UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. ____)

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under Section 240.14a-12 |

Inland Real Estate Income Trust, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

☒ | No fee required |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

INLAND REAL ESTATE INCOME TRUST, INC.

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

AND

PROXY STATEMENT

| |

Date: | November 2, 2021 |

Time: | 10:00 a.m. central time |

Place: | 2901 Butterfield Road |

| Oak Brook, Illinois 60523 |

Inland Real Estate Income Trust, Inc.

2901 Butterfield Road

Oak Brook, Illinois 60523

(800) 826-8228

Notice of Annual Meeting of Stockholders

to be held November 2, 2021

Dear Stockholder:

Our annual stockholders’ meeting will be held on November 2 2021, at 10:00 a.m. central time, at our principal executive offices located at 2901 Butterfield Road in Oak Brook, Illinois 60523. At our annual meeting, we will ask you to consider and vote upon:

| 1. | a proposal to elect six directors; |

| 2. | a proposal to ratify the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021; |

| 3. | a proposal to amend our charter to remove or revise provisions that relate to the terms and rights of our classes and series of stock, including our common stock, and to offerings of our stock; |

| 4. | a proposal to amend our charter to remove or revise, as applicable, provisions that relate to stockholder meetings; |

| 5. | a proposal to amend our charter to remove or revise provisions that relate to stockholder information rights; |

| 6. | a proposal to amend our charter to remove or revise those provisions that relate to the qualifications, number, election, removal and service of our directors; |

| 7. | a proposal to amend our charter to remove or revise those provisions that relate to the conduct of our board of directors and our business manager; |

| 8. | a proposal to amend our charter to remove or revise those provisions that limit or regulate how the Company operates and the process by which it engages in transactions; |

| 9. | a proposal to amend our charter to revise or add provisions restricting transfer and ownership of shares; |

| 10. | a proposal to amend our charter to remove provisions governing transactions with our business manager and its affiliates; |

| 11. | a proposal to amend our charter to remove or revise provisions relating to amendments of the charter and entering into extraordinary transactions; |

| 12. | a proposal to amend our charter to revise certain provisions that govern our ability to indemnify our officers, directors and business manager, among others; |

| 13. | a proposal to amend our charter to make conforming changes and other ministerial modifications to and to restate our charter; and |

| 14. | any other business that may be properly presented at the annual meeting and any postponement or adjournment thereof. |

If you were a stockholder of record at the close of business on August 5, 2021, you may vote at the annual meeting and any postponements or adjournments of the meeting. We may mail a printed copy of our proxy materials to a stockholder or we may use the “Notice and Access” method of providing proxy materials to a stockholder via the Internet. The Notice and Access method provides stockholders with a convenient and quick way to access the proxy materials and vote, while lowering our costs and reducing the environmental impact of our meeting. On or about August 18, 2021, we expect to begin mailing to each stockholder a full paper set of proxy materials, but we may choose to mail a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) to some stockholders. In any case, we will post a copy of our proxy materials on the website referenced in our proxy statement and in any Notice of Internet Availability, and the proxy materials available on that website may be accessed by any stockholder. As will be more fully described in any Notice of Internet Availability, stockholders who receive a Notice of Internet Availability may choose to access our proxy materials on the website or they may request to receive a printed set of our proxy materials.

Whether or not you plan to attend the meeting and vote in person, we urge you to have your vote recorded as early as possible. Stockholders have the following three options for submitting their votes by proxy: (1) via the Internet; (2) by telephone; or (3) by mail, if a paper proxy card has been provided to you.

Your vote is very important! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes.

By order of the Board of Directors,

Cathleen M. Hrtanek

Secretary

August 18, 2021

2

Table of Contents

i

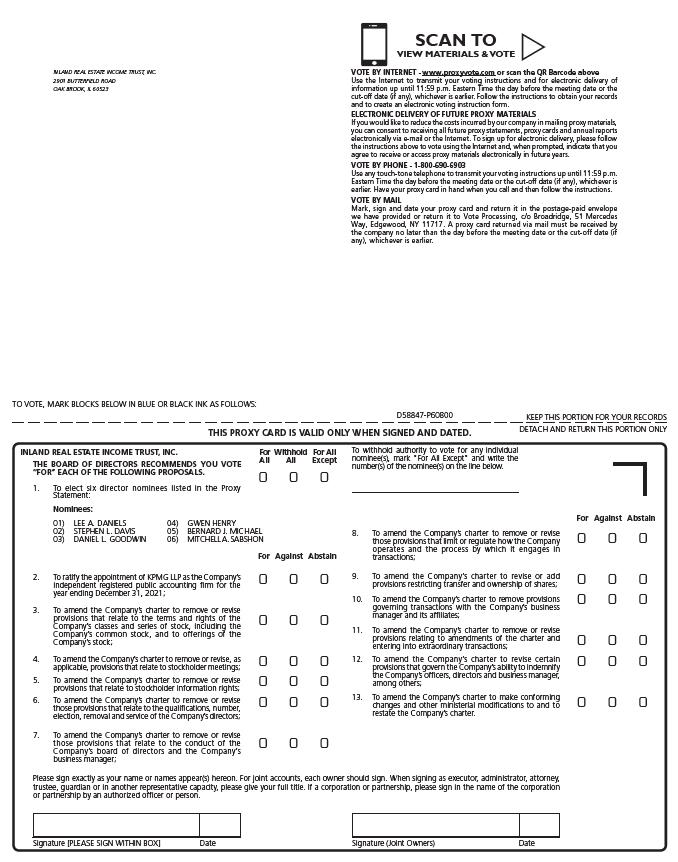

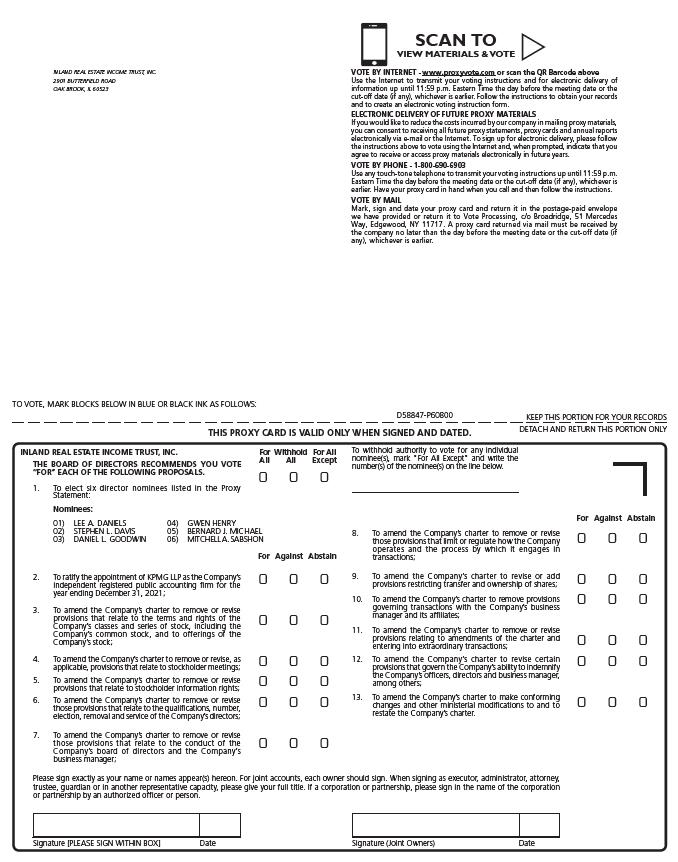

PROXY CARD

Exhibit A-I: Proposed Amended and Restated Charter

Exhibit A-II: Proposed Amended and Restated Charter – Marked to Show Changes Against THE Current Charter

