitable growth when they trade at a significant discount to intrinsic value. For the period, the All Cap Growth segment posted a positive absolute return. Our holdings in the industrials, communication services, consumer staples and financials sectors contributed positively to results.

Autodesk, Disney, and Deere were the largest contributors to performance during the period. A global leader in 3D design software and services, the Autodesk name is synonymous with computer-aided design. The company offers a broad suite of products that are viewed as mission critical among its clients and create high switching costs. In early 2016, the company began transitioning its business model to a cloud-delivered, subscription-based model where fees are recognized ratably over the life of the customer relationship. During the transition, margins, earnings, and cash flow have been predictably under pressure and operating margins were negative in the company’s 2017 and 2018 fiscal years, which we believe represented the trough for cash flow and operating margins. We believe the subscription model will result in increased visibility of future revenue streams and higher lifetime customer value, leading to increased revenue, profitability, and free cash flow. During the period, Autodesk reported strong results that exceeded consensus expectations for revenues, earnings, and free cash flow, despite customer usage patterns in the US and UK that remain below their pre-Covid-19 levels. While the US and UK remain impacted, usage patterns, which correlate strongly with new business trends, were above pre-Covid-19 levels in China, Korea, Japan, and most of Europe. Importantly, Autodesk demonstrated continued progress in its model transition, which is now largely complete, including recurring revenue that grew to 97% of the revenue mix from approximately 50% prior to the transition. As the business model transition matures over time, we believe Autodesk will be able to improve operating leverage and increase adjusted operating margins, resulting in high and sustainable free cash flow that we believe is not currently reflected in the share price. As a result, Autodesk’s shares are selling at a significant discount to our estimate of intrinsic value, creating a compelling reward-to-risk opportunity.

Disney is one of the largest and most renowned vertically integrated media companies in the world, with iconic entertainment brands and decades of film and TV content that it leverages across its media networks, theme parks, motion picture studios, and direct-to-consumer (DTC) businesses. The company’s financial results continue to reflect the negative impact of Covid-19, which has substantially disrupted some of Disney’s largest profit drivers. However, the company reported revenue and operating profit that exceeded consensus expectations, with profitability benefiting from better-than-expected results in media and networks and lower-than-expected losses in its parks and DTC businesses. Subscribers to its Disney+ streaming service reached 87 million within approximately twelve months of its November 2019 launch — a feat that took Netflix approximately seven years to achieve globally. The company substantially increased its estimate for global subscribers to its multiple DTC services to over 300 million by 2024, up from its prior estimate of approximately 130 million, and announced its intention to increase pricing for certain offerings, including Disney+. We believe that Covid-19 will continue to have a near-to-mid-term impact, but will ultimately be transient, and we added to

5 |

our position in the period. Over our long-term investment horizon, we believe the company’s portfolio of iconic brands, its massive scale and geographic reach, and nearly impossible-to-replicate guest experiences, leave the company well positioned to benefit from secular growth in global entertainment spending. We believe current market expectations substantially underestimate the uniqueness of the company’s intellectual property (IP), the opportunity to monetize that IP across several global business segments, and its ability to generate sustainable growth in free cash flow. As a result we believe the shares trade at a substantial discount to our estimate of intrinsic value and offer a compelling reward-to-risk opportunity.

Deere manufactures a full line of equipment used in agriculture, construction, forestry, and turf care, including value-added components such as precision agriculture tools. We believe the company’s competitive advantages include its iconic brand, scale, and global distribution. Deere’s distribution network of approximately 1,500 exclusive dealers in North America gives it unmatched reach for sales and service, and the company is also among the market leaders in Europe and Latin America. Deere reported better-than-expected financial results that reflected strong demand for smaller agricultural equipment, improvements in its key large agricultural equipment end markets, and operating margins in the agriculture and turf segment that reached their highest level since revenues peaked in 2013. While demand for large agricultural equipment remains well below mid-cycle, strong growth in its early order book and strengthening agricultural fundamentals led the company to provide guidance for strong revenue growth of 10-15% in 2021. We believe Deere’s long-term secular growth driver is the global growth in demand for agricultural equipment, fueled by the steady increase in global demand for grains from a growing population with increasing affluence. We believe Deere’s market leadership, superior technology, demonstrated pricing power, and improving margin structure leave it well positioned over our long-term investment horizon as its major agricultural end market improves. We believe the company’s shares trade at a significant discount to our estimate of intrinsic value and offer a compelling long-term reward-to-risk opportunity.

Alibaba, Regeneron Pharmaceuticals, and Salesforce.com were the three lowest contributors during the period. Alibaba is a leading China e-commerce and consumer-engagement platform provider. With over 60% of China’s e-commerce transactions estimated to take place through its marketplaces, we believe Alibaba’s scale and interconnected sites create an unparalleled and difficult-to-replicate business ecosystem. During the period, Alibaba reported financial results that reflected strong fundamentals, continued market share gains, and were above consensus expectations. However, shares have come under pressure due to a series of regulatory actions by the Chinese government, most recently a late-December notice from China’s State Administration for Market Regulation (SAMR) that it is looking into allegations that Alibaba requires merchants to enter exclusive relationships which prevent them from offering the same products on competing platforms. If the company is found to have violated the rules, it would need to change such practices and could potentially be fined a percentage of prior-year revenue. However, we do not believe the investigation or any currently proposed regulations will ultimately impact Alibaba’s strong and sustainable competitive advantages. Of course, such developments can weigh on stock prices over the short term. As we do with any legislative or regulatory developments, we continue to monitor and assess any potential structural impact to our investment thesis. We believe Alibaba continues to execute well on its business model, allowing it to expand its already dominant market position and to invest to strengthen its competitive advantages. The company benefits from secular growth in China e-commerce, as well as advertising growth, digitizing offline retail, cloud computing, and international expansion. We believe the current market price embeds expectations for revenue and cash flow growth that are well below our long-term assumptions. With its shares trading at a significant discount to our estimate of intrinsic value, we believe Alibaba offers a compelling reward-to-risk opportunity.

