UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-22678

Salient MF Trust

(Exact name of registrant as specified in charter)

4265 SAN FELIPE, 8TH FLOOR, HOUSTON, TX 77027

(Address of principal executive offices) (Zip code)

| | |

| | With a copy to: |

| John A. Blaisdell | | George J. Zornada |

| Salient MF Trust | | K & L Gates LLP |

| 4265 San Felipe, 8th Floor | | State Street Financial Center |

| Houston, TX 77027 | | One Lincoln Street |

| (Name and address of agent for service) | | Boston, MA 02111-2950 |

| | (617) 261-3231 |

Registrant’s telephone number, including area code: 713-993-4675

Date of fiscal year end: 12/31/14

Date of reporting period: 12/31/14

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

This report is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Funds’ risks, objectives, fees and expenses, experience of their management and other information.

Management Discussion of Fund Performance (Unaudited)

Letter to Shareholders

Dear Fellow Shareholders:1

We were pleased with the performance of the Salient Risk Parity Fund (the “Fund”) over 2014. As a result of the fund’s risk-balanced approach to diversification including an allocation to momentum, the Fund (Class I) produced a 13.99% return (attributable to losses from swap agreements offset by gains from futures contracts), while outperforming all other funds in Morningstar’s “Tactical Allocation” category.2

| | | | | | | | | | | | | | | | | | |

| | | | | | |

| Share Class | | Commencement

Date | | Net Performance

without Sales Charge | | 60/40 Index3 Return | | MSCI AC World Index3 Return | | Barclays Aggregate Bond

Index3 Return |

| | | 2014 | | Average

Annual

Since

Inception | | 2014 | | Average

Annual

Since

Inception of

Fund Share

Class | | 2014 | | Average

Annual

Since

Inception of

Fund Share

Class | | 2014 | | Average

Annual Since

Inception of

Fund Share

Class |

| Class A (SRPAX) | | 11/15/2012 | | 13.58% | | 4.98% | | 5.01% | | 10.56% | | 4.16% | | 16.59% | | 5.97% | | 1.78% |

| Class C (SRPCX) | | 10/01/2012 | | 12.84% | | 3.08% | | 5.01% | | 8.91% | | 4.16% | | 13.63% | | 5.97% | | 1.86% |

| Class I (SRPFX) | | 7/9/2012 | | 13.99% | | 4.24% | | 5.01% | | 10.38% | | 4.16% | | 16.06% | | 5.97% | | 2.02% |

| | | | | | |

| | | |

| Share Class | | Commencement

Date | | Net Performance with Maximum Sales

Charge |

| | | 2014 | | Since Inception |

| Class A (SRPAX) | | 11/15/2012 | | 7.31% | | 2.22% |

| Class C (SRPCX) | | 10/01/2012 | | 11.84% | | 3.08% |

Source: Salient Advisors, L.P. and Bloomberg, December 2014.

Returns above as of December 31, 2014.

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown. Returns with sales charge reflect the deduction of current maximum front end sales charge of 5.50% for Class A shares, and the maximum contingent deferred sales charge of 1.00% which is applied to Class C shares. All returns reflect reinvestment of all dividend and capital gain distributions. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual gross and net operating expense ratios for the Fund based on the current Fund prospectus dated April 30, 2014, are as follows: Class A shares are 1.84% and 1.60% respectively, Class C shares are 2.59% and 2.35% respectively and Class I shares are 1.59% and 1.35% respectively. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.55% for Class A, 2.30% for Class C and 1.30% for Class I shares, excluding certain expenses, until July 31, 2015. Performance shown in the tables does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities.

2 Morningstar, December 2014. Past performance does not guarantee future results.

Morningstar, Inc. defines Tactical Allocation portfolios as portfolios that seek to provide capital appreciation and income by actively shifting allocations across investments. These portfolios have material shifts across equity regions, and bond sectors on a frequent basis. To qualify for the tactical allocation category, the fund must have minimum exposures of 10% in bonds and 20% in equity. Next, the fund must historically demonstrate material shifts in sector or regional allocations either through a gradual shift over three years or through a series of material shifts on a quarterly basis. Within a three-year period, typically the average quarterly changes between equity regions and bond sectors exceeds 15% or the difference between the maximum and minimum exposure to a single equity region or bond sector exceeds 50%. Category Group Index: Morningstar Moderate Target Risk Category Index: Morningstar Moderately Aggressive Target Risk

3 The 60/40 Index represents an allocation of 60% MSCI AC World Index (Equities), 40% Barclays Aggregate Bond Index (Bonds) - formerly the Lehman Aggregate Bond Index through Nov. 2008. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Barclays Capital U.S. Aggregate Bond Index is a composite comprised of the Barclays Capital U.S. Intermediate Government/Credit Index and the Barclay Capital Mortgage-Backed Securities Index. All issues in the index are rated investment grade or higher, have a least one year to maturity, and have an outstanding par value of at least $100 million. Note that the Fund’s allocation may differ substantially from 60% equities and 40% stocks. The index returns are from 1/1/2013 onward. One cannot invest directly in an index. Index Performance does not reflect the deduction of fees and expenses.

1

Annual Update

In our semiannual update, we highlighted the merits of the diversification inherent in a risk parity approach citing how different asset classes contributed at different times over the first half of the year allowing the Fund to produce positive returns in five out of the six months (with the return in the other month being nearly flat). Over the second half of the year, long commodity positions consistently detracted from performance but were offset from contributions in other asset classes.

There was only one month during 2014 where all four sleeves of the Fund moved in the same direction. In the other 11 months, at least one sleeve produced negative returns. While it can be tempting to view the asset class with the negative return as a hindrance and wonder why the Fund did not have more exposure to the asset class with the best performance, the simple truth is that predicting which asset class will outperform in the future is an exceedingly difficult task. In a truly diversified portfolio, you expect to see sleeves moving in different directions so that unforeseen gains and losses can offset each other.

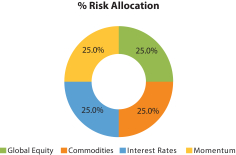

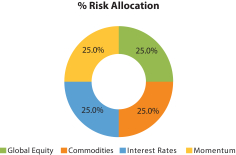

The Salient Risk Parity Fund includes a 25% risk allocation to “momentum.” This sleeve allows the portfolio to tilt exposures to the major asset classes in the other three sleeves (equities, sovereign debt, and commodities) based on market sentiment. Since this approach can go both long and short, it tends to be lowly correlated with the very asset classes it operates in while still generating a positive expected return. We believe that including this sleeve increases the potential diversification in the Fund.

The momentum sleeve proved valuable during the second half of 2014 as short tilts in commodities allowed the Fund to avoid potential losses that would have resulted from long only positions in the space. By the beginning of September, the momentum sleeve moved to a short position in every energy contract except natural gas. As a result, the momentum sleeve was the only additive component of the portfolio during September when equities, commodities and rates detracted. In November, the momentum sleeve contributed more than any other sleeve helping the Fund to its best month since inception with a 7.22% return.

If it were possible to accurately predict which asset class would perform best each year, investors would do best to forego diversification altogether and allocate 100% of their portfolios to the asset class that would perform best over the next holding period. However, history has shown that predicting asset class returns has been extremely difficult for even the most seasoned market professionals. This lack of certainty is the primary justification for risk parity. By allowing lowly correlated asset classes an equal chance to drive portfolio returns, risk parity strategies are designed to perform well across a variety of economic environments without making subjective bets as to what the next environment will look like. Put more simply, the investment industry makes a great deal of money selling crystal balls, but we don’t believe they exist.

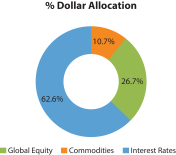

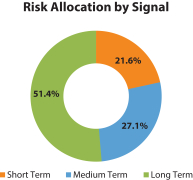

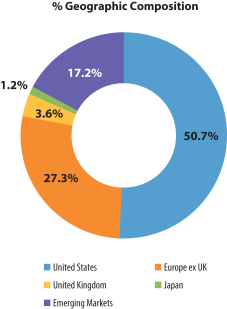

The Fund’s allocation as of December 31, 2014 is shown in the pie chart below:

The data displayed in pie charts have been rounded to the nearest whole number for illustrative purposes only. Allocations are subject to change.

Source: Salient Advisors, L.P., December 31, 2014.

