UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-22678

Salient MF Trust

(Exact name of registrant as specified in charter)

4265 SAN FELIPE, 8TH FLOOR, HOUSTON, TX 77027

(Address of principal executive offices) (Zip code)

| | |

| | With a copy to: |

| John A. Blaisdell | | George J. Zornada |

| Salient MF Trust | | K & L Gates LLP |

| 4265 San Felipe, 8th Floor | | State Street Financial Center |

| Houston, TX 77027 | | One Lincoln St. |

| (Name and address of agent for service) | | Boston, MA 02111-2950 |

| | (617) 261-3231 |

��

Registrant’s telephone number, including area code: 713-993-4675

Date of fiscal year end: 12/31/13

Date of reporting period: 12/31/13

Item 1. Reports to Stockholders.

Salient Risk Parity Fund

Salient MLP & Energy Infrastructure Fund II Salient Alternative Beta Fund

Salient Trend Fund (formerly Salient Pure Trend Fund)

Salient Global Equity Fund

Shareholders’ Report

For the periods ended December 31, 2013

TABLE OF CONTENTS

This report is prepared for shareholders of the Salient MF Trust mutual funds and may be distributed to others only if preceded or accompanied by a current prospectus.

Management Discussion of Fund Performance (Unaudited)

Letter to Shareholders

Dear Fellow Shareholders:1

Relative to the strong returns of equity markets, 2013 was a difficult year for risk parity strategies, including the Salient Risk Parity Fund (the “Fund”). After four months of positive performance, the Fund suffered a sharp drawdown during May and June as a result of speculation that the Federal Reserve would begin reducing quantitative easing earlier than expected. After the June drawdown, the Fund rallied, returning 6.9% from July through December, ultimately finishing down 4.6% for the year of which all was attributable to futures contracts.

| | | | | | | | | | |

| | | | |

Share Class | | Commencement

Date | | Net Performance without

Sales Charge | | 60/40 Index2 Return |

| | | 2013 | | Since Inception

(Annualized) | | 2013 | | Since Inception of

Fund Share Class

(Annualized) |

Class A (SRPAX) | | 11/15/2012 | | -4.78% | | -2.11% | | 12.34% | | 15.53% |

Class C (SRPCX) | | 10/01/2012 | | -5.49% | | -4.08% | | 12.34% | | 11.96% |

Class I (SRPFX) | | 7/9/2012 | | -4.59% | | -1.88% | | 12.34% | | 14.03% |

| | | | | | |

| | | |

| Share Class | | Commencement

Date | | Net Performance with

Maximum Sales Charge |

| | | 2013 | | Since Inception |

Class A (SRPAX) | | 11/15/2012 | | -10.00% | | -6.92% |

Class C (SRPCX) | | 10/01/2012 | | -6.37% | | -4.08% |

Source: Salient Advisors, L.P. and Bloomberg, December 2013.

Returns above as of December 31, 2013.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual gross and net operating expense ratios for the Fund based on the current Fund prospectus dated April 30, 2013, are as follows: Class A shares are 1.89% and 1.56% respectively, Class C shares are 2.64% and 2.31% respectively and Class I shares are 1.64% and 1.31% respectively. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.55% for Class A, 2.30% for Class C and 1.30% for Class I shares, excluding certain expenses, until July 31, 2014. Additional information pertaining to the December 31, 2013 expense ratios can be found in the financial highlights. Returns do not reflect the taxes that investors may pay or distributions or the sale of shares.

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities.

2 The 60/40 Index represents an allocation of 60% MSCI AC World Index (Equities), 40% Barclays Aggregate Bond Index (Bonds)—formerly the Lehman Aggregate Bond Index through Nov. 2008. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Barclays Capital U.S. Aggregate Bond Index is a composite comprised of the Barclays Capital U.S. Intermediate Government/Credit Index and the Barclay Capital Mortgage-Backed Securities Index. All issues in the index are rated investment grade or higher, have a least one year to maturity, and have an outstanding par value of at least $100 million. Note that the Fund’s allocation may differ substantially from 60% equities and 40% bonds. The index returns are from 1/1/2013 onward. One cannot invest directly in an index.

1

Equity markets, especially domestic equities for US investors, were among the best performers in 2013. Most notably, the S&P 500 Index rose by 32.4%. In contrast, commodities, fixed income and even many international equity markets produced negative returns. In brief periods where a small number of assets perform very well, we believe investors should expect diversified portfolios like risk parity to be challenged. As allocators, we believe it is prudent to recall that equity volatility is a two-way street. In fact, extreme negative return outliers in the equity markets have historically occurred more often than extreme positive return outliers. Just as an over-exposure to equity risk can yield excellent returns during periods of exceptional equity performance, it can also result in sharp losses during more turbulent periods.

If it were possible to accurately predict which asset class would perform best each year, investors would do best to forego diversification altogether and allocate 100% of their portfolios to the asset class that would perform best over the next holding period. However, history has shown that predicting asset class returns has been extremely difficult for even the most seasoned market professionals. This lack of certainty is the primary justification for risk parity. By allowing lowly correlated asset classes an equal chance to drive portfolio returns, risk parity strategies are designed to perform well across a variety of economic environments without making subjective bets as to what the next environment will look like. Put more simply, the investment industry makes a great deal of money selling crystal balls, but we don’t believe they exist.

While the negative return in 2013 could lend credence to the argument that risk parity strategies result in an overallocation to fixed income, we would argue that our allocation to rates is not too large, but just right in order to meet our objective of giving this asset class an equal opportunity to affect portfolio volatility. While 2013 was an extremely trying period for fixed income, we saw the power of diversification as the equity holdings in the Salient Risk Parity Fund returned more over the course of the year than the rates positions lost.

The Fund’s allocation as of December 31, 2013 is shown in the pie chart below:

The data displayed in pie charts have been rounded to the nearest whole number for illustrative purposes only. Allocations are subject to change.

Source: Salient Advisors, L.P., December 31, 2013.

Investment Strategies and Techniques

The Salient Risk Parity Fund seeks long term capital appreciation. The Fund seeks to achieve this goal by constructing a portfolio that balances equal risk exposure to a set of equities, commodities, interest rates, and momentum. While equities, commodities, and interest rates are asset classes, momentum is a strategy that trades the same underlying assets used in our long-only equity, commodity, and interest rate sleeves on a long/short basis. The momentum strategy buys exposure (i.e. “goes long”) assets that have appreciated in the past year and

2

sells exposure (i.e. “goes short) assets that have depreciated. Risk is measured in terms of a statistic called covariance, which measures the degree to which assets have moved together historically.^

Salient Advisors, L.P. (the “Advisor” or “Salient”) uses a mathematical approach in seeking to achieve the investment objective of the Fund. Using this approach, Salient determines the type, quantity, and mix of investment positions that the Fund should hold in order to achieve equal risk across asset classes/strategies and, to the degree possible, within the asset classes as well. The Advisor does not invest the assets of the Fund in securities or financial instruments based on its view of the investment merit of a particular security or instrument. In addition, the Advisor does not conduct conventional research or analysis, forecast market movements, or take defensive positions apart from those resulting from the systematic allocation to momentum.^

