UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. ____)

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under Section 240.14a-12 |

Inland Real Estate Income Trust, Inc. |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): | |

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(l) and 0-11. |

INLAND REAL ESTATE INCOME TRUST, INC.

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

AND

PROXY STATEMENT

Date: | November 6, 2024 |

Time: | 2:00 p.m. Central Time |

Place: | 2901 Butterfield Road |

| Oak Brook, Illinois 60523 |

Inland Real Estate Income Trust, Inc.

2901 Butterfield Road

Oak Brook, Illinois 60523

(866) 694-6526

Notice of Annual Meeting of Stockholders

to be held November 6, 2024

Dear Stockholder:

Our annual stockholders’ meeting will be held on November 6, 2024, at 2:00 p.m. Central Time, at our principal executive offices located at 2901 Butterfield Road in Oak Brook, Illinois 60523. At our annual meeting, we will ask you to consider and vote upon:

If you were a stockholder of record at the close of business on August 12, 2024, you may vote at the annual meeting and any postponements or adjournments of the meeting. Instead of mailing a printed copy of our proxy materials to all our stockholders, we are using the “Notice and Access” method of providing proxy materials to stockholders via the Internet. This process provides stockholders with a convenient and quick way to access the proxy materials and vote, while lowering our costs and reducing the environmental impact of our meeting. Accordingly, on or about August 20, 2024 we expect to begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) and will post our proxy materials on the website referenced in the Notice and in our proxy statement. As will be more fully described in any Notice, stockholders may choose to access our proxy materials on the website or you may request to receive a printed set of our proxy materials.

Whether or not you plan to attend the meeting and vote in person, we urge you to have your vote recorded as early as possible. Stockholders have the following three options for submitting their votes by proxy: (1) via the Internet; (2) by telephone; or (3) by mail, if a paper proxy card has been provided to you.

Your vote is very important! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes.

By order of the Board of Directors,

Cathleen M. Hrtanek

Secretary

August 14, 2024

Table of Contents

|

| Page |

| 1 | |

Important Notice Regarding the Availability of Proxy Materials |

| 1 |

| 2 | |

| 2 | |

| 3 | |

| 3 | |

| 3 | |

| 4 | |

| 4 | |

| 4 | |

| 5 | |

| 5 | |

| 5 | |

| 6 | |

| 6 | |

| 6 | |

| 7 | |

| 9 | |

| 9 | |

| 11 | |

Meetings of the Board of Directors, Committees and Stockholders |

| 12 |

| 13 | |

| 14 | |

| 14 | |

| 14 | |

| 16 | |

| 16 | |

| 17 | |

| 17 | |

Policies and Procedures with Respect to Related Party Transactions |

| 21 |

| 21 | |

| 22 | |

| 23 | |

| 24 | |

| 24 | |

| 24 | |

| 26 | |

| 26 | |

| 26 |

This proxy statement contains information related to the annual meeting of stockholders to be held November 6, 2024, beginning at 2:00 p.m. Central Time, at our principal executive offices located at 2901 Butterfield Road, Oak Brook, Illinois 60523, and at any postponements or adjournments thereof.

INFORMATION ABOUT THE ANNUAL MEETING

The board of directors of Inland Real Estate Income Trust, Inc. (referred to herein as the “Company,” “we,” “our” or “us”), a Maryland corporation, is soliciting your vote for the 2024 annual meeting of stockholders. At the meeting, you will be asked to consider and vote upon:

The board of directors recommends that you vote “FOR” each proposal.

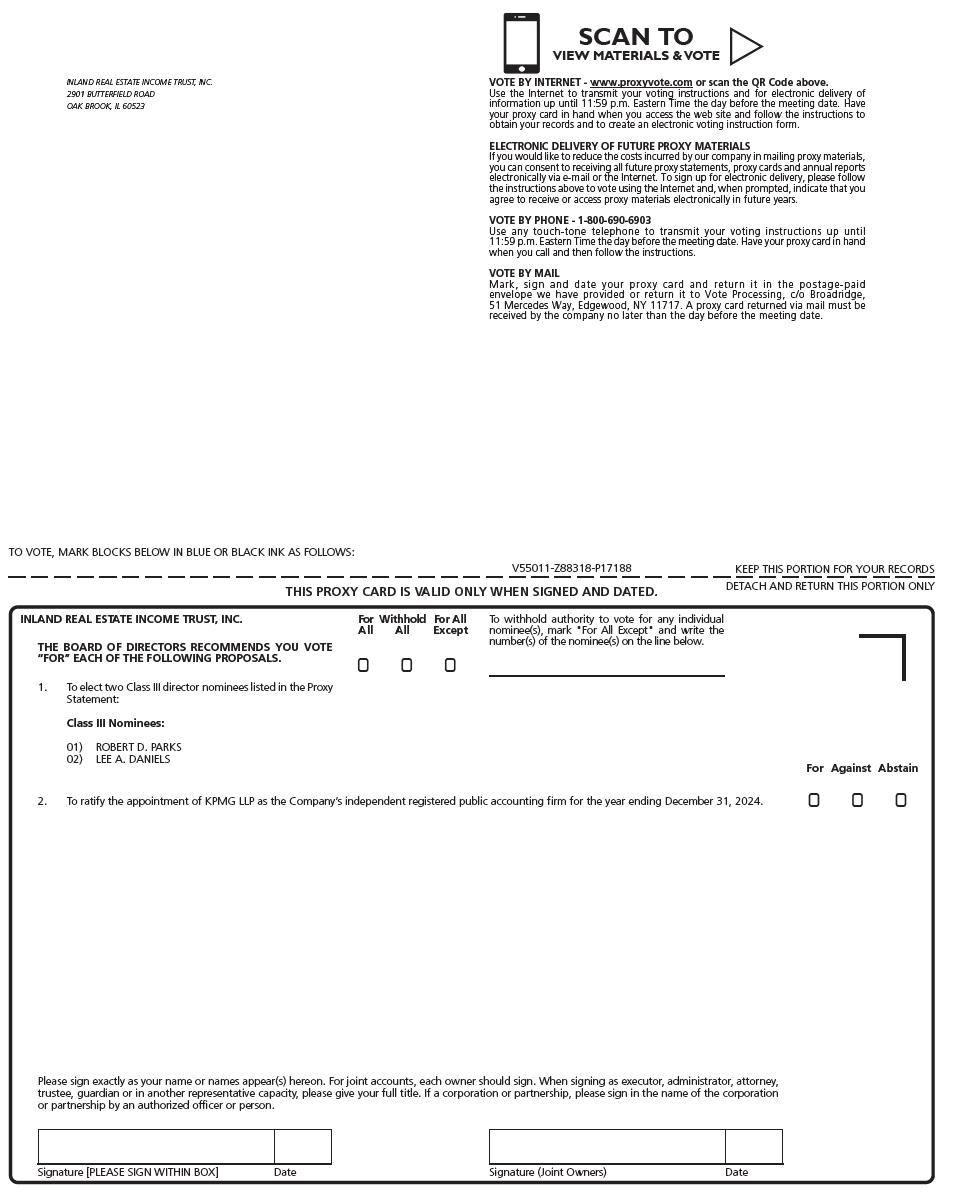

Important Notice Regarding the Availability of Proxy Materials

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on November 6, 2024. This proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2023 (our “Annual Report”) are available at www.proxyvote.com. Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we are providing stockholders with access to our proxy materials over the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of mailing paper copies of the proxy materials to each stockholder. This allows us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our annual meeting. On or about August 20, 2024, we will begin mailing to our stockholders the Notice containing instructions on how to access our proxy materials over the Internet and authorize your proxy online. The Notice is not a proxy and cannot be marked or submitted to vote your shares. All stockholders receiving the Notice will have the ability to request a paper copy of the proxy materials by mail by following the instructions provided on the Notice. In addition, the Notice contains instructions for electing to receive proxy materials by e-mail. If you own shares of common stock in more than one account, such as individually and jointly with your spouse, you may have received more than one Notice. Please make sure to vote all your shares.