2

Investment Strategies and Techniques

The Fund seeks long term capital appreciation. The Fund seeks to achieve this goal by constructing a portfolio that balances equal risk exposure to a set of equities, commodities, interest rates, and momentum. While equities, commodities, and interest rates are asset classes, momentum is a strategy that trades the same underlying assets used in our long-only equity, commodity, and interest rate sleeves on a long/short basis. The momentum strategy buys exposure (i.e. “goes long”) assets that have appreciated in the past year and sells exposure (i.e. “goes short”) assets that have depreciated. Risk is measured in terms of a statistic called covariance, which measures the degree to which assets have moved together historically.

Salient Advisors, L.P. (the “Advisor” or “Salient”) uses a mathematical approach in seeking to achieve the investment objective of the Fund. Using this approach, Salient determines the type, quantity, and mix of investment positions that the Fund should hold in order to achieve equal risk across asset classes/strategies and, to the degree possible, within the asset classes as well. The Advisor does not invest the assets of the Fund in securities or financial instruments based on its view of the investment merit of a particular security or instrument. In addition, the Advisor does not conduct conventional research or analysis, forecast market movements, or take defensive positions apart from those resulting from the systematic allocation to momentum.

The Fund invests, under normal conditions, in derivatives that create economic leverage and whose performance is expected to correspond to the performance of the underlying asset classes, without investing directly in those asset classes. Using derivatives allows us to gain more exposure to the asset classes than investing in more traditional assets such as stocks and bonds would allow. The performance of derivative instruments is tied to the performance of an underlying currency, security, index, commodity or other asset. In addition to risks relating to their underlying assets, the use of derivatives may include other, possibly greater, risks. Derivatives involve costs, may be volatile, and may involve a small initial investment relative to the risk assumed. Risks associated with the use of derivatives may include counterparty, margin, leverage, correlation, liquidity, tax, market, interest rate and management risks, as well as the risk of potential increased regulation of swaps and other derivatives. Derivatives may also be more difficult to purchase, sell or value than other investments. The Fund may lose more than the cash amount invested on investments in derivatives. Each of these risks is greater for the Fund than mutual funds that do not use derivatives to implement their investment strategy.4

The Fund’s top five positions based on risk contribution as of December 31, 2014 are shown below:

| | |

| Top 5 Positions by Risk | | % of Risk |

| 10 Yr UK Gilt Treasury | | 13.9% |

| 10 Yr US Treasury | | 10.6% |

| 10 Yr Australian Treasury | | 6.1% |

| S&P 500 | | 5.1% |

| Russell 2000 | | 4.9% |

The calculation of risk contribution is based on modern portfolio theory’s calculation of portfolio risk and the contribution of a portfolio’s underlying assets to the portfolio risk are based on the dollar weights, standard deviation, and correlation as calculated by Salient Advisors, L.P.

Allocations are subject to change. Data displayed here has been rounded to the nearest tenth for illustrative purposes only. The specific securities identified are not representative of all securities purchased or held by the Fund, and it should not be assumed that the investment in the securities was or will be profitable. Source: Salient Advisors, L.P., December 31, 2014.

4 Portfolio composition is subject to change.

3

2015 Macro Update

2014 marked the end of the Federal Reserve’s third round of quantitative easing. Just as the Federal Reserve wound down its purchases of U.S. Treasury Bonds and mortgages, heightened geopolitical and economic risks emerged. Growth rates in China and the rest of the emerging world continue to dissipate, which we believe resulted in part of the falling asset values across commodities generally. Tensions in Eastern Europe persist with Russia redoubling its commitment to occupy Crimea, combating Ukrainian nationalists. On the Western Front, the Euro zone was troubled by mounting imbalances that have most recently set the stage for Greece’s shrugging off of austerity measures after Alexis Tsipras was elected as Prime Minister. Greece’s testing of European resolve will likely inform Italy’s actions as it struggles with similar fiscal budget challenges. The Islamic State in Iraq & Syria group (ISIS) and other terrorist groups who associate themselves with the causes of Islam continue to escalate their acts of terror, furthering the chasm between the world of Islam and the rest of the developed world.

While the Swiss National Bank’s removal of the Franc/Euro peg caught a number of hedge funds off guard, we’ve been contemplating the implications of negative nominal term interest rates. As of February 5, 2015, the Swiss 10-year government bond yielded -0.10%. Slowing global growth, an aging populous, high debt loads and stretched fiscal budgets have resulted in lower growth expectations and a greater threat of deflationary pressure. For the first time in modern economic history, at 0.37% yields, the 10-year German bond yield is on top of 10-year Japanese Government Bond yields at 0.36%. The European Central Bank (ECB) has entered into the world of quantitative easing with its first announced action which will involve the purchase of at least 1.14 trillion euros between March 2015 and September 2016.

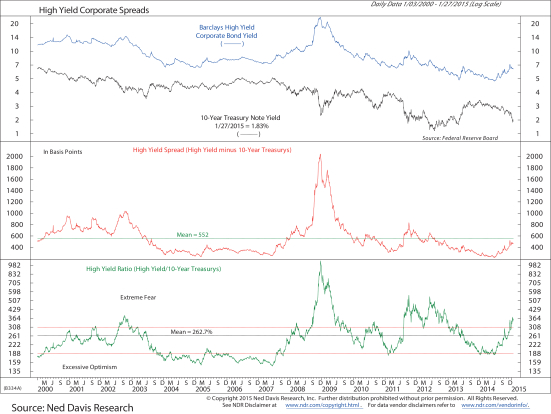

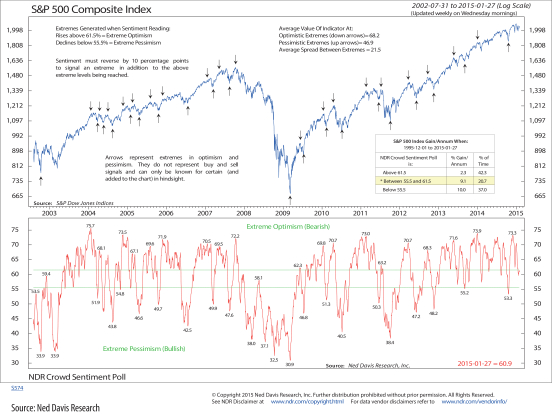

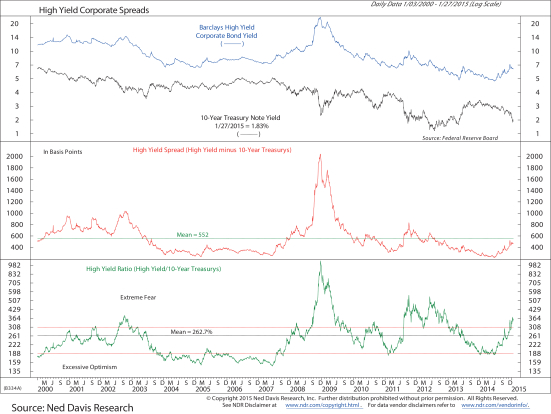

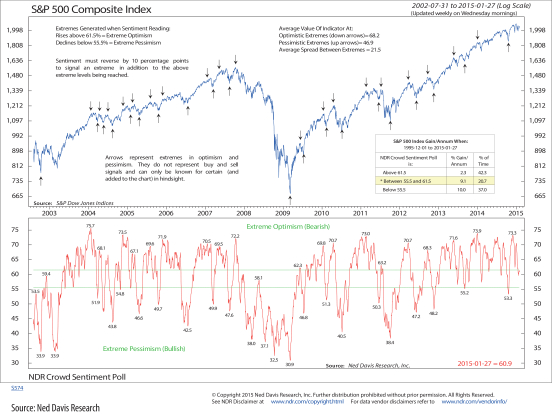

Finally, the strength of the U.S. Dollar will likely challenge the rate of profit growth in the United States as domestic exports become less competitive overseas and profits from foreign operations are muted as they are translated back to U.S. Dollars. In sum, we find this to be a challenging environment with less margin of safety than what we observed during the first stages of the peripheral debt crisis in 2011 when the price-to-earnings ratio (P/E) of the MSCI World index ebbed at 12X (TTM Earnings) and high yield credit spreads spiked to nearly 9% over comparable U.S. Treasuries (Barclays High Yield Credit Index). The MSCI World Index currently has a P/E ratio of 17.7X (TTM earnings) and high yield credit spreads have fallen to less than 5%. In our opinion, it’s likely that U.S. equities and bonds more generally will generate returns over the next five years that are considerably lower than the returns generated over the past five years. We also expect greater volatility of returns as economic imbalances work their way through the system.