The Fund invests, under normal conditions, in derivatives that create economic leverage and whose performance is expected to correspond to the performance of the underlying asset classes, without investing directly in those asset classes. Using derivatives allows us to gain more exposure to the asset classes than investing in more traditional assets such as stocks and bonds would allow. The performance of derivative instruments is tied to the performance of an underlying currency, security, index, commodity or other asset. In addition to risks relating to their underlying assets, the use of derivatives may include other, possibly greater, risks. Derivatives involve costs, may be volatile, and may involve a small initial investment relative to the risk assumed. Risks associated with the use of derivatives may include counterparty, margin, leverage, correlation, liquidity, tax, market, interest rate and management risks, as well as the risk of potential increased regulation of swaps and other derivatives. Derivatives may also be more difficult to purchase, sell or value than other investments. The Fund may lose more than the cash amount invested on investments in derivatives. Each of these risks is greater for the Fund than mutual funds that do not use derivatives to implement their investment strategy.^

The Fund’s top five positions based on risk contribution as of December 31, 2013 are shown below:

| | |

| | |

| Top 5 Positions by Risk | | % of Risk |

| S&P Mid Futures | | 4.9% |

| Russell 2K Mini | | 4.8% |

| S&P Futures | | 4.5% |

| JSE Futures | | 4.2% |

| MSCI Taiwan Futures | | 3.8% |

The calculation of risk contribution is based on modern portfolio theory’s calculation of portfolio risk and the contribution of a portfolio’s underlying assets to the portfolio risk are based on the dollar weights, standard deviation, and correlation as calculated by Salient Advisors, L.P.

Allocations are subject to change. Data displayed here has been rounded to the nearest tenth for illustrative purposes only. The specific securities identified are not representative of all securities purchased or held by the Fund, and it should not be assumed that the investment in the securities was or will be profitable. Source: Salient Advisors, L.P., December 31, 2013.

^ Portfolio composition is subject to change.

2014 Macro Outlook

More than ever following a year where investing domestically was so profitable for US-based investors, we believe that “globally” remains the operative word for 2014. The forces that drive investment returns, namely the behaviors and risk preferences of investors, are human forces, whether one is discussing sovereign debt in emerging Eastern Europe or small cap stocks here in the U.S.

Understanding the narratives which guide investor behaviors is important, but we believe that starting from a foundation of true diversification among the drivers of investment returns remains key. Thus, we believe that

3

shrewd investing starts from a place of humility, introducing views only where we believe we know something of value that should change our positioning. Here is what we know:

| | • | | US Equity Dominance: The U.S. led developed markets in 2013 with a 32.4% return while emerging markets lagged considerably, posting a -2.4% return for the year. |

| | • | | Low Rates Anchored: Low growth rates, low inflation rates and persistent unemployment have kept short term interest rates in core markets anchored at or near zero. |

| | • | | Rising Rates Already Discounted: In the U.S., markets have already priced in a significant expectation of rising rates into forward curves. |

Based on what we know, here is what we think:

| | • | | Emerging over Developed: We favor emerging equity versus developed equity markets as they approach a 40% discount to developed markets based on P/E multiples. Growing consensus against emerging markets serves only to increase our conviction. |

| | • | | US Valuations Not Extreme: Despite the recent outperformance of U.S. equity markets, they do not appear expensive versus other developed equity markets based upon either price to earnings or enterprise value to trailing 12-month Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA). |

| | • | | Rally is Old but Supported: Extremely positive sentiment provides a contrarian indicator as we approach the five-year mark of the current bull market; however, it seems unlikely that policy makers would stand idle should the threats of the financial crisis resurface. This may, in our view, place limits on the severity of any market correction this year. |

| | • | | Still Opportunities in Sovereign Debt: The sovereign debt of Latin American issuers and other resourced-based economies like Australia and New Zealand looks attractive as investors are compensated for higher inflation with higher real yields. Furthermore, the secular growth outlooks and structural underpinnings bolster the credit quality of these countries. |

| | • | | Corporate Debt Concerns: We expect any meaningful rise in interest rates to be contemporaneous with a counter-cyclical widening of spreads. The low absolute yield levels of corporate debt issues are justifiable based on the low interest rate environment and historically low default rates; however, the combination of narrow credit spreads and low interest rates renders them more vulnerable to rising rates than duration measures suggest. |

| | • | | Closer to Home: Energy infrastructure remains a favorite theme as domestic oil production has increased by 30% since 2008 and the breakdown between Brent and West Texas Intermediate crude prices reveals logistical impediments in the current architecture of the global energy supply chain. |

Summary

In spite of the negative return for 2013, we are optimistic about the future. We continue to believe in the viability of risk parity as a practical means of implementing modern portfolio theory. The fundamental principle that drives modern portfolio theory and our risk parity strategy is that over a long investment horizon, a truly diversified portfolio is the best way to maximize an investor’s return per unit of risk. In times where one asset class dramatically outperforms others, diversified portfolios can lag ones with concentrated positions in the best performing asset class; however, over the long run, we believe that it is exceedingly difficult to accurately predict which asset class will outperform over the next holding period. Therefore, a diversified portfolio targeting a consistent level of risk high enough to generate meaningful returns over time is in our opinion a sound core building block to many investment portfolios.

4

We look forward to providing regular updates in the future on our progress in executing the Fund’s business plan. Please visit our website at www.salientfunds.com for the latest updates.

Please note that this letter, including the financial information herein, is made available to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned herein.

Sincerely,

Lee Partridge

Chief Investment Officer

Roberto M. Croce, Ph.D.

Director of Quantitative Research

5

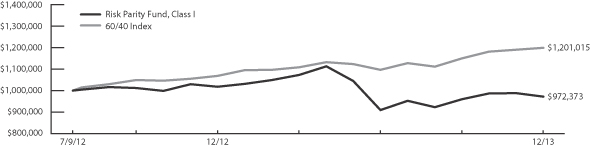

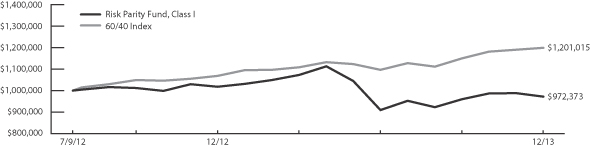

Salient Risk Parity Fund

|

| |

| Value of a $1,000,000 Investment |

|

The charts above represent a historical since inception performance comparison of a hypothetical $1,000,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through July 31, 2014.

The 60/40 Index represents an allocation of 60% MSCI AC World Index (Equities), 40% Barclays Aggregate Bond Index (Bonds)—formerly the Lehman Aggregate Bond Index through Nov. 2008. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Barclays Capital U.S. Aggregate Bond Index is a composite comprised of the Barclays Capital U.S. Intermediate Government/Credit Index and the Barclay Capital Mortgage-Backed Securities Index. All issues in the index are rated investment grade or higher, have a least one year to maturity, and have an outstanding par value of at least $100 million. Note that the Fund’s allocation may differ substantially from 60% equities and 40% bonds. The index returns are from 1/1/2013 onward. One cannot invest directly in an index.