Regeneron Pharmaceuticals, Inc. is a fully integrated biopharmaceutical company created with the vision to empower scientists to shape the path of the business. Regeneron has created enabling technologies, platforms, and methods that materially speed target discovery and development timelines, allowing the company to develop viable candidates for clinical trial faster than its competitors. As a result of these technologies, Regeneron was able to negotiate risk-mitigating collaborations with larger biopharmaceutical company partners that fund early-stage research and development in exchange for a share of potential profits, enabling Regeneron to access scale and distribution strength. Regeneron reported solid financial results that exceeded consensus expectations for both revenue and earnings per share (EPS), aided in part by the timing of government payments for its Covid-19 antibody therapy, but also reflected continued penetration for leading therapies Eylea and Dupixent. However, shares declined modestly in response to management’s suggestion that research and development (R&D) expenses would be higher in 2021 as more therapies in its robust pipeline progressed into later clinical stages and still-uncertain investments to support its Covid-19 therapy would further increase R&D costs. We view the market reaction to higher R&D as short-sighted as such investments lay the groundwork for sustainable long-term revenue generation. We believe Regeneron is among the highest quality businesses in healthcare, with both broad-based established therapies and meaningful pipeline assets, which include over 20 product candidates in clinical development that were generated using the company’s proprietary technology. We believe Regeneron’s market price embeds a lack of appreciation for the company’s multiple short-term and longer-term growth opportunities and the uniqueness of its financial model. We believe the shares trade at a significant discount to our estimate of intrinsic value and offer a compelling reward-to-risk opportunity.

| 6

NATIXIS U.S. EQUITY OPPORTUNITIES ETF

Founded in 1999, Salesforce.com is the leading provider of cloud-based enterprise software, services, and applications focused on customer relationship management (CRM). As an early mover in the shift to cloud solutions and digitization of CRM, the Salesforce brand became synonymous with CRM, and the company’s brand strength is reflected in its leading market share and premium pricing. Salesforce is focused on its Customer 360 platform that unites sales, service, marketing, and commerce to provide a comprehensive customer view, and today is one of very few companies that can offer solutions for every aspect of the customer lifecycle. Because its products serve mission-critical functions, they become deeply embedded in customer work flows and create high switching costs for users, resulting in customer retention rates in excess of 90%. During the period, Salesforce reported strong financial results that exceeded consensus expectations. However, shares were pressured following the company’s announcement that it reached an agreement to acquire business collaboration software provider Slack Technologies for $27.7 billion in cash and stock. While the market is understandably concerned about the price paid and dilutive impact of the company’s largest-ever acquisition, we see significant potential in driving long-term value for the company. We believe the acquisition has the potential to improve Salesforce’s competitive positioning by facilitating even better collaboration and decision making across CRM functions and further improving client experience. We believe salesforce will significantly improve the distribution strength of Slack, whose strong and successful viral offering can leverage the massive installed base of Salesforce clients and its direct sales force of approximately 10,000 employees. We expect the combined business will improve its margins and benefit from further scale. Ultimately, we believe Salesforce is one of very few companies capable of successfully delivering on the proposed integration and realizing value from the acquisition. We will continue to carefully monitor and assess the company’s progress for any impact to our investment thesis. We believe Salesforce’s strong and sustainable competitive advantages will enable it to continue to benefit from secular growth in adoption of its cloud-based applications and to grow faster than the industry as a whole. We believe Salesforce’s share price embeds expectations for key revenue and cash flow growth drivers that are well below our long-term assumptions. As a result, we believe the company is selling at a significant discount to our estimate of its intrinsic value and offers a compelling reward-to-risk opportunity.

Outlook:

The Natixis U.S. Equity Opportunities Fund is comprised of two separate segments combining the value expertise of Harris Associates with the growth expertise of Loomis Sayles. The two segments have common investment philosophies and a rigorous long-term, bottom-up research process focused on high quality businesses trading at a significant discount to intrinsic value. Given encouraging news around Covid-19 vaccines and treatments, we think economic activity in 2021 will look more like 2019, than 2020, and we expect to start seeing signs of that in the second half of 2021. Our thesis for each investment, almost by definition, differs from consensus. Our responsibility is, and always has been, to monitor any new information to constantly challenge those theses. If we are correct that normal will return faster than others expect it will, we believe our stocks are well-positioned. We are patient investors and maintain coverage of high-quality businesses in order to take advantage of meaningful price dislocations if and when they occur.