ii

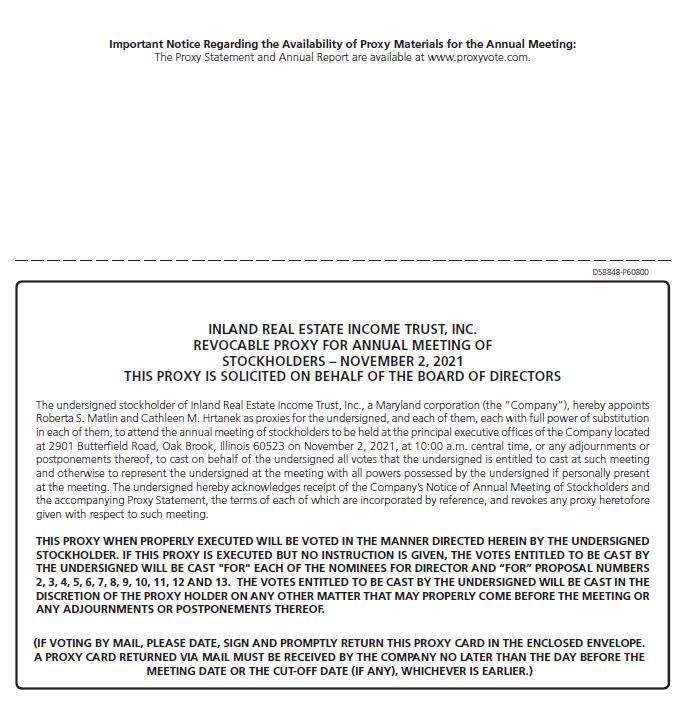

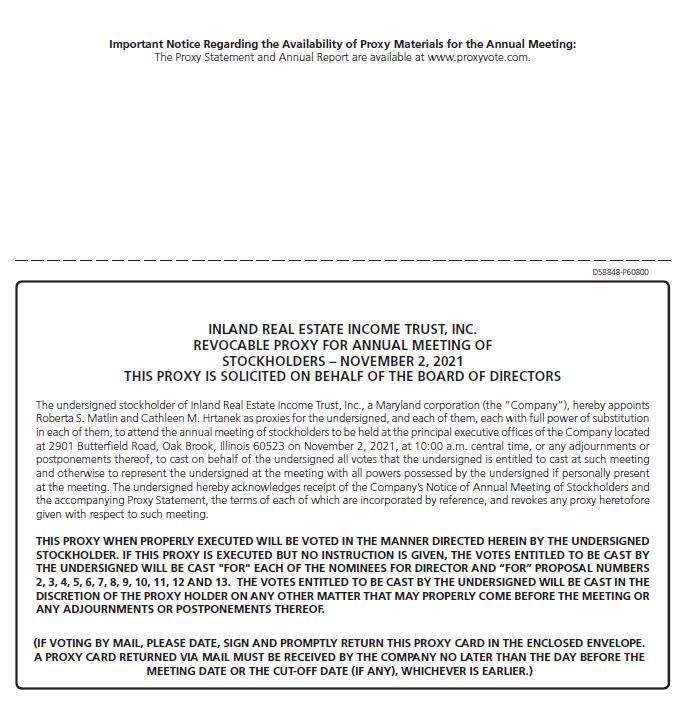

This proxy statement contains information related to the annual meeting of stockholders to be held November 2, 2021, beginning at 10:00 a.m. central time, at our principal executive offices located at 2901 Butterfield Road, Oak Brook, Illinois 60523, and at any postponements or adjournments thereof.

INFORMATION ABOUT THE ANNUAL MEETING

The board of directors of Inland Real Estate Income Trust, Inc. (referred to herein as the “Company,” “we,” “our” or “us”), a Maryland corporation, is soliciting your vote for the 2021 annual meeting of stockholders. At the meeting, you will be asked to consider and vote upon:

| 1. | a proposal to elect six directors; |

| 2. | a proposal to ratify the selection of KPMG LLP (sometimes referred to herein as “KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2021; |

| 3. | a proposal to amend our charter to remove or revise provisions that relate to the terms and rights of our classes and series of stock, including our common stock, and to offerings of our stock; |

| 4. | a proposal to amend our charter to remove or revise, as applicable, provisions that relate to stockholder meetings; |

| 5. | a proposal to amend our charter to remove or revise provisions that relate to stockholder information rights; |

| 6. | a proposal to amend our charter to remove or revise those provisions that relate to the qualifications, number, election, removal and service of our directors; |

| 7. | a proposal to amend our charter to remove or revise those provisions that relate to the conduct of our board of directors and our business manager; |

| 8. | a proposal to amend our charter to remove or revise those provisions that limit or regulate how the Company operates and the process by which it engages in transactions; |

| 9. | a proposal to amend our charter to revise or add provisions restricting transfer and ownership of shares; |

| 10. | a proposal to amend our charter to remove provisions governing transactions with our business manager and its affiliates; |

| 11. | a proposal to amend our charter to remove or revise provisions relating to amendments of the charter and entering into extraordinary transactions; |

| 12. | a proposal to amend our charter to revise certain provisions that govern our ability to indemnify our officers, directors and business manager, among others; |

1

| 13. | a proposal to amend our charter to make conforming changes and other ministerial modifications to and to restate our charter; and |

| 14. | any other business that may be properly presented at the annual meeting and any postponement or adjournment thereof. |

The board of directors recommends that you vote “FOR” each proposal.

Important Notice Regarding the Availability of Proxy Materials

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on November 2, 2021. This proxy statement and our 2020 annual report to stockholders, including our Annual Report on Form 10-K for the year ended December 31, 2020, are available at www.proxyvote.com. We may use the Securities and Exchange Commission (the “SEC”) notice and access rule that allows us to furnish our proxy materials over the Internet to our stockholders instead of mailing paper copies of those materials to each stockholder. This allows us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our annual meeting. On or about August 18, 2021, we will begin mailing to our stockholders either (i) a full paper set of our proxy materials or (ii) a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) containing instructions on how to access our proxy materials over the Internet and authorize your proxy online. The Notice of Internet Availability is not a proxy and cannot be marked or submitted to vote your shares. If you own shares of common stock in more than one account, such as individually and jointly with your spouse, you may have received more than one Notice of Internet Availability or full paper set of proxy materials. Please make sure to vote all of your shares.

If you only receive a Notice of Internet Availability, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the Notice of Internet Availability or on the website referred to on the Notice of Internet Availability. Paper copies of our Annual Report on Form 10-K for the year ended December 31, 2020 will also be furnished to you, without charge, by writing us at 2901 Butterfield Road, Oak Brook, Illinois 60523, Attention: Investor Services. If requested by stockholders, we also will provide copies of exhibits to our Annual Report on Form 10-K for the year ended December 31, 2020 for a reasonable fee.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read any reports, statements and other information we file with the SEC on the website maintained by the SEC at www.sec.gov.

Information About Attending the Annual Meeting

We welcome your attendance at the annual meeting of stockholders. If you plan on attending the meeting, please contact Ms. Roberta S. Matlin, our vice president, at (800) 826-8228, so that we can arrange for sufficient space to accommodate all attendees.

2

Information About Voting

Holders of our common stock at the close of business on August 5, 2021 (the “Record Date”) are entitled to receive notice of and to vote their shares at the annual meeting. As of the Record Date, there were 36,133,590 shares of our common stock outstanding (rounded up to the nearest whole share). Each share of common stock is entitled to one vote on each matter properly brought before the meeting.

Your vote is needed to ensure that the proposals can be acted upon. Your vote is very important, even if you own a small number of shares. Your immediate response will help avoid potential delays and may save the Company significant additional expense associated with soliciting stockholder votes.

You may vote in person or by granting us a proxy to vote on the proposals. You may authorize a proxy in any of the following ways:

| • | via the Internet, by following the instructions and using the control number or QR barcode provided on the proxy card or the Notice of Internet Availability provided to you; |

| • | via telephone, by calling (800) 690-6903 and following the instructions provided on the proxy card provided to you; or |

| • | via mail, if you received a printed set of proxy materials, by completing, signing, dating and returning the paper proxy card provided to you in the envelope enclosed therewith, if it is received by us no later than November 1, 2021. |

You can authorize a proxy via the Internet or by telephone at any time prior to 11:59 p.m., Eastern Time, on November 1, 2021, the day before the annual meeting.

If you return your proxy card but do not indicate how your shares should be voted, they will be voted “FOR” each proposal in accordance with the board’s recommendation.

If you grant us a proxy, you may nevertheless revoke your proxy at any time before it is exercised by: (1) sending written notice to us, Attention: Ms. Roberta S. Matlin, vice president, if the notice is received by us no later than November 1, 2021; (2) providing us with a later-dated proxy received by us no later than November 1, 2021; or (3) attending the annual meeting in person and voting your shares. Merely attending the annual meeting, without further action, will not revoke your proxy.

Information Regarding Tabulation of the Vote

We have hired Broadridge Investor Communication Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717 (“Broadridge ICS”), to solicit proxies on our behalf. In addition, Broadridge ICS will tabulate all votes cast at the annual meeting and will act as the inspector of election.