6

Management Discussion of Fund Performance (Unaudited)

Letter to Shareholders

Dear Fellow Shareholders:1

We are pleased to provide the annual report of the Salient MLP & Energy Infrastructure Fund II (“Fund”) for the period ended December 31, 2013. The Fund finished the year with a 5.5% return in December, which was 373 basis points ahead of the Alerian MLP Index (“AMZ”).2 We believe our outperformance in December was driven by stock selection as seven of the 35 names in our portfolio (representing an aggregate 25.0% of the Fund’s weighting) had monthly gains in excess of 10.0%. It should be noted that none of these names (two Shipping, three General Partners (GPs), and two “Other”- NYLD and PEGI) are represented in the AMZ. From a sector standpoint, our overarching theme to overweight General Partners and high-growth MLPs served us well in the month as our eight GPs averaged 8.2% total return for the month while our 14 MLPs averaged 4.3% in December3—both well above the 1.6% total return recorded by the AMZ. As of December 31, 2013, the Fund had total net assets of $509.0 million and a NAV per share (for Class I) of $12.76.

| | | | | | | | | | |

| | | | |

Share Class | | Commencement

Date | | Net Performance without

Sales Charge | | Alerian MLP Index Return |

| | | 2013 | | Since Inception

(Annualized) | | 2013 | | Since Inception of

Fund Share Class

(Annualized) |

Class A (SMAPX) | | 12/21/2012 | | 33.14% | | 31.01% | | 27.58% | | 24.67% |

Class C (SMFPX) | | 1/8/2013 | | 27.13% | | 27.13% | | 20.58% | | 20.58% |

Class I (SMLPX) | | 9/19/2013 | | 33.46% | | 26.58% | | 27.58% | | 17.83% |

| | | | | | |

| | | |

| Share Class | | Commencement

Date | | Net Performance with

Maximum Sales Charge |

| | | 2013 | | Since Inception |

Class A (SMAPX) | | 12/21/2012 | | 25.85% | | 23.98% |

Class C (SMFPX) | | 1/8/2013 | | 26.13% | | 26.13% |

Sources: Salient Capital Advisors, LLC and Alerian Capital Management, December 2013.

Returns above as of December 31, 2013.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual gross and net operating expense ratios for the Fund based on the current Fund prospectus dated April 30, 2013, are as follows: Class A shares are 2.94% and 1.58% respectively, Class C shares are 3.69% and 2.33% respectively and Class I shares are 2.69% and 1.33% respectively. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.55% for Class A, 2.30% for Class C and 1.30% for Class I shares, excluding certain expenses, until July 31, 2014. Additional information pertaining to the December 31, 2013 expense ratios can be found in the financial highlights. Returns do not reflect the taxes that investors may pay or distributions or the sale of shares.

1 Statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities.

2 Alerian MLP Index (AMZ) is a composite of the 50 most prominent energy MLPs that provides investors with a comprehensive benchmark for this emerging asset class. An investor may not invest directly in an index. Index performance does not reflect the deduction of fees and expenses.

3 FactSet, December 2013.

7

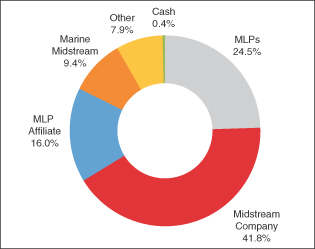

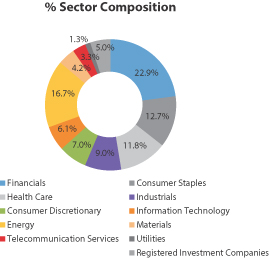

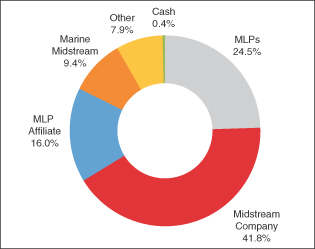

The Fund’s portfolio composition and holdings at year-end are shown below:

Sector Composition4,5

as of December 31, 2013

Top 10 Holdings4,5

as of December 31, 2013

| | | | | | | | |

| Company Name | | Ticker | | Sector | | Allocation | |

The Williams Companies, Inc. | | WMB | | Midstream Company | | | 7.5 | % |

Targa Resources Corp | | TRGP | | Midstream Company | | | 7.1 | % |

ONEOK, Inc. | | OKE | | Midstream Company | | | 6.1 | % |

Kinder Morgan Management, LLC | | KMR | | MLP Affiliate | | | 5.8 | % |

LinnCo, LLC | | LNCO | | MLP Affiliate | | | 5.8 | % |

Plains GP Holdings, LP | | PAGP | | Midstream Company | | | 4.7 | % |

Spectra Energy Corp | | SE | | Midstream Company | | | 4.5 | % |

NRG Yield, Inc. | | NYLD | | Other | | | 4.5 | % |

Enbridge Energy Management, LLC | | EEQ | | MLP Affiliate | | | 4.4 | % |

Semgroup Corp | | SEMG | | Midstream Company | | | 4.3 | % |

4 Data displayed here has been rounded to the nearest tenth for illustrative purposes only. The specific securities identified are not representative of all of the securities purchased or held by the Fund, and it should not be assumed that the investment in the securities identified was or will be profitable. Cash includes cash equivalents and unsettled security positions. Allocations are subject to change.

5 Source: Salient Capital Advisors, LLC, December 2013.

8

In 2013, the top and bottom contributors to the Fund’s performance included:

| | | | | | | | |

|

| Top 5 Contributors to Fund Performance |

| | | Security | | Ticker | | Return | | Fund

Contribution |

| 1 | | Targa Resources Corp. | | TRGP | | 69.6% | | 3.9% |

| 2 | | Crosstex Energy Inc. | | XTXI | | 149.9% | | 3.5% |

| 3 | | NRG Yield, Inc. | | NYLD | | 84.0% | | 2.4% |

| 4 | | Williams Companies, Inc. | | WMB | | 20.0% | | 1.7% |

| 5 | | ONEOK, Inc. | | OKE | | 35.4% | | 1.6% |

| | | | | | | | |

|

| Bottom 5 Contributors to Fund Performance |

| | | Security | | Ticker | | Return | | Fund

Contribution |

| 1 | | Cheniere Energy Partners, LP Holdings, LLC | | CQH | | -6.3% | | -0.1% |

| 2 | | TransCanada Corp. | | TRP | | -3.4% | | 0.1% |

| 3 | | SeaDrill Limited | | SDRL | | -27.4% | | -0.1% |

| 4 | | Kinder Morgan Inc warrants | | KMI | | -24.5% | | -0.3% |

| 5 | | EV Energy Partners LP | | EVEP | | -32.2% | | -0.8% |

Source: Salient Advisors, L.P., December 2013.

For illustrative purposes only. Past performance is no guarantee of future results.

Numbers have been rounded for illustrative purposes.

In 2013, MLPs gained 27.6% buoyed in our view by strong organic capex6 budgets that have supported attractive sector-wide distribution growth. Investor interest in MLPs continued to be robust as witnessed by five closed-end fund launches (raising an aggregate of nearly $4B) and a record 21 individual MLP IPOs which raised an additional $9.9 billion including the $2.9 billion Plains GP Holdings offering which was the single largest North American IPO in 2013.^

Performance was front-loaded with MLPs recording 70.0% of their 2013 returns during the first half of the year (through May) which we largely attribute to a “catch-up” as MLPs had lagged the broader market considerably during the prior year. When the Fed raised the possibility of “tapering” it’s quantitative easing (QE) program in late May, MLPs stalled as we believe investors mulled over what the impact would be for MLPs in what would likely be a rising interest rate environment. For the next three months (June-August), MLPs moved sideways gaining just 0.1% as investor’s continued to wrestle with the ultimate impact of the Fed’s actions. During this period, per our analysis, MLPs held up better than other income-oriented asset classes such as utilities which fell 1.7% while REITs tumbled 8.8%.7 Interestingly, MLPs resumed their upward trajectory following the Fed’s September “non-taper” announcement. MLPs gained 5.3% over the final three months of the year, we believe due to investors getting comfortable with slightly higher interest rates if those rates are rising as the result of an improving macroeconomic picture. Our research indicates that MLP performance historically has not gone negative until the yield spread between the US 10 Year Treasury yield and MLP yields dip below 150 bps. The current yield spread is 286 basis points as of December 31, 2013 with MLPs at 5.9% and the U.S. 10 Year Treasury yield at 3.0%, so we believe that MLPs still have some room to run.^

6 “Capex” or capital expenditures are expenditures creating future benefits. A capital expenditure is incurred when a business spends money either to buy fixed assets or to add to the value of an existing fixed asset with a useful life extending beyond the taxable year.