Top Ten Holdings as of December 31, 2020

| | | | | | | | |

| | | |

| | | | Security name | | % of net assets | |

| | 1 | | | Facebook, Inc., Class A | | | 4.63 | % |

| | 2 | | | Alphabet, Inc., Class A | | | 3.58 | |

| | 3 | | | Amazon.com, Inc. | | | 3.35 | |

| | 4 | | | Autodesk, Inc. | | | 2.62 | |

| | 5 | | | Capital One Financial Corp. | | | 2.53 | |

| | 6 | | | Citigroup, Inc. | | | 2.51 | |

| | 7 | | | Bank of America Corp. | | | 2.51 | |

| | 8 | | | Charles Schwab Corp. (The) | | | 2.36 | |

| | 9 | | | Booking Holdings, Inc. | | | 2.31 | |

| | 10 | | | NVIDIA Corp. | | | 2.28 | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

7 |

Total Returns – December 31, 20204

| | | | | | | | | | | | |

| | | |

| | | Life of Fund

(Inception 9/16/20) | | | Expense Ratios5 | |

| | Gross | | | Net | |

| NAV1 | | | 14.78 | % | | | 3.14 | % | | | 0.90 | % |

| Market1 | | | 14.82 | | | | | | | | | |

| | | | |

| Comparative Performance | | | | | | | | | | | | |

| S&P 500® Index2 | | | 11.45 | | | | | | | | | |

| Russell 1000® Index3 | | | 13.12 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem or sell their shares.

| 1 | The NAV return is based on the NAV of the Fund, and the market return is based on the market price per share of the Fund, which is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade on the secondary market until September 17, 2020, NAV is used as a proxy for the market price prior to that date. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively. |

| 2 | S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. It also measures the performance of the large cap segment of the US equities market. |

| 3 | Russell 1000® Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® Index represents approximately 92% of the U.S. market and is constructed to provide a comprehensive and unbiased barometer for the large-cap segment and is completely reconstituted annually to ensure new and growing equities are reflected. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 5 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/23. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| 8

NATIXIS VAUGHAN NELSON MID CAP ETF

| | |

| |

| Managers | | NYSE Arca: VNMC |

| |

| Dennis G. Alff, CFA® | | |

| |

| Chad D. Fargason | | |

| |

| Chris D. Wallis, CFA® | | |

| |

| Vaughan Nelson Investment Management, L.P. | | |

Investment Goal

The Fund seeks long-term capital appreciation.

Market Overview

The recovery in financial markets continued in Q4 2020 with the S&P 500®1 and Russell 2000 Value2 rising 12.13% and 33.36%, respectively. For the year, the S&P 500® and Russell 2000 Value rose 18.4% and 4.6%, respectively. Positive vaccine data, combined with election results that indicated further stimulus is expected, were the impetus for the strong fourth quarter rally. The equity market rally materially boosted valuation multiples indicating a portion of the 2021 earnings recovery has already been discounted. As the economy continues to recover, additional policy support may be needed to offset the damage that occurred to key service sectors and the commercial real estate market.

US and international economies remain buoyed by the continued strong recovery in the industrial sector as global supply chains are busy rebuilding inventories and preparing for a post-Covid-19 normalization of activity. The recovery in the services side of the economy continues at a modest pace as renewed lockdowns have presented headwinds in the fourth quarter. One of the brightest spots in the US economy has been the strength in housing. The rapid increase in demand has pushed home prices materially higher. Higher home prices represent a near-term headwind but are a harbinger of increased economic activity as additional supply is brought to market to balance supply and demand.

A key driver of the recovery has been the weaker US dollar, which boosted commodity prices and eased the debt service burden of foreign borrowers. However, the falling US dollar and supply chain disruptions are leading to domestic price increases which will likely cause headline inflation to exceed the Federal Reserve’s 2% target during the first half of 2021. Should this increase in inflationary pressure prove transitory, and there are no material shifts in real yields, then we would not expect a material impact to risk assets. To the extent higher inflation expectations become more entrenched, or real yields move higher, a broader repricing of risk assets across sectors and asset classes is expected.

Performance Results

The Natixis Vaughan Nelson Mid Cap ETF was launched on September 16, 2020. For the period ending December 31, 2020, the Fund returned 18.91% at net asset value. The Fund outperformed its benchmark, the Russell Midcap® Value Index, which returned 16.70%.

Explanation of Fund Performance

As a result of buys and sells and market action, the largest sector overweights are Industrials, Information Technology, Financials, Materials, Health Care, and Consumer Staples. Real Estate, Consumer Discretionary, Utilities, Communication Services, and Energy are the most underweight sectors.

During the quarter, the portfolio experienced positive absolute and relative performance. Positive relative contributions from Industrials, Consumer Staples, Materials, Consumer Discretionary, Utilities, Real Estate, Financials, and Communication Services were modestly offset by negative relative contribution in Information Technology, Health Care, and Energy.

Outlook

After decades of reliance on monetary stimulus, the economy and capital markets suffer from excess leverage, malinvestment and structural imbalances that hamper the effectiveness of monetary tools. With the election behind us, we expect fiscal policy in close coordination with the Federal Reserve to take center stage in driving economic growth.