You will not receive paper copies of the proxy materials, including our Annual Report, unless you request the materials by following the instructions on the Notice or on the website referred to in the Notice. If requested by stockholders, we also will provide copies of exhibits to our Annual Report for a reasonable fee.

The SEC has adopted a rule concerning the delivery of documents filed by us with the SEC, including proxy statements and annual reports. The rule allows us to, among other things, send a single set of any proxy statement, annual report, notices or information statement to any household at which two or more stockholders reside if they share the same address. This procedure is referred to as “Householding.” This rule benefits both you and us by reducing the volume of duplicate information received at your household and helps us reduce expenses. Each stockholder subject to Householding will continue to have a separate stockholder identification number and receive a separate proxy card or voting instruction card.

Upon written or oral request, we will promptly have a separate copy of our Annual Report and this Proxy Statement delivered to a stockholder at a shared address to which a single copy was previously delivered. If you have any questions about this Proxy Statement or the annual meeting or if you received a single set of disclosure documents for this year, but you would prefer to receive your own copy, you may direct requests for separate copies by calling (800) 579-1639 or email us a request to sendmaterial@materialnotice.com. You may also visit the following website to request materials: www.materialnotice.com.

1

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read any reports, statements and other information we file with the SEC on the website maintained by the SEC at www.sec.gov. Our SEC filings also are available to the public at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, DC 20549. You also may obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Washington, DC 20549. Please call the SEC at (800) SEC-0330 for further information regarding the public reference facilities.

Information about Attending the Annual Meeting

We welcome your attendance at the annual meeting of stockholders. If you plan on attending the meeting, please contact us at 866-694-6526, so that we can arrange for sufficient space to accommodate all attendees.

If your shares are held by a broker, bank or other nominee, you must follow the instructions provided by your broker, bank or other nominee to vote your shares and you may not vote your shares in person at the meeting unless you obtain a legal proxy. Beneficial holders who want to attend and also vote in person at the Annual Meeting will need to obtain a legal proxy, in PDF or Image (gif, jpg, or png) file format, from the organization that holds their shares giving the right to vote their shares in person at the Annual Meeting and by presenting it with their online ballot during the meeting.

Information about Voting

Holders of our common stock at the close of business on August 12, 2024 (the “Record Date”) are entitled to receive notice of and to vote their shares at the annual meeting. As of the Record Date, there were 36,108,944 shares of our common stock outstanding. Each share of common stock is entitled to one vote on each matter properly brought before the meeting.

Your vote is needed to ensure that the proposals can be acted upon. Your vote is very important, even if you own a small number of shares. Your immediate response will help avoid potential delays and may save the Company significant additional expense associated with soliciting stockholder votes.

You may vote in person or by granting us a proxy to vote on the proposals. A proxy is a person who votes the shares of stock of another person who could not attend a meeting. The term “proxy” also refers to the proxy card or other method of appointing a proxy. By submitting your proxy to us, you are appointing each of Catherine L. Lynch and Cathleen M. Hrtanek as your proxy, and you are giving each of them permission to vote your shares of the Company’s common stock at the annual meeting.

You may authorize a proxy in any of the following ways:

You can authorize a proxy via the Internet or by telephone at any time prior to 11:59 p.m., Eastern Time, on November 5, 2024, the day before the annual meeting. For those stockholders with Internet access, we encourage you to authorize a proxy to vote your shares via the Internet, because it is quick, convenient and provides a cost savings to us. Authorizing a proxy to vote your shares by following the instructions on the enclosed proxy card prior to the meeting date will ensure that your vote is recorded immediately and avoid postal delays that my cause your proxy to arrive late in which case your vote will not be counted. If you mail proxy cards, please sign, date and return each proxy card to guarantee that all your shares of common stock are voted.

2

If you return your proxy card but do not indicate how your shares should be voted, they will be voted (1) “FOR” the election of Lee A. Daniels and Robert D. Parks as Class III directors to serve until our 2027 annual meeting and until their respective successors are duly elected and qualify, and (2) “FOR” the ratification of the selection of KPMG as our independent registered public accounting firm for the fiscal year ending December 31, 2024. If you grant us a proxy, you may nevertheless revoke your proxy at any time before it is exercised by: (1) sending written notice that must be received by us no later than November 5, 2024 at Inland Real Estate Income Trust, Inc., 2901 Butterfield Road, Oak Brook, Illinois 60523, Attention: Ms. Judith Fu, Vice President, Administration; (2) providing us with a later-dated proxy received by us no later than November 5, 2024; or (3) attending the annual meeting in person and voting your shares. Merely attending the annual meeting, without further action, will not revoke your proxy.

Street Name Stockholders. If you are the beneficial owner of shares (that is, you held your shares in “street name” through an intermediary such as a broker, bank or other nominee) as of the close of business on the Record Date, you will receive instructions from your broker, bank or other nominee as to how to vote your shares or submit a proxy to have your shares voted. Please use the voting forms and instructions provided by your broker, bank or other nominee. In most cases, you will be able to do this by following the instructions on the enclosed proxy card or possibly by telephone depending on the broker’s procedures. You should instruct your broker, bank or other nominee how to vote your shares by following the directions provided by your broker, bank or other nominee.

If you are the beneficial owner of your shares but not a registered stockholder, you should contact your broker, bank or other nominee to change your vote or revoke your proxy.

Information Regarding Tabulation of the Vote

This solicitation of proxies is made by and on behalf of our Board of Directors. Under applicable regulations of the SEC, each of our directors and director nominees, and certain of our officers, may solicit proxies and are “participants” in this proxy solicitation on behalf of the Board. We have also engaged Broadridge Investor Communication Solutions, Inc. (“Broadridge”), 51 Mercedes Way, Edgewood, New York 11717, to solicit proxies on our behalf. In addition, Broadridge will tabulate all votes cast at the annual meeting and will act as the inspector of election.

Quorum Requirement

There must be a quorum present for stockholders to take action at the annual meeting. The presence, in person or by proxy, of stockholders entitled to cast a majority of all votes entitled to be cast at the annual meeting will constitute a quorum. If you submit a properly executed proxy card, even if you abstain from voting or do not give instructions for voting, then your shares will be considered present for purposes of establishing a quorum.

Information about Vote Necessary for Action to be Taken

Proposal No. 1. With regard to the election of Lee A. Daniels and Robert D. Parks as Class III directors to serve until our 2027 annual meeting and until their respective successors are duly elected and qualify, you may (i) vote “FOR ALL” of the nominees; (ii) withhold your vote for all of the nominees by voting “WITHHOLD ALL,” or (iii) vote for all of the nominees except for certain nominee(s) by voting “FOR ALL” and striking a line through that nominee(s’) name(s) or number(s) on the proxy card or, if voting electronically, making individual selections on the electronic proxy card. A plurality of all the votes of shares of common stock cast at the annual meeting, assuming a quorum is represented, is required to elect each nominee for director. Withheld votes will be counted for purposes of establishing a quorum and as a vote cast at the annual meeting but will have no effect on the result of the vote for a nominee if there is at least one vote “FOR” that nominee. For purposes of this proposal, broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

Proposal No. 2. With regard to the proposal relating to the ratification of the selection of KPMG as our independent registered public accounting firm for the fiscal year ending December 31, 2024, you may vote “FOR” or “AGAINST” the proposal, or you may “ABSTAIN” from voting on the proposal. A majority of the votes cast at the

3

annual meeting, assuming a quorum is represented, is required to ratify this proposal. Abstentions will not be counted as votes cast; however, a properly executed proxy card marked “ABSTAIN” will be counted for purposes of establishing a quorum.

Our board of directors (including all of the independent directors) unanimously approved each of the proposals at its meeting on August 12, 2024, and recommends that you vote “FOR” each of them.

