UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. ____)

| |

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

| |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under Section 240.14a-12 |

|

Inland Real Estate Income Trust, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

Payment of Filing Fee (Check the appropriate box): |

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(l) and 0-11. |

INLAND REAL ESTATE INCOME TRUST, INC.

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

AND

PROXY STATEMENT

| |

Date: | November 7, 2023 |

Time: | 1:30 p.m. Central Time |

Place: | 2901 Butterfield Road |

| Oak Brook, Illinois 60523 |

Inland Real Estate Income Trust, Inc.

2901 Butterfield Road

Oak Brook, Illinois 60523

(800) 826-8228

Notice of Annual Meeting of Stockholders

to be held November 7, 2023

Dear Stockholder:

Our annual stockholders’ meeting will be held on November 7, 2023, at 1:30 p.m. Central Time, at our principal executive offices located at 2901 Butterfield Road in Oak Brook, Illinois 60523. At our annual meeting, we will ask you to consider and vote upon:

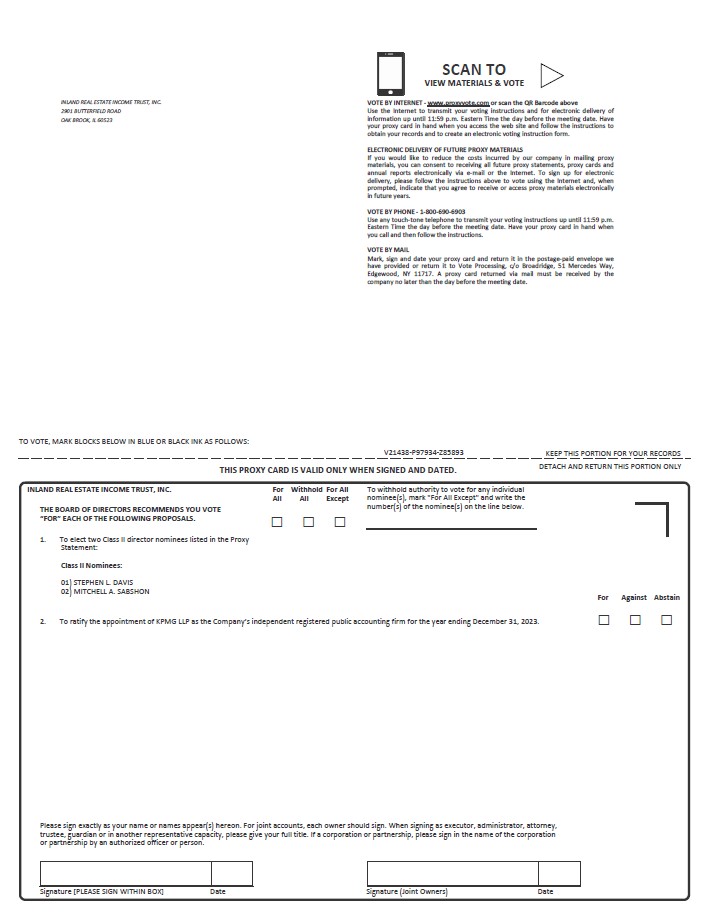

1.a proposal to elect two Class II directors;

2.a proposal to ratify the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and

3.any other business that may be properly presented at the annual meeting and any postponement or adjournment thereof.

If you were a stockholder of record at the close of business on August 11, 2023, you may vote at the annual meeting and any postponements or adjournments of the meeting. Instead of mailing a printed copy of our proxy materials to all of our stockholders, we are using the “Notice and Access” method of providing proxy materials to stockholders via the Internet. This process provides stockholders with a convenient and quick way to access the proxy materials and vote, while lowering our costs and reducing the environmental impact of our meeting. Accordingly, on or about August 22, 2023 we expect to begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) and will post our proxy materials on the website referenced in the Notice and in our proxy statement. As will be more fully described in any Notice, stockholders may choose to access our proxy materials on the website or you may request to receive a printed set of our proxy materials.

Whether or not you plan to attend the meeting and vote in person, we urge you to have your vote recorded as early as possible. Stockholders have the following three options for submitting their votes by proxy: (1) via the Internet; (2) by telephone; or (3) by mail, if a paper proxy card has been provided to you.

Your vote is very important! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes.

By order of the Board of Directors,

Cathleen M. Hrtanek

Secretary

August 14, 2023

Table of Contents

i

This proxy statement contains information related to the annual meeting of stockholders to be held November 7, 2023, beginning at 1:30 p.m. Central Time, at our principal executive offices located at 2901 Butterfield Road, Oak Brook, Illinois 60523, and at any postponements or adjournments thereof.

INFORMATION ABOUT THE ANNUAL MEETING

The board of directors of Inland Real Estate Income Trust, Inc. (referred to herein as the “Company,” “we,” “our” or “us”), a Maryland corporation, is soliciting your vote for the 2023 annual meeting of stockholders. At the meeting, you will be asked to consider and vote upon:

1.a proposal to elect two Class II directors;

2.a proposal to ratify the selection of KPMG LLP (sometimes referred to herein as “KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and

3.any other business that may be properly presented at the annual meeting and any postponement or adjournment thereof.

The board of directors recommends that you vote “FOR” each proposal.

Important Notice Regarding the Availability of Proxy Materials

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on November 7, 2023. This proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2022 (our “Annual Report”) are available at www.proxyvote.com. Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we are providing stockholders with access to our proxy materials over the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of mailing paper copies of the proxy materials to each stockholder. This allows us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our annual meeting. On or about August 22, 2023, we will begin mailing to our stockholders the Notice containing instructions on how to access our proxy materials over the Internet and authorize your proxy online. The Notice is not a proxy and cannot be marked or submitted to vote your shares. All stockholders receiving the Notice will have the ability to request a paper copy of the proxy materials by mail by following the instructions provided on the Notice. In addition, the Notice contains instructions for electing to receive proxy materials by e-mail. If you own shares of common stock in more than one account, such as individually and jointly with your spouse, you may have received more than one Notice. Please make sure to vote all of your shares.

You will not receive paper copies of the proxy materials, including our Annual Report, unless you request the materials by following the instructions on the Notice or on the website referred to in the Notice. If requested by stockholders, we also will provide copies of exhibits to our Annual Report for a reasonable fee.

The SEC has adopted a rule concerning the delivery of documents filed by us with the SEC, including proxy statements and annual reports. The rule allows us to, among other things, send a single set of any proxy statement, annual report, notices or information statement to any household at which two or more stockholders reside if they share the same address. This procedure is referred to as “Householding.” This rule benefits both you and us by reducing the volume of duplicate information received at your household and helps us reduce expenses. Each stockholder subject to Householding will continue to have a separate stockholder identification number and receive a separate proxy card or voting instruction card.

Upon written or oral request, we will promptly have a separate copy of our Annual Report and this Proxy Statement delivered to a stockholder at a shared address to which a single copy was previously delivered. If you have any questions about this Proxy Statement or the annual meeting or if you received a single set of disclosure documents for this year, but you would prefer to receive your own copy, you may direct requests for separate copies by calling (800) 579-1639 or email us a request to sendmaterial@materialnotice.com. You may also visit the following website to request materials: www.materialnotice.com.

1

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read any reports, statements and other information we file with the SEC on the website maintained by the SEC at www.sec.gov. Our SEC filings also are available to the public at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, DC 20549. You also may obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Washington, DC 20549. Please call the SEC at (800) SEC-0330 for further information regarding the public reference facilities.

Information about Attending the Annual Meeting

We welcome your attendance at the annual meeting of stockholders. If you plan on attending the meeting, please contact us at (800) 826-8228, so that we can arrange for sufficient space to accommodate all attendees.