The last bout of loose fiscal policy was combined with tight monetary policy, which sustained US dollar strength. The next round of loose fiscal policy will likely be combined with loose monetary policy, which will pressure the US dollar. Should such economic policy be pursued, and successfully increase nominal GDP growth, it will represent a fundamental shift in the underlying economic conditions that have not been witnessed in years. Such a shift in the economic environment will likely lead to increased market volatility and broad changes in market leadership.

| 1. | The S&P 500 Index or the Standard & Poor’s 500 Index is a market-capitalization-weighted index of 500 of the largest publicly traded companies in the U.S. |

| 2. | Russell 2000® Value Index is an unmanaged index that measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. |

9 |

Top Ten Holdings as of December 31, 2020

| | | | | | | | |

| | | |

| | | | Security name | | % of

net assets | |

| | 1 | | | Avantor, Inc. | | | 3.09 | % |

| | 2 | | | Timken Co. (The) | | | 3.04 | |

| | 3 | | | Nexstar Media Group, Inc., Class A | | | 2.99 | |

| | 4 | | | WillScot Mobile Mini Holdings Corp. | | | 2.86 | |

| | 5 | | | Crane Co. | | | 2.80 | |

| | 6 | | | Motorola Solutions, Inc. | | | 2.77 | |

| | 7 | | | Otis Worldwide Corp. | | | 2.55 | |

| | 8 | | | Vistra Corp. | | | 2.47 | |

| | 9 | | | nVent Electric PLC | | | 2.43 | |

| | 10 | | | AMETEK, Inc. | | | 2.17 | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

| 10

NATIXIS VAUGHAN NELSON MID CAP ETF

Total Returns – December 31, 20203

| | | | | | | | | | | | |

| | | |

| | | Life of Fund

(Inception 9/16/20) | | | Expense Ratios4 | |

| | Gross | | | Net | |

| NAV1 | | | 18.91 | % | | | 5.64 | % | | | 0.90 | % |

| Market1 | | | 18.99 | | | | | | | | | |

| | | | |

| Comparative Performance | | | | | | | | | | | | |

| Russell Midcap® Value Index2 | | | 16.70 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem or sell their shares.

| 1 | The NAV return is based on the NAV of the Fund, and the market return is based on the market price per share of the Fund, which is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade on the secondary market until September 17, 2020, NAV is used as a proxy for the market price prior to that date. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively. |

| 2 | Russell Midcap® Value Index is an unmanaged index that measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with lower price-to-book ratios and lower forecasted growth values. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/23. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

11 |

NATIXIS VAUGHAN NELSON SELECT ETF

| | |

| |

| Managers | | NYSE Arca: VNSE |

| |

| Scott J. Weber, CFA® | | |

| |

| Chris D. Wallis, CFA® | | |

| |

| Vaughan Nelson Investment Management, L.P. | | |

Investment Goal

The Fund seeks long-term capital appreciation.

Market Conditions

The recovery in financial markets continued in Q4 2020 with the S&P 500® and Russell 2000 Value rising 12.13% and 33.36%, respectively. For the year, the S&P 500® and Russell 2000 Value rose 18.4% and 4.6%, respectively. Positive vaccine data, combined with election results that indicated further stimulus is expected, were the impetus for the strong fourth quarter rally. The equity market rally materially boosted valuation multiples indicating a portion of the 2021 earnings recovery has already been discounted. As the economy continues to recover, additional policy support may be needed to offset the damage that occurred to key service sectors and the commercial real estate market.

US and international economies remain buoyed by the continued strong recovery in the industrial sector as global supply chains are busy rebuilding inventories and preparing for a post-Covid-19 normalization of activity. The recovery in the services side of the economy continues at a modest pace as renewed lockdowns have presented headwinds in the fourth quarter. One of the brightest spots in the US economy has been the strength in housing. The rapid increase in demand has pushed home prices materially higher. Higher home prices represent a near-term headwind but are a harbinger of increased economic activity as additional supply is brought to market to balance supply and demand.

A key driver of the recovery has been the weaker US dollar, which boosted commodity prices and eased the debt service burden of foreign borrowers. However, the falling US dollar and supply chain disruptions are leading to domestic price increases which will likely cause headline inflation to exceed the Federal Reserve’s 2% target during the first half of 2021. Should this increase in inflationary pressure prove transitory, and there are no material shifts in real yields, then we would not expect a material impact to risk assets. To the extent higher inflation expectations become more entrenched, or real yields move higher, a broader repricing of risk assets across sectors and asset classes is expected.

Performance Results

The Natixis Vaughan Nelson Select ETF was launched on September 16, 2020. For the period ending December 31, 2020, the Fund returned 10.37% at net asset value. The Fund underperformed its benchmark, the S&P 500® Index, which returned 11.45%.

Explanation of Fund Performance

As a result of buys and sells and market action, the largest sector overweights are Materials, Information Technology, Energy, and Industrials. Consumer Staples, Consumer Discretionary, Utilities, Financials, Real Estate, Health Care, and Communication Services are the most underweight sectors.

During the quarter, the portfolio experienced positive absolute and negative relative performance. Positive relative contributions from Information Technology, Health Care, Energy, Consumer Staples, Real Estate, and Utilities were modestly offset by negative relative contribution in Communication Services, Materials, Industrials, Financials, and Consumer Discretionary.

Outlook

After decades of reliance on monetary stimulus, the economy and capital markets suffer from excess leverage, malinvestment and structural imbalances that hamper the effectiveness of monetary tools. With the election behind us, we expect fiscal policy in close coordination with the Federal Reserve to take center stage in driving economic growth.