3

Quorum Requirement

The presence, in person or by proxy, of stockholders holding 50% or more of the shares of our common stock outstanding is necessary to constitute a “quorum.” There must be a quorum represented in order for the stockholders to take action at the annual meeting. If you submit a properly executed proxy card, even if you abstain from voting or do not give instructions for voting, then your shares will be considered present for purposes of establishing a quorum.

Information About Vote Necessary for Action to be Taken

Proposal No. 1. With regard to the election of directors, you may vote “FOR ALL” of the nominees, you may withhold your vote for all of the nominees by voting “WITHHOLD ALL,” or you may vote for all of the nominees except for certain nominee(s) by voting “FOR ALL” and striking a line through that nominee(s’) name(s) or number(s) on the proxy card or voting if electronically making individual selections. The affirmative vote of a majority of the shares of common stock present in person or by proxy at the annual meeting, assuming a quorum is represented, is required to elect each nominee for director. Withheld votes will be counted for purposes of establishing a quorum and will have the effect of a vote against each nominee for director for which authority is withheld. Broker non-votes (discussed below) will be counted for purposes of establishing a quorum and will have the effect of a vote against each nominee for director.

Proposal No. 2. With regard to the proposal relating to the ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021, you may vote “FOR” or “AGAINST” the proposal, or you may “ABSTAIN” from voting on the proposal. A majority of the votes cast at the annual meeting, assuming a quorum is represented, is required to ratify the selection of KPMG as our independent registered public accounting firm for the fiscal year ending December 31, 2021. Abstentions will not be counted as votes cast; however, a properly executed proxy card marked “ABSTAIN” will be counted for purposes of establishing a quorum. Because brokers are entitled to vote on Proposal No. 2, we do not anticipate any broker non-votes with regard to Proposal No. 2.

Proposal Nos. 3 through 13. With regard to proposal numbers 3 through 13, relating to the amendment and restatement of our charter, you may vote “FOR” or “AGAINST” each proposal, or you may “ABSTAIN” from voting on one or more of these proposals. Each of the proposals numbered 3 through 13 requires the affirmative vote (in other words, a vote “FOR” the proposal) of the stockholders entitled to cast a majority of all the votes entitled to be cast, which means that an abstention or failure to vote will have the effect of a vote “AGAINST” the proposal. In addition, approval of each of the proposals numbered 3 through 13 is conditioned on the approval of all of the other proposals numbered 3 through 13. An abstention, a failure to vote or a vote “AGAINST” one of the proposals numbered 3 through 13 will, if the proposal is not approved, have the effect of a vote “AGAINST” all of the other proposed amendments to our charter.

Our board of directors (including all of the independent directors) unanimously approved each of the proposals at its meeting on July 22, 2021, and recommends that you vote “FOR” each of them.

4

Broker Non-Votes

A “broker non-vote” occurs when a broker holding stock on behalf of a beneficial owner submits a proxy but does not vote on a particular proposal because the broker does not have discretionary power with respect to that particular proposal and has not received instructions from the beneficial owner. The ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021, is the only proposal for our stockholders’ consideration at the annual meeting on which brokers have discretionary voting power. Thus, beneficial owners of shares of common stock held in broker accounts are advised that, if they do not timely provide instructions to their broker, their shares will not be voted in connection with any of the proposals at the annual meeting other than Proposal No. 2, ratification of KPMG LLP.

Costs of Proxies

The Company will bear all costs and expenses incurred in connection with soliciting proxies. Our directors and executive officers, as well as certain employees of our business manager, IREIT Business Manager & Advisor, Inc. (sometimes referred to herein as the “Business Manager”), also may solicit proxies by mail, personal contact, letter, telephone, facsimile or other electronic means. These individuals will not receive any additional compensation for these activities, but may be reimbursed by us for their reasonable out-of-pocket expenses. In addition, the Company has hired Broadridge ICS to solicit proxies on its behalf. We expect to pay Broadridge ICS aggregate fees, costs and expenses of approximately $256,000 for soliciting proxies.

Other Matters

We are not aware of any other matter to be presented at the annual meeting. Generally, no business aside from the items discussed in this proxy statement may be transacted at the meeting. If, however, any other matter properly comes before the annual meeting as determined by the chairman of the meeting, your proxies are authorized to act on the proposal at their discretion.

5

STOCK OWNERSHIP

Stock Owned by Certain Beneficial Owners and Management

Based on a review of filings with the SEC, the following table reflects the amount of common stock beneficially owned (unless otherwise indicated) by (1) persons that beneficially own more than 5% of the outstanding shares of our common stock; (2) our directors and each nominee for director; (3) our executive officers; and (4) our directors and executive officers as a group. All information is as of June 30, 2021.

Name and Address of Beneficial Owner(1) | | Amount and Nature of Beneficial Ownership(2) | | | Percent of Class |

Daniel L. Goodwin, Director and Chairman of the Board(3) | | | 288,813 | | | * |

Lee A. Daniels, Lead Independent Director(4) | | | 5,431 | | | * |

Stephen L. Davis, Independent Director(5) | | | 4,243 | | | * |

Gwen Henry, Independent Director(6) | | | 4,150 | | | * |

Bernard J. Michael, Independent Director(7) | | | 3,699 | | | * |

Mitchell A. Sabshon, Director, President and Chief Executive Officer(8) | | | 2,654 | | | * |

Catherine L. Lynch, Chief Financial Officer(9) | | | 886 | | | * |

Roberta S. Matlin, Vice President(10) | | | 503 | | | * |

Cathleen M. Hrtanek, Secretary(11) | | | 222 | | | * |

All officers and directors as a group (9 persons) | | | 310,600 | | | * |

____________ | | | | | | |

* Less than 1%

(1) The business address of each person listed in the table is c/o Inland Real Estate Income Trust, Inc., 2901 Butterfield Road, Oak Brook, Illinois 60523.

(2) All fractional ownership amounts have been rounded to the nearest whole number.

(3) Mr. Goodwin shares voting and dispositive power with his wife over 5,556 shares. Mr. Goodwin’s beneficial ownership includes 134,788 shares owned by the Goodwin 2012 Descendants Trust, 17,140 shares owned by a 2012 Gift Trust, 34,440 shares owned by another 2012 Gift Trust and 96,889 shares owned by Inland Real Estate Investment Corporation. Mr. Goodwin’s wife, as trustee, has sole voting and investment power over the shares owned by the Goodwin 2012 Descendants Trust. Mr. Goodwin controls the voting and disposition decisions with respect to the shares owned by the two 2012 Gift Trusts and Inland Real Estate Investment Corporation.

(4) Includes 735 unvested restricted shares. Does not include 249 restricted share units granted to Mr. Daniels, which will be settled in future periods pursuant to their terms. Each restricted share unit represents the right to receive one share of common stock and an amount equal to the cash value of the dividends that would have been paid to Mr. Daniels if one share of common stock had been issued on the grant date for each restricted share unit granted to Mr. Daniels under the award, but does not confer current dispositive or voting control of any shares of common stock. Mr. Daniels has sole voting and investment power over all of the shares that he beneficially owns..

(5) Includes 983 unvested restricted shares. Mr. Davis has sole voting and investment power over all of the shares that he beneficially owns.

(6) Includes 983 unvested restricted shares. Ms. Henry shares voting and dispositive power with her husband over all of the shares that they own.

(7) Includes 983 unvested restricted shares. Mr. Michael has sole voting and investment power over all of the shares that he beneficially owns.

(8) Mr. Sabshon has sole voting and investment power over all of the shares that he beneficially owns.

(9) Ms. Lynch shares voting and dispositive power with her husband over all of the shares that they own.

(10) Ms. Matlin has sole voting and investment power over all of the shares that she beneficially owns.

(11) Ms. Hrtanek has sole voting and investment power over all of the shares that she beneficially owns.

Interest of Certain Persons in Matters to Be Acted On

The Company’s Chairman has direct and indirect ownership interests in the Business Manager and its parent entities and affiliates, including our sponsor, Inland Real Estate Investment

6

Corporation (“IREIC” or the “Sponsor”), and its ultimate parent, The Inland Group, LLC, and our executive officers are variously officers, managers, directors and employees of certain of these affiliated entities. See “Certain Relationships and Related Transactions.” If stockholders approve the amendments to our Charter, and the Proposed Amended and Restated Charter (as defined below under “Introductory Note – Proposal Numbers 3 through 13”) becomes effective, the possibility will exist for future amendments to our Business Management Agreement and other transactions and agreements with entities affiliated with our Sponsor that would not have been permitted under the Charter currently in effect unless approved by a majority of our independent directors, including amendments to the fees, term and termination provisions of the Business Management Agreement.