If your shares are held by a broker, bank or other nominee, you must follow the instructions provided by your broker, bank or other nominee to vote your shares and you may not vote your shares in person at the meeting unless you obtain a legal proxy. Beneficial holders who want to attend and also vote in person at the Annual Meeting will need to obtain a legal proxy, in PDF or Image (gif, jpg, or png) file format, from the organization that holds their shares giving the right to vote their shares in person at the Annual Meeting and by presenting it with their online ballot during the meeting.

Information about Voting

Holders of our common stock at the close of business on August 11, 2023 (the “Record Date”) are entitled to receive notice of and to vote their shares at the annual meeting. As of the Record Date, there were 36,155,115 shares of our common stock outstanding. Each share of common stock is entitled to one vote on each matter properly brought before the meeting.

Your vote is needed to ensure that the proposals can be acted upon. Your vote is very important, even if you own a small number of shares. Your immediate response will help avoid potential delays and may save the Company significant additional expense associated with soliciting stockholder votes.

You may vote in person or by granting us a proxy to vote on the proposals. A proxy is a person who votes the shares of stock of another person who could not attend a meeting. The term “proxy” also refers to the proxy card or other method of appointing a proxy. By submitting your proxy to us, you are appointing Catherine L. Lynch and Cathleen M. Hrtanek as your proxy, and you are giving them permission to vote your shares of the Company’s common stock at the annual meeting.

You may authorize a proxy in any of the following ways:

•via the Internet, by following the instructions and using the control number or QR barcode provided on the proxy card or the Notice;

•via telephone, by calling (800) 690-6903 and following the instructions provided on the proxy card provided to you; or

•via mail, if you received a printed set of proxy materials, by completing, signing, dating and returning the paper proxy card provided to you in the envelope enclosed therewith, if it is received by us no later than November 6, 2023.

You can authorize a proxy via the Internet or by telephone at any time prior to 11:59 p.m., Eastern Time, on November 6, 2023, the day before the annual meeting. For those stockholders with Internet access, we encourage you to authorize a proxy to vote your shares via the Internet, because it is quick, convenient and provides a cost savings to us. Authorizing a proxy to vote your shares by following the instructions on the enclosed proxy card prior to the meeting date will ensure that your vote is recorded immediately and avoid postal delays that my cause your proxy to arrive late in which case your vote will not be counted. If you mail proxy cards, please sign, date and return each proxy card to guarantee that all your shares of common stock are voted.

2

If you return your proxy card but do not indicate how your shares should be voted, they will be voted (1) “FOR” the election of Stephen L. Davis and Mitchell A. Sabshon as Class II directors to serve until our 2026 annual meeting and until their respective successors are duly elected and qualify, and (2) “FOR” the ratification of the selection of KPMG as our independent registered public accounting firm for the fiscal year ending December 31, 2023. If you grant us a proxy, you may nevertheless revoke your proxy at any time before it is exercised by: (1) sending written notice that must be received by us no later than November 6, 2023 at Inland Real Estate Income Trust, Inc., 2901 Butterfield Road, Oak Brook, Illinois 60523, Attention: Ms. Judith Fu, Vice President, Administration; (2) providing us with a later-dated proxy received by us no later than November 6, 2023; or (3) attending the annual meeting in person and voting your shares. Merely attending the annual meeting, without further action, will not revoke your proxy.

Street Name Stockholders. If you are the beneficial owner of shares (that is, you held your shares in “street name” through an intermediary such as a broker, bank or other nominee) as of the close of business on the Record Date, you will receive instructions from your broker, bank or other nominee as to how to vote your shares or submit a proxy to have your shares voted. Please use the voting forms and instructions provided by your broker, bank or other nominee. In most cases, you will be able to do this by following the instructions on the enclosed proxy card or possibly by telephone depending on the broker’s procedures. You should instruct your broker, bank or other nominee how to vote your shares by following the directions provided by your broker, bank or other nominee.

If you are the beneficial owner of your shares but not a registered stockholder, you should contact your broker, bank or other nominee to change your vote or revoke your proxy.

Information Regarding Tabulation of the Vote

This solicitation of proxies is made by and on behalf of our Board of Directors. Under applicable regulations of the SEC, each of our directors and director nominees, and certain of our officers, may solicit proxies and are “participants” in this proxy solicitation on behalf of the Board. We have also engaged Broadridge Investor Communication Solutions, Inc. (“Broadridge”), 51 Mercedes Way, Edgewood, New York 11717, to solicit proxies on our behalf. In addition, Broadridge will tabulate all votes cast at the annual meeting and will act as the inspector of election.

Quorum Requirement

There must be a quorum represented in order for the stockholders to take action at the annual meeting. The presence, in person or by proxy, of stockholders entitled to cast a majority of all votes entitled to be cast at the annual meeting will constitute a quorum. If you submit a properly executed proxy card, even if you abstain from voting or do not give instructions for voting, then your shares will be considered present for purposes of establishing a quorum.

Information about Vote Necessary for Action to be Taken

Proposal No. 1. With regard to the election of Stephen L. Davis and Mitchell A. Sabshon as Class II directors to serve until our 2026 annual meeting and until their respective successors are duly elected and qualify, you may (i) vote “FOR ALL” of the nominees; (ii) withhold your vote for all of the nominees by voting “WITHHOLD ALL,” or (iii) vote for all of the nominees except for certain nominee(s) by voting “FOR ALL” and striking a line through that nominee(s’) name(s) or number(s) on the proxy card or, if voting electronically, making individual selections on the electronic proxy card. A plurality of all the votes of shares of common stock cast at the annual meeting, assuming a quorum is represented, is required to elect each nominee for director. Withheld votes will be counted for purposes of establishing a quorum and as a vote cast at the annual meeting but will have no effect on the result of the vote for a nominee. if there is at least one vote “FOR” that nominee. For purposes of this proposal, broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

Proposal No. 2. With regard to the proposal relating to the ratification of the selection of KPMG as our independent registered public accounting firm for the fiscal year ending December 31, 2023, you may vote “FOR” or “AGAINST” the proposal, or you may “ABSTAIN” from voting on the proposal. A majority of the votes cast at the

3

annual meeting, assuming a quorum is represented, is required to ratify this proposal. Abstentions will not be counted as votes cast; however, a properly executed proxy card marked “ABSTAIN” will be counted for purposes of establishing a quorum.

Our board of directors (including all of the independent directors) unanimously approved each of the proposals at its meeting on August 8, 2023, and recommends that you vote “FOR” each of them.

Broker Non-Votes

A “broker non-vote” occurs when a broker holding stock on behalf of a beneficial owner submits a proxy but does not vote on a particular proposal, for example, because the broker does not have discretionary power with respect to that particular proposal and has not received instructions from the beneficial owner. Brokers are not allowed to exercise their voting discretion with respect to the election of directors or for the approval of other matters which applicable exchange rules determine to be “non-routine,” without specific instructions from the beneficial owner. Thus, beneficial owners of shares held in broker accounts are advised that, if they do not timely provide instructions to their broker, their shares will not be voted in connection with the election of directors at the annual meeting.

Costs of Proxies

The Company will bear all costs and expenses incurred in connection with soliciting proxies. Our directors and executive officers, as well as certain employees of our business manager, IREIT Business Manager & Advisor, Inc. (referred to herein as the “Business Manager”), also may solicit proxies by mail, personal contact, letter, telephone, facsimile or other electronic means. These individuals will not receive any additional compensation for these activities, but may be reimbursed by us for their reasonable out-of-pocket expenses. In addition, the Company has hired Broadridge to solicit proxies on its behalf. We expect to pay Broadridge aggregate fees, costs and expenses of approximately $113,900 for soliciting proxies plus other fees and expenses for other services related to this proxy distribution, including disseminating broker search cards; distributing proxy materials; operating online and telephone voting systems; and receiving executed proxies. We will reimburse brokers and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses to the extent they forward proxy materials to our stockholders.