Broker Non-Votes

A “broker non-vote” occurs when a broker holding stock on behalf of a beneficial owner submits a proxy but does not vote on a particular proposal, for example, because the broker does not have discretionary power with respect to that particular proposal and has not received instructions from the beneficial owner. Brokers are not allowed to exercise their voting discretion with respect to the election of directors or for the approval of other matters which applicable exchange rules determine to be “non-routine,” without specific instructions from the beneficial owner. Thus, beneficial owners of shares held in broker accounts are advised that, if they do not timely provide instructions to their broker, their shares will not be voted in connection with the election of directors at the annual meeting.

Costs of Proxies

The Company will bear all costs and expenses incurred in connection with soliciting proxies. Our directors and executive officers, as well as certain employees of our business manager, IREIT Business Manager & Advisor, Inc. (referred to herein as the “Business Manager”), also may solicit proxies by mail, personal contact, letter, telephone, facsimile or other electronic means. These individuals will not receive any additional compensation for these activities, but may be reimbursed by us for their reasonable out-of-pocket expenses. In addition, the Company has hired Broadridge to solicit proxies on its behalf. We expect to pay Broadridge aggregate fees, costs and expenses of approximately $118,650 for soliciting proxies plus other fees and expenses for other services related to this proxy distribution, including disseminating broker search cards; distributing proxy materials; operating online and telephone voting systems; and receiving executed proxies. We will reimburse brokers and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses to the extent they forward proxy materials to our stockholders.

Other Matters

We are not aware of any other matters to be presented at the annual meeting. Generally, no business aside from the items discussed in this proxy statement may be transacted at the meeting. If, however, any other matter properly comes before the annual meeting as determined by the chair of the meeting, your proxies are authorized to act on the proposal at their discretion.

4

STOCK OWNERSHIP

Stock Owned by Certain Beneficial Owners and Management

Based on a review of filings with the SEC, the following table reflects the amount of common stock beneficially owned (unless otherwise indicated) by (1) persons that beneficially own more than 5% of the outstanding shares of our common stock; (2) our directors and each nominee for director; (3) our executive officers; and (4) our directors and executive officers as a group. All information is as of August 14, 2024.

Name and Address of Beneficial Owner and Nature of Beneficial Ownership(1) |

| Amount(2) |

|

| Percent of Class | |

Robert D. Parks, Director and Chair of the Board(3) |

|

| 4,000 |

|

| * |

Lee A. Daniels, Lead Independent Director(4) |

|

| 9,890 |

|

| * |

Stephen L. Davis, Independent Director(5) |

|

| 7,745 |

|

| * |

Gwen Henry, Independent Director(6) |

|

| 8,217 |

|

| * |

Bernard J. Michael, Independent Director(7) |

|

| 7,722 |

|

| * |

Mark E. Zalatoris, Director, President and Chief Executive Officer |

|

| — |

|

| * |

Catherine L. Lynch, Chief Financial Officer(8) |

|

| 970 |

|

| * |

Judith Fu, Vice President(9) |

|

| 642 |

|

| * |

Cathleen M. Hrtanek, Secretary(10) |

|

| 222 |

|

| * |

Mitchell A. Sabshon, Former President and Chief Executive Officer(11) |

|

| 2,654 |

|

| * |

Daniel Zatloukal, Senior Vice President |

|

| — |

|

| * |

All officers and directors as a group (11 persons) |

|

| 42,062 |

|

| * |

* Less than 1%

(1) The business address of each person listed in the table is c/o Inland Real Estate Income Trust, Inc., 2901 Butterfield Road, Oak Brook, Illinois 60523. Footnotes below include the nature of the ownership of the corresponding beneficial owner.

(2) All fractional ownership amounts have been rounded to the nearest whole number.

(3) Mr. Parks shares voting and investment power with his wife over all of the shares that they own.

(4) Includes 2,369 unvested restricted shares. Mr. Daniels has sole voting and investment power over all of the shares that he beneficially owns.

(5) Includes 2,369 unvested restricted shares. Mr. Davis has sole voting and investment power over all of the shares that he beneficially owns.

(6) Includes 2,369 unvested restricted shares. Ms. Henry shares voting and dispositive power with her husband over all of the shares that they own.

(7) Includes 2,369 unvested restricted shares. Mr. Michael has sole voting and investment power over all of the shares that he beneficially owns.

(8) Ms. Lynch shares voting and dispositive power with her husband over all of the shares that they own.

(9) Ms. Fu has sole voting and investment power over all shares that she beneficially owns.

(10) Ms. Hrtanek has sole voting and investment power over all of the shares that she beneficially owns.

(11) Mr. Sabshon has sole voting and investment power over all of the shares that he beneficially owns.

Interest of Certain Persons in Matters to Be Acted On

No director, executive officer, nominee for election as a director or associate of any director, executive officer or nominee has any substantial interest, direct or indirect, through security holdings or otherwise, in any matter to be acted upon at the annual meeting.

5

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE PRINCIPLES

Board of Directors

In accordance with our charter, our board of Directors is divided into three classes of directors. Each director serves until the annual meeting of stockholders held in the third year following the year of their election and until their successor is duly elected and qualifies. At the annual meeting, two Class III directors will be elected to serve until our 2027 annual meeting and until their successors are duly elected and qualify. The number of directors in each class may be changed from time to time by the board to reflect matters such as an increase or decrease in the number of directors so that each class, to the extent possible, will have the same number of directors. Our bylaws provide that the number of directors may not be less than one, which is the minimum number required by the Maryland General Corporation Law (the “MGCL”), or more than 15. The number of directors on the board is currently fixed at six, of which four are independent.

Our corporate governance guidelines require a majority of our directors to be “independent directors” as that term is defined in the rules of the NYSE and the applicable rules of the SEC. Any director of the Company may resign at any time by delivering his or her resignation to the board, the chairman of the board or the secretary. Any resignation will take effect immediately upon its receipt or at such later time specified in the resignation. The acceptance of a resignation will not be necessary to make it effective unless otherwise stated in the resignation.

The table set forth below lists the names, ages and certain other information about Lee A. Daniels and Robert D. Parks, our Class III directors who are the nominees for election as Class III directors at the annual meeting, and each of the continuing members of our board:

Class III Director Nominees | Class | Age | Position | Director Since | Current Term Expires* | Expiration of Term For Which Nominated* |

| ||||||

Lee A. Daniels | III | 81 | Lead Independent Director | 2012 | 2024 | 2027 |

| ||||||

Robert D. Parks | III | 81 | Director, Chair of the Board | 2024 | 2024 | 2027 |

| ||||||

Continuing Directors | Class | Age | Position | Director Since | Current Term Expires* | Expiration of Term For Which Nominated* |

| ||||||

Gwen Henry | I | 83 | Independent Director, Audit Committee Chair | 2012 | 2025 | — |

| ||||||

Bernard J. Michael | I | 64 | Independent Director, Compensation Committee Chair | 2014 | 2025 | — |

| ||||||

Stephen L. Davis | II | 66 | Independent Director, Nominating and Corporate Governance Committee Chair | 2012 | 2026 | — |

| ||||||

Mark E. Zalatoris | II | 67 | Director, President and Chief Executive Officer | 2024 | 2026 | — |

|

*Each director will remain in office regardless of their term until a successor is duly elected and qualifies or they resign or are removed.

The following sets forth the principal occupation and business of each nominee and each continuing director, as well as the specific experience, qualifications, attributes and skills that led to the conclusion by the board that the nominee should serve as a director of the Company. All ages are stated as of January 1, 2024. As used herein, “Inland” refers to some or all of the entities that are a part of The Inland Real Estate Group of Companies, Inc., which is comprised of separate and independent legal entities, some of which may be affiliates, share some common ownership or have been sponsored and managed by such entities or subsidiaries thereof.

Nominees for Class III Directors

Lee A. Daniels, 82. Independent director since February 2012 and lead independent director since September 2017. Mr. Daniels serves as a member of the nominating and corporate governance committee, the audit committee,

6

and the compensation committee. Mr. Daniels served on the Board of Trustees of Kite Realty Group from 2014 to 2021. Mr. Daniels served on the board of directors of Inland Diversified Real Estate Trust, Inc. (“Inland Diversified”), an entity formed and sponsored by affiliates of the Business Manager, from inception in 2008 until the merger with Kite in 2014.