The last bout of loose fiscal policy was combined with tight monetary policy, which sustained US dollar strength. The next round of loose fiscal policy will likely be combined with loose monetary policy, which will pressure the US dollar. Should such economic policy be pursued, and successfully increase nominal GDP growth, it will represent a fundamental shift in the underlying economic conditions that have not been witnessed in years. Such a shift in the economic environment will likely lead to increased market volatility and broad changes in market leadership.

| 12

NATIXIS VAUGHAN NELSON SELECT ETF

Top Ten Holdings as of December 31, 2020

| | | | | | | | |

| | | |

| | | | Security name | | % of

net assets | |

| | 1 | | | Microsoft Corp. | | | 5.79 | % |

| | 2 | | | Facebook, Inc., Class A | | | 5.50 | |

| | 3 | | | Union Pacific Corp. | | | 5.41 | |

| | 4 | | | Amazon.com, Inc. | | | 5.28 | |

| | 5 | | | ON Semiconductor Corp. | | | 5.19 | |

| | 6 | | | Texas Instruments, Inc. | | | 5.13 | |

| | 7 | | | MasterCard, Inc., Class A | | | 4.98 | |

| | 8 | | | Sherwin-Williams Co. (The) | | | 4.93 | |

| | 9 | | | UnitedHealth Group, Inc. | | | 4.76 | |

| | 10 | | | Aon PLC, Class A | | | 4.04 | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

13 |

Total Returns – December 31, 20203

| | | | | | | | | | | | |

| | | |

| | | Life of Fund

(Inception 9/16/20) | | | Expense Ratios4 | |

| | Gross | | | Net | |

| NAV1 | | | 10.37 | % | | | 5.59 | % | | | 0.85 | % |

| Market1 | | | 10.41 | | | | | | | | | |

| | | | |

| Comparative Performance | | | | | | | | | | | | |

| S&P 500® Index2 | | | 11.45 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem or sell their shares.

| 1 | The NAV return is based on the NAV of the Fund, and the market return is based on the market price per share of the Fund, which is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade on the secondary market until September 17, 2020, NAV is used as a proxy for the market price prior to that date. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively. |

| 2 | S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. It also measures the performance of the large cap segment of the US equities market. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/23. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| 14

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

All investing involves risk, including the risk of loss. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis Affiliates”) and does not sponsor, endorse or participate in the provision of any Natixis Affiliates services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the Funds’ proxy voting policies and procedures is available without charge, upon request, by calling 800-458-7452; through the Funds’ website at im.natixis.com; and on the Securities and Exchange Commission’s (SEC) website at www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on Natixis Funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The Natixis Funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at www.sec.gov. First and third quarter schedules of portfolio holdings are also available at im.natixis.com/funddocuments. A hard copy may be requested from the Fund at no charge by calling 800-225-5478.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

15 |

UNDERSTANDING FUND EXPENSES

As a shareholder, you incur two types of costs: (1) transaction costs, which may include creation and redemption fees and brokerage charges, and (2) ongoing costs, including management fees and other fund expenses. These ongoing costs are described in more detail in the Fund’s prospectus. The following examples are intended to help you understand the ongoing costs of investing in the Fund and help you compare these with the ongoing costs of investing in other funds.

The first line in the table shows the actual account values and actual Fund expenses you would have paid on a $1,000 investment in the Fund from July 1, 2020 through December 31, 2020. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.60) and multiply the result by the number in the Expenses Paid During Period column as shown below for your class.

The second line in the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as brokerage commissions on purchases and sales of Fund shares. Therefore, the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| | | | | | | | | | | | |

| NATIXIS LOOMIS SAYLES SHORT DURATION INCOME ETF | | BEGINNING

ACCOUNT VALUE

7/1/2020 | | | ENDING

ACCOUNT VALUE

12/31/2020 | | | EXPENSES PAID

DURING PERIOD*

7/1/2020 – 12/31/2020 | |

| Actual | | | $1,000.00 | | | | $1,018.40 | | | | $1.93 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,023.23 | | | | $1.93 | |

The chart above represents historical performance of a hypothetical investment of $1,000 in the fund for the most recent six-month period. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement) of 0.38%, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 366 (to reflect the half-year period). |

| | | | | | | | | | | | |

| NATIXIS U.S. EQUITY OPPORTUNITIES ETF | | BEGINNING

ACCOUNT VALUE

7/1/20201 | | | ENDING

ACCOUNT VALUE

12/31/2020 | | | EXPENSES PAID

DURING PERIOD

7/1/20201 – 12/31/2020 | |

| Actual | | | $1,000.00 | | | | $1,147.80 | | | | $2.77 | 1 |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.61 | | | | $4.57 | * |

The chart above represents historical performance of a hypothetical investment of $1,000 in the fund for the most recent six-month period. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement) of 0.90%, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 366 (to reflect the half-year period). |

| 1 | Fund commenced operations on September 16, 2020. Actual expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement) of 0.90%, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal period (105), divided by 366 (to reflect the partial period). |

| 16

| | | | | | | | | | | | |

| NATIXIS VAUGHAN NELSON MID CAP ETF | | BEGINNING

ACCOUNT VALUE

7/1/20201 | | | ENDING

ACCOUNT VALUE

12/31/2020 | | | EXPENSES PAID

DURING PERIOD

7/1/20201 – 12/31/2020 | |

| Actual | | | $1,000.00 | | | | $1,189.10 | | | | $2.83 | 1 |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.61 | | | | $4.57 | * |

The chart above represents historical performance of a hypothetical investment of $1,000 in the fund for the most recent six-month period. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement) of 0.90%, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 366 (to reflect the half-year period). |

| 1 | Fund commenced operations on September 16, 2020. Actual expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement) of 0.90%, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal period (105), divided by 366 (to reflect the partial period). |

| | | | | | | | | | | | |

| NATIXIS VAUGHAN NELSON SELECT ETF | | BEGINNING

ACCOUNT VALUE

7/1/20201 | | | ENDING

ACCOUNT VALUE

12/31/2020 | | | EXPENSES PAID

DURING PERIOD

7/1/20201 – 12/31/2020 | |

| Actual | | | $1,000.00 | | | | $1,103.70 | | | | $2.56 | 1 |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.86 | | | | $4.32 | * |