Other Matters

We are not aware of any other matters to be presented at the annual meeting. Generally, no business aside from the items discussed in this proxy statement may be transacted at the meeting. If, however, any other matter properly comes before the annual meeting as determined by the chair of the meeting, your proxies are authorized to act on the proposal at their discretion.

4

STOCK OWNERSHIP

Stock Owned by Certain Beneficial Owners and Management

Based on a review of filings with the SEC, the following table reflects the amount of common stock beneficially owned (unless otherwise indicated) by (1) persons that beneficially own more than 5% of the outstanding shares of our common stock; (2) our directors and each nominee for director; (3) our executive officers; and (4) our directors and executive officers as a group. All information is as of August 14, 2023.

| | | | | | |

Name and Address of Beneficial Owner and Nature of Beneficial Ownership(1) | | Amount(2) | | | Percent of Class |

Daniel L. Goodwin, Director and Chair of the Board(3) | | | 300,889 | | | * |

Lee A. Daniels, Lead Independent Director(4) | | | 8,420 | | | * |

Stephen L. Davis, Independent Director(5) | | | 6,537 | | | * |

Gwen Henry, Independent Director(6) | | | 6,792 | | | * |

Bernard J. Michael, Independent Director(7) | | | 6,311 | | | * |

Mitchell A. Sabshon, Director, President and Chief Executive Officer(8) | | | 2,654 | | | * |

Catherine L. Lynch, Chief Financial Officer(9) | | | 944 | | | * |

Judith Fu, Vice President(10) | | | 642 | | | * |

Cathleen M. Hrtanek, Secretary(11) | | | 222 | | | * |

Daniel Zatloukal, Senior Vice President | | | — | | | * |

All officers and directors as a group (10 persons) | | | 333,411 | | | * |

* Less than 1%

(1) The business address of each person listed in the table is c/o Inland Real Estate Income Trust, Inc., 2901 Butterfield Road, Oak Brook, Illinois 60523. Footnotes below include the nature of the ownership of the corresponding beneficial owner.

(2) All fractional ownership amounts have been rounded to the nearest whole number.

(3) Mr. Goodwin shares voting and dispositive power with his wife over 5,556 shares. Mr. Goodwin’s beneficial ownership includes 143,522 shares owned by the Goodwin 2012 Descendants Trust, 18,250 shares owned by a 2012 Gift Trust, 36,671 shares owned by another 2012 Gift Trust and 96,889 shares owned by Inland Real Estate Investment Corporation. Mr. Goodwin’s wife, as trustee, has sole voting and investment power over the shares owned by the Goodwin 2012 Descendants Trust. Mr. Goodwin controls the voting and disposition decisions with respect to the shares owned by the two 2012 Gift Trusts and Inland Real Estate Investment Corporation.

(4) Includes 1,926 unvested restricted shares. Mr. Daniels has sole voting and investment power over all of the shares that he beneficially owns.

(5) Includes 1,926 unvested restricted shares. Mr. Davis has sole voting and investment power over all of the shares that he beneficially owns.

(6) Includes 1,926 unvested restricted shares. Ms. Henry shares voting and dispositive power with her husband over all of the shares that they own.

(7) Includes 1,926 unvested restricted shares. Mr. Michael has sole voting and investment power over all of the shares that he beneficially owns.

(8) Mr. Sabshon has sole voting and investment power over all of the shares that he beneficially owns.

(9) Ms. Lynch shares voting and dispositive power with her husband over all of the shares that they own.

(10) Ms. Fu has sole voting and investment power over all shares that she beneficially owns.

(11) Ms. Hrtanek has sole voting and investment power over all of the shares that she beneficially owns.

Interest of Certain Persons in Matters to Be Acted On

No director, executive officer, nominee for election as a director or associate of any director, executive officer or nominee has any substantial interest, direct or indirect, through security holdings or otherwise, in any matter to be acted upon at the annual meeting.

5

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE PRINCIPLES

Board of Directors

In accordance with our charter, our board of Directors is divided into three classes of directors. Each director serves until the annual meeting of stockholders held in the third year following the year of their election and until their successor is duly elected and qualifies. At the annual meeting, two Class II directors will be elected to serve until our 2026 annual meeting and until their successors are duly elected and qualify. The number of directors in each class may be changed from time to time by the board to reflect matters such as an increase or decrease in the number of directors so that each class, to the extent possible, will have the same number of directors. Our bylaws provide that the number of directors may not be less than one, which is the minimum number required by the Maryland General Corporation Law (the “MGCL”), or more than 15. The number of directors on the board is currently fixed at six, of which four are independent.

Our corporate governance guidelines require a majority of our directors to be “independent directors” as that term is defined in the rules of the NYSE and the applicable rules of the SEC. Any director of the Company may resign at any time by delivering his or her resignation to the board, the chairman of the board or the secretary. Any resignation will take effect immediately upon its receipt or at such later time specified in the resignation. The acceptance of a resignation will not be necessary to make it effective unless otherwise stated in the resignation.

The table set forth below lists the names, ages and certain other information about Stephen L. Davis and Mitchell A. Sabshon, our Class II directors who are the nominees for election as Class II directors at the annual meeting, and each of the continuing members of our board:

| | | | | | | | | | | | | |

Class I Director Nominees | | Class | | Age | | Position | | Director Since | | Current Term Expires* | | Expiration of Term For Which Nominated* | |

Stephen L. Davis | | II | | 65 | | Independent Director, Nominating and Corporate Governance Committee Chair | | 2012 | | 2023 | | 2026 | |

Mitchell A. Sabshon | | II | | 70 | | Director, President and Chief Executive Officer | | 2014 | | 2023 | | 2026 | |

Continuing Directors | | Class | | Age | | Position | | Director Since | | Current Term Expires* | | Expiration of Term For Which Nominated* | |

Lee A. Daniels | | III | | 80 | | Lead Independent Director | | 2012 | | 2024 | | — | |

Daniel L. Goodwin | | III | | 79 | | Director, Chair of the Board | | 2012 | | 2024 | | — | |

Gwen Henry | | I | | 82 | | Independent Director, Audit Committee Chair | | 2012 | | 2025 | | — | |

Bernard J. Michael | | I | | 63 | | Independent Director | | 2014 | | 2025 | | — | |

*Each director will remain in office regardless of their term until a successor is duly elected and qualifies or they resign or are removed.

The following sets forth the principal occupation and business of each nominee and each continuing director, as well as the specific experience, qualifications, attributes and skills that led to the conclusion by the board that the nominee should serve as a director of the Company. All ages are stated as of January 1, 2023. As used herein, “Inland” refers to some or all of the entities that are a part of The Inland Real Estate Group of Companies, Inc., which is comprised of separate and independent legal entities, some of which may be affiliates, share some common ownership or have been sponsored and managed by such entities or subsidiaries thereof.

Nominees for Class II Directors

Stephen L. Davis, 65. Independent director since February 2012. Mr. Davis serves as a member of the audit committee and the chair of the nominating and corporate governance committee. Mr. Davis has served as a member of the board of directors of Heska Corporation (NASDAQ: HSKA) since August 2020 and as a member of that

6

company’s audit committee and as the chair of its corporate governance committee in each case since February 2021. Mr. Davis has served as a member of the board of directors of PMI Energy Solutions, LLC since 2013. Additionally, Mr. Davis serves on the Board of the Trust Company of Illinois since 2016. Mr. Davis has over 30 years of experience in real estate development. Mr. Davis has been the president of The Will Group, Inc., a construction company, since founding the company in 1986. In his position with The Will Group, Mr. Davis was instrumental in the construction of Kennedy King College campus, located in Chicago, Illinois, and the coordination of the "Plan For Transformation" for Altgeld Gardens, a public housing development located in Chicago, Illinois. Since October 2003, Mr. Davis has also overseen property management operations for several properties owned by a family-owned real estate trust.