In February 2007, Mr. Daniels founded Lee Daniels & Associates, LLC, a consulting firm for government and community relations. Prior to that, Mr. Daniels was an equity partner at the Chicago law firm of Bell Boyd & Lloyd from 1992 to 2006, an equity partner at Katten, Muchin & Zavis from 1982 to 1991, and an equity partner at Daniels & Faris from 1967 to 1982. Mr. Daniels served as Special Assistant Attorney General for the State of Illinois from 1971 to 1974. He served as a member of the Illinois House of Representatives from 1975 to 2007, was the Republican Leader from 1983 to 1995 and 1998 to 2003, and was Speaker of the Illinois House of Representatives from 1995 to 1997.

Mr. Daniels currently serves as chair of the Board of Directors of Haymarket Center, a nonprofit behavioral health treatment center located in Chicago, Illinois. He served as the chair of the Presidential Search Committee for the College of DuPage from 2015 to 2016. He previously served on the Elmhurst Memorial Healthcare Board of Trustees from 1981 to 2013, the Board of Governors from 1990 to 2013, and the Elmhurst Memorial Hospital Foundation Board from 1980 to 1984 and 2013. Other boards Mr. Daniels has served on include the Suburban Bank and Trust Company of Elmhurst Board of Directors from 1994 to 1996, the Elmhurst Federal Savings and Loan Association Board of Directors from 1991 to 1994, and the DuPage Easter Seals Board of Directors from 1970 to 1973.

Mr. Daniels received his bachelor’s degree from the University of Iowa and his law degree from the University of Illinois at Chicago Law School (f/k/a/ The John Marshall Law School) in Chicago. He received a Distinguished Alumni Award from both The John Marshall Law School and the University of Iowa, and an Honorary Doctor of Laws from Elmhurst College.

Our board believes that Mr. Daniels’ depth of knowledge and experience, based on his over 50 years of legal practice and his service as a board member of other real estate investment trusts or “REITs” make him well qualified to serve as a member of our board of directors.

Robert D. Parks, 81. Director and the chair of our board since January 2024. Mr. Parks was elected as a director and chairman of the board to fill the vacancy resulting from the passing of our former director and chairman of the board, Daniel L. Goodwin. Mr. Parks is a manager of The Inland Real Estate Companies, LLC and one of the original principals of The Inland Group, LLC. Mr. Parks has served as a director on multiple boards, including as chairman of Inland Real Estate Investment Corporation (“IREIC”) from November 1984 to December 2016; chairman of the board of Inland Diversified Real Estate Trust, Inc. from June 2008 to July 2014; director of Inland Investment Advisors, Inc. from June 1995 to May 2013; chairman of the board of Retail Properties of America, Inc. from March 2003 to October 2010; director of Inland Securities Corporation from August 1984 to June 2009; director of Inland Real Estate Corporation (subsequently renamed IRC Retail Centers) from 1994 to June 2008, serving as chairman of the board from May 1994 to May 2004 and as president and chief executive officer from 1994 to April 2008; and chairman of the board of Inland Retail Real Estate Trust, Inc. from September 1998 to March 2006, serving as chief executive officer until December 2004. Mr. Parks earned his undergraduate degree from Northeastern Illinois University and his Master of Arts degree from the University of Chicago.

Our board believes that Mr. Parks’ significant experience, especially with the non-listed REITs, is of great benefit to the board and the Company and makes him well qualified to serve as a member of our board of directors.

Continuing Directors

Stephen L. Davis, 66. Independent director since February 2012. Mr. Davis serves as a member of the audit committee and the compensation committee as well as the chair of the nominating and corporate governance committee. Mr. Davis served as a member of the board of directors of Heska Corporation from August 2020 until July 2023 and as a member of its audit committee and as the chair of its corporate governance committee in each case from February 2021 until July 2023. Mr. Davis has served as a member of the board of directors of PMI Energy Solutions, LLC from 2013 until 2023. Additionally, Mr. Davis served on the board of the Trust Company of Illinois from 2016

7

until 2022. Mr. Davis has over 30 years of experience in real estate development. Mr. Davis has been the chairman of The Will Group, Inc., a construction-related company, since founding the company in 1986. In his position with The Will Group, Mr. Davis was instrumental in the construction of the Kennedy King College campus, located in Chicago, Illinois, and the coordination of the "Plan for Transformation" for Altgeld Gardens, a public housing development located in Chicago, Illinois. Since October 2003, Mr. Davis has also overseen property management operations for several properties owned by his family-owned real estate trust, including a $28 million industrial development in Chicago’s North Lawndale community.

Mr. Davis served as commissioner of aviation (board chair) of the DuPage County Airport Authority, in DuPage County, Illinois, which oversees management of the DuPage County Airport, Prairie Landing Golf Course, and the 500-acre DuPage County Business Park from March 2005 until 2022. From 2006 to 2016, Mr. Davis served as a director of Wheaton Bank & Trust, where he was a member of the loan committee, which was responsible for reviewing and analyzing residential and commercial loan portfolios, developer credentials and viability, home builders, and commercial and industrial loans. Mr. Davis obtained his bachelor's degree from the University of Tennessee, located in Knoxville.

Our board believes that Mr. Davis’s prior real estate development experience, his experience as a director of another public company, and his leadership qualities make him well qualified to serve as a member of our board of directors.

Gwen Henry, 83. Independent director since February 2012. Ms. Henry serves as chair of the audit committee and is a member of the nominating and corporate governance committee and the compensation committee. Ms. Henry currently serves as the Treasurer of DuPage County, Illinois, a position she has held since December 2006. In this position, Ms. Henry is responsible for the custody and distribution of DuPage County funds. In addition, from April 1981 to 2019, Ms. Henry was a partner at Dugan & Lopatka, a regional accounting firm, and a member of the firm’s controllership and consulting services practice, where she specialized in financial consulting and tax and business planning for privately-held companies. Since December 2009, Ms. Henry has served as a member of the Illinois Municipal Retirement Fund, a $52 billion fund which has investments in excess of $1.2 billion allocated to real estate. She currently serves as chair of the investment committee, and is a member of the audit committee and the legislative committee of the fund.

Ms. Henry previously served as DuPage County Forest Preserve Commissioner (from December 2002 to November 2006) and as chair to the special committee responsible for the DuPage County Budget (from December 2002 to November 2004), and was a member of the DuPage County Finance Committee (from November 1996 to November 2002). Ms. Henry also has held a number of board and chair positions for organizations such as the Marianjoy Rehabilitation Hospital (as treasurer from June 2002 to May 2008), the Central DuPage Health System (as chairperson of the board from October 1995 to September 1999), and the Central DuPage Hospital Foundation (as director from October 2002 to present). She was elected and served as Mayor of the City of Wheaton, Illinois from March 1990 to December 2002.

Ms. Henry received her bachelor degree from the University of Kansas, located in Lawrence, Kansas. She is a certified public accountant, a designated certified public funds investment manager and a certified public finance administrator.

Our board believes that Ms. Henry’s over 35 years of public accounting experience makes her well qualified to serve as a member of our board of directors.

Bernard J. Michael, 64. Independent director since September 2014. Mr. Michael has served as the chairman of the compensation committee since its formation, is as a member of the audit committee and, since September 2017, has been a member of the nominating and corporate governance committee. Mr. Michael founded AWH Partners, LLC, a privately held real estate investment, development and management firm. He served as managing partner of the firm until 2018. He now owns only a minority interest in the firm. Under Mr. Michael’s leadership, AWH acquired in excess of $1.4 billion of hotel investments and was managing or completed hotel redevelopment projects totaling more than $300 million. In early 2012, AWH acquired Lane Hospitality, which it rebranded as Spire Hospitality, a top-tier national hospitality platform formed in 1980. Mr. Michael also served as the chairman and chief executive officer and president of the Center for Jewish History, a not-for-profit museum and archive in New York until 2024.