4

Summary

The Salient Risk Parity Fund is designed to take advantage of the increased potential return efficiency that stems from diversification. By balancing our exposure, we believe that we are creating a diversified portfolio that has the potential to deliver improved risk-adjusted returns through time. Over 2014, this diversified approach has performed well as gains from different asset classes offset losses in other asset classes, producing a steady return at the Fund level. We believe that the merits of a diversified approach become more evident over longer holding periods as economic regimes shift and different asset classes outperform. We thank you for your investment in the Fund and look forward to 2015.

We look forward to providing regular updates in the future on our progress in executing the Fund’s business plan. Please visit our website at www.salientfunds.com for the latest updates.

Please note that this letter, including the financial information herein, is made available to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned herein.

Sincerely,

Lee Partridge

Chief Investment Officer

Roberto M. Croce, Ph.D.

Director of Quantitative Research

5

Salient Risk Parity Fund

|

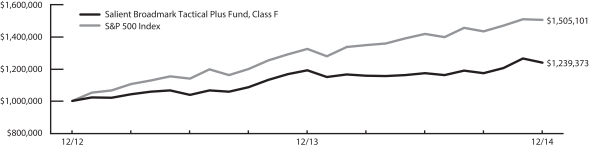

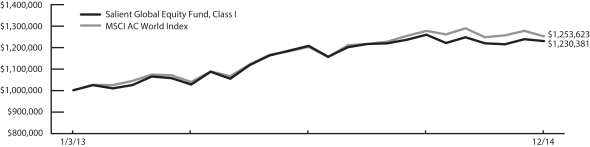

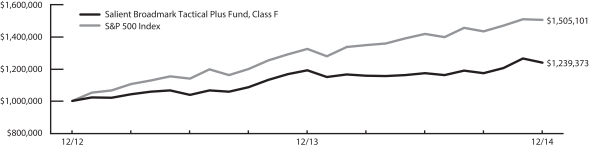

| Value of a $1,000,000 Investment |

|

The charts above represent a historical since inception performance comparison of a hypothetical $1,000,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through July 31, 2015.

The 60/40 Index represents an allocation of 60% MSCI AC World Index (Equities), 40% Barclays Aggregate Bond Index (Bonds) - formerly the Lehman Aggregate Bond Index through Nov. 2008. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Barclays Capital U.S. Aggregate Bond Index is a composite comprised of the Barclays Capital U.S. Intermediate Government/Credit Index and the Barclay Capital Mortgage-Backed Securities Index. All issues in the index are rated investment grade or higher, have a least one year to maturity, and have an outstanding par value of at least $100 million. Note that the Fund’s allocation may differ substantially from 60% equities and 40% bonds. The index returns are from 1/1/2013 onward. One cannot invest directly in an index.

6

Management Discussion of Fund Performance (Unaudited)

Letter to Shareholders

Dear Fellow Shareholders:1

After a difficult first four months of 2014, the Salient Alternative Beta Fund (the “Fund”) produced positive performance in seven of the eight months from May through December. Over this time, the Fund (Class I) gained 14.34%, leaving it down 9.1% for the year, which was attributable to gains from forward foreign currency exchange contracts offset by losses from futures contracts and swap agreements. While we are disappointed with the negative return since inception, we are encouraged by the results since May and believe that a divergence in global monetary policies is creating an environment where the strategies pursued in the Fund can thrive.

| | | | | | | | | | |

| | | | |

Share Class | | Commencement

Date | | Net Performance without Sales Charge | | HFRI Macro Index2 Return |

| | | 2014 | | Average Annual

Since Inception | | 2014 | | Average Annual

Since Inception of

Fund Share Class |

| | | | | | |

| Class A (SABAX) | | 3/28/2013 | | -9.16% | | -7.86% | | 5.71% | | 2.24% |

| | | | | | |

| Class C (SABCX) | | 3/28/2013 | | -9.79% | | -8.54% | | 5.71% | | 2.24% |

| | | | | | |

| Class I (SABFX) | | 2/28/2013 | | -9.10% | | -5.58% | | 5.71% | | 2.36% |

| | | | | | |

| | | |

Share Class | | Commencement

Date | | Net Performance with Maximum Sales

Charge |

| | | 2014 | | Since Inception |

| | | | |

| Class A (SABAX) | | 3/28/2013 | | -14.20% | | -10.75% |

| | | | |

| Class C (SABCX) | | 3/28/2013 | | -10.60% | | -8.54% |

Source: Salient Advisors, L.P. and Bloomberg, December 2014.

Returns above as of December 31, 2014.

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown. Returns with sales charge reflect the deduction of current maximum front end sales charge of 5.50% for Class A shares, and the maximum contingent deferred sales charge of 1.00% which is applied to Class C shares. All returns reflect reinvestment of all dividend and capital gain distributions. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual gross and net operating expense ratios for the Fund based on the current Fund prospectus dated April 30, 2014, are as follows: Class A shares are 2.16% and 1.62% respectively, Class C shares are 2.91% and 2.37% respectively and Class I shares are 1.91% and 1.37% respectively. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.55% for Class A, 2.30% for Class C and 1.30% for Class I shares, excluding certain expenses, until July 31, 2015. Performance shown in the tables does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value.

2 The HFRI Macro (Total) Index is an equally-weighted performance index of numerous hedge fund managers pursuing Macro strategies, which are predicated on theses about future movements in global macroeconomic variables and how financial instruments might respond to such movements. The Fund does not invest in hedge funds, rather it invests both long and short primarily in futures and forward contracts in order to gain exposure to a variety of non-traditional risk premia. The index only reports monthly data, thus the index returns above are from 4/1/2013 onwards (for Class A and C share comparisons) and from 3/1/2013 onwards (for I share comparison). One cannot invest directly in an index. Index performance does not reflect the deduction of fees and expenses.

7

Annual Update

As we discussed in our semi-annual update, we believe that the alternative risk exposures the Fund seeks out should have a positive expected return over time, and that including them alongside traditional holdings can potentially provide a valuable diversification benefit. We carefully chose the strategies in the Fund, selecting ones where we believe there is a positive risk premium in the strategy, theoretical justification for it to persist, and limited reason to believe it will lose value in sympathy with equities.

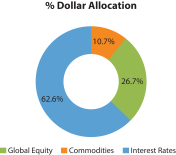

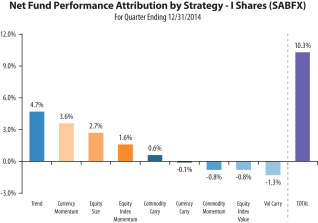

Over the course of 2014, we saw a split in international monetary policy as the US Federal Reserve announced an end to quantitative easing while many foreign central banks pursued more dovish measures. We believe that this split may create an environment that is more accommodative to the strategies pursued in the Fund. The best performing strategy for the year was currency carry followed by commodity momentum, commodity carry and trend. The Fund’s most defensive strategy, equity index value, detracted the most over the year with the majority of its losses occurring in the first quarter.

Over the second half of the year, the Trend sleeve contributed the most to Fund performance, continuing the streak of positive performance from the strategy that started in March. Rising volatility during July, September and December resulted in Volatility Carry detracting the most from performance over the second half of the year.

Heading in to 2015, we believe that investors who are concerned about the economic headwinds threatening global equity markets should consider including an allocation to strategies that pursue alternative risk premia. The Salient Alternative Beta Fund seeks to offer investors access to a collection of alternative return streams in a mutual fund that maintains daily liquidity. Since most of the strategies included in the Fund have zero net exposure to their underlying asset classes, we expect the Fund to remain lowly correlated with traditional asset class returns. We are encouraged by the Fund’s performance since May and look forward to 2015.

Investment Strategies and Techniques

The investment objective of the Salient Alternative Beta Fund is to seek long term capital appreciation with low correlation to traditional core equity and bond market exposures. The Fund invests both long and short, primarily in futures and forward contracts, in order to gain exposure to a variety of non-traditional risk premia.