Mr. Davis has served as commissioner of aviation (board chair) of the DuPage County Airport Authority, in DuPage County, Illinois, which oversees management of the DuPage County Airport, Prairie Landing Golf Course and the 500-acre DuPage County Business Park since March 2005. From 2006 to 2016, Mr. Davis served as a director of Wheaton Bank & Trust, where he was a member of the loan committee, which was responsible for reviewing and analyzing residential and commercial loan portfolios, developer credentials and viability, home builders and commercial and industrial loans. Mr. Davis obtained his bachelor degree from the University of Tennessee, located in Knoxville.

Our board believes that Mr. Davis’s prior real estate development experience, his experience as a director of another public company and his leadership qualities make him well qualified to serve as a member of our board of directors.

Mitchell A. Sabshon, 70. Director since September 2014, chief executive officer since April 2014 and president since December 2016. Mr. Sabshon has also served as a director and president of the Business Manager since October 2013 and December 2016, respectively. Mr. Sabshon also serves as a director, Chief Executive Officer and Chairman of the Board of InPoint Commercial Real Estate Income, Inc. ("InPoint"), positions he has held since October 2016 and September 2016, respectively. Mr. Sabshon is also the Chief Executive Officer of InPoint's Advisor, Inland InPoint Advisor, LLC, a position he has held since August 2016. Mr. Sabshon is also currently the chief executive officer, president and a director of IREIC, positions he has held since August 2013, January 2014 and September 2013, respectively. He is a director, the president and chief executive officer of the IRPT business manager since December 2013 and was a director and the president and chief executive officer of IRPT from December 2013 until December 2019. Mr. Sabshon is currently the chief executive officer of Inland Venture Partners, LLC, a position he has held since November 2018, chief executive officer of Inland Ventures MHC Manager, LLC, a position he has held since December 2018, and chief executive officer and director of MH Ventures Fund II, Inc. and its business manager, positions he has held since September 2020. In April 2022, Mr. Sabshon joined the board of trustees of Seritage Growth Properties (NYSE: SRG) as a trustee. Mr. Sabshon has also served as a director and chair of the board of IPCC since September 2013 and January 2015, respectively, and a director of Inland Securities Corporation (“Inland Securities”) since January 2014. He has also served as chief executive officer of Inland Venture Partners, LLC since November 2018.

Prior to joining the Company, Mr. Sabshon served as executive vice president and chief operating officer of Cole Real Estate Investments, where he oversaw the company's finance, leasing, property management and asset management operations. Prior to joining Cole, Mr. Sabshon held several senior executive positions at leading financial services firms. He spent almost 10 years at Goldman, Sachs & Co. in various leadership roles including president and chief executive officer of Goldman Sachs Commercial Mortgage Capital. He also served as a senior vice president in Lehman Brothers' real estate investment banking group. Prior to joining Lehman Brothers, Mr. Sabshon was an attorney in the corporate and real estate structured finance practice groups at Skadden, Arps, Slate, Meagher & Flom in New York. Mr. Sabshon is also a member of the International Council of Shopping Centers, the Urban Land Institute, the National Association of Corporate Directors, a member of the Board of Trustees of the American Friends of Hebrew University - Midwest Region and the Board of Directors of Timeline Theatre Company. Mr. Sabshon is also a member of the New York State Bar, a former chair emeritus of the Institute for Portfolio Alternatives and holds the Board Leadership Fellowship designation of the National Association of Corporate Directors. He also holds a real estate broker license in New York. He received his undergraduate degree from George Washington University and his law degree at Hofstra University School of Law.

Our board believes that Mr. Sabshon’s extensive finance and real estate experience make him well qualified to serve as a member of our board of directors.

7

Continuing Directors

Lee A. Daniels, 81. Independent director since February 2012 and Lead Independent Director since September 2017. Mr. Daniels serves as a member of the nominating and corporate governance committee and the audit committee. Mr. Daniels served on the Board of Trustees of Kite Realty Group from 2014 to 2021. Mr. Daniels served on the board of directors of Inland Diversified Real Estate Trust, Inc. (“Inland Diversified”) from its inception in 2008 until its merger with Kite in 2014.

In February 2007, Mr. Daniels founded Lee Daniels & Associates, LLC, a consulting firm for government and community relations. Prior to that, Mr. Daniels was an equity partner at the Chicago law firm of Bell Boyd & Lloyd from 1992 to 2006, an equity partner at Katten, Muchin & Zavis from 1982 to 1991, and an equity partner at Daniels & Faris from 1967 to 1982. Mr. Daniels served as Special Assistant Attorney General for the State of Illinois from 1971 to 1974. He served as a member of the Illinois House of Representatives from 1975 to 2007, was the Republican Leader from 1983 to 1995 and 1998 to 2003, and was Speaker of the Illinois House of Representatives from 1995 to 1997.

Mr. Daniels currently serves as chair of the Board of Directors of Haymarket Center, a nonprofit behavioral health treatment center located in Chicago, Illinois. He served as the chair of the Presidential Search Committee for the College of DuPage from 2015 to 2016. He previously served on the Elmhurst Memorial Healthcare Board of Trustees from 1981 to 2013, the Board of Governors from 1990 to 2013, and the Elmhurst Memorial Hospital Foundation Board from 1980 to 1984 and 2013. Other boards Mr. Daniels has served on include the Suburban Bank and Trust Company of Elmhurst Board of Directors from 1994 to 1996, the Elmhurst Federal Savings and Loan Association Board of Directors from 1991 to 1994, and the DuPage Easter Seals Board of Directors from 1970 to 1973.

Mr. Daniels received his bachelor’s degree from the University of Iowa and his law degree from The John Marshall Law School in Chicago. He received a Distinguished Alumni Award from both The John Marshall Law School and the University of Iowa, and an Honorary Doctor of Laws from Elmhurst College.

Our board believes that Mr. Daniels’ depth of knowledge and experience, based on his over 50 years of legal practice and his service as a board member of REITs make him well qualified to serve as a member of our board of directors.

Daniel L. Goodwin, 79. Director and the chair of our board since July 2012. Mr. Goodwin has also served as a director of the Business Manager since August 2011. Mr. Goodwin is the chair and chief executive officer of Inland, headquartered in Oak Brook, Illinois. Inland is comprised of separate real estate investment and financial companies with managed assets with a value of approximately $10.5 billion, doing business nationwide with a presence in 43 states, as of December 31, 2021. Inland owns and manages properties in all real estate sectors, including retail, office, industrial and apartments. Mr. Goodwin owns a majority of the equity interests in The Inland Group, LLC and is its controlling member and has served as its Chair and Chief Executive Officer since its founding. The Inland Group, LLC is the indirect parent of IREIC and our business manager and real estate manager. Mr. Goodwin also serves as a director or officer of other entities wholly owned or controlled by The Inland Group LLC. In addition, Mr. Goodwin has served as the chair of the board of Inland Mortgage Investment Corporation since March 1990, chair, director and chief executive officer of Inland Bancorp, Inc., a bank holding company, since January 2001 and chair of the board of IREIC since January 2017. Mr. Goodwin also served as a director of Inland Real Estate Corporation (n/k/a IRC Retail Centers LLC) (“IRC”) from 2001 until its merger in March 2016, and served as its chair of the board from 2004 to April 2008. Mr. Goodwin served as a director and the chair of the board of Inland Residential Properties Trust, Inc. (“IRPT”) and as a director and the chair of the board of the IRPT business manager, both from December 2013 until each company’s liquidation and dissolution in October 2019. Mr. Goodwin has served as chair of Inland InPoint Advisor, LLC since October 2016, as a director and chair of the board of MH Ventures Fund II, Inc. and its business manager, since September 2020, and as a director of IPCC since 2004. He also served as the chair of the National Association of Real Estate Investment Trusts Public Non-Listed REIT Council from January 2010 through December 2017, and as a past Vice Chair of the Chicago Better Government Association.