Also, if stockholders approve the amendments to our Charter, and the Proposed Amended and Restated Charter becomes effective, our directors and officers will no longer be subject to limitations on exculpation and indemnification, as well as limitations on advancements to directors and officers for legal and other expenses and costs, in excess of the Maryland General Corporation Law (the “MGCL”).

7

CORPORATE GOVERNANCE PRINCIPLES

Independence

Our business is managed under the direction and oversight of our board. The members of our board are Lee A. Daniels, Stephen L. Davis, Daniel L. Goodwin, Gwen Henry, Bernard J. Michael and Mitchell A. Sabshon. As required by our charter, a majority of our directors must be “independent.” As defined by our charter, an “independent director” is a director who is not, and within the last two years has not been, directly or indirectly associated with our sponsor, Inland Real Estate Investment Corporation (“IREIC” or the “Sponsor”), or the Business Manager by virtue of (1) an ownership of an interest in the Sponsor, Business Manager or any of their affiliates, (2) employment by the Sponsor, Business Manager or any of their affiliates, (3) service as an officer or director of the Sponsor, Business Manager or any of their affiliates, (4) performance of services, other than as a director, for the Company, (5) service as a director or trustee of more than three REITs sponsored by the Sponsor or managed by the Business Manager, or (6) a material business or professional relationship with the Sponsor, Business Manager or any of their affiliates. For purposes of this definition, an indirect affiliation includes circumstances in which a director’s spouse, parents, children, siblings, mothers- or fathers-in-law, sons- or daughters-in-law or brothers- or sisters-in-law have any of the relationships identified in the immediately preceding sentence of this definition with the Company, the Sponsor, the Business Manager or any of their affiliates during the applicable two year period. For purposes of determining whether or not the business or professional relationship is material, the aggregate gross revenue derived by the person from the Company, the Sponsor, the Business Manager and their affiliates will be deemed material per se if it exceeds five percent (5.0%) of the person’s: (i) annual gross revenue, derived from all sources, during either of the prior two years; or (ii) net worth, on a fair market value basis, during the prior two years. The definition of ”independent director” may be found on our website at www.inland-investments.com/inland-income-trust under the “Corporate Governance” tab.

Although our shares are not listed for trading on any national securities exchange, our board has evaluated the independence of our board members according to the director independence standard of the New York Stock Exchange (“NYSE”). The NYSE standards provide that to qualify as an independent director, among other things, the board of directors must affirmatively determine that the director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company).

After reviewing any relevant transactions or relationships between each director, or any of his or her family members, and the Company, our management and our independent registered public accounting firm, and considering each director’s direct and indirect association with IREIC, the Business Manager or any of their affiliates, the board has determined that Messrs. Daniels, Davis and Michael and Ms. Henry qualify as independent directors.

The board considered the relationship between AWH Partners, LLC and Inland Private Capital Corporation (IPC), an affiliate of IREIC, and Mr. Michael’s interest in AWH and its affiliated hotel management company. In December 2019, AWH and its affiliates completed a transaction pursuant to which an affiliate of AWH agreed to manage a DoubleTree Hotel in downtown Nashville, Tennessee, owned by third-party investors and controlled by an affiliate of IPC, and to provide disposition and construction management services in exchange for negotiated

8

fees customary in the industry. An affiliate of AWH also made a minority equity investment in the hotel. Mr. Michael has only an indirect interest in this transaction through his minority ownership of AWH and its affiliated management company and is not expected to participate directly in the management of the hotel or AWH’s investment in it. AWH and IPC had also considered a possible similar arrangement with respect to three secondary market select-service hotels, and AWH may enter into similar hotel transactions with affiliates of IPC in the future. Given the small size of the Nashville transaction relative to the size of AWH, the size of Mr. Michael’s indirect financial interest and lack of a direct management role, and the fact that the nature and size of future transactions between AWH and IPC, if any, are uncertain and unknown, the board concluded that Mr. Michael has no material relationship with IPC or IREIC and continues to be an independent director of the Company.

Board Leadership Structure and Risk Oversight

We have separated the roles of the president and chairman of the board in recognition of the differences between the two roles. Mr. Sabshon, in his role as both our president and chief executive officer and the president and chief executive officer of the Business Manager, is responsible for setting the strategic direction for the Company and for providing the day-to-day leadership of the Company. Mr. Goodwin, as chairman of the board, organizes the work of the board and ensures that the board has access to sufficient information to carry out its functions. Mr. Goodwin presides over meetings of the board of directors and stockholders, establishes the agenda for each meeting and oversees the distribution of information to directors.

Lee A. Daniels currently serves as our Lead Independent Director. Although each board member is kept apprised of our business and developments impacting our business, our board determined to designate a Lead Independent Director to coordinate the activities of the independent directors and serve as the principal liaison between the independent directors and the chairman of the board.

The Lead Independent Director presides at meetings when the chairman of the board is absent; establishes board meeting agendas in collaboration with the chairman of the board and the various committee chairs and recommends matters for the board and committees to consider; advises the chairman of the board as to the quality, quantity and timeliness of the information submitted to the directors that is appropriate for the directors to effectively perform their duties and approves the information submitted to them; calls meetings of the independent directors or calls for executive sessions during board meetings; and presides at meetings of the independent directors or executive sessions of the board. The Lead Independent Director also performs such other responsibilities as the board may determine.

Our board believes that its Lead Independent Director structure, including the duties and responsibilities described above, provides the same independent leadership, oversight, and benefits for the Company and the board that would be provided by an independent chairman of the board. Our full board of directors, including our independent directors, is responsible for approving all material transactions, and each transaction between us and the Business Manager or its affiliates must be approved by the affirmative vote of a majority of our directors, including a majority of our independent directors, not otherwise interested in the transaction. In addition, each board member is kept apprised of our business and developments impacting our business and has

9

complete and open access to the members of our management team, the Business Manager and our real estate manager, Inland Commercial Real Estate Services LLC (our “Real Estate Manager”).

Our board is actively involved in overseeing risk management for the Company. Our board of directors oversees risk through: (1) its review and discussion of regular periodic reports to the board of directors and its committees, including management reports and studies on existing market conditions, leasing activity and property operating data, as well as actual and projected financial results, and various other matters relating to our business; (2) the required approval by the board of directors of material transactions, including, among others, acquisitions and dispositions of properties, financings and our agreements with the Business Manager, our Real Estate Manager and the ancillary service providers; (3) the oversight of our business by the audit committee; and (4) its review and discussion of regular periodic reports from our independent registered public accounting firm and other outside consultants regarding various areas of potential risk, including, among others, those relating to the qualification of the Company as a REIT for tax purposes and our internal control over financial reporting.

Communicating with Directors

Stockholders wishing to communicate with our board and the individual directors may send communications by letter, e-mail or telephone, in care of our corporate secretary, who will review and forward all correspondence to the appropriate person or persons for a response.

Our non-retaliation policy, also known as our “whistleblower” policy, prohibits us from retaliating or taking any adverse action against our employees (if we ever have employees), or the employees of the Business Manager or its affiliates, for raising a concern, including concerns about accounting, internal controls or auditing matters. Employees may raise their concerns by contacting our compliance officer at (630) 218-8000. In addition, confidential complaints involving the Company’s accounting, auditing, and internal auditing controls and disclosure practices may be raised anonymously via email or mail as described in our non-retaliation policy. A complete copy of our non-retaliation policy may be found on our website at www.inland-investments.com/inland-income-trust under the “Corporate Governance” tab.

Anti-Hedging Policy

The insider trading policy of IREIC and its affiliated entities, including our Business Manager and Real Estate Manager, prohibits officers, directors and employees of these entities, including our executive officers, from engaging, without the prior written consent of the applicable employer, in hedging or monetization transactions such as zero-cost collars and forward sale contracts that allow a person to lock in a portion of the value of his or her shares in any Inland entity or any entity sponsored by or advised by IREIC or by any of its direct or indirect subsidiaries. This includes our securities such as shares of our common stock. Because there is no established public trading market for our common stock and we do not have any employees, the Company itself has not separately adopted any specific practices or policies regarding the ability of our directors, officers or employees to purchase financial instruments or otherwise engage in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our common stock or any other securities that we might issue.