7 Dow Jones U.S. Utilities Index measures the performance of utility companies within the United States. RISKS: Non-diversified and therefore may be more volatile than the S&P 500 Index. MSCI U.S. REIT Index, a free float-adjusted market capitalization index, consists of equity REITs that are included in the MSCI US Investable Market 2500 Index, except for specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. RISKS: Real estate industry concentration risk (non-diversification), interest rate risk (as interest rates rise bond prices usually fall), the risk of issuer default, and inflation risk exist.

^ Portfolio composition is subject to change.

9

Summary

Because fewer “bargains” exist as we continue into 2014, we believe that intelligent stock selection will be even more critical to investing success over the next 12 months than it usually is. We know it is trite to say that 2014 is going to be a “stock picker’s market” but with many MLPs trading at or near their highs as we close out 2013, correctly choosing the names that have the ability to outperform will be challenging. We readily accept this challenge for 2014 and beyond. Please visit our website at www.salientfunds.com for the latest updates.

Please note that this letter, including the financial information herein, is made available to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of the Fund or of any securities mentioned in this letter.

Sincerely,

Gregory A. Reid

President and Chief Executive Officer

MLP Business, Salient Capital Advisors, LLC

10

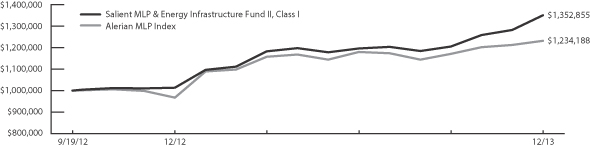

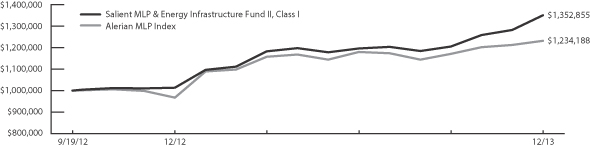

Salient MLP & Energy Infrastructure Fund II

|

| |

| Value of a $1,000,000 Investment |

|

The charts above represent a historical since inception performance comparison of a hypothetical $1,000,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through July 31, 2014.

Alerian MLP Index (AMZ) is a composite of the 50 most prominent energy MLPs that provides investors with a comprehensive benchmark for this emerging asset class.

An investor may not invest directly in an index. Index performance does not reflect the deduction of fees and expenses.

11

Management Discussion of Fund Performance (Unaudited)

Letter to Shareholders

Dear Fellow Shareholders:1

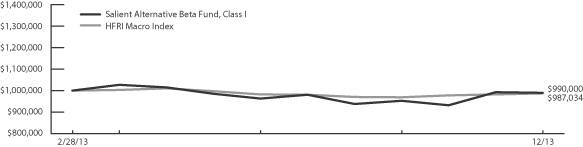

We were pleased to launch the Salient Alternative Beta Fund (the “Fund”) in February 2013. In a challenging environment for alternative funds executing global macro strategies, the Fund (Class I) lost 1% for the period since inception, which was attributable to gains from futures contracts offset by losses from forward currency exchange contracts and swap agreements. While we were pleased to see the Fund outperform its benchmark on both an absolute and risk-adjusted basis, our objective continues to be the generation of positive returns with the potential to diversify equity-oriented investment portfolios.

| | | | | | |

| | | | |

| Share Class | | Commencement

Date | | Net Performance Since

Inception

Without Sales Charge | | HFRI Macro

Index2 Return |

Class A (SABAX) | | 3/28/2013 | | -4.73% | | -1.66% |

Class C (SABCX) | | 3/28/2013 | | -5.30% | | -1.66% |

Class I (SABFX) | | 2/28/2013 | | -1.00% | | -1.26% |

| | | | |

| | | |

| Share Class | | Commencement

Date | | Net Performance Since

Inception With

Maximum Sales Charge |

Class A (SABAX) | | 3/28/2013 | | -9.94% |

Class C (SABCX) | | 3/28/2013 | | -6.25% |

Source: Salient Advisors, L.P. and Bloomberg, December 2013.

Returns above as of December 31, 2013.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual gross and net operating expense ratios for the Fund based on the current Fund prospectus dated April 30, 2013, are as follows: Class A shares are 2.66% and 1.69% respectively, Class C shares are 3.41% and 2.44% respectively and Class I shares are 2.41% and 1.44% respectively. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.55% for Class A, 2.30% for Class C and 1.30% for Class I shares, excluding certain expenses, until July 31, 2014. Additional information pertaining to the December 31, 2013 expense ratios can be found in the financial highlights. Returns do not reflect the taxes that investors may pay or distributions or the sale of shares.

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities.

2 The HFRI Macro (Total) Index: is an equally-weighted performance index of numerous hedge fund managers pursuing Macro strategies, which are predicated on theses about future movements in global macroeconomic variables and how financial instruments might respond to such movements. The Fund does not invest in hedge funds; rather it invests both long and short primarily in futures and forward contracts in order to gain exposure to a variety of non-traditional risk premia. The index only reports monthly data, thus the index returns above are from 4/1/2013 onwards (For Class A and C share comparisons) and from 3/1/2013 onwards (for I share comparison). One cannot invest directly in an index.

12

We believe that the alternative risk exposures the Fund seeks out should have a positive expected return over time, and that including them alongside traditional holdings can potentially provide a valuable diversification benefit. We carefully chose the strategies in the Fund, selecting ones where we believe there is substantial academic research documenting a positive risk premium in the strategy, theoretical justification for it to persist, and limited reason to believe it will lose value in sympathy with equities. Thus, while performance will vary from period to period, it is our intent that the portfolio over time will not be indicative or strongly related to equity market returns.

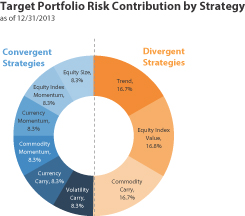

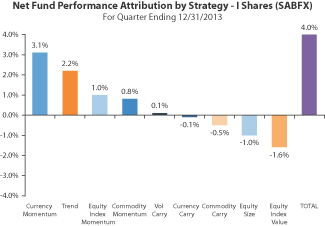

Six of the nine strategies employed in the Fund produced positive returns in 2013, but losses in the Fund’s most defensive strategy, Equity Index Value, along with losses in Commodity Carry and Currency Carry, left the Fund down for the year. Equity Index Value detracted the most from Fund performance as more expensive European equity markets outperformed less expensive Asian equities. Equity Index Momentum was the second largest contributor to Fund performance as positive trends in domestic and developed international equity markets continued through the year. Both Equity Index Value and Equity Index Momentum take offsetting positions resulting in a zero net exposure to equities in each sleeve. Even though both strategies operate in the equity asset class, they produced very different returns in 2013. This serves as an excellent illustration of how the strategies employed in Alternative Beta are designed to capture alternative risk premia within different asset classes, not the risk premia of the asset classes themselves.^