Housing. Mr. Goodwin is a member of the National Association of Realtors President’s Circle, the National Association of Realtors Hall of Fame, the Illinois Association of Realtors Hall of Fame and the Chicago Association

8

of Realtors Hall of Fame. He is also the author of a nationally recognized real estate reference book for the management of residential properties. Mr. Goodwin served on the Board of the Illinois State Affordable Housing Trust Fund. He served as an advisor for the Office of Housing Coordination Services of the State of Illinois, and as a member of the Seniors Housing Committee of the National Multifamily Housing Council. He has served as chair of the DuPage County Affordable Housing Task Force. Mr. Goodwin also founded New Directions Housing Corporation, a not-for-profit entity that develops affordable housing for low income individuals.

Education. Mr. Goodwin obtained his bachelor’s degree and master’s degree from Illinois State universities. Following graduation, he taught for five years in the Chicago Public Schools. Over the past twenty years, Mr. Goodwin served as a member of the Board of Governors of Illinois State Colleges and Universities, vice chair of the Board of Trustees of Benedictine University, vice chair of the Board of Trustees of Springfield College, and chair of the Board of Trustees of Northeastern Illinois University.

Our board believes that Mr. Goodwin’s 50 years of experience in real estate investing, commercial real estate brokerage, real estate securities, land development, construction and mortgage banking and commercial lending, make him well qualified to serve as a member of our board of directors.

Gwen Henry, 82. Independent director since February 2012. Ms. Henry serves as chair of the audit committee and a member of the nominating and corporate governance committee. Ms. Henry currently serves as the Treasurer of DuPage County, Illinois, a position she has held since December 2006. In this position, Ms. Henry is responsible for the custody and distribution of DuPage County funds. In addition, from April 1981 to 2019, Ms. Henry was a partner at Dugan & Lopatka, a regional accounting firm, and a member of the firm’s controllership and consulting services practice, where she specialized in financial consulting and tax and business planning for privately-held companies. Since December 2009, Ms. Henry has served as a member of the Illinois Municipal Retirement Fund, a $52 billion fund which has investments in excess of $1.2 billion allocated to real estate. She currently serves as chair of the investment committee, and is a member of the audit committee and the legislative committee of the fund.

Ms. Henry previously served as DuPage County Forest Preserve Commissioner (from December 2002 to November 2006) and as chair to the special committee responsible for the DuPage County Budget (from December 2002 to November 2004), and was a member of the DuPage County Finance Committee (from November 1996 to November 2002). Ms. Henry also has held a number of board and chair positions for organizations such as the Marianjoy Rehabilitation Hospital (as treasurer from June 2002 to May 2008), the Central DuPage Health System (as chairperson of the board from October 1995 to September 1999), and the Central DuPage Hospital Foundation (as director from October 2002 to present). She was elected and served as Mayor of the City of Wheaton, Illinois from March 1990 to December 2002.

Ms. Henry received her bachelor degree from the University of Kansas, located in Lawrence, Kansas. She is a certified public accountant, a designated certified public funds investment manager and a certified public finance administrator.

Our board believes that Ms. Henry’s over 35 years of public accounting experience makes her well qualified to serve as a member of our board of directors.

Bernard J. Michael, 63. Independent director since September 2014. Mr. Michael serves as a member of the audit committee and, since September 2017, the nominating and corporate governance committee. Mr. Michael founded AWH Partners, LLC, a privately held real estate investment, development and management firm. He served as managing partner of the firm until 2018 and now owns a minority interest. Under Mr. Michael’s leadership, AWH acquired in excess of $1.4 billion of hotel investments and was managing or completed hotel redevelopment projects totaling more than $300 million. In early 2012, AWH acquired Lane Hospitality, which it rebranded as Spire Hospitality, a top-tier national hospitality platform formed in 1980. Mr. Michael is also the chairman and chief executive officer and president of the Center for Jewish History, a not-for-profit museum and archive in New York.

Mr. Michael also has over 25 years of experience as a practicing lawyer specializing in real estate with a focus on sophisticated real estate transactions across all asset classes for some of the world's largest property owners, developers and lenders. Mr. Michael was the founder and senior partner of Michael, Levitt & Rubenstein, LLC, a law firm focusing on real estate sales, acquisitions, development, leasing and financing. Mr. Michael and his team worked

9

on some of the largest transactions in New York City, including the development of Time Warner Center and the Hudson Yards projects for The Related Companies. In addition, Mr. Michael and his firm represented developers on major multi-family, retail, office and hospitality projects in China, Saudi Arabia, and in most major cities across the United States.

Prior to forming Michael, Levitt & Rubenstein LLC, Mr. Michael was a partner in the Real Estate Group at Proskauer Rose, LLP. Prior to that, Mr. Michael was an attorney at Weil, Gotschal & Manges and Shea & Gould. Mr. Michael is a graduate of Brown University and New York University School of Law. Our board believes that Mr. Michael’s prior business experience and his leadership qualities make him well qualified to serve as a member of our board of directors.

Independence

Our business is managed under the direction and oversight of our board. The members of our board are Lee A. Daniels, Stephen L. Davis, Daniel L. Goodwin, Gwen Henry, Bernard J. Michael and Mitchell A. Sabshon. As required by our Corporate Governance Guidelines, a majority of our board must be comprised of “independent directors” according to the director independence standard of the New York Stock Exchange (“NYSE”) and applicable regulations promulgated by the SEC. The NYSE standards provide that to qualify as an independent director, among other things, the board of directors must affirmatively determine that the director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). The board annually reviews the relationships that each director has with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). Following the annual review, only those directors who the board affirmatively determines have no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company) will be considered independent directors, subject to additional qualifications prescribed by the NYSE Rules.

After reviewing any relevant transactions or relationships between each director, or any of his or her family members, and the Company, our management and our independent registered public accounting firm, and considering each director’s direct and indirect association with Inland Real Estate Investment Corporation (“IREIC”), the Business Manager or any of their affiliates, the board has determined that Messrs. Daniels, Davis and Michael and Ms. Henry qualify as independent directors.

Board Leadership Structure and Risk Oversight

We have separated the roles of the president and chair of the board to recognize the difference between the two roles. Mr. Sabshon, in his role as both our president and chief executive officer and the president and chief executive officer of the Business Manager, is responsible for establishing the strategic direction for the Company and for providing the day-to-day leadership of the Company. Mr. Goodwin, as chair of the board, organizes the work of the board and ensures that the board has access to sufficient information to carry out its functions. Mr. Goodwin presides over meetings of the board of directors and stockholders, establishes the agenda for each meeting and oversees the distribution of information to directors.

Mr. Daniels currently serves as our “Lead Independent Director.” Although each board member is apprised of our business and developments impacting our business, the Lead Independent Director coordinates the activities of the independent directors and serves as the principal liaison between the independent directors and the chair of the board.

Mr. Daniels, in his capacity as Lead Independent Director presides at board meetings if the chair of the board is absent; establishes board meeting agendas in collaboration with the chair of the board and the various committee chairs and recommends matters for the board and committees to consider; advises the chair of the board as to the quality, quantity and timeliness of the information submitted to the directors; calls meetings of the independent directors or calls for executive sessions during board meetings; and presides at meetings of the independent directors or executive sessions of the board. The Lead Independent Director also performs such other responsibilities as the board may determine.

10

Our board believes that having a Lead Independent Director with the duties and responsibilities described above, provides the same independent leadership, oversight, and benefits to the Company and the board that would be provided by an independent chair of the board. Our full board of directors, including our independent directors, is responsible for approving all material transactions, and each transaction between us and the Business Manager or its affiliates must be approved by the affirmative vote of a majority of our directors, including a majority of our independent directors, not otherwise interested in the transaction. In addition, each board member is kept apprised of our business and developments impacting our business and has complete and open access to the members of our management team, the Business Manager and our real estate manager, Inland Commercial Real Estate Services LLC (our “Real Estate Manager”).