8

Mr. Michael also has over 25 years of experience as a practicing lawyer specializing in real estate with a focus on sophisticated real estate transactions across all asset classes for some of the world's largest property owners, developers and lenders. Mr. Michael was the founder and senior partner of Michael, Levitt & Rubenstein, LLC, a law firm focusing on real estate sales, acquisitions, development, leasing and financing. Mr. Michael and his team worked on some of the largest transactions in New York City, including the development of Time Warner Center and the Hudson Yards projects for The Related Companies. In addition, Mr. Michael and his firm represented developers on major multi-family, retail, office and hospitality projects in China, Saudi Arabia, and in most major cities across the United States.

Prior to forming Michael, Levitt & Rubenstein LLC, Mr. Michael was a partner in the Real Estate Group at Proskauer Rose, LLP. Prior to that, Mr. Michael was an attorney at Weil, Gotschal & Manges and Shea & Gould. Mr. Michael is a graduate of Brown University and New York University School of Law.

Our board believes that Mr. Michael’s prior business experience and his leadership qualities make him well qualified to serve as a member of our board of directors.

Mark E. Zalatoris, 67. Director, president and chief executive officer since February 2024. Mr. Zalatoris was elected to serve as a director and the Company’s president and chief executive officer effective February 1, 2024. Since 2018, Mr. Zalatoris has been the lead independent director of Parkway Bancorp and wholly-owned subsidiary, Parkway Bank. Mr. Zalatoris also served in multiple positions at IRC Retail Centers, including as a member of the board of directors, chief executive officer and president from 2008 to 2017; executive vice president and chief operating officer from 2004 to 2008; and senior vice president, chief financial officer and treasurer from 2000 to 2004. IRC Retail Centers was a REIT originally formed and sponsored by affiliates of the Business Manager that was also listed on the NYSE from 2004_to 2016 when the entity completed a cash-out merger with a third party. Mr. Zalatoris earned his undergraduate degree from University of Illinois, Urbana-Champaign and his Master of Accounting Science degree from University of Illinois, Urbana-Champaign.

Our board believes that Mr. Zalatoris’ extensive finance and real estate experience, including previously serving as the chief executive officer of a publicly-traded REIT, make him well qualified to serve as a member of our board of directors.

Independence

Our business is managed under the direction and oversight of our board. The members of our board are Lee A. Daniels, Stephen L. Davis, Gwen Henry, Bernard J. Michael, Robert D. Parks and Mark E. Zalatoris. As required by our Corporate Governance Guidelines, a majority of our board must be comprised of “independent directors” according to the director independence standard of the New York Stock Exchange (“NYSE”) and applicable regulations promulgated by the SEC. The NYSE standards provide that to qualify as an independent director, among other things, the board of directors must affirmatively determine that the director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). The board annually reviews the relationships that each director has with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). Following the annual review, only those directors who the board affirmatively determines have no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company) will be considered independent directors, subject to additional qualifications prescribed by the NYSE Rules.

After reviewing any relevant transactions or relationships between each director, or any of his or her family members, and the Company, our management and our independent registered public accounting firm, and considering each director’s direct and indirect association with IREIC, the Business Manager or any of their affiliates, the board has determined that Messrs. Daniels, Davis and Michael and Ms. Henry qualify as independent directors.

Board Leadership Structure and Risk Oversight

We have separated the roles of the president and chair of the board to recognize the difference between the two roles. Mr. Zalatoris, in his role as our president and chief executive officer, is responsible for establishing the

9

strategic direction for the Company and for providing the day-to-day leadership of the Company. Mr. Parks, as chair of the board, organizes the work of the board and ensures that the board has access to sufficient information to carry out its functions. Mr. Parks presides over meetings of the board of directors and stockholders, establishes the agenda for each meeting and oversees the distribution of information to directors.

Mr. Daniels currently serves as our “Lead Independent Director.” Although each board member is apprised of our business and developments impacting our business, the Lead Independent Director coordinates the activities of the independent directors and serves as the principal liaison between the independent directors and the chair of the board.

Mr. Daniels, in his capacity as Lead Independent Director presides at board meetings if the chair of the board is absent; establishes board meeting agendas in collaboration with the chair of the board and the various committee chairs and recommends matters for the board and committees to consider; advises the chair of the board as to the quality, quantity and timeliness of the information submitted to the directors; calls meetings of the independent directors or calls for executive sessions during board meetings; and presides at meetings of the independent directors or executive sessions of the board. The Lead Independent Director also performs such other responsibilities as the board may determine.

Our board believes that having a Lead Independent Director with the duties and responsibilities described above, provides the same independent leadership, oversight, and benefits to the Company and the board that would be provided by an independent chair of the board. Our full board of directors, including our independent directors, is responsible for approving all material transactions, and each transaction between us and the Business Manager or its affiliates must be approved by the affirmative vote of a majority of our directors, including a majority of our independent directors, not otherwise interested in the transaction. In addition, each board member is kept apprised of our business and developments impacting our business and has complete and open access to the members of our management team, the Business Manager and our real estate manager, Inland Commercial Real Estate Services LLC (our “Real Estate Manager”).

Our board is actively involved in overseeing risk management for the Company. Our board of directors oversees risk through: (1) its review and discussion of regular periodic reports to the board of directors and its committees, including management reports and studies on existing market conditions, leasing activity and property operating data, as well as actual and projected financial results, and various other matters relating to our business; (2) the required approval by the board of directors of material transactions, including, among others, acquisitions and dispositions of properties, financings and our agreements with the Business Manager, our Real Estate Manager and the ancillary service providers; (3) reports from the audit committee; and (4) its review and discussion of regular periodic reports from our independent registered public accounting firm and other outside consultants or advisors regarding various areas of potential risk, including, among others, those relating to the qualification of the Company as a REIT for tax purposes and our internal control over financial reporting.

10

Independent Director Compensation

The following table summarizes compensation earned by the independent directors for the year ended December 31, 2023 (Dollar amounts in thousands).

Name |

| Fees Earned |

|

| Stock |

|

| Options |

|

| Non-Equity |

|

| Change in Pension Value and Nonqualified Deferred Compensation Earnings |

|

| All Other |

|

| Total |

| |||||||

Lee A. Daniels |

| $ | 79 |

|

| $ | 24 |

|

| $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | 3 |

|

| $ | 106 |

|

Stephen L. Davis |

| $ | 65 |

|

| $ | 24 |

|

| $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | 3 |

|

| $ | 92 |

|

Gwen Henry |

| $ | 78 |

|

| $ | 24 |

|

| $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | 3 |

|

| $ | 105 |

|

Bernard J. Michael |

| $ | 65 |

|

| $ | 24 |

|

| $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | 3 |

|

| $ | 92 |

|

Cash Compensation

For the year ended December 31, 2023, we paid our independent directors an annual fee of $50,000 plus $2,000 for each in-person meeting or meeting of the board by video conference and $750 for each meeting of the board by telephone; we also paid our independent directors $1,400 for each in-person meeting or meeting by video conference of each committee of the board and $550 for each meeting of each committee of the board by telephone. We paid the chairperson of the nominating and corporate governance committee of our board an annual fee of $8,500 and the chairperson of the audit committee of our board an annual fee of $13,200. We paid the Lead Independent Director an annual fee of $5,000.

On May 7, 2024, the board elected to eliminate per-meeting fees and increase the annual retainer. Effective June 1, 2024, we pay our independent directors an annual fee of $90,000, the chairperson of the nominating and corporate governance committee of our board an annual fee of $15,000, the chairperson of the compensation committee of our board an annual fee of $15,000, the chairperson of the audit committee of our board an annual fee of $20,000 and the Lead Independent Director an annual fee of $20,000.

We reimburse all of our directors for any out-of-pocket expenses incurred by them in attending meetings. Each independent director may elect to receive payment of all or a portion of his or her fee in the form of unrestricted shares in lieu of cash pursuant to our employee and director restricted share plan (the “RSP”) and may elect to defer the receipt of all or a portion of his or her fee pursuant to our director deferred compensation plan (the “Director Plan”). We do not compensate any director that also is an employee of the Business Manager or its affiliates.