The chart above represents historical performance of a hypothetical investment of $1,000 in the fund for the most recent six-month period. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement) of 0.85%, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 366 (to reflect the half-year period). |

| 1 | Fund commenced operations on September 16, 2020. Actual expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement) of 0.85%, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal period (105), divided by 366 (to reflect the partial period). |

17 |

BOARD APPROVAL OF THE INITIAL ADVISORY AND SUB-ADVISORY AGREEMENTS FOR NATIXIS U.S. EQUITY OPPORTUNITIES ETF, NATIXIS VAUGHAN NELSON MID CAP ETF AND NATIXIS VAUGHAN NELSON SELECT ETF

The Investment Company Act of 1940, as amended (the “1940 Act”), requires that both the full Board of Trustees of the Trust (the “Board”) and a majority of the Trustees who are not “interested persons” (as defined in the 1940 Act) of the Trust (the “Independent Trustees”), voting separately, initially approve any new investment advisory and sub-advisory agreements for a registered investment company, including a newly formed fund such as the Natixis U.S. Equity Opportunities ETF, Natixis Vaughan Nelson Mid Cap ETF and Natixis Vaughan Nelson Select ETF (each, a “Fund” and together, the “Funds”). The Trustees, including the Independent Trustees, unanimously approved, for an initial two-year term, the proposed investment advisory and sub-advisory agreements (together, the “Agreements”) for the Funds at a meeting held on June 4, 2020.

In connection with this review, Fund management and other representatives of the Funds’ adviser, Natixis Advisors, L.P. (the “Adviser”), and the Funds’ sub-advisers, Harris Associates L.P. (“Harris Associates”), Loomis, Sayles & Company, L.P. (“Loomis Sayles”) and Vaughan Nelson Investment Management, L.P. (“Vaughan Nelson,” and, together with Harris Associates and Loomis Sayles, the “Subadvisers”), as applicable, distributed to the Trustees materials including, among other items, information regarding (i) each Fund’s investment objective, strategies and risks, (ii) the proposed advisory and sub-advisory fees and other expenses to be charged to each Fund, including information comparing each Fund’s expenses to those of peer groups and categories of funds and information on fees charged to other funds and accounts advised by the Adviser and the proposed expense cap, (iii) the size, education and experience of the Adviser’s and Subadvisers’ respective investment staffs and the investment strategies proposed to be used in managing the Funds, (iv) proposed arrangements for the distribution and trading of each Fund’s shares, (v) information about the Adviser’s performance, (vi) information about the unique attributes of the Funds as semi-transparent, actively managed ETFs as compared with traditional ETFs and the policies and procedures being implemented in respect of those attributes, and (vi) the general economic outlook with particular emphasis on the asset management industry.

The Trustees also considered the fact that they oversee other funds advised by the Adviser and Subadvisers as well as information about the Adviser and Subadvisers they had received in connection with their oversight of those other funds. Because each Fund is newly formed and had not commenced operations at the time of the Trustees’ review, certain information, including data relating to Fund performance, was not available, and therefore could not be distributed to the Trustees. Throughout the process, the Trustees were afforded the opportunity to ask questions of, and request additional materials from, the Adviser and the Subadvisers.

In considering whether to initially approve the Agreements, the Board, including the Independent Trustees, did not identify any single factor as determinative. Individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreements included, but were not limited to, the factors listed below.

The nature, extent and quality of the services to be provided to the Funds under the Agreements. The Trustees considered the nature, extent and quality of the services to be provided by the Adviser, the Subadvisers and the Adviser’s affiliates to the Funds, which include advisory and non-advisory services directed to the needs and operations of each of the Funds as a semi-transparent, actively managed ETF. The Trustees also considered the resources to be dedicated to the Funds by the Adviser, the Subadvisers and the Adviser’s affiliates. The Trustees considered their experience with other funds advised or sub-advised by the Adviser and the Subadvisers, as well as the affiliation between the Adviser and Natixis Investment Managers, LLC (“Natixis Investment Managers”), whose affiliates provide investment advisory services to other funds in the same family of funds. In this regard, the Trustees considered not only the advisory and sub-advisory services proposed to be provided by the Adviser and the Subadvisers to the Funds, but also the monitoring and oversight services proposed to be provided by the Adviser. They also considered the administrative and shareholder services proposed to be provided by the Adviser and its affiliates to the Funds. They also considered the policies and infrastructure the Adviser and its affiliates had developed to operate the Funds as semi-transparent, actively managed ETFs.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreements, that the scope of the services to be provided to the Funds under the Agreements seemed consistent with the Funds’ operational requirements, and that the Adviser and the Subadvisers had the capabilities, resources and personnel necessary to provide the advisory and sub-advisory services that would be required by each Fund. The Trustees determined that the nature, extent and quality of services proposed to be provided under the Agreements supported approval of the Agreements.

Investment performance of the Funds, the Adviser and the Subadvisers. Because each Fund had not yet commenced operations, performance information for each Fund was not considered; however, the Board considered the performance of other funds and accounts managed by the Adviser and the Subadvisers.