Our board is actively involved in overseeing risk management for the Company. Our board of directors oversees risk through: (1) its review and discussion of regular periodic reports to the board of directors and its committees, including management reports and studies on existing market conditions, leasing activity and property operating data, as well as actual and projected financial results, and various other matters relating to our business; (2) the required approval by the board of directors of material transactions, including, among others, acquisitions and dispositions of properties, financings and our agreements with the Business Manager, our Real Estate Manager and the ancillary service providers; (3) reports from the audit committee; and (4) its review and discussion of regular periodic reports from our independent registered public accounting firm and other outside consultants or advisors regarding various areas of potential risk, including, among others, those relating to the qualification of the Company as a REIT for tax purposes and our internal control over financial reporting.

Independent Director Compensation

The following table summarizes compensation earned by the independent directors for the year ended December 31, 2022 (Dollar amounts in thousands).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Fees Earned

or Paid in

Cash | | | Stock

Awards(1) | | | Options

Awards | | | Non-Equity

Incentive Plan

Compensation | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings | | | All Other

Compensation(2) | | | Total

Compensation | |

Lee A. Daniels | | $ | 95 | | | $ | 24 | | | $ | — | | | $ | — | | | $ | — | | | $ | 3 | | | $ | 122 | |

Stephen L. Davis | | $ | 82 | | | $ | 24 | | | $ | — | | | $ | — | | | $ | — | | | $ | 3 | | | $ | 109 | |

Gwen Henry | | $ | 95 | | | $ | 24 | | | $ | — | | | $ | — | | | $ | — | | | $ | 3 | | | $ | 122 | |

Bernard J. Michael | | $ | 82 | | | $ | 24 | | | $ | — | | | $ | — | | | $ | — | | | $ | 3 | | | $ | 109 | |

(1)Represents 1,188 restricted shares granted on November 8, 2022 to each director.

(2)Represents the value of distributions received during the year ended December 31, 2022 on all stock awards received through December 31, 2022.

Cash Compensation

We pay our independent directors an annual fee of $50,000 plus $2,000 for each in-person meeting or meeting of the board by video conference and $750 for each meeting of the board by telephone; we also pay our independent directors $1,400 for each in-person meeting or meeting by video conference of each committee of the board and $550 for each meeting of each committee of the board by telephone. We pay the chairperson of the nominating and corporate governance committee of our board an annual fee of $8,500 and the chairperson of the audit committee of our board an annual fee of $13,200. We pay the Lead Independent Director an annual fee of $5,000.

We reimburse all of our directors for any out-of-pocket expenses incurred by them in attending meetings. Each independent director may elect to receive payment of all or a portion of his or her fee in the form of unrestricted shares in lieu of cash pursuant to our employee and director restricted share plan (the “RSP”) and may elect to defer the receipt of all or a portion of his or her fee pursuant to our director deferred compensation plan (the “Director Plan”). We do not compensate any director that also is an employee of the Business Manager or its affiliates.

11

Stock Compensation

On March 21, 2016 the board of directors approved the RSP, which was subsequently approved by the Company’s stockholders at the annual stockholders’ meeting on June 16, 2016. The RSP provides us with the ability to grant awards of restricted shares and restricted share units to directors, officers and employees (if we ever have employees) of us, our affiliate or the Business Manager. Under the RSP, on the date of the 2022 annual stockholders’ meeting, each director received an award of restricted shares of common stock or restricted share units in each case having a fair market value as of the date of grant equal to $24,000. Restricted shares and restricted share units issued to independent directors pursuant to these grants vest over a three-year period following the respective date of grant in increments of 33-1/3% per annum, subject to their continued service as directors until each vesting date, and become fully vested earlier upon a liquidity event or upon the termination of a director by reason of his or her death or disability. The total number of common shares granted under the RSP may not exceed 5.0% of our outstanding shares on a fully diluted basis at any time (as such number may be adjusted to reflect any increase or decrease in the number of outstanding shares resulting from a stock split, stock dividend, reverse stock split or similar change in our capitalization).

Other restricted share awards entitle the recipient to receive shares of common stock from us under terms that provide for vesting over a specified period of time or upon attainment of pre-established performance objectives. These awards would typically be forfeited with respect to the unvested shares upon the termination of the recipient’s employment or service as a director for any reason other than death or disability or, if applicable, the termination of the business management agreement with the Business Manager. Restricted shares may not, in general, be sold or otherwise transferred until restrictions are removed and the shares have vested. Holders of restricted shares have the right to vote such shares and may receive distributions prior to the time that the restrictions on the restricted shares have lapsed. As of December 31, 2022, there were 9,172 unvested restricted shares outstanding under the RSP.

The following table sets forth information regarding securities authorized for issuance under the RSP as of December 31, 2022.

| | | | | | | | | | | | |

Plan Category | | Number of Securities to

be Issued Upon Exercise

of Outstanding

Options, Warrants

and Rights | | | Weighted Average

Exercise Price of

Outstanding

Options, Warrants

and Rights | | | Number of Securities Remaining Available

for Future Issuance Under Equity

Compensation Plans (Excluding Securities

Reflected in Column (a)) | |

| | (a) | | | (b) | | | (c) | |

Equity Compensation Plans

approved by security holders | | | — | | | | — | | | | 1,786,570 | |

Equity Compensation Plans not

approved by security holders | | | — | | | | — | | | | — | |

Total | | | — | | | | — | | | | 1,786,570 | |

Deferred Compensation Plan

The Director Plan permits us to provide deferred compensation arrangements to our independent directors and their beneficiaries. Under the Director Plan, independent directors may elect to defer the receipt of all or a portion of their cash and stock compensation. Eligible cash compensation that is deferred is credited to a book entry account established for each participant in an amount equal to the amount deferred, and restricted share units are issued under the RSP in lieu of all or a portion of stock compensation otherwise payable in restricted shares. A participant has a fully vested right to his cash deferral amounts, and the deferred share unit awards will vest on the same terms and schedule as the underlying eligible stock compensation would have otherwise been subject if granted in restricted shares. Unless otherwise determined by the board, while restricted share units are unvested, participants will be credited with dividend equivalents equal in value to those declared and paid on shares of Company common stock, on all restricted share units granted to them. These dividend equivalents will be regarded as having been reinvested in restricted share units, and will only be paid to the extent the underlying restricted share units vest. Payment of restricted share units will be made, to the extent vested, in shares of Company common stock, unless otherwise determined by the board. Except as otherwise determined by the board, account balances under the Director Plan will not be credited

12

with interest or any other credits, although the Company may permit an account to be credited with earnings with respect to restricted share units.

The Director Plan provides our board with the discretion to amend, suspend or terminate the Director Plan at any time, provided that any amendment, suspension or termination will not be made if it would substantially impair the rights of any participant under the Director Plan.

Meetings of the Board of Directors, Committees and Stockholders

During the year ended December 31, 2022, our board met 14 times, the audit committee met five times and the nominating and corporate governance committee met three times. Each of our directors attended 100% of the aggregate amount of the meetings of the board during the period for which he or she was a director, and any committee on which he or she served, in 2022. We encourage our directors to attend our annual meeting of stockholders, and in 2022, each director did so attend.

Committees of our Board of Directors

Audit Committee. Our board has formed a separately-designated standing audit committee, comprised of Ms. Henry and Messrs. Daniels, Davis and Michael, each of whom has been found by the board to be “independent” within the meaning of the applicable listing standards of the NYSE, which have been adopted by the Company in its Corporate Governance Guidelines as its standard for director independence. Ms. Henry serves as the chairperson of this committee, and our board has determined that Ms. Henry qualifies as an “audit committee financial expert” as defined by the SEC. Our audit committee held five meetings during the year ended December 31, 2022. The audit committee assists the board in fulfilling its oversight responsibility relating to, among other things: (1) the integrity of our financial statements; (2) our compliance with legal and regulatory requirements; (3) the qualifications and independence of our independent registered public accounting firm; and (4) the performance of our internal audit function and independent registered public accounting firm. The report of the committee is included in this proxy statement.