The Fund invests, under normal conditions, in derivatives that create economic leverage and whose performance is expected to correspond to the performance of the underlying asset classes, without investing directly in those asset classes. Using derivatives allows us to gain more exposure to the asset classes than investing in more traditional assets such as stocks and bonds would allow. The performance of derivative instruments is tied to the performance of an underlying currency, security, index, commodity or other asset. In addition to risks relating to their underlying assets, the use of derivatives may include other, possibly greater, risks. Derivatives involve costs, may be volatile, and may involve a small initial investment relative to the risk assumed. Risks associated with the use of derivatives may include counterparty, margin, leverage, correlation, liquidity, tax, market, interest rate and management risks, as well as the risk of potential increased regulation of swaps and other derivatives. Derivatives may also be more difficult to purchase, sell or value than other investments. The Fund may lose more than the cash amount invested on investments in derivatives. Each of these risks is greater for the Fund than mutual funds that do not use derivatives to implement their investment strategy.3

3 Portfolio composition is subject to change.

8

The data displayed in pie chart have been rounded to the nearest tenth decimal for illustrative purposes only. Allocations are subject to change.

Source: Salient Advisors, L.P., December 31, 2014.

2015 Macro Update

2014 marked the end of the Federal Reserve’s third round of quantitative easing. Just as the Federal Reserve wound down its purchases of U.S. Treasury Bonds and mortgages, heightened geopolitical and economic risks emerged. Growth rates in China and the rest of the emerging world continue to dissipate, which we believe resulted in part of the falling asset values across commodities generally. Tensions in Eastern Europe persist with Russia redoubling its commitment to occupy Crimea, combating Ukrainian nationalists. On the Western Front, the Euro zone was troubled by mounting imbalances that have most recently set the stage for Greece’s shrugging off of austerity measures after Alexis Tsipras was elected as Prime Minister. Greece’s testing of European resolve will likely inform Italy’s actions as it struggles with similar fiscal budget challenges. The Islamic State in Iraq & Syria group (ISIS) and other terrorist groups who associate themselves with the causes of Islam continue to escalate their acts of terror, furthering the chasm between the world of Islam and the rest of the developed world.

While the Swiss National Bank’s removal of the Franc/Euro peg caught a number of hedge funds off guard, we’ve been contemplating the implications of negative nominal term interest rates. As of February 5, 2015, the Swiss 10-year government bond yielded -0.10%. Slowing global growth, an aging populous, high debt loads and stretched fiscal budgets have resulted in lower growth expectations and a greater threat of deflationary pressure. For the first time in modern economic history, at 0.37% yields, the 10-year German bond yield is on top of 10-year Japanese Government Bond yields at 0.36%. The European Central Bank (ECB) has entered into the world of quantitative easing with its first announced action which will involve the purchase of at least 1.14 trillion euros between March 2015 and September 2016.

Finally, the strength of the U.S. Dollar will likely challenge the rate of profit growth in the United States as domestic exports become less competitive overseas and profits from foreign operations are muted as they are translated back to U.S. Dollars. In sum, we find this to be a challenging environment with less margin of safety than what we observed during the first stages of the peripheral debt crisis in 2011 when the price-to-earnings ratio (P/E) of the MSCI World index ebbed at 12X (TTM Earnings) and high yield credit spreads spiked to nearly

9

9% over comparable U.S. Treasuries (Barclays High Yield Credit Index). The MSCI World Index currently has a P/E ratio of 17.7X (TTM earnings) and high yield credit spreads have fallen to less than 5%. In our opinion, it’s likely that U.S. equities and bonds more generally will generate returns over the next five years that are considerably lower than the returns generated over the past five years. We also expect greater volatility of returns as economic imbalances work their way through the system.

Summary

We remain highly convinced of the merits of the strategies pursued by the Fund and are encouraged by the performance since May. We believe diversifying alternative return streams offer investors additional breadth beyond traditional investment options. This affords them the opportunity to spread the risk in their portfolio and avoid concentrated positions in a single asset class. The Salient Alternative Beta Fund seeks to provide investors looking to diversify their core market exposures an efficient means of accessing a collection of nine alternative strategies. We thank you for your investment in the Fund and look forward to 2015.

We look forward to providing regular updates in the future on our progress in executing the Fund’s business plan. Please visit our website at www.salientfunds.com for the latest updates.

Please note that this letter, including the financial information herein, is made available to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned herein.

Sincerely,

Lee Partridge

Chief Investment Officer

Roberto M. Croce, Ph.D.

Director of Quantitative Research

10

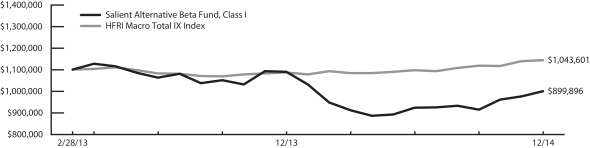

Salient Alternative Beta Fund

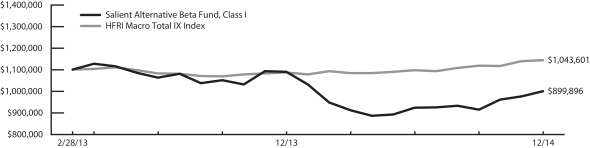

|

| Value of a $1,000,000 Investment |

|

The charts above represent a historical since inception performance comparison of a hypothetical $1,000,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through July 31, 2015.

The HFRI Macro (Total) Index: is an equally weighted performance index of numerous hedge fund managers pursuing Macro strategies, which are predicated on theses about future movements in global macroeconomic variables and how financial instruments might respond to such movements. The Fund does not invest in hedge funds; rather it invests both long and short primarily in futures and forward contracts in order to gain exposure to a variety of non-traditional risk premia. The index only reports monthly data, thus the index returns above are from 4/1/2013 onwards (For Class A and C share comparisons) and from 3/1/2013 onwards (for I share comparison). One cannot invest directly in an index.

11

Management Discussion of Fund Performance (Unaudited)

Letter to Shareholders

Dear Fellow Shareholders:1

After a difficult first quarter, the Salient Trend Fund (the “Fund”) produced positive performance in every month from April through December finishing the year up 14.21% (Class I), which was attributable to losses from futures contracts and swap agreements. The Fund was still outperforming the Barclays BTOP 50 Index for the second year in a row.

| | | | | | | | | | |

| | | | |

| Share Class | | Commencement

Date | | Net Performance without Sales Charge | | Barclay BTOP50 Index2 Return |

| | | 2014 | | Average Annual

Since Inception | | 2014 | | Average Annual

Since Inception of

Fund Share Class |

| | | | | | |

| Class A (SPTAX) | | 3/28/2013 | | 13.92% | | 16.39% | | 12.57% | | 6.28% |

| | | | | | |

| Class C (SPTCX) | | 3/28/2013 | | 13.08% | | 15.46% | | 12.57% | | 6.28% |

| | | | | | |

| Class I (SPTIX) | | 1/2/2013 | | 14.21% | | 18.21% | | 12.57% | | 6.60% |

| | | | | | |

| | | |

Share Class | | Commencement

Date | | Net Performance with

Maximum Sales Charge |

| | | 2014 | | Since Inception |

| | | | |

| Class A (SPTAX) | | 3/28/2013 | | 7.68% | | 12.71% |

| | | | |

| Class C (SPTCX) | | 3/28/2013 | | 12.08% | | 15.46% |

Source: Salient Advisors, L.P. and Barclay Hedge, December 2014.

Returns above as of December 31, 2014.

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown. Returns with sales charge reflect the deduction of current maximum front end sales charge of 5.50% for Class A shares, and the maximum contingent deferred sales charge of 1.00% which is applied to Class C shares. All returns reflect reinvestment of all dividend and capital gain distributions. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual gross and net operating expense ratios for the Fund based on the current Fund prospectus dated April 30, 2014, are as follows: Class A shares are 1.98% and 1.62% respectively, Class C shares are 2.73% and 2.37% respectively and Class I shares are 1.73% and 1.37% respectively. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.55% for Class A, 2.30% for Class C and 1.30% for Class I shares, excluding certain expenses, until July 31, 2015. Performance shown in the tables does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

12

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities.

2 The Barclay BTOP50 Index seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. To be included in the BTOP50, the trading advisors must be: open for investment, willing to provide daily returns, at least two years of trading activity, and the advisors must have at least three years of operating history. The BTOP50 portfolio is equally weighted among the selected programs at the beginning of each calendar year and is rebalanced annually. The BTOP50 consists of a subset of the advisors who make up the managed futures industry, whereas the Fund is a single advisor. The index returns are from 3/28/2013 onwards (For Class A and C share comparisons) and from 1/2/2013 onwards (for I share comparison). One cannot invest directly in an index. Index performance does not reflect the deduction of fees and expenses.

Annual Update

In our semi-annual update, we described how we designed the Salient Trend Fund with the goal of offering investors an impactful tool in building diversified portfolios. In our opinion, trend following strategies can provide an alternative means of hedging tail risk that has the potential to provide positive returns through time while remaining lowly correlated with traditional holdings. We have been pleased with the performance of the Fund and believe that it has provided the type of diversifying return stream that we were hoping to deliver.