10

Committees of our Board of Directors

Audit Committee. Our board has formed a separately-designated standing audit committee, comprised of Ms. Henry and Messrs. Daniels, Davis and Michael, each of whom is “independent” within the meaning of the applicable listing standards of the NYSE. Ms. Henry serves as the chairperson of this committee, and our board has determined that Ms. Henry qualifies as an “audit committee financial expert” as defined by the SEC. The audit committee assists the board in fulfilling its oversight responsibility relating to, among other things: (1) the integrity of our financial statements; (2) our compliance with legal and regulatory requirements; (3) the qualifications and independence of our independent registered public accounting firm; and (4) the performance of our internal audit function and independent registered public accounting firm. The report of the committee is included in this proxy statement.

Our board has adopted a written charter under which the audit committee operates. A copy of the charter is available on our website at www.inland-investments.com/inland-income-trust under the “Corporate Governance” tab.

Nominating and Corporate Governance Committee. Our board has formed a nominating and corporate governance committee consisting of Ms. Henry and Messrs. Daniels, Davis and Michael, each of whom is “independent” within the meaning of the applicable listing standards of the NYSE. Mr. Daniels serves as the chairman of this committee. The nominating and corporate governance committee is responsible for, among other things: (1) identifying individuals qualified to serve on the board and the nominating and corporate governance committee and recommending to the board a slate of director nominees for election by the stockholders at the annual meeting; (2) periodically reevaluating any corporate governance policies and principles adopted by the board, including recommending any amendments thereto if appropriate; and (3) overseeing an annual evaluation of the board. The nominating and corporate governance committee is also responsible for considering director nominees submitted by stockholders.

The committee considers all qualified candidates identified by members of the committee, by other members of the board of directors, by the Business Manager and by stockholders. In recommending candidates for director positions, the committee takes into account many factors and evaluates each director candidate in light of, among other things, the candidate’s knowledge, experience, judgment and skills such as an understanding of the real estate industry or financial industry or accounting or financial management expertise. Other considerations include the candidate’s independence from conflict with the Company, the Business Manager and the Sponsor and the ability of the candidate to devote an appropriate amount of effort to board duties. The committee also focuses on persons who are actively engaged in their occupations or professions or are otherwise regularly involved in the business, professional or academic community. A majority of our directors must be “independent,” as defined in our charter. Moreover, as required by our charter, at least one of our independent directors must have at least three years of relevant real estate experience, and each director must have at least three years of relevant experience demonstrating the knowledge and experience required to successfully acquire and manage the type of assets we acquire. The committee also considers diversity in its broadest sense, including persons diverse in geography, gender and ethnicity as well as representing diverse experiences, skills and backgrounds. The committee evaluates each individual candidate by considering all of

11

these factors as a whole, favoring active deliberation rather than the use of rigid formulas to assign relative weights to these factors.

Our board has adopted a written charter under which the nominating and corporate governance committee operates. A copy of the charter is available on our website at www.inland-investments.com/inland-income-trust under the “Corporate Governance” tab.

Other Committees. Our board does not have a compensation committee or charter that governs the compensation process. Instead, the full board of directors performs the functions of a compensation committee, including reviewing and approving all forms of compensation for our independent directors that have been reviewed and recommended by our nominating and corporate governance committee. In addition, our independent directors determine, at least annually, that the compensation that we contract to pay to the Business Manager is reasonable in relation to the nature and quality of services performed or to be performed, and is within the limits prescribed by our charter and applicable law. Our board does not believe that it requires a separate compensation committee at this time because we neither separately compensate our executive officers for their service as officers, nor do we reimburse either the Business Manager or our Real Estate Manager for any compensation paid to their employees who also serve as our executive officers.

Code of Ethics

Our board has adopted a code of ethics applicable to our directors, officers and employees (if we ever have employees) which is available on our website at www.inland-investments.com/inland-income-trust. In addition, printed copies of the code of ethics are available to any stockholder, without charge, by writing us at 2901 Butterfield Road, Oak Brook, Illinois 60523, Attention: Investor Services.

Any waivers of the provisions of the code of ethics for executive officers or directors may be granted only in exceptional circumstances by our board or a committee of our board. Any waivers will be promptly disclosed to the extent required by law. Any amendments to the code of ethics must also be approved by our board. If we make any substantive amendments to the code of ethics or grant any waiver, including any implicit waiver, from a provision of the code of ethics to our chief executive officer, chief financial officer, chief accounting officer or controller or persons performing similar functions, we may, rather than filing a Current Report on Form 8-K, satisfy the disclosure requirement by posting such information on our website as necessary.

12

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Our board has nominated the six individuals set forth below to serve as directors. Messrs. Daniels, Davis and Michael and Ms. Henry have been nominated to serve as independent directors. Messrs. Goodwin and Sabshon also have been nominated to serve as directors. The board nominated these six individuals to serve as members of the board on July 22, 2021.

If you return a proxy card but do not indicate how your shares should be voted, they will be voted “FOR” each of the nominees. We know of no reason why any nominee will be unable to serve if elected. If any nominee is unable to serve, your proxy may vote for another nominee proposed by the board, or the board may reduce the number of directors to be elected. If any director resigns, is removed, dies or is otherwise unable to serve out his or her term, or if the board increases the number of directors, the board may fill the vacancy until the next annual meeting of stockholders.

The following sets forth each nominee’s principal occupation and business, as well as the specific experience, qualifications, attributes and skills that led to the conclusion by the board that the nominee should serve as a director of the Company. All ages are stated as of January 1, 2021. As used herein, “Inland” refers to some or all of the entities that are a part of The Inland Real Estate Group of Companies, Inc., which is comprised of independent legal entities, some of which may be affiliates, share some common ownership or have been sponsored and managed by such entities or subsidiaries thereof.

Lee A. Daniels, 78. Independent director since February 2012 and Lead Independent Director since September 2017. Mr. Daniels serves as Chairman of the Nominating and Corporate Governance Committee and a member of the Audit Committee. Mr. Daniels has also served on the Kite Realty Group (“Kite”) Board of Trustees since 2014 and is a member of the Kite Corporate Governance and Nominating Committee. Mr. Daniels served on the board of directors of Inland Diversified Real Estate Trust, Inc. (“Inland Diversified”) from its inception in 2008 until its merger with Kite in 2014.

In February 2007, Mr. Daniels founded Lee Daniels & Associates, LLC, a consulting firm for government and community relations. Prior to that, Mr. Daniels was an equity partner at the Chicago law firm of Bell Boyd & Lloyd from 1992 to 2006, an equity partner at Katten, Muchin & Zavis from 1982 to 1991, and an equity partner at Daniels & Faris from 1967 to 1982. Mr. Daniels served as Special Assistant Attorney General for the State of Illinois from 1971 to 1974. He served as a member of the Illinois House of Representatives from 1975 to 2007, was the Republican Leader from 1983 to 1995 and 1998 to 2003, and was Speaker of the Illinois House of Representatives from 1995 to 1997.

Mr. Daniels currently serves as Chairman of the Board of Directors of Haymarket Center, a nonprofit behavioral health treatment center located in Chicago, Illinois. He served as the Chairman of the Presidential Search Committee for the College of DuPage from 2015 to 2016. He previously served on the Elmhurst Memorial Healthcare Board of Trustees from 1981 to 2013, the Board of Governors from 1990 to 2013, and the Elmhurst Memorial Hospital Foundation Board from 1980 to 1984 and 2013. Other boards Mr. Daniels has served on include the Suburban Bank and Trust Company of Elmhurst Board of Directors from 1994 to 1996, the Elmhurst Federal

13

Savings and Loan Association Board of Directors from 1991 to 1994, and the DuPage Easter Seals Board of Directors from 1970 to 1973.

Mr. Daniels received his bachelor’s degree from the University of Iowa and his law degree from The John Marshall Law School in Chicago. He received a Distinguished Alumni Award from both The John Marshall Law School and the University of Iowa, and an Honorary Doctor of Laws from Elmhurst College.

Our board believes that Mr. Daniels’ depth of knowledge and experience, based on his 50 years of legal practice and experience in commercial real estate, make him well qualified to serve as a member of our board of directors.