Investment Strategies and Techniques

The investment objective of the Salient Alternative Beta Fund is to seek long term capital appreciation with low correlation to traditional core equity and bond market exposures. The Fund invests both long and short, primarily in futures and forward contracts, in order to gain exposure to a variety of non-traditional risk premia.^

The Fund invests, under normal conditions, in derivatives that create economic leverage and whose performance is expected to correspond to the performance of the underlying asset classes, without investing directly in those asset classes. Using derivatives allows us to gain more exposure to the asset classes than investing in more traditional assets such as stocks and bonds would allow. The performance of derivative instruments is tied to the performance of an underlying currency, security, index, commodity or other asset. In addition to risks relating to their underlying assets, the use of derivatives may include other, possibly greater, risks. Derivatives involve costs, may be volatile, and may involve a small initial investment relative to the risk assumed. Risks associated with the use of derivatives may include counterparty, margin, leverage, correlation, liquidity, tax, market, interest rate and management risks, as well as the risk of potential increased regulation of swaps and other derivatives. Derivatives may also be more difficult to purchase, sell or value than other investments. The Fund may lose more than the cash amount invested on investments in derivatives. Each of these risks is greater for the Fund than mutual funds that do not use derivatives to implement their investment strategy.^

^ Portfolio composition is subject to change.

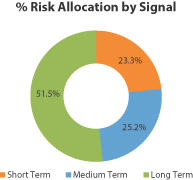

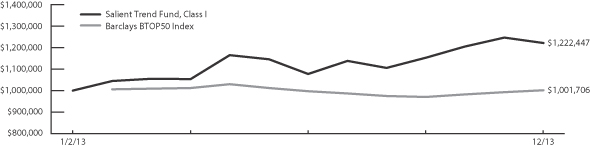

The data displayed in pie chart have been rounded to the nearest tenth decimal for illustrative purposes only. Allocations are subject to change.

Source: Salient Advisors, L.P., December 31, 2013.

13

2014 Macro Outlook

More than ever following a year where investing domestically was so profitable for US-based investors, we believe that “globally” remains the operative word for 2014. The forces that drive investment returns, namely the behaviors and risk preferences of investors, are human forces, whether one is discussing sovereign debt in emerging Eastern Europe or small cap stocks here in the U.S.

Understanding the narratives which guide investor behaviors is important, but we believe that starting from a foundation of true diversification among the drivers of investment returns remains key. Thus, we believe that shrewd investing starts from a place of humility, introducing views only where we believe we know something of value that should change our positioning. Here is what we know:

| | n | | US Equity Dominance: The U.S. led developed markets in 2013 with a 32.4% return while emerging markets lagged considerably, posting a -2.4% return for the year. |

| | n | | Low Rates Anchored: Low growth rates, low inflation rates and persistent unemployment have kept short term interest rates in core markets anchored at or near zero. |

| | n | | Rising Rates Already Discounted: In the U.S., markets have already priced in a significant expectation of rising rates into forward curves. |

Based on what we know, here is what we think:

| | n | | Emerging over Developed: We favor emerging equity versus developed equity markets as they approach a 40% discount to developed markets based on P/E multiples. Growing consensus against emerging markets serves only to increase our conviction. |

| | n | | US Valuations Not Extreme: Despite the recent outperformance of U.S. equity markets, they do not appear expensive versus other developed equity markets based upon either price to earnings or enterprise value to trailing 12-month Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA). |

| | n | | Rally is Old but Supported: Extremely positive sentiment provides a contrarian indicator as we approach the five-year mark of the current bull market; however, it seems unlikely that policy makers would stand idle should the threats of the financial crisis resurface. This may, in our view, place limits on the severity of any market correction this year. |

| | n | | Still Opportunities in Sovereign Debt: The sovereign debt of Latin American issuers and other resourced-based economies like Australia and New Zealand looks attractive as investors are compensated for higher inflation with higher real yields. Furthermore, the secular growth outlooks and structural underpinnings bolster the credit quality of these countries. |

| | n | | Corporate Debt Concerns: We expect any meaningful rise in interest rates to be contemporaneous with a counter-cyclical widening of spreads. The low absolute yield levels of corporate debt issues are justifiable based on the low interest rate environment and historically low default rates; however, the combination of narrow credit spreads and low interest rates renders them more vulnerable to rising rates than duration measures suggest. |

| | n | | Closer to Home: Energy infrastructure remains a favorite theme as domestic oil production has increased by 30% since 2008 and the breakdown between Brent and West Texas Intermediate crude prices reveals logistical impediments in the current architecture of the global energy supply chain. |

14

Summary

While we are hopeful that absolute returns in the future will be improved, performance in 2013 was in line with the benchmark and well within our range of expectations. The alternative return streams targeted in the Salient Alternative Beta Fund are ones that we believe have theoretical justification for a long term positive expected return. Furthermore, with the offsetting exposures in most of the strategies employed, we anticipate the Fund will remain loosely correlated with traditional beta exposures. For these reasons, we are proud to have launched the Salient Alternative Beta Fund and look forward to 2014.

We look forward to providing regular updates in the future on our progress in executing the Fund’s business plan. Please visit our website at www.salientfunds.com for the latest updates.

Please note that this letter, including the financial information herein, is made available to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned herein.

Sincerely,

Lee Partridge

Chief Investment Officer

Roberto M. Croce, Ph.D.

Director of Quantitative Research

15

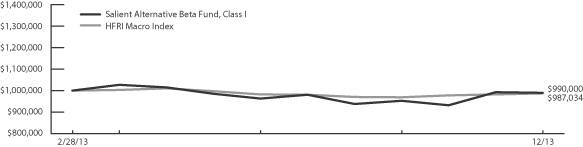

Salient Alternative Beta Fund

|

| |

| Value of a $1,000,000 Investment |

|

The charts above represent a historical since inception performance comparison of a hypothetical $1,000,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through July 31, 2014.

The HFRI Macro (Total) Index: is an equally weighted performance index of numerous hedge fund managers pursuing Macro strategies, which are predicated on theses about future movements in global macroeconomic variables and how financial instruments might respond to such movements. The Fund does not invest in hedge funds; rather it invests both long and short primarily in futures and forward contracts in order to gain exposure to a variety of non-traditional risk premia. The index only reports monthly data, thus the index returns above are from 4/1/2013 onwards (For Class A and C share comparisons) and from 3/1/2013 onwards (for I share comparison). One cannot invest directly in an index.

16

Management Discussion of Fund Performance (Unaudited)

Letter to Shareholders

Dear Fellow Shareholders:1

2013 was an exciting inaugural year for the Salient Trend Fund (the “Fund”) as surging equity markets and well-positioned commodity exposures resulted in a 22.24% return (for Class I), of which all was attributable to futures contracts. The Fund was able to capture gains from the equity markets while still achieving a moderately low correlation to the S&P 500 of 0.47. In the long run, we expect the correlation to equities to be substantially lower as the fund will take both long and short equity positions as market sentiment changes.

| | | | | | |

| | | | |

| Share Class | | Commencement

Date | | Net Performance Since

Inception

Without Sales Charge | | Barclay

BTOP 50

Index2 Return |

Class A (SPTAX) | | 3/28/2013 | | 14.73% | | -1.07% |

Class C (SPTCX) | | 3/28/2013 | | 13.96% | | -1.07% |

Class I (SPTIX) | | 1/2/2013 | | 22.24% | | 0.92% |

| | | | |

| | | |

| Share Class | | Commencement

Date | | Net Performance Since

Inception With

Maximum Sales Charge |

Class A (SPTAX) | | 3/28/2013 | | 8.42% |

Class C (SPTCX) | | 3/28/2013 | | 12.96% |

Source: Salient Advisors, L.P. and Barclay Hedge, December 2013.