The Trustees also considered the Adviser’s and the Subadvisers’ performance and reputation generally, the performance of the fund family generally, and the historical responsiveness of the Adviser to Trustee concerns about performance and the willingness of the Adviser to take steps intended to improve performance.

| 18

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreements, that these relevant factors supported approval of the Agreements.

The costs of the services to be provided by the Adviser and profits to be realized by the Adviser and its affiliates from their respective relationships with each Fund. Although each Fund had not yet commenced operations at the time of the Trustees’ review of the Agreements, the Trustees reviewed information comparing the proposed advisory and sub-advisory fees and estimated total expenses of each Fund with the fees and expenses of comparable funds identified by the Adviser, including information about how those funds were selected and information about differences in such fees. In evaluating each Fund’s proposed advisory and sub-advisory fees, the Trustees also took into account the demands, complexity and quality of the investment management of each Fund, including the additional responsibilities of the Adviser and the Subadvisers and their affiliates in managing a semi-transparent, actively managed ETF. The Trustees also noted that each Fund would have an expense cap in place. In addition, the Trustees considered information regarding the administrative fees to be paid by each Fund to the Adviser.

Because each Fund had not yet commenced operations, historical profitability information with respect to each Fund was not considered. However, the Trustees noted the information provided in court cases in which adviser profitability was an issue, the estimated expense level of each Fund, and that each Fund would be subject to an expense cap.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreements, that the advisory and sub-advisory fees and expenses proposed to be charged to each Fund were fair and reasonable, and supported the approval of the Agreements.

Economies of scale. The Trustees considered the extent to which the Adviser and the Subadvisers may realize economies of scale in the provision of services by the Adviser and the Subadvisers, respectively, and whether those economies could be shared with each Fund through breakpoints in its investment advisory and sub-advisory fees or other means, such as expense caps. The Trustees noted that each Fund will be subject to an expense cap. After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreements, that the extent to which economies of scale might be shared with each Fund supported the approval of the Agreements.

The Trustees also considered other factors, which included but were not limited to the following:

| • | | The compliance-related resources the Adviser, the Subadvisers and the Adviser’s affiliates would provide to each Fund. |

| • | | The nature, quality, cost and extent of administrative and shareholder services to be performed by the Adviser and its affiliates, both under the Agreements and under separate agreements covering administrative services. |

| • | | So-called “fallout benefits” to the Adviser and its affiliates, such as the engagement of the Adviser to provide administrative services to each Fund, the benefits to Natixis Investment Managers and the Adviser of being able to offer semi-transparent ETFs in the Natixis family of funds and the benefits of research made available to the Adviser by reason of brokerage commissions (if any) generated by each Fund’s securities transactions. The Trustees also considered the benefits to the parent company of the Adviser from the retention of the Adviser and the Subadvisers. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest. |

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that the Agreements should be approved.

19 |

Portfolio of Investments – as of December 31, 2020

Natixis Loomis Sayles Short Duration Income ETF

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | Bonds and Notes — 93.4% of Net Assets | |

| | | | ABS Car Loan — 11.0% | |

| $ | 160,000 | | | Ally Master Owner Trust, Series 2018-1, Class A2, 2.700%, 1/17/2023(a) | | $ | 160,143 | |

| | 20,000 | | | American Credit Acceptance Receivables Trust, Series 2020-2, Class B, 2.480%, 9/13/2024, 144A(a) | | | 20,480 | |

| | 105,000 | | | American Credit Acceptance Receivables Trust, Series 2019-4, Class C, 2.690%, 12/12/2025, 144A(a) | | | 107,235 | |

| | 15,000 | | | American Credit Acceptance Receivables Trust, Series 2020-1A, Class B, 2.080%, 12/13/2023, 144A | | | 15,144 | |

| | 5,000 | | | American Credit Acceptance Receivables Trust, Series 2020-3, Class B, 1.150%, 8/13/2024, 144A | | | 5,026 | |

| | 10,000 | | | American Credit Acceptance Receivables Trust, Series 2020-4, Class C, 1.310%, 12/14/2026, 144A(a) | | | 10,044 | |

| | 115,000 | | | AmeriCredit Automobile Receivables Trust, Series 2018-3, Class B, 3.580%, 10/18/2024(a) | | | 118,965 | |

| | 20,000 | | | AmeriCredit Automobile Receivables Trust, Series 2019-2, Class B, 2.540%, 7/18/2024(a) | | | 20,564 | |

| | 10,000 | | | AmeriCredit Automobile Receivables Trust, Series 2020-3, Class C, 1.060%, 8/18/2026 | | | 10,042 | |

| | 100,000 | | | Avis Budget Rental Car Funding AESOP LLC, Series 2019-2A, Class A, 3.350%, 9/22/2025, 144A(a) | | | 106,772 | |

| | 37,120 | | | CarMax Auto Owner Trust, Series 2019-4, Class A2A, 2.010%, 3/15/2023(a) | | | 37,360 | |

| | 20,114 | | | CarMax Auto Owner Trust, Series 2018-1, Class A3, 2.480%, 11/15/2022(a) | | | 20,258 | |

| | 15,000 | | | CarMax Auto Owner Trust, Series 2019-3, Class A3, 2.180%, 8/15/2024(a) | | | 15,373 | |

| | 35,000 | | | Carvana Auto Receivables Trust, Series 2020-P1, Class A3, 0.440%, 6/09/2025 | | | 35,051 | |