Our board has adopted a written charter under which the audit committee operates. A copy of the charter is available on our website at www.inland-investments.com/inland-income-trust under the “Corporate Governance” tab.

Nominating and Corporate Governance Committee. Our board has formed a nominating and corporate governance committee consisting of Ms. Henry and Messrs. Daniels, Davis and Michael, each of whom has been found to be “independent” within the meaning of the applicable listing standards of the NYSE by the board. Mr. Davis serves as the chair of this committee. Our nominating and corporate governance committee held three meetings during the year ended December 31, 2022. The nominating and corporate governance committee is responsible for, among other things: (1) identifying individuals qualified to serve on the board and the nominating and corporate governance committee and recommending to the board a slate of director nominees for election by the stockholders at the annual meeting; (2) periodically reevaluating any corporate governance policies and principles adopted by the board, including recommending any amendments thereto if appropriate; and (3) overseeing an annual evaluation of the board. The nominating and corporate governance committee is also responsible for considering director nominees submitted by stockholders.

The committee considers all qualified candidates identified by members of the committee, by other members of the board of directors, by the Business Manager and by stockholders. In recommending candidates for director positions, the committee takes into account many factors and evaluates each director candidate in light of, among other things, the candidate’s knowledge, experience, judgment and skills such as an understanding of the real estate industry or financial industry or accounting or financial management expertise. Other considerations include the candidate’s independence from conflict with the Company, the Business Manager and the Sponsor and the ability of the candidate to devote an appropriate amount of effort to board duties. The committee also focuses on persons who are actively engaged in their occupations or professions or are otherwise regularly involved in the business, professional or academic community. The committee considers diversity in its broadest sense, including persons diverse in geography, gender and ethnicity as well as representing diverse experiences, skills and backgrounds. The committee evaluates each individual candidate by considering all of these factors as a whole, favoring active deliberation rather than the use of rigid formulas to assign relative weights to these factors.

13

Our board has adopted a written charter under which the nominating and corporate governance committee operates. A copy of the charter is available on our website at www.inland-investments.com/inland-income-trust under the “Corporate Governance” tab.

Other Committees. Our board does not have a compensation committee or charter that governs the compensation process. Instead, the full board of directors performs the functions of a compensation committee, including reviewing and approving all forms of compensation for our independent directors that have been reviewed and recommended by our nominating and corporate governance committee. Our board does not believe that it requires a separate compensation committee at this time because we neither separately compensate our executive officers for their service as officers, nor do we reimburse either the Business Manager or our Real Estate Manager for any compensation paid to their employees who also serve as our executive officers. Our secretary is not considered an executive officer for purposes of these limits on reimbursement.

Communicating with Directors

Stockholders wishing to communicate with our board and the individual directors may send communications by letter, e-mail or telephone, in care of our corporate secretary, who will review and forward all correspondence to the appropriate person or persons for a response.

Our non-retaliation policy, also known as our “whistleblower” policy, prohibits us from retaliating or taking any adverse action against our employees (if we ever have employees), or the employees of the Business Manager or its affiliates, for raising a concern, including concerns about accounting, internal controls or auditing matters. These persons may raise their concerns by contacting our compliance officer, Cathleen M. Hrtanek, at (630) 218-8000. In addition, confidential complaints involving the Company’s accounting, auditing, and internal auditing controls and disclosure practices may be raised anonymously via email or mail as described in our non-retaliation policy. A complete copy of our non-retaliation policy may be found on our website at www.inland-investments.com/inland-income-trust under the “Corporate Governance” tab.

Anti-Hedging Policy

The insider trading policy of IREIC and its affiliated entities, including our Business Manager and Real Estate Manager, prohibits officers, directors and employees of these entities, including our executive officers, from engaging, without the prior written consent of the applicable employer, in hedging or monetization transactions such as zero-cost collars and forward sale contracts that allow a person to lock in a portion of the value of his or her shares in any Inland entity or any entity sponsored by or advised by IREIC or by any of its direct or indirect subsidiaries. This includes our securities such as shares of our common stock. Because there is no established public trading market for our common stock and we do not have any employees, the Company itself has not separately adopted any specific practices or policies regarding the ability of our directors, officers or employees to purchase financial instruments or otherwise engage in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our common stock or any other securities that we might issue.

Code of Ethics

Our board has adopted a code of ethics applicable to our directors, officers and employees (if we ever have employees) which is available on our website at www.inland-investments.com/inland-income-trust. In addition, printed copies of the code of ethics are available to any stockholder, without charge, by writing us at 2901 Butterfield Road, Oak Brook, Illinois 60523, Attention: Investor Services.

Any waivers of the provisions of the code of ethics for executive officers or directors may be granted only in exceptional circumstances by our board or a committee of our board. Any waivers will be promptly disclosed to the extent required by law. Any amendments to the code of ethics must also be approved by our board. If we make any substantive amendments to the code of ethics or grant any waiver, including any implicit waiver, from a provision of the code of ethics to our chief executive officer, chief financial officer, chief accounting officer or controller or persons performing similar functions, we may, rather than filing a Current Report on Form 8-K, satisfy the disclosure requirement by posting such information on our website as necessary.

14

EXECUTIVE COMPENSATION

Executive Officers

The board of directors annually elects our executive officers. These officers may be terminated at any time. Information about each of our executive officers, with the exception of Mr. Sabshon, whose biography is included above, follows. All ages are stated as of January 1, 2023.

Catherine L. Lynch, 64. Our chief financial officer since April 2014 and treasurer since April 2018, and a director of the Business Manager since August 2011. Ms. Lynch joined Inland in 1989 and has been a director of The Inland Group LLC since June 2012. She serves as the treasurer and secretary (since January 1995), the chief financial officer (since January 2011) and a director (since April 2011) of IREIC and as a director (since July 2000) and chief financial officer and secretary (since June 1995) of Inland Securities. She also served as the chief financial officer of IRPT and the IRPT business manager from December 2013 until October 2019. She also served as the treasurer of the IRPT business manager from December 2013 to October 2014. Ms. Lynch also serves as the chief financial officer and treasurer (since October 2016) of InPoint and as the chief financial officer and treasurer of the InPoint advisor (since August 2016). Ms. Lynch also has served as a director of IPCC since May 2012. Ms. Lynch served as the treasurer of Inland Capital Markets Group, Inc. from January 2008 until October 2010, as a director and treasurer of Inland Investment Advisors, LLC from June 1995 to December 2014 and as a director and treasurer of Inland Institutional Capital, LLC from May 2006 to December 2014. Ms. Lynch worked for KPMG Peat Marwick LLP from 1980 to 1989. Ms. Lynch received her bachelor degree in accounting from Illinois State University in Normal. Ms. Lynch is a member of the Illinois CPA Society. Ms. Lynch also is registered with the Financial Industry Regulatory Authority, Inc. (“FINRA”) as a financial operations principal.

Daniel Zatloukal, 43. Our senior vice president since December 2021, Mr. Zatloukal also serves as executive vice president and head of asset and portfolio management for all investment programs sponsored by IREIC, positions he has held since 2015. He also serves as senior vice president of IPCC, an affiliate of IREIC, a position he has held since 2014. As of December 31, 2021, IPCC has sponsored 287 private placement programs and has approximately $10.6 billion in assets under management. Mr. Zatloukal was president of Inland Investment Real Estate Services, Inc. from October 2015 through June 2017 and was responsible for overseeing all of IREIC’s real estate services group, which includes property management, leasing and asset management for commercial and residential portfolios owned or managed by IREIC and its affiliates. Mr. Zatloukal received his bachelor’s degree in finance from the University of Illinois at Urbana-Champaign.