Since the Fund’s inception, it has produced an 18.21% (Class I) annualized return with a 0.24 correlation to the S&P 500, -0.38 correlation to commodities and a 0.21 correlation to the Barclay’s Aggregate Bond Index,3 delivering the two key features of a sound alternative: positive returns and low correlations to traditional holdings. With growing uncertainty around international equity, commodity and fixed income markets, we believe that strategies like trend following have the potential to provide the diversification that many investors are seeking to move some of their portfolio away from traditional market exposure.

The Fund entered 2014 with long exposures across domestic, foreign developed and emerging market equities and short exposures to fixed income. The commodities sleeve was long energies, short metals and short agricultural commodities. By the second half of the year, the Fund shifted back to being long rates, a position that contributed to performance in five of the final six months in the year. September was the only month in the second half of the year when long rates positions did not produce a positive contribution to portfolio return. It was also the month when the Fund shifted to short positions in every energy contract with the exception of natural gas, contributing to a positive gain from commodity positions that was more than enough to offset losses from both rates and equities. Crude and Brent Oil both fell by more than 50% from September through the end of the year. In November, short commodity, long equity and long fixed income positions produced positive performance from each asset class, resulting in the Fund’s largest single month gain since inception (+11.45%).

Even though short positions in energies were additive over the final four month of 2014, the size of our short positions started coming down by the end of the year. Our allocation framework seeks a certain risk contribution from each position and dynamically adapts to changes in volatility and correlation. Since volatility in energies increased during the last four months, our model required less exposure to realize the risk target, illustrating the dynamic nature of the strategy.

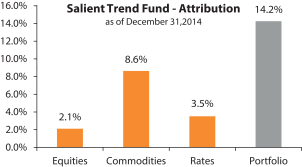

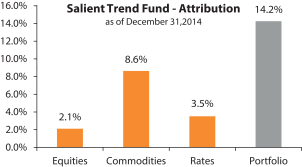

The following attribution graph shows the contribution of each of the major asset class returns to the total portfolio for the twelve months ending December 31, 2014:

3 Source: Bloomberg, correlations are based on monthly returns as of December 31, 2014.

13

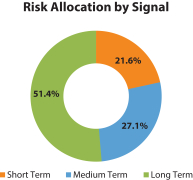

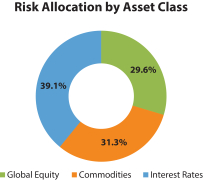

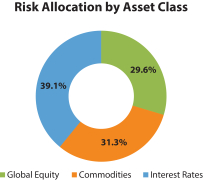

The Fund’s risk allocation as of December 31, 2014 is shown in the pie charts below:

The data displayed in the pie charts have been rounded to the nearest tenth for illustrative purposes only. Allocations are subject to change.

Source: Salient Advisors, L.P., December 31, 2014.

Investment Strategies and Techniques

The Fund seeks long term capital appreciation with low correlation to traditional core equity and bond market exposures. The Fund seeks to achieve this goal by constructing a portfolio that captures short, medium and long term price trends. The Fund can invest in equities, commodities, interest rates, and currencies. Risk is measured in terms of a statistic called covariance, which measures the degree to which assets have moved together historically.

The Fund’s investment process begins with the construction of a proprietary, systematic trend following strategy. Next, the Fund determines which global markets are appropriate for this strategy. The Fund then constructs a portfolio in which it attempts to balance the risk contribution of each trend following strategy and the asset classes within each strategy and for which it targets a 20% annualized standard deviation of returns. The risk calculation is derived from each strategy’s standard deviation of returns, its correlation with each of the other strategies within the portfolio and the percentage weight of each strategy within the portfolio. The portfolio is rebalanced dynamically according to this framework on a monthly basis.4

The Fund invests, under normal conditions, in derivatives that create economic leverage and whose performance is expected to correspond to the performance of the underlying asset classes, without investing directly in those asset classes. Using derivatives allows us to gain more exposure to the asset classes than investing in more traditional assets such as stocks and bonds would allow. The performance of derivative instruments is tied to the performance of an underlying currency, security, index, commodity or other asset. In addition to risks relating to their underlying assets, the use of derivatives may include other, possibly greater, risks. Derivatives involve costs, may be volatile, and may involve a small initial investment relative to the risk assumed. Risks associated with the use of derivatives may include counterparty, margin, leverage, correlation, liquidity, tax, market, interest rate and management risks, as well as the risk of potential increased regulation of swaps and other derivatives. Derivatives may also be more difficult to purchase, sell or value than other investments. The Fund may lose more than the cash amount invested on investments in derivatives. Each of these risks is greater for the Fund than mutual funds that do not use derivatives to implement their investment strategy.4

4 Portfolio composition is subject to change.

14

The Fund’s top five long and short positions based on risk contribution as of December 31, 2014 are shown below:4

| | | | | | | | |

| LONG POSITIONS | | | | SHORT POSITIONS |

| | | | |

| Holding | | % Risk

Allocation | | | | Holding | | % Risk

Allocation |

| 10 Yr Australian Treasury | | 4.4% | | | | Lead Futures | | 5.4% |

| 10 Yr Gilt Treasury | | 4.0% | | | | Copper Futures | | 4.1% |

| S&P CNX Nifty | | 3.8% | | | | Silver Futures | | 3.9% |

| S&P 500 | | 3.8% | | | | Heating Oil Futures | | 3.8% |

| S&P Midcap 400 | | 3.6% | | | | Gasoline Futures | | 3.8% |

Allocations are subject to change. Data displayed here has been rounded to the nearest tenth for illustrative purposes only. The specific securities identified are not representative of all securities purchased or held by the Fund, and it should not be assumed that the investment in the securities was or will be profitable. Source: Salient Advisors, L.P., December 31, 2014.

2015 Macro Update

2014 marked the end of the Federal Reserve’s third round of quantitative easing. Just as the Federal Reserve wound down its purchases of U.S. Treasury Bonds and mortgages, heightened geopolitical and economic risks emerged. Growth rates in China and the rest of the emerging world continued to dissipate, which we believe resulted in part of the falling asset values across commodities generally. Tensions in Eastern Europe persisted with Russia redoubling its commitment to occupy Crimea, combating Ukrainian nationalists. On the Western Front, the Euro zone was troubled by mounting imbalances that have most recently set the stage for Greece’s shrugging off of austerity measures after Alexis Tsipras was elected as Prime Minister. Greece’s testing of European resolve will likely inform Italy’s actions as it struggles with similar fiscal budget challenges. The Islamic State in Iraq & Syria group (ISIS) and other terrorist groups who associate themselves with the causes of Islam continued to escalate their acts of terror, furthering the chasm between the world of Islam and the rest of the developed world.

While the Swiss National Bank’s removal of the Franc/Euro peg caught a number of hedge funds off guard, we’ve been contemplating the implications of negative nominal term interest rates. As of February 5, 2015, the Swiss 10-year government bond yielded -0.10%. Slowing global growth, an aging populous, high debt loads and stretched fiscal budgets have resulted in lower growth expectations and a greater threat of deflationary pressure. For the first time in modern economic history, at 0.37% yields, the 10-year German bond yield is on top of 10-year Japanese Government Bond yields at 0.36%. The European Central Bank (ECB) has entered into the world of quantitative easing with its first announced action, which will involve the purchase of at least 1.14 trillion euros between March 2015 and September 2016.

Finally, the strength of the U.S. Dollar will likely challenge the rate of profit growth in the United States as domestic exports become less competitive overseas and profits from foreign operations are muted as they are translated back to U.S. Dollars. In sum, we find this to be a challenging environment with less margin of safety than what we observed during the first stages of the peripheral debt crisis in 2011 when the price-to-earnings ratio (P/E) of the MSCI World index ebbed at 12X (TTM Earnings) and high yield credit spreads spiked to nearly 9% over comparable U.S. Treasuries (Barclays High Yield Credit Index). The MSCI World Index currently has a P/E ratio of 17.7X (TTM earnings) and high yield credit spreads have fallen to less than 5%. In our opinion, it’s likely that U.S. equities and bonds more generally will generate returns over the next five years that are considerably lower than the returns generated over the past five years. We also expect greater volatility of returns as economic imbalances work their way through the system.