| | 70,145 | | | Carvana Auto Receivables Trust, Series 2019-3A, Class A3, 2.340%, 6/15/2023, 144A(a) | | | 70,543 | |

| | 104,283 | | | CIG Auto Receivables Trust, Series 2020-1A, Class A, 0.680%, 10/12/2023, 144A(a) | | | 104,303 | |

| | 6,633 | | | CPS Auto Receivables Trust, Series 2018-D, Class B, 3.610%, 11/15/2022, 144A(a) | | | 6,641 | |

| | 13,659 | | | Drive Auto Receivables Trust, Series 2018-5, Class B, 3.680%, 7/15/2023(a) | | | 13,678 | |

| | 5,000 | | | Drive Auto Receivables Trust, Series 2019-3, Class B, 2.650%, 2/15/2024 | | | 5,052 | |

| | 4,805 | | | DT Auto Owner Trust, Series 2018-2A, Class C, 3.670%, 3/15/2024, 144A | | | 4,822 | |

| | 35,000 | | | DT Auto Owner Trust, Series 2019-1A, Class C, 3.610%, 11/15/2024, 144A(a) | | | 35,658 | |

| | 35,000 | | | DT Auto Owner Trust, Series 2019-2A, Class C, 3.180%, 2/18/2025, 144A(a) | | | 35,721 | |

| | 10,000 | | | DT Auto Owner Trust, Series 2019-4A, Class B, 2.360%, 1/16/2024, 144A | | | 10,131 | |

| | 10,000 | | | DT Auto Owner Trust, Series 2020-1A, Class B, 2.160%, 5/15/2024, 144A | | | 10,147 | |

| | 15,000 | | | DT Auto Owner Trust, Series 2020-2A, Class C, 3.280%, 3/16/2026, 144A(a) | | | 15,767 | |

| | 35,799 | | | DT Auto Owner Trust, Series 2020-3A, Class A, 0.540%, 4/15/2024, 144A(a) | | | 35,864 | |

| | 35,000 | | | DT Auto Owner Trust, Series 2020-3A, Class C, 1.470%, 6/15/2026, 144A(a) | | | 35,190 | |

| | 17,111 | | | Exeter Automobile Receivables Trust, Series 2019-2A, Class B, 3.060%, 5/15/2023, 144A(a) | | | 17,198 | |

| | 9,768 | | | Exeter Automobile Receivables Trust, Series 2019-3A, Class B, 2.580%, 8/15/2023, 144A(a) | | | 9,828 | |

| | 20,000 | | | Exeter Automobile Receivables Trust, Series 2020-1A, Class B, 2.260%, 4/15/2024, 144A(a) | | | 20,240 | |

| | 25,000 | | | Exeter Automobile Receivables Trust, Series 2020-2A, Class C, 3.280%, 5/15/2025, 144A(a) | | | 26,244 | |

| | | | ABS Car Loan — continued | | | | |

| 30,000 | | | Exeter Automobile Receivables Trust, Series 2020-3A, Class C, 1.320%, 7/15/2025(a) | | | 30,156 | |

| | 15,143 | | | First Investors Auto Owner Trust, Series 2019-1A, Class A, 2.890%, 3/15/2024, 144A(a) | | | 15,294 | |

| | 27,999 | | | First Investors Auto Owner Trust, Series 2019-2A, Class A, 2.210%, 9/16/2024, 144A(a) | | | 28,243 | |

| | 35,994 | | | Flagship Credit Auto Trust, Series 2018-1, Class B, 3.130%, 1/17/2023, 144A(a) | | | 36,152 | |

| | 35,000 | | | Flagship Credit Auto Trust, Series 2018-4, Class B, 3.880%, 10/16/2023, 144A(a) | | | 35,837 | |

| | 10,000 | | | Flagship Credit Auto Trust, Series 2020-2, Class C, 3.800%, 4/15/2026, 144A(a) | | | 10,663 | |

| | 15,000 | | | Flagship Credit Auto Trust, Series 2020-4, Class C, 1.280%, 2/16/2027, 144A(a) | | | 15,119 | |

| | 40,000 | | | Ford Credit Auto Lease Trust, Series 2020-A, Class A3, 1.850%, 3/15/2023(a) | | | 40,537 | |

| | 4,221 | | | Ford Credit Auto Owner Trust, Series 2019-B, Class A2A, 2.350%, 2/15/2022(a) | | | 4,224 | |

| | 47,274 | | | Foursight Capital Automobile Receivables Trust, Series 2018-2, Class A3, 3.640%, 5/15/2023, 144A(a) | | | 47,614 | |

| | 18,188 | | | GLS Auto Receivables Issuer Trust, Series 2019-2A, Class A, 3.060%, 4/17/2023, 144A(a) | | | 18,308 | |

| | 35,000 | | | GLS Auto Receivables Issuer Trust, Series 2019-4A, Class B, 2.780%, 9/16/2024, 144A(a) | | | 35,964 | |

| | 3,403 | | | GLS Auto Receivables Trust, Series 2018-1A, Class A, 2.820%, 7/15/2022, 144A(a) | | | 3,406 | |

| | 32,384 | | | GLS Auto Receivables Trust, Series 2018-3A, Class B, 3.780%, 8/15/2023, 144A(a) | | | 32,912 | |

| | 65,000 | | | GLS Auto Receivables Trust, Series 2020-3A, Class B, 1.380%, 8/15/2024, 144A(a) | | | 65,573 | |