Stephen L. Davis, 63. Independent director since February 2012. Mr. Davis serves as a member of the Audit Committee and the Nominating and Corporate Governance Committee. Mr. Davis has over 30 years of experience in real estate development. Mr. Davis has been the president of The Will Group, Inc., a construction company, since founding the company in 1986. In his position with The Will Group, Mr. Davis was instrumental in the construction of Kennedy King College campus, located in Chicago, Illinois, and the coordination of the "Plan For Transformation" for Altgeld Gardens, a public housing development located in Chicago, Illinois. Since October 2003, Mr. Davis has also overseen property management operations for several properties owned by a family-owned real estate trust.

Since March 2004, Mr. Davis has served as commissioner of aviation (board chair) of the DuPage County Airport Authority, in DuPage County, Illinois, which oversees management of the DuPage County Airport, Prairie Landing Golf Course and the 500-acre DuPage County Business Park. From 2006 to 2016, Mr. Davis served as a director of Wheaton Bank & Trust, where he was a member of the loan committee, which was responsible for reviewing and analyzing residential and commercial loan portfolios, developer credentials and viability, home builders and commercial and industrial loans. Mr. Davis obtained his bachelor degree from the University of Tennessee, located in Knoxville.

Our board believes that Mr. Davis’ prior real estate development experience and his leadership qualities make him well qualified to serve as a member of our board of directors.

Daniel L. Goodwin, 77. Director and the chairman of our board since July 2012. Mr. Goodwin has also served as a director of the Business Manager since August 2011. Mr. Goodwin is the Chairman and CEO of Inland, headquartered in Oak Brook, Illinois. Inland is comprised of separate real estate investment and financial companies with managed assets with a value of approximately $10.5 billion, doing business nationwide with a presence in 49 states, as of December 31, 2020. Inland owns and manages properties in all real estate sectors, including retail, office, industrial and apartments. Mr. Goodwin also serves as a director or officer of entities wholly owned or controlled by The Inland Group LLC. In addition, Mr. Goodwin has served as the chairman of the board of Inland Mortgage Investment Corporation since March 1990, chairman, director and chief executive officer of Inland Bancorp, Inc., a bank holding company, since January 2001 and chairman of the board of IREIC since January 2017. Mr. Goodwin also served as a director of Inland Real Estate Corporation (n/k/a IRC Retail Centers LLC) (“IRC”) from 2001 until its merger in March 2016, and served as its chairman of the board from 2004 to April 2008.

14

Mr. Goodwin served as a director and the chairman of the board of Inland Residential Properties Trust, Inc. (“IRPT”) and as a director and the chairman of the board of the IRPT business manager, both from December 2013 until each company’s liquidation and dissolution in October 2019. Mr. Goodwin has served as chairman of Inland InPoint Advisor, LLC since October 2016, as a director and chairman of the board of MH Ventures Fund II, Inc. and its business manager, since September 2020, and as a director of IPCC since 2004. He also served as the chairman of the National Association of Real Estate Investment Trusts Public Non-Listed REIT Council from January 2010 through December 2017, and as a past Vice Chairman of the Chicago Better Government Association.

Housing. Mr. Goodwin is a member of the National Association of Realtors President’s Circle, the National Association of Realtors Hall of Fame, the Illinois Association of Realtors Hall of Fame and the Chicago Association of Realtors Hall of Fame. He is also the author of a nationally recognized real estate reference book for the management of residential properties. Mr. Goodwin served on the Board of the Illinois State Affordable Housing Trust Fund. He served as an advisor for the Office of Housing Coordination Services of the State of Illinois, and as a member of the Seniors Housing Committee of the National Multifamily Housing Council. He has served as Chairman of the DuPage County Affordable Housing Task Force. Mr. Goodwin also founded New Directions Housing Corporation, a not-for-profit entity that develops affordable housing for low income individuals.

Education. Mr. Goodwin obtained his bachelor’s degree and master’s degree from Illinois State universities. Following graduation, he taught for five years in the Chicago Public Schools. Over the past twenty years, Mr. Goodwin served as a member of the Board of Governors of Illinois State Colleges and Universities, vice chairman of the Board of Trustees of Benedictine University, vice chairman of the Board of Trustees of Springfield College, and chairman of the Board of Trustees of Northeastern Illinois University.

Our board believes that Mr. Goodwin’s 50 years of experience in real estate investing, commercial real estate brokerage, real estate securities, land development, construction and mortgage banking and commercial lending, make him well qualified to serve as a member of our board of directors.

Gwen Henry, 80. Independent director since February 2012. Ms. Henry serves as Chairman of the Audit Committee and a member of the Nominating and Corporate Governance Committee. Ms. Henry currently serves as the Treasurer of DuPage County, Illinois, a position she has held since December 2006. In this position, Ms. Henry is responsible for the custody and distribution of DuPage County funds. In addition, from April 1981 to 2019, Ms. Henry was a partner at Dugan & Lopatka, a regional accounting firm, and a member of the firm’s controllership and consulting services practice, where she specialized in financial consulting and tax and business planning for privately-held companies. Since December 2009, Ms. Henry has also served as a member of the Illinois Municipal Retirement Fund, a $43 billion fund which has investments in excess of $1.2 billion allocated to real estate. She currently serves as chair of the investment committee, and is a member of the audit committee and the legislative committee of the fund.

Ms. Henry previously served as DuPage County Forest Preserve Commissioner (from December 2002 to November 2006) and as chair to the special committee responsible for the

15

DuPage County Budget (from December 2002 to November 2004), and was a member of the DuPage County Finance Committee (from November 1996 to November 2002). Ms. Henry also has held a number of board and chair positions for organizations such as the Marianjoy Rehabilitation Hospital (as treasurer from June 2002 to May 2008), the Central DuPage Health System (as chairperson of the board from October 1995 to September 1999), and the Central DuPage Hospital Foundation (as director from October 2002 to present). She was elected Mayor of the City of Wheaton, Illinois from March 1990 to December 2002.

Ms. Henry received her bachelor degree from the University of Kansas, located in Lawrence, Kansas. She is a certified public accountant, a designated certified public funds investment manager and a certified public finance administrator.

Our board believes that Ms. Henry’s over 35 years of public accounting experience makes her well qualified to serve as a member of our board of directors.

Bernard J. Michael, 61. Independent director since September 2014. Mr. Michael serves as a member of the Audit Committee and, since September 2017, the Nominating and Corporate Governance Committee. Mr. Michael is a partner and founding member of AWH Partners, LLC, a privately held real estate investment, development and management firm. Since 2010, AWH has completed in excess of $1.4 billion of hotel investments, and is managing or has completed hotel redevelopment projects totaling more than $300 million. In early 2012, AWH acquired Lane Hospitality, which it rebranded as Spire Hospitality, a top-tier national hospitality platform formed in 1980.

Mr. Michael has over 25 years of experience as a real estate attorney working on sophisticated real estate transactions across all asset classes for some of the world's largest property owners, developers and lenders. Prior to founding AWH Partners, Mr. Michael was the founder and senior partner of Michael, Levitt & Rubenstein, LLC, a law firm focusing on real estate sales, acquisitions, development, leasing and financing. Mr. Michael and his team worked on some of the largest transactions in New York City, including the development of Time Warner Center and the Hudson Yards projects for The Related Companies. In addition, Mr. Michael and his firm represented developers on major multi-family, retail, office and hospitality projects in China, Saudi Arabia, and in most major cities across the United States.

Prior to forming Michael Levitt, Mr. Michael was a partner in the Real Estate Group at Proskauer Rose, LLP. Prior to that, Mr. Michael was an attorney at Weil, Gotschal & Manges and Shea & Gould. Mr. Michael is a graduate of Brown University and New York University School of Law.

Our board believes that Mr. Michael’s prior business experience and his leadership qualities make him well qualified to serve as a member of our board of directors.