Returns above as of December 31, 2013.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual gross and net operating expense ratios for the Fund based on the current Fund prospectus dated April 30, 2013, are as follows: Class A shares are 2.62% and 1.69% respectively, Class C shares are 3.37% and 2.44% respectively and Class I shares are 2.37% and 1.44% respectively. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.55% for Class A, 2.30% for Class C and 1.30% for Class I shares, excluding certain expenses, until July 31, 2014. Additional information pertaining to the December 31, 2013 expense ratios can be found in the financial highlights. Returns do not reflect the taxes that investors may pay or distributions or the sale of shares.

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities.

2 The Barclay BTOP50 Index: seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. To be included in the BTOP50, the trading advisors must be: open for investment, willing to provide daily returns, at least two years of trading activity, and the advisors must have at least three years of operating history. The BTOP50 portfolio is equally weighted among the selected programs at the beginning of each calendar year and is rebalanced annually. The BTOP50 consists of a subset of the advisors who make up the managed futures industry, whereas the Fund is a single advisor. The index returns are from 3/27/2013 onwards (For Class A and C share comparisons) and from 1/2/2013 onwards (for I share comparison). One cannot invest directly in an index.

17

The Salient Trend Fund generated positive returns in each quarter of 2013. During Q1, the Fund gained 5.5% from strong returns in the equities and commodities sleeves. Q2 started off with the strongest month of the year as the Fund generated a 10.62% gain in April with positive contributions from equities, commodities and fixed income. May and June were difficult months as the Fund gave back 7.6% as a result of losses in the equities and fixed income buckets. Following the drawdown, the Fund realized its strongest quarterly return for the year as large equity gains in July and September resulted in a 7.05% Q3 return. Equities generated a positive return in each month during Q4, which, along with a modest contribution from the fixed income sleeve, more than offset losses in the commodities sleeve, resulting in a 5.89% return for the quarter.^

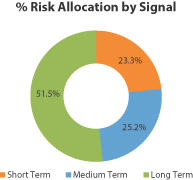

The majority of the returns for the year were generated by the long term signal as well-established trends in investor sentiment continued throughout 2013. The medium term signal was close to flat for the year while the short term signal detracted slightly from fund performance. March served as an excellent illustration of the diversifying power of the three signals as gains in the short and medium term signals nearly offset losses in the long term signal, leaving the fund down 0.09%.^

The Fund’s emphasis on long-term trend-following strategies, which we believe exhibit the lowest correlation to equity markets in periods of stress, was the primary source of strong results in 2013.

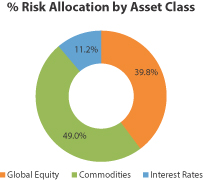

The Fund entered 2013 with a long position in equities and a slightly short fixed income position. The commodities sleeve was long energies, long metals, and short agricultural commodities. By the start of the second quarter, the allocation shifted to one that was short agricultural commodities and long fixed income. Rising yields in May shifted the fixed income positions back to slightly short, which proved to be a beneficial change as yields rose sharply in June. The Fund finished the year bullish on equities, short fixed income and short commodities.

The Fund’s risk allocation as of December 31, 2013 is shown in the pie charts below:

The data displayed in the pie charts have been rounded to the nearest tenth for illustrative purposes only. Allocations are subject to change.

Source: Salient Advisors, L.P., December 31, 2013.

^ Portfolio composition is subject to change.

Investment Strategies and Techniques

The Salient Trend Fund seeks long term capital appreciation with low correlation to traditional core equity and bond market exposures. The Fund seeks to achieve this goal by constructing a portfolio that captures short, medium and long term price trends. The Fund can invest in equities, commodities, interest rates, and currencies. Risk is measured in terms of a statistic called covariance, which measures the degree to which assets have moved together historically.

18

The Fund’s investment process begins with the construction of a proprietary, systematic trend-following strategy. Next, the Fund determines which global markets are appropriate for this strategy. The Fund then constructs a portfolio in which it attempts to balance the risk contribution of each trend-following strategy and the asset classes within each strategy and for which it targets a 20% annualized standard deviation of returns. The risk calculation is derived from each strategy’s standard deviation of returns, its correlation with each of the other strategies within the portfolio and the percentage weight of each strategy within the portfolio. The portfolio is rebalanced dynamically according to this framework on a monthly basis.^

The Fund invests, under normal conditions, in derivatives that create economic leverage and whose performance is expected to correspond to the performance of the underlying asset classes, without investing directly in those asset classes. Using derivatives allows us to gain more exposure to the asset classes than investing in more traditional assets such as stocks and bonds would allow. The performance of derivative instruments is tied to the performance of an underlying currency, security, index, commodity or other asset. In addition to risks relating to their underlying assets, the use of derivatives may include other, possibly greater, risks. Derivatives involve costs, may be volatile, and may involve a small initial investment relative to the risk assumed. Risks associated with the use of derivatives may include counterparty, margin, leverage, correlation, liquidity, tax, market, interest rate and management risks, as well as the risk of potential increased regulation of swaps and other derivatives. Derivatives may also be more difficult to purchase, sell or value than other investments. The Fund may lose more than the cash amount invested on investments in derivatives. Each of these risks is greater for the Fund than mutual funds that do not use derivatives to implement their investment strategy.^

The Fund’s top five long and short positions based on risk contribution as of December 31, 2013 are shown below:^

| | | | | | | | |

| | |

| LONG POSITIONS | | | | SHORT POSITIONS |

| Holding | | % Risk

Allocation | | | | Holding | | % Risk

Allocation |

| GasOil Futures | | 5.3% | | | | Aluminum Futures | | 5.0% |

| Cocoa Futures | | 5.1% | | | | Sugar Futures | | 4.9% |

| Nat Gas Futures | | 4.2% | | | | Silver Futures | | 4.8% |

| Soybean Futures | | 3.1% | | | | Nickel Futures | | 4.8% |

| MSCI Taiwan Futures | | 3.1% | | | | Gold Futures | | 4.7% |

Allocations are subject to change. Data displayed here has been rounded to the nearest tenth for illustrative purposes only. The specific securities identified are not representative of all securities purchased or held by the Fund, and it should not be assumed that the investment in the securities was or will be profitable. Source: Salient Advisors, L.P., December 31, 2013.

2014 Macro Outlook

More than ever following a year where investing domestically was so profitable for US-based investors, we believe that “globally” remains the operative word for 2014. The forces that drive investment returns, namely the behaviors and risk preferences of investors, are human forces, whether one is discussing sovereign debt in emerging Eastern Europe or small cap stocks here in the U.S.