Stock Compensation

On March 21, 2016 the board of directors approved the RSP, which was subsequently approved by the Company’s stockholders at the annual stockholders’ meeting on June 16, 2016. The RSP provides us with the ability to grant awards of restricted shares and restricted share units to directors, officers and employees (if we ever have employees) of us, our affiliate or the Business Manager. Under the RSP, on the date of the 2023 annual stockholders’ meeting, each director received an award of restricted shares of common stock or restricted share units in each case having a fair market value as of the date of grant equal to $24,000. On May 7, 2024, the board of directors approved an increase in the award of restricted shares of common stock or restricted share units that each director will receive under the RSP to a fair market value as of the date of grant equal to $40,000 beginning on the date of the Annual Meeting. Restricted shares and restricted share units issued to independent directors pursuant to these grants vest over a three-year period following the respective date of grant in increments of 33-1/3% per annum, subject to their continued service as directors until each vesting date, and become fully vested earlier upon a liquidity event or upon

11

the termination of a director by reason of his or her death or disability. The total number of common shares granted under the RSP may not exceed 5.0% of our outstanding shares on a fully diluted basis at any time (as such number may be adjusted to reflect any increase or decrease in the number of outstanding shares resulting from a stock split, stock dividend, reverse stock split or similar change in our capitalization).

Other restricted share awards entitle the recipient to receive shares of common stock from us under terms that provide for vesting over a specified period of time or upon attainment of pre-established performance objectives. These awards would typically be forfeited with respect to the unvested shares upon the termination of the recipient’s employment or service as a director for any reason other than death or disability or, if applicable, the termination of the business management agreement with the Business Manager. Restricted shares may not, in general, be sold or otherwise transferred until restrictions are removed and the shares have vested. Holders of restricted shares have the right to vote such shares and may receive distributions prior to the time that the restrictions on the restricted shares have lapsed. As of December 31, 2023, there were 9,477 unvested restricted shares outstanding under the RSP.

The following table sets forth information regarding securities authorized for issuance under the RSP as of December 31, 2023.

Plan Category |

| Number of Securities to |

|

| Weighted Average |

|

| Number of Securities Remaining Available |

| |||

|

| (a) |

|

| (b) |

|

| (c) |

| |||

Equity Compensation Plans |

|

| — |

|

|

| — |

|

|

| 1,780,741 |

|

Equity Compensation Plans not |

|

| — |

|

|

| — |

|

|

| — |

|

Total |

|

| — |

|

|

| — |

|

|

| 1,780,741 |

|

Deferred Compensation Plan

The Director Plan permits us to provide deferred compensation arrangements to our independent directors and their beneficiaries. Under the Director Plan, independent directors may elect to defer the receipt of all or a portion of their cash and stock compensation. Eligible cash compensation that is deferred is credited to a book entry account established for each participant in an amount equal to the amount deferred, and restricted share units are issued under the RSP in lieu of all or a portion of stock compensation otherwise payable in restricted shares. A participant has a fully vested right to his cash deferral amounts, and the deferred share unit awards will vest on the same terms and schedule as the underlying eligible stock compensation would have otherwise been subject if granted in restricted shares. Unless otherwise determined by the board, while restricted share units are unvested, participants will be credited with dividend equivalents equal in value to those declared and paid on shares of Company common stock, on all restricted share units granted to them. These dividend equivalents will be regarded as having been reinvested in restricted share units, and will only be paid to the extent the underlying restricted share units vest. Payment of restricted share units will be made, to the extent vested, in shares of Company common stock, unless otherwise determined by the board. Except as otherwise determined by the board, account balances under the Director Plan will not be credited with interest or any other credits, although the Company may permit an account to be credited with earnings with respect to restricted share units.

The Director Plan provides our board with the discretion to amend, suspend or terminate the Director Plan at any time, provided that any amendment, suspension or termination will not be made if it would substantially impair the rights of any participant under the Director Plan.

Meetings of the Board of Directors, Committees and Stockholders

During the year ended December 31, 2023, our board met five times, the audit committee met four times and the nominating and corporate governance committee met four times. With the exception of Mr. Davis, each of our

12

directors attended 100% of the aggregate amount of the meetings of the board during the period for which he or she was a director, and any committee on which he or she served, in 2023. Mr. Davis attended approximately 85% of the aggregate amount of the meetings of the board during the period for which he was a director, and any committee on which he served, in 2023. We encourage our directors to attend our annual meeting of stockholders, and in 2023, each director did so attend.

Committees of our Board of Directors

Audit Committee. Our board has formed a separately-designated standing audit committee, comprised of Ms. Henry and Messrs. Daniels, Davis and Michael, each of whom has been found by the board to be “independent” within the meaning of the applicable listing standards of the NYSE, which have been adopted by the Company in its Corporate Governance Guidelines as its standard for director independence. Ms. Henry serves as the chairperson of this committee, and our board has determined that Ms. Henry qualifies as an “audit committee financial expert” as defined by the SEC. Our audit committee held four meetings during the year ended December 31, 2023. The audit committee assists the board in fulfilling its oversight responsibility relating to, among other things: (1) the integrity of our financial statements; (2) our compliance with legal and regulatory requirements; (3) the qualifications and independence of our independent registered public accounting firm; and (4) the performance of our internal audit function and independent registered public accounting firm. The report of the committee is included in this proxy statement.

Our board has adopted a written charter under which the audit committee operates. A copy of the charter is available on our website at www.inland-investments.com/inland-income-trust under the “Corporate Governance” tab.

Nominating and Corporate Governance Committee. Our board has formed a nominating and corporate governance committee consisting of Ms. Henry and Messrs. Daniels, Davis and Michael, each of whom has been found to be “independent” within the meaning of the applicable listing standards of the NYSE by the board. Mr. Davis serves as the chair of this committee. Our nominating and corporate governance committee held four meetings during the year ended December 31, 2023. The nominating and corporate governance committee is responsible for, among other things: (1) identifying individuals qualified to serve on the board and the nominating and corporate governance committee and recommending to the board a slate of director nominees for election by the stockholders at the annual meeting; (2) periodically reevaluating any corporate governance policies and principles adopted by the board, including recommending any amendments thereto if appropriate; and (3) overseeing an annual evaluation of the board. The nominating and corporate governance committee is also responsible for considering director nominees submitted by stockholders.

The committee considers all qualified candidates identified by members of the committee, by other members of the board of directors, by the Business Manager and by stockholders. In recommending candidates for director positions, the committee takes into account many factors and evaluates each director candidate in light of, among other things, the candidate’s knowledge, experience, judgment and skills such as an understanding of the real estate industry or financial industry or accounting or financial management expertise. Other considerations include the candidate’s independence from conflict with the Company, the Business Manager and the Sponsor and the ability of the candidate to devote an appropriate amount of effort to board duties. The committee also focuses on persons who are actively engaged in their occupations or professions or are otherwise regularly involved in the business, professional or academic community. The committee considers diversity in its broadest sense, including persons diverse in geography, gender and ethnicity as well as representing diverse experiences, skills and backgrounds. The committee evaluates each individual candidate by considering all of these factors as a whole, favoring active deliberation rather than the use of rigid formulas to assign relative weights to these factors.

Our board has adopted a written charter under which the nominating and corporate governance committee operates. A copy of the charter is available on our website at www.inland-investments.com/inland-income-trust under the “Corporate Governance” tab.

Compensation Committee. Considering the Agreement entered into with Mr. Zalatoris in January 2024, the nominating and corporate governance committee recommended that the board create a compensation committee. The board accepted the recommendation and authorized the creation of a compensation committee to be comprised of independent directors to, among other things, review and approve all forms of compensation for the Company’s

13

independent directors, review and determine, at least annually, that the compensation the Company contracts to pay to the Business Manager is reasonable in relation to the nature and quality of services performed or to be performed, and to review and determine the compensation paid directly by the Company to its president and chief executive officer. On May 7, 2024, the board formed a compensation committee comprised of each of the independent directors. Mr. Michael was appointed to act as chairperson of the committee. The committee expects to adopt a charter which, when adopted, will be available on our website at www.inland-investments.com/inland-income-trust under the “Corporate Governance” tab.