Judith Fu, 62. Our vice president of administration since December 2021, and the vice president of the Business Manager since January 2022. Ms. Fu joined the Company in 2005 and currently also serves as a vice president of IREIC, a position she has held since August 2018. As chief of staff of IREIC, Ms. Fu provides organizational support to the executive management team of IREIC Ms. Fu also served as chief compliance officer for the registered investment advisor subsidiaries of Inland Mortgage Corporation from August 2008 to August 2010. In 2010, Ms. Fu began working for IREIC as the executive assistant to its then chief executive officer. While holding this position, she also acted as the chief compliance officer for Inland Institutional Capital Partners from March 2012 to September 2014. Ms. Fu holds FINRA Series 24, 63, 65 and 7 licenses and previously was a licensed managing real estate broker in the State of Illinois. Ms. Fu has a bachelor’s of science degree from Loyola University Chicago.

Cathleen M. Hrtanek, 46. Our corporate secretary and compliance officer, and the secretary of the Business Manager, since August 2011. Ms. Hrtanek joined the Company in 2005 and is currently assistant general counsel and senior vice president of The Inland Real Estate Group, LLC. In her capacity as assistant general counsel, Ms. Hrtanek represents many of the entities that are part of The Inland Real Estate Group of Companies on a variety of legal matters. Ms. Hrtanek also has served as secretary of Inland Diversified Real Estate Trust, Inc. from September 2008 through July 2014 and its business manager from September 2008 through March 2016, secretary of Inland Opportunity Business Manager & Advisor, Inc. since April 2009, secretary of IPCC from August 2009 to May 2017, secretary of IRPT from December 2013 to December 2019 and its business manager since December 2013, secretary of InPoint and as the secretary of InPoint Advisor, since March 2022 and August 2016, respectively, secretary of Inland Venture Partners, LLC since November 2018, secretary of MH Ventures Fund II, Inc. and its business manager since September 2020 and senior vice president – legal and secretary of IVP Milwaukee Manager, LLC since October

15

2022. Prior to joining the Company, Ms. Hrtanek was employed by Wildman Harrold Allen & Dixon LLP in Chicago, Illinois from September 2001 until 2005. Ms. Hrtanek has been admitted to practice law in the State of Illinois. Ms. Hrtanek received her bachelor degree from the University of Notre Dame in South Bend, Indiana and her law degree from Loyola University Chicago School of Law.

Compensation of Executive Officers

All of our executive officers are officers of IREIC or one or more of its affiliates and are compensated by those entities, in part, for services rendered to us. We neither compensate our executive officers nor reimburse either the Business Manager or Real Estate Manager for any compensation paid to individuals who also serve as our executive officers, or the executive officers of the Business Manager, our Real Estate Manager or their respective affiliates; provided that, for these purposes, our corporate secretary is not considered an “executive officer.” As a result, we do not have, and our board of directors has not considered, a compensation policy or program for our executive officers and has not included a “Compensation Discussion and Analysis,” a report from our board of directors with respect to executive compensation, a non-binding stockholder advisory vote on compensation of executives, a non-binding stockholder advisory vote on the frequency of the stockholder vote on executive compensation or the pay ratio between employees and our principal executive officer. The fees we pay to the Business Manager and Real Estate Manager under the business management agreement or the real estate management agreement, respectively, are described in more detail under “Certain Relationships and Related Transactions.”

In the future, our board may decide to pay annual compensation or bonuses or long-term compensation awards to one or more persons for services as officers. We also may, from time to time, grant restricted shares of our common stock to one or more of our officers. If we decide to pay our named executive officers in the future, the board of directors, or a committee thereof, will review all forms of compensation and approve all stock option grants, warrants, stock appreciation rights and other current or deferred compensation payable to the executive officers with respect to the current or future value of our shares.

Certain Relationships and Related Transactions

Set forth below is a summary of the material transactions between the Company and various affiliates of IREIC, including the Business Manager and Real Estate Manager, that have occurred since January 1, 2022, or are currently proposed.. IREIC is an indirect wholly-owned subsidiary of The Inland Group LLC. Please see the biographical information of our directors and executive officers elsewhere in this proxy statement for information regarding their relationships to Inland, including IREIC and The Inland Group LLC.

Business Management Agreement through March 31, 2023

We have entered into a business management agreement with IREIT Business Manager & Advisor Inc., which serves as the Business Manager with responsibility for overseeing and managing our day-to-day operations. The terms and conditions of the agreement described in this section, the Second Amended and Restated Business Management Agreement dated October 15, 2021 (the “Second Business Management Agreement”), were effective until April 1, 2023, whereupon a Third Amended and Restated Business Management Agreement entered into on March 23, 2023, took effect and resulted in some changes to the Second Business Management Agreement. For details regarding certain differences between these two agreements, including changes to certain terms and conditions in the Second Amended and Restated Business Management Agreement, please see the description of those changes in the section immediately below. To see the Third Amended and Restated Business Management Agreement in its entirety, please see the copy of this agreement filed as exhibit 10.25 to our Annual Report. Subject to satisfying the criteria described below, we paid the Business Manager an annual business management fee equal to 0.65% of our “average invested assets,” payable quarterly in an amount equal to 0.1625% of our average invested assets as of the last day of the immediately preceding quarter; provided that the Business Manager may decide, in its sole discretion, to be paid an amount less than the total amount to which it is entitled in any particular quarter, and the excess amount that is not paid may, in the Business Manager’s sole discretion, be waived permanently or deferred or accrued, without interest, to be paid at a later point in time. For the year ended December 31, 2022, the Business Manager was entitled to a business management fee of approximately $10.2 million. For the three months ended March 31, 2023, the Business

16

Manager was entitled to a business management fee of approximately $2.7 million, none of which remained unpaid as of June 30, 2023.

As used herein, “average invested assets” means, for any period, the average of the aggregate book value of our assets, including all intangibles and goodwill, invested, directly or indirectly, in equity interests in, and loans secured by, properties, as well as amounts invested in securities and consolidated and unconsolidated joint ventures or other partnerships, before reserves for amortization and depreciation or bad debts, impairments or other similar non-cash reserves, computed by taking the average of these values at the end of each month during the relevant calendar quarter.

If the business management agreement had been terminated, including in connection with the internalization of the functions performed by the Business Manager, the obligation to pay this business management fee would have terminated.

Upon a “triggering event,” we will pay the Business Manager a subordinated incentive fee equal to 10% of the amount by which (1) the “liquidity amount” (as defined below) exceeds (2) the “aggregate invested capital,” plus the total distributions required to be paid to our stockholders in order to pay them a 7% per annum cumulative, pre-tax non-compounded return on the aggregate invested capital, all measured as of the triggering event. If we have not satisfied this return threshold at the time of the applicable triggering event, the fee will be paid at the time of any future triggering event, provided that we have satisfied the return requirements. We did not experience a “triggering event,” and thus did not incur a subordinated incentive fee, during the year ended December 31, 2022, or the six-month period ended June 30, 2023.

As used herein, a “triggering event” means any sale of assets (excluding the sale of marketable securities) in which the net sales proceeds are specifically identified and distributed to our stockholders, or any liquidity event, such as a listing or any merger, reorganization, business combination, share exchange or acquisition, in which our stockholders receive cash or the securities of another issuer that are listed on a national securities exchange. “Aggregate invested capital” means the aggregate original issue price paid for the shares of our common stock, before reduction for organization and offering expenses, reduced by any distribution of sale or financing proceeds.

For purposes of this subordinated incentive fee, the “liquidity amount” will be calculated as follows:

•In the case of the sale of our assets, the net sales proceeds realized by us from the sale of assets since inception and distributed to stockholders, in the aggregate, plus the total amount of any other distributions paid by us from inception until the date that the liquidity amount is determined.