Mitchell A. Sabshon, 68. Director since September 2014, our chief executive officer since April 2014 and our president since December 2016. Mr. Sabshon has also served as a director and president of the Business Manager since October 2013 and December 2016, respectively. Mr. Sabshon is also currently the chief executive officer, president and a director of IREIC, positions he has held since August 2013, January 2014 and September 2013, respectively. He is a director,

16

the president and chief executive officer of the IRPT business manager since December 2013 and was a director and the president and chief executive officer of IRPT from December 2013 until December 2019. Mr. Sabshon is currently the Chief Executive Officer of Inland Venture Partners, LLC, a position he has held since November 2018, Chief Executive Officer of Inland Ventures MHC Manager, LLC, a position he has held since December 2018, and Chief Executive Officer and director of MH Ventures Fund II, Inc. and its business manager, positions he has held since September 2020. Mr. Sabshon also serves as the chairman of the board of directors and chief executive officer of InPoint Commercial Real Estate Income, Inc. (“InPoint”), positions he has held since September 2016 and October 2016, respectively, and as the chief executive officer of the InPoint advisor since August 2016. Mr. Sabshon has also served as a director and chairman of the board of IPCC since September 2013 and January 2015, respectively, and a director of Inland Securities Corporation (“Inland Securities”) since January 2014. He has also served as chief executive officer of Inland Venture Partners, LLC since November 2018.

Prior to joining Inland, Mr. Sabshon served as Executive Vice President and Chief Operating Officer of Cole Real Estate Investments, where he oversaw the company's finance, leasing, property management and asset management operations. Prior to joining Cole, Mr. Sabshon held several senior executive positions at leading financial services firms. He spent almost 10 years at Goldman, Sachs & Co. in various leadership roles including President and CEO of Goldman Sachs Commercial Mortgage Capital. He also served as a Senior Vice President in Lehman Brothers' real estate investment banking group. Prior to joining Lehman Brothers, Mr. Sabshon was an attorney in the corporate and real estate structured finance practice groups at Skadden, Arps, Slate, Meagher & Flom in New York. Mr. Sabshon is also a member of the International Council of Shopping Centers, the Urban Land Institute, the National Association of Corporate Directors, a member of the Board of Trustees of the American Friends of Hebrew University - Midwest Region and the Board of Directors of Timeline Theatre Company. Mr. Sabshon is also a member of the New York State Bar, a former Chairman Emeritus of the Institute for Portfolio Alternatives and holds the Board Leadership Fellowship designation of the National Association of Corporate Directors. He also holds a real estate broker license in New York. He received his undergraduate degree from George Washington University and his law degree at Hofstra University School of Law.

Our board believes that Mr. Sabshon’s extensive finance and real estate experience make him well qualified to serve as a member of our board of directors.

RECOMMENDATION OF THE BOARD: The board recommends that you vote “FOR” the election of all six nominees.

17

Independent Director Compensation

The following table summarizes compensation earned by the independent directors for the year ended December 31, 2020 (Dollar amounts in thousands).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Fees Earned

in Cash

($) | | Stock

Awards

($)(1) | | Option Awards

($) | | Non-Equity Incentive Plan Compensation ($) | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation Earnings

($) | | All Other Compensation ($)(2) | | Total Compensation

($) |

Lee A. Daniels | | | 73 | | | | 20 | | | | — | | | | — | | | | — | | | | — | | | 93 | | |

Stephen L. Davis | | | 62 | | | | 20 | | | | — | | | | — | | | | — | | | | — | | | 82 | | |

Gwen Henry | | | 75 | | | | 20 | | | | — | | | | — | | | | — | | | | — | | | 95 | | |

Bernard J. Michael | | | 62 | | | | 20 | | | | — | | | | — | | | | — | | | | — | | | 82 | | |

| (1) | Represents 1,102 restricted shares granted on June 16, 2020 to each director. |

| (2) | Represents the value of distributions received during the year ended December 31, 2020 on all stock awards received through December 31, 2020. |

Cash Compensation

We pay our independent directors an annual fee of $44,000 plus $2,000 for each in-person meeting of the board and $750 for each meeting of the board attended by telephone; we also pay our independent directors $1,400 for each in-person meeting of each committee of the board and $550 for each meeting of each committee of the board attended by telephone. Effective July 1, 2021, we began paying the same fee for meetings held by video conference as for in-person meetings. We pay the chairperson of the nominating and corporate governance committee of our board an annual fee of $8,500 and the chairperson of the audit committee of our board an annual fee of $13,200. We pay the Lead Independent Director an annual fee of $5,000.

We reimburse all of our directors for any out-of-pocket expenses incurred by them in attending meetings. Each independent director may elect to receive payment of all or a portion of his or her fee in the form of unrestricted shares in lieu of cash pursuant to our employee and director restricted share plan (the “RSP”) and may elect to defer the receipt of all or a portion of his or her fee pursuant to our director deferred compensation plan (the “DDCP”). We do not compensate any director that also is an employee of the Business Manager or its affiliates.

Stock Compensation

On March 21, 2016 the board of directors approved the RSP, which was subsequently approved by the Company’s stockholders at the annual stockholders’ meeting on June 16, 2016. The RSP provides us with the ability to grant awards of restricted shares and restricted share units to directors, officers and employees (if we ever have employees) of us, our affiliate or the Business Manager. Under the RSP, on the date of the annual stockholders’ meeting in 2020, each independent director received an award of restricted shares of common stock having a fair market value as of the date of grant equal to $20,000 or, in lieu thereof, restricted share units. Restricted shares and restricted share units issued to independent directors pursuant to these grants vest over a three-year period following the respective date of grant in increments of 33-1/3% per annum,

18

subject to their continued service as directors until each vesting date, and become fully vested earlier upon a liquidity event or upon the termination of a director by reason of his or her death or disability. The total number of common shares granted under the RSP may not exceed 5.0% of our outstanding shares on a fully diluted basis at any time (as such number may be adjusted to reflect any increase or decrease in the number of outstanding shares resulting from a stock split, stock dividend, reverse stock split or similar change in our capitalization).

Other restricted share awards entitle the recipient to receive shares of common stock from us under terms that provide for vesting over a specified period of time or upon attainment of pre-established performance objectives. Such awards would typically be forfeited with respect to the unvested shares upon the termination of the recipient’s employment or service as a director for any reason other than death or disability or, if applicable, the termination of the business management agreement with the Business Manager. Restricted shares may not, in general, be sold or otherwise transferred until restrictions are removed and the shares have vested. Holders of restricted shares have the right to vote such shares and may receive distributions prior to the time that the restrictions on the restricted shares have lapsed. As of December 31, 2020, there were 6,457 unvested restricted shares and 683 unvested restricted share units outstanding under the RSP.

The following table sets forth information regarding securities authorized for issuance under the RSP as of December 31, 2020:

| | | | | | | | | | | | |

Plan Category | | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | | | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) | |

| | | | | | | | | |

| | (a) | | | (b) | | | (c) | |

Equity Compensation Plans approved by security holders | | | — | | | | — | | | | 1,787,534 | |

Equity Compensation Plans not approved by security holders | | | — | | | | — | | | | — | |

Total | | | — | | | | — | | | | 1,787,534 | |

Deferred Compensation Plan

Effective November 9, 2016, we adopted the DDCP approved by our board that provides a deferred compensation arrangement to our independent directors and their beneficiaries. Under the DDCP, independent directors may elect to defer the receipt of all or a portion of their cash and stock compensation. Eligible cash compensation that is deferred is credited to a book entry account established for each participant in an amount equal to the amount deferred, and restricted share units are issued under the RSP in lieu of all or a portion of stock compensation otherwise payable in restricted shares. A participant has a fully vested right to his cash deferral amounts, and the deferred share unit awards will vest on the same terms and schedule as the underlying eligible stock compensation would have otherwise been subject if granted in restricted shares. Unless otherwise determined by the board, while restricted share units are unvested, participants will be

19

credited with dividend equivalents equal in value to those declared and paid on shares of Company common stock, on all restricted share units granted to them. These dividend equivalents will be regarded as having been reinvested in restricted share units, and will only be paid to the extent the underlying restricted share units vest. Payment of restricted share units will be made, to the extent vested, in shares of Company common stock, unless otherwise determined by the board. Except as otherwise determined by the board, account balances under the DDCP will not be credited with interest or any other credits, although the Company may permit an account to be credited with earnings with respect to restricted share units.

The DDCP provides our board with the discretion to amend, suspend or terminate the DDCP at any time, provided that any amendment, suspension or termination will not be made if it would substantially impair the rights of any participant under the DDCP.

Meetings of the Board of Directors, Committees and Stockholders

During the year ended December 31, 2020, our board met 15 times, the audit committee met four times and the nominating and corporate governance committee met three times. Each of our directors attended at least 75% of the aggregate amount of the meetings of the board during the period for which he or she was a director, and any committee on which he or she served, in 2020. We encourage our directors to attend our annual meeting of stockholders, and in 2020, each director did so attend.