Understanding the narratives which guide investor behaviors is important, but we believe that starting from a foundation of true diversification among the drivers of investment returns remains key. Thus, we believe that shrewd investing starts from a place of humility, introducing views only where we believe we know something of value that should change our positioning. Here is what we know:

| | n | | US Equity Dominance: The U.S. led developed markets in 2013 with a 32.4% return while emerging markets lagged considerably, posting a -2.4% return for the year. |

19

^ Portfolio composition is subject to change.

| | n | | Low Rates Anchored: Low growth rates, low inflation rates and persistent unemployment have kept short term interest rates in core markets anchored at or near zero. |

| | n | | Rising Rates Already Discounted: In the U.S., markets have already priced in a significant expectation of rising rates into forward curves. |

Based on what we know, here is what we think:

| | n | | Emerging over Developed: We favor emerging equity versus developed equity markets as they approach a 40% discount to developed markets based on P/E multiples. Growing consensus against emerging markets serves only to increase our conviction. |

| | n | | US Valuations Not Extreme: Despite the recent outperformance of U.S. equity markets, they do not appear expensive versus other developed equity markets based upon either price to earnings or enterprise value to trailing 12-month Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA). |

| | n | | Rally is Old but Supported: Extremely positive sentiment provides a contrarian indicator as we approach the five-year mark of the current bull market; however, it seems unlikely that policy makers would stand idle should the threats of the financial crisis resurface. This may, in our view, place limits on the severity of any market correction this year. |

| | n | | Still Opportunities in Sovereign Debt: The sovereign debt of Latin American issuers and other resourced-based economies like Australia and New Zealand looks attractive as investors are compensated for higher inflation with higher real yields. Furthermore, the secular growth outlooks and structural underpinnings bolster the credit quality of these countries. |

| | n | | Corporate Debt Concerns: We expect any meaningful rise in interest rates to be contemporaneous with a counter-cyclical widening of spreads. The low absolute yield levels of corporate debt issues are justifiable based on the low interest rate environment and historically low default rates; however, the combination of narrow credit spreads and low interest rates renders them more vulnerable to rising rates than duration measures suggest. |

| | n | | Closer to Home: Energy infrastructure remains a favorite theme as domestic oil production has increased by 30% since 2008 and the breakdown between Brent and West Texas Intermediate crude prices reveals logistical impediments in the current architecture of the global energy supply chain. |

Summary

We were very pleased with the Salient Trend Fund’s performance in 2013. We strongly believe in the viability of trend-following as a practical means of diversifying one’s traditional portfolio without potentially sacrificing the upside and without relying solely on interest rate-sensitive assets.

We look forward to providing regular updates in the future on our progress in executing the Fund’s business plan. Please visit our website at www.salientfunds.com for the latest updates.

Please note that this letter, including the financial information herein, is made available to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned herein.

Sincerely,

Lee Partridge

Chief Investment Officer

Roberto M. Croce, Ph.D.

Director of Quantitative Research

20

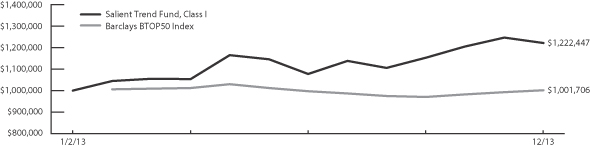

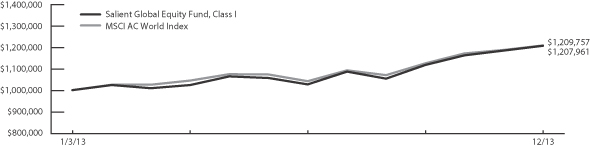

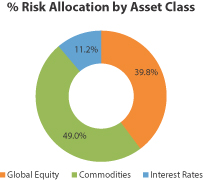

Salient Trend Fund

|

| |

| Value of a $1,000,000 Investment |

|

The charts above represent a historical since inception performance comparison of a hypothetical $1,000,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through July 31, 2014.

The Barclay BTOP50 Index: seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. To be included in the BTOP50, the trading advisors must be: open for investment, willing to provide daily returns, at least two years of trading activity, and the advisors must have at least three years of operating history. The BTOP50 portfolio is equally weighted among the selected programs at the beginning of each calendar year and is rebalanced annually. The BTOP50 consists of a subset of the advisors who make up the managed futures industry, whereas the Fund is a single advisor. The index returns are from 3/27/2013 onwards (For Class A and C share comparisons) and from 1/2/2013 onwards (for I share comparison). One cannot invest directly in an index.

21

Management Discussion of Fund Performance (Unaudited)

Letter to Shareholders

Dear Fellow Shareholders:1

It has been an exciting first year for the Salient Global Equity Fund (SGEAX, SGECX, SGEIX) (the “Fund”). As of December 31, 2013, the Fund had total investments of over $60 million and a NAV per share of $11.77 (for Class I) after paying $0.31 in dividends.

| | | | | | |

| | | | |

| Share Class | | Commencement

Date | | Net Performance Since

Inception

Without Sales Charge | | MSCI AC

World

Index2 Return |

Class A (SGEAX) | | 2/4/2013 | | 16.69% | | 16.52% |

Class C (SGECX) | | 2/4/2013 | | 15.84% | | 16.52% |

Class I (SGEIX) | | 1/3/2013 | | 20.80% | | 20.19% |

| | | | |

| | | |

| Share Class | | Commencement

Date | | Net Performance Since

Inception With

Maximum Sales Charge |

Class A (SGEAX) | | 2/4/2013 | | 10.28% |

Class C (SGECX) | | 2/4/2013 | | 14.84% |

Source: Salient Advisors, L.P. and MSCI, December 2013.

Returns above as of December 31, 2013.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual gross and net operating expense ratios for the Fund based on the current Fund prospectus dated April 30, 2013, are as follows: Class A shares are 3.14% and 1.85% respectively, Class C shares are 3.89% and 2.60% respectively and Class I shares are 2.89% and 1.60% respectively. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.85% for Class A, 2.60% for Class C and 1.60% for Class I shares, excluding certain expenses, until July 31, 2014. Additional information pertaining to the December 31, 2013 expense ratios can be found in the financial highlights. Returns do not reflect the taxes that investors may pay or distributions or the sale of shares.

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities.

2 The MSCI All Country World Index: is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Index consists of approximately 2,500 stocks as of December, 2013, while the Fund will build a portfolio of 40-60 stocks. The index returns are from 2/3/2013 onwards (For Class A and C share comparisons) and from 1/3/2013 onwards (for I share comparison). One cannot invest directly in an index.

22

Annual Update

2013 was a strong year for global equities, with MSCI ACWI up 22.8% (up 20.2% since the inception of the Fund). U.S. markets led with a 31.5% return for the S&P 500 while Europe lagged with the MSCI Europe Index returning 22.3%. Notably, emerging markets were down 2.6% and Japan, which was up 54.6% in local currency, was only up 27.2% in dollar terms. Although the Fund lagged in the first quarter of 2013, it subsequently experienced three consecutive quarters of outperformance, ending the year with a gain of 20.8% compared to the benchmark’s gain of 20.2%.

While global equities lagged the U.S. markets substantially in the first half of the year, they followed one another more closely in the second half of 2013 with the MSCI ACWI generating a total return of 15.8% compared to the

S&P 500’s 15.9%. Within the MSCI ACWI, Europe was the breakout performer with the MSCI Europe Index up 22.6%. Asia-Pacific markets and emerging markets lagged however, with Japan, Australia and the emerging markets indices up only 9.1%, 11.0% and 7.7%, respectively, during the second half of 2013.3

The Fund outperformed the MSCI ACWI benchmark in the second half primarily due to the Fund’s overweight to Europe. We remain bullish on Europe’s recovery and are collecting healthy dividends from investments in high quality multinationals with above-average yields while we wait for potential price appreciation. It is for this reason that we will look to maintain our approximate double weight to Europe/UK versus the MSCI ACWI.^

Throughout the second half of the year, we began cautiously adding exposure to emerging markets. It was our view and an operative theme at the start of 2013, that the commodity super-cycle had ended and that emerging markets would suffer due to their high correlations with commodity prices; however, we think valuations in markets like China have become increasingly compelling. We have added a few positions in China and will continue to look for attractively priced stocks that may benefit from our emerging markets consumption theme.^

The data displayed in pie charts have been rounded to the nearest whole number for illustrative purposes only. Allocations are subject to change.