15

Summary

We were happy to see the Fund bounce back from a beginning of year drawdown and outperform its benchmark for a second year in a row. We believe the Fund offers a meaningfully different return stream from most traditional holdings as evidenced by the low correlations to major asset classes since inception. Since its launch in January 2013, the Fund has delivered the return profile that we intended to offer, providing investors with a diversifying portfolio building block. We appreciate your investment and look forward to 2015.

We look forward to providing regular updates in the future on our progress in executing the Fund’s business plan. Please visit our website at www.salientfunds.com for the latest updates.

Please note that this letter, including the financial information herein, is made available to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned herein.

Sincerely,

Lee Partridge

Chief Investment Officer

Roberto M. Croce, Ph.D.

Director of Quantitative Research

16

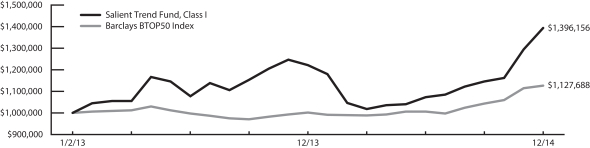

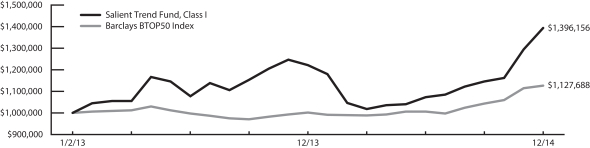

Salient Trend Fund

|

| Value of a $1,000,000 Investment |

|

The charts above represent a historical since inception performance comparison of a hypothetical $1,000,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through July 31, 2015.

The Barclay BTOP50 Index: seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. To be included in the BTOP50, the trading advisors must be: open for investment, willing to provide daily returns, at least two years of trading activity, and the advisors must have at least three years of operating history. The BTOP50 portfolio is equally weighted among the selected programs at the beginning of each calendar year and is rebalanced annually. The BTOP50 consists of a subset of the advisors who make up the managed futures industry, whereas the Fund is a single advisor. The index returns are from 3/27/2013 onwards (For Class A and C share comparisons) and from 1/2/2013 onwards (for I share comparison). One cannot invest directly in an index.

17

Management Discussion of Fund Performance (Unaudited)

Letter to Shareholders

Dear Fellow Shareholders:1

We are pleased to provide the annual report of the Salient MLP & Energy Infrastructure Fund II (the “Fund”) for the year ended December 31, 2014. The Fund’s investment objective is to provide a high level of total return with an emphasis on making quarterly cash distributions to its shareholders. The Fund generated a net total return of 8.6% (Class I) for the year ended December 31, 2014, compared to 4.8%, for the Alerian MLP Index (“AMZ”).2 The Fund ended the third quarter of 2014 up 24.5%, compared to 19.5% for the AMZ. In the fourth quarter of 2014, the Fund’s performance declined (12.8%), compared to (12.3%) for the AMZ, which was the third worst quarter in the history of the index.

The rapidly falling price of crude oil was the single biggest factor behind MLP performance. The price of West Texas Intermediate (“WTI”) crude oil fell (41.6%) in the fourth quarter of 2014. Ironically, we believe that MLP selling was exacerbated during 4Q because MLPs had done so well up to that point. Going into 4Q, the AMZ had gained a 19% total return year-to-date. As such, we believe a “sell your winners” scenario occurred. The three largest detractors in the Fund during the fourth quarter were The Williams Companies, Inc. (WMB), Targa Resources Corp. (TRGP), and ONEOK, Inc. (OKE). Going into the quarter, WMB had gained 47.1%, TRGP was up 56.6%, and OKE was up 23.41%. We believe investors decided to book profits with oil’s decline showing no sign of abating.

As of December 31, 2014, the Fund had total net assets of $1.48 billion and a NAV per share (for Class I) of $13.29.

| | | | | | | | | | |

| | | | |

| Share Class | | Commencement

Date | | Net Performance without Sales Charge | | Alerian MLP Index Return |

| | | 2014 | | Average Annual

Since Inception | | 2014 | | Average Annual

Since Inception of

Fund Share Class |

| | | | | | |

| Class A (SMAPX) | | 12/21/2012 | | 8.35% | | 19.31% | | 4.81% | | 14.45% |

| | | | | | |

| Class C (SMFPX) | | 1/8/2013 | | 7.53% | | 17.10% | | 4.81% | | 12.55% |

| | | | | | |

| Class I (SMLPX) | | 9/19/2012 | | 8.56% | | 18.34% | | 4.81% | | 11.75% |

| | | | | | |

| | | |

| Share Class | | Commencement

Date | | Net Performance with Maximum Sales Charge |

| | | 2014 | | Since Inception |

| | | | |

| Class A (SMAPX) | | 12/21/2012 | | 2.41% | | 16.02% |

| | | | |

| Class C (SMFPX) | | 1/8/2013 | | 6.53% | | 17.10% |

Sources: Salient Capital Advisors, LLC and Alerian Capital Management, December 2014.

Returns above as of 12/31/2014.

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown. Returns with sales charge reflect the deduction of current maximum front end sales charge of 5.50% for Class A shares, and the maximum contingent deferred sales charge of 1.00% which is applied to Class C shares. All returns reflect reinvestment of all dividend and capital gain distributions. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual gross and net operating expense ratios for the Fund based on the current Fund prospectus dated April 30, 2014 are as follows: Class A shares are 2.65% and 2.49% respectively, Class C shares are 3.40% and 3.24% respectively and Class I shares are 2.40% and 2.24% respectively. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.55% for Class A, 2.30% for Class C and 1.30% for Class I shares, excluding certain expenses, until July 31, 2015. Performance shown in the tables does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities.

2 Alerian MLP Index (AMZ) is a composite of the 50 most prominent energy MLPs that provides investors with a comprehensive benchmark for this emerging asset class. An investor may not invest directly in an index. Index performance does not reflect the deduction of fees and expenses.

18

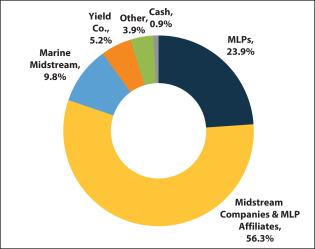

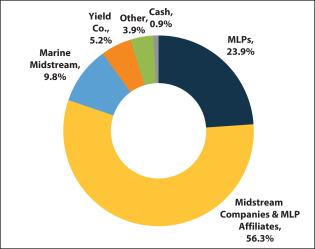

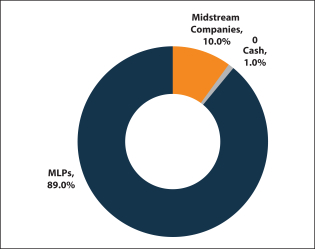

The Fund’s portfolio composition and holdings at December 31, 2014 are shown below:

Sector Composition3,4

as of 12/31/2014

Top 10 Holdings3,4

as of 12/31/2014

| | | | | | |

| Company Name | | Ticker | | Sector | | Allocation |

| Kinder Morgan, Inc. | | KMI | | Midstream Company | | 9.6% |

| The Williams Companies, Inc. | | WMB | | Midstream Company | | 7.5% |

| Targa Resources Corp. | | TRGP | | Midstream Company | | 7.2% |

| Plains GP Holdings, L.P. | | PAGP | | Midstream Company | | 6.4% |

| EnLink Midstream LLC | | ENLC | | Midstream Company | | 5.1% |

| ONEOK, Inc. | | OKE | | Midstream Company | | 4.8% |

| SemGroup Corporation | | SEMG | | Midstream Company | | 4.2% |

| Spectra Energy Corp | | SE | | Midstream Company | | 4.1% |

| NRG Yield, Inc. | | NYLD | | Yield Co. | | 3.5% |

| Enbridge Energy Management, L.L.C. | | EEQ | | MLP Affiliate | | 3.1% |

3 Data displayed here has been rounded to the nearest tenth for illustrative purposes only. The specific securities identified are not representative of all of the securities purchased or held by the Fund, and it should not be assumed that the investment in the securities identified was or will be profitable. Cash includes cash equivalents and unsettled security positions. Allocations are subject to change.