Other Committees. Through the fiscal year ended December 31, 2023, our board had not formed a compensation committee, and did not have a charter that governed the compensation process. Instead, for the fiscal year ended December 31, 2023, the full board of directors had performed the functions of a compensation committee, including reviewing and approving all forms of compensation for our independent directors that have been reviewed and recommended by our nominating and corporate governance committee.

Communicating with Directors

Stockholders wishing to communicate with our board and the individual directors may send communications by letter, e-mail or telephone, in care of our corporate secretary, who will review and forward all correspondence to the appropriate person or persons for a response.

Our non-retaliation policy, also known as our “whistleblower” policy, prohibits us from retaliating or taking any adverse action against our employees (if we ever have employees), or the employees of the Business Manager or its affiliates, for raising a concern, including concerns about accounting, internal controls or auditing matters. These persons may raise their concerns by contacting our compliance officer, Cathleen M. Hrtanek, at (630) 218-8000. In addition, confidential complaints involving the Company’s accounting, auditing, and internal auditing controls and disclosure practices may be raised anonymously via email or mail as described in our non-retaliation policy. A complete copy of our non-retaliation policy may be found on our website at www.inland-investments.com/inland-income-trust under the “Corporate Governance” tab.

Anti-Hedging Policy

The insider trading policy of IREIC and its affiliated entities, including our Business Manager and Real Estate Manager, prohibits officers, directors and employees of these entities, including our executive officers, from engaging, without the prior written consent of the applicable employer, in hedging or monetization transactions such as zero-cost collars and forward sale contracts that allow a person to lock in a portion of the value of his or her shares in any Inland entity or any entity sponsored by or advised by IREIC or by any of its direct or indirect subsidiaries. This includes our securities such as shares of our common stock. Because there is no established public trading market for our common stock and we do not have any employees, the Company itself has not separately adopted any specific practices or policies regarding the ability of our directors, officers or employees to purchase financial instruments or otherwise engage in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our common stock or any other securities that we might issue.

Code of Ethics

Our board has adopted a code of ethics applicable to our directors, officers and employees (if we ever have employees) which is available on our website at www.inland-investments.com/inland-income-trust. In addition, printed copies of the code of ethics are available to any stockholder, without charge, by writing us at 2901 Butterfield Road, Oak Brook, Illinois 60523, Attention: Investor Services.

Any waivers of the provisions of the code of ethics for executive officers or directors may be granted only in exceptional circumstances by our board or a committee of our board. Any waivers will be promptly disclosed to the extent required by law. Any amendments to the code of ethics must also be approved by our board. If we make any substantive amendments to the code of ethics or grant any waiver, including any implicit waiver, from a provision of the code of ethics to our chief executive officer, chief financial officer, chief accounting officer or controller or persons

14

performing similar functions, we may, rather than filing a Current Report on Form 8-K, satisfy the disclosure requirement by posting such information on our website as necessary.

15

EXECUTIVE COMPENSATION

Executive Officers

The board of directors annually elects our executive officers. These officers may be terminated at any time. Information about each of our executive officers, with the exception of Mr. Zalatoris, whose biography is included above, follows. All ages are stated as of January 1, 2024.

Catherine L. Lynch, 66. Our chief financial officer since April 2014 and treasurer since April 2018, and a director of the Business Manager since August 2011. Ms. Lynch joined Inland in 1989 and has been a director of The Inland Group, LLC since June 2012. She serves as the treasurer and secretary (since January 1995), the chief financial officer (since January 2011) and a director (since April 2011) of IREIC and as a director (since July 2000) and chief financial officer and secretary (since June 1995) of Inland Securities Corporation. She also served as the chief financial officer of Inland Residential Properties Trust, Inc. (“IRPT”) and the IRPT business manager from December 2013 until October 2019. She also served as the treasurer of the IRPT business manager from December 2013 to October 2014. Ms. Lynch also serves as the chief financial officer and treasurer (since October 2016) of InPoint Commercial Real Estate Income, Inc. (“InPoint”) and as the chief financial officer and treasurer of the InPoint advisor (since August 2016). Ms. Lynch also has served as a director of Inland Private Capital Corporation (“IPCC”) since May 2012. Ms. Lynch served as the treasurer of Inland Capital Markets Group, Inc. from January 2008 until October 2010, as a director and treasurer of Inland Investment Advisors, LLC from June 1995 to December 2014 and as a director and treasurer of Inland Institutional Capital, LLC from May 2006 to December 2014. Ms. Lynch worked for KPMG Peat Marwick LLP from 1980 to 1989. Ms. Lynch received her bachelor degree in accounting from Illinois State University in Normal. Ms. Lynch is a member of the Illinois CPA Society. Ms. Lynch also is registered with the Financial Industry Regulatory Authority, Inc. (“FINRA”) as a financial operations principal.

Daniel Zatloukal, 44. Our senior vice president since December 2021, Mr. Zatloukal also serves as executive vice president and head of asset and portfolio management for all investment programs sponsored by IREIC, positions he has held since 2015. He also serves as senior vice president of IPCC, an affiliate of IREIC, a position he has held since 2014. As of December 31, 2023, IPCC has sponsored 313 private placement programs and has approximately $12 billion in assets under management. In his role as executive vice president for IREIC, Mr. Zatloukal is responsible for overseeing the asset management function for IREIC and all of its affiliates. In addition, Mr. Zatloukal has been an executive vice president of IPC Alternative Real Estate Income Trust, Inc. (“Alt REIT”) since its inception in June 2023. Alt REIT is a monthly NAV REIT focused on alternative real estate sectors including self-storage facilities, student housing properties and healthcare-related properties. Mr. Zatloukal was president of Inland Investment Real Estate Services, Inc. from October 2015 through June 2017 and was responsible for overseeing all of IREIC’s real estate services group, which includes property management, leasing and asset management for commercial and residential portfolios owned or managed by IREIC and its affiliates. Prior to rejoining Inland at IPC in 2013, Mr. Zatloukal served as vice president of capital markets at Jones Lang LaSalle in Atlanta. Mr. Zatloukal received his bachelor’s degree in finance from the University of Illinois at Urbana-Champaign.

Judith Fu, 63. Our vice president of administration since December 2021, and the vice president of the Business Manager since January 2022. Ms. Fu joined the Company in 2005 and currently also serves as a vice president of IREIC, a position she has held since August 2018. As chief of staff of IREIC, Ms. Fu provides organizational support to the executive management team of IREIC Ms. Fu also served as chief compliance officer for the registered investment advisor subsidiaries of Inland Mortgage Corporation from August 2008 to August 2010. In 2010, Ms. Fu began working for IREIC as the executive assistant to its then chief executive officer. While holding this position, she also acted as the chief compliance officer for Inland Institutional Capital Partners from March 2012 to September 2014. Ms. Fu holds FINRA Series 24, 63, 65 and 7 licenses and previously was a licensed managing real estate broker in the State of Illinois. Ms. Fu has a bachelor’s of science degree from Loyola University Chicago.

Cathleen M. Hrtanek, 47. Our corporate secretary and the secretary of the Business Manager since August 2011. Ms. Hrtanek joined Inland in 2005 and is currently Chief Operating Officer of The Inland Real Estate Group, LLC, a position she assumed in May 2024 after most recently holding the titles of Associate General Counsel and Senior Vice President. Ms. Hrtanek has served as a Director of Inland Private Capital Corporation, Inland Securities Corporation, and a Manager of IPC Alternative Real Estate Advisor, LLC, respectively, since February 2024. Ms. Hrtanek has served as the Secretary of InPoint Commercial Real Estate Income, Inc. since March 2022, its Assistant

16

Secretary from August 2016 to March 2022 and Secretary of its advisor since August 2016. Ms. Hrtanek is also the Secretary of Inland Venture Partners, LLC, IVP MHC Fund III, LLC, MH Ventures Fund II, Inc., Inland Ventures MHC Manager, LLC and MH Ventures II Business Manager, LLC, and has served as the Secretary of Inland Opportunity Business Manager & Advisor, Inc. since April 2009. Ms. Hrtanek also served as the Secretary of Inland Diversified Real Estate Income Trust, Inc. from September 2008 to July 2014 and its business manager from September 2008 to March 2016, and as the Secretary of IPC from August 2009 to May 2017. Prior to joining Inland, Ms. Hrtanek had been employed by Wildman Harrold Allen & Dixon LLP in Chicago, Illinois starting in September 2001. Ms. Hrtanek has been admitted to practice law in the State of Illinois and holds a bachelor’s degree in Political Science and French from the University of Notre Dame and a J.D. from Loyola University Chicago School of Law.