Source: Salient Advisors, L.P., December 31, 2013.

3 Japan returns are based on the MSCI Japan Index. Australia returns are based on the MSCI Australia Index. Emerging markets returns are based on the MSCI Emerging Markets Index.

^ Portfolio composition is subject to change.

23

For the second half of 2013, the top five contributors to the Fund’s performance were Vivendi (VIV-PAR), Daimler AG, (DAI-ETR), Rockwell Automation (ROK), CVS Caremark (CVS), and Fiserv (FISV). The European names (VIV-PAR and DAI-ETR) were opportunistic investments that we believe benefited from our tactical view on Europe. ROK, CVS and FISV are quality companies that exhibit sustainable competitive advantages over their industry peers, reporting strong growth and profitability for the second half of 2013.^

The five largest detractors to the Fund’s performance were TGS Nopec Geophysical (TGS-NO), Saipem (SPM-MIL), Tenaris (TS), ICICI Bank (IBN), and Kellogg (K). TGS-NO is a seismic data company exposed to offshore exploration activity, which we decided to sell out of it due to a change in the industry outlook. Kellogg is a name which we trimmed and were monitoring for signs of business turnaround. However, after the fourth quarter earnings result we believed that the business may continue to deteriorate and decided to exit the position. Saipem is an Italian E&C Company specializing in energy infrastructure that is a turnaround play with a margin of safety from its asset value. It fits in the “Opportunistic” bucket of our portfolio. Tenaris is a high quality pipe manufacturer that is a beneficiary of the U.S. energy renaissance. Both Saipem and Tenaris depreciated sharply at the end of the year, but since then have rebounded considerably. ICICI is the largest private bank in India. We hold the view that the Indian markets have the potential to rally as we approach elections in May of this year.^

^ Portfolio composition is subject to change.

2014 Outlook

Following a year where investing domestically was so profitable for U.S.-based investors, we believe now, more than ever, that “global” remains the operative word for 2014.

In our view, valuations for global equities remain attractive. We believe that our thesis of a synchronous global recovery will play out in 2014. Sovereign bonds in Italy and Spain (two of our favorite markets this year) are still trading at a substantial premium to German Bunds, and a convergence in these rates to their historical norms (given implicit ECB backing) should help equity valuations. In the last 10 years, U.S. equities have compounded at an annual rate of 5.2%, nearly double that of the nominal U.S. Gross Domestic Product (GDP) growth rate of 2.8% per annum. However, while Italian GDP has stayed relatively flat through the credit crisis and the European crisis, Italian shares have fallen 60% from their peak and still have not fully recovered. Similarly, while Chinese GDP grew six-fold since 2001, share prices are essentially flat over this time period. We have found attractive opportunities in each of these markets.

Historically investing in global equities has delivered total returns similar to equity investing in the United States. However, in the last three years, MSCI ACWI has annualized returns of only 9.7% while the S&P 500 has annualized returns of 16.1%. By capitalizing on this divergence in the performance of global equities, and by investing in high quality companies, we believe that we can potentially generate positive risk-adjusted returns for investors.

We look forward to providing regular updates on our progress. Please visit our website at www.salientfunds.com for the latest details.

Please note this letter, including the financial information herein, is made available to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for the use in the purchase of sale of shares of the Fund.

Sincerely,

Ajay Mehra

Managing Director

Head of Equities, Salient Advisors, L.P.

24

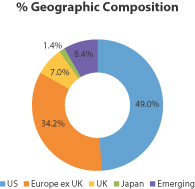

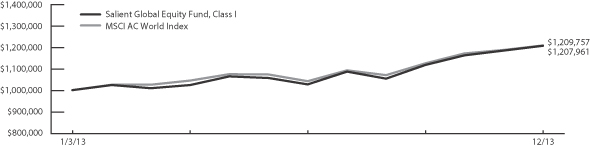

Salient Global Equity Fund

|

| |

| Value of a $1,000,000 Investment |

|

The charts above represent a historical since inception performance comparison of a hypothetical $1,000,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through July 31, 2014.

The MSCI All Country World Index: is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Index consists of approximately 2,500 stocks as of December, 2013, while the Fund will build a portfolio of 40-60 stocks. The index returns are from 2/3/2013 onwards (For Class A and C share comparisons) and from 1/3/2013 onwards (for I share comparison). One cannot invest directly in an index.

25

Expense Examples

26

Table of Shareholder Expenses—as of December 31, 2013 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases, redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare the cost with the ongoing costs of investing in other mutual funds.

These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2013 through December 31, 2013 (unless otherwise noted).

Actual Example

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | | | | | | | | | | | | | | | | |

| | | | | Beginning

Account Value

7/1/13 | | | Ending

Account Value

12/31/13 | | | Expenses Paid

During Period(1)

7/1/13 – 12/31/13 | | | Annualized

Expense Ratio

During Period

7/1/13 – 12/31/13 | |

Salient Risk Parity Fund | | Class A | | $ | 1,000.00 | | | $ | 1,069.00 | | | $ | 8.08 | | | | 1.55 | % |

| | Class C | | | 1,000.00 | | | | 1,063.80 | | | | 12.02 | | | | 2.31 | % |

| | Class I | | | 1,000.00 | | | | 1,070.00 | | | | 6.83 | | | | 1.31 | % |

Salient MLP & Energy Infrastructure Fund II | | Class A | | | 1,000.00 | | | | 1,127.20 | | | | 9.76 | | | | 1.82 | % |

| | Class C | | | 1,000.00 | | | | 1,123.50 | | | | 14.02 | | | | 2.62 | % |

| | Class I | | | 1,000.00 | | | | 1,129.50 | | | | 8.37 | | | | 1.56 | % |

Salient Alternative Beta Fund | | Class A | | | 1,000.00 | | | | 1,027.00 | | | | 8.28 | | | | 1.62 | % |

| | Class C | | | 1,000.00 | | | | 1,022.90 | | | | 12.03 | | | | 2.36 | % |

| | Class I | | | 1,000.00 | | | | 1,028.00 | | | | 6.80 | | | | 1.33 | % |

Salient Trend Fund | | Class A | | | 1,000.00 | | | | 1,133.50 | | | | 8.87 | | | | 1.65 | % |

| | Class C | | | 1,000.00 | | | | 1,127.90 | | | | 13.36 | | | | 2.49 | % |

| | Class I | | | 1,000.00 | | | | 1,134.00 | | | | 7.32 | | | | 1.36 | % |

Salient Global Equity Fund | | Class A | | | 1,000.00 | | | | 1,174.80 | | | | 10.47 | | | | 1.91 | % |

| | Class C | | | 1,000.00 | | | | 1,170.90 | | | | 14.61 | | | | 2.67 | % |

| | Class I | | | 1,000.00 | | | | 1,176.20 | | | | 8.89 | | | | 1.62 | % |

(1) Expenses are equal to the average account value multiplied by the Fund’s annualized expense ratio multiplied by 184/365 (the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year).

27

Table of Shareholder Expenses—as of December 31, 2013 (Unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | Beginning

Account Value

7/1/13 | | | Ending

Account Value

12/31/13 | | | Expenses Paid

During Period(1)