4 Source: Salient Capital Advisors, LLC, December 2014.

19

For the year ended December 31, 2014, the top contributors and bottom detractors to the Fund’s performance included:

| | | | | | | | |

| Top 5 Contributors to Fund Performance |

| | | Security | | Ticker | | Return | | Fund

Contribution |

| 1 | | Kinder Morgan Management, LLC | | KMR | | 37.99% | | 2.1% |

| 2 | | Targa Resources Corp. | | TRGP | | 21.99% | | 1.5% |

| 3 | | Enbridge Energy Management, L.L.C. | | EEQ | | 41.70% | | 1.3% |

| 4 | | Kinder Morgan, Inc. | | KMI | | 23.93% | | 1.2% |

| 5 | | The Williams Companies, Inc. | | WMB | | 17.91% | | 1.0% |

| | | | | | | | |

| Bottom 5 Detractors to Fund Performance |

| | | Security | | Ticker | | Return | | Fund

Contribution |

| 1 | | LinnCo, LLC | | LNCO | | (59.99%) | | (1.8%) |

| 2 | | Seadrill Partners LLC | | SDLP | | (43.92%) | | (0.9%) |

| 3 | | ONEOK, Inc. | | OKE | | (16.93%) | | (0.7%) |

| 4 | | Memorial Production Partners LP | | MEMP | | (22.61%) | | (0.4%) |

| 5 | | Teekay Corporation | | TK | | (24.51%) | | (0.4%) |

| | | | | | | | |

Source: Salient Capital Advisors, LLC, December 2014. For illustrative purposes only. Past performance is not indicative of future results. Numbers have been rounded for illustrative purposes. |

Market Review

The recent rout in crude oil prices continued through November culminating in OPEC’s Thanksgiving Day announcement that it would maintain its production quota at 30 mmbbl/d.5,6 Crude oil plummeted 10% the following day, ending the month at a five-year low of $66.15/bbl down nearly 40% from its June high. Investors, fearing sizable cuts to Exploration & Production (E&P) capital expenditure budgets due to low commodity prices, indiscriminately dumped Master Limited Partnerships (MLP) and the AMZ fell 5.3% on the final day of November and an additional 4.4% the following Monday, December 1st, to mark a third consecutive negative month for MLPs.

Ironically, we believe that at least some of the MLP underperformance of the last few months can be attributed to the increased maturity of the asset class. The Salient MLP investable universe had grown to an aggregate of $850 billion by the end of August up from just over $100 billion in 2009.7 As the space has matured, we believe that many investment firms now manage MLPs as a component of their overall energy portfolios rather than as an alternative investment vehicle. As such, with commodity prices continuing to decline, we believe many energy portfolio managers were given orders to reduce overall energy exposure and several MLPs were sold despite having little to zero exposure to crude oil or even natural gas liquids (NGL) prices for that matter.

In retrospect, what began as a “sell your winners” scenario in October when crude oil prices first dipped under $90/bbl and many individual MLPs were up >40% YTD on the heels of 2013’s 27.6% gains for the AMZ, morphed into semi-panic selling by the end of November and early December as the slide in crude oil prices showed no signs of abating.

5 Organization of the Petroleum Exporting Countries. OPEC 166th Meeting Concludes [Press Release]. Retrieved from: http://www.opec.org/opec_web/en/press_room/2938.htm

6 mmbbl/d = millions of barrels per day

7 Bloomberg, Salient Capital Advisors, LLC, August 2014. The investable universe incorporates energy MLPs, midstream companies (including general partners), marine midstream companies, Yield Co.’s and MLP affiliates.

20

Summary

Our long-term investment philosophy remains focused on MLPs and MLP-related companies that have the potential to achieve above average distribution growth which, we believe, leads to potentially higher long-term returns for investors. However, we believe that we are entering a period of heightened volatility where investors will likely place a premium on safety and predictability rather than focusing mainly on dividend growth potential. Fortunately, we do not believe that the two characteristics are mutually exclusive. It is our opinion that successful MLPs achieve above average distribution growth in no small part because their operations allow them to outperform in both rising and falling macro commodity price environments. Being disciplined and sticking to our focus on choosing quality names using our “bottom up” stock selection approach will be more important than ever as the recent broad-based sell-off in MLPs has potentially created an opportunity to build positions in names that are well positioned to weather the current volatility and emerge even stronger going forward.

Please visit our website at www.salientfunds.com for the latest updates.

Please note that this letter, including the financial information herein, is made available to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of the Fund or of any securities mentioned in this letter.

Sincerely,

Gregory A. Reid

President and Chief Executive Officer, MLP Business

Salient Capital Advisors, LLC

21

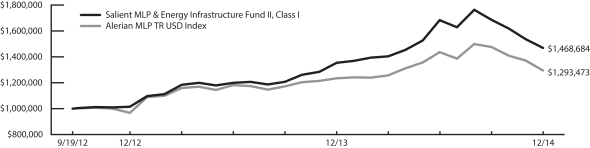

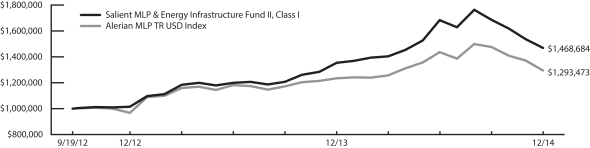

Salient MLP & Energy Infrastructure Fund II

|

| Value of a $1,000,000 Investment |

|

The charts above represent a historical since inception performance comparison of a hypothetical $1,000,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through July 31, 2015.

Alerian MLP Index (AMZ) is a composite of the 50 most prominent energy MLPs that provides investors with a comprehensive benchmark for this emerging asset class.

An investor may not invest directly in an index. Index performance does not reflect the deduction of fees and expenses.

22

Management Discussion of Fund Performance (Unaudited)

Letter to Shareholders

Dear Fellow Shareholders:1

We are pleased to provide the first annual report of the Salient MLP Fund (the “Fund”) for the period ended December 31, 2014. The Fund commenced operations on April 2, 2014 with an investment objective to provide a high level of total return with an emphasis of making quarterly cash distributions. The Fund (Class I) ended 2014 with a return of 0.03%, compared to the Alerian MLP Index (“AMZ”)2 total return of 1.4%. The AMZ declined (12.3%) in the fourth quarter of 2014, which was the third worst quarter in the history of the index.

The rapidly falling price of crude oil was the single biggest factor behind MLP performance. The price of West Texas Intermediate (“WTI”) crude oil fell (41.6%) during the fourth quarter of 2014. Ironically, we believe that MLP selling was exacerbated during 4Q because MLPs had done so well up to that point. Going into the fourth quarter, the AMZ had gained a 19% return year-to-date. As such, we believe a “sell your winners” scenario occurred. The three largest detractors in the Fund during the fourth quarter were Summit Midstream Partners, LP (SMLP); Rose Rock Midstream, L.P. (RRMS) and ONEOK Partners, L.P. (OKS). Going into the quarter, the three names had sizeable gains: SMLP (42.9%), RRMS (56.7%), and OKS (10.5%) and we believe were sold as investors decided to book profits with oil’s decline showing no sign of abating.

As of December 31, 2014, the Fund had total net assets of $18.4 million and a NAV per share (for Class I) of $9.60.

| | | | | | |

| | | | |

Share Class | | Commencement

Date | | Net Performance Since Inception

without Sales Charge | | Alerian MLP Index Return

Since Inception of Fund Share Class |

| | | | |

| Class A (SAMCX) | | 4/2/2014 | | -0.19% | | 1.35% |

| | | | |

| Class C (SCMCX) | | 4/2/2014 | | -0.66% | | 1.35% |

| | | | |

| Class I (SIMCX) | | 4/2/2014 | | 0.03% | | 1.35% |

| | | | |

| | | |

Share Class | | Commencement

Date | | Net Performance Since Inception with

Maximum Sales Charge |

| | | |

| Class A (SAMCX) | | 4/2/2014 | | -5.66% |

| | | |

| Class C (SCMCX) | | 4/2/2014 | | -1.62% |

Sources: Salient Capital Advisors, LLC and Alerian Capital Management, December 2014.

Returns above as of 12/31/2014.

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown. Returns with sales charge reflect the deduction of current maximum front end sales charge of 5.50% for Class A shares, and the maximum contingent deferred sales charge of 1.00% which is applied to Class C shares. All returns reflect reinvestment of all dividend and capital gain distributions. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual gross and net operating expense ratios for the Fund based on the current Fund prospectus dated April 30, 2014 are as follows: Class A shares are 3.23% and 1.87% respectively, Class C shares are 3.98% and 2.62% respectively and Class I shares are 2.98% and 1.62% respectively. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.55% for Class A, 2.30% for Class C and 1.30% for Class I shares, excluding certain expenses, until July 31, 2015. Performance shown in the tables does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities.