Compensation of Executive Officers

On January 19, 2024, the Company, on the recommendation of the nominating and corporate governance committee, entered into an agreement with Mark Zalatoris (the “Agreement”) pursuant to which the Company agreed to, among other things, pay Mr. Zalatoris an annual fee (payable pro rata monthly) equal to $350,000 per year to compensate him for performing services as our president and chief executive officer. The Agreement with Mr. Zalatoris does not contain any provisions that would pay Mr. Zalatoris any incentive compensation. Mr. Zalatoris is not employed by and has no position with IREIC. The rest of our executive officers are officers of IREIC or one or more of its affiliates and are compensated by those entities, in part, for services rendered to us. The amount we pay Mr. Zalatoris reduces the amount we pay to the Business Manager under the Business Management Agreement on a dollar-for-dollar basis. Except for the amounts payable to Mr. Zalatoris, we neither compensate our executive officers nor reimburse either the Business Manager or Real Estate Manager for any compensation paid to individuals who also serve as our executive officers, or the executive officers of the Business Manager, our Real Estate Manager or their respective affiliates; provided that, for these purposes, our corporate secretary is not considered an “executive officer.” For the fiscal year ended December 31, 2023, we did not have, and our board of directors did not consider, a compensation policy or program for our executive officers and has not included a “Compensation Discussion and Analysis,” a report from our board of directors with respect to executive compensation, a non-binding stockholder advisory vote on compensation of executives, a non-binding stockholder advisory vote on the frequency of the stockholder vote on executive compensation or the pay ratio between employees and our principal executive officer. Except for Mr. Zalatoris, we neither separately compensate our executive officers for their service as officers, nor do we reimburse either the Business Manager or our Real Estate Manager for any compensation paid to their employees who also serve as our executive officers. Our secretary is not considered an executive officer for purposes of these limits on reimbursement. The fees we pay to the Business Manager and Real Estate Manager under the business management agreement or the real estate management agreement, respectively, are described in more detail under “Certain Relationships and Related Transactions.”

In the future, the compensation committee will review the compensation paid to Mr. Zalatoris and any additional executive officers that the Company may decide to annually compensate, and approve all stock option grants, warrants, stock appreciation rights and other current or deferred compensation payable to the executive officers with respect to the current or future value of our shares. See “Board of Directors and Corporate Governance Principles – Committees of our Board of Directors – Compensation Committee” for additional discussion.

Certain Relationships and Related Transactions

Set forth below is a summary of the material transactions between the Company and various affiliates of IREIC, including the Business Manager and Real Estate Manager, that have occurred since January 1, 2023, or are currently proposed or anticipated. IREIC is an indirect wholly-owned subsidiary of The Inland Group, LLC. Please see the biographical information of our directors and executive officers elsewhere in this proxy statement for information regarding their relationships to Inland, including IREIC and The Inland Group, LLC.

Business Management Agreement through March 31, 2023

We have entered into a business management agreement with IREIT Business Manager & Advisor Inc., which serves as the Business Manager with responsibility for overseeing and managing our day-to-day operations. The terms and conditions of the Second Amended and Restated Business Management Agreement dated October 15, 2021 (the “Second Business Management Agreement”), were effective until April 1, 2023, whereupon a Third

17

Amended and Restated Business Management Agreement entered into on March 23, 2023 (“Third Business Management Agreement”), took effect and resulted in certain changes to the Second Business Management Agreement. For details regarding certain differences between these two agreements, including changes to certain terms and conditions in the Second Business Management Agreement, please see the description of those changes in the section immediately below. As further described herein, we subsequently entered into the Fourth Amended and Restated Business Management Agreement (the “Fourth Business Management Agreement”) with the Business Manager, effective February 1, 2024. From January 1, 2023 through March 31, 2023, we paid the Business Manager an annual business management fee equal to 0.65% of our “average invested assets,” payable quarterly in an amount equal to 0.1625% of our average invested assets as of the last day of the immediately preceding quarter. In connection with entering into the Third Business Management Agreement, beginning on April 1, 2023, we paid the Business Manager an annual business management fee equal to 0.55% of our “average invested assets,” payable quarterly in an amount equal to 0.1375% of our average invested assets as of the last day of the immediately preceding quarter. “The Business Manager has the sole discretion to be paid an amount less than the total amount to which it is entitled in any quarter, and the excess amount that is not paid may, in the Business Manager’s sole discretion, be waived permanently or deferred or accrued, without interest, to be paid at a later point in time. The Business Manager did not exercise this discretion in the year ended December 31, 2023.

As used in the business management agreement, “average invested assets” means, for any period, the average of the aggregate book value of our assets, including all intangibles and goodwill, invested, directly or indirectly, in equity interests in, and loans secured by, properties, as well as amounts invested in securities and consolidated and unconsolidated joint ventures or other partnerships, before reserves for amortization and depreciation or bad debts, impairments or other similar non-cash reserves, computed by taking the average of these values at the end of each month during the relevant calendar quarter.

If the business management agreement had been terminated, including in connection with the internalization of the functions performed by the Business Manager, the obligation to pay this business management fee would terminate.

Upon a “triggering event,” we are required to pay the Business Manager a subordinated incentive fee equal to 10% of the amount by which (1) the “liquidity amount” (as defined below) exceeds (2) the “aggregate invested capital,” plus the total distributions required to be paid to our stockholders in order to pay them a 7% per annum cumulative, pre-tax non-compounded return on the aggregate invested capital, all measured as of the triggering event. If we have not satisfied this return threshold at the time of the applicable triggering event, the fee is required to be paid at the time of any future triggering event, provided that we have satisfied the return requirements. We did not experience a “triggering event,” and thus did not incur a subordinated incentive fee, during the year ended December 31, 2023, or the six-month period ended June 30, 2024.

As used herein, a “triggering event” means any sale of assets (excluding the sale of marketable securities) in which the net sales proceeds are specifically identified and distributed to our stockholders, or any liquidity event, such as a listing or any merger, reorganization, business combination, share exchange or acquisition, in which our stockholders receive cash or the securities of another issuer that are listed on a national securities exchange. “Aggregate invested capital” means the aggregate original issue price paid for the shares of our common stock, before reduction for organization and offering expenses, reduced by any distribution of sale or financing proceeds.

For purposes of this subordinated incentive fee, the “liquidity amount” will be calculated as follows:

18

If the business management agreement is terminated pursuant to an internalization in accordance with the transition process set forth in that agreement, the Business Manager, or its successor or designee, will continue to be entitled to receive the subordinated incentive fee, on a prorated basis based on the duration of the Business Manager’s service to us. Specifically, in this case, the Business Manager, or its successor or designee, will be entitled to a fee equal to the product of: (1) the amount of the fee to which the Business Manager otherwise would have been entitled had the agreement not been terminated; and (2) the quotient of the number of days elapsed from the effective date of the agreement through the closing of the internalization, and the number of days elapsed from the effective date of the agreement through the date of the closing of the applicable triggering event.

Business Management Agreement effective April 1, 2023 through February 1, 2024

(Note: capitalized terms used in this Section below but not defined in this Proxy Statement have the definitions ascribed to them in the applicable business management agreement, each of which is filed with the SEC as exhibits 10.1, 10.23 and 10.24, respectively, to the Annual Report.)