EXECUTIVE COMPENSATION

Executive Officers

The board of directors annually elects our executive officers. These officers may be terminated at any time. Information about each of our executive officers, with the exception of Mr. Sabshon, whose biography is included above, follows. All ages are stated as of January 1, 2021.

Catherine L. Lynch, 62. Our chief financial officer since April 2014, and a director of the Business Manager since August 2011. Ms. Lynch joined Inland in 1989 and has been a director of The Inland Group LLC since June 2012. She serves as the treasurer and secretary (since January 1995), the chief financial officer (since January 2011) and a director (since April 2011) of IREIC and as a director (since July 2000) and chief financial officer and secretary (since June 1995) of Inland Securities. She also served as the chief financial officer of IRPT and the IRPT business manager from December 2013 until October 2019. She also served as the treasurer of the IRPT business manager from December 2013 to October 2014. Ms. Lynch also serves as the chief financial officer and treasurer (since October 2016) of InPoint and as the chief financial officer and treasurer of the InPoint advisor (since August 2016). Ms. Lynch also has served as a director of IPCC since May 2012. Ms. Lynch served as the treasurer of Inland Capital Markets Group, Inc. from January 2008 until October 2010, as a director and treasurer of Inland Investment Advisors, LLC from June 1995 to December 2014 and as a director and treasurer of Inland Institutional Capital, LLC from May 2006 to December 2014. Ms. Lynch worked for KPMG Peat Marwick LLP from 1980 to 1989. Ms. Lynch received her bachelor degree in accounting from Illinois State University in Normal. Ms. Lynch is a certified public accountant and a member of the American Institute of Certified Public Accountants and the Illinois CPA Society. Ms. Lynch also is registered

20

with the Financial Industry Regulatory Authority, Inc. (“FINRA”) as a financial operations principal.

Roberta S. Matlin, 76. Our vice president, and the vice president of the Business Manager, since August 2011. Ms. Matlin joined IREIC in 1984 as director of investor administration and currently serves as a director and senior vice president of IREIC. Ms. Matlin has served as senior vice president of MH Ventures II Business Manager, LLC since September 2020, vice president of The Inland Group, LLC, senior vice president of The Inland Real Estate Group, LLC since January 2015, a director of IPCC since May 2001, a vice president of Inland Institutional Capital, LLC since May 2006 and a manager since August 2012. She has served as president of Inland Opportunity Business Manager & Advisor, Inc. since April 2009 and as a director since January 2015. She also has served as a director and president of Inland Investment Advisors, LLC from June 1995 until May 2017, a director and president of Inland Securities from July 1995 to March 1997 and director and vice president since April 1997 and a director of Inland Business Manager & Advisor Group, Inc. since January 2014. Ms. Matlin has served as a director of Pan American Bank since December 2007. She served as vice president of administration of the IRPT business manager from December 2013 to October 2019 and as vice president of administration of the InPoint advisor since August 2016. Since February 2018 Ms. Matlin has severed as a Vice President of The Inland Group LLC. Ms. Matlin served as vice president of administration of Inland Diversified from June 2008 through July 2014 and also served as the president of Inland Diversified Business Manager & Advisor, Inc. from June 2008 through May 2009 and its vice president until July 2014. She served as vice president of administration of InvenTrust Properties Corp. since its inception in October 2004 through February 2014. She also served as the president of Inland American Business Manager & Advisor, Inc. from October 2004 until January 2012, its vice president until February 2014 and a director from March 2014 until March 2016. Ms. Matlin served as vice president of administration of Inland Western Retail Real Estate Trust, Inc. from 2003 until 2007, vice president of administration of Inland Retail Real Estate Trust, Inc. from 1998 until 2004, vice president of administration of IRC from 1995 until 2000 and trustee and executive vice president of Inland Mutual Fund Trust from 2001 until 2004.

Prior to joining Inland, Ms. Matlin worked for the Chicago Region of the Social Security Administration of the United States Department of Health and Human Services. Ms. Matlin is a graduate of the University of Illinois in Champaign. She holds Series 7, 22, 24, 39, 63, 65, 79 and 99 licenses from FINRA.

Cathleen M. Hrtanek, 44. Our corporate secretary, and the secretary of the Business Manager, since August 2011. Ms. Hrtanek joined Inland in 2005 and is currently assistant general counsel and senior vice president of The Inland Real Estate Group, LLC. In her capacity as assistant general counsel, Ms. Hrtanek represents many of the entities that are part of The Inland Real Estate Group of Companies on a variety of legal matters. Ms. Hrtanek also has served as secretary of MH Ventures Fund II, Inc. and its business manager since September 2020, the secretary of the InPoint advisor since August 2016, assistant secretary of InPoint since August 2019, secretary of IRPT and its business manager from December 2013 to October 2019, secretary of Inland Opportunity Business Manager & Advisor, Inc. since April 2009, secretary of Inland Diversified from September 2008 through July 2014 and its business manager from September 2008 through March 2016, and secretary of IPCC from August 2009 through May 2017. Prior to joining Inland, Ms. Hrtanek was employed by Wildman Harrold Allen & Dixon LLP in Chicago,

21

Illinois from September 2001 until 2005. Ms. Hrtanek has been admitted to practice law in the State of Illinois. Ms. Hrtanek received her bachelor degree from the University of Notre Dame in South Bend, Indiana and her law degree from Loyola University Chicago School of Law.

Compensation of Executive Officers

All of our executive officers are officers of IREIC or one or more of its affiliates and are compensated by those entities, in part, for services rendered to us. We neither compensate our executive officers nor reimburse either the Business Manager or Real Estate Manager for any compensation paid to individuals who also serve as our executive officers, or the executive officers of the Business Manager, our Real Estate Manager or their respective affiliates; provided that, for these purposes, a corporate secretary is not considered an “executive officer.” As a result, we do not have, and our board of directors has not considered, a compensation policy or program for our executive officers and has not included a “Compensation Discussion and Analysis,” a report from our board of directors with respect to executive compensation, a non-binding stockholder advisory vote on compensation of executives, a non-binding stockholder advisory vote on the frequency of the stockholder vote on executive compensation or the pay ratio between employees and our principal executive officer. The fees we pay to the Business Manager and Real Estate Manager under the business management agreement or the real estate management agreement, respectively, are described in more detail under “Certain Relationships and Related Transactions.”

In the future, our board may decide to pay annual compensation or bonuses or long-term compensation awards to one or more persons for services as officers. We also may, from time to time, grant restricted shares of our common stock to one or more of our officers. If we decide to pay our named executive officers in the future, the board of directors will review all forms of compensation and approve all stock option grants, warrants, stock appreciation rights and other current or deferred compensation payable to the executive officers with respect to the current or future value of our shares. In addition, the board will include the non-binding stockholder advisory votes on executive compensation and on the frequency of stockholder votes on executive compensation in the relevant proxy statement as required pursuant to Section 14A of the Exchange Act.

Certain Relationships and Related Transactions

Set forth below is a summary of the material transactions between the Company and various affiliates of IREIC, including the Business Manager and Real Estate Manager, since the January 1, 2020, and any currently proposed transactions. IREIC is an indirect wholly-owned subsidiary of The Inland Group LLC. Please see the biographical information of our directors and executive officers elsewhere in this proxy statement for information regarding their relationships to Inland, including IREIC and The Inland Group LLC.

Business Management Agreement

We have entered into a business management agreement with IREIT Business Manager & Advisor Inc., which serves as the Business Manager with responsibility for overseeing and managing our day-to-day operations. Subject to satisfying the criteria described below, we pay the

22

Business Manager an annual business management fee equal to 0.65% of our “average invested assets,” payable quarterly in an amount equal to 0.1625% of our average invested assets as of the last day of the immediately preceding quarter; provided that the Business Manager may decide, in its sole discretion, to be paid an amount less than the total amount to which it is entitled in any particular quarter, and the excess amount that is not paid may, in the Business Manager’s sole discretion, be waived permanently or deferred or accrued, without interest, to be paid at a later point in time. For the year ended December 31, 2020, the Business Manager was entitled to a business management fee of approximately $8.9 million. For the six months ended June 30, 2021, the Business Manager was entitled to a business management fee of approximately $4.5 million, of which approximately $2.2 million remained unpaid as of June 30, 2021.