2 Alerian MLP Index (AMZ) is a composite of the 50 most prominent energy MLPs that provides investors with a comprehensive benchmark for this emerging asset class. An investor may not invest directly in an index. Index performance does not reflect the deduction of fees and expenses.

23

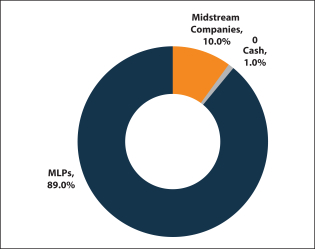

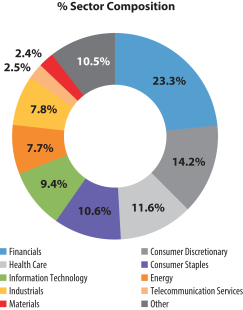

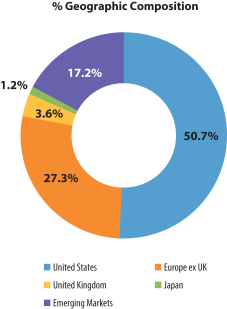

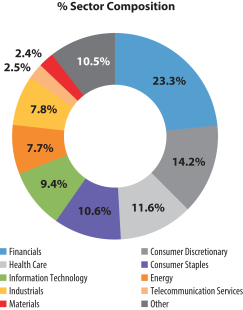

The Fund’s portfolio composition and holdings at December 31, 2014 are shown below:

Sector Composition3,4

as of 12/31/2014

Top 10 Holdings3,4

as of 12/31/2014

| | | | | | |

Company Name | | Ticker | | Sector | | Allocation |

| Magellan Midstream Partners, L.P. | | MMP | | MLP | | 5.6% |

| Enterprise Products Partners L.P. | | EPD | | MLP | | 5.5% |

| Energy Transfer Equity, L.P. | | ETE | | MLP | | 5.0% |

| Antero Midstream Partners LP | | AM | | MLP | | 5.0% |

| NGL Energy Partners LP | | NGL | | MLP | | 5.0% |

| Summit Midstream Partners, L.P. | | SMLP | | MLP | | 4.9% |

| ONEOK Partners, L.P. | | OKS | | MLP | | 4.9% |

| Oiltanking Partners, L.P. | | OILT | | MLP | | 4.7% |

| Western Gas Equity Partners, LP | | WGP | | MLP | | 4.6% |

| EnLink Midstream Partners, LP | | ENLK | | MLP | | 4.1% |

3 Data displayed here has been rounded to the nearest tenth for illustrative purposes only. The specific securities identified are not representative of all of the securities purchased or held by the Fund, and it should not be assumed that the investment in the securities identified was or will be profitable. Cash includes cash equivalents and unsettled security positions. Allocations are subject to change.

4 Source: Salient Capital Advisors, LLC, December 2014.

24

As of December 31, 2014, the top contributors and bottom detractors to the Fund’s performance included:

| | | | | | | | |

| Top 5 Contributors to Fund Performance |

| | | Security | | Ticker | | Return | | Fund

Contribution |

| 1 | | MPLX LP | | MPLX | | 51.0% | | 1.3% |

| 2 | | EQT Midstream Partners, LP | | EQM | | 19.5% | | 1.0% |

| 3 | | Energy Transfer Equity, L.P. | | ETE | | 22.2% | | 0.9% |

| 4 | | Magellan Midstream Partners, L.P. | | MMP | | 19.4% | | 0.9% |

| 5 | | Tallgrass Energy Partners, LP | | TEP | | 22.6% | | 0.8% |

| | | | | | | | |

| Bottom 5 Detractors to Fund Performance |

| | | Security | | Ticker | | Return | | Fund

Contribution |

| 1 | | ONEOK Partners LP | | OKS | | (22.5%) | | (1.3%) |

| 2 | | Summit Midstream Partners, LP | | SMLP | | (8.5%) | | (1.2%) |

| 3 | | NGL Energy Partners LP | | NGL | | (20.3%) | | (0.9%) |

| 4 | | American Midstream Partners LP | | AMID | | (23.5%) | | (0.6%) |

| 5 | | Regency Energy Partners, L.P. | | RGP | | (6.9%) | | (0.6%) |

| | | | | | | | |

Source: Salient Capital Advisors, LLC, December 2014. For illustrative purposes only. Past performance is not indicative of future results. Numbers have been rounded for illustrative purposes. |

Market Review

The recent rout in crude oil prices continued through November culminating in OPEC’s Thanksgiving Day announcement that it would maintain its production quota at 30 mmbbl/d.5,6 Crude oil plummeted 10% the following day, ending the month at a five-year low of $66.15/bbl down nearly 40% from its June high. Investors, fearing sizable cuts to Exploration & Production (E&P) capital expenditure budgets due to low commodity prices, indiscriminately dumped Master Limited Partnerships (MLP) and the AMZ fell 5.3% on the final day of November and an additional 4.4% the following Monday, December 1st, to mark a third consecutive negative month for MLPs.

Ironically, we believe that at least some of the MLP underperformance of the last few months can be attributed to the increased maturity of the asset class. The Salient MLP investable universe had grown to an aggregate of $850 billion by the end of August up from just over $100 billion in 2009.7 As the space has matured, we believe that many investment firms now manage MLPs as a component of their overall energy portfolios rather than as an alternative investment vehicle. As such, with commodity prices continuing to decline, we believe many energy portfolio managers were given orders to reduce overall energy exposure and several MLPs were sold despite having little to zero exposure to crude oil or even natural gas liquids (NGL) prices for that matter.

5 Organization of the Petroleum Exporting Countries. OPEC 166th Meeting Concludes [Press Release]. Retrieved from: http://www.opec.org/opec_web/en/press_room/2938.htm

6 mmbbl/d = millions of barrels per day

7 Bloomberg, Salient Capital Advisors, LLC, August 2014. The investable universe incorporates energy MLPs, midstream companies (including general partners), marine midstream companies, Yield Co.’s and MLP affiliates.

25

In retrospect, what began as a “sell your winners” scenario in October when crude oil prices first dipped under $90/bbl and many individual MLPs were up >40% YTD on the heels of 2013’s 27.6% gains for the AMZ, morphed into semi-panic selling by the end of November and early December as the slide in crude oil prices showed no signs of abating.

Summary

Our long-term investment philosophy remains focused on MLPs and MLP-related companies that have the potential to achieve above average distribution growth which, we believe, leads to potentially higher long-term returns for investors. However, we believe that we are entering a period of heightened volatility where investors will likely place a premium on safety and predictability rather than focusing mainly on dividend growth potential. Fortunately, we do not believe that the two characteristics are mutually exclusive. It is our opinion that successful MLPs achieve above average distribution growth in no small part because their operations allow them to outperform in both rising and falling macro commodity price environments. Being disciplined and sticking to our focus on choosing quality names using our “bottom up” stock selection approach will be more important than ever as the recent broad-based sell-off in MLPs has potentially created an opportunity to build positions in names that are well positioned to weather the current volatility and emerge even stronger going forward.

Please visit our website at www.salientfunds.com for the latest updates.

Please note that this letter, including the financial information herein, is made available to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of the Fund or of any securities mentioned in this letter.

Sincerely,

Gregory A. Reid

President and Chief Executive Officer, MLP Business

Salient Capital Advisors, LLC

26

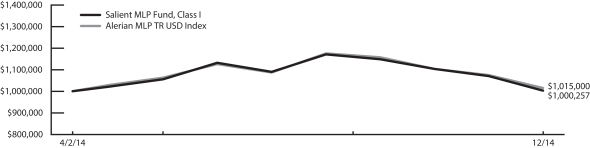

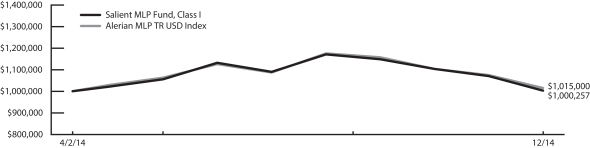

Salient MLP Fund

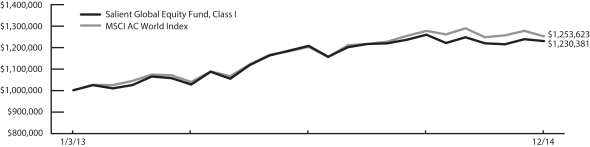

|

| Value of a $1,000,000 Investment |

|

The charts above represent a historical since inception performance comparison of a hypothetical $1,000,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.